UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08652

Croft Funds Corporation

(Exact name of registrant as specified in charter)

Canton House, 300 Water Street

Baltimore, Maryland 21202

(Address of principal executive offices)

(Zip code)

Mr. Kent Croft

Canton House, 300 Water Street

Baltimore, Maryland 21202

(Name and address of agent for service)

With copy to:

Leslie Cruz, Esquire

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004

Registrant's telephone number, including area code: (410) 576-0100

Date of fiscal year end: April 30

Date of reporting period: April 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

![[croftncsr0704amended002.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended002.jpg)

Croft-Leominster

Value Fund

ANNUAL REPORT

April 30, 2004

June 25, 2004

Dear Shareholder:

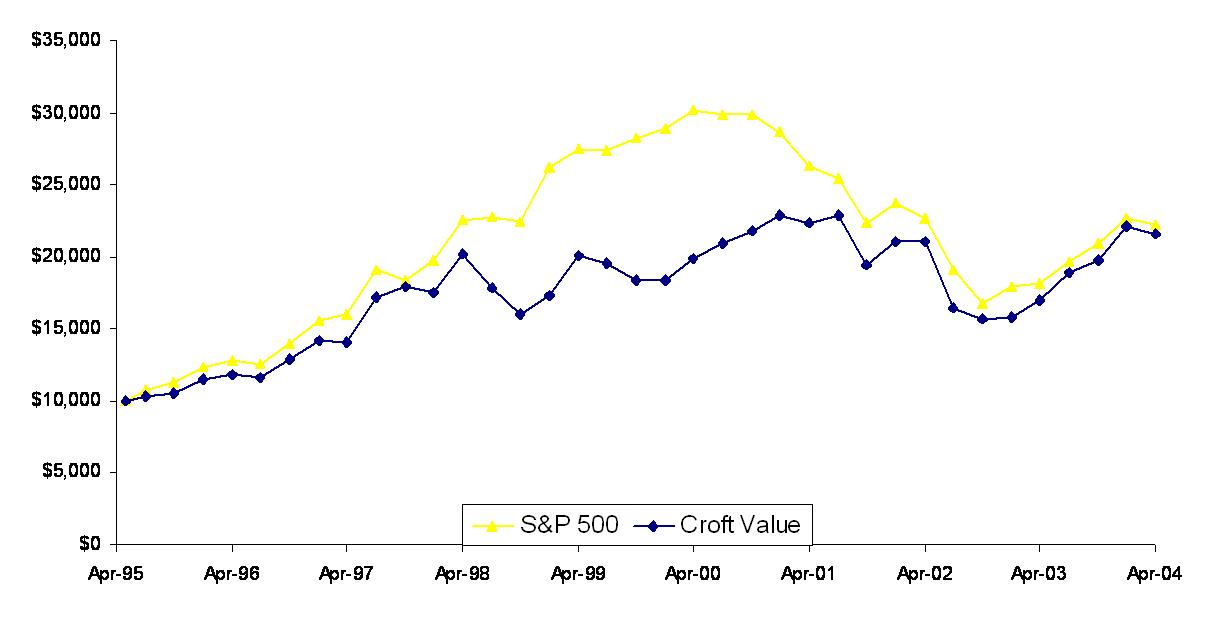

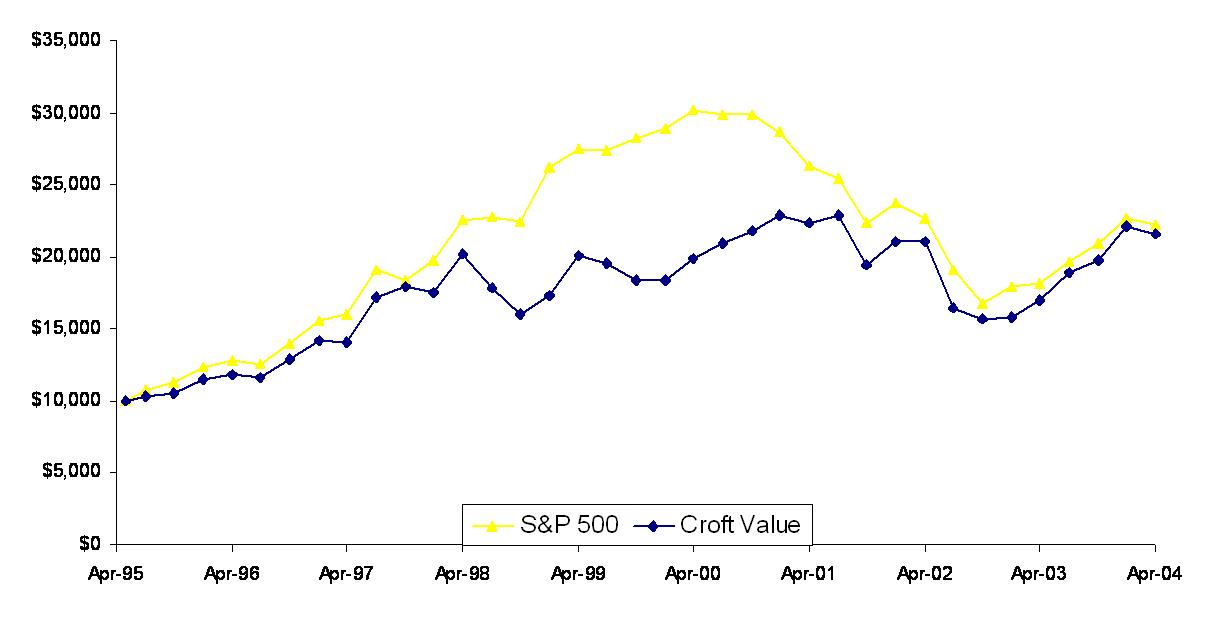

This calendar year through 6/25/04, your Croft-Leominster Value Fund has increased +2.8% while the S&P 500 Index has returned +3.0%. For the fiscal year ended 4/30/04, the Value Fund increased +26.55 versus an increase of +22.9% in the S&P 500.

Despite continued geopolitical risk and the uncertainty of the upcoming presidential election, the underlying fundamentals of the economy are sound. Evidence of the strengthening economy includes above average GDP growth, rebounding capital expenditures, and increasing employment. Also reflecting these conditions, corporate profits for 2004 have significantly improved over the previous year.

We continue to search for companies that have solid operating histories, cash flows, and earnings prospects. Additionally, we look for firms with low price to book values, low downside risk, and above average long-term appreciation potential. As of June 25, 2004 the Value Fund had the following characteristics:

| | Value Fund | S&P 500 Index |

Estimated 2004 Price/Earnings | 14.1x | 18.5X |

Estimated Growth Rate | 10.1% | 8.0% |

Yield | 1.3% | 1.6% |

Over the past year we added to Tyco Corp, one of the Fund’s top holdings. New CEO Mr. Ed Breen is focused on improving the operating results of the firm’s underlying businesses, and has already achieved significant improvement in the quality of earnings.

Liberty Media continues to be one of our larger holdings. Recently, Liberty management bought the remaining interest in QVC, and initiated a restructuring that culminated in the spin-off of the firm’s international assets. While the restructuring added to recent share price volatility, the underlying value of the assets is still compelling. We continue to see unrecognized value in the firm’s excellent cash flow, large cash position, and high quality asset base.

Thank you for your investment in the Croft-Leominster Value Fund.

Sincerely,

/s/Kent Croft

President

| | | |

CROFT-LEOMINSTER VALUE FUND | | |

| | Schedule of Investments |

| | | April 30, 2004 |

Shares | | Market Value | % of Assets |

| | | | |

Common Stock 85.13% | | | |

Accident & Health Insurance | | | |

1,200 | PartnerRe Ltd. | $68,760 | 1.04% |

| | | | |

Aircraft & Parts | | | |

1,200 | Textron, Inc. | 66,216 | 1.00% |

| | | |

Automatic Controls For Regulating Residential & Commercial | | | |

4,408 | Honeywell International, Inc. | 152,429 | 2.31% |

| | | | |

Ball & Roller Bearings | | | |

2,100 | Timken Co. | 46,326 | 0.70% |

| | | |

Biological Products, Except Diagnostic Substances | | | |

400 | Invitrogen Corp.* | 28,944 | 0.44% |

| | | | |

Cable & Other Pay Television Services | | | |

1,900 | Cablevision Systems Corp. Class A * | 41,477 | |

2,929 | Viacom, Inc. Class B | 113,206 | |

| | | 154,683 | 2.34% |

Chemicals & Allied Products | | | |

1,600 | FMC Corp.* | 68,624 | 1.04% |

| | | |

Commercial Physical And Biological Research | | | |

2,400 | Pharmaceutical Product Development, Inc. * | 70,944 | 1.07% |

| | | | |

Computer Integrated Systems Design | | | |

5,000 | Vastera, Inc. * | 19,750 | 0.30% |

| | | |

Eating & Drinking Places | | | |

1,400 | McDonalds Corp. | 38,122 | 0.58% |

| | | | |

Electric Services | | | |

2,800 | Allegheny Energy, Inc. * | 38,584 | |

7,000 | Calpine Corp. * | 30,380 | |

| | | 68,964 | 1.04% |

Electronic Connectors | | | |

12,775 | Tyco International, Inc. | 350,674 | 5.32% |

| | | |

Electronic & Other Electrical Equipment | | | |

800 | General Electric Co. | 23,960 | 0.36% |

| | | | |

Farm Machinery & Equipment | | | |

6,600 | Agco Corp. * | 127,050 | 1.93% |

| | | |

Fire, Marine & Casualty Insurance | | | |

4,550 | Ace Ltd. | 199,472 | |

2,763 | St. Paul Travelers | 112,371 | |

| | 311,843 | 4.73% |

Gas & Other Services Combined | | | |

1,100 | Sempra Energy | 34,925 | 0.53% |

| | | | |

General Industrial Machinery & Equipment | | | |

1,500 | Ingersoll-Rand | 96,825 | 1.47% |

| | | |

Industrial Instruments For Measurement, Display & Control | | | |

600 | Cognex Corp. | 19,116 | 0.29% |

| | | | |

Industrial Trucks, Tractors, Trailers & Stackers | | | |

4,500 | Terex Corp. * | 147,825 | 2.24% |

| | | |

Insurance Agents, Brokers & Service | | | |

1,700 | Marsh & McLennan Cos., Inc. | 76,670 | 1.16% |

| | | | |

Laboratory Analytical Instruments | | | |

800 | Beckman Coulter, Inc. | 44,672 | |

700 | Waters Corporation * | 30,205 | |

| | | 74,877 | 1.13% |

Life Insurance | | | |

1,200 | HCA, Inc. | 48,756 | |

1,743 | Lincoln National Corp. | 78,226 | |

4,100 | Prudential Financial, Inc. | 180,154 | |

| | 307,136 | 4.66% |

Lumber & Other Building Materials Dealers | | | |

3,570 | Lowe's Companies, Inc. | 185,854 | 2.82% |

| | | | |

Measuring and Controlling Devices, NEC | | | |

900 | Thermo Electron Corp. * | 26,280 | 0.40% |

| | | |

Metalworking Machinery & Equipment | | | |

2,424 | SPX Corp. | 107,504 | 1.63% |

| | | | |

Millwood, Veneer, Plywood & Structural Wood Members | | | |

3,136 | Masco Corp. | 87,839 | 1.33% |

| | | |

Miscellaneous Fabricated Metal Products | | | |

2,500 | Shaw Group, Inc. * | 30,000 | 0.45% |

| | | | |

Motor Vehicle Parts & Accessories | | | |

1,600 | Eaton Corporation | 95,008 | 1.44% |

| | | |

Motion Picture & Video Tape Production | | | |

27,159 | Liberty Media Corp. Class A* | 297,119 | |

9,800 | Time Warner, Inc. * | 164,836 | |

| | 461,955 | 7.00% |

National Commercial Banks | | | |

2,055 | Bank Of America Corp. | 165,407 | |

4,360 | Citigroup, Inc. | 209,672 | |

| | 375,079 | 5.69% |

Natural Gas Transmission | | | |

12,100 | Williams Cos., Inc. | 124,630 | 1.89% |

| | | | |

Orthopedic, Prosthetic, & Surgical Appliances& Supplies | | | |

1,100 | Edwards Lifesciences Corp. * | 37,906 | 0.57% |

| | | |

Paper Mills | | | |

9,000 | Abitibi Consolidated, Inc. | 63,000 | 0.96% |

| | | | |

Paperboard Containers & Boxes | | | |

1,500 | Packaging Corp. of America | 32,970 | 0.50% |

| | | |

Paperboard Mills | | | |

7,361 | Smurfit-Stone Container Corp.* | 126,536 | 1.92% |

| | | | |

Petroleum Refining | | | |

2,275 | Premcor, Inc. * | 78,328 | 1.19% |

| | | |

Pharmaceutical Preparations | | | |

1,900 | Abbott Laboratories | 83,638 | |

3,000 | Bristol Myers Squibb Co. | 75,300 | |

700 | Cephalon, Inc. * | 39,837 | |

700 | Johnson & Johnson | 37,821 | |

2,700 | Pfizer, Inc. | 96,552 | |

1,600 | Schering-Plough Corp. | 26,768 | |

500 | Watson Pharmaceuticals, Inc. * | 17,805 | |

2,715 | Wyeth | 103,360 | |

| | 481,081 | 7.29% |

Plastics Material Synthetic Resins, & Nonvulcanizable Elastics | | | |

13,000 | PolyOne Corp. * | 88,920 | 1.35% |

| | | | |

Plastics, Foil, & Coated Paper Bags | | | |

1,800 | Pactiv Corp. * | 41,310 | 0.63% |

| | | |

Prepackaged Software | | | |

1,100 | Synopsys Corp. * | 29,403 | 0.45% |

| | | | |

Primary Smelting & Refining Of Nonferrous Metals | | | |

2,000 | Inco Ltd. * | 57,500 | 0.87% |

| | | |

Printed Circuit Boards | | | |

698 | Flextronics International Ltd. * | 11,217 | 0.17% |

| | | | |

Radio & Television Broadcasting & Communication Equipment | | | |

2,700 | Nokia Corp. ADR | 37,827 | 0.57% |

| | | |

Railroads, Line-Haul Operating | | | |

1,025 | Kansas City Southern Industries, Inc. * | 14,196 | 0.22% |

| | | | |

Real Estate Agents & Managers | | | |

7,400 | Cendant Corp. | 175,232 | 2.66% |

| | | |

Real Estate Investment Trusts | | | |

13,000 | Meristar Hospitality Corp. * | 75,400 | |

2,345 | Mills Corporation | 95,207 | |

| | 170,607 | 2.59% |

Retail-Home Furniture, Furnishings & Equipment Stores | | | |

1,500 | Pier 1 Imports, Inc. | 30,990 | 0.47% |

| | | | |

Rolling Drawing & Extruding Of Nonferrous Metals | | | |

2,500 | Commonwealth Industries, Inc. * | 19,750 | 0.30% |

| | | |

Search, Detection, Navigation, Guidance & Aeronautical | | | |

500 | ESCO Technologies, Inc. * | 24,150 | 0.37% |

| | | | |

Semiconductors & Related Devices | | | |

1,800 | MEMC Electronic Materials, Inc. * | 14,346 | 0.22% |

| | | |

Soap, Detergent, Cleaning Preparations, Perfumes, Cosmetics | | | |

400 | Procter & Gamble Co. | 42,300 | 0.64% |

| | | | |

Telephone Communications, Except Radiotelephone | | | |

1,200 | Century Tel, Inc. | 34,656 | |

7,400 | Qwest Communications Intl, Inc. * | 29,748 | |

| | | 64,404 | 0.98% |

Water Transportation | | | |

3,025 | CP Ships Ltd. | 47,039 | 0.71% |

| | | |

Whole Sale Paper & Paper Products | | | |

2,300 | Boise Cascade Corp. | 77,580 | 1.18% |

| | | | |

| Total Common Stock (Cost $4,463,263) | 5,615,404 | 85.13% |

| | | | |

Preferred Stock 1.21% | | | |

3,500 | Equity Securities Trust I 6.5% Convertible | 79,834 | 1.21% |

| | | |

| | Total Preferred Stock (Cost $80,960) | 79,834 | 1.21% |

| | | |

Money Market Funds 13.81% | | | |

911,135 | First American Treasury Obligation Fund .26% (Cost $911,135) | 911,135 | 13.81% |

| | | | |

| Total Investments (Cost $5,455,358) | 6,606,373 | 100.16% |

| | | | |

| Liabilities in excess of other Assets | (10,360) | (0.16%) |

| | | | |

| NET ASSETS - 100.00% | $6,596,013 | 100.00% |

The accompanying notes are an integral part of the financial statements.

| | |

CROFT-LEOMINSTER VALUE FUND |

Statement of Assets and Liabilities |

April 30, 2004 |

| | |

| | |

| | |

Assets: | |

Investment Securities at Market Value | $ 6,606,373 |

(Identified Cost $5,455,358) | |

Receivables: | |

Dividends and Interest | 9,762 |

Prepaid Expenses | 1,630 |

Total Assets | 6,617,765 |

Liabilities: | |

Accrued Expenses | 18,836 |

Accrued Management Fees | 2,916 |

Total Liabilities | 21,752 |

Net Assets | $ 6,596,013 |

| |

Net Assets Consist of: | |

Paid In Capital | 5,245,919 |

Accumulated Undistributed Realized Gain (Loss) on Investments - Net | 199,079 |

Unrealized Appreciation/(Depreciation) in Value | |

of Investments Based on Identified Cost - Net | 1,151,015 |

Net Assets for 374,380 Shares Outstanding | |

(30,000,000 shares authorized, $.001 par value for Croft Funds Corporation, | |

which includes Croft-Leominster Value Fund and Croft-Leominster | |

Income Fund) | $ 6,596,013 |

| |

Net Asset Value, Offering price and Redemption Price Per Share | $ 17.62 |

($6,596,013/374,380 shares) | |

The accompanying notes are an integral part of the financial statements.

| |

CROFT-LEOMINSTER VALUE FUND |

Statement of Operations |

| | |

| | |

| | For the Year |

| | Ended |

| | 4/30/2004 |

Investment Income: | |

Dividends | $ 81,079 |

Interest | 4,000 |

Total Investment Income | 85,079 |

Expenses: | |

Advisory fees (Note 3) | 57,837 |

Transfer agent fees & accounting | 26,549 |

Legal fees | 13,146 |

Audit fees | 10,510 |

Custody fees | 5,095 |

Insurance expense | 5,014 |

Registration fees | 3,514 |

Trustee fees | 1,500 |

Printing and postage expense | 1,106 |

Other | 1,601 |

Total Expenses | 125,872 |

Less: | |

Advisory fee waiver (Note 3) | (33,580) |

Net Expenses | 92,292 |

Net Investment Income / (Loss) | (7,213) |

| |

Realized and Unrealized Gain (Loss) on Investments: | |

Realized Gain (Loss) on Investments | 603,034 |

Change in Unrealized Appreciation (Depreciation) on Investments | 773,191 |

Net Realized and Unrealized Gain (Loss) on Investments | 1,376,225 |

| | |

Net Increase (Decrease) in Net Assets from Operations | $ 1,369,012 |

The accompanying notes are an integral part of the financial statements.

| | |

CROFT-LEOMINSTER VALUE FUND | | |

Statements of Changes in Net Assets |

| | | |

| | For the year | For the year |

| | ended | ended |

| | April 30, 2004 | April 30, 2003 |

Operations: | | |

Net investment income (loss) | (7,213) | 7,797 |

Net realized gain (loss) on investment transactions | 603,034 | (397,735) |

Change in Net unrealized appreciation (depreciation) on investments | 773,191 | (661,168) |

Net increase (decrease) in net assets resulting from operations | 1,369,012 | (1,051,106) |

Distributions to Shareholders From: | | |

Net investment income | (7,696) | 0 |

Net realized gains | 0 | (4,788) |

Net Change in Net Assets from Distributions | (7,696) | (4,788) |

Capital Share Transactions: | | |

Proceeds From Sale of Shares | 406,887 | 853,693 |

Shares Issued on Reinvestment of Dividends | 7,294 | 4,604 |

Cost of Shares Redeemed | (457,631) | (251,497) |

Net Increase (Decrease) from Shareholder Activity | (43,450) | 606,800 |

| | |

Net Assets: | | |

Net increase (decrease) in net assets | 1,317,866 | (449,094) |

Beginning of year | 5,278,147 | 5,727,241 |

End of year ( including accumulated undistributed net investment income of $0 and $7,797, respectively) | $ 6,596,013 | $ 5,278,147 |

| | | |

Share Transactions: | | |

Shares sold | 24,120 | 64,943 |

Shares issued on reinvestment of dividends | 409 | 352 |

Shares redeemed | (28,674) | (18,750) |

Net increase (decrease) in shares | (4,145) | 46,545 |

Outstanding at beginning of period | 378,525 | 331,980 |

Outstanding at end of period | 374,380 | 378,525 |

The accompanying notes are an integral part of the financial statements.

CROFT-LEOMINSTER VALUE FUND | | | | | |

| | | | | Financial Highlights |

| | | | | | April 30, 2004 |

| | | Selected data for a share outstanding throughout the period. |

| | | | | | |

| | For the Year | For the Year | For the Year | For the Year | For the Year |

| | Ended | Ended | Ended | Ended | Ended |

| | April 30, 2004 | April 30, 2003 | April 30, 2002 | April 30, 2001 | April 30, 2000 |

| | | | | | |

Net Asset Value at Beginning of Period | $ 13.94 | $ 17.25 | $ 18.64 | $ 16.57 | $ 16.65 |

Net Investment Income/ (Loss) | (0.02) | 0.02 | (0.04) | 0.05 | (0.08) |

Net Gains or Losses on Securities (Realized and Unrealized) | 3.72 | (3.32) | (1.07) | 2.04 | 0.00 |

Total from Investment Operations | 3.70 | (3.30) | (1.11) | 2.09 | (0.08) |

| | | | | |

Distributions (From Net Investment Income) | (0.02) | 0.00 | (0.03) | (0.02) | 0.00 |

Distributions (From Capital Gains) | 0.00 | (0.01) | (0.25) | 0.00 | 0.00 |

Total Distributions | (0.02) | (0.01) | (0.28) | (0.02) | 0.00 |

| | | | | |

Net Asset Value at End of Period | $ 17.62 | $ 13.94 | $ 17.25 | $ 18.64 | $ 16.57 |

| | | | | |

Total Return (a) | 26.55 % | (19.11)% | (6.05)% | 12.61 % | (0.48)% |

| | | | | |

Ratios/Supplemental Data: | | | | | |

Net Assets at End of Period (Thousands) | $ 6,596 | $ 5,278 | $ 5,727 | $ 5,438 | $ 4,864 |

Ratio of Expenses to Average Net Assets before waivers and reimbursement | 2.05 % | 2.37 % | 2.23 % | 2.46 % | 2.47 % |

Ratio of Net Investment Income to Average Net Assets before waivers and reimbursement | (0.66)% | (0.71)% | (0.92)% | (0.74)% | (1.01)% |

Ratio of Expenses to Average Net Assets after waivers and reimbursement | 1.50 % | 1.50 % | 1.50 % | 1.44 % | 1.50 % |

Ratio of Net Investment Income to Average Net Assets after waivers and reimbursement | (0.12)% | 0.16 % | (0.22)% | 0.28 % | (0.49)% |

Portfolio Turnover Rate | 46.42 % | 54.64 % | 47.79 % | 54.57 % | 55.66 % |

| | | | | |

(a) Total return in the above table represents the rate that the investor would | | | | | |

have earned or lost on an investment in the Fund assuming reinvestment. | | | | | |

The accompanying notes are an integral part of the financial statements.

CROFT FUNDS CORPORATION

CROFT-LEOMINSTER VALUE FUND

NOTES TO FINANCIAL STATEMENTS

APRIL 30, 2004

Note 1. Organization

The Croft-Leominster Value Fund (the “Fund”), a managed portfolio of the Croft Funds Corporation (the “Corporation”), is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management company. The Fund is one of a series of Funds of the Corporation, which also includes the Croft-Leominster Income Fund. The Fund’s investment objective is to seek growth of capital. It invests primarily in common stocks of established mid-sized to large size companies believed by the Advisor to be undervalued and have good prospects for capital appreciation.

Note 2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation: The Fund’s portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price. If there are no sales reported, as in the case of certain securities traded over-the-counter, the Fund’s portfolio securities will be valued by using the last reported bid price. Many debt securities, including U.S. Government Securities, are traded in the over-the-counter market. Obligations having maturities of 60 days or less are valued at amortized cost. Certain securities and assets of the Fund may be valued at fair value as determined in good faith by the Board of Directors or by persons acting at their direction in accordance with guidelines established by the Board of Directors. The fair value of any restricted securities from time to time held by the Fund is determined by the Manager according to procedures approved by th e Board of Directors. Such valuations and procedures are reviewed periodically by the Board of Directors. The fair value of these securities is generally determined as the amount which the Fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time.

Federal Income Taxes: The Fund intends to comply with requirements of Sub-Chapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its net investment income as dividends to its shareholders. The Fund intends to distribute its net long-term capital gains and its net short-term capital gains at least once a year. Therefore no provision for income taxes is required.

Distributions to Shareholders: Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on ex-dividend date.

Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclose contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Other: The Fund follows industry practice and records security transactions on the trade date. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as information is available to the Fund. Interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the life of the Fund. Interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the life of the respective securities. Accounting principles generally accepted in the United States require that permanent financial reporting differences relating to shareholder distributions be reclassified to net realized short term gains or paid-in-capital. For th e year ended April 30, 2004, net investment loss in the amount of $7,213 was reclassified to net realized short term gains. This reclassification had no affect on net assets.

Note 3. Investment Advisory Fee and Other Transactions with Affiliates

The Fund retains Croft-Leominster Inc. (the “Advisor”) as its Investment Advisor. Under the terms of the management agreement, subject to such policies as the Directors of the Corporation may determine, the Advisor, at its expense, will continuously furnish an investment program for the Fund and will make investment decisions on behalf of the Fund and place all orders for the purchase and sale of portfolio securities subject always to applicable investment objectives, policies and restrictions. Pursuant to the management agreement and subject to the general oversight of the Directors, the Advisor also manages, supervises and conducts the other affairs and business of the Fund, furnishes office space and equipment, provides bookkeeping and certain clerical services and pays all fees and expenses of the officers of the Fund. For its services as Advisor, the Fund pays a fee, computed daily and payable monthly at the annual rate of 0.94% of the Fund’s average daily net asset value. For the year ended April 30, 2004, the Advisor earned $57,837. Through the year ended April 30, 2004, the Advisor has contractually agreed to waive management fees or reimburse expenses to the Fund to limit the overall expense ratio to 1.50% (excluding ordinary brokerage commissions and extraordinary expenses) of the Fund’s average net assets. For the year ended April 30, 2004, the Advisor waived $33,580 of the advisory fee. At April 30, 2004, a payable was due to the Advisor in the amount of $2,916 (net of waivers).

Pursuant to a plan of Distribution, the Fund pays a distribution fee of up to .25% of the average daily net assets to broker-dealers for distribution assistance, and to financial institutions and intermediaries such as banks, savings and loan associations, insurance companies and investment counselors as compensation for services rendered or expenses incurred in connection with distribution assistance. The Corporation elected to suspend the 12b-1 fee on May 1, 1999. The 12b-1 fee will be suspended into the foreseeable future; however, the Corporation reserves the right to terminate the suspension and reinstate the 12b-1 fee at any time in its sole discretion.

Certain Directors and officers of the Corporation are also officers and owners of the Advisor. Each “non-interested” Director is entitled to receive an annual fee of $500 plus expenses for services relating to the Corporation.

Note 4. Capital Share Transactions

At April 30, 2004, there were 30,000,000, $0.001 par value shares of capital stock authorized for the Croft Funds Corporation (which includes the Croft-Leominster Value Fund and the Croft-Leominster Income Fund), and paid-in capital amounted to $5,245,919 for the Fund.

Note 5. Investments

For the year ended April 30, 2004, the cost of purchases and the proceeds from sales, other than U.S. Government Securities and short-term securities, aggregated $2,677,546 and $3,267,576, respectively. Purchases and sales of U.S. Government Securities aggregated $0 and $0, respectively. As of April 30, 2004, the gross unrealized appreciation for all securities totaled $1,334,564 and the gross unrealized depreciation for all securities totaled $188,974, for a net unrealized appreciation of $1,145,590 on a tax basis. The aggregate cost of securities for federal income tax purposes at April 30, 2004 was $5,460,783. The difference between book cost and tax cost consists of wash sales in the amount of $5,425.

Note 6. Distributions to Shareholders

On December 31, 2003, the Fund paid a distribution of $0.02 per share from ordinary income.

The tax character of distributions paid during the fiscal years ended April 30, 2004 and 2003 were as follows:

Distributions paid from: | 2004 | 2003 |

Ordinary Income | $ 7,696 | - |

Short-Term Capital Gain | - | - |

Long-Term Capital Gain | - | 4,788 |

| $ 7,696 | $ 4,788 |

As of April 30, 2004 the components of distributable earnings/ (accumulated losses) on a tax basis were as follows:

Undistributed long-term capital gain/ (accumulated losses) | $ 204,504 |

Unrealized appreciation/ (depreciation) | 1,145,590 |

| $ 1,350,094 |

The difference between book basis and tax-basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales.

Note 7. Change In Accountants

On January 23, 2004, McCurdy & Associates CPA’s, Inc. (“McCurdy”) notified the Fund of its intention to resign as the Fund’s independent auditors upon selection of replacement auditors.

On March 9, 2004 the Fund’s Audit Committee and Board of Directors selected Cohen McCurdy, Ltd. (“Cohen”) to replace McCurdy as the Fund’s auditors for the fiscal year ending April 30, 2004, to be effective upon resignation of McCurdy.

On March 12, 2004, upon receipt of notice that Cohen was selected as the Fund’s auditor, McCurdy, whose audit practice was acquired by Cohen, resigned as independent auditors to the Fund. McCurdy’s report on the Croft Value Fund’s financial statements for the fiscal year ended April 30, 2003 contained no adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years stated above, there were no disagreements with McCurdy on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which if not resolved to the satisfaction of McCurdy would have caused the Advisor to make reference to the subject matter of the disagreements in connection with its reports on the Fund’s financial statements for such periods.

Neither the Fund nor anyone on its behalf consulted with Cohen on items which (i) concerned the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements or (ii) concerned the subject of disagreement (as defined in paragraph (a) (1) (iv) of Item 304 of Regulation S-K) or a reportable event (as described in paragraph (a) (1) (v) of said Item 304).

Information Regarding Directors and Officers

The Board of Directors supervises the business activities of the Corporation. Each Director serves as a Director until the termination of the Director unless the Director dies, resigns, retires or is removed.

The following table provides information regarding each Director who is not an “interested person” of the Corporation, as defined in the Investment Company Act of 1940.

Name, Age and Address | Principal Occupation(s) During last five years and Position held with Corporation | Number of Portfolios overseen by Director | Other Directorships held by Director or Officer | Length of Time Served |

Kent G. Croft, (02/26/63), 1317 Walnut Hill Lane Ruxton MD,

21204 | Director, President, and Secretary of the Corporation, President, Croft-Leominster, Inc. since 1989. | 2 | Croft-Leominster Inc., Wildfowl Trust of North America, St. Paul’s School | 8years |

George D. Edwards, II (10/22/37), 1016 Rolandvue

Baltimore MD, 21204 | George D. Edwards, II (10/22/37), Chairman of the Board, Partner of the Omega Organization Inc. since 1995. President and Chief Executive Officer, Hottman Edwards Advertising, Inc. (advertising agency), 1971-1995. | 2 | None | 8 years |

Frederick S. Billig (02/28/33), 15020 Rolling Hills Drive Glenwood MD,

21738 | Director of the Corporation. Chief Scientist and Associate Supervisor, John Hopkins University Applied Physics Lab since 1987; President, Pyrodyne, Inc. since 1977. | 2 | None | 8 years |

L. Gordon Croft (10/27/32), 7503 Club Road

Ruxton MD, 21204 | Vice President of the Corporation. Vice President, Chief Investment Officer and Director of Croft-Leominster, Inc. since 1989. | 2 | Croft-Leominster Inc. | 8 years |

Charles Jay McLaughlin 09/20/62), 28320 St. Michaels Road, Easton MD,

21601 | Director of the Corporation. Vice President Retail Sales, Orion Safety Products as of January 1, 1998. Vice President Marine Division, Orion Safety Products (1996-1998). Attorney, Oppenheimer Wolff & Donnelly (law firm, 1989-1995). | 2 | Orion Safety Products | 4 years |

The Statement of Additional Information includes additional information about the Directors and is available without charge upon request, by calling toll free at 1-800-551-0990.

![[croftncsr0704amended004.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended004.jpg)

1-800-746-3322

This report is provided for the general information of the shareholders of the Croft-Leominster Value Fund. This report is not intended for distribution to prospective investors in the funds, unless preceded or accompanied by an effective prospectus.

![[croftncsr0704amended006.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended006.jpg)

Croft-Leominster

Income Fund

ANNUAL REPORT

April 30, 2004

June 25, 2004

Dear Shareholder:

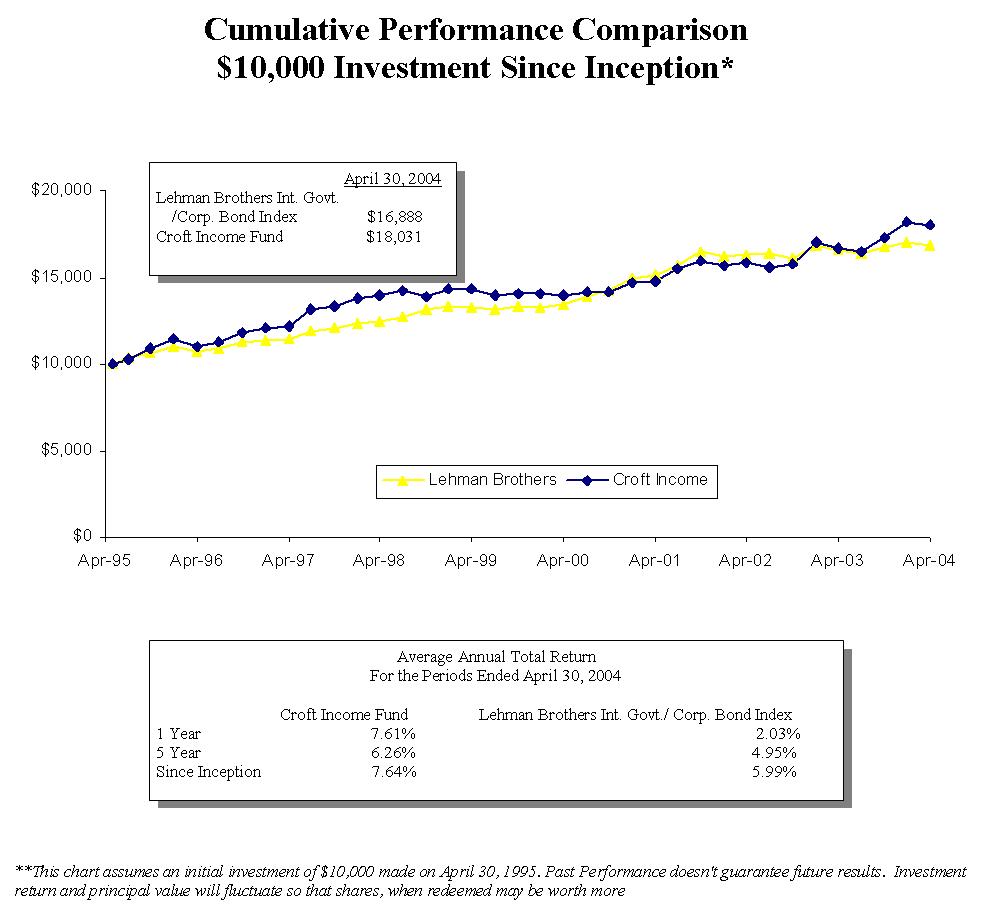

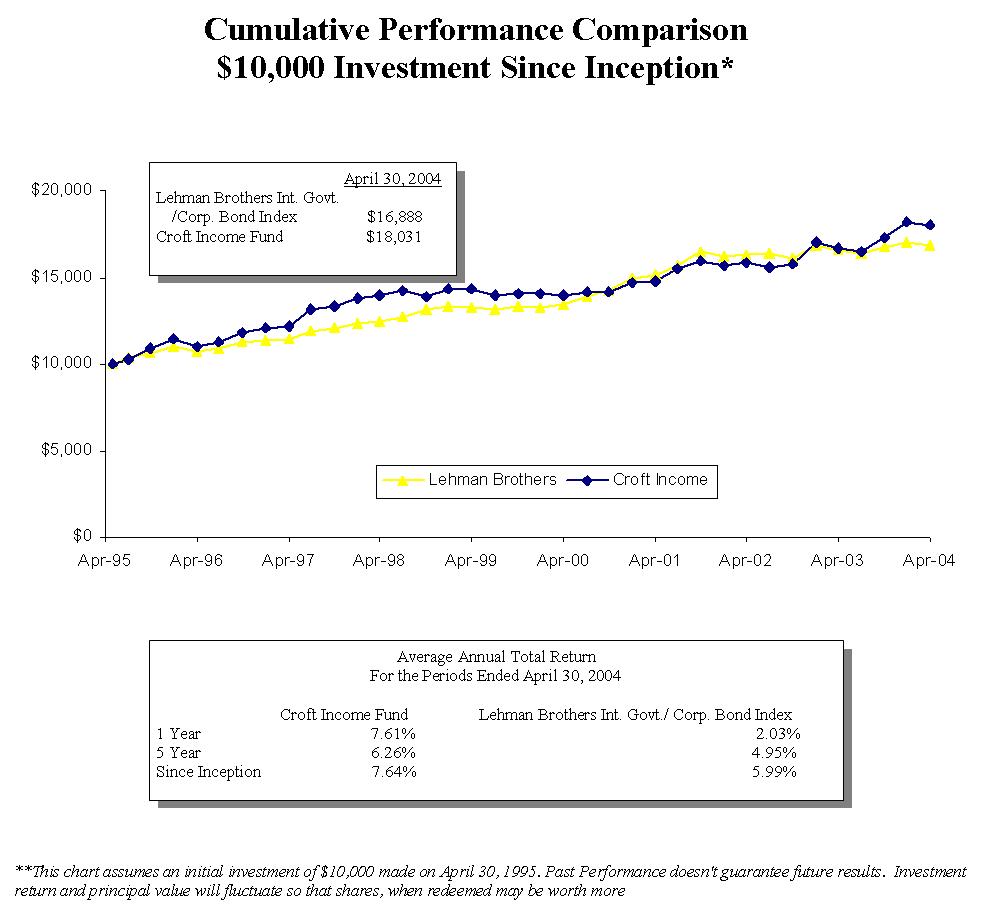

This calendar year through 6/25/04, your Income Fund has increased +0.1%, vs. a decline of -0.3% for the Lehman Government and Corporate Index and a decline of –1.0% for the Salomon Brothers High Grade Corporate Index. For the fiscal year ended 4/30/04, the Income Fund increased +7.61% vs. an increase of +2.0% for the Lehman Government and Corporate Index and an increase of +0.2% for the Salomon Brothers High Grade Corporate Index. The Fund’s net current yield is approximately 4.4%.

The Federal Reserve is widely expected to raise Fed Funds rate at its upcoming meeting in late June. Recent increases in commodities prices as well as significantly improved employment data have added credence to this view. We expect this move will mark the start of a gradual unwinding of the strong monetary stimulus that, until now, has resulted in the lowest Fed Funds rate in 47 years. In anticipation of this challenging environment, we have taken action to lower the duration and shorten the maturity of the Fund. Currently, the Fund has a position of approximately 38% in short, high-quality issues such as U.S. Treasury Notes and high-grade commercial paper. While this action has led to a decline in the Income Fund’s current yield, we believe it is a necessary hedge against the downside risk of rising interest rates. We plan to increase the Fund’s current yield during the next cou ple of years as the interest rate environment evolves.

As of June 1st, 2004 the Income Fund had the following characteristics:

weighted yield to maturity of 5.3%, weighted average duration (measure of sensitivity to interest rates) of 4.5 years, and weighted average maturity of 8.4 years. We continue to manage our credit risk through industry diversification and individual company analysis. We hold 56 corporate bond issues in 26 different industries. Additionally, 70.4% of the Income Fund’s assets are investment grade rated or better.

Thank you for your investment in the Croft-Leominster Income Fund.

With kindest regards,

Sincerely,

/s/Kent Croft

President

| | |

CROFT-LEOMINSTER INCOME FUND | |

| | Schedule of Investments |

| | April 30, 2004 |

| | | |

Shares/Principal Value | | Market Value |

| | | |

CLOSED END MUTUAL FUNDS - 2.87% | | |

Taxable Bond Funds - 2.87% | | |

6,200 | Alliance World Dollar Gov't Fund II | $ 68,510 |

4,500 | Salomon Brothers Worldwide Income Fund | 63,135 |

9,600 | Templeton Emerging Markets Income Fund | 110,880 |

| | | 242,525 |

| | |

Total Closed End Mutual Funds (Cost $227,526) | | $ 242,525 |

| | |

CORPORATE BONDS AND NOTES - 58.25% | | |

| | |

Cable TV & Cellular Telephone - 3.64% | | |

185,000 | CF Cable TV Inc. Senior Secured Notes, 9.125%, 7/15/07 | 192,456 |

100,000 | Tele-Communications, Inc. Senior Debentures, 7.875%, 8/1/13 | 115,400 |

| | 307,856 |

Chemicals - 7.29% | | |

65,000 | ARCO Chemical Co. Debentures, 10.250%, 11/1/10 | 66,625 |

150,000 | ARCO Chemical Co. Debentures, 9.800%, 2/1/20 | 149,250 |

75,000 | Agrium, Inc. Debentures (Yankee), 7.800%, 2/1/27 | 85,687 |

100,000 | Hanna (M.A.) Co. Notes 6.580%, 2/23/11 | 80,500 |

70,000 | IMC Global, Inc. Senior Notes, 11.250%, 6/1/11 | 81,200 |

30,000 | IMC Global, Inc. Senior Debentures, 9.450%, 12/15/11 | 32,250 |

30,000 | IMC Global, Inc. Debentures, 6.875%, 7/15/07 | 31,200 |

99,000 | Millennium American, Inc. Senior Unsecured Debentures, 7.625%, 11/15/26 | 89,100 |

| | 615,812 |

Containers & Paper - 2.54% | | |

150,000 | Abitibi-Consolidated, Inc. Debentures, 7.400%, 4/1/18 | 143,115 |

45,000 | Abitibi-Consolidated, Inc. Debentures, 7.500%, 4/1/28 | 40,721 |

30,000 | Abitibi-Consolidated, Inc. Debentures, 8.850%, 8/1/30 | 30,510 |

| | | 214,346 |

Electric & Gas Utilities - 1.79% | | |

67,000 | El Paso Corp. Senior Notes, 7.000%, 5/15/11 | 56,950 |

90,000 | Kansas Gas & Electric, 1st Mortgage, 6.500% 8/1/05 | 94,050 |

| | | 151,000 |

Electronic Instruments and Controls - 2.56% | | |

40,000 | Arrow Electronics, Inc. Senior Debentures, 6.875%, 6/1/18 | 40,340 |

60,000 | Arrow Electronics, Inc. Debentures, 7.500%, 1/15/27 | 61,110 |

100,000 | Avnet Inc. Notes, 9.750%, 2/15/08 | 115,000 |

| | 216,450 |

Energy and Energy Services - 0.83% | | |

65,000 | Global Marine, Inc., Notes, 7.000%, 6/1/28 | 70,343 |

| | | |

Environmental Service/Pollution Control - 0.68% | | |

50,000 | Waste Management, Inc. Debentures, 7.650%, 3/15/11 | 57,580 |

| | |

Financial Services - 7.30% | | |

100,000 | American Financial Group, Inc. Senior Debentures, 7.125%, 4/15/09 | 108,710 |

100,000 | Capital One Bank Senior Bank Notes, 8.250%, 6/15/05 | 106,350 |

53,000 | Capital One Bank Medium-Term Notes, 6.875%, 2/1/06 | 56,503 |

60,000 | CIGNA Corp. Debentures, 7.875%, 5/15/27 | 69,198 |

50,000 | CSC Holdings, Inc. Senior Notes, 7.875%, 12/15/07 | 53,250 |

105,000 | Lincoln National Corp. Debentures, 9.125%, 10/1/24 | 112,287 |

85,000 | Nationwide Mutual Insurance Surplus Notes, 7.500%, 2/15/24 | 87,780 |

20,000 | Washington Mutual Cap Company Guarantee, 8.375%, 6/1/27 | 22,668 |

| | 616,746 |

Food and Drug Producers - 0.95% | | |

80,000 | Borden, Inc. Sinking Fund Debentures, 9.250%, 6/15/19 | 80,400 |

| | | |

Gas & Gas Transmission - 1.27% | | |

100,000 | KN Energy, Inc. Senior Debentures , 7.250%, 3/1/28 | 107,590 |

| | |

Home Lawn & Garden Equipment - 1.27% | | |

100,000 | Toro Company Debentures, 7.800%, 6/15/27 | 107,760 |

| | | |

Hotels & Motels - 3.97% | | |

80,000 | Cendant Corp. Notes, 6.875%, 8/15/06 | 86,688 |

250,000 | ITT Corp. (New) Debentures , 7.750%, 11/15/25 | 248,750 |

| | | 335,438 |

Industrial Goods - 2.14% | | |

75,000 | Cummins Engine Company, Inc. Debentures, 6.750%, 2/15/27 | 77,625 |

50,000 | Tyco International Group, SA Company Guarantee, 5.800%, 8/1/06 | 52,455 |

50,000 | Tyco International Group, SA Company Guarantee, 6.875%, 1/15/29 | 50,440 |

| | 180,520 |

Media & Entertainment - 5.10% | | |

345,000 | Time Warner, Inc. Debentures, 9.150%, 2/1/23 | 430,871 |

| | | |

Heavy Construction other than Building Construction - 1.21% | | |

100,000 | Fluor Corp. Notes, 6.9500%, 3/1/07 | 102,500 |

| | |

Miscellaneous Consumer Goods & Services - 1.45% | | |

100,000 | Tenneco Packaging, Inc. Debentures, 8.125% 6/15/17 | 122,160 |

| | | |

Motor Vehicle Parts & Accessories - 0.45% | | |

40,000 | Dana Corp. Notes, 7.00%, 3/15/28 | 38,400 |

| | |

Paper & Paper Products - 2.53% | | |

100,000 | Boise Cascade Corp. Debentures, 7.350%, 2/1/16 | 101,950 |

100,000 | Bowater, Inc. Debentures, 9.375%, 12/15/21 | 112,000 |

| | 213,950 |

| | | |

Pipelines - 1.83% | | |

25,000 | Sonat Inc. Notes, 6.875%, 6/1/05 | 25,000 |

150,000 | Sonat Inc. Notes, 7.625%, 7/15/11 | 129,750 |

| | | 154,750 |

| | |

Printing & Publishing - 2.24% | | |

165,000 | News America Holdings, Inc. Senior Debentures, 7.750%, 2/1/24 | 188,892 |

| | | |

Retail Stores - 0.63% | | |

55,000 | Albertson's Medium-Term, Inc. Notes, 6.520%, 4/10/28 | 53,003 |

| | |

Semiconductors - 0.41% | | |

30,000 | Flextronics Intl., Ltd. Senior Subordinated Notes, 9.875%, 7/1/10 | 34,650 |

| | | |

Telephones & Communications - 4.02% | | |

186,000 | Liberty Media Senior Debentures 8.250%, 2/1/30 | 214,718 |

115,000 | Motorola, Inc. Debentures 6.500%, 11/15/28 | 111,815 |

11,647 | NYNEX Corp. Amortized Debentures, 9.550%, 5/1/10 | 13,412 |

| | 339,945 |

Tires - 0.80% | | |

80,000 | Goodyear Tire & Rubber Co. Notes, 7.857%, 8/15/11 | 67,200 |

| | | |

Wholesale-Computer & Peripheral Equipment & Software - 0.09% | | |

7,000 | IKON Office Solutions, 7.250%, 6/30/08 | 7,463 |

| | |

Steel Works, Blast Furnaces & Rolling Mills - 1.26% | | |

91,000 | U.S. Steel, LLC, Senior Notes 10.750%, 8/1/08 | 106,470 |

| | | |

Total Corporate Bonds and Notes (Cost $4,446,066) | | $ 4,922,095 |

| | | |

CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS - 37.93% | | |

| | | |

Commercial Paper - 15.38% | | |

250,000 | American Express Credit Corp. 1.02%, 5/12/04 | 250,000 |

250,000 | Aigfun Corp. 1.01%, 5/28/04 | 250,000 |

300,000 | General Electric Capital Services Corp., 1.02%, 5/28/04 | 300,000 |

250,000 | General Motors Acceptance Corp., 1.22%, 5/28/04 | 250,000 |

250,000 | Sears Roebuck Acceptance Corp., 1.06%, 5/11/04 | 250,000 |

| | 1,300,000 |

| | | |

U.S. Government Obligations - 17.81% | | |

1,000,000 | U.S. Treasury Notes, 2.875%, 6/30/04 | 1,003,100 |

500,000 | U.S. Treasury Notes, 1.875%, 8/1/08 | 501,550 |

| | | 1,504,650 |

| | |

Money Market Funds - 4.74% | | |

401,006 | U.S. Bank First American Treasury Obligation, .26% | 401,006 |

| | | |

Total Cash Equivalents And Short-Term Investments (Cost $3,213,662) | | $ 3,205,656 |

| | | |

| | |

TOTAL INVESTMENTS (Cost $7,887,254) 99.05% | | 8,370,276 |

| | |

| | | |

OTHER ASSETS LESS LIABILITIES - 0.95% | | 80,364 |

| | | |

NET ASSETS - 100.00% | | $ 8,450,640 |

| | |

CROFT-LEOMINSTER INCOME FUND | |

Statement of Assets and Liabilities |

| | April 30, 2004 |

| | |

| | |

| | |

Assets: | |

Investment Securities at Market Value | $ 8,370,276 |

(Identified Cost $7,887,254) | |

Cash | 1,069 |

Receivables: | |

Interest and Dividends | 119,924 |

From Advisor | 1,075 |

Prepaid Expenses | 2,533 |

Total Assets | 8,494,877 |

Liabilities: | |

Payables: | |

Shareholder Distributions | 23,801 |

Shareholder Redemptions | 4,000 |

Accrued Expenses | 16,436 |

Total Liabilities | 44,237 |

Net Assets | $ 8,450,640 |

| |

Net Assets Consist of: | |

Paid In Capital | $ 8,670,369 |

Accumulated Undistributed Net Investment Income | 10,192 |

Accumulated Realized Gain (Loss) on Investments - Net | (712,943) |

Unrealized Appreciation/(Depreciation) in Value | |

of Investments Based on Identified Cost - Net | 483,022 |

Net Assets for 835,220 Shares Outstanding | |

(30,000,000 shares authorized, $.001 par value for Croft Funds Corporation which | |

includes Croft-Leominster Value Fund and Croft-Leominster Income Fund) | $ 8,450,640 |

Net Asset Value, Offering Price and Redemption Price Per Share | $ 10.12 |

($8,450,640/835,220 shares) | |

| |

CROFT-LEOMINSTER INCOME FUND | |

Statement of Operations |

| | |

| | |

| | For the year |

| | ended |

| | April 30, 2004 |

Investment Income: | |

Dividends | $ 28,386 |

Interest | 482,320 |

Total Investment Income | 510,706 |

Expenses: | |

Advisory fees (Note 4) | 64,692 |

Transfer agent & Accounting fees | 27,450 |

Audit fees | 10,189 |

Legal fees | 12,146 |

Printing expense | 1,513 |

Custody fees | 5,095 |

Registration fees | 3,514 |

Insurance expense | 5,015 |

Other | 2,977 |

Trustee Fees | 1,476 |

Total Expenses | 134,067 |

| |

Less: Advisory fees waived (Note 4) | (43,990) |

Net Expenses | 90,077 |

| | |

Net Investment Income | 420,629 |

| | |

Realized and Unrealized Gain (Loss) on Investments: | |

Realized Gain (Loss) on Investments | 269,656 |

Change in Unrealized Appreciation (Depreciation) on Investments | (111,989) |

Net Realized and Unrealized Gain (Loss) on Investments | 157,667 |

| |

Net Increase (Decrease) in Net Assets from Operations | $578,296 |

| |

CROFT-LEOMINSTER INCOME FUND | |

Statements of Changes in Net Assets |

| | | |

| | | |

| | For the year | For the year |

| | ended | ended |

| | April 30, 2004 | April 30, 2003 |

Operations: | | |

Net investment income (loss) | $ 420,629 | $ 493,754 |

Net realized gain (loss) on investment transactions | 269,656 | (21,085) |

Change in net unrealized appreciation (depreciation) on investments | (111,989) | 587,528 |

Net increase (decrease) in net assets resulting from operations | 578,296 | 1,060,197 |

Distributions to Shareholders From: | | |

Net investment income | (410,437) | (496,247) |

Return of capital | 0 | 0 |

Net change in net assets from Distributions | (410,437) | (496,247) |

Capital Share Transactions: | | |

Proceeds from sale of shares | 475,969 | 575,263 |

Shares issued on reinvestment of dividends | 303,289 | 376,141 |

Cost of shares redeemed | (654,417) | (1,644,870) |

Net Increase (Decrease) from Shareholder Activity | 124,841 | (693,466) |

| | |

Net Assets: | | |

Net increase (decrease) in net assets | 292,700 | (129,516) |

Beginning of year | 8,157,940 | 8,287,456 |

End of year (Including accumulated undistributed net investment | | |

income of $10,192 and $0, respectively.) | $ 8,450,640 | $ 8,157,940 |

| | |

Share Transactions: | | |

Shares sold | 46,419 | 60,385 |

Shares issued on reinvestment of dividends | 30,403 | 40,433 |

Shares redeemed | (65,494) | (174,513) |

Net increase (decrease) in shares | 11,328 | (73,695) |

Outstanding at beginning of period | 823,892 | 897,587 |

Outstanding at end of period | 835,220 | 823,892 |

| | |

CROFT-LEOMINSTER INCOME FUND | |

| | | | Financial Highlights |

| | | | | April 30, 2004 |

Selected data for a share outstanding throughout the period. |

| | | | | | |

| | Year | Year | Year | Year | Year |

| | Ended | Ended | Ended | Ended | Ended |

| | 4/30/04 | 4/30/03 | 4/30/02 | 4/30/01 | 4/30/00 |

| | | | | | |

Net Asset Value at Beginning of Period | $ 9.90 | $ 9.23 | $ 9.24 | $ 9.43 | $ 10.47 |

Net Investment Income | 0.52 | 0.57 | 0.59 | 0.72 | 0.76 |

Net Gains or Losses on Securities | | | | | |

(Realized and Unrealized) | 0.22 | 0.67 | 0.04 | (0.20) | (1.02) |

Total from Investment Operations | 0.74 | 1.24 | 0.63 | 0.52 | (0.26) |

| | | | | | |

Distributions (From Net Investment Income) | (0.52) | (0.57) | (0.61) | (0.71) | (0.78) |

Distributions (From Capital Gains) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Return of Capital | 0.00 | 0.00 | (0.03) | 0.00 | 0.00 |

Total Distributions | (0.52) | (0.57) | (0.64) | (0.71) | (0.78) |

| | | | | |

Net Asset Value at End of Period | $ 10.12 | $ 9.90 | $ 9.23 | $ 9.24 | $ 9.43 |

| | | | | |

Total Return (a) | 7.61% | 14.04 % | 6.91 % | 5.78 % | (2.40)% |

| | | | | |

Ratios/Supplemental Data: | | | | | |

Net Assets at End of Period (Thousands) | $ 8,451 | $ 8,158 | $ 8,287 | $ 7,679 | $ 8,157 |

Ratio of Expenses to Average | | | | | |

Net Assets before waiver | 1.64 % | 1.72 % | 1.76 % | 1.91 % | 1.79 % |

Ratio of Expenses to Average | | | | | |

Net Assets after waiver | 1.10 % | 1.10 % | 1.10 % | 1.10 % | 1.10 % |

Ratio of Net Investment Income to Average | | | | | |

Net Assets before waiver | 4.61 % | 5.48 % | 5.57 % | 6.92 % | 6.97 % |

Ratio of Net Investment Income to Average | | | | | |

Net Assets after waiver | 5.15 % | 6.11 % | 6.23 % | 7.73 % | 7.66 % |

Portfolio Turnover Rate | 10.15 % | 37.26 % | 23.80 % | 12.33 % | 5.87 % |

| | | | | |

(a) Total return in the above table represents the rate that the investor would | | |

have earned or lost on an investment in the Fund assuming reinvestment. | | |

CROFT-LEOMINSTER INCOME FUND

NOTES TO FINANCIAL STATEMENTS

APRIL 30, 2004

Note 1. Organization

The Croft-Leominster Income Fund (the “Fund”), is a managed portfolio of the Croft Funds Corporation (the “Corporation”) and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management company. The Fund is one of a series of Funds of the Corporation, which also includes the Croft Leominster Value Fund. It was organized in 1994 to succeed to the business of Croft-Leominster Inc.’s Leominster Income Limited Partnership, an investment company organized as a limited partnership which commenced operations January 1, 1992 for the purpose of investing the partners’ capital in securities under professional investment management. This succession occurred on May 4, 1995 when the partnership’s net assets aggregating $3,175,041 were transferred to the Croft-Leominster Income Fund in exchange for 317,504 shares of the Fund’s capital stock. The Croft-Leominster Income Fund seeks a high level of current income with moderate risk of principal by investing primarily in a diversified portfolio of investment grade fixed-income securities.

Note 2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation: The Fund’s portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price. If there are no sales reported, as in the case of certain securities traded over-the-counter, the Fund’s portfolio securities will be valued by using the last reported bid price. Many debt securities, including U.S. Government Securities, are traded in the over-the counter market. Obligations having remaining maturities of 60 days or less are valued at amortized cost.

The amortized cost value of a security is determined by valuing it at cost originally and thereafter amortizing any discount or premium from its face value at a constant rate until maturity, regardless of the effect of fluctuating interest rates on the market value of the instrument. Although the amortized cost method provides certainty in valuation, it may result at times in determinations of value that are higher or lower than the price the Fund would receive if the instruments were sold. Consequently, changes in the market value of such portfolio instruments during periods of rising or falling interest rates will not be reflected in the computation of the Fund’s net assets value.

Certain securities and assets of the Fund may be valued at fair value as determined in good faith by the Board of Directors or by persons acting at their direction in accordance with guidelines established by the Board of Directors. The fair value of any restricted securities from time to time held by the Fund is determined by the Manager according to procedures approved by the Board of Directors. Such valuations and procedures are reviewed periodically by the Board of Directors. The fair value of these securities is generally determined as the amount which the Fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time.

Federal Income Taxes: The Fund intends to comply with requirements of Sub-Chapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its net investment income as dividends to its shareholders. The Fund intends to distribute its net long-term capital gains and its net short-term capital gains at least once a year. Therefore no provision for income taxes is required. Federal income tax loss carryfowards generated in prior years will be used to offset a portion of current year’s net realized gains.

Distributions to Shareholders: Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on ex-dividend date.

Other: The Fund follows industry practice and records security transaction on the trade date. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as information is available to the Fund. Interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the life of the respective securities.

Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Note 3. Restricted Securities

The investment of $85,000 in Nationwide Mutual Insurance Surplus Notes, 7.50%, maturing February 15, 2004 is a private placement. The entire issue was called at 103.27 effective May 5, 2004. The notes were valued at 103.27 at April 30, 2004.

Note 4. Investment Advisory Fee and Other Transactions with Affiliates

The Fund retains Croft-Leominster Inc. (the “Advisor”) as its Investment Advisor. Under the terms of the management agreement, subject to such policies as the Directors of the Corporation may determine, the Advisor, at its expense, will continuously furnish an investment program for the Fund and will make investment decisions on behalf of the Fund and place all orders for the purchase and sale of portfolio securities subject always to applicable investment objectives, policies and restrictions. Pursuant to the management agreement and subject to the general oversight of the Directors, the Advisor also manages, supervises and conducts the other affairs and business of the Fund, furnishes office space and equipment, provides bookkeeping and certain clerical services and pays all fees and expenses of the officers of the Fund. For its services as Advisor, the Fund pays a fee, computed daily and payable monthly at the annual ra te of .79% of the Fund’s average daily net assets. For the year ended April 30, 2004, the Advisor earned $64,692. Through the year ended April 30, 2004, the Advisor has contractually agreed to waive management fees and/or reimburse expenses to the Fund to limit the overall expense ratio to 1.10% (excluding ordinary brokerage commissions and extraordinary expenses) of the Fund’s average net assets. For the fiscal year ended April 30, 2004, the Advisor waived $43,990 of the advisory fee. At April 30, 2004 a receivable in the amount of $1,075 was due to the Fund from the Advisor.

Pursuant to a plan of Distribution, the Fund pays a distribution fee of up to .25% of the average daily net assets to broker-dealers for distribution assistance, and to financial institutions and intermediaries such as banks, savings and loan associations, insurance companies and investment counselors as compensation for services rendered or expenses incurred in connection with distribution assistance. The Corporation elected to suspend the 12b-1 fee for the Fund on August 23, 1995. The 12b-1 fee will be suspended into the foreseeable future; however, the Corporation reserves the right to terminate the waiver and reinstate the 12b-1 fee at any time in its sole discretion.

Certain directors and officers of the Corporation are also officers and owners of the Advisor. Each “non-interested” Director is entitled to receive an annual fee of $500 plus expenses for services related to the Corporation.

Note 5. Capital Share Transactions

At April 30, 2004, there were 30,000,000, $0.001 par value shares of capital stock authorized for the Croft Funds Corporation (which includes the Croft-Leominster Value and the Croft-Leominster Income Fund), and paid-in capital amounted to $8,670,369 for the Fund.

Note 6. Investments

For the year ended April 30, 2004, the cost of purchases and the proceeds from the sales, other than U.S Government securities and short-term securities, aggregated $622,786 and $2,358,884, respectively. Purchases and sales of U.S. Government securities aggregated $1,512,656 and $0, respectively. As of April 30, 2004, the gross unrealized appreciation for all securities totaled $540,450 and the gross unrealized depreciation for all securities totaled $49,014, for a net unrealized appreciation of $491,436 on a tax basis. The aggregate cost of securities for federal income tax purposes at April 30, 2004 was $7,878,840.

Note 7. Distributions to Shareholders

The Fund makes quarterly income distributions. During the fiscal year ended April 30, 2004, distributions of $0.52 aggregating $410,437 were declared from net investment income.

The tax character of distributions paid during the fiscal years ended April 30, 2004 and 2003 were as follows:

Distributions from: | 2004 | 2003 |

Ordinary Income | $410,437 | $496,247 |

Short-Term Capital Gain | 0 | 0 |

Long-Term Capital Gain | 0 | 0 |

| | $410,437 | $496,247 |

| | | |

| | | |

As of April 30, 2004 the components of distributable earnings/ (accumulated losses) on a tax basis were as follows:

Undistributed Ordinary income/ (accumulated losses) | $ 10,192 |

Undistributed Long-term capital gain/ (accumulated losses) | (712,943) |

Unrealized appreciation/ (depreciation) | 491,436 |

| | $(211,315) |

The difference between book basis and tax-basis unrealized appreciation (depreciation) is attributable to the difference in original cost and market value of securities at the time of conversion from a partnership to a regulated investment company on May 4, 1995.

Note 8. Capital Loss Carryforwards

At April 30, 2004, the Fund had available for federal income tax purposes an unused capital loss carryforward of $665,163, of which $504,318 expires in 2009, $139,760 expires in 2010, and $21,085 expires in 2011. Capital loss carryforwards are available to offset future gains. To the extent that these carryforwards are used to offset future capital gains, it is probable that the amount which is offset, will not be distributed to shareholders.

Note 9. Change In Accountants

On January 23, 2004, McCurdy & Associates CPA’s, Inc. (“McCurdy”) notified the Fund of its intention to resign as the Fund’s independent auditors upon selection of replacement auditors. On March 9, 2004 the Fund’s Audit Committee and Board of Directors selected Cohen McCurdy, Ltd. (“Cohen”) to replace McCurdy as the Fund’s auditors for the fiscal year ending April 30, 2004, to be effective upon resignation of McCurdy.

On March 12, 2004, upon receipt of notice that Cohen was selected as the Fund’s auditor, McCurdy, whose audit practice was acquired by Cohen, resigned as independent auditors to the Fund. McCurdy’s report on the Croft Income Fund’s financial statements for the fiscal year ended April 30, 2003 contained no adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal year stated above, there were no disagreements with McCurdy on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which if not resolved to the satisfaction of McCurdy would have caused the Advisor to make reference to the subject matter of the disagreements in connection with its reports on the Fund’s financial statements for such periods.

Neither the Fund nor anyone on its behalf consulted with Cohen on items which (i) concerned the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements or (ii) concerned the subject of disagreement (as defined in paragraph (a) (1) (iv) of Item 304 of Regulation S-K) or a reportable event (as described in paragraph (a) (1) (v) of said Item 304).

Information Regarding Directors and Officers

The Board of Directors supervises the business activities of the Corporation. Each Director serves as a Director until the termination of the Director unless the Director dies, resigns, retires or is removed.

The following table provides information regarding each Director who is not an “interested person” of the Corporation, as defined in the Investment Company Act of 1940.

Name, Age and Address | Principal Occupation(s) During last five years and Position held with Corporation | Number of Portfolios overseen by Director | Other Directorships held by Director or Officer | Length of Time Served |

Kent G. Croft, (02/26/63), 1317 Walnut Hill Lane Ruxton MD,

21204 | Director, President, and Secretary of the Corporation, President, Croft-Leominster, Inc. since 1989. | 2 | Croft-Leominster Inc., Wildfowl Trust of North America, St. Paul’s School | 8years |

George D. Edwards, II (10/22/37), 1016 Rolandvue

Baltimore MD, 21204 | George D. Edwards, II (10/22/37), Chairman of the Board, Partner of the Omega Organization Inc. since 1995. President and Chief Executive Officer, Hottman Edwards Advertising, Inc. (advertising agency), 1971-1995. | 2 | None | 8 years |

Frederick S. Billig (02/28/33), 15020 Rolling Hills Drive Glenwood MD,

21738 | Director of the Corporation. Chief Scientist and Associate Supervisor, John Hopkins University Applied Physics Lab since 1987; President, Pyrodyne, Inc. since 1977. | 2 | None | 8 years |

L. Gordon Croft (10/27/32), 7503 Club Road

Ruxton MD, 21204 | Vice President of the Corporation. Vice President, Chief Investment Officer and Director of Croft-Leominster, Inc. since 1989. | 2 | Croft-Leominster Inc. | 8 years |

Charles Jay McLaughlin 09/20/62), 28320 St. Michaels Road, Easton MD,

21601 | Director of the Corporation. Vice President Retail Sales, Orion Safety Products as of January 1, 1998. Vice President Marine Division, Orion Safety Products (1996-1998). Attorney, Oppenheimer Wolff & Donnelly (law firm, 1989-1995). | 2 | Orion Safety Products | 4 years |

The Statement of Additional Information includes additional information about the Directors and is available without charge upon request, by calling toll free at 1-800-551-0990.

Independent Auditors’ Report

Board of Directors

Croft-Leominster Income Fund

In planning and performing our audit of the financial statements of Croft-Leominster Income Fund (one of the series of the Croft Funds Corporation) for the year ended April 30, 2004, we considered its internal control, including control activities for safeguarding securities, in order to determine our auditing procedures for the purpose of expressing our opinion on the financial statements and to comply with the requirements of Form N-SAR, not to provide assurance on internal control.

The management of the Croft-Leominster Income Fund is responsible for establishing and maintaining internal control. In fulfilling this responsibility, estimates and judgments by management are required to assess the expected benefits and related costs of controls. Generally, controls that are relevant to an audit pertain to the entity’s objective of preparing financial statements for external purposes that are fairly presented in conformity with generally accepted accounting principles. Those controls include the safeguarding of assets against unauthorized acquisition, use or disposition.

Because of inherent limitations in internal control, errors or fraud may occur and not be detected. Also, projection of any evaluation of internal control to future periods is subject to the risk that it may become inadequate because of changes in conditions or that the effectiveness of the design and operation may deteriorate.

Our consideration of internal control would not necessarily disclose all matters in internal control that might be material weaknesses under standards established by the American Institute of Certified Public Accountants. A material weakness is a condition in which the design or operation of one or more of the internal control components does not reduce to a relatively low level the risk that misstatements caused by error or fraud in amounts that would be material in relation to the financial statements being audited may occur and not be detected within a timely period by employees in the normal course of performing their assigned functions. However, we noted no matters involving internal control and its operation, including controls for safeguarding securities, that we consider to be material weaknesses as defined above as of April 30, 2004.

This report is intended solely for the information and use of management and the Board of Directors of the Fund and the Securities and Exchange Commission and is not intended to be and should not be used by anyone other than these specified parties.

/s/Cohen McCurdy, Ltd.

Westlake, Ohio

June 24, 2004

![[croftncsr0704amended008.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended008.jpg)

1-800-746-3322

This report is provided for the general information of the shareholders of the Croft-Leominster Income Fund. This report is not intended for distribution to prospective investors in the funds, unless preceded or accompanied by an effective prospectus.

Item 2. Code of Ethics.

Item 2 refers to the Code of Ethics for Principal Executives and Senior Officers. Even though the SEC as of July 2003, required Code of Ethics for Principal Executives and Senior Officers, this was not adopted at the time of 4/30/04 filing. The Code of Ethics for Principal Executives and Senior Officers was adopted on September 28, 2004, and will be made available in future filings.

Item 3. Audit Committee Financial Expert.

(a)

The registrant’s board of trustees has determined that the registrant does not have an audit committee financial expert. This is because the Board has determined that in view of the nature of the publicly traded stock and cash nature of the holdings and unitary fee approach to expenses taken by the Fund, the financial experience and expertise of the Board members is adequate. This statement was not stated by the July 2003 SEC deadline, but will be stated in all future filings.

Item 4. Principal Accountant Fees and Services.

(a)

Audit Fees

FY 2003

$ 20,482

FY 2004

$ 21,628

(b)

Audit-Related Fees

Registrant

Adviser

FY 2003

$ 2,175

$ 0

FY 2004

$ 715

$ 0

Nature of the fees: Letters and other minor items.

(c)

Tax Fees

Registrant

Adviser

FY 2003

$ 1,610

$ 0

FY 2004

$ 1,780

$ 0

Nature of the fees: Federal and State Tax Returns.

(d)

All Other Fees

Registrant

Adviser

FY 2003

$ 0

$ 0

FY 2004

$ 0

$ 0

(e)

(1)

Audit Committee’s Pre-Approval Policies

Independent Board members pre-approve all work done by the outside auditors before the work is performed. The independent Board members select the independent audit firm at the beginning of the fiscal year and shortly thereafter the proposed work for the fiscal year is presented in writing by the audit firm, approved by the Adviser, and approved by the independent Board members. This will be stated in all future filings.

(2)

Percentages of Services Approved by the Audit Committee

Registrant

Audit-Related Fees:

100%

Tax Fees:

100%

All Other Fees:

N/A

(f)

During audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

(g)

The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant:

Registrant

FY 2003

$ 0

FY 2004

$ 0

(h)

The registrant's audit committee has not considered whether the provision of non-audit services to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant's independence.

Item 5. Audit Committee of Listed Companies. Not applicable.

Item 6. Schedule of Investments.

Not applicable – schedule filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. Not applicable.

Item 8. Purchases of Equity Securities by Closed-End Funds. Not applicable.

Item 9. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant's board of directors.

Item 10. Controls and Procedures.

(a)

Based on an evaluation of the registrant’s disclosure controls and procedures as of July 1, 2004, the disclosure controls and procedures are reasonably designed to ensure that the information required in filings on Forms N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b)

There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal half-year that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 11. Exhibits.

(a)(1)

EX-99.CODE ETH. Not Available.

(a)(2)

EX-99.CERT. Filed herewith.

(a)(3)

Any written solicitation to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable.

(b)

EX-99.906CERT. Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Croft Funds Corporation

By /s/Kent Croft, CEO

*Kent Croft CEO

Date July 9, 2004

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By Kent Croft, CEO

*Kent Croft CEO

Date July 9, 2004

By Carla Reedinger, CFO

*Carla Reedinger, CFO

Date July 9, 2004

* Print the name and title of each signing officer under his or her signature.

![[croftncsr0704amended002.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended002.jpg)

![[croftncsr0704amended004.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended004.jpg)

![[croftncsr0704amended006.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended006.jpg)

![[croftncsr0704amended008.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-04-000366/croftncsr0704amended008.jpg)