Washington, D.C. 20549

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

For Immediate Release

Contact:

María Paz Yañez

Planning & Control Manager

Phone: (56-2) 351-1209

Fax: (56-2) 679-2320

E-mail: myanezm@afpprovida.cl

Santiago, Chile – October 30, 2009 – AFP PROVIDA (NYSE: PVD) announces its consolidated financial results for the period ended September 30, 2009. All figures are expressed in constant Chilean pesos and are prepared in accordance with the Chilean Generally Accepted Accounting Principles (Chilean GAAP). Figures as of September 30, 2008 are inflation adjusted by the year on year CPI figure of -1.0%.

AFP PROVIDA S.A. reports its results for the nine months ended September 30, 2009

GENERAL HIGHLIGHTS FOR THE FIRST NINE MONTHS OF 2009

| Ü | In the first nine months of 2009, net income amounted to Ch$68,977.3 million, representing an increase of Ch$69,785.4 million with respect to the loss recorded in the same period in 2008. In this evolution, the operating component of results was highlighted with significant gains on mandatory investments and higher net fees (defined as fee income minus life and disability expenses) recorded in the period. Also the non-operating results contributed to this performance, boosted by gains on price level restatement due to the negative inflation applied in the period, adding higher profits attained by related companies, especially foreign subsidiaries. |

| Ü | The operating income amounted to Ch$71,417.2 million, higher by Ch$60,354.9 million or 545.6% with respect to the profit recorded the same period in 2008. Firstly contributing to this evolution was mandatory investments that exhibited a good performance with a deviation of Ch$45,921.7 million with respect to losses recorded in the same period in 2008, mainly due to the high returns obtained by local and foreign stock markets, which led to achieve an outstanding average nominal return of 20.8% in the period. |

Additionally, it should be mentioned that the analysis of results should be done considering net fees, defined as fee income minus expenses of the life and disability insurance, since beginning on July 2009 (effecting results since August) the fee charged by AFP Provida over mandatory contribution was reduced, as a result that AFP was excluded to provide the life and disability insurance. In figures, net fees increased by Ch$14,692.3 million or 23.4%, due to both the increasing trend of the salary base of clients where the fees are applied, as well as lower insurance costs mainly as a result of the favorable impact of positive returns of pension funds over the insurance cost assumed by Provida (since it covers the difference in the pensions as required by law and the savings of affiliates in their individual accounts) and the higher discount rates applied to value the cost of this obligation.

| Ü | In non-operating terms, the period recorded an income of Ch$7,129.6 million, implying a positive variation of Ch$15,822.0 million or 182.0% with respect to the loss recorded as of September 2008. Sustaining this performance were gains on price level restatement resulting from the negative inflation applied in the period over the Company’s net liability exposure. |

| Moreover, higher profits in related companies were registered in the period, exhibiting all the subsidiaries good performances, especially the foreign ones. |

| Ü | Since Provida became the sole shareholder in AFP Genesis (Ecuador) Provida’s financial statements are consolidated with this subsidiary, which implied to acknowledge in different components of its results, a net income of Ch$1,673.2 million in the first nine months of 2009, representing an increase of 27.6% with respect to the same period of last year. |

| Ü | As of September 30, 2009, Provida continued leading the Chilean pension fund industry in terms of assets under management, totaling US$32,461.4 million equivalent to a market share of 30.5%. Also, Provida is a leader in terms of clients with an average portfolio of 3.5 million affiliates and 1.7 million of contributors at the first nine months of 2009, representing a 41.4% and 39.6% of the market, respectively as of August 2009. |

GENERAL HIGHLIGHTS FOR THE THIRD QUARTER OF 2009

| Ü | Net income for the third quarter of 2009 (3Q09) amounted to Ch$25,664.9 million, an increment of Ch$41,437.1 million or 262.7% with respect to the loss recorded in the third quarter of 2008 (3Q08). Behind this performance was the positive operating result compared the operating losses registered in the 3Q08, due to both outstanding returns achieved by mandatory investments, as well as higher net fees received by the Company. Besides, the non-operating component also contributed to the result, with a profit that positively compared to the loss recorded in 3Q08, boosted by gains on price level restatement and to a better performance observed in related companies. |

| Ü | The operating income in the 3Q09 amounted to Ch$27,936.5 million, higher by Ch$38,377.7 million or 367.6% with respect to the losses recorded in the same quarter in 2008. This result was partly driven by gains on mandatory investments higher by Ch$28,320.0 million than the losses recorded in the 3Q08, boosted by returns achieved by global stock markets. Moreover, the Company registered a higher net fee of Ch$10,280.6 million, given both a higher salary base of clients, and the effect of the positive returns of pension funds over the insurance cost that the AFP must assume, adding higher discount rates to value such obligation. |

| Ü | In non-operating terms, the 3Q09 registered a result of Ch$1,302.9 million, higher by Ch$6,725.7 million or 124.0% with respect to the losses obtained in the 3Q08. This evolution was basically driven by the gains on price level restatement sustained by a negative inflation applied in the quarter over the Company’s net liability exposure, adding higher profits in related companies, mainly the foreign subsidiaries. |

AFP PROVIDA, leading company in the Chilean pension fund industry, provides pension fund management and related services throughout the country and has invested in similar companies in Peru, Ecuador and Mexico. In July 1999, PROVIDA was incorporated into the financial holding BBVA Group that enjoys pride of place in the pension fund industry and is one of the principal financial conglomerates in Latin America.

| | | | September | | Market |

| | Business Drivers | | 2009 | | Share |

| | | | | | | |

| | Average number of affiliates | | 3,510,275 | | 41.4% | (1) |

| | Average number of contributors | | 1,748,755 | | 39.6% | (1) |

| | Average number of pensioners | | 434,356 | | 37.9% | |

| | | | | | | |

| | Average collection base (US$ Million) | | 1,155 | | 32.1% | (1) |

| | AUM (US$ Million) | | 32,461 | | 30.5% | |

| | Average real return of Pension Fund (Cum Sep09) | 24.57% | | | |

| | Pension Fund Type A real return (Cum Sep09) | | 39.77% | | | |

| | Pension Fund Type B real return (Cum Sep09) | | 30.42% | | | |

| | Pension Fund Type C real return (Cum Sep09) | | 21.36% | | | |

| | Pension Fund Type D real return (Cum Sep09) | | 14.63% | | | |

| | Pension Fund Type E real return (Cum Sep09) | | 12.62% | | | |

| | | | | | | |

| | | | | | | |

| | | | September | | Market |

| | Other Variables | | 2009 | | Share |

| | | | | | | |

| | Average number of branches | | 101 | | 44.5% | |

| | Average number of administrative employees | | 1,047 | | 32.1% | (2) |

| | Average number of sales agents | | 533 | | 21.2% | (2) |

| | | | | | | |

| | | | | | | |

| (1) Market Share as of August, 2009 | (2) Market Share as of June, 2009 |

AFP PROVIDA S.A.

COMPARATIVE ANALYSIS FOR THE FIRST NINE MONTHS OF 2009

At global level, growth projections continue improving and the figures of activity for the second quarter of the year have been better than the expectations in most of the main worldwide economies. At the same time, the Chilean indicators of activity also exhibited improvements, where the growth of 7.7% in 12 months achieved by mining production and the rise of 3.5% in industrial sales in comparison with July 2009 were highlighted.

The monthly economic indicator in August (IMACEC) was higher than expected by the market, recording a drop of just 0.1% in twelve months and an improvement of 0.4% with respect to July 2009, reaching four consecutive months of improvement in the margin. Regarding the demand, it also exhibited important improvements where sales in supermarkets grew by 3.8% with respect to July 2009 and by 6.7% in twelve months. Minority sales grew by 2.9% in twelve months and the sales of durable goods kept their slowdown trend in the downturn rate, confirming the recovery of trust already observed from several months ago.

With respect to foreign trade, the trade balance accrued a positive balance of US$6,440.1 million in the first nine months of 2009, lower by 45.5% than the figure recorded in the same period of 2008. As of September 2009, exports amounted to US$30,888.6 million, decreasing by 38.9% with respect to the same period in 2008, mainly due to the reduction of copper price in the first part of 2009. In addition, imports totaled US$24,448.5 million, reducing by 36.9%, mainly due to lower imports of fuels (crude and diesel oil).

Likewise, the consumer price index (CPI) recorded a variation of 1.0% in September 2009 due to a growth in utilities (4.5%) mainly related to rises in electricity tariffs and transport (2.0%) as a result of the seasonal effect in the urban transport price. In the first nine months of 2009, inflation accumulated a negative variation of 0.6%, whereas the accrued variation in 12 months recorded a fall of 1.1%.

As in August 2009, the Central Bank decided to maintain its monetary policy at 0.5%, reaffirming that the monetary policy will remain at this level for a long period of time, since pressures to reduce inflation have been moderated and growth perspectives towards 2010 have improved.

In relation to the labor market, the mobile quarter June-August 2009 recorded an unemployment rate of 10.8%, implying an increase of 2.6 percent points with respect to the same quarter of the last year, and no variation with respect to the prior quarter.

In twelve months, employment decreased by 1.5% (loss of 98,150 jobs), while the labor force increased by 1.3% (incorporation of 96,870 workers in the labor market). The period recorded a growth in unemployed people (31%) and in people searching for a job for the first time (45%), the latter recording the highest variation in a context of a slow incorporation trend exhibited since the beginning of the year. The salaried employment keeps on falling while the component self-employment achieved its peak of growth of 6.7% in twelve months.

Net income

In the first nine months of 2009, the Company recorded net income of Ch$68,977.3 million, an increase of Ch$69,785.4 million with respect to the loss recorded in the same period in 2008. This outstanding result stemmed from the favorable performance recorded by both the operating and non-operating component. In operating terms, the favorable evolution achieved by mandatory investments and higher net fees (fee income minus life and disability expenses) were highlighted. Regarding non-operating evolution, the positive variation was sustained by gains on price level restatement due to the negative inflation applied in the period, as well as profits attained by related companies, especially foreign subsidiaries.

As of September 2009, operating income was Ch$71,417.2 million, higher by Ch$60,354.9 million or 545.6% with respect to the same period in 2008. This result was driven by the good performance of mandatory investments (Ch$45,921.7 million) with respect to losses recorded in the same period of last year, mainly due to high returns obtained by local and foreign stock markets, which led to achieve the outstanding average nominal return of 20.8% in the period. Additionally, given the modification of the fee charged by Provida boosted by the exclusion of rendering of the life and disability insurance by AFPs in July 2009 (effecting results in August), the comparison should be made as net fees received by the Company, which is defined as fee income minus life and disability expenses. The net fees increased by Ch$14,692.3 million or 23.4%, basically as a result of the favorable impact of positive returns achieved by pension funds over the insurance cost assumed by Provida (since it covers the difference in the pensions as required by law and the savings of affiliates in their individual accounts).

The non-operating result recorded an income of Ch$7,129.6 million, a positive variation of Ch$15,822.0 million or 182.0% with respect to the loss recorded as of September 2008. This result was basically explained by gains on price level restatement as a consequence of the negative inflation applied in the period over the Company’s net liability exposure. It added to the above, higher profits in related companies for the good performance achieved by all the subsidiaries, especially foreign subsidiaries.

Regarding income taxes, the period recorded higher expenses basically associated with higher results achieved in the period.

| | | Sep-09 | | | Sep-08 | | | Change | | | % | |

| | (Million of constant Chilean pesos as of September 30, 2009, except percentages) | |

| | | | | | | | | | | | | |

| Operating income | | | 71,417.2 | | | | 11,062.2 | | | | 60,354.9 | | | | 545.6 | % |

| Total operating revenues | | | 177,942.2 | | | | 133,713.1 | | | | 44,229.1 | | | | 33.1 | % |

| Total operating expenses | | | (106,525.1 | ) | | | (122,650.9 | ) | | | 16,125.8 | | | | -13.1 | % |

| | | | | | | | | | | | | | | | | |

| Other non operating income (expenses) | | | 7,129.6 | | | | (8,692.3 | ) | | | 15,822.0 | | | | 182.0 | % |

| | | | | | | | | | | | | | | | | |

| Income taxes | | | (9,569.5 | ) | | | (3,178.0 | ) | | | (6,391.4 | ) | | | 201.1 | % |

| | | | | | | | | | | | | | | | | |

| Net income | | | 68,977.3 | | | | (808.1 | ) | | | 69,785.4 | | | | 8635.3 | % |

Earnings per share (each ADR represents fifteen shares) was Ch$208.19 in the first nine months of 2009 compared to the loss per share of Ch$2.44 obtained in the same period in 2008. As of September 30, 2009, the total number of outstanding shares stood at 331,316,623, recording no changes with respect to September 2008.

BUSINESS DEVELOPMENT

Operating revenues

As of September 2009, operating revenues were Ch$177,942.2 million, growing by 33.1% or Ch$44,229.1 million with respect to the same period in 2008. In this result the positive variation recorded by mandatory investment of Ch$45,921.7 million with respect to the losses recorded in same period in 2008 was highlighted. Additionally, the period recorded higher financial revenues (Ch$2,047.1 million) resulting from increments in cash flows administered, as well as returns obtained by the insurer related to the contract with coverage from January 2005 to June 2009 and higher other operating revenues (Ch$566.5 million) due to the increase in fee income generated by AFP Genesis. Partially offsetting the latter was lower fee income of Ch$4,306.2 million as a consequence of the decreased fee charged to affiliates in connection with the elimination of the AFP’s exclusive responsibility in the life and disability insurance, which has had a counterpart in savings recorded by the insurance expense.

| · | Fee income was Ch$137,909.2 million during the first nine months of 2009, a decrease of 3.0% or Ch$4,306.2 million with respect to the same period of 2008. This result was the outcome of the decreased fee charged over taxable incomes from 2.64% to 1.54% beginning on July 2009 (effecting results in August 2009). Such modification belongs to the AFP’s exclusive responsibility in the life and disability insurance implemented by the Pension Reform Law. Thus, the average fee as of September 2009 was 2.40%, lower by 6.7% to the average fee charged as of September 2008 (2.57%). |

Given the above, it should be more accurate in comparative terms to do the analysis of the net fee received by the Company, which is defined as fee income minus the life and disability expense. As of September 2009, the net fee amounted to Ch$77,419.4 million, higher by Ch$14,692.3 million or 23.4% with respect to the same period in 2008. The above as a consequence of a higher salary base increasing around 4%, adding the lower insurance cost that will be deeply explain below.

It is important to mention that Provida has maintained its leading position in the pension industry with an average market share around 40% in terms of number of customers and over 30% in terms of salary base and assets under management as of August 2009. In figures, the average number of contributors was 1,748,755, the monthly average salary base was US$1,155.0 million and assets under management were US$32,461.4 million as of September 2009.

| · | Gains on mandatory investments were Ch$29,477.4 million, higher by Ch$45,921.7 million (279.3%) with respect to the losses recorded as of September 2008. This result was driven by the accumulated gains recorded by variable income in local (IPSA +41.9%, IGPA +40.2%) and foreign stock markets (MSCI World +21.8%, Europe +18.6%, USA +16.9%, Japan +12.3%, MSCI Emerging +59.5%, Russia +95.4%, Brazil +62.3%, China +48.6%, Mexico +29.5%,) The latter implied that the weighted average nominal return of pension funds was +20.80% as of September 2009, which was compared with -9.38% obtained in the same period in 2008. |

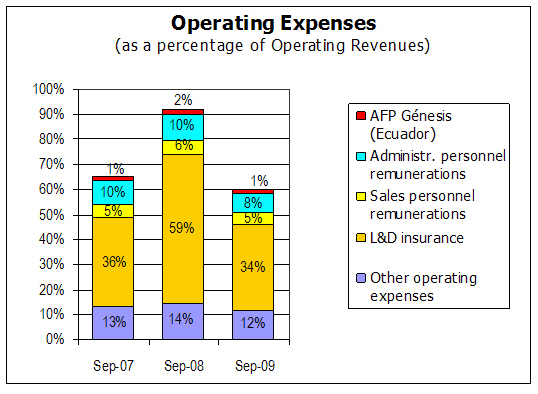

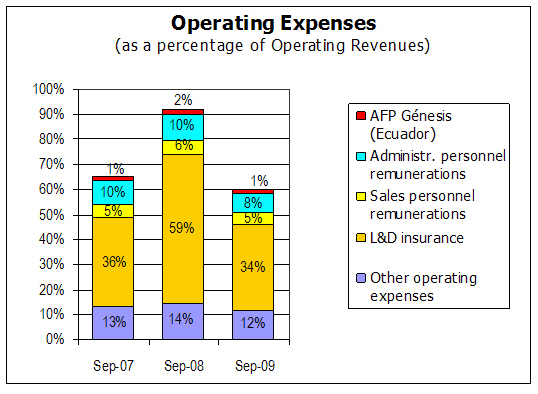

Operating expenses

They decreased by 13.1% or Ch$16,125.8 million from Ch$122,650.9 million as of September 2008 to Ch$106,525.1 million as of September 2009, partly due to lower costs in the life and disability insurance premium which has not registered expenses from August 2009 due to the Pension Reform Law eliminated the responsibility of purchasing such insurance policy. Besides, a lower accumulated cost was registered in the period, as a product of a minor insurance expense to be covered by the AFP given the high returns achieved by pension funds.

· | Remunerations of administrative personnel amounted to Ch$15,014.4 million in the first nine months of 2009, higher by 0.8% or Ch$124.7 million with respect to the figure recorded in the same period of the last year. In this evolution, AFP Genesis contributed with higher remunerations of administrative personnel of Ch$234.3 million basically due to adjustments in wages made in the period. Excluding the above, Provida’s administrative personnel remunerations decreased by Ch$109.6 million due to variable component regarding incentives in connection with adjustments in the commercial activity and the continuous rationalization process of overtime, adding the negative inflation that implied that no adjustments for this concept were made in the period. Partly offsetting the aforementioned factors were higher expenses in indemnities since the year 2009 includes a staff reduction plan basically implemented in the supportive areas. |

In figures, the average of the administrative staff was 1,047 workers as of September 2009, higher by 1.5% (15 workers) compared to the average as of September 2008. By comparing the end of both periods, the administrative staff decreased by 2.6% from 1,044 to 1,017 workers, evolution consistent with the aforementioned plan.

| · | Remunerations of sales personnel amounted to Ch$9,329.8 million as of September 2009, a variation of Ch$887.1 million (10.5%) with respect to the same period in the last year. This result was basically explained by higher indemnities paid, as a consequence of adjustments made to the sales force. As counterpart associated with a lower number of staff, lower remunerations and benefits were paid in the period. |

As of September 2009, the average number of sales agents was 533 workers, decreasing by 11.8% regarding the average number (604 workers) as of September 2008. With respect to the evolution at the each period end, the sales force decreased by 20.9% from 607 salespeople in September 2008 to 480 in September 2009.

| · | The cost of life and disability insurance was Ch$60,489.9 million during the first nine months of 2009, decreasing by Ch$18,998.5 million or 23.9% with respect to the same period in 2008. Explaining part of this evolution is the fact that the Pension Reform Law eliminated the responsibility of providing life and disability benefits, so Provida did not record expenses for temporary premium since August 2009, expenses that implied around Ch$6,000.0 million per month. |

Likewise, the accounted casualty rate diminished from 1.49% for the first nine months in 2008 to 1.35% for the same period in 2009, partly as a result of positive returns achieved by pension funds, which have decreased the insurance costs assumed by Provida, given that the AFP must cover the difference between the annuities stipulated by law and the affiliates’ savings in their individual accounts.

In addition to the above were higher discount rates applied in the period to value reserves since the insurance company voluntary adopted a rule that allows measuring monthly reserves at the market interest rate used for annuities instead of the historical rates (minimum of the previous semester), which were maintained until the casualties were paid. In figures, while the reserves were valued at an historical average rate of 3.03% in September 2008, the rate to measure the reserve under this new rule is 3.58% for September 2009, implying lower accruals to be required. Notwithstanding the latter and applying Provida´s model to calculate the real cost of casualties, an additional accrual over the one required was recorded since the average forward rates are lower than the rate currently prevailing in the market (average around 3.3% compared to the market rate of 3.58%).

| · | As of September 2009, other operating expenses amounted to Ch$21,691.1 million, increasing by Ch$1,860.9 million or 9.4% with respect to the same period in 2008. This result was basically driven by the higher amortization recorded in the period (Ch$1,291.1 million) boosted by the increased value of the asset Unified Platform due to adjustments related to evolutionary developments carried out in the previous period, adding that this asset is in its last period of amortization, implying that the effect of recent investments over the amount of the amortizations has been more relevant. |

Additionally, the period recorded higher expenses related to disability qualification (Ch$619.8 million) resulting from the higher number of claims evaluated in the period that partly came from 2008 due to the delay of the evaluation process given the higher volume of claims evidence in the second half of the year, since the implementation of the solidarity principle of the Pension Reform Law motivated a higher number of affiliates to request pension benefits.

Finally, the period registered a higher level of depreciation (Ch$256.6 million) in part related to new computing devices mainly in software. In terms of real estate, Provida is in a restructuring process of its commercial network, modifying its assistant model called Proyecto Top One. This project is aimed at integrating pension advisory and fast formalities, accompanied by the

externalization of collection and payment services in order to focus the network to customer assistance. Consequently, the renewal made to goods that are not going to be used under this new concept, have been completely depreciated in the period.

The latter was partly offset by lower administration costs (Ch$232.8 million) mainly due to external collection since now VAT generated by this service can be used as fiscal credit; national brokers due to a lower fund intermediation; services rendered by third parties due to lower external personnel hiring and lower cost in payroll typing.

Operating income

It amounted to Ch$71,417.2 million in the first nine months of 2009, higher by Ch$60,354.9 million or 545.6% with respect to the same period in 2008 due to both, the significant gains on mandatory investments in connection with high returns of global stock markets, as well as the increased net fee defined as fee income minus the life and disability insurance expenses.

Other non-operating income (expenses)

They recorded a gain of Ch$7,129.6 million in the first nine months of 2009, a positive variation of Ch$15,822.0 million or 182.0% with respect to the loss recorded in the same period in 2008. This result was partly sustained by the better evolution of price level restatement, implying a positive variation of Ch$13,299.5 million mainly due to the negative inflation applied in the period over the Company’s net liability exposure, and the positive effect of the appreciation of the Chilean peso against the dollar in the debt maintained with Provida Internacional. Moreover, the related companies favorably contributed (Ch$2,856.2 million), where most of the subsidiaries achieved positive results, specially the foreign related companies.

| · | The related companies results increased by Ch$2,856.2 million or 78.8% from Ch$3,626.2 million in the first nine months of 2008 to an income of Ch$6,482.4 million in the same period in 2009. Most of the subsidiaries participated to the above result, where the results attained by foreign subsidiaries were highlighted, contributing in the aggregate of Ch$2,435.3 million (82.5%), boosted by high returns obtained by their mandatory investments. Additionally, local subsidiaries generated Ch$420.9 million (62.3%). |

| | | | Sep-09 | | | Sep-08 | | | Change | | | % | |

| Company | Country | | (Million of constant Chilean pesos as of September 30, 2009, except percentages) | |

| | | | | | | | | | | | | | |

| Horizonte | Peru | | | 1,938.2 | | | | 496.0 | | | | 1,442.2 | | | | 290.8 | % |

| | | | | | | | | | | | | | | | | | |

| Bancomer | México | | | 3,447.7 | | | | 2,454.6 | | | | 993.1 | | | | 40.5 | % |

| | | | | | | | | | | | | | | | | | |

| DCV | Chile | | | 51.2 | | | | 53.5 | | | | (2.4 | ) | | | -4.4 | % |

| | | | | | | | | | | | | - | | | | | |

| PreviRed.com | Chile | | | 951.6 | | | | 599.1 | | | | 352.5 | | | | 58.8 | % |

| | | | | | | | | | | | | | | | | | |

| AFC | Chile | | | 93.9 | | | | 23.1 | | | | 70.8 | | | | 307.2 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL | | | 6,482.4 | | | | 3,626.2 | | | | 2,856.2 | | | | 78.8 | % |

In Peru, Provida Internacional has been a shareholder of AFP Horizonte since 1993, currently holding 15.87% of the shares. In the first nine months of 2009, this subsidiary generated an income of Ch$1,938.2 million for Provida, representing an increase of Ch$1,442.2 million or 290.8% with respect to the same period in 2008. This result was the outcome of higher gains on mandatory investments and lower operating expenses, mainly related to personnel remunerations, adding administration and marketing expenses. As of September 2009, this subsidiary accounted for a total of 1,194,991 affiliates and assets under

management for US$5,429.3 million, figures equivalent to market shares of 27% and 24% respectively, situating it in first place in terms of affiliates and in third place regarding assets under management.

Regarding Mexico, in November 2000, Provida Internacional materialized the purchase of 7.50% of AFORE Bancomer’s equity. In the first nine months of 2009, this subsidiary recorded an income of Ch$3,447.7 million, a positive variation of Ch$993.1 million or 40.5% with respect to the same period in 2008 due to lower operating expenses, basically administration costs and better results achieved by mandatory investments. As of September 2009, AFORE Bancomer maintained an affiliate portfolio of 4,510,879 and funds under management for US$11,981.3 million, representing market shares of 11% and 15%, respectively, situating it in second place in both variables.

Regarding local related companies, the electronic collection company PreviRed.com, where Provida holds a 37.9% ownership generated earnings of Ch$951.6 million in the first nine months of 2009 for Provida, a positive variation of Ch$352.5 million with respect to the same period of the last year mainly due to higher revenues yield in the period. The “Unemployment Funds Administrator of Chile S.A.” (AFC), a company that started operations in October 2002 and where Provida has a 37.8% ownership, generated an income of Ch$93.9 million for Provida, implying a positive variation of Ch$70.8 million (307.2%) with respect to September 2008. Finally, “Investments DCV” (DCV), generated for Provida an income of Ch$51.2 million as of September 2009, lower by Ch$2.4 million with respect to the same period in 2008. In this company, whose main purpose is to invest in entities engaged in public offerings of securities, Provida participates with a 23.14% stake. The rest of its main shareholders are other AFPs in the industry, the same as the other two local investments (AFC and PreviRed.com), adding other financial institutions that also participate.

| · | During the first nine months of 2009, the price level restatement recorded an income of Ch$3,714.5 million, higher by Ch$13,299.5 million than the loss recorded in the same period in 2008. This deviation was explained by the negative inflation applied over the Company’s net liability exposure of -2.8% as of September 2009, while as of September 2008 the inflation was positive in +6.9%. Adding to the latter were gains from foreign exchange rate during the period, associated with the maintenance of the dollar debt with Provida Internacional, since during the first nine months of 2009 the Chilean peso recorded an appreciation against the dollar of 13.5%, whereas in the same period of 2008, the Chilean peso recorded a depreciation against the dollar of 11.0%. |

Income taxes

As of September 30 2009, the income taxes were Ch$9,569.5 million recording a higher expense of Ch$6,391.4 million or 201.1% with respect to the same period in 2008, basically due to the higher results before taxes obtained in the period. The tax expense increased to a lower extent than earnings before taxes driven by the deferred taxes obligation, since the discount rate to value this liability increased by 18 basis points during the first nine months in 2009, thus, reducing income taxes acknowledged in the results.

Consolidated balance sheet

| · | As of September 30, 2009, total assets were Ch$335,180.9 million, higher by Ch$44,522.9 million (15.3%) with respect to the close of September 2008. This variation was partly explained by higher current assets of Ch$28,126.9 million due to superior liquidity levels evidenced by the Company, that were noticeable in cash, deposits and marketable securities (Ch$30,126.3 million). |

In addition to the above were the increased mandatory investments of Ch$21,707.1 million due to the normal contributions recorded by the growing salary base of clients, and the positive returns obtained by pension funds during the last twelve months.

The latter was partially offset by lower other assets of Ch$5,647.4 million, as a consequence of lower goodwill (Ch$5,652.5 million) in consideration of the normal amortization of goodwill mainly ex-AFP Proteccion, ex-AFP Union and AFORE Bancomer in Mexico. Besides, the asset Unified Platform, accounted for as intangible, experienced a net decrease of Ch$1,527.0 million since this asset is in its last year of amortization.

| · | Total liabilities increased by Ch$4,354.7 million or 7.9% from Ch$55,412.7 million as of September 30, 2008 to Ch$59,767.4 at the close of September 2009. This result was partly driven by higher current liabilities of Ch$3,313.5 million due to dividends to be paid (Ch$19,048.0 million) since in September 2008, the Company decided not distributing an interim dividend in light of its results. The aforementioned results were partially offset by lower accruals (Ch$13,444.6 million), basically decreased net accruals for unfavorable casualty rate of the life and disability insurance and lower pensions payables (Ch$2,220.4 million). |

The period recorded higher long term liabilities of Ch$1,041.2 million due to the obligation associated to the deferred taxes of long term (Ch$1,130.9 million) stemming from gains on mandatory investments recorded in 2009, a factor that was partially offset by the higher discount rate to value such obligation.

| · | Shareholders’ equity increased by Ch$40,168.2 million or 17.1% from Ch$235,245.2 million as of September 30, 2008 to Ch$275,413.4 million at the close of September 2009 due to higher retained earnings (Ch$40,300.2 million) sustained by higher income recorded as of September 2009, which was partly offset by interim dividends (Ch$19,077.2 million). |

Exchange rate

As of September 30, 2009, the exchange rate was Ch$550.36 per dollar, while at the same date in 2008 it was Ch$551.31. In the first nine months of 2009, an appreciation of 13.5% in the Chilean peso against the dollar was recorded, while in the same period in 2008 a depreciation of 11.0% in the Chilean peso against the dollar was registered.

CONSOLIDATED INCOME STATEMENT

| | | Sep-09 | | | Sep-08 | | | Change | | | % Change | |

| | | (Million of constant Chilean pesos as of September 30, 2009, except percentages) | |

| | | | | | | | | | | | | |

| OPERATING REVENUES | | | | | | | | | | | | |

| Fee income | | | 137,909.2 | | | | 142,215.4 | | | | (4,306.2 | ) | | | -3.0 | % |

| Gains on mandatory investments | | | 29,477.4 | | | | (16,444.3 | ) | | | 45,921.7 | | | | 279.3 | % |

| Rebates on L&D insurance | | | 4,175.8 | | | | 2,128.7 | | | | 2,047.1 | | | | 96.2 | % |

| Other operating revenues | | | 6,379.8 | | | | 5,813.3 | | | | 566.5 | | | | 9.7 | % |

| | | | | | | | | | | | | | | | | |

| Total Operating Revenues | | | 177,942.2 | | | | 133,713.1 | | | | 44,229.1 | | | | 33.1 | % |

| | | | | | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | | | | | |

| Administr. personnel remunerations | | | (15,014.4 | ) | | | (14,889.7 | ) | | | (124.7 | ) | | | 0.8 | % |

| Sales personnel remunerations | | | (9,329.8 | ) | | | (8,442.7 | ) | | | (887.1 | ) | | | 10.5 | % |

| L&D insurance | | | (60,489.8 | ) | | | (79,488.3 | ) | | | 18,998.5 | | | | -23.9 | % |

| Other operating expenses | | | (21,691.1 | ) | | | (19,830.2 | ) | | | (1,860.9 | ) | | | 9.4 | % |

| | | | | | | | | | | | | | | | | |

| Total Operating Expenses | | | (106,525.1 | ) | | | (122,650.9 | ) | | | 16,125.8 | | | | -13.1 | % |

| | | | | | | | | | | | | | | | | |

| OPERATING INCOME | | | 71,417.2 | | | | 11,062.2 | | | | 60,354.9 | | | | 545.6 | % |

| | | | | | | | | | | | | | | | | |

| OTHER NON OPERATING INCOME (EXPENSES) | | | | | | | | | | | | | | | | |

| Gains on investments | | | 190.0 | | | | 108.9 | | | | 81.1 | | | | 74.4 | % |

| Profit (loss) in affil. companies | | | 6,482.4 | | | | 3,626.2 | | | | 2,856.2 | | | | 78.8 | % |

| Amortization of goodwill | | | (4,271.3 | ) | | | (4,102.5 | ) | | | (168.8 | ) | | | 4.1 | % |

| Interest expense | | | (135.2 | ) | | | (542.9 | ) | | | 407.7 | | | | -75.1 | % |

| Other income (expenses) net | | | 1,149.2 | | | | 1,802.9 | | | | (653.7 | ) | | | -36.3 | % |

| Price level restatement | | | 3,714.5 | | | | (9,585.0 | ) | | | 13,299.5 | | | | 138.8 | % |

| | | | | | | | | | | | | | | | | |

| Total Other Non Operating Income (Expenses) | | | 7,129.6 | | | | (8,692.3 | ) | | | 15,822.0 | | | | 182.0 | % |

| | | | | | | | | | | | | | | | | |

| INCOME BEFORE TAXES | | | 78,546.8 | | | | 2,369.9 | | | | 76,176.9 | | | | 3214.3 | % |

| | | | | | | | | | | | | | | | | |

| INCOME TAXES | | | (9,569.5 | ) | | | (3,178.0 | ) | | | (6,391.4 | ) | | | 201.1 | % |

| | | | | | | | | | | | | | | | | |

| NET INCOME | | | 68,977.3 | | | | (808.1 | ) | | | 69,785.4 | | | | 8435.3 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEET | |

| | | | | | | | | | | | | |

| | | Sep-09 | | | Sep-08 | | | Change | | | % | |

| | | (Million of constant Chilean pesos as of September 30, 2009, except percentages) | |

| | | | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | |

| Current Assets | | | 55,711.0 | | | | 27,584.1 | | | | 28,126.9 | | | | 102.0 | % |

| Marketable Securities - Reserve | | | 175,033.2 | | | | 153,326.0 | | | | 21,707.1 | | | | 14.2 | % |

| Premises and Equipment | | | 28,075.2 | | | | 27,738.9 | | | | 336.3 | | | | 1.2 | % |

| Other Assets | | | 76,361.5 | | | | 82,008.9 | | | | (5,647.4 | ) | | | -6.9 | % |

| | | | | | | | | | | | | | | | | |

| TOTAL ASSETS | | | 335,180.9 | | | | 290,657.9 | | | | 44,522.9 | | | | 15.3 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | |

| Current Liabilities | | | 51,199.8 | | | | 47,886.3 | | | | 3,313.5 | | | | 6.9 | % |

| Long-Term Liabilities | | | 8,567.6 | | | | 7,526.4 | | | | 1,041.2 | | | | 13.8 | % |

| Shareholders´ Equity | | | 275,413.4 | | | | 235,245.2 | | | | 40,168.2 | | | | 17.1 | % |

| | | | | | | | | | | | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | | 335,180.9 | | | | 290,657.9 | | | | 44,522.9 | | | | 15.3 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| CONSOLIDATED CASH FLOW STATEMENT |

| | | | Sep-09 | | | | Sep-08 | | | | Change | | | | % | |

| | | | (Million of constant Chilean pesos as of September 30, 2009, except percentages) | |

| | | | | | | | | | | | | | | | | |

| CASH FLOW FROM OPERATING ACTIVITIES | | | 18,804.7 | | | | 32,749.4 | | | | (13,944.7 | ) | | | -42.6 | % |

| Total Operating Revenues | | | 155,558.8 | | | | 157,863.3 | | | | (2,304.5 | ) | | | -1.5 | % |

| Total Operating Expenses | | | (136,754.1 | ) | | | (125,113.9 | ) | | | (11,640.2 | ) | | | 9.3 | % |

| | | | | | | | | | | | | | | | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | | (1,382.7 | ) | | | (20,819.1 | ) | | | 19,436.4 | | | | 93.4 | % |

| | | | | | | | | | | | | | | | | |

| CASH FLOW FROM INVESTING ACTIVITIES | | | (4,851.4 | ) | | | (8,240.4 | ) | | | 3,389.0 | | | | -41.1 | % |

| | | | | | | | | | | | | | | | | |

| TOTAL NET CASH FLOW | | | 12,570.6 | | | | 3,689.9 | | | | 8,880.7 | | | | 240.7 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

A.F.P. PROVIDA S.A.

COMPARATIVE ANALYSIS OF THE THIRD QUARTER OF 2009

Net income

In the third quarter of 2009 (3Q09), the net income was Ch$25,664.9 million, higher by Ch$41,437.1 million or 262.7% with respect to the loss recorded in the third quarter of 2008 (3Q08). This evolution was basically driven by the positive operating result with respect to the operating losses recorded in the 3Q08, a result boosted by the outstanding returns achieved by mandatory investments, and the higher net fee received by the Company. In the quarter, the analysis of net fee defined as fee income minus expenses of the life and disability insurance became very relevant, since beginning on July 2009 (effecting results since August) the fee charged by AFP Provida over mandatory contribution was reduced, due to the AFP was excluded to provide the life and disability insurance. Also, the non-operating component positively contributed to the above, mainly due to gains on price level restatement and to the better performance observed in related companies.

The operating income in the 3Q09 amounted to Ch$27,936.5 million, higher by Ch$38,377.7 million or 367.6% with respect to the losses recorded in the same quarter in 2008. This result was driven by the positive evolution of mandatory investments (Ch$28,320.0 million) with respect to losses recorded in the 3Q08, basically due to returns achieved by global stock markets. Additionally, the Company registered a higher net fee of Ch$10,280.6 million due to both, a higher salary base of clients, as well as the effect of the positive returns of pension funds over the insurance cost that the AFP must assume, adding higher discount rates to value such obligation.

The non-operating result was Ch$1,302.9 million in the 3Q09, higher by Ch$6,725.7 million or 124.0% with respect to the losses obtained in the same quarter in 2008. This result was basically driven by the better evolution of price level restatement driven by a negative inflation applied in the quarter over the Company’s net liability exposure, adding higher profits in related companies, mainly the foreign subsidiaries.

| | | | 3Q09 | | | | 3Q08 | | | Change | | | % | |

| | | (Million of constant Chilean pesos as of September 30, 2009, except percentages) | |

| | | | | | | | | | | | | | | |

| Operating income | | | 27,936.5 | | | | (10,441.2 | ) | | | 38,377.7 | | | | 367.6 | % |

| Total operating revenues | | | 53,133.2 | | | | 34,717.6 | | | | 18,415.6 | | | | 53.0 | % |

| Total operating expenses | | | (25,196.8 | ) | | | (45,158.8 | ) | | | 19,962.1 | | | | -44.2 | % |

| | | | | | | | | | | | | | | | | |

| Other non operating income (expenses) | | | 1,302.9 | | | | (5,422.8 | ) | | | 6,725.7 | | | | 124.0 | % |

| | | | | | | | | | | | | | | | | |

| Income taxes | | | (3,574.5 | ) | | | 91.8 | | | | (3,666.2 | ) | | | -3994.5 | % |

| | | | | | | | | | | | | | | | | |

| Net income | | | 25,664.9 | | | | (15,772.3 | ) | | | 41,437.1 | | | | 262.7 | % |

Earnings per share (each ADR represents fifteen shares) during the quarter was Ch$77.46 that compared to the loss per share of Ch$47.60 obtained in the same period in 2008. At the close of the 3Q09, the total number of shares stood at 331,316,623, recording no changes with respect to the level observed in the 3Q08.

Operating revenues

They were Ch$53,133.2 million in the 3Q09, an increase of Ch$18,415.6 million or 53.0% with respect to the 3Q08. This result was basically driven by the best performance of mandatory investments (Ch$28,320.0 million), due to the positive returns achieved by local and foreign stock markets during the quarter. Adding to the above were higher financial revenues (Ch$857.9 million) resulting from increments in cash flows administered, as well as returns obtained by the insurer related to the contract with coverage from January 2005 to June 2009, and higher other operating revenues (Ch$182.6 million) basically in connection with higher fees generated by AFP Genesis. The above was partially offset by lower fee income (Ch$10,944.8 million), resulting from the decreased fee charged by Provida due to the cessation of providing the life and disability insurance by the AFP. The above had a counterpart in savings generated by the life and disability insurance.

| · | Fee income decreased by Ch$10,944.8 million or 23.3% with respect to the 3Q08, amounting to Ch$36,056.6 million in the period. The above result was attained by the reduction in the fee charged over the taxable income of clients from 2.64% to 1.54% starting July 2009 (effecting results in August), overshadowing the increasing trend of the salary base of clients. In figures, the average fee in the 3Q09 was 1.91%, lower by 26.4% than the average fee charged in the 3Q08 (2.59%). |

Given the above, the analysis should be done by comparing the net fee (fee income minus expenses of the life and disability insurance) received by the Company, which increased by Ch$10,280.6 million or 64.9% in the 3Q09 with respect to the same quarter in 2008. Behind the above was a higher salary base of clients and lower insurance costs that will be deeply explained below.

In terms of clients, the average number of contributors was 1,714,568 in the third quarter of 2009; hence, Provida maintains its leading position with an average market share around 40%.

| · | During the 3Q09, gains on mandatory investments were Ch$13,502.3 million, higher by Ch$28,320.0 million with respect to the losses recorded in the 3Q08. This result was mainly driven by positive returns achieved by local (IPSA +9.1%, IGPA +7.5%) and foreign stock markets (MSCI World +16.3%: Europe +17.7%, USA +14.9% and MSCI Emerging +18.6%, Russia +25.0%, Brazil +18.9%, Mexico +18.9%, China +6.9%) The latter implied that the weighted average nominal return of pension funds was +8.43% in the 3Q09, which was compared with -8.63% obtained in the same period in 2008. |

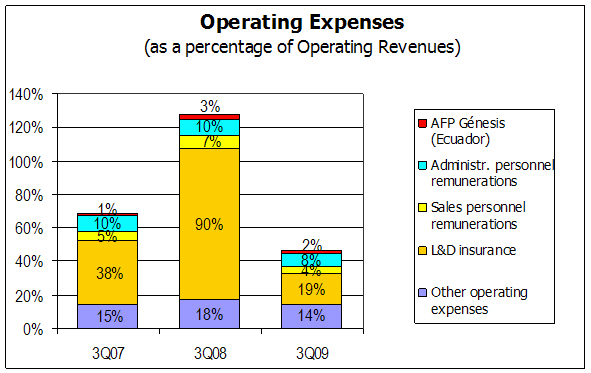

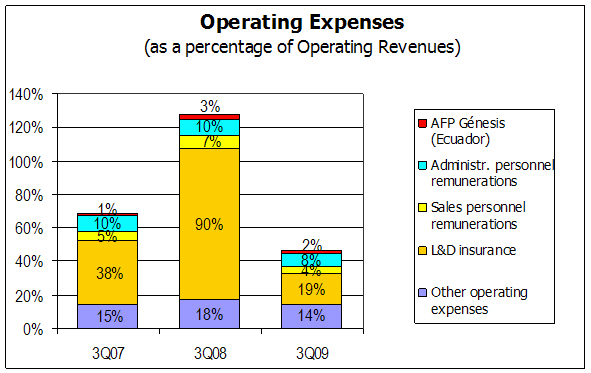

Operating expenses

During the 3Q09, they amounted to Ch$25,196.8 million, a decrease of 44.2% or Ch$19,962.1 million with respect to the 3Q08. This result was mainly explained by the lower life and disability insurance premium due to the period did not record expenses for this concept beginning on August 2009, given that the Pension Reform Law eliminated the responsibility of providing life and disability benefits. Additionally, the effect of positive returns of pension funds and higher discount rates to value the insurance obligation also contributed to register a lower insurance expense.

| · | The administrative personnel remunerations amounted to Ch$4,952.4 million in the 3Q09, higher by Ch$59.8 million or 1.2% with respect to the 3Q08. This result, as in the explanation for the first nine period, resulted from higher wages paid by AFP Genesis to its administrative personnel that increased by Ch$89.0 million, basically due adjustments to salaries made in the period. Isolating the latter, Provida’s administrative personnel remunerations decreased by Ch$29.2 million boosted by changes made in the commercial activity affecting variable incentives paid, adding higher consumption of vacations implying savings in accrued vacations. The above was partially offset by higher indemnities given the implementation of a reduction plan of personnel. |

In figures, the average administrative staff of 3Q09 decreased by 2.7% with respect to the 3Q08, from 1,041 employees to 1,013.

| · | The sales personnel remuneration amounted to Ch$2,518.0 million in the 3Q09, a decrease of Ch$135.4 million (5.1%) with respect to the same quarter in 2008. This variation was mainly driven by adjustments made to the commercial activity and its consequent impact on the variable incentives granted to sales agents, adding lower benefits paid in view of a lower number of staff, resulting from the reduction plan. |

Regarding sales staff, the average number of sale agents decreased from 600 in the 3Q08 to 477 in the 3Q09, representing a variation of 20.4%.

| · | During the 3Q09 the life and disability insurance expense was Ch$9,927.1 million, lower by Ch$21,225.4 million or 68.1% with respect to the figure recorded in the same quarter in 2008. This variation was partly due to Provida did not record expenses in temporary premium since August 2009, given that the Pension Reform Law eliminated the responsibility of providing life and disability benefits by the AFPs. In the 3Q09, the temporary premium line has only recorded one month of expense and those expenses resulted from recovering leftovers. |

Additionally, the 3Q09 recorded a lower accounted casualty rate of 1.41% that compares to 1.77% recorded in the 3Q08. This decrease was explained by positive returns achieved by pension funds in the quarter, which has led to a lower insurance cost assumed by the AFPs.

Also explaining a lower casualty rate were higher discount rates that were applied to value reserves in the period. Firstly, the insurance company voluntary adopted the rule that allows measuring monthly reserves at market interest rate, thus the obligation was measured at 3.58% instead of the historical average rate applied of 3.03% at September 2008. Then, the Company used its model to value the cost of casualties by applying an average forward rate around 3.30%, acknowledging a higher accrual than the accrual determined by the insurance company (minimum required by law), but lower than the levels recorded in 3Q08.

Other operating expenses increased by 20.7% or Ch$1,339.0 million with respect to the 3Q08, from Ch$6,460.4 million to Ch$7,799.4 million in the 3Q09. This variation was driven by the fact the expenses grew in several of its components. Firstly, the period recorded higher amortization costs in the period (Ch$422.5 million), basically due to the Unified Platform since this asset is in its last period of amortization, implying that effect of recent investments over the amount of amortization has been more relevant. In addition to the above were higher other expenses (Ch$373.0 million) basically due to disability qualification costs.

Also, the period recorded higher administration costs (Ch$220.4 million) basically regarding advisory services in connection to ISO 9000 matters and investments topics, rentals related to the new APV branch office, mails due to higher communications instructed by the norm related to delayed contributions. Additionally, the period recorded higher marketing expenses (Ch$204.1 million) due to advertising contracts and restructuring of Top One offices (graph charts, sign charts, notice boards)

Operating income

It totaled Ch$27,936.5 million, an increase of 367.6% or Ch$38,377.7 million with respect to losses recorded in the 3Q08 basically due to the better evolution achieved by mandatory investments and higher net fees defined as fee income minus expenses of the life and disability insurance.

Other non-operating income (expenses)

They recorded an income of Ch$1,302.9 million, higher by Ch$6,725.7 million or 124.0% than the loss recorded in the 3Q08. This result was basically attained by the better evolution of price level restatement, implying a positive variation of Ch$5,876.6 million given the negative inflation recorded in the period over the Company’s net liability exposure. Additionally, the period recorded higher profits generated by related companies of Ch$1,287.2 million mainly as a consequence of growths obtained by foreign subsidiaries.

| · | The results in related companies increased by Ch$1,287.2 million or 241.6% from an income of Ch$532.8 million in the 3Q08 to Ch$1,820.0 million in the 3Q09. In this performance, the main contribution of Ch$1,157.0 million were made by foreign subsidiaries, mainly boosted by gains on mandatory investments. Likewise, local related companies contributed in the aggregate of Ch$130.1 million, where the growth of 54.4% achieved by Previred.com in the quarter was underlined. |

| | | | | 3Q09 | | | | 3Q08 | | | Change | | | % | |

| Company | Country | | (Million of constant Chilean pesos as of September 30, 2009, except percentages) | |

| | | | | | | | | | | | | | | | |

| Horizonte | Peru | | | 504.8 | | | | (178.3 | ) | | | 683.2 | | | | 383.1 | % |

| | | | | | | | | | | | | - | | | | | |

| Bancomer | Mexico | | | 874.6 | | | | 400.7 | | | | 473.9 | | | | 118.3 | % |

| | | | | | | | | | | | | | | | | | |

| DCV | Chile | | | 5.1 | | | | 14.7 | | | | (9.6 | ) | | | -65.2 | % |

| | | | | | | | | | | | | | | | | | |

| PreviRed.com | Chile | | | 344.1 | | | | 222.8 | | | | 121.2 | | | | 54.4 | % |

| | | | | | | | | | | | | - | | | | | |

| AFC | Chile | | | 91.4 | | | | 72.9 | | | | 18.5 | | | | 25.4 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL | | | 1,820.0 | | | | 532.8 | | | | 1,287.2 | | | | 241.6 | % |

| · | The price level restatement recorded an income of Ch$801.1 million, higher by Ch$5,876.6 million with respect to the loss recorded in the same quarter in 2008. This variation was driven by the negative inflation of -0.46% applied over the Company’s net liability exposure, while in the 3Q08 the inflation was +3.58%. |

Income taxes

In the 3Q09 income taxes was Ch$3,574.5 million, higher by Ch$3,666.2 million with respect to the 3Q08, basically as a result of higher earnings before taxes obtained in the current quarter. It is important to stress that this increment could have been higher, since in the 3Q08 the adjustment to the deferred taxes obligation increased the income tax acknowledged in the results boosted by the drop of 45 basis points in the discount rate to value this liability during such quarter.

Exchange rate

In the 3Q09, a depreciation of 3.5% of the Chilean peso against the dollar was recorded, while in the 3Q08 the depreciation was 4.8%.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.