Filed Pursuant to Rule 424(b)(5)

Registration No 333-254191

The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated October 28, 2021

PRELIMINARY PROSPECTUS SUPPLEMENT

(To prospectus dated March 12, 2021)

Capital One Financial Corporation

$ % Fixed-to-Floating Rate Senior Notes Due 2027

$ % Fixed-to-Floating Rate Senior Notes Due 2032

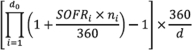

We will pay interest on the % fixed-to-floating rate senior notes due 2027 (the “2027 notes”) semi-annually during the fixed rate period from and including , 2021 to but excluding , 2026 (the “2027 Notes Fixed Rate Period”) in arrears on and of each year and quarterly during the floating rate period from and including , 2026 to but excluding the , 2027 maturity date (the “2027 Notes Floating Rate Period”) in arrears on the second business day following each 2027 Notes Floating Rate Interest Payment Period End-Date (as defined herein); provided that the 2027 Notes Floating Rate Interest Payment Date (as defined herein) with respect to the final 2027 Notes Floating Rate Interest Payment Period (as defined herein) will be the maturity date. We will make the first interest payment on the notes on , 2022. The 2027 notes will mature on , 2027. Interest will accrue (i) from the original issue date to, but excluding , 2026 at a fixed rate of % per annum and (ii) from and including , 2026 to but excluding the maturity date at a rate equal to the base rate (as described herein) plus % (the “2027 Notes Spread”).

We will pay interest on the % fixed-to-floating rate senior notes due 2032 (the “2032 notes” and, together with the 2027 notes, the “notes”) semi-annually during the fixed rate period from and including , 2021 to but excluding , 2031 (the “2032 Notes Fixed Rate Period”) in arrears on and of each year and quarterly during the floating rate period from and including , 2031 to but excluding the , 2032 maturity date (the “2032 Notes Floating Rate Period”) in arrears on the second business day following each 2032 Notes Floating Rate Interest Payment Period End-Date (as defined herein); provided that the 2032 Notes Floating Rate Interest Payment Date (as defined herein) with respect to the final 2032 Notes Floating Rate Interest Payment Period (as defined herein) will be the maturity date. We will make the first interest payment on the notes on , 2022. The 2032 notes will mature on , 2032. Interest will accrue (i) from the original issue date to, but excluding , 2031 at a fixed rate of % per annum and (ii) from and including , 2031 to but excluding the maturity date at a rate equal to the base rate (as described herein) plus % (the “2032 Notes Spread”).

We may redeem the 2027 notes at our option on , 2026 (which is the date that is one year prior to the maturity date of the notes), in whole but not in part, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest thereon to the redemption date. See “Description of the Notes—Optional Redemption.”

We may redeem the 2032 notes at our option on , 2031 (which is the date that is one year prior to the maturity date of the notes), in whole but not in part, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest thereon to the redemption date. See “Description of the Notes—Optional Redemption.”

The notes will be our unsecured obligations and will rank equally with all of our existing and future unsecured and unsubordinated indebtedness that may be outstanding from time to time.

We will issue the notes in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. There is no sinking fund for the notes. The notes are a new issue of securities with no established trading market. The notes will not be listed on any securities exchange.

Investing in the notes involves risks. Before buying any notes, you should read this prospectus supplement, the related prospectus and all information incorporated by reference herein, including the discussion of material risks of investing in our notes in the “Risk Factors” section beginning on page S-10 of this prospectus supplement.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The notes are not savings accounts, deposits or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation (the “FDIC”) or any other governmental agency or instrumentality.

| | | | | | | | | | | | |

| | | Price to Public | | | Underwriting

Discounts | | | Proceeds to

Capital One

(Before

Expenses) | |

Per 2027 Note | | | % | (1) | | | % | | | | % | |

2027 Notes Total | | $ | | | | $ | | | | $ | | |

Per 2032 Note | | | % | (1) | | | % | | | | % | |

2032 Notes Total | | $ | | | | $ | | | | $ | | |

Total | | $ | | | | $ | | | | $ | | |

| (1) | Plus accrued interest, if any, from , 2021. |

The underwriters expect to deliver the notes in book-entry form only through the facilities of The Depository Trust Company and its participants, including Euroclear Bank SA/NV and Clearstream Banking S.A., on or about , 2021, which is the third business day following the date of the pricing of the notes. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), trades in the secondary market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise.

Accordingly, purchasers who wish to trade the notes on any date prior to the second business day before delivery will be required by virtue of the fact that the notes initially will settle in three business days to specify alternative settlement arrangements to prevent a failed settlement.

Because our affiliate, Capital One Securities, Inc., is participating in the sale of the notes, the offering is being conducted in compliance with Financial Industry Regulatory Authority (“FINRA”) Rule 5121, as administered by FINRA.

Joint Book-Running Managers

| | | | | | | | | | |

| BofA Securities | | Citigroup | | Credit Suisse | | Goldman Sachs & Co. LLC | | J.P. Morgan | | Capital One Securities |

The date of this prospectus supplement is , 2021.