UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Fund Address: c/o BlackRock Fund Advisors, 400 Howard Street, San Francisco, CA 94105

Name and address of agent for service: The Corporation Trust Incorporated, 2405 York Road, Suite 201, Lutherville-Timonium, Maryland 21093

Registrant's telephone number, including area code:

Date of reporting period:

Item 1 — Report to Stockholders

(a) The Report to Shareholders is attached herewith

iShares International High Yield Bond ETF

HYXU | Cboe BZX Exchange

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about iShares International High Yield Bond ETF (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1‑800‑iShares (1‑800‑474‑2737).

What were the Fund costs for the last year ?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| iShares International High Yield Bond ETF | $43 | 0.40% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund returned 15.56%.

For the same period, the iBoxx Global Government Overall USD Hedged Index returned 8.84 and the Markit iBoxx® Global Developed Markets ex-US High Yield Index returned 15.52%.

What contributed to performance?

Bond returns were supported during the reporting period by an environment of slowing pricing pressures. Amid worries about growth prospects, the European Central Bank cut rates three times, while the United States economy stayed strong, prompting the U.S. Federal Reserve Bank to wait until September before decreasing short-term interest rates for the first since 2020. In contrast, Japan ended its negative interest rate regime and raised rates. Positive returns were registered by all countries represented in the Fund. UK bonds, particularly the industrial sector, led contributors for the Fund. Italian bonds also contributed to performance, particularly in the banking industry, benefiting from the economic and fiscal strategy navigated by the new Italian government. By credit rating, bonds rated Ba and B by Moody’s were the largest contributors.

What detracted from performance?

During the reporting period there were no significant detractors from the Fund’s return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

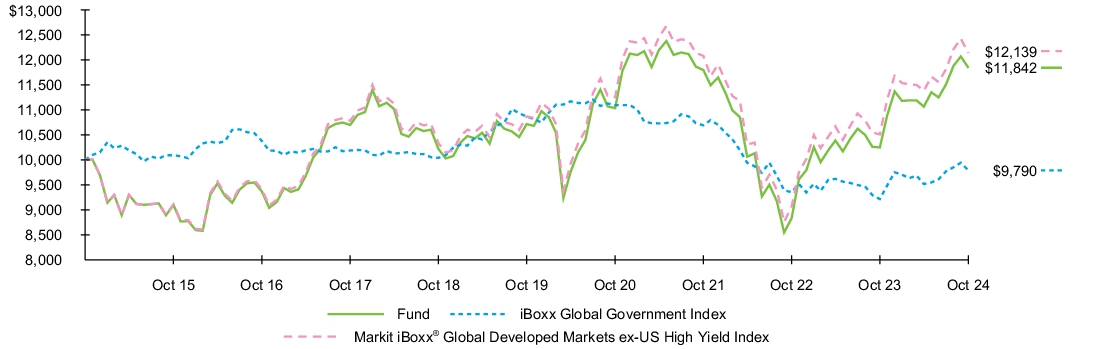

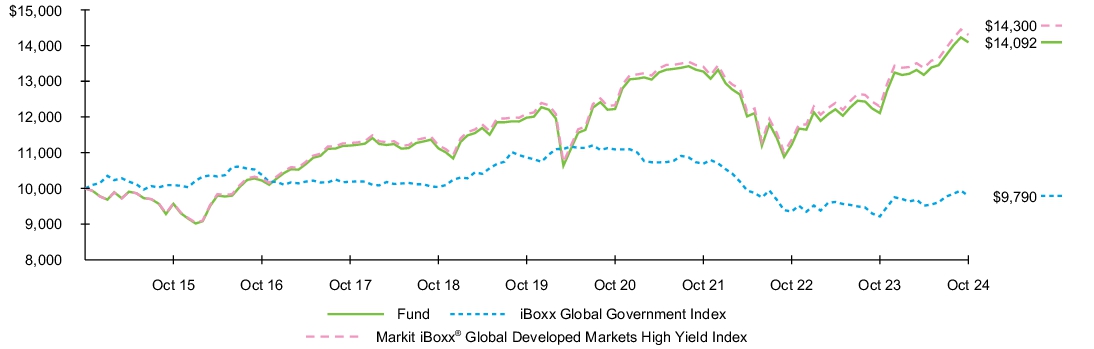

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Fund NAV | 15.56 | % | 2.02 | % | 1.70 | % |

| iBoxx Global Government Index | 6.24 | | (2.06 | ) | (0.21 | ) |

| Markit iBoxx® Global Developed Markets ex-US High Yield Index | 15.52 | | 2.24 | | 1.96 | |

| Key Fund statistics | |

| Net Assets | $51,198,963 |

| Number of Portfolio Holdings | 405 |

| Net Investment Advisory Fees | $196,972 |

| Portfolio Turnover Rate | 46% |

The Fund has added the iBoxx Global Government Index in response to new regulatory requirements.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

Credit quality allocation

| Moody's Credit Rating* | Percent of Total

Investments(a) | |

| Baa | 6.6 | % |

| Ba | 45.7 | % |

| B | 27.7 | % |

| Caa | 4.7 | % |

| Ca | 1.0 | % |

| Not Rated | 14.3 | % |

| Country/Geographic Region | Percent of Total

Investments(a) | |

| France | 16.7 | % |

| Italy | 15.1 | % |

| United Kingdom | 13.1 | % |

| United States | 12.2 | % |

| Germany | 10.3 | % |

| Spain | 4.5 | % |

| Luxembourg | 4.3 | % |

| Greece | 4.2 | % |

| Sweden | 3.2 | % |

| Netherlands | 3.2 | % |

(a) | Excludes money market funds. |

* | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Markit Indices Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares International High Yield Bond ETF

Annual Shareholder Report — October 31, 2024

HYXU-10/24-AR

iShares J.P. Morgan EM Corporate Bond ETF

CEMB | Cboe BZX Exchange

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about iShares J.P. Morgan EM Corporate Bond ETF (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1‑800‑iShares (1‑800‑474‑2737).

What were the Fund costs for the last year ?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| iShares J.P. Morgan EM Corporate Bond ETF | $54 | 0.50% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund returned 14.50%.

For the same period, the JPM Emerging Market Bond Index returned 14.94% and the J.P. Morgan CEMBI Broad Diversified Core Index returned 14.99%.

What contributed to performance?

Emerging market bonds delivered strong returns during the reporting period as expectations of interest rate cuts and then a cut by the U.S. Federal Reserve in September helped these bonds move higher. In addition, emerging market economies benefited from steady growth and from already being in the advanced stages of their easing cycles. In this landscape, the Fund’s allocation to financial bonds contributed to the Fund’s return during the reporting period. Industrials, specifically the basic and communications sectors, also contributed to performance. At the issuer level, Hong Kong industrial bonds were meaningful contributors. From a quality perspective, bonds on the lower end of the investment grade spectrum (rated Baa by Moody’s) benefited performance, followed by the highest rated high yield bonds, rated Ba.

What detracted from performance?

During the reporting period there were no significant detractors from the Fund’s return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

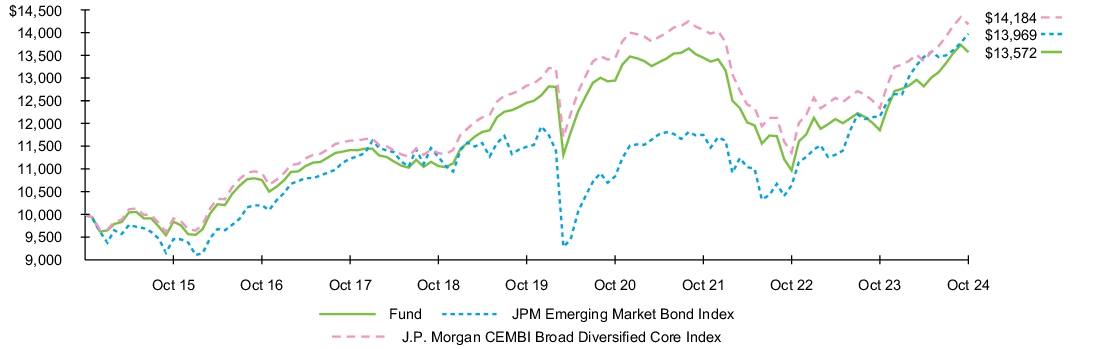

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Fund NAV | 14.50 | % | 1.74 | % | 3.10 | % |

| JPM Emerging Market Bond Index | 14.94 | | 3.99 | | 3.40 | |

| J.P. Morgan CEMBI Broad Diversified Core Index | 14.99 | | 2.02 | | 3.56 | |

| Key Fund statistics | |

| Net Assets | $444,432,505 |

| Number of Portfolio Holdings | 1,085 |

| Net Investment Advisory Fees | $2,113,528 |

| Portfolio Turnover Rate | 30% |

The Fund has added the JPM Emerging Market Bond Index in response to new regulatory requirements.

The performance of the J.P. Morgan CEMBI Broad Diversified Core Index in this report reflects the performance of the Morningstar® Emerging Markets Corporate Bond IndexSM through May 31, 2017 and, beginning on June 1, 2017, the performance of the J.P. Morgan CEMBI Broad Diversified Core Index.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

Credit quality allocation

| Moody's Credit Rating* | Percent of Total

Investments(a) | |

| Aaa | 0.4 | % |

| Aa | 7.8 | % |

| A | 17.9 | % |

| Baa | 30.9 | % |

| Ba | 14.8 | % |

| B | 7.1 | % |

| Caa | 1.6 | % |

| C | 0.9 | % |

| Not Rated | 18.6 | % |

| Country/Geographic Region | Percent of Total

Investments(a) | |

| China | 9.4 | % |

| Brazil | 5.3 | % |

| United Arab Emirates | 5.2 | % |

| Saudi Arabia | 4.8 | % |

| Mexico | 4.8 | % |

| South Korea | 4.6 | % |

| India | 4.6 | % |

| Turkey | 4.3 | % |

| Chile | 4.1 | % |

| Hong Kong | 3.9 | % |

(a) | Excludes money market funds. |

* | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by JPMorgan Chase & Co., Morningstar Inc., and their respective affiliates, nor do these companies make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the companies listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares J.P. Morgan EM Corporate Bond ETF

Annual Shareholder Report — October 31, 2024

CEMB-10/24-AR

iShares J.P. Morgan EM High Yield Bond ETF

EMHY | Cboe BZX Exchange

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about iShares J.P. Morgan EM High Yield Bond ETF (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1‑800‑iShares (1‑800‑474‑2737).

What were the Fund costs for the last year ?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| iShares J.P. Morgan EM High Yield Bond ETF | $56 | 0.50% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund returned 22.87%.

For the same period, the JPM Emerging Market Bond Index returned 14.94% and the J.P. Morgan USD Emerging Markets High Yield Bond Index returned 23.46%.

What contributed to performance?

Emerging market bonds delivered strong returns during the reporting period, as expectations of interest rate cuts and then a cut by the U.S. Federal Reserve in September helped these bonds move higher. In addition, emerging market economies benefited from steady growth and from already being in the advanced stages of their easing cycles. Both government and corporate bonds contributed to performance, with government debt, particularly sovereign issues, providing the bulk of outperformance. Within corporate bonds, financial issues benefited performance. From a quality perspective, issues rated B and Ba by Moody’s contributed the most to the Fund’s return.

What detracted from performance?

During the reporting period there were no significant detractors from the Fund’s return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

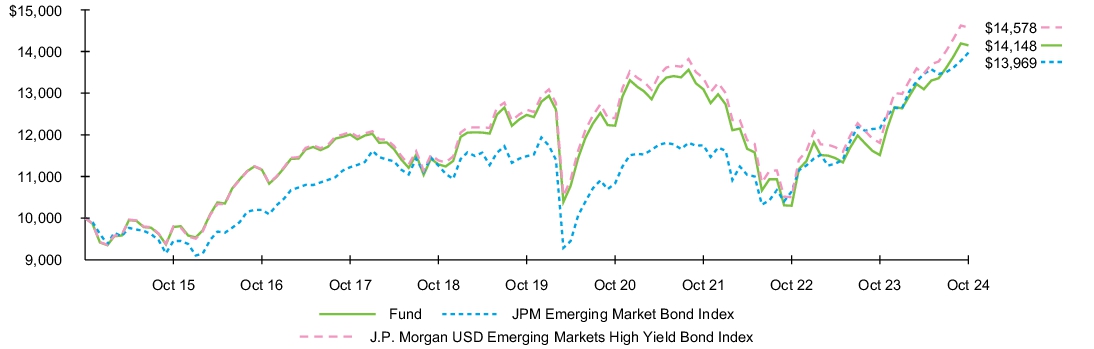

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Fund NAV | 22.87 | % | 2.54 | % | 3.53 | % |

| JPM Emerging Market Bond Index | 14.94 | | 3.99 | | 3.40 | |

| J.P. Morgan USD Emerging Markets High Yield Bond Index | 23.46 | | 2.96 | | 3.84 | |

| Key Fund statistics | |

| Net Assets | $457,667,766 |

| Number of Portfolio Holdings | 670 |

| Net Investment Advisory Fees | $1,902,829 |

| Portfolio Turnover Rate | 22% |

The Fund has added the JPM Emerging Market Bond Index in response to new regulatory requirements.

The performance of the J.P. Morgan USD Emerging Markets High Yield Bond Index in this report reflects the performance of the Morningstar® Emerging Markets High Yield Bond IndexSM through March 1, 2020 which terminated on April 1, 2020 and, beginning on March 2, 2020, the performance of the J.P. Morgan USD Emerging Markets High Yield Bond Index.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

Credit quality allocation

| Moody's Credit Rating* | Percent of Total

Investments(a) | |

| Aaa | 0.7 | % |

| Aa | 0.5 | % |

| A | 0.2 | % |

| Baa | 8.0 | % |

| Ba | 35.1 | % |

| B | 25.8 | % |

| Caa | 9.1 | % |

| Ca | 0.8 | % |

| C | 0.7 | % |

| Not Rated | 19.1 | % |

| Country/Geographic Region | Percent of Total

Investments(a) | |

| Turkey | 13.5 | % |

| Brazil | 12.9 | % |

| Mexico | 8.2 | % |

| Colombia | 7.4 | % |

| Argentina | 5.7 | % |

| Dominican Republic | 3.4 | % |

| South Africa | 3.3 | % |

| Oman | 3.2 | % |

| United Arab Emirates | 2.9 | % |

| China | 2.8 | % |

(a) | Excludes money market funds. |

* | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by JPMorgan Chase & Co., Morningstar Inc., and their respective affiliates, nor do these companies make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the companies listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares J.P. Morgan EM High Yield Bond ETF

Annual Shareholder Report — October 31, 2024

EMHY-10/24-AR

iShares J.P. Morgan EM Local Currency Bond ETF

LEMB | NYSE Arca

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about iShares J.P. Morgan EM Local Currency Bond ETF (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1‑800‑iShares (1‑800‑474‑2737).

What were the Fund costs for the last year ?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| iShares J.P. Morgan EM Local Currency Bond ETF | $31 | 0.30% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund returned 8.18%.

For the same period, the JPM Emerging Market Bond Index returned 14.94% and the J.P. Morgan GBI-EM Global Diversified 15% Cap 4.5% Floor Index returned 5.61%.

What contributed to performance?

Emerging market sovereign bonds delivered solid returns during the reporting period, buoyed by expectations of a rate cut from the U.S. Federal Reserve, which was realized in September. In addition, emerging market economies benefited from steady economic growth and their progress in monetary easing cycles. At the country level, China observed gains following government efforts to stimulate the world’s second-largest economy, while South African local currency bonds benefited from the country’s improving economic outlook. In terms of credit quality, investment-grade bonds rated BBB and A contributed the most to the Fund’s return.

What detracted from performance?

During the reporting period, Turkey contributed negatively to performance as the government enacted extreme measures to address inflation and widening deficits. As inflation concerns returned, Brazil’s central bank began to raise borrowing costs, pushing bond prices lower. (Bond yields and prices move in opposite directions.)

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

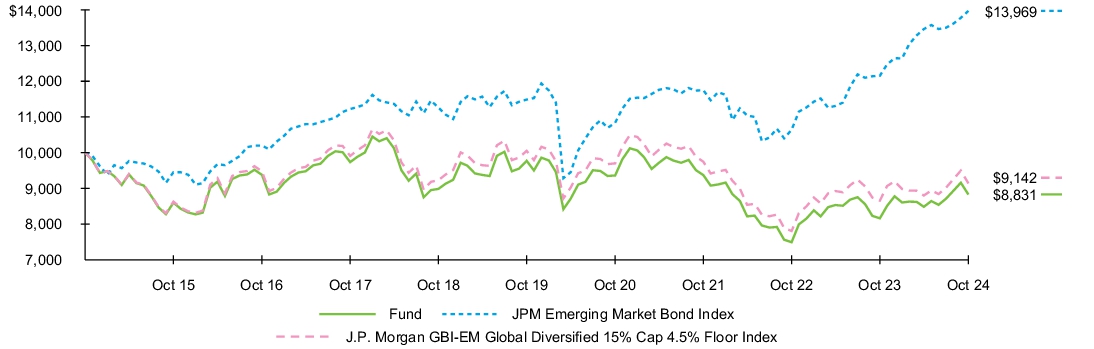

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Fund NAV | 8.18 | % | (2.01 | )% | (1.24 | )% |

| JPM Emerging Market Bond Index | 14.94 | | 3.99 | | 3.40 | |

| J.P. Morgan GBI-EM Global Diversified 15% Cap 4.5% Floor Index | 5.61 | | (1.88 | ) | (0.89 | ) |

| Key Fund statistics | |

| Net Assets | $362,469,397 |

| Number of Portfolio Holdings | 380 |

| Net Investment Advisory Fees | $1,283,298 |

| Portfolio Turnover Rate | 31% |

The Fund has added the JPM Emerging Market Bond Index in response to new regulatory requirements.

The performance of the J.P. Morgan GBI-EM Global Diversified 15% Cap 4.5% Floor Index in this report reflects the performance of the Bloomberg Emerging Markets Broad Local Currency Bond Index through May 31, 2017 and, beginning on June 1, 2017, the performance of the J.P. Morgan GBI-EM Global Diversified 15% Cap 4.5% Floor Index

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

Credit quality allocation

| Moody's Credit Rating* | Percent of Total

Investments(a) | |

| Aa | 3.3 | % |

| A | 20.8 | % |

| Baa | 30.9 | % |

| Ba | 9.6 | % |

| Not Rated | 35.4 | % |

| Country/Geographic Region | Percent of Total

Investments(a) | |

| China | 15.3 | % |

| Indonesia | 6.2 | % |

| Malaysia | 5.7 | % |

| Mexico | 5.2 | % |

| India | 4.9 | % |

| Thailand | 4.8 | % |

| Serbia | 4.5 | % |

| Dominican Republic | 4.5 | % |

| Uruguay | 4.5 | % |

| South Africa | 4.5 | % |

(a) | Excludes money market funds. |

* | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by JPMorgan Chase & Co., Bloomberg Index Services Limited and their respective affiliates, nor do these companies make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the companies listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares J.P. Morgan EM Local Currency Bond ETF

Annual Shareholder Report — October 31, 2024

LEMB-10/24-AR

iShares US & Intl High Yield Corp Bond ETF

GHYG | Cboe BZX Exchange

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about iShares US & Intl High Yield Corp Bond ETF (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1‑800‑iShares (1‑800‑474‑2737).

What were the Fund costs for the last year ?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| iShares US & Intl High Yield Corp Bond ETF | $43 | 0.40% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund returned 16.38%.

For the same period, the iBoxx Global Government Overall USD Hedged Index returned 8.84% and the Markit iBoxx® Global Developed Markets High Yield Index returned 16.32%.

What contributed to performance?

Bond returns were supported during the reporting period by an environment of slowing pricing pressures. Amid worries about growth prospects, the European Central Bank cut rates three times, while the United States economy stayed strong, prompting the U.S. Federal Reserve Bank to wait until September before decreasing short-term interest rates for the first since 2020. In contrast, Japan ended its negative interest rate regime and raised rates. Positive returns were registered by all countries, but contributions to the Fund’s return were dominated by U.S. corporate bonds, which have benefited from solid demand amid favorable bond conditions. By credit rating, bonds rated Ba and B by Moody’s were the largest contributors.

What detracted from performance?

During the reporting period there were no significant detractors from the Fund’s return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund performance

Cumulative performance: November 1, 2014 through October 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | | | |

| 1 Year | | 5 Years | | 10 Years | |

| Fund NAV | 16.38 | % | 3.30 | % | 3.49 | % |

| iBoxx Global Government Index | 6.24 | | (2.06 | ) | (0.21 | ) |

| Markit iBoxx® Global Developed Markets High Yield Index | 16.32 | | 3.42 | | 3.64 | |

| Key Fund statistics | |

| Net Assets | $148,041,255 |

| Number of Portfolio Holdings | 1,567 |

| Net Investment Advisory Fees | $538,239 |

| Portfolio Turnover Rate | 27% |

The Fund has added the iBoxx Global Government Index in response to new regulatory requirements.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

(as of October 31, 2024)

Credit quality allocation

| Moody's Credit Rating* | Percent of Total

Investments(a) | |

| Baa | 2.4 | % |

| Ba | 41.2 | % |

| B | 39.7 | % |

| Caa | 10.4 | % |

| Ca | 1.0 | % |

| Not Rated | 5.3 | % |

| Country/Geographic Region | Percent of Total

Investments(a) | |

| United States | 65.0 | % |

| United Kingdom | 5.9 | % |

| France | 5.2 | % |

| Italy | 4.1 | % |

| Canada | 3.5 | % |

| Germany | 3.4 | % |

| Luxembourg | 1.7 | % |

| Netherlands | 1.7 | % |

| Israel | 1.2 | % |

| Spain | 1.2 | % |

(a) | Excludes money market funds. |

* | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Markit Indices Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares US & Intl High Yield Corp Bond ETF

Annual Shareholder Report — October 31, 2024

GHYG-10/24-AR

(b) Not applicable

| Item 2 – | Code of Ethics – The registrant has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the registrant has not amended the code of ethics and there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, by calling 1-800-474-2737. |

| Item 3 – | Audit Committee Financial Expert – The registrant’s board of directors (the “board of directors”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent: |

Richard L. Fagnani

Madhav V. Rajan

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors.

| Item 4 – | Principal Accountant Fees and Services. |

The principal accountant fees disclosed in items 4(a), 4(b), 4(c), 4(d) and 4(g) are for the five series of the registrant for which the fiscal year-end is October 31, 2024 (the “Funds”), and whose annual financial statements are reported in Item 7.

(a) Audit Fees – The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Funds’ annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $82,000 for the fiscal year ended October 31, 2023 and $82,000 for the fiscal year ended October 31, 2024.

(b) Audit-Related Fees – There were no fees billed for the fiscal years ended October 31, 2023 and October 31, 2024 for assurance and related services by the principal accountant that were reasonably related to the performance of the audit of the Funds’ financial statements and are not reported under (a) of this Item.

(c) Tax Fees – The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning for the Funds were $48,500 for the fiscal year ended October 31, 2023 and $48,500 for the fiscal year ended October 31, 2024. These services related to the review of the Funds’ tax returns and excise tax calculations.

(d) All Other Fees – There were no other fees billed in each of the fiscal years ended October 31, 2023 and October 31, 2024 for products and services provided by the principal accountant, other than the services reported in (a) through (c) of this Item.

(e)(1) Audit Committee Pre-Approval Policies and Procedures – The registrant’s audit committee charter, as amended, provides that the audit committee is responsible for the approval, prior to appointment, of the engagement of the principal accountant to annually audit and provide their opinion on the registrant’s financial statements. The audit committee must also approve, prior to appointment, the engagement of the principal accountant to provide non-audit services to the registrant or to any entity controlling, controlled by or under common control with the registrant’s investment adviser (“Adviser Affiliate”) that provides ongoing services to the registrant, if the engagement relates directly to the operations and financial reporting of the registrant.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable

(g) The aggregate non-audit fees billed by the registrant’s principal accountant for services rendered to the Funds, and rendered to the registrant’s investment adviser, and any Adviser Affiliate that provides ongoing services to the registrant for the last two fiscal years were $48,500 for the fiscal year ended October 31, 2023 and $48,500 for the fiscal year ended October 31, 2024.

(h) The registrant’s audit committee has considered whether the provision of non-audit services rendered to the registrant’s investment adviser and any Adviser Affiliate that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, if any, is compatible with maintaining the principal accountant’s independence, and has determined that the provision of these services, if any, does not compromise the principal accountant’s independence.

(i) Not applicable

(j) Not applicable

| Item 5 – | Audit Committee of Listed Registrant |

(a) The following individuals are members of the registrant’s separately designated standing Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (15 U.S.C. 78c(a)(58)(A)):

Richard L. Fagnani

Laura F. Fergerson

Cecilia H. Herbert

Madhav V. Rajan

(b) Not applicable

(a) The registrant’s Schedule of Investments is included as part of the Financial Statements and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

| Item 7 – | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

2024 Annual Financial Statements and Additional Information |

|

• iShares International High Yield Bond ETF | HYXU | Cboe BZX Exchange |

• iShares J.P. Morgan EM Corporate Bond ETF | CEMB | Cboe BZX Exchange |

• iShares J.P. Morgan EM High Yield Bond ETF | EMHY | Cboe BZX Exchange |

• iShares J.P. Morgan EM Local Currency Bond ETF | LEMB | NYSE Arca |

• iShares US & Intl High Yield Corp Bond ETF | GHYG | Cboe BZX Exchange |

|

Schedule of InvestmentsOctober 31, 2024

iShares® International High Yield Bond ETF(Percentages shown are based on Net Assets)

| | |

|

|

APA Infrastructure Ltd., 7.13%, 11/09/83, (5-year EURIBOR ICE Swap + 4.098%)(a)(b) | | |

|

ams-OSRAM AG, 10.50%, 03/30/29(a) | | |

Benteler International AG, 9.38%, 05/15/28(a) | | |

| | |

|

| | |

| | |

| | |

Telenet Finance Luxembourg Notes SARL, 3.50%, 03/01/28(a) | | |

| | |

|

Air Canada, 4.63%, 08/15/29(c) | | |

Cineplex Inc., 7.63%, 03/31/29(c) | | |

Mattamy Group Corp., 4.63%, 03/01/28(a) | | |

Mattr Corp., 7.25%, 04/02/31(c) | | |

| | |

| | |

| | |

Primo Water Holdings Inc., 3.88%, 10/31/28(a) | | |

Southern Pacific Resource Corp., 8.75%, 01/25/18(c)(d)(e)(f) | | |

Tamarack Valley Energy Ltd., 7.25%, 05/10/27(c) | | |

| | |

|

Bank of Cyprus PCL, 2.50%, 06/24/27, (1-year EUR Swap + 2.785%)(a)(b) | | |

|

Allwyn Entertainment Financing U.K. PLC, 7.25%, 04/30/30(a) | | |

|

| | |

1.50%, (5-year EUR Swap + 1.860%)(a)(b) | | |

1.75%, (5-year EURIBOR ICE Swap + 1.952%)(a)(b) | | |

2.50%, (5-year GUK + 2.136%)(a)(b) | | |

5.13%, (5-year EURIBOR ICE Swap + 2.590%)(a)(b) | | |

| | |

|

Citycon Treasury BV, 1.25%, 09/08/26(a) | | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Banijay Entertainment SASU, 7.00%, 05/01/29(a) | | |

Banijay Group SAS, 6.50%, 03/01/26(a) | | |

CAB SELAS, 3.38%, 02/01/28(a) | | |

Cerba Healthcare SACA, 3.50%, 05/31/28(a) | | |

| | |

|

Chrome Holdco SASU, 5.00%, 05/31/29(a) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Emeria SASU, 7.75%, 03/31/28(a) | | |

Eramet SA, 6.50%, 11/30/29(a) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Holding d'Infrastructures des Metiers de l'Environnement | | |

| | |

Series ., 0.63%, Series ., 09/16/28(a) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Series ., 5.38%, Series ., 05/02/31(a) | | |

IPD 3 BV, 8.00%, 06/15/28(a) | | |

Kapla Holding SAS, 3.38%, 12/15/26(a) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

RCI Banque SA, 5.50%, 10/09/34, (5-year EURIBOR ICE Swap + 2.750%)(a)(b) | | |

| | |

| | |

| | |

| | |

| | |

32024 iShares Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

iShares® International High Yield Bond ETF(Percentages shown are based on Net Assets)

| | |

|

| | |

| | |

| | |

| | |

SNF Group SACA, 2.00%, 02/01/26(a) | | |

Tereos Finance Groupe I SA, 7.25%, 04/15/28(a) | | |

| | |

| | |

| | |

| | |

| | |

| | |

Viridien, 7.75%, 04/01/27(a) | | |

| | |

|

Aareal Bank AG, 5.63%, 12/12/34, (5-year EURIBOR ICE Swap + 3.250%)(a)(b) | | |

alstria office REIT-AG, 1.50%, 06/23/26(a) | | |

APCOA Group GmbH, 6.00%, 04/15/31(a) | | |

| | |

3.13%, 11/12/79, (5-year EUR Swap + 3.108%)(a)(b) | | |

3.90%, 09/25/83, (5-year EUR Swap + 3.896%)(a)(b) | | |

5.38%, 03/25/82, (5-year EUR Swap + 4.458%)(a)(b) | | |

5.50%, 09/13/54, (5-year EURIBOR ICE Swap + 3.269%)(a)(b) | | |

6.63%, 09/25/83, (5-year EUR Swap + 3.432%)(a)(b) | | |

Series N5.5, 4.50%, Series N5.5, 03/25/82, (5-year EUR Swap + 3.751%)(a)(b) | | |

Bertelsmann SE & Co. KGaA, 3.50%, 04/23/75, (5-year EUR Swap + 3.206%)(a)(b) | | |

Cheplapharm Arzneimittel GmbH | | |

| | |

| | |

| | |

Evonik Industries AG, 1.38%, 09/02/81, (5-year EUR Swap + 1.836%)(a)(b) | | |

| | |

| | |

| | |

| | |

6.75%, 11/15/29, (6.75% cash and 7.50% PIK)(a)(g) | | |

7.00%, 11/15/31, (7.00% cash and 7.75% PIK)(a)(g) | | |

8.75%, 05/15/28, (8.75% Cash and 9.50% PIK)(a)(g) | | |

| | |

| | |

| | |

Nidda Healthcare Holding GmbH | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Tele Columbus AG, 10.00%, 01/01/29, (10.00% PIK)(a)(g) | | |

TK Elevator Holdco GmbH, 6.63%, 07/15/28(a) | | |

TK Elevator Midco GmbH, 4.38%, 07/15/27(a) | | |

TUI Cruises GmbH, 6.25%, 04/15/29(a) | | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

2.50%, 03/23/28, (1-year EUR Swap + 2.849%)(a)(b) | | |

5.00%, 05/12/30, (1-year EUR Swap + 2.432%)(a)(b) | | |

7.50%, 06/16/27, (1-year EUR Swap + 5.084%)(a)(b) | | |

Alpha Services and Holdings SA | | |

5.50%, 06/11/31, (5-year EUR Swap + 5.823%)(a)(b) | | |

6.00%, 09/13/34, (5-year EURIBOR ICE Swap + 3.270%)(a)(b) | | |

Eurobank Ergasias Services and Holdings SA, 10.00%, 12/06/32, (5-year EUR Swap + 7.588%)(a)(b) | | |

Metlen Energy & Metals SA, 4.00%, 10/17/29(a) | | |

Mytilineos SA, 2.25%, 10/30/26(a) | | |

National Bank of Greece SA | | |

5.88%, 06/28/35, (5-year EURIBOR ICE Swap + 3.154%)(a)(b) | | |

8.00%, 01/03/34, (5-year EURIBOR ICE Swap + 4.646%)(a)(b) | | |

| | |

5.00%, 04/16/30, (1-year EURIBOR ICE Swap + 2.245%)(a)(b) | | |

6.75%, 12/05/29, (1-year EUR Swap + 3.837%)(a)(b) | | |

7.25%, 07/13/28, (1-year EUR Swap + 3.692%)(a)(b) | | |

Piraeus Financial Holdings SA | | |

5.38%, 09/18/35, (5-year EURIBOR ICE Swap + 3.150%)(a)(b) | | |

7.25%, 04/17/34, (5-year EUR Swap + 4.773%)(a)(b) | | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

|

Teva Pharmaceutical Finance Netherlands II BV | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Schedule of Investments (continued)October 31, 2024

iShares® International High Yield Bond ETF(Percentages shown are based on Net Assets)

| | |

|

Almaviva-The Italian Innovation Co. SpA, 5.00%, 10/30/30(a) | | |

| | |

| | |

| | |

Banca Monte dei Paschi di Siena SpA | | |

| | |

4.75%, 03/15/29, (3-mo. EURIBOR + 2.047%)(a)(b) | | |

6.75%, 09/05/27, (3-mo. EURIBOR + 3.283%)(a)(b) | | |

| | |

Banca Popolare di Sondrio SpA, 5.51%, 03/13/34, (5-year EUR Swap + 2.800%)(a)(b) | | |

| | |

3.25%, 01/14/31, (5-year EUR Swap + 3.800%)(a)(b) | | |

5.00%, 06/18/34, (5-year EUR Swap + 2.450%)(a)(b) | | |

| | |

3.88%, 07/25/32, (5-year EUR Swap + 3.728%)(a)(b) | | |

5.75%, 09/11/29, (3-mo. EURIBOR + 2.600%)(a)(b) | | |

6.13%, 02/01/28, (3-mo. EURIBOR + 3.600%)(a)(b) | | |

Cerved Group SpA, 6.00%, 02/15/29(a) | | |

Engineering - Ingegneria Informatica - SpA | | |

| | |

| | |

Fiber Bidco SpA, 6.13%, 06/15/31(a) | | |

Guala Closures SpA, 3.25%, 06/15/28(a) | | |

IMA Industria Macchine Automatiche SpA, 3.75%, 01/15/28(a) | | |

Infrastrutture Wireless Italiane SpA | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

6.18%, 02/20/34, (5-year EURIBOR ICE Swap + 3.250%)(a)(b) | | |

Lottomatica SpA, 7.13%, 06/01/28(a) | | |

Lottomatica SpA/Roma, 5.38%, 06/01/30(a) | | |

Mediobanca Banca di Credito Finanziario SpA, 3.75%, 06/16/26 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Pachelbel Bidco SpA, 7.13%, 05/17/31(a) | | |

Rossini SARL, 6.75%, 12/31/29(a) | | |

Saipem Finance International BV | | |

| | |

| | |

| | |

|

| | |

| | |

| | |

Telecom Italia SpA/Milano | | |

| | |

| | |

| | |

| | |

| | |

| | |

2.73%, 01/15/32, (5-year EUR Swap + 2.800%)(a)(b) | | |

5.38%, 04/16/34, (5-year EURIBOR ICE Swap + 2.800%)(a)(b) | | |

UnipolSai Assicurazioni SpA, 4.90%, 05/23/34(a) | | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Aston Martin Capital Holdings Ltd., 10.38%, 03/31/29(a) | | |

|

Albion Financing 1 SARL/Aggreko Holdings Inc., 5.25%, 10/15/26(a) | | |

| | |

| | |

| | |

Altice Finco SA, 4.75%, 01/15/28(a) | | |

| | |

| | |

| | |

ARD Finance SA, 5.00%, 06/30/27, (5.00% Cash and 5.75% PIK)(a)(g) | | |

| | |

| | |

| | |

Garfunkelux Holdco 3 SA, 6.75%, 11/01/25(a) | | |

| | |

| | |

| | |

Matterhorn Telecom SA, 3.13%, 09/15/26(a) | | |

| | |

5.50%, 09/12/54, (5-year EURIBOR ICE Swap + 3.232%)(a)(b) | | |

6.00%, 09/12/54, (5-year EURIBOR ICE Swap + 3.586%)(a)(b) | | |

Summer BC Holdco A SARL, 9.25%, 10/31/27(a) | | |

Summer BC Holdco B SARL, 5.75%, 10/31/26(a) | | |

| | |

8.00%, 08/31/28, (6.50% Cash and 1.40% PIK)(a)(g) | | |

| | |

| | |

52024 iShares Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

iShares® International High Yield Bond ETF(Percentages shown are based on Net Assets)

| | |

|

Boels Topholding BV, 5.75%, 05/15/30(a) | | |

Boost Newco Borrower LLC/GTCR W Dutch Finance Sub BV, 8.50%, 01/15/31(a) | | |

Odido Group Holding BV, 5.50%, 01/15/30(a) | | |

Odido Holding BV, 3.75%, 01/15/29(a) | | |

| | |

| | |

| | |

| | |

Sunrise HoldCo IV BV, 3.88%, 06/15/29(a) | | |

Trivium Packaging Finance BV, 3.75%, 08/15/26(a) | | |

VZ Vendor Financing II BV, 2.88%, 01/15/29(a) | | |

| | |

| | |

| | |

Ziggo BV, 2.88%, 01/15/30(a) | | |

| | |

|

Var Energi ASA, 7.86%, 11/15/83, (5-year EURIBOR ICE Swap + 4.765%)(a)(b) | | |

|

Banco Comercial Portugues SA, 4.00%, 05/17/32, (5-year EUR Swap + 4.065%)(a)(b) | | |

Caixa Economica Montepio Geral Caixa Economica Bancaria SA, 8.50%, 06/12/34, (5-year EURIBOR ICE Swap + 5.815%)(a)(b) | | |

| | |

1.50%, 03/14/82, (5-year EUR Swap + 1.888%)(a)(b) | | |

1.88%, 08/02/81, (5-year EUR Swap + 2.380%)(a)(b) | | |

1.88%, 03/14/82, (5-year EUR Swap + 2.080%)(a)(b) | | |

4.63%, 09/16/54, (5-year EURIBOR ICE Swap + 2.395%)(a)(b) | | |

4.75%, 05/29/54, (5-year EURIBOR ICE Swap + 2.052%)(a)(b) | | |

5.94%, 04/23/83, (5-year EUR Swap + 3.184%)(a)(b) | | |

Novo Banco SA, 9.88%, 12/01/33, (5-year EUR Swap + 6.714%)(a)(b) | | |

| | |

|

Summer BidCo BV, 10.00%, 02/15/29, (10.00% Cash and 10.75% PIK)(a)(g) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Abanca Corp. Bancaria SA, 8.38%, 09/23/33, (5-year EURIBOR ICE Swap + 5.245%)(a)(b) | | |

Banco de Credito Social Cooperativo SA | | |

1.75%, 03/09/28, (1-year EUR Swap + 2.150%)(a)(b) | | |

5.25%, 11/27/31, (5-year EUR Swap + 5.419%)(a)(b) | | |

7.50%, 09/14/29, (1-year EURIBOR ICE Swap + 4.269%)(a)(b) | | |

| | |

2.50%, 04/15/31, (5-year EUR Swap + 2.950%)(a)(b) | | |

| | |

|

5.13%, 06/27/34, (5-year EURIBOR ICE Swap + 2.400%)(a)(b) | | |

6.00%, (5-year EUR Swap + 3.150%)(a)(b) | | |

Cirsa Finance International SARL | | |

| | |

| | |

| | |

| | |

| | |

| | |

Kaixo Bondco Telecom SA, 5.13%, 09/30/29(a) | | |

Lorca Telecom Bondco SA, 4.00%, 09/18/27(a) | | |

| | |

5.50%, 06/22/34, (5-year EUR Swap + 2.800%)(a)(b) | | |

7.25%, 11/15/27, (1-year EUR Swap + 4.250%)(a)(b) | | |

| | |

|

Assemblin Caverion Group AB, 6.25%, 07/01/30(a) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Verisure Midholding AB, 5.25%, 02/15/29(a) | | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

|

888 Acquisitions Ltd., 7.56%, 07/15/27(a) | | |

Amber Finco PLC, 6.63%, 07/15/29(a) | | |

Ardonagh Finco Ltd., 6.88%, 02/15/31(a) | | |

BCP V Modular Services Finance II PLC, 4.75%, 11/30/28(a) | | |

Bellis Acquisition Co. PLC, 8.13%, 05/14/30(a) | | |

Bellis Finco PLC, 4.00%, 02/16/27(a) | | |

Belron U.K. Finance PLC, 4.63%, 10/15/29(a) | | |

British Telecommunications PLC | | |

5.13%, 10/03/54, (5-year EURIBOR ICE Swap + 2.542%)(a)(b) | | |

8.38%, 12/20/83, (5-year GUK + 3.820%)(a)(b) | | |

Canary Wharf Group Investment Holdings PLC, 3.38%, 04/23/28(a) | | |

Centrica PLC, 6.50%, 05/21/55, (5-year GUK + 2.512%)(a)(b) | | |

Deuce Finco PLC, 5.50%, 06/15/27(a) | | |

eG Global Finance PLC, 11.00%, 11/30/28(a) | | |

Schedule of Investments (continued)October 31, 2024

iShares® International High Yield Bond ETF(Percentages shown are based on Net Assets)

| | |

United Kingdom (continued) |

| | |

| | |

| | |

INEOS Quattro Finance 2 PLC | | |

| | |

| | |

INEOS Styrolution Ludwigshafen GmbH, 2.25%, 01/16/27(a) | | |

Jaguar Land Rover Automotive PLC | | |

| | |

| | |

Jerrold Finco PLC, 7.88%, 04/15/30(a) | | |

Market Bidco Finco PLC, 5.50%, 11/04/27(a) | | |

Miller Homes Group Finco PLC, 7.00%, 05/15/29(a) | | |

Motion Finco SARL, 7.38%, 06/15/30(a) | | |

NGG Finance PLC, 2.13%, 09/05/82, (5-year EUR Swap + 2.532%)(a)(b) | | |

| | |

| | |

| | |

| | |

| | |

| | |

Thames Water Utilities Finance PLC | | |

| | |

| | |

| | |

| | |

| | |

| | |

Virgin Media Finance PLC, 3.75%, 07/15/30(a) | | |

Virgin Media Secured Finance PLC | | |

| | |

| | |

Virgin Media Vendor Financing Notes III DAC, 4.88%, 07/15/28(a) | | |

Vmed O2 U.K. Financing I PLC | | |

| | |

| | |

| | |

| | |

| | |

2.63%, 08/27/80, (5-year EUR Swap + 3.002%)(a)(b) | | |

3.00%, 08/27/80, (5-year EUR Swap + 3.477%)(a)(b) | | |

4.20%, 10/03/78, (5-year EUR Swap + 3.427%)(a)(b) | | |

6.50%, 08/30/84, (5-year EUR Swap + 3.489%)(a)(b) | | |

8.00%, 08/30/86, (5-year GUK + 3.837%)(a)(b) | | |

Zegona Finance PLC, 6.75%, 07/15/29(a) | | |

| | |

|

Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 SARL, 3.63%, 06/01/28(a) | | |

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC | | |

| | |

| | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA Inc. | | |

| | |

| | |

Ashland Services BV, 2.00%, 01/30/28(a) | | |

| | |

United States (continued) |

Avantor Funding Inc., 2.63%, 11/01/25(a) | | |

| | |

| | |

| | |

Ball Corp., 1.50%, 03/15/27 | | |

Belden Inc., 3.88%, 03/15/28(a) | | |

Brookfield Property Finance ULC | | |

| | |

| | |

Carnival PLC, 1.00%, 10/28/29 | | |

Catalent Pharma Solutions Inc., 2.38%, 03/01/28(a) | | |

Chemours Co. (The), 4.00%, 05/15/26 | | |

Clarios Global LP/Clarios U.S. Finance Co., 4.38%, 05/15/26(a) | | |

Constellium SE, 5.38%, 08/15/32(a) | | |

| | |

| | |

| | |

Crown European Holdings SACA | | |

| | |

| | |

| | |

Dana Financing Luxembourg SARL, 8.50%, 07/15/31(a) | | |

Darling Global Finance BV, 3.63%, 05/15/26(a) | | |

EMRLD Borrower LP/Emerald Co-Issuer Inc., 6.38%, 12/15/30(a) | | |

Encore Capital Group Inc., 5.38%, 02/15/26(a) | | |

Energizer Gamma Acquisition BV, 3.50%, 06/30/29(a) | | |

Goodyear Europe BV, 2.75%, 08/15/28(a) | | |

IGT Lottery Holdings BV, 4.25%, 03/15/30(a) | | |

International Game Technology PLC, 3.50%, 06/15/26(a) | | |

| | |

| | |

| | |

| | |

Iron Mountain U.K. PLC, 3.88%, 11/15/25(a) | | |

Levi Strauss & Co., 3.38%, 03/15/27 | | |

MPT Operating Partnership LP/MPT Finance Corp. | | |

| | |

| | |

| | |

Novelis Sheet Ingot GmbH, 3.38%, 04/15/29(a) | | |

| | |

| | |

| | |

Olympus Water U.S. Holding Corp. | | |

| | |

| | |

Organon & Co./Organon Foreign Debt Co-Issuer BV, 2.88%, 04/30/28(a) | | |

Perrigo Finance Unlimited Co., 5.38%, 09/30/32 | | |

SCIL IV LLC/SCIL USA Holdings LLC, 9.50%, 07/15/28(a) | | |

Silgan Holdings Inc., 2.25%, 06/01/28 | | |

Standard Industries Inc./New York, 2.25%, 11/21/26(a) | | |

| | |

| | |

| | |

72024 iShares Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

iShares® International High Yield Bond ETF(Percentages shown are based on Net Assets)

| | |

United States (continued) |

Walgreens Boots Alliance Inc., 2.13%, 11/20/26 | | |

| | |

Total Corporate Bonds & Notes — 97.8%

(Cost: $50,626,648) | |

| | |

|

|

| | |

Total Common Stocks — 0.0%

(Cost: $159,437) | |

Total Long-Term Investments — 97.8%

(Cost: $50,786,085) | |

|

Money Market Funds — 0.0% |

BlackRock Cash Funds: Treasury, SL Agency Shares, 4.83%(i)(j) | | |

Total Short-Term Securities — 0.0%

(Cost: $20,000) | |

Total Investments — 97.8%

(Cost: $50,806,085) | |

Other Assets Less Liabilities — 2.2% | |

| |

| This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of period end. Security description also includes the reference rate and spread if published and available. |

| Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| Issuer filed for bankruptcy and/or is in default. |

| Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| Non-income producing security. |

| Payment-in-kind security which may pay interest/dividends in additional par/shares and/or in cash. Rates shown are the current rate and possible payment rates. |

| Step coupon security. Coupon rate will either increase (step-up bond) or decrease (step-down bond) at regular intervals until maturity. Interest rate shown reflects the rate currently in effect. |

| |

| Annualized 7-day yield as of period end. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended October 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | | | | | | | |

| Represents net amount purchased (sold). |

Schedule of Investments (continued)October 31, 2024

iShares® International High Yield Bond ETF

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments at the measurement date. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

See notes to financial statements.

92024 iShares Annual Financial Statements and Additional Information

Schedule of InvestmentsOctober 31, 2024

iShares® J.P. Morgan EM Corporate Bond ETF(Percentages shown are based on Net Assets)

| | |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

AngloGold Ashanti Holdings PLC | | |

| | |

| | |

China Ping An Insurance Overseas Holdings Ltd., 2.85%, 08/12/31(b) | | |

Franshion Brilliant Ltd., 3.20%, 04/09/26(b) | | |

| | |

|

AUB Sukuk Ltd., 2.62%, 09/09/26(b) | | |

BBK BSC, 6.88%, 06/06/29(b) | | |

| | |

|

Ooredoo International Finance Ltd., 4.63%, 10/10/34(a) | | |

|

Acu Petroleo Luxembourg SARL, 7.50%, 01/13/32(b) | | |

| | |

| | |

| | |

Amaggi Luxembourg International SARL, 5.25%, 01/28/28(b) | | |

Ambipar Lux SARL, 9.88%, 02/06/31(b) | | |

| | |

| | |

| | |

B3 SA - Brasil Bolsa Balcao, 4.13%, 09/20/31(b) | | |

Banco Bradesco SA/Cayman Islands, 4.38%, 03/18/27(b) | | |

Banco BTG Pactual SA/Cayman Islands | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

8.75%, (10-year CMT + 4.398%)(b)(d)(e)(f) | | |

Braskem America Finance Co., 7.13%, 07/22/41(b) | | |

Braskem Netherlands Finance BV | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

Centrais Eletricas Brasileiras SA | | |

| | |

| | |

| | |

| | |

| | |

| | |

Cosan Overseas Ltd., 8.25%(b)(d) | | |

CSN Inova Ventures, 6.75%, 01/28/28(b) | | |

| | |

| | |

| | |

| | |

Embraer Netherlands Finance BV | | |

| | |

| | |

Guara Norte SARL, 5.20%, 06/15/34(b) | | |

GUSAP III LP, 4.25%, 01/21/30(b) | | |

Itau Unibanco Holding SA/Cayman Island | | |

3.88%, 04/15/31, (5-year CMT + 3.446%)(b)(f) | | |

4.50%, 11/21/29, (5-year CMT + 2.822%)(b)(f) | | |

4.63%, (5-year CMT + 3.222%)(b)(d)(f) | | |

7.72%, (5-year CMT + 3.981%)(b)(d)(f) | | |

7.86%, (5-year CMT + 3.863%)(b)(d)(f) | | |

| | |

| | |

| | |

| | |

MARB BondCo PLC, 3.95%, 01/29/31(b) | | |

MC Brazil Downstream Trading SARL, 7.25%, 06/30/31(b) | | |

MercadoLibre Inc., 3.13%, 01/14/31 | | |

| | |

| | |

| | |

Movida Europe SA, 7.85%, 04/11/29(b) | | |

NBM U.S. Holdings Inc., 7.00%, 05/14/26(b) | | |

Nexa Resources SA, 6.75%, 04/09/34(b) | | |

Petrobras Global Finance BV | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Petrorio Luxembourg Holding SARL, 6.13%, 06/09/26(b) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Schedule of Investments10

Schedule of Investments (continued)October 31, 2024

iShares® J.P. Morgan EM Corporate Bond ETF(Percentages shown are based on Net Assets)

| | |

|

Rumo Luxembourg SARL, 5.25%, 01/10/28(b) | | |

Samarco Mineracao SA, 9.00%, 06/30/31, (9.00% PIK)(a)(e)(g) | | |

Simpar Europe SA, 5.20%, 01/26/31(b) | | |

Sitios Latinoamerica SAB de CV, 5.38%, 04/04/32(b) | | |

St Marys Cement Inc. Canada, 5.75%, 04/02/34(b) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Suzano International Finance BV, 5.50%, 01/17/27(e) | | |

Trident Energy Finance PLC, 12.50%, 11/30/29(b) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

XP Inc., 6.75%, 07/02/29(b) | | |

Yinson Boronia Production BV, 8.95%, 07/31/42(b) | | |

| | |

British Virgin Islands — 0.0% |

Joy Treasure Assets Holdings Inc., 5.50%, 02/01/27(b) | | |

|

Endeavour Mining PLC, 5.00%, 10/14/26(b) | | |

|

CCCI Treasure Ltd., 3.65%, (5-year CMT + 5.117%)(b)(d)(f) | | |

|

Al Rajhi Sukuk Ltd., 5.05%, 03/12/29(b) | | |

Alinma Tier 1 Sukuk Ltd., 6.50%, (5-year CMT + 2.201%)(b)(d)(f) | | |

Arabian Centres Sukuk III Ltd., 9.50%, 03/06/29(b) | | |

Doha Finance Ltd., 5.25%, 03/12/29(b) | | |

QNB Finance Ltd., 6.06%, 04/02/29, (1-day SOFR + 1.200%)(f) | | |

SNB Sukuk Ltd., 5.13%, 02/27/29(b) | | |

| | |

|

AES Andes SA, 8.15%, 06/10/55, (5-year CMT + 3.835%)(b)(f) | | |

Agrosuper SA, 4.60%, 01/20/32(b) | | |

Alfa Desarrollo SpA, 4.55%, 09/27/51(b) | | |

| | |

| | |

| | |

| | |

Banco de Chile, 2.99%, 12/09/31(b) | | |

Banco de Credito e Inversiones SA | | |

| | |

| | |

7.50%, (5-year CMT + 3.767%)(a)(d)(f) | | |

8.75%, (5-year CMT + 4.944%)(b)(d)(f) | | |

| | |

|

Banco Santander Chile, 3.18%, 10/26/31(b)(e) | | |

Celulosa Arauco y Constitucion SA | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Chile Electricity Lux MPC II SARL, 5.58%, 10/20/35(a) | | |

Chile Electricity Lux MPC SARL, 6.01%, 01/20/33(b) | | |

Cia. Cervecerias Unidas SA, 3.35%, 01/19/32(b) | | |

| | |

| | |

| | |

| | |

Empresa Nacional de Telecomunicaciones SA | | |

| | |

| | |

Enel Americas SA, 4.00%, 10/25/26 | | |

Enel Chile SA, 4.88%, 06/12/28 | | |

| | |

| | |

| | |

Falabella SA, 3.38%, 01/15/32(b) | | |

GNL Quintero SA, 4.63%, 07/31/29(b) | | |

Interchile SA, 4.50%, 06/30/56(b) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Sable International Finance Ltd., 7.13%, 10/15/32(a) | | |

Sociedad Quimica y Minera de Chile SA | | |

| | |

| | |

| | |

Telefonica Moviles Chile SA, 3.54%, 11/18/31(b) | | |

| | |

|

Agricultural Bank of China Ltd./New York, 5.47%, 01/24/27, (1-day SOFR Index + 0.630%)(b)(f) | | |

Alibaba Group Holding Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

112024 iShares Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

iShares® J.P. Morgan EM Corporate Bond ETF(Percentages shown are based on Net Assets)

| | |

|

| | |

| | |

Bank of China Ltd./Luxembourg, 1.40%, 04/28/26(b) | | |

Bank of China Ltd./New York, 4.63%, 06/26/26(b) | | |

Bank of China Ltd./Sydney, 5.47%, 06/14/27, (1-day SOFR Index + 0.500%)(b)(f) | | |

Bank of Communications Co. Ltd., 3.80%, (5-year CMT + 3.345%)(b)(d)(f) | | |

Bank of Communications Co. Ltd./Hong Kong | | |

| | |

5.73%, 08/01/27, (1-day SOFR Index + 0.550%)(b)(f) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

BOCOM International Blossom Ltd., 1.75%, 06/28/26(b) | | |

Bocom Leasing Management Hong Kong Co. Ltd., 5.54%, 06/26/27, (1-day SOFR Index + 0.680%)(b)(f) | | |

CCBL Cayman 1 Corp. Ltd., 1.80%, 07/22/26(b) | | |

CCCI Treasure Ltd., 3.43%, (5-year CMT + 4.998%)(b)(d)(f) | | |

CDBL Funding 2, 2.00%, 03/04/26(b) | | |

Central Plaza Development Ltd., 4.65%, 01/19/26(b) | | |

Chalco Hong Kong Investment Co. Ltd., 2.10%, 07/28/26(b) | | |

Charming Light Investments Ltd., 4.38%, 12/21/27(b) | | |

China Cinda 2020 I Management Ltd. | | |

| | |

| | |

| | |

| | |

| | |

China Cinda Finance 2017 I Ltd. | | |

| | |

| | |

China Construction Bank Corp. | | |

2.45%, 06/24/30, (5-year CMT + 2.150%)(b)(f) | | |

2.85%, 01/21/32, (5-year CMT + 1.400%)(b)(f) | | |

China Construction Bank Corp./Hong Kong, 1.46%, 04/22/26(b) | | |

China Construction Bank Corp/Hong Kong, 5.39%, 07/16/27, (1-day SOFR Index + 0.550%)(b)(f) | | |

China Development Bank Financial Leasing Co. Ltd., 2.88%, 09/28/30, (5-year CMT + 2.750%)(b)(f) | | |

China Everbright Bank Co. Ltd./Sydney, 5.56%, 09/20/26, (1-day SOFR Index + 0.630%)(b)(f) | | |

China Everbright Bank Co. Ltd/Hong Kong, 5.66%, 05/14/27, (1-day SOFR + 0.520%)(b)(f) | | |

| | |

|

China Great Wall International Holdings III Ltd., 3.88%, 08/31/27(b) | | |

China Modern Dairy Holdings Ltd., 2.13%, 07/14/26(b) | | |

China Overseas Finance Cayman VI Ltd., 6.45%, 06/11/34(b) | | |

China Overseas Finance Cayman VIII Ltd., 2.75%, 03/02/30(b) | | |

China Railway Xunjie Co. Ltd., 4.00%, 07/06/27(b) | | |

China Resources Land Ltd., 3.75%, (5-year CMT + 5.139%)(b)(d)(f) | | |

China State Construction Finance Cayman I Ltd., 3.40%, (5-year CMT + 5.581%)(b)(d)(f) | | |

China Taiping Insurance Holdings Co. Ltd., 6.40%, (5-year CMT + 2.072%)(b)(d)(f) | | |

CICC Hong Kong Finance 2016 MTN Ltd. | | |

| | |

| | |

5.78%, 01/18/27, (1-day SOFR Index + 0.950%)(b)(f) | | |

| | |

| | |

| | |

| | |

CMB International Leasing Management Ltd., 5.82%, 06/04/27, (1-day SOFR + 0.760%)(b)(f) | | |

CMHI Finance BVI Co. Ltd. | | |

| | |

| | |

CNOOC Finance 2011 Ltd., 5.75%, 01/26/41(b) | | |

| | |

| | |

| | |

CNOOC Finance 2015 USA LLC, 4.38%, 05/02/28 | | |

CNOOC Petroleum North America ULC, 6.40%, 05/15/37 | | |

CNPC HK Overseas Capital Ltd., 5.95%, 04/28/41(b) | | |

Coastal Emerald Ltd., 6.50%, (3-year CMT + 4.781%)(b)(d)(f) | | |

Contemporary Ruiding Development Ltd., 1.50%, 09/09/26(b) | | |

CSCEC Finance Cayman II Ltd., 3.50%, 07/05/27(b) | | |

CSCIF Hong Kong Ltd., 5.75%, 05/31/27, (1-day SOFR Index + 0.670%)(b)(f) | | |

ENN Clean Energy International Investment Ltd., 3.38%, 05/12/26(b) | | |

ENN Energy Holdings Ltd., 4.63%, 05/17/27(b) | | |

Far East Horizon Ltd., 6.63%, 04/16/27(b) | | |

Fortune Star BVI Ltd., 5.95%, 10/19/25(b) | | |

Franshion Brilliant Ltd., 4.25%, 07/23/29(b) | | |

GLP China Holdings Ltd., 2.95%, 03/29/26(b) | | |

Huarong Finance 2017 Co. Ltd. | | |

| | |

| | |

Huarong Finance 2019 Co. Ltd., 4.50%, 05/29/29(b) | | |

| | |

| | |

| | |

Industrial & Commercial Bank of China Ltd. | | |

3.20%, (5-year CMT + 2.368%)(b)(d)(f) | | |

| | |

Schedule of Investments12

Schedule of Investments (continued)October 31, 2024

iShares® J.P. Morgan EM Corporate Bond ETF(Percentages shown are based on Net Assets)

| | |

|

Industrial & Commercial Bank of China Ltd./Dubai DIFC, 5.76%, 01/19/26, (1-day SOFR Index + 0.930%)(b)(f) | | |

Industrial & Commercial Bank of China Ltd./Hong Kong, 1.63%, 10/28/26(b) | | |

Industrial & Commercial Bank of China Ltd./New York, 3.54%, 11/08/27 | | |

Industrial & Commercial Bank of China Ltd./Singapore, 5.43%, 10/25/26, (1-day SOFR Index + 0.600%)(b)(f) | | |

JD.com Inc., 3.38%, 01/14/30 | | |

| | |

| | |

| | |

Longfor Group Holdings Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SF Holding Investment 2021 Ltd., 3.13%, 11/17/31(b) | | |

SF Holding Investment Ltd., 2.38%, 11/17/26(b) | | |

Shanghai Port Group BVI Development 2 Co. Ltd., 2.38%, 07/13/30(b) | | |

Sinopec Capital 2013 Ltd., 4.25%, 04/24/43(b) | | |

Soar Wise Ltd., 5.15%, 03/18/27(b) | | |

Sunac China Holdings Ltd. | | |

6.75%, 09/30/28, (5.75% cash and 6.75% PIK)(b)(g) | | |

7.00%, 09/30/29, (12.00% PIK)(b)(g) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Tencent Music Entertainment Group, 2.00%, 09/03/30 | | |

Vanke Real Estate Hong Kong Co. Ltd., 3.98%, 11/09/27(b) | | |

Weibo Corp., 3.38%, 07/08/30 | | |

West China Cement Ltd., 4.95%, 07/08/26(b) | | |

Westwood Group Holdings Ltd., 2.80%, 01/20/26(b) | | |

| | |

|

Xiaomi Best Time International Ltd. | | |

| | |

| | |

Yanlord Land HK Co. Ltd., 5.13%, 05/20/26(b) | | |

Zhongsheng Group Holdings Ltd., 5.98%, 01/30/28(b) | | |

| | |

|

ABRA Global Finance, 14.00%, 10/22/29, (6.00% cash and 8.00% PIK)(a)(g) | | |

AI Candelaria Spain SA, 5.75%, 06/15/33(b) | | |

| | |

| | |

| | |

Banco Davivienda SA, 6.65%, (10-year CMT + 5.097%)(b)(d)(f) | | |

Banco de Bogota SA, 6.25%, 05/12/26(b) | | |

| | |

4.63%, 12/18/29, (5-year CMT + 2.944%)(f) | | |

8.63%, 12/24/34, (5-year CMT + 4.320%)(f) | | |

Canacol Energy Ltd., 5.75%, 11/24/28(b) | | |

Colombia Telecomunicaciones SA ESP, 4.95%, 07/17/30(b) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

EnfraGen Energia Sur SA/EnfraGen Spain SA/Prime Energia SpA, 5.38%, 12/30/30(b) | | |

Geopark Ltd., 5.50%, 01/17/27(b) | | |

Gran Tierra Energy Inc., 9.50%, 10/15/29(b) | | |

Grupo Aval Ltd., 4.38%, 02/04/30(b) | | |

Grupo de Inversiones Suramericana SA, 5.50%, 04/29/26(b) | | |

Promigas SA ESP/Gases del Pacifico SAC, 3.75%, 10/16/29(b) | | |

SierraCol Energy Andina LLC, 6.00%, 06/15/28(b) | | |

Transportadora de Gas Internacional SA ESP, 5.55%, 11/01/28(b) | | |

| | |

|

Allwyn Entertainment Financing U.K. PLC, 7.88%, 04/30/29(b) | | |

Dominican Republic — 0.1% |

Aeropuertos Dominicanos Siglo XXI SA, 7.00%, 06/30/34(b) | | |

|

Kosmos Energy Ltd., 8.75%, 10/01/31(a) | | |

Tullow Oil PLC, 10.25%, 05/15/26(b) | | |

| | |

|

Central American Bottling Corp./CBC Bottling Holdco SL/Beliv Holdco SL, 5.25%, 04/27/29(b) | | |

CT Trust, 5.13%, 02/03/32(b) | | |

132024 iShares Annual Financial Statements and Additional Information

Schedule of Investments (continued)October 31, 2024

iShares® J.P. Morgan EM Corporate Bond ETF(Percentages shown are based on Net Assets)

| | |

|

Investment Energy Resources Ltd., 6.25%, 04/26/29(b) | | |

Millicom International Cellular SA | | |

| | |

| | |

| | |

|

| | |

2.70%, (5-year CMT + 1.758%)(b)(d)(f) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Bank of Communications Hong Kong Ltd. | | |

2.30%, 07/08/31, (5-year CMT + 1.400%)(b)(f) | | |

3.73%, (5-year CMT + 2.525%)(b)(d)(f) | | |

Bank of East Asia Ltd. (The) | | |

4.00%, 05/29/30, (5-year CMT + 3.750%)(b)(f) | | |

4.88%, 04/22/32, (5-year CMT + 2.300%)(b)(f) | | |

5.83%, (5-year CMT + 5.527%)(b)(d)(f) | | |

6.75%, 06/27/34, (5-year CMT + 2.550%)(b)(f) | | |

CAS Capital No. 1 Ltd., 4.00%, (5-year CMT + 3.642%)(b)(d)(f) | | |

Castle Peak Power Finance Co. Ltd., 3.25%, 07/25/27(b) | | |

Cathay Pacific MTN Financing HK Ltd., 4.88%, 08/17/26(b) | | |

China CITIC Bank International Ltd. | | |

4.80%, (5-year CMT + 2.104%)(b)(d)(f) | | |

6.00%, 12/05/33, (5-year CMT + 1.650%)(b)(f) | | |

CLP Power HK Finance Ltd., 3.55%, (5-year CMT + 2.041%)(b)(d)(f) | | |

| | |

| | |

8.05%, (5-year CMT + 4.865%)(b)(d)(f) | | |

| | |

HKT Capital No. 4 Ltd., 3.00%, 07/14/26(b) | | |

HKT Capital No. 5 Ltd., 3.25%, 09/30/29(b) | | |

HKT Capital No. 6 Ltd., 3.00%, 01/18/32(b) | | |

Hongkong Electric Finance Ltd. | | |

| | |

| | |

Hongkong Land Finance Cayman Islands Co. Ltd. (The) | | |

| | |

| | |

HPHT Finance 21 II Ltd., 1.50%, 09/17/26(b) | | |

Hysan MTN Ltd., 2.82%, 09/04/29(b) | | |

IFC Development Corporate Treasury Ltd., 3.63%, 04/17/29(b) | | |

JMH Co. Ltd., 2.50%, 04/09/31(b) | | |

Joy Treasure Assets Holdings Inc. | | |

| | |

| | |

Li & Fung Ltd., 5.25%(b)(d) | | |

| | |

|

Link Finance Cayman 2009 Ltd. (The) | | |

| | |

| | |

Melco Resorts Finance Ltd. | | |

| | |

| | |

| | |

| | |

| | |

MTR Corp. Ltd., 1.63%, 08/19/30(b) | | |

Nan Fung Treasury III Ltd., 5.00%(b)(d) | | |

Nanyang Commercial Bank Ltd. | | |

3.80%, 11/20/29, (5-year CMT + 2.180%)(b)(f) | | |

6.00%, 08/06/34, (5-year CMT + 2.100%)(b)(f) | | |

| | |

4.13%, (5-year CMT + 5.858%)(b)(d)(f) | | |

| | |

5.25%, (5-year CMT + 7.889%)(b)(d)(f) | | |

| | |

NWD MTN Ltd., 4.13%, 07/18/29(b) | | |

Panther Ventures Ltd., 3.50%(b)(d) | | |

PCPD Capital Ltd., 5.13%, 06/18/26(b) | | |

Phoenix Lead Ltd., 4.85%(b)(d) | | |

Prudential Funding Asia PLC | | |

2.95%, 11/03/33, (5-year CMT + 1.517%)(b)(f) | | |

| | |

| | |

Seaspan Corp., 5.50%, 08/01/29(b) | | |

Sun Hung Kai Properties Capital Market Ltd. | | |

| | |

| | |

Swire Pacific MTN Financing HK Ltd., 2.88%, 01/30/30(b) | | |

Swire Properties MTN Financing Ltd., 3.63%, 01/13/26(b) | | |

Wharf REIC Finance BVI Ltd., 3.50%, 01/17/28(b) | | |

Wheelock MTN BVI Ltd., 2.38%, 01/25/26(b) | | |

| | |

|

| | |

7.50%, 05/25/27, (1-year CMT + 3.711%)(b)(f) | | |

8.75%, 05/15/33, (5-year CMT + 5.060%)(b)(f) | | |

| | |

|

ABJA Investment Co. Pte Ltd., 5.45%, 01/24/28(b) | | |

Adani Electricity Mumbai Ltd., 3.95%, 02/12/30(b) | | |

Adani Ports & Special Economic Zone Ltd. | | |

| | |

| | |

| | |