EXHIBIT 99.1

Wescast Industries Inc.

RENEWAL ANNUAL INFORMATION FORM

For the Year Ended January 2, 2005

March 18, 2005

Presentation of Information

Unless otherwise indicated, all information in this Annual Information Form (“AIF”) is presented as at and for the year ended January 2, 2005 and amounts are expressed in Canadian dollars.Financial information is presented in accordance with Canadian generally accepted accounting principles.

Documents Incorporated by Reference

The following documents are incorporated by reference into this AIF: (i) Wescast Industries Inc.‘s Management’s Discussion and Analysis for the year ended January 2, 2005, and (ii) Wescast Industries Inc.‘s audited consolidated financial statements and accompanying notes for the year ended January 2, 2005. These documents have been filed with applicable securities regulators in Canada and may be accessed atwww.sedar.com and have also been filed with the Securities and Exchange Commission in the United States.

Forward-Looking Statements

The contents of this Annual Information Form (and the documents incorporated by reference) contain statements which, to the extent that they are not recitations of historical fact may constitute forward-looking information made pursuant to the “safe harbor” provisions of the United StatesPrivate Securities Litigation Reform Act of 1995. Such forward-looking statements may include financial and other projections as well as statements regarding Wescast Industries Inc.‘s (“Wescast”) future plans, objectives, performance or the Company’s underlying assumptions. The words “may”, “would”, “could”, “will”, “likely”, “expect,” “anticipate,” “intend”, “estimate”, “intend”, “plan”, “forecast”, “project”, “estimate” and “believe” or other similar words and phrases are intended to identify forward-looking statements. Persons reading this Annual Information Form are cautioned that such statements are only predictions, and that Wescast’s actual future results or performance may be materially different.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties principally relate to the risks associated with the automotive industry and include, but are not limited to: our operating and/or financial performance, including the effect of new accounting standards on our reported financial results, fluctuations in interest rates, changes in consumer and business confidence levels, consumers’ personal debt levels, vehicle prices, the extent and nature of purchasing or leasing incentive campaigns offered by automotive manufacturers, environmental emission regulations, fuel prices and availability, the continuation and extent of outsourcing by automotive manufacturers, changes in raw material and other input costs, our ability to continue to meet customer specifications relating to product performance, cost, quality, delivery and service, industry cyclicality or seasonality, trade and/or labour issues or disruptions, customer pricing pressures, pricing concessions and cost absorptions; actual levels of program production volumes by our customers compared to original expectations, including program cancellations or delays price reduction pressures, dependence on certain engine programs and the market success and consumer acceptance of the vehicles into which such powertrain products are installed, our relationship with and dependence on certain customers, currency exposure, failures in implementing Wescast’s strategy, technological developments by Wescast’s competitors, government and regulatory policies and changes in the competitive environment in which Wescast operates. Wescast does not undertake any obligation to update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Information Form or to reflect the occurrence of unanticipated events, except as required by law.

TABLE OF CONTENTS

|

| | Page Reference | |

|

| | | | Annual | MD&A | |

| | | | Information | (Incorporated by | |

| | | | Form | Reference *) | |

|

| CORPORATE STRUCTURE | | | 4 |

|

| Name and Incorporation | | | 4 |

| Intercorporate Relationships | | | 4 |

|

| GENERAL DEVELOPMENT OF THE BUSINESS | | | 4 | | |

|

| DESCRIPTION OF THE BUSINESS | | | 7 |

|

| General | | | 7 |

| Sales and Marketing | | | 9 |

| Sources, Pricing and Availability of Raw Materials | | | 10 |

| Seasonality | | | 12 |

| Recent Trends in the Automotive Industry | | | 12 |

| Competition | | | 14 |

| Research and Development Activities | | | 15 |

| Economic/Contract Dependence | | | 16 |

| Environmental | | | 17 |

| Human Resources | | | 18 |

| Credit Facilities | | | 19 |

| Litigation | | | 20 |

| Principal Properties | | | 20 |

| Risk Factors | | | | 24 - 27 | |

|

| DIVIDENDS | | | 20 |

|

| DESCRIPTION OF CAPITAL STRUCTURE | | | 21 |

|

| MARKET FOR SECURITIES | | | 22 |

|

| Trading Price and Volume | | | 22 |

| Takeover Bid Protection | | | 23 |

|

| DIRECTORS AND OFFICERS | | | 23 |

|

| Directors - Name, Occupation & Security Holdings | | | 24 |

| Committee Memberships | | | 24 |

| Executive Officers | | | 26 |

| Additional Disclosure for Directors and Executive Officers | | | 27 |

|

| TRANSFER AGENT AND REGISTRAR | | | 27 |

|

| NAMES AND INTERESTS OF EXPERTS | | | 27 |

|

| CODE OF ETHICS | | | 27 |

|

| AUDIT COMMITTEE INFORMATION | | | 28 |

|

| MATERIAL CONTRACTS | | | 30 |

|

| ADDITIONAL INFORMATION | | | 30 |

|

|

| APPENDIX 1 - AUDIT COMMITTEE CHARTER | | | 32 |

|

* Reference: Parts of the 2004 Management's Discussion & Analysis of Wescast Industries Inc. for the year ended January 2, 2005 (“MD & A ”) are incorporated by reference into this Annual Information Form.

CORPORATE STRUCTURE

Name and Incorporation

Pursuant to articles of amalgamation dated October 31, 1994, Wescast Industries Inc. amalgamated with Western Machining Inc. and LFT Investments Ltd. under theBusiness Corporations Act(Ontario) to form Wescast Industries Inc. (“Wescast”). References to “Wescast” or the “Company” in this Annual Information Form (“AIF”) include Wescast Industries Inc. and its subsidiaries. Wescast’s corporate office is located at 150 Savannah Oaks Drive, Brantford, Ontario, N3T 5L8. Wescast’s registered office is located at 200 Water Street, Wingham, Ontario, N0G 2W0.

Intercorporate Relationships

The following is a list of subsidiaries of Wescast Industries Inc. as of January 2, 2005 and their respective jurisdictions of incorporation.

| | |

|---|

|

| | | Jurisdiction of | | Percent of voting | |

| Principal Subsidiaries of Wescast | | Incorporation | | shares owned by | |

| | | | | Wescast | |

|

| 1102734 Ontario Inc. | | Ontario | | 100 | |

|

| 1277521 Ontario Inc. | | Ontario | | 100 | |

|

| Wescast Industries GmbH | | Germany | | 100 | |

|

| Wescast U.K. Limited | | England | | 100 | |

|

| Wescast Japan, K.K | | Japan | | 100 | |

|

| Wescast France SARL | | France | | 100 | |

|

| Weslin Industries Inc. | | Ontario | | 100 | |

|

| • Wescast Hungary Autoipari Rt. | | Hungary | | 100 | |

|

| Wescast Holdings USA, Inc. | | Delaware | | 100 | |

|

| • Wescast (USA) Inc. | | Delaware | | 100 | |

|

| • Wescast Industries of Georgia, Inc. | | Delaware | | 100 | |

|

| - Wescast Industries Cordele, LLC | | Delaware | | 100 | |

| | |

|

| United Machining Inc. | | Michigan | | 49%(1) | |

|

(1) Wescast owns 100% of the outstanding shares of all subsidiaries except for United Machining Inc., of which Wescast owns 49% of the outstanding shares.

GENERAL DEVELOPMENT OF THE BUSINESS

Wescast is the successor to a company founded in 1901. The Company currently operates in the automotive industry, where substantially all of its revenues are generated through the sale of exhaust manifolds and related products.

On November 1, 1994, Wescast completed an initial public offering of Class A Subordinate Voting Shares (“Class A Shares”) and the Class A Shares began trading on the NASDAQ Stock Market.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 4 |

In January 1996, Wescast’s Class A Shares commenced trading on the Toronto Stock Exchange.

In early 1998, Wescast acquired a 49% joint venture interest in United Machining Inc. (“UMI”). The Michigan Minority Business Development Council certified UMI as a “minority” supply source. This certification enables UMI to bid on business that it might otherwise not be able to.

Since 1998, Wescast has established sales and technical development centres in the United States, Germany, United Kingdom, France and Japan. These initiatives are intended to support the Company’s present and future customers and to assist in future growth.

In 2000, a state of the art casting facility in Wingham, Ontario was successfully launched. Also in 2000, Wescast moved its US joint venture, UMI, into a new expanded production facility to accommodate increased volumes. In 2000, an addition to the Wingham machining facility was completed to provide for additional machine lines to accommodate new programs.

In 2001, Weslin Industries Inc., a joint venture between Wescast and Linamar Corporation, commissioned a state of the art foundry and integrated machining facility. This facility is located in Oroszlany, Hungary.

During 2001, the decision was made to close Wescast’s stainless steel facility in Stratford. All costs associated with the shutdown were reflected in the Company’s 2001 fiscal year. As of June 30, 2002, all production programs of the stainless steel business were transferred to other manufacturers. Several of the related manufacturing assets were transferred to other operating facilities and we are currently pursuing buyers for the remainder of the assets.

In 2002, Wescast became one of the first foundries to achieve ISO/TS 16949 certification at all five of its Ontario manufacturing facilities. This international quality system defines system and process expectations to ensure on-time delivery, cost control and quality assurance. It is recognized and required by all major original equipment manufacturers (“OEMs”) and replaced QS-9000. This certification recognizes Wescast’s strong commitment to customer requirements and quality.

Wescast entered the chassis segment in 2002 with the acquisition of 100% of Georgia Ductile Foundries, LLC (renamed Wescast Industries Cordele, LLC, “Cordele”). Cordele is a manufacturer of sand cast iron components primarily for the automotive industry, focusing on suspension and brake components. The total purchase price, including the assumption of debt, was $123 million.

During 2002, Wescast also completed construction of a new Technical Development Centre and Corporate Office, the Richard W. LeVan Centre. This centre is the home for the corporate support group including the technical teams which have been relocated from various facilities.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 5 |

It consolidates all of the Company’s research and development, product design and testing activities in one state-of- the- art facility, and houses a mini-foundry and a machine shop for making prototypes and for advanced engineering projects.

A sales and design office located in Yokohama, Japan, opened in late October, 2003. Wescast believes that increasing its presence with full-time local support provides benefits to current and new customers within the Asian market. This office is expected to network with the Company’s other sales and design centres in North America and Europe to design and develop cast products and systems for the powertrain segment.

In late 2003, the Company completed its impairment test of the goodwill acquired in conjunction with the 2002 acquisition of Cordele. The impairment test was carried out to determine whether the fair value of the Cordele operation supported the carrying value of the operations’ net assets including goodwill. As a result of the review, it was concluded that the goodwill was fully impaired. The Company recorded a pre-tax non-cash goodwill impairment charge of $41.5 million ($27.4 million, after tax) related to its chassis segment.

In June 2004, the Company adopted a revised customer-driven global powertrain strategy built on its successful core competency of designing, casting and machining powertrain components.

In July 2004, and in light of this revised strategy, the Company announced its decision to exit the chassis business conducted at its Cordele, Georgia operation. The impact of severe downward pressure on market prices and increased offshore competition combined with the escalation of raw materials costs, and inconsistent operating performance resulted in the chassis business falling well short of financial performance targets. With the assistance of outside advisors, the Company has been marketing this business for sale as a going concern. The Company has not been able to secure a buyer for the business. As a result, the Company has decided to wind down the facility and it is estimated that all production activities will be concluded at the Cordele operation by the end of the second quarter of 2005. The Company will coordinate with existing customers to ensure a continuity of supply while production requirements are transferred to other suppliers. The Company will be pursuing buyers for the manufacturing assets and property subsequent to completion of production. In 2004, the Company recorded a $61.6 million net loss for the Cordele facility and reclassified the operation as discontinued.

In August 2004, Wescast acquired Linamar Corporation’s 50% interest in Weslin Industries Inc., pursuant to the terms of the joint-venture agreement between the parties.

Wescast sees high potential in further expanding the powertrain business further by following its customers into the Asian marketplace. The Company continues to evaluate both the threats and opportunities that may exist in the emerging automotive industry in Asia, specifically China. The Company views the emerging domestic market opportunities in Asia to be well aligned with its global powertrain strategy. Throughout 2004, the Company was actively

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 6 |

reviewing specific business opportunities with potential business partners in Asia that will enable the Company to participate in this market.

In February 2005, the Company announced its decision to close its Brantford, Ontario foundry operation and expects to phase out this operation during the course of 2005. It is anticipated that the Brantford foundry will start transferring production requirements to other manufacturing facilities starting in April 2005, with the transition to be completed by the end of 2005. With the closure of the Brantford foundry, it is anticipated that approximately $25 million of operating costs can be eliminated on an annualized basis starting in 2006. Effective capacity utilization at the two Wingham foundries is expected to increase to a level in excess of 90%, allowing for greater efficiencies and improved capital asset utilization. The Company expects further savings and synergies associated with having three of its production facilities in close geographic proximity to one another. The closure of the Brantford foundry is expected to affect approximately 340 hourly and salaried employees, although there may be some opportunities for employees to transfer to the Wingham locations. The Company believes that the efficiency gains targeted in the Company’s core North American powertrain operations will allow the Company to become more cost-competitive.

In 2005, the focus of the Company’s core powertrain segment in North America will continue to become more cost-competitive in an effort to address the significant pressure on pricing that is being exerted by customers. This pressure has intensified with the growing threat from competitors based in low-cost countries, especially China, as well as increased raw material costs and lower Domestic Big 3 (as defined below) market share. To meet these challenges, the Company intends to continue to pursue aggressive year-over-year cost-reduction targets in the foundry and machining operations.

In 2005, the focus of the Company’s European powertrain segment Wescast Hungary Rt. (“Wescast Hungary”) will be to improve operating metrics and achieve the successful launch of six new programs which includes machine line commissioning. This segment is also experiencing high raw material costs for scrap steel and moly.

The Company plans to maintain its commitment to fund research and development activities, focusing on three specific areas, namely: product, process and materials.

For additional information regarding the general development of Wescast’s business, see pages 1 to 15 and 20 to 47 of the 2004 Annual Report of Wescast Industries Inc. which pages are incorporated herein by reference.

DESCRIPTION OF THE BUSINESS

General

Companies which supply directly to OEMs and which design, engineer and manufacture are generally referred to in the automotive industry as “Tier 1” suppliers. Tier 1 suppliers may be

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 7 |

awarded longer term purchase orders by OEMs as a result of their involvement in the development or design of the product with the OEM. Tier 1 suppliers generally have the capability to supply these components on a just-in-time basis which helps the OEMs reduce or otherwise better manage inventory levels.

As a Tier 1 supplier, Wescast currently designs, casts, machines and assembles high-quality engineered iron products for the automotive industry. Its resources are strategically aligned to meet the unique customer-specific requirements in two geographic segments – North America and Europe. The Company’s manufacturing facilities, where appropriate, are geographically situated to align with the physical location of its customer base. The Company believes that the combination of its design and high-quality manufacturing creates unique value for the customers in the markets that it serves.

The exhaust manifold is a critical engine component because its design affects overall engine performance, including fuel efficiency, output horsepower, effectiveness of the catalytic converter, environmental emissions and engine sound volume. The production of exhaust manifolds is essentially a two-step process consisting of: (1) casting, which is the pouring of molten iron into sand molds; and (2) machining, which is the finishing of the raw exhaust manifold by milling, drilling, tapping, assembling and testing by highly-automated machines to prepare the exhaust manifold for final assembly on the engine. Wescast’s exhaust manifolds are made of ductile iron or high alloy SiMo ductile iron, and currently cast at foundries in Brantford and Wingham, Ontario and in Oroszlany, Hungary. They are machined in Wingham and Strathroy, Ontario, Sterling Heights, Michigan and in Oroszlany, Hungary. The manifolds are designed, engineered and manufactured in close collaboration with the Company’s customers to meet their performance, pricing and quality requirements.

In 2004, Wescast’s operations were conducted primarily in Canada, the United States and Hungary; however, most of its products were exported to the United States and Europe. For the fiscal year ended January 2, 2005, consolidated sales to the Company’s three largest customers, General Motors, Ford Motor Company and DaimlerChrysler amounted to 88% of consolidated sales (compared to 84% of consolidated sales in 2003).

The North American powertrain segment is focused on the design and manufacturing of exhaust system components for sale primarily to General Motors, Ford Motor Company and DaimlerChrysler (“the Domestic Big 3”) as well as Tier 1 customers for car and light truck markets in North America and Europe. The Company’s powertrain operations in North America are well established and in the fiscal year ended January 2, 2005 represented 92% of consolidated sales compared to 95% in the preceding fiscal year.

The European powertrain segment is conducted through Wescast Hungary, a relatively new operation. The European operation represents a developing business and comprised 8% of the Company’s consolidated sales in the fiscal year ended January 2, 2005, compared to 5% in 2003. In January 2003, commercial production began and since then, Wescast Hungary has

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 8 |

captured 6% of the European market with a premier customer list that includes Renault, Honeywell (formerly Garrett), BorgWarner, Volkswagen, Audi and Ford of Europe. Europe represents Wescast’s best near-term opportunity to expand its customer base through our ability to design, cast and machine manifolds, integrated turbo manifolds and turbo housings – a distinct strategic advantage in a growing market. The European market also includes a high percentage of diesel engines – another opportunity for growth for turbo charger housings.

Over the longer term, we expect the turbo market to grow in North America as the market here turns to diesel as an alternative to increasing gasoline prices. Diesel is the obvious successor to gasoline because of its lower price and ease with which it fits in to the North American infrastructure. Our expertise in turbo diesel exhaust applications will enable us to capitalize on these opportunities when the time is right.

Sales and Marketing

Wescast sells its products to North American OEMs, located in Canada and the US through our sales personnel located at our U.S. sales office in Michigan. Sales to OEMs in Europe are made through the Company’s sales office located in Kassel, Germany. We also have sales offices in the United Kingdom, France and Japan.

The Company typically receives a purchase order to produce a particular product for one or more model years. However, firm orders are usually created only when Wescast receives releases under such purchase orders, authorizing the Company to produce and deliver specific quantities of the product. Once a purchase order is received by the Company from an OEM, the actual volume produced under the purchase order in any given year is dependent upon the actual number of engines produced or planned to be produced by the OEM. Actual OEM production levels of a particular engine program may vary significantly from OEM estimates and such product may be delayed or cancelled, often without any compensation to Wescast. The Company has seen a change in the sourcing practices of its OEM customers, as it relates to the Company’s products. The historical experience was for a customer to award the supplier with the commercial production requirements for a product related to a specific engine program. Assuming delivery, quality, and other performance criteria were maintained, the supplier would retain and supply the product over the life of the engine program. Customers now routinely market test their purchasing requirements globally, and throughout the life of the engine program, to ensure they are continuing to receive globally competitive pricing. This accelerates the timeframe over which the Company’s current business can be impacted by global competition. Although OEMs are not usually contractually committed to using a particular manufacturer to supply a product throughout the time such product is required by the OEM, it has been the Company’s experience that once a commercial production order for a product for a particular engine has been obtained, the Company will generally continue to produce that product throughout the entire time the product is required by the OEM.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 9 |

In certain circumstances, the Company may also obtain production programs on a “takeover” basis. These programs are typically already in production at OEM facilities or the facilities of our competitors and, for various reasons, are re-sourced to Wescast.

Sources, Pricing and Availability of Raw Materials

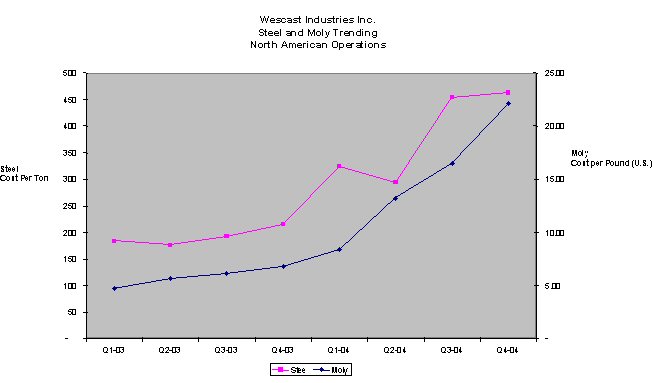

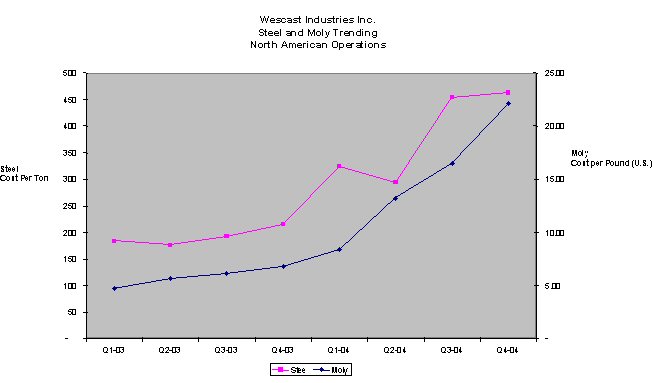

The Company’s production costs are dependent on the price of certain raw materials and other commodities, including scrap steel, molybdenum (“moly”) and electricity.

Scrap Steel Pricing

The key drivers to the significant upward price movement for steel has come from two fronts: One, the incremental demand of material moving off-shore, primarily to China; and the strong US economy which has seen US steel mills operating at over 90% capacity. China’s exponential growth continues to push the Pacific Rim region to be a large importer of scrap steel, primarily from Europe and North America. Pricing of scrap steel in Canada is heavily influenced by this “export” pressure and has been somewhat softened by the rising Canadian dollar against the US currency. Market forecasters have had difficulty in making accurate predictions, as the circumstances in 2004 were unprecedented in recent history. Only recently has the price of steel shown some signs of stability. While prices are predicted to drop in 2005 from their high point of $512 Canadian/ton in 2004, the prediction is that a new baseline will be established in the $300-$350 range. The Company has only limited ability to influence pricing partially due to its material specifications, but more importantly due to the global competition for Ontario’s scrap steel.

The factors that mainly influence the cost and supply of foundry scrap steel include: overseas demand, availability of scrap alternatives, increased use of high strength steel, offshore manufacturing and normal market factors.

However, Ontario is a net exporter of scrap steel and the Company believes that there is not an overall supply risk. The Company obtains the majority of its scrap steel from two producers in Ontario.

Molybdenum Pricing

The Company experienced an unprecedented upwards climb in molybdenum pricing throughout 2004. As a commodity that has no futures market, pricing has increased exponentially over the past 30 months. While the 15 year average price for moly prior to 2002 was under $4 US per pound, the average price per pound which the Company experienced in 2004 was $15 US per pound and has since reached $34 US per pound. Unlike previous years where the demand has been fairly stable, 2004 saw a large increase in demand and a supply base that has been unable to meet demand. There are two primary reasons for the rising prices witnessed in 2004. The first relates to global economic strength, specifically in China. Europe

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 10 |

remains the largest consumer of moly followed by Asia (primarily China and Japan) and then North America. Europe and Japan’s appetite for moly used in stainless steel production facilities remains a key driver in this increasing demand. China has begun to reduce its exports of moly in order to support its own domestic requirements. The second reason is a lack of global capacity to convert moly concentrates to moly oxide and then finally to ferro-moly, which is the form used by the Company. The research and manufacturing groups are evaluating alternate materials to use in the Company’s production processes.

The primary sources of supply of molybdenum are the United States, China, Chile, Russia and Canada. There are currently three suppliers in North America and one broker in China. The factors that influence the cost and supply of molybdenum include: global demand, environmental issues and merchant activity.

The Company has a current agreement with a North American supplier to ensure up to 110% coverage of the Company’s 2005 forecasted volume requirements. Additional volume can be supplemented by spot purchases.

The following graph shows the trend in steel and moly pricing for 2003 to 2004.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 11 |

Electricity Pricing

The Company’s Foundry Technology group maintains an electrical forecasting model for each plant which incorporates various operations data to estimate how much electrical energy is required and when it will be used. Energy cost varies on an hourly basis and its variability changes throughout the year. In order to manage the price risk, the Company’s approach has been to obtain a fixed price contract for approximately 80% of the operating demand in the on-peak period equating to about 95% of the on-peak energy requirement. The remainder of the energy is purchased at the Hourly Ontario Energy Price (HOEP). Energy delivery costs are regulated by the Ontario Energy Board (OEB).

Natural Gas Pricing

The Company’s Foundry Technology and Materials & Procurement groups establish natural gas purchase contracts in September and November of each year. This fixes the Company’s cost of natural gas for the following year. Included in the total cost of gas are delivery and transportation charges which represent approximately 25% of the Company’s total cost of natural gas. The delivery tariffs are regulated by the OEB.

The inability to maintain current sources for raw materials or energy or to develop alternate sources at competitive prices and quality could adversely affect the Company’s financial condition and results of operations.

Seasonality

Historically, Wescast’s sales and production volumes are generally lower in the months of July and August of each year due to summer shutdowns and model changeovers by the OEMs. Also, North American production volumes are usually lower during the months of December and January of each year because of the Domestic Big 3 shutdowns associated with the Christmas and New Year’s holiday season.

Recent Trends in the Automotive Industry

The Company believes that the following industry trends are driving opportunity and placing demands on suppliers.

Increasing pricing pressure on automotive suppliers

Lowest cost has become the single most important deciding factor by the Domestic Big 3 in sourcing new business to automotive suppliers. This has been caused by the fierce competition among all of them and the extreme financial pressure and loss of market share that the Domestic Big 3 have been experiencing. Increasing price reduction pressures from the Company’s customers could reduce profit margins. Historically, the Company has entered

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 12 |

into, and will continue to enter into, supply agreements with its customers that provide for, among other things, price concessions over the term of the agreement. In the past, these concessions have been largely offset by cost reductions resulting from product and process improvements. The competitive global automotive industry environment has caused these pricing pressures to intensify. To the extent that these price reductions continue in the future and are not offset through cost reductions, the Company’s future profit margins may be adversely affected.

Evolving role of automotive suppliers with respect to technology and innovation

OEMs have placed more and more responsibility for technology and design on Tier 1 suppliers such as Wescast. Suppliers are expected to bring new technology through design, new materials and new processes to help OEMs gain an edge with respect to competition.

Increasing outsourcing and processing

As the Domestic Big 3 strive to reduce capital expenditures and operating expenses, they have increasingly outsourced their requirements for assemblies and components. This is one of the reasons that Wescast has seen its machining penetration increase over recent years, along with an increase in sub-assembly work performed at Wescast’s machine shops. In 2004, Wescast’s North American machining penetration increased from 78% to 83% (meaning Wescast machined 83% of the manifolds that it cast). This trend represents an increase in total machining penetration of more than 20% since 2000. Wescast believes that the significant cost and competitive pressures faced by the Domestic Big 3, combined with the expansion in the capabilities of their suppliers, has resulted in the Domestic Big 3 looking to their suppliers to design and deliver fewer components and more automotive “systems” which reduces complexity and costs for the Domestic Big 3.

Globalization and consolidation of the automotive supply base

The Domestic Big 3 are working to reduce the number of suppliers they have and fewer, larger, competent suppliers with global reach and capabilities will emerge. Tier 1 suppliers such as Wescast are required to have the financial strength, technical capabilities and geographic reach required to support the design, engineering, manufacturing, sales and program support needs of the Domestic Big 3 in many countries. The cost pressure faced by the Domestic Big 3 has resulted in the development by them of global platforms. In order to achieve economies of scale on a worldwide basis, the Domestic Big 3 are increasingly developing vehicles based on common platforms. These “world cars” result in significantly reduced design, development and engineering costs and maximize the purchasing power of the Domestic Big 3 with respect to raw materials required in their production.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 13 |

Powertrain technology

Trends that specifically impact the Company’s core manifold business are those inherent to the internal combustion engine. These trends will continue driving current and future engine technology for quite some time and these include better engine performance, tighter emission regulations, lower cost, better fuel economy, lower weight, higher temperature requirements and increased diesel applications.

New engine technologies

Wescast continues to monitor new engine technologies, including fuel cell technology. The Company believes that there are several barriers to the success of fuel cell technology which include:

|

• | |

the relative cost of the product. The fuel cell stack and hydrocarbon reformer components are very expensive, as high as 4-10 times the cost of an internal combustion engine; |

| | • | | hydrogen infrastructure would require hundreds of billions of dollars to implement and refit existing fuel stations; |

| | • | | competitive technologies such as the internal combustion engine and hybrid technology (which requires an exhaust manifold) will continue to make improvements with respect to emissions and fuel economy to counter this possible threat; and |

| | • | | fuel cell technology will encounter political barriers as a large number of businesses and employment stem from the existence of the internal combustion engine. |

Competition

The exhaust manifold business is highly competitive. The Company believes that the primary elements of this competition are price, quality and service, including delivery time. The worldwide demand for exhaust manifolds is basically satisfied by two distinct types or styles of manifold designs: fabricated and cast. Wescast’s manifold production is exclusively focused on cast manifolds. A cast manifold is produced using various grades of ductile iron, each with different temperature and performance characteristics, using a green sand mould process. The manufacture of fabricated manifolds involves the bending and welding of steel tubes to meet the shape and style of the product design. In North America, the use of cast iron manifolds has traditionally dominated the marketplace. Cast manifold designs are currently estimated by the Company to represent approximately 80% of the overall demand for manifolds in North America. In other parts of the world fabricated manifolds command a far greater share of the marketplace. The Company estimates that 45% of the current worldwide demand for exhaust manifold production is represented by fabricated designs. The difference in demand is influenced by customer preferences, historical use and production volume levels.

Wescast’s overall share of the North American exhaust manifold market totalled approximately 55% in the fiscal year 2004 (holding steady from approximately 55% in fiscal year 2003),

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 14 |

based upon the total number of passenger cars and light trucks produced in North America. The decrease in market share was mainly due to our loss of market share at Ford, as it resourced four programs to Chinese suppliers. These lost programs, combined with less demand for the General Motors GEN III V8 and L850 programs, more than offset increased demand on newly launched General Motors 3500 V6, General Motors 3.6L HF V6, and DaimlerChrysler 2.7L and 3.5L LX manifold programs.

Wescast believes that it has distinguished itself from its North American and international competitors by taking a focused factory approach on manufacturing cast exhaust manifolds. Wescast also believes this specialization has enabled it to become a technological leader in the manufacture of exhaust manifolds and to capture efficiencies by reducing variation in its manufacturing processes. The Company’s exhaust manifold design, development, quality and production capabilities have been recognized by its customers on numerous occasions.

The Company’s competitors include U.S. and international suppliers who may enjoy lower labour and other costs and may not be subject to the currency risks that the Company bears. While the Company is the largest producer of exhaust manifolds for the North American market, many of its competitors or potential competitors are larger and more diversified and have greater resources than the Company. There can be no assurance that Wescast’s business will not be adversely affected by increased competition in the market in which it currently operates or in markets in which it will operate in the future, or that the Company will be able to improve or maintain its profit margins on sales to OEMs or their suppliers.

Research and Development Activities

Wescast spent approximately $6.6 million on research and development activities in 2004. The Company believes that products that are highly engineered generally carry better returns than simple commodity-type products, and that a significant portion of new programs in recent years have been the result of the Company’s design and engineering capabilities and product innovation.

Wescast believes that its engineering and design capabilities are well suited to meet the changing needs of its current and potential customers. Wescast believes that such customers are faced with, among others, the following specific needs:

| | • | | the need to reduce engine emission levels; |

| | • | | the need to deal with higher engine temperatures through new materials; |

| | • | | the need to meet customer-driven demand for high horsepower levels, given the constraints above; and |

| | • | | the potential for an increased use of diesel-powered vehicles in North America to help meet corporate average fuel economy (“CAFE”) levels. |

In 2004, the Company implemented a Product Knowledge Management system that consolidates and controls all sales, design and quality product data electronically as it relates to

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 15 |

the Advanced Quality Planning process. This system is a large centralized database available to functional groups containing product data organized by program and part number. It is a workflow “engine” that provides process management and automation along with a visualization tool that allows viewing, markup and interrogation of product geometry in two and three dimensions. The practice of managing and leveraging product information and knowledge more effectively translates into faster cycle times, better quality products, increased innovation, improved profitability and improved customer satisfaction.

Wescast has also introduced an “Evergreen” system, a process designed to manage the development of new technology in the areas of process, products and materials across our organization. The benefits of this system include improved partnership between manufacturing and technology groups, improved management of priorities and resources, and technology protection.

Economic/Contract Dependence

The Company is largely dependent upon three customers, the domestic Big 3 automakers. As a result, it is exposed to any loss in market share or less-than-projected light vehicle sales by General Motors, Ford and DaimlerChrysler, for which the Company supplies powertrain components.

The Company’s top five North American powertrain programs projected for 2005, based on unit production, are represented by the following customer platforms:

| | |

|---|

| | |

|---|

| | |

|---|

| OEM | | Platform/Program | | Vehicle Application(s) | |

|

| GM | | 4.8/5.3/6.0L GEN III V8 | | Silverado, Sierra, Suburban, Yukon, Escalade, etc. | |

|

| Ford | | 5.4 L 3V V8 | | F150, F250, Expedition, Navigator | |

|

| Ford / Navistar | | 6.0 L V8 Navistar Diesel | | F-250, F-350, Excursion | |

|

| GM | | 3500 V6 | | Malibu, G6 | |

|

| Nissan | | 3.5 L ZV5 V6 | | Maxima, Altima, Quest | |

|

Penetration of non-Big 3 customers would assist Wescast to diversify its revenue base and reduce this concentration of risk. The expansion of the Company’s global business platform will aid in these diversification efforts.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 16 |

The Company’s top five powertrain programs in Europe projected for 2005, based on unit production are represented by the following customer platforms:

| | |

|---|

| | |

|---|

| | |

|---|

|

| OEM | | Platform/Program | | Vehicle Application(s) | |

|

| Ford | | 4.0L SOHC V6 | | Explorer, Ranger | |

|

| BorgWarner | | 1.5L Diesel I4 | | Turbo-charger for 1.5l Diesel Renault Clio, Megane | |

|

| Ford | | 4.0L SOHC V6 | | Mustang | |

|

| | | | | Turbo charger for Fiat (Punto), Opel (Corsa), Suzuki (Wagon R+), Lancia | |

| BorgWarner | | 1.3L GM/Fiat | | (Epsilon) | |

|

| Audi | | 1.6L I4 | | Audi A3, VW Golf | |

|

The Company could be negatively impacted by government regulations, including U.S. Corporate Average Fuel Economy standards or emissions regulations and Canadian, European and American federal, provincial, state and local environmental laws and regulations that have an adverse impact on the automotive industry. New product research at Wescast is focused on innovations that will allow the Company to take advantage of these changes.

Environmental

Wescast believes it has established and maintains sound environmental practices. The ISO 14001 Environmental Management System International Standard is now integrated into the culture of Wescast. The most significant benefit from implementing ISO 14001 is the ability to demonstrate, through third party verification, Wescast’s degree of success in protecting the environment. The Company monitors and controls the impact of all production processes, and has developed policies, which in conjunction with its compliance with laws and regulations, have the objective of assuring a safe and healthy environment for its employees and communities. For example, Wescast has indoor air and noise monitoring programs in place at all facilities to ensure employee protection and shares those results with employees through its intranet site. External stack emissions are regulated by the Ministry of Environment and Wescast’s ventilation systems have been designed to maintain external emissions below regulated limits. Some facilities must also meet external noise requirements to ensure public disturbance is minimized and monitoring is in place for this purpose. Wescast strives to reduce water usage wherever possible through different cooling strategies and maintaining and optimizing equipment. Storm water that leaves Wescast sites is also monitored.

The Company strives to recycle materials wherever possible. In order to be environmentally conscious and help offset rising raw material costs, metal chips from our machining facilities are re-melted in our foundry operations. In 2003, equipment was installed to process the metal chips for re-melt internally, further reducing the environmental impact and costs of trucking to an outside company for processing. Wescast recycles or reuses almost 100% of the spent foundry materials either in-house or off-site.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 17 |

Internal environmental compliance audits and internal and external system audits are performed two times per year. Through the Company’s standardized Environmental Operating System (EOS) measurables at all of its facilities, it monitors opportunities to maximize recycling opportunities, reduce waste, employ efficient energy management and encourage the sharing of best management practices.

Wescast believes that existing environmental laws and regulations have not had a significant material effect on Wescast’s operations or financial condition. In 2003, the cost to operate and maintain emission control equipment and environmental monitoring and measurement at our Ontario facilities was approximately $5.0 million. Environmental monitoring and measurement for Wescast Hungary was approximately $300,000. Spending on capital improvements at these facilities relating to environmental practices was approximately $500,000.

The Company anticipates that in future years the amount of annual expenditures in respect of environmental operating expenses will remain substantially similar to such expenditures in the past year.

Human Resources

Wescast believes that an integral part of its success and reputation for quality and performance is due to each employee’s effort to maintain a commitment to excellence. In the late 1980‘s, Wescast began the process of developing a participative management process designed around the principles of identity, participation, competence, and equity. The formal plan became effective on July 1, 1989, and was named HEART (Helping Everyone Achieve Rewards Together). The components and structure of the plan, including an employee bonus plan, are reviewed and updated on a regular basis.

As at January 2, 2005, Wescast had approximately 2,500 employees (including employees of Wescast Hungary Autoipari Rt. and Wescast Cordele LLC (but excluding employees of the joint venture at United Machining Inc. in Michigan).

The Company’s manufacturing employees have specialized manufacturing process and tooling design expertise. The engineering and design staff have specialized manifold design, analysis and testing expertise, and the research group has proprietary materials knowledge, process and product knowledge.

The Canadian Auto Workers (“CAW”) union represents approximately 44% of the total number of the Company’s employees pursuant to four collective agreements. The agreement relating to Wescast’s two Wingham casting facilities, covering approximately 420 employees will expire on June 30, 2005. The Company believes that relations between the CAW and management are good and that these collective agreements will be successfully renegotiated. Collective labour agreements in place at the Wingham Machining, Strathroy Machining and Brantford Casting facilities, representing approximately 700 CAW employees, expired in 2004.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 18 |

The Strathroy Machining contract was settled after a 10 day work stoppage and the Wingham Machining contract was settled after a 4 day work stoppage. A new 3-year contract at the Brantford facility was successfully negotiated without any work stoppages. No customer shipments were delayed during any of these negotiations.

In July 2004, the Company announced its intention to exit the chassis business. As the Company has not been able to successfully negotiate a sale of this business, Wescast has decided to wind down the chassis business by the end of the second quarter of 2005. This will affect approximately 350 employees.

In February 2005, the Company announced its intention to phase out the Brantford facility in 2005. This decision will affect approximately 340 employees. Management has entered into discussions with Union leadership on how to provide appropriate support to those affected.

Credit Facilities

In December 2004, the Company amended its banking facilities. A credit agreement was put in place that provides for a committed revolving credit facility in the amount of $125 million through December 2007. The facility, which is unsecured, is guaranteed by the Company and one material subsidiary, Wescast Hungary. As of January 2, 2005, $93.9 million was available under the facility.

The credit agreement requires the Company to maintain certain financial ratios and imposes limitations on specified activities. The Company was in compliance with these covenants at January 2, 2005.

Borrowings under the credit agreement are available as selected by the Company by way of: i) Prime Loans, ii) U.S. Base Rate Loans, iii) LIBOR Loans, iv) Bankers’ Acceptances, and v) Letter of Credit or Letter of Guarantee, plus applicable interest rate margin. The margin varies depending on specified financial ratios.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 19 |

Litigation

The Company is not a party to, nor is any of its property the subject of, any legal proceedings involving a claim for damages exceeding 10% of the current assets of the Company.

Principal Properties

The Company’s principal facilities as at January 2, 2005 are listed below:

| |

|---|

| |

|---|

| |

|---|

| | Canada | |

|

| 200 Water Street, Wingham, Ontario | | 160,000 square foot owned facility; used to cast exhaust manifolds | |

| R.R.#4, Wingham, Ontario | | 125,600 square foot owned facility; used to cast exhaust manifolds | |

| 799 Powerline Road W., Brantford, Ontario | | 136,500 square foot owned facility; used to cast exhaust manifolds | |

| 100 Water Street ,Wingham, Ontario | | 121,400 square foot owned facility; used to machine exhaust manifolds | |

| 28648 Centre Road, Strathroy, Ontario | | 121,000 square foot owned facility; used to machine exhaust manifolds | |

| 150 Savannah Oaks Drive Brantford, Ontario | | 78,000 square foot owned facility, used to house the design and | |

| | | corporate support group. It houses a mini-foundry and machine shop. | |

| | | Hungary | |

|

| 2840 Oroszlany, Szent Borbala u. 16 | | 225,000 square foot owned facility; used to cast and machine exhaust | |

| | | manifolds | |

| | | United States | |

|

| 402 George Mathews Drive, Cordele, Georgia | | 147,200 square foot owned facility, used to cast suspension and brake | |

| | | components | |

| 49% owned joint venture | | | |

| 6300 - 181/2Mile Rd Sterling Heights, Michigan | | 80,000 square foot leased facility; used to machine exhaust manifolds | |

Wescast currently operates its manufacturing facilities on a multi-shift basis. As disclosed above, the Company has announced its intention to phase out the Brantford casting facility over the course of 2005. Wescast believes that the two Wingham casting foundries will be adequate to meet its anticipated production requirements for the foreseeable future. The Company does not have any immediate plans for the Brantford facility and is reviewing various alternatives.

As previously disclosed, the Company will also be winding down the Cordele casting operation in 2005.

DIVIDENDS

Wescast started paying cash dividends on its Class A Shares and Class B Common Shares on a quarterly basis in 1995. Unless the Board of Directors determines otherwise, the Company’s policy is to generally set its annual dividend to approximately 10% of the previous year’s net earnings.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 20 |

The following table outlines the amount of cash dividends declared per share for the Class A Shares and Class B Common Shares for each of the three most recently completed financial years.

|

| Dividends Paid | Total for the Year |

| | (Canadian $) |

|

| 2004 | | $ 0.48 | |

|

| 2003 | | $ 0.48 | |

|

| 2002 | | $ 0.48 | |

|

In February 2005, the Board of Directors’ approved a reduction in the quarterly dividend payment from $0.12 Canadian to $0.06 Canadian. The Company’s current intention is to pay quarterly dividends of $0.06 per share in 2005. The declaration and payment of dividends is at the sole discretion of the Board of Directors.

DESCRIPTION OF CAPITAL STRUCTURE

Authorized Capital

The classes and maximum number of shares that the Company is authorized to issue include:

| | (i) | | an unlimited number of Class A Shares; |

| | (ii) | | 9,000,000 Class B Common Shares; and |

| | (iii) | | an unlimited number of preference shares, issuable in series (the “Preference Shares”). |

No Preference Shares have been issued.

Dividends

The holders of Class A Shares and Class B Common Shares shall be entitled to receive dividends and the Company shall pay dividends, as and when declared by the Board of Directors. All dividends declared on both the Class A Shares and Class B Common Shares shall be paid in equal amounts per share and at the same time. The Preference Shares shall be entitled to priority over the Class A Shares and Class B Common Shares of the Company and over any other shares of any other class of the Company ranking junior to the Preference Shares with respect to priority in the payment of dividends and the return of capital and the distribution of assets in the event of the liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, or any other distribution of the assets of the Company among its shareholders for the purpose of winding-up its affairs.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 21 |

Dissolution

In the event of the liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, or any other distribution of assets of the Company among its shareholders for the purpose of winding up its affairs, subject to the prior rights of the holders of any shares ranking senior to the Class A Shares and Class B Common Shares with respect to priority in the distribution of assets upon liquidation, dissolution or winding-up, the holders of the Class A Shares and Class B Common Shares then outstanding shall be entitled to receive the remaining property and assets of the Company in equal amounts per share and at the same time.

Voting Rights

The holders of the Class A Shares shall be entitled to receive notice of and to attend all meetings of the shareholders of the Company and shall have one vote for each Class A Share held at all meetings of the shareholders of the Company, except for meetings at which only holders of another specified class or series of shares of the Company are entitled to vote separately as a class. The holders of the Class A Shares are entitled, voting separately as a class, to elect two directors at each annual meeting of the shareholders of the Company.

The holders of the Class B Common Shares shall be entitled to receive notice of and to attend all meetings of the shareholders of the Company and shall have five votes for each Class B Common Share held at all meetings of the shareholders of the Company, except for meetings at which only holders of another specified class or series of shares of the Company are entitled to vote separately as a class or series. 13.5% of the aggregate voting rights attached to the Company’s securities are represented by Class A Shares.

Any holders of Preference Shares as a class shall not be entitled to receive notice of, to attend or to vote at any meeting of the shareholders of the Company.

Conversion Rights

The Class B Common Shares may be converted at any time by the holder or holders into fully-paid Class A Shares of the Company on the basis of one Class A Share for each Class B Common Share held; provided, that in the event of liquidation, dissolution or winding-up of the Company, such right of conversion shall cease and expire on the date of such liquidation, dissolution or winding-up.

MARKET FOR SECURITIES

Trading Price and Volume

The Class A Shares are listed and posted for trading on the Toronto Stock Exchange under the trading symbol WCS.SV.A and on the NASDAQ under the trading symbol WCST. The Class

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 22 |

B Common Shares are not listed on a stock exchange. The holders of the Class A Shares are entitled to one vote per share. The holders of the Class B Common Shares are entitled to 5 votes per share.

The following table sets forth the reported high and low closing prices and trading volumes of the Class A Shares of Wescast on the TSX for the periods indicated.

|

| Common Shares (WCS.SV.A) | | |

|

| Month | High ($) | Low ($) | Volume Traded |

|

| 2004/December | | 33 | .00 | 31 | .80 | 146,513 | |

|

| 2004/November | | 33 | .00 | 31 | .61 | 68,133 | |

|

| 2004/October | | 34 | .35 | 32 | .60 | 194,751 | |

|

| 2004/September | | 35 | .75 | 33 | .00 | 31,443 | |

|

| 2004/August | | 37 | .00 | 35 | .50 | 50,422 | |

|

| 2004/July | | 35 | .00 | 32 | .01 | 319,697 | |

|

| 2004/June | | 33 | .30 | 32 | .00 | 189,510 | |

|

| 2004/May | | 36 | .50 | 33 | .92 | 151,755 | |

|

| 2004/April | | 39 | .55 | 34 | .00 | 291,449 | |

|

| 2004/March | | 39 | .50 | 36 | .50 | 452,913 | |

|

| 2004/February | | 40 | .00 | 36 | .75 | 107,602 | |

|

| 2004/January | | 40 | .84 | 38 | .00 | 90,206 | |

|

Takeover Bid Protection

The Company and the holders of Class B Common Shares entered into an agreement on November 1, 1994 (as amended by agreement dated January 1, 1996, the “Coattail Agreement”) with a trustee (the “Coattail Trustee”) in order to provide the holders of Class A Shares with specified rights in the event that a takeover bid (as defined under Ontario securities law) having certain characteristics is made for the Class B Common Shares. A takeover bid is generally defined under Ontario securities laws as an offer to acquire outstanding equity or voting shares by an offeror who, after the bid, would own more than 20% of the shares of the class which is the subject of the bid. Under securities law applicable in Canada, and apart from the Coattail Agreement, an offer to purchase Class B Common Shares would not necessarily require that an offer be made to purchase Class A Shares.

DIRECTORS AND OFFICERS

Directors

The following table sets out the directors of Wescast as at January 2, 2005 and for each director his or her province or state and country of residence, principal occupation during the 5 preceding years and the period each director has served as a director.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 23 |

All directors are elected on an annual basis at the Annual General Meeting.

| Name and Province/State | Director | Position | Principal Occupation During the |

|---|

| and Country | Since | | Five Preceding Years |

|---|

| of Residence | | | |

|---|

|

Edward G. Frackowiak(2) (4) |

|

1992 |

|

Chairman and Chief |

|

Executive Chairman of the Company since |

|

| Ontario, Canada | | | | Executive Officer | | May 2003. Prior to that, Mr. Frackowiak | |

| | | | | | | was Vice President and General | |

| | | | | | | Counsel/Canada of First American Title | |

| | | | | | | Insurance Company (title insurance | |

| | | | | | | company). | |

William R. LeVan(2) (3) | |

1991 | |

Director | |

Vice President, Technology of the | |

| Ontario, Canada | | | | | | Company until January 13, 2004. Prior to | |

| | | | | | | that, Mr. LeVan was Vice President, | |

| | | | | | | Manufacturing from 1997 to 2000. | |

Lawrence G. Tapp(1) (2) | |

1997 | |

Director | |

Chairman of the Board of ATS Automation | |

| British Columbia, Canada | | | | | | Tooling Systems Inc. (designer and | |

| (Lead Independent Director) | | | | | | producer of turn-key automated | |

| | | | | | | manufacturing and test systems). Prior | |

| | | | | | | to that, Mr. Tapp was Dean of the | |

| | | | | | | Richard Ivey School of Business, | |

| | | | | | | University of Western Ontario. | |

J. Dwane Baumgardner(1) (3) | |

1998 | |

Director | |

Retired Vice Chairman and President, | |

| Michigan, United States | | | | | | Magna Donnelly Corporation (automotive | |

| | | | | | | parts supplier). | |

Hugh W. Sloan Jr.(2) (3) | |

1998 | |

Director | |

Deputy Chairman of the Woodbridge Foam | |

| Michigan, United States | | | | | | Corporation (automotive parts supplier) | |

| | | | | | | since 1998. Prior to that, Mr. Sloan was | |

| | | | | | | President of the Woodbridge Automotive | |

| | | | | | | Group (automotive parts supplier). | |

J. Emilien Bolduc(1) | |

1999 | |

Director | |

Retired Vice Chairman of Royal Bank of | |

| Quebec, Canada | | | | | | Canada. | |

Robert A. Canuel(3) | |

2003 | |

Director | |

Vice President Human Resources of | |

| Ontario, Canada | | | | | | Hallmark Canada (a manufacturer/ | |

| | | | | | | distributor of social expression products). | |

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 24 |

| Name and Province/State | Director | Position | Principal Occupation During the |

|---|

| and Country | Since | | Five Preceding Years |

|---|

| of Residence | | | |

|---|

|

| Mary Theresa McLeod(1) (2) | | 2003 | | Director | | Member and Director of the Ontario | |

| Ontario, Canada | | | | | | Securities Commission. Founder and | |

| | | | | | | President of McLeod Capital Corporation | |

| | | | | | | (a financial and regulatory consulting | |

| | | | | | | firm). | |

Daniel Lam(1) | |

2004 | |

Director | |

Senior Vice President and Director at | |

| Ontario, Canada | | | | | | Hampton Securities Inc. Prior to that, | |

| | | | | | | Mr. Lam was Vice President & Director of | |

| | | | | | | HSBC Securities Canada Inc. | |

James R. Barton(3) | |

Appointed | |

Director | |

Chief Operating Officer, Dupont Canada | |

| Ontario, Canada | | | | | | Inc. (a diversified science company | |

| | | | | | | serving the agricultural, electronic, | |

| | | | | | | communications, safety and protection | |

| | | | | | | markets). | |

(1) Member of the Audit Committee.

(2) Member of the Nominating and Corporate Governance Committee.

(3) Member of the Human Resources Committee.

(4) Ex-officio member of the Human Resources Committee. Mr. Frackowiak attends Audit

Committee meetings at the invitation of the Audit Committee but does not participate in any decision-making or

voting of the Audit Committee.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 25 |

Officers

The executive officers of Wescast as at January 2, 2005, were as follows:

| Name and Province/State | Position | Principal Occupation During the |

| and Country | | Five Preceding Years |

| of Residence | | |

|

| Edward G. Frackowiak | | Chairman and Chief Executive Officer | | Chairman and CEO of the Company since | |

| Ontario, Canada | | | | May 2004. Executive Chairman of the | |

| | | | | Company from May 2003 to May 2004. | |

| | | | | Prior to that, Mr. Frackowiak was Vice | |

| | | | | President and General Counsel/Canada of | |

| | | | | First American Title Insurance Company | |

| | | | | (title insurance company). | |

Gordon E. Currie | |

Vice President and Chief Financial Officer | |

Vice President and Chief Financial | |

| Ontario, Canada | | | | Officer of the Company since July 2003. | |

| | | | | Prior to that, Mr. Currie was Vice | |

| | | | | President, Treasurer and Chief Financial | |

| | | | | Officer of Emco Limited | |

| | | | | (distributor/manufacturer of building | |

| | | | | products). | |

Paul A. Lawrence | |

Vice President, Sales and Marketing | |

Vice President, Sales and Marketing of | |

| Ontario, Canada | | | | the Company. | |

Larry D. Cerson | |

Vice President, Manufacturing | |

Vice President, Manufacturing since July | |

| Ontario, Canada | | | | 2004. Prior to that Mr. Cerson held the | |

| | | | | position of Director, New Products of | |

| | | | | the Company from 2001. Prior to that, | |

| | | | | he was the General Manager, Weslin | |

| | | | | Hungary Autoipari Rt. Mr. Cerson has | |

| | | | | worked for the Company for over 37 years. | |

Gordon D. Orlikow | |

Vice President, Human Resources | |

Vice President People - Rouge Valley | |

| Ontario, Canada | | (effective November 2004) | | Health System (provider of integrated | |

| | | | | health care services) 2003-2004. Prior | |

| | | | | to that Mr. Orlikow was Senior Vice | |

| | | | | President, People, at Alderwoods Group | |

| | | | | (provider of integrated death services) | |

| | | | | 1993-2003. | |

The number and percentage of securities of each class of voting securities of the Company beneficially owned, directly or indirectly, or over which control or direction was exercised, by all directors and officers of the Company as a group, was approximately 20,047 shares or 0.3% of

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 26 |

the Class A Shares as at March 18, 2005. Pursuant to the terms of the LeVan Family Voting Trust Agreement dated October 25, 1994, Mr. Edward Frackowiak as trustee exercises the votes attached to the 7,376,607 Class B Common Shares held pursuant to the Agreement in accordance with the voting directions given by the holders of a majority of the Class B Common Shares held pursuant to the Agreement. Mr. Frackowiak does not beneficially own, control or direct these shares.

Additional Disclosure for Directors and Officers

To the knowledge of the Company, no director or executive officer of the Company is or has been, in the last ten years, a director or executive officer of an issuer that, while that person was acting in that capacity, (a) was the subject of a cease trade order or similar order or an order that denied the issuer access to any exemptions under Canadian securities legislation, for a period of more than 30 consecutive days, (b) was subject to an event that resulted, after that person ceased to be a director or executive officer, in the issuer being the subject of a cease trade or similar order or an order that denied the issuer access to any exemption under Canadian securities legislation, for a period of more than 30 consecutive days, or (c) or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

TRANSFER AGENT AND REGISTRAR

The registrar and transfer agent for the Company’s Class A shareholders is Computershare Investor Services Inc. The register of the Class A Shares is maintained at Computershare’s office in Toronto (100 University Avenue, 9thFloor, Toronto, Ontario, M5J 2Y1).

INTERESTS OF EXPERTS

The Company’s auditors are Deloitte & Touche LLP, 4210 King Street East, Kitchener, Ontario, N2P 2G5. The Company’s consolidated financial statements as at January 2, 2005 have been filed under National Instrument 51-102 in reliance on the report of Deloitte & Touche LLP, independent chartered accountants, given on their authority as experts in auditing and accounting.

CODE OF ETHICS

The Company has established a Code of Business Conduct applicable to all employees, officers and directors. The Code of Business Conduct is available without charge by contacting the Corporate Secretary at 150 Savannah Oaks Drive, Brantford, Ontario, N3T 5L8, or by email to corp.secretary@wescast.com.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 27 |

AUDIT COMMITTEE INFORMATION

Composition of the Audit Committee

In 2004, the Audit Committee of the Company was composed of the following five members: J. Emilien Bolduc (Chair), J. Dwane Baumgardner, L.G. Tapp, M.T. McLeod and D. Lam. The responsibilities and duties of the Committee are set out in the Committee’s charter, the text of which is set forth in Appendix I to this Annual Information Form.

Financial Literacy

The Board of Directors believes that the composition of the Audit Committee reflects an appropriate level of financial literacy and expertise. Each member of the Audit Committee has been determined by the Board to be “independent” and “financially literate” as such terms are defined under Canadian and United States securities laws and Nasdaq rules.

Audit Committee Financial Expert

Wescast’s board of directors has determined that it has an audit committee financial expert (as such term is defined in the rules and regulations of the Securities and Exchange Commission “SEC”) serving on its audit committee. Mr. J. Emilien Bolduc has been determined to be an “audit committee financial expert” and is independent (as that term is defined by The NASDAQ Stock Market, Inc.‘s listing standards applicable to Wescast). The Board has made this determination based on the education and breadth and depth of experience of this member of the Committee. The SEC has indicated that the designation of Mr. Bolduc as an audit committee financial expert does not make him an “expert” for any purpose, impose on him any duties, obligations or liability that are greater than the duties, obligations or liability imposed on him as a member of the audit committee and board of directors in absence of such designation, or affect the duties, obligations or liabilities of any other member of the audit committee or board of directors. The following is a description of the education and experience of each member of the Committee that is relevant to the performance of his or her responsibilities as a member of the Audit Committee.

Mr. Bolduc obtained a Bachelor’s and Masters Degree in Commercial Science from Laval University. He is a retired Vice Chairman of the Royal Bank and has held various international positions with the Bank throughout his career including Chief Internal Auditor and chief Financial Officer. He was also a director of several Royal Bank subsidiaries.

Mr. Baumgardner retired as Vice Chairman and President, Magna Donnelly Corporation in 2003. For over 20 years, he supervised the CFO at Donnelly Corporation. He is also a director and member of the Audit Committee of SL Industries, Inc.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 28 |

Mr. Tapp has an EMBA from the University of Kansas and was the Dean of the Richard Ivey School of Business at The University of Western Ontario. He continues as a professor at that school regarding corporate governance and business strategy. He is also Chairman of Tapp Technologies Inc. and is chairman and a member of several audit committees of public companies.

Mrs. McLeod obtained a B.A. from the University of Ottawa and an MBA – Finance Concentration from The University of Western Ontario. She has 20 years experience as an investment banker with three major Canadian investment dealers and was a Managing Director or equivalent for 15 of those years. She is also a member of the Institute of Chartered Financial Analysts and has spent several years as a corporate director, primarily since 1997 as a member of audit committees.

Mr. Lam holds a B.A. in Mathematics, Business Studies and Motion Picture Studies from York University as well as an EMBA from The University of Western Ontario. He is currently Senior Vice President and a Director at Hampton Securities Inc. and Hampton Securities (Asia) Limited. He was also a Vice President and a Director of HSBC Securities Canada Inc. He has taught both Accounting and Financial Accounting and Financial Analysis at York University. Daniel Lam is not standing for re-election at the Annual Shareholders’ Meeting on May 9, 2005.

Auditors’ Service Fees

Deloitte & Touche LLP has been the company’s auditor since February 26, 2003. The approximate fees billed for professional services rendered by Deloitte & Touche LLP, Wescast’s principal auditor for the year ended January 2, 2005, and December 28, 2003 are set out below:

|

| | Fees billed by Deloitte | Fees billed by | Fees billed by Grant |

| | & Touche LLP in | Deloitte & Touche | Thornton LLP in |

| | 2004 ($) | LLP in 2003 ($) | 2003 ($) |

|

| Audit Fees (1) | | 210,000 | | 90,000 | | 60,300 | |

|

| Audit Related Fees (2) | | 0 | | 0 | | 10,800 | |

|

| Tax Fees (3) | | 638,500 | | 519,000 | | 30,300 | |

|

| All Other Fees | | 0 | | 0 | | 0 | |

|

| Total | | 848,500 | | 609,000 | | 101,400 | |

|

| (1) | | For the audit of Wescast’s annual financial statements and services normally provided by the principal auditor in connection with Wescast’s statutory and regulatory filings. |

| (2) | | For assurance and related services that are reasonably related to the performance of the audit and are not reported in (1), including accounting consultations and various agreed upon procedures. |

| (3) | | For tax compliance, advice, planning and return preparation and for services related to the submission and receipt of investment tax credits earned from Scientific Research and Experimental Development (SR&ED) qualified expenditures. These fees include administration charges and out-of-pocket costs. |

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 29 |

Audit Committee – Pre-Approval Policies and Procedures

The Company’s Audit Committee is responsible for overseeing the work of the independent auditors and considering whether the provision of services, other than audit services, is compatible with maintaining the auditors’ independence. The Company has adopted a policy regarding the Audit Committee’s pre-approval of all audit and permissible non-audit services provided by the independent auditors. The Committee determines, at least once a year, which audit services, audit-related services, tax services and other permissible non-audit services to pre-approve and creates a list of such pre-approved services, some with pre-approved fee thresholds.

At each regularly scheduled Audit Committee meeting, senior management provides the Audit Committee with the following:

| | • | | A report summarizing the services, or grouping of related services, including fees, provided by the independent auditor; and |

| | • | | An updated projection for the current fiscal year, presented in a manner consistent with the proxy disclosure requirements, of the estimated annual fees to be paid to the independent auditor. |

All fees paid to Wescast’s external auditors in 2004 were approved by Wescast’s Audit Committee.

MATERAL CONTRACTS

There are no material contracts entered into by the Corporation on or after January 1, 2002, other than contracts entered into in the ordinary course of business.

ADDITIONAL INFORMATION

Additional information about Wescast is available on the Company’s web site atwww.wescast.com, on SEDAR (System for Electronic Document Analysis and Retrieval) atwww.sedar.com and on the U.S. Securities and Exchange web site atwww.sec.gov/edgar.

Additional information, including information concerning directors’ and executive officers’ remuneration and indebtedness, principal holders of the Company’s securities and securities authorized for issuance under equity compensation plans where applicable, is contained in the Company’s Management Proxy Circular dated March 18, 2005, for the Annual Meeting of Shareholders for the year ended January 2, 2005.

| | |

|---|

wescast industries inc. |

Annual Information Form |

Page 30 |

Additional financial information is provided in the Company’s comparative audited consolidated financial statements and Management’s Discussion and Analysis in the 2004 Annual Report of Wescast for its fiscal year ended January 2, 2005.