UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09102

iShares, Inc.

(Exact name of registrant as specified in charter)

c/o: State Street Bank and Trust Company

100 Summer Street, 4th Floor, Boston, MA 02110

(Address of principal executive offices) (Zip code)

The Corporation Trust Incorporated

2405 York Road, Suite 201, Lutherville-Timonium, Maryland 21093

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: April 30, 2022

Date of reporting period: April 30, 2022

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

| APRIL 30, 2022 |

| 2022 Annual Report | ||

iShares, Inc.

| · | iShares Asia/Pacific Dividend ETF | DVYA | NYSE Arca |

| · | iShares Emerging Markets Dividend ETF | DVYE | NYSE Arca |

Dear Shareholder,

The 12-month reporting period as of April 30, 2022 saw the emergence of significant challenges that disrupted the economic recovery and strong financial markets which characterized 2021. The U.S. economy shrank in the first quarter of 2022, ending the run of robust growth which followed reopening and the development of the COVID-19 vaccines. Rapid changes in consumer spending led to supply constraints and elevated inflation, which reached a 40-year high. Moreover, while the foremost effect of Russia’s invasion of Ukraine has been a severe humanitarian crisis, the invasion has presented challenges for both investors and policymakers.

Equity prices were mixed but mostly down, as persistently high inflation drove investors’ expectations for higher interest rates, particularly weighing on relatively high valuation growth stocks and economically sensitive small-capitalization stocks. Overall, small-capitalization U.S. stocks declined, while large-capitalization U.S. stocks were nearly flat. Both emerging market stocks and international equities from developed markets fell significantly, pressured by rising interest rates and a strengthening U.S. dollar.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) rose during the reporting period as increasing inflation drove investors’ expectations for higher interest rates. The corporate bond market also faced inflationary headwinds, and increasing uncertainty led to higher corporate bond spreads (the difference in yield between U.S. Treasuries and similarly-dated corporate bonds).

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation is growing faster than expected, raised interest rates in March 2022, the first increase of this business cycle. Furthermore, the Fed wound down its bond-buying programs and raised the prospect of reversing the flow and reducing its balance sheet. Continued high inflation and the Fed’s new tone led many analysts to anticipate that the Fed will continue to raise interest rates multiple times throughout the year.

Looking ahead, however, the horrific war in Ukraine has significantly clouded the outlook for the global economy, leading to major volatility in energy and metal markets. Sanctions on Russia, Europe’s top energy supplier, and general wartime disruption are likely to drive already-high commodity prices even higher. We believe sharp increases in energy prices will exacerbate inflationary pressure while also constraining economic growth. Combating inflation without stifling a recovery, while buffering against ongoing supply and price shocks amid the ebb and flow of the pandemic, will be an especially challenging environment for setting effective monetary policy. Despite the likelihood of more rate increases on the horizon, we believe the Fed will err on the side of protecting employment, even at the expense of higher inflation.

In this environment, we favor an overweight to equities, as valuations have become more attractive and inflation-adjusted interest rates remain low. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and healthcare, are particularly attractive in the long term. We favor U.S. equities due to strong earnings momentum, while Japanese equities should benefit from supportive monetary and fiscal policy. We are underweight credit overall, but inflation-protected U.S. Treasuries, Asian fixed income, and emerging market local-currency bonds offer potential opportunities for additional yield. We believe that international diversification and a focus on sustainability and quality can help provide portfolio resilience.

Overall, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock, Inc.

Rob Kapito

President, BlackRock, Inc.

| Total Returns as of April 30, 2022 | ||||

| 6-Month | 12-Month | |||

U.S. large cap equities (S&P 500® Index) | (9.65)% | 0.21% | ||

U.S. small cap equities | (18.38) | (16.87) | ||

International equities | (11.80) | (8.15) | ||

Emerging market equities | (14.15) | (18.33) | ||

3-month Treasury bills | 0.07 | 0.08 | ||

U.S. Treasury securities | (10.29) | (8.86) | ||

U.S. investment grade bonds | (9.47) | (8.51) | ||

Tax-exempt municipal bonds | (7.90) | (7.88) | ||

U.S. high yield bonds | (7.40) | (5.22) | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

Financial Statements | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 38 | ||||

| 39 | ||||

iShares, Inc.

Global Market Overview

Global equity markets declined during the 12 months ended April 30, 2022 (“reporting period”). The MSCI ACWI, a broad global equity index that includes both developed and emerging markets, returned -5.44% in U.S. dollar terms for the reporting period.

In the first half of the reporting period, stocks were supported by economic recovery in most regions of the world. The global economy continued to rebound from the impact of restrictions imposed at the beginning of the coronavirus pandemic, as mitigation and adaptation allowed most economic activity to continue. However, significant challenges emerged in the second half of the reporting period, erasing earlier gains. Inflation rose significantly in many countries, reducing consumers’ purchasing power and leading many central banks to tighten monetary policy. Russia’s invasion of Ukraine presented a further challenge to the global economy, disrupting markets in important commodities such as oil, natural gas, and wheat.

The U.S. economy grew briskly over the final three quarters of 2021, powered primarily by consumers with strong household balance sheets. Record-high personal savings rates allowed consumers to spend at an elevated level throughout much of the reporting period, releasing pent-up demand for goods and services. Hiring increased as businesses restored capacity, and unemployment decreased substantially, falling to 3.6% in April 2022 — only marginally higher than the pre-pandemic rate of 3.5% in February 2020. However, the economy contracted in the first quarter of 2022 amid lower inventory investment and an inflation-driven decline in consumer sentiment.

Rising inflation led to a shift in policy from the U.S. Federal Reserve Bank (“Fed”). As the reporting period began, the Fed was using accommodative monetary policy to stimulate the economy. Short-term interest rates were kept at near zero levels, and the Fed used bond-buying programs to stabilize debt markets. However, rising prices led the Fed to tighten monetary policy in the second half of the reporting period in an attempt to prevent runaway inflation. The Fed slowed and then ended its bond-buying activities and discussed plans to begin reducing its balance sheet by selling bonds later in 2022. In March 2022, it raised short-term interest rates and indicated that further increases could be necessary. Interest rates rose significantly in anticipation of further tightening, leading to higher borrowing costs for businesses.

Stocks declined in Europe and economic growth stalled, with the Eurozone economy slowing substantially in the second half of the reporting period. Significantly higher inflation and Russia’s invasion of Ukraine negatively impacted equities. Russia is an important trading partner with many European countries, and new sanctions against Russia imposed limits on certain types of trade with Russia. Investors became concerned that the sharp rise in energy prices during the reporting period would constrain economic growth, as Europe relies on imported energy for much of its industrial and heating needs. The European Central Bank (“ECB”) maintained ultra-low interest rates but started to wind down its bond buying program.

Despite relatively low inflation by global standards, Asia-Pacific stocks declined significantly. Chinese stocks endured substantial declines, driving much of the negative performance in the region. Regulatory interventions by the Chinese government weighed on equity markets, particularly in the information technology sector. While China’s economy continued to expand at a solid pace, COVID-19 cases rose sharply late in the reporting period, and analysts became concerned that the subsequent lockdowns would constrain growth.

| 4 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

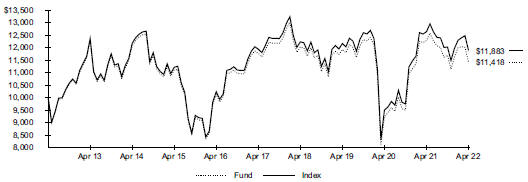

| Fund Summary as of April 30, 2022 | iShares® Asia/Pacific Dividend ETF |

Investment Objective

The iShares Asia/Pacific Dividend ETF (the “Fund”) seeks to track the investment results of an index composed of relatively high dividend paying equities in Asia/Pacific developed markets, as represented by the Dow Jones Asia/Pacific Select Dividend 50 IndexTM (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | 1 Year | 5 Years | 10 Years | |||||||||||||||||||||||

Fund NAV | (7.02 | )% | (0.59 | )% | 1.33 | % | (7.02 | )% | (2.93 | )% | 14.18 | % | ||||||||||||||||

Fund Market | (7.11 | ) | (0.65 | ) | 1.29 | (7.11 | ) | (3.22 | ) | 13.69 | ||||||||||||||||||

Index | (5.94 | ) | (0.08 | ) | 1.74 | (5.94 | ) | (0.42 | ) | 18.83 | ||||||||||||||||||

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 9 for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||

| | Beginning Account Value (11/01/21) | | | Ending Account Value (04/30/22) | | | Expenses Paid During | | | Beginning Account Value (11/01/21) | | | Ending Account Value (04/30/22) | | | Expenses Paid During the Period | (a) | | Annualized Expense Ratio | | ||||||||||

| $ 1,000.00 | $ 976.30 | $ 2.40 | $ 1,000.00 | $ 1,022.40 | $ 2.46 | 0.49 | % | |||||||||||||||||||||||

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” for more information. |

F U N D S U M M A R Y | 5 |

| Fund Summary as of April 30, 2022 (continued) | iShares® Asia/Pacific Dividend ETF |

Portfolio Management Commentary

Asia/Pacific dividend stocks declined during the reporting period amid high levels of volatility. Rising inflation, surging COVID-19 cases in some countries, tightening pandemic-related restrictions in China, and Russia’s invasion of Ukraine impeded the region’s nascent recovery and weighed on equities.

Japanese stocks were the largest detractors from the Index’s return, due in part to the Japanese yen’s significant depreciation relative to the U.S. dollar, which worked against dollar-denominated returns. In the industrials sector, marine transportation stocks, which advanced sharply in 2021 amid high shipping rates, declined toward the end of the reporting period as shipping rates decreased sharply. Inflationary pressures and high fuel prices weighed on consumer spending and increased costs for retailers, which helped reduce demand for ships. Shipping in the region was disrupted by lockdowns in China, which led to factory closures, truck driver shortages, and hundreds of ships waiting offshore at Chinese ports. As volumes dropped, investors became concerned about companies that ramped up spending plans to boost capacity. Japanese utilities stocks declined as high prices for coal, liquid natural gas (“LNG”), and oil weighed on profits of electric utilities companies. Under Japanese rules, it typically takes months for Japanese utilities to pass on cost increases to customers.

Stocks in Hong Kong also detracted significantly from the Index’s return as new regulations and lockdowns in China and Hong Kong pressured equities. Amid rising mortgage rates and a slowing economy, real estate stocks declined sharply as property sales and home prices declined, weighing on developers’ revenues. Strict pandemic-related restrictions drove many people and foreign companies to downsize operations in or leave Hong Kong. Rents declined sharply in the residential market amid the exodus, while the 2022 COVID-19 wave lowered retail traffic and rental rates amid government pressure. Downsizing and closures meant weakening demand for office leases and lower effective rents. One real estate conglomerate owns a major airline whose operations were severely curtailed by travel restrictions, even as many of the world’s airlines’ traffic levels recovered.

Portfolio Information

ALLOCATION BY SECTOR

| ||||

| Sector | Percent of Total Investments(a) | |||

| ||||

Financials | 30.4% | |||

Industrials | 16.2 | |||

Real Estate | 16.2 | |||

Consumer Discretionary | 10.7 | |||

Materials | 10.2 | |||

Utilities | 7.5 | |||

Communication Services | 5.0 | |||

Information Technology | 3.8 | |||

| ||||

GEOGRAPHIC ALLOCATION

| ||||

| Country/Geographic Region | Percent of Total Investments(a) | |||

| ||||

Australia | 36.4% | |||

Hong Kong | 30.7 | |||

Japan | 29.3 | |||

New Zealand | 2.1 | |||

United Kingdom | 1.5 | |||

| ||||

| (a) | Excludes money market funds. |

| 6 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

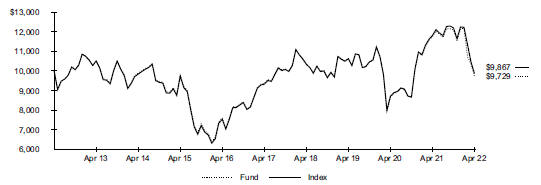

| Fund Summary as of April 30, 2022 | iShares® Emerging Markets Dividend ETF |

Investment Objective

The iShares Emerging Markets Dividend ETF (the “Fund”) seeks to track the investment results of an index composed of relatively high dividend paying equities in emerging markets, as represented by the Dow Jones Emerging Markets Select Dividend IndexTM (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | 1 Year | 5 Years | 10 Years | |||||||||||||||||||||||

Fund NAV | (17.19 | )% | 0.76 | % | (0.27 | )% | (17.19 | )% | 3.84 | % | (2.71 | )% | ||||||||||||||||

Fund Market | (17.31 | ) | 0.60 | (0.38 | ) | (17.31 | ) | 3.06 | (3.71 | ) | ||||||||||||||||||

Index | (16.43 | ) | 1.14 | (0.13 | ) | (16.43 | ) | 5.81 | (1.33 | ) | ||||||||||||||||||

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 9 for more information.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||

| | Beginning Account Value (11/01/21) | | | Ending Account Value (04/30/22) | | | Expenses Paid During the Period | (a) | | Beginning Account Value (11/01/21) | | | Ending Account Value (04/30/22) | | | Expenses Paid During the Period | (a) | | Annualized Expense Ratio | | ||||||||||

| $ 1,000.00 | $ 804.50 | $ 2.24 | $ 1,000.00 | $ 1,022.30 | $ 2.51 | 0.50 | % | |||||||||||||||||||||||

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” for more information. |

F U N D S U M M A R Y | 7 |

| Fund Summary as of April 30, 2022 (continued) | iShares® Emerging Markets Dividend ETF |

Portfolio Management Commentary

Emerging markets dividend stocks declined during the reporting period, falling sharply after Russia’s invasion of Ukraine. Prior to the invasion, the Index advanced as the continued global economic recovery provided tailwinds for stocks amid strengthening international trade and industrial production. Stocks with high dividends and lower valuations tend to do well when interest rates rise, as they did in early 2022. Although the Index declined following the invasion, certain stocks benefited as sanctions against Russia drove commodities prices sharply higher.

Russian stocks detracted the most from the Index’s return. Sanctions imposed to squeeze Russia’s economy and isolate the country from the global financial system led to widespread expectations for a sharp recession in Russia. Index providers removed Russian stocks from many widely tracked indexes, and exchanges suspended trading of Russian stocks. Credit rating agencies reduced or withdrew many companies’ credit ratings amid rising delinquency and fears of defaults. The sanctions, which targeted both companies and key shareholders, weighed heavily on the materials, energy, and industrials sectors. Metals and mining companies ceased shipments to the E.U., a major export market. Energy companies declined sharply as the U.S. banned imports of Russian fuels, while the E.U. halted new energy investments and pledged to reduce and eventually end Russian gas imports, leading Russian pipeline operators to set limits on receiving oil amid dwindling storage space. In the industrials sector, a Cyprus-based transportation company that primarily operates in Russia declined sharply amid targeted sanctions.

Chinese real estate stocks also weighed on the Index’s performance. A liquidity crisis drove a series of defaults by developers amid a government crackdown on real estate companies, and home sales declined sharply, shrinking earnings in the sector.

In contrast, stocks in Indonesia, the United Arab Emirates, India, and Brazil were modest contributors to the Index’s return. Energy stocks led contribution in Indonesia and India amid higher prices for energy commodities. The oil, gas, and consumable fuels industry benefited directly from rising prices of oil, gas, and coal, which drove profits and earnings expectations higher.

Portfolio Information

ALLOCATION BY SECTOR

| ||||

| Sector | Percent of Total Investments(a) | |||

| ||||

Real Estate | 17.8% | |||

Materials | 17.8 | |||

Financials | 12.8 | |||

Utilities | 12.2 | |||

Energy | 10.5 | |||

Health Care | 8.7 | |||

Industrials | 5.9 | |||

Information Technology | 5.4 | |||

Consumer Discretionary | 5.0 | |||

Consumer Staples | 2.1 | |||

Communication Services | 1.8 | |||

| ||||

TEN LARGEST GEOGRAPHIC ALLOCATION

| ||||

| Country/Geographic Region | Percent of Total Investments(a) | |||

| ||||

China | 25.5% | |||

Brazil | 25.4 | |||

Taiwan | 8.0 | |||

Malaysia | 7.3 | |||

India | 6.8 | |||

South Africa | 6.4 | |||

Chile | 5.6 | |||

Thailand | 5.2 | |||

Turkey | 2.1 | |||

Singapore | 2.1 | |||

| ||||

| (a) | Excludes money market funds. |

| 8 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Shareholders of each Fund may incur the following charges: (1) transactional expenses, including brokerage commissions on purchases and sales of fund shares and (2) ongoing expenses, including management fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in a Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

A B O U T F U N D P E R F O R M A N C E / S H A R E H O L D E R E X P E N S E S | 9 |

April 30, 2022 | iShares® Asia/Pacific Dividend ETF (Percentages shown are based on Net Assets) |

| Security | Shares | Value | ||||||

Common Stocks | ||||||||

| Australia — 35.8% | ||||||||

Australia & New Zealand Banking Group Ltd. | 37,896 | $ | 721,130 | |||||

Bank of Queensland Ltd. | 110,440 | 626,588 | ||||||

Bendigo & Adelaide Bank Ltd. | 103,500 | 771,678 | ||||||

CSR Ltd. | 153,463 | 657,218 | ||||||

Fortescue Metals Group Ltd. | 151,477 | 2,289,282 | ||||||

Harvey Norman Holdings Ltd. | 220,361 | 784,940 | ||||||

JB Hi-Fi Ltd. | 19,191 | 710,765 | ||||||

Magellan Financial Group Ltd. | 144,680 | 1,636,767 | ||||||

Nick Scali Ltd. | 78,017 | 556,543 | ||||||

Pendal Group Ltd. | 365,698 | 1,346,253 | ||||||

Perpetual Ltd. | 29,701 | 682,818 | ||||||

Rio Tinto Ltd. | 13,374 | 1,057,935 | ||||||

Suncorp Group Ltd. | 99,378 | 797,905 | ||||||

Super Retail Group Ltd. | 128,847 | 953,350 | ||||||

Westpac Banking Corp. | 41,062 | 687,377 | ||||||

|

| |||||||

|

14,280,549 |

| ||||||

| Hong Kong — 30.2% | ||||||||

BOC Hong Kong Holdings Ltd. | 165,500 | 599,087 | ||||||

CK Infrastructure Holdings Ltd. | 100,500 | 675,702 | ||||||

Henderson Land Development Co. Ltd. | 176,000 | 711,747 | ||||||

Hongkong Land Holdings Ltd. | 102,000 | 475,826 | ||||||

Hysan Development Co. Ltd. | 293,000 | 864,400 | ||||||

Kerry Properties Ltd. | 300,000 | 811,240 | ||||||

New World Development Co. Ltd. | 221,250 | 846,235 | ||||||

Orient Overseas International Ltd. | 37,000 | 1,020,981 | ||||||

PCCW Ltd. | 1,984,000 | 1,124,060 | ||||||

Power Assets Holdings Ltd. | 113,000 | 761,062 | ||||||

Sino Land Co. Ltd. | 570,000 | 753,416 | ||||||

Sun Hung Kai Properties Ltd. | 61,000 | 702,542 | ||||||

Swire Pacific Ltd., Class A | 109,500 | 623,702 | ||||||

Swire Properties Ltd. | 234,200 | 561,274 | ||||||

VTech Holdings Ltd. | 210,700 | 1,490,470 | ||||||

|

| |||||||

|

12,021,744 |

| ||||||

| Japan — 28.9% | ||||||||

Daiwa Securities Group Inc. | 138,900 | 680,767 | ||||||

Electric Power Development Co. Ltd. | 33,300 | 456,303 | ||||||

Fukuoka Financial Group Inc. | 28,900 | 528,040 | ||||||

Haseko Corp. | 51,700 | 566,478 | ||||||

Kansai Electric Power Co Inc/The | 56,900 | 498,785 | ||||||

Kumagai Gumi Co. Ltd. | 22,700 | 473,723 | ||||||

Mitsubishi HC Capital Inc. | 122,900 | 552,985 | ||||||

Mitsui OSK Lines Ltd. | 47,500 | 1,112,028 | ||||||

| Security | Shares | Value | ||||||

Japan (continued) | ||||||||

Mizuho Financial Group Inc. | 53,470 | $ | 649,271 | |||||

MS&AD Insurance Group Holdings Inc. | 17,200 | 511,997 | ||||||

NGK Spark Plug Co. Ltd. | 41,900 | 642,965 | ||||||

Nippon Yusen KK | 15,100 | 1,089,374 | ||||||

Nishimatsu Construction Co. Ltd. | 23,800 | 700,704 | ||||||

Sojitz Corp. | 41,980 | 640,125 | ||||||

Sumitomo Corp. | 45,900 | 726,305 | ||||||

Sumitomo Mitsui Financial Group Inc. | 20,400 | 616,364 | ||||||

Sumitomo Mitsui Trust Holdings Inc. | 16,200 | 502,808 | ||||||

Tohoku Electric Power Co. Inc. | 99,300 | 552,360 | ||||||

|

| |||||||

|

11,501,382 |

| ||||||

| New Zealand — 2.1% | ||||||||

Spark New Zealand Ltd. | 258,684 | 818,137 | ||||||

|

| |||||||

| United Kingdom — 1.5% | ||||||||

CK Hutchison Holdings Ltd. | 86,000 | 603,542 | ||||||

|

| |||||||

Total Common Stocks — 98.5% | 39,225,354 | |||||||

|

| |||||||

Warrants | ||||||||

| Australia — 0.0% | ||||||||

Magellan Financial Group Ltd. (Expires 04/16/27)(a) | 1 | 1 | ||||||

|

| |||||||

Total Warrants — 0.0% | 1 | |||||||

|

| |||||||

Short-Term Investments | ||||||||

| Money Market Funds — 0.0% | ||||||||

BlackRock Cash Funds: Treasury, SL Agency Shares, 0.34%(b)(c) | 10,000 | 10,000 | ||||||

|

| |||||||

Total Short-Term Investments — 0.0% |

| 10,000 | ||||||

|

| |||||||

Total Investments in Securities — 98.5% |

| 39,235,355 | ||||||

Other Assets, Less Liabilities — 1.5% |

| 610,804 | ||||||

|

| |||||||

Net Assets — 100.0% |

| $ | 39,846,159 | |||||

|

| |||||||

| (a) | Non-income producing security. |

| (b) | Affiliate of the Fund. |

| (c) | Annualized 7-day yield as of period end. |

| 10 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) April 30, 2022 | iShares® Asia/Pacific Dividend ETF |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended April 30, 2022 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| Affiliated Issuer | Value at 04/30/21 | Purchases at Cost | Proceeds from Sales | Net Realized Gain (Loss) | Change in Unrealized Appreciation (Depreciation) | Value at 04/30/22 | Shares Held at 04/30/22 | Income | Capital Gain Distributions from Underlying Funds | |||||||||||||||||||||||||||

BlackRock Cash Funds: Institutional, SL Agency Shares(a) | $ | 677,992 | $ | — | $(677,523 | )(b) | $ | (533 | ) | $ | 64 | $ | — | — | $ | 4,559 | (c) | $ | — | |||||||||||||||||

BlackRock Cash Funds: Treasury, SL Agency Shares | 10,000 | — | — | — | — | 10,000 | 10,000 | 6 | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

$ |

(533 |

) |

$ |

64 |

|

$ |

10,000 |

|

$ |

4,565 |

|

$ |

— |

| ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

| (a) | As of period end, the entity is no longer held. |

| (b) | Represents net amount purchased (sold). |

| (c) | All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| Description | Number of Contracts | Expiration Date | Notional Amount (000) | Value/ Unrealized Appreciation (Depreciation) | ||||||||||||

Long Contracts | ||||||||||||||||

MSCI Singapore Index | 13 | 05/30/22 | $ | 292 | $ | 4,043 | ||||||||||

Mini TOPIX Index | 21 | 06/09/22 | 307 |

| (6,960

| )

| ||||||||||

|

| |||||||||||||||

$

|

(2,917

|

)

| ||||||||||||||

|

| |||||||||||||||

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| Equity Contracts | ||||

Assets — Derivative Financial Instruments |

| |||

Futures contracts | ||||

Unrealized appreciation on futures contracts(a) | $ | 4,043 | ||

|

| |||

| Liabilities — Derivative Financial Instruments | ||||

Futures contracts | ||||

Unrealized depreciation on futures contracts(a) | $ | 6,960 | ||

|

| |||

| (a) | Net cumulative unrealized appreciation (depreciation) on futures contracts are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day’s variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended April 30, 2022, the effect of derivative financial instruments in the Statements of Operations was as follows:

| Equity Contracts | ||||

Net Realized Gain (Loss) from: |

| |||

Futures contracts | $

| (20,981

| )

| |

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) on: | ||||

Futures contracts | $

| 5,255

|

| |

|

| |||

Average Quarterly Balances of Outstanding Derivative Financial Instruments

Futures contracts: | ||||

Average notional value of contracts — long | $ | 320,404 |

S C H E D U L E O F I N V E S T M E N T S | 11 |

Schedule of Investments (continued) April 30, 2022 | iShares® Asia/Pacific Dividend ETF |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

Investments | ||||||||||||||||

Assets | ||||||||||||||||

Common Stocks | $ | 1,625,462 | $ | 37,599,892 | $ | — | $ | 39,225,354 | ||||||||

Warrants | 1 | — | — | 1 | ||||||||||||

Money Market Funds |

| 10,000

|

|

| —

|

|

| —

|

|

| 10,000

|

| ||||

|

|

|

|

|

|

|

| |||||||||

| $

| 1,635,463

|

| $

| 37,599,892

|

| $

| —

|

| $

| 39,235,355

|

| |||||

|

|

|

|

|

|

|

| |||||||||

Derivative financial instruments(a) | ||||||||||||||||

Assets | ||||||||||||||||

Futures Contracts | $ | — | $ | 4,043 | $ | — | $ | 4,043 | ||||||||

Liabilities | ||||||||||||||||

Futures Contracts |

| —

|

|

| (6,960

| )

|

| —

|

|

| (6,960

| )

| ||||

|

|

|

|

|

|

|

| |||||||||

| $

| —

|

| $

| (2,917

| )

| $

| —

|

| $

| (2,917

| )

| |||||

|

|

|

|

|

|

|

| |||||||||

| (a) | Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

See notes to financial statements.

| 12 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments April 30, 2022 | iShares® Emerging Markets Dividend ETF (Percentages shown are based on Net Assets) |

| Security | Shares | Value | ||||||

Common Stocks |

| |||||||

| Brazil — 14.6% | ||||||||

Auren Energia SA | 2,374,536 | $ | 7,041,070 | |||||

Banco Santander Brasil SA | 1,255,443 | 8,062,443 | ||||||

BB Seguridade Participacoes SA | 1,037,911 | 5,338,662 | ||||||

Cia Brasileira de Distribuicao | 363,087 | 1,493,049 | ||||||

CPFL Energia SA | 1,495,661 | 10,936,224 | ||||||

Cyrela Brazil Realty SA Empreendimentos | 1,815,806 | 5,196,989 | ||||||

Energisa SA | 764,761 | 7,369,252 | ||||||

Grendene SA | 4,731,622 | 9,044,151 | ||||||

JHSF Participacoes SA | 7,432,443 | 9,861,917 | ||||||

Qualicorp Consultoria e Corretora de Seguros SA | 3,805,321 | 10,213,819 | ||||||

Telefonica Brasil SA | 516,911 | 5,561,241 | ||||||

Transmissora Alianca de Energia Eletrica SA | 1,032,188 | 9,182,056 | ||||||

Vale SA | 589,039 | 9,923,454 | ||||||

|

| |||||||

|

99,224,327 |

| ||||||

| Chile — 5.6% | ||||||||

CAP SA | 856,755 | 10,626,551 | ||||||

Colbun SA | 145,139,991 | 10,370,303 | ||||||

Empresas CMPC SA | 5,336,388 | 7,953,644 | ||||||

Enel Chile SA | 329,734,559 | 8,696,151 | ||||||

|

| |||||||

|

37,646,649 |

| ||||||

| China — 25.3% | ||||||||

Agile Group Holdings Ltd.(a) | 19,382,000 | 9,281,837 | ||||||

Agricultural Bank of China Ltd., Class H | 12,342,000 | 4,629,013 | ||||||

Bank of China Ltd., Class H | 12,373,000 | 4,854,948 | ||||||

BBMG Corp., Class H | 22,391,000 | 3,663,641 | ||||||

China Construction Bank Corp., Class H | 5,527,000 | 3,937,429 | ||||||

China Jinmao Holdings Group Ltd. | 19,464,000 | 6,396,936 | ||||||

China Merchants Port Holdings Co. Ltd. | 1,644,000 | 2,870,089 | ||||||

China Minsheng Banking Corp. Ltd., Class H | 13,523,000 | 5,127,828 | ||||||

China Petroleum & Chemical Corp., Class H | 11,898,000 | 5,823,734 | ||||||

China Shenhua Energy Co. Ltd., Class H | 2,128,000 | 6,798,650 | ||||||

Chongqing Rural Commercial Bank Co. Ltd., Class H | 15,134,000 | 5,876,505 | ||||||

Country Garden Holdings Co. Ltd. | 7,422,000 | 5,133,623 | ||||||

Guangzhou R&F Properties Co. Ltd., Class H(a) | 22,422,400 | 8,323,808 | ||||||

Hopson Development Holdings Ltd.(a) | 2,821,300 | 5,439,732 | ||||||

Huadian Power International Corp. Ltd., Class H | 17,430,000 | 6,048,974 | ||||||

Industrial & Commercial Bank of China Ltd., Class H | 6,948,000 | 4,188,298 | ||||||

KWG Group Holdings Ltd. | 24,245,000 | 8,675,230 | ||||||

Logan Group Co. Ltd.(a) | 36,496,000 | 11,354,786 | ||||||

Lonking Holdings Ltd. | 34,653,000 | 9,566,639 | ||||||

PICC Property & Casualty Co. Ltd., Class H | 3,372,000 | 3,448,945 | ||||||

Poly Property Group Co. Ltd. | 14,612,000 | 3,671,010 | ||||||

Shenzhen Investment Ltd. | 28,524,000 | 6,153,645 | ||||||

Shimao Group Holdings Ltd.(a)(b) | 15,114,500 | 8,018,235 | ||||||

Sinopec Engineering Group Co. Ltd., Class H | 12,319,000 | 6,452,286 | ||||||

Sinopec Shanghai Petrochemical Co. Ltd., Class H | 19,778,000 | 3,700,369 | ||||||

Sunac China Holdings Ltd.(b) | 11,167,000 | 6,138,534 | ||||||

Times China Holdings Ltd.(a) | 29,656,000 | 10,515,015 | ||||||

Yankuang Energy Group Co Ltd, Class H | 812,000 | 2,290,787 | ||||||

Zhejiang Expressway Co. Ltd., Class H | 3,924,000 | 3,245,414 | ||||||

|

| |||||||

|

171,625,940 |

| ||||||

| Czech Republic — 0.8% | ||||||||

CEZ AS(a) | 128,385 | 5,503,296 | ||||||

|

| |||||||

Greece — 1.6% | ||||||||

Star Bulk Carriers Corp. | 378,000 | 10,621,800 | ||||||

|

| |||||||

| Security | Shares | Value | ||||||

| India — 6.8% | ||||||||

Bharat Petroleum Corp. Ltd. | 1,881,286 | $ | 8,853,278 | |||||

Coal India Ltd. | 3,294,389 | 7,811,932 | ||||||

Indian Oil Corp. Ltd. | 5,970,165 | 9,739,556 | ||||||

NMDC Ltd. | 4,009,477 | 8,317,882 | ||||||

Oil India Ltd. | 1,175,335 | 3,470,563 | ||||||

REC Ltd. | 4,766,494 | 7,871,568 | ||||||

|

| |||||||

|

46,064,779 |

| ||||||

| Indonesia — 1.7% | ||||||||

Adaro Energy Indonesia Tbk PT | 23,595,100 | 5,390,889 | ||||||

Hanjaya Mandala Sampoerna Tbk PT | 91,159,400 | 6,094,571 | ||||||

|

| |||||||

|

11,485,460 |

| ||||||

| Malaysia — 7.2% | ||||||||

British American Tobacco Malaysia Bhd | 2,172,700 | 6,437,999 | ||||||

Hartalega Holdings Bhd | 10,959,500 | 11,076,559 | ||||||

Kossan Rubber Industries Bhd(a) | 28,456,200 | 12,026,969 | ||||||

Malayan Banking Bhd | 4,064,500 | 8,453,423 | ||||||

Top Glove Corp. Bhd | 28,964,300 | 11,177,219 | ||||||

|

| |||||||

|

49,172,169 |

| ||||||

| Philippines — 0.5% | ||||||||

PLDT Inc. | 100,630 | 3,580,645 | ||||||

|

| |||||||

| Qatar — 0.5% | ||||||||

Barwa Real Estate Co. | 3,487,901 | 3,229,721 | ||||||

|

| |||||||

| Russia — 0.0% | ||||||||

Federal Grid Co. Unified Energy System PJSC(b) | 4,402,974,828 | 617 | ||||||

Globaltrans Investment PLC(b)(c) | 3,247,697 | 32,477 | ||||||

LUKOIL PJSC(b) | 124,880 | 18 | ||||||

Magnit PJSC(b) | 163,377 | 23 | ||||||

Magnitogorsk Iron & Steel Works PJSC(b) | 14,721,471 | 2,063 | ||||||

MMC Norilsk Nickel PJSC(b) | 23,712 | 3 | ||||||

Mobile TeleSystems PJSC(b) | 1,372,322 | 13,723 | ||||||

Moscow Exchange MICEX-RTS PJSC(b) | 2,788,700 | 391 | ||||||

Novolipetsk Steel PJSC, GDR(b) | 345,790 | 3,458 | ||||||

PhosAgro PJSC, NVS(b) | 3,484 | — | ||||||

PhosAgro PJSC, NVS(b) | 540,834 | 5,374 | ||||||

Rostelecom PJSC(b) | 4,681,247 | 656 | ||||||

Sberbank of Russia PJSC(b) | 2,500,255 | 351 | ||||||

Severstal PAO(b) | 695,941 | 98 | ||||||

Tatneft PJSC(b) | 1,165,907 | 163 | ||||||

Unipro PJSC(b) | 299,242,000 | 41,940 | ||||||

|

| |||||||

|

101,355 |

| ||||||

| Singapore — 2.0% | ||||||||

Riverstone Holdings Ltd./Singapore | 19,848,300 | 13,849,821 | ||||||

|

| |||||||

| South Africa — 6.3% | ||||||||

African Rainbow Minerals Ltd. | 507,131 | 8,409,849 | ||||||

Coronation Fund Managers Ltd. | 2,758,416 | 7,304,540 | ||||||

Exxaro Resources Ltd. | 854,776 | 12,214,898 | ||||||

Kumba Iron Ore Ltd. | 290,814 | 9,654,584 | ||||||

Truworths International Ltd. | 1,501,111 | 5,345,733 | ||||||

|

| |||||||

|

42,929,604 |

| ||||||

| Taiwan — 8.0% | ||||||||

Asustek Computer Inc. | 429,000 | 5,160,148 | ||||||

Chong Hong Construction Co. Ltd. | 1,924,000 | 4,771,948 | ||||||

Huaku Development Co. Ltd. | 1,874,000 | 5,852,914 | ||||||

Inventec Corp. | 6,423,475 | 5,487,521 | ||||||

Merry Electronics Co. Ltd. | 1,342,146 | 3,708,489 | ||||||

Radiant Opto-Electronics Corp. | 1,737,000 | 5,988,964 | ||||||

Simplo Technology Co. Ltd. | 437,600 | 4,300,242 | ||||||

S C H E D U L E O F I N V E S T M E N T S | 13 |

Schedule of Investments (continued) April 30, 2022 | iShares® Emerging Markets Dividend ETF (Percentages shown are based on Net Assets) |

| Security | Shares | Value | ||||||

| Taiwan (continued) | ||||||||

Supreme Electronics Co. Ltd. | 2,207,513 | $ | 3,420,833 | |||||

Systex Corp. | 1,655,000 | 4,524,527 | ||||||

United Integrated Services Co. Ltd | 1,157,000 | 6,997,222 | ||||||

WPG Holdings Ltd. | 2,187,280 | 4,012,642 | ||||||

|

| |||||||

|

54,225,450 |

| ||||||

| Thailand — 5.2% | ||||||||

Kiatnakin Phatra Bank PCL, NVDR | 1,646,800 | 3,448,353 | ||||||

Land & Houses PCL, NVDR | 14,349,200 | 3,987,886 | ||||||

Quality Houses PCL, NVDR | 49,724,400 | 3,243,075 | ||||||

Sri Trang Agro-Industry PCL, NVDR | 15,221,000 | 11,165,416 | ||||||

Thanachart Capital PCL, NVDR | 4,357,600 | 5,092,733 | ||||||

Tisco Financial Group PCL, NVDR | 1,912,400 | 5,044,588 | ||||||

Total Access Communication PCL, NVDR(a) | 2,422,900 | 3,247,026 | ||||||

|

| |||||||

|

35,229,077 |

| ||||||

| Turkey — 2.0% | ||||||||

Eregli Demir ve Celik Fabrikalari TAS | 4,802,095 | 10,853,691 | ||||||

Tofas Turk Otomobil Fabrikasi AS | 568,729 | 3,012,512 | ||||||

|

| |||||||

|

13,866,203 |

| ||||||

| United Arab Emirates — 0.5% | ||||||||

Dubai Islamic Bank PJSC | 1,884,242 | 3,295,848 | ||||||

|

| |||||||

Total Common Stocks — 88.6% |

| 601,652,144 | ||||||

|

| |||||||

Preferred Stocks |

| |||||||

| Brazil — 10.6% | ||||||||

Bradespar SA, Preference Shares, NVS | 1,632,291 | 9,670,365 | ||||||

Cia. de Transmissao de Energia Eletrica Paulista, Preference Shares, NVS | 1,719,631 | 8,751,285 | ||||||

Cia. Energetica de Minas Gerais, Preference Shares, NVS | 2,679,585 | 7,951,033 | ||||||

Gerdau SA, Preference Shares, NVS | 1,582,201 | 8,951,175 | ||||||

Metalurgica Gerdau SA, Preference Shares, NVS | 4,782,895 | 10,989,935 | ||||||

Petroleo Brasileiro SA, Preference Shares, NVS | 1,350,928 | 8,273,971 | ||||||

Unipar Carbocloro SA, Class B, Preference Shares, NVS | 617,774 | 11,996,979 | ||||||

| Security | Shares | Value | ||||||

| Brazil (continued) | ||||||||

Usinas Siderurgicas de Minas Gerais SA Usiminas, Class A, Preference Shares, NVS | 2,253,249 | $ | 5,154,633 | |||||

|

| |||||||

|

71,739,376 |

| ||||||

| Russia — 0.0% | ||||||||

Transneft PJSC, Preference Shares, NVS(b) | 5,767 | 1 | ||||||

|

| |||||||

Total Preferred Stocks — 10.6% |

| 71,739,377 | ||||||

|

| |||||||

Short-Term Investments |

| |||||||

| Money Market Funds — 3.6% | ||||||||

BlackRock Cash Funds: Institutional, SL Agency Shares, 0.38%(d)(e)(f) | 24,326,856 | 24,326,856 | ||||||

BlackRock Cash Funds: Treasury, SL Agency Shares, 0.34%(d)(e) | 380,000 | 380,000 | ||||||

|

| |||||||

|

24,706,856 |

| ||||||

|

| |||||||

Total Short-Term Investments — 3.6% |

| 24,706,856 | ||||||

|

| |||||||

Total Investments in Securities — 102.8% |

| 698,098,377 | ||||||

Other Assets, Less Liabilities — (2.8)% | (19,109,391 | ) | ||||||

|

| |||||||

| Net Assets — 100.0% | $ 678,988,986 | |||||||

|

| |||||||

| (a) | All or a portion of this security is on loan. |

| (b) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| (c) | This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| (d) | Affiliate of the Fund. |

| (e) | Annualized 7-day yield as of period end. |

| (f) | All or a portion of this security was purchased with the cash collateral from loaned securities. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended April 30, 2022 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| Affiliated Issuer | Value at 04/30/21 | Purchases at Cost | Proceeds from Sales | Net Realized Gain (Loss) | Change in Unrealized Appreciation (Depreciation) | Value at 04/30/22 | Shares Held at 04/30/22 | Income | Capital Gain Distributions from Underlying Funds | |||||||||||||||||||||||||||

BlackRock Cash Funds: Institutional, SL Agency Shares | $ | 9,627,376 | $ | 14,704,821 | (a) | $ | — | $ | (7,076 | ) | $ | 1,735 | $ | 24,326,856 | 24,326,856 | $ | 780,678 | (b) | $ | — | ||||||||||||||||

BlackRock Cash Funds: Treasury, SL Agency Shares | 1,090,000 | — | (710,000 | )(a) | — | — | 380,000 | 380,000 | 355 | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

| $ | (7,076 | ) | $ | 1,735 | $ | 24,706,856 | $ | 781,033 | $ | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

| (a) | Represents net amount purchased (sold). |

| (b) | All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| 14 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) April 30, 2022 | iShares® Emerging Markets Dividend ETF |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| Description | Number of Contracts | Expiration Date | Notional Amount (000) | Value/ Unrealized Appreciation (Depreciation) | ||||||||||||

Long Contracts | ||||||||||||||||

MSCI Emerging Markets Index | 117 | 06/17/22 | $ | 6,186 | $

| (285,195

| )

| |||||||||

|

| |||||||||||||||

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| Equity Contracts | ||||

Liabilities — Derivative Financial Instruments |

| |||

Futures contracts | ||||

Unrealized depreciation on futures contracts(a) | $ | 285,195 | ||

|

| |||

| (a) | Net cumulative unrealized appreciation (depreciation) on futures contracts are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day’s variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended April 30, 2022, the effect of derivative financial instruments in the Statements of Operations was as follows:

| Equity Contracts | ||||

Net Realized Gain (Loss) from: | ||||

Futures contracts | $ | (1,427,616 | ) | |

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) on: | ||||

Futures contracts | $ | (267,939 | ) | |

|

| |||

Average Quarterly Balances of Outstanding Derivative Financial Instruments

Futures contracts: | ||||

Average notional value of contracts — long | $ | 8,101,149 |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

Investments | ||||||||||||||||

Assets | ||||||||||||||||

Common Stocks | $ | 246,685,368 | $ | 340,708,652 | $ | 14,258,124 | $ | 601,652,144 | ||||||||

Preferred Stocks | 71,739,376 | — | 1 | 71,739,377 | ||||||||||||

Money Market Funds | 24,706,856 | — | — | 24,706,856 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 343,131,600 | $ | 340,708,652 | $ | 14,258,125 | $ | 698,098,377 | |||||||||

|

|

|

|

|

|

|

| |||||||||

Derivative financial instruments(a) | ||||||||||||||||

Liabilities | ||||||||||||||||

Futures Contracts | $ | (285,195 | ) | $ | — | $ | — | $ | (285,195 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

| (a) | Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

S C H E D U L E O F I N V E S T M E N T S | 15 |

Schedule of Investments (continued) April 30, 2022 | iShares® Emerging Markets Dividend ETF |

A reconciliation of Level 3 financial instruments is presented when the Fund had a significant amount of Level 3 investments and derivative financial instruments at the beginning and/or end of the year in relation to net assets. The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used in determining fair value:

| Common Stocks | Preferred Stocks | Total | ||||||||||

Assets: | ||||||||||||

Opening balance, as of April 30, 2021 | $ | — | $ | — | $ | — | ||||||

Transfers into Level 3(a) | 140,556,609 | 9,940,094 | 150,496,703 | |||||||||

Transfers out of Level 3 | (— | ) | (— | ) | (— | ) | ||||||

Accrued discounts/premiums | — | — | — | |||||||||

Net realized gain (loss) | 2,210,085 | 30,227 | 2,240,312 | |||||||||

Net change in unrealized appreciation (depreciation)(b)(c) | (169,159,940 | ) | (10,948,156 | ) | (180,108,096 | ) | ||||||

Purchases | 55,951,647 | 2,145,348 | 58,096,995 | |||||||||

Sales | (15,300,277 | ) | (1,167,512 | ) | (16,467,789 | ) | ||||||

|

|

|

|

|

| |||||||

Closing balance, as of April 30, 2022 |

$ |

14,258,124 |

|

$ |

1 |

|

$ |

14,258,125 |

| |||

|

|

|

|

|

| |||||||

Net change in unrealized appreciation (depreciation) on investment still held at April 30, 2022 |

$ |

(169,159,940 |

) |

$ |

(10,948,156 |

) |

$ |

(180,108,096 |

) | |||

|

|

|

|

|

| |||||||

| (a) | As of April 30, 2021, the Fund used observable inputs in determining the value of certain investments. As of April 30, 2022, the Fund used significant unobservable inputs in determining the value of the same investments. As a result, investments at beginning of period value were transferred from Level 1 or Level 2 to Level 3 in the fair value hierarchy. |

| (b) | Included in the related net change in unrealized appreciation (depreciation) in the Statement of Operations. |

| (c) | Any difference between net change in unrealized appreciation (depreciation) and net change in unrealized appreciation (depreciation) on investments still held at April 30, 2022 is generally due to investments no longer held or categorized as Level 3 at period end. |

The following table summarizes the valuation approaches used and unobservable inputs utilized by the BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) to determine the value of certain of the Fund’s Level 3 investments as of period end. The table does not include Level 3 investments with values based upon unadjusted third party pricing information in the amount of $101,356. A significant change in the third party information could result in a significantly lower or higher value of such Level 3 investments.

| Value | Valuation Approach | Unobservable Inputs | Range of Unobservable | |||||||||||||||||

Common Stock |

$ |

14,156,769 |

|

|

Income |

|

|

Discount Rate |

|

|

5% |

| ||||||||

| (a) | A significant change in unobservable input would have resulted in a correlated (inverse) significant change to value. |

See notes to financial statements.

| 16 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Statements of Assets and Liabilities

April 30, 2022

| iShares Asia/Pacific Dividend ETF | iShares Emerging Markets Dividend ETF | |||||||

ASSETS | ||||||||

Investments in securities, at value (including securities on loan)(a): | ||||||||

Unaffiliated(b) | $ | 39,225,355 | $ | 673,391,521 | ||||

Affiliated(c) | 10,000 | 24,706,856 | ||||||

Cash | 6,351 | 1,407,718 | ||||||

Foreign currency, at value(d) | 44,663 | 1,236,529 | ||||||

Cash pledged: | ||||||||

Futures contracts | — | 330,000 | ||||||

Foreign currency collateral pledged: | ||||||||

Futures contracts(e) | 27,215 | — | ||||||

Receivables: | ||||||||

Investments sold | 36 | 16,388,124 | ||||||

Securities lending income — Affiliated | 201 | 103,096 | ||||||

Variation margin on futures contracts | 8,417 | 15,108 | ||||||

Capital shares sold | — | 1,116,395 | ||||||

Dividends | 540,493 | 4,146,848 | ||||||

Tax reclaims | — | 11,751 | ||||||

|

|

|

| |||||

Total assets |

|

39,862,731 |

|

|

722,853,946 |

| ||

|

|

|

| |||||

LIABILITIES | ||||||||

Collateral on securities loaned, at value | — | 24,323,489 | ||||||

Deferred foreign capital gain tax | — | 410,520 | ||||||

Payables: | ||||||||

Investments purchased | — | 18,831,079 | ||||||

Bank borrowings | — | 7,325 | ||||||

Investment advisory fees | 16,572 | 284,780 | ||||||

Professional fees | — | 7,767 | ||||||

|

|

|

| |||||

Total liabilities |

|

16,572 |

|

|

43,864,960 |

| ||

|

|

|

| |||||

NET ASSETS | $ | 39,846,159 | $ | 678,988,986 | ||||

|

|

|

| |||||

NET ASSETS CONSIST OF: | ||||||||

Paid-in capital | $ | 60,072,126 | $ | 1,004,072,546 | ||||

Accumulated loss | (20,225,967 | ) | (325,083,560 | ) | ||||

|

|

|

| |||||

NET ASSETS |

$ |

39,846,159 |

|

$ |

678,988,986 |

| ||

|

|

|

| |||||

Shares outstanding |

|

1,100,000 |

|

|

22,200,000 |

| ||

|

|

|

| |||||

Net asset value |

$ |

36.22 |

|

$ |

30.59 |

| ||

|

|

|

| |||||

Shares authorized |

|

500 million |

|

|

500 million |

| ||

|

|

|

| |||||

Par value |

$ |

0.001 |

|

$ |

0.001 |

| ||

|

|

|

| |||||

(a) Securities loaned, at value | $ | — | $ | 23,107,396 | ||||

(b) Investments, at cost — Unaffiliated | $ | 42,940,023 | $ | 854,673,863 | ||||

(c) Investments, at cost — Affiliated | $ | 10,000 | $ | 24,701,833 | ||||

(d) Foreign currency, at cost | $ | 45,945 | $ | 1,265,646 | ||||

(e) Foreign currency collateral pledged, at cost | $ | 28,403 | $ | — | ||||

See notes to financial statements.

F I N A N C I A L S T A T E M E N T S | 17 |

Year Ended April 30, 2022

| iShares Asia/Pacific Dividend ETF | iShares Emerging Markets Dividend ETF | |||||||

INVESTMENT INCOME | ||||||||

Dividends — Unaffiliated | $ | 2,713,121 | $ | 67,168,084 | ||||

Dividends — Affiliated | 6 | 1,177 | ||||||

Securities lending income — Affiliated — net | 4,559 | 779,856 | ||||||

Foreign taxes withheld | (102,724 | ) | (7,044,252 | ) | ||||

Foreign withholding tax claims | — | 80,229 | ||||||

|

|

|

| |||||

Total investment income |

|

2,614,962 |

|

|

60,985,094 |

| ||

|

|

|

| |||||

EXPENSES | ||||||||

Investment advisory fees | 218,414 | 3,971,747 | ||||||

Commitment fees | — | 13,712 | ||||||

Professional fees | 217 | 8,240 | ||||||

Interest expense | — | 7,389 | ||||||

|

|

|

| |||||

Total expenses | 218,631 | 4,001,088 | ||||||

Less: | ||||||||

Investment advisory fees waived | (14 | ) | — | |||||

|

|

|

| |||||

Total expenses after fees waived |

|

218,617 |

|

|

4,001,088 |

| ||

|

|

|

| |||||

Net investment income |

|

2,396,345 |

|

|

56,984,006 |

| ||

|

|

|

| |||||

REALIZED AND UNREALIZED GAIN (LOSS) | ||||||||

Net realized gain (loss) from: | ||||||||

Investments — Unaffiliated(a) | (202,228 | ) | 32,127,596 | |||||

Investments — Affiliated | (533 | ) | (7,076 | ) | ||||

In-kind redemptions — Unaffiliated | 1,137,617 | 15,688,661 | ||||||

Futures contracts | (20,981 | ) | (1,427,616 | ) | ||||

Foreign currency transactions | 20,439 | (1,474,543 | ) | |||||

Payments by affiliate | — | 6,166 | ||||||

|

|

|

| |||||

Net realized gain |

|

934,314 |

|

|

44,913,188 |

| ||

|

|

|

| |||||

Net change in unrealized appreciation (depreciation) on: | ||||||||

Investments — Unaffiliated(b) | (5,839,902 | ) | (247,411,314 | ) | ||||

Investments — Affiliated | 64 | 1,735 | ||||||

Futures contracts | 5,255 | (267,939 | ) | |||||

Foreign currency translations | (34,753 | ) | (17,603 | ) | ||||

|

|

|

| |||||

Net change in unrealized appreciation (depreciation) | (5,869,336 | ) | (247,695,121 | ) | ||||

|

|

|

| |||||

Net realized and unrealized loss | (4,935,022 | ) | (202,781,933 | ) | ||||

|

|

|

| |||||

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (2,538,677 | ) | $ | (145,797,927 | ) | ||

|

|

|

| |||||

(a) Net of foreign capital gain tax and capital gain tax refund, if applicable | $ | — | $ | (300,860 | ) | |||

(b) Net of increase in deferred foreign capital gain tax of | $ | — | $ | (355,184 | ) | |||

See notes to financial statements.

| 18 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Statements of Changes in Net Assets

| iShares Asia/Pacific Dividend ETF | iShares Emerging Markets Dividend ETF | |||||||||||||||||||||||||||

| Year Ended 04/30/22 | Year Ended 04/30/21 | Year Ended 04/30/22 | Year Ended 04/30/21 | |||||||||||||||||||||||||

INCREASE (DECREASE) IN NET ASSETS | ||||||||||||||||||||||||||||

OPERATIONS | ||||||||||||||||||||||||||||

Net investment income | $ | 2,396,345 | $ | 1,449,294 | $ | 56,984,006 | $ | 37,635,152 | ||||||||||||||||||||

Net realized gain (loss) | 934,314 | (7,352,423 | ) | 44,913,188 | (50,964,970 | ) | ||||||||||||||||||||||

Net change in unrealized appreciation (depreciation) | (5,869,336 | ) | 13,799,889 | (247,695,121 | ) | 204,326,186 | ||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net increase (decrease) in net assets resulting from operations |

|

(2,538,677 |

) |

|

7,896,760 |

|

|

(145,797,927 |

) |

|

190,996,368 |

| ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

DISTRIBUTIONS TO SHAREHOLDERS(a) | ||||||||||||||||||||||||||||

Decrease in net assets resulting from distributions to shareholders | (2,220,607 | ) | (1,205,054 | ) | (58,982,161 | ) | (36,483,407 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

CAPITAL SHARE TRANSACTIONS | ||||||||||||||||||||||||||||

Net increase (decrease) in net assets derived from capital share transactions | (421,764 | ) | 14,297,841 | 41,784,008 | 102,187,925 | |||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

NET ASSETS | ||||||||||||||||||||||||||||

Total increase (decrease) in net assets | (5,181,048 | ) | 20,989,547 | (162,996,080 | ) | 256,700,886 | ||||||||||||||||||||||

Beginning of year | 45,027,207 | 24,037,660 | 841,985,066 | 585,284,180 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

End of year |

$ |

39,846,159 |

|

$ |

45,027,207 |

|

$ |

678,988,986 |

|

$ |

841,985,066 |

| ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

| (a) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

See notes to financial statements.

F I N A N C I A L S T A T E M E N T S | 19 |

(For a share outstanding throughout each period)

| iShares Asia/Pacific Dividend ETF | ||||||||||||||||||||

| Year Ended 04/30/22 | Year Ended 04/30/21 | Year Ended 04/30/20 | Year Ended 04/30/19 | Year Ended 04/30/18 | ||||||||||||||||

| ||||||||||||||||||||

Net asset value, beginning of year | $ | 40.93 | $ | 32.05 | $ | 43.76 | $ | 46.83 | $ | 48.14 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net investment income(a) | 2.09 | 1.80 | 2.05 | 2.49 | 2.30 | |||||||||||||||

Net realized and unrealized gain (loss)(b) | (4.91 | ) | 8.51 | (11.57 | ) | (2.96 | ) | (1.21 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net increase (decrease) from investment operations | (2.82 | ) | 10.31 | (9.52 | ) | (0.47 | ) | 1.09 | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Distributions(c) | ||||||||||||||||||||

From net investment income | (1.89 | ) | (1.43 | ) | (2.19 | ) | (2.60 | ) | (2.40 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total distributions | (1.89 | ) | (1.43 | ) | (2.19 | ) | (2.60 | ) | (2.40 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net asset value, end of year | $ | 36.22 | $ | 40.93 | $ | 32.05 | $ | 43.76 | $ | 46.83 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Return(d) | ||||||||||||||||||||

Based on net asset value | (7.02 | )% | 32.93 | % | (22.50 | )% | (0.83 | )% | 2.19 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Ratios to Average Net Assets(e) | ||||||||||||||||||||

Total expenses | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total expenses after fees waived | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net investment income | 5.38 | % | 4.89 | % | 4.99 | % | 5.65 | % | 4.72 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Supplemental Data | ||||||||||||||||||||

Net assets, end of year (000) | $ | 39,846 | $ | 45,027 | $ | 24,038 | $ | 32,823 | $ | 39,803 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Portfolio turnover rate(f) | 57 | % | 130 | % | 5 | % | 46 | % | 21 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (a) | Based on average shares outstanding. |

| (b) | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| (c) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (d) | Where applicable, assumes the reinvestment of distributions. |

| (e) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

| (f) | Portfolio turnover rate excludes in-kind transactions. |

See notes to financial statements.

| 20 | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| iShares Emerging Markets Dividend ETF | ||||||||||||||||||||

|

| |||||||||||||||||||

| Year Ended 04/30/22 | Year Ended 04/30/21 | Year Ended 04/30/20 | Year Ended 04/30/19 | Year Ended 04/30/18 | ||||||||||||||||

| ||||||||||||||||||||

Net asset value, beginning of year | $ | 39.62 | $ | 30.97 | $ | 40.67 | $ | 41.91 | $ | 39.86 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net investment income(a) | 2.66 | 1.94 | 2.25 | 2.31 | 1.86 | |||||||||||||||

Net realized and unrealized gain (loss)(b) |

| (8.93

| )

|

| 8.62

|

|

| (9.42

| )

|

| (1.33

| )

|

| 2.24

|

| |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net increase (decrease) from investment operations |

| (6.27

| )

|

| 10.56

|

|

| (7.17

| )

|

| 0.98

|

|

| 4.10

|

| |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Distributions(c) | ||||||||||||||||||||

From net investment income |

| (2.76

| )

|

| (1.91

| )

|

| (2.53

| )

|

| (2.22

| )

|

| (2.05

| )

| |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total distributions |

| (2.76

| )

|

| (1.91

| )

|

| (2.53

| )

|

| (2.22

| )

|

| (2.05

| )

| |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net asset value, end of year |

$ |

30.59 |

|

$ |

39.62 |

|

$ |

30.97 |

|

$ |

40.67 |

|

$ |

41.91 |

| |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Return(d) | ||||||||||||||||||||

Based on net asset value |

| (17.19

| )%(e)

|

| 35.51

| %

|

| (18.44

| )%

|

| 2.68

| %

|

| 10.50

| %

| |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Ratios to Average Net Assets(f) | ||||||||||||||||||||

Total expenses | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total expenses after fees waived | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total expenses excluding professional fees for foreign withholding tax claims | 0.49 | % | 0.49 | % | N/A | N/A | N/A | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net investment income | 7.03 | %(g) | 5.62 | %(g) | 6.00 | % | 5.79 | % | 4.42 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Supplemental Data | ||||||||||||||||||||

Net assets, end of year (000) | $ | 678,989 | $ | 841,985 | $ | 585,284 | $ | 571,435 | $ | 456,817 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Portfolio turnover rate(h) | 66 | % | 107 | % | 15 | % | 69 | % | 55 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (a) | Based on average shares outstanding. |

| (b) | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| (c) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (d) | Where applicable, assumes the reinvestment of distributions. |

| (e) | Includes payment received from an affiliate, which impacted the Fund’s total return. Excluding the payment from an affiliate, the Fund’s total return would have been -17.17%. |

| (f) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

| (g) | Reflects positive effect of foreign withholding tax claims, net of the associated professional fees, which resulted in the following increases for the years ended April 30, 2022 and April 30, 2021, respectively : |

• Ratio of net investment income to average net assets by 0.01% and 0.02%, respectively.

| (h) | Portfolio turnover rate excludes in-kind transactions. |

See notes to financial statements.

F I N A N C I A L H I G H L I G H T S | 21 |

| 1. | ORGANIZATION |

iShares, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company is organized as a Maryland corporation and is authorized to have multiple series or portfolios.

These financial statements relate only to the following funds (each, a “Fund” and collectively, the “Funds”):

| iShares ETF | Diversification Classification | |

Asia/Pacific Dividend | Diversified | |

Emerging Markets Dividend(a) | Diversified | |

| (a) | The Fund intends to be diversified in approximately the same proportion as its underlying index is diversified. The Fund may become non-diversified, as defined in the 1940 Act, solely as a result of a change in relative market capitalization or index weighting of one or more constituents of its underlying index. Shareholder approval will not be sought if the Fund crosses from diversified to non-diversified status due solely to a change in its relative market capitalization or index weighting of one or more constituents of its underlying index. |

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. Each Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. Below is a summary of significant accounting policies:

Investment Transactions and Income Recognition: For financial reporting purposes, investment transactions are recorded on the dates the transactions are executed. Realized gains and losses on investment transactions are determined using the specific identification method. Dividend income and capital gain distributions, if any, are recorded on the ex-dividend date. Non-cash dividends, if any, are recorded on the ex-dividend date at fair value. Dividends from foreign securities where the ex-dividend date may have passed are subsequently recorded when the Funds are informed of the ex-dividend date. Under the applicable foreign tax laws, a withholding tax at various rates may be imposed on capital gains, dividends and interest.

Foreign Currency Translation: Each Fund’s books and records are maintained in U.S. dollars. Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using prevailing market rates as quoted by one or more data service providers. Purchases and sales of investments are recorded at the rates of exchange prevailing on the respective dates of such transactions. Generally, when the U.S. dollar rises in value against a foreign currency, the investments denominated in that currency will lose value; the opposite effect occurs if the U.S. dollar falls in relative value.