UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | |

| (Mark One) | | |

| þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Fiscal Year Ended December 31, 2009 |

| | OR |

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the Transition Period from to |

Commission File Number 001-12755

Dean Foods Company

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 75-2559681 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2515 McKinney Avenue

Suite 1200

Dallas, Texas 75201

(214) 303-3400

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

Securities Registered Pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $.01par value | | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned-issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | |

| Large accelerated filer þ | | Accelerated filer | ¨ | | Non-accelerated filer | ¨ | | Smaller reporting company | ¨ |

| | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant at June 30, 2009, based on the $19.19 per share closing price for the registrant’s common stock on the New York Stock Exchange on June 30, 2009, was approximately $3.36 billion.

The number of shares of the registrant’s common stock outstanding as of February 19, 2010, was 181,300,615.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on or about May 19, 2010 (to be filed) are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

Forward-Looking Statements

This Annual Report on Form 10-K (the “Form 10-K”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are predictions based on our current expectations and our projections about future events, and are not statements of historical fact. Forward-looking statements include statements concerning our business strategy, among other things, including anticipated trends and developments in and management plans for our business and the markets in which we operate. In some cases, you can identify these statements by forward-looking words, such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” “could,” “predict,” and “continue,” the negative or plural of these words and other comparable terminology. All forward-looking statements included in this Form 10-K are based upon information available to us as of the filing date of this Form 10-K, and we undertake no obligation to update any of these forward-looking statements for any reason. You should not place undue reliance on these forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include the matters discussed in the section entitled “Part I — Item 1A — Risk Factors” in this Form 10-K, and elsewhere in this Form 10-K. You should carefully consider the risks and uncertainties described under these sections.

PART I

We are one of the leading food and beverage companies in the United States. Fresh Dairy Direct, previously referred to as DSD Dairy, is the largest processor and distributor of milk and other dairy products in the country, with products sold under more than 50 familiar local and regional brands and a wide array of private labels. WhiteWave-Morningstar markets and sells a variety of nationally branded dairy and dairy-related products, such asSilk®soymilk and cultured soy products,Horizon Organic®milk and other dairy products,The Organic Cow®,International Delight®coffee creamers,LAND O LAKES®creamers and fluid dairy products andRachel’s Organic®dairy products. With the addition of our recently acquired Alpro business in Europe, WhiteWave-Morningstar now offers branded soy-based beverages and food products in Europe, marketing its products under theAlpro® andProvamel® brands. Additionally, WhiteWave-Morningstar markets and sells private label cultured and extended shelf life dairy products.

Our principal executive offices are located at 2515 McKinney Avenue, Suite 1200, Dallas, Texas 75201. Our telephone number is (214) 303-3400. We maintain a worldwide web site atwww.deanfoods.com. We were incorporated in Delaware in 1994.

Our Reportable Segments

We have two reportable segments, Fresh Dairy Direct and WhiteWave-Morningstar.

Fresh Dairy Direct

Fresh Dairy Direct manufactures, markets and distributes a wide variety of branded and private label dairy case products, including milk, creamers, ice cream, cultured dairy products, juices and teas to retailers, distributors, foodservice outlets, educational institutions and governmental entities across the United States.

1

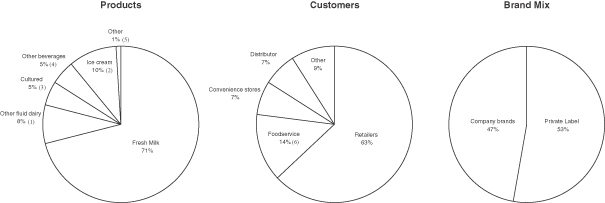

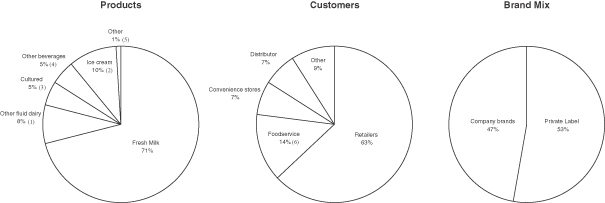

Fresh Dairy Direct’s net sales totaled $8.5 billion in 2009, or approximately 76% of our consolidated net sales. The following charts graphically depict Fresh Dairy Direct’s 2009 net sales by product and customer and the volume mix of company branded versus private label products.

| (1) | Includes half-and-half, whipping cream, dairy coffee creamers, and ice cream mix. |

| (2) | Includes ice cream and ice cream novelties. |

| (3) | Includes yogurt, cottage cheese, sour cream and dairy-based dips. |

| (4) | Includes fruit juice, fruit-flavored drinks, iced tea and water. |

| (5) | Includes items for resale such as butter, cheese, eggs and milk shakes. |

| (6) | Includes restaurants, hotels and other foodservice outlets. |

Fresh Dairy Direct sells the majority of its products under local and regional proprietary or licensed brands. Products not sold under these brands are sold as private label. Fresh Dairy Direct sells its products primarily on a local or regional basis through its local and regional sales forces, although some national customer relationships are coordinated by Fresh Dairy Direct’s corporate sales department. Fresh Dairy Direct’s largest customer is Wal-Mart, which includes its subsidiaries such as Sam’s Club, accounting for approximately 21% of Fresh Dairy Direct’s net sales in 2009.

As of December 31, 2009, Fresh Dairy Direct’s local and regional proprietary and licensed brands include the following:

| | | | |

| Alta Dena® | | Friendship® | | Oak Farms® |

| Arctic Splash® | | Gandy’s™ | | Over the Moon® |

| Atlanta Dairies® | | Garelick Farms® | | Pet® (licensed brand) |

| Barbers® | | Hershey’s® (licensed brand) | | Pog® (licensed brand) |

| Barbe’s® | | Hygeia® | | Price’s™ |

| Berkeley Farms® | | Jilbert™ | | Purity™ |

| Broughton® | | Knudsen® (licensed brand) | | Reiter™ |

| Borden® (licensed brand) | | LAND O LAKES® (licensed brand) | | Robinson® |

| Brown Cow® | | Land-O-Sun & design® | | Saunders™ |

| Brown’s Dairy® | | Lehigh Valley Dairy Farms® | | Schenkel’s All*Star™ |

| Bud’s Ice Cream™ | | Liberty™ | | Schepps® |

| Chug® | | Louis Trauth® | | Shenandoah’s Pride® |

| Country Charm® | | Maplehurst® | | Stroh’s® |

| Country Churn® | | Mayfield® | | Swiss Dairy™ |

| Country Delite™ | | McArthur® | | Swiss Premium™ |

| Country Fresh® | | Meadow Brook™ | | Trumoo™ |

| Country Love® | | Meadow Gold® | | TG Lee® |

| Creamland™ | | Mile High Ice Cream™ | | Tuscan® |

| Dairy Fresh® | | Model Dairy® | | Turtle Tracks® |

| Dean’s® | | Mountain High® | | Verifine® |

| Dipzz® | | Nature’s Pride® | | Viva® |

| Fieldcrest® | | Nurture® | | |

| Foremost® (licensed brand) | | NUTTYBUDDY® | | |

2

Fresh Dairy Direct currently operates 82 manufacturing facilities in 33 states. For more information about facilities in Fresh Dairy Direct, see “Item 2. Properties.” Due to the perishable nature of its products, Fresh Dairy Direct delivers the majority of its products directly to its customers’ locations in refrigerated trucks or trailers that we own or lease. This form of delivery is called a “direct store delivery” or “DSD” system. We believe that Fresh Dairy Direct has one of the most extensive refrigerated DSD systems in the United States.

The primary raw material used in Fresh Dairy Direct products is conventional raw milk (which contains both raw milk and butterfat) that we purchase primarily from farmers’ cooperatives, as well as from independent farmers. The federal government and certain state governments set minimum prices for raw milk on a monthly basis. Another significant raw material used by Fresh Dairy Direct is resin, which is a petroleum-based product used to make plastic bottles. The price of resin is subject to fluctuations based on changes in crude oil and natural gas prices. Other raw materials and commodities used extensively by Fresh Dairy Direct include diesel fuel, used to operate our extensive DSD system, juice concentrates and sweeteners used in our products. Fresh Dairy Direct generally increases or decreases the prices of its fluid dairy products on a monthly basis in correlation with fluctuations in the costs of raw materials, packaging supplies and delivery costs. However, in some cases, we are competitively or contractually constrained with respect to the means and/or timing of price increases, particularly non-dairy input costs such as diesel and resin.

The dairy industry is a mature industry that has traditionally been characterized by slow to flat growth, low profit margins, fragmentation and excess capacity. In this environment, price competition is particularly intense, as smaller processors seek to retain enough volume to cover their fixed costs. In addition, current economic conditions and historically low raw milk costs have led supermarkets, including vertically integrated supermarkets, and food retailers to utilize competitive pricing on dairy products to drive traffic volume and influence customer loyalty. Such activity has significantly reduced the profit margins realized by supermarkets and foods retailers on the sale of such products. Increasingly, this margin compression is being absorbed by dairy processors.

In response to this dynamic and significant competitive pressure, many processors, including us, are now placing an increased emphasis on cost reduction in an effort to increase margins. We made significant progress against such initiatives in 2009 and will continue these efforts for the foreseeable future. Historically, Fresh Dairy Direct’s volume growth has kept pace with or exceeded the industry, which we attribute largely to our national DSD system, brand recognition, service and quality. In 2009, due in part to acquisitions, we were able to increase our sales volume of fresh fluid milk and our market share in this product category.

Fresh Dairy Direct has several competitors in each of our major product and geographic markets. Competition between dairy processors for shelf-space with retailers is based primarily on price, service, quality and the expected or historical sales performance of the product compared to its competitors. In some cases Fresh Dairy Direct pays fees to customers for shelf-space. Competition for consumer sales is based on a variety of factors such as brand recognition, price, taste preference and quality. Dairy products also compete with many other beverages and nutritional products for consumer sales.

For more information on factors that can impact Fresh Dairy Direct, see “— Government Regulation — Milk Industry Regulation”, “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties — Prices of Raw Milk and Other Inputs,” as well as Note 20 to our Consolidated Financial Statements.

WhiteWave-Morningstar

WhiteWave-Morningstar consists of three aggregated operations including WhiteWave, Morningstar and Alpro, as well as a joint venture entered into in 2008 between WhiteWave and Hero Group (“Hero”). These operations have a higher concentration of branded products and rely more extensively on warehouse distribution. In 2008, we aligned these operations under a single leadership team to better leverage investments in people, tools and processes in various areas including marketing, supply chain, distribution, information technology and research and development.

3

Our WhiteWave operation (“WhiteWave”) manufactures, develops, markets and sells a variety of nationally branded soy, dairy and dairy-related products, such asSilksoymilk and cultured soy products,Horizon Organicmilk and other dairy products,The Organic Cow organic dairy products, International Delight coffee creamers,LAND O LAKEScreamer and fluid dairy products andRachel’s Organicdairy products. With the recent acquisition of Alpro, WhiteWave-Morningstar now offers branded soy-based beverages and food products in Europe, marketing its products under theAlpro andProvamel brands. Our Morningstar operation (“Morningstar”) is one of the leading U.S. manufacturers of private label cultured and extended shelf life dairy products such as ice cream mix, sour and whipped cream, yogurt and cottage cheese. Additionally, with our Hero/WhiteWave joint venture we have expanded the WhiteWave product footprint beyond the dairy case to capitalize on the chilled fruit-based beverage opportunity with the introduction ofFruit2Day®.

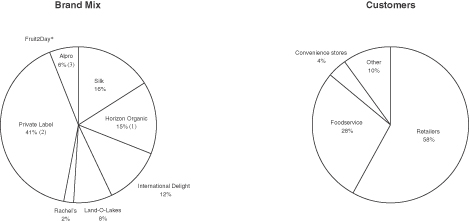

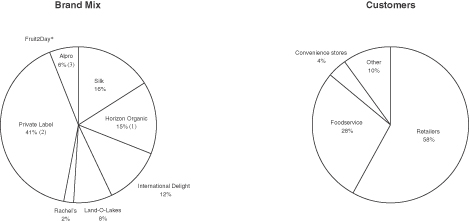

WhiteWave-Morningstar’s net sales totaled $2.7 billion in 2009, or approximately 24% of our consolidated net sales. WhiteWave-Morningstar sells its products to a variety of customers, including grocery stores, club stores, natural foods stores, mass merchandisers, convenience stores, drug stores and foodservice outlets. WhiteWave-Morningstar sells its products through a combination of internal and external sales forces. WhiteWave-Morningstar’s largest customer is Wal-Mart, which includes its subsidiaries such as Sam’s Club, accounting for approximately 14% of WhiteWave-Morningstar’s net sales in 2009.

The following charts graphically depict WhiteWave-Morningstar’s 2009 net sales by the mix of our branded versus private label products and customer:

| * | Represents less than 1% of our total brand mix. |

| (1) | IncludesHorizon OrganicandThe Organic Coworganic dairy products. |

| (2) | Includes cultured and extended shelf life dairy products such as ice cream mix, sour and whipped cream, yogurt and cottage cheese, as well as organic and soy products. |

| (3) | Includes bothAlpro andProvamel brands in Europe since July 2, 2009. |

WhiteWave-Morningstar currently operates 19 domestic and 5 international manufacturing facilities. For more information about facilities in WhiteWave-Morningstar, see “Item 2. Properties.” The remaining products are manufactured by third-party manufacturers under processing agreements. The majority of WhiteWave-Morningstar’s products are delivered through warehouse delivery systems.

The primary raw materials used in our soy-based products include both organic soybeans and non-genetically modified (“non-GMO”) soybeans. Both organic soybeans and non-GMO soybeans are generally available from several suppliers and we are not dependent on any single supplier for these raw materials.

The primary raw material used in our organic milk-based products is organic raw milk. We currently purchase approximately 85% of our organic raw milk from a network of over 500 dairy farmers across the United States. The balance of our organic raw milk is sourced from two farms that we own and operate and a third farm

4

that we lease and have contracted with a third party to manage and operate. We generally enter into supply agreements with organic dairy farmers with typical terms of two to three years, which obligate us to purchase certain minimum quantities of organic raw milk.

The primary raw material used in our private label cultured and extended shelf life dairy products, as well asLAND O LAKESand other non-organic dairy products, is conventional raw milk. WhiteWave-Morningstar also uses significant quantities of butterfat which is acquired through the purchase of raw milk and bulk cream. Bulk cream is typically purchased based on a multiple of the AA butter price on the Chicago Mercantile Exchange (“CME”). Other raw materials used in WhiteWave-Morningstar’s products include palm oil, flavorings and organic sugar. Certain of these raw materials are purchased under long-term contracts in order to better manage the supply and costs of our inputs.

WhiteWave-Morningstar has several competitors in each of its product markets. Competition to obtain shelf-space with retailers for a particular product is based primarily on the expected or historical sales performance of the product compared to its competitors. In some cases, WhiteWave-Morningstar pays fees to retailers to obtain shelf-space for a particular product. Competition for consumer sales is based on many factors, including brand recognition, price, taste preferences and quality. Consumer demand for soy and organic foods has grown in recent years due to growing consumer confidence in the health benefits of soy and organic foods, and we believe WhiteWave-Morningstar has a leading position in the soy and organic foods category.

For more information on factors that can impact the results of WhiteWave-Morningstar, see “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties — Prices of Raw Milk and Other Inputs” as well as Note 20 to our Consolidated Financial Statements.

Current Business Strategy

Our strategy historically has been centered on growth through acquisitions and aligning our operating activities with a consolidating customer base. Since 1994, we have completed over 40 acquisitions, increasing our net sales from $150 million to more than $11 billion. We believe our portfolio of manufacturing and distribution assets enables us to offer regional and national branded and private label products across a variety of product categories, ranging from short shelf life (less than 20 days) to extended shelf life (45 to 60 days) to shelf stable products (6 to 12 months), to its customers in a cost effective manner. We believe that Fresh Dairy Direct has one of the most extensive refrigerated DSD systems in the United States and WhiteWave-Morningstar’s branded and private label products maintain significant market share positions in the soy-based beverage, organic dairy, creamer, cultured products and extended shelf life product categories. With the acquisition of Alpro, we are uniquely positioned to take advantage of the global demand for soy-based products.

Currently, the our strategy is to build on our scale advantaged position in the dairy industry by extending our low cost position, driving sales and profit growth in our core businesses and investing for growth in the future. Our strategy encompasses the following:

| | • | | Continuing to reduce costs across the business and extend our low cost position in the marketplace, |

| | • | | Working to expand our core manufacturing and distribution processes and leveraging and building upon the strong net sales growth of our branded portfolio to drive revenue and operating profit growth and |

| | • | | Continuing to build stronger capabilities to drive sustainable long term growth. |

Within this strategy, we have a strong commitment to sustainable business practices that are focused on growing our business while promoting corporate social responsibility in the communities we serve. We have taken steps to reduce our green house gas emissions, water consumption and waste sent to landfills. We are also focused on engaging and developing talented individuals that will not only help grow our business but are also committed to our social efforts and supporting our communities.

5

We have analyzed and evaluated the foreseeable risks and opportunities to the business of potential legislative, regulatory and physical changes associated with climate change. While we consider our business to be subject to both risks and opportunities, we do not believe that the foreseeable risks and opportunities are material. We currently are included on the Carbon Disclosure Project’s S&P 500 Leadership Index, and WhiteWave participates in the EPA’s Climate Leaders Program. We have submitted our 2007 & 2008 Scope 1 and Scope 2 emissions data to the California Climate Action Registry for our California operations and we will submit similar 2009 emissions data for all of our facilities in the U.S. to The Climate Registry in 2010. We will be subject to mandatory emission reporting laws in various jurisdictions in which we operate in the ordinary course of our business and are prepared to comply with those obligations.

Fresh Dairy Direct

The Fresh Dairy Direct fluid and ice cream operation is focused on high velocity products where delivering low cost and high levels of customer service are critical to success. While a portion of our ice cream products are distributed through customer warehouse delivery channels, the ice cream supply chain remains highly integrated within our DSD system.

The Fresh Dairy Direct strategy is to achieve cost leadership and gain share in the core dairy business. The strategy encompasses the following:

| | • | | Driving to be the lowest cost, most effective manufacturer in every market in which we compete, |

| | • | | Building our selling and delivery capability and |

| | • | | Strengthening our capabilities through standardization and simplification of our underlying systems and processes. |

WhiteWave-Morningstar

The WhiteWave-Morningstar strategy is to lead in our categories and drive our customers’ businesses by providing nutritious, wholesome high quality retail and food service private label, extended shelf life and cultured products and be a top-tier consumer packaged goods company, consistently delivering superior results. The strategy encompasses the following:

| | • | | Growing our national and private label brands through innovation and superior marketing, |

| | • | | Accelerating growth in new businesses by segmenting consumers and innovating in value-added products, |

| | • | | Achieving cost excellence by leveraging our assets, focusing our portfolio and optimizing our supply chain, |

| | • | | Investing in people, processes and systems to drive organizational capacity and capabilities and |

| | • | | Incorporating sustainability initiatives at all levels to reduce green house gas emissions, water and waste. |

In July 2009, we completed the acquisition of the Alpro division of Vandemoortele, N.V. (Alpro), a privately held food company based in Belgium. Alpro manufactures and sells branded soy-based beverages and food products in Europe. The acquisition of Alpro will provide opportunities to leverage the collective strengths of our combined business across a global soy beverages and related products category.

Seasonality

Our business, particularly Fresh Dairy Direct, is affected by seasonal changes in the demand for dairy products. The demand for dairy is typically lower in the second and third quarters of the year primarily due to the reduction in dairy consumption associated with our school business; therefore, these quarters have historically generated lower Fresh Dairy Direct volumes than the first and fourth quarters. Our WhiteWave-Morningstar sales are typically higher in the fourth quarter associated with increased dairy consumption during seasonal holidays. Because certain of our operating expenses are fixed, fluctuations in volumes and revenue from quarter to quarter may have a material effect on operating income for the respective quarters.

6

Intellectual Property

We are continually developing new technology and enhancing existing proprietary technology related to our dairy operations. As of December 31, 2009, 19 United States patents have been issued to us and 21 United States patent applications are pending. We primarily rely on a combination of trademarks, copyrights, trade secrets, confidentiality procedures and contractual provisions to protect our technology and other intellectual property rights. Despite these protections, it may be possible for unauthorized parties to copy, obtain or use certain portions of our proprietary technology or trademarks.

Research and Development

With our state-of-the-art research and development (“R&D”) facility, we are building our capabilities through a team of top consumer packaged goods talent across many disciplines such as product development, dairy and soy science, culinary and sensory science, nutrition, packaging design and engineering, and process engineering. Our R&D activities primarily consist of generating and testing new product concepts, new flavors and packaging for our fluid milk, soy and ice cream products. Our total R&D expense was $25.5 million, $14.0 million and $7.5 million for 2009, 2008 and 2007, respectively.

Developments Since January 1, 2009

Current Dairy Environment

Conventional milk prices were at historically low levels for most of 2009, with a fairly sharp increase in the fourth quarter of the year. The lower conventional milk prices in 2009 were in sharp contrast to the historically high conventional milk prices we experienced throughout 2007 and 2008. With the domestic economy still struggling and little indication that export activity will have a meaningful impact to the U.S. dairy complex, we expect the average Class I mover will be fairly stable through the first half of 2010 with potential modest inflation in the back half of the year and we expect Class II butterfat prices to increase throughout 2010.

Organic Milk Environment

During 2009, we have continued experiencing a slowing of growth in the organic milk category from 2008, declining to relatively flat year-over-year levels by the end of 2009. As a result of the continuing economic downturn, we believe milk consumers have become price sensitive to organic milk and, as a result, we may experience a continued softening in sales in this category. We continue to monitor our position in the organic milk category, including taking proactive steps to manage our supply in the short-term, and we remain focused on maintaining our leading branded position as we balance market share considerations against profitability. With the more stabilized demand for organic milk we are anticipating modestly lower costs in 2010.

Appointment of Joe Scalzo as Dean Foods Chief Operating Officer (“COO”)

In October 2009, we announced the promotion of Joe Scalzo to COO, effective November 1, 2009. In his new role, Mr. Scalzo will oversee all of our operations, including Fresh Dairy Direct, WhiteWave, Morningstar, Alpro and the Hero/WhiteWave joint venture, as well as key strategic functions including worldwide supply chain, R&D and innovation.

Public Offering of Equity Securities

In May 2009, we issued and sold 25.4 million shares of our common stock in a public offering. We received net proceeds of $444.7 million from the offering. The net proceeds from the offering were used to repay the $122.8 million aggregate principal amount of our subsidiary’s 6.625% senior notes due May 15, 2009, and indebtedness under our receivables-backed facility.

Acquisitions

On July 2, 2009, we completed the acquisition of the Alpro division of Vandemoortele, N.V. (“Alpro”), a privately held food company based in Belgium, for an aggregate purchase price of €314.6 million ($440.3

7

million), after working capital adjustments, excluding transaction costs which were expensed as incurred. Alpro manufactures and sells branded soy-based beverages and food products in Europe. The acquisition of Alpro will provide opportunities to leverage the collective strengths of our combined businesses across a global soy beverages and related products category. During 2009, we completed four other acquisitions of businesses for an aggregate purchase price of approximately $143.5 million. All of these acquisitions were funded with borrowings under our senior revolving credit facility.

We recorded approximately $31.3 million in acquisition-related expenses during the year ended December 31, 2009, in connection with these acquisitions, including expenses related to due diligence, investment advisors and regulatory matters, as well as other non-material transactional activities.

Hero/WhiteWave Joint Venture

In January 2008, we entered into and formed a 50/50 strategic joint venture with Hero Group (“Hero”), producer of international fruit and infant nutrition brands, to introduce a new innovative product line to North America. The joint venture, Hero/WhiteWave, LLC, combines Hero’s expertise in fruit, innovation and process engineering with WhiteWave’s deep understanding of the American consumer and manufacturing network, as well as the go-to-market system of Dean Foods.

The joint venture, which is based in Broomfield, Colorado, serves as a strategic growth platform for both companies to further extend their global reach by leveraging their established innovation, technology, manufacturing and distribution capabilities over time. During the first quarter of 2009, the joint venture began to manufacture and distribute its primary product, Fruit2Day®, in limited test markets in the United States. During the second quarter of 2009, the product was nationally launched in grocery and club store channels.

Facility Closing and Reorganization Activities

We closed four facilities within Fresh Dairy Direct during 2009. We recorded facility closing and reorganization costs of $30.2 million including approximately $16.3 million in impairment charges and $13.9 million in employee termination and other costs associated with these and previously announced closures during the year ended December 31, 2009.

Strategic Initiatives

Currently, our strategy is to build on our scale advantaged position in the dairy industry with an initial and key strategic focus on cost reduction across the organization, but particularly within Fresh Dairy Direct. In 2009, we began a three to five year company-wide cost savings initiative targeting company-wide cost reductions of approximately $300 million over this timeframe. Our cost savings initiative efforts are primarily focused on three areas:

| | • | | Procurement, where we are leveraging our scale to drive our costs lower, |

| | • | | Conversion, where continuous improvement and network optimization are coupled to reduce the cost of production in and across our facilities and |

| | • | | Distribution, where we are leveraging technology and process best practices to drive increased productivity across our DSD network. |

Employees

As of December 31, 2009, we had the following employees:

| | | | | |

| | | No. of

Employees | | % of

Total | |

Fresh Dairy Direct | | 21,918 | | 81 | % |

WhiteWave-Morningstar | | 4,414 | | 16 | |

Corporate | | 825 | | 3 | |

| | | | | |

Total | | 27,157 | | 100 | % |

| | | | | |

8

Approximately 36% of Fresh Dairy Direct’s and 41% of WhiteWave-Morningstar’s employees participate in collective bargaining agreements. We believe our relationship with our employees and these organizations is satisfactory.

Government Regulation

Food Related Regulations

As a manufacturer and distributor of food products, we are subject to a number of food-related regulations, including the Federal Food, Drug and Cosmetic Act and regulations promulgated thereunder by the U.S. Food and Drug Administration (“FDA”). This comprehensive regulatory framework governs the manufacture (including composition and ingredients), labeling, packaging and safety of food in the United States. The FDA:

| | • | | regulates manufacturing practices for foods through its current good manufacturing practices regulations, |

| | • | | specifies the standards of identity for certain foods, including many of the products we sell and |

| | • | | prescribes the format and content of certain information required to appear on food product labels. |

In addition, the FDA enforces the Public Health Service Act and regulations issued thereunder, which authorizes regulatory activity necessary to prevent the introduction, transmission or spread of communicable diseases. These regulations require, for example, pasteurization of milk and milk products. We are subject to numerous other federal, state and local regulations involving such matters as the licensing and registration of manufacturing facilities, enforcement by government health agencies of standards for our products, inspection of our facilities and regulation of our trade practices in connection with the sale of food products.

We use quality control laboratories in our manufacturing facilities to test raw ingredients. Product quality and freshness are essential to the successful distribution of our products. To monitor product quality at our facilities, we maintain quality control programs to test products during various processing stages. We believe our facilities and manufacturing practices are in material compliance with all government regulations applicable to our business.

Employee Safety Regulations

We are subject to certain safety regulations, including regulations issued pursuant to the U.S. Occupational Safety and Health Act. These regulations require us to comply with certain manufacturing safety standards to protect our employees from accidents. We believe that we are in material compliance with all employee safety regulations applicable to our business.

Environmental Regulations

We are subject to various environmental regulations. Our plants use a number of chemicals that are considered to be “extremely” hazardous substances pursuant to applicable environmental laws due to their toxicity, including ammonia which is used extensively in our operations as a refrigerant. Such chemicals must be handled in accordance with such environmental laws. Also, on occasion, certain of our facilities discharge biodegradable wastewater into municipal waste treatment facilities in excess of levels allowed under local regulations. As a result, certain of our facilities are required to pay wastewater surcharges or to construct wastewater pretreatment facilities. To date, such wastewater surcharges have not had a material effect on our financial condition or results of operations.

We maintain above-ground and under-ground petroleum storage tanks at many of our facilities. We periodically inspect these tanks to determine whether they are in compliance with applicable regulations and, as a result of such inspections are required to make expenditures from time to time in order to ensure that these tanks remain in compliance. In addition, upon removal of the tanks, we are sometimes required to make expenditures to restore the site in accordance with applicable environmental laws. To date, such expenditures have not had a material effect on our financial condition or results of operations.

9

We believe that we are in material compliance with the environmental regulations applicable to our business. We do not expect the cost of our continued compliance to have a material impact on our capital expenditures, earnings, cash flows or competitive position in the foreseeable future. In addition, any asset retirement obligations are not material.

Milk Industry Regulation

The federal government establishes minimum prices that we must pay to producers in federally regulated areas for raw milk. Raw milk primarily contains raw skim milk, in addition to a small percentage of butterfat. Raw milk delivered to our facilities is tested to determine the percentage of butterfat and other milk components, and we pay our suppliers for the raw milk based on the results of these tests.

The federal government’s minimum prices vary depending on the processor’s geographic location or sales area and the type of product manufactured. Federal minimum prices change monthly. Class I butterfat and raw skim milk prices (which are the minimum prices we are required to pay for raw milk that is processed into Class I products such as fluid milk) and Class II raw milk prices (which are the prices we are required to pay for raw milk that is processed into Class II products such as cottage cheese, creams, creamers, ice cream and sour cream) for each month are announced by the federal government the immediately preceding month.

Some states have established their own rules for determining minimum prices for raw milk. In addition to the federal or state minimum prices, we also may pay producer premiums, procurement costs and other related charges that vary by location and supplier.

Organic Regulations

Our organic products are required to meet the standards set forth in the Organic Foods Production Act and the regulations adopted thereunder by the National Organic Standards Board. These regulations require strict methods of production for organic food products and limit the ability of food processors to use non-organic or synthetic materials in the production of organic foods or in the raising of organic livestock. We believe that we are in material compliance with the organic regulations applicable to our business.

10

Brief History

We commenced operations in 1988 through a predecessor entity. Our original operations consisted solely of a packaged ice business. Since then the following significant activity has occurred:

| | |

December 1993 | | Acquired Suiza Dairy Corporation, a regional dairy processor located in Puerto Rico. We then began acquiring other local and regional U.S. dairy processors, growing our dairy business rapidly primarily through acquisitions. |

| |

April 1996 | | Completed our initial public offering under our former name “Suiza Foods Corporation” and began trading on NASDAQ National Market. |

| |

March 1997 | | Began trading on the New York Stock Exchange. |

| |

August 1997 | | Acquired Franklin Plastics, Inc., a company engaged in the business of manufacturing and selling plastic containers. After the acquisition, we began acquiring other companies in the plastic packaging industry. |

| |

November 1997 | | Acquired Morningstar Foods Inc., whose business was a predecessor to our WhiteWave segment. This was our first acquisition of a company with national brands. |

| |

April 1998 | | Sold our packaged ice operations. |

| |

May 1998 | | Acquired Continental Can Company, making us one of the largest plastic packaging companies in the United States. |

| |

July 1999 | | Sold all of our U.S. plastic packaging operations to Consolidated Container Company in exchange for cash and a minority interest in the purchaser. |

| |

January 2000 | | Acquired Southern Foods Group, L.P., the third largest dairy processor in the United States, making us the largest dairy processor in the country. |

| |

February 2000 | | Acquired Leche Celta, one of the largest dairy processors in Spain. |

| |

March and May 2000 | | Sold our European packaging operations. |

| |

December 2001 | | Acquired the former Dean Foods Company (“Legacy Dean”) and changed our name from Suiza Foods Corporation to Dean Foods Company. Legacy Dean changed its name to Dean Holding Company. |

| |

May 2002 | | Acquired the portion of WhiteWave, Inc. that we did not already own. |

| |

January 2004 | | Acquired the portion of Horizon Organic that we did not already own. |

| |

January 2005 | | Consolidated our nationally branded business, including WhiteWave, Horizon Organic and Dean National Brand Group into a single operating unit called WhiteWave. |

| |

June 2005 | | Spun-off our Specialty Foods Group segment to our shareholders. |

| |

September 2006 | | Sold our Leche Celta operations in Spain. |

| |

January 2007 | | Sold our Leche Celta operations in Portugal. |

| |

March 2007 | | Acquired Friendship Dairies, one of the largest dairy products manufacturers, marketers and distributors in the northeastern United States. |

| |

April 2007 | | Paid a special cash dividend of $15 per share to our shareholders. |

| |

January 2008 | | Entered into and formed a strategic joint venture with Hero Group. |

| |

July 2009 | | Acquired Alpro, a leading provider of soy-based food and beverage products in Europe, providing us with the opportunity to leverage the collective strengths of our combined businesses across a global soy beverages and related products category. |

11

Minority Holdings and Other Interests

Consolidated Container Company

We own an approximately 25% non-controlling interest, on a fully diluted basis, in Consolidated Container Company (“CCC”), one of the nation’s largest manufacturers of rigid plastic containers and our largest supplier of plastic bottles and bottle components. We have owned a minority interest in CCC since July 1999 when we sold our U.S. plastic packaging operations to CCC. Vestar Capital Partners, an unaffiliated entity, controls CCC through a majority ownership interest. Pursuant to our agreements with Vestar, we control two of the eight seats on CCC’s Management Committee. We also have entered into various supply agreements with CCC pursuant to which we have agreed to purchase certain of our requirements for plastic bottles and bottle components from CCC. We spent $268.2 million and $330.3 million on products purchased from CCC for the years ended December 31, 2009 and 2008, respectively. See Note 3 to our Consolidated Financial Statements for more information on our relationship with CCC.

Hero/WhiteWave Joint Venture

In January 2008, we entered into and formed a 50/50 strategic joint venture with Hero Group (“Hero”), producer of international fruit and infant nutrition brands, to introduce a new innovative product line to North America. The joint venture, Hero/WhiteWave, LLC, combines Hero’s expertise in fruit, innovation and process engineering with WhiteWave’s deep understanding of the American consumer and manufacturing network, as well as the go-to-market system of Dean Foods.

The joint venture, which is based in Broomfield, Colorado, serves as a strategic growth platform for both companies to further extend their global reach by leveraging their established innovation, technology, manufacturing and distribution capabilities over time. During the first quarter of 2009, the joint venture began to manufacture and distribute its primary product, Fruit2Day®, in limited test markets in the United States. During the second quarter of 2009, the product was nationally launched in grocery and club store channels.

Beginning January 1, 2009, in conjunction with entering into several new agreements between WhiteWave and the joint venture, we concluded that we are the primary beneficiary of the joint venture and the financial position and the results of operations for the joint venture should be consolidated for financial reporting purposes. Accordingly, the joint venture has been consolidated as of January 1, 2009. The resulting non-controlling interest’s share in the equity of the joint venture is presented as a separate component of stockholders’ equity in the consolidated balance sheets and consolidated statement of stockholders’ equity and the net loss attributable to the non-controlling interest is presented in the consolidated statements of income.

During 2009, our joint venture partner made cash and non-cash contributions of $12.7 million and $0.5 million, respectively, to the joint venture. During 2009, we made cash contributions of $10.5 million and continued non-cash contributions in the form of the capital lease for the manufacturing facility constructed at one of our existing WhiteWave plants. From the inception of the venture through December 31, 2009, we and our joint venture partner have each invested $30.3 million in the Hero/WhiteWave joint venture.

Where You Can Get More Information

Our fiscal year ends on December 31. We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission.

You may read and copy any reports, statements or other information that we file with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. You can request copies of these documents, upon payment of a duplicating fee, by writing to the Securities and Exchange Commission. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

12

We file our reports with the Securities and Exchange Commission electronically through the Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system. The Securities and Exchange Commission maintains an Internet site that contains reports, proxy and information statements and other information regarding companies that file electronically with the Securities and Exchange Commission through EDGAR. The address of this Internet site ishttp://www.sec.gov.

We also make available free of charge through our website atwww.deanfoods.com our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

Our Code of Ethics is applicable to all of our employees and directors, with the exception of our Alpro employees, who are subject to a comparable code of ethics. Our Code of Ethics is available on our corporate website atwww.deanfoods.com, together with the Corporate Governance Principles of our Board of Directors and the charters of all of the Committees of our Board of Directors. Any waivers that we may grant to our executive officers or directors under the Code of Ethics, and any amendments to our Code of Ethics, will be posted on our corporate website. If you would like hard copies of any of these documents, or of any of our filings with the Securities and Exchange Commission, write or call us at:

Dean Foods Company

2515 McKinney Avenue, Suite 1200

Dallas, Texas 75201

(214) 303-3400

Attention: Investor Relations

Competitive Risks

Industry Consolidation Has Strengthened the Competitive Position of Our Retail Customers, Which Has Put Pressures on Our Operating Margins and Profitability.

Many of our customers, such as supermarkets, warehouse clubs and food distributors, have experienced industry consolidation in recent years and this consolidation is expected to continue. These consolidations have produced large, sophisticated customers with increased buying power, and have increased the significance of large-format retailers and discounters. As a result, we are increasingly dependent on key retailers, which have significant bargaining power. In addition, some of these customers are vertically integrated and may re-dedicate key shelf-space currently occupied by our products for their private label products. Higher levels of price competition and higher resistance to price increases are becoming more widespread in our business. During 2009, retailers began lowering their prices on milk to drive value for the end consumer and increase traffic flow, resulting in lower margins for the retailers. Increasingly, this margin compression is being absorbed by dairy processors. If we are unable to structure our business to appropriately respond to the pricing demands of our customers, we may lose these customers to other processors that are willing to sell product at a lower cost. Additionally, if we are not able to lower our cost structure adequately, our profitability could be adversely affected by the decrease in margin.

Increased Competition With Our Branded Products and Economic Conditions Could Impede Our Growth Rate and Profit Margin.

OurSilksoymilk andHorizon Organic food and beverage products have leading shares in their categories and have benefited in many cases from being the first to introduce products in their categories. As soy and organic products have gained in popularity with consumers, our products in these categories have attracted competitors, including private label competitors who sell their products at a lower price. In addition, we may incur increased marketing costs for our branded products, which can negatively impact our profitability. In periods of economic decline, consumers tend to purchase lower-priced products, including private label products and such as conventional milk, which could

13

reduce sales of our organic milk. The willingness of consumers to purchase our products will depend upon our ability to offer products providing the right consumer benefits at the right price. Further trade down to lower priced products could adversely affect our sales and profit margin for our branded products.

Many large food and beverage companies have substantially more resources than we do, and they may be able to market their products more successfully than we can, which could cause our growth rate in certain categories to be slower than our forecast and could cause us to lose sales. For example, OurInternational Delightcoffee creamer competes intensely with NestléCoffeeMate®. Our failure to successfully compete with Nestlé, which has substantially more resources than we do, could have a material adverse effect on the sales and profitability of ourInternational Delight business.

The Loss of Any of Our Largest Customers Could Negatively Impact Our Sales and Profits.

Our largest customer, Wal-Mart Stores, Inc. and its subsidiaries, including Sam’s Club, accounted for approximately 19.1% of consolidated net sales during 2009. During 2009, our top five customers, collectively, accounted for approximately 31.0% of our consolidated net sales. We do not generally enter into sales agreements with our customers, and where such agreements exist, they are generally terminable at will by the customer. The loss of any large customer for an extended length of time could negatively impact our sales and profits.

We are Subject to Competitive Bidding Situations, the Outcome of Which Could Negatively Impact Our Sales and Profits.

Many of our retail customers have become increasingly price sensitive in the current economic climate, which has intensified the competitive environment in which we operate. Over the past few years, we have been subject to a number of competitive bidding situations, particularly within Fresh Dairy Direct, which reduced our profitability on sales to several customers. We expect this trend of competitive bidding to continue. In bidding situations, we are subject to the risk of losing certain customers which could negatively impact our sales and profits.

Commodity Risks

Availability of and Changes in Raw Material and Other Input Costs Can Adversely Affect Us.

Our business is heavily dependent on raw materials such as conventional and organic raw milk, diesel fuel, resin and soybeans and other commodities. In addition to our dependence on conventional and organic raw milk, Fresh Dairy Direct is a large consumer of diesel fuel and WhiteWave-Morningstar is affected by the costs of petroleum-based products through the use of common carriers and packaging. The prices of these materials increase and decrease based on market conditions, and in some cases, governmental regulation. Weather, including the heightened impact of weather events related to climate change, also affects the availability and pricing of these inputs. Sometimes supplies of raw materials, such as resin, have been insufficient to meet demand. Volatility in the cost of our raw materials, particularly diesel fuel and other non-dairy inputs, can significantly adversely affect our performance as upward price changes often lag changes in costs we charge our customers. In some cases the price increases of these non-dairy inputs may exceed the price increases we are able to pass along to our customers due to contractual and other limitations. In periods of rapid movements in dairy commodities, our ability to pass through costs is impaired due to the timing of passing through the price increases. These lags and limitations may decrease our profit margins. In addition, raw material cost fluctuations from year to year can cause our revenues to increase or decrease significantly compared to prior periods.

The organic dairy industry remains a relatively new category and continues to experience significant swings in supply and demand. Industry regulation, and the costs of organic farming compared to prices paid for conventional farming can impact the supply of organic raw milk in the market. An oversupply of organic raw milk can cause significant discounting in the sale of organic packaged milk, which increases competitive pressure on our branded products and could cause our profitability to suffer. An undersupply or higher input costs can increase the costs of organic raw milk, which can cause retail price gaps between private label and branded products to expand, potentially decreasing our volumes and adversely affecting our results. The impact of retail price gaps may be compounded by the current economic environment as consumers become increasingly focused on product pricing. In addition, consumers may choose to purchase conventional milk instead of organic milk due to differences in cost, which could further decrease our volumes and results.

14

Capital Markets and General Economic Risks

We Have Substantial Debt and Other Financial Obligations and We May Incur Even More Debt.

We have substantial debt and other financial obligations and significant unused borrowing capacity. At December 31, 2009, we had outstanding borrowings of approximately $3.6 billion under our senior secured credit facility, of which $3.1 billion were in term loan borrowings with an additional $515.2 million in outstanding borrowings under our $1.5 billion senior secured revolving line of credit. In addition, we had $642.0 million of face value of senior unsecured notes outstanding and nothing outstanding under our receivables-backed facility at December 31, 2009.

We have pledged substantially all of our assets (including the assets of our subsidiaries) to secure our indebtedness. Our debt level and related debt service obligations:

| | • | | require us to dedicate significant cash flow to the payment of principal and interest on our debt which reduces the funds we have available for other purposes; |

| | • | | may limit our flexibility in planning for or reacting to changes in our business and market conditions or funding our strategic growth plan; |

| | • | | impose on us additional financial and operational restrictions; |

| | • | | expose us to interest rate risk since a portion of our debt obligations are at variable rates; and |

| | • | | restrict our ability to fund acquisitions. |

In addition, in the current economic climate, investors are apprehensive about investing in companies such as ours that carry a substantial amount of leverage on their balance sheets, and this apprehension may adversely affect the price of our common stock.

Also, under our senior secured credit facility, we are required to maintain certain financial covenants, including, but not limited to, maximum leverage and minimum interest coverage ratios. Failure to comply with the financial covenants (as defined in our credit agreement), or any other non-financial or restrictive covenant, could create a default under our senior secured credit facility and under our receivables-backed facility. Upon a default, our lenders could accelerate the indebtedness under the facilities, foreclose against their collateral or seek other remedies, which would jeopardize our ability to continue our current operations. We may be required to amend our credit facility, refinance all or part of our existing debt, sell assets, incur additional indebtedness or raise equity. Further, based upon our actual performance levels, our Leverage Ratio requirements or other financial covenants could limit our ability to incur additional debt under our senior secured credit facility, which could hinder our ability to execute our current business strategy.

Our ability to maintain an adequate level of liquidity in the future is dependent on our ability to renew our Receivables-backed facility annually and refinance our senior secured credit facility, of which a portion matures in 2012 and the remainder in 2014. The timing, approach, and terms of any such refinancing would depend upon market conditions and management’s judgment, among other factors. There are sizeable amounts of other outstanding credit facilities in the market that are currently scheduled to mature during the same timeframe as our senior secured credit facility. This future refinancing demand could potentially reduce liquidity and credit availability in the capital markets and impact our ability to refinance our senior credit facility.

While certain conditions in the worldwide and domestic economies may be showing signs of improvement, there continues to be volatility in the capital markets, diminished liquidity and credit availability and continued counterparty risk. Given the current economic and capital market environment, we expect that the interest rates on our debt will increase as a result of any such refinancing. In addition, the expenses associated with any such refinancing could be material.

Recent Adverse Market Events Have Caused Costs of Providing Employee Benefits to Escalate, Which May Adversely Affect Our Profitability and Liquidity.

We sponsor various defined benefit and defined contribution retirement plans, as well as contribute to various multi-employer plans on behalf of our employees. Changes in interest rates or in the market value of plan

15

assets could affect the funded status of our pension plans. This could cause volatility in our benefits costs and increase future funding requirements of our plans. Pension and post-retirement costs also may be significantly affected by changes in key actuarial assumptions including anticipated rates of return on plan assets and the discount rates used in determining the projected benefit obligation and annual periodic pension costs. A significant increase in future funding requirements could have a negative impact on our results of operations, financial condition and cash flows.

Certain of our defined benefit retirement plans, as well as many of the multi-employer plans in which we participate, are less than fully funded. Recent changes in federal laws require plan sponsors to eliminate, over defined time periods, the underfunded status of plans that are subject to ERISA rules and regulations. In addition, turmoil in the financial markets in 2008 brought significant declines in the fair market value of the equity and debt instruments that we hold within our defined benefit master trust to settle future defined benefit plan obligations. Although our funded status as of December 31, 2009 increased by approximately $24.1 million from the prior year end, it is still approximately $51.1 million lower than our funded status at December 31, 2007. This decline will continue to result in higher future funding requirements, as well as increased plan costs. In addition to the impact from our defined benefit retirement plan, we expect the market events in 2008 to continue to result in higher future funding requirements related to multi-employer plans in which we participate.

The Continued Recessionary Economy May Adversely Impact Our Business and Results of Operations.

The dairy industry is sensitive to changes in general economic conditions, both nationally and locally. The continued recessionary economy may have an adverse effect on consumer spending patterns. Higher levels of unemployment, higher consumer debt levels, or other unfavorable economic factors could adversely affect consumer demand for products we sell or distribute, which could adversely affect our results of operations. There can be no assurances that government responses to the economic downturn will restore consumer confidence.

Strategic Growth Plan Risks

We May Not Realize Anticipated Benefits from Our Strategic Growth Plan.

We are implementing a strategic growth plan, which includes a number of transformational initiatives, that we believe are necessary in order to position our business for future success and growth. Our success depends in part on our ability to achieve a lower cost structure and operate efficiently in the highly competitive food and beverage industry, particularly in an environment of increased competitive activity. In addition, it is critical that we have the appropriate personnel in place to continue to lead and execute our plan. We continue to implement profit-enhancing initiatives that impact our supply chain and related functions. These initiatives are focused on cost-saving opportunities in procurement, distribution, conversion and network optimization. Over the next several years, these initiatives will require investments in people, systems, tools and facilities. Our future success and earnings growth depends in part on our ability to reduce costs, improve efficiencies and better serve our customers. If we are unable to successfully implement these initiatives or fail to implement them as timely as we anticipate, we could become cost disadvantaged in the marketplace, and our competitiveness and our profitability could decrease.

Product, Supply Chain and Systems Risks

We Must Identify Changing Consumer Preferences and Develop and Offer Products to Meet Their Preferences.

Consumer preferences evolve over time and the success of our products depends on our ability to identify the tastes, dietary preferences and purchasing habits of consumers and to offer products that appeal to their preferences. Introduction of new products and product extensions requires significant development and marketing investment, and we may fail to realize anticipated returns on such investments due to lack of consumer acceptance of such products. Currently, we believe consumers are trending toward health and wellness

16

beverages. Although we have increased our investment in innovation in order to capitalize on this trend, there are currently several global companies with greater resources which compete with us in the health and wellness space. In 2009, we augmented our current product line by offering customers and consumers soy-based products manufactured with non-GMO soybeans. Our transition to non-GMO soybeans from organic soybeans may impact consumer acceptance of our products. In addition, as consumers become increasingly aware of the environmental and social impacts of the products they purchase their preferences and purchasing decisions may change. If our products fail to meet changing consumer preferences, the return on our investment in those areas will be less than anticipated and our product strategy may not succeed.

We May Experience Liabilities or Harm to Our Reputation as a Result of Product Issues, Such as Product Recalls.

We sell products for human consumption, which involves a number of risks. Product contamination, spoilage or other adulteration, product misbranding or product tampering could require us to recall products. We also may be subject to liability if our products or operations violate applicable laws or regulations or in the event our products cause injury, illness or death. In addition, we advertise our products and could be the target of claims relating to false or deceptive advertising under U.S. federal and state laws, including consumer protection statutes of some states. A significant product liability or other legal judgment against us or a widespread product recall may negatively impact our profitability. Even if a product liability or consumer fraud claim is unsuccessful or is not merited, the negative publicity surrounding such assertions regarding our products or processes could materially and adversely affect our reputation and brand image, particularly in categories such as fluid milk that have strong health and wellness credentials.

Disruption of Our Supply Chain or Transportation Systems Could Adversely Affect Our Business.

Damage or disruption to our manufacturing or distribution capabilities due to weather, natural disaster, fire, terrorism, pandemic, strikes, the financial and/or operational instability of key suppliers, distributors, warehousing and transportation providers, or other reasons could impair our ability to manufacture or distribute our products. To the extent that we are unable, or it is not financially feasible, to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, there could be an adverse effect on our business and results of operations, and additional resources could be required to restore our supply chain. In addition, we are subject to federal motor carrier regulations, such as the Federal Motor Carrier Safety Act, with which our extensive DSD Delivery system must comply. Failure to comply with such regulations could result in our inability to deliver product to our customers in a timely manner, which could adversely affect our reputation and our results.

Our Business Operations Could be Disrupted if Our Information Technology Systems Fail to Perform Adequately.

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our business data, communications, supply chain, logistics, accounting, and other business processes. If we do not allocate and effectively manage the resources necessary to build and sustain an appropriate technology infrastructure, our business or financial results could be negatively impacted. In addition, our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including systems failures, security breaches, and viruses. Any such damage or interruption could have a material adverse effect on our business.

Acquisition Risks

The Failure to Successfully Integrate Acquisitions into Our Existing Operations Could Adversely Affect Our Financial Results.

We have made several acquisitions in recent years including, most recently, our acquisition of the Alpro division of Vandemoortele N.V., and we regularly review opportunities for strategic growth through future acquisitions. Potential risks associated with these acquisitions include the diversion of management’s attention

17

from other business concerns, the inability to achieve anticipated benefits from these acquisitions in the timeframe we anticipate, or at all, the inherent risks in entering geographic locations, markets or lines of business in which we have limited prior experience, the inability to integrate the new operations, technologies and products of the acquired companies successfully with our existing businesses, the potential loss of key employees and customers of the acquired companies, and the possible assumption of unknown liabilities, and potential disputes with the sellers. In addition, acquisitions outside the United States may present unique challenges and increase our exposure to the risks associated with foreign operations, including foreign currency risks and compliance with foreign rules and regulations. Any or all of these risks could adversely impact our financial results.

Legal and Regulatory Risks

The Dairy Industry in Which We Operate Has Been Subject to Increased Government Scrutiny Which Could Have an Adverse Impact on Our Business.

We are subject to antitrust and other competition laws in the United States and in the other countries in which we operate. We cannot predict how these laws or their interpretation, administration and enforcement will impact us. Throughout 2009 and continuing in 2010, the dairy industry has been the subject of increased government scrutiny. Beginning in 2010, the current administration has initiated a review of existing dairy policies in order to consider potential changes to those policies. This review process may result in changes to the dairy industry that we cannot anticipate and that may have a material adverse impact on our business.

Pending Antitrust Lawsuits May have a Material Adverse Impact on Our Business.

We are the subject of several antitrust lawsuits, the outcome of which we are unable to predict. Increased scrutiny of the dairy industry has resulted, and may continue to result, in an increase in litigation or regulatory actions against us. Such lawsuits are expensive to defend and could cause a diversion of management’s attention. In addition to increased litigation costs, these actions could expose us to negative publicity, which might adversely affect our brands, reputation and/or customer preference for our products. In addition, acquisition activities are regulated by these antitrust and competition laws and such scrutiny could impact our ability to pursue strategic acquisitions in the future.

Litigation or Legal Proceedings Could Expose Us to Significant Liabilities and Have a Negative Impact on Our Reputation.

We are party to various litigation claims and legal proceedings. We evaluate these litigation claims and legal proceedings to assess the likelihood of unfavorable outcomes and to estimate, if possible, the amount of potential losses. Based on these assessments and estimates, we establish reserves and /or disclose the relevant litigation claims or legal proceedings, as appropriate. These assessments and estimates are based on the information available to management at the time and involve a significant amount of management judgment. Actual outcomes or losses may differ materially from our current assessments and estimates.

Labor Disputes Could Adversely Affect Us.

As of December 31, 2009, approximately 36% of Fresh Dairy Direct’s and 41% of WhiteWave-Morningstar’s employees participated in collective bargaining agreements. At any given time, we may face a number of union organizing drives. When we face union organizing drives, we and the union may disagree on important issues which, in turn, could possibly lead to a strike, work slowdown or other job actions at one or more of our locations. A strike, work slowdown or other labor unrest could in some cases impair our ability to supply our products to customers, which could result in reduced revenue and customer claims. In addition, proposed legislation, known as The Employee Free Choice Act, could make it significantly easier for union organizing drives to be successful and could give third-party arbitrators the ability to impose terms of collective bargaining agreements upon us and a labor union if we and such union are unable to agree to the terms of a collective bargaining agreement.

18

Our Business is Subject to Various Environmental Laws, Which May Increase Our Compliance Costs.

Our business operations are subject to numerous environmental and other air pollution control laws, including the federal Clean Air Act, the federal Clean Water Act, and the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, as well as state and local statutes. These laws and regulations cover the discharge of pollutants, wastewater, and hazardous materials into the environment. In addition, various laws and regulations addressing climate change are being considered or implemented at the federal and state levels. New legislation, as well as current federal and other state regulatory initiatives relating to these environmental matters, could require us to replace equipment, install additional pollution controls, purchase various emission allowances or curtail operations. These costs could adversely affect our results of operations and financial condition.

Changes in Laws, Regulations and Accounting Standards Could Have an Adverse Effect on Our Financial Results.

We are subject to federal, state, local and foreign governmental laws and regulations, including those promulgated by the United States Food and Drug Administration, the United States Department of Agriculture, the Sarbanes-Oxley Act of 2002 and numerous related regulations promulgated by the Securities and Exchange Commission and the Financial Accounting Standards Board. Changes in federal, state or local laws, or the interpretations of such laws and regulations, may negatively impact our financial results or our ability to market our products.

| Item 1B. | Unresolved Staff Comments |

None.

19

Our corporate headquarters are located in leased premises at 2515 McKinney Avenue, Suite 1200, Dallas, TX 75201. In June, 2009, we announced our intent to relocate our corporate headquarters to a leased facility located in Dallas, Texas. The new facility is in close proximity to our existing headquarters. The relocation of personnel began in the first quarter of 2010 and is expected to be completed in the second quarter of 2010.

In addition, we operate more than 100 manufacturing facilities. Management believes that Dean Food’s facilities are well maintained and are generally suitable and of sufficient capacity to support our current business operations and that the loss of any single facility would not have a material adverse effect on the operations or financial results. The following tables set forth, by business segment, our principal manufacturing facilities.

Fresh Dairy Direct

Fresh Dairy Direct currently conducts its manufacturing operations within the following 82 facilities, most of which are owned:

| | | | |

Birmingham, Alabama (2) Buena Park, California (2) City of Industry, California (2) Hayward, California Riverside, California Delta, Colorado Denver, Colorado Englewood, Colorado Greeley, Colorado Miami, Florida Orange City, Florida Orlando, Florida Baxley, Georgia Braselton, Georgia Hilo, Hawaii Honolulu, Hawaii Boise, Idaho Belvidere, Illinois Harvard, Illinois Huntley, Illinois O’Fallon, Illinois Decatur, Indiana Huntington, Indiana Rochester, Indiana LeMars, Iowa Louisville, Kentucky Newport, Kentucky | | New Orleans, Louisiana Shreveport, Louisiana Bangor, Maine Franklin, Massachusetts Lynn, Massachusetts Mendon, Massachusetts Evart, Michigan Grand Rapids, Michigan Livonia, Michigan Marquette, Michigan Thief River Falls, Minnesota Woodbury, Minnesota Billings, Montana Great Falls, Montana Las Vegas, Nevada Reno, Nevada Burlington, New Jersey Albuquerque, New Mexico Rensselaer, New York High Point, North Carolina Winston-Salem, North Carolina Bismarck, North Dakota Tulsa, Oklahoma Marietta, Ohio Springfield, Ohio Toledo, Ohio Erie, Pennsylvania | | Landsdale, Pennsylvania Lebanon, Pennsylvania Schuylkill Haven, Pennsylvania Sharpsville, Pennsylvania Florence, South Carolina Spartanburg, South Carolina Sioux Falls, South Dakota Athens, Tennessee Nashville, Tennessee (2) Dallas, Texas (2) El Paso, Texas Houston, Texas Lubbock, Texas McKinney, Texas San Antonio, Texas Waco, Texas Orem, Utah Salt Lake City, Utah Richmond, Virginia Springfield, Virginia DePere, Wisconsin Sheboygan, Wisconsin Waukesha, Wisconsin |

Each of Fresh Dairy Direct’s manufacturing facilities also serves as a distribution facility. In addition, Fresh Dairy Direct has numerous distribution branches located across the country, some of which are owned but most of which are leased. Fresh Dairy Direct’s headquarters are located in Dallas, Texas in leased premises.

20

WhiteWave-Morningstar

WhiteWave-Morningstar currently conducts its manufacturing operations from the following 24 facilities, most of which are owned:

| | | | |