Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 001-12755

Dean Foods Company

(Exact name of Registrant as specified in its charter)

| Delaware | 75-2559681 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

2711 North Haskell Avenue Suite 3400

Dallas, Texas 75204

(214) 303-3400

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $.01 par value | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant at June 30, 2012, based on the $17.03 per share closing price for the registrant’s common stock on the New York Stock Exchange on June 30, 2012, was approximately $3.10 billion.

The number of shares of the registrant’s common stock outstanding as of February 15, 2013 was 185,921,100.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on or about May 15, 2013, which will be filed within 120 days of the registrant’s fiscal year end, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

Table of Contents

Forward-Looking Statements

This Annual Report on Form 10-K (the “Form 10-K”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are predictions based on expectations and projections about future events, and are not statements of historical fact. Forward-looking statements include statements concerning business strategy, among other things, including anticipated trends and developments in and management plans for our business and the markets in which we operate. In some cases, you can identify these statements by forward-looking words, such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” “could,” “predict,” and “continue,” the negative or plural of these words and other comparable terminology. All forward-looking statements included in this Form 10-K are based upon information available to us as of the filing date of this Form 10-K, and we undertake no obligation to update any of these forward-looking statements for any reason. You should not place undue reliance on forward-looking statements. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include the matters discussed in the section entitled “Part I — Item 1A — Risk Factors” in this Form 10-K, and elsewhere in this Form 10-K. You should carefully consider the risks and uncertainties described in this Form 10-K.

PART I

| Item 1. | Business |

We are a leading food and beverage company and the largest processor and distributor of milk and other fluid dairy products in the United States as well as a North American and European leader in branded plant-based beverages, such as soy, almond and coconut milks, and other plant-based food products. As we continue to evaluate and seek to maximize the value of our leading brands and product offerings, we have aligned our leadership teams, operating strategies and supply chain initiatives around our two business segments: Fresh Dairy Direct and The WhiteWave Foods Company (“WhiteWave”), which is our publicly traded, majority-owned subsidiary.

Fresh Dairy Direct is the largest processor and distributor of fluid milk in the United States, and Fresh Dairy Direct also processes and distributes other dairy products in the United States, with products such as milk, ice cream, cultured dairy products, creamers, ice cream mix and other dairy products sold under more than 50 familiar local and regional brands and a wide array of private labels. Fresh Dairy Direct also produces and distributesTru Moo®, which is our nationally branded, healthier, reformulated flavored milk.

WhiteWave is a leading consumer packaged food and beverage company focused on high-growth product categories that are aligned with emerging consumer trends. WhiteWave manufactures, markets and sells plant-based foods and beverages, coffee creamers and beverages, and premium dairy products throughout North America and Europe under widely-recognized brands includingSilk® plant-based beverages,International Delight® andLAND O LAKES® coffee creamers and beverages andHorizon Organic® premium dairy products in North America, as well asAlpro® andProvamel® plant-based foods and beverages in Europe.

As of February 15, 2013, and as described below under “— Developments Since January 1, 2012”, we owned an 86.7% economic interest, and a 98.5% voting interest, in WhiteWave. Unless and until a spin-off of WhiteWave occurs or we cease to own a controlling financial interest in WhiteWave, we will continue to consolidate WhiteWave for financial reporting purposes, with a non-controlling interest adjustment for the economic interest in WhiteWave that we do not own.

Unless stated otherwise, any reference to income statement items in this Form 10-K refers to results from continuing operations.

1

Table of Contents

Our principal executive offices are located at 2711 North Haskell Avenue, Suite 3400, Dallas, Texas 75204. Our telephone number is (214) 303-3400. We maintain a web site atwww.deanfoods.com. We were incorporated in Delaware in 1994.

Developments since January 1, 2012

Initial Public Offering of The WhiteWave Foods Company and Proposed Spin-Off or Other Disposition — On October 31, 2012, our then wholly-owned subsidiary, WhiteWave, completed an initial public offering (the “WhiteWave IPO”) of 23 million shares of its Class A common stock at a price to the public of $17.00 per share. Prior to completion of the WhiteWave IPO, we contributed the capital stock of WWF Operating Company (“WWF Opco”), another previously wholly-owned subsidiary of ours that held substantially all of the assets and liabilities associated with our WhiteWave segment, to WhiteWave in exchange for 150 million shares of Class B common stock of WhiteWave.

WhiteWave contributed $282 million of the net proceeds from the WhiteWave IPO to WWF Opco, which used those proceeds, together with substantially all of the net proceeds of the initial borrowings described below, to repay then-outstanding obligations under intercompany notes owed to Dean Foods. Dean Foods subsequently utilized these proceeds to repay a portion of the outstanding indebtedness under its senior secured credit facility. See Note 10 to our Consolidated Financial Statements. The remaining net proceeds of approximately $86 million from the WhiteWave IPO and the initial borrowings described below were used to repay indebtedness under WhiteWave’s senior secured credit facilities.

Upon completion of the WhiteWave IPO, we owned no shares of WhiteWave Class A common stock and 150 million shares of WhiteWave Class B common stock, which represents 100% of the outstanding shares of WhiteWave’s Class B common stock. The rights of the holders of the shares of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share, and each share of class B common stock is entitled to ten votes per share, subject to reduction in accordance with the terms of WhiteWave’s amended and restated certificate of incorporation, on all matters presented to WhiteWave stockholders. Each share of Class B common stock is convertible into one share of Class A common stock at any time at our election and automatically in certain circumstances. Upon completion of the WhiteWave IPO, we owned an 86.7% economic interest, and a 98.5% voting interest, in WhiteWave.

We have announced our intention to effect a tax-free spin-off of shares of WhiteWave in May, following the April 23, 2013 expiration of the lock-up period under the WhiteWave IPO underwriting agreement. We have received a private letter ruling from the Internal Revenue Service (“IRS”) providing that, subject to certain conditions, the anticipated spin-off will be tax-free to us and our stockholders for U.S. federal income tax purposes. We have also announced plans to retain up to 19.9% of the outstanding WhiteWave shares, or up to 34.4 million shares, with the intention to monetize or otherwise distribute the position in a tax-free manner at a later date. The spin-off or other disposition is subject to various conditions, including Board approval, the receipt of any necessary regulatory or other approvals, the maintenance of the private letter ruling from the IRS, the receipt of an opinion of counsel and the existence of satisfactory market conditions. There can be no assurance as to when the proposed spin-off or any other disposition will be completed, if at all. Unless and until we cease to own a controlling financial interest in WhiteWave, we will consolidate WhiteWave for financial reporting purposes, with a non-controlling interest adjustment for the economic interest in WhiteWave that we do not own.

Additionally, on October 12, 2012, WhiteWave entered into a $1.35 billion senior secured credit facility, and on October 31, 2012, WhiteWave incurred approximately $885 million in new indebtedness under this facility. WhiteWave contributed substantially all of the initial net proceeds of this borrowing to WWF Opco and caused WWF Opco to use those net proceeds to repay then-outstanding obligations under intercompany notes owed to Dean Foods. We used those funds to repay a portion of the then-outstanding debt under our senior secured credit facilities. Dean Foods Company is not a guarantor under WhiteWave’s credit facilities.

2

Table of Contents

In connection with the WhiteWave IPO, we entered into various agreements relating to the separation of the WhiteWave business from the rest of Dean Foods’ businesses, including a separation and distribution agreement, a transition services agreement, a tax matters agreement, a registration rights agreement, an employee matters agreement and several commercial agreements. Additionally, in connection with the WhiteWave IPO, WhiteWave and its wholly-owned domestic subsidiaries were released from their obligations as guarantors of Dean Foods Company’s senior secured credit facility (and designated as “unrestricted subsidiaries” thereunder) and Dean Foods’ senior notes due 2016 and 2018, and Dean Foods Company has been released from its guarantee of Alpro’s revolving credit facility.

During the year ended December 31, 2012, we incurred approximately $26 million in transaction costs associated with the WhiteWave IPO and the related business separation, which were expensed as incurred. See Note 2 and Note 10 to our Consolidated Financial Statements for additional information regarding the WhiteWave IPO.

Divestiture of Morningstar Foods —During 2012, our management began evaluating strategic alternatives related to our Morningstar division, which is a leading manufacturer of dairy and non-dairy extended shelf-life (“ESL”) and cultured products, including creams and creamers, ice cream mixes, whipping cream, aerosol whipped toppings, iced coffee, half and half, value-added milks, sour cream and cottage cheese. On December 2, 2012, we entered into an agreement to sell the Morningstar division to a third party. The sale closed on January 3, 2013 and we received net proceeds of approximately $1.45 billion, a portion of which was used to retire outstanding debt under our senior secured credit facility. All of the operations of our Morningstar division, previously reported within the Morningstar segment, have been reclassified as discontinued operations in our Consolidated Financial Statements for the years ended December 31, 2012, 2011 and 2010 and as of December 31, 2012 and 2011. See Note 3 and Note 10 to our Consolidated Financial Statements for further information regarding the Morningstar divestiture and the use of related proceeds.

Management Changes — In connection with the WhiteWave IPO, on August 7, 2012, Gregg L. Engles was appointed Chief Executive Officer and Chairman of the Board of Directors of WhiteWave. Mr. Engles resigned as Chief Executive Officer of Dean Foods effective upon completion of the WhiteWave IPO on October 31, 2012.

Additionally, on August 7, 2012, in connection with the WhiteWave IPO, Gregg A. Tanner was appointed to serve as Chief Executive Officer of Dean Foods, effective as of the completion of the WhiteWave IPO, and he assumed that role on October 31, 2012. Mr. Tanner served as President, Fresh Dairy Direct and Chief Supply Chain Officer of Dean Foods since January 2012. Prior to that time, Mr. Tanner served as our Executive Vice President and Chief Supply Chain Officer since joining the Company in November 2007.

In connection with the WhiteWave IPO, the following additional management changes became effective:

| • | Blaine E. McPeak and Bernard P. J. Deryckere ceased serving as executive officers of Dean Foods but continued in their roles and serve as executive officers of WhiteWave, and |

| • | Thomas N. Zanetich, who formerly served as Executive Vice President, Human Resources of Dean Foods transitioned to Executive Vice President, Human Resources of WhiteWave. |

Further, on November 8, 2012, we announced the future resignations of Shaun Mara, our Executive Vice President and Chief Financial Officer, and Steve Kemps, our Executive Vice President, General Counsel and Corporate Secretary. Under the terms of letter agreements entered into in connection with their planned resignations, Messrs. Mara and Kemps will continue to serve in their current roles until March 1, 2013, at which time they will resign as officers of Dean Foods and will thereafter provide consulting services to us on a transitional basis until April 1, 2013.

Effective as of March 1, 2013, Chris Bellairs, who previously served as the Chief Financial Officer of our Fresh Dairy Direct business and currently serves as our Executive Vice President, Chief Financial Officer

3

Table of Contents

Designate, will assume the role of Executive Vice President and Chief Financial Officer, and Rachel Gonzalez, who previously served as our Senior Vice President and Deputy General Counsel and currently serves as our Executive Vice President, General Counsel Designate, will assume the role of Executive Vice President, General Counsel and Corporate Secretary.

Conventional Raw Milk Environment— Prices for conventional raw milk, our primary ingredient, declined in the first half of 2012 and rose materially every month of the third and fourth quarter of 2012, hitting a near-historic peak of $21.39 in December. This is the third highest month in the last five years and 40% above the June low price of the year. Class I prices declined moderately at the beginning of 2013, and we expect Class I prices to trade in a relatively narrow range and to remain at or near this level through the first half of the year.

Retail and Customer Environment— As conventional raw milk prices have fallen, retailers have restored the margin over milk (the difference between retail milk prices and raw milk costs) to be more consistent with historical averages, which is in contrast to 2010 and 2011, when retailers were deeply discounting private label milk. As a result, the price relationship between branded and private label milk has improved, our regional brand share has stabilized, and our regional brands have competed more effectively during 2012. Additionally, our volumes continued to outperform our peers throughout the year.

Over the course of 2013, we will continue to emphasize price realization, volume performance and disciplined cost management in an effort to improve gross margin and drive operating income growth. Organizational changes have been made to reduce our total cost to serve and our selling and general and administrative costs, and we remain focused on sustaining strong positive cash flow and generating shareholder value. Our focus on volume, cost and pricing effectiveness has yielded significantly improved results and renewed momentum within our Fresh Dairy Direct business; however, the fluid milk industry remains highly competitive. In January 2013, a request for proposal (“RFP”) for private label milk with a significant customer resulted in a loss of a portion of that customer’s business, which will begin to be reflected in the second quarter of 2013. The lost volumes were primarily related to low-margin, private label fluid milk business and were the result of the renegotiation of certain regional supply arrangements that going forward will be subject to renewal over various time frames. As a result, we expect total fluid milk volumes to decline in the low-single digits in 2013. We expect to accelerate our ongoing cost reduction efforts in 2013 to minimize the impact of these lost volumes.

Facility Closing and Reorganization Activities— During the first quarter of 2012, our management team reassessed our company-wide strategy, resulting in a shift in focus to deploying our capital and strategically investing in the value-added segments of our business. With this new strategy, our goal is to invest our strategic capital primarily in those initiatives that yield higher returns over shorter time frames. In connection with this change, our management team approved a cost reduction plan focused on aligning key functions within the Fresh Dairy Direct organization under a single leadership team and permanently removing costs from the Fresh Dairy Direct organization as well as certain functions that support this segment of our business. We incurred charges of $32.2 million under this initiative during the year ended December 31, 2012, primarily related to workforce reduction costs, the write-down of certain information technology assets and leasehold improvements, lease termination costs and costs associated with exiting other commitments deemed not necessary to execute our new strategy. Additionally, we approved the closure of four Fresh Dairy Direct facilities during 2012.

During the fourth quarter of 2012, our management team approved a plan to reorganize Fresh Dairy Direct’s field organization and certain functional areas that support our regional business teams, including finance, distribution, operations and human resources. We believe this streamlined leadership structure will enable faster decision-making and create enhanced opportunities to build our Fresh Dairy Direct business. During 2012, we recorded charges of $6.0 million under this initiative, related to severance costs associated with the first tranche of this program. We are committed to identifying opportunities for cost reductions, and we expect to incur additional costs related to these efforts and other initiatives in the near term as we continue to optimize our network and transform our business. Specifically, we plan to build upon the success of the cost reduction actions

4

Table of Contents

undertaken in 2012 and significantly accelerate those efforts in 2013. Although these plans are still being developed and have not yet been approved by our executive management team, we expect the cost reductions to include the closure of 10-15% of our production facilities and the elimination of a significant number of distribution routes, as well as associated selling, general and administrative expenses. See Note 17 to our Consolidated Financial Statements for more information regarding our facility closing and reorganization activities.

Obligations Related to Consolidated Container Company— On July 3, 2012, our approximate 25% non-controlling interest, on a fully diluted basis, in Consolidated Container Company (“CCC”), one of the nation’s largest manufacturers of rigid plastic containers and our largest supplier of plastic bottles and bottle components, was sold in connection with Vestar Capital Partners’ sale of the business operations of CCC. Vestar Capital Partners, an unaffiliated entity, controlled CCC through a majority ownership interest. Prior to the sale, our investment in CCC was accounted for under the equity method of accounting and had been recorded at zero value since 2001 when we determined the investment to be permanently impaired. As a result of the sale, we received cash proceeds of $58.0 million. As the tax basis of our investment in CCC is calculated differently than the carrying value of our investment, we incurred a cash tax obligation of approximately $90 million, which was paid during the fourth quarter of 2012. During 2012, we recorded a pre-tax gain from the sale of $58.0 million and additional income tax expense of $68.4 million, resulting in a net after-tax loss on the sale of the investment of $10.4 million. See Note 4 to our Consolidated Financial Statements for further information.

We have two reportable segments, Fresh Dairy Direct and WhiteWave, which are described below.

Fresh Dairy Direct

Fresh Dairy Direct manufactures, markets and distributes a wide variety of branded and private label dairy case products, including milk, ice cream, cultured dairy products, creamers, juices and teas to retailers, foodservice outlets, distributors, educational institutions and governmental entities across the United States.

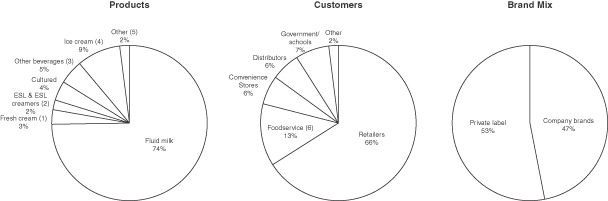

Fresh Dairy Direct’s net sales totaled $9.3 billion in 2012, or approximately 81% of our consolidated net sales. The following charts depict Fresh Dairy Direct’s 2012 net sales by product, customer and volume mix of company branded versus private label products.

| (1) | Includes half-and-half and whipping cream. |

| (2) | Includes creamers and other ESL fluids. |

| (3) | Includes fruit juice, fruit-flavored drinks, iced tea and water. |

| (4) | Includes ice cream, ice cream mix and ice cream novelties. |

| (5) | Includes items for resale such as butter, cheese, eggs and milkshakes. |

| (6) | Includes restaurants, hotels and other foodservice outlets. |

5

Table of Contents

Fresh Dairy Direct sells its products under local and regional proprietary or licensed brands. Products not sold under these brands are sold as private label. Fresh Dairy Direct sells its products primarily on a local or regional basis through its local and regional sales forces, although some national customer relationships are coordinated by a centralized corporate sales department. Fresh Dairy Direct’s largest customer is Wal-Mart, including its subsidiaries such as Sam’s Club, which accounted for approximately 23% of Fresh Dairy Direct’s net sales in 2012

As of December 31, 2012, Fresh Dairy Direct’s local and regional proprietary and licensed brands included the following:

Alta Dena®

Arctic Splash®

Atlanta Dairies®

Barbers®

Barbe’s®

Berkeley Farms®

Broughton™

Brown Cow®

Brown’s Dairy®

Bud’s Ice Cream™

Chug®

Country Churn®

Country Delite™

Country Fresh®

Country Love®

Creamland™

Dairy Fresh®

Dairy Pure®

Dean’s®

Dipzz®

Fieldcrest®

Foremost® (licensed brand)

Fruit Rush®

Gandy’s™

Garelick Farms®

Hershey’s® (licensed brand)

Hygeia®

Jilbert™

Knudsen® (licensed brand)

LAND O LAKES® (licensed brand)

Land-O-Sun & design®

Lehigh Valley Dairy Farms®

Liberty™

Louis Trauth Dairy Inc.®

Maplehurst®

Mayfield®

McArthur®

Meadow Brook®

Meadow Gold®

Mile High Ice Cream™

Model Dairy®

Morning Glory®

Nature’s Pride®

Nurture®

Nutty Buddy®

Oak Farms®

Over the Moon®

Pet® (licensed brand)

Pog® (licensed brand)

Price’s™

Purity™

Reiter™

Robinson™

Saunders™

Schenkel’s All*Star™

Schepps®

Shenandoah’s Pride®

Stroh’s®

Swiss Dairy™

Swiss Premium™

Trumoo®

T.G. Lee®

Tuscan®

Turtle Tracks®

Verifine®

Viva®

Fresh Dairy Direct currently operates 79 manufacturing facilities in 32 states located largely based on customer needs and other market factors. For more information about facilities in Fresh Dairy Direct, see “Item 2. Properties.” Due to the perishable nature of its products, Fresh Dairy Direct delivers the majority of its products directly to its customers’ locations in refrigerated trucks or trailers that we own or lease. This form of delivery is called a “direct store delivery” or “DSD” system. We believe that Fresh Dairy Direct has one of the most extensive refrigerated DSD systems in the United States.

The primary raw material used in Fresh Dairy Direct products is conventional milk (which contains both raw milk and butterfat) that we purchase primarily from farmers’ cooperatives, as well as from independent farmers. The federal government and certain state governments set minimum prices for raw milk and butterfat on a monthly basis. Another significant raw material used by Fresh Dairy Direct is resin, which is a fossil fuel-based product used to make plastic bottles. The price of resin fluctuates based on changes in crude oil and natural gas prices. Other raw materials and commodities used extensively by Fresh Dairy Direct include diesel fuel, used to operate our extensive DSD system, and juice concentrates and sweeteners used in our products. Fresh Dairy Direct generally increases or decreases the prices of its fluid dairy products on a monthly basis in correlation with fluctuations in the costs of raw materials, packaging supplies and delivery costs. However, in some cases, we are subject to the terms of sales agreements with respect to the means and/or timing of price increases, particularly for non-dairy input costs such as diesel and resin.

6

Table of Contents

Fresh Dairy Direct has several competitors in each of its major product and geographic markets. Competition between dairy processors for shelf-space with retailers is based primarily on price, service, quality and the expected or historical sales performance of the product compared to its competitors’ products. In some cases Fresh Dairy Direct pays fees to customers for shelf-space. Competition for consumer sales is based on a variety of factors such as brand recognition, price, taste preference and quality. Dairy products also compete with many other beverages and nutritional products for consumer sales.

The fluid milk category enjoys a number of attractive attributes. Specifically, fluid milk is a nutritious and healthy product that is found in over 90% of U.S. homes. As a result, fluid milk is a very large category, with approximately $20 billion of annual sales. This category’s size and pervasiveness, plus the limited shelf life of the product, make it an important category for retailers and consumers, as well as a large long-term opportunity for the best positioned dairy processors. However, the dairy industry is not without some well-documented challenges. It is a mature and fragmented industry that has traditionally been characterized by slow to flat growth and low profit margins. According to the USDA, per capita consumption of fluid milk continues to decline. Due in part to the current economic climate, which continues to be challenging for broad segments of the population, and historically high retail prices, the fluid milk category has posted declining volumes over the last several years. In addition, the industry experienced retail and wholesale margin erosion in 2010 and 2011 due to steady increases in conventional milk prices over that time; however, during the fourth quarter of 2011, milk prices decreased slightly and continued to decline through the second quarter of 2012. Retailers did not fully reflect such declines in shelf pricing, which partially restored the historical price relationship between branded and private label milk and allowed our regional brands to compete more effectively. Milk prices rose significantly during the second half of 2012; however, we were able to effectively adjust our pricing to offset these costs.

Throughout 2013, we will also continue to emphasize price realization, volume performance and disciplined cost management in an effort to improve gross margin and drive operating income growth. Organizational changes have been made to reduce our total cost to serve and our selling and general and administrative costs, and we remain focused on sustaining strong positive cash flow and generating shareholder value. Our focus on volume, cost and pricing effectiveness has yielded significantly improved results and renewed momentum within our Fresh Dairy Direct business; however, the fluid milk industry remains highly competitive. We expect total fluid milk volumes to decline in the low-single digits in 2013 due principally to the impact of the RFP described above in “Developments Since January 1, 2012”. We plan to accelerate our ongoing cost reduction efforts in 2013 to minimize the impact of these lost volumes.

For more information on factors that could impact Fresh Dairy Direct, see “— Government Regulation — Milk Industry Regulation”, “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties — Prices of Raw Milk and Other Inputs,” as well as Note 20 to our Consolidated Financial Statements.

WhiteWave

WhiteWave is a leading consumer packaged food and beverage company focused on high-growth product categories that are aligned with emerging consumer trends. WhiteWave manufactures, markets, distributes, and sells branded plant-based foods and beverages, coffee creamers and beverages, and premium dairy products throughout North America and Europe. Their widely-recognized, leading brands distributed in North America includeSilk plant-based foods and beverages,International Delight andLAND O LAKES coffee creamers and beverages, andHorizon Organic premium dairy products, while their popular European brands of plant-based foods and beverages includeAlpro andProvamel.

Going forward, WhiteWave expects to drive further sales and growth by strengthening its existing product categories, expanding its brands into logical adjacent product categories, focusing on new product development and capitalizing on emerging consumer trends.

7

Table of Contents

WhiteWave’s net sales totaled $2.2 billion in 2012, or approximately 19% of our consolidated net sales. WhiteWave sells its products across North America and Europe to a variety of customers, including grocery stores, mass merchandisers, club stores, convenience stores, and health food stores, as well as through various away-from-home channels, including restaurants and foodservice outlets. Core commercial capabilities, including speed-to-market and an extensive supply chain network, enable WhiteWave to achieve and sustain leading positions and drive growth in brand platforms. WhiteWave sells its products primarily through its direct sales force and independent brokers. WhiteWave’s largest customer is Wal-Mart, including its subsidiaries such as Sam’s Club, which accounted for approximately 19% of WhiteWave’s net sales in 2012. Approximately 84% of WhiteWave’s net sales are domestic.

The following charts graphically depict WhiteWave’s 2012 net sales by product category and customers:

WhiteWave currently operates five domestic and four international manufacturing facilities. For more information about our WhiteWave facilities, see “Item 2. Properties.” Some of WhiteWave’s products are manufactured by third-party manufacturers under processing agreements. The majority of WhiteWave’s products are delivered through warehouse delivery systems.

The primary raw material used in WhiteWave’s organic milk-based products is organic raw milk. WhiteWave currently works with more than 600 dairy farmers across the United States and purchases 93% of its organic raw milk from this network. The balance of its organic raw milk is sourced from two farms that it owns. WhiteWave generally enters into supply agreements with organic dairy farmers with typical terms of two to five years, which obligates it to purchase certain minimum quantities of organic raw milk. The organic dairy industry continues to experience significant swings in supply and demand. Industry regulation and the costs of organic farming compared to the cost for conventional farming can impact the supply of organic raw milk in the market.

The primary raw materials used in WhiteWave’s creamer products are conventional raw milk, palm oil, flavorings and sweeteners. Certain of these raw materials are purchased under long-term contracts to better manage the supply and costs of our inputs.

The primary raw materials used in WhiteWave’s plant-based products include non-genetically modified (“non-GMO”) soybeans, organic soybeans and almonds. Soybeans and almonds are generally available from several suppliers and WhiteWave is not dependent on any single supplier for these raw materials.

WhiteWave has several competitors in each of its product markets. Competition to obtain shelf-space with retailers for a particular product is based primarily on brand recognition and the expected or historical sales performance of the product compared to its competitors’ products. In some cases, WhiteWave pays fees to retailers to obtain shelf-space for its products. Competition for consumer sales is based on many factors, including brand recognition, price, taste preferences and quality. Consumer demand for plant-based and organic beverages and foods has grown in recent years due to growing consumer confidence in the health benefits attributable to these products, and WhiteWave believes it has a leading position in these categories.

8

Table of Contents

For more information on factors that could impact the results of our WhiteWave segment, see “— Government Regulation — Organic Regulations,” “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties — Prices of Raw Milk and Other Inputs,” as well as Note 19 to our Consolidated Financial Statements.

The evolution of Dean Foods into a leading dairy processor began in the early nineties with an acquisition-focused strategy centered on creating scale to align with a consolidating customer base. Between 1993 and 2009, we completed more than 40 acquisitions of high quality dairies, dairy products and plant-based brands, increasing net sales from $150 million to more than $11 billion in 2012. We believe our portfolio of manufacturing and distribution assets enables us to offer regional and national branded and private label products across a variety of product categories, ranging from short shelf life (less than 20 days) to extended shelf life (“ESL”) (45 to 60 days) to shelf stable products (6 to 12 months), to customers in a cost effective manner. We believe that Fresh Dairy Direct operates one of the most extensive refrigerated DSD networks in the United States, and WhiteWave maintains significant share positions in plant-based foods and beverages, coffee creamers and beverages and premium dairy products in North America and Europe.

Each of our reporting segments, Fresh Dairy Direct and WhiteWave, operates a distinct business, with separate strategies to address their respective sets of business opportunities and challenges. As explained more fully below, our Fresh Dairy Direct strategy focuses on volume growth and cost reduction, as well as effective pricing to pass through commodity cost changes. In contrast, we believe WhiteWave is well positioned to build on the continuing growth of its business, and it has developed strategies to further expand that growth while continuing to focus on cost reduction and capability building.

Fresh Dairy Direct

Fresh Dairy Direct’s strategy is to build on its unique capabilities and cost reduction opportunities to create an advantaged low-cost position in the fluid milk category. We have a continued focus on the core fundamentals that drove our successes in 2011 and 2012. We are the largest fluid dairy processor in the nation, and we are uniquely positioned as the largest fluid milk processor with a national network of processing assets. To build the core fluid milk business while meeting current market challenges and customer expectations, Fresh Dairy Direct focuses on the following:

Volume Performance

| • | Driving volume performance at attractive economic returns and continuing to grow our share in the fluid milk category through the acquisition of new customers and expanding relationships with existing customers. |

Cost Reduction

| • | Utilizing our unique size and national position to reduce costs to create a significantly advantaged low-cost position in private label milk; |

| • | Improving asset utilization across our coast-to-coast network to drive efficiency and lower our cost per unit through strategic network optimization activities; |

| • | Utilizing technological and financial capabilities to improve the routing and efficiency of our DSD network; |

| • | Distributing best practices and driving manufacturing efficiency through an employee-led continuous improvement initiative; and |

| • | Taking advantage of the size of our total procurement needs to drive greater savings across our major purchases. |

9

Table of Contents

Effective Pricing

| • | Utilizing improved pricing protocols and technology to effectively pass through increases in dairy and other significant commodity costs; and |

| • | Building on our current program to actively hedge commodity costs through the execution of derivative instruments and fixed-price forward purchase contracts to bring greater stability to our input costs. |

In addition to the core objectives outlined above, we continue to explore opportunities to selectively expand ourTru Moo brand.

We have continued our efforts to align our field and support functions under a single, streamlined leadership team, which we believe will facilitate the decision-making process in the field and create enhanced opportunities to build the Fresh Dairy Direct business.

WhiteWave

WhiteWave competes in the branded plant-based foods and beverages (such as soy, almond, coconut and hazelnut drinks), coffee creamers and beverages and premium dairy products categories, which it believes have strong long-term growth potential due to their relative immaturity, low household penetration numbers and strong consumer interest. Within these categories, WhiteWave brands are often category leaders. To further build growth, the WhiteWave strategy encompasses the following:

Build on the Equity in Core Brands

WhiteWave’s core brands are leaders in categories which are experiencing strong consumer momentum. WhiteWave intends to continue building on the equity of core brands by introducing innovative products and expanding offerings under those established brands to raise consumer awareness of its products’ attributes which, in turn, should allow it to expand sales to a broader set of consumers and consumption occasions. WhiteWave expects to expand the role of its brands even further with retail customers, who recognize the accelerated growth that these brands bring to their businesses.

Drive Growth Through Innovation

WhiteWave has a history of driving growth through pioneering new subcategories, capitalizing on emerging trends and introducing product extensions under its brands. WhiteWave’s recent product launches have allowed it to continue to grow in its existing categories and subcategories and deliver innovative products under trusted brands.

Continue to Identify Cost Reduction Opportunities to Reinvest in Brands and Operational Capabilities

WhiteWave is committed to pursuing operational cost reduction programs in order to maintain its competitive position and support its growth strategy. Company-wide cost reduction programs improve operational efficiency through the elimination of excess costs. By realizing savings through these cost reduction programs, WhiteWave can reinvest in its business to build its brands and improve its capabilities as it strives to drive growth and deliver superior service to retail and foodservice customers.

Selectively Pursue Expansion Opportunities in Attractive New Geographies

WhiteWave’s leading brands, on-trend innovative products, and sales, marketing and supply chain capabilities provide opportunities to expand its business globally by:

| • | broadening the distribution of successful products across existing geographies; |

| • | driving distribution of brands and products into geographies adjacent to existing geographies; and |

| • | introducing brands and products in new, high-growth regions across the globe. |

10

Table of Contents

Corporate Responsibility

Within our business strategies, a sense of corporate responsibility remains an integral part of our efforts, despite the economic challenges we have faced. As we work to strengthen our business, we are committed to do it in a way that is right for our employees, shareholders, consumers, customers and the environment. We intend to realize savings by reducing waste and duplication while we continue to support programs that improve our local communities. We believe that our customers, consumers and suppliers value our efforts to operate in an ethical, environmentally sustainable, and socially responsible manner.

Seasonality

Our business is affected by seasonal changes in the demand for dairy products. The demand for dairy is fairly stable through the first three quarters of the year with a marked increase in the fourth quarter. Fluid milk volumes tend to decrease in the second and third quarters of the year primarily due to the reduction in dairy consumption associated with our school business. However, this drop in volumes is partially offset by the increase in ice cream and ice cream mix consumption during the summer months. Sales volumes are typically higher in the fourth quarter associated with increased dairy consumption, especially fresh cream and creamers, during seasonal holidays. Because certain of our operating expenses are fixed, fluctuations in volumes and revenue from quarter to quarter may have a material effect on operating income for the respective quarters.

Intellectual Property

We are continually developing new technology and enhancing existing proprietary technology related to our dairy and plant-based operations. As of December 31, 2012, 16 U.S. and six international patents have been issued to us and 20 U.S. and 25 international patent applications are pending or published. Of this amount, WhiteWave has nine U.S. and four international patents issued and 14 U.S. and 17 international patents are pending or published. We primarily rely on a combination of trademarks, copyrights, trade secrets, confidentiality procedures and contractual provisions to protect our technology and other intellectual property rights. Despite these protections, it may be possible for unauthorized parties to copy, obtain or use certain portions of our proprietary technology or trademarks.

WhiteWave licenses the right to utilize certain brand names, includingLAND O LAKES,Almond Joy, Cold Stone, Cinnabon, Hershey’s, andYORK, on certain of its products. In addition, WhiteWave has entered into a license agreement with Martek Biosciences Corporation to use products covered by patents for supplementing certain of its premium dairy and soy products with DHA Omega-3.

Research and Development

Our research and development (“R&D”) activities, including those related to our Fresh Dairy Direct business, are conducted at WhiteWave’s facilities in Broomfield, Colorado and Wevelgem, Belgium. At these facilities, experienced consumer packaged goods professionals generate and test new product concepts, new flavors, and packaging. For example, the Broomfield, Colorado R&D facility includes capabilities in product development, dairy and plant-based chemistry, and processing technology, including ESL and shelf-stable technologies. We conduct focus group studies and consumer testing of new product concepts in WhiteWave’s on-site innovation center, which provides opportunities to develop product prototypes and marketing strategies with direct consumer input. The Wevelgem, Belgium R&D professionals have extensive experience in developing a broad range of plant-based products, including drinks, yogurts, desserts and creams.

The R&D organization primarily develops products internally, but also leverages external technical experts for open innovation for new product ideas and concepts. Additionally, our R&D teams are actively involved in cost reduction initiatives across all brands.

Our total R&D expense was $14.4 million, $14.6 million and $20.7 million for 2012, 2011 and 2010, respectively.

11

Table of Contents

As of December 31, 2012, we had the following employees:

| Number of Employees | % of Total Employees | |||||||

Fresh Dairy Direct | 18,898 | 86 | % | |||||

WhiteWave | 2,585 | 12 | ||||||

Corporate | 432 | 2 | ||||||

|

|

|

| |||||

Total | 21,915 | 100 | % | |||||

|

|

|

| |||||

Approximately 39% of Fresh Dairy Direct’s employees participate in collective bargaining agreements, and approximately 41% of WhiteWave’s employees are unionized or have works council representation. We believe our relationship with our employees and these organizations is satisfactory.

Food-Related Regulations

As a manufacturer and distributor of food products, we are subject to a number of food-related regulations, including the Federal Food, Drug and Cosmetic Act and regulations promulgated thereunder by the U.S. Food and Drug Administration (“FDA”). This comprehensive regulatory framework governs the manufacture (including composition and ingredients), labeling, packaging and safety of food in the United States. The FDA:

| • | regulates manufacturing practices for foods through its current good manufacturing practices regulations; |

| • | specifies the standards of identity for certain foods, including many of the products we sell; and |

| • | prescribes the format and content of certain information required to appear on food product labels. |

In addition, the FDA enforces the Public Health Service Act and regulations issued thereunder, which authorizes regulatory activity necessary to prevent the introduction, transmission or spread of communicable diseases. These regulations require, for example, pasteurization of milk and milk products. We are subject to numerous other federal, state and local regulations involving such matters as the licensing and registration of manufacturing facilities, enforcement by government health agencies of standards for our products, inspection of our facilities and regulation of our trade practices in connection with the sale of food products.

We use quality control laboratories in our manufacturing facilities to test raw ingredients. Product quality and freshness are essential to the successful distribution of our products. To monitor product quality at our facilities, we maintain quality control programs to test products during various processing stages. We believe our facilities and manufacturing practices are in material compliance with all government regulations applicable to our business.

Employee Safety Regulations

We are subject to certain safety regulations, including regulations issued pursuant to the U.S. Occupational Safety and Health Act. These regulations require us to comply with certain manufacturing safety standards to protect our employees from accidents. We believe that we are in material compliance with all employee safety regulations applicable to our business.

Environmental Regulations

We are subject to various environmental regulations. Our plants use a number of chemicals that are considered to be “extremely” hazardous substances pursuant to applicable environmental laws due to their toxicity, including ammonia, which is used extensively in our operations as a refrigerant. Such chemicals must be

12

Table of Contents

handled in accordance with such environmental laws. Also, on occasion, certain of our facilities discharge biodegradable wastewater into municipal waste treatment facilities in excess of levels allowed under local regulations. As a result, certain of our facilities are required to pay wastewater surcharges or to construct wastewater pretreatment facilities. To date, such wastewater surcharges have not had a material effect on our financial condition or results of operations.

We maintain above-ground and under-ground petroleum storage tanks at many of our facilities. We periodically inspect these tanks to determine whether they are in compliance with applicable regulations and, as a result of such inspections, we are required to make expenditures from time to time to ensure that these tanks remain in compliance. In addition, upon removal of the tanks, we are sometimes required to make expenditures to restore the site in accordance with applicable environmental laws. To date, such expenditures have not had a material effect on our financial condition or results of operations.

We believe that we are in material compliance with the environmental regulations applicable to our business. We do not expect the cost of our continued compliance to have a material impact on our capital expenditures, earnings, cash flows or competitive position in the foreseeable future. In addition, any asset retirement obligations are not material.

Milk Industry Regulation

The federal government establishes minimum prices that we must pay to producers in federally regulated areas for raw milk. Raw milk primarily contains raw skim milk, in addition to a small percentage of butterfat. Raw milk delivered to our facilities is tested to determine the percentage of butterfat and other milk components, and we pay our suppliers for the raw milk based on the results of these tests.

The federal government’s minimum prices vary depending on the processor’s geographic location or sales area and the type of product manufactured. Federal minimum prices change monthly. Class I butterfat and raw skim milk prices (which are the minimum prices we are required to pay for raw milk that is processed into Class I products such as fluid milk) and Class II raw milk prices (which are the prices we are required to pay for raw milk that is processed into Class II products such as cottage cheese, creams, creamers, ice cream and sour cream) for each month are announced by the federal government the immediately preceding month. Additionally, while WhiteWave is subject to federal government regulations that establish minimum prices for milk, the prices it pays producers of organic raw milk are generally well above such minimum prices, as organic milk production is generally more costly, and organic milk therefore commands a price premium.

Some states have established their own rules for determining minimum prices for raw milk. In addition to the federal or state minimum prices, we also may pay producer premiums, procurement costs and other related charges that vary by location and supplier.

Labeling Regulations

We are subject to various labeling requirements with respect to our products at the federal, state and local levels. At the federal level, the FDA has authority to review product labeling, and the FTC may review labeling and advertising materials, including online and television advertisements to determine if advertising materials are misleading. Similarly, many states review dairy product labels to determine whether they comply with applicable state laws. In addition, the European Union has issued and enforces rules governing foodstuff labeling, nutrition, and health claims. We believe we are in material compliance with all labeling laws and regulations applicable to our business.

Organic Regulations

WhiteWave’s organic products are required to meet the standards set forth in the Organic Foods Production Act and the regulations adopted thereunder by the National Organic Standards Board. These regulations require

13

Table of Contents

strict methods of production for organic food products and limit the ability of food processors to use non-organic or synthetic materials in the production of organic foods or in the raising of organic livestock. WhiteWave believes that it is in material compliance with the organic regulations applicable to its business.

Minority Holdings and Other Interests

Consolidated Container Company

On July 3, 2012, our approximate 25% non-controlling interest, on a fully diluted basis, in Consolidated Container Company (“CCC”), one of the nation’s largest manufacturers of rigid plastic containers and our largest supplier of plastic bottles and bottle components, was sold in connection with Vestar Capital Partners’ sale of the business operations of CCC. Vestar Capital Partners, an unaffiliated entity, controlled CCC through a majority ownership interest. Prior to the sale, our investment in CCC was accounted for under the equity method of accounting and had been recorded at zero value since 2001 when we determined the investment to be permanently impaired. As a result of the sale, we received cash proceeds of $58.0 million. As the tax basis of our investment in CCC is calculated differently than the carrying value of our investment, we incurred a cash tax obligation of approximately $90 million, which was paid during the fourth quarter of 2012. During 2012, we recorded a pre-tax gain from the sale of $58.0 million and additional income tax expense of $68.4 million, resulting in a net after-tax loss on the sale of the investment of $10.4 million.

We have entered into various supply agreements with CCC through December 31, 2014, pursuant to which we have agreed to purchase certain of our requirements for plastic bottles and bottle components from CCC. We spent $204.1 million on products purchased from CCC during 2012 through July 3rd (the date of sale) and $314.9 million and $268.2 million during the years ended December 31, 2011 and 2010, respectively. See Note 4 to our Consolidated Financial Statements for more information regarding our relationship with CCC.

Where You Can Get More Information

Our fiscal year ends on December 31. We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission.

You may read and copy any reports, statements or other information that we file with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. You can request copies of these documents, upon payment of a duplicating fee, by writing to the Securities and Exchange Commission. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

We file our reports with the Securities and Exchange Commission electronically through the Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system. The Securities and Exchange Commission maintains an Internet site that contains reports, proxy and information statements and other information regarding companies that file electronically with the Securities and Exchange Commission through EDGAR. The address of this Internet site ishttp://www.sec.gov.

We also make available free of charge through our website atwww.deanfoods.com our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

Our Code of Ethics is applicable to all of our employees and directors, with the exception of our Alpro employees, who are subject to a comparable code of ethics. Our Code of Ethics is available on our corporate website atwww.deanfoods.com, together with the Corporate Governance Principles of our Board of Directors and

14

Table of Contents

the charters of all of the Committees of our Board of Directors. Any waivers that we may grant to our executive officers or directors under the Code of Ethics, and any amendments to our Code of Ethics, will be posted on our corporate website. If you would like hard copies of any of these documents, or of any of our filings with the Securities and Exchange Commission, write or call us at:

Dean Foods Company

2711 North Haskell Avenue, Suite 3400

Dallas, Texas 75204

(214) 303-3400

Attention: Investor Relations

| Item 1A. | Risk Factors |

Business, Competitive and Strategic Risks

We may not realize anticipated benefits from our accelerated cost reduction efforts as expected.

We have implemented a number of cost reduction initiatives that we believe are necessary to position our business for future success and growth. In order to mitigate continued volume softness in our Fresh Dairy Direct segment, we expect to accelerate cost reduction activities in 2013 through, among other things, closing 10 – 15% of our plants. Our future success and earnings growth depend upon our ability to efficiently accelerate our cost reduction initiatives and execute our rationalization plan, the scope of which is significant, on time and within budget. We must be efficient in executing our plans to achieve a lower cost structure and operate efficiently in the highly competitive food and beverage industry, particularly in an environment of increased competitive activity and reduced profitability. To capitalize on our cost reduction efforts, it will be necessary to carefully evaluate future investments in our business, and concentrate on those areas with the most potential return on investment. If we are unable to realize the anticipated benefits from our cost cutting efforts, we could become cost disadvantaged in the marketplace, and our competitiveness and our profitability could decrease.

The loss of, or reductions in sales volume from, any of our largest customers could negatively impact our sales and profits.

Our largest customer, Wal-Mart Stores, Inc. and its subsidiaries, including Sam’s Club, accounted for approximately 22% of consolidated net sales during 2012. During 2012, our top five customers, collectively, accounted for approximately 33% of our consolidated net sales. Historically, we have not generally entered into written agreements with our customers, and where such agreements exist, they are generally terminable at will by the customer. In January 2013, as a result of an RFP, we were advised that a significant customer decided to transfer a meaningful portion of its business to other suppliers beginning in 2013, which we expect to result in low-single digit net fluid milk volume declines in the Fresh Dairy Direct business during 2013, and we are not able to predict the long-term effects of this volume loss on our financial position, results of operations or cash flows. In addition, the loss of volume from this RFP may be more significant than we expect, which could negatively impact our sales and profits. Furthermore, the loss of, or further declines in sales volumes from, any of our large customers for an extended period of time could negatively impact our sales and profits, particularly due to our significant fixed asset base, which may not be easily reduced in response to significant volume declines.

Past price concessions on fluid milk to large format retailers have negatively impacted, and continued price concessions could negatively impact, our operating margins and profitability.

Many of our customers, such as supermarkets, warehouse clubs and food distributors, have experienced industry consolidation in recent years and this consolidation is expected to continue. These consolidations have produced large, sophisticated customers with increased buying power, and have increased the significance of large-format retailers and discounters. As a result, we are increasingly dependent on key retailers, which have significant bargaining power. In addition, some of these customers are vertically integrated and have re-dedicated

15

Table of Contents

key shelf-space currently occupied by our regionally branded products for their private label products. Higher levels of price competition and higher resistance to price increases have had a significant impact on our business. In the past, retailers have at times pushed us for price concessions, which has negatively impacted our margins, and continued pressures to make such price concessions could negatively impact our profitability in the future. In addition, the fluid milk category continued to experience low pricing on private label milk during 2012. If we are not able to lower our cost structure adequately, our profitability could continue to be adversely affected by the decrease in margin.

Volume softness in the dairy category has had a negative impact on our sales and profits.

Industry-wide volume softness across dairy product categories continued in 2012. In particular, the fluid milk category has experienced declining volumes over the past several years. Decreasing dairy category volume has increased the impact of declining margins on our business. Periods of declining volumes limit the price increases that we can seek to recapture. We expect these trends to continue for the foreseeable future, which could further negatively affect our business. In addition, in recent years, we have experienced a decline in historical volumes from some of our largest customers, which has negatively impacted our sales and profitability and which will continue to have a negative impact in the future if we are not able to attract and retain a profitable customer mix.

We are subject to competitive bidding situations, the outcome of which could negatively impact our sales and profits.

Many of our retail customers have become increasingly price sensitive in the current economic climate, which has intensified the competitive environment in which we operate. As a result of the intensely competitive dairy environment, we have been subject to a number of competitive bidding situations, both formal and informal, particularly within our Fresh Dairy Direct segment which has meaningfully reduced our sales volumes and profitability on sales to several customers. We expect this trend of competitive bidding to continue. In some cases, we have replaced lost volume with lower margin business, which also negatively impacts our profitability. If we are unable to structure our business to appropriately respond to the pricing demands of our customers, we may lose these customers to other processors that are willing to sell product at a lower cost, which could negatively impact our sales and profits.

Increased competition with our branded products and the continued shift to private label products could impede our growth rate and profit margin.

In recent years, growth in our business has primarily resulted from the strength of our nationally and internationally branded products, the majority of which are produced by our WhiteWave segment, and our regionally branded dairy products, which are produced by our Fresh Dairy Direct segment. We believe that WhiteWave’s brands have benefited in many cases from being the first products introduced in their categories, and their success has attracted competition from other food and beverage companies that produce branded products, as well as from private label competitors. Some of WhiteWave’s competitors have substantial financial and marketing resources. They may be able to introduce innovative products more quickly or market their products more successfully than we can, which could cause our growth rate in certain categories to be slower than we have forecast and could cause us to lose sales.

In addition, we are experiencing a continued shift from branded to private label products. Private label competitors are generally able to sell their products at lower prices because private label products typically have lower marketing costs than their branded competitors. In periods of economic weakness, consumers tend to purchase lower-priced products, including conventional milk, coffee creamers and other private label products, which could reduce sales of our branded products. The willingness of consumers to purchase our products will depend upon our ability to offer products providing the right consumer benefits at the right price. Further trade down to lower priced products could adversely affect our sales and profit margin for our branded products.

16

Table of Contents

If our products fail to compete successfully with other branded or private label offerings in the industry, demand for our products and our sales volumes could be negatively impacted.

Product, Supply Chain and Systems Risks

If we fail to anticipate and respond to changes in consumer preferences, demand for our products could decline.

Consumer tastes and preferences are difficult to predict and evolve over time. Demand for our products depends on our ability to identify and offer products that appeal to these shifting preferences. Factors that may affect consumer tastes and preferences include:

| • | dietary trends and increased attention to nutritional values, such as the sugar, fat, protein, or calorie content of different foods and beverages; |

| • | concerns regarding the health effects of specific ingredients and nutrients, such as sugar, other sweeteners, dairy, soybeans, nuts, oils, vitamins, and minerals; |

| • | concerns regarding the public health consequences associated with obesity, particularly among young people; |

| • | increasing awareness of the environmental and social effects of product production; and |

| • | product attributes such as extended shelf life characteristics. |

If consumer demand for our products declines, our sales volumes and our business could be negatively affected.

We may incur liabilities or harm to our reputation, or be forced to recall products as a result of real or perceived product quality or other product-related issues.

We sell products for human consumption, which involves a number of risks. Product contamination, spoilage, other adulteration, misbranding, or product tampering could require us to recall products. We also may be subject to liability if our products or operations violate applicable laws or regulations, including environmental, health, and safety requirements, or in the event our products cause injury, illness, or death. In addition, our product advertising could make us the target of claims relating to false or deceptive advertising under U.S. federal and state laws, including the consumer protection statutes of some states, or laws of other jurisdictions in which we operate. For example, we and WhiteWave were named in a putative class action mislabeling complaint filed in the U.S. District Court for the Southern District of California in September 2011, which was followed by similar actions filed in six additional jurisdictions. All of these suits allege generally that we lack scientific substantiation for certain product claims related to our WhiteWave’sHorizon Organic products supplemented with DHA Omega-3. A significant product liability, consumer fraud, or other legal judgment against us or a widespread product recall may negatively impact our profitability. Moreover, claims or liabilities of this sort might not be covered by insurance or by any rights of indemnity or contribution that we may have against others. Even if a product liability, consumer fraud, or other claim is found to be without merit or is otherwise unsuccessful, the negative publicity surrounding such assertions regarding our products or processes could materially and adversely affect our reputation and brand image, particularly in categories that are promoted as having strong health and wellness credentials. Any loss of consumer confidence in our product ingredients or in the safety and quality of our products would be difficult and costly to overcome.

Disruption of our supply or distribution chains or transportation systems could adversely affect our business.

Damage or disruption to our manufacturing or distribution capabilities due to weather, natural disaster, fire, environmental incident, terrorism, pandemic, strikes, the financial or operational instability of key suppliers, distributors, warehousing and transportation providers, or other reasons could impair our ability to manufacture

17

Table of Contents

or distribute our products. For example, the loss of any of Alpro’s distribution partners for local representation in Europe could negatively affect our business there. If we are unable, or it is not financially feasible, to mitigate the likelihood or potential impact of such events, our business and results of operations could be negatively affected and additional resources could be required to restore our supply chain. In addition, we are subject to federal motor carrier regulations, such as the Federal Motor Carrier Safety Act, with which our extensive DSD system must comply. Failure to comply with such regulations could result in our inability to deliver product to our customers in a timely manner, which could adversely affect our reputation and our results.

Our business operations could be disrupted if our information technology systems fail to perform adequately or experience a security breach.

We maintain a large database of confidential information in our information technology systems, including confidential employee and customer information. The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our business data, communications, supply chain, logistics, accounting and other business processes. If we do not allocate and effectively manage the resources necessary to build and sustain an appropriate technology environment, our business or financial results could be negatively impacted. In addition, our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including systems failures, viruses, security breaches or cyber incidents such as intentional cyber attacks aimed at theft of sensitive data or inadvertent cyber-security compromises. A security breach of such information could result in damage to our reputation, and could negatively impact our relations with our customers or employees. Any such damage or interruption could have a material adverse effect on our business.

Reduced availability of raw materials and other inputs, as well as increased costs for our raw materials and other inputs, could adversely affect us.

Our business depends heavily on raw materials and other inputs, such as conventional and organic raw milk, sweeteners, petroleum-based products, almonds, organic and non-genetically modified (“non-GMO”) soybeans, butterfat, diesel fuel, resin, and other commodities. In addition to our dependence on conventional and organic raw milk, our Fresh Dairy Direct segment is a large consumer of diesel fuel, and WhiteWave is affected by the costs of petroleum-based products through the use of common carriers and packaging. Our raw materials are generally sourced from third parties, and we are not assured of continued supply, pricing, or exclusive access to raw materials from any of these suppliers. In addition, a substantial portion of our raw materials are agricultural products, which are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, frost, earthquakes, and pestilence. Adverse weather conditions and natural disasters also can lower dairy and crop yields and reduce supplies of these ingredients or increase their prices. Other events that adversely affect our suppliers and that are out of our control could also impair our ability to obtain the raw materials and other inputs that we need in the quantities and at the prices that we desire. Such events include problems with our suppliers’ businesses, finances, labor relations, costs, production, insurance, and reputation. Over the past several years, we have experienced increased costs and this may continue given recent weather conditions, which may negatively affect our business.

The organic ingredients (including milk, other dairy-related products, and soybeans) and non-GMO ingredients (including soybeans that we source exclusively from the United States and Canada) for our products are less plentiful and available from fewer suppliers, than their conventional counterparts. Competition with other manufacturers in the procurement of organic and non-GMO product ingredients may increase in the future if consumer demand for organic and non-GMO products increases. In addition, the dairy industry continues to experience periodic imbalances between supply and demand for organic raw milk, which can negatively affect availability and increase our costs. Industry regulation and the costs of organic farming compared to costs of conventional farming can impact the supply of organic raw milk in the market. Oversupply levels of organic raw milk can increase competitive pressure on our products, while supply shortages can cause product shortages and higher costs to us.

18

Table of Contents

Cost increases in raw materials and other inputs could cause our profits to decrease significantly compared to prior periods, as we may be unable to increase our prices to offset the increased cost of these raw materials and other inputs.

If we are unable to obtain raw materials and other inputs for our products or offset any increased costs for such raw materials and inputs, our business could be negatively affected.

Capital Markets and General Economic Risks

Our stock price has been volatile and may continue to be volatile or may decline regardless of our operating performance, and you could lose a significant part of your investment.

The market price of our common stock has historically been volatile, and in the future may be influenced by many factors, some of which are beyond our control, including those described in this section and the following:

| • | WhiteWave’s stock price and financial performance; |

| • | changes in financial estimates by analysts or our inability to meet those financial estimates; |

| • | strategic actions by us or our competitors, such as acquisitions, restructurings, significant contracts, acquisitions, joint marketing relationships, joint ventures, or capital commitments; |

| • | the potential tax-free spin-off or other distribution of all or a portion of our remaining ownership interest in WhiteWave to our stockholders and any resulting changes in our stock price or our inclusion in the S&P 500 Index as a result of such spin-off; |

| • | our ability to complete a reverse stock-split following the anticipated spin-off of all or a portion of our remaining ownership interest in WhiteWave or the impact of such split upon our stock price; |

| • | variations in our quarterly results of operations and those of our competitors; |

| • | general economic and stock market conditions; |

| • | changes in conditions or trends in our industry, geographies or customers; |

| • | terrorist acts; |