2005 Financial Highlights

| | | | | | | | | | | | | | | | | | | | | |

| For the year ended October 31 | | 2005 Target | | | | | | | 2005 | | | 2004 | | | 2003 | |

| |

Income Statement Highlights(Canadian $ in millions) | | | | | | | | | | | | | |

Total revenue (teb)(a) (c) | | | | | | | | | | | 9,958 | | | | 9,488 | | | | 9,149 | |

| Provision for (recovery of) credit losses | | | | | | | | | | | 179 | | | | (103 | ) | | | 455 | |

| Non-interest expense | | | | | | | | | | | 6,327 | | | | 6,157 | | | | 6,087 | |

| Net income | | | | | | | | | | | 2,400 | | | | 2,306 | | | | 1,781 | |

| |

Common Share Data($) (b) | | | | | | | | | | | | | | | | | | | | |

| Earnings per share | | | | | | | | | | | 4.64 | | | | 4.42 | | | | 3.44 | |

Cash earnings per share(c) | | | | | | | | | | | 4.79 | | | | 4.57 | | | | 3.59 | |

| |

Key Financial Measures(%) (b) | | | | | | | | | | | | | | | | | | | | |

| Five-year average annual total shareholder return | | | | | | | | | | | 13.8 | | | | 18.9 | | | | 12.9 | |

Earnings per share growth(b) | | | | | | | ü | | | | 5 | | | | 29 | | | | 28 | |

– on a targeted basis(c) | | | 3%-8%(d) | | | | ü | | | | 9 | | | na | | na |

| Return on equity | | | 17%-18% | | | | ü | | | | 18.8 | | | | 19.4 | | | | 16.4 | |

Revenue growth (teb)(c) | | | | | | | | | | | 5.0 | | | | 3.7 | | | | 4.7 | |

Cash productivity ratio (teb)(c) | | | | | | | | | | | 62.6 | | | | 63.8 | | | | 65.4 | |

| – targeted improvement (bps) | | 150-200 bps | | | | û | | | | 120 | | | | 160 | | | | 260 | |

| Provision for credit losses as a % of average net loans and acceptances | | | | | | | | | | | 0.11 | | | | (0.07 | ) | | | 0.30 | |

– targeted specific provision($ millions) | | | £ $400 | | | | ü | | | | 219 | | | | 67 | | | | 455 | |

| Tier 1 Capital Ratio | | | > 8% | | | | ü | | | | 10.25 | | | | 9.81 | | | | 9.55 | |

| |

| All ratios in this report are based on unrounded numbers. |

| |

| (a) | | All revenues in this report, except in the Consolidated Financial Statements, are reported on a taxable equivalent basis (teb). See pages 35 and 37. |

| |

| (b) | | All earnings per share (EPS) measures in this report refer to diluted EPS, unless otherwise specified. |

| |

| (c) | | This is a non-GAAP measure. See page 35. |

| |

| (d) | | Targeted EPS growth from a base of $4.21 (excluding changes in the general allowance). |

| |

| na – not applicable |

2005 Awards and

Recognition Highlights | | Excellence in Corporate Reporting | Excellence in Communicating to Investors | Leading

Corporate Governance |

One of Canada’s Most Respected Corporations

BMO Financial Group ranked 7th onThe Globe and Mail’s Top 25 of Canada’s Most Respected Corporationslist, up from 9th in 2003 and 20th in 2002. Excellence in Diversity

BMO Financial Group President and CEO Tony Comper was namedDiversity Leader of the Yearat the International Quality & Productivity Center’s (IQPC) 2005 Diversity Excellence Awards. IQPC also awarded BMO itsBest in Class Diversity Program Award. Best Private Bank

For the second year in a row,Euromoneymagazine has selected BMO Harris Private Banking as the best private bank in Canada. | BMO Board Ranked #1

In its fifth annual survey,Canadian Businessmagazine ranked BMO Financial Group’s Board of Directors first among Canada’s Top 25 boards. Best Corporate Citizen

BMO was named Canada’s Best Corporate Citizen of the Year byCorporate Knights. The top-50 ranking is based on performance indicators, including executive gender diversity, tax generation and executive retention rate as well as board independence and diversity. | The Canadian Institute of Chartered Accountants’ annual Corporate Reporting Awards gave us the Award of Excellence in the financial institutions category and gave BMO an Honourable Mention for Excellence in Electronic Disclosure. Excellence in Security Management

BMO was the first company in Canada to be awarded certification from the British Standards Institution for meeting the highest international standard for operating an Information Security Management System. Sustainability:

Best in Class

BMO Financial Group was chosen to be among the first Canadian companies listed on the newly createdDow Jones Sustainability North America Index, modelled on the benchmarkDow Jones Sustainability World Index.

| IR Magazine Canadagave BMO its “Best Communications with the Retail Market” award, recognizing the BMO Investor Relations web site for its quality, ease of navigation and presentation of information to the retail investor. Leader in Equity Research

For the 25th consecutive year, BMO Nesbitt Burns was ranked the top Equity Research Group by Canada’s leading institutional investors in the 2005 Brendan Wood International Survey. | The Globe and Mail’sReport on Businessannual review of corporate governance practices ranked BMO second overall among 209 Canadian reporting issuers. Top Online Brokerage

BMO InvestorLine® ranked #1 inThe Globe and Mail’s annual review of Canada’s online brokerage firms for the fourth consecutive year. Employer of Choice

BMO was named one of Canada’s Top 100 Employers byMaclean’smagazine and Mediacorp for the fourth consecutive year and was the only major Canadian bank to be named to this prestigious list. BMO Financial Group also ranked 16th overall inTraining magazine’s Top 100 North American corporations in 2005 and was the top Canadian company on the list. |

BMO Financial Group at a Glance

| | | | | | | | | | | |

| | | | | | | | | |

| | Established in 1817 as Bank of Montreal, BMO Financial Group (TSX, NYSE: BMO) is a highly diversified financial services organization. With total assets of $298 billion at October 31, 2005 and more than 34,000 employees, BMO provides a broad range of retail banking, wealth management and investment banking products and solutions. We serve our clients through three customer groups. | | | Personal and Commercial Client Group

Personal and Commercial Client Group (P&C) provides more than eight and a half million customers across Canada and the United States with fully integrated personal and commercial banking solutions. These include deposit accounts, loans and credit cards, insurance products and personal investment products. Our products and services are delivered by a highly skilled team of professionals through 1,180 BMO Bank of Montreal and Harris branches, through telephone and online banking at bmo.com and harrisbank.com, and through a network of almost 2,500 automated banking machines.

| | |  | |

| | | | | | | | | |

| | | | | | | 2005 Key Initiatives | | | Focus for 2006 | |

| | | | | | | | | |

| | Canadian Operations

We serve Canadian clients through BMO Bank of Montreal®, our personal and commercial banking business, and BMO Nesbitt Burns®*, one of Canada’s leading full-service investment and wealth management firms. | |  | | | • Achieved strong net income growth of 23.1%. • Achieved strong balance sheet growth, with deposit growth of 7% and average loans and acceptances growth of 7.9% including the effects of securitizations. • Improved cash productivity by 310 basis points to 57.3%. • Applied more discipline to our sales management through initiatives such as integrating financial planners into our delivery model and aligning desired customer experience with employee performance measurement and incentives. • Upgraded technology to streamline workflow and improve the quality of our customer information, allowing us to better recognize and meet the needs of our customers. • Continued to distinguish ourselves in commercial banking as reflected by the second-largest market share in business lending. | | | • Enhance the quality of sales and service delivery to build lasting relationships through exceptional service, leading to revenue growth, increased market share and improved customer loyalty. • Simplify processes and enhance technology for front-line sales and service representatives, increasing capacity and effectiveness to improve customer service. • Continue our track record of improving our cash productivity ratio. • Invest further in our distribution network, including the replacement of our ABM network. • Continue expanding programs and offers to meet our customers’ financial needs.

| |

| | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | |

| | U.S. Operations

In the United States, clients are served through Harris, a major U.S. Midwest financial services organization with a network of community banks in the Chicago area and wealth management offices across the United States, as well as Harris Nesbitt®1, a leading mid-market investment and corporate bank. | |  | | | • Achieved U.S.-dollar net income growth of 22.5%. • Improved cash productivity by 150 basis points, driven by higher revenues and continued expense management. • Increased average total loans and acceptances by 19% to US$15.9 billion. • Opened eight new branches in Chicagoland and acquired Mercantile Bancorp with 19 branches in Northwest Indiana, increasing Harris’ Community Banking network to 195 locations. • Consolidated 26 bank charters into one national bank charter at the end of May 2005 with no disruption to customer service. • Our Net Promoter Score, a measure of the intensity of our customers’ loyalty, rose from 26% in 2003 to 34% in 2005 – triple the network average. | | | • Improve our financial performance, focusing on revenue growth. • Continue to build our branch network in Chicagoland by opening five new branches and exploring acquisition opportunities in the Midwest. • Continue to refine our customer experience to provide the high customer service levels of a community bank. • Invest in our strategic infrastructure by refreshing the branch technology platform.

| |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| Private Client Group | | | | | | Investment Banking Group | | | |

| | | | | | | | | |

| Private Client Group (PCG) offers clients a full range of wealth management products and services, including full-service and direct investing, private banking and investment products. Our highly trained professionals are dedicated to serving the needs and goals of our clients to accumulate, protect and grow their financial assets. Private Client Group serves clients through BMO Bank of Montreal and Harris branches, as well as through stand-alone BMO InvestorLine, BMO Nesbitt Burns and BMO Harris Private Banking offices in Canada, and through Harris Private Bank offices in key U.S. centres, including family office services and customized investment services to the ultra affluent. | | |  | | | Investment Banking Group (IBG) combines all of our businesses serving corporate, institutional and government clients. In Canada, operating under the BMO Nesbitt Burns brand, our client base comprises large corporations and institutions across a broad range of industry sectors. In the United States, operating under the Harris Nesbitt brand, we serve corporate and institutional clients in selected sectors. Investment Banking Group offers clients complete financial solutions across the entire balance sheet, including public and private debt and equity underwriting, corporate lending, securitization, cash management, risk management and trade finance. We also offer leading financial advisory services in mergers and acquisitions and restructurings, and we provide investing clients with industry-leading research, sales and trading services. | | |  |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| 2005 Key Initiatives | | | Focus for 2006 | | | 2005 Key Initiatives | | | Focus for 2006 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

• BMO Nesbitt Burns introduced the Architect Program – the first of its kind in Canada – to provide clients with customized portfolios that combine separately managed accounts, mutual funds, exchange-traded funds, and alternative investment products in a single account. • BMO Harris Private Banking was named the best private bank in Canada byEuromoney magazine for the second consecutive year. • BMO Harris Private Banking introduced the enCircle®program, an innovative solution for mature clients, offering a range of services from bill payments and investment management to estate planning and home health-care education. • BMO InvestorLine was chosen byThe Globe and Mailas best online broker for the fourth consecutive year, its 14th top ranking in the past five years. • BMO Mutual Funds and Guardian Group of Funds outperformed the mutual fund industry, with annual net sales exceeding the industry average. • BMO Term Investments introduced the BMO Dividend Fund Linked GIC, the first of its kind offered by any of Canada’s major banks.

| | | • Continue to leverage our leadership position in client service and award-winning offerings, and increase our share of our existing clients’ investable assets. • Continue to improve performance through sales force productivity and operational efficiencies. | | | • Participated in 513 Canadian corporate debt and equity transactions that raised a total of $69 billion. • Advised on $21 billion of completed Canadian mergers and acquisitions. • Ranked the top Equity Research Group for the 25th consecutive year in the Brendan Wood International Survey of institutional investors, and ranked first for Overall Quality of Trader Service. • Ranked first overall in the 2004 StarMine Canadian Analysts’ survey. • Canadian Securitization unit ranked first in market share of asset-backed commercial paper conduit outstandings. • Expanded Real Estate investment and corporate banking practice. • Introduced Canadian mutual fund and equity linked notes, establishing a strong presence and setting the pace as the largest and fastest-growing issuer in Canada in 2005. | | | • Continue to reinforce our leading position. • Continue to broaden and deepen relationships with prospects and clients. |

| | | | | | | | | | |

| | | | | | | | | | |

| Group Initiatives | | | Group Focus | | | Group Initiatives | | | Group Focus |

| | | | | | | | | | |

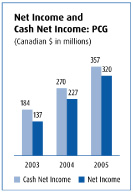

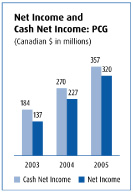

• Focused management of non-revenue based costs helped achieve relatively low expense growth of 1% compared to strong revenue growth of 10%, while product refinement and streamlined operations contributed to net income growth of 41%. • Cash productivity ratio improved by 580 basis points in 2005 – for a total of 1570 basis points in the past three years – driven by revenue growth and sustainable cost containment initiatives. | | | • Deepen client relationships and enhance our product offerings. • Drive revenue growth by expanding our sales force in key businesses. • Continue to improve our cash productivity ratio through revenue growth and expense management initiatives. | | | • Acquired a local currency Chinese Renminbi banking licence in Guangzhou – the only Canadian bank to do so. • Became the first Canadian bank to be granted a licence to sell derivatives in China. • The only Canadian bank in a group of ten banks selected to act as market-makers for foreign exchange trading in China. • Ranked #2 in the world for Canadian dollar foreign exchange byFX Week. • Launched eFXpedite®, an online foreign exchange trading system enabling users to access real-time foreign exchange prices and execute trades on the spot.

| | | • Continue focus on integrated coverage to bring the best solutions to our clients. • Implement high-value initiatives that build on both existing expertise and businesses, and new business ideas. • Continuously improve the profitability of client relationships. • Improve our cash productivity ratio. |

| | | | | | | | | | |

• Harris Private Bank enhanced its investment capabilities by expanding the range of alternative investments and third party managers, providing solutions for a broader client base. • Harris Private Bank was ranked among the top ten private banks in the U.S. market byEuromoneymagazine. • Sold Harrisdirect, allowing the redeployment of capital to higher-return businesses. • Introduced a successful new referral program that exceeded expectations. | | | • Accelerate growth in the United States by increasing our share of our existing clients’ investable assets and leveraging the Bank’s U.S. expansion strategy. • Improve performance through sales force productivity and operational efficiencies. | | | • Undertook a major initiative to improve our overall client coverage, capitalize on top-line growth opportunities and win more business from IBG clients. • Expanded and upgraded Harris Nesbitt’s pool of expertise with a number of key senior-level hires, including heads of Healthcare, Financial Institutions and Consumer and Leisure Groups. • Expanded Mergers and Acquisitions, Equity Capital Markets, Commodity Derivatives and Equity Research and Sales Groups. | | | • Refine sector focus to match our product and service capabilities to high-growth opportunities in the United States. • Develop U.S. investor strategy to accelerate growth. |

Every day, BMO’s Board, leadership

team and employees are driving us closer

to achieving our vision. It is, simply, to

be the top-performing financial services

company in North America.

| | | | | |

n Advancing our strategic priorities | | page 2 |

n Delivering consistently to our shareholders | | page 4 |

n Providing exceptional customer service | | page 10 |

n Focusing on our strength in credit risk management | | page 16 |

n Leading in corporate governance | | page 17 |

n Valuing every employee | | page 20 |

n Helping our communities | | page 21 |

n Caring about the environment | | page 22 |

| | | | | | | | | | | | | | | | |

| | | | | | |

| | Contents | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | BMO Financial Group at a Glance/Financial Highlights | | Inside Front Cover | | | Financial Performance and Condition at a Glance | | page 24 | |

| | | | | | |

| | | | | | |

| | 2005 Awards and Recognition Highlights | | Inside Front Cover | | | Supplemental Information | | page 79 | |

| | | | | | |

| | | | | | |

| | Vision and Priorities Overview | | page 2 | | | Consolidated Financial Statements | | page 92 | |

| | | | | | |

| | | | | | |

| | Chairman’s Message to Shareholders | | page 4 | | | Notes to Consolidated Financial Statements | | page 96 | |

| | | | | | |

| | | | | | |

| | Chief Executive Officer’s Message to Shareholders | | page 5 | | | Members of Management Board | | page 135 | |

| | | | | | |

| | | | | | |

| | Financial Review | | page 8 | | | Glossary of Financial Terms | | page 136 | |

| | | | | | |

| | | | | | |

| | Management’s Discussion and Analysis | | page 23 | | | Shareholder Information | | Inside Back Cover | |

| | | | | | |

| | | | | | |

Bank of Montreal uses a unified branding approach that links all of the organization’s member companies. Bank of Montreal, together with its subsidiaries, is known as BMO®Financial Group. As such, in this document, the names BMO and BMO Financial Group mean Bank of Montreal, together with its subsidiaries.

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 1 |

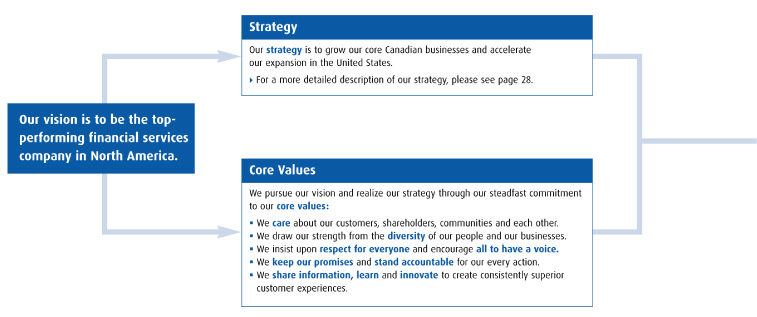

Vision and Priorities Overview

We will achieve our vision with an

unwavering focus on our strategic priorities

Being the best means becoming the top-performing financial services company in North America. It’s a bold vision – one we will strive to achieve by building on our enduring strengths and by advancing our growth strategy. Every day.

Our Enduring Strengths

| | | | | |

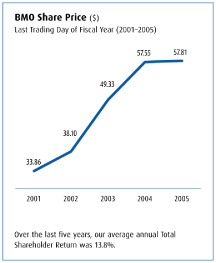

Long-Term Shareholder Return

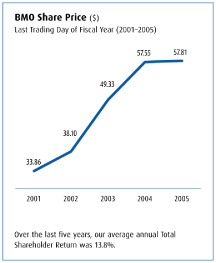

At the end of 2005, the five-year annual Total Shareholder Return on BMO common shares was 13.8%.

Excellence in Credit Risk Management

BMO has a proven ability to deliver strong returns at acceptable levels of risk. Our philosophy is to manage risk in a way that is disciplined and consistent – an approach that works for our business and our clients in both good times and bad.

Commercial Leadership in Canada and the United States

Our commercial business is a growth engine for BMO in both Canada and the United States. Particularly, we view our ability to serve our customers on both sides of the border as a unique advantage. | | Canada’s First Bank

Our core established business in Canada, focused on meeting the banking, investment and insurance needs of individual Canadians and businesses, is the financial backbone of BMO Financial Group.

Canadian Leader in U.S. Banking

Harris is one of the top three banks serving the Chicagoland area. Our strong personal and commercial presence in the U.S. Midwest continues to distinguish us as the Canadian leader in U.S. banking.

Technological Strength

BMO has a history of delivering innovative technology solutions to provide consistent, reliable and secure financial services that our customers trust. We are recognized for adopting best practices and achieving the highest standards for our products and services. | | Commitment to Productivity Improvement

Productivity improvement is an important measure of BMO’s long-term financial health. Our strategy is to continue making progress in containing costs while at the same time investing strategically to boost revenues.

Our People

Our people understand the importance of customer loyalty. They understand that it is their job to make BMO the only bank our customers will ever need.

Leadership in Corporate Governance

BMO continues to be a recognized leader in corporate governance. We were named Best Corporate Citizen for 2005 byCorporate Knightsand received a #1 ranking inCanadian Businessmagazine’s annual corporate governance survey. |

| | | |

| 2 | | BMO Financial Group 188th Annual Report 2005 |

| | | | | | | | | | | | |

| | | |

| | 2005 Targets | | | 2005 Performance | | | Targets for 2006 | |

| | | | | | | | | | | | |

| | 3%to8%EPS growth from a base of $4.21 (excluding changes in the general allowance) | | | ü | | | 9.0% to $4.59

4 See page 33 | | | 5%to10%EPS growth from a base of $4.59 (excluding changes in the general allowance) | |

| | | | | | | | | | | | |

| | ROE of17%to18% | | | ü | | | 18.8%

4 See page 34 | | | ROE of17%to19% | |

| | | | | | | | | | | | |

| | Specific provision for credit losses of$400 millionor less | | | ü | | | $219 million

4 See page 40 | | | Specific provision for credit losses of$400 millionor less | |

| | | | | | | | | | | | |

| | Tier 1 Capital Ratio of at least8.0% | | | ü | | | 10.25%

4 See page 59 | | | Tier 1 Capital Ratio of at least8.0% | |

| | | | | | | | | | | | |

| | Improve cash productivity ratio by150to200 bps | | | û | | | 120 bps improvement

4 See page 41 | | | Improve cash productivity ratio by100to150 bps | |

| | | | | | | | | | | | |

| | | | | | |

| | | |

| | Strategic Priorities | |

| | | | | | |

| | Achieve financial targetswith a particular focus on revenue growth to improve productivity.

4 See pages 5, 8, 9 and 28

| | |  | |

| | | | | | |

| | Drive revenue growthby providing a superior client experience, earning a larger share of customers’ business.

4 See pages 7, 8, 28 and 45

| | |  | |

| | | | | | |

| | Continue to improve U.S. performance.

4 See pages 5, 28 and 47

| | |  | |

| | | | | | |

| | Accelerate growth in the United Statesboth organically and through acquisitions.

4 See pages 7, 28 and 47

| | |  | |

| | | | | | |

| | Grow net income in Canadathrough operational efficiency and improved market share, accelerating our growth in commercial banking and wealth management.

4 See pages 8, 28 and 45

| | |  | |

| | | | | | |

| | Build a high-performance organizationby developing our people, living our values and being an employer of choice.

4 See pages 20 and 28

| | |  | |

| | | | | | |

| | Maintain our world-class foundationof leading governance, sound risk management, productive systems and excellent after-sales service.

4 See pages 16,17, 28 and 67

| | |  | |

| | | | | | |

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 3 |

Chairman’s Message to Fellow Shareholders

Building shareholder value continued to be BMO’s primary objective in 2005

In what proved to be a challenging year for the North American financial services sector, BMO focused on actions that will create value for our shareholders by executing our business strategy and maintaining focus on our foundational strengths which include sound corporate governance and strong credit risk management.

| | | |

| | David A. Galloway

Chairman |

| | | |

| | | “All of us associated with BMO are proud of our leadership position in corporate governance and recognize that this key foundational strength adds tremendous value to our company.” |

Consistent performance has long been a hallmark of BMO and something I believe all shareholders can be proud of. In 2005, the company faced tough financial targets as a result of strong performance the previous year. The previous year’s results were enhanced by loan losses being at an all time low. It is especially pleasing, therefore, to congratulate Tony Comper and the management team, as well as each BMO employee, for the successes that they achieved during the year.

The Board remained highly engaged and vigilant as BMO continued to operate in an ever more complex and tightly regulated financial services sector. The company’s proven strengths have never been more important, and I am very proud of the Board’s work on behalf of all stakeholders in ensuring the integrity of internal controls and processes and the effectiveness of compliance with external requirements. As the company moves closer to Basel II and proceeds with our efforts to give effect to the provisions of theSarbanes-Oxley Act, the Board will continue to make this a priority.

All of us associated with BMO are proud of our leadership position in corporate governance and recognize that this key foundational strength adds tremendous value to our company. Most recently, we were ranked number one among the top 25 Boards in Canada, according to a survey byCanadian Business magazine. While this is gratifying and a tribute to the calibre of my fellow Board members, we can only be satisfied to win awards when they accompany

good operational performance and enhanced shareholder value.

Each of our Board Committees had a full agenda over the course of the year, and we were successful in achieving our key priorities. I am particularly proud of the work that was done on strategy as we continue to focus on evolving trends and the opportunities we see ahead. During the year, top talent development, including succession planning across executive ranks, remained very much a focus. I am confident that BMO’s attention to nurturing and developing talent will serve shareholders well now and into the future.

I would like to take this opportunity to express my thanks to the Board members for their contribution and dedication. I also extend a special thank you to departing Board member Frank McKenna. Former premier of New Brunswick and now Canada’s ambassador to the United States, Frank served on our Board for eight years. He was an absolutely outstanding director and his contributions have been superb. All of us wish him well.

On behalf of our Board of Directors, we look forward to continuing to serve our fellow shareholders as we focus on our role in helping to make BMO the top-performing North American financial services provider.

-s- DAVID A. GALLOWAY

David A. Galloway

Chairman

| | | |

| 4 | | BMO Financial Group 188th Annual Report 2005 |

Chief Executive Officer’s Message to Fellow Shareholders

Intense customer focus, unlimited growth potential

Every day and in every way, my colleagues and I are aligning our hopes and ambitions for business success with our customers’ financial hopes and ambitions.

| | | |

Tony Comper

President and Chief Executive Officer | |  |

| | | |

| “Investors look to BMO for relatively high returns at relatively low risk.” | | |

As the customer stories featured in this report so vividly illustrate, at BMO Financial Group we are dedicated to the proposition that the surest route to strong returns for our shareholders is to deliver, first and foremost, truly exceptional service to our customers – exceeding their expectations and meeting more of their needs. This intense focus on developing lasting customer relationships requires disciplined execution of every task by every colleague every day.

Investors look to BMO for relatively high returns at relatively low risk. Stable, consistent and reliable returns. We are working hard to live up to our reputation, building on the distinctive BMO strengths highlighted in this report, notably credit and commercial leadership and our unparalleled U.S. operations.

We increased earnings per share by 9% in 2005 (excluding changes in the general allowance), bringing BMO’s three-year annual EPS growth rate to an outstanding 20%. Return on equity was 18.8%. We also raised dividends twice as the value of dividends declared rose 16% from 2004 to $1.85 per share. Overall we surpassed four of our five financial targets for the year (see page 3), falling short on our aggressive productivity target while still delivering the second-best productivity ratio in our Canadian peer group. We have improved the cash productivity ratio by a total of 540 basis points over the past three years, creating a strong culture of cost discipline that will serve BMO well for years to come.

We are also aware that revenue growth is the primary driver of shareholder value creation for top-performing companies, and we are determined to continue to improve productivity in 2006 through a stronger emphasis on increasing revenues. While preserving BMO’s hard-won achievements in productivity improvement, we will seek opportunities to accelerate revenue growth both organically and through acquisitions.

Our financial targets for the year ahead (see next page) reflect the management team’s continuing confidence in BMO’s enterprise growth strategy, which is to grow our core Canadian businesses and accelerate our expansion in the United States. The targets also reflect our assessment of economic and market conditions in 2006. An ongoing challenge for BMO and our entire industry is the narrowing of the spread between lending and borrowing rates. Nonetheless, our domestic bank has done a good job of maintaining margins and we are encouraged by the favourable relative performance of our Canadian personal and commercial and private client businesses. In the United States, where relative performance was also very good after factoring out the impact of acquisition costs, we continue our hunt for personal and commercial acquisitions that will accelerate progress toward our goal to transform Harris into a “super-regional” player as the leading personal and commercial bank in the U.S. Midwest.

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 5 |

Chief Executive Officer’s Message to Fellow Shareholders

We are not content to see ourselves as one of the big Canadian banks with a niche play in the U.S. market. We want to be acknowledged as #1 in the markets where we have chosen to compete. And we want to be seen for what we are: the most successful Canadian bank in the United States.

Management is confident in the strategic course we have set. In its five-year global ranking of large cap financial services companies published in May 2005, The Boston Consulting Group ranks BMOsecond in the world with an average Risk-adjusted Relative Total Shareholder Return of 12.9%. We believe our consistent and disciplined approach, in combination with BMO’s differentiating strengths, will enable us to continue to outperform globally, propelling BMO closer to our long-term vision to become the top-performing financial services organization in North America.

BMO has led the Canadian banking industry in credit performance in 14 of the past 15 years. The only exception was 2001, when our advanced credit culture led us to be early recognizers of emerging problems that hit our peers’ results harder the following year. We believe this strength will increasingly differentiate BMO as the credit cycle progresses and investors

recognize the value of our ability to maintain consistent underwriting standards through good and bad times. There is good alignment of BMO values with the values and needs of our customers. They know they can count on BMO.

While we are using our credit expertise to drive growth in all our businesses, we believe it will be particularly helpful in extending our existing leadership in commercial banking in North America. Even in an increasingly competitive Canadian market where others are re-focusing on their personal and commercial businesses, BMO’s relationship-building approach has enabled us to gain and maintain a market leadership position over time. And we are a leading commercial player in our chosen U.S. markets, through both Harris’ increasing business banking operations in the greater Chicago area and Harris Nesbitt’s well-entrenched mid-market client base in the Midwest.

| | | | | | | |

9.0%

Earnings per Share Growth

(excluding changes in the general allowance)

| | | 10.25%

Tier 1 Capital Ratio

| | | Targets for 2006

5%to10%EPS growth from a base

of $4.59 (excluding changes in the

general allowance)

ROE of17%to19%

|

18.8%

Return on Equity

$219million

Specific Provision for Credit Losses | | | 120basis points

Improvement in

Cash Productivity Ratio | | | Specific provision for credit losses

of$400 millionor less

Tier 1 Capital Ratio of at least8.0%

Improve our cash productivity ratio

by100to150 bps |

| | | |

| 6 | | BMO Financial Group 188th Annual Report 2005 |

BMO’s most important differentiating strength is the quality of our people, whose expertise, dedication and sheer enthusiasm are unsurpassed in our industry. It is great to see my colleagues rising to the challenge of creating a peak-condition, higher-performing organization.

Given all the work under way to meet more of our customers’ needs, our commercial clients provide an excellent pipeline to expand our personal banking and wealth management businesses. And we are gathering evidence of a new growth opportunity: seamless solutions for customers with financial interests in both Canada and the United States. None of our competitors is as well positioned as we are to fill this growing need.

A singular strength in this regard is our well-established, integrated U.S. operations. Including our acquisition of Harris in 1984, we have invested $2.4 billion in U.S. retail acquisitions, transforming a handful of private Chicago banks into a community banking network of nearly 200 branches in the Chicago area and Northwest Indiana. A highlight of 2005 was the successful consolidation of the Harris bank charters into one national charter with no disruption to customer service – the latest in a series of major investments to create a highly efficient back office while maintaining the best of the Harris community banking heritage. These investments, plus the invaluable experience we have gained from our acquisitions to date, position us well to increase revenues while managing costs as we continue the expansion of our Harris personal and commercial operations beyond the Chicago area and Northwest Indiana in the Midwest. We are now aiming to double our network to 350 to 400 branches over the next five years.

What will it take for Harris to become the leading personal and commercial bank in the U.S. Midwest? We need to grow faster from a core business perspective

than our competitors, lead the market in customer service scores, continue to improve productivity and profitability, and acquire suitable properties as they become available. And this is what we intend to do. We are not content to see ourselves as one of the big Canadian banks with a niche play in the U.S. market. We want to be acknowledged as #1 in the markets where we have chosen to compete. And we want to be seen for what we are: the most successful Canadian bank in the United States.

In my message to shareholders last year I explained that we have set our sights on becoming our industry’s top performer because we should (we need to reach for the top in order to get there); and because we can. I continue to believe that BMO’s most important differentiating strength is the quality of our people, whose expertise, dedication and sheer enthusiasm are unsurpassed in our industry. It is great to see my colleagues rising to the challenge of creating a peak-condition, higher-performing organization.

Despite the growing complexity of financial services – perhaps because of it – our fundamental job has never been simpler. We come to work each day to help our customers achieve their financial hopes and ambitions. If we keep this top of mind, there is no limit to BMO’s potential for growth.

/s/ Tony Comper

Tony Comper

President and Chief Executive Officer

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 7 |

2005 Financial Review

In more challenging times, we continue to perform well

In 2005, BMO once again achieved record results. We attribute our success to our focus every day on revenue growth, continued productivity improvement and superior credit management.

| | | | | |

| | |  | | Karen Maidment

Senior Executive Vice-President and Chief Financial Officer |

| | | | | “Over the past five years, shareholders have earned an average annual total return of nearly 14%.” |

Every day at BMO Financial Group, our goal is to ensure that we grow and protect the long-term value of our shareholders’ investments. While in 2005 we produced a total shareholder return for the year of 4%, over the past five years shareholders have earned an average annual total return of nearly 14%. This compared to the S&P/TSX Composite average annual total return of 3% over the same period. Net Economic Profit (NEP), another key value measure, remained high at $1,120 million, just below last year’s record level, despite higher capital, as each operating group’s NEP rose.

We surpassed four of the five financial targets we set for the year, including targets for earnings growth and return on

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | 2005 Canadian Bank Scorecard(%) | |

| | | |

| | | | | BMO | | | | RBC | | | | CIBC | | | | Scotia | | | | TD | | | | National | | |

| | | | | | | | | | | | | | | | | | | | | |

| | Average annual total shareholder return (5-year) | | | | 13.8 | | | | | 14.8 | | | | | 11.9 | | | | | 18.1 | | | | | 9.1 | | | | | 22.5 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | EPS growth | | | | 5.0 | | | | | 21.3 | | | | | (108.3 | ) | | | | 11.7 | | | | | (5.6 | ) | | | | 21.0 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | Return on equity | | | | 18.8 | | | | | 18.0 | | | | | (1.6 | ) | | | | 20.9 | | | | | 15.3 | | | | | 20.7 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | Net economic profit growth2 | | | | (0.3 | ) | | | | 30.3 | | | | | (162.2 | ) | | | | 16.3 | | | | | (29.7 | ) | | | | 31.9 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | Revenue growth1,2 | | | | 5.0 | | | | | 6.1 | | | | | 6.2 | | | | | 4.2 | | | | | 11.7 | | | | | 5.5 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | Cash productivity ratio2 | | | | 62.6 | | | | | 68.2 | | | | | 85.5 | | | | | 56.1 | | | | | 67.4 | | | | | 64.9 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | PCL as a % of average net loans and acceptances | | | | 0.11 | | | | | 0.20 | | | | | 0.43 | | | | | 0.12 | | | | | 0.03 | | | | | 0.06 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | o BMO equal to or better than other bank (17/35) | |

| | o BMO worse than other bank (18/35) | |

| | | |

| | |

| 1. | | On a taxable equivalent basis.

|

| |

| 2. | | Non-GAAP measure. See page 35. |

equity. Our productivity ratio improved significantly by 120 basis points, but was short of our target in a challenging revenue environment. We earned record net income of $2,400 million for the fiscal year, an increase of $94 million or 4% from our extremely successful result in 2004. Our earnings per share (EPS) rose 5% to $4.64, representing an annual compound EPS growth rate of 20% over the last three years, and cash EPS was $4.79, also up 5%.

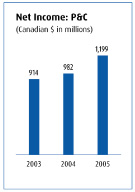

Operating Groups

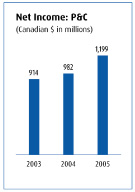

Each of our client operating groups delivered record results with our retail and business banking and wealth management businesses contributing significantly to our success. Our Personal and Commercial Client Group (P&C) earned net income of $1,199 million, up $217 million or 22% from a year ago. Our Private Client Group (PCG), meanwhile, earned net income of $320 million, up $93 million or 41%. Investment Banking Group (IBG) earned net income of $852 million, up $20 million or 3% from 2004.

Increased Revenue

Revenue continued to grow, increasing $470 million or 5% to $9,958 million. There was strong growth in P&C, which benefited from higher product volumes, insurance and card fee revenues. There was also growth in PCG full-service investing, mutual fund and term investment product revenues. Not surprisingly, revenue declined in IBG as increased trading revenues and advisory fees were more than offset by reduced revenues from interest-rate-sensitive businesses, which were adversely affected by a flatter yield curve and competitive market conditions.

| | | |

| 8 | | BMO Financial Group 188th Annual Report 2005 |

Productivity Improvement

Improving cash productivity, particularly through top-line revenue growth, is a key component of enhanced shareholder value and continues to be a top priority at BMO. Over the last three years, we have improved our productivity ratio by 540 basis points – while continuing to invest in our business. In 2005, our cash productivity ratio was 62.6%, a 120 basis point improvement from 2004. Both P&C and PCG made significant improvements in productivity, driven by strong revenue growth, but IBG’s productivity worsened in the challenging interest rate environment described above. Although we fell short of our target to improve our productivity ratio by 150 to 200 basis points in 2005, we remain encouraged by our significant and steady progress in recent years.

Credit Risk Management

In 2005, provisions for credit losses increased by $282 million, mostly due to lower reversals and recoveries and a lower reduction in the general allowance this year. The provision in 2005 was $179 million, consisting of $219 million of specific provisions and a $40 million reduction in the general allowance for credit losses. Although in marked contrast to a $103 million net recovery of credit losses in 2004, which included specific provisions of $67 million and a $170 million reduction in the general allowance, our provisions in 2005 were actually lower than the targets we established at the beginning of the year when we anticipated a weaker credit environment. BMO’s top-tier credit management continues to distinguish us from our peers.

Foreign Exchange

Although the Canadian dollar continued to strengthen in 2005, we managed the effects of foreign exchange fluctuations effectively, holding the negative impact on our bottom line to $42 million.

Capital

In 2005, our Tier 1 Capital Ratio increased to 10.25%, up from 9.81% a year ago and well above our target. It’s a result that mirrors our strong earnings, particularly in the fourth quarter

| | | | | | |

| | | | | | |

| | | |

| | 2005 Economic Climate:

Weathering the Storms | |

| | | |

| | | | | | |

| | | | | | |

| | Flatter Yield Curve

The flattening of the yield curve –the narrowing gap between long and short-term interest rates –caused some investors to worry about a potential market slowdown. The flatter curve also had a significant impact on our industry, resulting in lower net interest margins which reduced revenue growth, particularly in wholesale businesses.

Dollars Up and Down

In Canada, exporters were negatively affected as the Canadian dollar rose to its highest levels in 13 years. Meanwhile, businesses and consumers in the United States grappled with the downside of a falling dollar.

Soaring Oil Prices

Canadians and Americans also found themselves coping with higher prices for gasoline, home heating oil and natural gas as energy prices soared. Although oil production and refining operations located along the U.S. Gulf Coast did not suffer the full force of hurricanes Katrina and Rita, | | | there’s no question that the damage caused by the great storms put upward pressure on already high oil and natural gas prices.

Consumer Confidence

As the year moved into the third quarter, it’s perhaps not surprising that the combination of currency fluctuations, higher commodity prices and natural disasters caused a drop in consumer confidence on both sides of the border.

Fundamental Strength

In spite of these developments, the Canadian and American economies remained fundamentally strong. In 2005, the U.S. economy is estimated to have expanded at an above-potential pace while the Canadian economy recorded a respectable, albeit more moderate advance. Meanwhile, on both sides of the border, consumers continued to spend and take advantage of the still-low interest rate environment to buy homes and other goods. For its part, business ramped up investment spending. | |

| | | | | | |

| | | | | | |

of the year when our net income increased by 20%, and also reflects the sale of Harrisdirect.

We have the right strategy to grow our business and best serve our shareholders. BMO’s differentiating strengths, our focus on growing revenues to improve our productivity as well as our strong capital base position us well for the future.

| | | | | | | |

$2,400

million

Net income – up 4%

$4.64

Earnings per share – up 5% | | | $9,958

million

Revenue (teb) – up 5%

13.8%

Average annual total shareholder return (5-year) | | |  |

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 9 |

In Canada

“BMO’s people took the time to understand

our business and our industry.”

We are committed to helping our clients across Canada succeed.

This means tailoring financial solutions that meet all of their individual financial needs and providing exceptional service that can help them achieve every goal, every dream.

Client Profile: Gienow Windows and Doors Income Fund

Taking the time to understand

When a group of Calgary businessmen, including Dave Munro and Dennis Zentner, purchased Gienow Building Products Ltd. in 1983, their vision was to transform the local window and door manufacturer into a leading national company. It’s a goal they have realized. Today, Gienow employs 1,400 people, boasts manufacturing and distribution facilities from British Columbia to Quebec, and sells its products across Canada as well as in the United States, Europe and Asia.

BMO has been a partner in Gienow’s journey. Says Neil Runions, Senior Manager, Corporate Finance Division at BMO Bank of Montreal, “Although our relationship with Gienow is relatively new, it has proven to be significant.” BMO has helped the company obtain the financing it needed to grow its business both organically and through acquisitions, and has provided tailored cash management services. In 2001, BMO Bank of Montreal provided senior debt financing to Gienow, enabling the company to consolidate its presence in Western Canada. More recently, the Bank led a loan syndication to expand Gienow’s credit facilities and BMO Nesbitt Burns co-led a syndication that assisted Gienow in its conversion to an income fund. Capital raised through Gienow’s initial public offering in 2004, combined with loan facilities, made it possible for the company to acquire Farley Windows of Alexandria, Ontario in 2004 and Chantecler Windows and Doors Inc.

of Gatineau, Quebec in 2005, giving Gienow a firm foothold in Eastern Canada.

“BMO’s people took the time to understand our business and our industry,” explains Dave Munro, President and CEO at Gienow. “Representatives from across the BMO organization came together, looked at our financial needs and came back with a solution that recognized our success and reflected our growth strategy and vision. We feel that BMO is part of our team.”

“BMO looked at our financial needs and came back with a solution that recognized our success and reflected our growth strategy and vision.”

Dave Munro, President and CEO

Gienow Windows and Doors Income Fund

Commercial banking clients since 2001

| | | | | |

#2 | | $34billion | | 1,900 |

| BMO has the second largest market share in business lending in Canada. | | BMO participated in 268 corporate equity transactions that raised $34 billion for Canadian companies. | | Across Canada, we have a total of 1,900 investment professionals located in BMO branches and offices – a reflection of BMO’s commitment to providing our customers with the depth and breadth of financial products and services they need. |

| | | |

| 10 | | BMO Financial Group 188th Annual Report 2005 |

Dave Munro, President and CEO, Gienow Windows and Doors Income Fund

| | | | | |

| | | Left to right:

David Farmer, Vice President and Underwriter Corporate Finance Loan Syndications, BMO Bank of Montreal

Debra Puckett, Business Development Leader,

Cash Management BMO Bank of Montreal

Neil Runions, Senior Manager, Corporate Finance Division, BMO Bank of Montreal | |  |

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 11 |

In the United States

“Harris is a bank that stands for continuity and trust in our community.”

Through organic growth and acquisition, and by providing every customer every day a range and depth of products and services, Harris is well on the way toward achieving our goal of becoming the leading Midwest personal and commercial bank in the United States.

Client Profile: Namasté Laboratories

Looking out for our interests

In 1998, shortly after the sale of a family business, Chicagoan Gary Gardner turned to Harris to help him manage his financial affairs. He sought the services of Harris Private Bank to oversee his personal accounts as well as those belonging to his wife, Denise, and their two college-aged sons. He also looked to Harris to provide lending and cash management services for a new business venture, Namasté Laboratories, which develops and markets natural organic hair, skin and body renewal products to the multicultural market.

Why Harris? “That’s easy,” says Gardner. “There is so much change going on in the financial services industry in the U.S. Midwest. Amid all the flux, Harris is a bank that stands for continuity and trust in our community.”

Seven years later, Gardner remains more than pleased by his choice.“Harris is a strong partner,” he says.“It provided the support we needed when Namasté was developing its business. And it continues to look out for our interests as we expand. Just recently, for instance, Joe Dillon and his Harris relationship team encouraged us to take advantage of an interest rate risk management strategy that would protect our term loan against any future interest rate hikes. It’s already proven to be good advice.”

Gardner is equally happy with his private banking service. “I particularly appreciate that Mike Stanton and his colleagues at Harris Private Bank have taken the time to help my sons learn about matters ranging from portfolio management to buying a car,” he says. “It’s very important to me that they have a knowledge and understanding of financial matters. After all, the family business will be theirs one day.”

“I particularly appreciate that

Harris Private Bank has taken the

time to help my sons learn about

matters ranging from portfolio

management to buying a car.”

Gary Gardner, President

Namasté Laboratories

Commercial banking clients since 1998

| | | | | |

195branches | | 89% | | #1 |

| | | | | |

Harris’ community banking network has grown to

195 branches offering personal and business clients

a full suite of financial products and services. | | Harris retains 89% of its business banking customers, compared to the industry average of 83%. | | Harris is tied for first in both the small and

micro-business segments and is among

the Top 3 in the commercial mid-market

segment in Chicagoland. |

| | | |

| 12 | | BMO Financial Group 188th Annual Report 2005 |

Right:Gary Gardner,President, Namasté Laboratories with model and stylist

| | | | | |

| | | Left to right:

Joe Dillon,Market Manager, Harris

Nellie Tomicich, Assistant Vice President, Cash Management Specialist, Harris

Mike Stanton,Managing

Director, Harris Private Bank | |  |

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 13 |

Cross Border

“We liked the all-encompassing nature of BMO’s offering on both sides of the border.”

Every day, BMO is winning business thanks to our unique and proven ability to provide integrated North American solutions that help our Canadian and American clients expand their operations across our shared border.

Client Profile: Sanimal Inc.

Sharing our excitement and our future

In the summer of 2004, the executive team at Sanimal Inc. agreed to acquire Wisconsin-based Anamax Group of Companies. Sanimal, a family-owned business, is the largest animal rendering company in eastern Canada, employing over 900 people.

As the deal was being completed in January 2005, Martin Couture, President, Sanimal Inc. received a telephone call. It was Richard Nadeau,Vice-President Corporate Finance at BMO Bank of Montreal. “When we learned of Sanimal’s plans, we thought that given our scope and expertise in both Canada and the United States, BMO had much to offer,” says Nadeau.

After an initial meeting with BMO, Sanimal’s leadership team agreed. “We liked the all-encompassing nature of BMO’s offering on both sides of the border,” says Sanimal CFO Claude Saulnier. He was also pleased to see at the table Brian Moeller, Managing Director, Food Group at Harris Nesbitt in Chicago and a well-known expert in the rendering industry.

It was the beginning of a lasting relationship. Over the next several months, BMO put together a North American solution for Sanimal that included a private placement arranged by Harris Nesbitt’s New York office as well as senior debt financing packaged jointly by BMO Bank of Montreal in Montreal and Harris Nesbitt in Chicago. Sanimal, which had been the client of

a competitor for 25 years, also transferred its cash management business on both sides of the border to BMO Bank of Montreal. At the same time, the company’s principals chose to transfer their personal accounts to BMO Harris Private Banking.

“It was not an easy decision to change our financial services provider,” says Couture. “But BMO’s offer was simply better. Just as important is that BMO’s people share our excitement and enthusiasm about our plans and future. Our company wants to continue to expand in the United States. We believe BMO is a partner with the expertise, professionalism and will to help us realize our goal.”

“BMO’s people share our excitement and enthusiasm about our plans and future.”

Martin Couture, President

Sanimal Inc.

Commercial banking clients since 2005

| | | | | | | |

$1.4 | | billion

(US)

| | 50years | | 1stfor customers |

| | | | | |

| Harris has become one of the leading commercial banks in the Chicago area, adding US$1.4 billion in business banking loans and US$900 million in business banking deposits between 2001 and 2005. | | BMO’s more than 50 years of expertise in the food and agricultural business in the United States is well recognized. | | In 2005, our Personal and Commercial Client Group established its first Chicago-based unit to coordinate organization-wide capabilities for customers needing banking services on both sides of the border. |

| | | |

| 14 | | BMO Financial Group 188th Annual Report 2005 |

Left to right (all from Sanimal Inc.):Claude Saulnier,Vice-President Finance;André Couture, Chairman;

Julie Couture,Board Member;Martin Couture,President

| | | | | |

| | | Left to right:

Brian Moeller,Managing Director, Food Group, Harris Nesbitt

Luc Bernier,Senior Manager, Corporate Finance Division, Personal and Commercial Client Group, BMO Bank of Montreal

Amy Lauterjung, Director, U.S. Debt Products Group, Harris Nesbitt

Richard Nadeau,Vice-President, Corporate Finance Division, Personal and Commercial Client Group, BMO Financial Group

Norman Shaffer, Managing Director, U.S. Debt Product Group, Harris Nesbitt | |  |

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 15 |

Credit Risk Management

Leadership in

Credit Risk Management

Our record of excellence in credit risk management

is a fundamental strength that benefits both our

customers and our shareholders.

At BMO, a disciplined, consistent and prudent approach to credit risk is a core value. We don’t follow the pack to embrace the latest favourite sector or product, nor do we change our lending criteria according to whether the economy is growing or slowing. All significant commercial and corporate lending proposals are thoroughly investigated and analysed and credit decisions are made by experienced, well-trained and fully qualified personnel supported by time-tested policies and procedures. As a result of our industry-leading credit loss history and our transparency in credit reporting, we are a recognized leader in credit risk management.

A Better Deal for our Clients

What does BMO’s disciplined, consistent and prudent approach to credit risk management mean to our clients?

It means that they can rely on us in good times and, more importantly, in bad times. Our focus on consistency means we maintain the same underwriting standards throughout the credit cycle, whereas many lenders tighten their standards in response to deteriorating loan portfolios. It’s a fact that lenders who have opened the vaults too wide in bullish times often retrench when the economy contracts. It’s a pattern that can be unsettling at the least, and at the worst, disastrous for clients.

BMO’s approach is rather to deal with tough times by doing what we reasonably can to maintain valued relationships with our clients. Across Canada, members of our risk management groups have the mandate, training and resources necessary to work closely with customers to provide meaningful solutions tailored to their situations and needs.

A case in point involves our partnership with Canadian cattle ranchers following the crisis that developed when an Alberta cow tested positive for Bovine Spongiform Encephalopathy (BSE) in 2003. It was an event that prompted countries including the United States and Japan to close their borders to Canadian cattle. Reasoning that this difficult situation was beyond our customers’ ability to contend with on their own, we introduced BMO Bank of Montreal’sBSE Disaster Assistance Program, which allowed customers dealing with hundreds of thousands of dollars in lost income to defer principal payments on their loans until conditions improved.

As expected, conditions did improve. Last summer, the United States reopened its border to young Canadian cattle and our clients were back in business. And that, after all, is the point.

Better Results for Shareholders

What does our credit risk management approach mean for our shareholders? It’s simple. We gain market share without increased risks as the credit cycle deteriorates while many of our peers tighten their credit standards.

It also means better returns. Excellence in managing credit risk assets enables us to provide more predictable and consistent returns over time than our peers. Over the past 15 years BMO’s average credit loss was 36% below the average of its Canadian peer group. In 14 of those 15 years BMO’s credit losses were better than the average of its peer group. The one exception was 2001 when BMO recognized early losses associated with the telecom industry.

This early recognition of credit losses is a hallmark of our leading credit disclosures: we are vigilant in recognizing deterioration in credit assets and continually seek to provide the most meaningful information for shareholders and investors to enable them to accurately assess our credit quality. In 2004 we were the first Canadian bank to distinguish new specific provisions from reversals and recoveries in our specific provision for credit losses. This information assists investors in understanding emerging losses. Similarly, our disclosure of new impaired loans provides a leading indicator of potential future loss.

| | | |

| 16 | | BMO Financial Group 188th Annual Report 2005 |

Corporate Governance

Corporate Governance

Through our steadfast commitment to sound

principles of corporate governance, we strive

to retain the trust of every shareholder.

BMO Financial Group has a long-standing tradition as a leader in corporate governance. As we move forward, we strive to remain at the forefront of best practices.

Board Leadership, Independence and Accountability

Sound governance and ethical behaviour begin with our Board of Directors, which represents and is accountable to our shareholders and also sets the standard of good governance for the entire enterprise. The Board’s Governance and Nominating Committee is responsible for shaping our corporate governance policies and practices. The committee keeps abreast of developments in the world of corporate governance and oversees our compliance. When appropriate, it recommends new practices to the Board that will keep us at the forefront of best practices.

At BMO we believe that having independent directors –including our chairman – helps the Board operate autonomously and ensures that we are accountable to all our stakeholders. All our directors, with the exception of the CEO, are currently independent. Chairman David Galloway ensures that the Board operates independently of management and that directors have access to an independent leader.

Mr. Galloway is anex-officio member of all Board committees of which he is not a member. In that role he is able to manage the affairs of the Board, assisting the committees and the Board to function effectively and meet their responsibilities.

Annual Director and Committee Reviews

The effectiveness of the Board’s operations is monitored by annual evaluations of the Board, its committees and each director. The director evaluations are carried out through a “peer” performance review – one of the first of its kind in Canada –

| | | |

| | | |

| | | |

| | Recognition for Excellence in Disclosure

and Corporate Governance | |

| | | |

| | | |

| | | |

| | In 2005,Canadian Businessmagazine named BMO’s Board of Directors “Best Board in Canada.” BMO scored 99 out of a possible 100 points in the survey, which assessed companies on the basis of accountability, board independence, disclosure, three-year total return and three-year return vs. the S&P/TSX. | |

| | | |

| | | |

| | | |

| | The Globe and Mail’sReport on Businessannual review of corporate governance practices ranked BMO second overall among 209 Canadian reporting issuers. | |

| | | |

| | | |

| | | |

| | The Canadian Institute of Chartered Accountants’ annual Corporate Reporting Awards gave us the Award of Excellence in the financial institutions category and gave BMO an Honourable Mention for Excellence in Electronic Disclosure. | |

| | | |

| | | |

| | | |

| | Enterprise.com, a Europe-based researcher and publisher that conducts an annual review of corporate annual reports, has ranked each of our last six Annual Reports among the world’s top 30. Our last Annual Report was ranked 20th best in the world and our “Financial and Performance Reporting” was ranked No.1. | |

| | | |

| | | |

| | | |

| | I.R. Global Rankings recognized our investor relations web site for its timely and accurate disclosure of information for investors. | |

| | | |

| | | |

Board of Directors

The Board of Directors, either directly or through Board committees, is responsible for the management or supervision of management of the business and affairs of the Bank with the objective of enhancing shareholder value. Our Board is comprised of 14 independent directors and one management director, the President and CEO Tony Comper.

| | | | | |

Robert M. AstleyWaterloo, ON Corporate Director and former President and Chief Executive Officer Clarica Life Insurance Company and former President Sun Life Financial Canada | |

Stephen E. Bachand

Ponte Vedra Beach, FL

Corporate Director and retired President and Chief Executive Officer Canadian Tire Corporation, Limited | |

David R. Beatty, O.B.E.

Toronto, ON

Chairman and Chief Executive Officer Beatinvest Limited |

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 17 |

Corporate Governance

Corporate Governance at BMO Financial Group

For more details regarding corporate governance at BMO, please see the following documents, which are posted on our web site – www.bmo.com.

Notice of Annual Meeting of Shareholders and Proxy Circular– Shareholders are invited to attend our Annual Meeting on March 2, 2006 at 9:30 a.m. in Calgary, Alberta or view a webcast of the event. Details of the webcast are available on our web site.

Corporate Governance– Our web site contains information on our corporate governance practices, including our code of conduct, titledFirst Principles, ourDirector Independence Standardsand Board and Committee Charters.

Proxy Circular– Our Proxy Circular contains information on each of the directors, Board Committee reports and a complete discussion of our corporate governance practices.

BMO Corporate Social Responsibility Report including ourPublic Accountability Statement– This annual report documents our corporate citizenship activities throughout the year. The 2005 report will be released in February 2006.

Each of the above documents is available in print to any shareholder upon request.

which is a comprehensive survey that requires all directors to assess the contribution of each of their peers on measures ranging from ethics to strategic insight, financial literacy and business judgment.

Governance Beyond Compliance

The Board of Directors serves as an example to our entire organization by affirming that sound corporate governance means not just abiding by the rules but also embracing the spirit of those rules. In fact, some of our corporate governance practices go beyond the requirements of the law.

We are committed to building on our success in the area of corporate governance, so that we remain at the forefront of best practices. At BMO, we recognize that our governance standards must respond to changes in our organization, stakeholder expectations, regulatory requirements and evolving best practices.

Continuously Enhancing Disclosure

BMO considers disclosure to be an essential component of effective corporate governance. To a large extent, the success of the multitude of regulatory requirements, voluntary best practices and an organization’s own culture of integrity is determined by the degree to which all stakeholders of the organization are able to truly understand its operations, goals and values as well as the extent of its assets in comparison to its liabilities.

Our efforts to continuously enhance public disclosure have made us an innovator in this area. Our Board encourages, and management actively seeks, ways to provide more information, clarity and insight to our stakeholders. A hallmark of our annual report is our financial performance scorecard, which made us a pioneer in financial disclosure. The scorecard is a report and comparison of eleven important financial measures including shareholder return, return on equity, earnings per share growth, productivity and credit performance. We disclose our performance on these measures relative to Canada’s major banks and our North American peer group.

We believe that assessing performance relative to our competition puts results in an appropriate context for our stakeholders and provides further clarity. BMO has disclosed these comparatives every year since it started the practice in 1992,

| | | |

| 18 | | BMO Financial Group 188th Annual Report 2005 |

reporting in good years and in bad. We believe that when we are open and honest in explaining results we earn the trust of stakeholders over the long term.

Stock Exchange Guidelines

As a Canadian reporting issuer with securities listed on the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE), our corporate governance practices meet, and in some cases exceed, the applicable guidelines adopted by the Canadian Securities Administrators (CSA), the rules of the U.S. Securities and Exchange Commission (SEC) which give effect to the provisions of theSarbanes-Oxley Actand the NYSE standards. Our governance practices differ significantly in only one respect from those required of U.S. domestic issuers under the NYSE standards. The NYSE standards require shareholder approval of all equity compensation plans and any material revisions to such plans, regardless of whether the securities to be delivered under such plans are newly issued or purchased on the open market, subject to a few limited exceptions. The TSX rules only require shareholder approval of equity compensation plans that involve newly issued securities, subject to a few limited exceptions. The TSX rules require that equity compensation plans that do not provide for a fixed maximum number of securities to be issued must have a rolling maximum number of securities to be issued based on a fixed percentage of the issuer’s outstanding securities and must be approved by shareholders every three years. If the plan provides a procedure for its amendment, the TSX rules require shareholder approval of amendments only where the amendment involves a reduction in the exercise price or an extension of the term of options held by insiders.

Honorary Directors

| | | |

Charles F. Baird | | J. Peter Gordon, O.C. |

| Skillman, NJ, U.S.A. | | Burlington, ON |

Ralph M. Barford | | Richard M. Ivey, C.C., Q.C. |

| Toronto, ON | | London, ON |

Matthew W. Barrett, O.C., LL.D. | | Senator Betty Kennedy, O.C., LL.D. |

| London, ENG | | Campbellville, ON |

Peter J. G. Bentley, O.C., LL.D. | | J. Blair MacAulay |

| Vancouver, BC | | Oakville, ON |

Claire P. Bertrand | | Ronald N. Mannix, O.C. |

| Montreal, QC | | Calgary, AB |

Frederick S. Burbidge, O.C. | | The Honourable Frank McKenna |

| Frelighsburg, QC | | Cap Pelé, NB |

Pierre Côté, C.M. | | Robert H. McKercher, Q.C. |

| Quebec City, QC | | Saskatoon, SK |

C. William Daniel, O.C., LL.D. | | Eric H. Molson |

| Toronto, ON | | Montreal, QC |

Graham R. Dawson | | William D. Mulholland, LL.D. |

| Vancouver, BC | | Georgetown, ON |

Louis A. Desrochers, C.M., c.r. | | Jerry E. A. Nickerson |

| Edmonton, AB | | North Sydney, NS |

A. John Ellis, O.C., LL.D., O.R.S. | | Lucien G. Rolland, O.C. |

| Vancouver, BC | | Montreal, QC |

John F. Fraser, O.C., LL.D. | | Joseph L. Rotman, O.C., LL.D. |

| Winnipeg, MB | | Toronto, ON |

Thomas M. Galt | | Mary Alice Stuart, C.M., O.Ont., LL.D. |

Toronto, ON

| | Toronto, ON |

| | | |

| BMO Financial Group 188th Annual Report 2005 | | 19 |

Employees

Ours is a culture that embraces diversity, delivers opportunity and demands respect for all

We are committed to ensuring a workplace where the voice of every colleague is listened to and encouraged.

| | | | | | |

| | | | | | |

| | 2005 Awards | | | Awarded by | |

| | | | | | |

| | Canada’s Top 100

Employers | | | BMO was named one of Canada’s Top 100 Employers byMaclean’smagazine and Mediacorp Inc. for the fourth consecutive year. Once again, BMO was the only major Canadian bank included on this prestigious list. | |

| | | | | | |

| | Best in Class

Diversity Program Award | | | BMO was recognized by International Quality & Productivity Center for having a successful diversity program, which demonstrates best practices and has key leadership support. | |

| | | | | | |

| | Diversity Leader of

the Year Award | | | Tony Comper, President and CEO of BMO Financial Group, was recognized by International Quality & Productivity Center for his leadership in initiating and implementing successful diversity programs that are integrated throughout the organization. | |

| | | | | | |

| | Training Top 100 | | | BMO Financial Group ranked 16th overall inTrainingmagazine’s Top 100 North American corporations in 2005. For the fourth consecutive year, BMO was the top Canadian company on the list. | |

| | | | | | |

| | Award of Excellence:

Corporate Category | | | The Canadian Race Relations Foundation recognized BMO Financial Group for excellence and innovation in race relations practice in Canada. | |

| | | | | | |

| | Most Innovative

Recruiting & Staffing

Program/Initiative

| | | BMO Financial Group Bank-wide Student Training Program was recognized with a Recruiting & Staffing Best in Class Award from International Quality & Productivity Center. | |

| | | | | | |

| | Diamond Club | | | BMO was recognized by the Canadian Paraplegic Association for outstanding corporate philanthropy and service. | |

| | | | | | |

At BMO, we are proud of our reputation as an employer of choice. It attests to the emphasis we place on

getting it rightwith our employees, which helps enhance our ability to attract and retain top people and fosters top performance. Getting it right with our employees helps them get it right with our customers.

Listening to Our People: Annual Employee Survey

Getting it right involves an ongoing dialogue. For more than 20 years, we have sought out – and listened to – the views of our people through our Annual Employee Survey (AES). The AES provides vital information about our employees’ experiences and opinions. It is an essential part of our journey to be the top-performing financial services company in North America and a vital tool in honing our customer service practices.

The results of our 2005 AES were encouraging. The participation rate of 88% was the highest ever. Meanwhile, our Enterprise Engagement Index, which represents the strength of our overall relationship with employees, is at its highest point since the index was introduced in 2001.

Diversity: An Ongoing Commitment

BMO’s commitment to ensuring a diverse culture remains strong. In 1990, we launched groundbreaking task forces on the advancement of women, visible minorities, people with disabilities and Aboriginal employees. The reports helped generate fact-based diversity and workplace equity goals and led directly to the development of numerous tools and programs designed to recognize, monitor, and eliminate barriers to advancement.

We are proud of our diversity achievements. But we are not satisfied. We recently introduced an initiative designed to build on our current leadership position and set our diversity strategy for the next 10 years. EntitledAbove & Beyond, the program will ensure that we maintain and strengthen our international recognition for diversity and equity.

| | | |

| 20 | | BMO Financial Group 188th Annual Report 2005 |

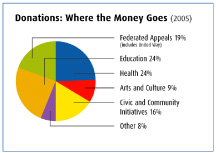

Community

A tradition of giving back to our communities

Every day, we are helping to make our communities stronger, happier places to live and work.

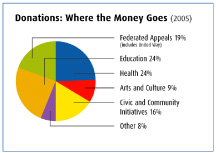

BMO is one of Canada’s most generous corporate benefactors. Through our donations and sponsorship programs, we contribute to causes that include education, health, arts and culture, community development and sports and athletics. Our efforts are augmented by our people, thousands of whom give substantial amounts of their time, energy and income to support their communities.

Physicians for the North

Providing excellent health care to every Canadian is a societal responsibility – and a challenge. With both these truths in mind, we announced our support for two innovative programs developed to train physicians for practice in northern and rural communities. In British Columbia, BMO committed $150,000 over five years to support theNorthern Medical Programs Trustat the University of Northern British Columbia in Prince George. It is expected by 2015 that 150 students will have graduated from this program. In Ontario, we have pledged $100,000 over four years to establish theBMO Financial Group Bursary Fundat Northern Ontario School of Medicine (NOSM). With main campuses located in Thunder Bay and Sudbury, NOSM is the first new medical school in Canada in more than 30 years.

Supporting the Arts