UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission (as permitted by Rule 14A-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to Rule 14A-11(c) or Rule 14A-12 | | |

ISTA PHARMACEUTICALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14A-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ISTA PHARMACEUTICALS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 19, 2006

TO OUR STOCKHOLDERS:

You are cordially invited to the Annual Meeting of Stockholders of ISTA PHARMACEUTICALS, INC., a Delaware corporation. The meeting will be held on Thursday, October 19, 2006 at 11:00 a.m., local time, at our headquarters located at 15295 Alton Parkway, Irvine, California 92618 for the following purposes (as more fully described in the Proxy Statement accompanying this Notice):

| | 1. | To elect three Class III directors to serve for a term of three years expiring upon the 2009 Annual Meeting of Stockholders or until his or her successor is elected; |

| | 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2006; |

| | 3. | To approve the Third Amendment and Restatement of our 2004 Performance Incentive Plan, which increases the number of shares of common stock reserved for issuance under the plan by an additional 3,100,000 shares; and |

| | 4. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

Our Board of Directors recommends that you vote in favor of the foregoing items of business, which are more fully described in the Proxy Statement accompanying this notice.

Only our stockholders of record at the close of business on September 1, 2006 are entitled to notice of and to vote at the meeting.

All stockholders are cordially invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to mark, sign, date and return the enclosed Proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if he or she has returned a Proxy.

FOR THE BOARD OF DIRECTORS

/s/ VICENTE ANIDO, JR.

Vicente Anido, Jr., Ph.D.

Chief Executive Officer, President and Director

Irvine, California

September 8, 2006

YOUR VOTE IS IMPORTANT

IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

ISTA PHARMACEUTICALS, INC.

PROXY STATEMENT FOR THE 2006

ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 19, 2006

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors of ISTA Pharmaceuticals, Inc., for use at the Annual Meeting of Stockholders to be held Thursday, October 19, 2006 at 11:00 a.m., local time, or at any postponement or adjournment thereof (the “Annual Meeting”), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at our headquarters located at 15295 Alton Parkway, Irvine, California 92618. The telephone number at that location is (949) 788-6000.

These proxy solicitation materials and our annual report for the year ended December 31, 2005, including financial statements, were first mailed on or about September 14, 2006 to all stockholders entitled to vote at the meeting.

Record Date and Principal Share Ownership

Holders of shares of our common stock of record at the close of business on September 1, 2006 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. The shares of our common stock are our only class of voting securities. As of the Record Date, approximately 25,931,924 shares of our common stock were issued and outstanding and held of record by approximately 254 stockholders.

Revocability of Proxies

Stockholders who execute proxies retain the right to revoke them at any time before they are voted. Any proxy given by a stockholder may be revoked or superseded by executing a later dated proxy, by giving notice of revocation to Secretary, ISTA Pharmaceuticals, Inc., 15295 Alton Parkway, Irvine, California 92618 in writing prior to or at the meeting or by attending the meeting and voting in person.

Stockholders Sharing the Same Last Name and Address

In accordance with notices we sent to certain stockholders, we are sending only one copy of our annual report and proxy statement to stockholders who share the same last name and address, unless they have notified us that they want to continue receiving multiple copies. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs as well as natural resources.

If you received a householded mailing this year and you would like to have additional copies of our annual report and/or proxy statement mailed to you or you would like to opt out of this practice for future mailings, please submit your request to Secretary, ISTA Pharmaceuticals, Inc., 15295 Alton Parkway, Irvine, California 92618.

Voting and Solicitation

Each stockholder is entitled to one vote for each share held as of the Record Date. Stockholders will not be entitled to cumulate their votes in the election of directors.

The cost of soliciting proxies will be borne by us. We expect to reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial

owners. Proxies may also be solicited by certain of our directors, officers, and regular employees, without additional compensation, personally or by telephone or facsimile.

Quorum; Abstentions; Broker Non-votes

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections appointed for the meeting who will determine whether or not a quorum is present.

The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of our common stock issued and outstanding on the Record Date. Shares that are voted “FOR,” “AGAINST” or “WITHHELD FROM” a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the Annual Meeting with respect to such matter.

Abstentions and broker non-votes are each included in the determination of the number of shares present and voting for the purpose of determining whether a quorum is present. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker does not receive voting instructions from the beneficial owner, and (2) the broker lacks discretionary authority to vote the shares. Banks and brokers cannot vote on their clients’ behalf on “non-routine” proposals, such as Proposal 3, approval of the Third Amendment and Restatement of our 2004 Performance Incentive Plan.

Abstentions will be treated as shares present and entitled to vote for purposes of any matter requiring the affirmative vote of a majority or other proportion of the shares present and entitled to vote. Accordingly, abstentions will have the same effect as a vote against the proposal. With respect to shares relating to any proxy as to which a broker non-vote is indicated on a proposal, those shares will not be considered present and entitled to vote with respect to any such proposal. Thus, a broker non-vote will not affect the outcome of the voting on a proposal. Abstentions or broker non-votes or other failures to vote will have no effect in the election of directors, who will be elected by a plurality of the affirmative votes cast.

Any proxy which is returned using the form of proxy enclosed and which is not marked as to a particular item will be voted for the election of the Class III directors, for the ratification of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2006, for the approval of the Third Amendment and Restatement of our 2004 Performance Incentive Plan, and as the proxy holders deem advisable on other matters that may come before the meeting, as the case may be, with respect to the items not marked.

Other Business; Stockholder Proposals

We do not intend to present any other business for action at the Annual Meeting and do not know of any other business to be presented by others.

Pursuant to our bylaws, in order for business to be properly brought by a stockholder before an annual meeting, our Secretary must receive, at our corporate office, written notice of the matter not less than 120 days prior to the first anniversary of the date our proxy statement was released to stockholders in connection with the preceding year’s annual meeting. We did not receive any such notices from our stockholders for matters to be considered at the Annual Meeting. Any stockholder desiring to submit a proposal for action at our 2007 annual meeting of stockholders and presentation in our proxy statement for such meeting should deliver the proposal to our Secretary at our corporate office no later than May 18, 2007 in order to be considered for inclusion in our proxy statement relating to that meeting.

Under Rule 14a-4 promulgated under the Securities Exchange Act of 1934, as amended, if a proponent of a proposal that is not intended to be included in the proxy statement fails to notify us of such proposal at least 45 days prior to the anniversary of the mailing date of the preceding year’s proxy statement, then we will be allowed

2

to use our discretionary voting authority under proxies solicited by us when the proposal is raised at the meeting, without any discussion of the matter in the proxy statement. We were not notified of any stockholder proposals to be addressed at our Annual Meeting, and will therefore be allowed to use our discretionary voting authority if any stockholder proposals are raised at the meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of August 17, 2006, by (i) each person or entity who is known by us to own beneficially more than 5% of the outstanding shares of common stock, (ii) each of our directors, (iii) each of the executive officers named in the Summary Compensation Table, and (iv) all of our directors and executive officers as a group.

| | | | | |

Name And Address of Beneficial Owner (1) | | Amount And Nature of Beneficial

Ownership (2) | | Approximate

Percent Owned (2) | |

DIRECTORS AND NAMED EXECUTIVE OFFICERS | | | | | |

Vicente Anido, Jr., Ph.D. (3) | | 820,774 | | 3.2 | % |

Rolf Classon (4) | | 37,667 | | * | |

Marvin J. Garrett (5) | | 193,985 | | * | |

Lisa R. Grillone, Ph.D. (6) | | 185,977 | | * | |

Peter Barton Hutt (7) | | 73,750 | | * | |

Kathleen D. LaPorte (8) | | 6,664,677 | | 24.4 | % |

Benjamin F. McGraw III, Pharm.D. (9) | | 81,583 | | * | |

Dean J. Mitchell (10) | | 37,667 | | * | |

Thomas A. Mitro (11) | | 219,905 | | * | |

Andrew J. Perlman | | — | | * | |

Wayne I. Roe (12) | | 84,172 | | * | |

Lauren P. Silvernail (13) | | 193,763 | | * | |

Richard C. Williams (14) | | 100,250 | | * | |

All executive officers and directors as a group

(13 persons) (15) | | 8,694,170 | | 30.0 | % |

5% STOCKHOLDERS | | | | | |

Investor AB (16) | | 3,285,409 | | 12.3 | % |

Credit Suisse First Boston (17) | | 6,589,927 | | 24.2 | % |

Sanderling Investment Entities (18) | | 1,578,070 | | 6.0 | % |

Elizabeth R. Foster, Michael P. Walsh and Kilkenny Capital Management, L.L.C. (19) | | 1,479,214 | | 5.7 | % |

James E. Flynn and Deerfield Investment Entities (20) | | 3,678,748 | | 13.9 | % |

AXA Financial, Inc. and related entities (21) | | 1,375,975 | | 5.3 | % |

A. Alex Porter (22) Paul Orlin Geoffrey Hulme Jonathan W. Friedland | | 1,609,134 | | 6.2 | % |

HBK Investments L.P. (23) | | 2,580,645 | | 9.0 | % |

| (1) | Unless otherwise indicated, the business address of each stockholder is c/o ISTA Pharmaceuticals, Inc., 15295 Alton Parkway, Irvine, California 92618. |

| (2) | This table is based upon information supplied by officers, directors, principal stockholders, and Schedules 13D and 13G, as well as Forms 4, filed with the SEC. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. Applicable percentage ownership is based on 26,009,187 shares of common stock outstanding as of August 17, 2006. Shares of common stock subject to |

3

| | options and warrants currently exercisable, or exercisable within 60 days of the August 17, 2006, are deemed outstanding for computing the ownership percentage of the person holding such options or warrants, but are not deemed outstanding for computing the ownership percentage of any other person. Except as otherwise noted, we believe that each of the stockholders named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to applicable community property laws. |

| (3) | Includes 788,874 shares subject to options exercisable within 60 days after August 17, 2006. |

| (4) | Consists of shares subject to options exercisable within 60 days after August 17, 2006. |

| (5) | Includes 187,885 shares subject to options exercisable within 60 days after August 17, 2006. |

| (6) | Includes 182,477 shares subject to options exercisable within 60 days after August 17, 2006. |

| (7) | Consists of shares subject to options exercisable within 60 days after August 17, 2006. |

| (8) | Consists of 6,255,718 shares (including 653,978 shares issuable upon exercise of warrants and 552,931 shares issuable upon conversion of a convertible note) of Sprout Capital IX, L.P. (“Spout IX”), 25,001 shares (including 2,577 shares issuable upon exercise of warrants and 2,323 shares issuable upon conversion of a convertible note) of Sprout Entrepreneurs’ Fund, L.P. (“SEF”) and 309,082 shares (including 32,919 shares issuable upon exercise of warrants and 25,392 shares issuable upon conversion of convertible note) of Sprout IX Plan Investors, L.P. (“SIPI”). Ms. LaPorte is a Managing Director of New Leaf Venture Partners, LLC, which has entered into a management agreement with DLJ Capital Corporation whereby New Leaf Venture Partners, LLC will act as a sub-manager to DLJ Capital Corporation with respect to the shares held by Sprout Group. Ms. LaPorte is designated to our Board of Directors by Sprout Group pursuant to its contractual right. Ms. LaPorte disclaims beneficial ownership except to the extent of her pecuniary interest therein. Ms. LaPorte’s beneficial ownership also includes 73,750 shares subject to options exercisable within 60 days after August 17, 2006. Ms. LaPorte’s business address is c/o New Leaf Venture Partners, LLC, 3000 Sand Hill Road, 3-170, Menlo Park, CA 94025. |

| (9) | Includes 80,083 shares subject to options exercisable within 60 days after August 17, 2006. |

| (10) | Consists of shares subject to options exercisable within 60 days after August 17, 2006. |

| (11) | Includes 216,005 shares subject to options exercisable within 60 days after August 17, 2006. |

| (12) | Includes 83,046 shares subject to options exercisable within 60 days after August 17, 2006. |

| (13) | Includes 181,042 shares subject to options exercisable within 60 days after August 17, 2006. |

| (14) | Includes 73,750 shares subject to options exercisable within 60 days after August 17, 2006. |

| (15) | Includes 3,286,116 shares subject to options, warrants and convertible notes exercisable or convertible, as the case may be, within 60 days after August 17, 2006. |

| (16) | Based on Forms 4 and 4/A filed with the SEC on July 22, 2005 and September 1, 2005, respectively, by Investor AB. Consists of 2,300,501 shares (including 372,105 shares issuable upon exercise of warrants) held by Investor Growth Capital Limited and 985,928 shares (including 159,474 shares issuable upon exercise of warrants) held by Investor Group, L.P., of which Investor AB serves as the ultimate general partner. Investor Growth Capital Limited is a Guernsey company, with its principal place of business at National Westminster House, Le Truchot, St. Peter Port, Guernsey, Channel Islands GYI, 4PW. Investor Growth Capital Limited is ultimately a wholly owned subsidiary of Investor AB, a publicly held Swedish company with its principal place of business at Arsenalsgatan 8c, S-103 32, Stockholm, Sweden. |

| (17) | Based on a Schedule 13D/A filed with the SEC on July 21, 2006 by Credit Suisse First Boston (the “Bank”), on behalf of the Investment Banking division. The Bank may be deemed to beneficially own an aggregate of 6,589,927 shares of Common Stock, consisting of (i) 5,048,809 shares of Common Stock held directly by Sprout Capital IX, L.P. (“Spout IX”), 552,931 shares of Common Stock issuable upon the conversion of $4,285,215 aggregate principal amount of Notes held directly by Sprout IX and 653,978 shares of Common Stock issuable upon the exercise of warrants held directly by Sprout IX, (ii) 20,101 shares of Common Stock held directly by Sprout Entrepreneurs’ Fund, L.P. (“Sprout Entrepreneurs”), 2,323 shares of Common Stock issuable upon the conversion of $18,000 aggregate principal amount of Notes held directly by Sprout Entrepreneurs and 2,577 shares of Common Stock issuable upon the exercise of warrants held directly by Sprout Entrepreneurs, (iii) 250,771 shares of Common Stock held directly by Sprout IX Plan Investors, L.P. (“IX Plan”), 25,391 shares of Common Stock issuable upon the conversion of $196,785 aggregate principal amount of Notes held directly by IX Plan and 32,918 shares of Common |

4

| | Stock issuable upon the exercise of warrants held directly by IX Plan and (iv) 128 shares of Common Stock held directly by Credit Suisse Securities (USA) LLC (“CS Sec USA LLC”). The address of the Bank’s principal business and office is Uetlibergstrasse 231, P.O. Box 900, CH 8070 Zurich, Switzerland and the Bank’s principal business and office in the United States is 11 Madison Avenue, New York, New York 10010. The Bank owns directly a majority of the voting stock, and all of the non-voting stock, of Credit Suisse Holdings (USA), Inc. (“CS Hldgs USA Inc”), a Delaware corporation. The Bank’s voting stock is entirely owned by Credit Suisse Group (“CSG”), a corporation formed under the laws of Switzerland. CSG also owns the remainder of the voting stock of CS Hldgs USA Inc. Sprout IX, Sprout Entrepreneurs and IX Plan are Delaware limited partnerships which make investments for long term appreciation. DLJ Capital Corporation (“DLJCC”), a Delaware corporation and a wholly-owned subsidiary of CS USA Inc, acts as a venture capital partnership management company. DLJCC is also the general partner of Sprout Entrepreneurs. DLJCC is also the managing general partner of Sprout IX and, as such, is responsible for its day-to-day management. DLJCC makes all of the investment decisions on behalf of Sprout IX and Sprout Entrepreneurs. DLJ Associates IX, L.P. (“Associates IX”), a Delaware limited partnership, is a general partner of Sprout IX and in accordance with the terms of the relevant partnership agreement, does not participate in investment decisions made on behalf of Sprout IX. DLJ Capital Associates IX, Inc. (“DLJCA IX”), a Delaware corporation and wholly-owned subsidiary of DLJCC, is the managing general partner of Associates IX. DLJ LBO Plans Management Corporation II (“DLJLBO II”), a Delaware corporation, is the general partner of IX Plan and, as such, is responsible for its day-to-day management. DLJLBO II makes all of the investment decisions on behalf of IX Plan. DLJLBO II is a wholly-owned subsidiary of Credit Suisse First Boston Private Equity, Inc. (“CSFBPE”), a Delaware corporation, which, in turn, is a wholly-owned subsidiary of CS USA Inc. The address of the principal business and office of each of DLJCC, DLJCA IX, Associates IX, Sprout IX, Sprout Entrepreneurs, IX Plan, DLJLBO II and CSFBPE is Eleven Madison Avenue, New York, New York 10010. |

| (18) | Consists of 966 shares owned by Sanderling IV Biomedical, 1,595 shares owned by Sanderling IV Limited Partnership, 118,900 shares (including 17,664 shares issuable upon exercise of warrants) owned by Sanderling V Beteiligungs GmbH & Co. KG, 495,973 shares (including 74,153 shares issuable upon exercise of warrants) owned by Sanderling V Biomedical Co-Investment Fund, 133,775 shares (including 20,001 shares issuable upon exercise of warrants) owned by Sanderling V Limited Partnership, 3,604 shares owned by Sanderling Venture Partners IV, 4,098 shares owned by Sanderling Venture Partners IV LP, 776 shares owned by Sanderling Venture, 818,081 shares (including 122,312 shares issuable upon exercise of warrants) owned by Sanderling Venture Partners V Co-Investment Fund and 302 shares owned by Sanderling IV Biomedical Limited LP. Sanderling Venture Partners is located at 2730 Sand Hill Road, Suite 200, Menlo Park, California 94024. |

| (19) | Based on a Schedule 13G filed with the SEC on February 14, 2005 by Michael P. Walsh and Elizabeth R. Foster, individually, and on behalf of Kilkenny Capital Management, L.L.C. The number of shares consists of 1,479,214 shares beneficially owned by Kilkenny Capital Management, L.L.C., 1,479,214 shares beneficially owned by Michael P. Walsh and 1,479,214 shares beneficially owned by Elizabeth R. Foster. Kilkenny Capital Management, L.L.C. is a registered investment advisor. Michael P. Walsh is the executive manager of Kilkenny Capital Management and Michael P. Walsh and Elizabeth R. Foster are the controlling members of Kilkenny Capital Management, L.L.C. Kilkenny Capital Management, L.L.C., Michael P. Walsh and Elizabeth R. Foster constitute a group as defined in Rule 13d-5(b)(1) and have shared voting power and shared dispositive power over the 1,479,214 shares. The business address of the foregoing is 311 South Wacker Drive, Suite 6350, Chicago, Illinois 60606. |

| (20) | Based on (i) a Schedule 13G/A filed with the SEC on May 11, 2006 by James E. Flynn and Arnold H. Snider, individually, and on behalf of Deerfield Capital, L.P., Deerfield Partners, L.P., Deerfield Special Situations Fund, L.P., Deerfield Management Company, L.P., Deerfield International Limited, Deerfield Special Situations Fund International Limited, and (ii) a Form 4 filed jointly with the SEC on June 23, 2006 by James E. Flynn, Deerfield Capital L.P., Deerfield Management Company, L.P., Deerfield Partners L.P. and Deerfield International Limited. Consists of (i) 1,139,186 shares (including 199,096 shares issuable upon conversion of a convertible note) held by Deerfield Partners, L.P., (ii) 290,757 shares held by Deerfield Special Situations Fund, L.P., (iii) 1,583,750 (including 317,032 shares issuable upon |

5

| | conversion of a convertible note) held by Deerfield International Limited, (iv) 585,055 shares held by Deerfield Special Situations Fund International Limited, and (v) 80,000 shares held by James E. Flynn. Deerfield Capital, L.P. is the general partner of Deerfield Partners, L.P. and Deerfield Special Situations Fund, L.P. James E. Flynn is the managing member of the general partner of Deerfield Capital, L.P. Deerfield Management Company, L.P. is the investment manager of Deerfield International Limited and Deerfield Special Situations Fund International Limited. Mr. Flynn is the managing member of the general partner of Deerfield Management Company, L.P. Mr. Flynn disclaims beneficial ownership in shares held by the various Deerfield entities except to the extent of his pecuniary interest therein. The business address of James E. Flynn, Deerfield Capital, L.P., Deerfield Partners, L.P. Deerfield Special Situations Fund, L.P. and Deerfield Management Company, L.P. is 780 Third Avenue, 37th Floor, New York, NY 10017. The business address of Deerfield International Limited and Deerfield Special Situations International Limited is c/o Hemisphere Management (B.V.I.) Limited, Bison Court, Columbus Centre, P.O. Box 3460, Road Town, Tortola, British Virgin Islands. |

| (21) | Based on a Schedule 13G filed jointly with the SEC on February 14, 2006 by AXA Financial, Inc. and AXA Assurances I.A.R.D. Mutuelle, AXA Assurances Vie Mutuelle, AXA Courtage Assurance Mutuelle, as a group. Consists of 1,362,375 shares beneficially owned by AXA Framlington, a subsidiary of AXA, and 13,600 shares beneficially owned by Alliance Capital Management, L.P., a subsidiary of AXA Financial, Inc., based on information set forth in a Schedule 13G filed with the SEC on February 14, 2006. The address for AXA Financial, Inc. is 1290 Avenue of the Americas, New York, New York 10104 and the address for AXA is 25, avenue Matignon, 75008 Paris, France. |

| (22) | Based on information set forth in a Schedule 13G filed with the SEC on February 10, 2006. The business address for Messrs. Porter, Orlin, Hulme and Friedland is 666 5th Avenue, 34th Floor, New York, New York 10103. |

| (23) | Based on a Schedule 13G filed with the SEC on June 30, 2006 by HBK Investments L.P. (“HBK Investments”). Consists of shares of Common Stock issuable upon conversion of a convertible note (collectively, the “Securities”) owned by HBK Master Fund L.P. (the “Fund”). HBK Investments has sole voting and dispositive power over the Securities pursuant to an Investment Management Agreement with the Fund. Accordingly, the Fund has no beneficial ownership of such Securities. HBK Investments’ power is exercised by its general partner, HBK Partners II L.P., whose general partner is HBK Management L.L.C. The principal business office of HBK Investments is 300 Crescent Court, Suite 700, Dallas, Texas 75201. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, officers and beneficial owners of more than 10% of our common stock to file reports of ownership and reports of changes in the ownership with the Securities and Exchange Commission. Such persons are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms submitted to us during the year ended December 31, 2005, we believe that all Section 16(a) filing requirements applicable to our officers and directors were complied with.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Director and Nominees for Director

Pursuant to our Restated Certificate of Incorporation and Amended and Restated Bylaws, our Board of Directors currently consists of nine persons, divided into three classes serving staggered terms of three years. The Class III directors, Rolf Classon, Dean J. Mitchell and Wayne I. Roe, are scheduled to serve until the Annual Meeting. The Class I directors, Peter Barton Hutt, Benjamin F. McGraw III, Pharm.D. and Andrew J. Perlman, are scheduled to serve until the annual meeting of stockholders in 2007. The Class II directors, Vicente Anido, Jr., Ph.D., Kathleen D. LaPorte, and Richard C. Williams, are scheduled to serve until the annual meeting of stockholders in 2008.

In the event that any person nominated as a Class III director becomes unavailable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the proxies in their discretion for any nominee who is designated by the current Board of Directors to fill the vacancy. It is not expected that any of the nominees will be unavailable to serve.

The name of the Class III nominees for election to the Board of Directors at the Annual Meeting, age as of the Record Date, and certain information are set forth below. The names of the current Class I and Class II directors with unexpired terms, their ages as of the Record Date, and certain information about them are also stated below.

| | | | | | | |

Name | | Age | | Principal Occupation | | Director

Since | |

Nominees for Class III Directors | | | | | | | |

Dean J. Mitchell | | 50 | | President and Chief Executive Officer of Alpharma, Inc. | | 2004 | |

Rolf Classon | | 61 | | Retired | | 2004 | |

Wayne I. Roe | | 56 | | Retired | | 1998 | * |

| | | |

Continuing Class I Directors | | | | | | | |

Peter Barton Hutt | | 71 | | Senior Counsel, Covington & Burling | | 2002 | |

Benjamin F. McGraw III, Pharm.D. | | 57 | | Chairman, President and Chief Executive Officer of Valentis, Inc. | | 2000 | * |

Andrew J. Perlman | | 58 | | Chief Executive Officer of Innate Immune, Inc. | | 2006 | |

| | | |

Continuing Class II Directors | | | | | | | |

Vicente Anido, Jr., Ph.D. | | 53 | | President and Chief Executive Officer | | 2001 | |

Kathleen D. LaPorte | | 44 | | Managing Director, New Leaf Venture Partners, L.L.C. | | 2002 | |

Richard C. Williams | | 63 | | President, Conner-Thoele Limited | | 2002 | |

| * | Dr. McGraw and Mr. Roe resigned as directors on November 19, 2002 in connection with the closing of a private placement financing and were reappointed as directors in December 2002. |

There are no family relationships among any of our directors or executive officers.

Nominees for Terms Expiring at the Annual Meeting

Class III Directors

Dean J. Mitchell was appointed to our Board of Directors in July 2004. In July 2006, Mr. Mitchell assumed the role of President and Chief Executive Officer at Alpharma Inc., a global specialty pharmaceutical company, and was also appointed a member of its board of directors. Prior to Alpharma, he was President and Chief Executive Officer of Guilford Pharmaceuticals Inc., from December 2004 until its acquisition by MGI Pharma Inc. in October 2005, and is now a non-executive Director of MGI. Mr. Mitchell was at Bristol-Myers Squibb (BMS) from 2001 until 2004 in several roles including President, International, President US Primary Care and

7

Vice President, Strategy. He also spent 15 years at Glaxo SmithKline (GSK) and its predecessor companies, most recently as Senior Vice President, Clinical Development and Product Strategy from 1999 to 2001, and prior to that as Vice President and General Manager, Specialty Divisions, Strategic Planning and Business Development, from 1995 to 1999. He received his MBA degree from City University Business School (London, UK) and his B.Sc. degree in Biology from Coventry University, UK.

Rolf Classon was appointed to our Board of Directors in July 2004. In May 2005, Mr. Classon assumed the roles of interim President and Chief Executive Officer of Hillenbrand Industries, Inc. From October 2002 to July 2004, Mr. Classon was the President and Chief Executive Officer of Bayer HealthCare LLC, a subsidiary of Bayer AG. From December 1995 to October 2002, Mr. Classon served as President of Bayer Diagnostics. From September 1991 to December 1995, Mr. Classon was an Executive Vice President in charge of Bayer Diagnostics’ Worldwide Marketing, Sales and Service operations. From May 1990 to September 1991, Mr. Classon was the President and Chief Operating Officer of Pharmacia Biosystems A.B. Prior to 1991, Mr. Classon served as President of Pharmacia Development Company Inc. and Pharmacia A.B.’s Hospital Products Division. Mr. Classon is a member of the Board of Directors of Enzon Pharmaceuticals, Inc., Hillenbrand Industries, Auxilium Pharmaceuticals and Millipore Corporation. He received his Chemical Engineering Certificate from the Gothenburg School of Engineering, and he has a Business Degree from the University of Gothenburg.

Wayne I. Roe has served on our Board of Directors since June 1998, except for the period from November 2002 to December 2002. Mr. Roe was Senior Vice President for United Therapeutics, Inc., a biotechnology company, from November 1999 to November 2000. From November 1988 to March 1999, Mr. Roe founded and served in various management positions at Covance Health Economics and Outcome Services, a consulting firm for life sciences companies, last serving as Chairman of the Board of Directors. Mr. Roe is also currently a director of Favrille, Inc., a biopharmaceutical company focused on the treatment of cancer and other diseases of the immune system. Mr. Roe received a M.A. in Political Economy from the State University of New York and an M.A. in Economics from the University of Maryland.

Directors Whose Terms Extend Beyond the Annual Meeting

Class I Directors

Peter Barton Hutt has served on our Board of Directors since November 2002. Mr. Hutt is a senior counsel specializing in food and drug law in the Washington, D.C. law firm of Covington & Burling. From time to time, Covington & Burling provides legal services to us. Mr. Hutt joined Covington & Burling in 1960 and was named partner in 1968, leaving from 1971 to 1975 to serve as Chief Counsel for the Food and Drug Administration and returning to Covington & Burling in September 1975. Mr. Hutt is the co-author of the casebook used to teach Food and Drug Law throughout the country and teaches a full course on the subject annually at Harvard Law School. Mr. Hutt is a member of the Board of Directors of Introgen Therapeutics, Inc., CV Therapeutics, Inc., Momenta Pharmaceuticals, Inc., Favrille, Inc. and Xoma Ltd. Mr. Hutt received a B.A. from Yale University and a LL.B. from Harvard University. In addition, Mr. Hutt received a Master of Laws degree in Food and Drug Law from New York University Law School.

Benjamin F. McGraw, III, Pharm.D.has served on our Board of Directors since April 2000, except for the period from November 2002 to December 2002. Dr. McGraw has been President and Chief Executive Officer since 1994, and Chairman of the Board since 1996, of Valentis, Inc., a biotechnology company. Prior to this, Dr. McGraw was Corporate Vice President for Corporate Development of Allergan. Before that, he was an equity analyst and a fund manager at Carerra Capital Management. Prior to this, he was Vice-President, Development for Marion Laboratories and Marion, Merrell Dow. Dr. McGraw received B.S. and Doctor of Pharmacy degrees from the University of Tennessee Center for the Health Sciences where he also completed a clinical practice residency.

Andrew J. Perlman, M.D., Ph.D. was appointed to our Board of Directors in April 2006. Dr. Perlman is the co-founder and has served since October 2004 as the Chief Executive Officer of Innate Immune, Inc., a company

8

engaged in the discovery and development of therapeutics for asthma and autoimmune diseases. Dr. Perlman served in various senior management positions, culminating as Executive Vice President, at Tularik, Inc., a public biotechnology company; from 1993 through October 2004; except from February to October 2002, when he served as the Chief Executive Officer and a member of the Board of Directors of Affymax, Inc., a privately-held biopharmaceutical company. While at Tularik, Dr. Perlman’s principal responsibilities were in the areas of clinical research and business development by which he provided medical input and strategy for all Tularik clinical projects, and played an active role in Tularik’s financing activities and in its merger with Amgen in 2004. Prior to 1993, Dr. Perlman was a Senior Director of Clinical Research at Genentech, Inc. and served as a faculty member in the Department of Medicine at Stanford University. Dr. Perlman presently is a member of the Board of Directors of IntegriGen Inc. Dr. Perlman received his M.D. and his Ph.D. in Physiology from New York University.

Class II Directors

Vicente Anido, Jr., Ph.D. has served as our President and Chief Executive Officer and on our Board of Directors since December 2001. From June 2000 to September 2001, Dr. Anido was general partner for Windamere Venture Partners. From 1996 to 1999, Dr. Anido served as President and Chief Executive Officer of CombiChem, Inc., a biotechnology company. From 1993 to 1996, he served as President of the Americas Region of Allergan, a specialty pharmaceutical company focusing on ophthalmology, dermatology and neuromuscular indications. Dr. Anido is also a director of Apria Healthcare, Inc. Dr. Anido received a Ph.D. in Pharmacy Administration from the University of Missouri.

Kathleen D. LaPorte has served on our Board of Directors since November 2002. Ms. LaPorte is a Managing Director of New Leaf Venture Partners, LLC located in Menlo Park, California. Previously, Ms. LaPorte was a General Partner in the Healthcare Technology Group of the Sprout Group located in Menlo Park, California, which she joined in 1993 and became a General Partner in 1994. Between 1987 and 1993, Ms. LaPorte was a principal at Asset Management Company, a venture capital firm focused on early-stage investments. Previously, Ms. LaPorte was a financial analyst with The First Boston Corporation. Ms. LaPorte is a member of the Board of Directors of Adeza Biomedical Corporation and VNUS Medical Technologies, Inc. Ms. LaPorte received a B.S. from Yale University and a M.B.A. from Stanford University Graduate School of Business. Sprout Group has a contractual right to designate two representatives to be nominated to our Board of Directors. Ms. LaPorte is the designated representative of Sprout Group.

Richard C. Williams has served on our Board of Directors since December 2002 and as Chairman of our Board of Directors since July 2004. Since 1989, Mr. Williams has served as the founder and President of Conner-Thoele Limited, a consulting and financial advisory firm specializing in the healthcare industry and pharmaceutical segment. From 2000 to April 2001, Mr. Williams also served as Vice Chairman-Strategic Planning and director of King Pharmaceuticals, Inc. From 1992 to 2000, Mr. Williams served as Chairman and director of Medco Research, a cardiovascular pharmaceutical development company, prior to its acquisition by King Pharmaceuticals in 2000. From 1997 to 1999, Mr. Williams was Co-Chairman and a director of Vysis, a genetic biopharmaceutical company. Prior to founding Conner-Thoele Limited, Mr. Williams held various operational and financial management officer positions with Erbamont, N.V., Field Enterprises, Inc., Abbott Laboratories and American Hospital Supply Corporation. Mr. Williams is also a director of EP Med Systems and a director, Chairman and interim Chief Executive Officer of Cellegy Pharmaceuticals, Inc., a specialty biopharmaceutical company. Mr. Williams received a B.A. degree from DePauw University and an M.B.A. from the Wharton School of Finance.

Vote Required

The nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them shall be elected Class III directors. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum for the transaction of business, but have no other legal effect under Delaware law.

9

Recommendation of the Board of Directors

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES SET FORTH ABOVE.

Board Meetings, Committees and Directors Compensation

Our Board of Directors held seven meetings during the fiscal year ended December 31, 2005. Each of the directors serving at the time attended in person or by teleconference at least 75% of the aggregate of all of the meetings held by the Board of Directors and any committees of the Board of Directors on which such person served during the last fiscal year. Although we have no formal policy requiring director attendance at annual meetings of stockholders, directors are encouraged to attend the annual meetings of stockholders. Four incumbent directors attended the 2005 annual meeting of stockholders.

Our securities are listed on The Nasdaq Global Market and are governed by its listing standards. Our Board has determined that the following eight directors satisfy the current “independent director” standards established by Nasdaq Marketplace Rules: Rolf Classon, Peter Barton Hutt, Kathleen D. LaPorte, Benjamin F. McGraw III, Pharm.D., Dean J. Mitchell, Andrew J. Perlman, Wayne I. Roe and Richard C. Williams.

Our Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each Committee is described as follows:

| | | | |

Name of Committees and Members | | Functions of the Committees | | Number of Meetings in Fiscal 2005 |

AUDIT COMMITTEE Richard C. Williams (Chairperson) Benjamin F. McGraw, III, Pharm.D. Wayne I. Roe | | • Oversees our accounting and financial reporting processes • Appoints, determines compensation for and oversees the work of the independent auditors • Approves the services performed by the independent auditors • Approves related party transactions | | 6 |

| | |

COMPENSATION COMMITTEE Benjamin F. McGraw, III, Pharm.D. (Chairperson) Kathleen D. LaPorte Dean J. Mitchell | | • Sets executive compensation guidelines • Administers the Company’s stock incentive plans • Recommends to Board of Directors compensation of Chief Executive Officer and members of the Board of Directors • Approves compensation of executive officers other than Chief Executive Officer | | 4 |

| | |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Rolf Classon (Chairperson) Andrew J. Perlman Peter Barton Hutt | | • Recommends corporate governance principles • Reviews and makes recommendations regarding candidates for service on the Board of Directors • Assists with executive development and succession matters | | 3 |

10

Audit Committee.The Audit Committee has adopted an Amended and Restated Charter, a copy of which is included in this Proxy Statement as Appendix A. Our Board of Directors has determined that both Richard C. Williams and Benjamin F. McGraw, III, Pharm.D. are “audit committee financial experts” as defined by SEC regulations. All of the members of the Audit Committee, including the audit committee financial experts, meet the independence standards of Nasdaq Marketplace Rule 4200(a)(15) and the independence standards promulgated by the SEC.

Compensation Committee.All of the members of the Compensation Committee meet the independence standards of Nasdaq Marketplace Rule 4200(a)(15).

Nominating and Corporate Governance Committee.The Nominating and Corporate Governance Committee reports to the Board on a periodic basis with regard to matters of corporate governance, evaluation and recommendation of director candidates, executive development and succession planning. All of the members of the Nominating and Corporate Governance Committee meet the independence standards of Nasdaq Marketplace Rule 4200(a)(15). The Amended and Restated Charter of the Nominating and Corporate Governance Committee was adopted on August 25, 2005. A copy of this Amended and Restated Charter is available at the Company’s website atwww.istavision.com, under the Committee Composition of the Corporate Governance section.

As reflected in the charter of the Nominating and Corporate Governance Committee, factors considered by the Nominating and Corporate Governance Committee in the selection of director nominees are experience in business, finance, administration or healthcare, familiarity with our business and industry and, as applicable, specific expertise, including but not limited to such matters as clinical development, regulatory strategy or business development. The Nominating and Corporate Governance Committee also gives consideration to candidates with appropriate non-business backgrounds, illustratively, with backgrounds in medicine, research, government or intellectual property. The Nominating and Corporate Governance Committee gives consideration to individuals identified by stockholders, management and members of the Board.

Our bylaws provide for business to be brought by a stockholder before an annual meeting, including nominations for the election of directors, so long as our Secretary receives, at the corporate office, written notice of the matter not less than 120 days prior to the first anniversary of the date our proxy statement was released to stockholders in connection with the preceding year’s annual meeting.

In addition it is our policy that director candidates recommended by stockholders will be given appropriate consideration in the same manner as other director candidates presented to the Nominating and Corporate Governance Committee. Stockholders who wish to submit a director candidate for consideration by the Nominating and Corporate Governance Committee may do so by submitting a comprehensive written resume of the recommended nominee’s business and educational experience and background and a consent in writing signed by the recommended nominee that he or she is willing to be considered as a nominee and if nominated and elected, he or she will serve as a director. Stockholders should send their written recommendations of nominees accompanied by the candidate’s resume and consent to: Chairperson of the Nominating and Corporate Governance Committee, c/o ISTA Pharmaceuticals, 15295 Alton Parkway, Irvine, California 92618. The foregoing policy is subject to our Restated Certificate of Incorporation, our bylaws and applicable law. No director nominations by stockholders have been received as of the filing of this proxy statement.

Stockholder Communications to the Board of Directors

Stockholders may submit communications to our Board of Directors, its Committees or the Chairperson of the Board of Directors or any of its Committees or any individual members of the Board of Directors by addressing a written communication to: Board of Directors, c/o ISTA Pharmaceuticals, Inc., 15295 Alton Parkway, Irvine, California 92618. Stockholders should identify in their communication the addressee, whether it is our Board of Directors, its Committees or the Chairperson of the Board of Directors or any of its Committees or any individual member of the Board of Directors. Stockholder communications will be forwarded to our Vice

11

President, Human Resources. The Vice President, Human Resources will acknowledge receipt to the sender, unless the sender has submitted the communication anonymously, and forward a copy of the communication to the addressee on our Board of Directors or if the communication is addressed generally to our Board of Directors to our Chairperson of the Board of Directors.

Compensation of Directors

Our non-employee directors receive an annual retainer of $20,000 and $1,500 in cash compensation from us for their service as members of the Board of Directors for each Board meeting attended, $1,000 for each committee meeting attended and $1,000 for telephonic attendance at any Board or committee meeting. In addition, the Chairperson of the Board and the Chairperson of the Audit Committee each received an additional $10,000 annual retainer. The Chairperson of each of the Compensation and Nominating and Governance Committees each receive an additional $5,000 annual retainer. All non-employee directors are reimbursed for travel and miscellaneous expenses in connection with attendance at Board and committee meetings.

Under our 2004 Performance Incentive Plan, as amended, our Board of Directors, upon the recommendation of our Board’s Compensation Committee, has approved (i) that each non-employee director is granted options to purchase 20,000 shares of our common stock upon their initial election or appointment to the Board, and (ii) that such non-employee directors who, immediately after the annual meeting of stockholders, continue to serve on the Board and have served on the Board for at least the six (6) months preceding the annual meeting of stockholders shall receive annual grants of options to purchase 16,000 shares of our common stock. The shares subject to the initial option grants vest in three equal annual installments while the shares subject to the subsequent annual grants will be fully vested upon the first anniversary of the date of grant. During the fiscal year ending December 31, 2005, we granted our non-employee directors options to purchase an aggregate of 128,000 shares of common stock each at an exercise price of $5.82 per share under our 2004 Performance Incentive Plan.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ending December 31, 2005, no member of the Compensation Committee was an officer or employee of ISTA. During fiscal 2005, no member of the Compensation Committee or executive officer of ISTA served as a member of the Board of Directors or Compensation Committee of any entity that has an executive officer serving as a member of our Board of Directors or Compensation Committee.

RELATED PARTY TRANSACTIONS

Peter Barton Hutt, a member of our Board of Directors since November 2002, is a senior counsel in the Washington, D.C. law firm of Covington & Burling. From time to time, Covington & Burling provides legal services to us.

OTHER EXECUTIVE OFFICERS

Marvin J. Garrett(56) has served as our Vice President, Regulatory Affairs, Quality & Compliance since June 1999. From May 1994 to June 1999, Mr. Garrett was Vice President, Regulatory Affairs and Clinical Research for Xoma, Ltd., a biotechnology company. From 1990 to 1994, he was President and General Manager of Coopervision Pharmaceutical, a division of the Cooper Companies, Inc. Mr. Garrett received a B.S. in Microbiology from California State University, Long Beach.

Lisa R. Grillone, Ph.D. (56) has served as our Vice President, Clinical Research and Medical Affairs since August 2000. From 1990 to July 2000, Dr. Grillone served in various drug development positions with ISIS Pharmaceuticals, Inc., a biotechnology company, last serving as Executive Director, Intellectual Property Licensing. Dr. Grillone received a Ph.D. in Cell Biology and Anatomy from New York University.

12

Kathleen McGinley (56) has served as our Vice President, Human Resources and Corporate Services, since November 2003. From January 2003 to November 2003, Ms. McGinley served as a consultant to ISTA. From May 2000 to January 2003, Ms. McGinley served as Director and Vice President, Human Resources for Littlefeet, Inc. From December 1999 to May 2000 she served as Director of Human Resources for Combi-Chem/Dupont Pharmaceuticals in San Diego, CA. Ms. McGinley received a M.S. from the University of Tennessee, Knoxville.

Kirk McMullin (53) has served as Vice President, Operations since August 2002. From 1995 to 2002, Mr. McMullin was Vice President, Worldwide Manufacturing Support for Allergan. Mr. McMullin received a B.A. from Humboldt State University.

Thomas A. Mitro (49) has served as our Vice President, Sales & Marketing since July 2002. From 1980 to 2002, Mr. Mitro held several positions at Allergan, including Vice President, Skin Care, Vice President, Business Development and Vice President, e-Business. Mr. Mitro received a B.S. degree from Miami University.

Lauren P. Silvernail (47) has served as our Chief Financial Officer, Chief Accounting Officer and Vice President, Corporate Development, since March 2003. From 1995 to March 2003, Mrs. Silvernail served in various operating and corporate development positions for Allergan, most recently serving as Vice President, Business Development. From 1989 to 1994, she was a general partner at Glenwood Ventures and served as a director and operating manager for several portfolio companies. Mrs. Silvernail received a M.B.A. from the University of California, Los Angeles.

EXECUTIVE OFFICER COMPENSATION

The following table sets forth information for the years ended December 31, 2003, 2004 and 2005 regarding the compensation of our Chief Executive Officer and each of our four other most highly compensated executive officers whose total annual salary and bonus for such fiscal years were in excess of $100,000 (collectively, the “Named Executive Officers”).

| | | | | | | | | | | |

| | | Annual Compensation | | Long-Term

Compensation

Awards Securities

Underlying Options | | All Other

Compensation

($)* |

Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | |

Vicente Anido, Jr., Ph.D President and Chief Executive Officer | | 2005

2004

2003 | | 409,019

392,533

381,100 |

| | 184,490

114,330

138,750 | | 95,601

88,000

— | | 3,539

3,000

5,000 |

| | | | | |

Marvin J. Garrett Vice President, Regulatory Affairs, Quality and Compliance | | 2005

2004

2003 | | 265,000

255,543

252,871 |

| | 75,000

43,500

60,000 | | 20,000

21,000

— | | 5,000

4,475

5,000 |

| | | | | |

Lisa R. Grillone, Ph.D. Vice President, Clinical Research And Medical Affairs | | 2005

2004

2003 | | 262,000

254,800

245,000 |

| | 70,000

43,500

58,000 | | 17,000

25,000

— | | 4,726

3,545

5,000 |

| | | | | |

Thomas A. Mitro Vice President, Sales and Marketing | | 2005

2004

2003 | | 255,000

246,891

239,700 |

| | 80,000

48,000

60,000 | | 18,000

25,000

— | | 5,000

4,000

5,000 |

| | | | | |

Lauren P. Silvernail Chief Financial Officer, Chief Accounting Officer and Vice President, Corporate Development | | 2005

2004

2003 | | 230,000

215,672

157,692 |

(1) | | 75,000

43,050

— | | 20,000

28,000

165,000 | | 5,000

4,500

5,000 |

| * | Life insurance or medical benefits. |

| (1) | Ms. Silvernail joined ISTA in May 2003. Her annualized salary for 2003 was $205,000. |

13

Option Grants

Option Grants During Last Fiscal Year. The following table sets forth each grant of stock options made during the fiscal year ended December 31, 2005 to each of the Named Executive Officers:

Option Grants in Fiscal 2005

| | | | | | | | | | | | | | | | |

| | | Individual Grants |

| | | Number of

Securities

Underlying

Options

Granted

(#) (1) | | % of Total

Options

Granted to

Employees

in

Fiscal

Year(2) | | | Exercise

Price

($/Share) | | Expiration

Date | | Potential Realizable at

Assumed Annual Rates of

Stock Price Appreciation

for Option Term ($)(3) |

Name | | | | | | 5% | | 10% |

Vicente Anido, Jr., Ph.D | | 95,601 | | 10.0 | % | | $ | 10.27 | | 02/17/15 | | $ | 617,463 | | $ | 1,564,772 |

Marvin J. Garrett | | 20,000 | | 2.1 | % | | $ | 10.27 | | 02/17/15 | | $ | 129,175 | | $ | 327,355 |

Lisa R. Grillone, Ph.D | | 17,000 | | 1.8 | % | | $ | 10.27 | | 02/17/15 | | $ | 109,799 | | $ | 278,252 |

Thomas A. Mitro | | 18,000 | | 1.9 | % | | $ | 10.27 | | 02/1715 | | $ | 116,257 | | $ | 294,619 |

Lauren P. Silvernail | | 20,000 | | 2.1 | % | | $ | 10.27 | | 02/17/15 | | $ | 129,175 | | $ | 327,355 |

| (1) | These options vest in equal monthly installments over four years from the date of grant. |

| (2) | Options to purchase an aggregate of 958,651 shares of common stock were granted to employees, including the Named Executive Officers, during the fiscal year ended December 31, 2005. |

| (3) | In accordance with rules and regulations of the Securities and Exchange Commission, these columns show gains that could accrue for the respective options, assuming that the market price of our common stock appreciates from the date of grant over a period of 10 years at an annualized rate of 5% and 10%, respectively. The potential realizable value at 5% and 10% annual rates of stock price appreciation for each person is based on the market price of the underlying shares of Common Stock on the date each option was granted. Unless the market price of the common stock appreciates over the option term, no value will be realized from the option grants made to the executive officers. |

Option Exercises in Last Fiscal Year and Fiscal Year End Option Values. The following table sets forth the information with respect to stock option exercises during the year ended December 31, 2005, by the Named Executive Officers, and the number and value of securities underlying unexercised options held by the Named Executive Officers at December 31, 2005.

Aggregate Option Exercises in Fiscal 2005 and Year-End Option Values

| | | | | | | | | | | | | | |

| | | Shares

Acquired

Upon

Exercise (#) | | Value

Realized ($) | | Number of Securities

Underlying Unexercised

Options At

December 31, 2005 (#) | | Value of Unexercised

In-the-Money Options at

December 31, 2005 (1) |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Vicente Anido, Jr., Ph.D. | | — | | — | | 446,249 | | 148,751 | | $ | 1,280,735 | | $ | 426,915 |

Marvin J. Garrett | | — | | — | | 138,000 | | 0 | | $ | 396,060 | | $ | 0 |

Lisa R. Grillone, Ph.D. | | — | | — | | 140,000 | | 0 | | $ | 401,800 | | $ | 0 |

Thomas A. Mitro | | — | | — | | 122,999 | | 41,001 | | $ | 353,007 | | $ | 117,673 |

Lauren P. Silvernail | | — | | — | | 113,437 | | 51,563 | | $ | 108,900 | | $ | 49,500 |

| (1) | Closing price of our Common Stock at fiscal year-end minus the exercise price. The fair market value of our Common Stock at the close of business on December 31, 2005, was $6.36. |

14

2006 Cash Bonus Plan

In February 2006, our Board of Directors, upon recommendation of the Board’s Compensation Committee (“Compensation Committee”), adopted a cash bonus plan (“Bonus Plan”) pursuant to which our participating executive officers and employees will be eligible to earn cash bonus compensation based on 2006 company and individual performance. The terms of the Bonus Plan are not contained in a formal written document.

A summary of the material terms of the Bonus Plan are as follows:

| | • | | Under the Bonus Plan, participating employees may be eligible to receive all or a portion of a target bonus expressed as a percentage of their respective base salaries. The target bonus of our Chief Executive Officer is 50% of his base salary and the other participating executive officers’ target bonuses are between 30% and 35% of their respective annual base salaries. |

| | • | | Upon recommendation of the Compensation Committee, the Board of Directors, at its discretion, will approve the amount of the total funding of the Bonus Plan based on 2006 company performance which will take into account our accomplishment of the following goals: achieving certain 2006 financial targets approved by the Board, advancing the development and commercialization of certain of our product candidates as determined by the Board, and acquiring, licensing or developing a new product candidate for our pipeline. Achievement of each goal is given a certain percentage weight toward funding of the Bonus Plan with the potential of decreased funding for underachievement and increased funding for overachievement of our 2006 financial goal. |

| | • | | The Compensation Committee will evaluate the Chief Executive Officer’s individual performance for 2006 and will submit to the Board the Compensation Committee’s recommendation regarding the amount of the cash bonus payable to the Chief Executive Officer under the Bonus Plan. The Compensation Committee’s recommendation will be based upon 2006 company performance and such other relevant factors considered in the discretion of the Compensation Committee. The Board shall have the final authority to approve the Compensation Committee’s recommendation regarding the amount of the cash bonus payable to the Chief Executive Officer under the Bonus Plan. |

| | • | | The Chief Executive Officer will evaluate each participating executive officer’s 2006 performance and will submit to the Compensation Committee his recommendations regarding the amount of the cash bonus payable to each such executive officer. The Chief Executive Officer’s recommendations will be based upon the Chief Executive Officer’s assessment of each executive officer’s individual performance for 2006 and other relevant factors considered in the discretion of the Chief Executive Officer. The Compensation Committee shall have the final authority to approve the Chief Executive Officer’s recommendations regarding the amount of the cash bonus payable to each executive officer under the Bonus Plan. |

Employment and Change in Control Agreements

Executive Employment Agreements with Each of Vicente Anido, Jr. Ph.D., Marvin J. Garrett, Lisa R. Grillone, Ph.D., Kathleen McGinley, Kirk McMullin and Thomas A. Mitro

We have entered into executive employment agreements (“Executive Employment Agreements”) with our President and Chief Executive Officer, Vicente Anido, Jr. Ph.D. and each of the following officers of the Company: Marvin J. Garrett, Lisa R. Grillone, Ph.D., Kathleen McGinley, Kirk McMullin and Thomas A. Mitro. Each Executive Employment Agreement provides for an annual base salary and eligibility to receive an annual target bonus and equity awards. Annual adjustments to base salary, determination of bonuses and equity awards are at the discretion of our Board of Directors, with respect to Dr. Anido, and the Board’s Compensation Committee, with respect to the other officers.

Each officer’s employment may be terminated at any time with or without cause, or by reason of death or disability, or each officer may voluntarily resign at any time with or without good reason.

15

In the event the officer’s employment is terminated by us without cause absent a change in control of ISTA, we will provide the officer with the following severance compensation and benefits: (a) a lump sum severance payment, less legally required withholdings, in an amount equal to twelve months base salary with respect to Dr. Anido, and nine months base salary with respect to the other officers; (b) health insurance premiums payable by us for continued health insurance coverage for such officer and all then insured dependents for a period of up to twelve months with respect to Dr. Anido, and up to nine months with respect to the other officers, (provided such officer makes a timely election to continue such coverage under COBRA, and provided further that, our obligation to pay the monthly health insurance premiums for continued group medical insurance will end when such officer becomes eligible for health insurance with a new employer); and (c) outplacement services for one year, at our expense not to exceed $25,000, with a nationally recognized service selected by ISTA.

In the event of a change in control of ISTA and if within twenty-four months following such change in control the officer’s employment is terminated by us without cause or such officer resigns for good reason within sixty days of the event forming the basis for such good reason termination, then we will provide the officer with severance compensation and benefits consisting of: (a) a lump sum severance payment, less legally required withholdings, in an amount equal to (i) with respect to Dr. Anido, twenty-four months base salary and two times the target bonus to be earned for the year in which termination occurs or two times the bonus amount in the prior year, whichever is greater, or (ii) with respect to the other officers, twelve months base salary and one times the target bonus to be earned for the year in which termination occurs or one times the bonus amount in the prior year, whichever is greater; (b) health insurance premiums payable by us for continued health insurance coverage for such officer and all then insured dependents for a period of up to twenty-four months with respect to Dr. Anido and twelve months with respect to all other officers (provided such officer makes a timely election to continue such coverage under COBRA, and provided further that, our obligation to pay the monthly health insurance premiums for continued group medical insurance will end when such officer becomes eligible for health insurance with a new employer); (c) outplacement services for one year, at our expense not to exceed $25,000, with a nationally recognized service selected by us; and (d) any unvested options, restricted shares or other equity based awards then held by such officer will become fully vested and, with respect to options, immediately exercisable, as of the date of termination.

Employment Agreement and Change of Control Severance Agreement with Lauren P. Silvernail

We have also entered into an employment agreement with Lauren P. Silvernail. Mrs. Silvernail’s employment agreement sets forth her compensation arrangements, including her initial annual base salary and initial option grant. Mrs. Silvernail is also entitled to a performance bonus of up to 35% of her annual base salary. In the event of termination of employment other than voluntarily or for cause, Mrs. Silvernail will receive six months of base salary as severance; provided that, in the event such termination occurs after a “change of control” of ISTA, Mrs. Silvernail will receive the benefits discussed in the paragraph below.

We have entered into a change of control severance agreement with Mrs. Silvernail. Such agreement provides that if Mrs. Silvernail’s employment is terminated as a result of an “involuntary termination” within 24 months after a “change of control,” then she will be entitled to nine months of base salary and healthcare related benefits and a pro rata portion of her performance bonus based upon the number of months that she was employed during the year of termination. In addition, all options to purchase our common stock held by Mrs. Silvernail shall vest in full upon a “change of control” regardless of whether she is terminated, and all shares of stock subject to a right of repurchase by the Company (or its successor) that were purchased prior to the change of control shall have such right of repurchase lapse with respect to all of such shares.

16

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Notwithstanding anything to the contrary in any of our previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings with the Securities and Exchange Commission, in whole or in part, the foregoing Compensation Committee Report shall not be “soliciting material” or “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any such filing.

The Compensation Committee of the Board of Directors, comprising three non-employee directors, oversees our executive compensation programs. These programs include base salary for executive officers and both annual and long-term incentive compensation programs. Our compensation programs are designed to provide a competitive level of total compensation and include incentive and equity ownership opportunities linked to our performance and stockholder return.

Compensation Philosophy. Our overall executive compensation philosophy is based on a series of guiding principles derived from our values, business strategy, and management requirements. These principles are summarized as follows:

| | • | | Provide competitive levels of total compensation which will enable us to attract and retain the best possible executive talent; |

| | • | | Motivate executives to achieve optimum performance for us; |

| | • | | Align the financial interest of executives and stockholders through equity-based plans; and |

| | • | | Provide a total compensation program that recognizes individual contributions as well as overall business results. |

Compensation Program. The Compensation Committee is responsible for reviewing and recommending to the Board of Directors the compensation and benefits of our Chief Executive Officer and for approving the compensation and benefits of our other executive officers. In addition, the Compensation Committee sets our executive compensation guidelines and reviews, approves and evaluates our executive compensation plans, policies and programs. The Compensation Committee is also responsible for the administration of our 2004 Performance Incentive Plan, which provides for the grant of stock options, restricted stock awards and performance shares to qualified employees, officers, directors, consultants and other service providers. There are two major components to our executive compensation: base salary and potential cash bonus, as well as potential long-term compensation in the form of equity awards, which may include stock options and shares of restricted stock. The Compensation Committee considers the total current and potential long-term compensation of each executive officer in recommending and approving each element of compensation.

1.Base Salary. In recommending compensation levels for our Chief Executive Officer or setting compensation levels for our other executive officers, the Compensation Committee reviews competitive information relating to compensation levels for comparable positions at pharmaceutical and other life sciences companies. In addition, the Compensation Committee may, from time to time, hire compensation and benefit consultants to assist in developing and reviewing overall salary strategies. Individual executive officer base and potential bonus compensation may vary based on time in position, assessment of individual performance, salary relative to internal and external equity and critical nature of the position relative to our success.

2. Long-Term Incentives. Our 2004 Performance Incentive Plan provides for the grant of stock options, restricted stock awards and performance shares to qualified employees and officers. Equity awards, which may include stock options and restricted stock grants, are provided to our executive officers and other employees both as a reward for past individual and corporate performance and as an incentive for future performance. The Compensation Committee believes that stock-based performance compensation arrangements are essential in aligning the interests of management and the stockholders in enhancing the value of our equity.

17

2005 Compensation for the Chief Executive Officer. In recommending Dr. Anido’s salary for 2005 for Board approval, the Compensation Committee considered competitive compensation data for chief executive officers and presidents of similar companies within the life sciences industry, taking into account Dr. Anido’s experience and knowledge. Based upon this review, the Compensation Committee found that Dr. Anido’s total compensation (and, in the case of severance and change-in-control scenarios, the potential payouts) in the aggregate to be reasonable and not excessive. Dr. Anido’s annual salary for 2005 was $409,019.

Section 162(m) of the Internal Revenue Code Limitations on Executive Compensation. Section 162(m) of the United States Internal Revenue Code of 1986, as amended, (the “Code”) may limit our ability to deduct for United States federal income tax purposes compensation in excess of $1,000,000 paid to the our Chief Executive Officer and our four other highest paid executive officers in any one fiscal year. None of our executive officers received any such compensation in excess of this limit during fiscal 2005.

Section 162(m) of the Code places limits on the deductibility for United States federal income tax purposes of compensation paid to certain of our executive officers. In order to preserve our ability to deduct the compensation income associated with equity awards granted to such person, for the purposes of Section 162(m) of the Code, the 2004 Performance Incentive Plan provides that no employee may be granted, in any of one calendar year, options relating to more than 400,000 shares of common stock and restricted shares and performance shares relating to more than 100,000 shares of common stock. In addition, the 2004 Performance Incentive Plan provides that in connection with an employee’s initial employment, the employee may be granted options relating to up to 800,000 shares of common stock and restricted shares and performance shares relating to up to 200,000 shares of common stock. To the extent grants under the 2004 Performance Incentive Plan are in excess of these limitations, such excess shall not be exempt from the deductibility limits of Section 162(m) of the Code.

Respectfully submitted,

Benjamin F. McGraw III, Pharm.D., Chair

Kathleen D. LaPorte

Dean J. Mitchell

18

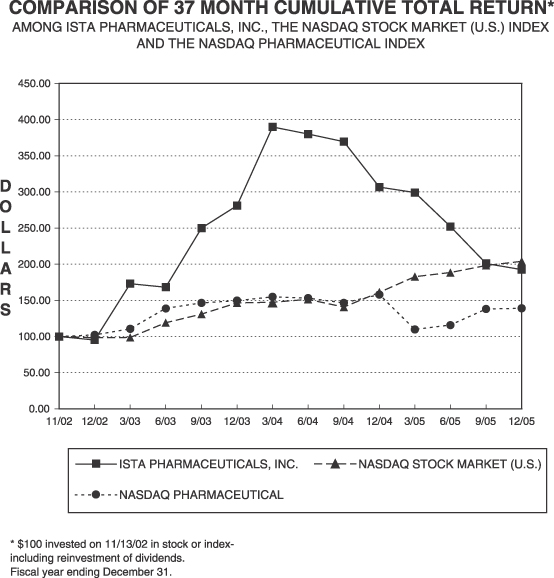

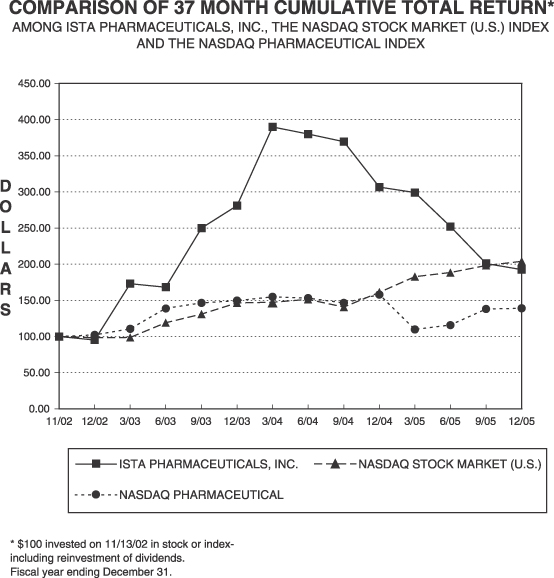

STOCK PERFORMANCE GRAPH

The following graph compares our total cumulative stockholder return as compared to The Nasdaq Global Market and U.S. index (“Nasdaq U.S. Index”) and the Nasdaq Pharmaceutical Index for the period beginning on August 22, 2000, our first day of trading after our initial public offering, and ending on December 31, 2005. Total stockholder return assumes $100.00 invested at the beginning of the period in our common stock, the stocks represented by the Nasdaq U.S. Index and the Nasdaq Pharmaceutical Index, respectively. Total return assumes reinvestment of dividends; we have paid no dividends on our common stock.

19

Notwithstanding anything to the contrary in any of our previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings with the Securities and Exchange Commission, in whole or in part, the material in these performance graphs shall not be “soliciting material” or “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any such filing.

20

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has elected to engage Ernst & Young LLP, independent registered public accounting firm, to audit our consolidated financial statements for the fiscal year ending December 31, 2006.

Although we are not required to submit the selection of independent registered public accountants for shareholder approval, if the shareholders do not ratify this selection, the Audit Committee will reconsider its selection of Ernst & Young LLP. Even if the selection is ratified, our Audit Committee may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that the change would be in the best interests of ISTA.

Fees billed to us by Ernst & Young LLP during the Fiscal Year Ended December 31, 2005 and December 31, 2004.

The following is a summary of the fees billed to ISTA by Ernst & Young LLP for professional services rendered for the fiscal years ended December 31, 2005 and December 31, 2004:

| | | | | | |

Fee Category | | Fiscal

2005

Fees | | Fiscal

2004

Fees |

Audit Fees | | $ | 367,449 | | $ | 383,068 |

Audit Related Fees | | | — | | | 3,575 |

Tax Fees | | | 24,059 | | | 12,000 |

All Other Fees | | | — | | | — |

| | | | | | |

Total Fees | | $ | 391,508 | | $ | 398,643 |

| | | | | | |

Audit Fees. We paid Ernst & Young LLP fees in the aggregate of (i) $157,161 and $114,211 for the fiscal years ended December 31, 2005 and December 31, 2004, respectively, for professional services rendered for the audits of our annual financial statements, (ii) $146,409 and $143,259 for the fiscal years ended December 31, 2005 and December 31, 2004, respectively, for the audits of management’s assessment and effectiveness of internal control over financial reporting, and (iii) $56,579 and $37,903 for the fiscal years ended December 31, 2005 and December 31, 2004, respectively for the review of the financial statements included in our quarterly reports on Form 10-Q during the last two fiscal years.

Audit-Related Fees.In addition to fees disclosed under “Audit Fees” above, the aggregate fees for professional services rendered by Ernst & Young LLP for assurance and related services that are reasonably related to the performance of the audit and reviews of our financial statements were $0 and $3,575 for the fiscal years ended December 31, 2005 and December 31, 2004, respectively. These services include consultations concerning financial accounting and reporting standards.

Tax Fees. The aggregate fees for professional services rendered by Ernst & Young LLP for tax compliance, tax planning and tax advice were $24,059 and $12,000 for the fiscal years ended December 31, 2005 and December 31, 2004, respectively. These services include assistance related to state tax incentives.