UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2012 OR |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file number 0-24960

COVENANT TRANSPORTATION GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 88-0320154 |

| (State / other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 400 Birmingham Hwy. | | |

| Chattanooga, TN | | 37419 |

| (Address of principal executive offices) | | (Zip Code) |

| Registrant's telephone number, including area code: | 423 - 821-1212 |

| | |

| Securities registered pursuant to Section 12(b) of the Act: | $0.01 Par Value Class A Common Stock – The NASDAQ Global Select Market |

| | (Title of class) |

| | |

| Securities registered pursuant to Section 12(g) of the Act: | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "accelerated filer,"large accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 29, 2012, was approximately $28 million (based upon the $3.74 per share closing price on that date as reported by NASDAQ). In making this calculation the registrant has assumed, without admitting for any purpose, that all executive officers, directors, and affiliated holders of more than 10% of a class of outstanding common stock, and no other persons, are affiliates.

As of March 25, 2013, the registrant had 12,411,602 shares of Class A common stock and 2,350,000 shares of Class B common stock outstanding.

Portions of the materials from the registrant's definitive proxy statement for the 2013 Annual Meeting of Stockholders to be held on May 29, 2013, have been incorporated by reference into Part III of this Form 10-K.

| Part I | | |

| | Item 1. | Business | |

| | Item 1A. | Risk Factors | |

| | Item 1B. | Unresolved Staff Comments | |

| | Item 2. | Properties | |

| | Item 3. | Legal Proceedings | |

| | Item 4. | Mine Safety Disclosures | |

| | | | |

| Part II | | |

| | Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| | Item 6. | Selected Financial Data | |

| | Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

| | Item 8. | Financial Statements and Supplementary Data | |

| | Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| | Item 9A. | Controls and Procedures | |

| | Item 9B. | Other Information | |

| | | | |

| Part III | | |

| | Item 10. | Directors, Executive Officers, and Corporate Governance | |

| | Item 11. | Executive Compensation | |

| | Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| | Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| | Item 14. | Principal Accounting Fees and Services | |

| | | | |

| Part IV | | |

| | Item 15. | Exhibits and Financial Statement Schedules | |

| | | | |

Signatures | |

| | |

Report of Independent Registered Public Accounting Firm | |

| | |

| Financial Data | |

| | Consolidated Balance Sheets | |

| | Consolidated Statements of Operations | |

| | Consolidated Statements of Comprehensive Income (Loss) | |

| | Consolidated Statements of Stockholders' Equity | |

| | Consolidated Statements of Cash Flows | |

| | Notes to Consolidated Financial Statements | |

PART I

This Annual Report on Form 10-K contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of earnings, revenues, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; and any statements of belief and any statement of assumptions underlying any of the foregoing. Such statements may be identified by their use of terms or phrases such as "believe," "may," "could," "expects," "estimates," "projects," "anticipates," "plans," "intends," and similar terms and phrases. Forward-looking statements are based on currently available operating, financial, and competitive information. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitles "Item 1A. Risk Factors," set forth below. Readers should review and consider the factors discussed in "Item 1A. Risk Factors," along with various disclosures in our press releases, stockholder reports, and other filings with the Securities and Exchange Commission.

All such forward-looking statements speak only as of the date of this Annual Report. You are cautioned not to place undue reliance on such forward-looking statements. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in the events, conditions, or circumstances on which any such statement is based.

References in this Annual Report to "we," "us," "our," or the "Company" or similar terms refer to Covenant Transportation Group, Inc. and its subsidiaries.

GENERAL

Background

We provide truckload transportation services throughout the continental United States, into and out of Mexico and into and out of portions of Canada. Generally, we transport full trailer loads of freight from origin to destination without intermediate stops or handling. Our truckload freight services utilize equipment we own or lease or equipment owned by independent contractors for the pick-up and delivery of freight. In most of our truckload business, we transport freight over nonroutine routes. Our dedicated freight service offering provides similar transportation services, but does so pursuant to agreements whereby we make our equipment available to a specific customer for shipments over particular routes at specified times. To complement our truckload operations, we provide freight brokerage services. Through our asset based and non-asset based capabilities, we transport many types of freight for a diverse customer base.

We were founded in 1986 as a provider of expedited long-haul freight transportation, primarily using two-person driver teams in transcontinental lanes. Since that time, we have grown from 25 trucks to approximately 3,000 trucks and expanded our services from predominantly long-haul dry van to include refrigerated, dedicated, cross-border, regional, brokerage, and other offerings. The expansion of our fleet and service offerings have placed us among the nation's largest truckload transportation companies.

As our fleet grew and our service platform matured, several important trends dramatically affected the truckload industry and our business. First, supply chain patterns became more fluid in response to dynamic changes in labor and transportation costs, ocean freight and rail-intermodal service standards, retail distribution center networks, governmental regulations, and other industry-wide factors. Second, the cost structure of the truckload business, particularly equipment and fuel prices, rose dramatically, impacting us and our customers' freight decisions. Third, customers used technology to constantly optimize their supply chains which necessitated expanding our own technological capability to optimize our asset allocation, manage yields, and drive operational efficiency. Fourth, a confluence of regulatory constraints, safety and security demands, and scarcity of qualified applicants, negatively impacted our asset productivity and reinforced what a precious resource professional truck drivers are (and we believe increasingly will be) in our industry.

In the fourth quarter of 2011, we began examining the key components of each of our business units, including: market trends and our relative positioning in the market; leadership and our personnel's ability to execute; financial results, investment returns, and capital requirements; importance of our service to our customers; and growth prospects.

As a result of this assessment process, we identified several key initiatives that we began executing in 2012, including the following:

| • | Expanding our refrigerated, non-asset based brokerage and ancillary services, and specialized team operation, while reducing capital allocated to certain other operations; |

| • | Increasing the use of owner-operators, particularly in our team operations, to more flexibly match equipment positioning to changes in freight patterns and economic demand, as well as reduce the capital allocated to this very mileage-intensive business; |

| • | Improving our debt-to-capitalization ratio through capital decisions and other means; |

| • | Implementing a more comprehensive sales and marketing approach that emphasizes to customers the enterprise-wide breadth of services we offer and encourages all sales associates to market all of our services; and |

| • | Designing our business to optimize the career opportunity for our drivers. |

To accompany our operational goals, we also adopted the following financial goals:

| • | Grow freight revenue meaningfully without increasing our fleet of owned trucks; |

| • | Improve operating ratio to the low to mid 90s; |

| • | Generate a return on invested capital approaching double digits; and |

| • | Reduce total leverage by a meaningful amount. |

Based on our return to profitability in 2012, we believe that certain of the initiatives are starting to provide positive results. However, we still have significant work ahead to achieve our goals, deliver a strong and stable product for our customers, provide a bright future for our employees and owner-operators, and create meaningful value for our stockholders.

Business Units

We have two reportable segments: asset-based truckload services ("Truckload") and non-asset based brokerage and ancillary services ("Solutions").

The Truckload segment consists of three asset-based operating fleets that are aggregated because they have similar economic characteristics and meet the aggregation criteria. The three operating fleets that comprise our Truckload segment are as follows: (i) Covenant Transport, Inc. ("Covenant Transport"), which provides expedited long-haul, dedicated, temperature-controlled, and solo-driver regional service; (ii) Southern Refrigerated Transport, Inc. ("SRT"), which provides primarily long-haul and regional temperature-controlled service; and (iii) Star Transportation, Inc. ("Star"), which provides regional solo-driver and dedicated services, primarily in the southeastern United States.

The Solutions segment provides: (i) freight brokerage service directly and through freight brokerage agents who are paid a commission for the freight they provide; (ii) less-than-truckload consolidation services; and (iii) accounts receivable factoring.

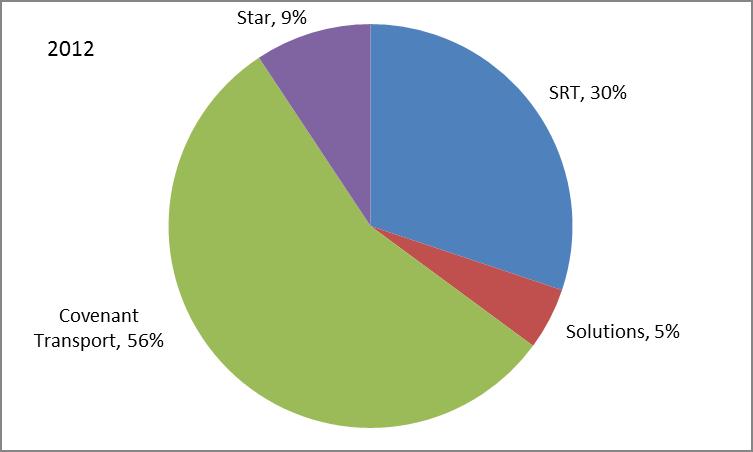

The following charts reflect the size of each of our subsidiaries measured by 2012 freight revenue:

| Distribution of Revenue Among Subsidiaries |

| 56% |

| SRT | 30% |

| Star | 9% |

| Solutions | 5% |

Our Truckload segment comprised approximately 95%, 95%, and 93% of our total freight revenue in 2012, 2011, and 2010, respectively.

In our Truckload segment, we primarily generate revenue by transporting freight for our customers. Generally, we are paid a predetermined rate per mile for our truckload services. We enhance our truckload revenue by charging for tractor and trailer detention, loading and unloading activities, and other specialized services, as well as through the collection of fuel surcharges to mitigate the impact of increases in the cost of fuel. The main factors that affect our Truckload revenue are the revenue per mile we receive from our customers, the percentage of miles for which we are compensated, and the number of shipments and miles we generate. These factors relate, among other things, to the general level of economic activity in the United States, inventory levels, specific customer demand, the level of capacity in the trucking industry, and driver availability.

The main expenses that impact the profitability of our Truckload segment are the variable costs of transporting freight for our customers. These costs include fuel expenses, driver-related expenses, such as wages, benefits, training, and recruitment, and purchased transportation expenses, which primarily include compensating independent contractors. Expenses that have both fixed and variable components include maintenance and tire expense and our total cost of insurance and claims. These expenses generally vary with the miles we travel, but also have a controllable component based on safety, self-insured retention versus insurance premiums, fleet age, efficiency, and other factors. Our main fixed costs include rentals and depreciation of long-term assets, such as revenue equipment and terminal facilities, and the compensation of non-driver personnel.

We measure the productivity of our Truckload segment with three key performance metrics: average freight revenue per total mile (excluding fuel surcharges), average miles per tractor, and average freight revenue per tractor per week (excluding fuel surcharges). A description of each follows:

Average Freight Revenue Per Total Mile. Our average freight revenue per total mile is primarily a function of 1) the allocation of assets among our subsidiaries and 2) the macro U.S. economic environment including supply/demand of freight and carriers. The increase in 2012 and 2011 compared to 2010 and 2009 is a result of allocating more tractors to our niche/specialized service offerings that provide higher rates (including high-value/constant security, temperature controlled, cross boarder services and expedited/critical freight). Also, shipper concerns about the prospect of tighter capacity and rate increases required to mitigate inflationary costs, afforded an environment more conducive to rate increases. | |

| Average Freight Revenue Per Total Mile (excludes fuel surcharge revenue) | 2008 | 2009 | 2010 | 2011 | 2012 |

| $1.36 | $1.27 | $1.31 | $1.38 | $1.47 |

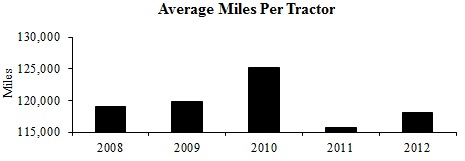

Average Miles Per Tractor. Average miles per tractor reflect economic demand, driver availability, regulatory constraints, and the allocation of tractors among the service offerings. The increase in utilization in 2012 is a result of a decrease in our unseated truck count, allocation of assets to business units with better freight, and a full year without a system conversion, which more than overcame negative regulatory impact. |  |

| Average Miles Per Tractor | 2008 | 2009 | 2010 | 2011 | 2012 |

| 118,992 | 119,836 | 125,178 | 115,775 | 118,103 |

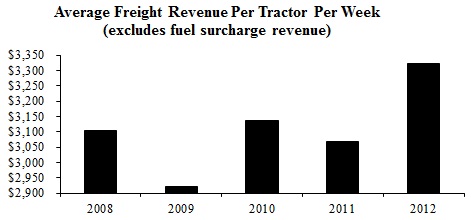

Average Freight Revenue Per Tractor Per Week. We use average freight revenue per tractor per week as our main measure of asset productivity. This operating metric takes into account the effects of freight rates, non-revenue miles, and miles per tractor. In addition, because we calculate average freight revenue per tractor using all of our trucks, it takes into account the percentage of our fleet that is unproductive due to lack of drivers, repairs, and other factors. The increase in average freight revenue per tractor per week in 2012 is primarily due to allocation of tractors to more productive service offerings, which contributed to higher rates and utilization. | |

| Average Freight Revenue Per Tractor Per Week (excludes fuel surcharge revenue) | 2008 | 2009 | 2010 | 2011 | 2012 |

| $3,105 | $2,920 | $3,137 | $3,069 | $3,322 |

Our Solutions segment comprised approximately 5%, 5%, and 7% of our total operating revenue in 2012, 2011, and 2010, respectively. Solutions derives revenue from arranging transportation services for customers through relationships with thousands of third-party carriers and integration with our Truckload segment. Solutions provides freight brokerage services through freight brokerage agents, who are paid a commission for the freight brokerage service they provide, and directly through in-house brokerage personnel working in direct contact with customers. The main factors that impact profitability in terms of expenses are the variable costs of outsourcing the transportation freight for our customers and managing fixed costs, including salaries and selling, general, and administrative expenses. Our brokerage loads increased to 22,965 in 2012, from 14,773 in 2011, while average revenue per load decreased approximately 38% to $1,144 in 2012, from $1,853 in 2011, primarily due to the loss of a large agent in January 2012 and the addition of less-than-truckload services offerings, which changed the mix of Solutions’ business. Solutions also experienced a decrease in the number of special projects, resulting in a decrease in miles per load of approximately 15% and began factoring receivables adding approximately $0.8 million in related revenue.

On May 31, 2011, we acquired a 49.0% interest in Transport Enterprise Leasing, LLC ("TEL"). TEL is a tractor and trailer equipment leasing company and used equipment reseller. We have accounted for our investment in TEL using the equity method of accounting and thus our financial results include our proportionate share of TEL’s net income since May 31, 2011, or $1.9 million in 2012 and $0.7 million in 2011. As a result, TEL’s results and growth are significant to our current year results and, in our estimation, to our longer-tem vision.

Refer to Note 15, "Segment Information," of the accompanying consolidated financial statements for further information about each of our reporting segments' operating and financial results for 2012, 2011, and 2010.

Customers and Operations

We focus on targeted markets throughout the United States where we believe our service standards can provide a competitive advantage. We are a major carrier for transportation companies such as freight forwarders, less-than-truckload carriers, and third-party logistics providers that require a high level of service to support their businesses, as well as for traditional truckload customers such as manufacturers, retailers, and food and beverage shippers. All of our asset-based subsidiaries are truckload carriers and as such generally dedicate an entire trailer to one customer from origin to destination. We also generate revenue through a subsidiary that provides freight brokerage services. No customer accounted for more than 10% of our consolidated revenue in 2012, 2011, or 2010. Our top five customers accounted for approximately 24%, 31%, and 31% of our total revenue in 2012, 2011, and 2010, respectively.

We operate tractors driven by a single driver and also tractors assigned to two-person driver teams. Our single driver tractors generally operate in shorter lengths of haul, generate fewer miles per tractor, and experience more non-revenue miles, but the lower productive miles are expected to be offset by generally higher revenue per loaded mile and the reduced employee expense of compensating only one driver. In contrast, our two-person driver tractors generally operate in longer lengths of haul, generate greater miles per tractor, and experience fewer non-revenue miles, but we typically receive lower revenue per loaded mile and incur higher employee expenses of compensating both drivers. We expect operating statistics and expenses to shift with the mix of single and team operations.

We operate throughout the U.S. and in parts of Canada and Mexico, with substantially all of our revenue generated from within the U.S. All of our tractors are domiciled in the U.S., and we have generated less than two percent of our revenue in Canada and Mexico in 2012 and less than one percent in 2011 and 2010.

In 2009, we began a multi-year project to upgrade the hardware and software of our information systems. The goal upon completion of the project is to have uniform operational and financial systems across the entire Company as we believe this will improve customer service, utilization, and enhance our visibility into and across the organization. Star, Solutions, and Covenant Transport are currently operating on the new system. We encountered difficulties when we converted our Covenant Transport subsidiary to the new system in the third quarter of 2011, which disrupted our operations and impacted our customer service, driver relations, and results of operations. All significant problems associated with the Covenant Transport conversion were addressed by the end of January 2012 and efficiencies from the new system were realized by Covenant Transport in 2012. We expect to implement the new operating system at SRT in 2014.

Drivers and Other Personnel

Driver recruitment, retention, and satisfaction are essential to our success, and we have made each of these factors a primary element of our strategy. We recruit both experienced and student drivers as well as independent contractor drivers who own and drive their own tractor and provide their services to us under lease. We conduct recruiting and/or driver orientation efforts from five of our locations, and we offer ongoing training throughout our terminal network. We emphasize driver-friendly operations throughout our organization. We have implemented automated programs to signal when a driver is scheduled to be routed toward home, and we assign fleet managers specific tractor units, regardless of geographic region, to foster positive relationships between the drivers and their principal contact with us.

The truckload industry has periodically experienced difficulty in attracting and retaining enough qualified truck drivers. It is also common for the driver turnover rate of individual carriers to exceed 100% in a year. At times, there are driver shortages in the trucking industry. In past years, when there were driver shortages, the number of qualified drivers had not kept pace with freight growth because of (i) changes in the demographic composition of the workforce; (ii) alternative employment opportunities other than truck driving that became available in a growing economy; and (iii) individual drivers' desire to be home more often.

While driver recruiting and retention were challenging in 2012, we had fewer open trucks, including wrecked units, throughout the year, with approximately 3.9% at December 31, 2012 compared to approximately 5.7% at December 31, 2011. We believe this decrease is the result of positive recruiting efforts due to improved driver compensation arrangements and certain company specific initiatives during the year, partially offset by increased year over year driver turnover, as well as a reduction in tractor count in 2012 over 2011. Management's goal is to reduce open trucks, including wrecked units, to less than 3% of our fleet, and we will continue to work towards this goal in 2013.

We believe having a happy, healthy, and safe driver is the key to our success, both in the short term and over a longer period. As a result, we are actively working to enhance our drivers' experience in an effort to recruit and retain more drivers.

Independent contractors provide a tractor and a driver and are responsible for all operating expenses in exchange for a fixed payment per mile. We do not have the capital outlay of purchasing the tractor. The payments to independent contractors are recorded in revenue equipment rentals and purchased transportation. When independent contractor tractors are utilized, we avoid expenses generally associated with company-owned equipment, such as driver compensation, fuel, interest, and depreciation. Obtaining equipment from independent contractors and under operating leases effectively shifts financing expenses from interest to "above the line" operating expenses. We evaluate our efficiency using net margin as well as operating ratio. We have increased the number of independent contractors in our fleet to 252 at December 31, 2012 from 216 at December 31, 2011, reaching a yearly average of 249 for 2012 compared to 165 in 2011. We expect the trend of increased independent contractors as a percentage of our fleet to continue into 2013.

Internal education and evaluation of the Federal Motor Carrier Safety Administration ("FMCSA") Safety Accountability program ("CSA") (formerly "Comprehensive Safety Analysis 2010") are priorities as we develop plans to keep our top talent and challenge those drivers that need improvement. Overall, we believe this regulation will bring challenges as well as opportunities for truckload carriers. CSA, in conjunction with the new U.S. Department of Transportation ("DOT") reductions in hours-of-service for drivers, may reduce effective capacity in our industry as well as negatively impact equipment utilization. Nevertheless, for carriers that successfully manage the new environment with driver-friendly equipment, compensation, and operations, we believe opportunities to increase market share may be available. Driver pay may increase as a result of regulation and economic expansion, which could provide more alternative employment opportunities. If economic growth is sustained, however, we expect the supply/demand environment to be favorable enough for us to offset expected compensation increases with better freight pricing.

We use driver teams in a substantial portion of our tractors. Driver teams permit us to provide expedited service on selected long-haul lanes because teams are able to handle longer routes and drive more miles while remaining within DOT hours-of-service rules. The use of teams contributes to greater equipment utilization of the tractors they drive than obtained with single drivers. The use of teams, however, increases the accumulation of miles on tractors and trailers as well as personnel costs as a percentage of revenue and the number of drivers we must recruit. At December 31, 2012, teams operated approximately 29% of our tractors versus 27% in the preceding year.

We are not a party to a collective bargaining agreement. At December 31, 2012, we employed approximately 4,289 drivers and approximately 835 non-driver personnel. At December 31, 2012, we also contracted with approximately 252 independent contractors.

Revenue Equipment

At December 31, 2012, we operated 2,884 tractors and 6,904 trailers. Of these tractors, 2,025 were owned, 607 were financed under operating leases, and 252 were provided by independent contractors, who own and drive their own tractors. Of these trailers, 2,643 were owned, 3,816 were financed under operating leases, and 445 were financed under capital leases. Furthermore, at December 31, 2012, approximately 71% of our trailers were dry vans and the remaining trailers were refrigerated vans.

We believe that operating high quality, late-model equipment contributes to operating efficiency, helps us recruit and retain drivers, and is an important part of providing excellent service to customers. Our policy is to operate a modern fleet of tractors, with the majority of units under warranty, to minimize repair and maintenance costs and reduce service interruptions caused by breakdowns. We also order most of our equipment with uniform specifications to reduce our parts inventory and facilitate maintenance. At December 31, 2012, our tractor fleet had an average age of approximately 2.1 years, and our trailer fleet had an average age of approximately 5.8 years. As of December 31, 2012, almost 100% of our tractor fleet had engines compliant with stricter regulations regarding emissions that became effective in 2007 and 51.8% of our tractor fleet had engines compliant with stricter regulations regarding emissions that became effective in 2010. We equip our tractors with a satellite-based tracking and communications system that permits direct communication between drivers and fleet managers. We believe that this system enhances our operating efficiency and improves customer service and fleet management. This system also updates the tractor's position every thirty minutes, which allows us and our customers to locate freight and accurately estimate pick-up and delivery times. We also use the system to monitor engine idling time, speed, performance, and other factors that affect operating efficiency. At December 31, 2012, 100% of our fleet was equipped with electronic on board recorders (“EOBR’s), which electronically monitor truck miles and enforce hours-of-service.

Over the past several years, the price of new tractors has risen dramatically and there has been significant volatility in the used equipment market. This has substantially increased our costs of operation over the past several years.

Industry and Competition

The U.S. market for truck-based transportation services was estimated to have generated $603.9 billion in 2011, according to the most recently available data published by American Trucking Associations, Inc. The trucking industry includes both private fleets and "for-hire" carriers. We operate in the highly fragmented for-hire truckload segment of this market, which generated revenues of approximately $215.0 billion in 2011. Our dedicated business also competes in the estimated $250.0 billion private fleet portion of the overall trucking market, by seeking to convince private fleet operators to outsource or supplement their private fleets.

The U.S. trucking industry is highly competitive and includes thousands of "for-hire" motor carriers, none of which dominate the market. Service and price are the principal means of competition in the trucking industry. We compete to some extent with railroads and rail-truck intermodal service but attempt to differentiate ourselves from our competition on the basis of service. Rail and rail-truck intermodal movements are more often subject to delays and disruptions arising from rail yard congestion, which reduce the effectiveness of such service to customers with time-definite pick-up and delivery schedules. In times of high fuel prices or less consumer demand, however, rail-intermodal competition becomes more significant.

We believe that the cost and complexity of operating trucking fleets are increasing and that economic and competitive pressures are likely to force many smaller competitors and private fleets to consolidate or exit the industry. As a result, we believe that larger, better-capitalized companies, like us, will have opportunities to increase profit margins and gain market share. In the market for dedicated services, we believe that truckload carriers, like us, have a competitive advantage over truck lessors, which are the other major participants in the market, because we can offer lower prices by utilizing back-haul freight within our network that traditional lessors may not have.

Regulation

Our operations are regulated and licensed by various U.S. agencies. Our Canadian business activities are subject to similar requirements imposed by the laws and regulations of Canada, as well as its provincial laws and regulations. We operate within Mexico by utilizing third-party carriers within that country. Our Company drivers and independent contractors also must comply with the safety and fitness regulations of the DOT, including those relating to drug and alcohol testing and hours-of-service. Such matters as weight and equipment dimensions are also subject to U.S. regulations. We also may become subject to new or more restrictive regulations relating to fuel emissions, drivers' hours-of-service, ergonomics, or other matters affecting safety or operating methods. Other agencies, such as the Environmental Protection Agency ("EPA") and the Department of Homeland Security ("DHS") also regulate our equipment, operations, and drivers.

The DOT, through the FMCSA, imposes safety and fitness regulations on us and our drivers. In December 2011, the FMCSA published its 2011 Hours-of-Service Final Rule (the "2011 Rule"). The 2011 Rule preserved the 11-hour daily driving limit, but the FMCSA indicated that this daily limit may be revisited in the future. The 2011 Rule requires drivers to take 30-minute breaks after eight hours of consecutive driving and reduces the total number of hours a driver is permitted to work during each week from 82 to 70. The 2011 Rule also modified the requirements for when the weekly hours-of-service limit can be reset by having the drive refrain from working for a period of 34 hours, known as a "34-hour restart." The 2011 Rule also provides that the 34-hour restart may only be used once per week and must include two rest periods between one a.m. and five a.m. These rule changes are scheduled to become effective July 1, 2013. We anticipate that the 2011 Rule will be challenged prior to its effective date. We are unable to predict how a court may address challenges to the rule and to what extent the FMCSA might attempt to materially revise the rules under the current or future presidential administrations. On the whole, however, we believe these modifications to the current rule will decrease productivity and cause some loss of efficiency, as drivers and shippers may need to be retrained, computer programming may require modifications, additional drivers may need to be employed or engaged, additional equipment may need to be acquired, and some shipping lanes may need to be reconfigured.

The FMCSA also is considering revisions to the existing rating system and the safety labels assigned to motor carriers evaluated by the DOT. We currently have a "satisfactory" DOT rating, which is the highest available rating under the current safety rating scale. If we were to receive a conditional or unsatisfactory DOT safety rating, it could adversely affect our business because some of our customer contracts require a satisfactory DOT safety rating, and a conditional or unsatisfactory rating could negatively impact or restrict our operations. Under the revised rating system being considered by the FMCSA, our safety rating would be evaluated more regularly, and our safety rating would reflect a more in-depth assessment of safety-based violations.

CSA introduced a new enforcement and compliance model. Under CSA, drivers and fleets are evaluated and ranked based on certain safety-related standards. The methodology for determining a carrier’s DOT safety rating has been expanded to include the on-road safety performance of the carrier’s drivers. As a result, certain current and potential drivers may no longer be eligible to drive for us, our fleet could be ranked poorly as compared to our peer firms, and our safety rating could be adversely impacted. The occurrence of future deficiencies could affect driver recruitment and retention by causing high-quality drivers to seek employment with other carriers, or could cause our customers to direct their business away from us and to carriers with higher fleet safety rankings, either of which would adversely affect our results of operations and productivity. Additionally, we may incur greater than expected expenses in our attempts to improve our scores as a result of those scores.

Certain of our subsidiaries have exceeded the established intervention thresholds in several of the seven safety-related standards of CSA. Based on these unfavorable ratings, we may be prioritized for an intervention action or roadside inspection, either of which could adversely affect our results of operations. We have put new maintenance procedures in place in an attempt to address maintenance issues that were cited. Additionally, we have reduced the maximum speed on a large portion of our fleet and enhanced programs that reward drivers for positive safety behavior.

The FMCSA proposed new rules that would require nearly all carriers, including us, to install and use EOBRs in their tractors to electronically monitor truck miles and enforce hours-of-service. These rules were vacated by the Seventh Circuit Court of Appeals in August 2011. In July 2012, Congress passed a federal transportation bill that requires promulgation of rules mandating the use of EOBRs by July 2013 with full adoption by all trucking companies no later than July 2015. It is uncertain if this adoption date will be challenged or extended. We have proactively installed EOBRs on 100% of our owned tractors.

The Transportation Security Administration ("TSA") has adopted regulations that require determination by the TSA that each driver who applies for or renews his or her license for carrying hazardous materials is not a security threat. This could reduce the pool of qualified drivers, which could require us to increase driver compensation, limit our fleet growth, or result in trucks sitting idle. These regulations also could complicate the matching of available equipment with hazardous material shipments, thereby increasing our response time on customer orders and our non-revenue miles. As a result, it is possible we could fail to meet the needs of our customers or could incur increased expenses to do so.

We are subject to various environmental laws and regulations dealing with the hauling and handling of hazardous materials, fuel storage tanks, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. Our truck terminals often are located in industrial areas where groundwater or other forms of environmental contamination could occur. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. Certain of our facilities have waste oil or fuel storage tanks and fueling islands. A small percentage of our freight consists of low-grade hazardous substances, which subjects us to a wide array of regulations. Although we have instituted programs to monitor and control environmental risks and promote compliance with applicable environmental laws and regulations, if we are involved in a spill or other accident involving hazardous substances, if there are releases of hazardous substances we transport, if soil or groundwater contamination is found at our facilities or results from our operations, or if we are found to be in violation of applicable laws or regulations, we could be subject to cleanup costs and liabilities, including substantial fines or penalties or civil and criminal liability, any of which could have a materially adverse effect on our business and operating results.

EPA regulations limiting exhaust emissions became more restrictive in 2010. In May 2010, President Obama signed an executive memorandum directing the National Highway Traffic Safety Administration ("NHTSA") and the EPA to develop new, stricter fuel efficiency standards for heavy tractors, beginning in 2014. In August of 2011, the EPA released fuel economy standards for heavy trucks for the first time. These standards will require a fuel economy improvement of approximately 20% by 2018, starting with the 2014 model year. In December 2008, California adopted new performance requirements for diesel tractors, with targets to be met between 2011 and 2023, and California also has adopted aerodynamics requirements for certain trailers. These regulations, as well as proposed regulations or legislation related to climate change that potentially impose restrictions, caps, taxes, or other controls on emissions of greenhouse gas, could adversely affect our operations and financial results. In addition, increasing efforts to control emissions of greenhouse gases are likely to have an impact on us. The EPA has announced a finding relating to greenhouse gas emissions that may result in promulgation of greenhouse gas emission limits. Federal and state lawmakers also are considering a variety of climate-change proposals. Compliance with such regulations could increase the cost of new tractors and trailers, impair equipment productivity, and increase operating expenses. These effects, combined with the uncertainty as to the operating results that will be produced by the newly designed diesel engines and the residual values of these vehicles, could increase our costs or otherwise adversely affect our business or operations.

In order to reduce exhaust emissions, some states and municipalities have begun to restrict the locations and amount of time where diesel-powered tractors, such as ours, may idle. These restrictions could force us to alter our drivers' behavior, purchase on-board power units that do not require the engine to idle, or face a decrease in productivity.

Fuel Availability and Cost

The cost of fuel trended higher in 2012, compared to 2011 and 2010, as a result of geo-political tensions and volatility in the Middle East, weakness of the U.S. dollar, and an increase in global demand for petroleum products. To mitigate the cost and volatility in the cost of fuel, we utilize a variety of initiatives.

We actively manage our fuel costs by routing our drivers through fuel centers with which we have negotiated volume discounts and through jurisdictions with lower fuel taxes, where possible. We have also reduced the maximum speed of many of our trucks, implemented strict idling guidelines for our drivers, purchased technology to enhance our management and monitoring of out-of-route miles, encouraged the use of shore power units in truck stops, and imposed standards for accepting broker freight that includes minimum rates and fuel surcharges. This combination of initiatives has contributed to significant improvements in fleet-wide average fuel mileage. Moreover, we have a fuel surcharge revenue program in place with the majority of our customers, which has historically enabled us to recover some of the higher fuel costs. However, even with the fuel surcharges, the price of fuel has affected our profitability. Our fuel surcharges are billed on a lagging basis, meaning we typically bill customers in the current week based on a previous week's applicable index. Therefore, in times of increasing fuel prices, we do not recover as much as we are currently paying for fuel. In periods of declining prices, the opposite is true. In addition, we incur additional costs when fuel prices rise that cannot be fully recovered due to our engines being idled during cold or warm weather, empty or out-of-route miles, and for fuel used by refrigerated trailer units that generally are not billed to customers. In addition, time-to-time customers attempt to modify their surcharge programs, some successfully, which can result in recovery of a smaller portion of fuel price increases. Rapid increases in fuel costs or shortages of fuel could have a materially adverse effect on our operations or future profitability.

To reduce the variability of the ultimate cash flows associated with fluctuations in diesel fuel prices, we periodically enter into various derivative instruments, including forward futures swap contracts. As diesel fuel is not a traded commodity on the futures market, heating oil is used as a substitute for diesel fuel as prices for both generally move in similar directions. Under these contracts, we pay a fixed rate per gallon of heating oil and receive the monthly average price of New York heating oil per the "NYMEX" (New York Mercantile Exchange). At December 31, 2012, we had forward futures swap contracts on approximately 12.1 million gallons of diesel to be purchased in 2013, or approximately 20% of our projected annual 2013 fuel requirements, and approximately 4.0 million gallons to be purchased in 2014, or approximately 6% of our projected annual 2014 fuel requirements.

Seasonality

In the trucking industry, revenue generally decreases as customers reduce shipments after the winter holiday season and as inclement weather impedes operations. At the same time, operating expenses generally increase, with fuel efficiency declining because of engine idling and weather, creating more equipment repairs. For the reasons stated, first quarter operating results historically have been lower than results in each of the other three quarters of the year excluding charges. Our equipment utilization typically improves substantially between May and October of each year because of the trucking industry's seasonal shortage of equipment on traffic originating in California and because of general increases in shipping demand during those months. During September and October, business sometimes increases as a result of increased retail merchandise shipped in anticipation of the holidays. Due to the economic downturn and related low inventory levels, this historical trend has been less pronounced over the past several years, including fiscal 2012, 2011, and 2010, as we have seen increases in demand at varying times, specifically between March and June, based primarily on restocking required to replenish inventories and less pronounced seasonal spikes prior to the holidays.

Additional Information

At December 31, 2012, our corporate structure included Covenant Transportation Group, Inc., a Nevada holding company organized in May 1994, and its wholly owned subsidiaries: Covenant Transport, Inc., a Tennessee corporation; Southern Refrigerated Transport, Inc., an Arkansas corporation; Star Transportation, Inc., a Tennessee corporation; Covenant Transport Solutions, Inc., a Nevada corporation; Covenant Logistics, Inc., a Nevada corporation; Covenant Asset Management, Inc., a Nevada corporation; and CTG Leasing Company, a Nevada corporation.

Our headquarters is located at 400 Birmingham Highway, Chattanooga, Tennessee 37419, and our website address is www.ctginvestor.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all other reports we file with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") are available free of charge through our website. Information contained in or available through our website is not incorporated by reference into, and you should not consider such information to be part of, this Annual Report on Form 10-K.

Additionally, you may read all of the materials that we file with the SEC by visiting the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. If you would like information about the operation of the Public Reference Room, you may call the SEC at 1-800-SEC-0330. You may also visit the SEC's website at www.sec.gov. This site contains reports, proxy and information statements and other information regarding the Company and other companies that file electronically with the SEC.

Factors That May Affect Future Results

Our future results may be affected by a number of factors over which we have little or no control. The following discussion of risk factors contains forward-looking statements as discussed in Item 1 above. The following issues, uncertainties, and risks, among others, should be considered in evaluating our business and growth outlook.

Our business is subject to general economic and business factors affecting the trucking industry that are largely out of our control, any of which could have a materially adverse effect on our operating results.

Our business is dependent on a number of factors that may have a materially adverse effect on our results of operations, many of which are beyond our control. Some of the most significant of these factors include excess tractor and trailer capacity in the trucking industry, declines in the resale value of used equipment, strikes or other work stoppages, increases in interest rates, fuel taxes, tolls, and license and registration fees, and rising costs of healthcare.

We also are affected by recessionary economic cycles, changes in customers' inventory levels, and downturns in customers' business cycles, particularly in market segments and industries, such as retail and manufacturing, where we have a significant concentration of customers, and regions of the country, such as California, Texas, and the Southeast, where we have a significant amount of business. Some of the principal risks are as follows:

| • | We may experience a reduction in overall freight levels, which may impair our asset utilization; |

| • | Certain of our customers may face credit issues and could experience cash flow problems that may lead to payment delays, increased credit risk, bankruptcies, and other financial hardships that could result in even lower freight demand and may require us to increase our allowance for doubtful accounts; |

| • | Freight patterns may change as supply chains are redesigned, resulting in an imbalance between our capacity and our customers' freight demand; |

| • | Customers may bid out freight or select competitors that offer lower rates from among existing choices in an attempt to lower their costs, and we might be forced to lower our rates or lose freight; and |

| • | We may be forced to accept more freight from freight brokers, where freight rates are typically lower, or may be forced to incur more non-revenue miles to obtain loads. |

We also are subject to increases in costs and other events that are outside of our control that could materially reduce our profitability if we are unable to increase our rates sufficiently. Such cost increases include, but are not limited to, fuel and energy prices, taxes and interest rates, tolls, license and registration fees, insurance, revenue equipment and related maintenance costs, and healthcare and other benefits for our employees. We could be affected by strikes or other work stoppages at our service centers or at customer, port, border, or other shipping locations. Changing impacts of regulatory measures could impair our operating efficiency and productivity, decrease our revenues and profitability, and result in higher operating costs. In addition, declines in the resale value of revenue equipment can also affect our profitability and cash flows. From time-to-time, various federal, state, or local taxes are also increased, including taxes on fuels. We cannot predict whether, or in what form, any such increase applicable to us will be enacted, but such an increase could adversely affect our profitability.

In addition, we cannot predict future economic conditions, fuel price fluctuations, or how consumer confidence could be affected by actual or threatened armed conflicts or terrorist attacks, government efforts to combat terrorism, military action against a foreign state or group located in a foreign state, or heightened security requirements. Enhanced security measures could impair our operating efficiency and productivity and result in higher operating costs.

We operate in a highly competitive and fragmented industry, and numerous competitive factors could impair our ability to improve our profitability.

These factors include:

| • | We compete with many other truckload carriers of varying sizes and, to a lesser extent, with less-than-truckload carriers, railroads, intermodal companies, and other transportation companies, many of which have more equipment and greater capital resources than we do; |

| • | Many of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or maintain significant growth in our business; |

| • | Many of our customers, including four of our top ten, are other transportation companies, and they may decide to transport their own freight; |

| • | Many customers reduce the number of carriers they use by selecting "core carriers" as approved service providers, and in some instances we may not be selected; |

| • | Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some business to competitors; |

| • | The trend toward consolidation in the trucking industry may create other large carriers with greater financial resources and other competitive advantages relating to their size; |

| • | Advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher freight rates to cover the cost of these investments; and |

| • | Competition from non-asset-based logistics and freight brokerage companies may adversely affect our customer relationships and freight rates. |

We have a recent history of net losses and may be unsuccessful in improving our profitability.

We have generated a profit in only two of the last five years and our aggregate net losses during the five year period are significantly more than our aggregate net income. We may not be able to achieve profitability or, if we do, we may not be able to sustain or increase profitability in the future. If we are unable to improve our profitability, then our liquidity, financial position, and results of operations may be adversely affected.

We self-insure for a significant portion of our claims exposure, which could significantly increase the volatility of, and decrease the amount of, our earnings.

Our future insurance and claims expense could reduce our earnings and make our earnings more volatile. We self-insure for a significant portion of our claims exposure and related expenses. We accrue amounts for liabilities based on our assessment of claims that arise and our insurance coverage for the periods in which the claims arise, and we evaluate and revise these accruals from time-to-time based on additional information. Due to our significant self-insured amounts, we have significant exposure to fluctuations in the number and severity of claims and the risk of being required to accrue or pay additional amounts if our estimates are revised or the claims ultimately prove to be more severe than originally assessed. Further, our self-insured retention levels could change and result in more volatility than in recent years. Historically, we have had to significantly adjust our reserves on several occasions, and future significant adjustments may occur.

We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe our aggregate insurance limits are sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed those limits. If any claim was to exceed our coverage, we would bear the excess, in addition to our other self-insured amounts. Our insurance and claims expense could increase, or we could find it necessary to again raise our self-insured retention or decrease our aggregate coverage limits when our policies are renewed or replaced. Our operating results and financial condition may be adversely affected if these expenses increase, if we experience a claim in excess of our coverage limits, if we experience a claim for which we do not have coverage, if we experience an increase in number of claims, or if we have to increase our reserves. Healthcare legislation and inflationary cost increases could also negatively affect our financial results.

Fluctuations in the price or availability of fuel, hedging activities, and the volume and terms of diesel fuel purchase commitments, and surcharge collection and surcharge policies approved by customers may increase our costs of operation, which could materially and adversely affect our profitability.

Fuel is one of our largest operating expenses. Diesel fuel prices fluctuate greatly due to economic, political, weather, and other factors beyond our control, each of which may lead to an increase in the cost of fuel. Fuel also is subject to regional pricing differences and often costs more on the West Coast, where we have significant operations. From time-to-time, we use hedging contracts and volume purchase arrangements to attempt to limit the effect of price fluctuations. We may be forced to make cash payments under the hedging arrangements. We use a fuel surcharge program to recapture a portion of the increases in fuel prices over a base rate negotiated with our customers. Our fuel surcharge program does not protect us against the full effect of increases in fuel prices. The terms of each customer's fuel surcharge program vary and certain customers have sought to modify the terms of their fuel surcharge programs to minimize recoverability for fuel price increases. A failure to improve our fuel price protection through these measures, increases in fuel prices, or a shortage or rationing of diesel fuel, could materially and adversely affect our results of operations.

We depend on the proper functioning and availability of our information systems and a system failure or unavailability or an inability to effectively upgrade our information systems could cause a significant disruption to our business and have a materially adverse effect on our results of operation.

We depend on the proper functioning and availability of our information systems, including financial reporting and operating systems, in operating our business. Our operating system is critical to understanding customer demands, accepting and planning loads, dispatching equipment and drivers, and billing and collecting for our services. Our financial reporting system is critical to producing accurate and timely financial statements and analyzing business information to help us manage effectively. We are in the process of implementing a multi-year project to upgrade the hardware and software of our information systems. When we have converted portions of our operations in the past, we have experienced difficulties. If any of our critical information systems fail or become otherwise unavailable, whether as a result of the upgrade project or otherwise, we would have to perform the functions manually, which could temporarily impact our ability to manage our fleet efficiently, to respond to customers' requests effectively, to maintain billing and other records reliably, and to bill for services and prepare financial statements accurately or in a timely manner. Our business interruption insurance may be inadequate to protect us in the event of an unforeseeable and extreme catastrophe. Any system failure, delay, or complication in the upgrade, security breach, or other system failure could interrupt or delay our operations, damage our reputation, cause us to lose customers, or impact our ability to manage our operations and report our financial performance, any of which could have a materially adverse effect on our business.

Our Third Amended and Restated Credit Facility ("Credit Facility") and other financing arrangements contain certain covenants, restrictions, and requirements, and we may be unable to comply with the covenants, restrictions, and requirements. A default could result in the acceleration of all or part of our outstanding indebtedness, which could have an adverse effect on our financial condition, liquidity, results of operations, and the price of our common stock.

We have a $95.0 million Credit Facility with a group of banks and numerous other financing arrangements. The Credit Facility contains certain restrictions and covenants relating to, among other things, dividends, liens, acquisitions and dispositions outside of the ordinary course of business, affiliate transactions, and a fixed charge coverage ratio, if availability is below a certain threshold. We have had difficulty meeting budgeted results and have had to request amendments in the past. If we are unable to meet budgeted results or otherwise comply with our Credit Facility, we may be unable to obtain amendments or waivers under our Credit Facility, or we may incur fees in doing so. See "Material Debt Agreements" under Item 7 in Part II of this Annual Report on Form 10-K for additional information.

Certain other financing arrangements contain certain restrictions and non-financial covenants in addition to those contained in our Credit Facility. If we fail to comply with any of our financing arrangement covenants, restrictions, and requirements, we will be in default under the relevant agreement, which could cause cross-defaults under our other financing arrangements. In the event of any such default, if we failed to obtain replacement financing, amendments to, or waivers under the applicable financing arrangements, our lenders could cease making further advances, declare our debt to be immediately due and payable, fail to renew letters of credit, impose significant restrictions and requirements on our operations, institute foreclosure procedures against their collateral, or impose significant fees and transaction costs. If acceleration occurs, economic conditions such as the recent credit market crisis may make it difficult or expensive to refinance the accelerated debt or we may have to issue equity securities, which would dilute stock ownership. Even if new financing is made available to us, credit may not be available to us on acceptable terms. A default under our financing arrangements could cause a materially adverse effect on our liquidity, financial condition, and results of operations.

Our substantial indebtedness and capital and operating lease obligations could adversely affect our ability to respond to changes in our industry or business.

As a result of our level of debt, capital leases, operating leases, and encumbered assets, we believe:

| • | Our vulnerability to adverse economic conditions and competitive pressures is heightened; |

| • | We will continue to be required to dedicate a substantial portion of our cash flows from operations to lease payments and repayment of debt, limiting the availability of cash for other purposes; |

| • | Our flexibility in planning for, or reacting to, changes in our business and industry will be limited; |

| • | Our profitability is sensitive to fluctuations in interest rates because some of our debt obligations are subject to variable interest rates, and future borrowings and lease financing arrangements will be affected by any such fluctuations; |

| • | Our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, or other purposes may be limited; and |

| • | We may be required to issue additional equity securities to raise funds, which would dilute the ownership position of our stockholders. |

Our financing obligations could negatively impact our future operations, our ability to satisfy our capital needs, or our ability to engage in other business activities. We also cannot assure you that additional financing will be available to us when required or, if available, will be on terms satisfactory to us.

We have significant ongoing capital requirements that could affect our profitability if we are unable to generate sufficient cash from operations and obtain financing on favorable terms.

The truckload industry is capital intensive, and our policy of operating newer equipment requires us to expend significant amounts annually. We expect to pay for projected capital expenditures with cash flows from operations, borrowings under our Credit Facility, proceeds from the sale of our used revenue equipment, proceeds under our financing facilities, and leases of revenue equipment. If we are unable to generate sufficient cash from operations and obtain financing on favorable terms in the future, we may have to limit our fleet size, enter into less favorable financing arrangements, or operate our revenue equipment for longer periods, any of which could have a materially adverse effect on our profitability.

We derive a significant portion of our revenue from our major customers, the loss of one or more of which could have a materially adverse effect on our business.

A significant portion of our revenue is generated from our major customers. Economic conditions and capital markets may adversely affect our customers and their ability to remain solvent. Our customers' financial difficulties can negatively impact our results of operations and financial condition, especially if our customers were to delay or default on payments to us. Generally, we do not have long-term contractual relationships with our major customers, and our customers may not continue to use our services or could reduce their use of our services. For some of our customers, we have entered into multi-year contracts, and the rates we charge may not remain advantageous. A reduction in or termination of our services, by one or more of our major customers, could have a materially adverse effect on our business and operating results.

We depend on third parties, particularly in our brokerage business, and service instability from these providers could increase our operating costs and reduce our ability to offer brokerage services, which could adversely affect our revenue, results of operations, and customer relationships.

Our brokerage business is dependent upon the services of third-party capacity providers, including other truckload carriers. These third-party providers seek other freight opportunities and may require increased compensation in times of improved freight demand or tight trucking capacity. Our inability to secure the services of these third parties, or increases in the prices we must pay to secure such services, could have an adverse effect on our operations and profitability.

Increases in driver compensation or difficulty in attracting and retaining qualified drivers could adversely affect our profitability.

Like many truckload carriers, we experience substantial difficulty in attracting and retaining sufficient numbers of qualified drivers, including independent contractors. Our industry periodically experiences a shortage of qualified drivers, particularly during periods of economic expansion, in which alternative employment opportunities are more plentiful and freight demand increases, or during periods of economic downturns, in which unemployment benefits might be extended and financing is limited for independent contractors who seek to purchase equipment or for students who seek financial aid for driving school. Regulatory requirements, including CSA and hours-of-service changes, and an improved economy could further reduce the number of eligible drivers or force us to increase driver compensation to attract and retain drivers. A shortage of qualified drivers and intense competition for drivers from other trucking companies will create difficulties in maintaining or increasing the number of our drivers, including independent contractor drivers. The compensation we offer our drivers and independent contractors is subject to market conditions, and we may find it necessary to increase driver and independent contractor compensation in future periods. In addition, we and our industry suffer from a high turnover rate of drivers. The high turnover rate requires us to continually recruit a substantial number of drivers in order to operate existing revenue equipment. If we are unable to continue to attract and retain a sufficient number of drivers, we could be forced to, among other things, adjust our compensation packages, increase the number of our tractors without drivers, or operate with fewer trucks and face difficulty meeting shipper demands, any of which could adversely affect our growth and profitability.

If our independent contractor drivers are deemed by regulators or judicial process to be employees, our business and results of operations could be adversely affected.

Tax and other regulatory authorities have in the past sought to assert that independent contractor drivers in the trucking industry are employees rather than independent contractors, and our classification of independent contractors has been the subject of audits by such authorities from time-to-time. Federal legislators have introduced legislation in the past to make it easier for tax and other authorities to reclassify independent contractor drivers as employees, including legislation to increase the recordkeeping requirements for employers of independent contractor drivers and to heighten the penalties of employers who misclassify their employees and are found to have violated employees' overtime and/or wage requirements. Additionally, federal legislators have sought to abolish the current safe harbor allowing taxpayers meeting certain criteria to treat individuals as independent contractors if they are following a long-standing, recognized practice, extend the Fair Labor Standards Act to independent contractors, and impose notice requirements based upon employment or independent contractor status and fines for failure to comply. Some states have put initiatives in place to increase their revenues from items such as unemployment, workers' compensation, and income taxes, and a reclassification of independent contractor drivers as employees would help states with this initiative. Taxing and other regulatory authorities and courts apply a variety of standards in their determination of independent contractor status. If our independent contractor drivers are determined to be our employees, we would incur additional exposure under federal and state tax, workers' compensation, unemployment benefits, labor, employment, and tort laws, including for prior periods, as well as potential liability for employee benefits and tax withholdings.

We operate in a highly regulated industry, and changes in existing regulations or violations of existing or future regulations could have a materially adverse effect on our operations and profitability.

We operate in the U.S. pursuant to operating authority granted by the DOT and in various Canadian provinces pursuant to operating authority granted by the Ministries of Transportation and Communications in such provinces. We operate within Mexico by utilizing third-party carriers within that country. Our Company drivers and independent contractors also must comply with the safety and fitness regulations of the DOT, including those relating to drug and alcohol testing and hours-of-service. Such matters as weight and equipment dimensions also are subject to government regulations. We also may become subject to new or more restrictive regulations relating to exhaust emissions, drivers’ hours-of-service, ergonomics, on-board reporting of operations, collective bargaining, security at ports, and other matters affecting safety or operating methods. Future laws and regulations may be more stringent and require changes in our operating practices, influence the demand for transportation services, or require us to incur significant additional costs. Higher costs incurred by us or by our suppliers who pass the costs onto us through higher prices could adversely affect our results of operations. The Regulation section in Item 1 of Part I of this Annual Report on Form 10-K discusses in detail several proposed, pending, and final regulations that could significantly impact our business and operations.

CSA could adversely affect our profitability and operations, our ability to maintain or grow our fleet, and our customer relationships.

Under CSA, drivers and fleets are evaluated and ranked based on certain safety-related standards. The methodology for determining a carrier's DOT safety rating has been expanded to include the on-road safety performance of the carrier's drivers. As a result, certain current and potential drivers may no longer be eligible to drive for us, our fleet could be ranked poorly as compared to our peer carriers, and our safety rating could be adversely impacted. We recruit and retain first-time drivers to be part of our fleet, and these drivers may have a higher likelihood of creating adverse safety events under CSA. The occurrence of future deficiencies could affect driver recruitment by causing high-quality drivers to seek employment with other carriers or could cause our customers to direct their business away from us and to carriers with higher fleet safety rankings, either of which would adversely affect our results of operations. Additionally, competition for drivers with favorable safety ratings may increase and thus could necessitate increases in driver-related compensation costs. Further, we may incur greater than expected expenses in our attempts to improve our scores or as a result of those scores.

Certain of our subsidiaries have exceeded the established intervention thresholds in a number of the seven safety-related standards. Based on these unfavorable ratings, we may be prioritized for an intervention action or roadside inspection, either of which could adversely affect our results of operations. In addition, customers may be less likely to assign loads to us. We have put new procedures in place in an attempt to address areas where we have exceeded the thresholds. However, we cannot assure you these measures will be effective.

The FMCSA also is considering revisions to the existing rating system and the safety labels assigned to motor carriers evaluated by the DOT. We currently have a satisfactory DOT rating, which is the highest available rating under the current safety rating scale. If we were to receive a conditional or unsatisfactory DOT safety rating, it could adversely affect our business as customer contracts may require a satisfactory DOT safety rating, and a conditional or unsatisfactory rating could negatively impact or restrict our operations. Under the revised rating system being considered by the FMCSA, our safety rating would be evaluated more regularly, and our safety rating would reflect a more in-depth assessment of safety-based violations.

Increased prices, reduced productivity, and scarcity of financing for new revenue equipment may adversely affect our earnings and cash flows.

We are subject to risk with respect to higher prices for new tractors. Prices have increased and may continue to increase, due, in part, to government regulations applicable to newly manufactured tractors and diesel engines and due to the pricing discretion of equipment manufacturers. More restrictive EPA emissions standards have required vendors to introduce new engines. Compliance with such regulations has increased the cost of our new tractors and could impair equipment productivity, lower fuel mileage, and increase our operating expenses. These adverse effects, combined with the uncertainty as to the reliability of the vehicles equipped with the newly designed diesel engines and the residual values realized from the disposition of these vehicles, could increase our costs or otherwise adversely affect our business or operations as the regulations become effective.

We have a combination of agreements and non-binding statements of indicative trade values covering the terms of trade-in commitments from our primary equipment vendors for disposal of a portion of our revenue equipment. From time-to-time, prices we expect to receive under these arrangements may be higher than the prices we would receive in the open market. We may suffer a financial loss upon disposition of our equipment if these vendors refuse or are unable to meet their financial obligations under these agreements, if we do not enter into definitive agreements consistent with the indicative trade values, if we fail to or are unable to enter into similar arrangements in the future, or if we do not purchase the number of replacement units from the vendors required for such trade-ins.

If we are unable to retain our key employees, our business, financial condition, and results of operations could be harmed.