UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November, 2015

Commission File Number: 333-13302

ETABLISSEMENTS DELHAIZE FRÈRES

ET CIE “LE LION” (GROUPE DELHAIZE)

(Exact name of registrant as specified in its charter)*

DELHAIZE BROTHERS AND CO.

“THE LION” (DELHAIZE GROUP)

(Translation of registrant’s name into English)*

SQUARE MARIE CURIE 40

1070 BRUSSELS, BELGIUM

(Address of principal executive offices)

| * | | The registrant’s charter (articles of association) specifies the registrant’s name in French, Dutch and English. |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SRI Conference ING Paris

November 5, 2015

Disclaimers

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the U.S. federal securities laws that are subject to risks and uncertainties. Forward-looking statements describe further expectations, plans, options, results or strategies. Actual outcomes and results may differ materially from those projected depending upon a variety of factors, including but not limited to changes in the general economy or the markets of Delhaize Group (“Delhaize”), in consumer spending, in inflation or currency exchange rates or in legislation or regulation; competitive factors; adverse determination with respect to claims; inability to timely develop, remodel, integrate or convert stores; and supply or quality control problems with vendors. Additional risks and uncertainties that could cause actual results to differ materially from those stated or implied by such forward-looking statements are described in our most recent annual report or Form 20-F and other filings with the Securities and Exchange Commission (the “SEC”). Delhaize disclaims any obligation to update or revise the information contained in this presentation. This presentation also contains forward-looking statements with respect to the financial condition, results of operations and business of Delhaize and Koninklijke Ahold N.V. also known as Royal Ahold (“Ahold”) and the merger of Delhaize and Ahold, including the expected effects of any proposed transaction. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors which are beyond the control of Delhaize and Ahold, including, among other things, the possibility that the expected synergies and value creation from the transaction will not be realized, or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; the possibility that the transaction will not receive the necessary approvals, that the expected timing of such approvals will be delayed or will require actions that adversely impact the benefits expected to be realized in the transaction; and the possibility that the transaction does not close. Neither Delhaize nor Ahold, nor any of their respective directors, officers, employees and advisors nor any other person is therefore in a position to make any representation as to the accuracy of the forward-looking statements included in this communication, such as economic projections and predictions or their impact on the financial condition, credit rating, financial profile, distribution policy or share buyback program of Delhaize, Ahold or the combined company, or the market for the shares of Delhaize, Ahold or the combined company. The actual performance, the success and the development over time of the business activities of Delhaize, Ahold and the combined company may differ materially from the performance, the success and the development over time expressed in or implied from the forward-looking statements contained in this presentation.

Important Information for Investors and Shareholders

The transaction will be submitted to the shareholders of Delhaize for their consideration. In connection with the transaction, Delhaize and Ahold will prepare a prospectus for Delhaize’s shareholders to be filed with the SEC and Delhaize will mail the prospectus to its shareholders and file other documents regarding the proposed transaction with the SEC. Investors and shareholders are urged to read the prospectus and the registration statement of which it forms a part when it becomes available, as well as other documents filed with the SEC, because they will contain important information. Investors and shareholders of Delhaize will be able to receive the prospectus and other documents free of charge at the SEC’s web site, http://www.sec.gov and from Delhaize by contacting Investor Relations at Investor@delhaizegroup.com or by calling +32 2 412 2151.

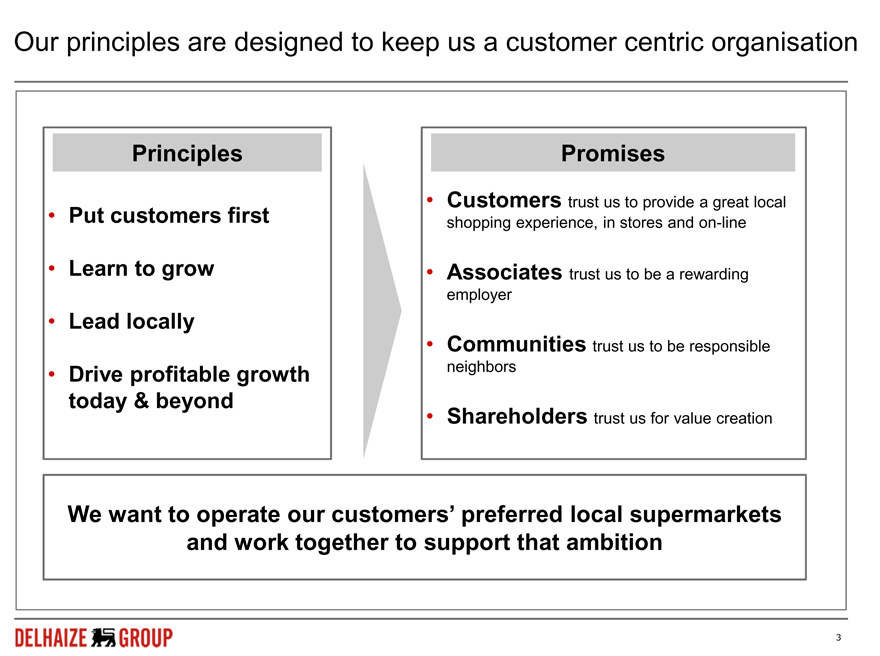

Our principles are designed to keep us a customer centric organisation

Principles Promises

Put customers first Customers trust us to provide a great local shopping experience, in stores and on-line

Learn to grow Associates trust us to be a rewarding employer

Lead locally

Communities trust us to be responsible

Drive profitable growth neighbors today & beyond Shareholders

trust us for value creation

We want to operate our customers’ preferred local supermarkets and work together to support that ambition

3

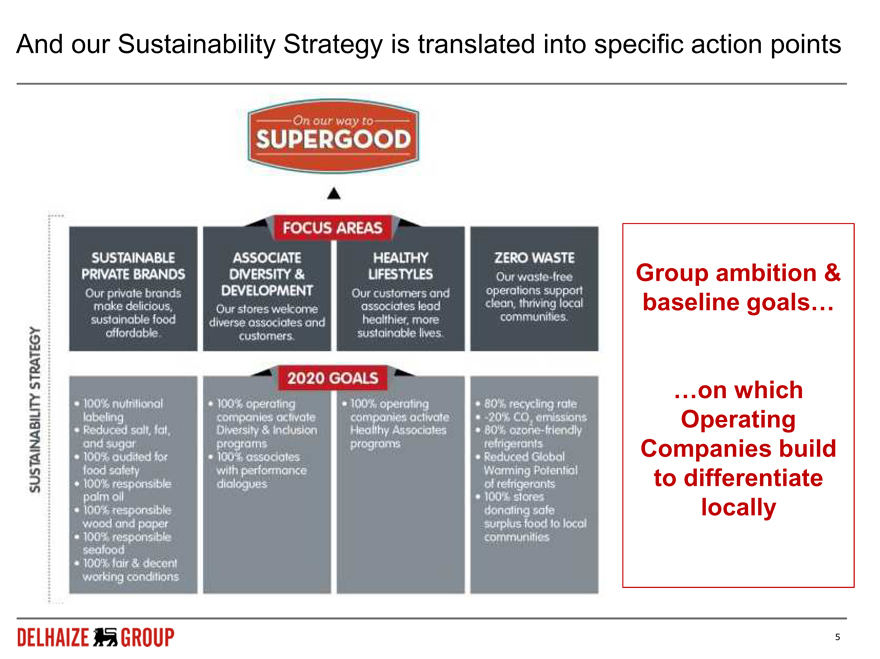

We have defined our 2020 sustainability ambition

We will delight our customers and energize our associates by helping them live happier and eat healthier in thriving local communities.

This is our big ambition and we call it Supergood.

And our Sustainability Strategy is translated into specific action points

Group ambition &

baseline goals…

…on which

Operating

Companies build

to differentiate

locally

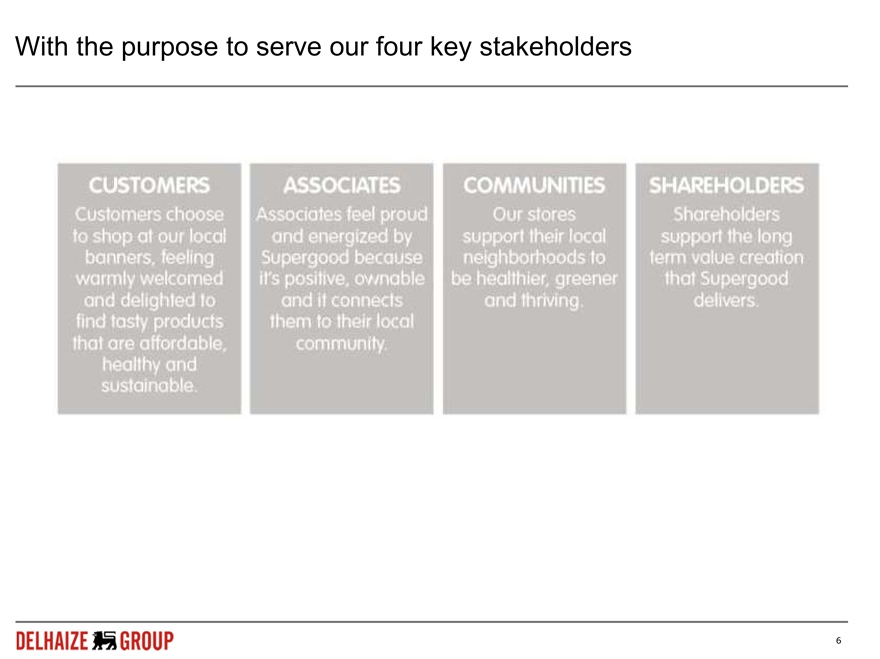

With the purpose to serve our four key stakeholders

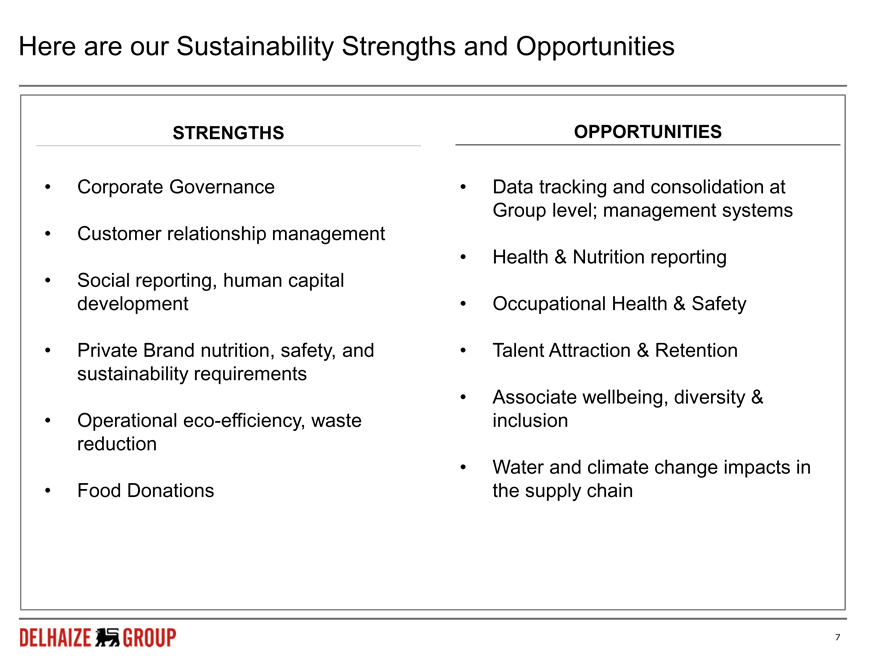

Here are our Sustainability Strengths and Opportunities

STRENGTHS OPPORTUNITIES

Corporate Governance Data tracking and consolidation at Group level; management systems

Customer relationship management

Health & Nutrition reporting

Social reporting, human capital development Occupational Health & Safety

Private Brand nutrition, safety, and Talent Attraction & Retention sustainability requirements

Associate wellbeing, diversity &

Operational eco-efficiency, waste inclusion reduction

Water and climate change impacts in

Food Donations the supply chain

7

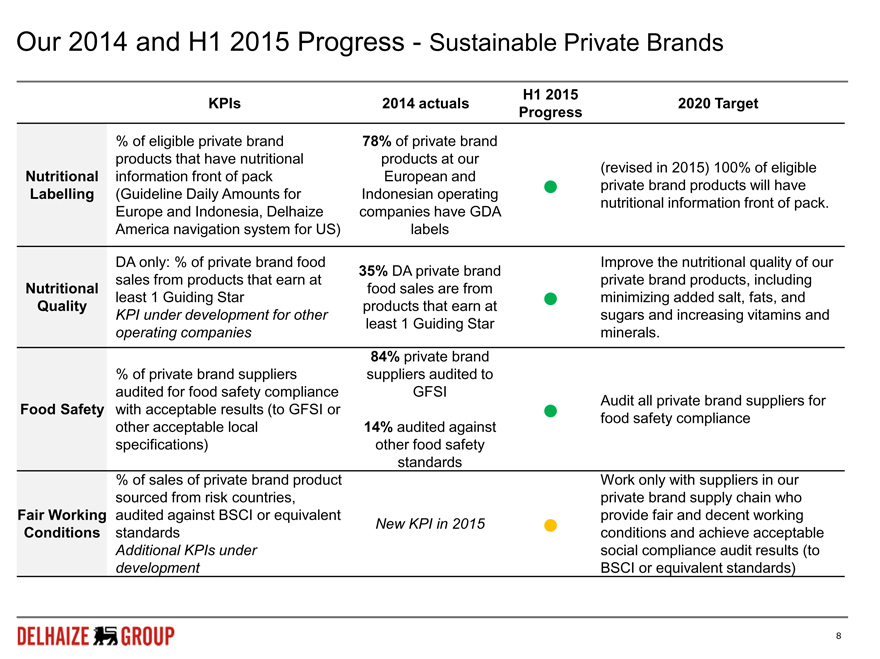

Our 2014 and H1 2015 Progress—Sustainable Private Brands

H1 2015

KPIs 2014 actuals 2020 Target

Progress

% of eligible private brand 78% of private brand

products that have nutritional products at our

(revised in 2015) 100% of eligible

Nutritional information front of pack European and

Labelling (Guideline Daily Amounts for Indonesian operating • private brand products will have

nutritional information front of pack.

Europe and Indonesia, Delhaize companies have GDA

America navigation system for US) labels

DA only: % of private brand food Improve the nutritional quality of our

35% DA private brand

sales from products that earn at private brand products, including

Nutritional food sales are from

Quality least 1 Guiding Star products that earn at • minimizing added salt, fats, and

KPI under development for other sugars and increasing vitamins and

least 1 Guiding Star

operating companies minerals.

84% private brand

% of private brand suppliers suppliers audited to

audited for food safety compliance GFSI

Audit all private brand suppliers for

Food Safety with acceptable results (to GFSI or • food safety compliance

other acceptable local 14% audited against

specifications) other food safety

standards

% of sales of private brand product Work only with suppliers in our

sourced from risk countries, private brand supply chain who

Fair Working audited against BSCI or equivalent provide fair and decent working

Conditions standards New KPI in 2015 • conditions and achieve acceptable

Additional KPIs under social compliance audit results (to

development BSCI or equivalent standards)

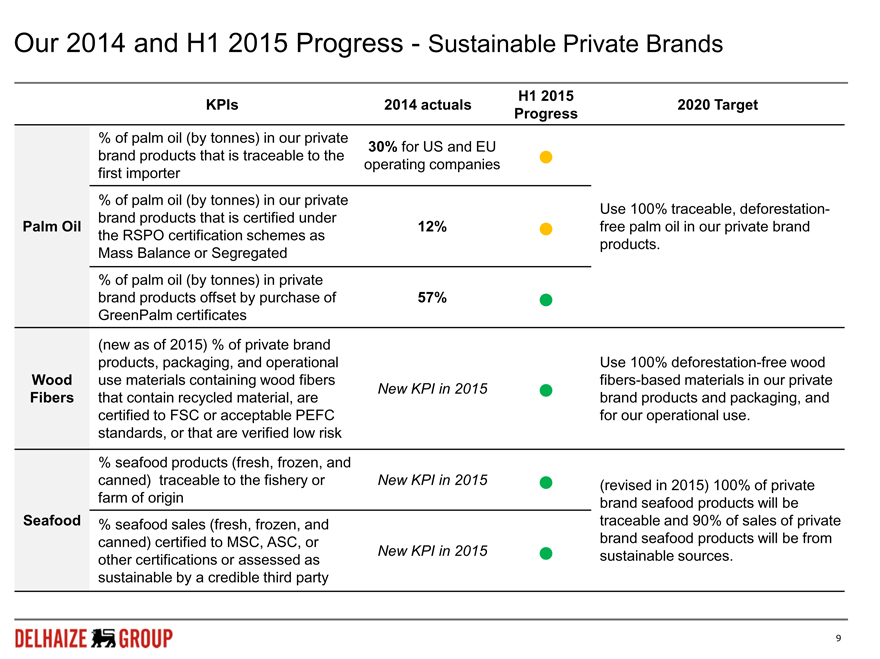

Our 2014 and H1 2015 Progress—Sustainable Private Brands

H1 2015

KPIs 2014 actuals 2020 Target

Progress

% of palm oil (by tonnes) in our private

30% for US and EU

brand products that is traceable to the operating companies •

first importer

% of palm oil (by tonnes) in our private

Use 100% traceable, deforestation-

brand products that is certified under

Palm Oil the RSPO certification schemes as 12% • free palm oil in our private brand

products.

Mass Balance or Segregated

% of palm oil (by tonnes) in private

brand products offset by purchase of 57% •

GreenPalm certificates

(new as of 2015) % of private brand

products, packaging, and operational Use 100% deforestation-free wood

Wood use materials containing wood fibers fibers-based materials in our private

Fibers that contain recycled material, are New KPI in 2015 • brand products and packaging, and

certified to FSC or acceptable PEFC for our operational use.

standards, or that are verified low risk

% seafood products (fresh, frozen, and

canned) traceable to the fishery or New KPI in 2015 • (revised in 2015) 100% of private

farm of origin brand seafood products will be

Seafood % seafood sales (fresh, frozen, and traceable and 90% of sales of private

canned) certified to MSC, ASC, or brand seafood products will be from

other certifications or assessed as New KPI in 2015 • sustainable sources.

sustainable by a credible third party

9

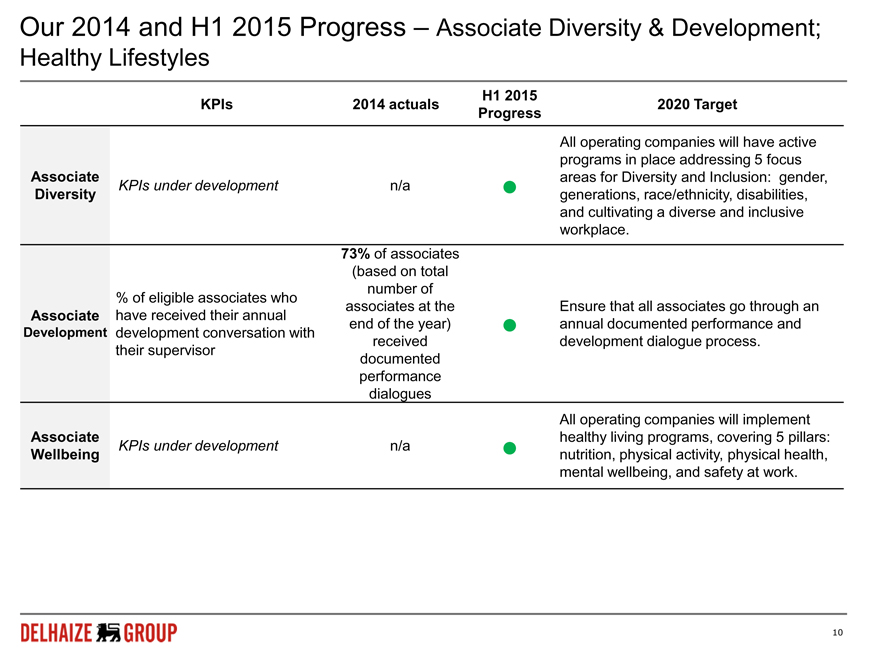

Our 2014 and H1 2015 Progress – Associate Diversity & Development;

Healthy Lifestyles

H1 2015

KPIs 2014 actuals 2020 Target

Progress

All operating companies will have active

programs in place addressing 5 focus

Associate areas for Diversity and Inclusion: gender,

Diversity KPIs under development n/a • generations, race/ethnicity, disabilities,

and cultivating a diverse and inclusive

workplace.

73% of associates

(based on total

number of

% of eligible associates who

associates at the Ensure that all associates go through an

Associate have received their annual

Development development conversation with end of the year) • annual documented performance and

received development dialogue process.

their supervisor

documented

performance

dialogues

All operating companies will implement

Associate healthy living programs, covering 5 pillars:

Wellbeing KPIs under development n/a • nutrition, physical activity, physical health,

mental wellbeing, and safety at work.

10

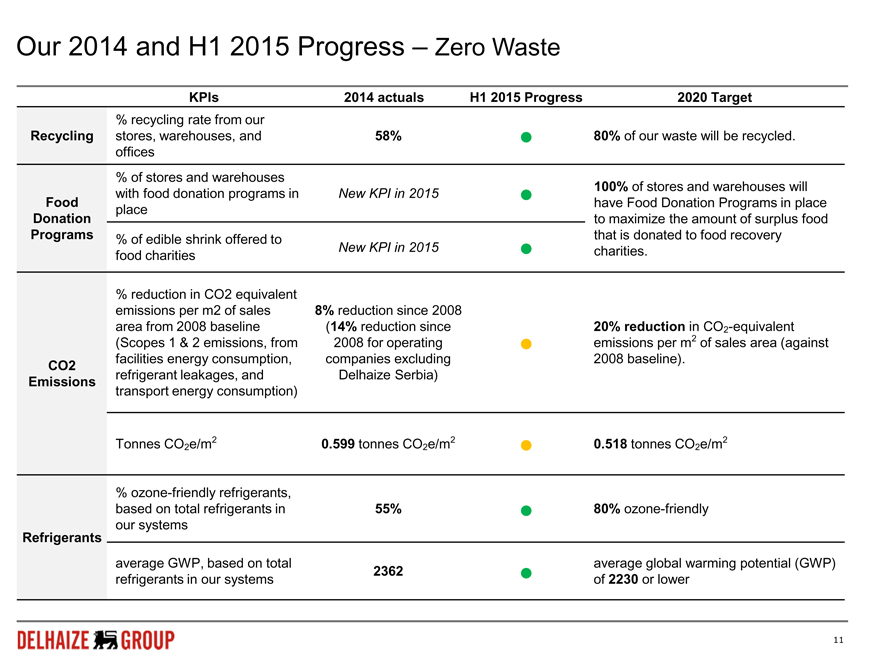

Our 2014 and H1 2015 Progress – Zero Waste

KPIs 2014 actuals H1 2015 Progress 2020 Target

% recycling rate from our

Recycling stores, warehouses, and 58% • 80% of our waste will be recycled.

offices

% of stores and warehouses

with food donation programs in New KPI in 2015 • 100% of stores and warehouses will

Food have Food Donation Programs in place

place

Donation to maximize the amount of surplus food

Programs % of edible shrink offered to that is donated to food recovery

food charities New KPI in 2015 • charities.

% reduction in CO2 equivalent

emissions per m2 of sales 8% reduction since 2008

area from 2008 baseline (14% reduction since 20% reduction in CO2 -equivalent

(Scopes 1 & 2 emissions, from 2008 for operating • emissions per m2 of sales area (against

CO2 facilities energy consumption, companies excluding 2008 baseline).

Emissions refrigerant leakages, and Delhaize Serbia)

transport energy consumption)

Tonnes CO2 e/m 0.599 tonnes CO2 e/m • 0.518 tonnes CO2 e/m

% ozone-friendly refrigerants,

based on total refrigerants in 55% • 80% ozone-friendly

our systems

Refrigerants

average GWP, based on total average global warming potential (GWP)

refrigerants in our systems 2362 • of 2230 or lower

11

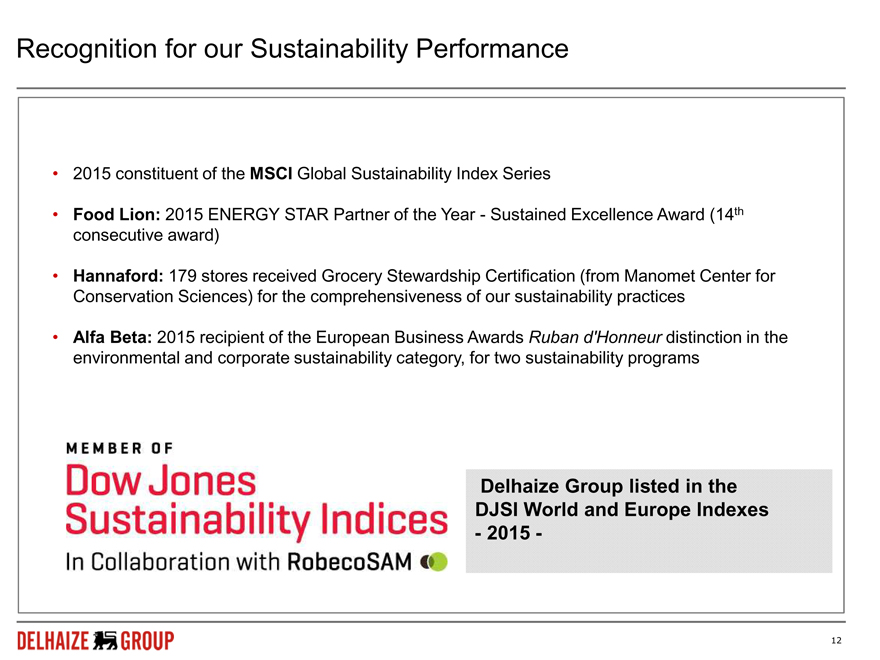

Recognition for our Sustainability Performance

2015 constituent of the MSCI Global Sustainability Index Series

Food Lion: 2015 ENERGY STAR Partner of the Year—Sustained Excellence Award (14th consecutive award)

Hannaford: 179 stores received Grocery Stewardship Certification (from Manomet Center for Conservation Sciences) for the comprehensiveness of our sustainability practices

Alfa Beta: 2015 recipient of the European Business Awards Ruban d’Honneur distinction in the environmental and corporate sustainability category, for two sustainability programs

Delhaize Group listed in the DJSI World and Europe Indexes

- 2015 -

12

Q3 2015 update

13

Q3 2015 highlights by region

U.S.

Continued solid CSS and real growth at Food Lion and Hannaford (excluding competitor disruption last year)

Underlying operating margin impacted by pre-opening expenses at Food Lion

Relaunched 162 Easy, Fresh & Affordable Food Lion stores in Raleigh mid-October

Belgium

Returned to positive CSS and market share growth, supported by Affiliates

Underlying operating margin impacted by slightly lower gross margin and implementation of Transformation Plan

SEE

Positive CSS, real growth and market share growth in the 3 countries

Continued underlying operating margin improvement

14

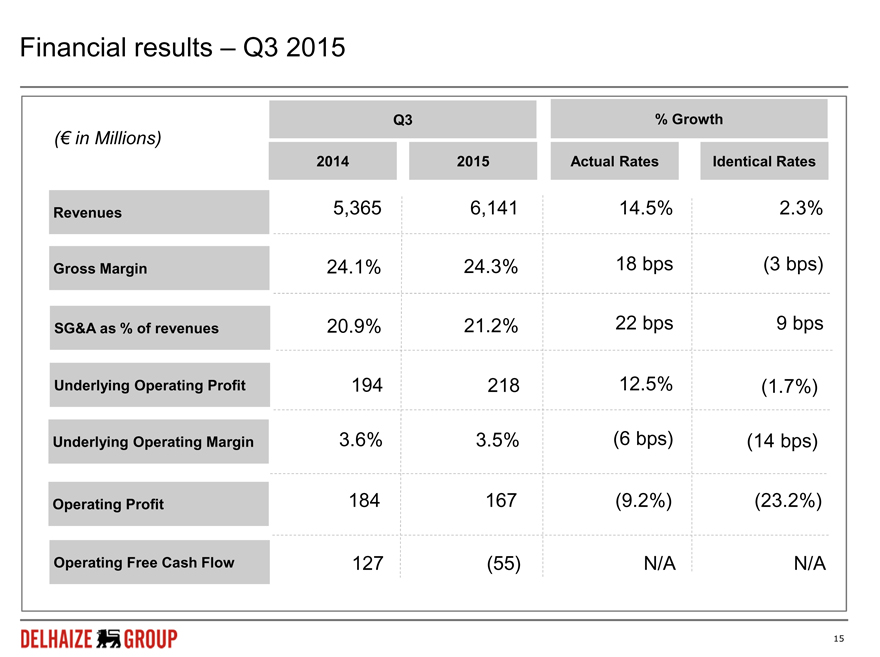

Financial results – Q3 2015

Q3 % Growth

(€ in Millions)

2014 2015 Actual Rates Identical Rates

Revenues 5,365 6,141 14.5% 2.3%

Gross Margin 24.1% 24.3% 18 bps (3 bps)

SG&A as % of revenues 20.9% 21.2% 22 bps 9 bps

Underlying Operating Profit 194 218 12.5% (1.7%)

Underlying Operating Margin 3.6% 3.5% (6 bps) (14 bps)

Operating Profit 184 167 (9.2%) (23.2%)

Operating Free Cash Flow 127 (55) N/A N/A

15

1144

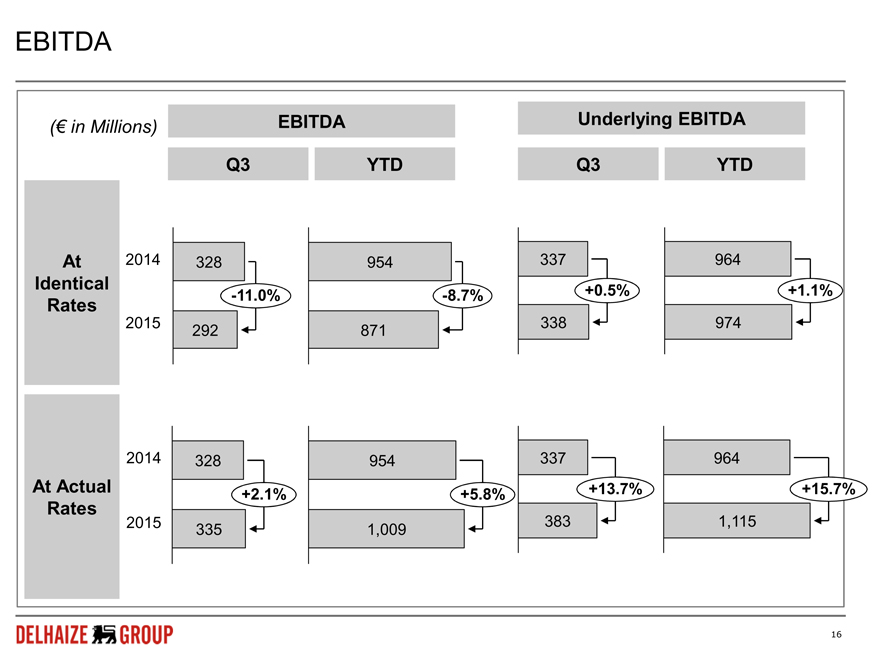

EBITDA

(€ in Millions) EBITDA Underlying EBITDA

Q3 YTD Q3 YTD

At 2014 328 954 337 964

Identical

-11.0% -8.7% +0.5% +1.1%

Rates

2015 338 974

292 871

2014 328 954 337 964

At Actual +2.1% +5.8% +13.7% +15.7%

Rates

2015 383 1,115

335 1,009

16

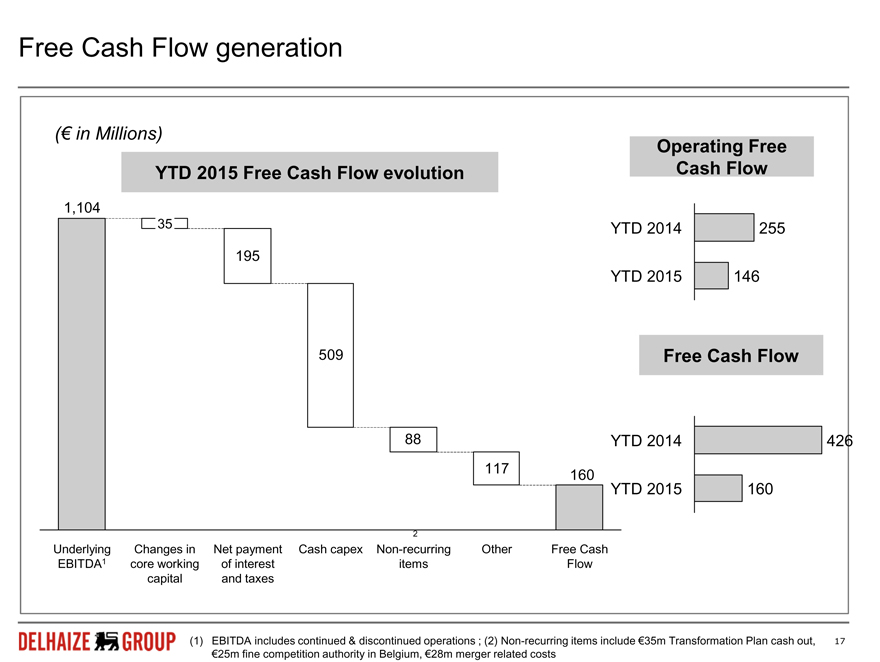

Free Cash Flow generation

(€ in Millions)

Operating Free

YTD 2015 Free Cash Flow evolution Cash Flow

1,104

35 YTD 2014 255

195

YTD 2015 146

509 Free Cash Flow

88 YTD 2014 426

117 160

YTD 2015 160

Underlying Changes in Net payment Cash capex Non-recurring Other Free Cash

EBITDA1 core working of interest items Flow

capital and taxes

(1) EBITDA includes continued & discontinued operations ; (2) Non-recurring items include €35m Transformation Plan cash out, €25m fine competition authority in Belgium, €28m merger related costs

17

Delhaize America is delivering on its 2015 plans

Easy, Fresh & Affordable – remodelings

76 stores in Wilmington and Greenville

Significant progress on shrink, gross margin and labor

162 additional stores in Raleigh launched on October 14

Currently working on 2016 plans

Easy, Fresh & Affordable – bannerwide initiatives

Strengthened price communication and price investment in July

Hannaford highlights

Opened 20,000 ft² store in Maine in August

Made selective price investments in Q3

Well prepared for Q4

18

Transformation Plan in Belgium executed according to plan

Process to sign up voluntary leavers has been completed in October 2015

Aim to generate at least €80 million savings by 2018

New Store Organisation implemented in 53 stores by mid-November

Strong performance of our Affiliated network

19

SEE: market share gains continue thanks to well adapted store formats and concepts and constant customer focus

Strong performance in the region, driven by all countries

Double-digit CSS growth in Romania

Market share growth in Greece, Serbia & Romania

Optimistic to continue growing in Greece despite impact of crisis on consumer

Good results of remodeled Maxi stores in Serbia

Strong commercial activity in Romania

20

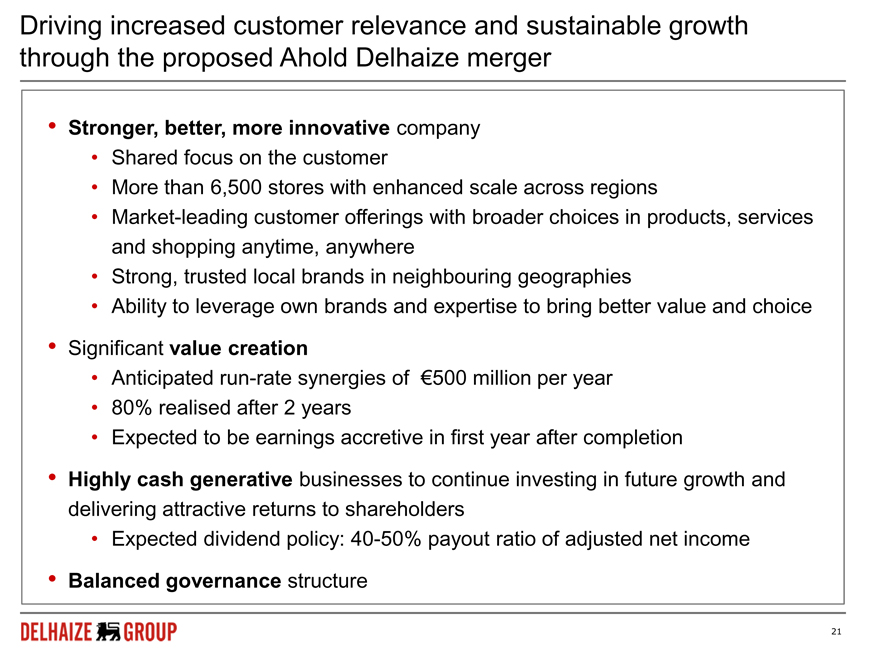

Driving increased customer relevance and sustainable growth through the proposed Ahold Delhaize merger

Stronger, better, more innovative company

Shared focus on the customer

More than 6,500 stores with enhanced scale across regions

Market-leading customer offerings with broader choices in products, services and shopping anytime, anywhere

Strong, trusted local brands in neighbouring geographies

Ability to leverage own brands and expertise to bring better value and choice

Significant value creation

Anticipated run-rate synergies of €500 million per year

80% realised after 2 years

Expected to be earnings accretive in first year after completion

Highly cash generative businesses to continue investing in future growth and delivering attractive returns to shareholders

Expected dividend policy: 40-50% payout ratio of adjusted net income

Balanced governance structure

21

Ahold Delhaize merger process is on track

Moving forward with the integration planning

Closing still foreseen for mid 2016

Different workstreams underway on key topics (synergies, strategy, operating model, …)

Key milestones

Ahold F-4 (US SEC), Dutch prospectus (AFM)

EGMs

Competition authorities in the U.S. and Belgium

Upcoming joint roadshows with CEOs of both groups

22

2015 outlook

Continue to focus on our two strategic initiatives

Food Lion « Easy, Fresh and Affordable »

162 Raleigh stores relaunched on October 14

Delhaize Belgium Transformation Plan

Implementation of New Store Organisation

Trends for Q4 2015

Positive volume growth in the 3 segments

Positive market share and CSS in Belgium in particular

Healthy Free Cash Flow generation

(1)

Cash capex of approximately €700 million

(1) At identical exchange rates (€1 = $1.3285)

23

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | |

| | | | | ETABLISSEMENTS DELHAIZE FRÈRES ET CIE “LE LION” (GROUPE DELHAIZE) |

| | | |

| Date: November 16, 2015 | | | | By: | | /s/ G. Linn Evans

|

| | | | | | | G. Linn Evans |

| | | | | | | Senior Vice President |