historical performance. Hypothetical or historical performance data are not indicative of, and have no bearing on, the potential performance of SOFR or the notes. Changes in the levels of SOFR will affect the base rate and, therefore, the return on the notes and the trading price of such notes, but it is impossible to predict whether such levels will rise or fall. There can be no assurance that SOFR or the base rate will be positive.

Any failure of SOFR to gain market acceptance could adversely affect the notes.

SOFR may fail to gain market acceptance. SOFR was developed for use in certain U.S. dollar derivatives and other financial contracts as an alternative to U.S. dollar LIBOR in part because it is considered a good representation of general funding conditions in the overnight Treasury repo market. However, as a rate based on transactions secured by U.S. Treasury securities, it does not measure bank-specific credit risk and, as a result, is less likely to correlate with the unsecured short-term funding costs of banks. This may mean that market participants would not consider SOFR a suitable substitute or successor for all of the purposes for which LIBOR historically has been used (including, without limitation, as a representation of the unsecured short-term funding costs of banks), which may, in turn, lessen market acceptance of SOFR. Any failure of SOFR to gain market acceptance could adversely affect the return on the notes and the price at which you can sell such notes.

The composition and characteristics of SOFR are not the same as those of LIBOR and there is no guarantee that either SOFR or the base rate is a comparable substitute for LIBOR.

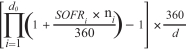

In June 2017, the New York Federal Reserve’s Alternative Reference Rates Committee (the “ARRC”) announced SOFR as its recommended alternative to U.S. dollar LIBOR. However, the composition and characteristics of SOFR are not the same as those of LIBOR. SOFR is a broad Treasury repo financing rate that represents overnight secured funding transactions. This means that SOFR is fundamentally different from LIBOR for two key reasons. First, SOFR is a secured rate, while LIBOR is an unsecured rate. Second, SOFR is an overnight rate, while LIBOR represents interbank funding over different maturities. As a result, there can be no assurance that SOFR will perform in the same way as LIBOR would have at any time, including, without limitation, as a result of changes in interest and yield rates in the market, market volatility or global, national or regional economic, financial, political, regulatory, judicial or other events. For example, since publication of SOFR began on April 3, 2018, daily changes in SOFR have, on occasion, been more volatile than daily changes in comparable benchmark or other market rates. For additional information regarding SOFR, see “Description of the Notes—Floating Rate Period Interest Rates—Secured Overnight Financing Rate (SOFR).”

The secondary trading market for notes linked to SOFR may be limited.

Since SOFR is a relatively new market rate, the notes will likely have no established trading market when issued and an established trading market may never develop or may not be very liquid. Market terms for debt securities linked to SOFR (such as the notes) such as the applicable spread may evolve over time and, as a result, trading prices of the notes may be lower than those of later-issued debt securities that are linked to SOFR. Similarly, if SOFR does not prove to be widely used in debt securities similar to the notes, the trading price of the notes may be lower than that of debt securities linked to rates that are more widely used. Investors in the notes may not be able to sell such notes at all or may not be able to sell such notes at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. Further, investors wishing to sell the notes of any series in the secondary market during the applicable Floating Rate Period will have to make assumptions as to the future performance of SOFR during the applicable Floating Rate Interest Payment Period in which they intend the sale to take place. As a result, investors may suffer from increased pricing volatility and market risk.

The administrator of SOFR may make changes that could change the value of SOFR or discontinue SOFR and has no obligation to consider your interests in doing so.

The New York Federal Reserve (or a successor), as administrator of SOFR, may make methodological or other changes that could change the value of SOFR, including changes related to the method by which SOFR is

S-15