UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09102

iShares, Inc.

(Exact name of registrant as specified in charter)

c/o: State Street Bank and Trust Company

100 Summer Street, 4th Floor, Boston, MA 02110

(Address of principal executive offices) (Zip code)

The Corporation Trust Incorporated

2405 York Road, Suite 201, Lutherville-Timonium, Maryland 21093

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: October 31, 2021

Date of reporting period: October 31, 2021

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

| OCTOBER 31, 2021 |

2021 Annual Report

| ||

iShares, Inc.

| · | iShares International High Yield Bond ETF | HYXU | Cboe BZX |

| · | iShares J.P. Morgan EM Corporate Bond ETF | CEMB | Cboe BZX |

| · | iShares J.P. Morgan EM High Yield Bond ETF | EMHY | Cboe BZX |

| · | iShares J.P. Morgan EM Local Currency Bond ETF | LEMB | NYSE Arca |

| · | iShares US & Intl High Yield Corp Bond ETF | GHYG | Cboe BZX |

Dear Shareholder,

The 12-month reporting period as of October 31, 2021 was a remarkable period of adaptation and recovery, as the global economy dealt with the implications of the coronavirus (or “COVID-19”) pandemic. The United States began the reporting period as the initial reopening-led economic rebound was beginning to slow. Nonetheless, the economy continued to grow at a solid pace for the reporting period, eventually regaining the output lost from the pandemic. However, a rapid rebound in consumer spending pushed up against supply constraints and led to elevated inflation.

Equity prices rose with the broader economy, as the implementation of mass vaccination campaigns and passage of two additional fiscal stimulus packages further boosted stocks, and many equity indices neared or surpassed all-time highs late in the reporting period. In the United States, returns of small-capitalization stocks, which benefited the most from the resumption of in-person activities, out-paced large-capitalization stocks. International equities also gained, as both developed and emerging markets continued to recover from the effects of the pandemic.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) had fallen sharply prior to the beginning of the reporting period, which meant bonds were priced for extreme risk avoidance and economic disruption. Despite expectations of doom and gloom, the economy expanded rapidly, stoking inflation concerns in early 2021, which led to higher yields and a negative overall return for most U.S. Treasuries. In the corporate bond market, support from the U.S. Federal Reserve (the “Fed”) assuaged credit concerns and led to solid returns for high-yield corporate bonds, outpacing investment-grade corporate bonds.

The Fed remained committed to accommodative monetary policy by maintaining near-zero interest rates and by reiterating that inflation could exceed its 2% target for a sustained period without triggering a rate increase. In response to rising inflation late in the period, the Fed changed its market guidance, raising the possibility of higher rates in 2022 and reducing bond purchasing beginning in late 2021.

Looking ahead, we believe that the global expansion will continue to broaden as Europe and other developed market economies gain momentum, although the Delta variant of the coronavirus remains a threat, particularly in emerging markets. While we expect inflation to remain elevated in the medium-term as the expansion continues, we believe the recent uptick owes more to temporary supply disruptions than a lasting change in fundamentals. The change in Fed policy also means that moderate inflation is less likely to be followed by interest rate hikes that could threaten the economic expansion.

Overall, we favor a moderately positive stance toward risk, with an overweight in equities. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and health care, are particularly attractive in the long-term. U.S. small-capitalization stocks and European equities are likely to benefit from the continuing vaccine-led restart, while Chinese equities stand to gain from a more accommodative monetary and fiscal environment as the Chinese economy slows. We are underweight long-term credit, but inflation-protected U.S. Treasuries, Asian fixed income, and emerging market local-currency bonds offer potential opportunities. We believe that international diversification and a focus on sustainability can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock, Inc.

Rob Kapito

President, BlackRock, Inc.

| Total Returns as of October 31, 2021 | ||||

6-Month | 12-Month | |||

U.S. large cap equities | 10.91% | 42.91% | ||

U.S. small cap equities | 1.85 | 50.80 | ||

International equities | 4.14 | 34.18 | ||

Emerging market equities | (4.87) | 16.96 | ||

3-month Treasury bills | 0.01 | 0.06 | ||

U.S. Treasury securities | 1.59 | (4.77) | ||

U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) | 1.06 | (0.48) | ||

Tax-exempt municipal bonds (S&P Municipal Bond Index) | 0.33 | 2.76 | ||

U.S. high yield bonds | 2.36 | 10.53 | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

Financial Statements | ||||

| 73 | ||||

| 75 | ||||

| 77 | ||||

| 80 | ||||

| 85 | ||||

| 95 | ||||

| 96 | ||||

| 97 | ||||

| 102 | ||||

| 104 | ||||

| 106 | ||||

| 107 | ||||

iShares, Inc.

Global Bond Market Overview

Global investment-grade bonds declined slightly for the 12 months ended October 31, 2021 (“reporting period”). The Bloomberg Global Aggregate Index, a broad measure of global bond market performance, returned -1.24% in U.S. dollar terms for the reporting period.

While the global economy continued its rebound from the impact of the coronavirus pandemic, the recovery was uneven and beset with challenges. The creation of multiple COVID-19 vaccines and the implementation of vaccination programs globally helped to mitigate the pandemic’s impact and led to the lifting of restrictions in many countries. However, while nearly half of the world’s population received at least one vaccine dose by the end of the reporting period, vaccine distribution varied substantially. The spread of the highly contagious Delta variant led to swift case increases in some areas, causing renewed restrictions and constraining global growth.

Bond performance differed by type, but in general corporate bonds gained more than government bonds, and lower-rated bonds gained more than higher-rated bonds. The improving economic environment and vaccination progress led to investor optimism about the lower-rated segments of the market. However, a notable rise in global inflation pressured bonds, which typically lose value in an inflationary environment.

Bonds in the U.S. established these global patterns, as corporate bonds, particularly high-yield bonds, posted solid returns, backed by strong investor demand for yield, while U.S. Treasuries declined, largely due to rising inflation. Bond issuance was high by historical standards, as corporations were eager to take advantage of low borrowing costs, while the federal government issued debt to finance stimulus and other spending. The U.S. Federal Reserve Bank (“Fed”) continued to keep short-term interest rates at near-zero levels and maintained a significant bond-buying program for U.S. Treasuries and mortgage-backed securities, although it discontinued its corporate bond purchase program. The Fed indicated that it would begin slowing its bond buying activities late in 2021, and their forecast showed that an interest rate increase is possible in 2022. However, the improving employment environment and a sharp rise in inflation led investors to anticipate a more accelerated tightening of monetary policy. Trading activity showed that investors view multiple interest rate increases as probable in 2022.

European bond prices declined overall, as supply chain frictions and increasing commodities prices, particularly for energy commodities, led to the highest Eurozone inflation rate in 13 years. In response, the European Central Bank (“ECB”) slowed the pace of its bond purchases, while keeping its benchmark interest rate at 0%. The E.U. issued €20 billion in common European bonds to partially finance its pandemic recovery fund, attracting high investor interest. Bond prices also declined in the U.K. amid a relatively early vaccination push and robust economic recovery. While the Bank of England kept interest rates at record lows, it signaled that it would soon raise interest rates to counter growing inflation.

In contrast, bonds in the Asia/Pacific region posted a solid gain overall, although gains were mostly concentrated in corporate bonds, particularly the lower-rated segment of the market. Japanese government bonds were nearly flat, as inflation concerns were much less prominent in Japan compared to other regions, and the Bank of Japan showed no signs of tightening monetary policy. Emerging market bonds also advanced, benefiting from higher yields compared with developed economies, as investors sought income in a low interest rate environment. However, concerns late in the reporting period surrounding China’s highly indebted property companies weighed on returns of some emerging market bonds.

| 4 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

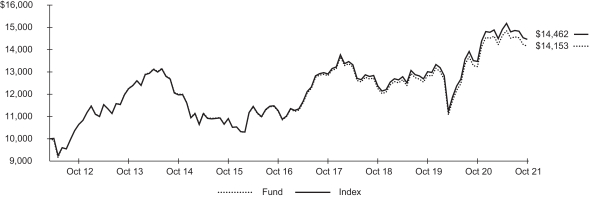

| Fund Summary as of October 31, 2021 | iShares® International High Yield Bond ETF |

Investment Objective

The iShares International High Yield Bond ETF (the “Fund”) seeks to track the investment results of an index composed of euro, British pound sterling and Canadian dollar-denominated, high yield corporate bonds, as represented by the Markit iBoxx® Global Developed Markets ex-US High Yield Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception | 1 Year | 5 Years | Since Inception | |||||||||||||||||||||||

Fund NAV | 6.90 | % | 4.72 | % | 3.69 | % | 6.90 | % | 25.94 | % | 41.53 | % | ||||||||||||||||

Fund Market | 6.91 | 4.67 | 3.68 | 6.91 | 25.62 | 41.36 | ||||||||||||||||||||||

Index | 7.34 | 5.12 | 3.93 | 7.34 | 28.35 | 44.62 | ||||||||||||||||||||||

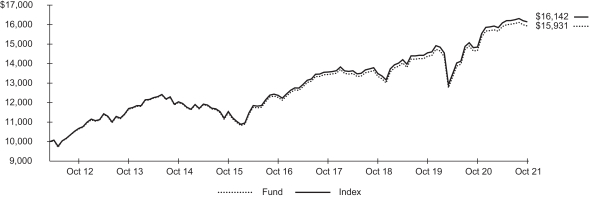

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/3/12. The first day of secondary market trading was 4/3/12.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 15 for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||

| Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Annualized Expense Ratio | ||||||||||||||||||||||||

| $ | 1,000.00 | $ | 967.30 | $ | 1.98 | $ | 1,000.00 | $ | 1,023.20 | $ | 2.04 | 0.40 | % | |||||||||||||||||

| (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 15 for more information. |

F U N D S U M M A R Y | 5 |

| Fund Summary as of October 31, 2021 (continued) | iShares® International High Yield Bond ETF |

Portfolio Management Commentary

International high-yield bonds advanced strongly during the reporting period, supported by accommodative monetary policies from many central banks. Investor demand for higher yielding debt was strong despite investment grade corporate yields (which move inversely to prices) declining to historically low levels. Toward the end of the reporting period, concerns about rising inflation and investors’ anticipation of tightening monetary policies eroded part of the Index’s advance.

From a country perspective, euro-denominated, high-yield corporate bonds contributed the most to the Index’s return. The ECB implemented a program purchasing higher quality corporate debt, leading investors to lower quality bonds, driving down yields, which in some cases were negative. In France, despite concerns about the effects of the Delta variant of COVID-19, the country’s economy grew robustly, as widespread COVID-19 vaccination led to rising consumer spending. High yield corporate bonds in the U.K. also benefited from a successful COVID-19 vaccine rollout, as well as rising demand as the economy reopened. Amid the economic recovery, companies that issued high yield bonds benefited from investor optimism that reduced restrictions, especially for travel, would help restore revenues.

In the U.S., corporate bond yields declined to record lows due to strong corporate balance sheets combined with robust investor demand. Bond issuance reached historically high levels as companies sought to capitalize on rising investor demand to shore up their balance sheets.

From a bond quality perspective, higher rated bonds contributed more to the Index’s performance than lower rated bonds. Bonds rated Ba and B, which represented approximately 52% and 22% of the Index on average, respectively, during the reporting period, contributed the most to the Index’s return.

Portfolio Information

ALLOCATION BY CREDIT QUALITY

| Moody’s Credit Rating* | | Percent of Total Investments | (a) | |

Baa | 5.0 | % | ||

Ba | 52.5 | |||

B | 22.4 | |||

Caa | 6.7 | |||

Ba3u | 0.2 | |||

Not Rated | 13.2 |

TEN LARGEST GEOGRAPHIC ALLOCATION

| Country/Geographic Region | | Percent of Total Investments | (a) | |

Italy | 20.7 | % | ||

United States | 15.3 | |||

France | 11.7 | |||

United Kingdom | 11.1 | |||

Germany | 10.0 | |||

Spain | 7.1 | |||

Luxembourg | 3.9 | |||

Sweden | 3.4 | |||

Netherlands | 2.8 | |||

Canada | 2.3 |

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| 6 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

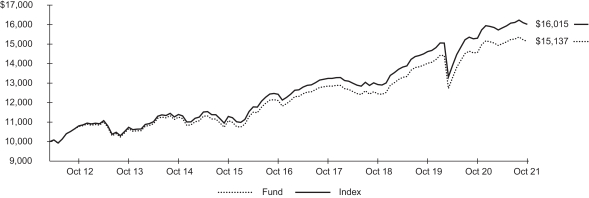

| Fund Summary as of October 31, 2021 | iShares® J.P. Morgan EM Corporate Bond ETF |

Investment Objective

The iShares J.P. Morgan EM Corporate Bond ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. dollar-denominated, emerging market corporate bonds, as represented by the J.P. Morgan CEMBI Broad Diversified Core Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception | 1 Year | 5 Years | Since Inception | |||||||||||||||||||||||

Fund NAV | 3.88 | % | 4.57 | % | 4.44 | % | 3.88 | % | 25.02 | % | 51.37 | % | ||||||||||||||||

Fund Market | 4.16 | 4.55 | 4.48 | 4.16 | 24.89 | 51.90 | ||||||||||||||||||||||

Index | 4.64 | 5.20 | 5.06 | 4.64 | 28.86 | 60.15 | ||||||||||||||||||||||

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/17/12. The first day of secondary market trading was 4/19/12.

Index Performance through May 31, 2017 reflects the performance of the Morningstar® Emerging Markets Corporate Bond IndexSM. Index performance beginning on June 1, 2017 reflects the performance of the J.P. Morgan CEMBI Broad Diversified Core Index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 15 for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||

| Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Annualized Expense Ratio | ||||||||||||||||||||||||

| $ | 1,000.00 | $ | 1,007.60 | $ | 2.53 | $ | 1,000.00 | $ | 1,022.70 | $ | 2.55 | 0.50 | % | |||||||||||||||||

| (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 15 for more information. |

F U N D S U M M A R Y | 7 |

| Fund Summary as of October 31, 2021 (continued) | iShares® J.P. Morgan EM Corporate Bond ETF |

Portfolio Management Commentary

Emerging market high-yield bonds advanced for the reporting period, benefiting from investors’ search for yield in a low interest rate environment and rising energy prices. Brazilian bonds contributed the most to the Index’s return. High and rising inflation led to a series of interest rate increases by the Central Bank of Brazil, but annual inflation still registered 10.67% as of October 2021. Nevertheless, the bonds of a large, state-owned oil company posted gains, as rising oil and gas prices drove strong cash flows.

Turkish bonds also contributed to the Index’s return, as investors were enticed by extremely high yields despite the country’s high inflation rate and accommodative monetary policy. Bonds issued by Turkish banks generally benefited from the rebound in economic growth, as earnings rose substantially during the coronavirus pandemic due to a steep increase in lending within the country and continued demand for banking services.

Argentinian bonds were strong contributors to the Index’s return, as the country moved from a sharp economic contraction into expansion. In particular, bonds issued by a state-run oil company benefited from rising revenue due to higher oil and gas prices. Mexican corporate bonds also contributed to the Index’s return despite higher interest rates and rising inflation, as bonds issued by a wide variety of Mexican companies advanced due to investors’ increasing appetite for risk and the country’s economic rebound.

On the downside, Chinese bonds detracted from the Index’s performance, as investors became concerned about potential defaults on debt issued by two large, heavily indebted real estate developers. From a credit quality perspective, higher-yielding, lower-rated corporate bonds contributed the most to the Index’s return for the reporting period.

Portfolio Information

ALLOCATION BY CREDIT QUALITY

| Moody’s Credit Rating* | | Percent of Total Investments | (a) | |

Aa | 5.2 | % | ||

A | 16.3 | |||

Baa | 39.2 | |||

Ba | 11.9 | |||

B | 7.4 | |||

Caa | 1.9 | |||

C | 0.1 | |||

Not Rated | 18.0 |

TEN LARGEST GEOGRAPHIC ALLOCATION

| Country/Geographic Region | | Percent of Total Investments | (a) | |

China | 7.7 | % | ||

Brazil | 5.5 | |||

Mexico | 5.2 | |||

Hong Kong | 4.9 | |||

India | 4.6 | |||

United Arab Emirates | 4.5 | |||

Russia | 4.5 | |||

Saudi Arabia | 4.5 | |||

South Korea | 4.2 | |||

Singapore | 4.2 |

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| 8 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

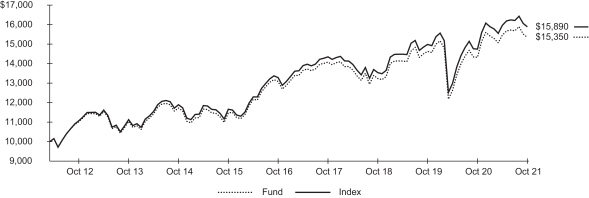

| Fund Summary as of October 31, 2021 | iShares® J.P. Morgan EM High Yield Bond ETF |

Investment Objective

The iShares J.P. Morgan EM High Yield Bond ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. dollar-denominated, emerging market high yield sovereign and corporate bonds, as represented by the J.P. Morgan USD Emerging Markets High Yield Bond Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception | 1 Year | 5 Years | Since Inception | |||||||||||||||||||||||

Fund NAV | 7.16 | % | 3.25 | % | 4.57 | % | 7.16 | % | 17.33 | % | 53.50 | % | ||||||||||||||||

Fund Market | 6.90 | 3.25 | 4.58 | 6.90 | 17.31 | 53.64 | ||||||||||||||||||||||

Index | 7.77 | 3.65 | 4.96 | 7.77 | 19.65 | 58.90 | ||||||||||||||||||||||

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/3/12. The first day of secondary market trading was 4/3/12.

Index performance through March 01, 2020 reflects the performance of the Morningstar Emerging Markets High Yield Bond IndexSM which terminated on April 01, 2020. Index performance beginning on March 02, 2020 reflects the performance of the J.P. Morgan USD Emerging Markets High Yield Bond Index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 15 for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||

| Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Annualized Expense Ratio | ||||||||||||||||||||||||

| $ | 1,000.00 | $ | 992.30 | $ | 2.51 | $ | 1,000.00 | $ | 1,022.70 | $ | 2.55 | 0.50 | % | |||||||||||||||||

| (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 15 for more information. |

F U N D S U M M A R Y | 9 |

| Fund Summary as of October 31, 2021 (continued) | iShares® J.P. Morgan EM High Yield Bond ETF |

Portfolio Management Commentary

Emerging market high-yield bonds posted solid gains for the reporting period, benefiting from investors’ search for yield in the low interest rate environment and rising energy prices. Despite higher interest rates and rising inflation, Mexican bonds were the largest contributors to the Index’s return, largely reflecting the performance of bonds issued by a large, state-owned oil company, which primarily benefited from rising oil and gas prices.

Turkish government bonds, which are rated below investment grade by Moody’s, also contributed to the Index’s performance, as investors were enticed by extremely high yields despite the country’s elevated inflation rate and uncertainty surrounding governance at the Central Bank of the Republic of Turkey. Annual inflation in Turkey rose to 19.89% in October 2021, but the country’s central bank lowered interest rates late in the reporting period, reflecting a divergence from conventional monetary policy. Despite high inflation, Turkey’s growth-oriented monetary policy drove the Turkish lira lower, but relatively high yields ultimately led to the positive performance of Turkish bonds.

Omani bonds were solid contributors to the Index’s return. The Omani government sought to lower its relatively large budget deficit by seeking spending cuts and tax increases amid stronger revenue from rising oil prices. The government also issued an additional $3.25 billion in debt, which was met with strong demand.

South African bonds also contributed to the Index’s return, as interest payments offset a modest increase in 10-year government bond yields (which move inversely to prices). Similarly, the South African rand benefited from record trade and rising demand for the country’s precious metals. On the downside, Chinese bonds detracted from the Index’s performance, as investors became concerned about potential defaults on debt issued by two large, heavily indebted real estate developers.

Portfolio Information

ALLOCATION BY CREDIT QUALITY

| Moody’s Credit Rating* | | Percent of Total Investments | (a) | |

Baa | 12.5 | % | ||

Ba | 36.5 | |||

B | 28.4 | |||

Caa | 4.6 | |||

Ca | 0.3 | |||

C | 0.2 | |||

Not Rated | 17.5 |

TEN LARGEST GEOGRAPHIC ALLOCATION

| Country/Geographic Region | | Percent of Total Investments | (a) | |

Brazil | 15.3 | % | ||

Turkey | 10.6 | |||

Mexico | 7.7 | |||

Colombia | 6.7 | |||

China | 3.9 | |||

Oman | 3.7 | |||

South Africa | 3.7 | |||

Argentina | 3.5 | |||

Egypt | 2.8 | |||

Dominican Republic | 2.8 |

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| 10 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

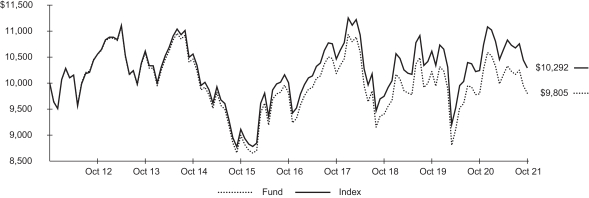

| Fund Summary as of October 31, 2021 | iShares® J.P. Morgan EM Local Currency Bond ETF |

Investment Objective

The iShares J.P. Morgan EM Local Currency Bond ETF (the “Fund”) seeks to track the investment results of an index composed of local currency denominated, emerging market sovereign bonds, as represented by the J.P. Morgan GBI-EM Global Diversified 15% Cap 4.5% Floor Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | 1 Year | 5 Years | 10 Years | |||||||||||||||||||||||

Fund NAV | 0.12 | % | (0.02 | )% | (0.20 | )% | 0.12 | % | (0.09 | )% | (1.95 | )% | ||||||||||||||||

Fund Market | 0.46 | 0.09 | (0.16 | ) | 0.46 | 0.44 | (1.58 | ) | ||||||||||||||||||||

Index | 0.48 | 0.56 | 0.29 | 0.48 | 2.82 | 2.92 | ||||||||||||||||||||||

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 10/18/11. The first day of secondary market trading was 10/20/11.

Index performance through May 31, 2017 reflects the performance of the Bloomberg Emerging Markets Broad Local Currency Bond Index. Index performance beginning on June 1, 2017 reflects the performance of the J.P. Morgan GBI-EM Global Diversified 15% Cap 4.5% Floor Index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 15 for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||

| Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Annualized Expense Ratio | ||||||||||||||||||||||||

| $ | 1,000.00 | $ | 964.60 | $ | 1.49 | $ | 1,000.00 | $ | 1,023.70 | $ | 1.53 | 0.30 | % | |||||||||||||||||

| (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 15 for more information. |

F U N D S U M M A R Y | 11 |

| Fund Summary as of October 31, 2021 (continued) | iShares® J.P. Morgan EM Local Currency Bond ETF |

Portfolio Management Commentary

As represented by the Index, local currency emerging market bonds posted a modest return for the reporting period. Emerging market bonds generally offer higher yields relative to bonds issued by developed market countries. However, gains from interest payments were mostly offset by higher bond yields (which are inversely related to prices), which generally rose amid growth-oriented monetary policy and rising inflation in many countries. The U.S. dollar advanced relative to many local emerging market currencies, as rising U.S. Treasury yields weighed on emerging markets. From a credit quality perspective, higher-rated bonds detracted from the Index’s performance while lower-rated bonds contributed, reflecting demand for higher-yielding investments.

Chinese bonds were the largest contributors to the Index’s return, as interest rates fell and the Chinese yuan strengthened relative to the U.S. dollar. The Chinese economy was one of the first to emerge from the global recession brought on by pandemic-related restrictions, which led to record foreign direct investment and capital flows into Chinese bonds. The comparatively higher yields of Chinese bonds also drove demand from investors. South African bonds also contributed to the Index’s return, as relatively high yields offset a modest increase in interest rates. The South African rand advanced relative to the U.S. dollar amid record trade and rising demand for the country’s precious metals. Indonesian bonds also benefited from high yields and a rising currency.

On the downside, Chilean bonds were the largest detractors from the Index’s return. Rising inflation drove local interest rates higher, while the Chilean peso declined relative to the U.S. dollar. Peruvian bonds also detracted from the Index’s performance. The election of a new president, rising inflation, and the highest COVID-19 mortality rate in the world weighed on the Peruvian sol.

Portfolio Information

ALLOCATION BY CREDIT QUALITY

| Moody’s Credit Rating* | | Percent of Total Investments | (a) | |

Aa | 0.7 | % | ||

A | 5.7 | |||

Baa | 24.0 | |||

Ba | 10.5 | |||

Not Rated | 59.1 |

TEN LARGEST GEOGRAPHIC ALLOCATION

| Country/Geographic Region | | Percent of Total Investments | (a) | |

China | 14.8 | % | ||

Peru | 4.7 | |||

Malaysia | 4.6 | |||

Philippines | 4.6 | |||

Indonesia | 4.6 | |||

Thailand | 4.6 | |||

Russia | 4.6 | |||

Dominican Republic | 4.5 | |||

Poland | 4.5 | |||

Hungary | 4.5 |

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| 12 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of October 31, 2021 | iShares® US & Intl High Yield Corp Bond ETF |

Investment Objective

The iShares US & Intl High Yield Corp Bond ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. dollar, euro, British pound sterling and Canadian dollar-denominated, high yield corporate bonds, as represented by the Markit iBoxx® Global Developed Markets High Yield Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception | 1 Year | 5 Years | Since Inception | |||||||||||||||||||||||

Fund NAV | 8.56 | % | 5.36 | % | 4.98 | % | 8.56 | % | 29.86 | % | 59.31 | % | ||||||||||||||||

Fund Market | 8.63 | 5.30 | 4.98 | 8.63 | 29.48 | 59.37 | ||||||||||||||||||||||

Index | 8.72 | 5.46 | 5.13 | 8.72 | 30.46 | 61.42 | ||||||||||||||||||||||

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 4/3/12. The first day of secondary market trading was 4/5/12.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 15 for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||

| Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Beginning Account Value (05/01/21) | Ending Account Value (10/31/21) | Expenses Paid During the Period (a) | Annualized Expense Ratio | ||||||||||||||||||||||||

| $ | 1,000.00 | $ | 1,001.80 | $ | 2.02 | $ | 1,000.00 | $ | 1,023.20 | $ | 2.04 | 0.40 | % | |||||||||||||||||

| (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 15 for more information. |

F U N D S U M M A R Y | 13 |

| Fund Summary as of October 31, 2021 (continued) | iShares® US & Intl High Yield Corp Bond ETF |

Portfolio Management Commentary

High-yield corporate bonds advanced during the reporting period amid a strong economic recovery from the disruptions of the coronavirus pandemic and elevated investor demand for higher-yield investments in a low interest rate environment. Corporate earnings recovered as economies reopened, pushing the ratio of debt to profits back to pre-pandemic levels, driving investor optimism of credit quality. On the supply side, high-yield bond issuance reached historically high levels as companies sought to capitalize on rising investor demand and lower interest rates to refinance existing, higher-cost debt. Bonds issued to finance mergers and acquisitions further bolstered supply.

Corporate bonds issued by companies in the U.S. led contribution to the Index’s return despite increasing concerns regarding ongoing inflation. High-yield credit spreads, the difference in yield between high-yield bonds and U.S. Treasuries, declined during the reporting period. While the Fed maintained interest rates at historically low levels, high-yield corporate bond yields (which move inversely to prices) declined to record lows due to strong corporate balance sheets combined with strong investor demand.

High-yield corporate bonds in the U.K. were also contributors to the Index’s return. The U.K. benefited from a successful coronavirus vaccine rollout and rising consumer demand as the economy reopened. Canadian corporate bonds similarly showed strength amid economic recovery and strong investor demand, bolstered by strengthening of the Canadian dollar relative to the U.S. dollar. In France, despite concerns about the effects of a new variant of the coronavirus, the country’s economy grew robustly, supported by rising consumer spending. From a bond quality perspective, bonds rated Ba, which represented approximately 49% of the Index on average for the reporting period, contributed the most to the Index’s return, though all bond rating categories were contributors.

Portfolio Information

ALLOCATION BY CREDIT QUALITY

| Moody’s Credit Rating* | | Percent of Total Investments | (a) | |

Baa | 3.8 | % | ||

Ba | 50.0 | |||

B | 32.1 | |||

Caa | 9.5 | |||

Not Rated | 4.6 |

TEN LARGEST GEOGRAPHIC ALLOCATION

| Country/Geographic Region | | Percent of Total Investments | (a) | |

United States | 65.0 | % | ||

Italy | 7.2 | |||

United Kingdom | 5.0 | |||

Germany | 4.0 | |||

France | 3.9 | |||

Canada | 2.9 | |||

Spain | 1.8 | |||

Netherlands | 1.6 | |||

Luxembourg | 1.6 | |||

Israel | 1.2 |

| * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (a) | Excludes money market funds. |

| 14 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined by using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

As a shareholder of your Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested at the beginning of the period (or from the commencement of operations if less than 6 months) and held through the end of the period, is intended to help you understand your ongoing costs (in dollars and cents) of investing in your Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses – The table provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes – The table also provides information about hypothetical account values and hypothetical expenses based on your Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

A B O U T F U N D P E R F O R M A N C E / S H A R E H O L D E R E X P E N S E S | 15 |

October 31, 2021 | iShares® International High Yield Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) | Value | ||||||||||

Corporate Bonds & Notes |

| |||||||||||

| Australia — 0.6% | ||||||||||||

Commerzbank Ag Subordinated, 1.38%, 12/29/31 (Call 09/29/26)(a)(b) | EUR | 100 | $ | 112,459 | ||||||||

Energias De Portugal SA, 1.88%, 03/14/82 | EUR | 100 | 111,761 | |||||||||

Eurobank SA, 2.25%, 03/14/28 | EUR | 100 | 111,405 | |||||||||

Kaixo Bondco Telecom SA, 5.13%, 09/30/29 | EUR | 100 | 114,412 | |||||||||

|

| |||||||||||

|

450,037 |

| ||||||||||

| Austria — 0.2% | ||||||||||||

ams AG, 6.00%, 07/31/25 (Call 07/31/22)(a) | EUR | 100 | 122,037 | |||||||||

|

| |||||||||||

| Belgium — 0.2% | ||||||||||||

Telenet Finance Luxembourg Notes Sarl, 3.50%, 03/01/28 (Call 12/01/22)(a) | EUR | 100 | 118,581 | |||||||||

|

| |||||||||||

| Canada — 2.2% | ||||||||||||

ADLER Group SA, 2.25%, 01/14/29 | EUR | 200 | 197,589 | |||||||||

Air Canada, 4.63%, 08/15/29 (Call 02/15/26)(c) | CAD | 325 | 261,128 | |||||||||

Brookfield Property Finance ULC, 3.93%, 08/24/25 (Call 07/24/25) | CAD | 100 | 81,601 | |||||||||

Iccrea Banca SpA, 2.25%, 10/20/25 | EUR | 100 | 117,975 | |||||||||

Mattamy Group Corp., 4.63%, 03/01/28 | CAD | 50 | 41,011 | |||||||||

Parkland Corp./Canada | ||||||||||||

3.88%, 06/16/26 (Call 06/16/23)(c) | CAD | 100 | 80,973 | |||||||||

4.38%, 03/26/29 (Call 03/26/24) | CAD | 100 | 81,234 | |||||||||

Parts Europe SA, 6.50%, 07/16/25 | EUR | 100 | 120,090 | �� | ||||||||

Southern Pacific Resource Corp., 8.75%, 01/25/18(c)(d)(e)(f) | CAD | 50 | — | |||||||||

Videotron Ltd. | ||||||||||||

3.13%, 01/15/31 (Call 01/15/26) | CAD | 50 | 37,337 | |||||||||

3.63%, 06/15/28 (Call 06/15/24)(c) | CAD | 150 | 119,880 | |||||||||

4.50%, 01/15/30 (Call 10/15/24) | CAD | 150 | 124,232 | |||||||||

5.63%, 06/15/25 (Call 03/15/25) | CAD | 50 | 43,633 | |||||||||

5.75%, 01/15/26 (Call 09/15/22)(a) | CAD | 50 | 41,268 | |||||||||

VZ Vendor Financing II BV, 2.88%, 01/15/29 | EUR | 200 | 225,546 | |||||||||

|

| |||||||||||

|

1,573,497 |

| ||||||||||

| Cayman Islands — 0.2% | ||||||||||||

UPCB Finance VII Ltd., 3.63%, 06/15/29 | EUR | 100 | 117,628 | |||||||||

|

| |||||||||||

| Cyprus — 0.2% | ||||||||||||

Bank of Cyprus PCL, 2.50%, 06/24/27 | EUR | 100 | 112,472 | |||||||||

|

| |||||||||||

| Denmark — 0.5% | ||||||||||||

DKT Finance ApS, 7.00%, 06/17/23 | EUR | 200 | 235,035 | |||||||||

TDC AS, 6.88%, 02/23/23(a) | GBP | 100 | 146,024 | |||||||||

|

| |||||||||||

|

381,059 |

| ||||||||||

| Finland — 1.4% | ||||||||||||

Nokia OYJ | ||||||||||||

2.00%, 03/15/24 (Call 12/15/23)(a) | EUR | 100 | 119,485 | |||||||||

2.00%, 03/11/26 (Call 12/11/25)(a) | EUR | 150 | 180,825 | |||||||||

2.38%, 05/15/25 (Call 02/15/25)(a) | EUR | 200 | 243,367 | |||||||||

Teollisuuden Voima Oyj, 1.38%, 06/23/28 | EUR | 200 | 227,859 | |||||||||

Teollisuuden Voima OYJ, 1.13%, 03/09/26 | EUR | 200 | 230,854 | |||||||||

|

| |||||||||||

|

1,002,390 |

| ||||||||||

| France — 11.4% | ||||||||||||

Accor SA | ||||||||||||

2.50%, 01/25/24(a) | EUR | 100 | 119,983 | |||||||||

3.00%, 02/04/26 (Call 11/04/25)(a) | EUR | 200 | 241,997 | |||||||||

Altice France SA/France | ||||||||||||

2.13%, 02/15/25 (Call 02/15/22)(a) | EUR | 150 | 168,050 | |||||||||

3.38%, 01/15/28 (Call 09/15/22)(a) | EUR | 200 | 221,443 | |||||||||

| Security | Par (000) | Value | ||||||||||

France (continued) | ||||||||||||

4.25%, 10/15/29 (Call 10/15/24)(a) | EUR | 100 | $ | 114,463 | ||||||||

5.88%, 02/01/27 (Call 02/01/22)(a) | EUR | 150 | 181,154 | |||||||||

Banijay Entertainment SASU, 3.50%, 03/01/25 | EUR | 200 | 230,886 | |||||||||

CAB SELAS, 3.38%, 02/01/28 (Call 02/01/24)(a) | EUR | 200 | 229,699 | |||||||||

Casino Guichard Perrachon SA | ||||||||||||

3.58%, 02/07/25 (Call 11/07/24)(a) | EUR | 200 | 213,466 | |||||||||

4.50%, 03/07/24 (Call 12/07/23)(a) | EUR | 100 | 112,668 | |||||||||

4.56%, 01/25/23(a) | EUR | 100 | 115,133 | |||||||||

5.25%, 04/15/27 (Call 04/15/23)(a) | EUR | 100 | 109,518 | |||||||||

Chrome Bidco SASU, Series OCT, 3.50%, 05/31/28 (Call 05/31/24)(a) | EUR | 100 | 115,590 | |||||||||

Chrome Holdco SASU, 5.00%, 05/31/29 | EUR | 100 | 115,455 | |||||||||

Elis SA | ||||||||||||

1.00%, 04/03/25 (Call 01/03/25)(a) | EUR | 100 | 114,668 | |||||||||

1.63%, 04/03/28 (Call 01/03/28)(a) | EUR | 100 | 114,492 | |||||||||

1.75%, 04/11/24 (Call 01/11/24)(a) | EUR | 100 | 118,211 | |||||||||

Elis Sa Co., 1.63%, 04/03/28 (Call 01/03/28)(a) | EUR | 100 | 114,492 | |||||||||

Faurecia SE | ||||||||||||

2.63%, 06/15/25 (Call 11/29/21)(a) | EUR | 250 | 292,135 | |||||||||

3.13%, 06/15/26 (Call 06/15/22)(a) | EUR | 100 | 117,678 | |||||||||

3.75%, 06/15/28 (Call 06/15/23)(a) | EUR | 200 | 239,530 | |||||||||

Iliad Holding SAS | ||||||||||||

5.13%, 10/15/26 (Call 10/15/23)(a) | EUR | 150 | 178,246 | |||||||||

5.63%, 10/15/28 (Call 10/15/24)(a) | EUR | 100 | 119,302 | |||||||||

Kapla Holding SAS, 3.38%, 12/15/26 | EUR | 100 | 114,006 | |||||||||

La Financiere Atalian SASU, 4.00%, 05/15/24 | EUR | 200 | 227,214 | |||||||||

Loxam SAS | ||||||||||||

2.88%, 04/15/26 (Call 04/15/22)(a) | EUR | 100 | 113,568 | |||||||||

3.25%, 01/14/25 (Call 11/08/21)(a) | EUR | 100 | 115,541 | |||||||||

3.50%, 05/03/23 (Call 11/08/21)(a) | EUR | 200 | 230,790 | |||||||||

Orano SA | ||||||||||||

2.75%, 03/08/28 (Call 12/08/27)(a) | EUR | 100 | 119,047 | |||||||||

3.13%, 03/20/23 (Call 12/20/22)(a) | EUR | 100 | 119,287 | |||||||||

3.38%, 04/23/26 (Call 01/23/26)(a) | EUR | 100 | 124,078 | |||||||||

4.88%, 09/23/24 | EUR | 100 | 129,043 | |||||||||

Paprec Holding SA | ||||||||||||

3.50%, 07/01/28 (Call 07/01/24)(a) | EUR | 100 | 115,406 | |||||||||

4.00%, 03/31/25 (Call 11/29/21)(a) | EUR | 100 | 116,943 | |||||||||

Picard Bondco SA, 5.38%, 07/01/27 | EUR | 100 | 113,972 | |||||||||

Picard Groupe SA, 3.88%, 07/01/26 | EUR | 100 | 115,855 | |||||||||

Quatrim SASU, 5.88%, 01/15/24 | EUR | 100 | 118,724 | |||||||||

RCI Banque SA, 2.63%, 02/18/30 | EUR | 200 | 232,099 | |||||||||

Renault SA | ||||||||||||

1.00%, 03/08/23 (Call 12/08/22)(a) | EUR | 100 | 116,456 | |||||||||

1.00%, 04/18/24 (Call 01/18/24)(a) | EUR | 100 | 115,855 | |||||||||

1.00%, 11/28/25 (Call 08/28/25)(a) | EUR | 100 | 115,076 | |||||||||

1.13%, 10/04/27 (Call 07/04/27)(a) | EUR | 100 | 107,873 | |||||||||

1.25%, 06/24/25 (Call 03/24/25)(a) | EUR | 100 | 114,073 | |||||||||

2.00%, 09/28/26 (Call 06/28/26)(a) | EUR | 100 | 114,881 | |||||||||

2.38%, 05/25/26 (Call 02/25/26)(a) | EUR | 200 | 234,395 | |||||||||

2.50%, 04/01/28 (Call 01/01/28)(a) | EUR | 100 | 115,537 | |||||||||

Rexel SA, 2.13%, 06/15/28 (Call 06/15/24)(a) | EUR | 100 | 116,992 | |||||||||

SPCM SA, 2.63%, 02/01/29 (Call 09/15/23)(a) | EUR | 100 | 116,789 | |||||||||

SPIE SA | ||||||||||||

2.63%, 06/18/26 (Call 12/18/25)(a) | EUR | 100 | 119,822 | |||||||||

3.13%, 03/22/24 (Call 09/22/23)(a) | EUR | 100 | 120,720 | |||||||||

| 16 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) October 31, 2021 | iShares® International High Yield Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) | Value | ||||||||||

France (continued) | ||||||||||||

Tereos Finance Groupe I SA | ||||||||||||

4.13%, 06/16/23 (Call 03/16/23)(a) | EUR | 100 | $ | 117,339 | ||||||||

7.50%, 10/30/25 (Call 10/30/22)(a) | EUR | 100 | 124,217 | |||||||||

Valeo | ||||||||||||

0.63%, 01/11/23 (Call 10/11/22)(a) | EUR | 100 | 116,210 | |||||||||

1.50%, 06/18/25 (Call 03/18/25)(a) | EUR | 200 | 236,551 | |||||||||

3.25%, 01/22/24(a) | EUR | 100 | 123,180 | |||||||||

Valeo SA, 1.00%, 08/03/28 (Call 05/03/28)(a) | EUR | 100 | 110,977 | |||||||||

|

| |||||||||||

| 8,140,775 | ||||||||||||

| Germany — 9.8% | ||||||||||||

ADLER Group SA | ||||||||||||

1.50%, 07/26/24 (Call 04/26/24)(a) | EUR | 100 | 106,063 | |||||||||

1.88%, 01/14/26 (Call 10/14/25)(a) | EUR | 100 | 101,716 | |||||||||

3.25%, 08/05/25 (Call 05/05/25)(a) | EUR | 100 | 106,778 | |||||||||

ADLER Real Estate AG | ||||||||||||

1.88%, 04/27/23 (Call 03/27/23)(a) | EUR | 100 | 109,848 | |||||||||

3.00%, 04/27/26 (Call 02/27/26)(a) | EUR | 100 | 108,979 | |||||||||

Bayer AG | ||||||||||||

2.38%, 11/12/79 (Call 02/12/25)(a)(b) | EUR | 200 | 230,868 | |||||||||

3.13%, 11/12/79 (Call 08/12/27)(a)(b) | EUR | 100 | 117,637 | |||||||||

3.75%, 07/01/74 (Call 07/01/24)(a)(b) | EUR | 200 | 241,144 | |||||||||

Bertelsmann SE & Co. KGaA | ||||||||||||

3.00%, 04/23/75 (Call 04/23/23)(a)(b) | EUR | 100 | 118,898 | |||||||||

3.50%, 04/23/75 (Call 04/23/27)(a)(b) | EUR | 100 | 124,631 | |||||||||

Commerzbank AG | ||||||||||||

4.00%, 03/23/26(a) | EUR | 200 | 255,468 | |||||||||

4.00%, 03/30/27(a) | EUR | 100 | 129,417 | |||||||||

4.00%, 12/05/30 (Call 09/05/25)(a)(b) | EUR | 100 | 125,266 | |||||||||

Deutsche Bank AG | ||||||||||||

2.75%, 02/17/25(a) | EUR | 125 | 152,227 | |||||||||

4.50%, 05/19/26(a) | EUR | 200 | 264,469 | |||||||||

5.63%, 05/19/31 (Call 02/19/26)(a)(b) | EUR | 200 | 271,273 | |||||||||

Deutsche Lufthansa AG | ||||||||||||

0.25%, 09/06/24 | EUR | 50 | 56,212 | |||||||||

3.00%, 05/29/26 (Call 02/28/26)(a) | EUR | 300 | 352,485 | |||||||||

3.50%, 07/14/29 (Call 04/14/29)(a) | EUR | 100 | 116,892 | |||||||||

Evonik Industries AG, 1.38%, 09/02/81 | EUR | 100 | 115,447 | |||||||||

Gruenenthal GMBH, 4.13%, 05/15/28 | EUR | 150 | 179,387 | |||||||||

K+S AG, 2.63%, 04/06/23 | EUR | 100 | 117,246 | |||||||||

LANXESS AG, 4.50%, 12/06/76 | EUR | 75 | 91,496 | |||||||||

Nidda BondCo GmbH, 5.00%, 09/30/25 | EUR | 200 | 227,854 | |||||||||

Nidda Healthcare Holding GmbH, 3.50%, 09/30/24 (Call 11/08/21)(a) | EUR | 200 | 227,556 | |||||||||

Schaeffler AG | ||||||||||||

1.88%, 03/26/24 (Call 12/26/23)(a) | EUR | 100 | 118,144 | |||||||||

2.75%, 10/12/25 (Call 07/12/25)(a) | EUR | 200 | 244,676 | |||||||||

3.38%, 10/12/28 (Call 07/12/28)(a) | EUR | 100 | 127,737 | |||||||||

Techem Verwaltungsgesellschaft 674 mbH, 6.00%, 07/30/26 (Call 11/08/21)(a) | EUR | 88 | 104,160 | |||||||||

Techem Verwaltungsgesellschaft 675 mbH, 2.00%, 07/15/25 (Call 01/15/22)(a) | EUR | 150 | 169,879 | |||||||||

thyssenkrupp AG | ||||||||||||

1.88%, 03/06/23 (Call 02/06/23)(a) | | EUR EUR | | | 250 300 | | | 289,582 351,763 | | |||

TK Elevator Midco GmbH, 4.38%, 07/15/27 | EUR | 100 | 118,884 | |||||||||

Vertical Holdco GmbH, 6.63%, 07/15/28 | EUR | 180 | 217,406 | |||||||||

ZF Europe Finance BV | ||||||||||||

2.00%, 02/23/26 (Call 12/23/25)(a) | EUR | 200 | 231,586 | |||||||||

2.50%, 10/23/27 (Call 07/23/27)(a) | EUR | 100 | 116,896 | |||||||||

| Security | Par (000) | Value | ||||||||||

Germany (continued) | ||||||||||||

ZF Finance GmbH | ||||||||||||

2.00%, 05/06/27 (Call 02/06/27)(a) | EUR | 100 | $ | 115,514 | ||||||||

2.25%, 05/03/28 (Call 02/03/28)(a) | EUR | 100 | 115,054 | |||||||||

2.75%, 05/25/27 (Call 02/25/27)(a) | EUR | 100 | 118,104 | |||||||||

3.00%, 09/21/25 (Call 06/21/25)(a) | EUR | 100 | 121,056 | |||||||||

3.75%, 09/21/28 (Call 06/21/28)(a) | EUR | 100 | 124,745 | |||||||||

ZF North America Capital Inc., 2.75%, 04/27/23(a) | EUR | 200 | 238,019 | |||||||||

|

| |||||||||||

|

6,972,462 |

| ||||||||||

| Greece — 1.0% | ||||||||||||

Alpha Bank SA, 2.50%, 03/23/28 | EUR | 100 | 111,218 | |||||||||

Eurobank SA, 2.00%, 05/05/27 | EUR | 100 | 111,533 | |||||||||

Mytilineos SA, 2.25%, 10/30/26(a) | EUR | 100 | 116,327 | |||||||||

Piraeus Financial Holdings SA, 9.75%, 06/26/29 (Call 06/26/24)(a)(b) | EUR | 100 | 125,828 | |||||||||

Public Power Corp. SA | ||||||||||||

3.38%, 07/31/28 (Call 07/31/24)(a) | EUR | 100 | 117,477 | |||||||||

3.88%, 03/30/26 (Call 03/30/23)(a) | EUR | 100 | 119,116 | |||||||||

|

| |||||||||||

|

701,499 |

| ||||||||||

| Ireland — 1.2% | ||||||||||||

AIB Group PLC | ||||||||||||

1.88%, 11/19/29 (Call 11/19/24)(a)(b) | EUR | 200 | 235,558 | |||||||||

2.88%, 05/30/31 (Call 05/30/26)(a)(b) | EUR | 100 | 121,937 | |||||||||

Bank of Ireland Group PLC | ||||||||||||

1.38%, 08/11/31 (Call 05/11/26)(a)(b) | EUR | 100 | 114,144 | |||||||||

2.38%, 10/14/29 (Call 10/14/24)(a)(b) | EUR | 100 | 119,363 | |||||||||

eircom Finance DAC | ||||||||||||

1.75%, 11/01/24 (Call 11/29/21)(a) | EUR | 100 | 115,634 | |||||||||

3.50%, 05/15/26 (Call 05/15/22)(a) | EUR | 100 | 117,293 | |||||||||

|

| |||||||||||

|

823,929 |

| ||||||||||

| Israel — 1.5% | ||||||||||||

Teva Pharmaceutical Finance Netherlands II BV | ||||||||||||

1.13%, 10/15/24(a) | EUR | 300 | 334,097 | |||||||||

1.25%, 03/31/23 (Call 12/31/22)(a) | EUR | 200 | 230,074 | |||||||||

1.63%, 10/15/28(a) | EUR | 150 | 155,116 | |||||||||

3.25%, 04/15/22 (Call 01/15/22) | EUR | 100 | 116,001 | |||||||||

4.50%, 03/01/25 (Call 12/01/24) | EUR | 200 | 237,623 | |||||||||

|

| |||||||||||

|

1,072,911 |

| ||||||||||

| Italy — 20.3% | ||||||||||||

ADLER Group SA, 2.25%, 04/27/27 | EUR | 100 | 100,176 | |||||||||

Alpha Services and Holdings SA, 4.25%, 02/13/30 (Call 02/13/25)(a)(b) | EUR | 100 | 113,737 | |||||||||

Altice Financing SA, 2.25%, 01/15/25 | EUR | 100 | 111,398 | |||||||||

Altice France SA/France, 4.00%, 07/15/29 | EUR | 100 | 112,759 | |||||||||

Atlantia SpA | ||||||||||||

1.63%, 02/03/25(a) | EUR | 100 | 118,442 | |||||||||

1.88%, 07/13/27 (Call 04/13/27)(a) | EUR | 275 | 329,565 | |||||||||

1.88%, 02/12/28 (Call 11/12/27)(a) | EUR | 100 | 119,604 | |||||||||

Autostrade per l’Italia SpA | ||||||||||||

1.75%, 06/26/26(a) | EUR | 100 | 119,494 | |||||||||

1.75%, 02/01/27(a) | EUR | 100 | 119,544 | |||||||||

1.88%, 09/26/29 (Call 06/26/29)(a) | EUR | 200 | 240,387 | |||||||||

2.00%, 01/15/30 (Call 10/15/29)(a) | EUR | 400 | 485,380 | |||||||||

4.38%, 09/16/25(a) | EUR | 100 | 131,283 | |||||||||

Banca IFIS SpA, 2.00%, 04/24/23(a) | EUR | 100 | 117,177 | |||||||||

Banca Monte dei Paschi di Siena SpA | ||||||||||||

2.63%, 04/28/25(a) | EUR | 100 | 116,683 | |||||||||

3.63%, 09/24/24(a) | EUR | 300 | 355,604 | |||||||||

4.00%, 07/10/22(a) | EUR | 100 | 116,131 | |||||||||

5.38%, 01/18/28 (Call 01/18/23)(a)(b) | EUR | 100 | 83,738 | |||||||||

S C H E D U L E O F I N V E S T M E N T S | 17 |

Schedule of Investments (continued) October 31, 2021 | iShares® International High Yield Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) | Value | ||||||||||

Italy (continued) | ||||||||||||

10.50%, 07/23/29(a) | EUR | 100 | $ | 104,708 | ||||||||

Banca Popolare di Sondrio SCPA, | EUR | 100 | 119,856 | |||||||||

Banco BPM SpA | ||||||||||||

0.88%, 07/15/26(a) | EUR | 100 | 114,071 | |||||||||

1.75%, 04/24/23(a) | EUR | 109 | 128,697 | |||||||||

1.75%, 01/28/25(a) | EUR | 200 | 237,427 | |||||||||

3.25%, 01/14/31 (Call 01/14/26)(a)(b) | EUR | 100 | 117,599 | |||||||||

4.25%, 10/01/29 (Call 10/01/24)(a)(b) | EUR | 200 | 244,468 | |||||||||

BPER Banca | ||||||||||||

1.38%, 03/31/27 (Call 03/31/26)(a)(b) | EUR | 100 | 115,057 | |||||||||

1.88%, 07/07/25(a) | EUR | 100 | 119,181 | |||||||||

Brunello Bidco SpA, 3.50%, 02/15/28 | EUR | 100 | 114,519 | |||||||||

Catalent Pharma Solutions Inc., 2.38%, 03/01/28 (Call 03/01/23)(a) | EUR | 150 | 173,195 | |||||||||

CGG SA, 7.75%, 04/01/27 (Call 04/01/24)(a) | EUR | 100 | 114,872 | |||||||||

Cheplapharm Arzneimittel GmbH, | EUR | 150 | 178,117 | |||||||||

Deutsche Lufthansa AG | ||||||||||||

2.00%, 07/14/24 (Call 06/14/24)(a) | EUR | 100 | 115,938 | |||||||||

2.88%, 02/11/25 (Call 01/11/25)(a) | EUR | 200 | 235,461 | |||||||||

Douglas GmbH, 6.00%, 04/08/26 | EUR | 200 | 229,291 | |||||||||

Energizer Gamma Acquisition BV, | EUR | 100 | 111,869 | |||||||||

Esselunga SpA, 0.88%, 10/25/23 | EUR | 100 | 116,968 | |||||||||

Faurecia SE, 2.38%, 06/15/27 (Call 06/15/23)(a) | EUR | 100 | 114,871 | |||||||||

Gamma Bidco SpA, 5.13%, 07/15/25 | EUR | 200 | 233,014 | |||||||||

Grifols SA, 2.25%, 11/15/27 (Call 11/15/22)(a) | EUR | 100 | 115,561 | |||||||||

Iccrea Banca SpA, 4.13%, 11/28/29 | EUR | 100 | 116,657 | |||||||||

IMA Industria Macchine Automatiche SpA, | EUR | 100 | 114,762 | |||||||||

INEOS Quattro Finance 2 PLC, 2.50%, 01/15/26 (Call 01/15/23)(a) | EUR | 100 | 115,194 | |||||||||

Infrastrutture Wireless Italiane SpA | ||||||||||||

1.63%, 10/21/28 (Call 07/21/28)(a) | EUR | 100 | 116,526 | |||||||||

1.75%, 04/19/31 (Call 01/19/31)(a) | EUR | 100 | 114,388 | |||||||||

1.88%, 07/08/26 (Call 04/08/26)(a) | EUR | 150 | 179,043 | |||||||||

International Consolidated Airlines Group SA, 2.75%, 03/25/25 (Call 12/25/24)(a) | EUR | 100 | 115,156 | |||||||||

Intesa Sanpaolo SpA | ||||||||||||

2.93%, 10/14/30(a) | EUR | 100 | 120,439 | |||||||||

3.93%, 09/15/26(a) | EUR | 175 | 224,278 | |||||||||

6.63%, 09/13/23(a) | EUR | 100 | 128,539 | |||||||||

Leonardo SpA, 2.38%, 01/08/26 | EUR | 100 | 119,810 | |||||||||

Mahle GmbH, 2.38%, 05/14/28 | EUR | 200 | 224,094 | |||||||||

Mediobanca Banca di Credito Finanziario SpA | ||||||||||||

3.75%, 06/16/26 | EUR | 75 | 94,809 | |||||||||

5.75%, 04/18/23 | EUR | 50 | 62,276 | |||||||||

National Bank of Greece SA, 2.75%, 10/08/26 | EUR | 200 | 232,736 | |||||||||

Nexi SpA | ||||||||||||

1.63%, 04/30/26 (Call 01/30/26)(a) | EUR | 200 | 229,810 | |||||||||

1.75%, 10/31/24 (Call 07/31/24)(a) | EUR | 100 | 117,405 | |||||||||

2.13%, 04/30/29 (Call 01/30/29)(a) | EUR | 150 | 171,206 | |||||||||

PPF Telecom Group BV, 3.50%, 05/20/24 | EUR | 100 | 122,625 | |||||||||

Rossini Sarl, 6.75%, 10/30/25 (Call 11/29/21)(a) | EUR | 100 | 119,482 | |||||||||

Saipem Finance International BV | ||||||||||||

2.63%, 01/07/25(a) | EUR | 100 | 118,158 | |||||||||

3.75%, 09/08/23(a) | EUR | 200 | 241,189 | |||||||||

Telecom Italia SpA/Milano | ||||||||||||

1.63%, 01/18/29 (Call 10/18/28)(a) | EUR | 100 | 109,778 | |||||||||

2.38%, 10/12/27 (Call 07/12/27)(a) | EUR | 300 | 349,446 | |||||||||

| Security | Par (000) | Value | ||||||||||

Italy (continued) | ||||||||||||

2.50%, 07/19/23(a) | EUR | 100 | $ | 119,455 | ||||||||

2.88%, 01/28/26 (Call 10/28/25)(a) | EUR | 418 | 505,095 | |||||||||

3.25%, 01/16/23(a) | EUR | 150 | 179,096 | |||||||||

3.63%, 01/19/24(a) | EUR | 307 | 375,871 | |||||||||

3.63%, 05/25/26(a) | EUR | 100 | 126,246 | |||||||||

4.00%, 04/11/24 (Call 01/11/24)(a) | EUR | 125 | 153,188 | |||||||||

5.25%, 02/10/22(a) | EUR | 100 | 117,184 | |||||||||

Teva Pharmaceutical Finance Netherlands II BV, 6.00%, 01/31/25 (Call 10/31/24) | EUR | 100 | 124,064 | |||||||||

UniCredit SpA | ||||||||||||

2.00%, 09/23/29 (Call 09/23/24)(a)(b) | EUR | 200 | 232,362 | |||||||||

2.73%, 01/15/32 (Call 01/15/27)(a)(b) | EUR | 200 | 234,949 | |||||||||

4.38%, 01/03/27 (Call 01/03/22)(a)(b) | EUR | 100 | 116,372 | |||||||||

6.95%, 10/31/22(a) | EUR | 300 | 369,911 | |||||||||

Unione di Banche Italiane SpA | ||||||||||||

4.38%, 07/12/29 (Call 07/12/24)(a)(b) | EUR | 150 | 187,750 | |||||||||

5.88%, 03/04/29 (Call 03/04/24)(a)(b) | EUR | 150 | 192,433 | |||||||||

Unipol Gruppo SpA | ||||||||||||

3.00%, 03/18/25(a) | EUR | 175 | 219,127 | |||||||||

3.25%, 09/23/30 (Call 06/23/30)(a) | EUR | 200 | 265,974 | |||||||||

Verisure Holding AB, 3.88%, 07/15/26 | EUR | 100 | 117,728 | |||||||||

Vodafone Group PLC | ||||||||||||

2.63%, 08/27/80 (Call 05/27/26)(a)(b) | EUR | 200 | 236,677 | |||||||||

3.00%, 08/27/80 (Call 05/27/30)(a)(b) | EUR | 250 | 294,135 | |||||||||

Webuild SpA, 1.75%, 10/26/24(a) | EUR | 250 | 288,639 | |||||||||

ZF Europe Finance BV, 3.00%, 10/23/29 | EUR | 100 | 119,287 | |||||||||

Ziggo Bond Co. BV, 3.38%, 02/28/30 | EUR | 150 | 170,595 | |||||||||

|

| |||||||||||

|

14,449,786 |

| ||||||||||

| Japan — 2.0% | ||||||||||||

SoftBank Group Corp. | ||||||||||||

2.13%, 07/06/24 (Call 04/06/24)(a) | EUR | 175 | 200,308 | |||||||||

2.88%, 01/06/27 (Call 10/06/26)(a) | EUR | 100 | 112,063 | |||||||||

3.13%, 09/19/25 (Call 06/21/25)(a) | EUR | 250 | 289,730 | |||||||||

3.38%, 07/06/29 (Call 04/06/29)(a) | EUR | 125 | 138,713 | |||||||||

3.88%, 07/06/32 (Call 04/06/32)(a) | EUR | 100 | 110,628 | |||||||||

4.00%, 04/20/23 (Call 01/20/23)(a) | EUR | 100 | 118,293 | |||||||||

4.00%, 09/19/29 (Call 06/21/29)(a) | EUR | 100 | 115,533 | |||||||||

5.00%, 04/15/28 (Call 01/16/28)(a) | EUR | 250 | 304,853 | |||||||||

|

| |||||||||||

|

1,390,121 |

| ||||||||||

| Luxembourg — 3.8% | ||||||||||||

Albion Financing 1 SARL/Aggreko Holdings Inc., 5.25%, 10/15/26 (Call 10/15/23)(a) | EUR | 100 | 116,069 | |||||||||

Altice Financing SA | ||||||||||||

3.00%, 01/15/28 (Call 01/15/23)(a) | EUR | 200 | 219,127 | |||||||||

4.25%, 08/15/29 (Call 08/15/24)(a) | EUR | 100 | 113,371 | |||||||||

Altice Finco SA, 4.75%, 01/15/28 | EUR | 100 | 109,841 | |||||||||

Altice France Holding SA | ||||||||||||

4.00%, 02/15/28 (Call 02/15/23)(a) | EUR | 100 | 107,904 | |||||||||

8.00%, 05/15/27 (Call 05/15/22)(a) | EUR | 200 | 245,158 | |||||||||

Garfunkelux Holdco 3 SA | ||||||||||||

6.75%, 11/01/25 (Call 11/01/22)(a) | EUR | 100 | 119,748 | |||||||||

7.75%, 11/01/25 (Call 11/01/22)(a) | GBP | 100 | 141,759 | |||||||||

INEOS Finance PLC | ||||||||||||

2.13%, 11/15/25 (Call 11/08/21)(a) | EUR | 100 | 114,615 | |||||||||

2.88%, 05/01/26 (Call 05/01/22)(a) | EUR | 300 | 350,059 | |||||||||

Matterhorn Telecom SA, 3.13%, 09/15/26 (Call 09/15/22)(a) | EUR | 200 | 228,461 | |||||||||

Mytilineos Financial Partners SA, 2.50%, 12/01/24 (Call 06/01/24)(a) | EUR | 100 | 118,394 | |||||||||

PLT VII Finance Sarl, 4.63%, 01/05/26 (Call 07/15/22)(a) | EUR | 100 | 117,612 | |||||||||

| 18 | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) October 31, 2021 | iShares® International High Yield Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) | Value | ||||||||||

Luxembourg (continued) | ||||||||||||

SIG Combibloc Purchase Co. Sarl, 2.13%, 06/18/25 (Call 03/18/25)(a) | EUR | 100 | $ | 120,808 | ||||||||

Summer BC Holdco A Sarl, 9.25%, 10/31/27 | EUR | 90 | 112,624 | |||||||||

Summer BC Holdco B Sarl, 5.75%, 10/31/26 | EUR | 150 | 180,766 | |||||||||

Vivion Investments Sarl | ||||||||||||

3.00%, 08/08/24(a) | EUR | 100 | 110,619 | |||||||||

3.50%, 11/01/25(a) | EUR | 100 | 111,110 | |||||||||

|

| |||||||||||

|

2,738,045 |

| ||||||||||

| Netherlands — 2.7% | ||||||||||||

Lincoln Financing Sarl, 3.63%, 04/01/24 | EUR | 200 | 232,284 | |||||||||

OCI NV, 3.13%, 11/01/24 (Call 11/29/21)(a) | EUR | 200 | 234,206 | |||||||||

PPF Telecom Group BV | ||||||||||||

2.13%, 01/31/25 (Call 10/31/24)(a) | EUR | 200 | 237,119 | |||||||||

3.25%, 09/29/27 (Call 06/29/27)(a) | EUR | 100 | 124,816 | |||||||||

Q-Park Holding I BV, 2.00%, 03/01/27 | EUR | 100 | 109,425 | |||||||||

Sigma Holdco BV, 5.75%, 05/15/26 | EUR | 100 | 106,760 | |||||||||

SNS Bank NV, 6.25%, 10/26/20(e) | EUR | 50 | — | |||||||||

Trivium Packaging Finance BV, 3.75%, 08/15/26 (Call 08/15/22)(a) | EUR | 100 | 116,022 | |||||||||

United Group BV | ||||||||||||

3.13%, 02/15/26 (Call 02/15/22)(a) | EUR | 100 | 111,112 | |||||||||

3.63%, 02/15/28 (Call 02/15/23)(a) | EUR | 200 | 221,615 | |||||||||

4.63%, 08/15/28 (Call 08/15/24)(a) | EUR | 100 | 114,458 | |||||||||

4.88%, 07/01/24 (Call 11/29/21)(a) | EUR | 100 | 116,781 | |||||||||

UPC Holding BV, 3.88%, 06/15/29 | EUR | 100 | 117,510 | |||||||||

Ziggo BV, 4.25%, 01/15/27 (Call 01/15/22)(a) | EUR | 80 | 94,565 | |||||||||

|

| |||||||||||

|

1,936,673 |

| ||||||||||

| Norway — 0.3% | ||||||||||||

Adevinta ASA, 2.63%, 11/15/25 | EUR | 200 | 235,181 | |||||||||

|

| |||||||||||

| Portugal — 1.8% | ||||||||||||

Banco Comercial Portugues SA | ||||||||||||

1.13%, 02/12/27 (Call 02/12/26)(a)(b) | EUR | 100 | 111,884 | |||||||||

4.50%, 12/07/27 (Call 12/07/22)(a)(b) | EUR | 100 | 118,795 | |||||||||

Banco Commercial Portugues, 1.75%, 04/07/28 (Call 04/07/27)(a)(b) | EUR | 100 | 112,675 | |||||||||

Caixa Geral de Depositos SA, 5.75%, 06/28/28 (Call 06/28/23)(a)(b) | EUR | 200 | 250,058 | |||||||||

EDP - Energias de Portugal SA | ||||||||||||

1.70%, 07/20/80 (Call 04/20/25)(a)(b) | EUR | 100 | 115,783 | |||||||||

1.88%, 08/02/81 (Call 05/02/26)(a)(b) | EUR | 100 | 115,796 | |||||||||

4.50%, 04/30/79 (Call 01/30/24)(a)(b) | EUR | 200 | 249,008 | |||||||||

Energias De Portugal SA, 1.50%, 03/14/82 | EUR | 100 | 112,830 | |||||||||

Novo Banco SA, 8.50%, 07/06/28 | EUR | 100 | 118,013 | |||||||||

|

| |||||||||||

|

1,304,842 |

| ||||||||||

| Spain — 7.0% | ||||||||||||

Abanca Corp. Bancaria SA, 4.63%, 04/07/30 | EUR | 100 | 124,763 | |||||||||

Banco de Sabadell SA | ||||||||||||

0.88%, 06/16/28 (Call 06/16/27)(a)(b) | EUR | 100 | 111,850 | |||||||||

1.13%, 03/27/25(a) | EUR | 200 | 232,909 | |||||||||

1.75%, 05/10/24(a) | EUR | 100 | 118,757 | |||||||||

2.50%, 04/15/31 (Call 01/15/26)(a)(b) | EUR | 100 | 115,520 | |||||||||

5.38%, 12/12/28 (Call 12/12/23)(a)(b) | EUR | 100 | 126,011 | |||||||||

5.63%, 05/06/26(a) | EUR | 100 | 134,565 | |||||||||

Banco do Brasil SA/Cayman | ||||||||||||

1.75%, 03/09/28 (Call 03/09/27)(a)(b) | EUR | 100 | 113,254 | |||||||||

5.25%, 11/27/31 (Call 05/27/26)(a)(b) | EUR | 100 | 121,597 | |||||||||

| Security | Par (000) | Value | ||||||||||

Spain (continued) | ||||||||||||

Cellenex Finance Co. | ||||||||||||

1.00%, 09/15/27 (Call 06/15/27)(a) | EUR | 100 | $ | 111,781 | ||||||||

2.00%, 09/15/32 (Call 06/15/32)(a) | EUR | 200 | 221,785 | |||||||||

Cellnex Finance Co. SA | ||||||||||||

0.75%, 11/15/26 (Call 08/15/26)(a) | EUR | 100 | 113,121 | |||||||||

1.25%, 01/15/29 (Call 10/15/28)(a) | EUR | 200 | 221,225 | |||||||||

1.50%, 06/08/28 (Call 03/08/28)(a) | EUR | 100 | 113,638 | |||||||||

2.00%, 02/15/33 (Call 11/15/32)(a) | EUR | 300 | 329,936 | |||||||||

Cellnex Telecom SA | ||||||||||||

1.00%, 04/20/27 (Call 01/20/27)(a) | EUR | 100 | 112,742 | |||||||||

1.88%, 06/26/29 (Call 03/26/29) | EUR | 100 | 115,006 | |||||||||

2.38%, 01/16/24 (Call 10/16/23)(a) | EUR | 100 | 120,361 | |||||||||

2.88%, 04/18/25 (Call 01/18/25)(a) | EUR | 100 | 123,450 | |||||||||

Cirsa Finance International, 4.50%, 03/15/27 | EUR | 100 | 113,864 | |||||||||

Cirsa Finance International Sarl, 6.25%, 12/20/23 (Call 11/08/21)(a) | EUR | 85 | 99,351 | |||||||||

ContourGlobal Power Holdings SA | ||||||||||||

2.75%, 01/01/26 (Call 01/01/23)(a) | EUR | 100 | 114,491 | |||||||||

4.13%, 08/01/25 (Call 11/29/21)(a) | EUR | 100 | 117,136 | |||||||||

El Corte Ingles SA | ||||||||||||

3.00%, 03/15/24 (Call 11/08/21)(a) | EUR | 100 | 116,165 | |||||||||

3.63%, 03/15/24 (Call 03/15/22)(a) | EUR | 100 | 118,796 | |||||||||

Grifols Escrow Issuer SA, 3.88%, 10/15/28 | EUR | 250 | 289,300 | |||||||||

Grifols SA | ||||||||||||

1.63%, 02/15/25 (Call 02/15/22)(a) | EUR | 150 | 172,804 | |||||||||

3.20%, 05/01/25 (Call 11/29/21)(a) | EUR | 200 | 231,371 | |||||||||

Ibercaja Banco SA, 2.75%, 07/23/30 | EUR | 100 | 116,420 | |||||||||

Lorca Telecom Bondco, 4.00%, 09/18/27 | EUR | 200 | 232,446 | |||||||||

Lorca Telecom Bondco SA, 4.00%, 09/18/27 | EUR | 100 | 116,264 | |||||||||

Repsol International Finance BV, 4.50%, 03/25/75 (Call 03/25/25)(a)(b) | EUR | 175 | 218,156 | |||||||||

Unicaja Banco SA, 2.88%, 11/13/29 | EUR | 100 | 118,355 | |||||||||

|

| |||||||||||

|

4,957,190 |

| ||||||||||

| Sweden — 3.3% | ||||||||||||

Akelius Residential Property AB | ||||||||||||

2.25%, 05/17/81 (Call 02/17/26)(a)(b) | EUR | 100 | 113,641 | |||||||||

3.88%, 10/05/78 (Call 07/08/23)(a)(b) | EUR | 100 | 120,924 | |||||||||

Dometic Group AB | ||||||||||||

2.00%, 09/29/28 (Call 06/29/28)(a) | EUR | 100 | 113,227 | |||||||||

3.00%, 09/13/23 (Call 08/13/23)(a) | EUR | 100 | 120,371 | |||||||||

Fastighets AB Balder | ||||||||||||

2.87%, 06/02/81 (Call 03/02/26)(a)(b) | EUR | 100 | 110,475 | |||||||||

3.00%, 03/07/78 (Call 03/07/23)(a)(b) | EUR | 100 | 115,885 | |||||||||

Intrum AB | ||||||||||||

3.00%, 09/15/27 (Call 09/15/22)(a) | EUR | 100 | 111,788 | |||||||||

3.13%, 07/15/24 (Call 11/29/21)(a) | EUR | 100 | 115,627 | |||||||||

3.50%, 07/15/26 (Call 07/15/22)(a) | EUR | 175 | 201,734 | |||||||||

4.88%, 08/15/25 (Call 08/15/22)(a) | EUR | 200 | 238,875 | |||||||||

Verisure Holding AB | ||||||||||||

3.25%, 02/15/27 (Call 02/15/23)(a) | EUR | 150 | 172,818 | |||||||||

3.50%, 05/15/23 (Call 11/08/21)(a) | EUR | 100 | 116,314 | |||||||||

Verisure Midholding AB, 5.25%, 02/15/29 | EUR | 300 | 351,418 | |||||||||

Volvo Car AB | ||||||||||||

2.00%, 01/24/25 (Call 10/24/24)(a) | EUR | 200 | 239,407 | |||||||||

2.13%, 04/02/24 (Call 01/02/24)(a) | EUR | 100 | 119,257 | |||||||||

|

| |||||||||||

|

2,361,761 |

| ||||||||||

| Switzerland — 0.5% | ||||||||||||

Dufry One BV | ||||||||||||

2.00%, 02/15/27 (Call 02/15/23)(a) | EUR | 100 | 108,940 | |||||||||

2.50%, 10/15/24 (Call 11/29/21)(a) | EUR | 100 | 113,737 | |||||||||

S C H E D U L E O F I N V E S T M E N T S | 19 |

Schedule of Investments (continued) October 31, 2021 | iShares® International High Yield Bond ETF (Percentages shown are based on Net Assets) |

| Security | Par (000) | Value | ||||||||||

Switzerland (continued) | ||||||||||||

3.38%, 04/15/28 (Call 04/15/24)(a) | EUR | 100 | $ | 113,542 | ||||||||

|

| |||||||||||

|

336,219 |

| ||||||||||

| United Kingdom — 10.8% | ||||||||||||

Arqiva Broadcast Finance PLC, 6.75%, 09/30/23 (Call 11/29/21)(a) | GBP | 150 | 208,384 | |||||||||

BCP Modular Services, 4.75%, 11/30/28 | EUR | 200 | 230,786 | |||||||||

BCP V Modular Services Finance II PLC, | GBP | 100 | 136,725 | |||||||||

Bellis Acquisition Co. PLC, 3.25%, 02/16/26 | GBP | 300 | 392,764 | |||||||||

Bellis Finco PLC, 4.00%, 02/16/27 (Call 02/24/23)(a) | GBP | 200 | 258,217 | |||||||||

British Telecommunications PLC, 1.87%, 08/18/80 (Call 05/18/25)(a)(b) | EUR | 100 | 109,377 | |||||||||

Cidron Aida Finco Sarl, 5.00%, 04/01/28 | EUR | 100 | 113,417 | |||||||||

Deuce Finco PLC, 5.50%, 06/15/27 | GBP | 100 | 135,950 | |||||||||

eG Global Finance PLC, 4.38%, 02/07/25 | EUR | 225 | 256,233 | |||||||||

GKN Holdings Ltd., 4.63%, 05/12/32(a) | GBP | 100 | 146,452 | |||||||||

Heathrow Finance PLC | ||||||||||||

4.38%, 03/01/27(a)(g) | GBP | 100 | 138,354 | |||||||||

4.75%, 03/01/24 (Call 12/01/23)(a)(g) | GBP | 100 | 142,095 | |||||||||

Iceland Bondco PLC, 4.38%, 05/15/28 | GBP | 100 | 119,209 | |||||||||