While our business continued growing in 2023, our operating results, financial condition and cash flows remain vulnerable to fluctuations in the Argentine economy. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Argentina.”

Management review of 2023 and outlook

Review

During 2023, our financial position has remained stable and, as discussed in “B. Liquidity and capital resources”, cash flow from operations has been sufficient to finance our capital expenditures for 2023. The devaluation of the Argentine peso against the U.S. dollar on December 13, 2023, from Ps. 366.65 to Ps. 799.95 (118.3%) had a negative impact on our foreign currency liability position.

Given the economic context and the foreign exchange restrictions, during 2023, we have increased our debt in foreign currency after taking from financial institutions short term loans to cancelled to settle trade payables abroad. During 2023 we incurred new indebtedness with well-known financial institutions of Ps. 35,744 million (US$ 74.0 million) and repaid Ps. 10,891 million (US$ 24.1 million). For additional information regarding the new indebtedness incurred during 2023 see “B. Liquidity and capital resources. Description of indebtedness” below.

We have allocated our short-term investment in financial instruments to protect our financial position from inflation and devaluation by increasing our position in financial assets at amortized cost and measured at fair value through profit or loss.

Notwithstanding the above, we cannot assure that the evolution of inflation and other macroeconomic variables will not have an adverse effect on our financial position and results of operations. For further information, see “Item 3. Key Information—D. Risk Factors”.

In addition to the above-mentioned respect of the impact of the devaluation of the Argentine peso on our foreign currency liability position, as of December 31, 2023, there have not been material changes to our Statement of Financial Position compared to December 31, 2022.

Our revenues were negatively impacted by the evolution of inflation and the lack of tariff adjustment of the natural gas transportation segment, among others. For further information, see “Discussion of results of operations for the years ended December 31, 2023 and 2022” below.

Outlook and other material events that may impact in our financial condition

Since April 3, 2024 we received a transitional tariff increase of 675% and a monthly increase calculated in accordance with the Transitional Adjustment Index. In 2024, we expect to continue negotiating with ENARGAS the tariffs adjustments under the RTI process that will allow us to obtain a fair and reasonable tariff. See “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Tariff Situation” for more information.

Regarding the Liquids segment, the global inflationary context and increase in NGL costs, are expected to increase the volatility in international reference prices. Additionally, as a result of the increase in sea freight costs, the prices at which our products are exported are foreseen to be subject to reduced margins, which could negatively impact the operating margins of the Liquids business segment.

We are expecting inflationary cost to continue at an elevated level throughout 2024 across our business.

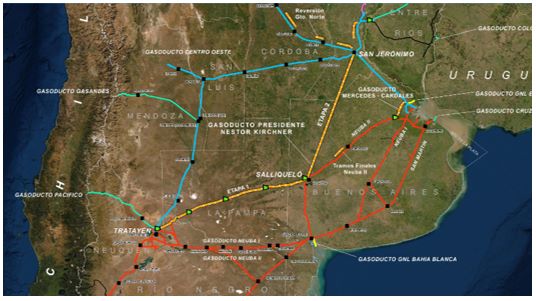

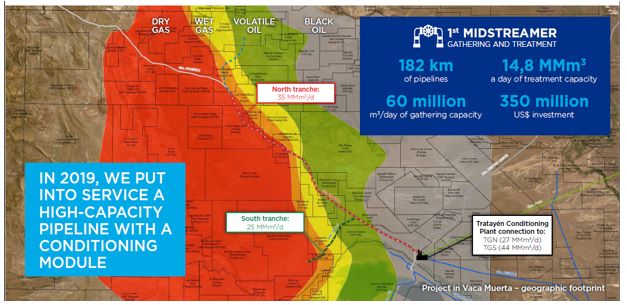

To prepare for our long-term growth, we expect to continue focusing on Vaca Muerta and exploring alternatives that will allow us to profit from our investments and to increase our portfolio of services. In this regard, the expansion work we are carrying out in the area is expected to be completed during the winter of 2024, which will allow us to increase our sales revenues from the Midstream business segment.

New accounting pronouncements adopted after January 1, 2023, and pronouncements not yet effective as of December 31, 2023

For more information, see Note 4.a Critical accounting policies to our Financial Statements.

Discussion of Results of Operations for the Years Ended December 31, 2023 and 2022

The following table presents a summary of our consolidated results of operations for the years ended December 31, 2023 and 2022, stated in millions of pesos, and the increase or decrease and percentage of change between the periods presented:

| | | | |

| | | | | | | | | | | | | |

| | | | |

| Revenues | | | 452,809 | | | | 512,343 | | | | (59,534 | ) | | | (11.6 | ) |

| Net costs of sales | | | (284,746 | ) | | | (299,081 | ) | | | 14,335 | | | | (4.8 | ) |

Gross profit

| | | 168,063 | | | | 213,262 | | | | (45,199 | ) | | | (21.2 | ) |

| Administrative and selling expenses | | | (50,867 | ) | | | (49,695 | ) | | | (1,172 | ) | | | 2.4 | |

| Other operating results | | | (759 | ) | | | (238 | ) | | | (521 | ) | | | 218.9 | |

| Operating profit | | | 116,437 | | | | 163,329 | | | | (46,892 | ) | | | (28.7 | ) |

| Net financial results | | | (72,781 | ) | | | (9,840 | ) | | | (62,941 | ) | | | 639.6 | |

| Share of profit / (loss) from associates | | | (30 | ) | | | 281 | | | | (311 | ) | | | (110.7 | ) |

| Income tax expense | | | (20,108 | ) | | | (53,130 | ) | | | 33,022 | | | | (62.2 | ) |

| Total comprehensive income for the year | | | 23,518 | | | | 100,640 | | | | (77,122 | ) | | | (76.6 | ) |

Year 2023 Compared to Year 2022

Total comprehensive income

For the year ended December 31, 2023, we reported a total net income and a total comprehensive income of Ps. 23,518 million, which represents a Ps. 77,122 million decrease compared to the total comprehensive income of Ps. 100,640 million reported in 2022.

The material factors affecting total comprehensive income were as follows:

| • | Net revenues to third-parties reached Ps. 452,809 million in 2023, which represents a Ps. 59,534 million decrease compared to the 2022 fiscal year. This decrease was mainly due to the reduction in the Liquids Production and Commercialization and Natural Gas Transportation business segments revenues of Ps. 59,120 million and Ps. 27,514 million, respectively. For more information see Item 5. Operating and Financial Review and Prospects —A. Operating Results—Regulated Natural Gas Transportation Segment and Liquids Production and Commercialization.” |

| • | Cost of sales, including depreciation of PPE, reached Ps. 284,746 million in 2023, which represents a Ps. 14,335 million decrease compared to the 2022 fiscal year. This decrease was mainly due to: (i) 19,246 the reduction in the cost of natural gas processed in the Cerri Complex (mainly due a decrease in price, measured in current pesos) and (ii) technical operator assistance fee by Ps. 3,473 million. These effects were partially offset by an increase in the labor cost by Ps. 3,264 million and third parties services by Ps.1,927 million. |

| • | Administrative and selling expenses were Ps. 50,867 million in 2023, which represents a Ps. 1,172 million increase compared to the 2022 fiscal year. This increase was mainly due to higher: (i) labor costs by Ps. 1,937 million, and (ii) professional services fees by Ps. 3,081 million These effects were partially offset, principally, by a decrease in taxes and contributions by Ps. 3,160 million (reduction in tax on exports and turnover tax). |

During 2023, subsidies decreased by Ps.7,090 million, this mainly driven by the decrease in international prices, the lack of updating and the measures issued by the government to reduce them during 2023. For more information see “Item 4. Our Information—B. Business Overview—Liquids Production and Commercialization.”

Net cost of sales for the years ended on December 31, 2023 and 2022, represented 62.9% and 58.4%, respectively, of net revenues reported in the corresponding year.

Administrative and selling expenses for the years ended on December 31, 2023 and 2022, represented 11.2% and 9.7%, respectively, of net revenues reported in the corresponding year.

See. “—Analysis of Operating Profit by Business Segment for the Years Ended December 31, 2023 and 2022.”

Share of (loss) / profit from associates

For the year ended December 31, 2023, we recorded a loss from our investment in associates of Ps. 30 million, compared to the profit of Ps. 281 million recorded in 2022.

Net Financial Results

In accordance with IAS 29 we presented the financial results in gross terms considering the effects of the change in the currency purchasing power in a single separate line (“Gain on monetary position”). Gains and losses from monetary positions represent the effects of inflation on our monetary liabilities and assets, respectively.

Net financial results for the years ended December 31, 2023 and 2022, are as follows:

| | | | |

| | | | | | | |

| | | (in millions of pesos) | |

| Financial income | | | | | | |

| Interest income | | | 24,190 | | | | 5,712 | |

| Foreign exchange gain | | | 270,216 | | | | 87,014 | |

| Subtotal | | | 294,405 | | | | 92,727 | |

| Financial expenses | | | | | | | | |

| Interest expense | | | (24,628 | ) | | | (21,171 | ) |

| Foreign exchange loss | | | (479,075 | ) | | | (162,262 | ) |

| Subtotal | | | (503,703 | ) | | | (183,433 | ) |

| Other financial results | | | | | | | | |

| Notes repurchase results | | | - | | | | (3,208 | ) |

| Fair value gain on financial instruments through profit and loss | | | 195,809 | | | | 75,136 | |

| Derivative financial instruments results | | | - | | | | (397 | ) |

| Other financial charges | | | (2,771 | ) | | | (2,400 | ) |

| Subtotal | | | 193,037 | | | | 69,131 | |

| (Loss) / gain on monetary position | | | (56,521 | ) | | | 11,735 | |

| Total | | | (72,781 | ) | | | (9,840 | ) |

In accordance with the provisions of IAS 29, we opted to present the gain on the monetary position in a single line included in the financial results. This presentation implies that the nominal values of the financial results have been adjusted for inflation. The real values of financial results are different from the components of financial results presented above.

For fiscal year 2023, the net financial loss increased by Ps. 62,941 million compared to the prior year. This negative variation is mainly due to higher negative net foreign exchange difference of Ps.133,612 caused by the devaluation that occurred in mid-December 2023.

The peso/US dollar exchange rate ended at a value of Ps. 808.45 per US dollar as of December 31, 2023, representing an increase of 356% (or Ps. 631.29 per US dollar) compared to the exchange observed as of December 31, 2022. As of December 31, 2022, such rate increased by 72% (or $74.44 for each US dollar) respect to the exchange rate as of December 31, 2021. Our net liability position in US dollars decrease in 2023.

Likewise, we recorded a loss on net monetary position of Ps. 56,521 million as opposed with the gain of Ps. 11,735 million represented a negative variation of Ps. 68,255 as a consequence of the acceleration of inflation and the net asset monetary position.

The effects mentioned above were partially offset by the positive variation in results generated by financial assets of Ps. 120,673.

Income tax expense

Income tax for fiscal year 2023 was an expense of Ps. 20,108 million, compared to the expense of Ps. 53,130 million in fiscal year 2022. The lower income tax charge was primarily due to the decrease in taxable income in fiscal year 2023.

The following table sets forth revenues and operating income for each of our business segments for the years ended December 31, 2023 and 2022:

| | | | | | Year ended December 31, 2023 compared to year ended December 31, 2022 | |

| | | | | | | | | | | | | |

| | | (in millions of pesos) | | | | |

Natural Gas Transportation(1) | | | | | | | | | | | | |

| Revenues | | | 101,862 | | | | 130,194 | | | | (28,332 | ) | | | (21.8 | ) |

| Net cost of sales | | | (90,767 | ) | | | (91,420 | ) | | | 653 | | | | (0.7 | ) |

| Gross profit | | | 11,094 | | | | 38,774 | | | | (27,680 | ) | | | (71.4 | ) |

| Administrative and selling expenses | | | (22,514 | ) | | | (22,577 | ) | | | 63 | | | | (0.3 | ) |

| Other operating expense | | | (813 | ) | | | (562 | ) | | | (252 | ) | | | 44.9 | |

| Operating (loss) /profit | | | (12,233 | ) | | | 15,635 | | | | (27,868 | ) | | | (178.2 | ) |

| | | | | | | | | | | | | | | | | |

| Liquids Production and Commercialization | | | | | | | | | | | | | | | | |

| Revenues | | | 265,413 | | | | 324,533 | | | | (59,120 | ) | | | (18.2 | ) |

| Net cost of sales | | | (161,943 | ) | | | (183,060 | ) | | | 21,118 | | | | (11.5 | ) |

| Gross profit | | | 103,470 | | | | 141,473 | | | | (38,002 | ) | | | (26.9 | ) |

| Administrative and selling expenses | | | (17,629 | ) | | | (20,451 | ) | | | 2,822 | | | | (13.8 | ) |

| Other operating (expense) / income | | | (77 | ) | | | 118 | | | | (196 | ) | | | (166.1 | ) |

| Operating profit | | | 85,764 | | | | 121,140 | | | | (35,376 | ) | | | (29.2 | ) |

| | | | | | | | | | | | | | | | | |

| Midstream | | | | | | | | | | | | | | | | |

| Revenues | | | 85,615 | | | | 58,380 | | | | 27,235 | | | | 46.7 | |

| Net cost of sales | | | (32,605 | ) | | | (26,182 | ) | | | (6,424 | ) | | | 24.5 | |

| Gross profit | | | 53,009 | | | | 32,198 | | | | 20,811 | | | | 64.6 | |

| Administrative and selling expenses | | | (10,155 | ) | | | (6,116 | ) | | | (4,039 | ) | | | 66.0 | |

| Other operating income | | | 132 | | | | 205 | | | | (73 | ) | | | (35.6 | ) |

| Operating profit | | | 42,986 | | | | 26,287 | | | | 16,699 | | | | 63.5 | |

| Telecommunications | | | | | | | | | | | | | | | | |

| Revenues | | | 2,729 | | | | 2,863 | | | | (135 | ) | | | (4.7 | ) |

| Net cost of sales | | | (2,239 | ) | | | (2,045 | ) | | | (194 | ) | | | 9.5 | |

| Gross profit | | | 489 | | | | 818 | | | | (328 | ) | | | (40.1 | ) |

| Administrative and selling expenses | | | (568 | ) | | | (550 | ) | | | (18 | ) | | | 3.3 | |

| Other operating expense | | | - | | | | - | | | | - | | | | - | |

| Operating (loss) / profit | | | (79 | ) | | | 267 | | | | (346 | ) | | | (129.6 | ) |

(1) Includes intersegment revenues of Ps. 2,809 million and Ps. 3,627 million for the fiscal years 2023 and 2022, respectively.

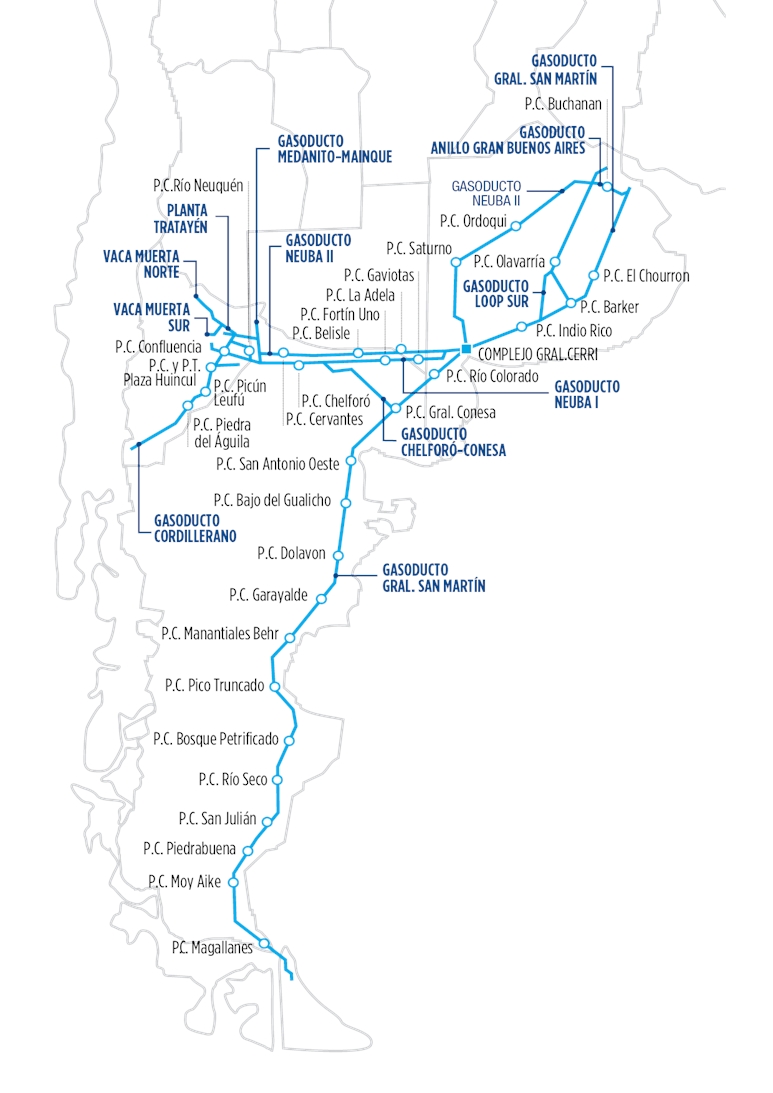

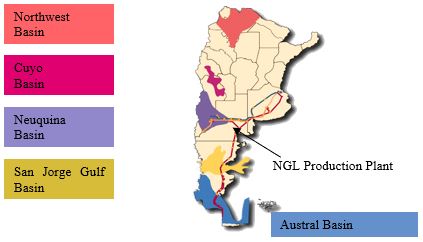

Regulated Natural Gas Transportation Segment

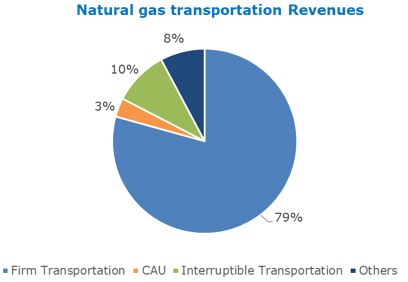

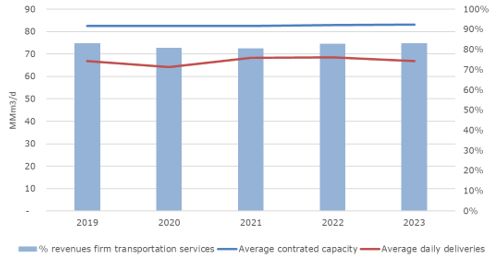

The Natural Gas Transportation business segment represented 22.5% and 25.4% of our total revenues during the years 2023 and 2022, respectively. Natural Gas Transportation revenues are derived mainly from firm contracts, under which pipeline capacity is reserved and paid for regardless of actual usage by the shipper. We also provide interruptible natural gas transportation services subject to availability of the pipeline capacity. In addition, we render operation and maintenance services for the Natural Gas Transportation facilities, which belong to certain gas trusts created by the Government to expand the capacity of the Argentine natural gas transportation pipeline system. This business segment is subject to ENARGAS regulation.

For additional information regarding the history of our discussions with various governmental authorities in relation to the adjustment of our gas transportation tariffs see “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Regulatory Framework.”

| • | During 2023, the Natural Gas Transportation business segment recorded an operating loss of Ps. 12,233 million, compared to the operating profit of Ps.15,635 million profit recorded in 2022. The main factors that affected the results of operations of this segment compared to 2023 are the following: |

| • | Revenues from the Natural Gas Transportation business segment decreased by Ps.28,332 million for the year 2023 compared to 2022. |

| • | During 2023, we had only received a nominal tariff increase of 95% as of April 29, 2023 while annual inflation was 211,4%. |

| • | Revenues related to natural gas firm transportation contracts for the year ended December 31, 2023, decreased by Ps.24,846 million for the year 2023 compared to 2022, as we had only received a nominal tariff increases of 95 % as of April 29, 2023, while the cumulative inflation rate for the Year 2023 was 211.4%. See “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Regulatory Framework—Regulation of Transportation Rates—Actual Rates” for additional information. |

| • | Revenues related to interruptible natural gas transportation service decreased by Ps. 1,523 million for the year 2023 compared to 2022. The decrease mainly resulted from tariff increase discussed above, partially offset by higher volumes dispatched. |

| • | Revenues relating to the Access and charged (“CAU”) decreased by Ps. 1,145 million for the year 2023 compared to 2022 primarily as a result of the same tariff effect. The value of the CAU is much lower than the transportation tariff we are permitted to charge for our natural gas transportation services, because we were not required to make any investment in the construction and expansion of the assets to which the CAU relates. See “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Pipeline Operations—Pipeline Expansions” for additional information regarding the CAU. |

| • | Costs of sales, administrative and selling expenses for the year ended December 31, 2023 decreased by Ps. 716 million, from Ps. 113,997 million to Ps. 113,282 million, as compared to the year ended December 31, 2022. This decrease was mainly attributable to lower depreciation of Ps. 4,243 million and taxes and contributions of Ps. 1,340 million mainly as a consequence of the reduction in turnover tax. These effects were partially offset by higher labor costs of Ps. 2,547 million, third parties services received by Ps. 1,608 million and easements of Ps. 313 million. |

| • | Other operating expenses decreased by Ps. 252 million for the year 2023 compared to 2022, primarily as a result of lower provision for contingencies. |

On March 16, 2023, our Board of Directors approved the 2023 Transition Agreement. This addendum was subsequently ratified by the PEN through Decree No. 250/2023 of April 29, 2023. Previously, on April 27, 2023, ENARGAS issued Resolution No. 186/2023 through which the new tables were published.

Current tariffs

The 2023 Transition Agreement has similar conditions to the 2022 Transition Agreement and includes:

- As of April 29, 2023, a temporary rate increase of 95% on the natural gas transportation rate and the CAU.

- During its term, tgs may not under any circumstances: a) Distribute dividends; nor b) Cancel in advance directly or indirectly financial and commercial debts contracted with shareholders, acquire other companies or grant credits, unless the credits benefit the users or are granted to contractors that do not fall within the aforementioned assumptions. In the event that tgs deems it appropriate to proceed in a direction contrary to the provisions of paragraph a) above, attaching the corresponding supporting documentation, it will request ENARGAS to submit a status report to the Ministry of Economy, so that the Ministry may authorize or no, and if applicable, determine the manner and form of the request. In the event that tgs considers it appropriate to proceed in a direction contrary to the provisions of paragraph b) above, it must also present to ENARGAS documented grounds that support such decision, for authorization. If a covert operation to distribute dividends is noticed, the request will be made to the Ministry of Economy for its substantiation in that sphere. To this end, the Ministry will notify its decision to the applicant and ENARGAS.

On December 14, 2023, ENARGAS Resolution No. 704/2023 called for a public hearing to be held on January 8, 2024. Effective April 1, 2024, we have received a transitional tariff increase of 675%. In addition, the resulting tariffs will be adjusted monthly from May 2024 until the RTI process is completed in 2024 in accordance with the Transitional Adjustment Index. See “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Tariff Situation” for more information.

On December 16, 2023, decree No. 55/2023 was issued declaring the emergency of the national energy sector until December 31, 2024. Among other issues, this decree: (i) establishes the beginning of the process of RTI, (ii) the intervention of ENARGAS as of January 1, 2024 and (iii) instructs the Ministry of Energy to issue the necessary standards and procedures for the sanction of market prices for the public transport service of natural gas.

Liquids Production and Commercialization Segment

Unlike the Natural Gas Transportation segment, revenues of the Liquids Production and Commercialization segment are not subject to full regulation by ENARGAS and the Ministry of Energy. However, in recent years, the Government has enacted a number of laws and regulations that have limited our ability to receive the full international market prices for all of the liquids that the Cerri Complex produces. In addition, ENARGAS has the ability to redirect the volumes of natural gas in the system to cover certain uses and that may result in lower volumes of natural gas to be processed in the Cerri Complex. See “Item 4. Our Information—B. Business Overview—Liquids Production and Commercialization—Regulation” for more information.

The Liquids Production and Commercialization segment represented 58.6% and 63.3% of our total revenues during the years ended December 31, 2023, and 2022, respectively. Liquids Production and Commercialization activities are conducted at the Cerri Complex, which is located near Bahía Blanca and is connected to each of our main pipelines. At the Cerri Complex, we recover ethane, LPG and natural gasoline for our own account, on behalf of our customers and on a fee basis, collecting a commission for the extracted Liquids delivered to our customers.

For the fiscal years 2023 and 2022, all of our sales were made for our own account.

All ethane produced by our Liquids segment in the years ended December 31, 2023 and 2022 was sold locally to PBB.

Our ethane sales for the years 2023 and 2022 represented 38.1% and 24.6% of our Liquids Production and Commercialization net revenues.

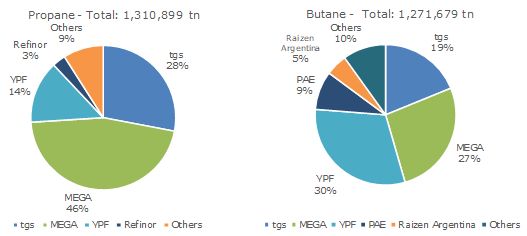

In 2023, we sold 60.6% of our production of LPG in the local market to LPG marketers, compared to 50.9% in 2022, with the remainder exported to LPG traders. In addition, all natural gasoline produced during 2023 and 2022 was exported. For more information about these contracts, see “Item 4. Our Information—B. Business Overview—Liquids Production and Commercialization.”

The total annual sales for the Cerri Complex for 2023 and 2022 in tons were as follows:

| | | | | | Year ended December 31, 2023

compared to year ended December 31, 2022 | |

| | | | | | | |

| | | | | | | | | | | | | |

| Local Market | | | | | | | | | | | | |

| Ethane | | | 394,370 | | | | 329,232 | | | | 65,138 | | | | 19.8 | |

| Propane | | | 209,058 | | | | 215,753 | | | | (6,695 | ) | | | (3.1 | ) |

| Butane | | | | | | | | | | | | | | | | |

| Subtotal | | | 768,805 | | | | 730,457 | | | | 38,348 | | | | 5.2 | |

| | | | | | | | | | | | | | | | | |

| Exports | | | | | | | | | | | | | | | | |

| Propane | | | 160,625 | | | | 194,810 | | | | (34,185 | ) | | | (17.5 | ) |

| Butane | | | 70,484 | | | | 78,460 | | | | (7,976 | ) | | | (10.2 | ) |

| Natural Gasoline | | | | | | | | | | | | | | | | |

| Subtotal | | | | | | | | | | | | | | | | |

| Total Liquids | | | | | | | | | | | | | | | | |

Export revenues from our Liquids Production and Commercialization segment command a price premium, as compared to our domestic market sales, primarily as a result of regulation of domestic prices See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Exports.”

For the years ended December 31, 2023 and 2022, the total accrued exports withholding amounted to Ps.8,236 million and Ps.11,396 million, respectively.

In the domestic market, the Secretary of Energy continued issuing a series of measures with the aim of reducing the impact of the subsidies in public accounts in order to reduce the negative impact that the participation in the Households with Bottles Program and Propane for Networks Agreement have in the results of operations of natural gas liquids producers. These measures include an increase in the sales price from selling LPG bottles the above-mentioned agreements.

The sales prices under the program for fiscal years 2023 and 2022 were as follows:

| Resolution Nro. | Period | Ps. Per ton (at values determined by each resolution) |

| 15/23 | January 2023 | Ps. 29,481 |

| 62/23 | February 2023 | Ps. 32,429 |

| 168/23 | March 2023 | Ps. 35,672 |

| 326/23 | April 2023 | Ps. 38,704 |

| 391/23 | May 2023 | Ps. 40,252 |

| 391/23 | June 2023 | Ps. 41,862 |

| 391/23 | July 2023 | Ps. 43,537 |

| 391/23 | August 2023 | Ps. 45,278 |

| 762/23 | August 2023 to December 2023 | Ps. 50,938 |

Participation in this program forces tgs to commercialize LPG volumes required by the controlling entity at prices below to market values and under certain circumstances at prices lower than their processing cost.

Regarding the Propane for Networks Agreement, on August 28, 2023 we signed its twentieth renewal, in effect until December 31, 2023.

This agreement contemplates compensations to be paid by the Argentine Government to the participants, calculated as the difference between the price at which propane is commercialized under this agreement and the export parity issued monthly by the Secretary of Energy. However, there have been significant delays in the collection of the mentioned compensation. Its overdue balance as of December 31, 2023 was of Ps. 4,672 million. The twentieth renewal stipulates those payments shall be conducted through fiscal credit certificates to be used by the producers for the payment of hydrocarbon export withholdings. As of this date, said certificates have not been issued. Beyond the supply programs mentioned above, we sold 158,794 tons of propane and 1,290 tons of butane mainly to the fractionating market and to a lesser extent to the industrial, propellant and automobile segments.

In 2023, we continued commercializing ethane, under a long-term agreement entered with PBB. This agreement contemplates similar terms to the ones agreed in the previous one, but involves improvements in the take or pay clause of annual compliance, which ensures us an increase in our sales volume to be implemented gradually over the first five years of the agreement. In the year 2023, ethane tons sold to PBB slightly went up to 394,370 tons, from the 329,232 tons recorded in 2022.

See “Item 4. Our Information—B. Business Overview—Competition—Liquids Production and Commercialization—Regulation—International Market.” for additional information.

During 2023 the Liquids Production and Commercialization business segment recorded operating profit of Ps. 85,764 million, compared to Ps.121,140 million in 2022. The main factors that affected the results of operations for this segment compared to 2022 were the following:

| • | Segment revenue decreased by Ps.59,120 million for the year 2023 compared to 2022. This negative effect was mainly due to the negative real exchange rate variation by Ps. 14,370 million, lower volumes of propane and butane dispatched by Ps. 12,524 million and international benchmark prices by Ps. 51,337 million. These effects were partially offset by higher ethane price by Ps. 8,758 million and higher volumes of natural gasoline and ethane shipped by Ps. 17,962 million. |

| • | Subsidies decreased by Ps. 7,090 million in the year 2023 compared with 2022. |

| • | In 2023 propane, butane and natural gasoline average export prices recorded decreases of 30%, 24% and 16%, respectively, compared to 2022. |

| • | During 2023, the production of Liquids reached 1,129,186 tons (182 tons more than in 2022). |

| • | It should be noted that there were no production restrictions during the winter period, as a result of a greater supply of local gas due to non-conventional gas developments. |

| • | Notwithstanding the changes made to the Households with Bottles Program to supply butane to the domestic market described above, our obligations under this program continues to have an adverse impact on this segment, resulting, under some circumstances, in a negative operating margin on domestic sales of LPG. |

| • | Costs of sales, administrative and selling expenses for the year ended December 31, 2023, decreased by Ps. 23,939 million, to Ps. 179,572 million from Ps. 203,511 million, as compared to the year ended December 31, 2022. This decrease was mainly due to lower: (i) cost of natural gas purchased as RTP of Ps. 19,246 million (principally as a consequence of the decrease in the price of the natural gas), (ii) taxes and contributions of Ps. 4,129 million (mainly tax on exports and turnover tax) and (iii) third parties services received by Ps. 2,846 million. These effects were partially offset higher: (i) repair and maintenance expenses by Ps. 1,129 million, (ii) labor costs by Ps. 783 million and (iii) depreciations by Ps. 428 million. |

| • | Other operating expenses decreased by Ps. 196 million. |

In 2023, export revenues from the Liquids Production and Commercialization segment were Ps.95,390 million and accounted for 21% (28% in 2022) of total net sales and 36% (44% in 2022) of total Liquids Production and Commercialization revenues.

In 2023, we exported propane and butane at spot prices, which allowed us to capture opportunities associated with different market niches, allowing us to considerably increase the individual fixed prices of each operation.

We sold our LPG exports at spot prices and to the date of this Annual Report, we are under negotiations for new agreements.

As in prior years, in the period from May to September 2023, the sales of these products were conducted mainly in the domestic market, due to the restrictions in natural gas consumption for the production of Liquids and governmental requirements to supply the domestic market within the framework of the programs outlined by the Government for the supply of LPG.

Regarding natural gasoline exports, throughout the year 2023 and until February 2024 we traded such product by means of an agreement entered with Trafigura Pte Ltd at an international price, less a discount. As of the date of the present Annual Report, a new agreement has been entered with Trafigura Pte Ltd., with expiration date in February 2026 and better terms than the previous agreement in force in 2023.

Regarding international reference prices of the products, we export —propane, butane and natural gasoline— they recorded some variations in 2023 compared to the previous year, presenting an uneven trend. During the first months of the year, they increased within the context of commodities prices recovery given the world economy recovery and the energy setbacks that Asia and Europe faced. As from the second quarter of the year prices contracted and stabilized similar to the levels of prices at the closing of 2022 and starting the last 2023 quarter they started to rise again.

In 2023, we continued commercializing LPG by land, dispatching roughly 15,518 trucks (379,544 tons) loaded with our own product, compare to the approximately 16,156 trucks (390,914 tons) of our own product dispatched in 2022. Trucks dispatches are basically carried out to meet our domestic demand but also allow us to export our products to neighboring countries. Although their volumes are substantially lower than the exports conducted by sea, they capitalize a higher operative margin and increase our clients’ portfolio. Propane and butane deliveries overseas were conducted in a spot modality in 2023, seizing opportunities related to different niche markets, which allowed us to increase considerably the fixed premiums of each transaction. We keep upholding our positioning in the Brazilian market, which constitutes a 2024 goal, maintaining our sea exports in a direct modality (with no go-betweens) to Brazilian LPG distributors.

In 2023, we continued participating in the several supply programs dictated by the National Government. Such is the case of the program for LPG Supply at subsidized prices (“Household Program”)— which had been created by National Executive Decree N° 470/2015. The Household Program establishes a maximum reference price to the different links of the Liquefied Petroleum Gas (“LPG”) commercialization chain to ensure its supply to low- income residential users, forcing producers to provide LPG to fractionating companies at a determined price and with a defined quota for each of them.

Participation in this program forces tgs to commercialize LPG volumes required by the controlling entity at prices inferior to market values and under certain circumstances at prices lower than their processing cost.

Regarding the Propane for Networks Agreement, on August 28, 2023 we signed its twentieth renewal, in effect until December 31, 2023.

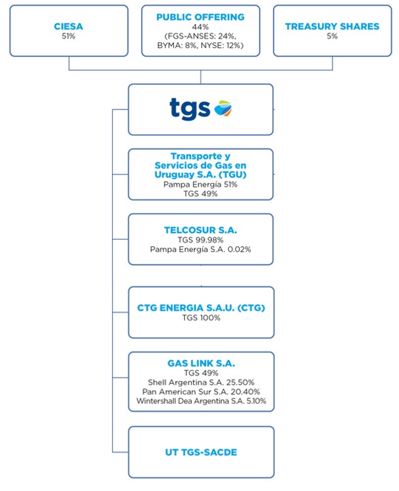

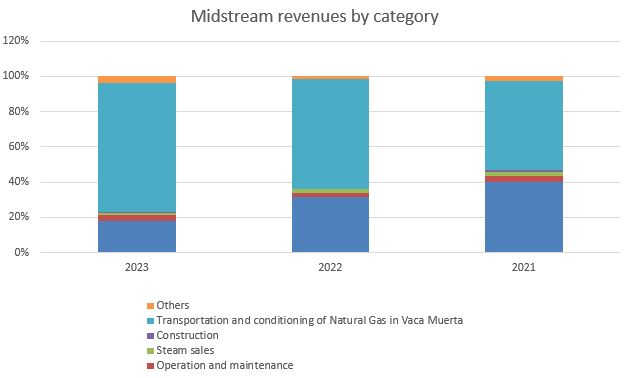

Midstream

This segment includes midstream services. Midstream services include natural gas treatment, separation and removal of impurities from the natural gas stream and compression services, which are generally rendered to the natural gas producers at the wellhead, transportation and conditioning services in Vaca Muerta, as well as activities, related to construction, operation and maintenance of pipelines and compressor plants.

During 2023, the Midstream business segment recorded an operating profit of Ps.42,986 million, which represents a Ps.16,699 million increase compared to Ps. 26,287 million in 2022.

The main factors that affected the results of operations of this segment during 2023 are the following:

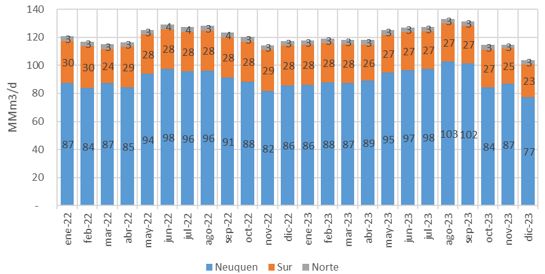

| • | Revenues increased by Ps. 27,235 million primarily due to: (i) higher natural gas transportation and conditioning services in Vaca Muerta for Ps. 27,905 million and (ii) higher operating and maintenance NK pipeline and Transpor.Ar Program by Ps. 3,393. These effects were partially offset by the decrease in the exchange rate on sales revenues denominated in U.S. dollars for Ps. 2,912 million, compression of natural gas services by Ps.750 million and lower operation and maintenance services rendered by Ps. 223 million. |

| • | Costs of sales, administrative and selling expenses increased by Ps. 10,463 million, mainly due to the increase in: (i) depreciations of Ps. 3,491 million, (ii) turnover tax by Ps. 1,997 million, (iii) salaries, wages, and other compensation by Ps. 1,842 million, (iv) repair and maintenance expenses by Ps. 1,346 million and (v) third party services by Ps. 1,066 million. |

Telecommunications

Telecommunication services are rendered by our subsidiary, Telcosur. During 2023, the Telecommunications business segment recorded an operating profit of Ps. (79) million, compared to a profit of Ps. 267 million in 2022. The main factors that affected the results of operations of this segment during 2023 are the following:

| • | Net revenues decreased by Ps.135 million in the year ended December 31, 2023, when compared to 2022. |

| • | Costs of sales, administrative and selling expenses increased by Ps.212 million in the year ended December 31, 2023, when compared to 2022, mainly due to higher salaries, wages and contributions and third party services. |

Year 2022 Compared to Year 2021

| | | | |

| | | | | | | | | | | | | |

| | | | |

| Revenues | | | 512,343 | | | | 539,731 | | | | (27,388 | ) | | | (5.1 | ) |

| Net costs of sales | | | (299,081 | ) | | | (289,121 | ) | | | (9,959 | ) | | | 3.4 | |

| Gross profit | | | 213,262 | | | | 250,610 | | | | (37,348 | ) | | | (14.9 | ) |

| Administrative and selling expenses | | | (49,695 | ) | | | (44,642 | ) | | | (5,052 | ) | | | 11.3 | |

| Other operating results | | | (238 | ) | | | 781 | | | | (1,020 | ) | | | (130.5 | ) |

| Operating profit | | | 163,329 | | | | 206,749 | | | | (43,420 | ) | | | (21.0 | ) |

| Net financial results | | | (9,840 | ) | | | (2,647 | ) | | | (7,193 | ) | | | 271.7 | |

| Share of profit from associates | | | 281 | | | | 129 | | | | 152 | | | | 117.8 | |

| Income tax expense | | | (53,130 | ) | | | (77,263 | ) | | | 24,133 | | | | (31.2 | ) |

| Total comprehensive income for the year | | | 100,640 | | | | 126,968 | | | | (26,328 | ) | | | (20.7 | ) |

Total comprehensive income

For the year ended December 31, 2022, we reported a total net income and a total comprehensive income of Ps. 100,640 million, which represents a Ps. 26,328 million decrease compared to the total net income and total comprehensive income of Ps. 126,968 million reported in 2021.

The material factors affecting total comprehensive income were as follows:

| • | Net revenues to third-parties reached Ps. 512,343 million in 2022, which represents a Ps. 27,388 million decrease compared to the 2021 fiscal year. This decrease was mainly due to the reduction in the Natural Gas Transportation and Liquids Production and Commercialization business segments revenues of Ps. 23,902 million and Ps. 13,530 million, respectively. |

| • | Cost of sales, including depreciation of fixed assets, reached Ps. 299,081 million in 2022, which represents a Ps. 9,959 million increase compared to the 2021 fiscal year. This increase was mainly due to: (i) the growth in the cost of natural gas processed in the Cerri Complex (mainly due an increase in price, measured in constant pesos) by Ps. 9,749 million, (ii) labor costs by Ps. 3,920 million and (iii) depreciations by Ps. 2,899 million. These effects were partially offset by a decrease in the repair and maintenance costs by Ps. 4,197 million and third parties services by Ps. 2,105 million. |

| • | Administrative and selling expenses were Ps. 49,695 million in 2022, which represents a Ps. 5,052 million increase compared to the 2021 fiscal year. This increase was mainly due to higher: (i) labor costs by Ps. 1,836 million, (ii) tax on export and taxes by Ps.2,171 million, (iii) services received from third parties by Ps. 903 million and a lower charge for doubtful accounts by Ps. 404 million. These effects were partially offset, principally, by a decrease in turnover tax of Ps. 691 million. |

During 2022, subsidies increased by Ps.4,176 million, this mainly driven by the increase in international prices and the lack of updating of the prices paid in the local market. For more information see “Item 4. Our Information—B. Business Overview—Liquids Production and Commercialization.”

Cost of sales for the years ended on December 31, 2022 and 2021, represented 58.4% and 53.6%, respectively, of net revenues reported in the corresponding year.

Administrative and selling expenses for the years ended on December 31, 2022 and 2021, represented 9.7% and 8.3%, respectively, of net revenues reported in the corresponding year.

See. “—Analysis of Operating Profit by Business Segment for the Years Ended December 31, 2022 and 2021.”

Share of profit from associates

For the year ended December 31, 2022, we recorded a profit from our investment in associates of Ps.281 million, compared to the profit of Ps.129 million recorded in 2021.

Net Financial Results

In accordance with IAS 29 we presented the financial results in gross terms considering the effects of the change in the currency purchasing power in a single separate line. Gains and losses from monetary positions represent the effects of inflation on our monetary liabilities and assets, respectively.

Net financial results for the years ended December 31, 2022 and 2021, are as follows:

| | | | |

| | | | | | | |

| | | (in millions of pesos) | |

| Financial income | | | | | | |

| Interest income | | | 5,712 | | | | 4,805 | |

| Foreign exchange gain | | | 87,014 | | | | 36,882 | |

| Subtotal | | | 92,727 | | | | 41,687 | |

| Financial expenses | | | | | | | | |

| Interest expense | | | (21,171 | ) | | | (27,103 | ) |

| Foreign exchange loss | | | (162,262 | ) | | | (75,483 | ) |

| Subtotal | | | (183,433 | ) | | | (102,586 | ) |

| Other financial results | | | | | | | | |

| Notes repurchase results | | | (3,208 | ) | | | (2,513 | ) |

| Fair value (loss) / gain on financial instruments through profit and loss | | | 75,136 | | | | 7,224 | |

| Derivative financial instruments results | | | (397 | ) | | | (490 | ) |

| Other financial charges | | | (2,400 | ) | | | (2,992 | ) |

| Subtotal | | | 69,131 | | | | 1,231 | |

| Gain on monetary position | | | 11,735 | | | | 57,022 | |

| Total | | | (9,840 | ) | | | (2,647 | ) |

In accordance with the provisions of IAS 29, we opted to present the gain on the monetary position in a single line included in the financial results. This presentation implies that the nominal magnitudes of the financial results have been adjusted for inflation. The real magnitudes of financial results are different from the components of financial results presented above.

For fiscal year 2022, the net financial loss increased by Ps. 7,193 million compared to the 2021 fiscal year. This negative variation is mainly due to the lower gain on net monetary position (due to the lower net monetary liability position during 2022) and the higher negative net foreign exchange difference. These effects were partially offset by the gain recognized in 2022 for generated by financial assets measured at fair value and higher interest.

The selling peso/U.S. dollar ended exchange rate closed at a value of Ps. 177.96 per U.S. dollar as of December 31, 2022, representing an increase of 72% (or Ps. 74.44 per U.S. dollar) compared to the exchange rate observed at the closing of 2021. As of December 31, 2021, said rate had increased by 22% (or Ps. 18.57 for each U.S. dollar) regarding its quote at the closing of the 2020. For its part, our net liability position in U.S. dollars has been reduced in 2022.

Income tax

Income tax for fiscal year 2022 was an expense of Ps. 53,130 million, compared to the expense of Ps. 77,263 million in fiscal year 2021. The lower income tax charge was primarily due to the decrease in taxable income in fiscal year 2022.

Analysis of Operating Profit by Business Segment for the Years Ended December 31, 2022 and 2021

The following table sets forth revenues and operating income for each of our business segments for the years ended December 31, 2022 and 2021:

| | | | | | Year ended December 31, 2022 compared to year

ended December 31, 2011 | |

| | | | | | | | | | | | | |

Natural Gas Transportation(1) | | | | | | | | | | | | |

| Revenues from sales | | | 130,194 | | | | 154,096 | | | | (23,902 | ) | | | (15.5 | ) |

| Net cost of sales | | | (91,420 | ) | | | (94,663 | ) | | | 3,243 | | | | (3.4 | ) |

| Gross profit | | | 38,774 | | | | 59,433 | | | | (20,659 | ) | | | (34.8 | ) |

| Administrative and selling expenses | | | (22,577 | ) | | | (22,340 | ) | | | (237 | ) | | | 1.1 | |

| Other operating expense | | | (562 | ) | | | (1,236 | ) | | | 674 | | | | (54.5 | ) |

| Operating profit | | | 15,635 | | | | 35,857 | | | | (20,222 | ) | | | (56.4 | ) |

| | | | | | | | | | | | | | | | | |

| Liquids Production and Commercialization | | | | | | | | | | | | | | | | |

| Revenues from sales | | | 324,533 | | | | 338,063 | | | | (13,530 | ) | | | (4.0 | ) |

| Net cost of sales | | | (183,060 | ) | | | (175,262 | ) | | | (7,798 | ) | | | 4.4 | |

| Gross profit | | | 141,473 | | | | 162,801 | | | | (21,328 | ) | | | (13,1 | ) |

| Administrative and selling expenses | | | (20,451 | ) | | | (17,293 | ) | | | (3,158 | ) | | | 18.3 | |

| Other operating income | | | 118 | | | | 1,952 | | | | (1,834 | ) | | | (94.0 | ) |

| Operating profit | | | 121,140 | | | | 147,460 | | | | (26,320 | ) | | | (17.8 | ) |

| | | | | | | | | | | | | | | | | |

| Midstream | | | | | | | | | | | | | | | | |

| Revenues from sales | | | 58,380 | | | | 50,254 | | | | 8,126 | | | | 16.2 | |

| Net cost of sales | | | (26,182 | ) | | | (22,716 | ) | | | (3,466 | ) | | | 15.3 | |

| Gross profit | | | 32,198 | | | | 27,538 | | | | 4,660 | | | | 16.9 | |

| Administrative and selling expenses | | | (6,116 | ) | | | (4,596 | ) | | | (1,520 | ) | | | 33.1 | |

| Other operating (expense) / income | | | 205 | | | | 63 | | | | 142 | | | | 227.9 | |

| Operating profit | | | 26,287 | | | | 23,004 | | | | 3,283 | | | | 14.3 | |

| | | | | | | | | | | | | | | | | |

| Telecommunications | | | | | | | | | | | | | | | | |

| Revenues from sales | | | 2,863 | | | | 2,779 | | | | 84 | | | | 3.0 | |

| Net cost of sales | | | (2,045 | ) | | | (1,942 | ) | | | (103 | ) | | | 5.3 | |

| Gross profit | | | 818 | | | | 838 | | | | (20 | ) | | | (2.3 | ) |

| Administrative and selling expenses | | | (550 | ) | | | (412 | ) | | | (138 | ) | | | 33.7 | |

| Other operating expense | | | - | | | | 2 | | | | (2 | ) | | | (100.0 | ) |

| Operating profit | | | 267 | | | | 428 | | | | (161 | ) | | | (37.5 | ) |

(1) Includes intersegment revenues of Ps. 3,627 million and Ps.5,462 million for the fiscal years 2022 and 2021, respectively.

Regulated Natural Gas Transportation Segment

The Natural Gas Transportation business segment represented 25.4% and 28.5% of our total revenues during the years 2022 and 2021, respectively.

For additional information regarding the history of our discussions with various governmental authorities in relation to the adjustment of our gas transportation tariffs see “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Regulatory Framework.”

| • | During 2022, the Natural Gas Transportation business segment recorded an operating profit of Ps. 15,635 million, compared to a Ps.35,857 million profit recorded in 2021. The main factors that affected the results of operations of this segment compared to 2022 are the following: |

| • | Revenues from the Natural Gas Transportation business segment decreased by Ps.23,902 million for the year 2022 compared to 2021. |

| • | During 2022, we had only received a nominal tariff increase of 60% as of March 1, 2022 while annual inflation was 94.8%. |

| • | Revenues related to natural gas firm transportation contracts for the year ended December 31, 2022, decreased by Ps.15,016 million for the year 2022 compared to 2021, as we had only received a nominal tariff increases of 60% as of March 1, 2022, while the cumulative inflation rate for the Year 2022 was 94.8%. See “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Regulatory Framework—Regulation of Transportation Rates—Actual Rates” for additional information. |

| • | Revenues related to interruptible natural gas transportation service decreased by Ps. 6,210 million for the year 2022 compared to 2021. The decrease mainly resulted from tariff increase discussed above, partially offset by higher volumes dispatched. |

| • | Revenues relating to the CAU decreased by Ps. 841 million for the year 2022 compared to 2021 primarily as a result of the same tariff effect. The value of the CAU is much lower than the transportation tariff we are permitted to charge for our natural gas transportation services, because we were not required to make any investment in the construction and expansion of the assets to which the CAU relates. See “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Pipeline Operations—Pipeline Expansions” for additional information regarding the CAU. |

| • | Costs of sales and administrative and selling expenses for the year ended December 31, 2022 decreased by Ps. 3,006 million, from Ps. 117,004 million to Ps. 113,998 million, as compared to the year ended December 31, 2021. This decrease was mainly attributable to lower PPE maintenance expenses of Ps. 4,631 million, as during 2022 we performed less repairs, technical operator assistance fees of Ps. 1,442 million and lower turnover tax by Ps. 1,520 million. These effects were partially offset, principally, by higher: (i) labor costs of Ps. 1,691 million, (ii) depreciation of Ps. 1,934 million. |

| • | Other operating expenses decreased by Ps. 673 million for the year 2022 compared to 2021, primarily as a result of higher provision for contingencies. |

Liquids Production and Commercialization Segment

The Liquids Production and Commercialization segment represented 63.3% and 62.6% of our total revenues during the years ended December 31, 2022 and 2021, respectively

For the fiscal years 2022 and 2021, all of our sales were made for our own account.

All ethane produced by our Liquids segment in the years ended December 31, 2022 and 2021 was sold locally to PBB.

Our ethane sales for the years 2022 and 2021 represented 24.6% of our Liquids Production and Commercialization net revenues.

In 2022, we sold 50.9% of our production of LPG in the local market to LPG marketers, compared to 55.1% in 2021, with the remainder exported to LPG traders. In addition, all natural gasoline produced during 2022 and 2021 was exported. For more information about these contracts, see “Item 4. Our Information—B. Business Overview—Liquids Production and Commercialization.”

The total annual sales for the Cerri Complex for 2022 and 2021 in tons were as follows:

| | | | | | Year ended December 31, 2022 compared to year ended December 31, 2021 | |

| | | | | | | |

| | | | | | | | | | | | | |

| Local Market | | | | | | | | | | | | |

| Ethane | | | 329,232 | | | | 353,078 | | | | (23,846 | ) | | | (6.7 | ) |

| Propane | | | 215,753 | | | | 238,284 | | | | (22,531 | ) | | | (9.4 | ) |

| Butane | | | | | | | | | | | | | | | | |

| Subtotal | | | 730,457 | | | | 773,314 | | | | (42,857 | ) | | | (5.5 | ) |

| | | | | | | | | | | | | | | | | |

| Exports | | | | | | | | | | | | | | | | |

| Propane | | | 194,810 | | | | 144,801 | | | | 50,009 | | | | 34.5 | |

| Butane | | | 78,460 | | | | 85,627 | | | | (7,167 | ) | | | (8.4 | ) |

| Natural Gasoline | | | | | | | | | | | | | | | | |

| Subtotal | | | | | | | | | | | | | | | | |

| Total Liquids | | | | | | | | | | | | | | | | |

For the years ended December 31, 2022 and 2021, the total accrued exports withholding amounted to Ps.11,394 million and Ps.9,560 million, respectively.

In the domestic market, the Secretary of Energy continued issuing a series of measures with the aim of reducing the impact of the subsidies in public accounts in order to reduce the negative impact that the participation in the Households with Bottles Program and Propane for Networks Agreement have in the results of operations of natural gas liquids producers. These measures include an increase in the sales price from selling LPG bottles the above-mentioned agreements.

The sales prices under the program for fiscal 2022 and 2021 were as follows:

| Resolution Nro. | Period | Ps. Per ton (at values determined by each

resolution) |

| 249 | April 2021 to April 2022 | Ps. 12,627 |

| 270 | April 2022 to July 2022 | Ps. 15,152 |

| 609 | July 2022 to August 2022 | Ps. 17,500 |

| 609 | September 2022 to October 2022 | Ps. 18,375 |

| 861 | November 2022 to December 2022 | Ps. 26,801 |

See “Item 4. Our Information—B. Business Overview—Competition—Liquids Production and Commercialization—Regulation—International Market.” for additional information.

During 2022 the Liquids Production and Commercialization business segment recorded operating profit of Ps.121,140 million, compared to Ps.147,460 million in 2021. The main factors that affected the results of operations for this segment compared to 2021 were the following:

| • | Segment revenue decreased by Ps.13,530 million for the year 2022 compared to 2021. This negative effect was mainly due to the negative real exchange rate variation by Ps. 57,810 million and lower volumes of ethane and butane dispatched by Ps. 8,137 million. These effects were partially offset by higher ethane by Ps. 18,974 million and international benchmark prices by Ps. 15,617 million and higher volumes of natural gasoline and propane shipped by Ps. 14,898 million. |

| • | Subsidies increased by Ps. 3,802 million in the year 2022 compared with 2021. |

| • | In 2022 propane, butane and natural gasoline average export prices recorded increases of 5%, 8% and 16%, respectively, compared to 2021. |

| • | During 2022, the production of Liquids reached 1,129,004 tons (9,585 tons or 0.9% more than in 2021). |

| • | It should be noted that there were no production restrictions during the winter period, as a result of a greater supply of local gas due to non-conventional gas developments. |

| • | Notwithstanding the changes made to the Households with Bottles Program to supply butane to the domestic market described above, our obligations under this program continues to have an adverse impact on this segment, resulting, under some circumstances, in a negative operating margin on domestic sales of LPG. |

| • | Costs of sales, administrative and selling expenses for the year ended December 31, 2022, increased by Ps. 10,956 million, to Ps. 203,511 million from Ps. 192,556 million, as compared to the year ended December 31, 2021. This increase was mainly due to higher: (i) cost of natural gas purchased as RTP of Ps. 9,750 million (principally as a consequence of the increase in the price of the natural gas), (ii) taxes of Ps. 2,046 million (especially tax on exports) and iii) salaries, wages and other compensations by Ps. 626 million. These effects were partially offset by technical operator assistance fees of Ps. 2,332 million. |

| • | Other operating expenses decreased by Ps. 1,834 million. |

In 2022, export revenues from the Liquids Production and Commercialization segment were Ps.144,224 million and accounted for 28% (26% in 2021) of total net sales and 44% (41% in 2021) of total Liquids Production and Commercialization revenues.

In 2022, we exported propane and butane at spot prices, which allowed us to capture opportunities associated with different market niches, allowing us to considerably increase the individual fixed prices of each operation.

We sold our LPG exports at spot prices and to the date of this Annual Report, we are under negotiations for new agreements.

As in prior years, in the period ranging from May to September 2022, the sales of these products were conducted mainly in the domestic market, due to the restrictions in natural gas consumption for the production of Liquids and governmental requirements to supply the domestic market within the framework of the programs outlined by the Government for the supply of LPG.

Regarding the export of natural gasoline, after the termination of the term contract with Petrobras Global Trading B.V. traded until January 31, 2021, spot trades with Trafigura Pte Ltd were conducted until May. Starting in June, we traded with Trafigura Pte Ltd under a term agreement, with an extension until March 2023 inclusive.

In March 2023, we signed a new agreement with Trafigura to export natural gasoline. This agreement will expired in February 2024 and includes similar conditions as the previous one.

As mentioned above, overall international prices showed a rising trend, mainly in the first quarter of 2022, slightly contracting during the first half of the year and towards the year end. International prices are expected to increase in the short term, though below the averages of the first half of 2022. Additionally, as a result of the increase in sea freight costs, the prices at which our products are exported are foreseen to be subject to reduced margins, which could negatively impact the operating margins of the Liquids business segment.

We keep expanding our positioning in the Brazilian market and in 2022 continued exports by sea to Brazilian LPG distributors, which started in 2021 in a direct modality, with no go-betweens. Besides, in September 2022 we conducted our first direct sea export to a Brazilian industrial user. Also, in December 2022, we conducted the largest LPG export to private Brazilian companies by sea.

Additionally, we export to Chile, Paraguay and Brazil by trucks.

Regarding the price of natural gas, measured in U.S. dollars, acquired for RTP for processing at the Cerri Complex, it has suffered an increase of approximately 29% with respect to 2021 Said increase is related to the start up of the Plan Gas.Ar, implemented by the National Government, the aim of which is to generate the framework that facilitates the recovery of national gas production, establishing new market price references, added to a drop in the supply of certain productive basins and transportation restrictions from the Neuquén basin.

Although the Plan Gas.Ar could have a positive effect allowing to stop the fall in production levels that has been registered in the last periods, it is important to highlight the impact that it could have on the prices at which we would acquire the natural gas used in the Cerri Complex.

Midstream

During 2022, the Midstream business segment recorded an operating profit of Ps.26,287 million, which represents a Ps.3,283 million increases compared to Ps.23,004 million in 2021. The main factors that affected the results of operations of this segment during 2022 are the following:

| • | Net revenues increased by Ps. 8,126 million primarily due to: (i) higher natural gas transportation and conditioning services in Vaca Muerta for Ps. 12,927 million, and (ii) compression of natural gas services by Ps. 1,934 million. These effects were partially offset by the decrease in the exchange rate on sales revenues denominated in U.S. dollars for Ps. 7,000 million and lower operation and maintenance services rendered by Ps. 411 million. |

| • | Costs of sales, administrative and selling expenses increased by Ps. 4,986 million, mainly due to the increase in: (i) professional services fees by Ps.1,249 million, (ii) depreciations of Ps. 613 million, (iii) salaries, wages and other compensation by Ps. 551 million, and (iv) turnover tax by Ps. 579 million. |

Telecommunications

During 2022, the Telecommunications business segment recorded an operating profit of Ps.267 million, compared to a profit of Ps.428 million in 2021. The main factors that affected the results of operations of this segment during 2021 are the following:

| • | Net revenues increased by Ps.84 million in the year ended December 31, 2022, when compared to 2021. |

| • | Costs of sales, administrative and selling expenses increased by Ps.242 million in the year ended December 31, 2022, when compared to 2021. |

B. Liquidity and Capital Resources

We expect our main sources of liquidity in the near term to be cash flow from operations and, to a lesser extent due to the limited availability of financing for Argentine companies, cash flow from third parties obtained from financial institutions. Because of the aforementioned, we closely monitor our liquidity levels in order to ensure compliance with our financial obligations and to achieve our objectives. Our principal uses of cash flows are expected to be capital expenditures, operating expenses, dividend payments to our shareholders, payments of financial debt and for general corporate purposes. We expect working capital, funds generated from operations and, to a lesser extent, financing from third parties to be sufficient. We assume that we will be able to access the domestic and international capital markets to refinance our 2018 Notes, if necessary.

To preserve cash surpluses, we invest in low-risk and highly liquid financial assets offered by high-quality financial institutions that are located in Argentina and the United States. Our policy is designed to diversify credit risk. Given that our total financial indebtedness is denominated a different currency than the Argentine peso, we prioritize the placement of funds in U.S. dollar-denominated investments.

We currently do not have any off-balance sheet arrangements or significant transactions with unconsolidated entities not reflected in our Financial Statements. All of our interests in and/or relationships with our subsidiaries are recorded in our Financial Statements.

In the short-term, the most significant factors generally affecting our cash flow from operating activities are: (i) fluctuations in international prices for LPG products, (ii) fluctuations in production levels and demand for our products and services, (iii) changes in regulations, such as taxes, taxes on exports, tariffs for our regulated business segment and price controls, (iv) fluctuations in the natural gas price used as RTP, (iv) fluctuations in exchange rates and (v) operating cost increases given inflation.

Our cash flows from operations have been affected in past years due to the lack of adjustment to our natural gas transportation tariffs to cover increases in our operating costs and capital expenditures. Along these lines, and as a guiding principle, financial solvency is our main objective.

During 2023, our cash generation has allowed us to cover all our financial needs, mainly the investments made for the maintenance of the transportation system and other operating assets of the remaining business segments, as well as those made for new projects.

In 2023, we have pursued the diversification of our investment’s portfolio. To that end, we acquired public and private bonds linked to the U.S. dollar and to CER (BCRA’s index: Stabilization Reference Coefficient) to mitigate the exchange rate risk on our liabilities in United States dollars and the impact of inflation on availabilities denominated in pesos.

The performance of the Natural Gas Transportation segment was marked by the lack of tariff updates, the last of which was received in April 2023 (the previous tariff increase had been received in March 2022), which in the framework of the Solidarity Law and its complementary rules provided for a tariff freeze and the renegotiation of the RTI.

During 2023, we continued participating in the Households with Bottles Program, which generates operating margins by virtue of the fact that the price determined by the SHR is significantly lower than the costs of processing natural gas. For further information, see “Item 4. Our Information—B. Business Overview—Liquids Production and Commercialization.”

We believe that we will have to rely only on our operating cash inflow to meet our working capital, debt service and capital expenditure requirements for the foreseeable future. Actual results may differ materially from our expectations described above as a result of various factors affecting the Argentine economy.

In the Liquids Production and Marketing business segment, despite the volatility of prices of commodities, we were able to maintain a positive cash flow.

As a result of a combination of external and local factors in the macroeconomic context, the exchange rate of the U.S. dollar increased by 356.3% during 2023, from Ps.177.16 to Ps.808.45. As of December 31, 2023, 89%, or U.S.$404 million, of our fund placements were denominated in U.S. dollars, to mitigate such risk. During the period ended on December 31, 2023, sales revenues denominated in U.S. dollars amounted to 65%.

The foregoing allows us to conclude that we managed to limit the impact of the recent turbulence in the exchange rate on the future cancellation of indebtedness.

A further devaluation of the peso or further inflation with no compensating effect in our natural gas transportation tariffs or lower liquids prices could harm our cash-generating ability and materially adversely affect our liquidity, our ability to carry out mandatory capital investments and our ability to service our debt.

Our financial position is and will be significantly dependent on its operating performance, our indebtedness and capital expenditure programs.

Our primary sources and uses of cash during the years ended December 31, 2023, 2022 and 2021 are shown in the table below:

| | | | |

| | | | | | | | | | |

| | | (in millions of pesos) | |

| Cash and cash equivalents at the beginning of the year | | | 9,308 | | | | 26,865 | | | | 42,607 | |

| Cash flows provided by operating activities | | | 189,571 | | | | 110,282 | | | | 183,804 | |

| Cash flows used in investing activities | | | (206,428 | ) | | | (125,235 | ) | | | (183,701 | ) |

| Cash flows provided by / (used in) financing activities | | | 24,653 | | | | 11,292 | | | | (5,821 | ) |

| Net (decrease) / increase in cash and cash equivalents | | | 7,796 | | | | (3,660 | ) | | | (5,718 | ) |

| Foreign exchange gains on cash and cash equivalents | | | 1,451 | | | | 911 | | | | 1,960 | |

| Monetary results effect on Cash and cash equivalents | | | (11,955 | ) | | | (14,808 | ) | | | (11,984 | ) |

| Cash and cash equivalents at the end of the year | | | 6,599 | | | | 9,308 | | | | 26,865 | |

In our opinion, the working capital is sufficient for the company’s present requirement.

Cash Flows Provided by Operating Activities

The cash flow provided by operating activities for the year ended December 31, 2023, increased by Ps. 79,289 million, mainly due to lower income tax payments by. 68,813 million and the increase in cash inflows by Ps. 22,663 million in connection with changes in assets and liabilities. The increase in cash inflows was mainly due to higher contract liabilities and trade payables, partially offset by the increase in trade receivables. These effects were partially offset by lower comprehensive income, adjusted for non-cash income and expense by Ps. 12,187 million.

The cash flow generated by operating activities for the year ended December 31, 2022, decreased by Ps. 73,522 million, mainly due to higher income tax payments by. 53,958 million, lower net income adjusted by non-cash items (including depreciation and financial results accrued) by Ps. 43,719 million. These effects were partially offset by higher collections of trade and other receivables by Ps. 14,892 million and lower interest paid by Ps. 4,917 million.

Cash Flows Used in Investing Activities

The cash flow used in investment activities for the year ended December 31, 2023, increased by Ps. 81,194 million, mainly driven by higher acquisitions of capital assets within the framework of Midstream projects by Ps. 56,273 and financial assets not considered cash equivalents according to IFRS Accounting Standards by Ps.24,921 million.

The cash flow used in investment activities for the year ended December 31, 2022, decreased by Ps.58,467 million, mainly driven by lower acquisitions of financial assets not considered cash equivalents by Ps.79,851 million. This effect was offset by higher funds earmarked for the acquisition of capital goods within the framework of projects for other services undertaken by Ps.20,282 million.

Cash Flows Provided by / (Used in) Financing Activities

Cash flow provided by financing activities, amounted to Ps. 24,653 million compared to the cash flow used in financing activities for Ps. 11,292 million for 2022. This effect was due to net proceeds of financial debt during 2023 by Ps 16,546.

Cash flow provided by financing activities, amounted to Ps. 11,292 million compared to the cash flow used in financing activities for Ps. 5,820 million for 2021. This effect was due to net proceeds of financial debt during 2022 as opposed to the repurchase of notes of 2021.

Description of Indebtedness

As of December 31, 2023, 100% of our total indebtedness was entirely denominated in U.S. dollars. The following table shows our total indebtedness as of 2023 and 2022:

| | | | | | | | | | |

| | | (in millions of U.S. dollars) (2) | | | (in millions of pesos) | |

| Current loans: | | | | | | | | | |

| 2018 Notes Interest | | | 5 | | | | 4,278 | | | | 2,919 | |

| Bank loans | | | 62 | | | | 49,995 | | | | 5,663 | |

| Leasing | | | | | | | | | | | | |

| Total current loans | | | 75 | | | | 60,567 | | | | 12,207 | |

| Non-current loans: | | | | | | | | | | | | |

| 2018 Notes | | | 470 | | | | 380,226 | | | | 259,379 | |

| Leasing | | | 14 | | | | 10,921 | | | | 9,648 | |

| Bank loans | | | 25 | | | | 19,934 | | | | 13,402 | |

| Total non-current loans | | | | | | | | | | | | |

Total loans(1) | | | | | | | | | | | | |

(1) Issuance expenses net.

(2) Converted at the exchange rate of Ps.808.45 per U.S.$1.00, which was the selling exchange rate as of December 31, 2023.

In order to improve the maturity profile of our financial debt, on April 19, 2018, we launched the Tender Offer (as defined below) to purchase for cash any and all of our negotiable instruments class 1 issued in February 2014 (the “2014 Notes”), which expired on April 26, 2018, and settled on February 11, 2014. On April 27, 2018, U.S.$80,083,898.25 in aggregate principal amount of the 2014 Notes (or approximately 41.80% of the 2014 Notes then outstanding), were redeemed pursuant to the Tender Offer and the remaining 2014 Notes were redeemed on May 2, 2018, pursuant to the provisions of the indenture, dated February 11, 2014, among Delaware Trust Company (successor to Law Debenture Trust Company of New York), as trustee, co registrar, principal paying agent and transfer agent, and Banco Santander Rio S.A., as registrar (the “2014 Indenture”). The redemption of the 2014 Notes was financed with the proceeds from the offering of the 2018 Notes.

On January 3, 2014, the CNV authorized the public offering through Resolution No. 17,226. Our Board of Directors proposed that the 2017 Shareholders’ Meeting authorize an increase of up to U.S.$700,000,000 (or its equivalent in other currencies) of the medium-term note program approved by the CNV on January 3, 2014, for the issuance of short- and medium-term bonds not convertible into shares. On October 31, 2018, we obtained approval from the CNV for the extension of the program to January 3, 2024. On 9 October 2019, we obtained approval from the CNV for the extension of the program to U.S.$1.2 billion.

On October 11, 2023, the CNV approved the expansion of the bonds program to a maximum amount of U.S.$ 2,000 million and the extension of its maturity up to January 3, 2029.

On May 2, 2018, within the framework of the 2017 short- and medium-term negotiable obligations program approved by the CNV, we issued the 2018 Notes with the following characteristics:

| Amount in U.S.$ | | 500,000,000 | |

| Interest Rate | | 6,75% annual | |

| Pricing | | 99,725% | |

| | | | Percentage on the Principal Amount to be Paid |

| Amortization | | May 2, 2025 |

| 100% |

| Frequency of Interest Payment | | Semiannual, payable on May 2 and November 2 of each year. |

| Guarantor | | None. |

The proceeds obtained from the 2018 Notes were used to: (i) repurchase the 2014 Notes for an amount equivalent to U.S.$86,511,165; (ii) cancel and totally redeem the 2014 Notes for U.S.$120,786,581; and (iii) make capital investments with the remaining balance.

As of December 31, 2023 the principal amount of outstanding 2018 Notes was U.S.$ 500 million. During 2022, we repurchased our marketable debt for a nominal value of U.S.$ 29.7 million for which it paid Ps. 7,637,322. This transaction generated a result of (Ps. 3,208,025), recognized in the financial results of the Statement of Income.

We are subject to several restrictive covenants under our 2018 Notes that limit our ability to obtain additional financing, including limitations on our ability to incur additional indebtedness to create liens on our property, assets or revenues. In addition to the required principal amortization payment obligations, we are also subject to other restrictive covenants that affect our use of cash on hand, such as limitations on our ability to pay dividends to our shareholders and limitations on our ability to sell our assets. See “Item 10. Additional Information—C. Material Contracts—Debt Obligations” for a detailed discussion of the terms of our financial debt, including the interest rates and material covenants applicable to such indebtedness.

It should be noted that, given the economic context and the foreign exchange restrictions, which generated some delays to pay our imports, during 2023, we incurred new indebtedness with well-known financial institutions of Ps. 35,744 million (US$ 74.0 million) and paid Ps. 10,891 million (US$ 24.1 million).

The following table shows the details of other financial indebtedness as of December 31, 2023:

| Currency | | Amount (in miles) | | | Interest rate | | | Expiration date |

| USD | | | 60,162 | | | | 7.76 | % | | Between January and November 2024 |

| Euros | | | 61 | | | | 7.00 | % | | May 2024 |

All of these loans are guaranteed by time deposits included as “Financial Assets at Current and Non-Current Amortized Cost.”

In March 2023, our subsidiary Telcosur, renew the loan for U.S.$24 million taken in March 2022. The main terms of such loan are:

Amount in US$ | 24,000,000 |

Interest rate | 1.5% annual rate |

Amortization | January 25, 2025 |

Interest payment frequency | Upon maturity |

Collateral | Fixed-term deposit in foreign currency (1) |

Included as “Other financial assets at amortized cost, non-current.”

We regularly implement actions aimed at minimizing the impact of the exchange rate variation on our financial indebtedness, including entering into currency-forward agreements with major financial institutions for the purchase of U.S. dollars to cover exposure to the exchange rate risk derived from our financial indebtedness. In addition, we are able to invest in financial instruments, which reflect the variation of the exchange rate. During 2023 and 2022, we did not enter into any derivative instruments to hedge the foreign exchange risk.

Future Capital Requirements

As of December 31, 2023, our estimated material short-term and long-term contractual cash obligations consist of our borrowings, purchases of natural gas used in our Liquids Production and Commercialization business segment, and lease commitments and are detailed by maturity in Note 22 to our Financial Statements.

As it was mentioned before, we’re engaged in increasing our conditioning capacity in our Midstream business segment. for the year of 2024, we expect to invest U.S.$177 million to completed our current expansion project in Vaca Muerta area. For additional information see “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Midstream.”]

Operation of our assets imply that we must incur in capital expenditures to comply with the safety and maintenance of our natural gas pipeline system and other facilities of our business segments.

We currently expect to continue to rely on cash flow from operations and short-term borrowings and other additional financing activities to finance capital expenditures in the near term.

As from December 31, 2023, to the date of this Annual report, we have increased net financial indebtedness by Ps. 7,711 million for Vaca Muerta capital expenditures capex.

Currently we have a debt program and given that the 2018 Notes are expiring in May 2025, we will be looking for alternatives for its refinancing, as long as the financing conditions are adequate.

Our level of investments will depend on a variety of factors, many of which are beyond our control. Among them we can mention changes in current regulations, including the status of negotiations with ENARGAS in order to conclude the RTI process, the development of the Vaca Muerta area and the increase in natural gas supply, changes in tax legislation, and the political, economic and social situation prevailing in Argentina.

Currency and Exchange Rates

Due to the fact that our entire financial indebtedness is denominated in U.S. dollars, any significant devaluation of the peso would result in an increase in the cost of paying our debt, and therefore, may have a material adverse effect on our results of operations. Our results of operations and financial condition are also sensitive to changes in the peso-U.S. dollar exchange rate because most of our capital expenditures, and the cost of natural gas used in our Liquids business are denominated in U.S. dollars.

Therefore, our primary market risk exposure is associated with changes in the foreign currency exchange rates because our debt obligations are denominated in U.S. dollars and 35% of our consolidated revenues were peso-denominated for the fiscal year ended December 31, 2023. Contributing to this exposure are the measures taken by the Government since the repeal of the Argentine Convertibility Act and the pesification of our regulated tariffs described elsewhere in this Annual Report. This exposure is mitigated in part by our revenues from our Liquids Production and Commercialization business segment, 87% of which are denominated in U.S. dollars for the year ended December 31, 2023. Likewise, 83% of the operating costs of this business segment for that period were denominated in U.S. dollars. For more information, see “Presentation of Financial and Other Information—Currency.”

We place our cash and current investments in high quality financial institutions in Argentina and the United States. Our policy is to limit exposure with any financial institution. Our temporary investments primarily consist of money market mutual funds and Government bonds.