Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |

McKESSON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) Title of each class of securities to which transaction applies: | ||

| (2) Aggregate number of securities to which transaction applies: | ||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) Proposed maximum aggregate value of transaction: | ||

| (5) Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) Amount Previously Paid: | ||

| (2) Form, Schedule or Registration Statement No.: | ||

| (3) Filing Party: | ||

| (4) Date Filed: | ||

Table of Contents

A LETTER FROM OUR INDEPENDENT CHAIR

| Dear Fellow Shareholders,

First and foremost, on behalf of the Board of Directors, I would like to thank you for your investment in McKesson and for the confidence you place in this Board to oversee your interests in our Company particularly through the most unprecedented global health crisis in modern history. McKesson plays a critical role in healthcare, and our highest priorities during theCOVID-19 pandemic are to continue delivering critical supplies and medications to address the crisis, and protecting the health and safety of and supporting our employees. Employees throughout the enterprise and at all levels rally together every day, including in the midst of a pandemic, to deliver on our mission of improving care in every setting — one product, one partner, one patient at a time.

The Board’s purpose as stewards of the Company is to oversee the long-term performance and sustainability of McKesson for the benefit of all our stakeholders, while continuously creating value for our shareholders. With this focus over the past year, the Company continued its transformation and made significant progress executing against priorities to drive growth while fulfilling its mission. |

The Board remains as high functioning and engaged as ever, continuously monitoring the Company’s strategy, leadership, operations, and risk management in the dynamic global healthcare environment in which we operate.

As we approach the 2020 Annual Meeting, I would like to share some of the ways that your Board is working to provide strong governance and independent oversight to represent your interests.

OurCOVID-19 Response Efforts

As one of the world’s largest healthcare companies, we have a critical role to play in making medications and supplies available to customers and patients when they need them. McKesson plays an important role in healthcare delivery, and it is something we take seriously every day — even more so now as the world is facing this healthcare challenge. Over the past few months, we have taken a number of meaningful steps to advance public health goals, maintain essential access to medications and supplies for our customers, and safeguard our employees from the spread ofCOVID-19.

We awarded approximately $30 million in specialone-time bonus payments to recognize frontline workers and certain other staff for their contributions. In addition, we invested approximately $15 million forCOVID-19 related relief and response efforts, which includes a $10 million contribution to the McKesson Foundation. A portion of that contribution will be deployed to McKesson’s Taking Care of Our Own Fund to provide support for employees impacted by theCOVID-19 pandemic.

Other measures we have taken to mitigate the impact of theCOVID-19 health crisis include:

| • | Partnering with the U.S. Department of Health and Human Services and the Federal Emergency Management Agency of the U.S. Department of Homeland Security (FEMA) in their sourcing and distribution efforts to expedite the shipment and delivery of personal protective equipment (PPE) and other critical supplies into the United States; |

| • | Coordinating closely with federal and state agencies in North America and Europe to optimize and expedite sourcing opportunities, and to move products to the front lines of the fight against the pandemic; |

| • | Actively working with manufacturers, suppliers, industry partners and government agencies to anticipate shortages and respond to unprecedented demand for supplies like PPE, as well as certain medications and diagnostic tools; |

| • | Implementing workplace changes to promote safety, including disinfectant cleanings throughout the day, requiring temperature testing before coming to work, making face masks available, social distancing measures, and placing hand sanitizer and sanitizing wipes throughout the workplace; and |

| • | Supporting our employees by undertaking multiple measures to provide access to the care they need and a supportive work environment, including expanded leave policies, special compensation, telemedicine and wellness offerings, and expanding our Taking Care of Our Own Fund to help with expenses such as childcare, groceries, housing and utilities. |

Cultivating a Strong Ethical Culture

At McKesson, doing business in the right way is fundamental to, and embedded in, our culture. Our long-term success depends on embracing and expecting the highest ethical standards in everything we do, everywhere we operate. For us, compliance is more than just following rules. It includes considering the actions we take, and adapting to new challenges and situations, always guided by our ICARE principles. Our Board, which has long believed that oversight of the Company’s culture and reputation are key Board responsibilities, collaborates with management to establish and communicate the right ethical tone, which guides our conduct and helps protect the Company’s reputation. Our Board has provided guidance to our CEO,

Table of Contents

Brian Tyler, as he launched Team McKesson, a FY 2020 corporate culture initiative focused on winning as one team, and as we have worked to continually strengthen our culture of empowerment, recognition and belonging. Further, the entire Board and its committees, including the Compliance Committee, work to understand and review our corporate risks, overseeing matters ranging from legal and compliance risks, including with respect to opioids, financial reporting risk, reputational risks, compensation practices and cybersecurity.

We remain deeply concerned about the ongoing opioid crisis. We are proud of our Controlled Substance Monitoring Program and are dedicated to ongoing enhancements. We are also working with others to advance a series of initiatives focused on helping to address the opioid epidemic, advocate for public policy recommendations and support innovative programs and partnerships that we believe can have a meaningful impact on the opioid health crisis. Please see pages 6-7 for more information regarding the Board’s oversight of risk and the Company’s work to address the opioid crisis.

Focus on Corporate Responsibility

At McKesson, we want to do everything we can to continue delivering critical healthcare supplies and medicines. Our approach to addressing the pandemic thus far underscores how we view corporate responsibility. Corporate responsibility means better health for our planet and people everywhere. We strive to use our economic, environmental, social and governance resources thoughtfully and responsibly.

In 2018, the Company conducted a materiality assessment that involvedin-depth interviews and surveys with 95 stakeholders from Canada, Europe and the U.S., including employees, customers, suppliers, industry associations, government agencies,non-governmental organizations and joint venture partners. Based on that assessment, and considering shareholder feedback, the Company published its 2019 Corporate Responsibility Report, which highlights work in three important areas: product quality and patient safety;eco-efficient transportation and operations; and better health for employees and communities. Our work in these areas is grounded in our shared ICARE (integrity, customer first, accountability, respect and excellence) principles, which guide us in making a positive impact for patients, the environment and our society every day.

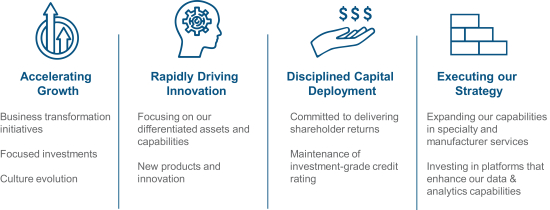

Executing on Strategy

An essential role of the Board is to provide effective oversight related to McKesson’s corporate strategy and execution. The Board works closely with senior leadership in developing the Company’s strategy and positioning us to continue as a leading healthcare company. As we reflect on FY 2020, our results demonstrate continued momentum in our business as we executed on priorities we believe will drive growth, including: optimizing performance in our U.S. Pharmaceutical and Specialty Solutions segment, simplifying the business and operating with increased focus and speed, and accelerating our strategic growth initiatives. As we looked to become a simpler, more focused, and nimbler organization under the leadership of CEO Brian Tyler, our organization has rallied around these efforts, and it is showing in our culture and results.

In addition to transforming and energizing the culture of McKesson, building on the already strong foundation of our ICARE and ILEAD values, we saw great execution across the enterprise in FY 2020. As an example, we came together to identify significant cost savings, and are tracking towards our target of $400 million to $500 million in gross pretax savings by the end of FY 2021. In March, we also successfully completed the exit of our investment in Change Healthcare, in line with our stated objective of unlocking value for our shareholders in a manner designed to betax-efficient. We are excited to move forward and continue executing against our strategic growth initiatives as a more focused organization, and believe McKesson is well positioned with a broad set of differentiated assets and capabilities.

Engaging with Shareholders

Engagement with our shareholders remains a key focus for our Company and an important part of our Board’s governance commitment. Our robust shareholder engagement program, which includes an integrated outreach team, meets with a broad base of shareholders throughout the year to discuss corporate governance, executive compensation, corporate responsibility practices, and other matters of importance. Our commitment to this program enables ongoing dialogue that results in adopting sound and effective corporate governance practices as well continuous improvements. It also provides us with valuable insight and feedback from shareholders throughout the year, allowing the Board to better understand our shareholders’ priorities and perspectives and to incorporate them into its deliberations and decision making.

During FY 2020, we proactively reached out to shareholders representing nearly 66% of our outstanding common stock and we engaged with shareholders representing approximately 50% of our outstanding common stock. Our Compensation Committee Chair led engagements with shareholders representing nearly 29% of our outstanding common stock to discuss executive compensation matters and changes to our FY 2020 compensation program, among other matters. Various members of management, including our CEO, also participated in discussions with portfolio managers, analysts and others. Please turn to page 10 to learn more about how we responded to feedback from our shareholders over the past year.

Aligning Pay and Performance

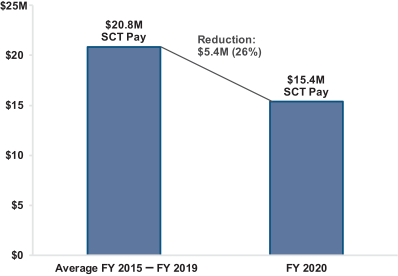

Ensuring that the Company has an executive compensation program that appropriately attracts, retains and incentivizes our management team is one of the Board’s most critical responsibilities. It is important to us that the interests of our executives are aligned with the interests of shareholders by setting rigorous performance targets that are tied to key financial results and strategic objectives designed to further the Company’s long-term strategy.

Table of Contents

We believe our program effectively links our executive compensation program to financial objectives consistent with ourlong-term goals and are aligned with our shareholders’ interests. We are committed to maintaining a compensation structure that aligns pay with performance, drives long-term value creation and reflects the views of our shareholders. This proxy statement includes a letter from the Compensation Committee on page 35 describing their efforts over the last year and more recently, salary reductions and other actions affecting our Board, executive officers and business unit presidents in light of the uncertainty and adverse global business impacts of theCOVID-19 pandemic.

We Ask for Your Support

We take seriously the trust you place in us through your investment in McKesson. We appreciate the opportunity to serve McKesson on your behalf, and will continue our work to ensure the sustainable and long-term growth of the Company. We look forward to hearing your views at this year’s Annual Meeting and in the year to come.

Your vote is very important to us. We strongly encourage you to read both our proxy statement and annual report in their entirety prior to the Annual Meeting on July 29, 2020, and kindly request that you support our voting recommendations.

Edward A. Mueller

Independent Chair

Table of Contents

Notice of 2020 Annual Meeting of Shareholders To be Held on July 29, 2020 |

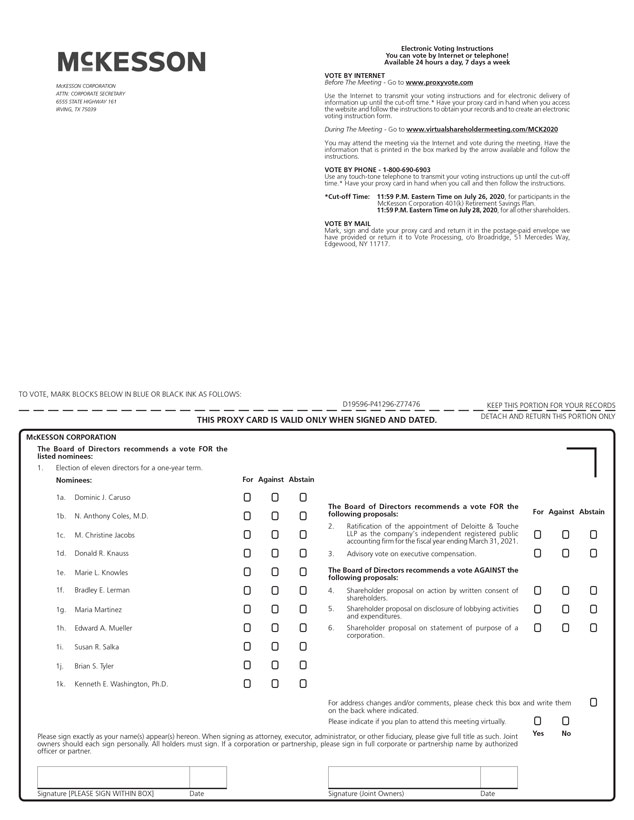

Due to the public health impact of the coronavirusoutbreak (COVID-19) and to support the health and well-being of our employees and shareholders, we have decided not to have a physical annual meeting this year. The meeting will be solely by means of remote communication as a virtual meeting. You will be able to attend the Annual Meeting online, vote and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/MCK2020 and enteringthe 16-digit control number included in our Notice Regarding the Availability of Proxy Materials (Notice), voting instructions form or proxy card. Online access to the audio webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for you to log in and test the computer audio system.

ITEMS OF BUSINESS:

| • | Elect for aone-year term a slate of 11 directors as nominated by the Board of Directors; |

| • | Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2021; |

| • | Conduct anon-binding advisory vote on executive compensation; |

| • | Vote on three (3) proposals submitted by shareholders, if properly presented; and |

| • | Conduct such other business as may properly be brought before the meeting. |

Shareholders of record at the close of business on June 1, 2020 are entitled to notice of and to vote at the meeting or any adjournment or postponement of the meeting.

June 18, 2020

By Order of the Board of Directors

Michele Lau

Senior Vice President,

Corporate Secretary and

Associate General Counsel

On June 18, 2020, we began delivering proxy materials to all shareholders of record at the close of business on June 1, 2020. The mailing address of our principal executive offices is McKesson Corporation, 6555 State Highway 161, Irving, Texas 75039.

| Vote via Internet |

|

| Call Toll-Free |

|

| Vote by Mail |

|

| Vote at Meeting | |||||||||

|  |  |  | |||||||||||||||

| www.proxyvote.com or visit the URL located on your proxy card | Call the phone number located at the top of your proxy card1-800-690-6903

| Follow the instructions on your proxy card | Join our Annual Meeting at www.virtualshareholdermeeting.com/MCK2020 | |||||||||||||||

Table of Contents

Table of Contents

This summary highlights certain information in this proxy statement and does not contain all the information you should consider in voting your shares. Please refer to the complete proxy statement and our annual report prior to voting at the Annual Meeting of Shareholders to be held on July 29, 2020.

Meeting Information

2020 Annual Meeting of Shareholders

| ||

Date and Time | Wednesday, July 29, 2020 | 8:30 a.m. Central Daylight Time | |

Location | This year’s Annual Meeting will be held entirely online due to the public health impact of | |

| the coronavirusoutbreak (COVID-19) and to support the health and well-being of our employees and shareholders. Shareholders of record as of the record date will be able to attend and participate in the Annual Meeting online atwww.virtualshareholdermeeting.com/MCK2020. | ||

Record Date

| June 1, 2020

| |

Voting Items

| Items | Your Board’s Recommendation | |||

| ||||

| 1. | Election of 11 Directors for a One-Year-Term (see page 13) | FOR | ||

Diverse slate of Directors with broad and relevant leadership and professional experience. Ten out of eleven nominees are independent. | ||||

| ||||

| 2. | Ratification of Appointment of the Independent Registered Public Accounting Firm (see page 30) | FOR | ||

Deloitte & Touche LLP is an independent accounting firm with the breadth of expertise and knowledge necessary to effectively audit our company. | ||||

| ||||

| 3. | Non-Binding Advisory Vote on Executive Compensation (see page 69) | FOR | ||

Our simplified executive compensation program is the result of thorough Compensation Committee review, continues to emphasize pay for performance, includes a new CEO pay package and reflects shareholder feedback. | ||||

| ||||

| 4. | Shareholder Proposal on Action by Written Consent of Shareholders (see page 70) | AGAINST | ||

Our existing governance structures, including proxy access and shareholder right to call a special meeting at a 15% ownership threshold, provide meaningful avenues for shareholder action. | ||||

| ||||

| 5. | Shareholder Proposal on Lobbying Activities and Expenditures (see page 72) | AGAINST | ||

Following refinements during FY 2017, 2018 and 2019 in response to shareholder feedback, we revised our political engagement and lobbying policy again in FY 2020 to specify our Board’s oversight of lobbying matters pertaining to the distribution of controlled substances and our Board’s commitment to make annual disclosures to our shareholders. | ||||

| ||||

| 6. | Shareholder Proposal on Board Report on Business Roundtable Statement of Purpose of a Corporation (see page 75) | AGAINST | ||

Our governance and management systems closely align with the Business Roundtable Statement on the Purpose of a Corporation and our ICARE principles. | ||||

- 2020 Proxy Statement - 2020 Proxy Statement | 1 |

Table of Contents

PROXY SUMMARY

McKesson At a Glance

Who We Are

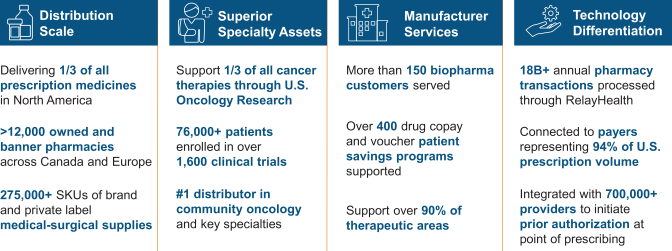

McKesson is a leader in:

| • | Distribution and services for specialty providers |

| • | Pharmaceutical distribution in North America and Europe |

| • | Medical-surgical distribution to alternate sites of care |

| • | Generics pharmaceutical distribution |

| • | Business and clinical services for providers |

| • | Pharmacy transactions and solutions |

Our Vision and Business Strategy

To improve patient care in every setting — one product, one partner, one patient at a time, we partner with pharmaceutical manufacturers, providers, pharmacies, governments and other organizations in healthcare to help provide the right medicines, medical products and healthcare services to the right patients at the right time, safely and cost-effectively. Our employees work every day to innovate and deliver opportunities that make our customers and partners more successful — all for the better health of patients. McKesson remains focused on executing against clear priorities to drive value.

| Accelerate growth through business transformation initiatives and focused investments | |

|

Expand our capabilities in specialty and manufacturer services with enhanced data & analytics | |

|

Drive innovation while focusing on our differentiated assets and capabilities | |

Board Oversight of Business Strategy |

Our Board of Directors meets regularly to discuss McKesson’s business strategy, including considerations concerning the implications of the evolvingCOVID-19 pandemic. Our Board engages in regular and deep-dive sessions with senior management, our corporate strategy and business development leaders and business unit leaders throughout the year. |

| 2 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

PROXY SUMMARY

Fiscal 2020 Highlights

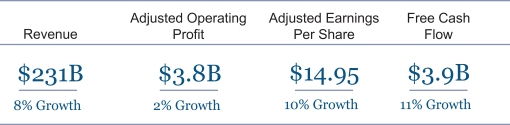

| • | FY 2020 revenues of $231 billion, full-year revenue growth of 8% |

| • | FY 2020 cash flow from operations of $4.4 billion and free cash flow of $3.9 billion |

| • | FY 2020 operating profit increased 59% year-over-year to $1.4 billion; adjusted operating profit increased 2% to $3.8 billion |

| • | Returned $2.2 billion to shareholders through share repurchases and dividends |

| • | Tax-efficient exit from Change Healthcare, unlocking value for our shareholders |

| • | Signed agreement to create a German pharmaceutical wholesale joint venture with Walgreens Boots Alliance |

| • | Selected by the U.S. Department of Veterans Affairs to continue as prime pharmaceutical provider |

See Appendix A to this proxy statement for a reconciliation of free cash flow and adjusted operating profit to the most directly comparable GAAP metrics.

Response toCOVID-19

As theCOVID-19 health crisis continues to unfold, we remain focused on our two most important priorities — supporting the needs of our employees and their families at work and home and continuing to play a critical role in the global healthcare community during this unprecedented time. As one of the world’s largest healthcare companies, we know we have a critical role to play in making medications and supplies available to customers and patients when they need them. In normal times, our daily work is essential to the provision of healthcare and it is even more so right now as the world faces this unique healthcare challenge.

We are deeply committed to supporting and protecting our colleagues who — through their determined efforts — are playing a vital role in helping to ensure that healthcare supplies and medicines are available for healthcare workers and their patients who need them during this critical time. We have undertaken multiple measures to promote safety in our facilities, including placement of hand sanitizer and sanitizing wipes throughout the workplace, reinforcing the practice of social distancing in our distribution centers to avoid unnecessary proximity where feasible, and disinfectant cleaning throughout the day. We are making face masks available to essential employees and requiring temperature testing before coming to work. We also instituted a global mandatory work from home policy to reduce density in our facilities. This helps to protect the health and safety of those employees who are able to perform their work responsibilities from home as well as those with essential roles that must be performed at our distribution centers and other facilities.

We have provided additional employee benefit offerings such as waived deductibles forCOVID-19 diagnostic testing and consultations, free mental health counseling, special payments totaling approximately $30 million to reward the hard work of our associates in frontline distribution center, call center and transportation roles and paid emergency sick leave which may be used for several reasons, including physician ordered self-quarantine. We also invested approximately $15 million forCOVID-19 related relief and response efforts, which includes a $10 million contribution to the McKesson Foundation, a portion of which will be deployed to McKesson’s Taking Care of Our Own Fund to provide support for employees impacted by theCOVID-19 pandemic.

We are taking a proactive approach to manage inventory during this pandemic and helping our provider partners to obtain needed supplies and medications to treat those who are ill and to help stop the spread of the disease. This includes allocating key product categories to attempt equitable distribution and closely monitoring increased demand in order to try to mitigate future product supply issues. To further protect inventory, we have taken steps to limit sales of certain supply-challenged personal protective equipment to healthcare providers and first responders only and are prioritizing FEMA-identified “hot zones” and critical settings of care. Additionally, we are providing daily data feeds on inventories, orders and additional sourcing opportunities to FEMA to help get limited supplies to where they are most needed.

In challenging times, we rally around our customers, support our employees, and take to heart the role that we can play in helping our communities globally. It’s what we do because it’s who we are.

- 2020 Proxy Statement - 2020 Proxy Statement | 3 |

Table of Contents

PROXY SUMMARY

Our Commitment to Our Stakeholders and the Environment

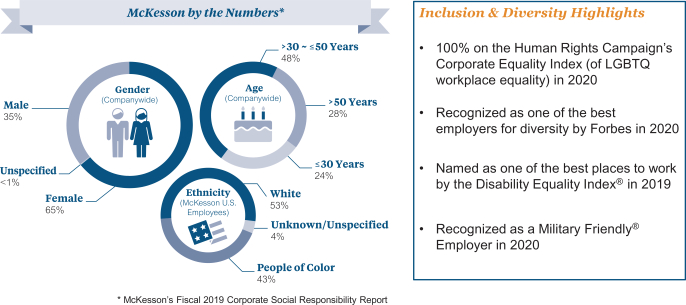

Investing in Team McKesson

| Our people are the key to our success. We aim to be an employer of choice and to help employees leverage their strengths. To support their growth, we provide regular feedback and training and work to create and maintain an inclusive environment where everyone brings their authentic self to work and knows they are appreciated and their perspectives heard and considered.

| |

|

Last year, our CEO launched our Team McKesson corporate culture initiative focused on winning as one team. Mr. Tyler personally deployed a multi-month Behavior Sprints campaign for McKesson’s top 600 leaders across the Company emphasizing workplace behaviors critically important to him as CEO of the Company.

| |

| Team leaders received both internal and external resources in a variety of formats that included pointers and best practices about being open and candid, how to debate, decide and commit when making decisions within and across business units and the importance of maintaining an enterprise first mindset. The top 600 leaders are expected to demonstrate and share these important workplace behaviors with their respective teams throughout the Company.

|

We build the best teams by recruiting, developing and retaining diverse talent. We are proud to be recognized by prominent organizations for our culture of inclusion which we recognize as an important element that drives long-term shareholder value. We continue to keep inclusion and diversity top of mind as we enter the final phases of our headquarters move to Irving, Texas.

Our Board of Directors is focused on human capital management (HCM), providing guidance to our CEO on culture initiatives, discussing inclusion, diversity and equality efforts, and participating in employee town halls and panel discussions hosted by the Company’s employee resource groups.

| 4 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

PROXY SUMMARY

Delivering Value to Our Customers

We work hard to deliver medical and pharmaceutical products to our customers and the patients they serve. We deliverone-third of prescription medicine in North America, and we serve more than 2 million customers every day in Europe. Our RelayHealth Pharmacy Solutions’ and CoverMyMeds’ combined network includes more than 62,000 pharmacies, 500 EHRs, 700,000 providers and nearly all payers. It’s crucial to deliver the safest products to all of these patients, because both the people making the medicine and the people taking it count on us. |

|

| Dealing Fairly and Ethically with Suppliers

We work with suppliers across the globe who must agree to McKesson Sustainable Supply Chain Principles (MSSP). The MSSP covers compliance with applicable laws along with adherence to our strict policies on protecting workers, preparing for emergencies, identifying and managing environmental risk, and protecting the environment.

|

Embracing Sustainable Practices

Communities thrive in a healthier environment, and that is why we are sharpening our focus on environmental sustainability. Establishing new environmental best practices is a priority across McKesson businesses. We work to capture the metrics most relevant to our lines of business and act on recommendations that lead to a healthier environment. We are currently focused on:

|

| |

• Increasing LED lighting at facilities across the globe

• Monitoring and benchmarking energy use across the enterprise

• Pursuing environmental certifications and minimizing our carbon footprint

• Reducing movement of inventory through our redistribution center model

• Recycling and reusing resources in corporate and warehouse settings |

Board Oversight of Corporate Social Responsibility, ESG and Human Capital Management |

Our Board of Directors oversees the Company’s environmental, social and governance (ESG) and human capital management efforts by leading initiatives to integrate environmental sustainability, pay equity and inclusion and diversity into the Company’s business principles. Our Governance Committee regularly reviews and discusses the Company’s corporate social responsibility practices, including environmental sustainability and matters concerning the Company’s commitment to delivering value to its customers, employees, suppliers, shareholders and local communities. |

- 2020 Proxy Statement - 2020 Proxy Statement | 5 |

Table of Contents

PROXY SUMMARY

A Culture of Compliance

At McKesson, we take seriously our role in helping to protect the safety and integrity of the pharmaceutical and medical supply chain. Each day, our distribution team delivers life-saving medicines and supplies to pharmacies, hospitals and clinics that serve millions of patients. We take to heart that each and every item delivered is not just a package, it’s a patient.

In 2019, our Board formed a standing Compliance Committee to assist the Board in overseeing the Company’s compliance programs and management’s identification and evaluation of its principal legal and regulatory compliance risks. Recognizing the critical role fresh perspectives and expertise play in risk oversight, our Board has committed to:

McKesson’s Controlled Substance Monitoring Program

Our Controlled Substance Monitoring Program (CSMP) uses sophisticated algorithms designed to monitor for suspicious orders, block the shipment of controlled substances to pharmacies when certain thresholds are reached and report those blocked orders to the U.S. Drug Enforcement Administration (DEA). We are proud of our CSMP and dedicated to ongoing enhancements. Some highlights of the program include:

| Experienced compliance team |

| Thorough customer due diligence and ongoing oversight | ||

McKesson’s compliance team is comprised of more than 40 diversion and subject-matter experts with more than 215 years of cumulative DEA enforcement experience. Our organization is made up of pharmacists, state and local investigators as well as experts with experience in the retail pharmacy industry, pharmaceutical manufacturing and data analytics.

| McKesson performs comprehensive analyses on prospective customers before agreeing to supply prescription medications. This process includes gathering specific pharmacy information and the validation of state and federal regulatory licensure. McKesson monitors orders of controlled substances throughout the customer relationship. | |||

| Advanced customer purchasing analysis | Regular ARCOS reporting | |||

Using dynamic algorithms, McKesson has developed a system to help identify suspicious orders. This system establishes what is known as the customer’s threshold that limits the quantity of controlled substances a customer may order within a specified period. The system makes ongoing refinements by analyzing various data points including customer-specific information and business trends, blocking orders when certain thresholds are met.

| McKesson reports transactions to the DEA via the DEA’s automated ARCOS drug reporting system, which allows the DEA to monitor the flow of controlled substances from the point of manufacture through commercial distribution channels to the point of sale or pharmaceutical distribution. Reports include orders deemed suspicious and blocked by our CSMP. | |||

| 6 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

PROXY SUMMARY

Tightly controlled physical supply chain |

|

Regular customer education | ||

Controlled substances are locked, monitored and stored in two DEA-regulated spaces. Schedule 2 substances go in a high-security “vault” and inventory checks of controlled substances are conducted frequently. Formal background checks are given to all employees who handle all controlled substances. Controlled substances are packaged under stringent security procedures and shipped using various security measures.

| McKesson has been proactive in educating its customers about the importance of compliance with DEA and state agency regulations. In addition to providing its customers with literature on how to identify the warning signs of prescription opioid abuse and diversion, McKesson conducts informational meetings at medical trade shows and pharmacy association meetings to emphasize the importance of preventing diversion. Similarly, McKesson educates its own employees on the company’s regulatory obligations, including CSMP-specific training sessions at annual sales meetings.

| |||

Ongoing state and federal collaboration efforts | ||||

McKesson is an active participant in state and federal legislative efforts around controlled substances. The company also strongly supports the Center for Disease Control’s clinical guidelines and calls for additional formal medical education on the risks of opioid use as important ways to curb clinically inappropriate prescribing, doctor-shopping and diversion.

| ||||

Company Initiatives. We are also working with others to advance a series of initiatives focused on helping to address the opioid epidemic, offer public policy recommendations — including the Prescription Safety-Alert System (RxSAS) technology proposal — and to support innovative programs and partnerships that we believe can have a meaningful impact on this challenging issue. We are committed to engaging with all who share our dedication to acting with urgency to address this crisis. Please visithttps://www.mckesson.com/About-McKesson/Fighting-Opioid-Abuse/to learn more about these initiatives.

Foundation for Opioid Response Efforts.In March 2018 the Company contributed $100 million to establish the Foundation for Opioid Response Efforts (FORE), a Section 501(c)(3) nonprofit organization whose vision is to inspire and accelerate action to end the opioid epidemic. Earlier this year, FORE announced grant awards to 19 organizations, with a particular focus on urban, rural, minority, tribal andlow-income communities. Visit https://forefdn.org/for more information about FORE’s opioid response efforts.

Board Oversight of Compliance Risks |

Our Board of Directors is committed to maintaining strong oversight and compliance processes, including forming a Compliance Committee, requiring the Chair of the Audit Committee to serve on the Compliance Committee and creating a dedicated Chief Compliance Officer position, with comprehensive focus on compliance matters across the enterprise. |

- 2020 Proxy Statement - 2020 Proxy Statement | 7 |

Table of Contents

PROXY SUMMARY

Director Nominees and Our Approach to Governance

Our director nominees exhibit a mix of skills, experience, diversity and perspectives. Additional information about each director’s experience, qualifications and skills can be found beginning on page 13.

| Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Other Public Company Boards | ||||||

Dominic J. Caruso |

62 |

2018 |

Retired EVP & CFO, |

✓ | • Audit (Chair) • Compliance • Finance |

0 | ||||||

N. Anthony Coles, M.D. |

60 |

2014 | CEO & Chair, Cerevel Therapeutics, LLC |

✓ | • Compensation (Chair) • Finance |

1 | ||||||

M. Christine Jacobs |

69 |

1999 | Retired Chairman, President & CEO, Theragenics Corporation |

✓ | • Audit • Governance |

0 | ||||||

Donald R. Knauss |

69 |

2014 | Retired Chairman & CEO, The Clorox Company |

✓ | • Audit • Finance (Chair) |

2 | ||||||

Marie L. Knowles |

73 |

2002 |

Retired EVP & CFO, |

✓ | • Audit • Compliance • Finance |

0 | ||||||

Bradley E. Lerman |

64 |

2018 |

SVP, General Counsel & Corporate Secretary, Medtronic plc |

✓ | • Compensation • Compliance (Chair) • Governance |

0 | ||||||

Maria Martinez |

62 |

2019 | EVP & CCEO, Cisco Systems, Inc. |

✓ |

• Audit |

0 | ||||||

Edward A. Mueller |

73 |

2008 | Retired Chairman & CEO, Qwest Communications International, Inc. |

✓ | • Compensation • Governance |

0 | ||||||

Susan R. Salka |

55 |

2014 | CEO & President, AMN Healthcare Services, Inc. |

✓ | • Compensation • Governance (Chair) |

1 | ||||||

| Brian S. Tyler | 53 | 2019 | CEO, McKesson Corporation | 0 | ||||||||

Kenneth E. Washington |

59 |

2019 |

CTO, Ford Motor Company |

✓ | • Compliance • Finance |

0 | ||||||

| 8 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

PROXY SUMMARY

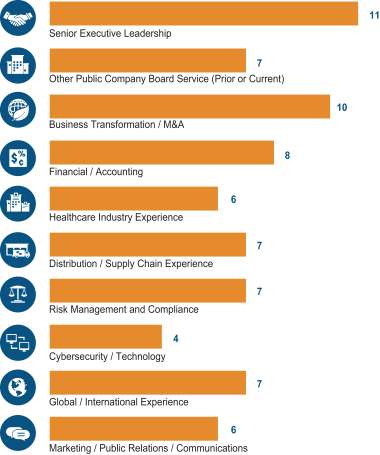

Breadth of Experience and Qualifications

The graphic below identifies a selection of our director nominees’ prominent experiences and qualifications. Each director nominee brings his or her own unique background and range of expertise, knowledge and experience which provides an appropriate and diverse mix of qualifications necessary for our Board to effectively fulfill its oversight responsibilities. By its nature, this summary is neither detailed nor exhaustive, but aims to convey the breadth of experience and qualifications that our director nominees bring to their work on the McKesson Board of Directors to oversee strategy, performance, culture and risk at the Company.

Governance Highlights

Board refreshment.Two independent directors joined our Board in FY 2020 — Maria Martinez and Ken Washington. Additionally, our Board has committed to electing an additional director to our Board by no later than the 2021 Annual Meeting, and our two longest serving directors will retire from the Board by that time.

Leading corporate governance practices. Below we highlight some of the key features of our corporate governance practices. Please see the section entitled “Corporate Governance” beginning on page 22 for more information.

| Shareholder Rights |

|

| Board of Directors |

|

| Corporate Governance | ||||||

• Proxy access • Right to call special meeting of shareholders (15%) • No supermajority vote provisions | • Independent board chair • Commitment to adopt director tenure policy by 2022 • 10 of 11 director nominees are independent

| • Pay for performance alignment • No poison pill • Robust senior management succession planning process | ||||||||||

- 2020 Proxy Statement - 2020 Proxy Statement | 9 |

Table of Contents

PROXY SUMMARY

Our Shareholder Engagement Efforts

Our Board recognizes the trust you place in them through your investment in McKesson, and we believe that solicitation and consideration of shareholder feedback is critical to driving long-term growth and creating shareholder value. Our shareholder engagement program is a robust, year-round process encompassing two formal shareholder engagement roadshows conducted in the summer and winter, and also meetings throughout the year with shareholders in various forums to encourage ongoing, meaningful dialogue about the issues they find most important. As described in the diagram below, we report shareholder feedback regularly to our Board, which in turn evaluates feedback year-round.

Our Year-Round Shareholder Engagement Process

Scope of Shareholder Outreach and Common Themes

During FY 2020, we proactively reached out to shareholders representing nearly 66% of our outstanding common stock and we engaged with shareholders representing approximately 50% of our outstanding common stock. We were disappointed to receive low support for ouradvisory say-on-pay proposal at our 2019 Annual Meeting and actively sought to understand what actions we could take to address our shareholders’ concerns. Our Compensation Committee Chair led engagements with shareholders representing nearly 29% of our outstanding common stock to discuss executive compensation matters and changes to our FY 2020 compensation program. Various members of management, including our CEO, also participated in discussions with portfolio managers, analysts and others this past year. We discussed a diverse range of topics with our shareholders, including:

Executive compensation | Our commitment to aligning pay with performance | Board composition and recent refreshment efforts | ||

| Our CEO leadership transition | Our Board’s oversight of risks | Our corporate culture initiatives | ||

Corporate governance practices | Business strategy and progress updates on our strategic growth initiative |

ESG and human capital management, including inclusion and diversity | ||

| 10 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

PROXY SUMMARY

Shareholder Feedback

The table below highlights how we responded to shareholder feedback in several areas. We report shareholder feedback to our Board on a regular basis throughout the year. We discussed our executive compensation program in detail with many shareholders and appreciate their perspectives. Please see the table below and pages 37-38 for a discussion regarding the changes made to our executive compensation program in response to shareholder feedback.

| Topics of Shareholder Concern | How We Have Addressed Concerns in FY 2020 | |||||

| ||||||

| Executive Compensation | Supplemental pension benefits | There are no actively employed participants in the Company’s supplemental pension plan. | ||||

Legacy employment agreements | None of our current executive officers has an employment agreement. The Company no longer enters into executive employment agreements. | |||||

Perquisites | Our CEO will assume the costs of ongoing home security monitoring beginning with FY 2021. | |||||

Clawback policy | The Compensation Committee approved adoption of “reputational harm” as a new potential trigger under our Compensation Recoupment Policy. | |||||

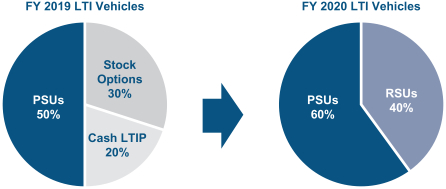

Long-term incentive (LTI) program | The Compensation Committee simplified the LTI program by discontinuing the use of stock options and the long-term cash incentive.

This program structure (60% PSUs, 40% RSUs) aligns more closely to our compensation peer group’s practices. | |||||

Excise taxgross-ups | The Compensation Committee eliminated excise taxgross-ups. | |||||

| ||||||

| ||||||

| Corporate Governance | Maintaining board diversity after Chris Jacobs and Marie Knowles indicated they will be leaving the Board no later than the 2021 Annual Meeting | We appointed Maria Martinez to the Board in October 2019 and continue to pay close attention to Board diversity in terms of gender, ethnicity and skill, among other categories.

We plan to implement a modified tenure policy by 2022, which will require continual board refreshment and succession planning. | ||||

| ||||||

| ||||||

| Sustainability and HCM | Disclosure on the Company’s approach to ESG risk oversight and human capital management oversight | We have expanded disclosure on oversight of ESG matters, including how the Board oversees human capital management. Please see the section entitled “Our Commitment to Our Stakeholders and the Environment” beginning on page 4. | ||||

| ||||||

Board Oversight of Shareholder Engagement |

Our Board of Directors oversees our shareholder engagement program and participates in shareholder discussions to develop our understanding of shareholder interests and continually improve and enhance our corporate practices and policies throughout the year. |

- 2020 Proxy Statement - 2020 Proxy Statement | 11 |

Table of Contents

PROXY SUMMARY

Executive Compensation Highlights

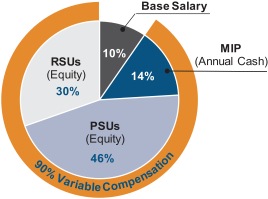

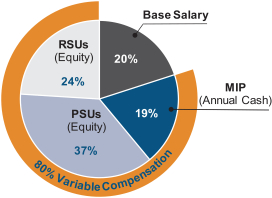

As discussed in detail under “Compensation Discussion and Analysis,” with the goal of building long-term value for our shareholders, we have developed an executive compensation program designed to strike the right balance of pay for performance; attracting and retaining an exceptionally talented executive team; and steering McKesson’s leadership to meet ambitious goals without taking undue risk.

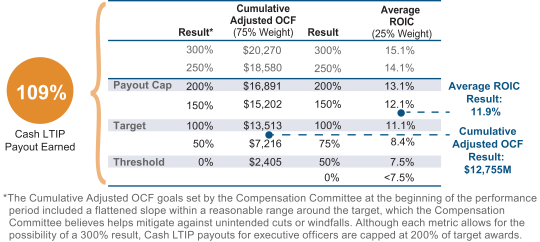

FY 2020 Pay Elements and Performance Metrics

Our executive compensation program is predominantly performance-based, consisting of four primary compensation elements that each serve a unique purpose. The metrics below incentivize our executives to focus on operational objectives that are expected to drive shareholder value.

| Pay Element | Performance Metric | Rationale | Target Pay | |||||

| ||||||||

Base Salary |

— | Attracts and retains high-performing executives by providing market-competitive fixed pay |

— | |||||

| ||||||||

| ||||||||

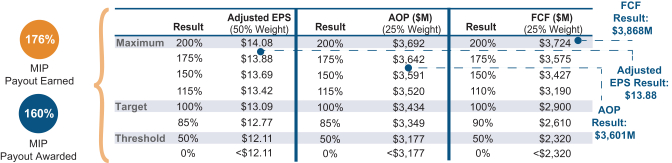

Management Incentive (annual cash incentive) |

Adjusted EPS (50%) | Rewards operational performance and profitability; important driver of share price valuation and shareholder expectations | 100% — 150% of Base Salary | |||||

Adjusted Operating Profit (25%) | Rewards focus on operational performance and profitability | |||||||

Free Cash Flow (25%) | Rewards generating cash to invest in growth and return capital to shareholders; important valuation metric | |||||||

| ||||||||

| ||||||||

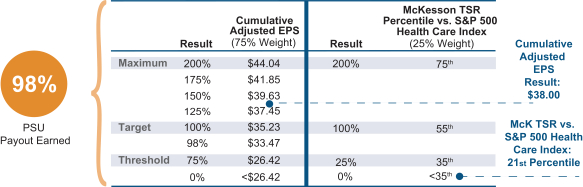

Performance Stock Units (long-term equity incentive) | 3-Year Cumulative Adjusted EPS (50%) | Measures long-term earnings power, drives returns for the Company and directly correlates to share price performance | 60% of Target LTI Value | |||||

3-Year Average ROIC (25%) | Encourages leaders to make sound investments that generate strong returns for shareholders | |||||||

MCK TSR vs. Comparator Group (25%) |

Rewards share price performance relative to comparator group over time | |||||||

| ||||||||

| ||||||||

Restricted Stock Units (long-term equity) |

— |

Directly aligns with value delivered to shareholders | 40% of Target LTI Value | |||||

| ||||||||

Best Practices in Compensation Governance

| What We Do | ||||||

| ✓ | Pay for performance | ✓ | Engage with shareholders throughout the year | |||

| ✓ | Emphasize long-term performance | ✓ | Align with business strategy | |||

| ✓ | Design with mix of operational and market-based metrics | ✓ | Balance mix of annual and long-term metrics | |||

| ✓ | Develop sound financial goals | ✓ | Engage independent advisors | |||

| ✓ | Maintain robust compensation recoupment policy with trigger for reputational harm | ✓ | Review Compliance Committee’s assessment of senior management efforts on compliance matters | |||

| ✓ | Manage use of equity incentive plan conservatively | ✓ | Monitor progress on culture initiatives | |||

| ✓ | Use double-trigger change in control vesting provisions | ✓ | Review tally sheets | |||

| ✓ | Maintain rigorous stock ownership guidelines | ✓ | Mitigate undue risk-taking through sound plan design | |||

| What We Don’t Do | ||||||

| Allow directors and executive officers to hedge or pledge Company securities |  | Provide excise taxgross-ups | |||

| Re-price or exchange stock options without shareholder approval |  | Accrue or pay dividend equivalents during performance periods | |||

| Provide taxgross-ups on perquisites for executives, except in the case of certain business-related relocation expenses |  | Pay above-market interest on deferred compensation | |||

| 12 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

| ITEM 1. | Election of Directors |

There are 11 nominees for election to the Board of Directors of the Company. The directors elected at the Annual Meeting will hold office until the 2021 Annual Meeting of Shareholders and until their successors have been elected and qualified, or until their earlier resignation, removal or death.

All nominees are current directors. Dominic Caruso, Tony Coles, Chris Jacobs, Don Knauss, Marie Knowles, Brad Lerman, Ed Mueller, Susan Salka, Brian Tyler and Ken Washington were elected to the Board at the 2019 Annual Meeting of Shareholders. Maria Martinez was appointed to the Board effective October 18, 2019.

The Governance Committee has recommended the reelection of each nominee as a director at the Annual Meeting. Each nominee has informed the Board that he or she is willing to serve as a director. If any nominee should decline or become unable or unavailable to serve as a director for any reason, your proxy authorizes the persons named in the proxy to vote for a replacement nominee, or the Board may reduce its size.

The following is a brief description of the age, principal occupation, position and business experience, including other public company directorships, for at least the past five years and major affiliations of each of the nominees. Each director’s biographical information includes a description of the director’s experience, qualifications, attributes or skills that qualify the director to serve on the Company’s Board at this time.

Your Board recommends a vote “FOR” each Nominee.

Age: 62

Director since: 2018

Committees:

Audit (Chair)

Compliance

Finance

Director Qualification Highlights:

Financial Expertise

Risk Management and Controls |

Dominic J. Caruso

Retired Executive Vice President and Chief Financial Officer, Johnson & Johnson

Mr. Caruso retired as executive vice president and chief financial officer from Johnson & Johnson, a manufacturer of medical devices, pharmaceutical and consumer packaged goods, in August 2018, having served in the role since 2007. He led the company’s financial and investor relation activities, as well as the procurement organization. Mr. Caruso joined Johnson & Johnson in October 1999 as chief financial officer for Centocor, Inc., upon the completion of the merger of Centocor and Johnson & Johnson. Prior to joining Centocor he had varied industry experiences with KPMG. Mr. Caruso is actively involved in government relations activities globally, including having served as co-chair of the U.S. Chamber of Commerce Global Initiative on Health and the Economy. He currently serves on the Board of Trustees of The Children’s Hospital of Philadelphia and the Cystic Fibrosis Foundation.

Skills & Qualifications: Having previously served as an executive officer of a publicly traded healthcare company, Mr. Caruso adds financial expertise and leadership to the Board, as well as a deep familiarity with investors’ perspectives in the healthcare industry. Mr. Caruso’s healthcare compliance focus throughout his career at Johnson & Johnson, Centocor, Inc. and KPMG deepen the Board’s experience in financial and compliance risk oversight. |

- 2020 Proxy Statement - 2020 Proxy Statement | 13 |

Table of Contents

ITEM 1. ELECTION OF DIRECTORS

Age: 60

Director since: 2014

Committees:

Compensation (Chair)

Finance

Director Qualification Highlights:

Healthcare Industry Experience

Business Transformation |

N. Anthony Coles, M.D.

Chief Executive Officer & Chair, Cerevel Therapeutics, LLC

Dr. Coles has served as chief executive officer of Cerevel Therapeutics since September 2019. He also serves as chairperson of the Board of Directors of Cerevel — a position he has held since December 2018. Prior to Cerevel, Dr. Coles served as co-founder and chief executive officer of Yumanity Therapeutics, LLC from October 2014 to August 2019. Dr. Coles continues to serve as executive chair of the Board of Directors of Yumanity Therapeutics. Previously, Dr. Coles served as chair and chief executive officer of Onyx Pharmaceuticals, Inc., which was acquired by Amgen Inc. in 2013. Prior to Onyx, he was president, chief executive officer and a member of the Board of Directors of NPS Pharmaceuticals, Inc. Before joining NPS Pharmaceuticals, Dr. Coles was senior vice president of commercial operations at Vertex Pharmaceuticals Inc., and earlier, held several executive positions at Bristol-Myers Squibb Company and positions of increasing responsibility at Merck & Co., Inc. Dr. Coles currently serves as a director of Regeneron Pharmaceuticals, Inc.

Skills & Qualifications: Dr. Coles brings to the Board executive and board leadership experience, as well as business management and strategic planning experience in the healthcare industry. As a founding investor of Yumanity, Dr. Coles’ entrepreneurial and innovative mindset is a valuable addition to our Board. We believe Dr. Coles’ diverse perspective as a physician businessman and as a member of the Harvard Medical School Advisory Board aligns with the Company’s commitment to put the patient at the center of our work. | |||

Age: 69

Director since: 1999

Committees:

Audit

Governance

Director Qualification Highlights:

Healthcare Industry Experience

Risk Management and Compliance |

M. Christine Jacobs

Retired Chairman, President & Chief Executive Officer, Theragenics Corporation

Ms. Jacobs retired from Theragenics Corporation, a manufacturer of prostate cancer treatment devices and surgical products, in 2013, having served as its chairman, president and chief executive officer. She held the position of chair from 2007 to 2013, and previously from 1998 to 2005. She was co-chairman of the board from 1997 to 1998 and was elected president in 1992 and chief executive officer in 1993. Ms. Jacobs served as co-chair of the Securities and Exchange Commission Advisory Committee on Small and Emerging Companies from September 2011 to September 2015.

Skills & Qualifications: Having led a public company within the healthcare industry for over 20 years, Ms. Jacobs brings to our Board significant relevant industry experience and a keen understanding of and strong insight into issues, challenges and opportunities facing the Company, including those related to legislative healthcare initiatives. As chairman and chief executive officer of Theragenics Corporation, she was at the forefront of her company regarding the evolving corporate governance environment, which enables her to provide ongoing valuable contributions as a member of the Governance Committee of our Board. Ms. Jacobs’ leadership and public company experience, including capital formation experience, makes her an asset to our Board. |

| 14 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

ITEM 1. ELECTION OF DIRECTORS

Age: 69

Director since: 2014

Committees:

Finance (Chair)

Audit

Director Qualification Highlights:

Human Capital Management

Distribution/Supply Chain Experience |

Donald R. Knauss

Retired Chairman & Chief Executive Officer, The Clorox Company

Mr. Knauss retired from the Clorox Company, a consumer goods company, in 2015, having served as executive chairman of the board from November 2014 until July 2015 and chairman and chief executive officer from October 2006 until November 2014. He was executive vice president of the Coca-Cola Company and president and chief operating officer for Coca-Cola North America from February 2004 until September 2006. Prior to his employment with The Coca-Cola Company, he held various positions in marketing and sales with PepsiCo, Inc. and Procter & Gamble and served as an officer in the United States Marine Corps. He currently serves as a director of the Kellogg Company and Target Corporation. Mr. Knauss also serves as the chairman of the board of trustees for the University of San Diego. He was formerly a director of URS Corporation.

Skills & Qualifications: Mr. Knauss has gained substantial board leadership skills through his chairmanship role at The Clorox Company. He also brings substantial executive experience through which he has developed valuable operational insights and strategic and long-term planning capabilities. As CEO of The Clorox Company, he oversaw the integration of corporate responsibility into company operations and launched the company’s award-winning corporate responsibility strategy. In addition, Mr. Knauss possesses extensive international business management experience, which provides him with valuable insights into global business strategy. He also possesses extensive retail expertise, which includes experience in the retail pharmacy area. Mr. Knauss also has significant other public company board experience. Having worked outside of the healthcare industry, Mr. Knauss enhances the diverse perspectives on the Board. | |||

Age: 73

Director since:2002

Committees:

Audit

Compliance

Finance

Director Qualification Highlights:

Financial Expertise

Marketing, Public Relations, Communications |

Marie L. Knowles

Retired Executive Vice President & Chief Financial Officer, Atlantic Richfield Company (ARCO)

Ms. Knowles retired from Atlantic Richfield Company, a petroleum company, in 2000 and was executive vice president and chief financial officer from 1996 until 2000. She joined Atlantic Richfield Company in 1972 and held a number of financial and operating management positions including president of ARCO Transportation Company from 1993 to 1996. Ms. Knowles is also an Independent Trustee of Fidelity Fixed Income and Asset Allocation Funds. Ms. Knowles was formerly a director of America West Holdings Corporation, Atlantic Richfield Company, Phelps Dodge Corporation and URS Corporation.

Skills & Qualifications: Ms. Knowles brings to the Board extensive executive leadership and financial experience gained through her career at ARCO. Her experience also enables Ms. Knowles to provide critical insight into, among other things, the Company’s financial statements, accounting principles and practices, internal control over financial reporting, and risk management processes. Ms. Knowles was named a 2013 Outstanding Director by the San Francisco Business Times and the Silicon Valley Business Journal. |

- 2020 Proxy Statement - 2020 Proxy Statement | 15 |

Table of Contents

ITEM 1. ELECTION OF DIRECTORS

Age: 64

Director since:2018

Committees:

Compliance (Chair)

Compensation

Governance

Director Qualification Highlights:

Risk Management and Compliance

Healthcare Industry Experience |

Bradley E. Lerman

Senior Vice President, General Counsel & Corporate Secretary, Medtronic plc

Mr. Lerman was named senior vice president, general counsel and corporate secretary of Medtronic plc, a provider of medical technology, services and solutions, in May of 2014 and serves as a member of the executive committee. In this role, he leads Medtronic’s global legal, government affairs and ethics and compliance functions. Prior to Medtronic, Mr. Lerman served as executive vice president, general counsel and corporate secretary for the Federal National Mortgage Association (Fannie Mae). Previous to Fannie Mae, he served as senior vice president, associate general counsel and chief litigation counsel for Pfizer. Mr. Lerman also served as a litigation partner at Winston & Strawn LLP in Chicago and as an assistant U.S. attorney in the Northern District of Illinois.

Skills & Qualifications: Mr. Lerman brings to our Board significant legal and regulatory expertise gained from years of large law firm practice and government positions with law enforcement responsibilities. His legal experience and seasoned judgment are instrumental in helping the Board navigate legal and compliance challenges. Mr. Lerman’s multilayered understanding of the healthcare industry and experience linking compliance and legal consideration with corporate strategy also bring valuable insights to our Board. | |||

Age: 62

Director since: 2019

Committee:

Audit

Director Qualification Highlights:

Technology

International Experience |

Maria Martinez

Executive Vice President & Chief Customer Experience Officer, Cisco Systems Inc.

Ms. Martinez has served as executive vice president and chief customer experience officer at Cisco Systems, Inc. since April 2018. Previous to her role at Cisco, Ms. Martinez served in a variety of senior executive roles at salesforce.com, inc. including president, Global Customer Success and Latin America from March 2016 to April 2018; president, Sales and Customer Success from February 2013 to March 2016; executive vice president and chief growth officer from February 2012 to February 2013; and executive vice president, Customers for Life from February 2010 to February 2012. Prior to joining salesforce.com, inc., she managed the global services business for Microsoft Corporation, including professional services and customer support for all products. Ms. Martinez has also held several other leadership positions at Motorola, Inc. and AT&T Inc., and served as chief executive officer of Embrace Networks, Inc. She currently serves on the board of directors for Silicon Valley Education Foundation.

Skills & Qualifications: Ms. Martinez’s leadership experience at leading technology companies enhances the Board’s depth of experience in business and digital transformation, and her global leadership broadens the Board’s perspective. Her focus on customer success and customer experience contributes to the Board’s oversight of the Company’s long-term strategy as McKesson works to enhance its patient-centered approach as part of its mission of improving care. Ms. Martinez has also received several distinctions for her leadership, most recently being ranked No. 2 on the ALPFA (Association of Latino Professionals for America) list of the 50 Most Powerful Latinas. |

| 16 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

ITEM 1. ELECTION OF DIRECTORS

Age: 73

Director since: 2008

Committees:

Compensation

Governance

Director Qualification Highlights:

Distribution/Supply Chain Experience

International Experience |

Edward A. Mueller

Retired Chairman & Chief Executive Officer, Qwest Communications International, Inc.

Mr. Mueller retired as chairman and chief executive officer of Qwest Communications International Inc., a provider of voice, data and video services, in April 2011. He held the position of chairman and chief executive officer of Qwest Communications from August 2007 to April 2011. From January 2003 until July 2006, he served as chief executive officer of Williams-Sonoma, Inc., a provider of specialty products for cooking. Prior to joining Williams-Sonoma, Inc., Mr. Mueller served as president and chief executive officer of Ameritech Corporation, a subsidiary of SBC Communications, Inc., from 2000 to 2002. He was formerly a director of The Clorox Company, CenturyLink, Inc., Williams-Sonoma, Inc. and VeriSign, Inc. Mr. Mueller has been a director of the Company since April 2008 and was elected as independent board chair, effective April 1, 2019. Prior to this, he served as the Company’s lead independent director from 2013 to 2019.

Skills & Qualifications: Mr. Mueller brings to the Board executive leadership and business management experience, as well as a strong business acumen and strategic planning expertise. Having worked outside the healthcare industry, he also adds to the mix of experiences and perspectives on our Board that promote a robust and deliberative decision-making process. While Chairman of the Board of Qwest Communications, Mr. Mueller had a leadership role in corporate governance, which enables him to provide valuable contributions as a member of the Governance Committee of our Board. He also has public company board experience with audit committee service. | |||

Age: 55

Director since: 2014

Committees:

Governance (Chair)

Compensation

Director Qualification Highlights:

Human Capital Management

Financial Expertise |

Susan R. Salka

Chief Executive Officer & President, AMN Healthcare Services, Inc.

Ms. Salka serves as chief executive officer and president of AMN Healthcare Services, Inc., a provider of healthcare workforce solutions and staffing services to healthcare facilities across the nation, since 2005, and a director of the company since 2003. Since joining AMN Healthcare Services Inc. in 1990, she was chief operating officer, chief financial officer, and senior vice president of business development. Ms. Salka is passionate and actively involved in the areas of corporate social responsibility, inclusion and diversity, and gender equality. A member of Women Business Leaders and Women Corporate Directors Foundation, Ms. Salka is a proponent of promoting women in leadership. She was formerly a director of Beckman Coulter Inc. and Playtex Products. Ms. Salka currently serves on the editorial advisory board ofDirectors & Boards magazine, a quarterly journal dedicated to the topics of leadership and corporate governance.

Skills & Qualifications: With over 30 years of experience in the healthcare services industry, Ms. Salka brings to the Board a deep understanding of emerging trends in healthcare services. This industry experience gives her insight into important aspects of the Company’s businesses, including opportunities potentially available to those businesses. She has also served in several executive leadership positions which have provided her with business management, operation, financial and long-range planning experience. Ms. Salka also brings valuable experience acquired through significant public company board service. |

- 2020 Proxy Statement - 2020 Proxy Statement | 17 |

Table of Contents

ITEM 1. ELECTION OF DIRECTORS

Age: 53

Director since: 2019

Director Qualification Highlights:

Business Transformation

International experience |

Brian S. Tyler

Chief Executive Officer, McKesson Corporation

Mr. Tyler has served as chief executive officer of McKesson Corporation since April 1, 2019 and previously served as the Company’s president and chief operating officer from August 2018 to March 2019. Mr. Tyler served as chairman of the Management Board of McKesson Europe AG from 2017 to 2018, president and chief operating officer McKesson Europe from 2016 to 2017, the Company’s president of North American Pharmaceutical Distribution and Services from 2015 to 2016, and as the Company’s executive vice president, corporate strategy and business development from 2012 to 2015. Mr. Tyler previously served in various other leadership roles in the Company, including as president of U.S. Pharmaceutical, president of McKessonMedical-Surgical, and president of McKesson Specialty Health. Mr. Tyler is a member of the board of directors of the International Federation of Pharmaceutical Wholesalers (IFPW) and a member of the IFPW Foundation board of directors. He is a member of the American Cancer Society’s CEOs Against Cancer group in the North Texas chapter. He has been a director of the Company since April 2019.

Skills & Qualifications: Mr. Tyler brings more than 20 years of business and healthcare experience to the Board, and prior to that, earned his Ph.D. from the University of Chicago, Department of Economics specializing in industrial organization, labor economics and public finance/project evaluation. As McKesson’s CEO and a long-time leader of McKesson’s businesses, Mr. Tyler has extensive knowledge of the Company’s culture and workforce, and its challenges and opportunities. | |||

Age: 59

Director since: 2019

Committees:

Compliance

Finance

Director Qualification Highlights:

Cybersecurity and technology

Risk management and compliance |

Kenneth E. Washington, Ph.D.

Chief Technology Officer, Ford Motor Company

Dr. Washington has served as chief technology officer of Ford Motor Company, an automotive manufacturer, since June 2017. In this role, he leads Ford’s worldwide research organization, oversees the development and implementation of Ford’s technology strategy and plans, and plays a key role in Ford’s expansion into emerging mobility opportunities. Before his role as chief technology officer, Dr. Washington was appointed as Ford’s vice president of Research and Advanced Engineering in August 2014. Prior to joining Ford, Dr. Washington was vice president of the Advanced Technology Center at Lockheed Martin Corporation’s first Space Systems Company. Prior to this, he served as Lockheed Martin Corporation’s first chief privacy officer. Dr. Washington also previously served as the vice president and chief technology officer for the Lockheed Martin internal IT organization. Prior to joining Lockheed Martin in February 2007, Dr. Washington served as chief information officer for Sandia National Laboratories, where he also previously served in a variety of technical, management and program leadership positions.

Skills & Qualifications:Dr. Washington’s leadership in technology, research, and privacy at complex, global organizations will contribute to the Board’s oversight of risk and strategy, particularly in the areas of cybersecurity and other compliance matters as the Company continues to pursue grown opportunities globally. Dr. Washington earned his bachelor’s, master’s and doctorate degree in Nuclear Engineering from Texas A&M University and is a fellow of the MIT Seminar XXI program on International Relations. |

| 18 |  - 2020 Proxy Statement - 2020 Proxy Statement |

Table of Contents

ITEM 1. ELECTION OF DIRECTORS

The Board, Committees and Meetings

The Board of Directors is the Company’s governing body with responsibility for oversight, counseling and direction of the Company’s management to serve the long-term interests of the Company and its shareholders. The Board’s goals are to build long-term value for the Company’s shareholders and to ensure the vitality of the Company for its customers, employees and other individuals and organizations that depend on the Company. To achieve its goal, the Board monitors both the performance of the Company and the performance of the Chief Executive Officer. The Board consists of 11 directors. Ed Mueller serves as the Board’s Independent Chair. All of the directors during FY 2020 were, and the director nominees are, independent with the exception of Brian Tyler, the Company’s CEO.

The Board has five standing committees: The Audit Committee, Compensation Committee, Compliance Committee, Finance Committee, and Governance Committee. Each of these committees is governed by a written charter approved by the Board in compliance with the requirements of the SEC and the New York Stock Exchange, where applicable. The charter of each committee is reviewed annually by that committee and the Board. Each member of our standing committees is independent, as determined by the Board, under the NYSE listing standards and the Company’s director independence standards. In addition, each member of the Audit Committee and Compensation Committee meets the additional, heightened independence criteria applicable to such committee members under the applicable rules. The members of each standing committee are appointed by the Board each year for a term of one year or until their successors are elected and qualified or their earlier resignation.

Board and Meeting Attendance

The Board met eight times during FY 2020. Each director attended at least 75% of the aggregate number of meetings of the Board and of its committees on which he or she served. The independent directors also met in executive session during FY 2020, as necessary. Directors meet their responsibilities not only by attending Board and committee meetings, but also through communication with senior management, independent accountants, advisors and consultants and others on matters affecting the Company. Directors are also expected to attend the upcoming Annual Meeting. All directors attended the 2019 Annual Meeting of Shareholders. The membership of each standing committee in FY 2020 and the number of meetings held during FY 2020 are identified below.

Committee Membership, Responsibilities and Other Information

The following are the standing committees of the Board of Directors:

Audit Committee

| Responsibilities include:

| |||

Members in FY 2020: Dominic J. Caruso*, Chair M. Christine Jacobs Donald R. Knauss Marie L. Knowles* Maria Martinez

Meetings in FY 2020: 10 (includes 1 joint meeting with the Compliance Committee)

All members are independent and financially literate

* designated as “audit committee financial expert”

| • Reviewing with management the interim and annual audited financial statements filed in the Quarterly Reports on Form10-Q and Annual Report on Form10-K, respectively, including any major issues regarding accounting principles and practices, critical audit matters, and the adequacy and effectiveness of internal controls over financial reporting that could significantly affect the Company’s financial statements

• Reviewing with management and the independent registered public accounting firm the interim and annual financial statements

• Appointing the independent accountants, monitoring their independence, evaluating their performance and approving their fees

• Reviewing and overseeing the annual audit plan, including the scope of the audit activities of the independent accountants and performance of the Company’s internal audit function

• Assisting the Board with respect to its oversight of the Company’s policies and procedures regarding compliance with applicable laws and regulations

| |||

- 2020 Proxy Statement - 2020 Proxy Statement | 19 |

Table of Contents

ITEM 1. ELECTION OF DIRECTORS

Compensation Committee

| Responsibilities include:

| |||

Members in FY 2020: N. Anthony Coles, M.D., Chair Bradley E. Lerman Edward A. Mueller Susan R. Salka

Meetings in FY 2020: 5

| • Reviewing and overseeing the Company’s overall compensation philosophy and the development and implementation of compensation programs aligned with the Company’s business strategy

• Determining the structure and amount of all elements of executive officer compensation and benefits, including material perquisites, after consideration of management’s recommendation and in consultation with the committee’s independent compensation consultant

• Reviewing and making determinations regarding the adoption, administration, and amendments to all equity incentive plans for employees, and cash incentive plans for executive officers

• Evaluating the relationship between the incentives associated with Company plans and the level of risk-taking by executive officers in response to such incentives

• Participating with management in the preparation of the Compensation Discussion and Analysis for the Company’s proxy statement

• Evaluating the qualifications, performance and independence of its advisors

| |||

Compliance Committee

| Responsibilities include:

| |||

Members in FY 2020: Bradley E. Lerman, Chair Dominic J. Caruso Marie L. Knowles Kenneth Washington

Meetings in FY 2020: 7 (includes 1 joint meeting with the Audit Committee)

| • Overseeing the Company’s compliance programs and policies

• Reviewing the Company’s approach to, and results of, risk identification, assessment and mitigation plans for the principal legal and regulatory compliance risks facing the Company

• Overseeing any significant complaints and other matters raised through the Company’s compliance reporting mechanisms

• Reviewing any significant government inquiries or investigations and other significant legal actions

• Receiving information about current and emerging legal and regulatory compliance risks and enforcement trends that may affect the Company’s business operations, performance or strategy

• Commissioning studies, surveys, reviews as appropriate to evaluate the Company’s compliance and quality of personnel/committees providing compliance

• Reviewing appointment, performance, compensation and replacement of the Company’s Chief Compliance Officer

| |||

Finance Committee

| Responsibilities include:

| |||

Members in FY 2020: Donald R. Knauss, Chair Dominic J. Caruso N. Anthony Coles, M.D. Marie L. Knowles Kenneth Washington

Meetings in FY 2020: 5

| • Reviewing with management the long-range financial policies of the Company