Item 2. Code of Ethics.

(a)

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b)

For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

(1)

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

(2)

Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant;

(3)

Compliance with applicable governmental laws, rules, and regulations;

(4)

The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5)

Accountability for adherence to the code.

(c)

Amendments:

During the period covered by the report, there have not been any amendments to the provisions of the code of ethics.

(d)

Waivers:

During the period covered by the report, the registrant has not granted any express or implicit waivers from the provisions of the code of ethics.

For purposes of this paragraph:

(a)

The term "waiver" means the approval by the registrant of a material departure from a provision of the code of ethics; and

(b)

The term "implicit waiver" means the registrant's failure to take action within a reasonable period of time regarding a material departure from a provision of the code of ethics that has been made known to an executive officer, as defined in Rule 3b-7 under the Exchange Act (17 CFR 240.3b-7), of the registrant.

Item 3. Audit Committee Financial Expert.

(a)

The registrant’s board of directors has determined that the registrant does not have an audit committee financial expert. This is because the Board has determined that in view of the nature of the publicly traded stock and cash nature of the holdings and unitary fee approach to expenses taken by the Fund, the financial experience and expertise of the Board members is adequate.

Item 4. Principal Accountant Fees and Services.

(a)

Audit Fees

FY 2005

$ 20,000

FY 2006

$ 21,000

(b)

Audit-Related Fees

Registrant

FY 2005

$ 0

FY 2006

$ 0

Nature of the fees:

N/A

(c)

Tax Fees

Registrant

FY 2005

$ 2,000

FY 2006

$ 2,620

Nature of the fees:

Federal and State Tax Returns. The 2006 amount is an estimate and has not been billed yet.

(d)

All Other Fees

Registrant

FY 2005

$ 1,380

FY 2006

$ 845

Nature of the fees:

Out of pocket expenses and consents. Part of the 2006 amount is an estimate and has not been billed yet.

(e)

(1)

Audit Committee’s Pre-Approval Policies

Independent Board members pre-approve all work done by the outside auditors before the work is performed. The independent Board members select the independent audit firm at the beginning of the fiscal year and shortly thereafter the proposed work for the fiscal year is presented in writing by the audit firm, approved by the Adviser, and approved by the independent Board members.

(2)

Percentages of Services Approved by the Audit Committee

Registrant

Audit-Related Fees:

100 %

Tax Fees:

100 %

All Other Fees:

N/A %

(f)

During audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

(g)

The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant:

Registrant

FY 2005

$ 3,380

FY 2006

$ 3,465

Part of the 2006 amount is an estimate and has not been billed yet.

(h)

The registrant's audit committee has not considered whether the provision of non-audit services to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant's independence. All non audit services were pre-approved by the audit committee.

Item 5. Audit Committee of Listed Companies. Not applicable.

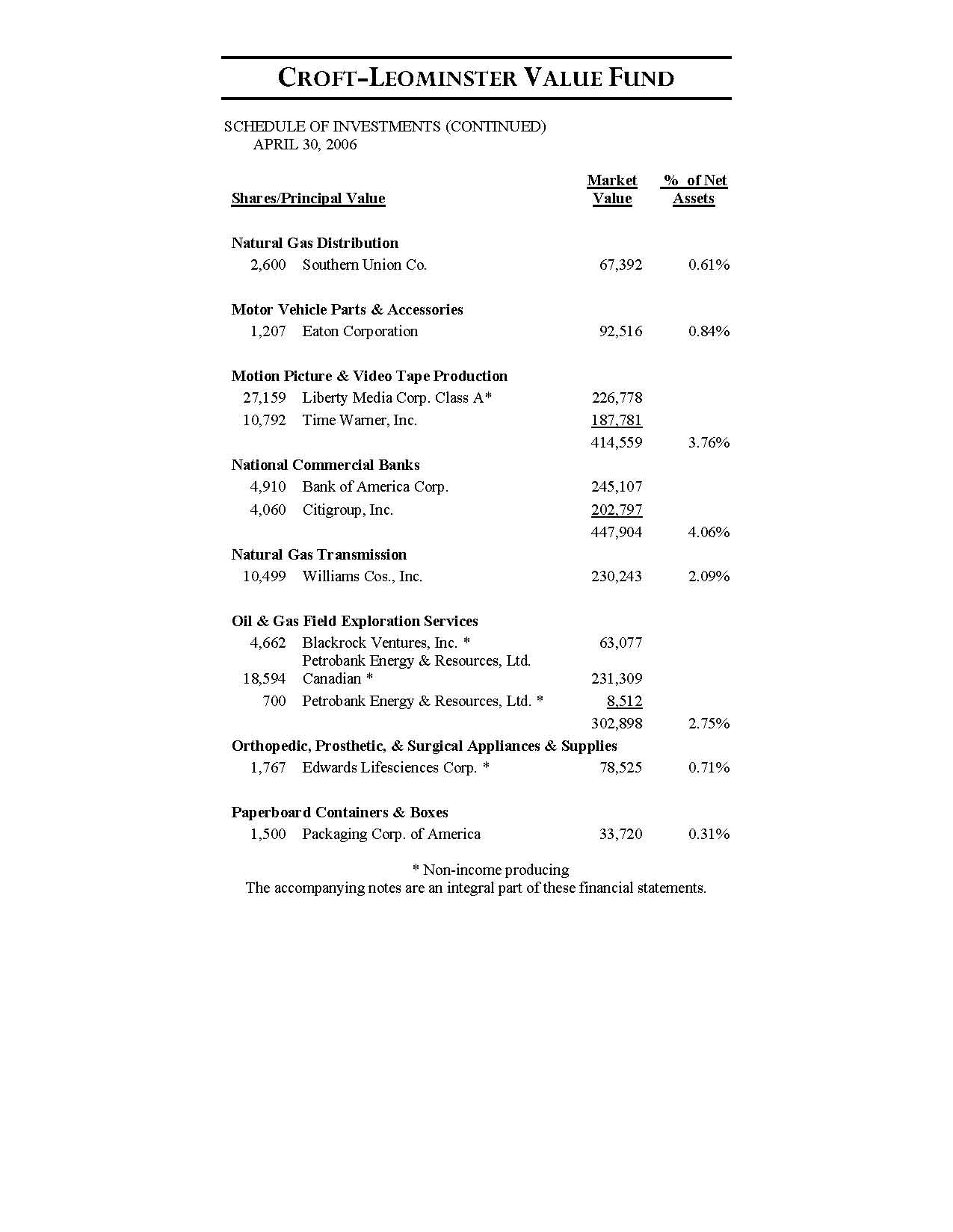

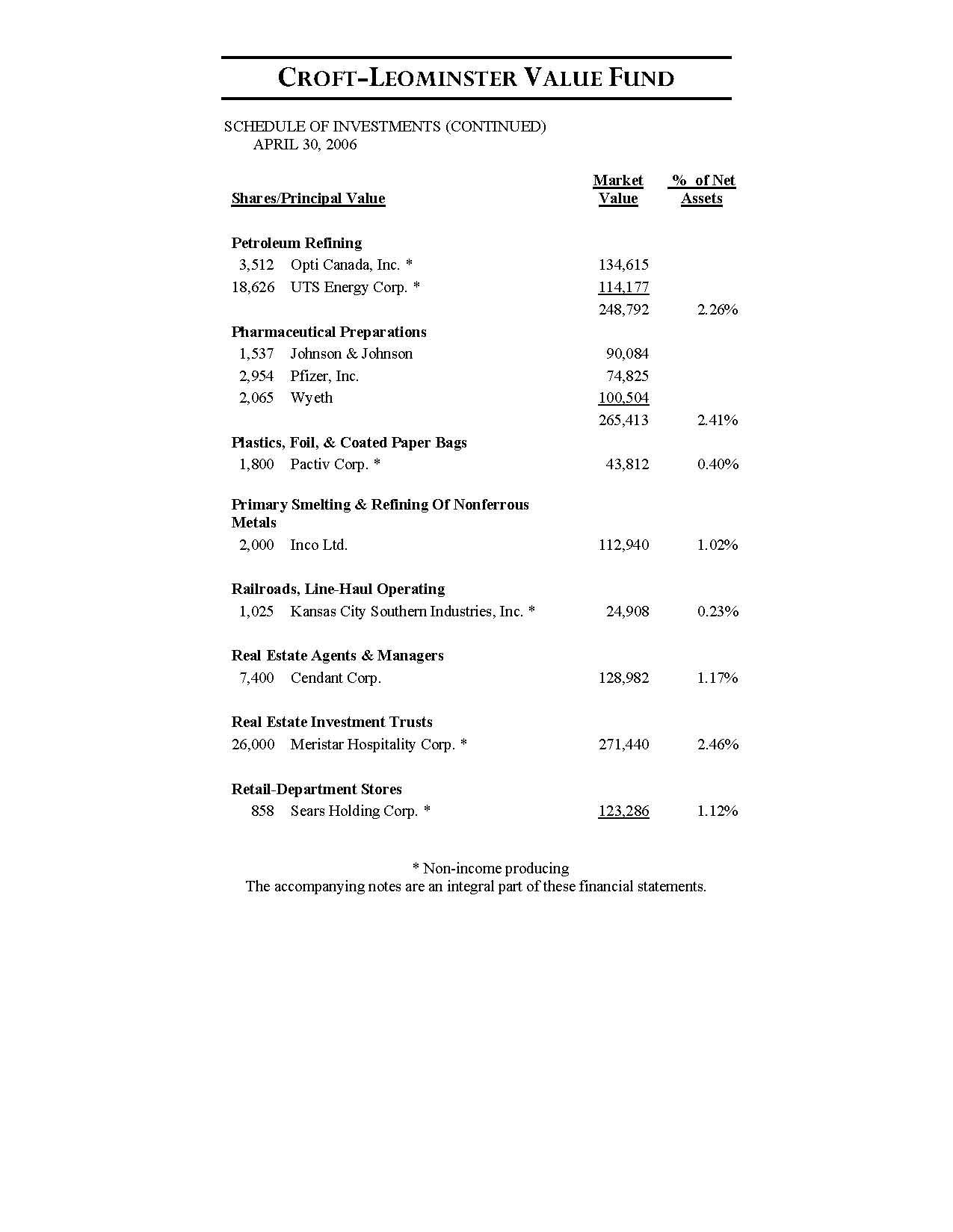

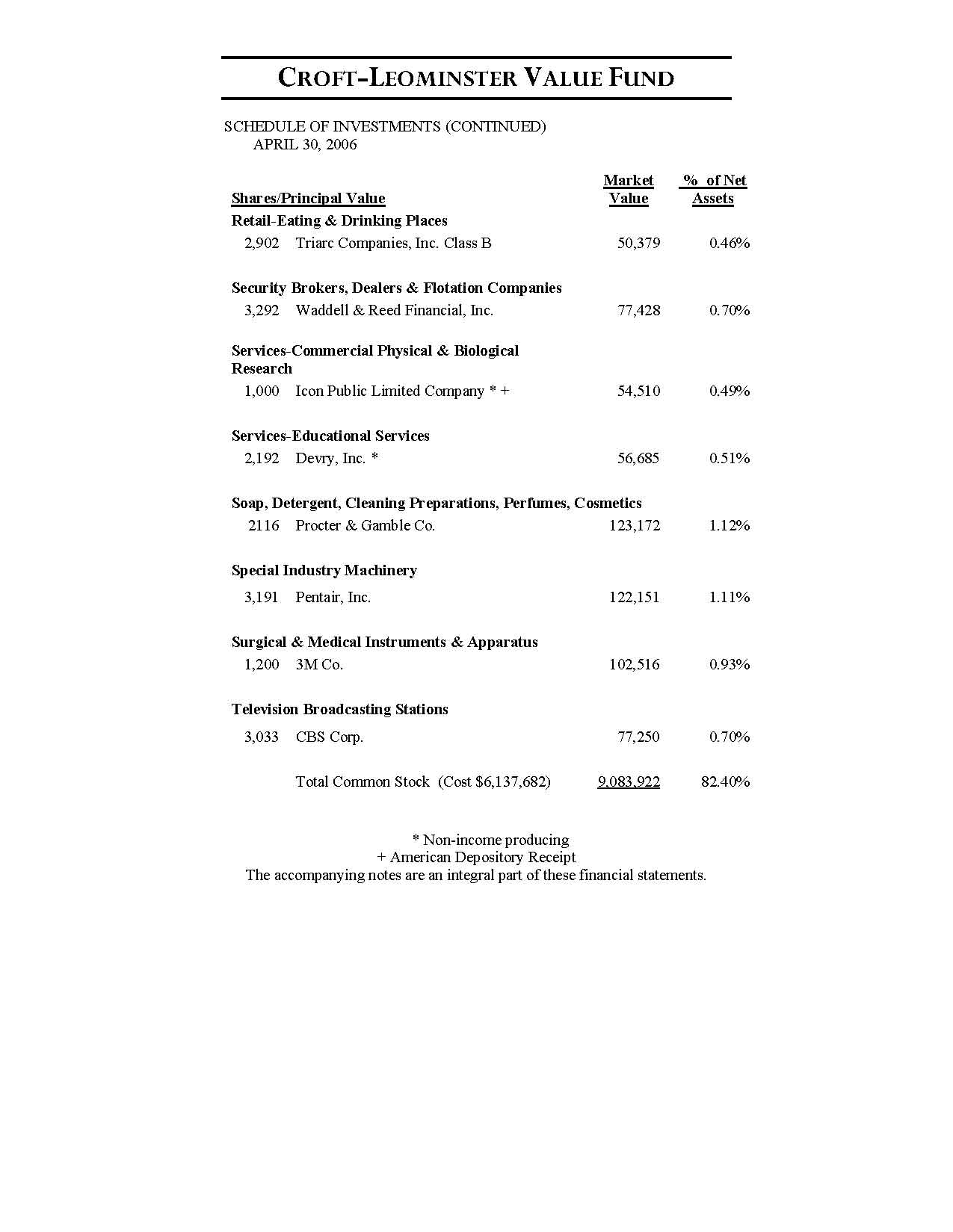

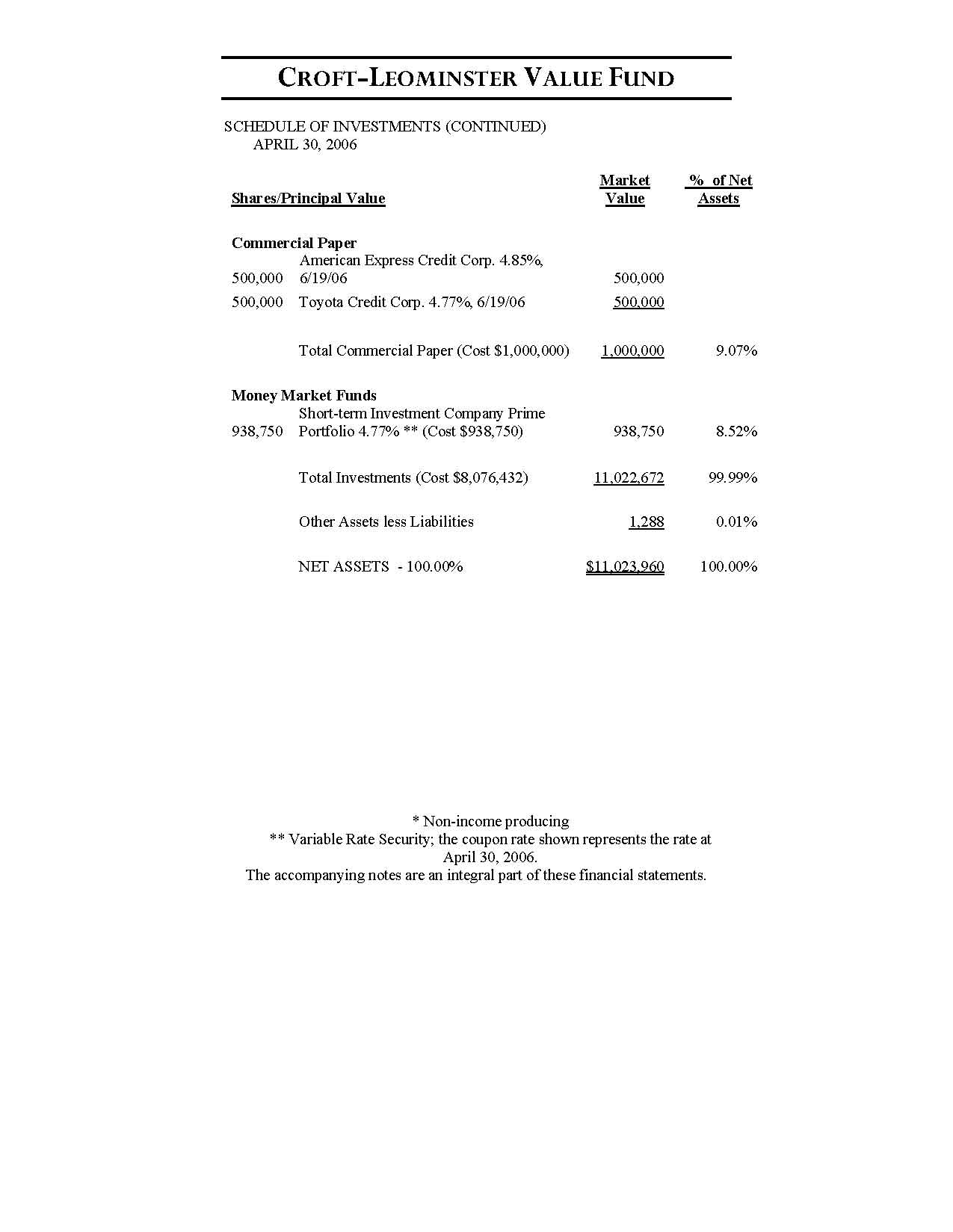

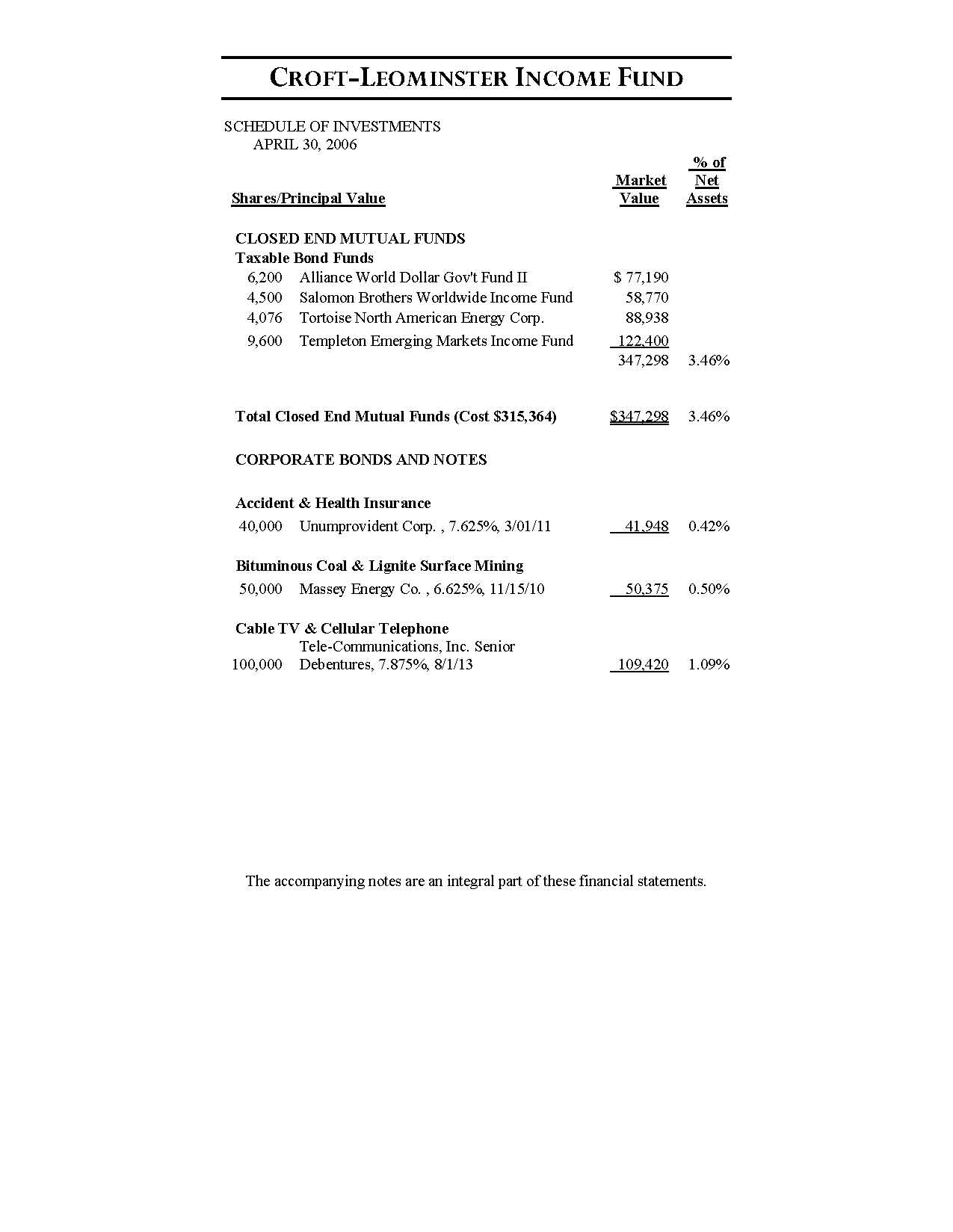

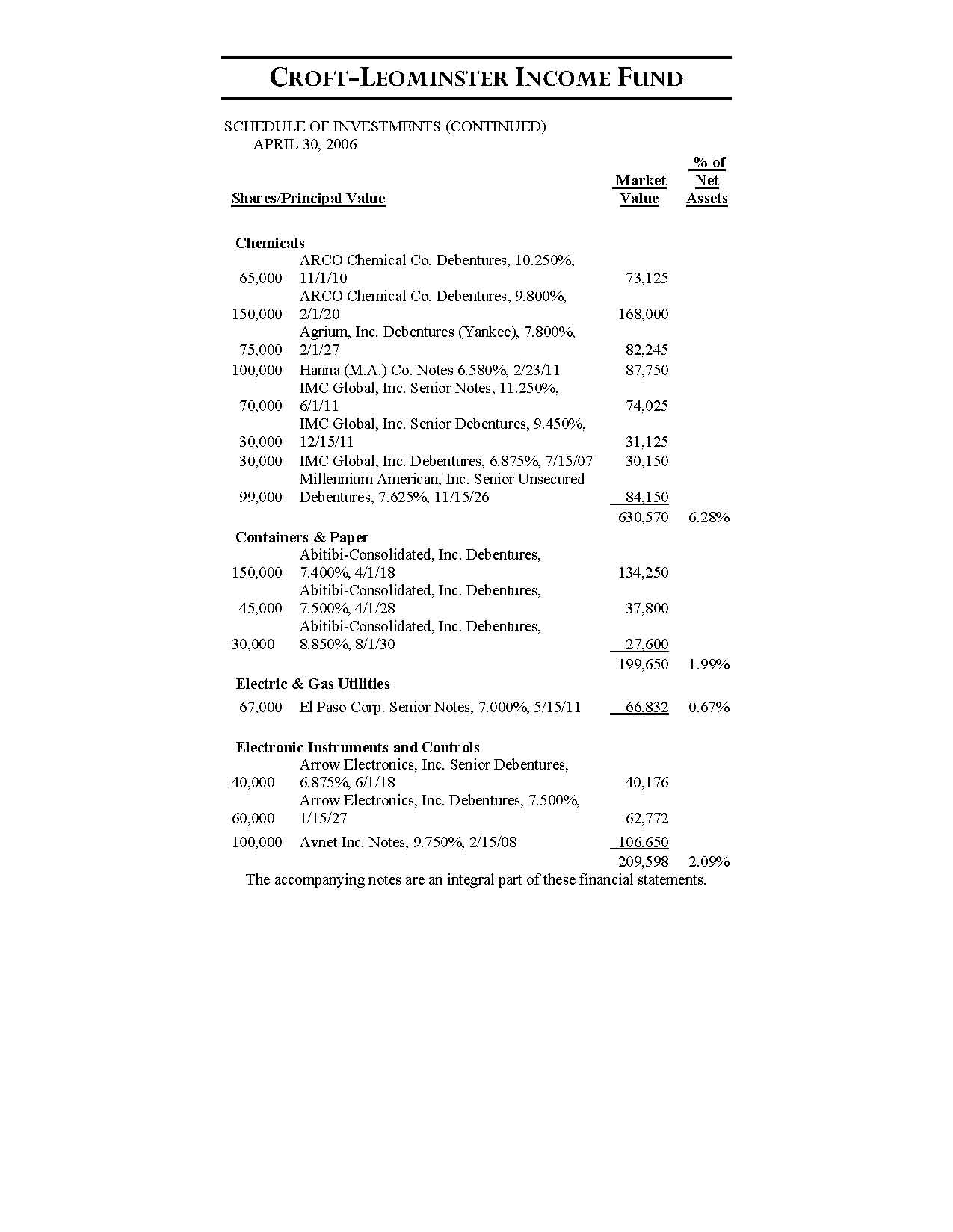

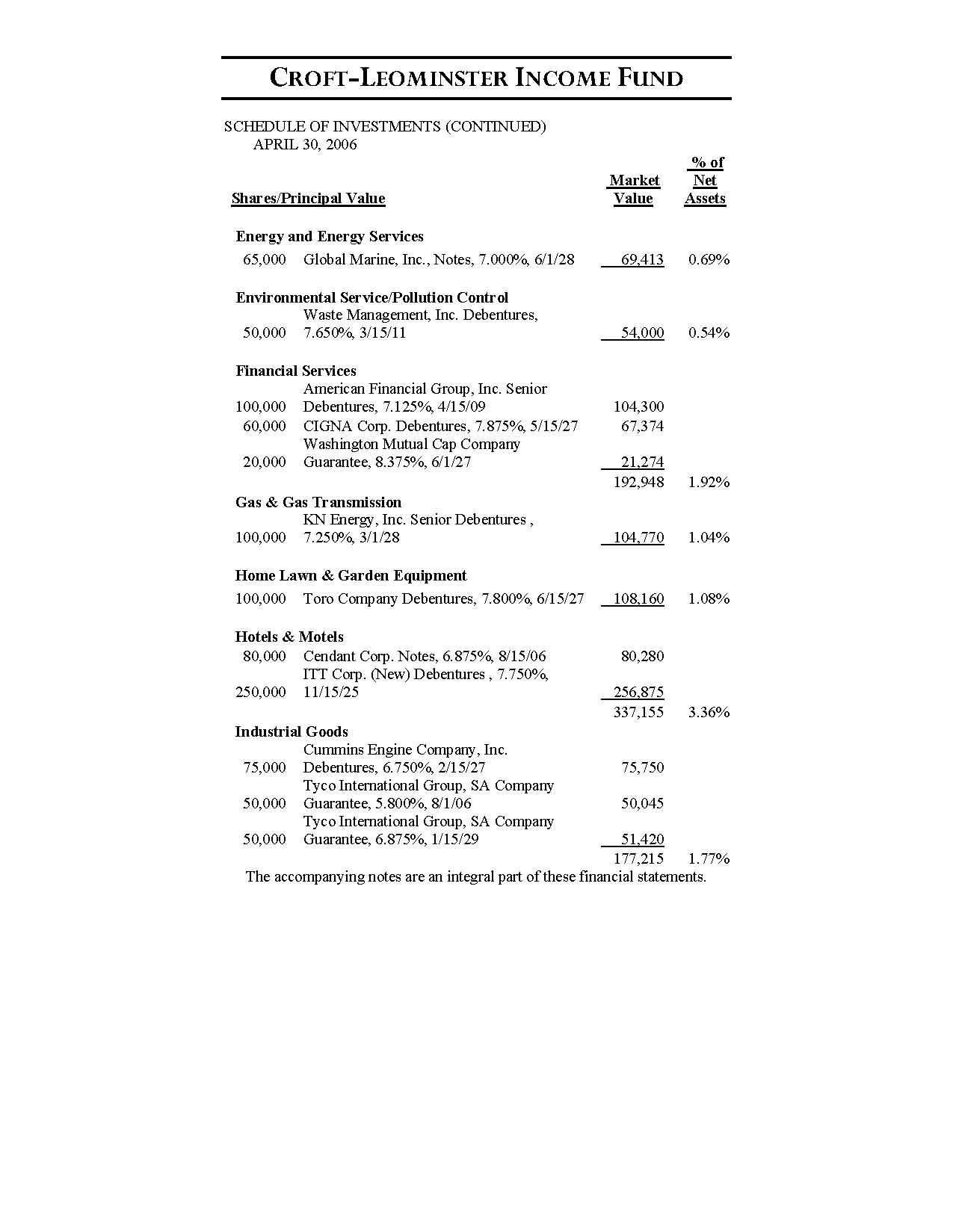

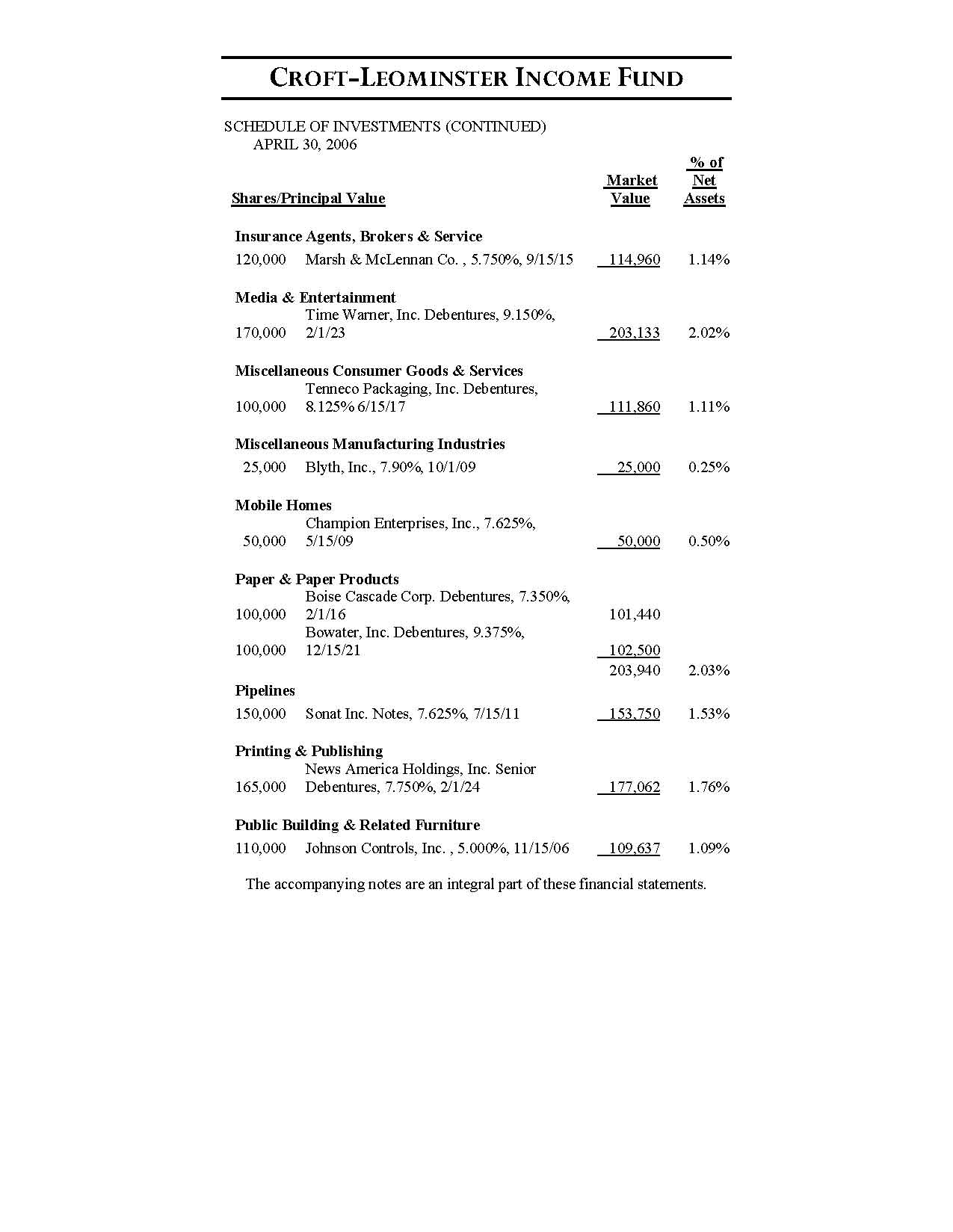

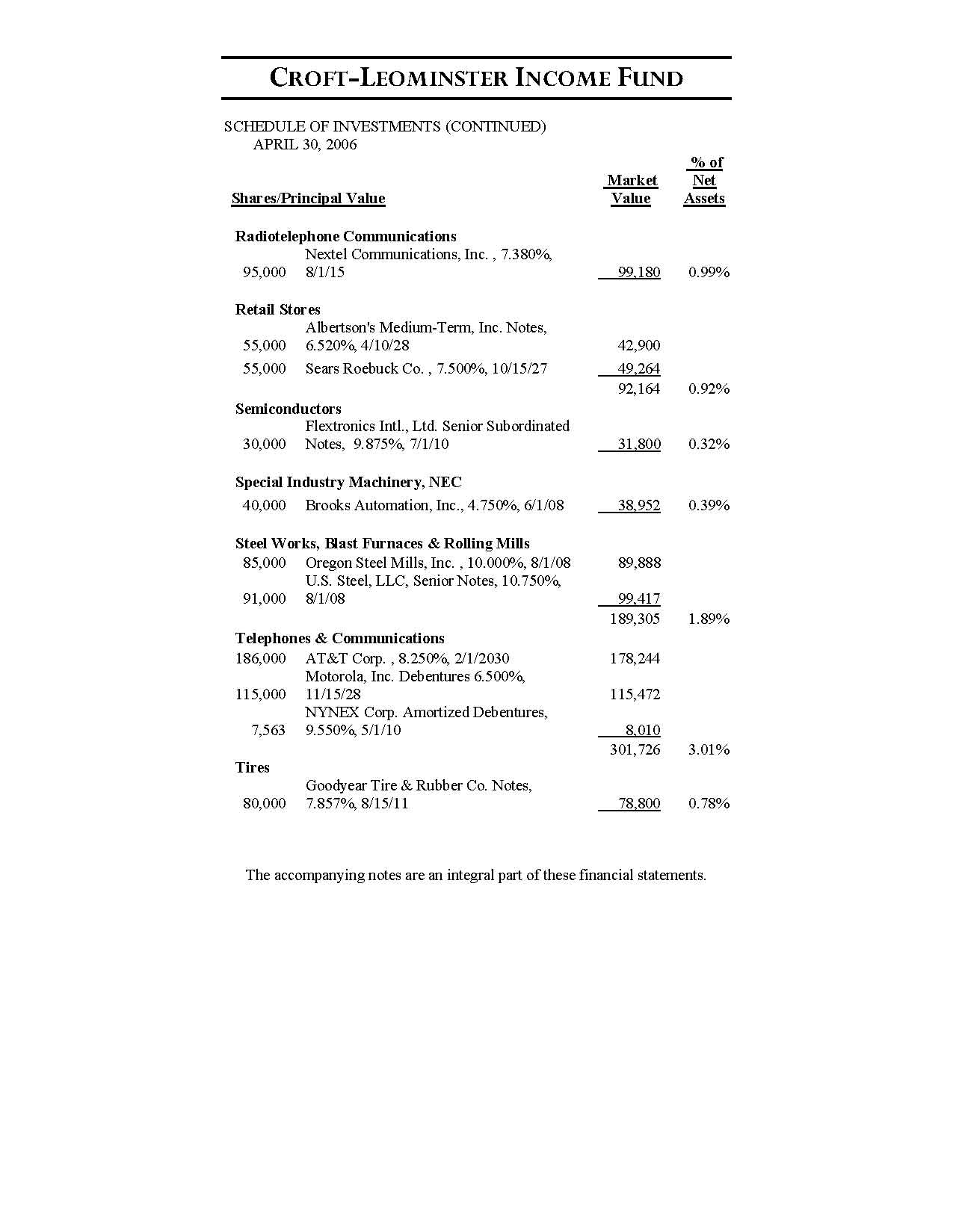

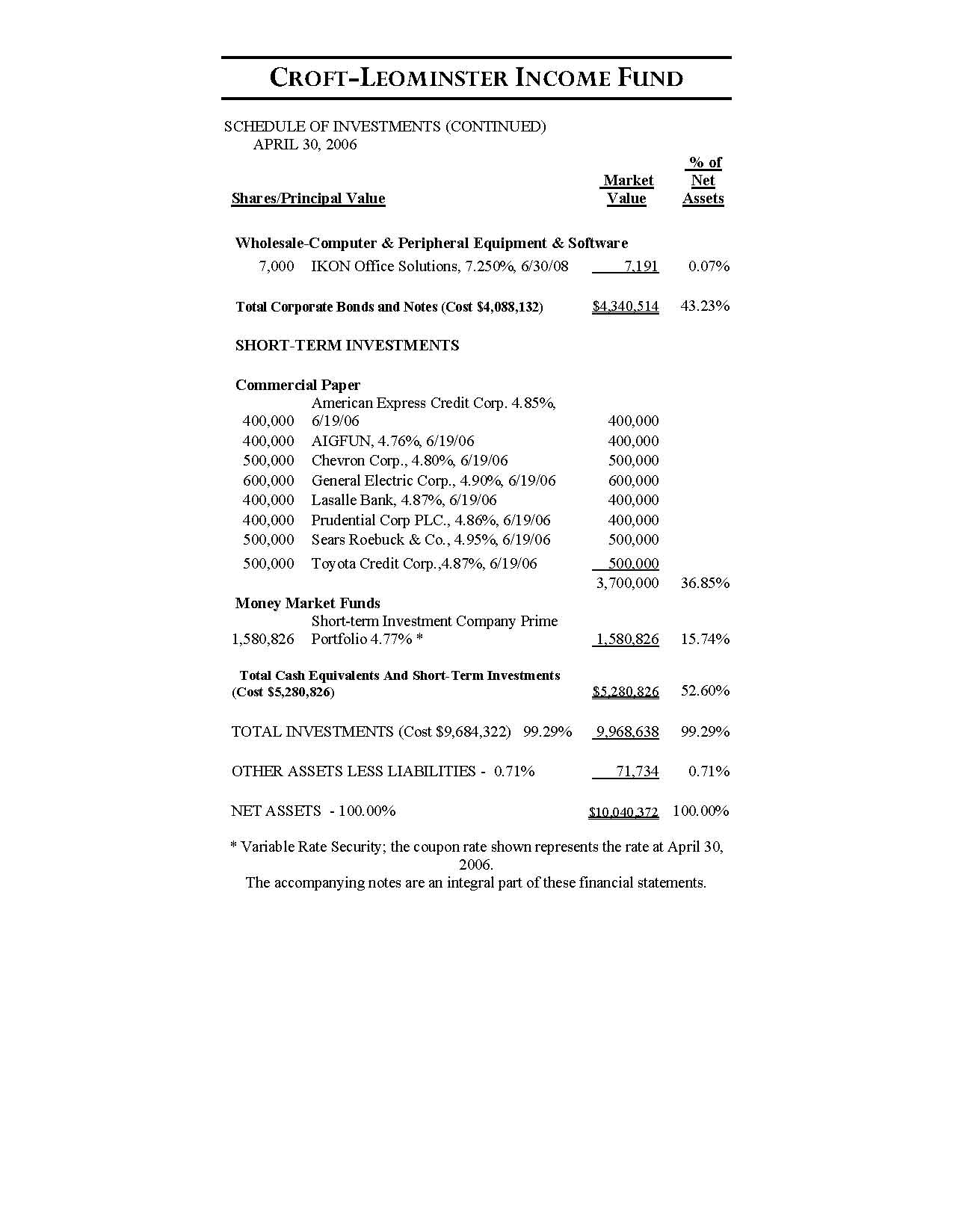

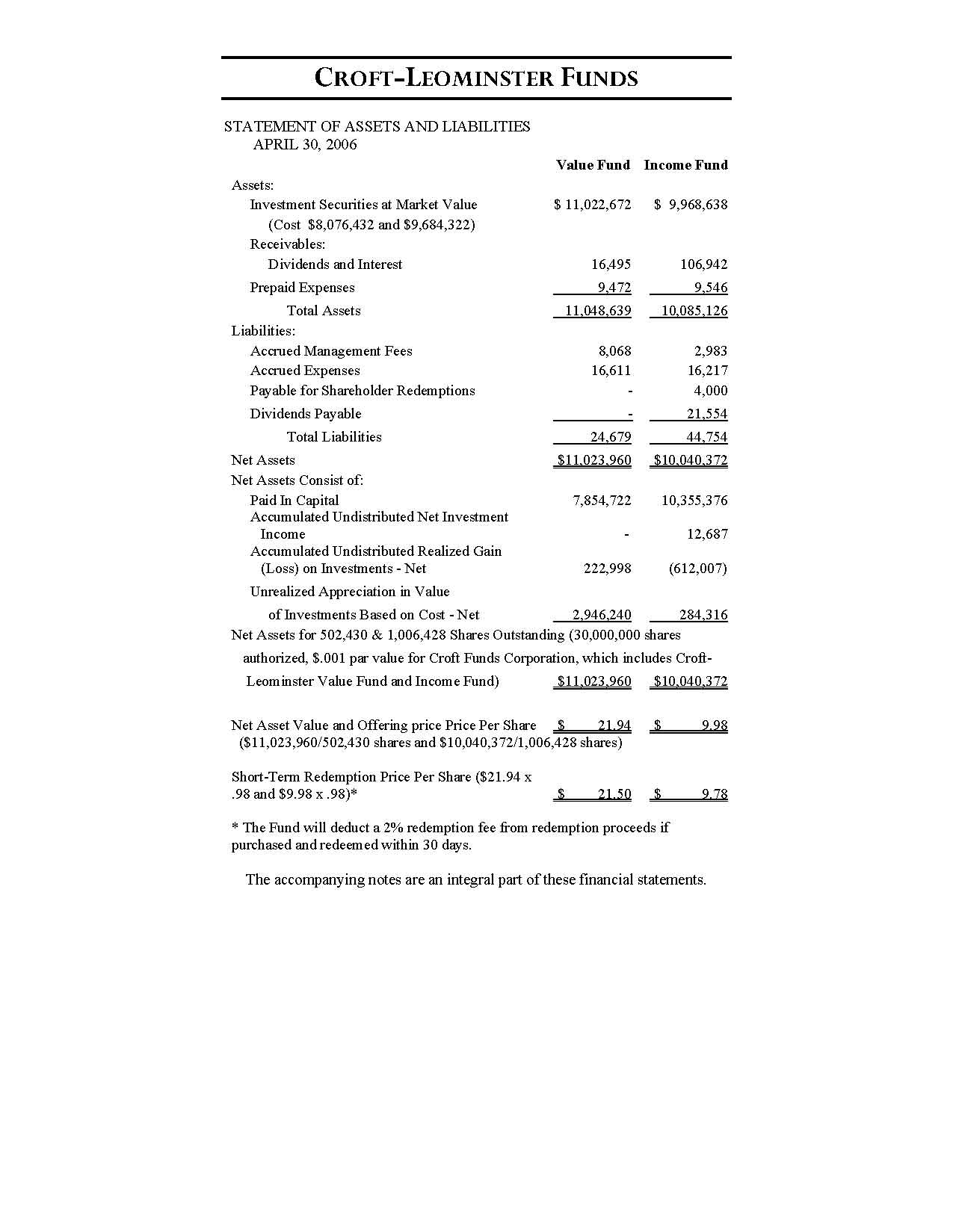

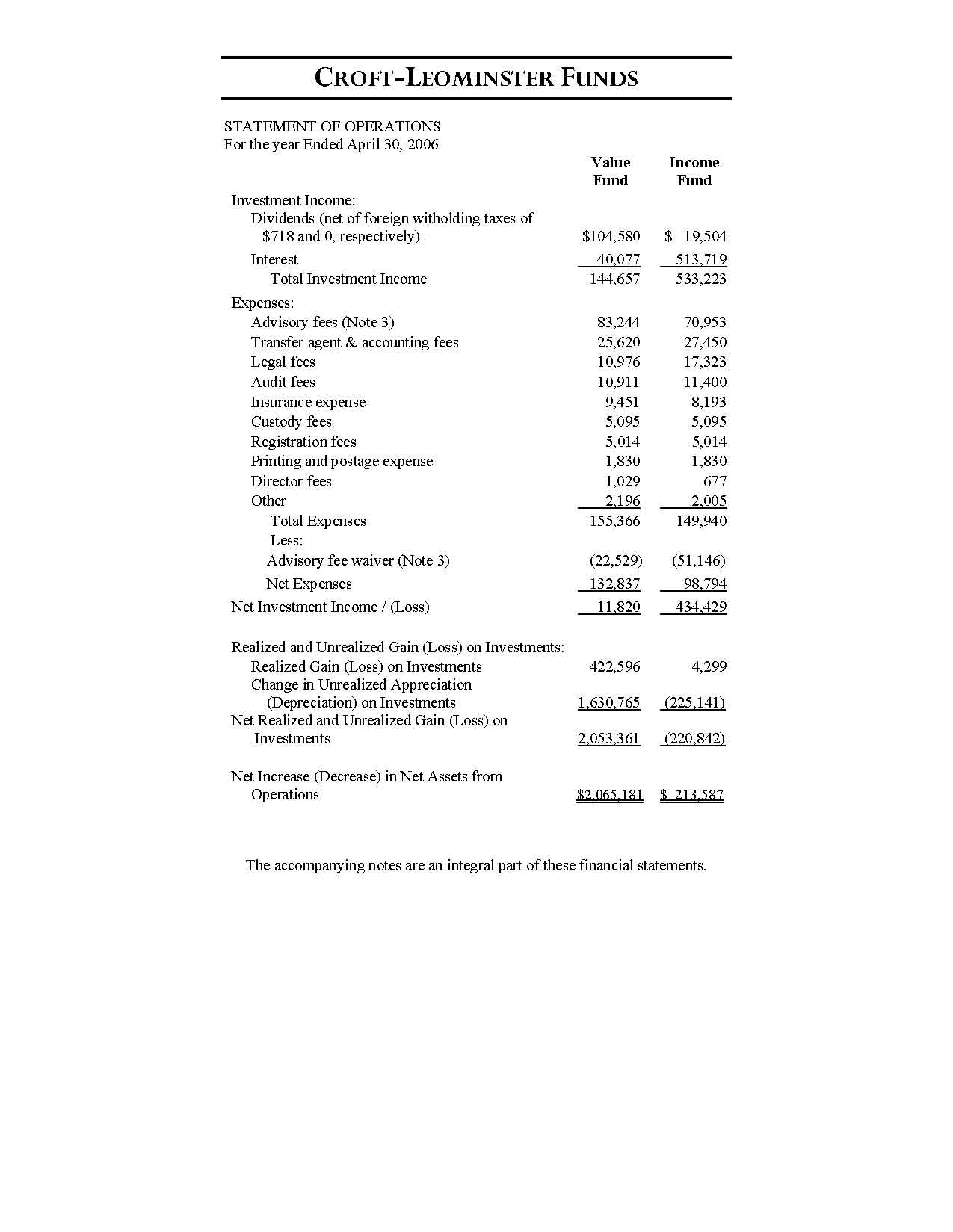

Item 6. Schedule of Investments.

Not applicable – schedule filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. Not applicable.

Item 8. Portfolio Managers of Closed-End Funds. Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Funds. Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant's board of directors.

Item 11. Controls and Procedures.

(a)

Based on an evaluation of the registrant’s disclosure controls and procedures as of July 1, 2006, the disclosure controls and procedures are reasonably designed to ensure that the information required in filings on Forms N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b)

There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal half-year that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1)

EX-99.CODE ETH. Filed herwith.

(a)(2)

EX-99.CERT. Filed herewith.

(a)(3)

Any written solicitation to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable.

(b)

EX-99.906CERT. Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Croft Funds Corporation

By /s/Kent Croft, CEO

*Kent Croft CEO

Date July 1, 2006

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By Kent Croft, CEO

*Kent Croft CEO

Date July 1, 2006

By Phillip Vong, Treasurer

*Phillip Vong, Treasurer

Date July 1, 2006

* Print the name and title of each signing officer under his or her signature.