- MCK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

McKesson (MCK) DEF 14ADefinitive proxy

Filed: 9 Jun 22, 4:11pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

Check the appropriate box: | ||

☐ | Preliminary Proxy Statement | |

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to §240.14a-12 | |

McKESSON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. | |

A LETTER FROM OUR INDEPENDENT CHAIR

| June 9, 2022

Dear Fellow Shareholders,

On behalf of the entire Board, I thank you for your continued investment in McKesson and the confidence you place in this Board to oversee your interests in our Company. As directors, we play a key role in overseeing our Company’s culture, setting the tone at the top and ensuring a continued focus on our mission of improving care in every setting — one product, one partner, one patient at a time. Over the last year, we have made significant changes to the leadership structure and composition of our Board. Following a planned transition led by former Independent Chair Edward A. Mueller, the Board elected me Independent Chair of the Board as of April 1, 2022. We thank Mr. Mueller for his years of steady leadership and invaluable contributions as the chair of our Board. I am excited to collaborate with my fellow Board members, our CEO, Brian Tyler, and our talented management team as we all work to deliver shareholder value and execute against priorities to drive growth at McKesson.

As we approach the 2022 Annual Meeting, I would like to share an update on some of the key aspects of the Board’s work over the last year: |

Executing on Our Strategic Priorities

Supporting the development of our Company’s strategy and overseeing its execution is our Board’s most critical function. As a Board, we are proud that our Company has developed a clear enterprise strategy, centered around a set of four company priorities. First, we are focused on our people and culture, building a strong and talented team anchored by our I2CARE values (integrity, inclusion, customer-first, accountability, respect and excellence). Our second priority is to drive sustainable growth in our core pharmaceutical and medical distribution businesses and enhance our ability to compete as the partner of choice for hospitals, health systems and pharmacies of all sizes. Third, we are streamlining the portfolio by maximizing the organization’s operational efficiency and focusing our resources on the highest growth opportunities. Our final priority is to expand our oncology and biopharma ecosystems. By leveraging our differentiated assets and capabilities, we are developing innovative solutions and services that solve complicated healthcare problems and improve patients’ lives. As we reflect on FY 2022, our financial results are a strong testament to the significant progress against our Company priorities and our transformation to a diversified healthcare services company. McKesson continues to rise to the challenge and meet the evolving demands of our customers and partners. Page 2 of this proxy statement provides highlights of some of our more significant financial and strategic accomplishments.

Commitment to Board and Committee Refreshment

As Independent Chair, I recognize that thoughtful and ongoing attention to Board composition is an important part of my role — and that of the Governance Committee — as we seek to ensure an appropriate mix of tenure and expertise that provides a balance of fresh perspectives and significant institutional knowledge. Since our last annual meeting, we appointed Richard H. Carmona, James H. Hinton, Kathleen Wilson-Thompson and W. Roy Dunbar to the Board. Our new directors’ deep expertise in healthcare, technology and environmental, social and governance (ESG) matters is particularly valuable as we build on our commitment to positively impact healthcare for all as a diversified healthcare services company. We also refreshed the composition of all five board committees. As part of this, in addition to refreshing the members within each committee, we have appointed Maria N. Martinez as Chair of the Governance Committee, Susan R. Salka as Chair of the Finance Committee and Linda P. Mantia as Chair of the Compensation Committee.

Consistent with our commitment to thoughtful governance, we continually assess our policies and structures to incorporate best practices. Last year we committed to establishing science-based greenhouse gas emissions targets that are intended to meet the standards of the Science Based Targets initiative. We also implemented a policy, beginning this year, requiring directors with a tenure of more than 12 years to offer to resign from Board service annually. If the Board were to decide that the Company’s and its shareholders’ interests are best served by rejecting a resignation offer, the Board would disclose its rationale.

Holistic Approach to ESG Matters

McKesson takes a holistic approach to ESG matters. Earlier this year, we created an executive steering committee comprised of our Chief Impact Officer, Chief Human Resources Officer, Chief Financial Officer and Chief Legal Officer to focus on the implications of ESG across the enterprise, and in May 2022, our Board approved charter amendments to rename our Governance and Sustainability Committee and Compensation and Talent Committee (formerly, Governance Committee and Compensation Committee, respectively) to refine their oversight of ESG matters. As part of this oversight, the Governance and Sustainability Committee’s charter expressly provides for an annual review of McKesson’s sustainability and ESG strategy. Similarly, the Compensation and Talent Committee’s charter expressly provides for its oversight of talent development, employee engagement, culture and diversity, equity, and inclusion (DEI). The Company’s Corporate Governance Guidelines were also revised to provide for coordination amongst the Board and its committees to help manage overlapping oversight responsibilities.

We continue to make DEI integral to everything we do at McKesson. As we consider the importance of DEI at our Company, we have set forth public goals to increase representation of women (across North America) and people of color (across the U.S.) amongst our leadership ranks by 20% in 2025, as compared to FY 2021. We are also investing in a culture where we want everyone to feel a sense of belonging and passion to build a rewarding, dynamic career. We are proud to have launched “Leading Inclusively” for all our people leaders, an interactive session that encourages inclusive behavior and tactics to build a team culture. We also launched “Ignite Inclusion” to help all our employees improve their understanding of inclusion, identify tactics that lead to belonging, and teach ways to address bias in the workplace.

Global Actions to Support COVID-19 Vaccination Efforts

As the COVID-19 pandemic has continued to present challenges, the Board and management have been collaborating to help ensure the stability of our critical services to our customers while protecting our employees. Our purpose of advancing health outcomes for all has been magnified throughout this pandemic. Between operating as the U.S. government’s centralized distributor for certain COVID-19 vaccines and assembling ancillary supply kits needed to administer the vaccines, our response has spanned multiple disciplines across our enterprise.

This critical work highlights the important role McKesson plays in the health care supply chain and the depth of our expertise. The Board is proud to see that our global approach to supporting vaccine efforts and addressing the pandemic has been consistent with our vision to improve care in every setting. We believe that McKesson will continue to be part of the recovery, serving our customers, partners and patients every step of the way.

Approach to Risk Oversight

We take our role in risk oversight seriously, including on matters related to controlled substances. Our Board works with management to establish and communicate the right ethical tone, which is designed to guide our conduct and helps protect the Company’s reputation. Further, the entire Board and its committees seek to understand and review our corporate risks — including oversight of matters such as reputation, legal reporting risk, compensation practices and cyber.

One area in particular that we continue to prioritize is our effort to help communities’ prevent and reduce opioid use disorder, in partnership with the national, independent Foundation for Opioid Response Efforts (FORE®). Over the years, FORE has funded several projects to expand access to treatment and recovery services for underserved populations, including people of color, those in rural and tribal communities, and those involved with the criminal justice system. We are focused on making progress on these initiatives and our proactive policy work, as well as continuing to enhance our Controlled Substances Monitoring Program (CSMP) to address changing needs. In July 2021, the Company announced that it, along with two other national distributors, had negotiated a settlement that would resolve the substantial majority of opioid lawsuits filed by states and local governments. We believe that this settlement is in the best interests of our shareholders and is an important step toward delivering meaningful relief to affected communities across the United States.

We Ask for Your Support

On behalf of the Board, I thank McKesson’s investors for regularly engaging with the Company and sharing their valuable perspectives on what we are doing well and how we can continue to improve. As part of our year-long, robust outreach and engagement program, we spoke with many of our investors on topics including Board composition and refreshment, sustainability, human capital management, human rights oversight, our executive compensation program, our CSMP and COVID-19 efforts. We look forward to hearing your views at this year’s annual meeting and in the years to come.

We value the trust you place in us through your investment in McKesson. Your board members appreciate the opportunity to serve McKesson on your behalf in 2022 and beyond, and we will continue our focus on the sustainable and long-term growth of the Company. Your vote is very important to us. We strongly encourage you to read both our proxy statement and annual report in their entirety prior to the Annual Meeting on July 22, 2022, and request that you support our voting recommendations.

Donald R. Knauss

Independent Chair

Notice of 2022 Annual Meeting of Shareholders To be Held on July 22, 2022 |

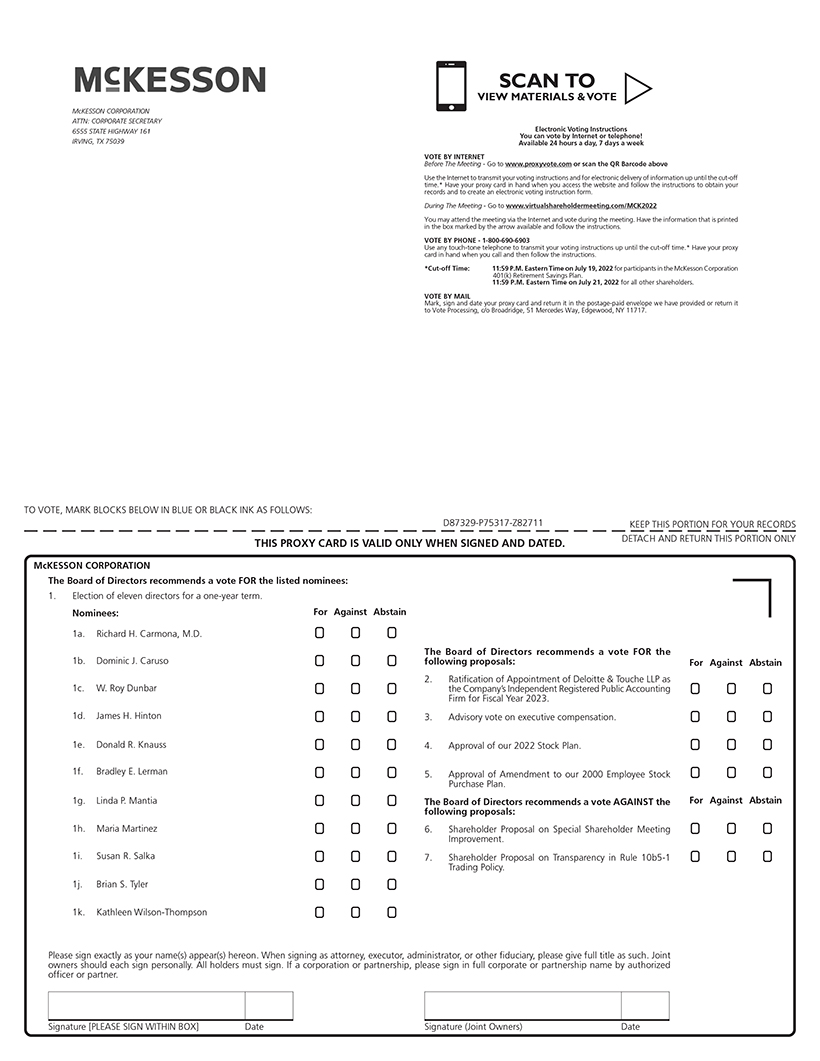

The 2022 Annual Meeting of Shareholders (Annual Meeting) will be held on July 22, 2022 at 8:30 a.m. Central Daylight Time, solely by means of remote communication. You will be able to attend the Annual Meeting online, vote, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/MCK2022 and entering the 16-digit control number included in our Notice Regarding the Availability of Proxy Materials, voting instructions form or proxy card. Online access to the audio webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for you to log in and test the computer audio system.

ITEMS OF BUSINESS:

| • | Elect for a one-year term a slate of 11 directors as nominated by the Board of Directors; |

| • | Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2023; |

| • | Conduct a non-binding advisory vote on executive compensation; |

| • | Approve our 2022 Stock Plan; |

| • | Approve an Amendment to our 2000 Employee Stock Purchase Plan; |

| • | Vote on 2 shareholder proposals, if properly presented; and |

| • | Conduct such other business as may properly be brought before the meeting. |

Shareholders of record at the close of business on May 27, 2022 are entitled to notice of and to vote at the meeting or any adjournment or postponement of the meeting.

June 9, 2022

By Order of the Board of Directors

Saralisa C. Brau

Corporate Secretary and

Assistant General Counsel

On or about June 9, 2022, we began delivering proxy materials to all shareholders of record at the close of business on May 27, 2022. The mailing address of our principal executive offices is McKesson Corporation, 6555 State Highway 161, Irving, Texas 75039.

| Vote via Internet |

|

| Call Toll-Free |

|

| Vote by Mail |

|

| Vote at Meeting | |||||||||

|  |  |  | |||||||||||||||

| www.proxyvote.com or visit the URL located on your proxy card | Call the phone number located at the top of your proxy card

| Follow the instructions on your proxy card | Join our Annual Meeting at www.virtualshareholdermeeting.com/MCK2022 | |||||||||||||||

This summary highlights certain information in this proxy statement and does not contain all the information you should consider in voting your shares. Please refer to the complete proxy statement and our annual report prior to voting at the Annual Meeting of Shareholders to be held on July 22, 2022.

Meeting Information

2022 Annual Meeting of Shareholders

| ||

Date and Time | Friday, July 22, 2022 | 8:30 a.m. Central Daylight Time | |

Location | This year’s Annual Meeting will be held virtually. Shareholders of record as of the record | |

date will be able to attend and participate in the Annual Meeting online at | ||

Record Date

| May 27, 2022

| |

Voting Items

| Items | Your Board’s Recommendation | |||

| ||||

| 1 | Election of 11 Directors for a One Year Term (see page 10) | FOR | ||

Diverse slate of Directors with broad and relevant leadership and profession. Ten out of eleven nominees are independent. | ||||

| ||||

| 2 | Ratification of Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal Year 2023 (see page 27) | FOR | ||

Deloitte & Touche LLP is an independent accounting firm with the breadth of expertise and knowledge necessary to audit our company. | ||||

| ||||

| 3 | Advisory Vote on Executive Compensation (see page 63) | FOR | ||

Our executive compensation program is the result of thorough Compensation Committee review, continues to emphasize pay for performance, and reflects shareholder feedback. | ||||

| ||||

| 4 | Approval of our 2022 Stock Plan (see page 64) | FOR | ||

Approval of the 2022 Stock Plan will enable the Company to continue to provide stock-based compensation to our employees and non-employee directors. | ||||

| ||||

| 5 | Approval of Amendment to our 2000 Employee Stock Purchase Plan (see page 72) | FOR | ||

Approval of the amendment to the ESPP enable the Company to continue to offer the plan to a broad-based employee population. | ||||

| ||||

| 6 | Shareholder Proposal on Special Shareholder Meeting Improvement (see page 76) | AGAINST | ||

Lower than the ownership threshold set at most S&P 500 companies with a special meeting right, a 15% ownership threshold effectively balances our shareholders’ ability to act on important matters and concerns to protect the Company and its shareholders from small groups with special interests. | ||||

| ||||

| 7 | Shareholder Proposal on Transparency in Rule 10b5-1 Trading Policy (see page 79) | AGAINST | ||

McKesson has robust processes and procedures for monitoring executive trading and the proposed policy would subject the Company to reporting requirements not required of other public companies. | ||||

- 2022 Proxy Statement - 2022 Proxy Statement | 1 |

PROXY SUMMARY

The Foundation of McKesson

McKesson Corporation is a diversified healthcare services leader. We partner with biopharma companies, care providers, pharmacies, manufacturers, governments, and others to deliver insights, products and services to help make quality care more accessible and affordable. The foundation of our company is focused on addressing the changing needs of our customers, their patients, and the broader healthcare industry. We developed a clear enterprise strategy centered around a set of four company priorities:

Focus on People and Culture

| Everything we do starts with our talent – especially our leaders. Our strong focus is centered in a cultural foundation, which starts with our purpose, advancing health outcomes for all. And it includes our vision, to improve care in every setting – one product, one partner, one patient at a time. Our culture is also anchored in our I2CARE values: integrity, inclusion, customer-first, accountability, respect and excellence. |

Sustainable Core Growth

| Our operational excellence and ability to leverage our scale and distribution expertise is one of the many reasons why McKesson continues to be the partner of choice for hospitals, health systems and pharmacies of all sizes. |

Streamline the Portfolio

| We are focused on unlocking more innovation, more speed and improving focus of the organization by maximizing the organization’s operational efficiency and focusing our resources on the highest growth opportunities. |

Expand Oncology and Biopharma Ecosystems

| We are building integrated ecosystems that leverage our differentiated assets and capabilities. We continue to develop innovative solutions and services that solve complicated healthcare problems and improve patients’ lives. |

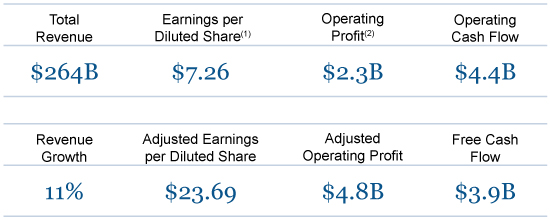

Fiscal Year 2022 Highlights

Our results are a testament to McKesson’s ability to execute during challenging times, and speak to the dedication of our people, the resilience of our business, and the important leadership role McKesson plays in the healthcare supply chain:

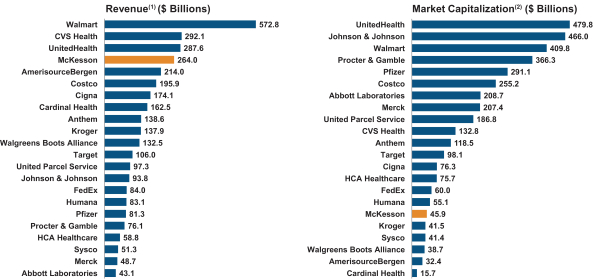

| • | Full-year total revenues of $264.0 billion, an increase of 11%; |

| • | Full-year operating cash flow of $4.4 billion and free cash flow of $3.9 billion; |

| • | Returned $3.8 billion of cash to shareholders, including $3.5 billion in share repurchases; |

| • | Announced our strategic intent to exit from the European market and entered into agreements to sell operations in 10 of 12 countries; |

| • | Continued to expand our differentiated Oncology and Biopharma ecosystems, further demonstrating significant progress against company priorities; and |

| • | Played a leading role in the fight against COVID-19 and continued to support the U.S. Government as a centralized distributor of COVID-19 vaccines and ancillary supplies. |

See Appendix A to this proxy statement for a reconciliation of free cash flow to the most directly comparable U.S. GAAP metrics.

| 2 |  - 2022 Proxy Statement - 2022 Proxy Statement |

PROXY SUMMARY

Executing Our Corporate Responsibility

Our Board’s goal is to build long-term value for the Company’s shareholders and strengthen the vitality of the Company for its employees, customers, suppliers and other stakeholders that depend on McKesson. To help achieve this goal, the Board continues to monitor the Company’s overall performance with respect to certain environmental, social and governance (ESG) matters. In FY 2022, we created an executive steering committee comprised of our Chief Impact Officer, Chief Human Resources Officer, Chief Financial Officer and Chief Legal Officer to coordinate and focus ESG efforts across the enterprise. Our Board also approved amendments to the Governance Committee Charter and the Compensation Committee Charter in May 2022 to further strengthen oversight of ESG matters as highlighted in the table below:

| ESG Oversight Responsibilities | ||

| ||

| Governance and Sustainability Committee (Governance Committee) | The committee’s new name reflects its responsibility to lead the oversight of certain ESG matters, including an annual review of the Company’s sustainability and ESG strategy. The committee continues to receive periodic updates from the Chief Impact Officer on ESG matters. The Chief Legal Officer and Corporate Secretary also provide updates on regulatory matters and corporate governance trends. The committee has first oversight of corporate governance, environmental, climate, and sustainability matters, among others. | |

| ||

| Compensation and Talent Committee (Compensation Committee) | The committee’s expanded responsibilities include oversight of senior management succession planning and talent development, employee engagement, culture, and diversity, equity and inclusion matters, in coordination with the Board and other committees. | |

| ||

The Board also revised the Company’s Corporate Governance Guidelines (Guidelines) to provide for coordination between the Board and its committees to facilitate the execution of coinciding oversight responsibilities, among other matters.

Please refer to page 19 of this proxy statement for additional corporate governance highlights and instructions for finding the charter governing each of the Board’s five standing committees, including the Governance and Sustainability Committee Charter and the Compensation and Talent Committee Charter. | ||

Focus on People & Culture

With our I2CARE and ILEAD values as our anchor, our first priority is our people, our teams and our culture. Part of our focus on culture is our continued improvement in diversity and inclusion. While we are proud of our Board’s diversity, we also placed particular focus on hiring, developing and promoting what we call a best talent strategy at McKesson. We invest heavily in employee growth and development and provide regular feedback and training to our employees. For example, we have implemented employee development programs, including Amplify, a program designed specifically for McKesson’s high potential talent, and Women in Leadership. These programs include training and coaching, and support not only the careers of future leaders, but also employees in their organizations. The health and safety of our employees also remains critical in our day-to-day work, and we are deeply committed to supporting our team and their families through various initiatives, including our first-ever day of wellness — “Your Day, Your Way” — giving employees a special day off to relax and recharge.

Our employees lead 10 employee resource groups, offering opportunities to make authentic connections, showcase leadership skills and create a positive impact. Recently, we were recognized as one of the best places to work for LGBTQ+ equality for the ninth year in a row. McKesson previously stated that by 2025, we would strive to increase representation of women across North America and people of color across the United States amongst our VP+ leadership ranks, each by 20% as compared to FY 2021. The Company remains committed to these aspirational goals and we are encouraged that progress is on track. At March 31, 2022, women and people of color represented the following:

| Metric(1) | McKesson Overall | McKesson Leadership(2) | ||||||||

Women(3) | 64% | 46% | ||||||||

People of Color(4) (5) | 47% | 22% | ||||||||

| (1) | The data for our metrics is derived from our voluntary self-identification process as of March 31, 2022 and therefore represents our best estimate at this time. For fiscal year 2021, our metrics did not include our employees related to The U.S. Oncology Network as the data was not available. |

| (2) | Represents our leadership at the vice president level and above. |

| (3) | Represents worldwide employees. In North America, women represent 60% of “McKesson Overall” and 48% of “McKesson Leadership.” |

| (4) | Represents U.S. employees only because the data for Canada and Europe is not available. |

| (5) | People of Color includes the following races and ethnicities: American Indian or Alaska Native, Asian, Black or African American, Hispanic or Latino, Native Hawaiian or Other Pacific Islander, or Two or More Races. |

- 2022 Proxy Statement - 2022 Proxy Statement | 3 |

PROXY SUMMARY

Protecting the Planet

In FY 2022, McKesson committed to set science-based targets for scope 1, 2 and 3 greenhouse gas (GHG) emissions that are intended to meet the standards of the Science Based Targets initiative (SBTi). We anticipate that SBTi will begin the validation process later this calendar year. We will publish a report within 90 days of receiving validation by SBTi that describes the validated targets and objectives and strategies on GHG reduction, renewable energy, and energy efficiency.

Investing in Local Communities

During FY 2022, our employees volunteered more than 26,500 hours, supported 30 projects as part of McKesson’s annual Community Days volunteer event and logged the ‘Most Accrued Distance’ in the American Cancer Society’s Fit2Be Cancer Free Challenge. Our General Counsel Organization also made a meaningful impact through its volunteer and pro bono efforts by supporting a myriad of events and activities near office locations in the Dallas Metro Area, the Atlanta Metro Area, and beyond.

Additionally, the McKesson Foundation, a 501(c)(3) corporate entity (Foundation), continued to support our employees and their communities disbursing nearly $4.5 million to support three focus areas: Reducing the Burden of Cancer; Diversifying the Healthcare Talent Pipeline; and Accelerating Disaster Relief and Improving Emergency Preparedness. In FY 2022, the Foundation’s donations included:

| • | $1.4M to nonprofit organizations working to reduce the burden of cancer and diversify the healthcare talent pipeline; |

| • | $900K to charitable organizations working to accelerate disaster relief and improve emergency preparedness, including food banks striving to mitigate rising food insecurity during the COVID-19 pandemic; |

| • | $1.1M in matching gifts by employees to benefit more than 1,700 charities selected by them; and |

| • | $286K in recognition of employees’ nonprofit volunteer and board service activities. |

McKesson also remains committed to help fight the opioid crisis. Earlier this year, McKesson and other distributors announced a comprehensive agreement to settle the vast majority of the opioid lawsuits filed by state and local governmental entities against them. This settlement will provide thousands of communities across the U.S. with up to approximately $19.5 billion over 18 years.

We believe this proposed settlement is an important step toward delivering meaningful relief to communities across the U.S. We are committed to work and engage with others who share our dedication to act with urgency to address the opioid epidemic, offer thoughtful public policy recommendations and support innovative programs and partnerships.

| 4 |  - 2022 Proxy Statement - 2022 Proxy Statement |

PROXY SUMMARY

We Solicit Shareholder Feedback Year Round

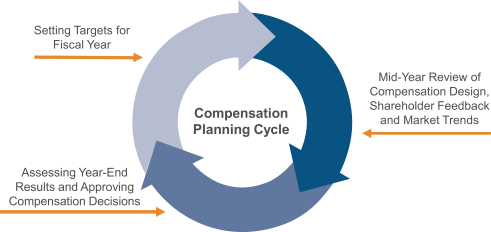

Our Board believes proactive solicitation and consideration of shareholder feedback is critical to driving long-term growth and creating shareholder value. Our shareholder engagement program is a robust, year round process encompassing meetings held throughout the year with shareholders during which we encourage ongoing, meaningful dialogue about the issues they find most important. We report shareholder feedback regularly to our Board.

Our Board reviews our annual meeting results, ongoing shareholder feedback and corporate governance and compensation trends to help drive and develop our shareholder engagement priorities.

Scope of Outreach and Key Topics

Since our 2021 Annual Meeting, we proactively reached out to shareholders representing almost 62% of our outstanding common stock and engaged with shareholders representing nearly 40% of our outstanding common stock. Our current Independent Chair led an engagement regarding the Board’s oversight of human rights risk. Other topics discussed with our shareholders included:

| • | Board Oversight, Refreshment & Diversity |

| • | COVID-19 Response Efforts |

| • | Sustainability and ESG |

| • | Pay for Performance Alignment |

| • | Human Capital Management |

| • | Controlled Substances Monitoring Program Developments |

| • | Lobbying Expenditures and Activities |

| • | Corporate Governance Practices and Policies |

Moreover, our Chief Executive Officer, Chief Financial Officer, and Investor Relations team hosted an Investor Day event and attended six healthcare conferences in FY 2022 together with other members of Team McKesson to discuss the Company’s strategic priorities and other topics.

- 2022 Proxy Statement - 2022 Proxy Statement | 5 |

PROXY SUMMARY

Executive Compensation Highlights

As discussed in detail under “Compensation Discussion and Analysis,” with the goal of building long-term value for our shareholders, we have developed an executive compensation program designed to strike the right balance of pay for performance; attracting and retaining an exceptionally talented executive team; and steering McKesson’s leadership to meet ambitious goals without taking undue risk.

The Compensation Committee continually evaluates our executive compensation program and results, considering the formulaic outcomes built into the program in the broader context of performance, shareholder feedback and other events. We were pleased to receive positive feedback from shareholders regarding our program over the past year, including at our 2021 Annual Meeting of Shareholders, where approximately 90% of votes cast were in favor of our say-on-pay proposal.

Under our executive team’s leadership, McKesson’s dedicated employees delivered outstanding performance, while playing a critical role in the COVID-19 vaccine distribution and kitting programs with the U.S. government. In FY 2022, we delivered adjusted operating results that exceeded our original expectations at the enterprise level and across all our business units. We focused on execution against our Company priorities, making solid progress on people and culture, delivering sustainable core growth, streamlining the businesses and continued advancement of our strategic growth pillars. McKesson’s accomplishments remain the foundation for McKesson’s future and our ability to continue creating long-term value for our shareholders.

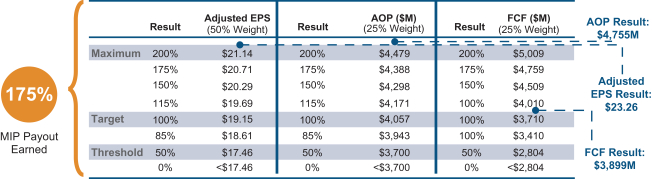

FY 2022 Pay Elements and Performance Metrics

Our executive compensation program is predominantly performance-based, consisting of four primary compensation elements that each serve a unique purpose. The metrics below incentivize our executives to focus on operational objectives that are expected to drive shareholder value.

Pay Element |

| Performance Metric | Rationale | Target Pay | ||||

| ||||||||

Base Salary |

— | Attracts and retains high-performing executives by providing market-competitive fixed pay |

— | |||||

| ||||||||

| ||||||||

Management Incentive (annual cash incentive) |

Adjusted EPS (50%) | Rewards operational performance and profitability; important driver of share price valuation and shareholder expectations | 100% — 175% of Base Salary | |||||

Adjusted Operating Profit (25%) |

Rewards focus on operational performance | |||||||

Free Cash Flow (25%) |

Rewards generating cash to invest in growth and return of capital to shareholders; important valuation metric | |||||||

| ||||||||

| ||||||||

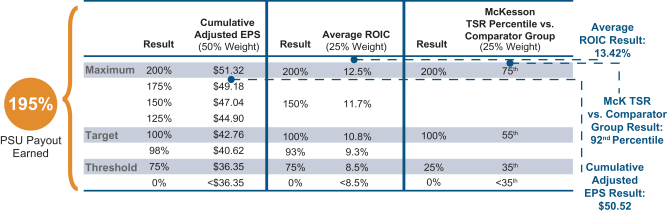

Performance Stock Units (long-term equity incentive) | 3-Year Cumulative Adjusted EPS (50%) | Measures long-term earnings power, drives long-term returns for the Company and directly correlates to share price performance | 60% of Target LTI Value | |||||

3-Year Average ROIC (25%) |

Encourages leaders to make sound investments that generate returns for shareholders; important valuation metric | |||||||

MCK TSR vs. (25%) |

Rewards share price performance relative to comparator group over time | |||||||

| ||||||||

| ||||||||

Restricted Stock Units (long-term equity) |

— |

Directly aligns with value delivered to shareholders | 40% of Target LTI Value | |||||

| ||||||||

| 6 |  - 2022 Proxy Statement - 2022 Proxy Statement |

PROXY SUMMARY

Director Nominees and Our Approach to Governance

Our director nominees exhibit a mix of skills, experience, backgrounds and perspectives. Additional information about each director’s experience and qualifications can be found beginning on page 10 of this proxy statement.

| Name | Age | Director Since | Independent | Current Committee Memberships | Other Public Company Boards | |||||||||||||

| Richard H. Carmona, M.D. Chief of Health Innovations of Canyon Ranch Inc. and 17th Surgeon General of the United States | 72 | 2021 | ✓ | • Compensation • Compliance | • The Clorox Company • Herbalife Nutrition Ltd. • Better Therapeutics, Inc. | ||||||||||||

| Dominic J. Caruso Retired EVP & CFO, | 64 | 2018 | ✓ | • Audit (Chair) • Compliance | • Kyndryl Holdings, Inc. | ||||||||||||

| W. Roy Dunbar Retired CEO and Chairman, | 61 | 2022 | ✓ | • Audit • Governance | • SiteOne Landscape Supply, Inc. • Johnson Controls International plc • Duke Energy Corp. | ||||||||||||

| James H. Hinton Operating Partner, | 63 | 2022 | ✓ | • Compliance • Finance | None | ||||||||||||

| Donald R. Knauss Retired Chairman & CEO, The Clorox Company | 71 | 2014 | ✓ | • Compensation • Finance | • Kellogg Company • Target Corporation | ||||||||||||

| Bradley E. Lerman Retired SVP, General Counsel & Corporate Secretary, Medtronic plc | 65 | 2018 | ✓ | • Audit • Compliance (Chair) | None | ||||||||||||

| Linda P. Mantia Retired SEVP & COO, Manulife Financial Corporation | 53 | 2020 | ✓ | • Compensation (Chair) • Governance | • Ceridian HCM Holding Inc. | ||||||||||||

| Maria Martinez EVP & COO, Cisco Systems, Inc. | 64 | 2019 | ✓ | • Finance • Governance (Chair) | • Cue Health Inc. | ||||||||||||

| Susan R. Salka CEO & President, AMN Healthcare Services, Inc. | 57 | 2014 | ✓ | • Audit • Finance (Chair) | • AMN Healthcare Services, Inc. | ||||||||||||

| Brian S. Tyler McKesson Corporation | 55 | 2019 | • Republic Services, Inc. | ||||||||||||||

| Kathleen Wilson-Thompson Retired EVP & Global CHRO, Walgreens Boots Alliance, Inc. | 64 | 2022 | ✓ | • Compensation • Governance | • Tesla, Inc • Wolverine World Wide, Inc. | ||||||||||||

Diversity

5 out of 11 director nominees are women or persons of color

| Independent Directors

10 out of 11 director nominees are independent | Board Refreshment

At least 1 new director joined our Board each year since 2018 | ||

- 2022 Proxy Statement - 2022 Proxy Statement | 7 |

PROXY SUMMARY

Diverse Skills, Experiences and Qualifications

The skills matrix below identifies our director nominees’ prominent experiences and qualifications by name. Each director nominee brings his or her own unique background and range of expertise, knowledge and experience which provides an appropriate and diverse mix of qualifications necessary for our Board to effectively fulfill its oversight responsibilities. By its nature, the information contained in this summary is not intended to be exhaustive, however, it aims to convey the general breadth of experience and qualifications that our director nominees bring to their work on the McKesson Board of Directors to oversee strategy, performance, culture and risk at the Company.

| Board Skills | 6 Directors with Risk Management & Compliance

8 Directors with Healthcare Industry Experience

4 Directors with Sustainability and ESG Experience | |||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

|  |  |  |  |

|  |  |

|  |

| ||||||||||||||||||

| Senior Executive Leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||

|

Other Public Company Board |

● |

● |

● |

● |

● |

● |

● |

● |

● | ||||||||||||||||||

|

Business Transformation / M&A | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||

| Financial / Accounting | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||

|

Healthcare Industry Experience |

● |

● |

● |

● |

● |

● |

● |

● | |||||||||||||||||||

|

Distribution / Supply Chain |

● |

● |

● |

● | |||||||||||||||||||||||

| Risk Management and Compliance | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||

|

Sustainability and ESG | ● | ● | ● | ● | |||||||||||||||||||||||

| Cyber / Technology | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Global / International Experience | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||

|

Marketing / Public Relations / |

● |

● |

● |

● |

● | ||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| Additional Diversity Highlights | ||||||||||||||||||||||

| Persons of Color | Women | Country Location Outside of U.S. | Veteran Status | |||

| 3 | 4 | 1 | 2 | |||

| - two Black/African-American and one Hispanic - | - three of whom chair a Board committee - | - one director based in Canada - | - two directors served in the U.S. military - |

| 8 |  - 2022 Proxy Statement - 2022 Proxy Statement |

PROXY SUMMARY

Governance Highlights

Board and Committee refreshment. Don Knauss serves as the Board’s Independent Chair, effective April 1, 2022. Four independent directors joined our Board in the last year. Rich Carmona was appointed to the Board effective, September 6, 2021. Jim Hinton and Kathleen Wilson-Thompson were appointed to our Board effective January 13, 2022. Roy Dunbar was appointed to our Board effective, April 1, 2022. Ed Mueller will not stand for reelection at the 2022 Annual Meeting. In FY 2022, Linda Mantia, Maria Martinez and Susan Salka were appointed to serve as Chair of the Compensation, Governance and Finance committees, respectively.

This year we also adopted a modified tenure policy, which will contribute to our continual board refreshment and succession planning. The policy requires directors with a tenure of more than 12 years to offer their resignation from Board service annually. If the Board were to decide it is in the best interests of the Company and its shareholders to not accept a resignation offer, the Board would disclose its rationale.

Other leading corporate governance practices. Below we highlight some of the key features of our corporate governance practices:

| Shareholder Rights |

|

| Board of Directors |

|

| Corporate Governance | ||||||

• Proxy access • Meaningful right to call special meeting of shareholders (15% ownership threshold) • No supermajority vote provisions | • Separate CEO/Chair roles • Independent Board Chair • 10 of 11 director nominees are independent • Regular executive sessions of independent directors • Annual elections

| • Pay for performance alignment • No poison pill • Robust board and senior management succession planning process | ||||||||||

Please see the section entitled “Corporate Governance” on page 19 of this proxy statement for more information on our corporate governance practices.

- 2022 Proxy Statement - 2022 Proxy Statement | 9 |

PROPOSALS TO BE VOTED ON

| ITEM 1. | Election of Directors |

There are 11 nominees for election to the Board of Directors of the Company. The directors elected at the 2022 Annual Meeting of Shareholders (Annual Meeting) will hold office until the 2023 Annual Meeting of Shareholders and until their successors have been elected and qualified, or until their earlier resignation, removal or death.

All nominees are current directors. Dominic Caruso, Don Knauss, Brad Lerman, Linda Mantia, Maria Martinez, Susan Salka and Brian Tyler were elected to the Board at the 2021 Annual Meeting of Shareholders. Rich Carmona was appointed to the Board effective September 6, 2021. Jim Hinton and Kathleen Wilson-Thompson were appointed to the Board effective January 13, 2022, and Roy Dunbar was appointed the Board effective April 1, 2022.

The Governance Committee has recommended the reelection of each nominee as a director at the Annual Meeting. Each nominee has informed the Board that he or she is willing to serve as a director. If any nominee should decline or become unable or unavailable to serve as a director for any reason, your proxy authorizes the persons named in the proxy to vote for a replacement nominee, or the Board may reduce its size.

The following section provides a brief description of the age, principal occupation, position and business experience, including other public company directorships, for at least the past five years and major affiliations of each of the nominees. Each nominee’s biographical information includes a description of the nominee’s experience, qualifications, attributes or skills that qualify the nominee to serve on the Company’s Board at this time.

Your Board recommends a vote “FOR” each Nominee.

Age: 72

Director since: 2021

Committees:

Compensation

Compliance

Director Qualification Highlights:

Public Health and |

Richard H. Carmona, M.D.

Chief of Health Innovations of Canyon Ranch Inc. and 17th Surgeon General of the United States

Dr. Carmona has served as chief of health innovations of Canyon Ranch Inc. since 2017. He has also served in several other executive roles since joining Canyon Ranch Inc. in 2006, including vice chairman, chief executive officer of the Canyon Ranch health division and president of the nonprofit Canyon Ranch Institute. Prior to Canyon Ranch, Dr. Carmona served as the 17th Surgeon General of the United States from 2002 through 2006, achieving the rank of Vice Admiral. Prior to serving as the Surgeon General, he was chairman of the State of Arizona Southern Regional Emergency Medical System, a professor of surgery, public health, and family and community medicine at the University of Arizona, and surgeon and deputy sheriff of the Pima County, Arizona Sheriff’s Department. He also served in the United States Army and the Army’s Special Forces and is a combat-decorated veteran. Dr. Carmona is a director of The Clorox Company, Herbalife Nutrition Ltd. and Better Therapeutics, Inc. He joined the board of directors of Axon Enterprise, Inc. in 2007, serving until he retired from that role effective May 20, 2022.

Skills & Qualifications: Dr. Carmona has gained valuable public company experience serving on public company boards and committees for the past 15 years. In addition, he brings hands-on experience in public health, clinical sciences and healthcare management. He is well-versed in the international and domestic legislative and policy aspects of the healthcare industry through his experience as the 17th U.S. Surgeon General and as the CEO of a hospital and health care system. Dr. Carmona brings insight into the Company’s mission to improve care in every setting. |

| 10 |  - 2022 Proxy Statement - 2022 Proxy Statement |

ITEM 1. ELECTION OF DIRECTORS

Age: 64

Director since: 2018

Committees:

Audit (Chair)

Compliance

Director Qualification Highlights:

Financial Expertise

Risk Management and Controls |

Dominic J. Caruso

Retired Executive Vice President and Chief Financial Officer, Johnson & Johnson

Mr. Caruso retired as executive vice president and chief financial officer of Johnson & Johnson, a manufacturer of medical devices, pharmaceutical and consumer packaged goods, in August 2018, having served in the role since 2007. He led the company’s financial and investor relations activities, as well as the procurement organization. Mr. Caruso joined Johnson & Johnson in October 1999 as chief financial officer for Centocor, Inc., upon the completion of the merger of Centocor and Johnson & Johnson. Prior to joining Centocor he had varied industry experiences with KPMG. Mr. Caruso is actively involved in government relations activities globally, including having served as co-chair of the U.S. Chamber of Commerce Global Initiative on Health and the Economy. He currently serves on the Board of Trustees of The Children’s Hospital of Philadelphia, the Cystic Fibrosis Foundation and is on the board of directors for Kyndryl Holdings, Inc.

Skills & Qualifications: Mr. Caruso brings to the Board financial expertise and leadership, as well as a deep familiarity with investors’ perspectives, having previously served as an executive officer of a publicly traded healthcare company. With a focus on healthcare compliance throughout his career at Johnson & Johnson, Centocor, Inc. and KPMG, Mr. Caruso also brings experience in financial and compliance risk oversight. | |||

Age: 61

Director since: 2022

Committees:

Audit

Governance

Director Qualification Highlights:

Technology

Sustainability & ESG |

W. Roy Dunbar

Retired CEO and Chairman, Network Solutions, LLC

Mr. Dunbar most recently served as chief executive officer and chairman at Network Solutions, LLC. From 2004 to 2008, he served as president of global technology and operations for MasterCard where he was responsible for its global payments platform and operations. Prior to that, he spent over a decade at Eli Lilly and Company where he served as president for the intercontinental region, vice president of information technology and chief information officer. In 2003, he was named CIO of the Year by Information Week. Mr. Dunbar graduated from Manchester University in the United Kingdom with a pharmacy degree and a master’s degree in business administration from Manchester Business School. He currently serves on the boards of SiteOne Landscape Supply, Inc., Johnson Controls International plc, and Duke Energy Corp. Mr. Dunbar served on the board of directors of Humana Inc. from 2005 to 2020.

Skills & Qualifications: Mr. Dunbar brings to the Board experience in technology, operations and healthcare, as well as in the evolving areas of data governance and cybersecurity. He also brings additional expertise in sustainability and ESG matters to help guide the Company’s increasing focus on global impact initiatives. Mr. Dunbar has served in various executive capacities where he was accountable for international operations. |

- 2022 Proxy Statement - 2022 Proxy Statement | 11 |

ITEM 1. ELECTION OF DIRECTORS

Age: 63

Director since: 2022

Committees:

Compliance

Finance

Director Qualification Highlights:

Healthcare Operations and Compliance |

James H. Hinton

Operating Partner, Welsh Carson Anderson & Stowe

Mr. Hinton currently serves as an operating partner for the private equity firm Welsh Carson Anderson & Stowe. From 2017 through 2021, he served as the CEO of Baylor Scott & White Health, the largest not-for-profit health system in Texas and one of the largest in the U.S. Beginning in 1983, Mr. Hinton served for 21 years as president and CEO of not-for-profit Presbyterian Healthcare Services, New Mexico’s largest not-for-profit healthcare provider. During that time, he was a member of the American Hospital Association Board of Trustees and served as its Chair in 2014. Mr. Hinton holds a master’s degree in healthcare administration from Arizona State University and a bachelor’s degree in economics from the University of New Mexico.

Skills & Qualifications: Mr. Hinton brings to the Board broad-based healthcare experience, including in all aspects of leading a complex healthcare services organization, as well as experience in healthcare operations and compliance. He also brings expertise into the development of integrated systems, adding value to the customer experience and affordability. | |||

Age: 71

Director since: 2014

Committees:

Compensation

Finance

Director Qualification Highlights:

Human Capital Management

Distribution/Supply Chain Experience |

Donald R. Knauss

Retired Chairman & Chief Executive Officer, The Clorox Company

Mr. Knauss retired from the Clorox Company, a consumer goods company, in 2015, having served as executive chairman of the board from November 2014 until July 2015 and chairman and chief executive officer from October 2006 until November 2014. He was executive vice president of the Coca-Cola Company and president and chief operating officer for Coca-Cola North America from February 2004 until September 2006. Prior to his employment with The Coca-Cola Company, he held various positions in marketing and sales with PepsiCo, Inc. and Procter & Gamble and served as an officer in the United States Marine Corps. He currently serves as a director of the Kellogg Company and the Target Corporation. Mr. Knauss also serves as the chairman of the board of trustees for the University of San Diego. He was formerly a director of URS Corporation.

Skills & Qualifications: Mr. Knauss brings to the Board substantial board leadership skills through his prior chairmanship role at The Clorox Company. He also brings substantial executive experience through which he has developed valuable operational insights and strategic and long-term planning capabilities, as well as extensive international business management and retail expertise, which includes experience in the retail pharmacy area. Mr. Knauss also has significant other public company board experience. |

| 12 |  - 2022 Proxy Statement - 2022 Proxy Statement |

ITEM 1. ELECTION OF DIRECTORS

Age: 65

Director since: 2018

Committees:

Audit

Compliance (Chair)

Director Qualification

Risk Management and Compliance

Healthcare Industry Experience |

Bradley E. Lerman

Retired Senior Vice President, General Counsel and Corporate Secretary of Medtronic plc

Mr. Lerman retired as the senior vice president, general counsel and corporate secretary of Medtronic plc in January 2022, having served in the role since May 2014. He led the company’s global legal, government affairs and ethics and compliance functions. Prior to Medtronic, Mr. Lerman served as executive vice president, general counsel and corporate secretary for the Federal National Mortgage Association (Fannie Mae). Prior to Fannie Mae, he served as senior vice president, associate general counsel and chief litigation counsel for Pfizer. Mr. Lerman also served as a litigation partner at Winston & Strawn LLP in Chicago and as an assistant U.S. attorney in the Northern District of Illinois. He received a law degree from Harvard Law School and his bachelor’s degree in economics from Yale University.

Skills & Qualifications: Mr. Lerman brings to the Board significant legal and regulatory expertise gained from years of large law firm practice and government positions with law enforcement responsibilities. He also brings a multilayered understanding of the healthcare industry and experience linking compliance and legal consideration with corporate strategy. |

Age: 53

Director since: 2020

Committees:

Compensation (Chair) Governance

Director Qualification Highlights:

Technology

Financial Expertise |

Linda P. Mantia

Retired SEVP & COO, Manulife Financial Corporation

Ms. Mantia retired as senior executive vice president and chief operating officer of Manulife Financial Corporation (operating as John Hancock in the U.S.), an international insurance and financial services company, in 2019, having served in the role since 2016. She played a critical role in defining Manulife’s corporate strategy and oversaw its innovation portfolio and other corporate functions. Ms. Mantia has also served in a series of leadership roles at Royal Bank of Canada, a multinational financial services company, including executive vice president of Digital Banking, Payments and Cards. Earlier in her career, she worked at McKinsey & Co., and practiced law at Davies Ward Phillips & Vineberg LLP. Ms. Mantia also serves on the board of directors at Ceridian HCM Holding Inc. and serves on the advisory board of Verily Life Sciences. Additionally, Ms. Mantia is active in the Canadian community on the boards of Sunnybrook Health Sciences Centre and Canada’s Walk of Fame. She was formerly a director at MindBeacon Holdings, Inc. Ms. Mantia received a law degree from Queen’s University Faculty of Law and has been twice recognized as one of Canada’s Top 100 Most Powerful Women.

Skills & Qualifications: Ms. Mantia brings to the Board significant financial services, global payments, digital technology and corporate strategy experience. She also brings a multinational perspective to our Board. |

- 2022 Proxy Statement - 2022 Proxy Statement | 13 |

ITEM 1. ELECTION OF DIRECTORS

Age: 64

Director since: 2019

Committees:

Finance

Governance (Chair)

Director Qualification Highlights:

Technology

International Experience |

Maria Martinez

Executive Vice President & Chief Operating Officer, Cisco Systems, Inc.

Ms. Martinez has served as executive vice president and chief operating officer since March 2021 and was executive vice president and chief experience officer from April 2018 until March 2021 at Cisco Systems, Inc. Prior to joining Cisco, Ms. Martinez served in a variety of senior executive roles at Salesforce, Inc., including president, Global Customer Success and Latin America from March 2016 to April 2018; president, Sales and Customer Success from February 2013 to March 2016; executive vice president and chief growth officer from February 2012 to February 2013; and executive vice president, Customers for Life from February 2010 to February 2012. Prior to joining Salesforce, she managed the global services business for Microsoft Corporation, including professional services and customer support for all products. Ms. Martinez has also held a number of other leadership positions at Motorola, Inc. and AT&T Inc., and served as chief executive officer of Embrace Networks, Inc. She also serves on the board of directors for Cue Health Inc. and the Silicon Valley Education Foundation. Ms. Martinez has received several distinctions for her leadership, most recently being ranked No. 2 on the ALPFA (Association for Latino Professionals for America) list of the 50 Most Powerful Latinas.

Skills & Qualifications: Ms. Martinez brings to our Board leadership experience at leading technology companies, which enhances the Board’s depth of experience in business and digital transformation. She also brings a global leadership perspective, as well as a focus on customer success and customer experience. |

Age: 57

Director since: 2014

Committees: Audit

Finance (Chair)

Director Qualification Highlights:

Human Capital Management

Financial Expertise |

Susan R. Salka

Chief Executive Officer & President, AMN Healthcare Services, Inc.

Ms. Salka has served as chief executive officer and president of AMN Healthcare Services, Inc., a provider of healthcare workforce solutions and staffing services to healthcare facilities across the nation, since 2005, and a director of the company since 2003. Since joining AMN Healthcare Services Inc. in 1990, she has also served as chief operating officer, chief financial officer, and senior vice president of business development. Ms. Salka is passionately and actively involved in the areas of corporate social responsibility, diversity and inclusion, and gender equality. A member of Women Business Leaders and Women Corporate Directors Foundation, Ms. Salka is a proponent of promoting women in leadership. She was formerly a director of Beckman Coulter Inc. and Playtex Products. Ms. Salka currently serves on the editorial advisory board of Directors & Boards Magazine, a quarterly journal dedicated to the topics of leadership and corporate governance.

Skills & Qualifications: Ms. Salka brings to the Board a deep understanding of emerging trends in healthcare services, having over 30 years of experience in the healthcare industry. She also brings significant leadership experience through having served in several executive leadership positions, which have provided her with business management, operations, financial and long-range planning experience, and through her significant public company board service. |

| 14 |  - 2022 Proxy Statement - 2022 Proxy Statement |

ITEM 1. ELECTION OF DIRECTORS

Age: 55

Director since: 2019

Director Qualification Highlights:

Business Transformation

International Experience |

Brian S. Tyler

Chief Executive Officer, McKesson Corporation

Mr. Tyler has served as chief executive officer of McKesson Corporation since April 1, 2019 and previously served as the Company’s president and chief operating officer from August 2018 to March 2019. Mr. Tyler served as chairman of the Management Board of McKesson Europe AG from 2017 to 2018, president and chief operating officer McKesson Europe from 2016 to 2017, the Company’s president of North American Pharmaceutical Distribution and Services from 2015 to 2016, and as the Company’s executive vice president, corporate strategy and business development from 2012 to 2015. Mr. Tyler previously served in various other leadership roles in the Company, including as president of U.S. Pharmaceutical, president of McKesson Medical-Surgical, and president of McKesson Specialty Health. Mr. Tyler is a member of the board of directors of the International Federation of Pharmaceutical Wholesalers (IFPW) and a member of the IFPW Foundation board of directors. He is a member of the American Cancer Society’s CEOs Against Cancer group in the North Texas chapter. He has been a member of the board of directors of Republic Services since March 2021. Mr. Tyler earned his Ph.D. from the University of Chicago, Department of Economics specializing in industrial organization, labor economics and public finance/project evaluation.

Skills & Qualifications: Mr. Tyler brings more than 22 years of business and healthcare experience to the Board. As McKesson’s CEO and a long-time leader of McKesson’s businesses, Mr. Tyler has extensive knowledge of the Company’s culture and workforce, and its challenges and opportunities. |

Age: 64

Director since: 2022

Committees: Compensation

Governance

Director Qualification Highlights:

Healthcare Industry Sustainability & ESG |

Kathleen Wilson-Thompson

Retired EVP & Global Chief Human Resource Officer, Walgreens Boots Alliance, Inc.

Ms. Wilson-Thompson served as executive vice president and global chief human resources officer of Walgreens Boots Alliance, Inc. from December 2014 to January 2021, after serving as senior vice president and chief human resources officer of Walgreens from January 2010 to December 2014. She served as senior vice president, global human resources from January 2010 to December 2014 at Kellogg Company, where she also served as chief labor and employment counsel. Ms. Wilson-Thompson earned an A.B. degree from the University of Michigan, and J.D. and LL.M. (Corporate and Finance Law) degrees from Wayne State University. She serves on the boards of Tesla, Inc. and Wolverine World Wide, Inc. Ms. Wilson-Thompson is also chair of the board of directors of the University of Michigan Alumni Association and a member of the board of trustees of the NAACP Foundation.

Skills & Qualifications: Ms. Wilson-Thompson brings to the Board more than a decade of senior executive level experience leading human resources and human capital management strategy at global healthcare companies. She also brings experience through her extensive board service at large public companies in the manufacturing and retail industries. |

- 2022 Proxy Statement - 2022 Proxy Statement | 15 |

ITEM 1. ELECTION OF DIRECTORS

The Board, Committees and Meetings

The Board of Directors is the Company’s governing body with responsibility for oversight, counseling and direction of the Company’s management to serve the long-term interests of the Company and its shareholders. The Board’s goals are to build long-term value for the Company’s shareholders and to ensure the vitality of the Company for its customers, employees and other individuals and organizations that depend on the Company. To achieve its goal, the Board monitors both the performance of the Company and the performance of the Chief Executive Officer. The Board currently consists of twelve directors. After the 2022 Annual Meeting, if all nominees are elected, the Board will consist of eleven directors. Don Knauss serves as the Board’s Independent Chair, effective April 1, 2022. All of the directors during the time they served on the Board were, and the director nominees are, independent with the exception of Brian Tyler, the Company’s CEO.

The Board has five standing committees: the Audit Committee, Compensation Committee, Compliance Committee, Finance Committee, and Governance Committee. Each of these committees is governed by a written charter approved by the Board in compliance with the requirements of the Securities and Exchange Commission (SEC) and the New York Stock Exchange (NYSE), where applicable. The charter of each committee is reviewed annually by that committee and the Board. Each member of our standing committees is independent, as determined by the Board, under the NYSE listing standards and the Company’s director independence standards. In addition, each member of the Audit Committee and Compensation Committee meets the additional, heightened independence criteria applicable to such committee members under the applicable rules. The members of each standing committee are appointed by the Board each year for a term of one year or until their successors are elected and qualified or their earlier resignation.

Board and Meeting Attendance

The Board met seven times during FY 2022. Each director attended at least 75% of the aggregate number of meetings of the Board and meetings of its committees during the period on which he or she served as a member of the Board and of such committees. The independent directors also met in executive session during FY 2022, as necessary. Directors meet their responsibilities not only by attending Board and committee meetings, but also through communication with senior management, independent accountants, advisors and consultants and others on matters affecting the Company. Directors are also expected to attend the upcoming virtual Annual Meeting. All directors then serving attended the 2021 Annual Meeting of Shareholders. The current membership of each standing committee and the number of committee meetings held during FY 2022 are identified in the section immediately below.

Committee Membership, Responsibilities and Other Information

As discussed under “Executing Our Corporate Responsibility” on page 3 of this proxy statement, our Board approved in May 2022 amendments to the Governance Committee Charter and the Compensation Committee Charter to address the oversight of certain ESG matters. The charter governing each of the Board’s five standing committees can be found at www.mckesson.com/investors/corporate-governance. We also refreshed the composition of those committees in May 2022, which are as follows:

Audit Committee

|

Current responsibilities include: | |||

Current Members: Dominic J. Caruso*, Chair W. Roy Dunbar Bradley E. Lerman Susan S. Salka*

Meetings in FY 2022: 10 (Includes 1 joint meeting with the Compliance Committee)

All members are independent and financially literate

* designated as “audit committeefinancial expert” | • Reviewing with management the interim and annual audited financial statements filed in the Quarterly Reports on Form 10-Q and Annual Report on Form 10-K, respectively, including any major issues regarding accounting principles and practices, critical audit matters, and the adequacy and effectiveness of internal controls over financial reporting that could significantly affect the Company’s financial statements

• Reviewing with management and the independent registered public accounting firm the interim and annual financial statements

• Appointing the independent accountants, monitoring their independence, evaluating their performance, and approving their fees

• Reviewing and overseeing the annual audit plan, including the scope of the audit activities of the independent accountants and performance of the Company’s internal audit function

• Assisting the Board with respect to its oversight of the Company’s policies and procedures regarding compliance with applicable laws and regulations

| |||

| 16 |  - 2022 Proxy Statement - 2022 Proxy Statement |

ITEM 1. ELECTION OF DIRECTORS

Compensation Committee

|

Current responsibilities include: | |||

Current Members: Linda P. Mantia, Chair Richard H. Carmona, M.D. Donald R. Knauss Edward A. Mueller Kathleen Wilson-Thompson

Meetings in FY 2022: 5 | • Reviewing and overseeing the Company’s overall compensation philosophy and the development and implementation of compensation programs aligned with the Company’s business strategy

• Reviewing ESG matters relevant to the Committee’s oversight responsibilities, including succession planning and talent development, employee engagement, culture and DEI matters, in coordination with the Board and other committees

• Determining the structure and amount of all elements of executive officer compensation and benefits, including material perquisites, after consideration of management’s recommendation and in consultation with the committee’s independent compensation consultant

• Reviewing and making determinations regarding the adoption, administration, and amendments to all equity incentive plans for employees, and cash incentive plans for executive officers

• Evaluating the relationship between the incentives associated with Company plans and the level of risk-taking by executive officers in response to such incentives

• Participating with management in the preparation of the Compensation Discussion and Analysis for the Company’s proxy statement

• Evaluating the qualifications, performance and independence of its advisors

| |||

Compliance Committee

|

Current responsibilities include: | |||

Current Members: Bradley E. Lerman, Chair Richard H. Carmona, M.D. Dominic J. Caruso James H. Hinton

Meetings in FY 2022: 7 (includes 1 joint meeting with the Audit Committee) | • Overseeing the Company’s compliance programs and policies relating to the Company’s principal legal and regulatory compliance risks

• Reviewing the Company’s approach to, and results of, risk identification, assessment and mitigation plans for the principal legal and regulatory compliance risks facing the Company

• Reviewing the Company’s compliance with laws and policies governing the distribution of controlled substances and reporting of suspicious orders

• Overseeing any significant complaints and other matters raised through the Company’s compliance reporting mechanisms that involve allegations relating to violations of non-compliance with the Controlled Substances Monitoring Program or distribution of opioids.

• Reviewing any significant government inquiries or investigations and other significant legal actions

• Receiving information about current and emerging legal and regulatory compliance risks and enforcement trends that may affect the Company’s business operations, performance or strategy

• Commissioning studies, surveys, reviews as appropriate to evaluate the Company’s compliance and quality of personnel/committees providing compliance

• Reviewing appointment, performance, compensation and replacement of the Company’s Chief Compliance Officer and the Senior Vice President of the Controlled Substances Monitoring Program

| |||

Finance Committee

|

Current responsibilities include: | |||

Current Members: Susan R. Salka, Chair James H. Hinton Donald R. Knauss Maria N. Martinez

Meetings in FY 2022: 5

| • Reviewing with management the long-range financial policies of the Company

• Providing advice and counsel to management on the financial aspects of significant acquisitions and divestitures, major capital commitments, proposed financings and other significant financial transactions

• Reviewing with management significant changes in the capital structure of the Company

• Reviewing tax policy utilized by management and the funding status and investment policies of the Company’s tax-qualified retirement plans

| |||

- 2022 Proxy Statement - 2022 Proxy Statement | 17 |

ITEM 1. ELECTION OF DIRECTORS

Governance Committee

| Current responsibilities include:

| |||

Current Members: Maria N. Martinez, Chair W. Roy Dunbar Linda P. Mantia Edward A. Mueller Kathleen Wilson-Thompson

Meetings in FY 2022: 5

| • Reviewing the size and composition of the Board and recommending measures to be taken so that the Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity

• Recommending the slate of nominees to be proposed for election at the annual meeting of shareholders, recommending qualified candidates to fill Board vacancies

• Evaluating the Board’s overall performance, reviewing the level and form of non-employee director compensation, and administering the Company’s related party transactions policy

• Monitoring emerging corporate governance trends, and overseeing and evaluating the Company’s corporate governance policies and programs

• Annual review of the Company’s sustainability and ESG strategy

| |||

Director Qualifications, Nomination and Diversity

To fulfill its responsibility to recruit and recommend to the Board nominees for election as directors, the Governance Committee considers all qualified candidates who may be identified by any of the following sources: current or former Board members, a professional search firm, Company employees, shareholders or other parties.

Shareholders may make a recommendation for a director candidate by submitting the candidate’s name, resume and biographical information and qualifications to the attention of the Corporate Secretary’s Office by email at CorpSecretary@mckesson.com or by courier or regular mail at 6555 State Highway 161, Irving, Texas 75039. All recommendations received by the Corporate Secretary will be presented to the Governance Committee for its consideration. The Governance Committee will consider recommendations from shareholders using the same process it follows for other candidates. The Governance Committee will consider director candidates who meet the criteria described below, and the Governance Committee will recommend to the Board nominees who best suit the Board’s needs. In order for a shareholder to make a nomination of a director candidate for election at an upcoming annual meeting of shareholders, such shareholder’s nomination must comply with the requirements set forth in the Company’s By-Laws.

In evaluating candidates for the Board, the Governance Committee reviews each candidate’s independence, skills, experience and expertise against the criteria adopted by the Board. Members of the Board should have the highest professional and personal ethics, integrity and values, and represent diverse backgrounds and experience consistent with the Company’s values. They should have broad experience at the policy-making level in business, technology, healthcare or public interest, or have achieved prominence in a relevant field. The Governance Committee will consider whether the candidate’s background and experience demonstrate the ability to make the kind of important and sensitive judgments that the Board is called upon to make, and whether the nominee’s skills are complementary to the existing Board members’ skills. In addition, Board members must be able to devote sufficient time and energy to the performance of his or her duties as a director and must be open to hearing different perspectives.

Messrs. Carmona, Dunbar and Hinton and Ms. Wilson-Thompson have been nominated to stand for election by the shareholders for the first time. Each of these candidates was identified by either a third-party search firm or by other Board members. Several members of the Board interviewed each candidate prior to their appointment to serve on the Board. The Board does not maintain a formal policy regarding diversity; however, the Governance Committee considers diversity to include diversity of backgrounds, cultures, education, experience, skills, thought, perspectives, personal qualities and attributes, and geographic profiles (i.e., where the individuals have lived and worked), as well as race, ethnicity, gender, national origin and other categories. Our Governance Committee and the Board believe that a diverse representation on the Board fosters a robust, comprehensive, and balanced deliberation and decision-making process that is essential to the continued effective functioning of the Board and continued success of the Company. Women and people of color comprise approximately 36% and 27%, respectively, of our slate of director nominees.

| 18 |  - 2022 Proxy Statement - 2022 Proxy Statement |

ITEM 1. ELECTION OF DIRECTORS

We are committed to continually assessing our governance policies and structures to incorporate best practices. We highlight some of our corporate governance practices below.

| Key Governance Attributes | ||

| ||

Independent Chair |

In 2019, we adopted an independent chair structure with the election of Ed Mueller as Independent Chair. Following a planned transition, the Board elected Don Knauss as Independent Chair, effective April 1, 2022. | |

| ||

CEO and Senior Management Succession Planning | Recognizing that succession planning is a key component of the Company’s continued success, the Board is committed to CEO and senior management succession planning. Brian Tyler’s appointment as CEO in 2019 is a product of that work and commitment. The Board continues its focus on senior management succession planning. | |

| ||

Reduced Ownership Threshold | In 2019, the Company reduced the ownership threshold required to call a special meeting of shareholders from 25% to 15%. | |

| ||

Committed to Board Refreshment | Nine of our 11 nominees have served on our Board for fewer than five years. In 2021 we added one new director, and we added three new directors in 2022. This year, we also implemented a policy that would require directors with a tenure of more than 12 years to offer to resign from Board service annually. | |

| ||

Significant Risk Oversight | The Board and its committees devote significant time and effort to understanding and reviewing enterprise risks. This includes oversight of our Company’s strategy and review of risks related to financial reporting, compensation practices, cyber, ESG, and distribution of controlled substances, among other risks. In 2019, the Board established a standing Compliance Committee. The purpose of the Compliance Committee is to assist the Board in oversight of McKesson’s compliance programs and management’s identification and evaluation of our primary legal and regulatory compliance risks. The FY 2022 report of the Compliance Committee is included on page 22. | |

| ||

Code of Conduct | Revised in May 2022, McKesson’s Code of Conduct describes fundamental principles, policies and procedures that shape our work and help our employees, officers and directors make ethical decisions. The Code of Conduct is available in multiple languages. Please visit www.mckesson.com/Investors/Corporate-Governance/Code-of-Conduct/ for more information. | |

| ||

Other Governance Best Practices | • Regular executive sessions of the independent directors • Proxy access right since 2015 • Eliminated supermajority voting requirements in 2011 • Majority voting standard for uncontested director elections • Annual director elections • No poison pill | |

The following governance materials appear on our website at www.mckesson.com/investors/corporate-governance:

• Certificate of Incorporation | • Committee Charters | |

• By-Laws | • Director Independence Standards | |

• Corporate Governance Guidelines | • Code of Conduct |

- 2022 Proxy Statement - 2022 Proxy Statement | 19 |

ITEM 1. ELECTION OF DIRECTORS

Evaluating Board Composition, Performance and Effectiveness

Board evaluations play a critical role in assessing the effective functioning of our Board, which conducts an annual evaluation to consider where they believe our Board functions most effectively, and more importantly, to identify areas in which they believe the Board can make a better contribution to the Company. The following graphic illustrates the core elements of our Board’s evaluation process:

Our Governance Committee leads the evaluation of the Board and the performance of the Independent Chair. Our Independent Chair also speaks to directors individually, and that feedback is later reported to the entire Board. Each committee is responsible for evaluating its own performance and determining their workplan for the following year. The Governance Committee establishes a workplan for the Board, and reviews periodically the Board’s evaluation process and makes enhancements based on the Company’s evolving business strategies and risks.

Director Independence