UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2021

Commission File Number 001-13314

Huaneng Power International, Inc.

(Translation of registrant’s name into English)

Huaneng Power International, Inc.

Huaneng Building,

6 Fuxingmennei Street,

Xicheng District,

Beijing, 100031 PRC

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This Form 6-K consists of:

1. a copy of first quarterly report for the year of 2021 of Huaneng Power International, Inc.(the "Registrant");

2. an announcement of connected transaction regarding formation of joint venture of the Registrant; and

3. an announcement regarding issue of super short-term debentures of the Registrant;

Each made by the Registrant on April 28, 2021.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | HUANENG POWER INTERNATIONAL, INC. |

| | |

| | |

| | By: | /s/ Huang Chaoquan |

| | Name: | Huang Chaoquan |

| | Title: | Company Secretary |

| | |

| Date: April 29, 2021 | |

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document.

FIRST QUARTERLY REPORT OF 2021

Pursuant to the regulations of the China Securities Regulatory Commission, the Company is required to publish a quarterly report for each of the first and third quarters.

All financial information set out in this quarterly report is unaudited and prepared in accordance with the PRC Accounting Standards (“PRC GAAP”).

This announcement is made by the Company pursuant to Rule 13.09 and Rules 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and the Inside Information Provisions under Part XIVA of the Securities and Futures Ordinance (Chapter 571, Laws of Hong Kong).

| 1.1 | The board of directors and the supervisory committee of Huaneng Power International, Inc. (the “Company”, “Huaneng International”) together with the members thereof and the senior management warrant that the information contained in this report does not contain any false statements, misleading representations or material omissions. All of them jointly and severally accept responsibility as to the truthfulness, accuracy and completeness of the content of this report. |

| 1.2 | All financial information set out in this quarterly report is unaudited and prepared in accordance with the PRC GAAP. |

| 1.3 | Zhao Keyu (legal representative), Huang Lixin (person in charge of accounting function) and Wei Zhongqian (person in charge of the Accounting Department) warrant the truthfulness, accuracy and completeness of the content of the quarterly report. |

| 1.4 | This announcement is made by the Company pursuant to Rule 13.09 and Rules 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and the Inside Information Provisions under Part XIVA of the Securities and Futures Ordinance (Chapter 571, Laws of Hong Kong). |

| 2 | BASIC INFORMATION OF THE COMPANY |

| 2.1 | Major financial information PRC GAAP (unaudited) |

| | End of current

reporting period | | | End of last year | | | Variance from

end of last year

(%) | |

| | | | | | | | | | |

| Total Assets | | 443,633,073,191 | | | 438,205,752,374 | | | 1.24 | |

| Equity holders’ equity attributable to equity holders of the Company | | 123,874,003,940 | | | 121,698,538,280 | | | 1.79 | |

| | | From the

beginning of

the year to the

end of current

reporting period

(January to

March) | | | From the

beginning of

the preceding year

to the end of

the equivalent

period

(January to

March) | | | Variance from

equivalent

period of

last year

(%) | |

| | | | | | | | | | |

| Net cash flows generated from operating activities | | 11,330,462,982 | | | 8,147,977,457 | | | 39.06 | |

| | | From the

beginning of

the year to the

end of current

reporting period

(January to

March) | | | From the

beginning of

the preceding year

to the end of

the equivalent

period

(January to

March) | | | Variance from

equivalent

period of

last year

(%) | |

| | | | | | | | | | |

| Operating Revenue | | 49,909,188,093 | | | 40,382,606,300 | | | 23.59 | |

| Net profit attributable to equity holders of the Company | | 3,126,672,348 | | | 2,060,382,424 | | | 51.75 | |

| Net profit after deducting non-recurring items attributable to equity holders of the Company | | 2,863,647,779 | | | 2,056,171,982 | | | 39.27 | |

| Return on net assets (weighted average) (%) | | 3.47 | | | 2.38 | | | Increase by | |

| | | | | | | | | 1.09 percentage | |

| Basic earnings per share (RMB per share) | | 0.17 | | | 0.11 | | | points

54.55 | |

| Diluted earnings per share (RMB per share) | | 0.17 | | | 0.11 | | | 54.55 | |

Non-recurring items and amounts:

|  | Applicable |  | Not applicable |

(Amounts: In RMB Yuan)

| | Total amount of | | |

| | current reporting | | |

| | period | | |

| Items | (January to March) | | Notes |

| | | | |

| Gains from disposal of non-current assets | 185,523,890 | | Luohuang Power gained RMB170 million from the disposal of buildings. |

Government grant recorded in income statement, excluding government grant closely related to the Company’s business and calculated according to national unified standards | 181,132,590 | | |

| Profits and losses from entrusted loans | 2,599,803 | | |

| Other non-operating income and expenses excluding the above items | 16,944,844 | | |

| Other non-recurring items | (4,145,630 | ) | |

| Impact of non-controlling interests, net of tax | (75,324,862 | ) | |

| Tax impact of non-recurring items | (43,706,066 | ) | |

Total | 263,024,569 | | |

| 2.2 | Total number of shareholders, ten largest shareholders and shareholding of top ten holders of circulating shares whose shares are not subject to any selling restrictions as at the end of the reporting period |

Unit: share

| Total number of shareholders | 108,293 |

| Top ten holders of shares |

| Name (in full) of shareholders | Number of

shares held

at end of

reporting

period | Percentage (%) | Number of

shares held

with selling

restriction | Status on charges

or pledges etc. | Nature of

shareholders |

Status of

shares | Number |

| Huaneng International Power Development Corporation | 5,066,662,118 | 32.28 | – | Nil | – | State-owned entity |

| HKSCC Nominees Limited | 4,098,429,122 | 26.11 | – | Nil | – | Foreign entity |

| China Huaneng Group Co., Ltd. | 1,555,124,549 | 9.91 | – | Nil | – | State-owned entity |

| Hebei Construction & Investment Group Co., Ltd. | 527,548,946 | 3.36 | – | Nil | – | State-owned entity |

| China Hua Neng Group Hong Kong Limited | 472,000,000 | 3.01 | – | Nil | – | Foreign entity |

| China Securities Finance Corporation Limited | 466,953,720 | 2.97 | – | Nil | – | State-owned entity |

| Jiangsu Guoxin Investment Group Limited | 416,500,000 | 2.65 | – | Nil | – | State-owned entity |

| Liaoning Energy Investment (Group) Limited Liability Company | 284,204,999 | 1.81 | – | Nil | – | State-owned entity |

| Fujian Investment Development Group Liability Company | 251,814,185 | 1.60 | – | Nil | – | State-owned entity |

| Dalian Municipal Construction Investment Company Limited | 151,500,000 | 0.97 | – | Charges | 149,375,000 | State-owned entity |

| Top ten holders of circulating shares whose shares are not subject to selling restrictions |

| Name (in full) of shareholders | Number of shares in

circulation without

any selling restrictions

as at the end of

the reporting period | Type and number of shares |

| Type | Number |

| Huaneng International Power Development Corporation | 5,066,662,118 | RMB denominated ordinary shares | 5,066,662,118 |

| HKSCC Nominees Limited | 4,098,429,122 | Overseas listed foreign invested shares | 4,098,429,122 |

| China Huaneng Group Co., Ltd. | 1,555,124,549 | RMB denominated ordinary shares | 1,555,124,549 |

| Hebei Construction & Investment Group Co., Ltd. | 527,548,946 | RMB denominated ordinary shares | 527,548,946 |

| China Hua Neng Group Hong Kong Limited | 472,000,000 | Overseas listed foreign invested shares | 472,000,000 |

| China Securities Finance Corporation Limited | 466,953,720 | RMB denominated ordinary shares | 466,953,720 |

| Jiangsu Guoxin Investment Group Limited | 416,500,000 | RMB denominated ordinary shares | 416,500,000 |

| Liaoning Energy Investment (Group) Limited Liability Company | 284,204,999 | RMB denominated ordinary shares | 284,204,999 |

| Fujian Investment Development Group Limited Liability Company | 251,814,185 | RMB denominated ordinary shares | 251,814,185 |

| Dalian Municipal Construction Investment Company Limited | 151,500,000 | RMB denominated ordinary shares | 151,500,000 |

| Details relating to the related relationship of the above shareholders or the parties acting in concert | Among the above shareholders, China Huaneng Group Co., Ltd., Huaneng International Power Development Corporation and China Hua Neng Group Hong Kong Limited are regarded as parties acting in concert under the “Management Rules on Acquisition of Listing Companies”. The Company is not aware of any related relationship among other shareholders. |

| Explanatory statement regarding the restored voting rights and shareholdings of holders of preference shares | – |

| 2.3 | Total number of holders of preference shares, ten largest holders of preference shares and shareholding of top ten holders of preference shares whose shares are not subject to selling restriction as at the end of the reporting period |

|  | Applicable |  | Not applicable |

| 3.1 | Disclosure as to, and reasons for, material changes in accounting items and financial indices of the Company |

|  | Applicable |  | Not applicable |

| (a) | Consolidated Statement of Financial Position |

| 1. | Derivative financial assets increased by RMB258 million compared with the end of the last year, mainly due to the increase of the fuel price, resulting in an increase in the fair value of fuel swap contracts held by the Company’s subsidiary, SinoSing Power. |

| 2. | Accounts receivable increased by RMB2.005 billion compared with the end of the last year, mainly due to the increase of power receivables in relation to renewable energy subsidies and Pakistan operations. |

| 3. | Accounts receivable financing increased by 46% compared with the end of the last year. Accounts receivable financing recorded the power sales receivables held by Shandong Power, a subsidiary of the Company, that might be disposed and transferred under certain assets management plans. This part of the power sale receivables has increased during the first quarter of 2021. |

| 4. | Prepayments increased by 59% compared with the end of the last year, mainly due to the increase in prepayments of fuel during the first quarter of 2021. |

| 5. | Fixed assets increased by RMB1.464 billion compared with the end of the last year, mainly due to the combined effects of the fact that construction in progress was completed and transferred into fixed assets such as Shengdong Rudong Offshore and the normal depreciation of fixed assets. |

| 6. | Construction in progress decreased by RMB1.243 billion compared with the end of the last year, mainly due to the fact that the scale of infrastructure construction transferred into fixed assets in the first quarter was larger than that of the new investments. |

| 7. | Short-term borrowings decreased by RMB1.161 billion compared with the end of the last year, mainly due to the decrease of short-term borrowings from Shanxi Integrated Energy and Qinbei Power Generation, which was amounting to RMB570 million and RMB500 million, respectively. |

| 8. | Derivative financial liabilities decreased by 49% compared with the end of the last year, mainly due to the increase of the fuel price, resulting in an increase in the fair value of fuel swap contracts held by SinoSing Power. |

| 9. | Accounts payable and bills payable increased by RMB1.188 billion and RMB725 million compared with the end of the last year, respectively. Which was mainly due to the increase in fuel price in the first quarter of 2021. |

| 10. | Contract liabilities decreased by 21% compared with the end of the last year, mainly due to the combined effects of the reduction in pre-collected heating fees since the end of the heating season; and the relocation compensation of RMB1.406 billion received by Jining Power Plant. |

| 11. | Other current liabilities decreased by RMB2.048 billion compared with the end of the last year, mainly due to the maturity of the Company’s short-term bonds. |

| 12. | Bonds payable increased by 1.028 billion compared with the end of the last year, mainly due to the issuance of 1 billion Carbon Neutral bond. |

| 13. | Long-term payables increased by RMB940 million compared with the end of the last year, mainly due to the wind turbine leases of Zhuanghe Wind Power in the first quarter of 2021. |

| 14. | Other comprehensive income increased by RMB240 million compared with the end of the last year, mainly due to the increase in the fair value of the fuel swap contracts of SinoSing Power. |

| (b) | Fluctuation analysis of the consolidated income statement items |

| 1. | Operating revenue increased by 24% compared with the same period of the last year, mainly due to the year-on-year increase in power sales volume. |

| 2. | Operating expenses increased by 27% compared with the same period of the last year, mainly due to the year-on-year increase in fuel costs which was caused by the increase in power sales volume and fuel price. |

| 3. | General and administrative expenses increased by 35% compared with the same period of the last year, mainly due to the increase in employee compensation which was caused by the year-on-year increased Company’s profit, leading to the total wages, welfare fees, labor union funds, and employee education and training fees increased accordingly. In addition, due to the epidemic in the same period of the last year, the social security fee reduction policy was implemented in various places then, which relatively led to the increase of the current period’s social security fee. |

| 4. | Financial expenses decreased by 18% compared with the same period of the last year, mainly due to the decrease in the scale of the Company’s interest- bearing liabilities whose interests were recorded in financial expenses and the decrease of debt cost. |

| 5. | Investment income increased by RMB239 million compared with the same period of the last year, mainly due to the year-on-year increase in the investment income from associates and joint ventures. |

| 6. | Gain on disposal of assets increased by RMB174 million compared with the same period of the last year, mainly due to the income from the assets disposal of Chongqing Luohuang Power. |

| (c) | Fluctuation analysis of the consolidated cash flow statement items |

| 1. | The net inflow of cash flow from operating activities was RMB11.330 billion, representing an increase of RMB3.182 billion compared with the same period of the last year, which was mainly due to the year-on-year increase of power sales volume and profits in the current period. |

| 2. | The net outflow of cash flow from investing activities was RMB9.210 billion, representing an increase of RMB3.188 billion compared with the same period of the last year, mainly due to the increase of investments in infrastructure projects, which led to the increase in the fixed asset purchases, engineering expenditures and engineering material purchases. |

| 3. | The net outflow of cash flow from financing activities was RMB1.932 billion, representing an increase of RMB1.542 billion compared with the same period of the last year, mainly due to the year-on-year increase of net repayments. |

| 3.2 | Analysis and description of significant events and their impacts and solutions |

|  | Applicable |  | Not applicable |

| 3.3 | Undertaking not performed in time during the reporting period |

| |  | Applicable |  | Not applicable |

| 3.4 | Warnings on any potential loss in accumulated net profit for the period from the beginning of the year to the end of next reporting period or any material changes from the corresponding period last year and the reasons therefor |

| |  | Applicable |  | Not applicable |

By Order of the Board

Huaneng Power International, Inc.

Zhao Keyu

Chairman

As at the date of this announcement, the Directors of the Company are:

| Zhao Keyu (Executive Director) | | Xu Mengzhou (Independent Non-executive Director) |

| Zhao Ping (Executive Director) | | Liu Jizhen (Independent Non-executive Director) |

| Huang Jian (Non-executive Director) | | Xu Haifeng (Independent Non-executive Director) |

| Wang Kui (Non-executive Director) | | Zhang Xianzhi (Independent Non-executive Director) |

| Lu Fei (Non-executive Director) | | Xia Qing (Independent Non-executive Director) |

| Teng Yu (Non-executive Director) | | |

| Mi Dabin (Non-executive Director) | | |

| Cheng Heng (Non-executive Director) | | |

| Li Haifeng (Non-executive Director) | | |

| Lin Chong (Non-executive Director) | | |

Beijing, the PRC

28 April 2021

APPENDIX

HUANENG POWER INTERNATIONAL, INC.

UNAUDITED CONSOLIDATED AND THE COMPANY’S BALANCE SHEETS (PRC GAAP)

AS AT 31 MARCH 2021

| | | | | | Amounts: In RMB Yuan, Except as noted | |

| | | | | | | | | | | | | |

| | | 31 March 2021 | | | 31 December 2020 | | | 31 March 2021 | | | 31 December 2020 | |

| ASSETS | | | Consolidated | | | | Consolidated | | | | The Company | | | | The Company | |

| | | | | | | | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | | | | | | | |

| Bank balances and cash | | | 14,282,951,974 | | | | 13,871,523,445 | | | | 640,273,048 | | | | 968,343,541 | |

| Derivative financial assets | | | 325,976,322 | | | | 110,178,653 | | | | – | | | | – | |

| Notes receivable | | | 8,434,556,982 | | | | 8,325,965,654 | | | | 1,514,345,481 | | | | 1,147,783,085 | |

| Accounts receivable | | | 30,638,609,715 | | | | 28,633,861,767 | | | | 2,855,240,750 | | | | 3,237,917,659 | |

| Accounts receivable financing | | | 1,838,841,368 | | | | 1,255,887,993 | | | | – | | | | – | |

| Advances to suppliers | | | 2,471,884,459 | | | | 1,555,336,077 | | | | 477,197,138 | | | | 199,818,412 | |

| Other receivables | | | 2,096,730,299 | | | | 2,148,012,863 | | | | 4,654,213,624 | | | | 12,540,450,773 | |

| Inventories | | | 6,688,352,823 | | | | 6,602,459,007 | | | | 1,005,869,754 | | | | 780,089,468 | |

| Contract assets | | | 45,574,137 | | | | 29,678,153 | | | | – | | | | – | |

| Current portion of non-current assets | | | 499,343,812 | | | | 478,681,793 | | | | – | | | | – | |

| Other current assets | | | 3,122,067,518 | | | | 3,126,045,908 | | | | 2,235,973,367 | | | | 4,073,526,835 | |

Total current assets | | | 70,444,889,409 | | | | 66,137,631,313 | | | | 13,383,113,162 | | | | 22,947,929,773 | |

| | | | | | | | | | | | | | | | | |

| NON-CURRENT ASSETS | | | | | | | | | | | | | | | | |

Derivative financial assets | | | 116,570,586 | | | | 74,554,339 | | | | – | | | | – | |

| Long-term receivables | | | 10,155,304,621 | | | | 10,286,927,639 | | | | 2,330,195,133 | | | | 1,350,195,133 | |

| Long-term equity investments | | | 22,568,428,950 | | | | 22,224,738,792 | | | | 124,046,243,446 | | | | 121,843,775,149 | |

| Other equity instrument investments | | | 717,137,935 | | | | 664,946,056 | | | | 603,700,030 | | | | 589,208,111 | |

| Investment property | | | 650,153,363 | | | | 647,470,539 | | | | 141,885,988 | | | | 143,113,744 | |

| Fixed assets | | | 245,165,814,284 | | | | 243,701,964,464 | | | | 22,281,071,519 | | | | 22,822,208,504 | |

| Construction-in-progress | | | 50,336,393,179 | | | | 51,579,694,944 | | | | 1,393,243,923 | | | | 1,353,175,726 | |

| Right-of-use assets | | | 6,092,473,973 | | | | 6,812,966,364 | | | | 355,441,715 | | | | 374,779,660 | |

| Intangible assets | | | 14,004,817,313 | | | | 14,090,511,406 | | | | 1,210,000,712 | | | | 1,231,907,927 | |

| Goodwill | | | 11,578,637,433 | | | | 11,696,735,103 | | | | – | | | | – | |

| Long-term deferred expenses | | | 123,706,949 | | | | 127,210,330 | | | | 19,597,956 | | | | 20,290,703 | |

| Deferred income tax assets | | | 2,936,899,426 | | | | 2,996,689,691 | | | | 630,942,819 | | | | 638,486,430 | |

| Other non-current assets | | | 8,741,845,770 | | | | 7,163,711,394 | | | | 23,735,676,182 | | | | 14,897,073,108 | |

Total non-current assets | | | 373,188,183,782 | | | | 372,068,121,061 | | | | 176,747,999,423 | | | | 165,264,214,195 | |

TOTAL ASSETS | | | 443,633,073,191 | | | | 438,205,752,374 | | | | 190,131,112,585 | | | | 188,212,143,968 | |

| LIABILITIES AND EQUITY | | 31 March 2021

Consolidated | | | 31 December 2020

Consolidated | | | 31 March 2021

The Company | | | 31 December 2020

The Company | |

| | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | |

| Short-term loans | | | 65,149,715,627 | | | | 66,311,160,062 | | | | 24,869,830,681 | | | | 23,238,497,699 | |

| Derivative financial liabilities | | | 52,231,838 | | | | 106,861,682 | | | | – | | | | – | |

| Notes payable | | | 1,906,986,448 | | | | 1,181,836,586 | | | | – | | | | – | |

| Accounts payable | | | 15,783,939,432 | | | | 14,595,947,809 | | | | 1,974,768,224 | | | | 2,044,449,388 | |

| Contract liabilities | | | 2,293,210,090 | | | | 2,903,295,902 | | | | 1,512,341,901 | | | | 357,428,052 | |

| Salary and welfare payables | | | 1,120,456,739 | | | | 955,117,838 | | | | 238,427,906 | | | | 192,628,370 | |

| Taxes payable | | | 1,935,579,291 | | | | 2,044,868,790 | | | | 116,404,756 | | | | 73,207,011 | |

| Other payables | | | 24,251,449,884 | | | | 26,088,007,806 | | | | 1,368,213,018 | | | | 1,474,386,122 | |

| Current portion of non-current liabilities | | | 31,221,935,032 | | | | 34,228,813,571 | | | | 13,791,029,351 | | | | 13,474,812,231 | |

| Other current liabilities | | | 3,583,701,732 | | | | 5,632,180,524 | | | | 3,183,793,196 | | | | 5,188,172,797 | |

Total current liabilities | | | 147,299,206,113 | | | | 154,048,090,570 | | | | 47,054,809,033 | | | | 46,043,581,670 | |

| | | | | | | | | | | | | | | | | |

| NON-CURRENT LIABILITIES | | | | | | | | | | | | | | | | |

Long-term loans | | | 118,259,602,404 | | | | 112,077,394,506 | | | | 2,689,566,692 | | | | 2,917,306,484 | |

| Derivative financial liabilities | | | 99,071,311 | | | | 188,139,392 | | | | – | | | | – | |

| Bonds payable | | | 21,410,847,183 | | | | 20,382,405,580 | | | | 17,500,222,372 | | | | 16,497,016,960 | |

| Lease liabilities | | | 3,805,202,788 | | | | 3,774,175,853 | | | | 226,390,001 | | | | 238,812,182 | |

| Long-term payables | | | 1,599,504,995 | | | | 655,227,903 | | | | 1,677,315 | | | | 1,613,015 | |

| Long-term employee benefits payable | | | 50,730,520 | | | | 51,065,130 | | | | – | | | | – | |

| Provision | | | 10,137,926 | | | | 12,181,164 | | | | 129,650 | | | | 259,300 | |

| Deferred income | | | 1,857,804,757 | | | | 1,940,144,115 | | | | 484,938,531 | | | | 502,446,964 | |

| Deferred income tax liabilities | | | 1,047,279,188 | | | | 977,810,420 | | | | – | | | | – | |

| Other non-current liabilities | | | 2,575,460,625 | | | | 2,623,763,846 | | | | 237,103,899 | | | | 246,407,414 | |

Total non-current liabilities | | | 150,715,641,697 | | | | 142,682,307,909 | | | | 21,140,028,460 | | | | 20,403,862,319 | |

TOTAL LIABILITIES | | | 298,014,847,810 | | | | 296,730,398,479 | | | | 68,194,837,493 | | | | 66,447,443,989 | |

| LIABILITIES AND EQUITY (continued) | | 31 March 2021 Consolidated | | 31 December 2020

Consolidated | | 31 March 2021

The Company | | 31 December 2020

The Company |

| | | | | | | | | |

| EQUITY | | | | | | | | |

| Share capital | | 15,698,093,359 | | 15,698,093,359 | | 15,698,093,359 | | 15,698,093,359 |

| Other equity instruments | | 48,660,062,360 | | 48,419,779,167 | | 48,660,062,360 | | 48,419,779,167 |

| Including: perpetual corporate bonds | | 48,660,062,360 | | 48,419,779,167 | | 48,660,062,360 | | 48,419,779,167 |

| Capital surplus | | 17,637,804,773 | | 18,551,589,304 | | 13,239,542,791 | | 13,239,201,750 |

| Other comprehensive income | | (239,117,788) | | (478,627,559) | | 230,620,169 | | 252,767,878 |

| Special reserves | | 80,418,414 | | 73,076,887 | | 67,398,911 | | 57,161,273 |

| Surplus reserves | | 8,186,274,738 | | 8,186,274,738 | | 8,186,274,738 | | 8,186,274,738 |

| Undistributed profits | | 33,850,468,084 | | 31,248,352,384 | | 35,854,282,764 | | 35,911,421,814 |

| | | | | | | | | |

| Equity attributable to equity holders of the Company | | 123,874,003,940 | | 121,698,538,280 | | 121,936,275,092 | | 121,764,699,979 |

| Non-controlling interests | | 21,744,221,441 | | 19,776,815,615 | | – | | – |

| | | | | | | | | |

| Total equity | | 145,618,225,381 | | 141,475,353,895 | | 121,936,275,092 | | 121,764,699,979 |

TOTAL LIABILITIES AND EQUITY | | 443,633,073,191 | | 438,205,752,374 | | 190,131,112,585 | | 188,212,143,968 |

| Legal representative | Person in charge of

accounting function | Person in charge of

accounting department |

| Zhao Keyu | Huang Lixin | Wei Zhongqian |

HUANENG POWER INTERNATIONAL, INC.

UNAUDITED CONSOLIDATED AND THE COMPANY’S INCOME STATEMENTS (PRC GAAP)

FOR THE FIRST QUARTER ENDED 31 MARCH 2021

| | | Amounts: In RMB Yuan, Except as noted |

| | | |

| | | For the first quarter |

| | | 2021 Consolidated | | 2020 Consolidated | | 2021

The Company | | 2020

The Company |

| | | | | (Restated) | | | | |

| | | | | | | | | |

| Operating revenue | | 49,909,188,093 | | 40,382,606,300 | | 6,695,580,252 | | 9,816,384,694 |

| Less: | Operating cost | | 41,605,797,258 | | 32,749,180,370 | | 5,762,136,911 | | 8,042,303,753 |

| | Tax and levies on operations | | 518,553,846 | | 441,489,585 | | 81,808,105 | | 118,733,592 |

| | Selling expenses | | 39,068,711 | | 24,582,716 | | 1,557,033 | | 6,774,520 |

| | General and administrative expenses | | 1,325,529,448 | | 983,211,995 | | 454,186,765 | | 394,921,798 |

| | Research and development expenses | | 36,683,084 | | 2,576,647 | | 11,500,697 | | 4,784 |

| | Financial expenses | | 2,200,593,812 | | 2,671,785,189 | | 525,034,328 | | 806,897,248 |

| Add: | Other income | | 192,150,572 | | 117,434,204 | | 23,998,980 | | 43,368,998 |

| | Investment income | | 357,335,226 | | 118,058,227 | | 586,292,598 | | 478,109,554 |

| | Including: | Investment income from associates

and joint ventures | | 358,870,478 | | 169,836,069 | | 300,592,863 | | (148,536,541) |

| | | Gain on derecognition of financial assets measured at amortised cost | | (5,364,650) | | (460,018) | | – | | – |

| | Gain/(loss) on fair value changes of financial | | | | | | | | |

| | assets/liabilities | | – | | (61,327,464) | | – | | – |

| | Credit loss | | 374,834 | | (341,913) | | – | | – |

| | Assets impairment loss | | 615,203 | | (1,458,079) | | – | | – |

| | Gain on disposal of assets | | 174,427,600 | | 208,829 | | 226,950 | | 208,829 |

| | | | | | | | | |

| Operating profit | | 4,907,865,369 | | 3,682,353,602 | | 469,874,941 | | 968,436,380 |

| Add: | Non-operating income | | 48,521,337 | | 71,974,901 | | 9,602,965 | | 51,411,192 |

| Less: | Non-operating expenses | | 26,778,736 | | 7,953,024 | | 4,516,698 | | 2,850,355 |

| | | | | | | | | |

| Profit before tax | | 4,929,607,970 | | 3,746,375,479 | | 474,961,208 | | 1,016,997,217 |

| Less: | Income tax expense | | 900,015,173 | | 927,934,715 | | 7,543,611 | | 255,231,446 |

| | | | | | | | | |

| Net profit | | 4,029,592,797 | | 2,818,440,764 | | 467,417,597 | | 761,765,771 |

| | | | | | | | | |

| The net income of the merged parties before the merger under common control | | – | | 513,432 | | – | | – |

| | | | | | | | | |

| (1) Classification according to the continuity of operation | | | | | | | | |

| Continuous operating net profit | | 4,029,592,797 | | 2,818,440,764 | | 467,417,597 | | 761,765,771 |

| | | | | | | | | |

| (2) Classification according to ownership | | | | | | | | |

| Attributable to: | | | | | | | | |

| | Equity holders of the Company | | 3,126,672,348 | | 2,060,382,424 | | 467,417,597 | | 761,765,771 |

| | Non-controlling interests | | 902,920,449 | | 758,058,340 | | – | | – |

| | | For the first quarter |

| | | 2021 Consolidated | | 2020 Consolidated | | 2021

The Company | | 2020

The Company |

| | | | | (Restated) | | | | |

| | | | | | | | | |

Earnings per shares attributable to the shareholders of the Company (expressed in RMB per share) – Basic earnings per share | | 0.17 | | 0.11 | | – | | – |

| – Diluted earnings per share | | 0.17 | | 0.11 | | �� | | – |

| | | | | | | | | |

| Other comprehensive income/(loss), net of tax | | 372,915,824 | | (1,120,390,474) | | (22,147,709) | | (9,415,309) |

| | | | | | | | | |

Other comprehensive income/(loss) (net of tax) attributed to equity holders of the Company | | 239,509,771 | | (1,003,011,435) | | (22,147,709) | | (9,415,309) |

| | | | | | | | | |

| Other comprehensive income (net of tax) attributed to equity holders of the Company that may not be reclassified to profit or loss | | | | | | | | |

| Including | | | | | | | | |

| Share of other comprehensive income /(loss) of investees accounted for under the equity method | | (22,308,790) | | (10,074,876) | | (22,308,790) | | (10,074,876) |

| Losses arising from changes in fair value of other equity instrument investments | | 522,978 | | (527,262) | | – | | – |

| Other comprehensive income (net of tax) attributed to equity holders of the Company that may be reclassified to profit or loss | | | | | | | | |

| Including: | | | | | | | | |

| Share of other comprehensive income/(loss) of | | | | | | | | |

| investees accounted for under the equity method | | 161,081 | | 659,567 | | 161,081 | | 659,567 |

| Effective portion of cash flow hedges | | 318,976,934 | | (471,263,613) | | – | | – |

Translation differences of the financial statements of

foreign operations | | (57,842,432) | | (521,805,251) | | – | | – |

| Other comprehensive loss, net of tax, attributable to non- | | | | | | | | |

| controlling interests | | 133,406,053 | | (117,379,039) | | – | | – |

| | | | | | | | | |

| Total comprehensive income | | 4,402,508,621 | | 1,698,050,290 | | 445,269,888 | | 752,350,462 |

| | | | | | | | | |

Attributable to: Equity holders of the Company | | 3,366,182,119 | | 1,057,370,989 | | 445,269,888 | | 752,350,462 |

| Non-controlling interests | | 1,036,326,502 | | 640,679,301 | | – | | – |

| Legal representative | Person in charge of

accounting function | Person in charge of

accounting department |

| Zhao Keyu | Huang Lixin | Wei Zhongqian |

HUANENG POWER INTERNATIONAL, INC.

UNAUDITED CONSOLIDATED AND THE COMPANY’S CASH FLOW STATEMENTS (PRC GAAP)

FOR THE FIRST QUARTER ENDED 31 MARCH 2021

| | Amounts: In RMB Yuan, Except as noted | |

| | | |

| | | For the first quarter | |

| | 2021

Consolidated | | | | 2020

Consolidated (Restated) | | | | 2021

The Company | | | | 2020

The Company | |

| | | | | | | | | | | | | | | | |

| Cash flows generated from operating activities | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Cash received from sales of goods and services rendered | | 53,143,484,684 | | | | 44,181,794,504 | | | | 8,621,400,989 | | | | 11,383,185,125 | |

| Cash received from return of taxes and fees | | 27,017,375 | | | | 15,243,074 | | | | 1,278,012 | | | | 81,998 | |

| Other cash received relating to operating activities | | 242,449,087 | | | | 267,176,670 | | | | 79,866,738 | | | | 73,459,885 | |

| Sub-total of cash inflows of operating activities | | 53,412,951,146 | | | | 44,464,214,248 | | | | 8,702,545,739 | | | | 11,456,727,008 | |

| Cash paid for goods and services received | | 34,602,415,209 | | | | 29,565,455,108 | | | | 5,695,910,933 | | | | 8,763,762,289 | |

| Cash paid to and on behalf of employees including salary, social welfare, education funds and others in such manner | | 3,877,301,967 | | | | 3,464,822,838 | | | | 688,130,152 | | | | 937,243,337 | |

| Payments of taxes | | 3,384,249,350 | | | | 3,067,047,738 | | | | 542,602,598 | | | | 877,779,979 | |

| Other cash paid relating to operating activities | | 218,521,638 | | | | 218,911,107 | | | | 257,972,291 | | | | 295,783,496 | |

| Sub-total of cash outflows of operating activities | | 42,082,488,164 | | | | 36,316,236,791 | | | | 7,184,615,974 | | | | 10,874,569,101 | |

| Net cash flows generated from operating activities | | 11,330,462,982 | | | | 8,147,977,457 | | | | 1,517,929,765 | | | | 582,157,907 | |

| Cash flows generated from investing activities | | | | | | | | | | | | | | | |

| Proceeds from disposal of investments | | 223,759,636 | | | | – | | | | 2,856,097,636 | | | | 1,812,657,000 | |

| Cash received on investment income | | 2,582,803 | | | | – | | | | 514,688,483 | | | | 1,653,156,393 | |

| Proceeds from disposal of property, plant and equipment, land use rights and other non-current assets | | 202,647,939 | | | | 81,884,927 | | | | 2,752,279 | | | | 14,242,267 | |

| Other cash received relating to investing activities | | – | | | | – | | | | 20,111,252 | | | | – | |

| Sub-total of cash inflows of investing activities | | 428,990,378 | | | | 81,884,927 | | | | 3,393,649,650 | | | | 3,480,055,660 | |

| Payment for the purchase of property, plant and equipment, land use rights and other non-current assets | | 9,587,582,227 | | | | 6,042,710,053 | | | | 193,543,986 | | | | 300,951,510 | |

| Cash paid for investments | | 51,472,222 | | | | 61,691,648 | | | | 4,820,836,378 | | | | 2,217,880,400 | |

| Sub-total of cash outflows of investing activities | | 9,639,054,449 | | | | 6,104,401,701 | | | | 5,014,380,364 | | | | 2,518,831,910 | |

| Net cash flows (used in) generated from investing activities | | (9,210,064,071 | ) | | | (6,022,516,774 | ) | | | (1,620,730,714 | ) | | | 961,223,750 | |

| | | For the first quarter | |

| | 2021

Consolidated | | | 2020

Consolidated (Restated) | | | 2021

The Company | | | 2020

The Company | |

| | | | | | | | | | | | | |

| Cash flows generated from financing activities | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cash received from investments | | | 87,211,989 | | | | 3,075,732,430 | | | | – | | | | 2,986,582,830 | |

| Including: cash received from non-controlling interests of subsidiaries | | | 87,211,989 | | | | 89,149,600 | | | | – | | | | – | |

| Cash received from borrowings | | | 46,746,098,708 | | | | 41,443,830,415 | | | | 14,495,000,000 | | | | 16,172,123,220 | |

| Cash received from issuance of bonds | | | 9,000,000,000 | | | | 8,220,089,154 | | | | 9,000,000,000 | | | | 4,000,000,000 | |

| | | | | | | | | | | | | | | | | |

| Sub-total of cash inflows of financing activities | | | 55,833,310,697 | | | | 52,739,651,999 | | | | 23,495,000,000 | | | | 23,158,706,050 | |

| | | | | | | | | | | | | | | | | |

| Repayments of borrowings | | | 54,391,135,672 | | | | 50,219,229,036 | | | | 23,120,341,784 | | | | 23,386,606,656 | |

| Payments for dividends, profit or interest expense | | | 2,289,618,528 | | | | 2,547,469,854 | | | | 525,975,587 | | | | 473,764,398 | |

| Including: dividends paid to non-controlling interests of subsidiaries | | | 62,920,909 | | | | 255,083,988 | | | | – | | | | – | |

| Other cash paid relating to financing activities | | | 1,084,551,051 | | | | 363,308,866 | | | | 30,262,954 | | | | 39,468,418 | |

| | | | | | | | | | | | | | | | | |

| Sub-total of cash outflows of financing activities | | | 57,765,305,251 | | | | 53,130,007,756 | | | | 23,676,580,325 | | | | 23,899,839,472 | |

| | | | | | | | | | | | | | | | | |

| Net cash flows used in financing activities | | | (1,931,994,554 | ) | | | (390,355,757 | ) | | | (181,580,325 | ) | | | (741,133,422 | ) |

| | | | | | | | | | | | | | | | | |

| Effect of foreign exchange rate changes, net | | | 154,440,328 | | | | (83,020,353 | ) | | | 9,153 | | | | 46,838 | |

| | | | | | | | | | | | | | | | | |

| Net increase/(decrease) in cash | | | 342,844,685 | | | | 1,652,084,573 | | | | (284,372,121 | ) | | | 802,295,073 | |

| Add: cash at beginning of period | | | 13,257,892,557 | | | | 12,494,972,947 | | | | 879,887,510 | | | | 1,224,528,545 | |

| | | | | | | | | | | | | | | | | |

| Cash at end of period | | | 13,600,737,242 | | | | 14,147,057,520 | | | | 595,515,389 | | | | 2,026,823,618 | |

| Legal representative | | Person in charge of

accounting function | | Person in charge of

accounting department |

| Zhao Keyu | | Huang Lixin | | Wei Zhongqian |

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss however arising from or reliance upon the whole or any part of the contents of this announcement.

CONNECTED TRANSACTION

FORMATION OF JOINT VENTURE

On 27 April 2021, the Company entered into the Investment Agreement with Pro-Power Investment. Pursuant to the terms and conditions of the Investment Agreement, the Company and Pro-Power Investment will jointly fund the establishment of Wushan Company. The Company will contribute no more than RMB81 million and Pro-Power Investment will contribute RMB27 million (or its equivalent). After the completion of the Transaction, the Company will hold 75% of the equity interest of Wushan Company, while Pro-Power Investment will hold 25% of the equity interest of Wushan Company.

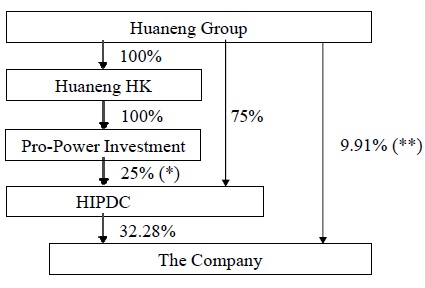

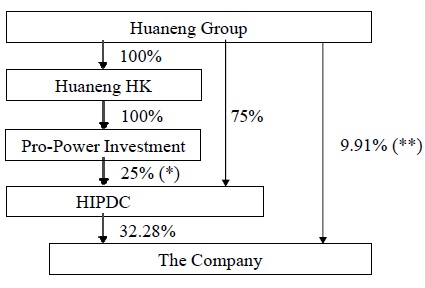

As of the date of this announcement, Huaneng Group holds a 75% direct interest and a 25% indirect interest in HIPDC, while HIPDC, being the direct controlling shareholder of the Company, holds a 32.28% interest in the Company. Huaneng Group also holds a 9.91% direct interest in the Company and holds a 3.01% indirect interest in the Company through its wholly- owned subsidiary Huaneng HK, a 0.84% indirect interest in the Company through China Huaneng Group Treasury Management (Hong Kong) Limited, its indirect wholly-owned subsidiary, and a 0.39% indirect interest in the Company through its controlling subsidiary Huaneng Finance. Pro- Power Investment is an indirect wholly-owned subsidiary of Huaneng Group. According to the Hong Kong Listing Rules, Pro-Power Investment is connected person/associate of the Company, the Transaction constitutes a connected transaction of the Company.

According to relevant percentage ratios as calculated pursuant to Rule 14.07 of the Hong Kong Listing Rules, the Transaction does not constitute a notifiable transaction under Chapter 14 of the Hong Kong Listing Rules. However, the Transaction constitutes a connected transaction under Chapter 14A of the Hong Kong Listing Rules. As the scale of the Transaction exceeds 0.1% but does not exceed 5% of the applicable percentage ratios (other than the profit ratio) as calculated pursuant to Rule 14.07 of the Hong Kong Listing Rules, the Company is only required to comply with the reporting and announcement requirements under Rules 14A.71 and 14A.35 of the Hong Kong Listing Rules but is exempt from independent shareholders' approval requirements.

On 27 April 2021, the Company entered into the Investment Agreement with Pro-Power Investment. Pursuant to the terms and conditions of the Investment Agreement, the Company and Pro-Power Investment will jointly fund the establishment of Wushan Company. The Company will contribute no more than RMB81 million and Pro-Power Investment will contribute RMB27 million (or its equivalent). After the completion of the Transaction, the Company will hold 75% of the equity interest of Wushan Company, while Pro-Power Investment will hold 25% of the equity interest of Wushan Company.

| II. | RELATIONSHIP AMONG THE COMPANY, HUANENG GROUP AND PRO-POWER INVESTMENT |

The Company and its subsidiaries mainly develop, construct, operate and manage large-scale power plants in China. It is one of the largest listed power suppliers in China. As at the date of this announcement, the Company’s controlled generation capacity is 113,805 MW and the equity based generation capacity is 99,570 MW.

Huaneng Group is principally engaged in the operation and management of enterprise investments, the development, investment, construction, operation and management of power plants; organising the generation and sale of power (and heat); and the development, investment, construction, production and sale of products in relation to energy, transportation, new energy and environmental protection industries.

Pro-Power Investment is a limited liability company incorporated in Hong Kong which is principally engaged in investment business. Huaneng Group, through its wholly-owned subsidiary, Hua Neng HK, indirectly wholly owns Pro-Power Investment.

As of the date of this announcement, Huaneng Group holds a 75% direct interest and a 25% indirect interest in HIPDC, while HIPDC, being the direct controlling shareholder of the Company, holds a 32.28% interest in the Company. Huaneng Group also holds a 9.91% direct interest in the Company and holds a 3.01% indirect interest in the Company through its wholly- owned subsidiary Huaneng HK, a 0.84% indirect interest in the Company through China Huaneng Group Treasury Management (Hong Kong) Limited, its indirect wholly-owned subsidiary, and a 0.39% indirect interest in the Company through its controlling subsidiary Huaneng Finance. Pro-Power Investment is an indirect wholly-owned subsidiary of Huaneng Group. According to the Hong Kong Listing Rules, Pro-Power Investment is connected person/ associate of the Company, the Transaction constitutes a connected transaction of the Company.

As of the date of this announcement, the connected relationship between the Company, Huaneng Group and Pro-Power Investment is illustrated as follows:

* Huaneng Group, through its wholly-owned subsidiary i.e. Huaneng HK, indirectly holds 100% of Pro- Power Investment while Pro-Power Investment Limited holds a 25% interest in HIPDC. Therefore, Huaneng Group holds a 25% indirect interest in HIPDC.

** Huaneng Group holds a 9.91% direct interest in the Company, a 3.01% indirect interest in the Company through Hua Neng HK (a wholly-owned subsidiary of Huaneng Group), a 0.84% indirect interest in the Company through China Huaneng Group Treasury Management (Hong Kong) Limited (an indirect wholly-owned subsidiary of Huaneng Group) and a 0.39% indirect interest in the Company through Huaneng Finance (a controlling subsidiary of Huaneng Group).

| III. | BASIC INFORMATION OF THE CONNECTED TRANSACTION |

The principal terms of the Investment Agreement are set out as follows:

| 3. | Payment of the capital contribution |

The registered capital of Wushan Company shall be RMB108 million, of which, the Company will contribute RMB81 million in cash, with a shareholding ratio of 75%, while Pro-Power will contribute RMB27 million or its equivalent (in cash) in US dollars, with a shareholding ratio of 25%. The time for making the contribution shall be 31 December 2021. The Company shall pay the capital contribution by its own internal fund.

Wushan Company does not have a board of directors, but has an executive director appointed by the Company with a term of three years. There is no board of supervisor, but two supervisors with a term of three years. Each of the Company and Pro-Power Investment shall have a right to appoint one supervisor. There shall be one president, who shall be nominated by the Company, several vice presidents and one officer responsible for the financial affairs, who shall be nominated by the president.

The Investment Cooperation Agreement shall become effective upon being duly signed and sealed by the legal representatives or authorized representatives from parties.

| IV. | BASIC INFORMATION OF THE TARGET |

The Company and Pro-Power Investment will jointly fund the establishment of Wushan Company in the Transaction. In order to develop the Wushan wind power project, and given that foreign-invested enterprises can at the same time fully enjoy the preferential tax policies for the development of the western region, the Company plans to establish Wushan Company jointly with Pro-Power Investment.

| V. | PURPOSE OF THE TRANSACTION AND THE EFFECT ON THE COMPANY |

In order to meet the development and construction requirements of the wind power project in Wushan and to enjoy tax preferential policies, it is proposed to establish Wushan Company, with the Company holding 75% thereof and Pro-Power Investment holding 25% thereof.

Following completion of the Transaction, the Company will consolidate Wushan Company into its consolidated statement. The Transaction will not have a significant impact on the Company’s financial status, and there does not exist any situation that will jeopardise the interest of the Company and its shareholders.

| VI. | IMPLICATIONS UNDER THE HONG KONG LISTING RULES |

According to the relevant percentage ratios as calculated pursuant to Rule 14.07 of the Hong Kong Listing Rules, the Transaction does not constitute a notifiable transaction under Chapter 14 of the Hong Kong Listing Rules. However, the Transaction constitutes a connected transaction under Chapter 14A of the Hong Kong Listing Rules. As the scale of the Transaction exceeds 0.1% but does not exceed 5% of the applicable percentage ratios (other than the profit ratio) as calculated pursuant to Rule 14.07 of the Hong Kong Listing Rules, the Company is only required to comply with the reporting and announcement requirement under Rules 14A.71 and 14A.35 of the Hong Kong Listing Rules but is exempt from independent shareholders’ approval requirements.

| VII. | PROCEDURAL MATTER RELATING TO THE TRANSACTION |

On 27 April 2021, the Twelfth Meeting of the Tenth Session of the Board of Directors of the Company has considered and approved the resolution regarding the Transaction. According to the SSE Listing Rules and the Hong Kong Listing Rules, Messrs. Zhao Keyu, Zhao Ping, Huang Jian, Wang Kui, Lu Fei and Teng Yu, all being Directors of the Company having related relationship, abstained from voting on the resolution relating to the Transaction.

The Directors (including the independent non-executive Directors) are of the view that the Investment Agreement was entered into: (i) on normal commercial terms (on arm’s length basis or on terms no less favorable to the Company than terms available from independent third parties); (ii) on terms that are fair and reasonable and are in the interests of the Company and its shareholders as a whole; and (iii) in the ordinary and usual course of business of the Company.

| “associate(s)” | has the meaning ascribed to it in the Hong Kong Listing Rules |

| “Company” | Huaneng Power International, Inc. |

| “connected person(s)” | has the meaning ascribed to it in the Hong Kong Listing Rules |

| “Director(s)” | the director(s) of the Company (including independent non- executive director(s)) |

| “ HIPDC” | Huaneng International Power Development Corporation the Rules |

| | “Hong Kong Listing Rules” | Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited |

| “Huaneng Finance” | China Huaneng Finance Corporate Limited . |

| | “Huaneng Group” | China Huaneng Group Co., Ltd |

| “Huaneng HK” | China Hua Neng Group Hong Kong Limited |

| “Investment Agreement” | the investment agreement entered into between the Company and Pro-Power Investmenton 27 April 2021 regarding Huaneng Chongqing Wushan Wind Power Limited Liability Company |

| “PRC” or “China” | the People’s Republic of China |

| | “Pro-Power Investment” | Pro-Power Investment Limited |

| “RMB” | Renminbi, the lawful currency of the PRC |

| “SSE Listing Rules” | Rules Governing the Listing of Securities on Shanghai Stock Exchange |

| “Transaction” | the establishment of the Wushan Company jointly between the Company and Pro-Power Investment pursuant to the Investment Cooperation Agreement |

| “Wushan Company” | Huaneng Chongqing Wushan Wind Power Limited Liability Company (provisional name, subject to final approval by the Administration for Market Regulation), which is to be established by the Company and Pro-Power Investment |

| | By order of the Board |

| | Huaneng Power International, Inc. |

| | Huang Chaoquan |

| | Company Secretary |

As of the date of the announcement, the directors of the Company are:

| Zhao Keyu (Executive Director) | Xu Mengzhou (Independent Non-executive Director) |

| Zhao Ping (Executive Director) | Liu Jizhen (Independent Non-executive Director) |

| Huang Jian (Non-executive Director) | Xu Haifeng (Independent Non-executive Director) |

| Wang Kui (Non-executive Director) | Zhang Xianzhi (Independent Non-executive Director) |

| Lu Fei (Non-executive Director) | Xia Qing (Independent Non-executive Director) |

| Teng Yu (Non-executive Director) | |

| Mi Dabin (Non-executive Director) | |

| Cheng Heng (Non-executive Director) | |

| Li Haifeng (Non-executive Director) | |

| Lin Chong (Non-executive Director) | |

| | |

| Beijing, the PRC | |

| 28 April 2021 | |

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

OVERSEAS REGULATORY ANNOUNCEMENT

ISSUE OF SUPER SHORT-TERM DEBENTURES

This announcement is made pursuant to Rule 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”).

As resolved at the 2019 annual general meeting of Huaneng Power International, Inc. (the “Company”) held on 16 June 2020, the Company has been given a mandate to issue super short-term debentures (in either one or multiple tranches on rolling basis) with a principal amount of up to RMB30 billion (which means that the outstanding principal balance of the super short-term debentures in issue shall not exceed RMB30 billion at any time within the period as prescribed therein) within the period from approval obtained at 2019 annual general meeting to the conclusion of the 2020 annual general meeting.

The Company has recently completed the issue of the fourth tranche of the Company’s super short- term debentures for 2021 (the “Debentures”). The total issuing amount was RMB2 billion with a maturity period of 37 days whereas the unit face value is RMB100 and the interest rate is 2.10%.

Shanghai Pudong Development Bank Co., Ltd. and Bank of Communications Co., Ltd. act as the lead underwriters to form the underwriting syndicates for the Debentures, which were placed through book-building and issued in the domestic bond market among banks. The proceeds from the Debentures will be used to supplement the working capital of the headquarters of the Company, adjust debts structure and repay bank loans and the debt due.

The relevant documents in respect of the Debentures are posted on China Money and Shanghai Clearing House at websites of www.chinamoney.com.cn and www.shclearing.com, respectively.

The Debentures do not constitute any transaction under Chapter 14 and Chapter 14A of the Listing Rules.

| | By Order of the Board |

| | Huaneng Power International, Inc. |

| | Huang Chaoquan |

| | Company Secretary |

As at the date of this announcement, the directors of the Company are:

| Zhao Keyu (Executive Director) | Xu Mengzhou (Independent Non-executive Director) |

| Zhao Ping (Executive Director) | Liu Jizhen (Independent Non-executive Director) |

| Huang Jian (Non-executive Director) | Xu Haifeng (Independent Non-executive Director) |

| Wang Kui (Non-executive Director) | Zhang Xianzhi (Independent Non-executive Director) |

| Lu Fei (Non-executive Director) | Xia Qing (Independent Non-executive Director) |

| Teng Yu (Non-executive Director) | |

| Mi Dabin (Non-executive Director) | |

| Cheng Heng (Non-executive Director) | |

| Li Haifeng (Non-executive Director) | |

| Lin Chong (Non-executive Director) | |

| | |

| Beijing, the PRC | |

| 28 April 2021 | |