UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2010 OR |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file number 0-24960

COVENANT TRANSPORTATION GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 88-0320154 |

| (State / other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 400 Birmingham Hwy. | | |

| Chattanooga, TN | | 37419 |

| (Address of principal executive offices) | | (Zip Code) |

| Registrant's telephone number, including area code: | 423 - 821-1212 |

| | |

| Securities registered pursuant to Section 12(b) of the Act: | $0.01 Par Value Class A Common Stock – The NASDAQ Global Select Market |

| | (Title of class) |

| | |

| Securities registered pursuant to Section 12(g) of the Act: | None |

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in rule 12b-2 of the Exchange Act.

| [ ] Large Accelerated Filer | [ ] Accelerated Filer | [X] Non-Accelerated Filer |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 30, 2010, was approximately $51 million (based upon the $6.76 per share closing price on that date as reported by NASDAQ). In making this calculation the registrant has assumed, without admitting for any purpose, that all executive officers, directors, and affiliated holders of more than 10% of a class of outstanding common stock, and no other persons, are affiliates.

As of February 25, 2011, the registrant had 12,258,255 shares of Class A common stock and 2,350,000 shares of Class B common stock outstanding.

Materials from the registrant's definitive proxy statement for the 2011 Annual Meeting of Stockholders to be held on May 17, 2011, have been incorporated by reference into Part III of this Form 10-K.

Table of Contents

| Part I | | |

| | Item 1. | Business | |

| | Item 1A. | Risk Factors | |

| | Item 1B. | Unresolved Staff Comments | |

| | Item 2. | Properties | |

| | Item 3. | Legal Proceedings | |

| | Item 4. | Removed and Reserved | |

| | | | |

| Part II | | |

| | Item 5. | Market for Registrant's Common Equity and Related Stockholder Matters | |

| | Item 6. | Selected Financial Data | |

| | Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

| | Item 8. | Financial Statements and Supplementary Data | |

| | Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| | Item 9A. | Controls and Procedures | |

| | Item 9B. | Other Information | |

| | | | |

| Part III | | |

| | Item 10. | Directors, Executive Officers, and Corporate Governance | |

| | Item 11. | Executive Compensation | |

| | Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| | Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| | Item 14. | Principal Accountant Fees and Services | |

| | | | |

| Part IV | | |

| | Item 15. | Exhibits and Financial Statement Schedules | |

| | | | |

Signatures | |

| | |

Report of Independent Registered Public Accounting Firm | |

| | |

| Financial Data | |

| | Consolidated Balance Sheets | |

| | Consolidated Statements of Operations | |

| | Consolidated Statements of Stockholders' Equity and Comprehensive Income (Loss) | |

| | Consolidated Statements of Cash Flows | |

| | Notes to Consolidated Financial Statements | |

PART I

This Annual Report on Form 10-K contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended and such statements are subject to the safe harbor created by those sections. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of earnings, revenues, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; and any statements of belief and any statement of assumptions underlying any of the foregoing. Such statements may be identified by their use of terms or phrases such as "expects," "estimates," "projects," "believes," "anticipates," "plans," "intends," and similar terms and phrases. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Readers should review and consider the factors discussed in "Risk Factors" of this Annual Report on Form 10-K, along with various disclosures in our press releases, stockholder reports, and other filings with the Securities and Exchange Commission.

All such forward-looking statements speak only as of the date of this Annual Report on Form 10-K. You are cautioned not to place undue reliance on such forward-looking statements. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in the events, conditions, or circumstances on which any such statement is based.

References in this Annual Report to "we," "us," "our," or the "Company" or similar terms refer to Covenant Transportation Group, Inc. and its subsidiaries.

General

We focus on targeted markets throughout the United States where we believe our service standards can provide a competitive advantage. We are a major carrier for transportation companies such as freight forwarders, less-than-truckload carriers, and third-party logistics providers that require a high level of service to support their businesses, as well as for traditional truckload customers such as manufacturers, retailers, and food and beverage shippers. All of our asset-based subsidiaries are truckload carriers and as such generally dedicate an entire trailer to one customer from origin to destination. We also generate revenue through a subsidiary that provides freight brokerage services.

We were founded as a provider of expedited long-haul freight transportation, primarily using two-person driver teams in transcontinental lanes. A combination of customer demand for additional services and changes in freight distribution patterns resulted in additional services. Through several acquisitions in the late 1990's and continuing through 2006, we entered the refrigerated, solo, and regional markets. In addition, over the past several years, we internally developed the capacity to provide dedicated fleet and freight brokerage services.

We have two reportable segments: Asset-Based Truckload Services ("Truckload") and our Brokerage Services, also known as Covenant Transport Solutions, Inc. ("Solutions").

The Truckload segment consists of three asset-based operating fleets that are aggregated because they have similar economic characteristics and meet the aggregation criteria. The three operating fleets that comprise our Truckload segment are as follows: (i) Covenant Transport, Inc. ("Covenant Transport"), our historical flagship operation, which provides expedited long-haul, dedicated, and regional solo-driver service; (ii) Southern Refrigerated Transportation, Inc. ("SRT"), which provides primarily long-haul and regional temperature-controlled service; and (iii) Star Transportation, Inc. ("Star"), which provides regional solo-driver service, primarily in the southeastern United States.

The Solutions segment provides freight brokerage service directly and through freight brokerage agents who are paid a commission for the freight they provide. The brokerage operation has helped us continue to serve customers when we lacked capacity in a given area or when the load has not met the operating profile of our Truckload segment.

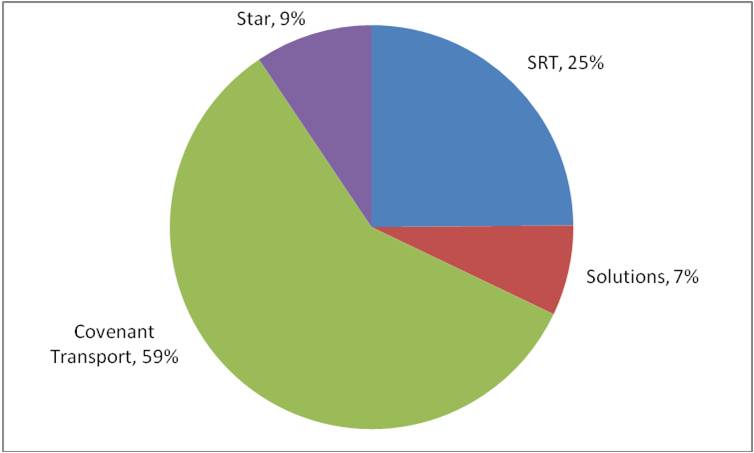

The following chart reflects the size of each of our subsidiaries measured by 2010 freight revenue:

| Distribution of Revenue Among Subsidiaries |

| 59% |

| SRT | 25% |

| Star | 9% |

| Solutions | 7% |

Asset-Based Truckload Services

Our Truckload segment comprised approximately 93%, 91%, and 91% of our total freight revenue in 2010, 2009, and 2008, respectively.

We primarily generate revenue by transporting freight for our customers. Generally, we are paid a predetermined rate per mile for our truckload services. We enhance our truckload revenue by charging for tractor and trailer detention, loading and unloading activities, and other specialized services, as well as through the collection of fuel surcharges to mitigate the impact of increases in the cost of fuel. The main factors that affect our truckload revenue are the revenue per mile we receive from our customers, the percentage of miles for which we are compensated, and the number of shipments and miles we generate. These factors relate, among other things, to the general level of economic activity in the United States, inventory levels, specific customer demand, the level of capacity in the tr ucking industry, and driver availability.

The main factors that impact our profitability in terms of expenses are the variable costs of transporting freight for our customers. These costs include fuel expenses, driver-related expenses, such as wages, benefits, training, and recruitment, and purchased transportation expenses, which primarily include compensating independent contractors. Expenses that have both fixed and variable components include maintenance and tire expense and our total cost of insurance and claims. These expenses generally vary with the miles we travel, but also have a controllable component based on safety, self-insured retention versus insurance premiums, fleet age, efficiency, and other factors. Our main fixed costs include rentals and depreciation of long-term assets, such as revenue equipment and terminal facilities, an d the compensation of non-driver personnel.

The development of our business has affected our operating metrics over time. We measure performance of our Truckload segment and the related subsidiaries' service offerings in four areas: average length-of-haul, average freight revenue per total mile (excluding fuel surcharges), average miles per tractor, and average freight revenue per tractor per week (excluding fuel surcharges). A description of each follows:

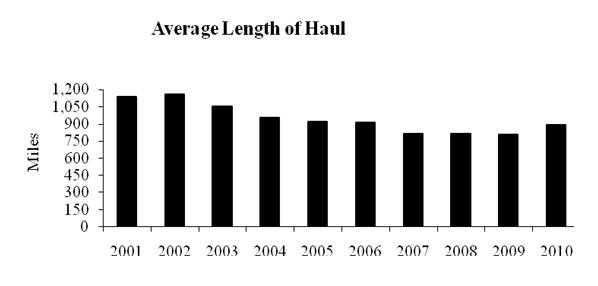

Average Length-of-Haul. Our average length-of-haul has decreased over time as we have increased the use of solo-driver tractors and increased our presence in regional markets. The increase in the length- of-haul in 2010 resulted from changes in our allocation of assets among our subsidiaries and focus on lane selection between target markets. | |

| | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Average Length-of-Haul in Miles | 1,136 | 1,159 | 1,055 | 950 | 920 | 908 | 815 | 815 | 805 | 887 |

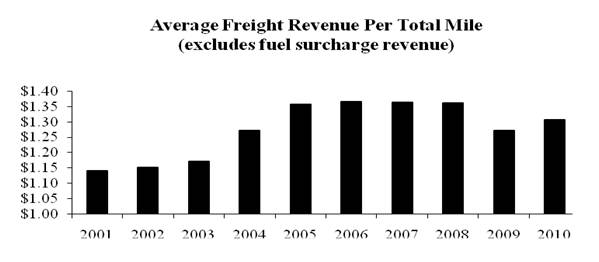

Average Freight Revenue Per Total Mile. Our average freight revenue per total mile is primarily a function of the macro U.S. economic environment including supply/demand of freight and carriers. The increase in 2010 compared to 2009 is a result of the strengthening U.S. economy and tighter capacity along with expected tighter capacity in 2011. | |

| | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Average Freight Revenue Per Total Mile (excludes fuel surcharge revenue) | 1.14 | 1.15 | 1.17 | 1.27 | 1.357 | 1.364 | 1.363 | 1.36 | 1.271 | 1.307 |

Average Miles Per Tractor. Average miles per tractor reflects economic demand, our ability to match fleet size to demand, and the percentage of team-driven tractors in our fleet. The increase in utilization in 2010 is a result of an improved freight environment caused by the strengthening U.S. economy, the replenishment of inventory levels from record lows in preceding years, and our allocation of assets among our subsidiaries. | |

| | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Average Miles Per Tractor | 127,714 | 129,906 | 129,656 | 122,899 | 115,765 | 117,621 | 118,159 | 118,992 | 119,836 | 125,178 |

Average Freight Revenue Per Tractor Per Week. We use average freight revenue per tractor per week as our main measure of asset productivity. This operating metric takes into account the effects of freight rates, non-revenue miles, and miles per tractor. In addition, because we calculate average freight revenue per tractor using all of our trucks, it takes into account the percentage of our fleet that is unproductive due to lack of drivers, repairs, and other factors. The increase in 2010 back to more normalized levels is a result of improved demand in 2010, tighter industry-wide tractor capacity, high-quality customer service, and improved freight selection. | |

| | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Average Freight Revenue Per Tractor Per Week(excludes fuel surcharge revenue) | 2,803 | 2,870 | 2,897 | 2,995 | 3,013 | 3,077 | 3,088 | 3,105 | 2,920 | 3,137 |

Brokerage Services

Our Solutions segment comprised approximately 7%, 9%, and 9% of our total operating revenue in 2010, 2009, and 2008, respectively. Solutions derives revenue from arranging transportation services for customers through relationships with thousands of third-party carriers and integration with our Truckload segment. Solutions provides freight brokerage services through freight brokerage agents, who are paid a commission for the freight brokerage service they provide, and directly through in-house brokerage personnel working in direct contact with customers. The main factors that impact profitability in terms of expenses are the variable costs of outsourcing the transportation freight for our customers and managing selling, general, and administrative expenses. Our brokerage loads decreased to 19,589 in 201 0, from 24,769 in 2009, primarily due to a reduction in agents. Average revenue per load increased approximately 5% to $2,014 in 2010, from $1,912 in 2009, primarily due to increased rates as a result of the improved economic climate in 2010 and resulting tighter capacity for trucks along with year-over-year increases in fuel costs.

Refer to Note 16, "Segment Information," of the accompanying consolidated financial statements for further information about each of our reporting segment's operating and financial results for 2010, 2009, and 2008.

Customers and Operations

Our primary customers include manufacturers and retailers, as well as other transportation companies. In 2010, our five largest customers were Conway Inc., Estes Express Lines, Georgia Pacific, UPS, and Wal-Mart. Conway Inc., Estes Express Lines, and UPS are other transportation providers who seek our services when our team-driven tractors or other service capabilities offer them an advantage. No customer accounted for more than 10% of our consolidated revenue in 2010, 2009, or 2008. Our top five customers accounted for approximately 31%, 26%, and 20% of our total revenue in 2010, 2009, and 2008, respectively.

We operate tractors driven by a single driver and also tractors assigned to two-person driver teams. Our single driver tractors generally operate in shorter lengths of haul, generate fewer miles per tractor, and experience more non-revenue miles, but the lower productive miles are expected to be offset by generally higher revenue per loaded mile and the reduced employee expense of compensating only one driver. In contrast, our two-person driver tractors generally operate in longer lengths of haul, generate greater miles per tractor, and experience fewer non-revenue miles, but we typically receive lower revenue per loaded mile and incur higher employee expenses of compensating both drivers. We expect operating statistics and expenses to shift with the mix of single and team operations.

At December 31, 2010, we operated 3,087 tractors and 7,332 trailers. Of these tractors, 2,919 were owned, 28 were financed under operating leases, and 140 were provided by independent contractors, who own and drive their own tractors. Of these trailers, 2,373 were owned, 4,611 were financed under operating leases, and 348 were financed under capital leases.

Independent contractors (owner-operators) provide a tractor and a driver and are responsible for all operating expenses in exchange for a fixed payment per mile. We do not have the capital outlay of purchasing the tractor. The payments to independent contractors are recorded in revenue equipment rentals and purchased transportation. Expenses associated with owned equipment, such as interest and depreciation, are not incurred, and for independent contractor tractors, driver compensation, fuel, and other expenses are not incurred. Because obtaining equipment from independent contractors and under operating leases effectively shifts financing expenses from interest to "above the line" operating expenses, we evaluate our efficiency using net margin as well as operating ratio.

We equip our tractors with a satellite-based tracking and communications system that permits direct communication between drivers and fleet managers. We believe that this system enhances our operating efficiency and improves customer service and fleet management. This system also updates the tractor's position every thirty minutes, which allows us and our customers to locate freight and accurately estimate pick-up and delivery times. We also use the system to monitor engine idling time, speed, performance, and other factors that affect operating efficiency.

As an additional service to customers, we offer electronic data interchange and internet-based communication for customer usage in tendering loads and accessing information such as cargo position, delivery times, and billing information. These services allow us to communicate electronically with our customers, permitting real-time information flow, reductions or eliminations in paperwork, and the employment of fewer clerical personnel. We use a document imaging system to reduce paperwork and enhance access to important information.

We operate throughout the U.S. and in parts of Canada and Mexico, with substantially all of our revenue generated from within the U.S. All of our tractors are domiciled in the U.S., and for the past three years, we estimate that less than one percent of our revenue has been generated in Canada and Mexico. We do not separately track domestic and foreign revenue from customers or domestic and foreign long-lived assets, and providing such information would not be meaningful.

In 2009, we began a multi-year project to upgrade the hardware and software of our information systems. The goal upon completion of the project is to have uniform operational and financial systems across the entire Company as we believe this will improve customer service, utilization, and enhance our visibility into and across the organization. Star and Solutions are currently operating on the new system, and management is planning for implementations at Covenant Transport and SRT.

Drivers and Other Personnel

Driver recruitment, retention, and satisfaction are essential to our success, and we have made each of these factors a primary element of our strategy. We recruit both experienced and student drivers as well as independent contractor drivers who own and drive their own tractor and provide their services to us under lease. We conduct recruiting and/or driver orientation efforts from five of our locations, and we offer ongoing training throughout our terminal network. We emphasize driver-friendly operations throughout our organization. We have implemented automated programs to signal when a driver is scheduled to be routed toward home, and we assign fleet managers specific tractor units, regardless of geographic region, to foster positive relationships between the drivers and their principal co ntact with us.

The truckload industry has periodically experienced difficulty in attracting and retaining enough qualified truck drivers. It is also common for the driver turnover rate of individual carriers to exceed 100% in a year. At times, there are driver shortages in the trucking industry. In past years, when there were driver shortages, the number of qualified drivers had not kept pace with freight growth because of (i) changes in the demographic composition of the workforce; (ii) alternative employment opportunities other than truck driving that became available in a growing economy; and (iii) individual drivers' desire to be home more often.

Driver recruiting and retention were challenging in 2010 as evidenced by an increase in our average number of open trucks. While open trucks, excluding wrecked units, approximated 3% of our fleet at December 31, 2010 and 2009, there were less open trucks throughout most of 2009 as a result of the weakness in the economy contributing to more candidates entering the driver market in the early part of the year and as a result of reductions in our fleet in 2009. Management's goal is to reduce open trucks, excluding wrecked units, to less than 1% of our fleet, although no significant progress was made in 2010. We continue to work toward this goal, and we employed certain initiatives in the latter half of 2010 that we expect to provide for improvement in 2011.

Internal education and evaluation of the Federal Motor Carrier Safety Administration ("FMCSA") Comprehensive Safety Analysis 2010 ("CSA 2010") are priorities as we develop plans to keep our top talent and challenge those drivers that need improvement. Overall, we believe this regulation will bring challenges as well as opportunities for truckload carriers. CSA 2010, in conjunction with potential reductions in hours-of-service for drivers, may reduce effective capacity in our industry as well as negatively impact equipment utilization. Nevertheless, for carriers that successfully manage the new environment with driver friendly equipment, compensation, and operations, we believe opportunities to increase market share may be available. Driver pay may increase as a result of regulation and economic expansion, which provides mor e alternative employment opportunities. If economic growth is sustained; however, we expect the supply/demand environment to be favorable enough for us to offset expected compensation increases with better freight pricing.

We use driver teams in a substantial portion of our tractors. Driver teams permit us to provide expedited service on selected long-haul lanes because teams are able to handle longer routes and drive more miles while remaining within U.S. Department of Transportation ("DOT") hours-of-service rules. The use of teams contributes to greater equipment utilization of the tractors they drive than obtained with single drivers. The use of teams, however, increases the accumulation of miles on tractors and trailers as well as personnel costs as a percentage of revenue and the number of drivers we must recruit. At December 31, 2010, teams operated approximately 27% of our tractors versus 29% in the preceding year.

We are not a party to a collective bargaining agreement. At December 31, 2010, we employed approximately 3,950 drivers and approximately 790 non-driver personnel. At December 31, 2010, we also contracted with approximately 140 independent contractor drivers.

Revenue Equipment

We believe that operating high quality, late-model equipment contributes to operating efficiency, helps us recruit and retain drivers, and is an important part of providing excellent service to customers. Our policy is to operate a modern fleet of tractors, with the majority of units under warranty, to minimize repair and maintenance costs and reduce service interruptions caused by breakdowns. We also order most of our equipment with uniform specifications to reduce our parts inventory and facilitate maintenance. At December 31, 2010, our tractor fleet had an average age of approximately 1.6 years, and our trailer fleet had an average age of approximately 5.4 years. At December 31, 2010, approximately 88% of our tractors were equipped with 2007 emission-compliant engines in addition to 3% of our tractors being equ ipped with 2010 emission-compliant engines. Furthermore, at December 31, 2010, approximately 79% of our trailers were dry vans and the remaining trailers were refrigerated vans.

Over the past several years, the price of new tractors has risen dramatically, while the resale value of the equipment has generally not increased proportionately and in some periods has decreased. This has substantially increased our costs of operation over the past several years. Tractor manufacturers have again increased prices in connection with the manufacturing of 2010 emission-compliant engines.

Industry and Competition

The U.S. market for truck-based transportation services was estimated to have generated $544.4 billion in 2009, according to the most recently available data published by American Trucking Associations, Inc. The trucking industry includes both private fleets and "for-hire" carriers. We operate in the highly fragmented for-hire truckload segment of this market, which generated revenues of approximately $246.2 billion in 2009. Our dedicated business also competes in the estimated $259.6 billion private fleet portion of the overall trucking market, by seeking to convince private fleet operators to outsource or supplement their private fleets.

The U.S. trucking industry is highly competitive and includes thousands of "for-hire" motor carriers, none of which dominate the market. Service and price are the principal means of competition in the trucking industry. We compete to some extent with railroads and rail-truck intermodal service but attempt to differentiate ourselves from them on the basis of service. Rail and rail-truck intermodal movements are more often subject to delays and disruptions arising from rail yard congestion, which reduce the effectiveness of such service to customers with time-definite pick-up and delivery schedules. In times of high fuel prices or less consumer demand, however, rail-intermodal competition becomes more significant.

We believe that the cost and complexity of operating trucking fleets are increasing and that economic and competitive pressures are likely to force many smaller competitors and private fleets to consolidate or exit the industry. As a result, we believe that larger, better-capitalized companies, like us, will have opportunities to increase profit margins and gain market share. In the market for dedicated services, we believe that truckload carriers, like us, have a competitive advantage over truck lessors, who are the other major participants in the market, because we can offer lower prices by utilizing back-haul freight within our network that traditional lessors may not have.

Regulation

Our operations are regulated and licensed by various U.S. agencies. Our Canadian business activities are subject to similar requirements imposed by the laws and regulations of Canada, as well as its provincial laws and regulations. We operate within Mexico by utilizing third-party carriers within that country. Our Company drivers and independent contractors also must comply with the safety and fitness regulations of the DOT, including those relating to drug and alcohol testing and hours-of-service. Such matters as weight and equipment dimensions are also subject to U.S. regulations. We also may become subject to new or more restrictive regulations relating to fuel emissions, drivers' hours-of-service, ergonomics, or other matters affecting safety or operating methods. Ot her agencies, such as the Environmental Protection Agency ("EPA") and the Department of Homeland Security ("DHS") also regulate our equipment, operations, and drivers.

The DOT, through the FMCSA, imposes safety and fitness regulations on us and our drivers. New rules that limit driver hours-of-service were adopted effective January 4, 2004, and then modified effective October 1, 2005 (the "2005 Rules"). In July 2007, a federal appeals court vacated portions of the 2005 Rules. Two of the key portions that were vacated include the expansion of the driving day from 10 hours to 11 hours, and the "34-hour restart," which allowed drivers to restart calculations of the weekly on-duty time limits after the driver had at least 34 consecutive hours off duty. The court indicated that, in addition to other reasons, it vacated these two portions of the 2005 Rules because FMCSA failed to provide adequate data supporting its decision to increase the driving day and provid e for the 34-hour restart. In November 2008, following the submission of additional data by FMCSA and a series of appeals and related court rulings, FMCSA published its final rule, which retains the 11 hour driving day and the 34-hour restart (the "Final Rule"). However, advocacy groups have continued to challenge the Final Rule. On December 20, 2010, the FMCSA issued a Notice of Proposed Rulemaking that would place additional limits on the time drivers may operate a commercial motor vehicle. Among the proposed revisions is a provision that all driving time must be completed within a 14-hour period and that timeframe must include at least a one-hour break. The proposal also provides that the 34-hour restart may only be used once per week and must include two periods between midnight and six a.m. The rule also contemplates reducing the maximum driving time in a 24-hour period from 11 hours to 10 hours. The public comment period on th e proposal closes on March 4, 2011, and a Final Rule is expected to be published by July 26, 2011.

We are unable to predict what form the new rules may take, how a court may rule on such challenges to such rules, and to what extent the FMCSA might attempt to materially revise the rules under the current presidential administration. On the whole, however, we believe any modifications to the current rules will decrease productivity and cause some loss of efficiency, as drivers and shippers may need to be retrained, computer programming may require modifications, additional drivers may need to be employed or engaged, additional equipment may need to be acquired, and some shipping lanes may need to be reconfigured.

The FMCSA's CSA 2010 introduced a new enforcement and compliance model, which implements driver standards in addition to the company standards currently in place. Under CSA 2010, the methodology for determining a carrier's DOT safety rating has been expanded to include the on-road safety performance of the carrier's drivers. As a result, certain current and potential drivers may no longer be eligible to drive for us, our fleet could be ranked poorly as compared to our peer firms, and our safety rating could be adversely impacted. A reduction in eligible drivers or a poor fleet ranking may result in difficulty attracting and retaining qualified drivers, and could cause our customers to direct their business away from us and to carriers with higher fleet rankings, which would adversely affect our results of operatio ns.

Recently, our CSA 2010 ratings scored us above the established intervention threshold for one of the safety-related standards. Based on this unfavorable rating, we may be prioritized for an intervention action and roadside inspection, either of which could adversely affect our results of operations. In response to this unfavorable rating, we have updated safety training for drivers, including specific focus on drivers with scores in the lower percentiles of certain of the standards. Additionally, we have reduced the maximum speed on a large portion of our fleet and enhanced programs that reward drivers for positive safety behavior.

The FMCSA also is considering revisions to the existing rating system and the safety labels assigned to motor carriers evaluated by the DOT. We currently have a satisfactory DOT rating, which is the highest available rating under the current safety rating scale. Under the revised rating system being considered by the FMCSA, our safety rating would be evaluated more regularly, and our safety rating would reflect a more in-depth assessment of safety-based violations.

Finally, the FMCSA has proposed new rules that will require nearly all carriers, including us, to install and use electronic, on-board recorders in their tractors to electronically monitor truck miles and enforce hours-of-service. Approximately, 36% of our owned tractors are equipped with electronic on-board recorders, and we plan to have these devices installed on the majority of the fleet by December 31, 2011.

The Transportation Security Administration ("TSA") has adopted regulations that require determination by the TSA that each driver who applies for or renews his or her license for carrying hazardous materials is not a security threat. This could reduce the pool of qualified drivers, which could require us to increase driver compensation, limit our fleet growth, or result in trucks sitting idle. These regulations also could complicate the matching of available equipment with hazardous material shipments, thereby increasing our response time on customer orders and our non-revenue miles. As a result, it is possible we could fail to meet the needs of our customers or could incur increased expenses to do so.

Certain states and municipalities continue to restrict the locations and amount of time where diesel-powered tractors, such as ours, may idle, in order to reduce exhaust emissions. These restrictions could force us to alter our drivers' behavior, purchase on-board power units that do not require the engine to idle, or face a decrease in productivity.

We are subject to various environmental laws and regulations dealing with the hauling and handling of hazardous materials, fuel storage tanks, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. Our truck terminals often are located in industrial areas where groundwater or other forms of environmental contamination could occur. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. Certain of our facilities have waste oil or fuel storage tanks and fueling islands. A small percentage of our freight consists of low-grade hazardous substances, which subjects us to a wide array of regulations. Although we have instituted programs to monitor and control environ mental risks and promote compliance with applicable environmental laws and regulations, if we are involved in a spill or other accident involving hazardous substances, if there are releases of hazardous substances we transport, if soil or groundwater contamination is found at our facilities or results from our operations, or if we are found to be in violation of applicable laws or regulations, we could be subject to cleanup costs and liabilities, including substantial fines or penalties or civil and criminal liability, any of which could have a materially adverse effect on our business and operating results.

Regulations limiting exhaust emissions became more restrictive in 2010. On May 21, 2010, President Obama signed an executive memorandum directing the National Highway Traffic Safety Administration ("NHTSA") and the EPA to develop new, stricter fuel efficiency standards for heavy trucks, beginning in 2014. On October 25, 2010, the NHTSA and the EPA proposed regulations that regulate fuel efficiency and greenhouse gas emissions beginning in 2014. In December 2008, California adopted new performance requirements for diesel trucks, with targets to be met between 2011 and 2023, and California also has adopted aerodynamics requirements for certain trailers. These regulations, as well as proposed regulations or legislation related to climate change that potentially impose restrictions, caps, taxes, or oth er controls on emissions of greenhouse gas, could adversely affect our operations and financial results. In addition, increasing efforts to control emissions of greenhouse gases are likely to have an impact on us. The EPA has announced a finding relating to greenhouse gas emissions that may result in promulgation of greenhouse gas emission limits. Compliance with such regulations has increased the cost of new tractors, could impair equipment productivity, lower fuel mileage, and increase our operating expenses. These adverse effects, combined with the uncertainty as to the reliability of the new diesel engines and the residual values of these vehicles, could materially increase our costs or otherwise adversely affect our business or operations.

Fuel Availability and Cost

We actively manage our fuel costs by routing our drivers through fuel centers with which we have negotiated volume discounts and through jurisdictions with lower fuel taxes, where possible. The cost of fuel trended higher in 2010, after a reprieve in 2009 from the historical highs for petroleum products in 2008. We have also reduced the maximum speed of many of our trucks, implemented strict idling guidelines for our drivers, purchased technology to enhance our management and monitoring of out-of-route miles, encouraged the use of shore power units in truck stops, and imposed standards for accepting broker freight that include minimum rates and fuel surcharges. This combination of initiatives has contributed to significant improvements in fleet wide average fuel mileage. Moreover, we have a fuel surcharge revenu e program in place with the majority of our customers, which has historically enabled us to recover some of the higher fuel costs; however, even with the fuel surcharges, the price of fuel has affected our profitability. Our fuel surcharges are billed on a lagging basis, meaning we typically bill customers in the current week based on a previous week's applicable index. Therefore, in times of increasing fuel prices, we do not recover as much as we are currently paying for fuel. In periods of declining prices, the opposite is true. In addition, we incur additional costs when fuel prices rise that cannot be fully recovered due to our engines being idled during cold or warm weather, empty or out-of-route miles, and for fuel used by refrigerated trailer units that generally are not billed to customers. In addition, during 2009 and 2008, many customers attempted to modify their surcharge programs, some successfully, which has resulted in recovery of a smaller portion o f fuel price increases. In 2010, we refocused on ensuring fuel surcharges from customers were acceptable to mitigate the rising cost of fuel in 2010 and expected continued increase in 2011. Rapid increases in fuel costs or shortages of fuel could have a materially adverse effect on our operations or future profitability.

We engage in activities that expose us to market risks, including the effects of changes in fuel prices. Financial exposures are evaluated as an integral part of our risk management program, which seeks, from time-to-time, to reduce the potentially adverse effects that the volatility of fuel markets may have on operating results. In an effort to seek to reduce the variability of the ultimate cash flows associated with fluctuations in diesel fuel prices, we periodically enter into various derivative instruments, including forward futures swap contracts. As diesel fuel is not a traded commodity on the futures market, heating oil is used as a substitute for diesel fuel because prices for both generally move in similar directions. Under these contracts, we pay a fixed rate per gallon of heating oil and receive the m onthly average price of New York heating oil per the New York Mercantile Exchange ("NYMEX"). The retrospective and prospective regression analyses provided that changes in the prices of diesel fuel and heating oil were deemed to be highly effective based on the relevant authoritative guidance. We do not engage in speculative transactions, nor do we hold or issue financial instruments for trading purposes.

We recognize all derivative instruments at fair value on our consolidated balance sheets. Our derivative instruments are designated as cash flow hedges, thus the effective portion of the gain or loss on the derivative is reported as a component of accumulated other comprehensive income and will be reclassified into earnings in the same period during which the hedged transaction affects earnings. The effective portion of the derivative represents the change in fair value of the hedge that offsets the change in fair value of the hedged item. To the extent the change in the fair value of the hedge does not perfectly offset the change in the fair value of the hedged item, the ineffective portion of the hedge is immediately recognized in other income on our consolidated statements of operations.

During the fourth quarter of 2010, we sold all of our contracts related to the forecasted purchase of diesel fuel in 2011 to lock-in the related gains. The gains totaling $0.5 million are included in accumulated other comprehensive income, net of tax of $0.3 million. As such, there are no outstanding derivative instruments at December 31, 2010. During 2010, $1.8 million was reclassified from accumulated other comprehensive income to earnings related to gains on contracts that expired or were sold and for which we completed the forecasted transaction by purchasing the hedged diesel fuel. At December 31, 2009, our derivative instruments had a fair value of $0.5 million and were included in other assets in the consolidated balance sheet, while the offsetting $0.3 million, net of tax of $0.2 million, was include d in accumulated other comprehensive income. No amounts were reclassified from accumulated other comprehensive income into earnings in 2009 given the futures swap contracts were forward starting in 2010 and as such there had been no transactions involving purchases of the related diesel fuel being hedged at December 31, 2009.

Based on the amounts in accumulated other comprehensive income as of December 31, 2010 and the expected timing of the purchases of the diesel hedged, we expect to reclassify $0.8 million of gains on derivative instruments from accumulated other comprehensive income to earnings during the next twelve months due to the actual diesel fuel purchases.

We perform both a prospective and retrospective assessment of the effectiveness of our hedge contracts at inception and quarterly, including assessing the possibility of counterparty default. If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge accounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. We believe hedge contracts have been and will continue to be highly effective in offsetting changes in cash flows attributable to the hedged risk.

Seasonality

In the trucking industry, revenue generally decreases as customers reduce shipments during the winter holiday season and as inclement weather impedes operations. At the same time, operating expenses generally increase, with fuel efficiency declining because of engine idling and weather, creating more equipment repairs. For the reasons stated, first quarter results historically have been lower than results in each of the other three quarters of the year excluding charges. Our equipment utilization typically improves substantially between May and October of each year because of the trucking industry's seasonal shortage of equipment on traffic originating in California and because of general increases in shipping demand during those months. During September and October, business sometimes increa ses as a result of increased retail merchandise shipped in anticipation of the holidays. Due to the economic downturn and related low inventory levels, this historical trend has not been present over the past several years, including fiscal 2010 and 2009, as we have seen increases in demand at varying times based primarily on restocking required to replenish inventories and less pronounced seasonal spikes prior to the holidays.

Additional Information

At December 31, 2010, our corporate structure included Covenant Transportation Group, Inc., a Nevada holding company organized in May 1994, and its wholly owned subsidiaries: Covenant Transport, Inc., a Tennessee corporation; Southern Refrigerated Transport, Inc., an Arkansas corporation; Star Transportation, Inc., a Tennessee corporation; Covenant Transport Solutions, Inc., a Nevada corporation; Covenant Logistics, Inc., a Nevada corporation; Covenant Asset Management, Inc., a Nevada corporation; CTG Leasing Company, a Nevada corporation; and Volunteer Insurance Limited, a Cayman Islands company.

Our headquarters is located at 400 Birmingham Highway, Chattanooga, Tennessee 37419, and our website address is www.ctginvestor.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all other reports we file with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") are available free of charge through our website. Information contained in or available through our website is not incorporated by reference into, and you should not consider such information to be part of, this Annual Report on Form 10-K.

Factors That May Affect Future Results

Our future results may be affected by a number of factors over which we have little or no control. The following discussion of risk factors contains forward-looking statements as discussed in Item 1 above. The following issues, uncertainties, and risks, among others, should be considered in evaluating our business and growth outlook.

Our business is subject to general economic and business factors affecting the trucking industry that are largely out of our control, any of which could have a materially adverse effect on our operating results.

Our business is dependent on a number of factors that may have a materially adverse effect on our results of operations, many of which are beyond our control. Some of the most significant of these factors include excess tractor and trailer capacity in the trucking industry, declines in the resale value of used equipment, strikes or other work stoppages, increases in interest rates, fuel taxes, tolls, and license and registration fees, and rising costs of healthcare.

We also are affected by recessionary economic cycles, changes in customers' inventory levels, and downturns in customers' business cycles, particularly in market segments and industries, such as retail and manufacturing, where we have a significant concentration of customers, and regions of the country, such as California, Texas, and the Southeast, where we have a significant amount of business. Some of the principal risks are as follows:

| • | We may experience a reduction in overall freight levels, which may impair our asset utilization; |

| • | Certain of our customers may face credit issues and could experience cash flow problems that may lead to payment delays, increased credit risk, bankruptcies, and other financial hardships that could result in even lower freight demand and may require us to increase our allowance for doubtful accounts; |

| • | Freight patterns may change as supply chains are redesigned, resulting in an imbalance between our capacity and our customers' freight demand; |

| • | Customers may bid out freight or select competitors that offer lower rates from among existing choices in an attempt to lower their costs, and we might be forced to lower our rates or lose freight; and |

| • | We may be forced to accept more freight from freight brokers, where freight rates are typically lower, or may be forced to incur more non-revenue miles to obtain loads. |

In addition, it is not possible to predict the effects of actual or threatened terrorist attacks, efforts to combat terrorism, military action against any foreign state, heightened security requirements, or other related events. Such events, however, could negatively impact the economy and consumer confidence in the U.S. Such events could also have a materially adverse effect on our future results of operations.

We self-insure for a significant portion of our claims exposure, which could significantly increase the volatility of, and decrease the amount of, our earnings.

Our future insurance and claims expense could reduce our earnings and make our earnings more volatile. We self-insure for a significant portion of our claims exposure and related expenses. We accrue amounts for liabilities based on our assessment of claims that arise and our insurance coverage for the periods in which the claims arise, and we evaluate and revise these accruals from time-to-time based on additional information. Due to our significant self-insured amounts, we have significant exposure to fluctuations in the number and severity of claims and the risk of being required to accrue or pay additional amounts if our estimates are revised or the claims ultimately prove to be more severe than originally assessed. Historically, we have had to significantly adjust our reserves on several occasions, and future significant adjustments may occur.

We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe our aggregate insurance limits are sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed those limits. If any claim was to exceed our coverage, we would bear the excess, in addition to our other self-insured amounts. Our insurance and claims expense could increase, or we could find it necessary to again raise our self-insured retention or decrease our aggregate coverage limits when our policies are renewed or replaced. Our operating results and financial condition may be adversely affected if these expenses increase, if we experience a claim in excess of our coverage limits, if we experience a claim for which we do not have covera ge, or if we have to increase our reserves.

Fluctuations in the price or availability of fuel, hedging activities, and the volume and terms of diesel fuel purchase commitments, and surcharge collection and surcharge policies approved by customers may increase our costs of operation, which could materially and adversely affect our profitability.

Fuel is one of our largest operating expenses. Diesel fuel prices fluctuate greatly due to economic, political, weather, and other factors beyond our control each of which may lead to an increase in the cost of fuel. Fuel also is subject to regional pricing differences and often costs more on the West Coast, where we have significant operations. From time-to-time, we use hedging contracts and volume purchase arrangements to attempt to limit the effect of price fluctuations. We may be forced to make cash payments under the hedging arrangements. We use a fuel surcharge program to recapture a portion of the increases in fuel prices over a base rate negotiated with our customers. Our fuel surcharge program does not protect us against the full effect of increases in fuel prices. The terms of each customer's fuel surcharge program vary and certain customers have sought to modify the terms of their fuel surcharge programs to minimize recoverability for fuel price increases. A failure to improve our fuel price protection through these measures, increases in fuel prices, or a shortage of diesel fuel, could materially and adversely affect our results of operations.

We depend on the proper functioning and availability of our information systems and a system failure or inability to effectively upgrade our information systems could cause a significant disruption to our business and have a materially adverse effect on our results of operation.

We depend on the proper functioning and availability of our information systems, including financial reporting and operating systems, in operating our business. Our operating system is critical to understanding customer demands, accepting and planning loads, dispatching equipment and drivers, and billing and collecting for our services. Our financial reporting system is critical to producing accurate and timely financial statements and analyzing business information to help us manage effectively. We have begun a multi-year project to upgrade the hardware and software of our information systems. If any of our critical information systems fail or become otherwise unavailable, whether as a result of the upgrade project or otherwise, we would have to perform the functions manually, which could temporarily impact our a bility to manage our fleet efficiently, to respond to customers' requests effectively, to maintain billing and other records reliably, and to bill for services and prepare financial statements accurately or in a timely manner. Our business interruption insurance may be inadequate to protect us in the event of an unforeseeable and extreme catastrophe. Any system failure, delay, or complication in the upgrade, security breach, or other system failure could interrupt or delay our operations, damage our reputation, cause us to lose customers, or impact our ability to manage our operations and report our financial performance, any of which could have a materially adverse effect on our business.

We may not be successful in improving our profitability.

We had significant losses from 2007 through 2009, attributable to operations, impairments, and other charges. As a result of improvements in the economic environment in 2010, combined with certain Company-specific initiatives centered around decreasing our cost structure and focusing on target markets, we generated a profit in 2010. Management believes profitable results are sustainable so long as the economic environment supports customer rate increases in excess of increases in our operating costs. If we are unable to maintain and/or improve our profitability, then our liquidity, financial position, and results of operations may be adversely affected.

Our Third Amended and Restated Credit Facility ("Credit Facility") and other financing arrangements contain certain covenants, restrictions, and requirements, and we may be unable to comply with the covenants, restrictions, and requirements. A default could result in the acceleration of all or part of our outstanding indebtedness, which could have an adverse effect on our financial condition, liquidity, results of operations, and the price of our common stock.

We have an $85.0 million Credit Facility with a group of banks and numerous other financing arrangements. The Credit Facility contains certain restrictions and covenants relating to, among other things, dividends, liens, acquisitions and dispositions outside of the ordinary course of business, affiliate transactions, and a fixed charge coverage ratio. We have had difficulty meeting budgeted results in the past. If we are unable to meet budgeted results or otherwise comply with our Credit Facility, we may be unable to obtain amendments or waivers under our Credit Facility, or we may incur fees in doing so. See "Material Debt Agreements" below for additional information.

Certain other financing arrangements contain certain restrictions and non-financial covenants, as well. If we fail to comply with any of our financing arrangement covenants, restrictions, and requirements, we will be in default under the relevant agreement, which could cause cross-defaults under our other financing arrangements. In the event of any such default, if we failed to obtain replacement financing, amendments to, or waivers under the applicable financing arrangements, our lenders could cease making further advances, declare our debt to be immediately due and payable, fail to renew letters of credit, impose significant restrictions and requirements on our operations, institute foreclosure procedures against their collateral, or impose significant fees and transaction costs. If acceleration occur s, economic conditions such as the recent credit market crisis may make it difficult or expensive to refinance the accelerated debt or we may have to issue equity securities, which would dilute stock ownership. Even if new financing is made available to us, credit may not be available to us on acceptable terms. A default under our financing arrangements could cause a materially adverse effect on our liquidity, financial condition, and results of operations.

Our substantial indebtedness and capital and operating lease obligations could adversely affect our ability to respond to changes in our industry or business.

As a result of our level of debt, capital leases, operating leases, and encumbered assets:

| • | Our vulnerability to adverse economic conditions and competitive pressures is heightened; |

| • | We will continue to be required to dedicate a substantial portion of our cash flows from operations to lease payments and repayment of debt, limiting the availability of cash for other purposes; |

| • | Our flexibility in planning for, or reacting to, changes in our business and industry will be limited; |

| • | Our profitability is sensitive to fluctuations in interest rates because some of our debt obligations are subject to variable interest rates, and future borrowings and lease financing arrangements will be affected by any such fluctuations; |

| • | Our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, or other purposes may be limited; and |

| • | We may be required to issue additional equity securities to raise funds, which would dilute the ownership position of our stockholders. |

Our financing obligations could negatively impact our future operations, our ability to satisfy our capital needs, or our ability to engage in other business activities. We also cannot assure you that additional financing will be available to us when required or, if available, will be on terms satisfactory to us.

We operate in a highly competitive and fragmented industry, and numerous competitive factors could impair our ability to improve our profitability.

These factors include:

| • | We compete with many other truckload carriers of varying sizes and, to a lesser extent, with less-than-truckload carriers, railroads, intermodal companies, and other transportation companies, many of which have more equipment and greater capital resources than we do. |

| • | Many of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or maintain significant growth in our business. |

| • | Many of our customers, including the majority of our top ten, are other transportation companies, and they may decide to transport their own freight. |

| • | Many customers reduce the number of carriers they use by selecting "core carriers" as approved service providers, and in some instances we may not be selected. |

| • | Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some business to competitors. |

| • | The trend toward consolidation in the trucking industry may create other large carriers with greater financial resources and other competitive advantages relating to their size. |

| • | Advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher freight rates to cover the cost of these investments. |

| • | Competition from non-asset-based logistics and freight brokerage companies may adversely affect our customer relationships and freight rates. |

We derive a significant portion of our revenue from our major customers, the loss of one or more of which could have a materially adverse effect on our business.

A significant portion of our revenue is generated from our major customers. Generally, we do not have long-term contractual relationships with our major customers, and our customers may not continue to use our services or could reduce their use of our services. For some of our customers, we have entered into multi-year contracts, and the rates we charge may not remain advantageous. A reduction in or termination of our services, by one or more of our major customers, could have a materially adverse effect on our business and operating results.

Increases in driver compensation or difficulty in attracting and retaining qualified drivers could adversely affect our profitability.

Like many truckload carriers, we experience substantial difficulty in attracting and retaining sufficient numbers of qualified drivers, including independent contractors. In addition, due in part to current economic conditions, including the cost of fuel, insurance, and tractors, the available pool of independent contractor drivers has been declining. Regulatory requirements, including CSA 2010 and proposed hours-of-service changes (both discussed below), and an improved economy could reduce the number of eligible drivers or force us to pay more to attract and retain drivers. A shortage of qualified drivers and intense competition for drivers from other trucking companies will create difficulties in maintaining or increasing the number of our drivers, including independent contractor drivers. The compen sation we offer our drivers and independent contractors is subject to market conditions, and we may find it necessary to increase driver and independent contractor compensation in future periods. In addition, we and our industry suffer from a high turnover rate of drivers. The high turnover rate requires us to continually recruit a substantial number of drivers in order to operate existing revenue equipment. If we are unable to continue to attract and retain a sufficient number of drivers, we could be forced to, among other things, adjust our compensation packages, increase the number of our tractors without drivers, or operate with fewer trucks and face difficulty meeting shipper demands, any of which could adversely affect our growth and profitability.

We operate in a highly regulated industry, and changes in existing regulations or violations of existing or future regulations could have a materially adverse effect on our operations and profitability.

We operate in the U.S. pursuant to operating authority granted by the DOT and in various Canadian provinces pursuant to operating authority granted by the Ministries of Transportation and Communications in such provinces. We operate within Mexico by utilizing third-party carriers within that country. Our Company drivers and independent contractors also must comply with the safety and fitness regulations of the DOT, including those relating to drug and alcohol testing and hours-of-service. Such matters as weight and equipment dimensions also are subject to government regulations. We also may become subject to new or more restrictive regulations relating to fuel emissions, drivers’ hours-of-service, ergonomics, on-board reporting of operations, collective bargaining, security at ports, and other matters a ffecting safety or operating methods. Other agencies, such as the EPA and the DHS, also regulate our equipment, operations, and drivers. Future laws and regulations may be more stringent and require changes in our operating practices, influence the demand for transportation services, or require us to incur significant additional costs. Higher costs incurred by us or by our suppliers who pass the costs onto us through higher prices could adversely affect our results of operations.

The DOT, through the FMCSA, is currently engaged in a rulemaking proceeding regarding drivers’ hours-of-service, and the result could negatively impact utilization of our equipment. We are unable to predict what form the new hours-of-service rules may take, how a court may rule on challenges to such rules, and to what extent the FMCSA might attempt to materially revise the rules. On the whole, however, we believe that any modifications to the current rules may decrease productivity and cause some loss of efficiency, as drivers and shippers may need to be retrained, computer programming may require modifications, additional drivers may need to be employed or engaged, additional equipment may need to be acquired, and some shipping lanes may need to be reconfigured. We are also unable to predict the effect of a ny new rules that might be proposed if the issued rule is stricken by a court, but any such proposed rules could increase costs in our industry or decrease productivity.

The FMCSA also is considering revisions to the existing rating system and the safety labels assigned to motor carriers evaluated by the DOT. We currently have a satisfactory DOT rating, which is the highest available rating under the current safety rating scale. If we were to receive a conditional or unsatisfactory DOT safety rating, it could adversely affect our business because some of our customer contracts require a satisfactory DOT safety rating, and a conditional or unsatisfactory rating could negatively impact or restrict our operations. Failure to comply with DOT safety regulations or downgrades in our safety rating could have a materially adverse impact on our operations or financial condition. A downgrade in our safety rating could cause us to lose the ability to self-insure. & #160;The loss of our ability to self-insure for any significant period of time would materially increase our insurance costs. In addition, we may experience difficulty in obtaining adequate levels of coverage in that event. Under the revised rating system being considered by the FMCSA, our safety rating would be evaluated more regularly, and our safety rating would reflect a more in-depth assessment of safety-based violations.

The FMCSA’s CSA 2010 implemented a new enforcement and compliance model that ranks both fleets and individual drivers on certain safety-related standards. As discussed more fully below, CSA 2010 may reduce the number of eligible drivers and/or negatively impact our fleet ranking.

Additionally, the FMCSA has proposed new rules that will require nearly all carriers, including us, to install and use electronic, on-board recorders in our tractors to electronically monitor truck miles and enforce hours-of-service. Such installation could cause an increase in driver turnover, adverse information in litigation, cost increases, and decreased asset utilization.

In the aftermath of the September 11, 2001 terrorist attacks, federal, state, and municipal authorities implemented and continue to implement various security measures, including checkpoints and travel restrictions on large trucks. The TSA has adopted regulations that require determination by the TSA that each driver who applies for or renews his license for carrying hazardous materials is not a security threat. This could reduce the pool of qualified drivers, which could require us to increase driver compensation, limit fleet growth, or let trucks sit idle. These regulations also could complicate the matching of available equipment with hazardous material shipments, thereby increasing our response time and our deadhead miles on customer shipments. As a result, it is possible we may fail to m eet the needs of our customers or may incur increased expenses to do so. These security measures could negatively impact our operating results.

Some states and municipalities have begun to restrict the locations and amount of time where diesel-powered tractors, such as ours, may idle and/or travel. These restrictions could force us to alter our drivers’ behavior and routes, purchase on-board power units that do not require the engine to idle, or face a decrease in productivity.

From time-to-time, various federal, state, or local taxes are increased, including taxes on fuels. We cannot predict whether, or in what form, any such increase applicable to us will be enacted, but such an increase could adversely affect our profitability.

CSA 2010 could adversely affect our profitability and operations, our ability to maintain or grow our fleet, and our customer relationships.

Under CSA 2010, drivers and fleets are evaluated and ranked based on certain safety-related standards. The methodology for determining a carrier’s DOT safety rating has been expanded to include the on-road safety performance of the carrier’s drivers. As a result, certain current and potential drivers may no longer be eligible to drive for us, our fleet could be ranked poorly as compared to our peers, and our safety rating could be adversely impacted. Additionally, we have received certain deficiencies in our safety-related standards in the past. Failure to cure such deficiencies, or the occurrence of future deficiencies could cause high-quality drivers to seek other carriers or could cause our customers to direct their business away from us and to carriers with higher fleet rankings, either of which would adversely affect our results of operations. Additionally, competition for drivers with favorable safety ratings may increase and thus provide for increases in driver related compensation costs.

We have significant ongoing capital requirements that could affect our profitability if we are unable to generate sufficient cash from operations and obtain financing on favorable terms.

The truckload industry is capital intensive, and our policy of operating newer equipment requires us to expend significant amounts annually. We expect to pay for projected capital expenditures with cash flows from operations, borrowings under our Credit Facility, proceeds under our financing facilities, and leases of revenue equipment. If we are unable to generate sufficient cash from operations and obtain financing on favorable terms in the future, we may have to limit our fleet size, enter into less favorable financing arrangements, or operate our revenue equipment for longer periods, any of which could have a materially adverse effect on our profitability.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

We are subject to various environmental laws and regulations dealing with the hauling and handling of hazardous materials, fuel storage tanks, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. Our truck terminals often are located in industrial areas where groundwater or other forms of environmental contamination could occur. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. Certain of our facilities have waste oil or fuel storage tanks and fueling islands. A small percentage of our freight consists of low-grade hazardous substances, which subjects us to a wide array of regulations. Although we have instituted programs to monitor and control environ mental risks and promote compliance with applicable environmental laws and regulations, if we are involved in a spill or other accident involving hazardous substances, if there are releases of hazardous substances we transport, if soil or groundwater contamination is found at our facilities or results from our operations, or if we are found to be in violation of applicable laws or regulations, we could be subject to cleanup costs and liabilities, including substantial fines or penalties or civil and criminal liability, any of which could have a materially adverse effect on our business and operating results.

EPA regulations limiting exhaust emissions became more restrictive in 2010. Additionally, the current presidential administration has directed the EPA and NHTSA to develop new, stricter fuel efficiency standards for heavy trucks, beginning in 2014. California has adopted new performance requirements for diesel trucks, with targets to be met between 2011 and 2023, and California also has adopted aerodynamics requirements for certain trailers. These regulations, as well as proposed regulations or legislation related to climate change that potentially impose restrictions, caps, taxes, or other controls on emissions of greenhouse gas, could adversely affect our operations and financial results. In addition, increasing efforts to control emissions of greenhouse gases are likely to have an impact on us. The EPA has anno unced a finding relating to greenhouse gas emissions that may result in promulgation of greenhouse gas emission limits. Compliance with such regulations has increased the cost of new tractors, could impair equipment productivity, lower fuel mileage, and increase our operating expenses. These adverse effects, combined with the uncertainty as to the reliability of the new diesel engines and the residual values of these vehicles, could materially increase our costs or otherwise adversely affect our business or operations.

Increased prices, reduced productivity, and scarcity of financing for new revenue equipment may adversely affect our earnings and cash flows.

We are subject to risk with respect to higher prices for new tractors. Prices have increased and may continue to increase, due, in part, to government regulations applicable to newly manufactured tractors and diesel engines and due to the pricing power among equipment manufacturers. More restrictive EPA emissions standards have required vendors to introduce new engines. Compliance with such regulations has increased the cost of our new tractors and could impair equipment productivity, lower fuel mileage, and increase our operating expenses. These adverse effects, combined with the uncertainty as to the reliability of the vehicles equipped with the newly designed diesel engines and the residual values realized from the disposition of these vehicles, could increase our costs or otherwise adversely affect our busines s or operations as the regulations become effective.

We have a combination of agreements and non-binding statements of indicative trade values covering the terms of trade-in commitments from our primary equipment vendors for disposal of a portion of our revenue equipment. From time-to-time, prices we expect to receive under these arrangements may be higher than the prices we would receive in the open market. We may suffer a financial loss upon disposition of our equipment if these vendors refuse or are unable to meet their financial obligations under these agreements, if we fail to enter into definitive agreements consistent with the indicative trade values, if we fail to enter into similar arrangements in the future, or if we do not purchase the required number of replacement units from the vendors.

If we are unable to retain our key employees, our business, financial condition, and results of operations could be harmed.

We are highly dependent upon the services of the following key employees: David R. Parker, our Chairman of the Board, Chief Executive Officer, and President and Joey B. Hogan, our Senior Executive Vice President and Chief Operating Officer. We currently do not have employment agreements with Messrs. Parker or Hogan. The loss of any of their services could negatively impact our operations and future profitability. We must continue to develop and retain a core group of managers if we are to continue to improve our profitability and have appropriate succession planning for key management personnel.

We may not make acquisitions in the future, or if we do, we may not be successful in our acquisition strategy.