Washington, D.C. 20549

Mr. Hal Liebes

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to Stockholders of any report to be transmitted to Stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

The Alger Funds II

Shareholders’ Letter (Unaudited) | April 30, 2023 |

Dear Shareholders,

The Pendulum of Market Sentiment

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Benjamin Graham.

Stock prices may have fluctuated over the six month period ended April 30, 2023, mostly based on interest rate movements, but we agree with Graham that over the longer term, company earnings and cash flows ultimately determine stock prices. We believe the rise in interest rates and the corresponding decline in equity valuations are subsiding, leaving Graham’s proverbial scale to determine where stocks are headed. In the final two months of 2022, optimism surrounding the potential peak of the Federal Reserve Bank’s (Fed) tightening cycle was reinforced by lower-than-expected core Consumer Price Index (CPI) readings for both November and December. Persistent inflation, particularly in wages, remained a focal point for the Fed, and the inverted yield curve amplified fears of a policy misstep or a looming economic downturn. Fed Chairman Jerome Powell indicated in December 2022, that the institution would maintain its “higher-for-longer” approach for interest rates and projected a long-run terminal rate exceeding 5.0%, which sparked concerns about the sustainability of a stock market rebound.

The first quarter of 2023 saw a reversal in the bearish investor sentiment that had marked much of the previous year. In February, the Fed reduced the pace of rate hikes to 25 basis points (bps), after a 50 bps hike in December. Powell, acknowledging the disinflation trend, did not resist the easing of financial conditions, and U.S. Treasury yields fell during the first quarter. In March, concerns around bank funding and liquidity emerged following the collapse of two regional banks, leading to significant deposit outflows at the regional level. However, the Fed, U.S. Treasury, and Federal Deposit Insurance Corporation (FDIC) took steps to contain market concerns. These steps included announcing an emergency liquidity program, guaranteeing uninsured deposits at the impacted regional banks, and allowing some bank mergers and acquisitions to take place. At the end of March, the Fed raised rates by another 25 bps, bringing the Federal Funds rate to 5.0%. In April, U.S. Gross Domestic Product (GDP) grew 1.1%, missing the 2.0% forecast and falling from the prior quarter’s 2.6%, despite robust consumer spending.

Among non-U.S. equities, developed markets saw strong performance during the fiscal six-month period ended April 30, 2023. Notable strength was driven by Europe avoiding an energy crisis due to a mild winter, and global supply chain bottlenecks seeing continued relief. As such, the MSCI EAFE Index was up 24.6%, driven by strong performance in the Financials and Industrials sectors, while the Real Estate and Energy sectors experienced relative weakness. From a broader perspective, the MSCI ACWI Index rose 13.0% during the fiscal six-month period, where the Communication Services and Information Technology sectors showed strong results, while the Healthcare and Energy sectors saw weaker performance. Within Emerging Markets, notable strength was driven by China reopening its borders, and the MSCI Emerging Markets Index was up 16.5% during the fiscal six-month period. Strong performance within the Communication Services and Information Technology sectors was slightly offset by relative weakness in the Real Estate and Energy sectors.

During the fiscal six-month period, growth outperformed value, with the Russell 3000 Growth Index returning 10.8%, outperforming the Russell 3000 Value Index, which posted a return of 3.4% for the period. There was also a notable bifurcation between small- and large-cap stocks, where the -3.5% return of the Russell 2000 Index considerably underperformed the 7.2% return of the Russell 1000 Index during the fiscal six-month period.

Slow Dance into Recession

The Conference Board’s Index of Leading Economic Indicators (LEI) – a composite of economic information that includes housing, consumer confidence and durable goods orders – has historically proven to be a strong predictor of recessions, particularly when the index moves into negative territory. The LEI fell into negative territory in August 2022, and as of March 2023, it shows a year-over-year decline of 7.8%.

Further, over the past thirteen tightening cycles, the United States has only achieved a soft landing (i.e., an economic slowdown without a recession) on three occasions (1984, 1994-1995 and 2020). In each of these instances, interest rates were increased by only 300 bps. As of April 30, 2023, the Fed has increased rates by approximately 500 bps since it began its hiking cycle in March 2022. If history is any guide, we find it unlikely that the Fed can successfully orchestrate a soft landing, given the Fed has now hiked well above the approximate “soft landing” rate increase of 300 bps.

Further challenging the ability for a soft landing is the lagged impact of the Fed’s aggressive tightening cycle. It is important to note the strong historical relationship between small bank lending standards and U.S. corporate business spending, known as capital expenditures. As bank lending standards tighten, fewer loans are made and companies’ cost of capital rises. As a result, companies reduce their capital projects, either due to a lack of funds or because the higher cost makes these projects less financially attractive. In our view, bank lending standards will likely continue to tighten and slow business capital expenditures, pressuring earnings for more economically sensitive companies that rely on capital expansion projects.

As of the writing of this letter, the Fed has continued to tighten financial conditions via its interest rate increases and the roll-off of debt from its balance sheet. Further, the broader money supply growth is decelerating and is now in outright contraction for the first time since 1938, which is likely to slow economic activity. For these reasons, we believe the United States may have already entered a recession.

Going Forward

We continue to believe that unprecedented levels of innovation are creating compelling investment opportunities - corporations are digitizing their operations, cloud computing growth continues to support future in novation, and artificial intelligence, which is at an inflection point in our view, potentially enabling significant increases in productivity. In the Healthcare sector, we believe that advances in surgical technologies and innovations within biotechnology offer attractive opportunities ahead. As such, we intend to continue to focus on conducting in-depth fundamental research as we seek leaders of innovation rather than taking short-term bets on market sentiment. We believe doing so is the best strategy for helping our valued shareholders reach their investment goals.

Portfolio Matters

Alger Spectra Fund

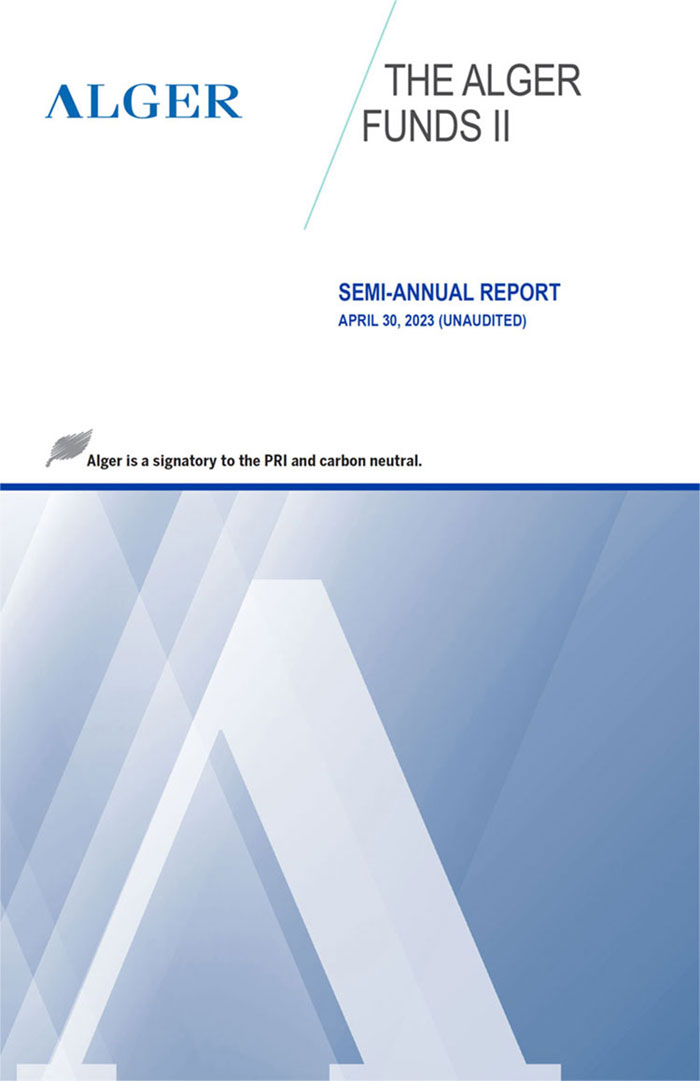

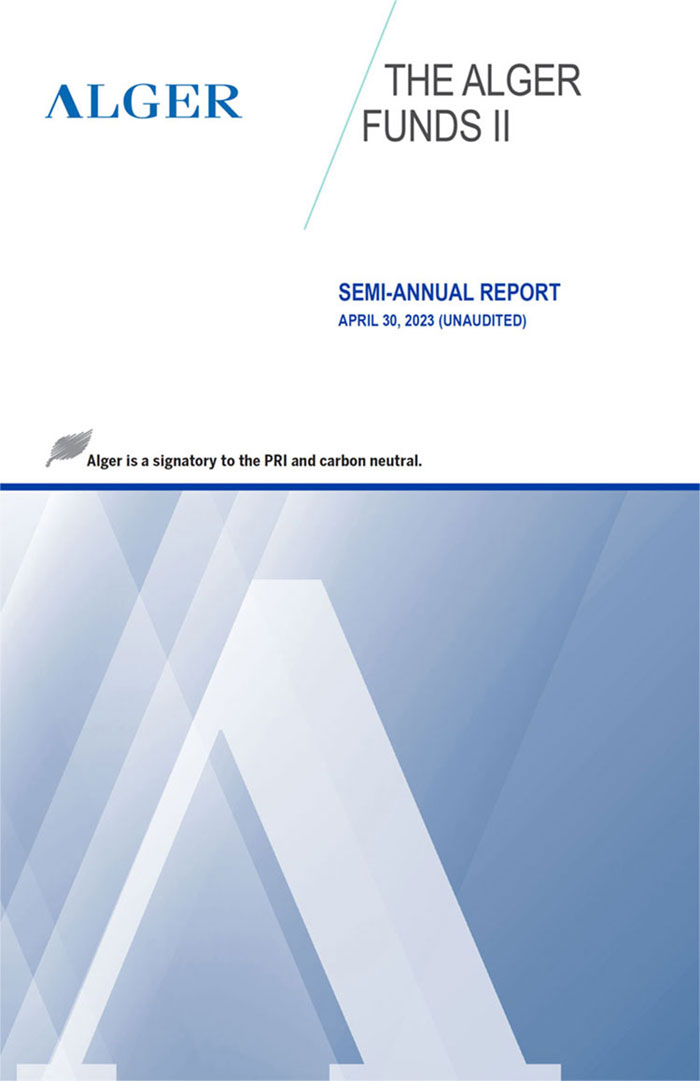

The Alger Spectra Fund returned 8.66% for the fiscal six-month period ended April 30, 2023, compared to the 10.77% return of the Russell 3000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Energy and the largest sector underweight was Consumer Staples.

Contributors to Performance

The Consumer Discretionary and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corporation; NVIDIA Corporation; Prometheus Biosciences, Inc.; Las Vegas Sands Corp.; and MercadoLibre, Inc. were among the top contributors to absolute performance.

Microsoft is a beneficiary of corporate America’s transformative digitization. Microsoft’s CEO expects technology spending as a percent of GDP to jump from about 5% now to 10% in 10 years and that Microsoft will continue to capture market share within the technology sector. The company operates through three segments: Productivity and Business Processes (Office, LinkedIn, and Dynamics), Intelligent Cloud (Server Products and Cloud Services, Azure, and Enterprise Services), and More Personal Computing (Windows, Devices, Gaming, and Search). While the company reported fiscal second quarter results that met consensus estimates, their investment in OpenAI’s ChatGPT captured the attention of investors, contributing to positive performance. Throughout the period, Microsoft surprised investors with continual rollouts of new AI capabilities across the company’s portfolio (e.g., Bing, GitHub, Teams, Office 365). Furthermore, the company announced Microsoft 365 Copilot, which leverages GPT-4, a large language model, combined with the Microsoft Graph of data to provide AI virtual assistance. We believe Microsoft’s investment in OpenAI provides a first-mover advantage in the AI transformer model space.

Short exposure to a Central and Eastern European software service delivery platform contributed to performance. While we believe this is a well-run company, we established the short exposure based on our belief that the company’s top 10 customers will face challenges in their core businesses, leading to a reduction in technology spending. During the period, the company reported decent, where revenues were in-line with analyst estimates but recorded better-than-expected profits. However, shares fell after management gave weaker-than-expected revenue and earnings guidance for fiscal 2023. The company noted that revenue growth will be negatively impacted due to pockets of moderation around its retail and consumer segment, as businesses remain cautious of slowing demand given the challenging macroeconomic backdrop. As the company’s share price declined, the short exposure contributed to performance.

Detractors from Performance

The Materials and Energy sectors were the largest detractors from relative performance. Regarding individual positions, Tesla, Inc.; Albemarle Corporation; Datadog Inc.; Pioneer Natural Resources Company; and Live Nation Entertainment, Inc. were among the top detractors from absolute performance.

Tesla is an electric vehicle manufacturer with a significant technological lead in its large and rapidly growing addressable market. Shares detracted from results during the period as the company confronted transportation capacity issues that caused deliveries to fall short of estimates, as well as developing demand softness. However, Tesla addressed the weakened domestic consumer demand by cutting process late in 2022 by discounting the Models 3 and Y as well as introducing supercharging credits.

Short exposure to a supplier of wafer fabrication equipment and services for semiconductor manufacturing detracted from performance. We established a short position based on our belief that the company’s top customers may cut capital expenditures in 2023, as demand for most end-markets could continue to weaken. However, the company reported better-than-expected results, driven by strong company execution in the context of an improving supply-chain environment.

Alger Dynamic Opportunities Fund

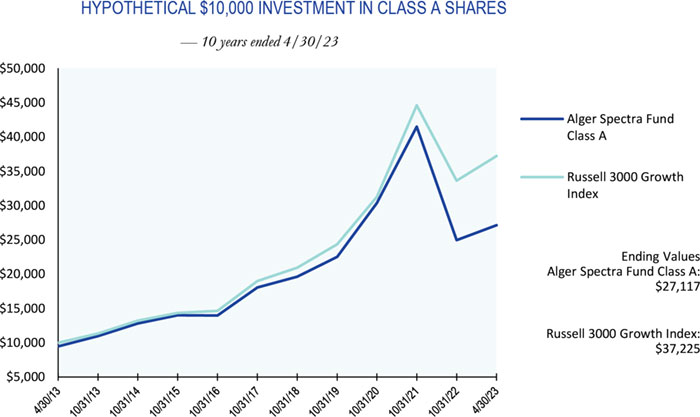

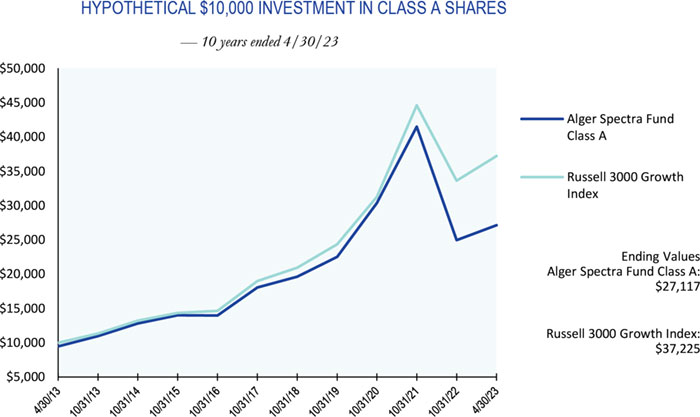

The Alger Dynamic Opportunities Fund returned 2.47% for the fiscal six-month period ended April 30, 2023, compared to the 8.63% return of the S&P 500 Index and the 5.20% return of the HFRI Equity Hedge (Total) Index. During the reporting period, the average allocation to long positions was 80.11% and the average allocation to short positions was -34.87%. The Fund’s average cash allocation, which includes short sale proceeds, was 54.76%.

Based on the net exposure of long and short positions, the Industrials and Healthcare sectors were the largest sector weightings for the reporting period. Industrials was the largest sector overweight and the Information Technology sector was the largest underweight. Long positions, in aggregate, detracted from absolute and relative performance while short positions contributed to absolute performance but detracted from relative performance.

Contributors to Performance

Based on the net exposure of long and short positions, the Real Estate and Industrials sectors were the largest contributors to relative performance. Regarding long positions, TransDigm Group Incorporated; TransMedics Group, Inc.; FirstService Corp; MercadoLibre, Inc.; and Microsoft Corporation were among the top contributors to absolute performance.

TransDigm Group specializes in the production of engineered aerospace components, systems and subsystems. Its core Power and Control segment includes operations that primarily develop, produce and market systems and components that provide power to or control power of aircrafts utilizing electronic, fluid, power and mechanical motion control technologies. During the period, the company reported solid fiscal first quarter results, where both revenues and earnings beat analyst estimates. Better-than-expected results were driven by strength in all three of their major market channels – commercial original equipment manufacturing (OEM), commercial aftermarket and defense – as well as strong order bookings. Moreover, management raised their fiscal full year guidance, noting favorable trends in the commercial aerospace market recovery.

Short exposure to a bank holding company that provides solutions and services to participants in the digital currency industry contributed to performance during the period. The company offers an instantaneous payment network that allows customers to actively engage in the digital currency ecosystem. However, after the collapse of a large cryptocurrency exchange that triggered a run on the bank, the company announced it would wind down operations and voluntarily liquidate the bank in an orderly manner and in accordance with the applicable regulatory process. As a result, the short position contributed to performance due to the precipitous share price decline.

Detractors from Performance

Based on the net exposure of short and long positions, the Information Technology and Communication Services sectors were the largest detractors from relative performance. Regarding long positions, Signature Bank; Montrose Environmental Group Inc.; 908 Devices Inc.; Progyny, Inc.; and Xometry, Inc. were among the top detractors to absolute performance.

Montrose Environmental Group offers various environmental services to a diverse client base, primarily in the United States. The company has expertise in a wide variety of areas, including environmental assessment and permitting, measurement and analysis, and remediation and reuse. During the period, shares detracted from performance as the company reported slightly weaker than expected results, where revenues came in below consensus estimates. Moreover, management lowered their full-year margin expansion trajectory due to additional investments needed in the near-term in order to strengthen organic growth. Disappointed investors contributed to the share selloff, despite analysts’ expectations of strong margin expansion in 2023. Despite the near-term setback, we believe the company fundamentals remain intact as they remain a key beneficiary of remediation work on polyfluoroalkyl substances (PFAS) compounds, environmental regulations and U.S. infrastructure spending.

Short exposure to a manufacturer and distributor of building products for the recreational vehicle (RV) market and, to a lesser extent, marine, manufactured housing and industrial markets detracted from performance. The short position was based on our view that the RV industry and, to a lesser extent, the company’s other markets, should come under increasing pressure due to weakening economic conditions, exacerbated by channel destocking. During the period, shares rose as the company reported results that came in better-than-expected. However, the outlook for RVs continues to deteriorate with retail demand slowing. Moreover, we believe the company may struggle as demand headwinds potentially intensify for high priced items, such as RVs. Additionally, elevated interest rates may amplify demand weakness, in our view, as most RV purchases involve financing.

Alger Emerging Markets Fund

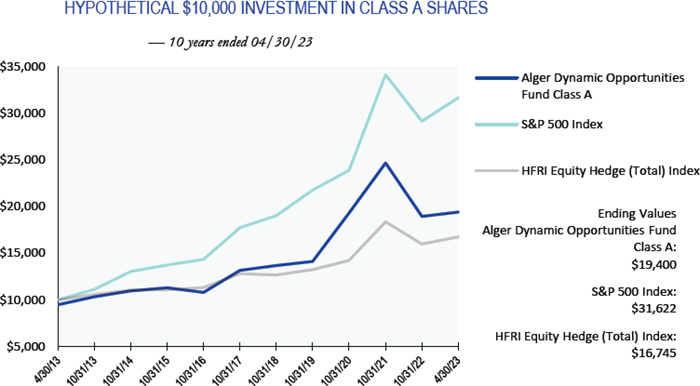

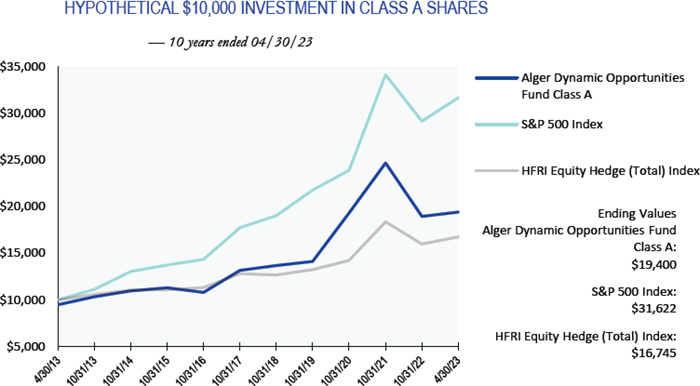

The Alger Emerging Markets Fund returned 5.47% for the fiscal six-month period ended April 30, 2023, compared to the 16.53% return of the MSCI Emerging Markets Index. During the reporting period, the largest sector weightings were Consumer Discretionary and Information Technology. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials.

Contributors to Performance

The Consumer Discretionary and Utilities sectors provided the largest contributions to relative performance. Regarding individual positions, Jumbo S.A.; BYD Company Limited; New Oriental Education & Technology Group, Inc.; MercadoLibre, Inc.; and Hong Kong Exchanges & Clearing Ltd. were among the top contributors to absolute performance.

MercadoLibre is the largest e-commerce company in Latin America, with its largest markets being Brazil, Argentina, and Mexico. The company offers a comprehensive suite of services, including an online marketplace for buyers and sellers, payment solutions through Mercado Pago, merchant and buyer financing through Mercado Credito, shipping services through Mercado Envios, and asset management through Mercado Fondo, among other services. We believe the e-commerce market within Latin America remains underpenetrated, creating a favorable backdrop for MercadoLibre, as they have been growing and investing heavily to expand its first mover advantage. Moreover, we believe that the company’s growing fintech payments business, Mercado Pago, is well-positioned to potentially emerge as a leader in Latin America, as well as an emerging online advertising presence that offers attractive margin expansion potential, in our view. During the period, shares contributed to performance after the company reported resilient fiscal fourth quarter earnings that exceeded analyst estimates. Notable drivers that contributed to the earnings beat included strong gross-merchandise-value and an increase in the average take-rate within both e-commerce and Mercado Pago.

Detractors from Performance

The Communication Services and Financials sectors were the largest detractors from relative performance. Regarding individual positions, Arezzo Industria e Comercio S.A.; Banco BTG Pactual SA; Angel One Limited; Hangzhou Tigermed Consulting Co., Ltd.; and Tencent Holdings Ltd. were among the top detractors from absolute performance.

Arezzo is Brazil’s largest women’s footwear retailer, specializing in the design, manufacture, development, molding and sale of women’s footwear, bags and accessories. The company’s brand portfolio includes Arezzo, Schutz, Alexandre Birman, Anacapri and Fiever. It distributes footwear through various channels, such as owned and franchised stores, multi-brand stores and e-commerce platforms. During the period, shares detracted from performance where the company reported lower-than-expected earnings. While quarterly revenues were strong, driven by Arezzo’s apparel segment, higher investments and variable compensation expenses led to weaker-than-expected profitability. Despite the near-term cost pressures, we believe company fundamentals remain strong given its resilient local market expansion, boosted by e-commerce and multichannel growth, along with growing demand among more affluent consumers as the market normalizes from the COVID-19 pandemic.

Alger Responsible Investing Fund

The Alger Responsible Investing Fund returned 12.48% for the fiscal six-month period ended April 30, 2023, compared to the 11.51% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Financials and the largest sector underweight was Consumer Staples.

Contributors to Performance

The Information Technology and Consumer Discretionary sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corporation; NVIDIA Corporation; Apple Inc.; Visa Inc.; and ASML Holding NV were among the top contributors to absolute performance.

NVIDIA is a leading supplier of graphics processing units for a variety of end markets, such as gaming, PCs, data centers, virtual reality and high-performance computing. The company is leading in most secular growth categories in computing, and especially artificial intelligence and super-computing parallel processing techniques for solving complex computational problems. NVIDIA’s computational power is a critical enabler of AI and therefore critical to AI adoption, in our view. During the period, NVIDIA reported results that met expectations, as the company navigated through an inventory correction associated with the broad macroeconomic slowdown. Moreover, management gave fiscal year earnings guidance that was better than analyst estimates, noting strong year-over-year growth in gaming and datacenters. Management’s constructive assessment of 2023 prospects, coupled with the rapid rollout and adoption of generative AI offerings, led to positive share price performance.

Detractors from Performance

The Communication Services and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, Tesla, Inc.; Bristol-Myers Squibb Company; Live Nation Entertainment, Inc.; Trimble Inc.; and Cigna Group were among the top detractors from absolute performance. Shares of Tesla detracted from performance in response to developments identified in the Alger Spectra Fund discussion.

I thank you for putting your trust in Alger.

Sincerely,

Daniel C. Chung, CFA

Chief Executive Officer, Chief Investment Officer

Fred Alger Management, LLC

Investors cannot invest directly in an index. Index performance does not reflect the deduction for fees, expenses, or taxes.

This report and the financial statements contained herein are submitted for the general information of shareholders of the funds. This report is not authorized for distribution to prospective investors in a fund unless preceded or accompanied by an effective prospectus for the fund. Performance of funds discussed above represents the six-month period return of Class A shares prior to the deduction of any sales charges and includes the reinvestment of any dividends or distributions.

The performance data quoted in this material represents past performance, which is not an indication or a guarantee of future results.

Standard performance results can be found on the following pages. The investment return and principal value of an investment in a Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit us at www.alger.com, or call us at (800) 992-3863.

The views and opinions of the funds’ management in this report are as of the date of the Shareholders’ Letter and are subject to change at any time subsequent to this date. There is no guarantee that any of the assumptions that formed the basis for the opinions stated herein are accurate or that they will materialize. Moreover, the information forming the basis for such assumptions is from sources believed to be reliable; however, there is no guarantee that such information is accurate. Any securities mentioned, whether owned in a fund or otherwise, are considered in the context of the construction of an overall portfolio of securities and therefore reference to them should not be construed as a recommendation or offer to purchase or sell any such security. Inclusion of such securities in a fund and transactions in such securities, if any, may be for a variety of reasons, including, without limitation, in response to cash flows, inclusion in a benchmark, and risk control. The reference to a specific security should also be understood in such context and not viewed as a statement that the security is a significant holding in a fund. Please refer to the Schedule of Investments for each fund which is included in this report for a complete list of fund holdings as of April 30, 2023. Securities mentioned in the Shareholders’ Letter, if not found in the Schedules of Investments, may have been held by the funds during the fiscal six-month period ended April 30, 2023.

Risk Disclosures

Alger Spectra Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Short sales could increase market exposure, magnifying losses and increasing volatility. Leverage increases volatility in both up and down markets and its costs may exceed the returns of borrowed securities. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Dynamic Opportunities Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Options and short sales could increase market exposure, magnifying losses and increasing volatility. Assets may be invested in Financial Derivatives Instruments (FDIs) such as Total Return Swaps (TRS) or options, which involve risks including possible counterparty default, illiquidity, and the risk of losses greater than if they had not been used. Issuers of convertible securities may be more sensitive to economic changes. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Leverage increases volatility in both up and down markets and its costs may exceed the returns of borrowed securities. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Emerging Markets Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Foreign securities, Frontier Markets, and Emerging Markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Responsible Investing Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. The environmental, social and governance investment criteria may limit the number of investment opportunities available, and as a result, returns may be lower than vehicles not subject to such considerations. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

For a more detailed discussion of the risks associated with a fund, please see the prospectus.

Before investing, carefully consider a fund’s investment objective, risks, charges, and expenses. For a prospectus and summary prospectus containing this and other information or for The Alger Funds II’s most recent month-end performance data, visit www.alger.com, call (800) 992-3863 or consult your financial advisor. Read the prospectus and summary prospectus carefully before investing.

Distributor: Fred Alger & Company, LLC

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Definitions:

| ● | Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. |

| ● | The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending. |

| ● | The HFRI Equity Hedge (Total) Index (“HFRI”) publishes equally weighted monthly performance based on a number of hedge funds reporting to create a composite, net of fees. |

| ● | The MSCI ACWI captures large- and mid-cap representation across developed markets and emerging markets countries. The index covers approximately 85% of the global equity opportunity set. |

| ● | The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. |

| ● | The MSCI Emerging Markets Index captures large-and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. |

| ● | The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 1000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. |

| ● | The Russell 1000 Index measures the performance of the large-cap segment of the US equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. |

| ● | The Russell 2000 Growth Index measures the performance of the small cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2000 Growth Index is constructed to provide a comprehensive and unbiased barometer of the small to mid-cap growth market. |

| ● | The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is constructed to provide a comprehensive and unbiased barometer of the small-cap segment. |

| ● | The Russell 3000 Growth Index combines the large-cap Russell 1000 Growth, the small-cap Russell 2000 Growth and the Russell Microcap Growth Index. It includes companies that are considered more growth oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 3000 Growth Index is constructed to provide a comprehensive, unbiased, and stable barometer of the growth opportunities within the broad market. |

| ● | The Russell 3000 Index measures the performance of the largest 3,000 US companies of the investable US equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad market. |

| ● | The Russell 3000 Value Index measures the performance of the broad value segment of the US equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000 Value Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad value market. |

| ● | The Russell Microcap Growth Index measures the performance of the microcap growth segment of the US equity market. It includes Russell Microcap companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). |

| ● | The Russell Microcap Index measures the performance of the microcap segment of the US equity market. The Russell Microcap Index is constructed to provide a comprehensive and unbiased barometer for the microcap segment trading on national exchanges. |

| ● | The S&P 500 Index is an unmanaged index considered representative of large-cap growth stocks. |

ALGER SPECTRA FUND

Fund Highlights Through April 30, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Spectra Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell 3000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Figures for the Alger Spectra Fund Class A shares and the Russell 3000 Growth Index include reinvestment of dividends. Figures for the Alger Spectra Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Spectra Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to the operating expenses and the current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER SPECTRA FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | 10 YEARS |

| Class A | (8.76)% | 5.99% | 10.49% |

| Class C | (5.40)% | 6.31% | 10.24% |

| Class I | (3.69)% | 7.14% | 11.10% |

| Class Z | (3.37)% | 7.47% | 11.44% |

| Russell 3000 Growth Index | 2.25% | 13.14% | 14.05% |

| | | | |

| | 1 YEAR | 5 YEARS | Since Inception |

| Class Y (Inception 12/3/18) | (3.26)% | n/a | 7.19% |

| Russell 3000 Growth Index | 2.25% | n/a | 13.29% |

| | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER DYNAMIC OPPORTUNITIES FUND

Fund Highlights Through April 30, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Dynamic Opportunities Fund Class A shares, with an initial 5.25% maximum sales charge, the S&P 500 Index (an unmanaged Index of Common Stocks) and the HFRI Equity Hedge (Total) Index (an unmanaged index of hedge funds) for the ten years ended April 30, 2023. Effective March 1, 2017, Weatherbie Capital, LLC (“Weatherbie”), an indirect, wholly-owned subsidiary of Alger Group Holdings, LLC, the parent company of Fred Alger Management, LLC, began providing investment sub-advisory services for a portion of the assets of the Alger Dynamic Opportunities Fund. Figures for the Alger Dynamic Opportunities Fund Class A shares, the S&P 500 Index and the HFRI Equity Hedge (Total) Index include reinvestment of dividends. Figures for the Alger Dynamic Opportunities Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Dynamic Opportunities Fund Class C and Class Z shares will vary from the results shown above due to the operating expenses and the current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER DYNAMIC OPPORTUNITIES FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS |

| Class A | | | (5.15 | )% | | | 6.67 | % | | | 6.85 | % |

| Class C | | | (1.67 | )% | | | 7.02 | % | | | 6.62 | % |

| Class Z | | | 0.35 | % | | | 8.11 | % | | | 7.73 | % |

| S&P 500 Index | | | 2.66 | % | | | 11.45 | % | | | 12.20 | % |

| HFRI Equity Hedge (Total) Index | | | 0.10 | % | | | 5.02 | % | | | 5.33 | % |

| | | | | | | | | | | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER EMERGING MARKETS FUND

Fund Highlights Through April 30, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Emerging Markets Fund Class A shares, with an initial 5.25% maximum sales charge, and the MSCI Emerging Markets Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Prior to September 24, 2019, Alger Emerging Markets Fund followed different investment strategies and was managed by different portfolio managers. Performance prior to this date reflects these prior management styles and does not reflect the Alger Emerging Markets Fund’s current investment strategies and investment personnel. Figures for the Alger Emerging Markets Fund Class A shares and the MSCI Emerging Markets Index include reinvestment of dividends. Figures for the Alger Emerging Markets Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Emerging Markets Fund Class C, Class I and Class Z shares will vary from the results shown above due to the operating expenses and current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER EMERGING MARKETS FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS |

| Class A | | | (17.03 | )% | | | (3.64 | )% | | | 0.30 | % |

| Class C | | | (13.99 | )% | | | (3.34 | )% | | | 0.07 | % |

| Class I | | | (12.36 | )% | | | (2.51 | )% | | | 0.87 | % |

| MSCI Emerging Markets Index | | | (6.09 | )% | | | (0.67 | )% | | | 2.18 | % |

| | | | | | | | | | | | | |

| | | 1 YEAR | | 5 YEARS | | Since

Inception |

| Class Z (Inception 2/28/14) | | | (12.11 | )% | | | (2.08 | )% | | | 1.31 | % |

| MSCI Emerging Markets Index | | | (6.09 | )% | | | (0.67 | )% | | | 2.93 | % |

| | | | | | | | | | | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Prior to September 24, 2019, Alger Emerging Markets Fund followed different investment strategies and was managed by different portfolio managers. Performance prior to this date reflects these prior management styles and does not reflect the Alger Emerging Markets Fund’s current investment strategies and investment personnel. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER RESPONSIBLE INVESTING FUND

Fund Highlights Through April 30, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Responsible Investing Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell 1000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Prior to December 29, 2016, the Alger Responsible Investing Fund followed different investment strategies under the name “Alger Green Fund” and was managed by different portfolio management teams. Performance during that period does not reflect the Fund’s current investment strategies. Figures for the Alger Responsible Investing Fund Class A shares and the Russell 1000 Growth Index include reinvestment of dividends. Figures for the Alger Responsible Investing Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Responsible Investing Fund Class C, Class I and Class Z shares will vary from the results shown above due to the operating expenses and the current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER RESPONSIBLE INVESTING FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS |

| Class A | | | (4.75 | )% | | | 10.23 | % | | | 10.75 | % |

| Class C | | | (1.25 | )% | | | 10.56 | % | | | 10.48 | % |

| Class I | | | 0.56 | % | | | 11.40 | % | | | 11.35 | % |

| Russell 1000 Growth Index | | | 2.34 | % | | | 13.80 | % | | | 14.46 | % |

| | | | | | | | | | | | | |

| | | 1 YEAR | | 5 YEARS | | Since

Inception |

| Class Z (Inception 10/14/16) | | | 0.92 | % | | | 11.85 | % | | | 13.83 | % |

| Russell 1000 Growth Index | | | 2.34 | % | | | 13.80 | % | | | 15.75 | % |

| | | | | | | | | | | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. Prior to December 29, 2016, the Alger Responsible Investing Fund followed different investment strategies under the name “Alger Green Fund” and was managed by different portfolio management teams. Performance during that period does not reflect the Fund’s current investment strategies. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger. com or call us at (800) 992-3863.

PORTFOLIO SUMMARY†

April 30, 2023 (Unaudited)

| SECTORS | | Alger Spectra Fund* | | Alger Dynamic

Opportunities Fund* | | Alger Responsible

Investing Fund |

| Communication Services | | | 9.6 | % | | | 4.3 | % | | | 5.4 | % |

| Consumer Discretionary | | | 18.1 | | | | 7.1 | | | | 16.3 | |

| Consumer Staples | | | (0.2 | ) | | | (1.5 | ) | | | 3.3 | |

| Energy | | | 5.2 | | | | 4.3 | | | | 0.0 | |

| Exchange Traded Funds | | | (0.4 | ) | | | 0.0 | | | | 0.0 | |

| Financials | | | 6.1 | | | | 2.3 | | | | 8.9 | |

| Healthcare | | | 15.3 | | | | 14.3 | | | | 13.1 | |

| Industrials | | | 8.9 | | | | 7.9 | | | | 5.7 | |

| Information Technology | | | 35.9 | | | | 13.3 | | | | 41.5 | |

| Market Indices | | | (2.3 | ) | | | 0.0 | | | | 0.0 | |

| Materials | | | 2.6 | | | | (0.5 | ) | | | 2.1 | |

| Real Estate | | | 1.6 | | | | (0.4 | ) | | | 2.7 | |

| Utilities | | | 0.0 | | | | 0.0 | | | | 0.8 | |

| Short-Term Investments and Net Other Assets | | | (0.4 | ) | | | 48.9 | | | | 0.2 | |

| | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| COUNTRY | | Alger Emerging Markets Fund | | | | | | |

| Argentina | | | 5.6 | % | | | | | | | | |

| Brazil | | | 9.0 | | | | | | | | | |

| China | | | 34.2 | | | | | | | | | |

| Greece | | | 5.7 | | | | | | | | | |

| Hong Kong | | | 2.7 | | | | | | | | | |

| India | | | 14.8 | | | | | | | | | |

| Mexico | | | 2.6 | | | | | | | | | |

| Poland | | | 2.3 | | | | | | | | | |

| South Korea | | | 11.6 | | | | | | | | | |

| Taiwan | | | 5.4 | | | | | | | | | |

| United Arab Emirates | | | 2.5 | | | | | | | | | |

| Cash and Net Other Assets | | | 3.6 | | | | | | | | | |

| | | | 100.0 | % | | | | | | | | |

* Includes short sales as a reduction of sector exposure.

† Based on net assets for each Fund.

| THE ALGER FUNDS II | ALGER SPECTRA FUND |

| Schedule of Investments April 30, 2023 (Unaudited) |

| | | | | |

| COMMON STOCKS—105.7% | | SHARES | | VALUE |

| ADVERTISING—0.9% | | | | |

| The Trade Desk, Inc., Cl. A* | | | 402,601 | | | $ | 25,903,348 | |

| AEROSPACE & DEFENSE—5.5% | | | | | | | | |

| HEICO Corp., Cl. A+ | | | 632,127 | | | | 84,850,407 | |

| TransDigm Group, Inc.+ | | | 100,777 | | | | 77,094,405 | |

| | | | | | | | 161,944,812 | |

| APPAREL ACCESSORIES & LUXURY GOODS—1.3% | | | | | | | | |

| LVMH Moet Hennessy Louis Vuitton SE | | | 38,136 | | | | 36,682,305 | |

| APPLICATION SOFTWARE—4.3% | | | | | | | | |

| Adobe, Inc.* | | | 35,424 | | | | 13,374,685 | |

| Cadence Design Systems, Inc.* | | | 149,683 | | | | 31,351,104 | |

| Datadog, Inc., Cl. A*,+ | | | 368,749 | | | | 24,846,308 | |

| Intuit, Inc.+ | | | 107,611 | | | | 47,773,904 | |

| Salesforce, Inc.* | | | 37,014 | | | | 7,342,467 | |

| | | | | | | | 124,688,468 | |

| AUTOMOBILE MANUFACTURERS—1.8% | | | | | | | | |

| Ferrari NV | | | 43,438 | | | | 12,103,565 | |

| Tesla, Inc.*,+ | | | 241,933 | | | | 39,752,011 | |

| | | | | | | | 51,855,576 | |

| AUTOMOTIVE PARTS & EQUIPMENT—0.5% | | | | | | | | |

| Mobileye Global, Inc., Cl. A* | | | 423,653 | | | | 15,946,299 | |

| BIOTECHNOLOGY—7.3% | | | | | | | | |

| AbbVie, Inc. | | | 210,431 | | | | 31,800,333 | |

| Apellis Pharmaceuticals, Inc.* | | | 99,028 | | | | 8,261,906 | |

| Biogen, Inc.* | | | 51,810 | | | | 15,762,156 | |

| Natera, Inc.*,+ | | | 1,397,444 | | | | 70,878,359 | |

| Prometheus Biosciences, Inc.* | | | 244,749 | | | | 47,469,068 | |

| Regeneron Pharmaceuticals, Inc.* | | | 14,130 | | | | 11,329,293 | |

| Vaxcyte, Inc.* | | | 357,584 | | | | 15,315,323 | |

| Vertex Pharmaceuticals, Inc.* | | | 35,616 | | | | 12,135,440 | |

| | | | | | | | 212,951,878 | |

| BROADLINE RETAIL—8.6% | | | | | | | | |

| Amazon.com, Inc.*,+ | | | 1,543,891 | | | | 162,803,306 | |

| MercadoLibre, Inc.* | | | 68,984 | | | | 88,126,370 | |

| | | | | | | | 250,929,676 | |

| CARGO GROUND TRANSPORTATION—0.9% | | | | | | | | |

| Old Dominion Freight Line, Inc. | | | 84,412 | | | | 27,044,761 | |

| CASINOS & GAMING—3.5% | | | | | | | | |

| Flutter Entertainment PLC* | | | 177,919 | | | | 35,551,343 | |

| Las Vegas Sands Corp.* | | | 1,057,854 | | | | 67,543,978 | |

| | | | | | | | 103,095,321 | |

| COAL & CONSUMABLE FUELS—0.3% | | | | | | | | |

| Cameco Corp. | | | 320,184 | | | | 8,801,858 | |

| COMMUNICATIONS EQUIPMENT—0.8% | | | | | | | | |

| Arista Networks, Inc.* | | | 148,726 | | | | 23,819,956 | |

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—105.7% (CONT.) | | SHARES | | VALUE |

| CONSTRUCTION MACHINERY & HEAVY TRANSPORTATION EQUIPMENT—0.9% |

| Wabtec Corp. | | | 255,914 | | | $ | 24,995,120 | |

| CONSTRUCTION MATERIALS—1.3% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 107,713 | | | | 39,121,362 | |

| CONSUMER STAPLES MERCHANDISE RETAIL—0.5% | | | | | | | | |

| Costco Wholesale Corp.+ | | | 29,622 | | | | 14,906,383 | |

| DIVERSIFIED BANKS—1.0% | | | | | | | | |

| JPMorgan Chase & Co. | | | 201,009 | | | | 27,787,484 | |

| ENVIRONMENTAL & FACILITIES SERVICES—1.4% | | | | | | | | |

| GFL Environmental, Inc. | | | 1,130,275 | | | | 41,028,983 | |

| FINANCIAL EXCHANGES & DATA—2.1% | | | | | | | | |

| CME Group, Inc., Cl. A | | | 92,870 | | | | 17,252,460 | |

| S&P Global, Inc.+ | | | 120,185 | | | | 43,576,677 | |

| | | | | | | | 60,829,137 | |

| FOOTWEAR—1.1% | | | | | | | | |

| NIKE, Inc., Cl. B | | | 197,999 | | | | 25,090,433 | |

| On Holding AG, Cl. A* | | | 221,433 | | | | 7,185,501 | |

| | | | | | | | 32,275,934 | |

| HEALTHCARE DISTRIBUTORS—0.5% | | | | | | | | |

| McKesson Corp. | | | 43,367 | | | | 15,795,996 | |

| HEALTHCARE EQUIPMENT—2.3% | | | | | | | | |

| Dexcom, Inc.* | | | 122,310 | | | | 14,841,095 | |

| Intuitive Surgical, Inc.* | | | 119,512 | | | | 35,999,405 | |

| TransMedics Group, Inc.* | | | 215,348 | | | | 17,034,027 | |

| | | | | | | | 67,874,527 | |

| HEALTHCARE FACILITIES—1.2% | | | | | | | | |

| Acadia Healthcare Co., Inc.* | | | 484,978 | | | | 35,059,060 | |

| HOTELS RESORTS & CRUISE LINES—1.5% | | | | | | | | |

| Hilton Worldwide Holdings, Inc. | | | 108,154 | | | | 15,576,339 | |

| Trip.com Group Ltd.#,* | | | 788,359 | | | | 27,994,628 | |

| | | | | | | | 43,570,967 | |

| INTERACTIVE MEDIA & SERVICES—4.8% | | | | | | | | |

| Alphabet, Inc., Cl. C*,+ | | | 711,526 | | | | 77,001,344 | |

| Meta Platforms, Inc., Cl. A* | | | 265,631 | | | | 63,836,442 | |

| | | | | | | | 140,837,786 | |

| INTERNET SERVICES & INFRASTRUCTURE—0.2% | | | | | | | | |

| MongoDB, Inc., Cl. A* | | | 23,758 | | | | 5,700,970 | |

| LIFE SCIENCES TOOLS & SERVICES—1.4% | | | | | | | | |

| Danaher Corp. | | | 116,448 | | | | 27,587,696 | |

| West Pharmaceutical Services, Inc. | | | 39,711 | | | | 14,345,201 | |

| | | | | | | | 41,932,897 | |

| MANAGED HEALTHCARE—2.1% | | | | | | | | |

| UnitedHealth Group, Inc. | | | 121,980 | | | | 60,025,138 | |

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—105.7% (CONT.) | | SHARES | | VALUE |

| MOVIES & ENTERTAINMENT—4.2% | | | | | | | | |

| Liberty Media Corp. Series C Liberty Formula One* | | | 551,987 | | | $ | 39,847,942 | |

| Netflix, Inc.* | | | 138,580 | | | | 45,721,699 | |

| The Walt Disney Co.* | | | 358,743 | | | | 36,771,158 | |

| | | | | | | | 122,340,799 | |

| OIL & GAS EQUIPMENT & SERVICES—0.9% | | | | | | | | |

| Schlumberger Ltd.+ | | | 553,185 | | | | 27,299,680 | |

| OIL & GAS EXPLORATION & PRODUCTION—3.1% | | | | | | | | |

| Diamondback Energy, Inc. | | | 203,483 | | | | 28,935,283 | |

| EOG Resources, Inc. | | | 314,335 | | | | 37,553,602 | |

| Pioneer Natural Resources Co.+ | | | 111,851 | | | | 24,333,185 | |

| | | | | | | | 90,822,070 | |

| OIL & GAS STORAGE & TRANSPORTATION—0.9% | | | | | | | | |

| Cheniere Energy, Inc. | | | 167,762 | | | | 25,667,586 | |

| PASSENGER GROUND TRANSPORTATION—0.2% | | | | | | | | |

| Uber Technologies, Inc.* | | | 218,480 | | | | 6,783,804 | |

| PHARMACEUTICALS—0.6% | | | | | | | | |

| Catalent, Inc.* | | | 66,123 | | | | 3,314,085 | |

| Eli Lilly & Co. | | | 22,599 | | | | 8,946,040 | |

| Reata Pharmaceuticals, Inc., Cl. A* | | | 50,612 | | | | 5,003,502 | |

| | | | | | | | 17,263,627 | |

| PROPERTY & CASUALTY INSURANCE—1.0% | | | | | | | | |

| The Progressive Corp. | | | 207,297 | | | | 28,275,311 | |

| REAL ESTATE SERVICES—1.6% | | | | | | | | |

| FirstService Corp. | | | 305,966 | | | | 46,121,315 | |

| RESEARCH & CONSULTING SERVICES—0.7% | | | | | | | | |

| CoStar Group, Inc.* | | | 250,253 | | | | 19,256,968 | |

| RESTAURANTS—0.5% | | | | | | | | |

| Yum China Holdings, Inc. | | | 242,145 | | | | 14,814,431 | |

| SEMICONDUCTORS—9.0% | | | | | | | | |

| Advanced Micro Devices, Inc.*,+ | | | 261,534 | | | | 23,373,294 | |

| First Solar, Inc.* | | | 71,249 | | | | 13,008,643 | |

| Marvell Technology, Inc. | | | 1,136,986 | �� | | | 44,888,207 | |

| NVIDIA Corp.+ | | | 523,121 | | | | 145,160,846 | |

| ON Semiconductor Corp.* | | | 183,541 | | | | 13,207,610 | |

| Taiwan Semiconductor Manufacturing Co., Ltd.# | | | 278,619 | | | | 23,487,582 | |

| | | | | | | | 263,126,182 | |

| SPECIALTY CHEMICALS—1.3% | | | | | | | | |

| Albemarle Corp. | | | 204,811 | | | | 37,984,248 | |

| SYSTEMS SOFTWARE—14.1% | | | | | | | | |

| Microsoft Corp.+ | | | 1,170,287 | | | | 359,582,383 | |

| Oracle Corp. | | | 216,094 | | | | 20,468,424 | |

| SentinelOne, Inc., Cl. A* | | | 413,671 | | | | 6,647,693 | |

| ServiceNow, Inc.* | | | 56,707 | | | | 26,052,330 | |

| | | | | | | | 412,750,830 | |

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—105.7% (CONT.) | | SHARES | | VALUE |

| TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—7.3% | | | | | | | | |

| Apple, Inc.+ | | | 1,251,125 | | | $ | 212,290,890 | |

| TRANSACTION & PAYMENT PROCESSING SERVICES—2.3% | | | | | | | | |

| Visa, Inc., Cl. A | | | 285,947 | | | | 66,548,445 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $2,291,664,429) | | | | | | | 3,086,752,188 | |

| | | | | | | | | |

| PREFERRED STOCKS—0.3% | | | SHARES | | | | VALUE | |

| BIOTECHNOLOGY—0.0% | | | | | | | | |

| Prosetta Biosciences, Inc., Series D*,@,(a),(b) | | | 2,912,012 | | | | — | |

| DATA PROCESSING & OUTSOURCED SERVICES—0.3% | | | | | | | | |

| Chime Financial, Inc., Series G*,@,(a) | | | 188,583 | | | | 8,110,955 | |

| TOTAL PREFERRED STOCKS | | | | | | | | |

| (Cost $26,129,444) | | | | | | | 8,110,955 | |

| | | | | | | | | |

| SPECIAL PURPOSE VEHICLE—0.4% | | | | | | | VALUE | |

| DATA PROCESSING & OUTSOURCED SERVICES—0.4% | | | | | | | | |

| Crosslink Ventures Capital C, LLC, Cl. A*,@,(a),(b) | | | | | | | 7,672,812 | |

| Crosslink Ventures Capital C, LLC, Cl. B*,@,(a),(b) | | | | | | | 4,805,031 | |

| | | | | | | | 12,477,843 | |

| TOTAL SPECIAL PURPOSE VEHICLE | | | | | | | | |

| (Cost $11,925,000) | | | | | | | 12,477,843 | |

| Total Investments | | | | | | | | |

| (Cost $2,329,718,873) | | | 106.4 | % | | $ | 3,107,340,986 | |

| Affiliated Securities (Cost $25,029,054) | | | | | | | 12,477,843 | |

| Unaffiliated Securities (Cost $2,304,689,819) | | | | | | | 3,094,863,143 | |

| Securities Sold Short (Proceeds $186,601,926) | | | (6.0 | )% | | | (176,150,058 | ) |

| Liabilities in Excess of Other Assets | | | (0.4 | )% | | | (10,497,624 | ) |

| NET ASSETS | | | 100.0 | % | | $ | 2,920,693,304 | |

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| + | All or a portion of this security is held as collateral for securities sold short. |

| # | American Depositary Receipts. |

| (a) | Security is valued in good faith at fair value determined using significant unobservable inputs pursuant to procedures established by the Valuation Designee (as defined in Note 2). |

| (b) | Deemed an affiliate of the Fund in accordance with Section 2(a)(3) of the Investment Company Act of 1940. See Note 11 - Affiliated Securities. |

| * | Non-income producing security. |

| @ | Restricted security - Investment in security not registered under the Securities Act of 1933. Sales or transfers of the investment may be restricted only to qualified buyers. |

| Security | | Acquisition

Date(s) | | | Acquisition

Cost | | | % of net assets

(Acquisition

Date) | | | Market

Value | | | % of net assets

as of

4/30/2023 | |

| Chime Financial, Inc., Series G | | 8/24/21 | | | $ | 13,025,390 | | | | 0.15 | % | | $ | 8,110,955 | | | | 0.28 | % |

| Crosslink Ventures Capital C, LLC, Cl. A | | 10/2/20 | | | | 7,350,000 | | | | 0.10 | % | | | 7,672,812 | | | | 0.26 | % |

| Crosslink Ventures Capital C, LLC, Cl. B | | 12/16/20 | | | | 4,575,000 | | | | 0.06 | % | | | 4,805,031 | | | | 0.16 | % |

| Prosetta Biosciences, Inc., Series D | | 2/6/15 | | | | 13,104,054 | | | | 0.28 | % | | | 0 | | | | 0.00 | % |

| Total | | | | | | | | | | | | | $ | 20,588,798 | | | | 0.70 | % |

See Notes to Financial Statements.

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments - Securities Sold Short April 30, 2023 (Unaudited)

| COMMON STOCKS—(6.0)% | | SHARES | | | VALUE | |

| AEROSPACE & DEFENSE—(0.3)% | | | | | | | | |

| General Dynamics Corp. | | | (36,826 | ) | | $ | (8,040,589 | ) |

| APPAREL ACCESSORIES & LUXURY GOODS—(0.1)% | | | | | | | | |

| Carter’s, Inc. | | | (39,973 | ) | | | (2,788,916 | ) |

| APPAREL RETAIL—(0.1)% | | | | | | | | |

| Urban Outfitters, Inc. | | | (104,549 | ) | | | (2,829,096 | ) |

| APPLICATION SOFTWARE—(0.2)% | | | | | | | | |

| Atlassian Corp., Cl. A | | | (18,116 | ) | | | (2,675,009 | ) |

| HubSpot, Inc. | | | (10,104 | ) | | | (4,253,279 | ) |

| | | | | | | | (6,928,288 | ) |

| AUTOMOBILE MANUFACTURERS—(0.2)% | | | | | | | | |

| Thor Industries, Inc. | | | (63,644 | ) | | | (5,029,149 | ) |

| AUTOMOTIVE PARTS & EQUIPMENT—(0.1)% | | | | | | | | |

| Luminar Technologies, Inc., Cl. A | | | (156,420 | ) | | | (941,648 | ) |

| QuantumScape Corp., Cl. A | | | (466,725 | ) | | | (3,267,075 | ) |

| | | | | | | | (4,208,723 | ) |

| BROADLINE RETAIL—(0.1)% | | | | | | | | |

| eBay, Inc. | | | (90,648 | ) | | | (4,208,787 | ) |

| CABLE & SATELLITE—(0.2)% | | | | | | | | |

| Charter Communications, Inc., Cl. A | | | (15,426 | ) | | | (5,687,566 | ) |

| CONSTRUCTION MACHINERY & HEAVY TRANSPORTATION EQUIPMENT—(0.2)% | | | | | | | | |

| Wabash National Corp. | | | (213,231 | ) | | | (5,473,640 | ) |

| CONSUMER FINANCE—(0.1)% | | | | | | | | |

| Capital One Financial Corp. | | | (28,175 | ) | | | (2,741,428 | ) |

| DIVERSIFIED BANKS—(0.2)% | | | | | | | | |

| SPDR S&P Regional Banking ETF | | | (138,614 | ) | | | (5,913,273 | ) |

| ELECTRONIC EQUIPMENT & INSTRUMENTS—(0.2)% | | | | | | | | |

| Cognex Corp. | | | (91,042 | ) | | | (4,341,793 | ) |

| EXCHANGE TRADED FUNDS—(0.4)% | | | | | | | | |

| ARK Innovation ETF | | | (153,608 | ) | | | (5,517,599 | ) |

| Renaissance IPO ETF | | | (205,706 | ) | | | (5,709,699 | ) |

| | | | | | | | (11,227,298 | ) |

| HEALTHCARE SERVICES—(0.1)% | | | | | | | | |

| Amedisys, Inc. | | | (36,026 | ) | | | (2,892,888 | ) |

| HOUSEHOLD PRODUCTS—(0.3)% | | | | | | | | |

| The Clorox Co. | | | (60,209 | ) | | | (9,971,815 | ) |

| INDUSTRIAL MACHINERY & SUPPLIES & COMPONENTS—(0.2)% | | | | | | | | |

| Parker-Hannifin Corp. | | | (22,289 | ) | | | (7,241,250 | ) |

| INTERACTIVE MEDIA & SERVICES—(0.1)% | | | | | | | | |

| ZoomInfo Technologies, Inc., Cl. A | | | (133,528 | ) | | | (2,925,598 | ) |

| LEISURE PRODUCTS—(0.1)% | | | | | | | | |

| YETI Holdings, Inc. | | | (75,132 | ) | | | (2,963,957 | ) |

| LIFE & HEALTH INSURANCE—0.0% | | | | | | | | |

| Trupanion, Inc. | | | (31,384 | ) | | | (1,101,892 | ) |

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments - Securities Sold Short April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—(6.0)% (CONT.) | | SHARES | | | VALUE | |

| MARKET INDICES—(2.3)% | | | | | | | | |

| Direxion NASDAQ-100 Equal Weighted Index Shares | | | (228,978 | ) | | | (16,232,250 | ) |

| iShares Russell Mid-Cap Growth ETF | | | (228,277 | ) | | $ | (20,485,578 | ) |

| SPDR S&P 500 ETF Trust | | | (72,880 | ) | | | (30,312,978 | ) |

| | | | | | | | (67,030,806 | ) |

| PACKAGED FOODS & MEATS—(0.4)% | | | | | | | | |

| Campbell Soup Co. | | | (92,549 | ) | | | (5,025,411 | ) |

| Kellogg Co. | | | (72,341 | ) | | | (5,047,232 | ) |

| | | | | | | | (10,072,643 | ) |

| SEMICONDUCTORS—(0.1)% | | | | | | | | |

| Silicon Laboratories, Inc. | | | (18,167 | ) | | | (2,530,663 | ) |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Proceeds $186,601,926) | | | | | | $ | (176,150,058 | ) |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $186,601,926) | | | | | | $ | (176,150,058 | ) |

See Notes to Financial Statements.

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2023 (Unaudited)

| COMMON STOCKS—87.1% | | SHARES | | | VALUE | |

| ADVERTISING—1.7% | | | | | | | | |

| The Trade Desk, Inc., Cl. A*,+ | | | 104,935 | | | $ | 6,751,518 | |

| AEROSPACE & DEFENSE—6.6% | | | | | | | | |

| HEICO Corp.+ | | | 39,079 | | | | 6,590,283 | |

| HEICO Corp., Cl. A+ | | | 26,042 | | | | 3,495,618 | |

| Kratos Defense & Security Solutions, Inc.*,+ | | | 59,956 | | | | 773,432 | |

| TransDigm Group, Inc.+ | | | 20,590 | | | | 15,751,350 | |

| | | | | | | | 26,610,683 | |

| APPAREL RETAIL—0.3% | | | | | | | | |

| MYT Netherlands Parent BV#,* | | | 52,415 | | | | 257,358 | |

| The TJX Cos., Inc. | | | 12,086 | | | | 952,618 | |

| | | | | | | | 1,209,976 | |

| APPLICATION SOFTWARE—6.6% | | | | | | | | |

| Adobe, Inc.*,+ | | | 7,720 | | | | 2,914,763 | |

| AppFolio, Inc., Cl. A* | | | 19,648 | | | | 2,743,254 | |

| Everbridge, Inc.* | | | 2,061 | | | | 54,163 | |

| HubSpot, Inc.*,+ | | | 8,207 | | | | 3,454,737 | |

| Instructure Holdings, Inc.* | | | 36,750 | | | | 974,977 | |

| Paylocity Holding Corp.*,+ | | | 22,170 | | | | 4,285,239 | |

| Salesforce, Inc.* | | | 7,661 | | | | 1,519,713 | |

| SPS Commerce, Inc.*,+ | | | 32,865 | | | | 4,841,014 | |

| Vertex, Inc., Cl. A*,+ | | | 285,138 | | | | 5,888,100 | |

| | | | | | | | 26,675,960 | |

| ASSET MANAGEMENT & CUSTODY BANKS—1.2% | | | | | | | | |

| Hamilton Lane, Inc., Cl. A+ | | | 30,796 | | | | 2,269,049 | |

| StepStone Group, Inc., Cl. A+ | | | 111,298 | | | | 2,451,895 | |

| | | | | | | | 4,720,944 | |

| AUTOMOBILE MANUFACTURERS—0.1% | | | | | | | | |

| BYD Co., Ltd., Cl. H | | | 19,379 | | | | 587,692 | |

| AUTOMOTIVE PARTS & EQUIPMENT—0.7% | | | | | | | | |

| Mobileye Global, Inc., Cl. A* | | | 72,791 | | | | 2,739,853 | |

| BIOTECHNOLOGY—6.3% | | | | | | | | |

| AbbVie, Inc. | | | 11,707 | | | | 1,769,162 | |

| ACADIA Pharmaceuticals, Inc.*,+ | | | 114,678 | | | | 2,446,082 | |

| ADMA Biologics, Inc.* | | | 614,522 | | | | 2,058,649 | |

| Biogen, Inc.* | | | 6,710 | | | | 2,041,384 | |

| BioMarin Pharmaceutical, Inc.*,+ | | | 37,212 | | | | 3,573,840 | |

| Cabaletta Bio, Inc.*,+ | | | 232,987 | | | | 2,418,405 | |

| Larimar Therapeutics, Inc.* | | | 204,283 | | | | 966,258 | |

| Morphic Holding, Inc.* | | | 43,888 | | | | 2,074,147 | |

| Natera, Inc.*,+ | | | 77,458 | | | | 3,928,670 | |

| Ultragenyx Pharmaceutical, Inc.* | | | 23,170 | | | | 1,011,834 | |

| Vaxcyte, Inc.* | | | 46,653 | | | | 1,998,148 | |

| Vertex Pharmaceuticals, Inc.* | | | 3,007 | | | | 1,024,575 | |

| | | | | | | | 25,311,154 | |

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—87.1% (CONT.) | | SHARES | | | VALUE | |

| BROADLINE RETAIL—3.7% | | | | | | | | |

| Amazon.com, Inc.*,+ | | | 58,331 | | | $ | 6,151,004 | |

| MercadoLibre, Inc.*,+ | | | 4,752 | | | | 6,070,632 | |

| Ollie’s Bargain Outlet Holdings, Inc.*,+ | | | 39,524 | | | | 2,578,941 | |

| | | | | | | | 14,800,577 | |

| CARGO GROUND TRANSPORTATION—0.5% | | | | | | | | |

| RXO, Inc.* | | | 71,123 | | | | 1,286,615 | |

| XPO, Inc.* | | | 16,709 | | | | 738,204 | |

| | | | | | | | 2,024,819 | |

| CASINOS & GAMING—2.2% | | | | | | | | |

| Flutter Entertainment PLC* | | | 16,304 | | | | 3,257,826 | |

| Las Vegas Sands Corp.*,+ | | | 64,729 | | | | 4,132,946 | |

| MGM Resorts International+ | | | 36,003 | | | | 1,617,255 | |

| | | | | | | | 9,008,027 | |

| COMMUNICATIONS EQUIPMENT—0.3% | | | | | | | | |

| Arista Networks, Inc.* | | | 6,391 | | | | 1,023,583 | |

| CONSTRUCTION MACHINERY & HEAVY TRANSPORTATION EQUIPMENT—0.1% |

| Wabtec Corp. | | | 4,958 | | | | 484,248 | |

| CONSTRUCTION MATERIALS—1.0% | | | | | | | | |

| Martin Marietta Materials, Inc.+ | | | 11,491 | | | | 4,173,531 | |

| CONSUMER FINANCE—0.1% | | | | | | | | |

| Upstart Holdings, Inc.*,+ | | | 15,166 | | | | 210,807 | |

| EDUCATION SERVICES—1.4% | | | | | | | | |

| Chegg, Inc.*,+ | | | 240,560 | | | | 4,325,269 | |

| Duolingo, Inc., Cl. A* | | | 10,435 | | | | 1,420,829 | |

| | | | | | | | 5,746,098 | |

| ELECTRONIC EQUIPMENT & INSTRUMENTS—1.2% | | | | | | | | |

| 908 Devices, Inc.*,+ | | | 541,605 | | | | 3,661,250 | |

| Novanta, Inc.* | | | 8,917 | | | | 1,362,874 | |

| | | | | | | | 5,024,124 | |

| ENVIRONMENTAL & FACILITIES SERVICES—5.9% | | | | | | | | |

| Casella Waste Systems, Inc., Cl. A*,+ | | | 86,832 | | | | 7,728,048 | |

| Montrose Environmental Group, Inc.*,+ | | | 169,758 | | | | 5,170,829 | |

| Waste Connections, Inc.+ | | | 77,155 | | | | 10,736,118 | |

| | | | | | | | 23,634,995 | |

| FOOTWEAR—2.3% | | | | | | | | |

| Deckers Outdoor Corp.* | | | 8,662 | | | | 4,152,043 | |

| On Holding AG, Cl. A* | | | 158,559 | | | | 5,145,240 | |

| | | | | | | | 9,297,283 | |

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—87.1% (CONT.) | | SHARES | | | VALUE | |

| HEALTHCARE EQUIPMENT—7.8% | | | | | | | | |

| Dexcom, Inc.* | | | 32,164 | | | $ | 3,902,780 | |

| GE HealthCare Technologies, Inc.*,+ | | | 20,587 | | | | 1,674,547 | |

| Glaukos Corp.*,+ | | | 119,442 | | | | 5,674,689 | |

| Impulse Dynamics PLC, Class E*,@,(a) | | | 1,056,141 | | | | 3,485,265 | |

| Inogen, Inc.* | | | 92,718 | | | | 1,234,077 | |

| Inspire Medical Systems, Inc.* | | | 7,060 | | | | 1,889,468 | |

| Insulet Corp.*,+ | | | 8,383 | | | | 2,666,129 | |

| Intuitive Surgical, Inc.* | | | 13,758 | | | | 4,144,185 | |

| Nevro Corp.*,+ | | | 100,156 | | | | 2,931,566 | |

| Teleflex, Inc. | | | 3,695 | | | | 1,006,961 | |

| TransMedics Group, Inc.*,+ | | | 38,232 | | | | 3,024,151 | |

| | | | | | | | 31,633,818 | |

| HEALTHCARE SERVICES—1.4% | | | | | | | | |

| Accolade, Inc.* | | | 91,876 | | | | 1,243,082 | |

| Agiliti, Inc.*,+ | | | 254,391 | | | | 4,253,418 | |

| | | | | | | | 5,496,500 | |

| HEALTHCARE TECHNOLOGY—0.3% | | | | | | | | |

| Definitive Healthcare Corp., Cl. A* | | | 101,535 | | | | 1,086,425 | |

| HOTELS RESORTS & CRUISE LINES—1.9% | | | | | | | | |

| Airbnb, Inc., Cl. A* | | | 23,591 | | | | 2,823,135 | |

| Booking Holdings, Inc.* | | | 770 | | | | 2,068,459 | �� |

| Trip.com Group Ltd.#,* | | | 81,924 | | | | 2,909,121 | |

| | | | | | | | 7,800,715 | |

| INTEGRATED OIL & GAS—0.6% | | | | | | | | |

| Occidental Petroleum Corp.+ | | | 41,714 | | | | 2,566,662 | |

| INTERACTIVE MEDIA & SERVICES—1.9% | | | | | | | | |

| Alphabet, Inc., Cl. A* | | | 37,263 | | | | 3,999,810 | |

| Meta Platforms, Inc., Cl. A* | | | 8,386 | | | | 2,015,324 | |

| Pinterest, Inc., Cl. A* | | | 69,880 | | | | 1,607,240 | |

| | | | | | | | 7,622,374 | |

| INTERNET SERVICES & INFRASTRUCTURE—0.2% | | | | | | | | |

| MongoDB, Inc., Cl. A* | | | 1,698 | | | | 407,452 | |

| Shopify, Inc., Cl. A*,+ | | | 10,464 | | | | 506,981 | |

| | | | | | | | 914,433 | |

| INVESTMENT BANKING & BROKERAGE—1.5% | | | | | | | | |

| Morgan Stanley | | | 33,315 | | | | 2,997,350 | |

| The Charles Schwab Corp. | | | 19,758 | | | | 1,032,158 | |

| The Goldman Sachs Group, Inc. | | | 5,963 | | | | 2,047,933 | |

| | | | | | | | 6,077,441 | |

| IT CONSULTING & OTHER SERVICES—0.3% | | | | | | | | |

| CI&T, Inc., Cl. A* | | | 73,262 | | | | 288,652 | |

| Globant SA* | | | 5,285 | | | | 829,058 | |

| | | | | | | | 1,117,710 | |

| LEISURE FACILITIES—1.1% | | | | | | | | |

| Planet Fitness, Inc., Cl. A*,+ | | | 51,836 | | | | 4,309,645 | |

| LEISURE PRODUCTS—0.0% | | | | | | | | |

| Latham Group, Inc.* | | | 9,271 | | | | 22,343 | |

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—87.1% (CONT.) | | SHARES | | | VALUE | |

| LIFE SCIENCES TOOLS & SERVICES—0.5% | | | | | | | | |

| Bio-Techne Corp. | | | 12,927 | | | $ | 1,032,609 | |

| Repligen Corp.* | | | 5,568 | | | | 844,276 | |

| | | | | | | | 1,876,885 | |

| MANAGED HEALTHCARE—2.5% | | | | | | | | |

| Progyny, Inc.*,+ | | | 298,021 | | | | 9,906,218 | |

| MOVIES & ENTERTAINMENT—2.6% | | | | | | | | |

| Liberty Media Corp. Series C Liberty Formula One* | | | 13,429 | | | | 969,439 | |

| Netflix, Inc.*,+ | | | 12,521 | | | | 4,131,054 | |

| Roku, Inc., Cl. A* | | | 17,467 | | | | 981,820 | |

| Spotify Technology SA*,+ | | | 22,748 | | | | 3,039,133 | |

| World Wrestling Entertainment, Inc., Cl. A | | | 14,387 | | | | 1,541,855 | |

| | | | | | | | 10,663,301 | |

| OIL & GAS EQUIPMENT & SERVICES—2.5% | | | | | | | | |

| Core Laboratories NV+ | | | 226,059 | | | | 5,088,588 | |

| Dril-Quip, Inc.*,+ | | | 104,774 | | | | 2,858,235 | |

| Schlumberger Ltd.+ | | | 42,340 | | | | 2,089,479 | |

| | | | | | | | 10,036,302 | |

| OIL & GAS EXPLORATION & PRODUCTION—1.8% | | | | | | | | |

| Diamondback Energy, Inc.+ | | | 21,471 | | | | 3,053,176 | |

| Pioneer Natural Resources Co. | | | 18,901 | | | | 4,111,913 | |

| | | | | | | | 7,165,089 | |

| PASSENGER GROUND TRANSPORTATION—0.3% | | | | | | | | |

| Uber Technologies, Inc.* | | | 32,777 | | | | 1,017,726 | |

| PHARMACEUTICALS—1.1% | | | | | | | | |

| AstraZeneca PLC# | | | 26,704 | | | | 1,955,267 | |

| Pliant Therapeutics, Inc.* | | | 6,600 | | | | 186,450 | |

| Reata Pharmaceuticals, Inc., Cl. A* | | | 20,929 | | | | 2,069,041 | |

| Ventyx Biosciences, Inc.* | | | 8,808 | | | | 331,181 | |

| | | | | | | | 4,541,939 | |

| REAL ESTATE SERVICES—2.6% | | | | | | | | |

| FirstService Corp.+ | | | 70,820 | | | | 10,675,407 | |

| REGIONAL BANKS—0.2% | | | | | | | | |

| Axos Financial, Inc.*,+ | | | 3,525 | | | | 143,362 | |

| Seacoast Banking Corp. of Florida | | | 24,434 | | | | 542,190 | |

| Signature Bank | | | 44,390 | | | | 4,133 | |

| | | | | | | | 689,685 | |

| RESTAURANTS—1.6% | | | | | | | | |

| Chipotle Mexican Grill, Inc., Cl. A* | | | 611 | | | | 1,263,316 | |

| Kura Sushi USA, Inc., Cl. A* | | | 41,576 | | | | 2,865,418 | |

| Wingstop, Inc. | | | 2,402 | | | | 480,664 | |

| Yum China Holdings, Inc. | | | 33,376 | | | | 2,041,944 | |

| | | | | | | | 6,651,342 | |

| SEMICONDUCTOR MATERIALS & EQUIPMENT—0.7% | | | | | | | | |

| ASML Holding NV# | | | 3,182 | | | | 2,026,488 | |

| SolarEdge Technologies, Inc.*,+ | | | 3,390 | | | | 968,286 | |

| | | | | | | | 2,994,774 | |

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2023 (Unaudited) (Continued)

| COMMON STOCKS—87.1% (CONT.) | | SHARES | | | VALUE | |

| SEMICONDUCTORS—2.5% | | | | | | | | |

| Analog Devices, Inc. | | | 5,424 | | | $ | 975,669 | |

| Impinj, Inc.* | | | 7,133 | | | | 630,629 | |

| NVIDIA Corp. | | | 29,859 | | | | 8,285,574 | |

| | | | | | | | 9,891,872 | |

| SYSTEMS SOFTWARE—4.5% | | | | | | | | |

| Microsoft Corp.+ | | | 54,270 | | | | 16,675,000 | |

| Oracle Corp. | | | 15,995 | | | | 1,515,047 | |

| Rapid7, Inc.* | | | 2,415 | | | | 117,393 | |

| | | | | | | | 18,307,440 | |

| TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—2.0% | |

| Apple, Inc.+ | | | 48,228 | | | | 8,183,327 | |

| TRADING COMPANIES & DISTRIBUTORS—0.7% | | | | | | | | |

| SiteOne Landscape Supply, Inc.*,+ | | | 16,477 | | | | 2,434,312 | |

| Xometry, Inc., Cl. A* | | | 42,550 | | | | 591,019 | |

| | | | | | | | 3,025,331 | |

| TRANSACTION & PAYMENT PROCESSING SERVICES—1.8% | |

| Flywire Corp.* | | | 114,254 | | | | 3,332,789 | |

| Toast, Inc., Cl. A* | | | 221,331 | | | | 4,028,224 | |

| | | | | | | | 7,361,013 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $342,064,346) | | | | | | | 351,671,589 | |

| | | | | | | | | |

| PREFERRED STOCKS—0.0% | | SHARES | | | VALUE | |

| BIOTECHNOLOGY—0.0% | | | | | | | | |