186th Annual Report 2003

Delivering

To our fellow shareholders,

This 186th Annual Report tells the story of the financial performance we achieved in 2003,

the ethical codes that guide our actions and how we evaluate our performance. It is about the strength that

comes from balancing priorities: Delivering results to investors, building trust with our employees and

the communities where we do business, and creating value for our customers. The pages in this report show how we are delivering.

About BMO Financial Group

BMO Financial Group (NYSE, TSX: BMO) is one of the largest financial services providers in North America. With assets of $256 billion at October 31, 2003 and 34,000 employees, BMO provides a comprehensive offering of retail banking, wealth management and investment banking products and solutions.

Canadian clients are served through our personal and commercial banking business, BMO Bank of Montreal, and BMO Nesbitt Burns, one of Canada’s largest full-service investment and wealth management firms. In the United States, clients are served through Harris Bank, a major Midwest financial services organization with a network of community banks in the Chicago area, and wealth management offices across the United States, as well as Harris Nesbitt, a leading mid-market investment bank.

We help our customers manage their financial affairs by delivering the broadest range of financial services through a single point of contact. Our financial service professionals provide access to any services our customers require across the entire enterprise. BMO Financial Group is made up of three client groups: Personal and Commercial Client Group, Private Client Group and Investment Banking Group.

Historical Strengths

On November 3, 1817, Bank of Montreal became Canada’s first chartered bank, and was the first financial institution to offer Canadians a sound domestic currency. The Bank played a major and continuing role in the development of the country, taking part in the financing of the first transcontinental railway in the 1880s. As a partner in the creation of Confederation in 1867, Bank of Montreal served as Canada’s central bank until 1935. Always with a view to expansion, Bank of Montreal was the first Canadian bank to open branches in Europe, Latin America, Asia and the United States.

| | | | | | | |

| Vision | | Growth Strategy |

| • | | To be the best financial services company, wherever we choose to compete. | | • | | Continue to invest in strengthening our core Canadian franchise while expanding selectively and substantially in the United States. |

| Values | |

| • | | We care about our customers, shareholders, communities and each other.

| | Strategic Priorities for 2004

|

| • | | We draw our strength from the diversity of our people and our businesses.

| | • | | Improve productivity.

|

| • | | We insist upon respect for everyone and encourage all to have a voice.

| | • | | Pursue U.S. acquisitions.

|

| • | | We keep our promises and stand accountable for our every action.

| | • | | Increase share of wallet and customer loyalty.

|

| • | | We share information, learn and innovate to create consistently superior customer experiences. | | • | | Maintain status as an employer of choice. |

| | | | | • | | Create a sustainable high-performance culture. |

| | | | | |

| CONTENTS | | |

| | | |

| IFC | | BMO Financial Group at a Glance |

| 1 | | Financial Highlights |

| 2 | | Chairman’s Message to Shareholders |

| 4 | | Year in Review: Delivering Results |

| 5 | | Delivering Ethical Leadership |

| 8 | | Delivering Customer Service |

| | | |

| 10 | | Financial Performance and Condition at a Glance |

| 13 | | Management’s Discussion and Analysis of Operations and Financial Condition |

| 13 | | Caution Regarding Forward-Looking Statements |

| 14 | | Financial Objectives, Targets and Measures |

| 15 | | Value Measures |

| 18 | | Enterprise-Wide Strategic Management |

| 19 | | Economic and Financial Services Developments |

| 20 | | Financial Performance Review |

| 27 | | Operating Group Review |

| 28 | | Personal and Commercial Client Group |

| 33 | | Private Client Group |

| 36 | | Investment Banking Group |

| 40 | | Corporate Support, including Technology and Solutions |

| 41 | | Financial Condition Review |

| 43 | | Enterprise-Wide Capital Management |

| 44 | | Critical Accounting Policies |

| 45 | | Enterprise-Wide Risk Management |

| 53 | | Review of 2002 Financial Performance |

| 54 | | Supplemental Information |

| | | |

| 69 | | Statement of Management’s Responsibility for Financial Information |

| 69 | | Shareholders’ Auditors’ Report |

| 70 | | Consolidated Financial Statements |

| 70 | | Consolidated Balance Sheet |

| 71 | | Consolidated Statement of Income |

| 72 | | Consolidated Statement of Changes in Shareholders’ Equity |

| 73 | | Consolidated Statement of Cash Flow |

| 74 | | Notes to Consolidated Financial Statements |

| 101 | | Bank-Owned Corporations |

| 102 | | Board of Directors and Honorary Directors |

| 103 | | Members of Management Board |

| 104 | | Glossary of Financial Terms |

| IBC | | Shareholder Information |

BMO Financial Group at a Glance

| | | | | |

| | | Business Profile | | |

|

Personal and Commercial Client Group

– Brand Names

BMO Bank of Montreal

Harris Bank | | The Personal and Commercial Client Group provides more than eight and a half million customers across Canada and in the United States with fully integrated personal and business banking solutions. These include deposit accounts, loans and credit cards, mutual fund and GIC investments, insurance products, and investments such as RRSPs, RESPs and RRIFs. Our products and services are delivered by a highly skilled team through 1,142 BMO Bank of Montreal and Harris Bank branches, telephone and online banking and a network of more than 2,290 automated banking machines. | |  |

|

Private Client Group

– Brand Names

BMO Private Client Group

BMO Harris Private Banking

BMO Nesbitt Burns

BMO InvestorLine

BMO Mutual Funds

The Harris

Harris Private Bank

Harris AdvantEdge Investing

Harrisdirect

Harris Insight Funds | | The Private Client Group offers clients a full range of wealth management products and services, including full service and direct investing, private banking and investment products. Our highly trained professionals are dedicated to serving the needs and goals of our clients to accumulate, protect and grow their financial assets. Operating as BMO Private Client Group in Canada and The Harris®1 in the United States, we have total assets under management and administration, including term deposits, of $282 billion. | |  |

|

Investment Banking Group

– Brand Names

BMO Nesbitt Burns

Harris Nesbitt | | Operating under the BMO Nesbitt Burns brand in Canada and the Harris Nesbitt®1 brand in the United States, the Investment Banking Group offers corporate, institutional and government clients complete financial services across the entire balance sheet. This includes advisory, capital-raising, investment and operating services. Supported by top-ranked research, our Investment Banking Group is a leader in mergers and acquisitions, advisory, debt and equity underwriting, institutional equity, securitization, trade finance and sales and trading services. | |  |

|

Bank of Montreal has taken a unified branding approach that links all of the organization’s together with its subsidiaries, is known as BMO®Financial Group. As such, in this document, the names BMO and BMO Financial Group mean Bank of Montreal.

BMO Financial Group at a Glance

2003 Key Initiatives

| | | |

| • | | Achieved combined Canada-U.S. revenue growth of 5.4% in an increasingly competitive environment. |

| | | In Canada: |

| • | | Improved productivity, as the expense-to-revenue ratio improved 142 basis points to 60.3%. |

| • | | Completed implementation of Pathway ConnectTM, our improved sales and service technology platform, in branches across Canada. |

| • | | Commercial Banking, our division that focuses on the needs of our upper

mid-market customers, increased its balance sheet growth by approximately double the 6% forecasted general market growth rate. |

| • | | Solidified our second-place ranking for loans of less than $5 million to small business. |

| • | | Improved and expanded our online banking service based on extensive feedback from our customers. We now offer e-mail money transfers, multiple post-dated bill payments, automated account openings and enhanced U.S.-dollar transactions. |

| | | In the United States: |

| • | | Improved productivity by 210 basis points to 76.4%. |

| • | | Opened nine new branches in Chicagoland. |

Focus for 2004

| | | |

| | | In Canada: |

| • | | Continue to focus on revenue growth and improved operational efficiency, while building our distribution capabilities. |

| • | | Improve customer loyalty in both personal and business banking segments. |

| • | | Increase our business banking market share faster than our major competitors. |

| • | | Grow our personal banking market share relative to our major competitors. |

| | | In the United States: |

| • | | Continue to expand our branch network in Chicagoland. |

| • | | Distinguish Harris Bank from our competitors by continuing to improve our community banking model. |

| | | |

| • | | Achieved net income growth of 93% and improved productivity, as the expense-to-revenue ratio improved 500 basis points despite general market uncertainty and the conservative investor climate throughout most of fiscal 2003. |

| • | | BMO InvestorLine® was ranked number one for the third consecutive time in Gómez Canada’s Direct Investing Report and for the fourth consecutive time inThe Globe and Mail’s online brokerage surveys. |

| • | | Acquired select assets of myCFO, Inc., a California-based provider of customized investment and advisory services to ultra-high net worth clients. |

| • | | Acquired Sullivan, Bruyette, Speros & Blayney Inc., a Virginia-based provider of open-access relationship-based financial planning, establishing a presence in the high-growth Washington, D.C. area. |

| • | | Achieved significant cost reductions in Harrisdirectby reducing the number of staff and optimizing call centre and branch sites. |

| | | |

| • | | Pursue opportunities that focus on deepening client relationships and building momentum in the high-growth affluent market segment. |

| • | | Focus on delivering the highest levels of service and integrated offerings to our clients by leveraging partnerships within the Private Client Group and across BMO Financial Group. |

| • | | Enhance our business models by continuing to improve productivity and invest in our high-growth businesses. |

| | | |

| • | | Improved productivity, as the expense-to-revenue ratio improved 410 basis points to 51.5%. |

| • | | Ranked number one in completed Canadian merger and acquisition transactions, with a total value in excess of $18 billion. |

| • | | Participated in 617 corporate debt and equity transactions on behalf of Canadian clients, raising $67 billion. |

| • | | Ranked Top Overall Research Team in the Brendan Wood International Survey for the 23rd consecutive year. We were also ranked first for Overall Quality of Sales Service. |

| • | | Ranking of number one for our Canadian Securitization unit in market share for asset-backed commercial paper conduit outstandings. |

| • | | Acquired Gerard Klauer Mattison, adding a solid U.S. equity research, sales and trading platform to our service offering as Harris Nesbitt Gerard. |

| • | | Expanded U.S. mid-market client base in Business Services, Consumer, Media and Entertainment, Technology and Telecom, and Health Care sectors. |

| | | |

| • | | Maintain Canadian leadership in the high-return fee businesses of mergers and acquisitions, debt and equity underwriting and securitization. |

| • | | Accelerate growth through further integration of our U.S. operations with a focus on increasing the proportion of fee-based revenue. |

| • | | Deepen and broaden relationships with target clients by leveraging the full range of our cross-border capabilities, including enhancing our product offering through the full integration of Harris Nesbitt Gerard. |

| • | | Continue a disciplined approach to cost and capital management. |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | |

| For the year ended or as at October 31, as appropriate | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

|

| Income Statement Highlights(Canadian $ in millions) |

| Total revenue (teb) (a) | | | 9,271 | | | | 8,859 | | | | 8,863 | | | | 8,664 | | | | 7,928 | |

| Provision for credit losses | | | 455 | | | | 820 | | | | 980 | | | | 358 | | | | 320 | |

| Non-interest expense | | | 6,087 | | | | 6,030 | | | | 5,671 | | | | 5,258 | | | | 5,288 | |

| Net income | | | 1,825 | | | | 1,417 | | | | 1,471 | | | | 1,857 | | | | 1,382 | |

|

Common Share Data(Canadian $ per share) | | | | | | | | | | | | | | | | | | | | |

| Closing share price | | | 49.33 | | | | 38.10 | | | | 33.86 | | | | 35.25 | | | | 28.33 | |

| Earnings per share (b) | | | 3.44 | | | | 2.68 | | | | 2.66 | | | | 3.25 | | | | 2.34 | |

| Dividends declared per share | | | 1.34 | | | | 1.20 | | | | 1.12 | | | | 1.00 | | | | 0.94 | |

|

Primary Financial Measures(%) | | | | | | | | | | | | | | | | | | | | |

| Five-year average annual total shareholder return | | | 12.9 | | | | 7.9 | | | | 14.3 | | | | 22.9 | | | | 22.0 | |

| Earnings per share growth | | | 28.4 | | | | 0.8 | | | | (18.2 | ) | | | 38.9 | | | | 2.2 | |

| Return on equity | | | 16.4 | | | | 13.4 | | | | 13.8 | | | | 18.0 | | | | 14.1 | |

| Revenue growth | | | 4.7 | | | | — | | | | 2.3 | | | | 9.3 | | | | 9.0 | |

| Provision for credit losses as a % of average net loans and acceptances | | | 0.30 | | | | 0.56 | | | | 0.66 | | | | 0.25 | | | | 0.22 | |

| Tier 1 Capital Ratio | | | 9.55 | | | | 8.80 | | | | 8.15 | | | | 8.83 | | | | 7.72 | |

|

All ratios in this report are based on unrounded numbers.

(a) Reported on a taxable equivalent basis (teb). See pages 20 and 22.

(b) All earnings per share (EPS) measures in this report refer to diluted EPS unless otherwise specified.

| | | | | | | |

| |  | |  | |  |

Net Income

Net income increased $408 million or 29%, driven by a lower provision for credit losses, higher business income in each of our operating groups and lower investment securities losses. | | Earnings per Share

Earnings per share increased $0.76 to a record $3.44 per share. The 28% increase exceeded our target of 10% to 15% growth. | | Return on Equity

Return on equity rose 3.0 percentage points to 16.4%. This exceeded our ROE target of 14% to 15%. | | One-Year Total Shareholder Return

The total return on an investment in BMO’s common shares in 2003 was 33.4%. This return was above the TSX Composite and S&P 500 Total Return indices (for the third straight year). |

BMO Financial Group 186th Annual Report 20031

Delivering on our promise:

Results to our investors, trust to our

stakeholders and value to our customers

Fellow shareholders,

When I accepted the responsibilities of Chairman and Chief Executive Officer four years ago, we undertook a major repositioning of BMO Financial Group to produce stronger returns for investors and a more profitable and secure future for the enterprise. Now, as we close the books on a year in which BMO achieved all financial targets, I am pleased to report that we are indeed delivering on our promise.

With rising performance in all three operating groups in 2003, BMO delivered earnings per share growth of 28.4%.

Since 1999, we have made a lot of tough choices. We have exited businesses that were low return or lacked scale, including corporate trust, global custody and our U.S. credit card business. We have dramatically reduced risk-weighted assets in our non-relationship corporate loan portfolio. And we have sold 84 slower-growth branches through innovative deals that safeguarded branches for customers and jobs for employees. At the same time, we have implemented our Canada-U.S. growth strategy with focus and consistency, making significant investments in areas such as a major new technology platform for our personal and commercial operations in Canada, and direct brokerage, private banking and personal and commercial banking acquisitions in the United States.

This major shift of our resources toward investments with high growth potential tested shareholders’ patience as we temporarily sacrificed revenues of more than $600 million per year in order to set the stage for growth. Now, this patience is being rewarded. With rising performance in all three operating groups in 2003, BMO delivered earnings per share growth of 28.4%. What is more, we raised our quarterly dividend by 16.7% during the year — a positive reflection of our confidence in sustaining earnings growth. Investors applauded our efforts, as BMO’s total shareholder return was 33% this fiscal year.

| | | |

| 2003 Target | | 2003 Performance |

|

| Achieve EPS growth of 10% to 15% | | 28.4% (see page 16) |

|

| Achieve ROE of 14% to 15% | | 16.4% (see page 17) |

|

| Maintain an annual provision for credit losses at or below the 2002 level of $820 million | | $455 million (see page 24) |

|

| Maintain a Tier 1 Capital Ratio of at least 8.0% | | 9.55% (see page 43) |

|

As we continue to transform BMO into a leading transnational financial institution operating broadly in Canada and through significant focused franchises in the United States, our growth strategy remains the same. Targeting clients who value personalized service, we are focusing our collective energies on delivering our offerings efficiently, prudently and profitably as we continue to invest in strengthening our core Canadian franchise and selectively and substantially expanding in personal and commercial, mid-market and individual investing markets in the United States.

Our number-one priority, this year as last, is to improve productivity by driving inefficiencies out of our operations.

Our number-one priority, this year as last, is to improve productivity by driving inefficiencies out of our operations and building a sustainable high-performance business culture. We improved our expense-to-revenue ratio by 240 basis points in 2003, moving up from fourth to third among Canada’s major banks in this key measure, and we already have programs well underway to improve productivity by a further 150 to 200 basis points in 2004 and in subsequent years. We will achieve this stronger performance while maintaining our

2 BMO Financial Group 186th Annual Report 2003

long-standing leadership in credit risk management — and by making the investments and taking the actions necessary to accelerate revenue growth while containing costs, therebysecuringinstead of mortgaging our future.

One way in which we are addressing the revenue side of the productivity equation is through a multi-faceted drive to improve and deepen customer loyalty in order to earn a larger share of each client’s business. This is our most significant challenge in Canada. With this challenge in mind, we have made large investments in technology and our sales force in recent years, and we are continuing to invest in the front-line people, sales tools and improved processes and incentives to serve our customers better.

Canada-U.S. growth strategy

Deliver our offerings efficiently, prudently and profitably by: |

• Continuing to invest in strengthening our core Canadian franchise |

• Selectively and substantially expanding in personal and commercial, mid-market and individual investing markets in the United States |

In the United States, one of our biggest challenges is to expand the Harris Bank branch network and grow market share despite increased competition from new market entrants. A major differentiating strength is superior customer satisfaction and loyalty. Strong customer relationships and our consistent community banking model position us well both to increase sales to existing customers and to be perceived as an acquirer of choice in our pursuit of shareholder-friendly branch expansion in Chicago, Illinois and surrounding states.

This brings me to my most important observation about the future. As illustrated in the pages that follow, BMO Financial Group is focused as never before on delivering value to our clients in a manner that earns and keeps their trust. As I wrote in this space four years ago, we have a clear guiding principle at BMO, and it goes like this: In order to get it right with customers and shareholders, we must first get it right with our people. If we provide our people with the work environment, tools and incentives required to capture the loyalty of customers, they will reward us with more business and wonderful word-of-mouth referrals — which will result in higher returns for our shareholders.

In order to get it right with customers and shareholders, we must first get it right with our people.

I was convinced back then that our success was dependent on this all-out people focus. And I am even more convinced today. I want to personally thank my 34,000 colleagues across BMO whose deep commitment and hard work contributed so significantly to our collective ability to deliver on our promise to shareholders in 2003.

Finally, as steward of Canada’s first bank, which can now look forward to a glowing transnational future, I thank you our shareholders for your support over the past few years of repositioning. On behalf of the entire BMO team, I promise that we will continue to do everything we can to earn your ongoing trust and support.

-s- Tony Comper

Tony Comper

Chairman and

Chief Executive Officer

BMO Financial Group 186th Annual Report 20033

Year in review

Delivering results by improving

productivity ratios and achieving all financial targets

Karen E. Maidment

Senior Executive Vice-President and Chief Financial Officer

BMO Financial Group

“We want to continue to be the leader in full, plain and balanced disclosure. When we are open and honest in explaining our results — both good news and bad — we earn the trust of investors over the long term. Our integrity doesn’t rely on laws, regulations or standards. It comes from the character of our people and the quality of our processes.”

$1,825 million

net income — an increase of 29%

33%

total shareholder return

$3.44

EPS — up 28%

16.4%

ROE — up from 13.4% in 2002

For fiscal 2003, we achieved all our financial targets. This along with improved productivity ratios, contributed to BMO Financial Group’s improved share price and 33% total shareholder return. Our focus on continual productivity improvement serves to align all resources for the maximum benefit of our customers and, ultimately, our shareholders. It means we spend only what is necessary to generate increased sales, while maintaining strict controls on our cost base. When our productivity ratios improve, we are on track to achieve the optimum balance between current profitability and future growth.

In 2003, all operating groups improved their cash productivity ratio by more than 150 basis points on revenue growth of 5% and an increase in expenses of just 1%.

We reported net income of $1,825 million in fiscal 2003, an increase of $408 million, or 29%, from a year ago, as earnings per share (EPS) rose 28% to $3.44. The growth in net income and EPS was primarily driven by lower provisions for credit losses ($455 million, down from $820 million), reduced net losses on investment securities and solid revenue growth.

All operating groups contributed to the $412 million or 5% increase in revenue. The Personal and Commercial Client Group continued to experience broadly based volume growth, while revenue in the Private Client Group rose on better market fundamentals and improved performance in direct and full-service investing and investment products. The Investment Banking Group’s results rose on stronger income trust origination and higher trading gains.

4 BMO Financial Group 186th Annual Report 2003

Delivering ethical leadership

by doing what’s best for people

and business

J. Blair MacAulay

Lead Director

Bank of Montreal

“Providing good governance and ethical leadership is not about any one thing; rather, it’s about ensuring that you have a comprehensive set of ethical principles, and the right team to make sure the business is run according to those principles. It means you must live up to a high and independently verifiable standard, taking nothing for granted.”

Those who lead set the example for the entire organization. At BMO Financial Group, we believe that good governance and ethical behaviour begin with our Board of Directors. It is the responsibility of the Board to ensure that each member of senior management is held accountable for his or her actions to our shareholders, customers and employees, and to the communities where we operate.

We hold our Board accountable to clear and verifiable standards. BMO has adopted a Charter of Expectations for our directors that sets out the specific responsibilities they must discharge, as well as the personal and professional attributes required of each director. To ensure accountability, the Board annually retains outside consultants to survey its effectiveness in all areas.

The Board also oversees an annual director “peer” performance review. The survey, which is conducted by an outside consultant to ensure confidentiality, requires that every director assess the contribution of each of his or her peers on measures ranging from ethics to strategic insight, financial literacy and business judgment. Comprehensive information regarding corporate governance and the role of the Board can be found in theNotice of Annual Meeting of Shareholders and Proxy Circular.

At BMO, we believe that good governance and high ethical standards must be matters of duty, care and concern for every person in our organization. We work hard to ensure that our ethical principles are living values, not abstract ideas.

To this end, all employees are provided with a framework for the conduct and ethical decision-making that are integral to their work.First Principlesis our comprehensive code of business conduct and ethics. Every director and employee is asked to read this document once a year — and sign a declaration attesting to that fact — to remind themselves of what’s expected and how to deal with the day-to-day ethical issues that arise in the workplace.

BMO Financial Group 186th Annual Report 20035

Delivering Ethical Leadership

First Principlesguides employees to ask themselves three questions before taking any course of action. Is it fair? Is it right? Is it legal? By keeping these questions front and centre in our decision-making, we ensure that honesty, integrity and well-defined ethical standards are the foundation of everything we do.

First Principles— our code of business

conduct and ethics

• Do what is fair, honest and ethical

• Respect the rights of others

• Work to the letter and spirit of the law

• Protect privacy and confidentiality

• Deal with conflicts of interest

• Conduct ourselves appropriately at all times

Accountability and disclosure

The senior management team of BMO Financial Group is personally accountable for the results we achieve and the manner in which we achieve them. Each quarter, senior executives meet with our CEO, Tony Comper, to attest that the reported results relating to their area of responsibility are true and accurate. This act of attestation cascades throughout the organization, as senior managers apply the same rigorous standards of accountability to all who report to them.

We are accountable to our regulators, shareholders, customers and employees. Because our common shares are also listed in the United States, we have put in place policies and procedures to meet the requirements of the Sarbanes-OxleyAct.

Our Chairman and CEO, Tony Comper, and our Chief Financial Officer, Karen Maidment, certify the accuracy and completeness of BMO’s financial disclosures to the Securities and Exchange Commission.

In addition toFirst Principles, we have a Code of Ethics for the Chief Executive Officer and Senior Financial Officers. We’ve also taken the extra step of appointing a governance officer whose responsibility is to oversee all issues relating to governance and ethical behaviour.

We believe that corporate reporting is about much more than compliance. It is the consistency of our efforts that builds momentum for our business, creates value for our customers and increases returns for our shareholders in a manner that earns trust.

Our employees

We endeavour to foster an equitable and supportive work environment for our employees. More than 20 years ago, we introduced our Annual Employee Survey. Every year we ask the 34,000 people who work for us to tell us how we’re doing. The responses, which are submitted anonymously, are rich with valuable feedback. This year the participation rate was over 75% — the highest ever. With this survey we have created the understanding that we will not only listen to our employees’ suggestions, we will also respond to them.

This year, for the first time, all employees were asked questions concerning our corporate values. The responses were very encouraging and have set an important benchmark for the future. Our efforts to articulate our corporate values and engage our workforce on issues like inclusiveness are led by the Chairman’s Council on the Equitable Workplace, which is in turn supported by BMO’s Diversity Advisory Councils and Affinity Groups.

These councils, of which there are eight in Canada and 16 in the United States, draw members from all levels of BMO. They perform a grassroots role by collecting and disseminating information, increasing awareness and providing advice to senior decision-makers. There are also numerous other groups across our organization that advocate for inclusion, address workplace issues and initiate change within their businesses. The groups include Aboriginal sharing circles, U.S. Affinity Groups offering mentoring and career support for African Americans, Asian Americans and Hispanics, networks of employees who are deaf, deafened or hard of hearing, and a transnational group of gay, lesbian, bisexual and transgendered employees.

BMO Financial Group has made solid progress toward our goal of developing an equitable, supportive and diverse workforce. In 1990, only 9% of BMO’s executives were women; the percentage has increased to 32.8% today. Visible minorities accounted for 12.5% of our workforce in 1991, while today they comprise 19.8%. In 1992, only 0.5% of employees were Aboriginal people, but that number has now grown to 1.3%. Similarly, people with disabilities made up 1.8% of BMO’s workforce in 1992, but now account for 3.0%. We are proud of this progress and, along with our strategy of attracting and retaining the most talented, high-performing employees, we will continue our efforts to ensure our workforce reflects the diversity of the communities in which we do business.

Executive Compensation

The compensation of our senior executives is tied directly to performance, particularly when it comes to stock options. Senior executives can exercise 33% of their options only when BMO’s share price has risen by 50% and another 34% only when the share price has risen by 100%. In this way, executives are rewarded only when all shareholders have recognized equally substantial gains.

6 BMO Financial Group 186th Annual Report 2003

Learning and development

We’re approaching the tenth anniversary of the opening of our Institute for Learning, BMO’s corporate university. Over the past decade, tens of thousands of employees have received professional training and development. The content of our programs emphasizes ethical behaviour and our corporate values, as well as practical sales and service, risk, information technology and managerial leadership skills. More than half a billion dollars has been spent in the past 10 years on employee development.

Our commitment to lifelong learning and our ability to link employee development to our strategic goals placed BMO 29th in U.S.-basedTrainingmagazine’s Top 100 North American corporations for 2003. For the second year in a row, we ranked ahead of all other Canadian corporations on the list.

Giving back to our communities

Trust is the foundation of our success. One of the most important ways we build trust is by developing strong relationships in the communities where we do business. We support our employees’ efforts as active participants in their communities — and they are very active on both sides of the border. In Canada, employees and pensioned employees have a foundation, BMO Fountain of Hope®, through which their volunteer efforts raise millions of dollars each year for charity. Because BMO covers all administration costs, 100% of the funds raised go directly to charities in communities across the country. In 2003, BMO Fountain of Hope raised $5.8 million.

BMO Financial Group takes its responsibility for good corporate citizenship very seriously, so along with supporting the extraordinary efforts of our employees, we are also highly involved in giving back to the communities we serve.

In the United States, Harris Bank has been involved with the Chicagoland community since 1882. The major focus of this involvement now is on supporting efforts to provide affordable housing for low and middle-income families. Our support for this and many other community initiatives takes the form of partnerships with local and nonprofit organizations, donations, sponsorships and community outreach.

In 2003, we contributed $36.1 million to support charities and nonprofit organizations. As one of the largest corporate donors in Canada, we contribute to large and small organizations active in areas ranging from education to health, arts and culture, to sports and athletics. Throughout, our focus is on learning. We believe this is the way to build strong communities and a secure future.

We also respond in times of need. Whether it’s supporting a major centre like Toronto in the aftermath of SARS, Western farmers affected by drought or communities ravaged by forest fires, BMO is there to lend a helping hand through donations and customer-assistance programs. Complete details and many examples of our commitment to communities in Canada can be found in our2003 Public Accountability Statement and online at www.bmo.com/community.

| | | |

| 2003 Awards | | Awarded by |

|

| Canada’s Top 100 Employers | | For the second year in a row, BMO Financial Group was named one of the Top 100 Employers in Canada byMaclean’smagazine and Mediacorp. Selected from among 51,000 companies, we were cited for our employee review process, our benefits and our ability to attract and retain employees. We were the only Canadian bank on the list. |

|

| Best 50 Corporate Citizens | | BMO Financial Group was recognized byCorporate Knightsas one of its Best 50 Corporate Citizens. BMO also received a Gold Medal for our human resources practices and a Silver Medal for our contributions to the community. |

|

| Ovation Award | | BMO’s Career Discovery intranet site was recognized for outstanding achievement in the area of employee communication by the International Association of Business Communicators. |

|

| Training Top 100 | | For the second consecutive year, U.S.-basedTrainingmagazine ranked BMO Financial Group as the top Canadian corporation in its Top 100 North American corporations for our dedication to learning and development. |

|

Canadian Human Rights Commission

Employment Equity Audit | | BMO was the first Canadian bank found to be in compliance with all 12 statutory requirements in phase one of the audit, with no undertakings ordered. |

|

BMO Financial Group 186th Annual Report 20037

Delivering personalized service and customized solutions to our clients at every

point of contact

BMO Financial Group is committed to providing highly personalized service and customized financial solutions. Whether customers access our services online, by phone, at an ABM or in person, our goal is to distinguish ourselves by how well we serve them. Every business day our network of knowledgeable and highly motivated employees works to bring this commitment to life. Our competitive strength lies in our commitment to service.

Responding to what our customers need

For our Canadian personal and commercial banking customers, we’ve undertaken initiatives to become the only bank they need. In 2003, we completed the rollout of our new sales and service technology platform. Pathway Connect helps us deliver better customer service by allowing staff fast access to relevant customer information. We’ve also launched detailed customer knowledge and decision support software that enables staff to anticipate our customers’ needs and deliver relevant personalized solutions regardless of access channel.

When it comes to delivering highly personalized financial service, Mosaik® MasterCard®2 is what it’s all about. With this credit card, customers can choose the reward program, the interest rate plan, the travel insurance options and even the card design they want. We believe that clients should have the opportunity to change their card’s features as their needs change without having to apply for a new card.

We have added 10 instore locations in Sobeys®3, Safeway®4 and A&PTM2 stores, bringing the total number of instore locations to 102. The personalized service, convenience and extended hours of our instore locations meet the needs of busy individuals and families. It’s a level of service that’s being noticed: more than 50% of those using our instore locations are new customers.

As our customers’ financial needs change and evolve, we’re working to match the right products and services to their needs. Since 2000, we’ve placed 580 financial planners in BMO Bank of Montreal branches to make it easier for our customers to reach informed decisions about their financial affairs. Providing knowledgeable professionals right in our branches is how we customize and personalize the delivery of the financial services that our customers need.

Providing a superior banking experience is about high-quality service delivered right where our customers are.

For our commercial banking customers, we’ve maintained our commitment to helping small business grow through good times and bad, in part by maintaining lending guidelines that are predictable. This reliability and consistency are important to our customers and have allowed us to double our market share within the past decade. We’re closing in on our goal of being number one in the market for loans up to $5 million.

Help provided in good times and bad

The year 2003 was a challenging one for many of our clients, as they experienced devastating fires and floods in British Columbia, “mad cow disease” (bovine spongiform encephalopathy) and drought in the Prairies, hurricane damage in the Maritimes and the economic fallout of SARS and the power blackout in Ontario. Through it all, we have provided special financial assistance programs for our customers.

8 BMO Financial Group 186th Annual Report 2003

William A. Downe

Deputy Chair, BMO Financial Group

and Chief Executive Officer, BMO Nesbitt Burns

“Each time we have contact with a customer it is an opportunity to demonstrate the best of BMO and Harris. Our staff are knowledgeable and incredibly motivated to deliver personal attention and relevant solutions. We want to be the financial resource that our clients can count on.”

Understanding community banking needs

In the United States, through Harris Bank, we’re delivering value — and it’s being recognized. The exceptional service delivered by our people in the Chicago Southeast Region prompted a number-one rating from our customers polled by a local newspaper for the third year in a row. Employees in our Harris Buffalo Grove call centre, on their own initiative, surveyed their collective language skills and now deliver service in 13 languages.

Our goal is to expand our existing branch network by 50 branches in the Chicagoland area, which has eight million people and a gross domestic product more than one third the size of Canada’s. This year we opened nine new branches, bringing the total to 153, and we will continue to aggressively pursue acquisitions and expansion. We’re growing so that we can offer our customers more choices, convenience and service.

Delivering solutions that fit

Our Private Client Group is focused on helping our clients protect and grow their financial resources. Regardless of how our wealth management clients want to do business — in person, online or both — we’re adding new products and services.

In Canada, for our direct investing clients we continue to add features such as the ability to conduct foreign exchange transactions online, as well as detailed information on options. This higher level of customer service was recognized as bothThe Globe and Mailand Gómez Canada again ranked BMO InvestorLine as the number-one online investing service, noting specifically the breadth of our investment tools and services. Through BMO Harris Private Banking, we have augmented our offering of financial planning, investment management and estate services with philanthropic planning for wealthy families and individuals.

In the United States, we have added to our well-established Harris Private Bank with the acquisition of Washington, D.C.’s Sullivan, Bruyette, Speros & Blayney. Additionally, through myCFO donor advised funds, we are able to offer a convenient vehicle for philanthropic giving.

Learning by listening

The best way to improve our service is by listening to our customers. We redesigned our web sites this year to make it easier to do business with us. Most of the improvements were in response to feedback from our customers. We believe in adjusting to our customers’ behaviour and needs, rather than expecting them to adjust to ours. We also believe in asking our clients to tell us how we’re doing. A recent survey of BMO Nesbitt Burns clients indicated very high levels of client satisfaction and highlighted additional ways we can provide even better service.

Innovative thinking works

Our Investment Banking Group serves corporate, institutional and government clients. In Canada, operating under the BMO Nesbitt Burns brand, our client base is large corporations and institutions across a broad range of industry sectors. In the United States, under the Harris Nesbitt brand, we serve middle-market and institutional clients in selected sectors. We also serve institutional and government clients in the United Kingdom, Europe and Asia.

Our commitment to service begins with knowing what our clients need and understanding intimately the business sectors in which they operate. The research we provide to our clients is widely recognized as the best. For the 23rd year in a row, Brendan Wood International has given our Canadian equity research a number-one ranking. This research helps our clients understand their options and opportunities.

In the United States, we are focused on serving middle-market public and private companies. In 2003, we acquired New York-based Gerard Klauer Mattison, now operating as Harris Nesbitt Gerard. As a result, we expanded our U.S. middle-market client base in sectors such as Business Services, Consumer, Media and Entertainment, Technology and Telecom, and Health Care. We also expanded our U.S. product offering to clients to include equity sales and trading and tripled our research coverage of U.S.-based companies to 300 from 100 companies. The acquisition of Gerard Klauer Mattison adds key products and services for investment and corporate banking clients.

Whether our customers are large, small, individual or corporate, our goal is to provide the best personalized service and customized financial solutions possible, and we’re doing it through a team of highly motivated and knowledgeable financial professionals.

BMO Financial Group 186th Annual Report 20039

FINANCIAL PERFORMANCE AND CONDITION AT A GLANCE

| | | | | |

| Our Performance* | | | | Peer Group Comparison* |

| | | | | |

| Total Shareholder Return (TSR) | |  | | Five-Year Total Shareholder

Return (TSR)(%) |

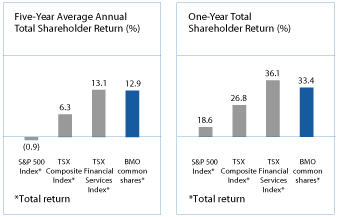

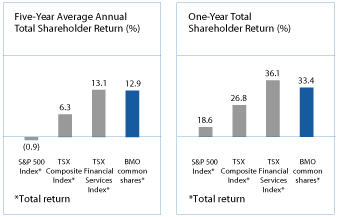

• BMO’s average five-year TSR of 12.9% improved from 7.9% a year ago and was better than the TSX and S&P Composite Indices and in line with the TSX Financial Services Index.

| | | • BMO’s average five-year TSR of 12.9% was above the North American peer group average of 9.6% but below the Canadian peer group average of 16.3%. |

• BMO’s 33.4% one-year TSR was better than the TSX and S&P Indices, but was slightly below the TSX Financial Services Index, which we outperformed by 18 percentage points in 2002. | | | • More recent relative performance is better, as BMO’s average two-year TSR and three-year TSR were both third best of the six-bank Canadian peer group. |

| | | | | |

| Further details are provided on page 15. | | | | |

| | | | | |

| Earnings per Share (EPS) Growth | |  | | Earnings per Share (EPS) Growth (%) |

• EPS rose 28% to a record $3.44 after growing 1% a year ago. Growth was driven by a lower provision for credit losses, business growth in all operating groups and lower net losses on investment securities. | | | • BMO’s EPS growth of 28.4% in 2003 was above the 17-bank North American peer group average of 14.0% but below the Canadian peer group average of 64.9%. |

• EPS growth of 28% exceeded our 2003 target of 10% to 15% growth. | | | • The Canadian peer group average growth rate was unusually high, as some members of our peer group had weak earnings in 2002. |

| Further details are provided on page 16. | | | | |

| | | | | |

| Return on Equity (ROE) | |  | | Return on Equity (ROE)(%) |

• ROE was 16.4%, up from 13.4% in 2002, and above our 2003 target of 14% to 15%.

• BMO has generated ROE of more than 13% in each of the past 14 years, and is the only major North American bank to meet this test of earnings consistency. | | | • ROE of 16.4% in 2003 was above the Canadian peer group average of 15.8% and equal to the North American peer group average. |

| | | | | |

| Further details are provided on page 17. | | | | |

| | | | | |

| Net Economic Profit (NEP) Growth | |  | | Net Economic Profit (NEP)

Growth(%) |

• NEP, a measure of economic value added, rose 92% to $703 million, after declining in 2002. | | | • NEP growth of 92% in 2003 was above the North American peer group average of 45% but below the Canadian peer group average. |

• Personal and Commercial Client Group accounted for approximately three-quarters of our NEP. Investment Banking Group accounted for approximately 50% of NEP growth. | | | • The Canadian peer group average growth rate was almost 3,000% because two members of the peer group had net economic losses in 2002. |

| | | | |

| | | | | |

| Further details are provided on page 17. | | | | |

| | | | | |

| Revenue Growth | |  | | Revenue Growth(%) |

• Revenue increased $412 million or 5% in 2003 and improved in each of our client operating groups. | | | • Revenue growth of 4.7% in 2003 was above the Canadian peer group average of 1.2% and the North American peer group average of negative 1.9%. |

• The weaker U.S. dollar lowered revenue growth in 2003 by 3 percentage points, while the incremental effect of acquired businesses increased revenue growth by 1.4 percentage points. | | | • BMO’s revenue growth was above the Canadian peer group average for the first time since 1995. |

| | | | |

| | | | | |

| Further details are provided on page 22. | | | | |

| | | | | |

Expense-to-Revenue Ratio(a)

(or Productivity Ratio) | |  | | Expense-to-Revenue Ratio(%) |

• The productivity ratio improved 240 basis points to 65.7%in 2003. | | | • BMO’s productivity ratio of 65.7% was better than the Canadian peer group average of 67.3% but above the North American peer group average of 60.0%. |

• Each of our client operating groups improved their cash productivity ratios by more than 150 basis points and increased revenues more than expenses, in both absolute and percentage terms. | | | • Improving productivity was BMO’s top priority in 2003. |

| | | | |

| | | | | |

| Further details are provided on page 25. | | | | |

| * | | Adjustments to GAAP results to derive cash and other non-GAAP results and measures, including adjusting revenue to a taxable equivalent basis (teb), are outlined on page 20. |

| (a) | | For consistency with our peer groups, the non-interest expense-to-revenue ratios for BMO and the peer groups reflected in the graphs for 1999 to 2001 include goodwill amortization. |

See page 12 for further comments on peer group comparisons.

10 BMO FINANCIAL GROUP 186TH ANNUAL REPORT 2003

| | | | | |

| Our Performance | | | | Peer Group Comparison |

| | | | | |

| Credit Risk | |  | | Provision for Credit Losses as a % of Average Net Loans and Acceptances |

• The provision for credit losses was $455 million or 30 basis points of average net loans and acceptances, down from $820 million or 56 basis points in 2002. | | | • BMO’s provision for credit losses of 0.30% of average net loans and acceptances was better than the Canadian peer group average of 0.39% and the North American peer group average of 0.95%. |

• The provision in 2003 was significantly lower than our 2003 target provision of $820 million or less. | | | • BMO’s credit loss experience remains top-tier. |

| | | | | |

| Further details are provided on pages 24 and 47. | | | | |

| | | | | |

| Impaired Loans | |  | | Gross Impaired Loans and Acceptances as a % of Equity and Allowances for Credit Losses |

• Gross impaired loans and acceptances were $1,918 million, compared with $2,337 million in 2002, and represented 12.2% of equity and allowances for credit losses, versus 15.2% a year ago. | | | • BMO’s ratio was higher than the Canadian peer group average of 11.4% and the North American peer group average of 7.6%. |

• Impaired loans and acceptances formations were $1,303 million, down from $1,945 million in 2002. | | | |

| | | | | |

| Further details are provided on page 24 and 47. | | | | |

| | | | | |

Cash and Securities-to-Total Assets

| |  | | Cash and Securities-to-Total Assets(%) |

• The cash and securities-to-total assets ratio increased to 29.1% from 24.9% in 2002 due to higher trading securities positions.

• Liquidity remains sound and continues to be supported by broad diversification of deposits. | | | • BMO’s ratio of 29.1% was below the Canadian peer group average of 31.4% and the North American peer group average of 38.2%.

• Our ratio remains higher than our minimum target ratio. |

| | | | |

| Further details are provided on page 50. | | | | |

| | | | | |

| Capital Adequacy | |  | | Tier 1 Capital Ratio(%) |

• The Tier 1 Capital Ratio was 9.55%, up from 8.80% last year. | | | • Our Tier 1 Capital Ratio of 9.55% was below the Canadian peer group average of 10.20% but above our minimum target of 8%. |

• The Total Capital Ratio was 12.09%, down from 12.23% in 2002, as we chose to redeem two subordinated debt issues to optimize our capital level.

| | | • On a U.S. basis, our Tier 1 Capital Ratio was 9.17%, above the North American peer group average of 8.75%. |

| Further details are provided on page 43. | | | | |

| | | | | |

| Credit Rating(Standard & Poor’s) | |  | | Credit Rating |

• Our credit rating, as measured by Standard & Poor’s®5 (S&P) senior debt ratings, remained at AA-, the best of Canada’s major banks, together with one of our competitors. | | | • BMO’s credit rating of AA-, as measured by S&P’s senior debt ratings, was better than the Canadian peer group average and the North American peer group average of A+. |

• S&P upgraded its ratings outlook on BMO to stable from negative in the fourth quarter of 2003. | | | |

| | | | | |

| Further details are provided on page 43. | | | | |

| | | | | |

| Credit Rating(Moody’s) | |  | | Credit Rating |

• Our credit rating, as measured by Moody’s®6 senior debt ratings, remained at Aa3, slightly below the highest-rated Canadian bank and consistent with the highest of the remaining major Canadian banks. | | | • BMO’s credit rating of Aa3, as measured by Moody’s senior debt ratings, was comparable to the Canadian and North American peer group averages. |

• Moody’s upgraded its ratings outlook on BMO to stable from negative in the second quarter of 2003. | | | |

| | | | | |

| Further details are provided on page 43. | | | | |

See page 12 for further comments on peer group comparisons.

BMO FINANCIAL GROUP 186TH ANNUAL REPORT 2003 11

CANADIAN AND NORTH AMERICAN PEER GROUP COMPARISONS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2003 | | 2002* | | Five-Year Average |

| | | |

| |

| |

|

| | | | | | | | | | | | Cdn. | | N.A. | | N.A. | | | | | | | | | | Cdn. | | N.A. | | N.A. | | | | | | | | | | Cdn. | | N.A. | | N.A. |

| | | | BMO | | Rank | | bank | | bank | | bank | | BMO | | Rank | | bank | | bank | | bank | | BMO | | Rank | | bank | | bank | | bank |

| | | | perf. | | of six | | avg. | | avg. | | q’tile | | perf. | | of six | | avg. | | avg. | | q’tile | | perf. | | of six | | avg. | | avg. | | q’tile |

| | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Financial Performance Measures(%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Five-year total shareholder return (TSR) | | | 12.9 | | | | 6 | | | | 16.3 | | | | 9.6 | | | | 2 | | | | 7.9 | | | | 4 | | | | 8.2 | | | | 3.3 | | | | 1 | | | | 12.9 | | | | 6 | | | | 16.3 | | | | 9.6 | | | | 2 | |

| Diluted earnings per share (EPS) growth | | | 28.4 | | | | 5 | | | | 64.9 | | | | 14.0 | | | | 2 | | | | 0.8 | | | | 2 | | | | (29.6 | ) | | | 18.2 | | | | 3 | | | | 10.4 | | | | 6 | | | | 14.3 | | | | 8.8 | | | | 4 | |

| Return on common shareholders’ equity (ROE) | | | 16.4 | | | | 5 | | | | 15.8 | | | | 16.4 | | | | 3 | | | | 13.4 | | | | 2 | | | | 9.9 | | | | 14.1 | | | | 3 | | | | 15.1 | | | | 3 | | | | 15.1 | | | | 15.9 | | | | 3 | |

| Net economic profit (NEP) growth | | | 91.8 | | | | 3 | | | | 2,997.0 | | | | 45.0 | | | | 2 | | | | (15.2 | ) | | | 2 | | | | (97.0 | ) | | | 24.5 | | | | 3 | | | | 21.9 | | | | 5 | | | | 593.2 | | | | 17.5 | | | | 3 | |

| Revenue growth | | | 4.7 | | | | 3 | | | | 1.2 | | | | (1.9 | ) | | | 3 | | | | — | | | | 3 | | | | 0.8 | | | | 6.5 | | | | 3 | | | | 5.0 | | | | 6 | | | | 7.5 | | | | 7.4 | | | | 3 | |

| Expense-to-revenue ratio | | | 65.7 | | | | 3 | | | | 67.3 | | | | 60.0 | | | | 3 | | | | 68.1 | | | | 4 | | | | 68.6 | | | | 59.9 | | | | 4 | | | | 65.4 | | | | 3 | | | | 66.6 | | | | 62.3 | | | | 3 | |

| Provision for credit losses as a % of average net loans and acceptances | | | 0.30 | | | | 2 | | | | 0.39 | | | | 0.95 | | | | 1 | | | | 0.56 | | | | 2 | | | | 0.96 | | | | 1.42 | | | | 1 | | | | 0.40 | | | | 1 | | | | 0.55 | | | | 1.00 | | | | 1 | |

| | | | | | | | |

Financial Condition Measures(%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross impaired loans and acceptances as a % of equity and allowance for credit losses | | | 12.2 | | | | 5 | | | | 11.4 | | | | 7.6 | | | | 4 | | | | 15.2 | | | | 4 | | | | 14.6 | | | | 10.0 | | | | 4 | | | | 12.1 | | | | 3 | | | | 13.7 | | | | 8.4 | | | | 4 | |

| Cash and securities-to-total assets | | | 29.1 | | | | 6 | | | | 31.4 | | | | 38.2 | | | | 3 | | | | 24.9 | | | | 6 | | | | 28.7 | | | | 38.2 | | | | 4 | | | | 26.8 | | | | 5 | | | | 29.0 | | | | 37.0 | | | | 3 | |

| Tier 1 Capital Ratio | | | 9.55 | | | | 6 | | | | 10.20 | | | | 8.75 | | | | 1 | | | | 8.80 | | | | 4 | | | | 9.07 | | | | 8.50 | | | | 2 | | | | 8.61 | | | | 6 | | | | 8.96 | | | | 8.26 | | | | 2 | |

| Credit rating | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Standard & Poor’s | | AA– | | | 1 | | | | A+ | | | | A+ | | | | 1 | | | AA– | | | 1 | | | AA– | | | A+ | | | | 1 | | | AA– | | | 1 | | | AA– | | | A+ | | | | 1 | |

| | Moody’s | | Aa3 | | | 2 | | | | Aa3 | | | | Aa3 | | | | 2 | | | Aa3 | | | 2 | | | Aa3 | | Aa3 | | | 2 | | | Aa3 | | | 2 | | | Aa3 | | Aa3 | | | 2 | |

The Canadian bank peer group average is based on the performance of Canada’s six largest banks: BMO Financial Group, Canadian Imperial Bank of Commerce, National Bank of Canada, RBC Financial Group, Scotiabank and TD Bank Financial Group. The North American bank peer group average is based on the performance of North America’s 17 largest banks, consisting of all banks in North America having shareholders’ equity that is at least 75% as large as BMO’s. It includes the Canadian peer group, except National Bank of Canada, as well as Bank of America Corporation, Bank One Corporation, Citigroup, FleetBoston Financial Corporation, J.P. Morgan Chase & Co., KeyCorp, National City Corporation, The PNC Financial Services Group Inc., SunTrust Banks Inc., U.S. Bancorp, Wachovia Corporation, and Wells Fargo & Company.

Results are as at or for the years ended October 31 for Canadian banks and as at or for the years ended September 30 for U.S. banks, as appropriate.

For consistency with our peer groups, the non-interest expense-to-revenue ratios include amortization of goodwill for all banks for years prior to 2002 in the calculation of the five-year average.

* In the 2002 MD&A, performance data was based on results excluding non-recurring items. See page 20.

Canadian Peer Group Comparison

BMO’s absolute performance in 2003 was appreciably better than in 2002 on all 11 of our primary financial performance and condition measures. Our 2003 performance was better than our five-year average on 7 of 11 measures and our five-year average performance improved on 8 of 11 measures relative to the five-year average in 2002.

In 2003, our performance was above the Canadian peer group average on four of seven financial performance measures, compared with above average performance on five measures in 2002.

Notwithstanding our improved results in 2003, our rankings in the Canadian peer group deteriorated from the relatively strong rankings of a year ago. In 2002, two of our five peers experienced sharp declines in EPS while another two experienced declines of more than 18%. BMO’s EPS increased modestly in 2002 in the difficult operating environment. Our reasonably strong operating results in fiscal 2002 and the relatively weak results of some of our peers that year have affected our rankings and performance relative to the peer group averages in 2003 in certain of the growth-related performance measures.

Improving productivity was BMO’s top priority for 2003. Our expense-to-revenue ratio improved by 240 bps and our ranking climbed from fourth to third among Canadian banks. BMO’s cash productivity ratio (see page 20) improved 260 bps in 2003 to 64.5%, rising from fifth best to second best of Canada’s major banks. In 2004, we are targeting a further 150 to 200 bps improvement in cash productivity.

BMO’s provision for credit losses represented 30 bps of average net loans and acceptances, the second best of Canada’s banks. The top-ranked bank in 2003 recorded a provision representing 183 bps of average net loans and acceptances a year ago, compared with BMO’s 56 bps charge in 2002.

Our ranking declined on three of the four financial condition measures and was also below average on three of four. However, our Tier 1 Capital Ratio and cash and securities-to-total assets ratio are both above our minimum targets.

BMO’s gross impaired loans and acceptances as a percentage of equity and allowance for credit losses improved by 3 percentage points from 2002 to 12.2%, but our ranking slipped to fifth among Canadian banks. The ratio can be affected by the speed with which companies designate loans as impaired, the level of losses companies experience on their impaired loans and the timing of write-offs. BMO’s credit experience, as measured by required provisions for credit losses, remains top-tier in Canada and North America.

North American Peer Group Comparison

Our rankings in the North American peer group were better in 2003 than a year ago. Our quartile ranking improved on three of the financial performance measures, declined on one and was unchanged on the remaining three. Our performance was better than average on five of the measures in 2003 and was average on another. In 2002, our performance was better than average on two of the seven measures.

BMO’s quartile ranking improved on two of the financial condition measures and was unchanged on the remaining two. Our performance was above average on three of four measures in 2003, consistent with 2002.

12 BMO FINANCIAL GROUP 186TH ANNUAL REPORT 2003

MANAGEMENT’S DISCUSSION AND ANALYSIS OF OPERATIONS AND FINANCIAL CONDITION

BMO’s Chairman and Chief Executive Officer and Chief Financial Officer have signed a statement outlining management’s responsibility for financial information in this Annual Report. The statement, which can be found on page 69, also explains the roles of the Audit Committee and Board of Directors in respect of financial information in the Annual Report.

Management’s Discussion and Analysis of Operations and Financial Condition (MD&A) comments on BMO’s operations and financial condition for the years ended October 31, 2003 and 2002. The commentary is as of November 25, 2003, except for peer group comparisons, which are as of December 4, 2003.

| | | | | |

| Index |

|

|

|

|

|

|

|

10 | Financial Performance and Condition at a Glance | | | Financial Performance Review |

13 | Index | | 20 | Enterprise-Wide Review |

13 | Caution Regarding Forward-Looking Statements | | | Operating Group Review |

14 | Financial Objectives, Targets and Measures | | 27 | Summary |

| | 28 | Personal and Commercial Client Group |

| | Value Measures | | 33 | Private Client Group |

15 | Total Shareholder Return | | 36 | Investment Banking Group |

16 | Earnings per Share Growth | | 40 | Corporate Support, including Technology and Solutions |

17 | Return on Equity | | | |

17 | Net Economic Profit Growth | | | Financial Condition Review |

| | 41 | Balance Sheet |

18 | Enterprise-Wide Strategic Management | | 42 | Off-Balance Sheet Arrangements |

19 | Economic and Financial Services Developments | | | |

| | | | 43 | Enterprise-Wide Capital Management |

| | | | 44 | Critical Accounting Policies |

| | | | 45 | Enterprise-Wide Risk Management |

| | | | 53 | Review of 2002 Financial Performance |

| | | | 54 | Supplemental Information |

Caution Regarding Forward-Looking Statements

Bank of Montreal’s public communications often include written or oral forward-looking statements. Statements of this type are included in this Annual Report, and may be included in filings with Canadian securities regulators or the U.S. Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve, but are not limited to, comments with respect to our objectives for 2004 and beyond, our strategies or future actions, our targets, expectations for our financial condition or share price, and the results of or outlook for our operations or for the Canadian and U.S. economies.

By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. We caution readers of this document not to place undue reliance on our forward-looking statements as a number of factors could cause actual future results, conditions, actions or events to differ materially from the targets, expectations, estimates or intentions expressed in the forward-looking statements.

The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: global capital market activities; interest rate and currency value fluctuations; the effects of war or terrorist activities; the effects of disease or illness that impact on local, national or international economies; the effects of disruptions to public infrastructure, such as transportation, communications, power or water supply disruptions; industry and worldwide economic and political conditions; regulatory and statutory developments; the effects of competition in the geographic and business areas in which we operate; management actions; and technological changes. We caution that the foregoing list of factors is not exhaustive and that when relying on forward-looking statements to make decisions with respect to Bank of Montreal, investors and others should carefully consider these factors, as well as other uncertainties and potential events, and the inherent uncertainty of forward-looking statements. Bank of Montreal does not undertake to update any forward-looking statement, whether written or oral, that may be made, from time to time, by the organization or on its behalf.

BMO FINANCIAL GROUP 186TH ANNUAL REPORT 2003 13

Management’s Discussion and Analysis of Operations and Financial Condition

FINANCIAL OBJECTIVES, TARGETS AND MEASURES

Governing Objective

To maximize the total return to BMO shareholders and generate, over time, first-quartile total shareholder return relative to our Canadian and North American peer groups.

Medium-Term Financial Performance and Condition Objectives

To grow EPS by a minimum of 10% per year over time; to increase ROE to between 18% and 19% over time; and to maintain a strong regulatory capital position, consistent with our peers.

| | | | | | | |

| 2003 Financial Targets | | 2003 Financial Performance | | Target Met | | 2004 Financial Targets |

| |

| |

| |

|

• 10% to 15% EPS1,2 growth | | • EPS2 growth of 28.4% | | ü | | • 10% to 15% EPS growth |

• ROE of 14% to 15% | | • ROE of 16.4% | | ü | | • ROE of 16% to 18% |

• Provision for credit losses of $820 million or less | | • Provision for credit losses of $455 million | | ü | | • Provision for credit losses of $500 million or less |

• Tier 1 Capital Ratio of at least 8% | | • Tier 1 Capital Ratio of 9.55% | | ü | | • Tier 1 Capital Ratio of at least 8% |

• Improve cash productivity ratio of each operating group by 150 to 200 bps2,3 | | • All groups improved more than 150 bps and BMO improved2260 bps | | ü | | • Improve cash productivity ratio by 150 bps to 200 bps |

| (1) | | All EPS figures in this MD&A refer to diluted EPS, unless indicated otherwise. |

| (2) | | In 2002, we followed a practice of reporting results and establishing targets on a basis excluding amounts categorized as non-recurring. We discontinued this practice in 2003, as explained on page 20. BMO’s EPS in 2002 was $2.68 but, excluding $62 million ($39 million after tax) of acquisition-related costs that were designated as non-recurring items in 2002, EPS was $2.76. Our 2003 EPS growth target was set in relation to EPS of $2.76 in 2002. EPS of $3.44 in 2003 increased 24.6% from 2002 EPS of $2.76, excluding non-recurring items. Excluding the impact of the acquisition-related costs in 2002, BMO’s cash productivity ratio of 64.5% in 2003 improved by 190 bps and the ratio of each operating group improved by more than 150 bps. |

| (3) | | Improved cash productivity ratio was not originally designated as a 2003 financial target. It was added as a priority focus in the first quarter of 2003. It is a non-GAAP measure and is explained on page 20. |

Financial Performance Objectives, Targets and Measures

BMO has established an overall governing objective and medium-term financial performance and condition objectives, which are outlined at the top of the page. BMO also establishes annual financial targets for certain of our performance and condition measures, which are outlined in the table above. Our success in achieving our overall governing objective of first-quartile total shareholder return is dependent on achieving our minimum medium-term financial performance and condition objectives, and on the relative performance of our peer group.

Because annual financial targets represent checkpoints in the achievement of our medium-term financial objectives, they reflect economic conditions prevailing at the time and may be higher or lower than the medium-term financial objectives in any particular year.

Our operating philosophy is to increase revenues at higher rates than general economic growth rates, while limiting expense growth rates to equal to or less than revenue growth rates, over time. We strive for efficiencies in expense management and a balance between current profitability and the need to invest for future growth. When possible, expense efficiencies partially or totally fund the costs of investing for the future. However, the relationship between revenues and expenses in any year is affected by economic conditions.

Our targets for 2004 were established in the context of our expectations for the economy in the year ahead, as detailed on page 19.

Much of the performance analysis in the MD&A occurs in the context of the primary measures BMO management uses to assess performance. The 11 primary measures are outlined in the Financial Performance and Condition at a Glance section on pages 10 and 11. Four of these measures are categorized as our value measures: Total Shareholder Return, Earnings per Share Growth, Return on Equity and Net Economic Profit Growth. These value measures, which are reviewed on pages 15 to 17, are those that measure shareholder return or most directly influence shareholder return.

The remaining seven primary measures are reviewed in the Financial Performance Review, starting on page 20, and in the Financial Condition Review, starting on page 41, and form the basis of our review of the consolidated financial statements. Pages 20 and 21 of the Financial Performance Review discuss non-GAAP measures, foreign exchange and acquired businesses, which are important factors influencing much of the results discussion in the MD&A.

Achievement of Targets in Prior Years

In 2002, we achieved three of our four financial targets; the provision for credit losses was higher than our target because of the difficult credit environment. In 2001, economic conditions were worse than anticipated when performance targets for the year were established. In 2001, we achieved three of our nine financial targets, as expense growth outstripped revenue growth and provisions for credit losses increased significantly.

14 BMO FINANCIAL GROUP 186TH ANNUAL REPORT 2003

Management’s Discussion and Analysis of Operations and Financial Condition

VALUE MEASURES

| | | | | | | |

| Highlights | | | | |

| • | | BMO investors have earned an average annual return of 12.9% over the past five years and earned 33.4% in 2003. | | • | | BMO is the only major bank in North America to earn an ROE of more than 13% for 14 consecutive years. |

| • | | We surpassed all our performance targets in 2003. | | • | | ROE of 16.4% rose from 13.4% in 2002. |

| • | | EPS increased 28% from a year ago. | | • | | The stated quarterly dividend rate increased 16.7% from a year ago. |

Total Shareholder Return

BMO’s governing objective is to maximize the total return to shareholders and generate, over time, first-quartile total shareholder return (TSR) relative to our Canadian and North American peer groups.

The five-year average annual TSR is a primary measure of shareholder value and is the most important of our financial performance and condition measures since it assesses our success in achieving our governing objective of maximizing return to shareholders. Over the past five years, shareholders have earned an average annual TSR of 12.9% on their investment in BMO’s common shares. This compares favourably with an average annual return for the TSX Composite Total Return Index of 6.3% over the same period and was in line with the return for the TSX Financial Services Total Return Index. Dividends paid over the period and appreciation in BMO’s share price are outlined in the table below. An investment of $1,000 in Bank of Montreal common shares at the beginning of fiscal 1999 would have been worth $1,832 at October 31, 2003, assuming reinvestment of dividends, for a total return of 83%. Dividends declared over the five years have increased at an average annual rate of 8.8%. In 2003, the stated quarterly dividend was raised twice, increasing 16.7% from the fourth quarter of 2002.

The average annual TSR of 12.9% for this most recent five-year period was up appreciably from the 7.9% average annual return for the five years ended October 31, 2002. The averages are affected by the yearly TSRs included in the calculations. The improvement reflected the removal of the 6.4% yearly return earned in 1998 from the averaging calculation and its replacement with the 33.4% return earned this year.

The 33.4% TSR earned in fiscal 2003 compared favourably with the 26.8% return of the TSX Composite Total Return Index. Our one-year TSR was slightly below the TSX Financial Services Total Return Index, but BMO common shares had outperformed that index by 18.3 percentage points in 2002.

Pages 10 and 12 provide further comment on shareholder return and include peer group comparisons.

Thefive-year average annual total shareholder return (TSR)represents the average annual total return earned on an investment in BMO common shares made at the beginning of a five-year period. The return includes the change in share price and assumes that dividends received were reinvested in additional common shares. The one-year TSR also assumes that dividends were reinvested in shares.

Total Shareholder Return

| | | | | | | | | | | | | | | | | | | | | | | | | |

| For the year ended October 31 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 |

| |

| |

| |

| |

| |

| |

|

| Closing market price per common share ($) | | | 49.33 | | | | 38.10 | | | | 33.86 | | | | 35.25 | | | | 28.33 | | | | 31.55 | |

| Dividends paid per common share ($) | | | 1.29 | | | | 1.18 | | | | 1.09 | | | | 0.99 | | | | 0.93 | | | | 0.88 | |

| Dividends paid (%) | | | 3.4 | | | | 3.5 | | | | 3.1 | | | | 3.5 | | | | 2.9 | | | | 2.9 | |

| Increase (decrease) in share price (%) | | | 29.5 | | | | 12.5 | | | | (3.9 | ) | | | 24.4 | | | | (11.4 | ) | | | 3.7 | |

| Total annual shareholder return (%) | | | 33.4 | | | | 16.2 | | | | (1.2 | ) | | | 29.0 | | | | (7.4 | ) | | | 6.4 | |

Total annual shareholder return assumes reinvestment of quarterly dividends and therefore does not equal the sum of dividend and share price returns in the table.

BMO FINANCIAL GROUP 186TH ANNUAL REPORT 2003 15

Management’s Discussion and Analysis of Operations and Financial Condition

Earnings per Share Growth

The year-over-year percentage change in earnings per share (EPS) is our primary measure for analyzing earnings growth. All references to EPS are to diluted EPS.

EPS was a record $3.44, up 28% from $2.68 in 2002. Cash EPS was $3.59, up 27% from $2.83 a year ago. EPS growth exceeded our annual target of 10% to 15% growth from a base of $2.76, which represented our 2002 EPS excluding non-recurring acquisition-related costs. EPS in 2003 grew 25% from the $2.76 base. In 2004, we are again targeting EPS growth of 10% to 15%. This target was set in the context of our economic outlook for 2004, which is outlined on page 19.

Our five-year compound average annual EPS growth rate was 8.5%, below our medium-term financial performance objective of 10%, as EPS increased from $2.29 in 1998 to $3.44 in 2003. If we achieve our minimum target of 10% EPS growth in 2004, our five-year compound average annual growth rate will be 10.1% at the end of 2004.