SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission (as

permitted by Rule 14A-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14A-11(c) or Rule 14A-12 |

ISTA PHARMACEUTICALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | $125 per Exchange Act Rules O-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

| | ¨ | Fee computed on table below per Exchange Act Rules 14A-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials: |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ISTA PHARMACEUTICALS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 20, 2004

TO OUR STOCKHOLDERS:

You are cordially invited to the Annual Meeting of Stockholders of ISTA PHARMACEUTICALS, INC., a Delaware corporation. The meeting will be held on Wednesday, October 20, 2004 at 2:00 p.m. local time, at ISTA’s headquarters located at 15279 Alton Parkway, Suite 100, Irvine, California 92618 for the following purposes (as more fully described in the Proxy Statement accompanying this Notice):

1. To elect three Class I directors to serve for a term of three years expiring upon the 2007 Annual Meeting of Stockholders or until his or her successor is elected.

2. To ratify the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2004.

3. To approve, ratify and adopt the 2004 Performance Incentive Plan, under which up to 2,053,107 shares of common stock are authorized for issuance pursuant to stock options, restricted stock awards, performance shares, performance units and stock appreciation rights.

4. To transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

Our Board of Directors recommends that you vote in favor of the foregoing items of business, which are more fully described in the Proxy Statement accompanying this notice.

Only our stockholders of record at the close of business on September 13, 2004 are entitled to notice of and to vote at the meeting.

All stockholders are cordially invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to mark, sign, date and return the enclosed Proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if he or she has returned a Proxy.

|

FOR THE BOARD OF DIRECTORS |

|

Vicente Anido, Jr., Ph.D. |

Chief Executive Officer, President and Board Member |

Irvine, California

September 15, 2004

YOUR VOTE IS IMPORTANT

IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

ISTA PHARMACEUTICALS, INC.

PROXY STATEMENT FOR THE 2004

ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 20, 2004

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors of ISTA Pharmaceuticals, Inc. (“ISTA”), for use at the Annual Meeting of Stockholders to be held Wednesday, October 20, 2004 at 2:00 p.m. local time, or at any postponement or adjournment thereof (the “Annual Meeting”), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at our headquarters located at 15279 Alton Parkway, Suite 100, Irvine, California 92618. The telephone number at that location is (949) 788-6000.

These proxy solicitation materials and the Annual Report to Stockholders for the year ended December 31, 2003, including financial statements, were first mailed on or about September 20, 2004 to all stockholders entitled to vote at the meeting.

Record Date and Principal Share Ownership

Holders of shares of our common stock of record at the close of business on September 13, 2004 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. The shares of our common stock are our only class of voting securities. As of the Record Date, approximately 19,292,799 shares of our common stock were issued and outstanding and held of record by approximately 226 stockholders.

Revocability of Proxies

Stockholders who execute proxies retain the right to revoke them at any time before they are voted. Any proxy given by a stockholder may be revoked or superseded by executing a later dated proxy, by giving notice of revocation to Secretary, ISTA Pharmaceuticals, Inc., 15279 Alton Parkway, Suite 100, Irvine, California 92618 in writing prior to or at the meeting or by attending the meeting and voting in person.

Stockholders Sharing the Same Last Name and Address

In accordance with notices we sent to certain stockholders, we are sending only one copy of our annual report and proxy statement to stockholders who share the same last name and address, unless they have notified us that they want to continue receiving multiple copies. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs as well as natural resources.

If you received a householded mailing this year and you would like to have additional copies of our annual report and/or proxy statement mailed to you or you would like to opt out of this practice for future mailings, please submit your request to Secretary, ISTA Pharmaceuticals, Inc., 15279 Alton Parkway, Suite 100, Irvine, California 92618.

Voting and Solicitation

Each stockholder is entitled to one vote for each share held as of the Record Date. Stockholders will not be entitled to cumulate their votes in the election of directors.

The cost of soliciting proxies will be borne by us. We expect to reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of our directors, officers, and regular employees, without additional compensation, personally or by telephone or facsimile.

1

Quorum; Abstentions; Broker Non-votes

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections (the “Inspector”) appointed for the meeting who will determine whether or not a quorum is present.

The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of our common stock issued and outstanding on the Record Date. Shares that are voted “FOR,” “AGAINST” or “WITHHELD FROM” a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the Annual Meeting with respect to such matter.

Abstentions and broker non-votes are each included in the determination of the number of shares present and voting for the purpose of determining whether a quorum is present. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker does not receive voting instructions from the beneficial owner, and (2) the broker lacks discretionary authority to vote the shares. Banks and brokers cannot vote on their clients’ behalf on “non-routine” proposals, such as the adoption of our 2004 Performance Incentive Plan.

Abstentions will be treated as shares present and entitled to vote for purposes of any matter requiring the affirmative vote of a majority or other proportion of the shares present and entitled to vote. Accordingly, abstentions will have the same effect as a vote against the proposal. With respect to shares relating to any proxy as to which a broker non-vote is indicated on a proposal, those shares will not be considered present and entitled to vote with respect to any such proposal. Thus, a broker non-vote will not affect the outcome of the voting on a proposal. Abstentions or broker non-votes or other failures to vote will have no effect in the election of directors, who will be elected by a plurality of the affirmative votes cast.

Any proxy which is returned using the form of proxy enclosed and which is not marked as to a particular item will be voted for the election of the Class I director, for the confirmation of the appointment of the designated independent auditors, and as the proxy holders deem advisable on other matters that may come before the meeting, as the case may be, with respect to the items not marked.

Other Business; Stockholder Proposals

We do not intend to present any other business for action at the Annual Meeting and do not know of any other business to be presented by others.

Pursuant to our bylaws, in order for business to be properly brought by a stockholder before an annual meeting, our Secretary must receive, at our corporate office, written notice of the matter not less than 120 days prior to the first anniversary of the date our proxy statement was released to stockholders in connection with the preceding year’s annual meeting. We did not receive any such notices from our stockholders for matters to be considered at the Annual Meeting. Any stockholder desiring to submit a proposal for action at our 2005 annual meeting of stockholders and presentation in our proxy statement for such meeting should deliver the proposal to our Secretary at our corporate office no later than May 23, 2005 in order to be considered for inclusion in our proxy statement relating to that meeting.

Under Rule 14a-4 promulgated under the Securities and Exchange Act of 1934, as amended, if a proponent of a proposal fails to notify us at least 45 days prior to the current year’s anniversary of the date of mailing of the prior year’s proxy statement, then we will be allowed to use our discretionary voting authority under proxies solicited by us when the proposal is raised at the meeting, without any discussion of the matter in the proxy statement. We were not notified of any stockholder proposals to be addressed at our Annual Meeting, and will therefore be allowed to use our discretionary voting authority if any stockholder proposals are raised at the meeting.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of September 13, 2004, by (i) each person or entity who is known by us to own beneficially more than 5% of the outstanding shares of common stock, (ii) each of our directors, (iii) each of the executive officers named in the Summary Compensation Table, and (iv) all of our directors and executive officers as a group.

| | | | | | | |

Name of Beneficial Owner

| | Number of shares

outstanding

| | Number of shares

underlying

options

| | Approximate Percent

Owned(1)

| |

DIRECTORS AND NAMED EXECUTIVE OFFICERS | | | | | | | |

Vicente Anido, Jr., Ph.D. | | 0 | | 360,366 | | * | |

Rolf Classon | | 0 | | 0 | | * | |

William S. Craig, Ph.D. | | 0 | | 52,205 | | * | |

Marvin J. Garrett | | 0 | | 105,873 | | * | |

Lisa R. Grillone, Ph.D. | | 0 | | 102,881 | | * | |

Peter Barton Hutt | | 0 | | 27,084 | | * | |

Kathleen D. LaPorte (3) | | 5,163,155 | | 27,084 | | 25.9 | % |

Benjamin F. McGraw III, Pharm.D. | | 0 | | 32,823 | | * | |

Dean J. Mitchell | | 0 | | 0 | | * | |

Thomas A. Mitro | | 0 | | 97,352 | | * | |

Liza Page Nelson (2) | | 3,952,630 | | 27,084 | | 20.0 | % |

Wayne I. Roe | | 0 | | 35,786 | | * | |

Lauren P. Silvernail | | | | 73,998 | | | |

Richard C. Williams | | 0 | | 27,084 | | * | |

All executive officers and directors as a group (14 persons) | | 9,115,785 | | 969,620 | | 51.1 | % |

5% STOCKHOLDERS | | | | | | | |

Investor Growth Capital Limited | | 2,766,841 | | 0 | | 14.1 | % |

Investor Group LP | | 1,185,789 | | 0 | | 6.1 | % |

Sprout Capital IX LP | | 4,897,342 | | 0 | | 24.6 | % |

Sanderling Venture Partners (4) | | 1,654,247 | | 0 | | 8.5 | % |

| (1) | This table is based upon information supplied by officers and directors, and with respect to principal stockholders, Schedules 13D and 13G filed with the SEC. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. Applicable percentage ownership is based on 19,292,799 shares of common stock as of September 13, 2004. Shares of common stock subject to options and warrants currently exercisable, or exercisable within 60 days of the September 13, 2004, are deemed outstanding for computing the percentage of any other person. Except as otherwise noted, we believe that each of the stockholders named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to applicable community property laws. |

| (2) | Consists of 2,766,841 shares (including 372,105 shares issuable upon exercise of warrants) of Investor Growth Capital Limited and 1,185,789 shares (including 159,474 shares issuable upon exercise of warrants) of Investor Group L.P. Ms. Nelson is a Managing Director and Co-Head of Healthcare Investing Activities for Investor Growth Capital, an affiliate of Investor Group, L.P. Ms. Nelson disclaims beneficial ownership except to the extent of her pecuniary interest therein. Ms. Nelson’s business address is c/o Investor Growth Capital, 12 East 49th Street, 27th Floor, New York, New York 10017. |

| (3) | Consists of 4,897,342 shares (including 653,978 shares issuable upon exercise of warrants) of Sprout Capital IX L.P., 19,298 shares (including 2,577 shares issuable upon exercise of warrants) of Sprout Entrepreneurs’ Fund L.P. and 246,515 shares (including 32,919 shares issuable upon exercise of warrants) of Sprout IX Plan, L.P. Ms. LaPorte is a General Partner in the Healthcare Technology Group of the Sprout Group, and is a Managing Director of DLJ Capital Corp., which is the Managing General Partner of Sprout |

3

| | Capital IX, L.P. and the General Partner of Sprout Entrepreneurs’ Fund, L.P. Ms. LaPorte disclaims beneficial ownership except the extent of her pecuniary interest therein. Ms. LaPorte’s business address is c/o The Sprout Group, 3000 Sand Hill Road, Suite 170, Menlo Park, California 94024. |

| (4) | Consists of 966 shares owned by Sanderling IV Biomedical; 1,595 shares owned by Sanderling IV Limited Partnership; 118,900 shares (including 17,664 shares issuable upon exercise of warrants) owned by Sanderling V Beteiligungs GmbH & Co. KG; 495,973 shares (including 74,153 shares issuable upon exercise of warrants) owned by Sanderling V Biomedical Co-Investment Fund; 133,775 shares (including 20,001 shares issuable upon exercise of warrants) owned by Sanderling V Limited Partnership; 3,604 shares owned by Sanderling Venture Partners IV; 4,098 shares owned by Sanderling Venture Partners IV LP; 776 shares owned by Sanderling Venture; 818,081 shares (including 122,312 shares issuable upon exercise of warrants)owned by Sanderling Venture Partners V Co-Investment Fund; 302 shares owned by Sanderling IV Biomedical Limited LP; 6,098 shares owned by the John T. Parrish & Robert G. McNeil Joint Tenancy Trust; 511 shares owned by the Middleton McNeil Retirement Trust Robert G. McNeil; 65,461 shares (including 12,831 shares issuable upon exercise of warrants) owned by Robert G. McNeil c/o Sanderling Ventures; and 4,107 shares owned by the Middleton McNeil Retirement Trust F/B/O Robert G. McNeil. Dr. McNeil is a Managing Director of Middleton, McNeil & Mills Associates V., LLC, an affiliate of the Sanderling entities. Sanderling Venture Partners business address is 2730 Sand Hill Road, Suite 200, Menlo Park, California 94024. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, officers and beneficial owners of more than 10% of our common stock to file reports of ownership and reports of changes in the ownership with the Securities and Exchange Commission (SEC). Such persons are required by Securities Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms submitted to us during the year ended December 31, 2003, we believe that all Section 16(a) filing requirements applicable to our officers and directors were complied with, except that Robert G. McNeil filed late one Form 4, Kathleen D. LaPorte filed late one Form 4, Liza Page Nelson filed one late Form 4, Wayne I. Roe filed one late Form 4, Richard C. Williams filed one late Form 4, Benjamin F. McGraw III, Pharm.D. filed one late Form 4 and Peter Barton Hutt filed one late Form 4.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Director and Nominees for Director

Pursuant to our Amended and Restated Certificate of Incorporation and Bylaws, our Board of Directors currently consists of nine persons, divided into three classes serving staggered terms of three years. The Class I directors, Peter Barton Hutt, Benjamin F. McGraw III, Pharm.D. and Liza Page Nelson, are scheduled to serve until the annual meeting of stockholders in 2004. The Class II directors, Vicente Anido, Jr., Ph.D., Kathleen D. LaPorte, and Richard C. Williams, are scheduled to serve until the annual meeting of stockholders in 2005. The Class III directors, Dean J. Mitchell, Rolf Classon and Wayne I. Roe, are scheduled to serve until the annual meeting of stockholders in 2006.

In the event that any person nominated as a Class I director becomes unavailable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the proxies in their discretion for any nominee who is designated by the current Board of Directors to fill the vacancy. It is not expected that any of the nominees will be unavailable to serve.

4

The name of the Class I nominees for election to the Board of Directors at the Annual Meeting, age as of the Record Date, and certain information are set forth below. The names of the current Class II and Class III directors with unexpired terms, their ages as of the Record Date, and certain information about them are also stated below.

| | | | | | | |

Name

| | Age

| | Principal Occupation

| | Director

Since

| |

Nominees for Class I Directors | | | | | | | |

Peter Barton Hutt | | 69 | | Partner, Covington & Burling | | 2002 | |

Benjamin F. McGraw III, Pharm.D. | | 55 | | President and Chief Executive Officer, Valentis, Inc. | | 2000 | * |

Liza Page Nelson | | 44 | | Managing Director, Investor Growth Capital | | 2002 | |

| | | |

Continuing Class II Directors | | | | | | | |

Vicente Anido, Jr., Ph.D. | | 51 | | President and Chief Executive Officer | | 2001 | |

Kathleen D. LaPorte | | 42 | | General Partner, Sprout Group | | 2002 | |

Richard C. Williams | | 60 | | President, Conner-Thoele Limited | | 2002 | |

| | | |

Continuing Class III Directors | | | | | | | |

Dean J. Mitchell | | 48 | | Vice President, Strategy, Bristol-Meyers Squibb | | 2004 | |

Rolf Classon | | 59 | | Retired | | 2004 | |

Wayne I. Roe | | 54 | | Retired | | 1998 | * |

| * | Dr. McGraw and Mr. Roe resigned as directors of the Company on November 19, 2002 with the closing of its PIPE financing and were reappointed as directors in December 2002. |

There are no family relationships among any of our directors or executive officers.

Nominees for Terms Expiring at the Annual Meeting

Peter Barton Hutt has served on our Board of Directors since November 2002. Mr. Hutt is a partner specializing in food and drug law in the Washington, D.C. law firm of Covington & Burling. Mr. Hutt joined Covington & Burling in 1960 and was named partner in 1968, leaving from 1971 to 1975 to serve as Chief Counsel for the Food and Drug Administration and returning to Covington & Burling in September 1975. Mr. Hutt is the co-author of the casebook used to teach Food and Drug Law throughout the country and teaches a full course on the subject annually at Harvard Law School. Mr. Hutt received a B.A. from Yale University and a LL.B. from Harvard University. In addition, Mr. Hutt received a Master of Laws degree in Food and Drug Law from New York University Law School.

Benjamin F. McGraw, III, Pharm.D. has served on our Board of Directors since April 2000, except for the period from November 2002 to December 2002. Dr. McGraw has been President, Chief Executive Officer, and Chairman of the Board of Directors of Valentis, Inc., a biotechnology company, since 1994. Dr. McGraw received a Pharm.D. from the University of Tennessee.

Liza Page Nelsonhas served on our Board of Directors since November 2002. Ms. Nelson is a Managing Director and Co-Head of Healthcare investing activities for Investor Growth Capital, Inc. Prior to joining Investor Growth Capital in 1998, from 1988 to 1998, Ms. Nelson held a series of positions with increasing responsibility in corporate finance, strategic planning, contracting, marketing, business development and operating management at Pfizer, Inc. Prior to joining Pfizer, Ms. Nelson was with the Boston Consulting Group and E.M. Warburg, Pincus & Co. Ms. Nelson received a B.A. degree in Economics from Wesleyan University and a M.B.A. in Finance and Marketing from the Yale School of Management. Investor Growth Capital Limited has a contractual right to designate a representative to be nominated to our Board of Directors. Ms. Nelson is the designated representative of Investor Growth Capital Limited.

5

Directors Whose Terms Extend Beyond the Annual Meeting

Class II Directors

Vicente Anido, Jr., Ph.D. has served as our President and Chief Executive Officer and on our Board of Directors since December 2001. From June 2000 to September 2001, Dr. Anido was general partner for Windamere Venture Partners. From 1996 to 1999, Dr. Anido served as President and Chief Executive Officer of CombiChem, Inc., a biotechnology company. From 1993 to 1996, he served as President of the Americas Region of Allergan, Inc., a specialty pharmaceutical company focusing on ophthalmology, dermatology and neuromuscular indications. Dr. Anido is also a director of Apria Healthcare, Inc. Dr. Anido received a Ph.D. in Pharmacy Administration from the University of Missouri.

Kathleen D. LaPorte has served on our Board of Directors since November 2002. Ms. LaPorte is a General Partner in the Healthcare Technology Group of the Sprout Group located in Menlo Park, California. Ms. LaPorte joined the Sprout Group in 1993 and became a General Partner in 1994. Between 1987 and 1993, Ms. LaPorte was a principal at Asset Management Company, a venture capital firm focused on early-stage investments. Previously, Ms. LaPorte was a financial analyst with The First Boston Corporation. Ms. LaPorte received a B.S. from Yale University and a M.B.A. from Stanford University Graduate School of Business. Sprout Capital has a contractual right to designate representatives to be nominated to our Board of Directors. Ms. LaPorte is the designated representative of Sprout Group.

Richard C. Williams has served on our Board of Directors since December 2002 and as Chairman of our Board of Directors since July 2004. Since 1989, Mr. Williams has served as the founder and President of Conner-Thoele Limited, a consulting and financial advisory firm specializing in the healthcare industry and pharmaceutical segment. From 2000 to April 2001, Mr. Williams also served as Vice Chairman-Strategic Planning and director of King Pharmaceuticals, Inc. From 1992 to 2000, Mr. Williams served as Chairman and director of Medco Research, a cardiovascular pharmaceutical development company, prior to its acquisition by King Pharmaceuticals in 2000. From 1997 to 1999, Mr. Williams was Co-Chairman and a director of Vysis, a genetic biopharmaceutical company. Prior to founding Conner-Thoele Limited, Mr. Williams held various operational and financial management officer positions with Erbamont, N.V., Field Enterprises, Inc., Abbott Laboratories and American Hospital Supply Corporation. Mr. Williams is also a director of EP Med Systems and a director and Chairman of Cellegy Pharmaceuticals, Inc., a specialty biopharmaceutical company. Mr. Williams received a B.A. degree from DePauw University and an M.B.A. from the Wharton School of Finance.

Class III Directors

Dean J. Mitchellwas appointed to our Board of Directors on July 12, 2004. Mr. Mitchell has been the Vice President, Strategy at Bristol-Myers Squibb (BMS) since February 2004. From March 2002 to January 2004, he was the President, U.S. Primary Care, Worldwide Medicines Pharmaceuticals Group, a division of BMS. From September 2001 to February 2002, he was the President, International, Worldwide Medicines Pharmaceuticals Group, a division of BMS. From September 1999 to August 2001, he was the Senior Vice President, Clinical Development and Product Strategy of GlaxoSmithKline plc. From June 1995 to September 1999, he was the Vice President and General Manager, Specialty Divisions, Strategic Planning and Business Development of GlaxoSmithKline. Mr. Mitchell is on the Board of the National Pharmaceutical Council and serves as its Treasurer. He received his MBA degree from City University Business School (London, UK) and his B.Sc. degree in Biology from Coventry University, UK.

Rolf Classon was appointed to our Board of Directors on July 12, 2004. From October 2002 to July 2004, Mr. Classon was the President of Bayer HealthCare LLC, a subsidiary of Bayer AG. From October 2002 to July 2004, Mr. Classon served as the Chief Executive Officer of Bayer Healthcare LLC. From December 1995 to October 2002, Mr. Classon served as President of Bayer Diagnostics. From September 1991 to December 1995, Mr. Classon was an Executive Vice President in charge of Bayer Diagnostics’ Worldwide Marketing, Sales and Service operations. From May 1990 to September 1991, Mr. Classon was the President and Chief Operating

6

Officer of Pharmacia Biosystems A.B. Prior to 1991, Mr. Classon served as President of Pharmacia Development Company Inc. and Pharmacia A.B.’s Hospital Products Division. Mr. Classon is a member of the Board of Directors of Enzon Pharmaceuticals, Inc., Hillenbrand Industries and Auxilium Pharmaceuticals. He received his Chemical Engineering Certificate from the Gothenburg School of Engineering, and he has a Business Degree from the University of Gothenburg.

Wayne I. Roehas served on our Board of Directors since June 1998, except for the period from November 19, 2002 to December 2002. Mr. Roe was Senior Vice President for United Therapeutics, Inc., a biotechnology company, from November 1999 to November 2000. From November 1988 to March 1999, Mr. Roe founded and served in various management positions at Covance Health Economics and Outcome Services, a consulting firm for life sciences companies, last serving as Chairman of the Board of Directors. Mr. Roe is also currently a director of Aradigm Corporation, a developer of drug delivery systems. Mr. Roe received a M.A. in Political Economy from the State University of New York and an M.A. in Economics from the University of Maryland.

Vote Required

The nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them shall be elected Class I directors. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum for the transaction of business, but have no other legal effect under Delaware law.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES SET FORTH HEREIN.

Board Meetings, Committees and Directors Compensation

Our Board of Directors held nine meetings during the fiscal year ended December 31, 2003. Each incumbent Director attended at least 75% of the Board meetings held during the period for which he or she has been a Director. Each incumbent Director attended at least 75% of the meetings held by all Committees of the Board on which he or she served during the period that he or she served. Although we have no formal policy requiring director attendance at annual meetings of stockholders, directors are encouraged to attend the annual meetings of stockholders. The only incumbent director who attended the 2003 annual meeting of stockholders was Vicente Anido, Jr., Ph.D.

Our securities are listed on the Nasdaq Stock Market and are governed by its listing standards. Our Board has determined that the following six directors satisfy the current “independent director” standards established by rules of the Nasdaq Stock Market: Rolf Classon, Peter Barton Hutt, Benjamin F. McGraw III, Pharm.D., Dean J. Mitchell, Wayne I. Roe and Richard C. Williams.

7

The Board has an Audit Committee, Compensation Committee, and Nominating Committee. Each Committee is described as follows:

| | | | |

Name of Committees and Members

| | Functions of the Committees

| | Number of Meetings in Fiscal 2003

|

AUDIT COMMITTEE Richard C. Williams (Chairperson) Benjamin F. McGraw, III, Pharm.D. Wayne I. Roe | | • Oversees our accounting and financial reporting processes • Appoints, determines compensation for and oversees the work of the independent auditors • Approves the services performed by the independent auditors • Approves related party transactions | | 10 |

| | |

COMPENSATION COMMITTEE Benjamin F. McGraw, III, Pharm.D. (Chairperson) Kathleen D. LaPorte Dean J. Mitchell* | | • Reviews and recommends the executive compensation policies • Administers the employee stock option and stock purchase plans | | 4 |

| | |

NOMINATING COMMITTEE Rolf Classon* Peter Barton Hutt* Liza Page Nelson (Chairperson) | | • Recommends corporate governance principles • Reviews and makes recommendations regarding candidates for service on the Board of Directors • Assists with executive development and succession matters | | 0** |

| * | In July 2004, Dean J. Mitchell, Rolf Classon and Peter Barton Hutt were appointed to their respective positions on the Compensation Committee and Nominating Committee. Dean J. Mitchell replaced Liza Page Nelson on the Compensation Committee. Rolf Classon and Peter Barton Hutt replaced Robert G. McNeil, Ph.D. and Jeffrey L. Edwards on the Nominating Committee. |

| ** | The Nominating Committee did take action, by written consent with respect to nominees to our Board of Directors for election at our 2003 Annual Meeting of Stockholders. |

Audit Committee.The Audit Committee has adopted an amended and restated charter, a copy of which was filed with the Proxy Statement filed in connection with the 2003 annual meeting of stockholders. All of the members of the Audit Committee meet the independence standards of Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards and the independence standards promulgated by the SEC. Our Board of Directors has determined that both Richard C. Williams and Benjamin F. McGraw, III, Pharm.D. are “audit committee financial experts” as defined by SEC regulations.

Compensation Committee.All of the members of the Compensation Committee meet the independence standards of Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards, except for Kathleen D. LaPorte. Ms. LaPorte is a representative of The Sprout Group, which is a stockholder that owns beneficially at least 5% of our common stock. The Board has determined that it is in our best interest and the best interest of our stockholders that Ms. LaPorte serve as a member of the Compensation Committee pursuant to the exception granted by Rule 4350(c)(3)(C) of the National Association of Securities Dealer’s listing standards. Ms. LaPorte brings unique expertise to our Compensation Committee because she has served on compensation committees of other companies and has experience in assessing and overseeing compensation programs of companies comparable to us.

8

Nominating Committee.The Nominating Committee reviews and reports to the Board on a periodic basis with regard to matters of corporate governance, succession planning and the nomination and evaluation of Directors. The charter of the Nominating Committee was adopted by the Board of Directors on February 5, 2004. The charter of the Nominating Committee is available on our web site at http://www.istavision.com. A copy of this Nominating Committee charter is attached as Appendix A to this proxy statement.

All of the members of the Nominating Committee meet the independence standards of Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards, except for Liza Page Nelson. Ms. Nelson is a representative of Investor Growth Capital, which is a stockholder that owns beneficially at least 5% of our common stock. The Board has determined that it is in our best interest and in the best interest of our stockholders that Ms. Nelson serve as a member of the Nominating Committee pursuant to the exception granted by Rule 4350(c)(4)(C) of the National Association of Securities Dealers’ listing standards. Ms. Nelson brings unique expertise to our Nominating Committee because she understands and is proficient in the rules and regulations relating to corporate governance and has experience in assessing the qualification of directors and officers in our industry.

As reflected in the charter of the Nominating Committee, factors considered by the Nominating Committee in the selection of Director nominees are experience in business, finance, administration or healthcare, familiarity with our business and industry and, as applicable, specific expertise, including but not limited to such matters as clinical development, regulatory strategy or business development. The Nominating Committee also gives consideration to candidates with appropriate non-business backgrounds, illustratively, with backgrounds in medicine, research, government or intellectual property. The Nominating Committee gives consideration to individuals identified by stockholders, management and members of the Board.

Our bylaws provide for business to be brought by a stockholder before an annual meeting, including nominations for the election of directors, so long as our Secretary receives, at the corporate office, written notice of the matter not less than 120 days prior to the first anniversary of the date our proxy statement was released to stockholders in connection with the preceding year’s annual meeting.

In addition it is our policy that director candidates recommended by stockholders will be given appropriate consideration in the same manner as other director candidates presented to the Nominating Committee. Stockholders who wish to submit a director candidate for consideration by the Nominating Committee may do so by submitting a comprehensive written resume of the recommended nominee’s business and educational experience and background and a consent in writing signed by the recommended nominee that he or she is willing to be considered as a nominee and if nominated and elected, he or she will serve as a director. Stockholders should send their written recommendations of nominees accompanied by the candidate’s resume and consent to Attention: Chairperson of Nominating Committee, c/o ISTA Pharmaceuticals, 15279 Alton Parkway, Suite 100, Irvine, California 92618. The foregoing policy is subject to our Restated Certificate of Incorporation, our bylaws and applicable law. No director nominations by stockholders have been received as of the filing of this proxy statement.

Stockholder Communications to the Board of Directors

Stockholders may submit communications to our Board of Directors, its Committees or the Chairperson of the Board of Directors or any of its Committees or any individual members of the Board of Directors by addressing a written communication to: Board of Directors, ISTA Pharmaceuticals, Inc., 15279 Alton Parkway, Suite 100, Irvine, California 92618. Stockholders should identify in their communication the addressee whether it is the Company’s Board of Directors, its Committees or the Chairperson of the Board of Directors or any of its Committees or any individual member of the Board of Directors. Stockholder communications will be forwarded to our Vice President, Human Resources. The Vice President, Human Resources will acknowledge receipt to the sender, unless the sender has submitted the communication anonymously, and forward a copy of the communication to the addressee on the Company’s Board of Directors or if the communication is addressed generally to the Company’s Board of Directors to our Chairperson of the Board of Directors.

9

Compensation of Directors

Our non-employee directors received $2,500 in cash compensation from us for their service as members of the Board of Directors for each Board meeting attended in 2003 and $1,000 for each Committee meeting attended in 2003; provided, however that directors only received $500 for telephonic attendance at any Board or Committee meeting. Effective as of September 2004, directors will receive an annual retainer of $20,000. In addition, directors will receive $1,500 in cash compensation from us for their service as members of the Board of Directors for each Board meeting attended in 2004 and $1,000 for each Committee meeting attended in 2004; and $1,000 for telephonic attendance at any Board or Committee meeting. The Chairperson of the Board, and each Chairperson of each of the Audit, Compensation and Nominating Committees will each receive an additional $5,000 annual retainer. All non-employee directors are reimbursed for travel and miscellaneous expenses in connection with attendance at Board and Committee meetings. Liza Page Nelson and former director, Jeffrey L. Edwards, declined any cash compensation in 2003 for their respective service as a member of our Board of Directors.

Our 2000 Stock Plan provides for initial option grants to purchase 32,500 shares of our common stock to each non-employee director upon their appointment to the Board and subsequent annual grants to purchase 16,250 shares of our common stock. During the fiscal year ending December 31, 2003, we granted our non-employee directors options to purchase 113,750 shares of common stock each at an exercise price of $6.96 per share. The shares subject to the initial option grants vest annually in three equal installments while the shares subject to the subsequent annual grants are fully vested upon the first anniversary of the date of grant.

Upon adoption of the 2004 Performance Incentive Plan, each non-employee director will be granted options to purchase 20,000 shares of our common stock upon their election or appointment to the board and subsequent annual grants of options to purchase 9,000 shares of our common stock, and 1,500 shares of restricted stock. The shares subject to the initial option grants vest in three equal installments while the shares subject to the subsequent annual grants will be fully vested upon the first anniversary of the date of grant.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ending December 31, 2003, no member of the Compensation Committee was an officer or employee of ISTA. During fiscal 2003, no member of the Compensation Committee or executive officer of ISTA served as a member of the Board of Directors or Compensation Committee of any entity that has an executive officer serving as a member of our Board of Directors or Compensation Committee.

RELATED PARTY TRANSACTIONS

There were no transactions in which the amount involved exceeded $60,000 and in which any director, executive officer or holder of more than 5% of our capital stock had or will have a direct or indirect material interest during the fiscal year ending December 31, 2003, other than compensation arrangements that are described under “Compensation of Directors” and “Executive Officer Compensation.”

OTHER EXECUTIVE OFFICERS

William S. Craig, Ph.D.has served as our Vice President, Research and Product Development since March 2001. From 1996 to December 1999, Dr. Craig was Vice President, Research and Development for Alpha Therapeutics Corporation, a biotechnology company. From 1988 to 1996 he was Senior Director Research and Development for Telios Pharmaceuticals, Inc., a biotechnology company. Dr. Craig received a Ph.D. in Chemistry from the University of California, San Diego.

Marvin J. Garretthas served as our Vice President, Regulatory Affairs, Quality & Compliance since February 1999. From May 1994 to February 1999, Mr. Garrett was Vice President, Regulatory Affairs and

10

Clinical Research for Xoma, Ltd., a biotechnology company. From 1990 to 1994, he was President and General Manager of Coopervision Pharmaceutical, a division of the Cooper Companies, Inc. Mr. Garrett received a B.S. in Microbiology from California State University Long Beach.

Lisa R. Grillone, Ph.D. has served as our Vice President, Clinical Research and Medical Affairs since August 2000. From 1990 to July 2000, Dr. Grillone served in various drug development positions with ISIS Pharmaceuticals, Inc., a biotechnology company, last serving as Executive Director, Intellectual Property Licensing. Dr. Grillone received a Ph.D. in Cell Biology and Anatomy from New York University.

Kathleen McGinley has served as our Vice President, Human Resources and Corporate Facilities, since November 2003. From January 2003 to November 2003, Ms. McGinley served as a consultant to ISTA. From May 2000 to January 2003, Ms. McGinley served as Director and Vice President, Human Resources for Littlefeet, Inc. From December 1999 to May 2000 she served as Director of Human Resources for Combi-Chem/Dupont Pharmaceuticals in San Diego, CA. Ms. McGinley received a M.S. from the University of Tennessee, Knoxville.

Kirk McMullin has served as Vice President, Operations since August 2002. From 1995 to 2002, Mr. McMullin was Vice President, Worldwide Manufacturing Support for Allergan. Mr. McMullin received a B.A. from Humboldt State University.

Thomas A. Mitro has served as our Vice President, Sales & Marketing since July 2002. From 1980 to 2002, Mr. Mitro held several positions at Allergan, including Vice President, Skin Care, Vice President, Business Development and Vice President, e-Business. Mr. Mitro received a B.S. degree from Miami University.

Lauren P. Silvernail has served as our Chief Financial Officer and Vice President, Corporate Development, since March 2003. From 1995 to March 2003, Mrs. Silvernail served in various operating and corporate development positions for Allergan, most recently serving as Vice President, Business Development. From 1989 to 1994 she was a general partner at Glenwood Ventures and served as a director and operating manager for several portfolio companies. Mrs. Silvernail received a M.B.A. from the University of California, Los Angeles.

11

EXECUTIVE OFFICER COMPENSATION

The following table sets forth information for the years ended December 31, 2001, 2002 and 2003 regarding the compensation of our Chief Executive Officer, each of our four other most highly compensated executive officers whose total annual salary and bonus for such fiscal years were in excess of $100,000 (the “Named Executive Officers”).

Summary Compensation Table

| | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual

Compensation

| | Long-Term

Compensation

Awards

Securities

Underlying

Options

| | All Other

Compensation

($)

| |

| | | Salary

($)

| | | Bonus

($)

| | |

Vicente Anido, Jr., Ph.D | | 2001 | | 15,417 | (1) | | — | | 100,461 | | — | |

President and Chief Executive | | 2002 | | 370,000 | | | — | | 595,000 | | 2,717 | * |

Officer | | 2003 | | 381,100 | | | 138,750 | | — | | 5,000 | * |

| | | | | |

Marvin J. Garrett | | 2001 | | 230,450 | | | 24,750 | | 3,500 | | 6,219 | * |

Vice President, Regulatory Affairs, | | 2002 | | 240,820 | | | 25,926 | | 140,000 | | 5,000 | * |

Quality and Compliance | | 2003 | | 252,871 | | | 60,000 | | — | | 5,000 | * |

| | | | | |

Thomas A. Mitro | | 2002 | | 117,500 | (2) | | — | | 194,000 | | 2,067 | * |

Vice President, Sales and Marketing | | 2003 | | 239,700 | | | 60,000 | | — | | 5,000 | * |

| | | | | |

William S. Craig, Ph.D. | | 2001 | | 220,000 | | | 21,874 | | 6,000 | | 2,500 | * |

Vice President, Research and | | 2002 | | 228,800 | | | 16,500 | | 66,500 | | 1,990 | * |

Product Development | | 2003 | | 235,700 | | | 45,000 | | — | | 5,000 | * |

| | | | | |

Lisa R. Grillone, Ph.D. | | 2001 | | 219,614 | | | 13,439 | | 3,500 | | 3,340 | * |

Vice President, Clinical Research | | 2002 | | 231,000 | | | 24,707 | | 148,250 | | 4,267 | * |

and Medical Affairs | | 2003 | | 245,000 | | | 58,000 | | — | | 5,000 | * |

| * | Life insurance or medical benefits. |

| (1) | Dr. Anido joined ISTA in December 2001. His annualized salary for 2001 was $370,000. |

| (2) | Mr. Mitro joined ISTA in July 2002. His annualized salary for 2002 was $235,000. |

Option Grants

Option Grants During Last Fiscal Year. There were no options granted during the fiscal year ended December 31, 2003 to any of the Named Executive Officers.

Option Exercises in Last Fiscal Year and Fiscal Year End Option Values. The following table sets forth the information with respect to stock option exercises during the year ended December 31, 2003, by the Named Executive Officers, and the number and value of securities underlying unexercised options held by the Named Executive Officers at December 31, 2003.

Aggregate Option Exercises in Fiscal 2003 and

Year-End Option Values

| | | | | | | | | | | | | | |

Name

| | Shares

Acquired

Upon

Exercise(#)

| | Value

Realized

($)

| | Number of Securities Underlying

Unexercised Options At

December 31, 2003 (#)

| | Value of Unexercised In-the-

Money Options at

December 31, 2003(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Vicente Anido, Jr., Ph.D. | | — | | — | | 198,980 | | 496,481 | | $ | 861,256 | | $ | 2,583,793 |

Marvin J. Garrett | | — | | — | | 79,520 | | 81,017 | | $ | 378,794 | | $ | 449,530 |

Thomas A. Mitro | | — | | — | | 52,249 | | 141,751 | | $ | 246,159 | | $ | 726,801 |

William S. Craig, Ph.D. | | — | | — | | 37,619 | | 41,177 | | $ | 174,802 | | $ | 212,377 |

Lisa R. Grillone, Ph.D. | | — | | — | | 73,043 | | 84,957 | | $ | 354,638 | | $ | 455,963 |

12

| (1) | Closing price of our common stock at fiscal year-end minus the exercise price. The fair market value of our common stock at the close of business on December 31, 2003, was $9.28. |

Employment and Change in Control Agreements

We have entered into an employment agreement with Dr. Anido. Dr. Anido’s employment agreement sets forth his compensation arrangements, including his initial annual base salary and initial option grant. Dr. Anido is also entitled to a performance bonus of up to 50% of his salary. In the event of termination of employment other than voluntarily or for cause, Dr. Anido will receive nine months of base salary as severance; provided that, in the event such termination occurs after a “change of control” of ISTA, Dr. Anido will receive twenty-four months of base salary as severance and all outstanding options to purchase our common stock then held by Dr. Anido will become fully vested and exercisable.

We have entered into change of control severance agreements with the following executive officers: Mr. Mitro, Mr. Garrett, Dr. Craig, Dr. Grillone, Mr. McMullin, Mrs. Silvernail and Ms. McGinley. Each of these agreements provides that if the executive’s employment is terminated as a result of an “involuntary termination” within 24 months after a “change of control,” the executive will be entitled to nine months of base salary and healthcare related benefits and a pro rata portion of his or her performance bonus based upon the number of months that such employee was employed during the year of termination. In addition, all options to purchase our common stock held by the executive at the time of such termination shall vest in full.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Notwithstanding anything to the contrary in any of our previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings with the Securities Exchange Commission, in whole or in part, the foregoing Compensation Committee Report shall not be “soliciting material” or “filed” with the Securities Exchange Commission, nor shall such information be incorporated by reference into any such filing.

The Compensation Committee of the Board of Directors, comprising three non-employee directors, is responsible for the administration of our executive compensation programs. These programs include base salary for executive officers and both annual and long-term incentive compensation programs. Our compensation programs are designed to provide a competitive level of total compensation and include incentive and equity ownership opportunities linked to our performance and stockholder return.

Compensation Philosophy. Our overall executive compensation philosophy is based on a series of guiding principles derived from our values, business strategy, and management requirements. These principles are summarized as follows:

| | • | Provide competitive levels of total compensation which will enable us to attract and retain the best possible executive talent; |

| | • | Motivate executives to achieve optimum performance for us; |

| | • | Align the financial interest of executives and stockholders through equity-based plans; and |

| | • | Provide a total compensation program that recognizes individual contributions as well as overall business results. |

Compensation Program. The Compensation Committee is responsible for reviewing and recommending to the Board the compensation and benefits of all of our officers and the general policies relating to compensation and benefits of our employees. The Compensation Committee is also responsible for the administration of the

13

2000 Stock Plan. There are two major components to our executive compensation: base salary and potential cash bonus, as well as potential long-term compensation in the form of stock options. The Compensation Committee considers the total current and potential long-term compensation of each executive officer in establishing each element of compensation.

1. Base Salary. In setting compensation levels for executive officers, the Compensation Committee reviews competitive information relating to compensation levels for comparable positions at biotechnology, pharmaceutical and high technology companies. In addition, the Compensation Committee may, from time to time, hire compensation and benefit consultants to assist in developing and reviewing overall salary strategies. Individual executive officer base compensation may vary based on time in position, assessment of individual performance, salary relative to internal and external equity and critical nature of the position relative to our success.

2. Long-Term Incentives. Our 2000 Stock Plan provides for the issuance of stock options to our officers and employees to purchase shares of our common stock at an exercise price equal to the fair market value of such stock on the date of grant. Stock options are granted to our executive officers and other employees both as a reward for past individual and corporate performance and as an incentive for future performance. The Compensation Committee believes that stock-based performance compensation arrangements are essential in aligning the interests of management and the stockholders in enhancing the value of our equity.

2003 Compensation for the Chief Executive Officer. In determining Dr. Anido’s salary for 2003, the Board of Directors considered competitive compensation data for chief executive officers and presidents of similar companies within the biotechnology and pharmaceutical industry, taking into account Dr. Anido’s experience and knowledge. The Board of Directors determined that it was appropriate to offer an annual salary of $381,100 for 2003.

Section 162(m) of the Internal Revenue Code Limitations on Executive Compensation. Section 162(m) of the United States Internal Revenue Code of 1986, as amended, (the “Code”) may limit our ability to deduct for United States federal income tax purposes compensation in excess of $1,000,000 paid to the our Chief Executive Officer and our four other highest paid executive officers in any one fiscal year. None of our executive officers received any such compensation in excess of this limit during fiscal 2003. Grants under the 2000 Stock Plan will not be subject to the deduction limitation, including the option grant limitations described below.

Section 162(m) of the Code places limits on the deductibility for United States federal income tax purposes of compensation paid to certain of our executive officers. In order to preserve our ability to deduct the compensation income associated with options granted to such person, for the purposes of Section 162(m) of the Code, the 2000 Stock Plan provides that no employee may be granted, in any of our fiscal years, options to purchase more than 100,000 shares of common stock. In addition, the 2000 Stock Plan provides that in connection with an employee’s initial employment, the employee may be granted an additional 200,000 shares of common stock. To the extent grants under the 2000 Stock Plan are in excess of these limitations, such excess shall not be exempt from the deductibility limits of Section 162(m) of the Code.

Respectfully submitted,

Benjamin F. McGraw III, Pharm.D., Chairman

Kathleen D. LaPorte

Liza Page Nelson

14

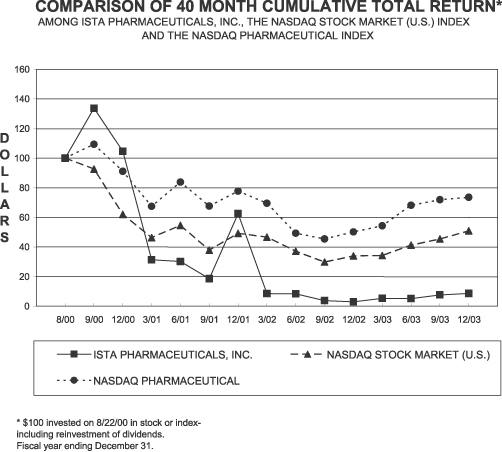

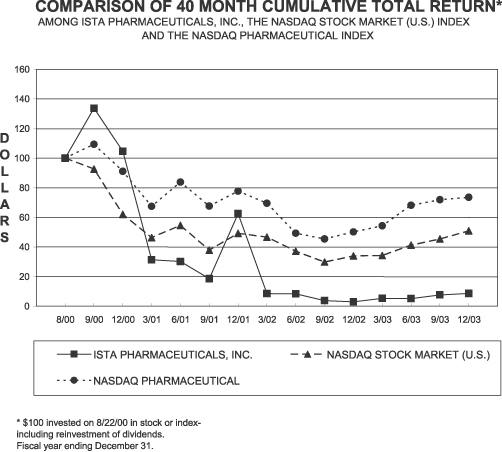

STOCK PERFORMANCE GRAPH

The following graph compares our total cumulative stockholder return as compared to the Nasdaq National Market and U.S. index (“Nasdaq U.S. Index”) and the Nasdaq Pharmaceutical Index for the period beginning on August 22, 2000, our first day of trading after our initial public offering, and ending on December 31, 2003. Total stockholder return assumes $100.00 invested at the beginning of the period in our common stock, the stocks represented by the Nasdaq U.S. Index and the Nasdaq Pharmaceutical Index, respectively. Total return assumes reinvestment of dividends; we have paid no dividends on our common stock.

15

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has elected to engage Ernst & Young LLP, independent auditors, to audit our consolidated financial statements for the fiscal year ending December 31, 2004, and recommends that stockholders vote “FOR” ratification of such appointment.

Although ratification by stockholders is not a prerequisite to the ability of the Audit Committee to select Ernst & Young LLP as our independent auditor, we believes such ratification to be desirable. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection.

Fees billed to us by Ernst & Young LLP during the Fiscal Year Ended December 31, 2003 and December 31, 2002

Audit Fees:

Audit fees billed to us by Ernst & Young LLP for the audit of our 2003 annual financial statements and the review of the financial statements included in our quarterly reports on Form 10-Q in 2003 totaled $264,872.

Audit fees billed to us by Ernst & Young LLP for the audit of our 2002 annual financial statements and the review of the financial statements included in our quarterly reports on Form 10-Q in 2002 totaled $197,297.

Audit-Related Fees:

We did not incur any audit-related fees billed by Ernst & Young LLP during the fiscal year ended December 31, 2003 or during the fiscal year ended December 31, 2002. Such audit-related fees typically consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” These services may include consultations related to the Sarbanes-Oxley Act and consultations concerning financial accounting and reporting standards.

Tax Fees:

Audit fees billed to us by Ernst & Young LLP for professional services for tax compliance, tax advice and tax planning during the fiscal year ended December 31, 2003 totaled $13,191.

Audit fees billed to us by Ernst & Young LLP for professional services for tax compliance, tax advice and tax planning during the fiscal year ended December 31, 2002 totaled $40,580.

The fees disclosed under this category are comprised by services that include assistance related to state tax incentives.

All Other Fees:

We did not incur any other fees billed to us by Ernst & Young LLP during our fiscal year ended December 31, 2003 or December 31, 2002.

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services performed by the independent auditors. These services may include audit services, audit-related services, tax services and other services. For audit services, the independent auditor provides an engagement letter in advance of the February meeting of the Audit Committee, outlining the scope of the audit and related audit fees. If agreed to by the Audit Committee, this engagement letter is formally accepted by the Audit Committee at its February Audit Committee meeting.

16

For non-audit services, our senior management will submit from time to time to the Audit Committee for approval non-audit services that it recommends the Audit Committee engage the independent auditor to provide for the fiscal year. Our senior management and the independent auditor will each confirm to the Audit Committee that each non-audit service is permissible under all applicable legal requirements. A budget, estimating non-audit service spending for the fiscal year, will be provided to the Audit Committee along with the request. The Audit Committee must approve both permissible non-audit services and the budget for such services. The Audit Committee will be informed routinely as to the non-audit services actually provided by the independent auditor pursuant to this pre-approval process.

The Audit Committee approved 100% of the services provided by Ernst & Young LLP described above.

Ernst & Young LLP has audited our financial statements annually since our inception in 1992. Representatives of Ernst & Young LLP are expected to be present at the meeting with the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions. If stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2004.

AUDIT COMMITTEE REPORT

Notwithstanding anything to the contrary in any of our previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings with the Securities Exchange Commission, in whole or in part, the foregoing Audit Committee Report shall not be “soliciting material” or “filed” with the Securities Exchange Commission, nor shall such information be incorporated by reference into any such filing.

The Audit Committee of the Board of Directors met ten times during the fiscal year ended December 31, 2003 with representatives of the independent auditors. Each Audit Committee member is qualified as “Independent” as defined by Rule 4200(a)(14) of the National Association of Securities Dealers and under the rules promulgated by the Securities and Exchange Commission (SEC). The Audit Committee also met on March 12, 2004 and during the meeting reviewed the financial statements and related notes for the year ended December 31, 2003.

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the integrity of our financial statements, compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence, the performance of the internal audit function and the performance of the independent auditor, and such other duties as directed by the Board of Directors. The Audit Committee operates under a written Audit Committee Charter. A copy of this charter is filed with the proxy statement for the 2003 annual meeting of stockholders.

In the performance of its oversight function, the Audit Committee has considered and discussed the audited financial statements with management and the independent auditors. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as currently in effect. The Audit Committee also considered whether the provision by the independent auditors of non-audit services to us is compatible with maintaining the independent auditors’ independence. Finally, the Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with the independent auditors, the independent accountant’s independence.

17

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent auditors. Accordingly, the Audit Committees’ oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audits of our financial statements have been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that our auditors are in fact “independent”.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the Audit Committee Charter, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our annual report to stockholders for the most recent fiscal year ended December 31, 2003. The Audit Committee has also selected Ernst & Young LLP, independent auditors, as our independent auditors to audit our consolidated financial statements for the year ending December 31, 2004, and recommends that the stockholders vote for ratification of such appointment.

Respectfully submitted,

Richard C. Williams, Chairman

Benjamin F. McGraw, III, Pharm.D.

Wayne I. Roe

18

PROPOSAL NO. 3

APPROVAL OF THE 2004 PERFORMANCE INCENTIVE PLAN

At the Annual Meeting, our stockholders will be asked to consider and vote upon a proposal to adopt the 2004 Performance Incentive Plan (the “2004 Plan”) which will permit us to provide a broader range of stock awards to our employees, directors and consultants. The 2004 Plan is intended to replace our 2000 Stock Plan, as amended (the “2000 Plan”) as our primary equity incentive plan.

Description of the 2004 Plan

The following is a summary of the principal provisions of the 2004 Plan. This summary is qualified in its entirety by reference to the full text of the 2004 Plan, which is attached as Appendix A to this proxy statement.

Purposes of the 2004Plan. Historically, we have used options to purchase shares of our common stock as an incentive to attract and retain the services of qualified employees, officers and directors, consultants and other service providers upon whose judgment, initiative and efforts the successful conduct and development of our business largely depends, by providing them with an opportunity to participate in the ownership of ISTA and thereby have an interest in our success and increased value of ISTA.

Our Board of Directors believes that it is in our best interest to have available an equity incentive plan for use as a part of our compensation strategy. In addition the Board of Directors believes that such a plan should provide for the grant of stock options, restricted stock awards, performance shares, performance units and stock appreciation rights to qualified employees, officers, directors, consultants and other service providers. Therefore, to further these purposes, the Board of Directors unanimously adopted the 2004 Plan on June 10, 2004, subject to stockholder approval.

Shares Reserved for Issuance. We have outstanding options to purchase shares of our common stock under individual option agreements, our 1993 Stock Plan, as amended (the “1993 Plan”) and our 2000 Plan. All of the outstanding options granted under the individual option agreements, 1993 Plan and 2000 Plan will remain outstanding and subject to the provisions of the applicable agreement and plan until they are either exercised or expire in accordance with their respective terms. No options have been issued under the 1993 Plan after the adoption of the 2000 Plan as shares of common stock available for future issuance under the 1993 Plan were assumed under the 2000 Plan. If the 2004 Plan is approved by the stockholders, no additional options will be awarded under the 2000 Plan. Any shares available for future issuance under the 2000 Plan have been included in the shares of common stock authorized for issuance under the 2004 Plan.

Shareholder approval of the 2004 Plan will initially authorize us to grant options and/or rights to purchase up to an aggregate of 2,053,107 shares of common stock assumed from our 2000 Plan. 200,000 shares authorized for issuance under the 2004 Plan may only be issued in connection with restricted stock awards.

In the event that all or any portion of any option or restricted stock granted or offered under the 2004 Plan can no longer under any circumstances be exercised or is reacquired by ISTA, the shares of common stock allocable to the unexercised portion of such option or such stock purchase agreement, or the shares so reacquired, will become available for grant or issuance under the 2004 Plan. Additionally, the number of shares available for issuance under the 2004 Plan will be subject to adjustment in the event of stock splits, stock dividends or certain other similar changes in the capital structure of ISTA.

Administration. The 2004 Plan is to be administered by an “Administrator,” which, under the 2004 Plan, shall be either the Board of Directors or a committee appointed by the Board of Directors. Subject to the provisions of the 2004 Plan, the Administrator has full authority to implement, administer and make all determinations necessary under the 2004 Plan.

19

The Board of Directors may from time to time alter, amend, suspend or terminate the 2004 Plan in such respects as the Board of Directors may deem advisable; provided, however, that no such alteration, amendment, suspension or termination shall be made that would substantially affect or impair the rights of any person under any incentive option, nonqualified option or restricted share theretofore granted to such person without his or her consent. Unless previously terminated by the Board of Directors, the 2004 Plan will terminate on June 10, 2014.

Eligibility.The 2004 Plan provides that awards may be granted to employees, officers, directors, consultants, independent contractors and advisors of ISTA or of any parent or subsidiary corporation of ISTA, whether now existing or hereafter created or acquired (an “Affiliated Company”) (including directors if they also are employees of ISTA or an Affiliated Company), as may be determined by the Administrator. In no event may any individual be granted options or performance-based awards under the 2004 Plan for more than 400,000 shares of our common stock in any one calendar year. However, in connection with his or her initial service to ISTA, an individual may be eligible to be granted options for up to 800,000 shares of our common stock during the calendar year which includes such individual’s initial service to ISTA.

The actual number of individuals who will receive awards cannot be determined in advance because the Administrator has discretion to select the participants. Nevertheless, as of July 31, 2004, 8 officers and directors of ISTA and approximately 57 other employees of were eligible to participate in the 2004 Plan.

Terms of Options.As discussed above, the Administrator determines many of the terms and conditions of awards granted under the 2004 Plan, including whether an option will be an “incentive stock option” (ISO) or a “non-qualified stock option” (NQSO). Each option is evidenced by any agreement in such form as the Administrator approves and is subject to the following conditions (as described in further detail in the 2004 Plan):

| | • | Vesting and Exercisability:Options become vested and exercisable, as applicable, within such periods as determined by the Administrator and as set forth in the related stock option agreement, provided that options must expire no later than ten years from the date of grant (five years with respect to ISOs granted to optionees who own more than 10% of the outstanding common stock). |

| | • | Exercise Price:The exercise price of ISOs shall not be less than the fair market value of a share of common stock at the time the option is granted. The exercise price of NQSOs shall be determined by the Administrator, but for options granted to “Section 162(m) Covered Employees” (as defined in the 2004 Plan), the exercise price must be at least 100% of the fair market value of a share of common stock at the time such option is granted. The exercise price of any ISO granted to an optionee that owns more than 10% of the outstanding common stock shall not be less than 110% of the fair market value of a share of common stock at the time of grant. The minimum price per share for restricted share awards shall not be less than the minimum lawful amount under applicable state law. Without limiting the generality of the foregoing, the Administrator may determine to issue restricted shares as consideration for continued employment or the achievement of specified performance goals or objectives. |

| | • | Method of Exercise: Payment of the exercise price may be made, in the discretion of the Administrator, in cash, by check, by delivery of shares of our common stock, or any combination of the foregoing methods of payment or any other consideration or method of payment as shall be permitted by applicable corporate law. |

| | • | Termination of Service: Options cease vesting on the date of termination of service or the death or disability of the optionee. Options granted under the 2004 Plan generally expire three months after the termination of the optionee’s service, except in the case of death or disability, in which case the awards generally may be exercised up to 12 months following the date of death or termination of service due to disability. However, if the optionee is terminated for cause (e.g. for committing an alleged criminal act or intentional tort against ISTA), the optionee’s options will expire upon termination. |

| | • | Change of Control:In the event of a change in control of ISTA (as defined in the 2004 Plan), vesting of options will accelerate automatically unless the options are to be assumed by the acquiring or successor entity (or parent thereof) or substituted for by such entity with new options or other incentives with such |

20

| | terms and provisions as the Administrator in its discretion may consider equitable. If options are assumed or replaced with new options or other incentives by an acquiring or successor entity (or parent thereof), then the options shall accelerate and become fully vested if the optionee is terminated under certain circumstances within a specified period of time (as provided in option agreements) following a change in control. However, the Administrator may at its discretion provide for other vesting arrangements in option agreements, including arrangements which provide for full acceleration of vesting upon a change in control whether or not the acquiring entity agrees to assume or substitute for existing options in such change in control. |

| | • | Additional Restrictions.No ISOs may be granted to an optionee under the 2004 Plan if the aggregate fair market value (determined at the time of grant) of the stock with respect to which ISOs first become exercisable by such optionee in any calendar year under our stock option plans and any Affiliated Company exceeds $100,000. Options are nontransferable, other than by will and the laws of descent and distribution or in any manner permitted by the Administrator that is not prohibited by the Code. |

Terms of Restricted Stock Awards. Each restricted stock award is evidenced by a restricted stock purchase agreement in such form as Administrator approves and is subject to the following conditions (as described in further detail in the 2004 Plan):

| | • | Vesting: Shares subject to a restricted stock award may become vested over time or upon completion of performance goals set out in advance. |

| | • | Purchase Price: Each restricted stock purchase agreement states the purchase price, which may not be less than the par value of our common stock on the date of the award (and not less than 110% of fair market value with respect to an award to a 10% of greater stockholder), payment of which may be made as described under “Terms of Stock Options” above. |

| | • | Termination of Service: Restricted stock awards shall cease to vest immediately if a participant is terminated for any reason, unless provided otherwise in the applicable restricted stock purchase agreement or unless otherwise determined by the committee, and we will generally have the right to repurchase any unvested shares subject thereto. |

| | • | Change of Control: Restricted stock awards shall be treated in the same manner as described under “Terms of Stock Options” above. |

Stock Appreciation Rights.The 2004 Plan provides for the grant of stock appreciation rights. Each stock appreciation right granted under the 2004 Plan must be evidenced by a written agreement specifying the number of shares subject to the award and the other terms and conditions of the award, consistent with the requirements of the 2004 Plan. A stock appreciation right gives a participant the right to receive the appreciation in fair market value of our common stock between the date of grant of the award and the date of its exercise. We may pay the appreciation either in cash or in shares of common stock. The Administrator may grant stock appreciation rights under the 2004 Plan in tandem with a related stock option or as a freestanding award. A tandem stock appreciation right is exercisable only at the time and to the same extent that the related option is exercisable, and its exercise causes the related option to be canceled. Freestanding stock appreciation rights vest and become exercisable at the times and on the terms established by the Administrator. The maximum term of any stock appreciation right granted under the 2004 Plan is ten years. Stock appreciation rights are generally nontransferable by the participant other than by will or by the laws of descent and distribution, and are generally exercisable during the participant’s lifetime only by the participant.