UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

ý Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2012.

OR

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number 1-13053

STILLWATER MINING COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 81-0480654 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1321 DISCOVERY DRIVE, BILLINGS, MONTANA 59102

(Address of principal executive offices and zip code)

(406) 373-8700

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

|

| | | | | | |

| Large Accelerated Filer | | ý | | Accelerated Filer | | ¨ |

| | | | |

| Non-Accelerated Filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

YES o NO ý

At August 6, 2012 the Company had outstanding 115,986,494 shares of common stock, par value $0.01 per share.

STILLWATER MINING COMPANY

FORM 10-Q

QUARTER ENDED JUNE 30, 2012

INDEX

|

| | |

| |

| | | |

| Item 1. | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | |

| |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 4. | | |

| | | |

| Item 6. | | |

| | |

| |

| | |

| CERTIFICATIONS | |

PART I – FINANCIAL INFORMATION

ITEM 1

CONSOLIDATED FINANCIAL STATEMENTS

Stillwater Mining Company

Consolidated Statements of Operations and Comprehensive Income

(Unaudited)

(in thousands, except per share data)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2012 | | 2011 | | 2012 | | 2011 |

| Revenues | | | | | | | |

| Mine production | $ | 116,190 |

| | $ | 139,733 |

| | $ | 232,894 |

| | $ | 261,713 |

|

| PGM recycling | 96,585 |

| | 82,872 |

| | 182,932 |

| | 130,953 |

|

| Total revenues | 212,775 |

| | 222,605 |

| | 415,826 |

| | 392,666 |

|

| Costs and expenses | | | | | | | |

| Costs of metals sold | | | | | | | |

| Mine production | 74,996 |

| | 65,094 |

| | 149,025 |

| | 125,344 |

|

| PGM recycling | 93,149 |

| | 79,552 |

| | 177,264 |

| | 124,706 |

|

| Total costs of metals sold | 168,145 |

| | 144,646 |

| | 326,289 |

| | 250,050 |

|

| Depletion, depreciation and amortization | | | | | | | |

| Mine production | 14,601 |

| | 15,395 |

| | 29,005 |

| | 31,196 |

|

| PGM recycling | 261 |

| | 265 |

| | 529 |

| | 527 |

|

| Total depletion, depreciation and amortization | 14,862 |

| | 15,660 |

| | 29,534 |

| | 31,723 |

|

| Total costs of revenues | 183,007 |

| | 160,306 |

| | 355,823 |

| | 281,773 |

|

| Exploration | 2,000 |

| | 75 |

| | 12,117 |

| | 75 |

|

| Marketing | 3,650 |

| | 2,800 |

| | 5,988 |

| | 3,653 |

|

| Research and development | 77 |

| | 621 |

| | 782 |

| | 1,080 |

|

| General and administrative | 10,117 |

| | 9,893 |

| | 22,595 |

| | 16,255 |

|

| Abandonment of non-producing property | — |

| | — |

| | 2,835 |

| | — |

|

| Loss/(Gain) on disposal of property, plant and equipment | 297 |

| | (207 | ) | | 292 |

| | (226 | ) |

| Total costs and expenses | 199,148 |

| | 173,488 |

| | 400,432 |

| | 302,610 |

|

| Operating income | 13,627 |

| | 49,117 |

| | 15,394 |

| | 90,056 |

|

| Other income/(expense) | | | | | | | |

| Other | 577 |

| | 4 |

| | 585 |

| | 12 |

|

| Interest income | 790 |

| | 951 |

| | 1,435 |

| | 1,733 |

|

| Interest expense | (1,153 | ) | | (1,637 | ) | | (2,868 | ) | | (3,272 | ) |

| Foreign currency transaction gain | 3,778 |

| | — |

| | 6,709 |

| | 182 |

|

| Income before income tax provision | 17,619 |

| | 48,435 |

| | 21,255 |

| | 88,711 |

|

| Income tax benefit/(provision) | 210 |

| | (5,737 | ) | | (987 | ) | | (9,821 | ) |

| Net income | $ | 17,829 |

| | $ | 42,698 |

| | $ | 20,268 |

| | $ | 78,890 |

|

| Net loss attributable to noncontrolling interest | (371 | ) | | — |

| | (371 | ) | | — |

|

| Net income attributable to common stockholders | $ | 18,200 |

| | $ | 42,698 |

| | $ | 20,639 |

| | $ | 78,890 |

|

| Other comprehensive income/(loss), net of tax | | | | | | | |

| Net unrealized (losses)/gains on securities available for sale | (109 | ) | | 86 |

| | 199 |

| | (104 | ) |

| Comprehensive income attributable to common stockholders | $ | 18,091 |

| | $ | 42,784 |

| | $ | 20,838 |

| | $ | 78,786 |

|

| Weighted average common shares outstanding | | | | | | | |

| Basic | 115,819 |

| | 103,037 |

| | 115,686 |

| | 102,688 |

|

| Diluted | 123,855 |

| | 111,123 |

| | 116,671 |

| | 110,924 |

|

| Basic earnings per share attributable to common stockholders | $ | 0.16 |

| | $ | 0.41 |

| | $ | 0.18 |

| | $ | 0.77 |

|

| Diluted earnings per share attributable to common stockholders | $ | 0.15 |

| | $ | 0.39 |

| | $ | 0.18 |

| | $ | 0.73 |

|

Stillwater Mining Company

Consolidated Balance Sheets

(Unaudited)

(in thousands, except share and per share data)

|

| | | | | | | |

| | June 30,

2012 | | December 31,

2011 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 197,157 |

| | $ | 109,097 |

|

| Investments, at fair market value | 57,953 |

| | 49,533 |

|

| Inventories | 121,578 |

| | 131,856 |

|

| Trade receivables | 8,568 |

| | 6,188 |

|

| Deferred income taxes | 109,629 |

| | 96,036 |

|

| Other current assets | 12,473 |

| | 9,433 |

|

| Total current assets | 507,358 |

| | 402,143 |

|

| Mineral properties | 597,187 |

| | 596,686 |

|

| Property, plant and equipment, net of $465,847 and $436,612 of accumulated depletion, depreciation and amortization | 394,923 |

| | 367,727 |

|

| Restricted cash | 24,995 |

| | 25,070 |

|

| Other noncurrent assets | 11,444 |

| | 11,915 |

|

| Total assets | $ | 1,535,907 |

| | $ | 1,403,541 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Accounts payable | $ | 24,582 |

| | $ | 26,880 |

|

| Accrued compensation and benefits | 28,846 |

| | 27,573 |

|

| Property, production and franchise taxes payable | 14,853 |

| | 14,071 |

|

| Current portion of long-term debt and capital lease obligations | 168,228 |

| | — |

|

| Income taxes payable | — |

| | 1,235 |

|

| Other current liabilities | 1,811 |

| | 4,576 |

|

| Total current liabilities | 238,320 |

| | 74,335 |

|

| Long-term debt | 34,849 |

| | 196,046 |

|

| Deferred income taxes | 277,085 |

| | 270,101 |

|

| Accrued workers compensation | 6,558 |

| | 6,056 |

|

| Asset retirement obligation | 7,641 |

| | 7,331 |

|

| Other noncurrent liabilities | 5,318 |

| | 5,704 |

|

| Total liabilities | 569,771 |

| | 559,573 |

|

| Equity | | | |

| Stockholders’ equity | | | |

| Preferred stock, $0.01 par value, 1,000,000 shares authorized; none issued | — |

| | — |

|

| Common stock, $0.01 par value, 200,000,000 shares authorized; 115,907,989 and 115,375,604 shares issued and outstanding | 1,159 |

| | 1,154 |

|

| Paid-in capital | 927,356 |

| | 878,050 |

|

| Accumulated deficit | (13,636 | ) | | (34,275 | ) |

| Accumulated other comprehensive loss | (762 | ) | | (961 | ) |

| Total stockholders’ equity | 914,117 |

| | 843,968 |

|

| Noncontrolling interest | 52,019 |

| | — |

|

| Total equity | 966,136 |

| | 843,968 |

|

| Total liabilities and stockholders’ equity | $ | 1,535,907 |

| | $ | 1,403,541 |

|

See accompanying notes to consolidated financial statements

Stillwater Mining Company

Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2012 | | 2011 | | 2012 | | 2011 |

| Cash flows from operating activities | | | | | | | |

| Net income | $ | 17,829 |

| | $ | 42,698 |

| | $ | 20,268 |

| | $ | 78,890 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depletion, depreciation and amortization | 14,862 |

| | 15,660 |

| | 29,534 |

| | 31,723 |

|

| Loss/(Gain) on disposal of property, plant and equipment | 297 |

| | (207 | ) | | 292 |

| | (226 | ) |

| Abandonment of non-producing property | — |

| | — |

| | 2,835 |

| | — |

|

| Accretion of asset retirement obligation | 157 |

| | 145 |

| | 310 |

| | 286 |

|

| Amortization of debt issuance costs | 315 |

| | 246 |

| | 629 |

| | 491 |

|

| Share based compensation and other benefits | 4,115 |

| | 2,689 |

| | 7,887 |

| | 5,789 |

|

| Changes in operating assets and liabilities: | | | | | | | |

| Inventories | 11,486 |

| | (15,505 | ) | | 9,920 |

| | (55,569 | ) |

| Trade receivables | 802 |

| | 81 |

| | (2,380 | ) | | (393 | ) |

| Accrued compensation and benefits | 377 |

| | 3,051 |

| | 1,234 |

| | 4,341 |

|

| Accounts payable | (7,029 | ) | | 1,450 |

| | (2,336 | ) | | 4,644 |

|

| Property, production and franchise taxes payable | (22 | ) | | 1,273 |

| | 396 |

| | 2,944 |

|

| Income taxes payable | (268 | ) | | 5,737 |

| | (3,115 | ) | | 9,821 |

|

| Workers compensation | 502 |

| | (78 | ) | | 502 |

| | (554 | ) |

| Restricted cash | — |

| | — |

| | 75 |

| | 3,000 |

|

| Other | (4,051 | ) | | 1,571 |

| | (10,683 | ) | | 7,496 |

|

| Net cash provided by operating activities | 39,372 |

| | 58,811 |

| | 55,368 |

| | 92,683 |

|

| Cash flows from investing activities | | | | | | | |

| Capital expenditures | (36,593 | ) | | (23,110 | ) | | (59,313 | ) | | (46,295 | ) |

| Purchase of long-term investment | — |

| | — |

| | — |

| | (616 | ) |

| Proceeds from disposal of property, plant and equipment | 20 |

| | 207 |

| | 28 |

| | 228 |

|

| Purchases of investments | (26,637 | ) | | (32,801 | ) | | (31,887 | ) | | (98,096 | ) |

| Proceeds from maturities of investments | 19,088 |

| | 58,575 |

| | 23,549 |

| | 137,017 |

|

| Net cash (used in) provided by investing activities | (44,122 | ) | | 2,871 |

| | (67,623 | ) | | (7,762 | ) |

| Cash flows from financing activities | | | | | | | |

| Proceeds from sale of noncontrolling interest, net of transaction costs | 94,669 |

| | — |

| | 93,821 |

| | — |

|

| Issuance of long-term debt | 7,176 |

| | — |

| | 7,176 |

| | — |

|

| Payments on long term debt and capital lease obligations | (495 | ) | | — |

| | (495 | ) | | — |

|

| Payments for debt issuance costs | — |

| | — |

| | (219 | ) | | — |

|

| Issuance of common stock | 3 |

| | 7 |

| | 32 |

| | 725 |

|

| Net cash provided by financing activities | 101,353 |

| | 7 |

| | 100,315 |

| | 725 |

|

| Cash and cash equivalents | | | | | | | |

| Net increase | 96,603 |

| | 61,689 |

| | 88,060 |

| | 85,646 |

|

| Balance at beginning of period | 100,554 |

| | 43,320 |

| | 109,097 |

| | 19,363 |

|

| Balance at end of period | $ | 197,157 |

| | $ | 105,009 |

| | $ | 197,157 |

| | $ | 105,009 |

|

See accompanying notes to consolidated financial statements

Stillwater Mining Company

Notes to Consolidated Financial Statements

(Unaudited)

NOTE 1

GENERAL

In the opinion of management, the accompanying unaudited consolidated financial statements contain all adjustments (consisting only of normal recurring adjustments) necessary to present fairly the financial position of Stillwater Mining Company (the “Company”) as of June 30, 2012, and the results of its operations and its cash flows for the three- and six- month periods ended June 30, 2012 and 2011. The results of operations for the first six months of 2012 are not necessarily indicative of the results to be expected for the full year. The accompanying consolidated financial statements in this quarterly report should be read in conjunction with the consolidated financial statements and notes thereto included in the Company's March 31, 2012 Quarterly Report on Form 10-Q and in the Company’s 2011 Annual Report on Form 10-K. All intercompany transactions and balances have been eliminated in consolidation.

The preparation of the Company’s consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in these consolidated financial statements and accompanying notes. The more significant areas requiring the use of management’s estimates relate to mineral reserves, reclamation and environmental obligations, valuation allowance for deferred tax assets, useful lives utilized for depreciation, amortization and accretion calculations, future cash flows from long-lived assets, and fair value of derivatives and other financial instruments. Actual results could differ from these estimates.

No subsequent events were identified that required additional disclosure in the consolidated financial statements through the date of this filing.

NOTE 2

SALES

Mine Production

The Company mines and processes ores containing palladium, platinum, rhodium, gold, silver, copper and nickel into intermediate and final products for sale to customers. Palladium, platinum, rhodium, gold and silver are sent to third party refineries for final processing from where they are sold to a number of consumers and dealers with whom the Company has established trading relationships. Refined platinum group metals (PGMs) of 99.95% purity (rhodium of 99.9%) in sponge form are transferred upon sale from the Company’s account at third party refineries to the account of the purchaser. By-product precious metals are normally sold at market prices to customers, brokers or outside refiners. By-products of copper and nickel are produced by the Company at less than commercial grade, so prices for these metals typically reflect a quality discount. By-product sales are included in revenues from mine production. During the second quarter of 2012 and 2011, total by-product (copper, nickel, gold, silver and mined rhodium) sales were $7.2 million and $8.0 million, respectively. During the first six months of 2012 and 2011, total by-product (copper, nickel, gold, silver and mined rhodium) sales were $16.4 million and $15.5 million, respectively.

The Company has a three year supply agreement with General Motors Corporation (GM) that provides for fixed quantities of palladium to be delivered each month. The supply agreement with GM expires on December 31, 2013. The Company has a one year platinum supply agreement with Tiffany & Co set to expire at the end of 2012. The Company also has a new supply agreement with Johnson Matthey and recently renewed its year-to-year supply agreement with Ford Motor Company. Some of these agreements provide for pricing at a small discount to a trailing market price. The Company currently sells its remaining mine production under spot sales agreements.

Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred either physically or through an irrevocable transfer of metals to customers’ accounts, the price is fixed or determinable, no related obligations remain and collectability is probable.

PGM Recycling

The Company purchases spent catalyst materials from third parties and processes these materials in its facilities in Columbus, Montana to recover palladium, platinum and rhodium for sale. It also accepts material supplied from third parties on a tolling basis, processing it for a fee and returning the recovered metals to the supplier. The Company has entered into sourcing arrangements for catalyst material with several suppliers. Under these sourcing arrangements as currently structured, the Company advances cash against a shipment of material shortly before actually receiving the physical shipment. These advances are included in Other current assets on the Company’s Consolidated Balance Sheet until such time as the material has been physically received and title has transferred to the Company. The Company holds a security interest in materials procured by its largest recycling supplier that have not been received by the Company. Once the material is physically received and title has transferred, the associated advance is reclassified from Other current assets into Inventories. Finance charges collected on advances and inventories prior to being earned are included in Other current liabilities on the Company’s Consolidated Balance Sheet. Finance charges are reclassified from Other current liabilities to Interest income ratably from the time the advance was made until the out-turn date of the inventory.

At the same time the Company purchases recycling material, it typically enters into a fixed forward contract for future delivery of the PGMs contained in the recycled material at a price consistent with the purchase cost of the recycled material. The contract commits the Company to deliver finished metal on a specified date that normally corresponds to the expected out-turn date for the metal from the final refiner. The purpose of this arrangement is to eliminate the Company’s exposure to fluctuations in market prices during processing, while at the same time creating an obligation for the Company to deliver metal at a future point in time that could be subject to operational risks. If the Company were unable to complete the processing of the recycled material by the contractual delivery date, it could either cover its delivery commitments with mine production or purchase finished metal in the open market. If open market purchases are used, the Company would bear the cost (or benefit) of any change in the market price relative to the price stipulated in the delivery contract.

Total Sales

Total sales to significant customers as a percentage of total revenues for the three- and six- month periods ended June 30, 2012 and 2011 were as follows:

|

| | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2012 | | 2011 | | 2012 | | 2011 |

| Customer A | 25 | % | | 24 | % | | 25 | % | | 24 | % |

| Customer B | 17 | % | | 19 | % | | 17 | % | | 21 | % |

| Customer C | 16 | % | | — | % | | 17 | % | | — | % |

| Customer D | 13 | % | | — | % | | 12 | % | | — | % |

| Customer E | — | % | | 24 | % | | — | % | | 21 | % |

| Customer F | — | % | | — | % | | — | % | | 10 | % |

| | 71 | % | | 67 | % | | 71 | % | | 76 | % |

-% represents less than 10% of total revenues

NOTE 3

NONCONTROLLING INTEREST

On March 28, 2012, the Company entered into an agreement with Mitsubishi Corporation (Mitsubishi) in which a Mitsubishi subsidiary acquired a 25% interest in the Company's wholly owned subsidiary, Stillwater Canada Inc. (SCI), which owns the Marathon PGM-copper project and related properties for approximately $81.25 million and an additional $13.6 million to satisfy Mitsubishi's portion of the venture's initial cash call. Mitsubishi will be responsible for funding its 25% share of operating, capital and exploration expenditures on the Marathon properties and has agreed to cooperate and support efforts to secure project financing for Marathon. Mitsubishi will have an option to purchase up to 100% of Marathon's future PGM production under a related supply agreement at a relatively small discount to market. The transaction closed on April 10, 2012. The Company incurred transaction costs of approximately $1.1 million related to the agreement with Mitsubishi in the first six months of 2012 which was recorded within Stockholders' Equity upon closing of the transaction.

The noncontrolling interests' share of equity is reflected as Noncontrolling interest in the accompanying Consolidated Balance Sheet and was $52.0 million as of June 30, 2012.

The change in the parent company's equity as a result of the sale of the noncontrolling interest was to increase additional paid in capital by $42.5 million, offset by expenses incurred of $0.3 million in the three months ended June 30, 2012 and $1.1 million for the six months ended June 30, 2012.

NOTE 4

DERIVATIVE INSTRUMENTS

The Company uses various derivative instruments to manage its exposure to changes in PGM market commodity prices. Some of these derivatives are designated as hedges. Because the Company hedges only with instruments that have a high correlation with the value of the underlying exposures, changes in the derivatives’ fair value are expected to be offset by changes in the value of the hedged transaction.

Commodity Derivatives

The Company customarily enters into fixed forward contracts and on occasion it also enters into financially settled forward contracts to offset the price risk in its PGM recycling activity. From time to time, it also has entered into these types of contracts on portions of its mine production. Under these customary fixed forward transactions, the Company agrees to deliver a stated quantity of metal on a specific future date at a price stipulated in advance. The Company uses fixed forward transactions primarily to price in advance the metals acquired for processing in its recycling segment. Under the occasional financially settled forward transactions, at each settlement date the Company receives the net difference between the forward price and the market price if the market price is below the forward price and the Company pays the net difference between the forward price and the market price if the market price is above the forward price. These financially settled forward contracts are settled in cash at maturity and do not require physical delivery of metal at settlement. The Company typically has used financially settled forward contracts with third parties to reduce its exposure to price risk on metal it is obligated to deliver under long-term sales agreements.

Mine Production

At present the Company has no outstanding derivative contracts pertaining to its mined production.

PGM Recycling

The Company regularly enters into fixed forward sales relating to its recycling of PGM catalyst materials. The metals from PGM recycled materials are typically sold forward at the time of purchase and delivered against the fixed forward contracts when the ounces are recovered. All of these fixed forward sales contracts open at June 30, 2012, will settle at various periods through December 2012. The Company has credit agreements with its major trading partners that provide for margin deposits in the event that forward prices for metals exceed the Company’s hedged prices by a predetermined margin limit. As of June 30, 2012, no such margin deposits were outstanding or due.

Occasionally, the Company also has entered into financially settled forward contracts on its recycled materials. Such contracts are utilized when the Company wishes to establish a firm forward price for recycled metal on a specific future date. No financially settled forward contracts were entered into during the second quarter of 2012. The Company generally has not designated these contracts as cash flow hedges, so they are marked to market at the end of each accounting period. The change in the fair value of the derivatives is reflected in the consolidated statement of operations and comprehensive income.

The following is a summary of the Company’s commodity derivatives as of June 30, 2012:

|

| | | | | | | | | | | | | | | | | | | | | |

| PGM Recycling: | | | | | | | | | | | | |

| Fixed Forwards | | | | | | | | | | | | |

| | | Platinum | | Palladium | | Rhodium |

| Settlement Period | | Ounces | | Avg. Price | | Ounces | | Avg. Price | | Ounces | | Avg. Price |

| Third Quarter 2012 | | 20,981 |

| | $ | 1,498 |

| | 30,681 |

| | $ | 631 |

| | 4,803 |

| | $ | 1,359 |

|

| Fourth Quarter 2012 | | 2,051 |

| | $ | 1,447 |

| | 1,800 |

| | $ | 614 |

| | 1,905 |

| | $ | 1,232 |

|

NOTE 5

SHARE-BASED COMPENSATION

Stock Plans

The Company sponsors stock plans (the “Plans”) that enable the Company to grant stock options or other equity based compensation to employees and non-employee directors. Effective March 1, 2011, the Company ceased offering stock options as incentive compensation to employees and non-employee directors, and began to and expects to continue to issue only cash awards or restricted stock units in lieu of stock options. The Company continues to have previously issued stock options that remain outstanding under three separate plans: the 1994 Incentive Plan, the General Employee Plan and the 2004 Equity Incentive Plan. At inception of the plans, approximately 16.4 million shares of common stock were authorized for issuance under the Plans, including approximately 5.0 million, 5.2 million, 1.4 million and 4.8 million authorized shares for the 2012 Equity Incentive Plan, 2004 Equity Incentive Plan, the General Employee Plan and the 1994 Incentive Plan (as amended by the 1998 Incentive Plan), respectively. The 1998 Incentive Plan and the General Employee Plan have been terminated and no additional options, shares or units may be issued under these two terminated plans. Approximately 5.4 million shares were available and reserved for grant under the 2004 Equity Incentive Plan and the 2012 Equity Incentive Plan combined, as of June 30, 2012.

In April 2012, stockholders approved the 2012 Equity Incentive Plan. The number of shares of common stock authorized for issuance under the 2012 Equity Compensation Plan is 5.0 million.

The Compensation Committee of the Company’s Board of Directors administers the Plans and determines the type of equity awards to be issued, the exercise period, vesting period and all other terms of instruments issued under the Plans. Employees’ options and the majority of restricted stock units vest in equal annual installments over a three years period after date of grant. Some restricted stock units vest 100% one year after the date of grant. Officers’ and directors’ options expire ten years after the date of grant. All other employee options expire five to ten years years after the date of grant, depending upon the original grant date. The Company received a minimal amount of cash from the exercise of stock options in the three- and six- month periods ended June 30, 2012. The Company received $0.7 million in cash from the exercise of stock options in the six- month period ended June 30, 2011.

The Company recognizes compensation expense associated with its stock option grants based on their fair market value on the date of grant using a Black-Scholes option pricing model. The Company recognizes stock option expense ratably over the vesting period of the options. If options are canceled or forfeited prior to vesting, the Company stops recognizing the related expense effective with the date of forfeiture. The compensation expense, recorded in General and administrative in the Consolidated Statements of Operations and Comprehensive Income, related to the fair value of stock options during the three- month periods ended June 30, 2012 and 2011, was $25,900 and $61,500, respectively, and $55,300 and $131,100 during the six- month periods ended June 30, 2012 and 2011, respectively. Total compensation expense not yet recognized related to nonvested stock options is $41,500, $32,700 and $500 for the remaining six months of 2012 and for years 2013 and 2014, respectively.

Nonvested Shares

The following table summarizes the status of and changes in the Company’s nonvested shares during the first six months of 2012:

|

| | | | | | |

| | Nonvested Shares | | Weighted-Average Grant-Date Fair Value |

| Nonvested shares at January 1, 2012 | 1,502,611 |

| | $ | 10.95 |

|

| Granted | 557,910 |

| | 13.37 |

|

| Vested | (751,686 | ) | | 6.65 |

|

| Forfeited | (1,267 | ) | | 17.77 |

|

| Nonvested shares at March 31, 2012 | 1,307,568 |

| | $ | 14.45 |

|

| | | | |

| Granted | 47,834 |

| | 10.51 |

|

| Vested | (3,658 | ) | | 20.04 |

|

| Forfeited | (4,860 | ) | | 14.65 |

|

| Nonvested shares at June 30, 2012 | 1,346,884 |

| | $ | 14.29 |

|

Compensation expense related to grants of nonvested shares was $2.0 million and $1.6 million in the three- month periods ended June 30, 2012 and 2011, respectively, and is included within General and administrative in the Consolidated Statements of Operations and Comprehensive Income. Compensation expense related to grants of nonvested shares was $3.7 million and $3.1 million in the six- month periods ended June 30, 2012 and 2011, respectively.

The following table presents the compensation expense of the nonvested shares outstanding at June 30, 2012, to be recognized over the remaining vesting periods:

|

| | | |

| (In millions) | |

| Third quarter 2012 | $ | 2.0 |

|

| Fourth quarter 2012 | 1.9 |

|

| 2013 | 5.4 |

|

| 2014 | 2.8 |

|

| 2015 | 0.4 |

|

| Total | $ | 12.5 |

|

NOTE 6

INCOME TAXES

The Company determines income taxes using the asset and liability approach which results in the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amount and the tax basis of those assets and liabilities, as well as operating loss and tax credit carryforwards, using enacted tax rates in effect in the years in which the differences are expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred tax assets and liabilities are recorded on a jurisdictional basis.

At June 30, 2012, the Company has net operating loss carryforwards (NOLs), which expire at various times in years 2012 through 2030. The Company has reviewed its net deferred tax assets and has provided a valuation allowance to reflect the estimated amount of net deferred tax assets which management considers, more likely than not, will not be realized. Included in the provision for income taxes at June 30, 2012 is a $0.9 million adjustment for AMT. This adjustment is a result of a decrease in depreciation recorded for tax purposes in 2011. The Company recognized an income tax provision of $5.7 million in the second quarter of 2011. The Company has AMT net operating loss carry-forwards, and anticipates that all of its 2012 AMT income estimated at $48.7 million will be subject to offset by available AMT NOLs. Changes in the Company’s net deferred tax assets and liabilities have been offset by a corresponding change in the valuation allowance.

The Company’s policy is to recognize interest and penalties on unrecognized tax benefits in Income tax provision in the Consolidated Statements of Operations and Comprehensive Income. There were no interest or penalties for the three- and six- month periods ended June 30, 2012 and 2011. Tax years still open for examination by the taxing authorities are the years ending December 31, 2011, 2010, and 2009.

NOTE 7

DEBT AND CAPITAL LEASE OBLIGATION

Convertible Debentures

On March 12, 2008, the Company issued and sold $181.5 million aggregate principal amount of senior convertible debentures due March 15, 2028 (“debentures”). The debentures pay interest at 1.875% per annum, payable semi-annually on March 15 and September 15 of each year, and commenced on September 15, 2008. The debentures will mature on March 15, 2028, subject to earlier repurchase or conversion. Each $1,000 principal amount of debentures is initially convertible, at the option of the holders, into approximately 42.5351 shares of the Company’s common stock, at any time prior to the maturity date. The conversion rate is subject to certain adjustments, but will not be adjusted for accrued interest or any unpaid interest. The conversion rate initially represents a conversion price of $23.51 per share. Holders of the debentures may require the Company to repurchase all or a portion of their debentures on March 15, 2013, March 15, 2018 and March 15, 2023, or at any time before March 15, 2028 upon the occurrence of certain events including a change in control. The Company may redeem the debentures for cash beginning on or after March 22, 2013. In October 2009, the Company undertook the exchange of $15.0 million face amount of the convertible debentures for 1.84 million shares of the Company's common stock. The debentures so acquired were retired. The outstanding balance of $166.5 million is reported as short-term debt obligation as of June 30, 2012.

Amortization expense related to the issuance costs of the debentures was approximately $0.2 million in each of the three- month periods ended June 30, 2012 and 2011, respectively, and $0.5 million for each of the six- month periods ended June 30, 2012 and 2011, respectively. The interest expense on the debentures was approximately $0.8 million, respectively, for each of the three- month periods ended June 30, 2012 and 2011, and $1.6 million, respectively, for each of the six- month periods ended June 30, 2012 and 2011. The Company made cash payments of $1.6 million for interest on the debentures during each of the six- month periods ended June 30, 2012 and 2011.

Exempt Facility Revenue Bonds

The Company also has outstanding a $30.0 million offering of 8.0% Exempt Facility Revenue Bonds, Series 2000, issued through the State of Montana Board of Investments and due July 1, 2020. The balance outstanding at June 30, 2012, was $29.5 million, which is net of unamortized discount of $0.5 million. The Company made cash payments of $1.2 million for interest on the revenue bonds during the second quarter of 2012.

Asset-Backed Revolving Line of Credit

Effective December 23, 2011, the Company signed a $100.0 million asset-backed revolving credit agreement with Wells Fargo Capital Finance, incurring debt issuance costs of $1.1 million. Borrowings under this working capital facility are limited to a borrowing base comprised of 85% of eligible accounts receivable and 70% of eligible inventories. Borrowings will be secured by the Company’s accounts receivable, metals inventories and other accounts. The asset-backed revolving credit facility includes a single fixed-charge coverage covenant that only takes effect when less than 30% of the total borrowing capacity under the line remains available. The facility includes a $50.0 million letter of credit sub-facility. Outstanding borrowings under the facility accrue interest at a spread over the London Interbank Offer Rate that varies from 2.25% to 2.75%, decreasing progressively as the percentage drawn against the facility increases. The Company also pays an unused line fee on committed but unutilized commitments under the facility at a rate per annum of 0.375% or 0.5%, depending on utilization of the facility. On January 13, 2012, the Company completed the syndication of this facility to a group of four banks and simultaneously expanded the maximum line of credit to $125.0 million. The Company recognized $0.2 million in fees associated with the asset-backed revolving credit agreement in the three- and six- month periods ended June 30, 2012. Amortization expense related to the issuance costs of the credit agreement was approximately $0.1 million for the three- and six- month periods ended June 30, 2012. As of June 30, 2012, there was no drawn balance under this revolving credit facility, although approximately $5.3 million in undrawn letters of credit had been issued under this facility as collateral for sureties.

Capital Lease Obligation

On June 1, 2012, the Company entered into a lease agreement with General Electric Capital Corporation covering the acquisition of a tunnel-boring machine for use on the Blitz Project adjacent to the Stillwater Mine. The transaction is structured as a capital lease with a four-year term; lease payments are due quarterly in advance. As of June 30, 2012, the outstanding balance under the capital lease was $6.7 million.

The following is a schedule by year of the future minimum lease payments for the capital lease together with the present value of the net minimum lease payments:

|

| | | | |

| Quarter ended June 30, 2012 (in thousands) | | |

| Remaining 2012 | | $ | 991 |

|

| 2013 | | 1,982 |

|

| 2014 | | 1,982 |

|

| 2015 | | 1,982 |

|

| 2016 | | 496 |

|

| Total minimum lease payments | | 7,433 |

|

| Less amount representing interest | | 752 |

|

| Present value of net minimum lease payments | | 6,681 |

|

| Less current portion | | 1,651 |

|

| Total long-term capital lease obligation | | $ | 5,030 |

|

Capitalized Interest

The Company capitalizes interest incurred on its various debt instruments as a cost of properties under development.

For the six- month period ended June 30, 2012, the Company capitalized interest of $0.6 million.

NOTE 8

SEGMENT INFORMATION

The Company operates five reportable business segments: Mine Production, PGM Recycling, Canadian Properties, South American Properties and All Other. These segments are managed separately based on fundamental differences in their operations and geographic separation.

The Mine Production segment consists of two business components: the Stillwater Mine and the East Boulder Mine. The Mine Production segment is engaged in the development, extraction, processing and refining of PGMs. The Company sells PGMs from mine production under short-term and long-term sales agreements, through derivative financial instruments and in open PGM markets. The financial results of the Stillwater Mine and the East Boulder Mine have been aggregated, as both have similar products, processes, customers, distribution methods and economic characteristics.

The PGM Recycling segment is engaged in the recycling of spent catalyst material to recover the PGMs contained in the material. The Company allocates costs of the smelter and base metal refinery to both the Mine Production segment and to the PGM Recycling segment for internal and segment reporting purposes because the Company’s smelting and refining facilities support the PGM extraction of both business segments. The Company also accepts material supplied from third parties on a tolling basis, processing it for a fee and returning the recovered metals to the supplier.

The Canadian Properties segment consists of the Marathon PGM assets (the majority of which is mineral property) and the Bermuda exploration mineral property. The principal Marathon property acquired is a large PGM and copper deposit located near the town of Marathon, Ontario, Canada. The Marathon deposit is currently in the permitting stage and will not be in production for several years. The Bermuda exploration mineral property is located adjacent to the Marathon property. Financial information available for this segment of the Company as of June 30, 2012, consists of total asset values, general and administrative costs, exploration costs and capital expenditures as the properties are developed.

The South American Properties segment consists of the Peregrine Metals Ltd. assets. The principal Peregrine property acquired is a copper-gold discovery, located in the San Juan province of Argentina. The Peregrine deposit is currently in the exploration stage. Financial information available for this segment of the Company consists of total asset values, general and administrative costs and exploration costs.

The All Other group primarily consists of assets, revenues, and expenses of various corporate and support functions.

The Company evaluates performance and allocates resources based on income or loss before income taxes.

The following financial information relates to the Company’s business segments:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | | | | | | | South American

Properties | | | | |

| | | Mine Production | | PGM Recycling | | Canadian Properties | | | All Other | | Total |

| Three Months Ended June 30, 2012 | |

| Revenues | | $ | 116,190 |

| | $ | 96,585 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 212,775 |

|

| Depletion, depreciation and amortization | | $ | 14,601 |

| | $ | 261 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 14,862 |

|

| Interest income | | $ | — |

| | $ | 649 |

| | $ | 4 |

| | $ | 48 |

| | $ | 89 |

| | $ | 790 |

|

| Interest expense | | $ | — |

| | $ | — |

| | $ | 12 |

| | $ | — |

| | $ | 1,141 |

| | $ | 1,153 |

|

| Income (loss) before income taxes | | $ | 26,296 |

| | $ | 3,674 |

| | $ | (1,247 | ) | | $ | 1,443 |

| | $ | (12,547 | ) | | $ | 17,619 |

|

| Capital expenditures | | $ | 33,410 |

| | $ | 23 |

| | $ | 1,565 |

| | $ | — |

| | $ | 1,595 |

| | $ | 36,593 |

|

| Total assets | | $ | 441,090 |

| | $ | 61,349 |

| | $ | 246,449 |

| | $ | 427,748 |

| | $ | 359,271 |

| | $ | 1,535,907 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | | | | | | | South American

Properties | | | | |

| | | | | | | | | | | | |

| Three Months Ended June 30, 2011 | | Mine Production | | PGM Recycling | | Canadian Properties | | | All Other | | Total |

| Revenues | | $ | 139,733 |

| | $ | 82,872 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 222,605 |

|

| Depletion, depreciation and amortization | | $ | 15,395 |

| | $ | 265 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 15,660 |

|

| Interest income | | $ | — |

| | $ | 544 |

| | $ | — |

| | $ | — |

| | $ | 407 |

| | $ | 951 |

|

| Interest expense | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 1,637 |

| | $ | 1,637 |

|

| Income (loss) before income taxes | | $ | 59,451 |

| | $ | 3,449 |

| | $ | (766 | ) | | $ | — |

| | $ | (13,699 | ) | | $ | 48,435 |

|

| Capital expenditures | | $ | 21,492 |

| | $ | 39 |

| | $ | 1,510 |

| | $ | — |

| | $ | 69 |

| | $ | 23,110 |

|

| Total assets | | $ | 402,990 |

| | $ | 89,855 |

| | $ | 192,859 |

| | $ | — |

| | $ | 353,233 |

| | $ | 1,038,937 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | | | | | | | South American

Properties | | | | |

| | | | | | | | | | | | |

| Six Months Ended June 30, 2012 | | Mine Production | | PGM Recycling | | Canadian Properties | | | All Other | | Total |

| Revenues | | $ | 232,894 |

| | $ | 182,932 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 415,826 |

|

| Depletion, depreciation and amortization | | $ | 29,005 |

| | $ | 529 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 29,534 |

|

| Interest income | | $ | — |

| | $ | 1,189 |

| | $ | 9 |

| | $ | 122 |

| | $ | 115 |

| | $ | 1,435 |

|

| Interest expense | | $ | — |

| | $ | — |

| | $ | 12 |

| | $ | — |

| | $ | 2,856 |

| | $ | 2,868 |

|

| Income (loss) before income taxes | | $ | 54,572 |

| | $ | 6,028 |

| | $ | (4,892 | ) | | $ | (7,548 | ) | | $ | (26,905 | ) | | $ | 21,255 |

|

| Capital expenditures | | $ | 53,824 |

| | $ | 54 |

| | $ | 3,323 |

| | $ | — |

| | $ | 2,112 |

| | $ | 59,313 |

|

| Total assets | | $ | 441,090 |

| | $ | 61,349 |

| | $ | 246,449 |

| | $ | 427,748 |

| | $ | 359,271 |

| | $ | 1,535,907 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | | | | | | | South American

Properties | | | | |

| | | | | | | | | | | | |

| Six Months Ended June 30, 2011 | | Mine Production | | PGM Recycling | | Canadian Properties | | | All Other | | Total |

| Revenues | | $ | 261,713 |

| | $ | 130,953 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 392,666 |

|

| Depletion, depreciation and amortization | | $ | 31,196 |

| | $ | 527 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 31,723 |

|

| Interest income | | $ | — |

| | $ | 919 |

| | $ | — |

| | $ | — |

| | $ | 814 |

| | $ | 1,733 |

|

| Interest expense | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 3,272 |

| | $ | 3,272 |

|

| Income (loss) before income taxes | | $ | 105,399 |

| | $ | 6,339 |

| | $ | (1,040 | ) | | $ | — |

| | $ | (21,987 | ) | | $ | 88,711 |

|

| Capital expenditures | | $ | 36,747 |

| | $ | 64 |

| | $ | 9,350 |

| | $ | — |

| | $ | 134 |

| | $ | 46,295 |

|

| Total assets | | $ | 402,990 |

| | $ | 89,855 |

| | $ | 192,859 |

| | $ | — |

| | $ | 353,233 |

| | $ | 1,038,937 |

|

NOTE 9

INVESTMENTS

The Company classifies the marketable securities in which it invests as available-for-sale securities. These securities are measured at fair market value in the financial statements with unrealized gains or losses recorded in other comprehensive income (loss). At the time the securities are sold or otherwise disposed of, gains or losses are included in net income.

The cost, gross unrealized gains, gross unrealized losses, and fair market value of available-for-sale investment securities by major security type and class of security for the periods ended June 30, 2012 and 2011, are as follows:

|

| | | | | | | | | | | | | | | | | |

| | | Investments |

| | (In thousands) | Cost | | Gross unrealized gains | | Gross unrealized losses | | Fair market value |

| 2012 |

| | | | | | | | |

| | Federal agency notes | $ | 24,523 |

| | | | $ | (154 | ) | | $ | 24,369 |

|

| | Commercial paper | 34,329 |

| | | | (745 | ) | | 33,584 |

|

| | Mutual funds | 1,374 |

| | 137 |

| | | | 1,511 |

|

| | Total | $ | 60,226 |

| | $ | 137 |

| | $ | (899 | ) | | $ | 59,464 |

|

| | | | | | | | | |

| 2011 |

| | | | | | | | |

| | Federal agency notes | $ | 117,261 |

| | | | $ | (295 | ) | | $ | 116,966 |

|

| | Commercial paper | 33,754 |

| | | | (841 | ) | | 32,913 |

|

| | Mutual funds | 1,090 |

| | 179 |

| | | | 1,269 |

|

| | Total | $ | 152,105 |

| | $ | 179 |

| | $ | (1,136 | ) | | $ | 151,148 |

|

| | | | | | | | | |

The mutual funds included in the investment table above are included in Other noncurrent assets on the Consolidated Balance Sheet.

The Company has long-term investments in several Canadian exploration companies, recorded under the cost method. At June 30, 2012, these long-term investments totaled $4.9 million and are recorded in Other noncurrent assets on the Consolidated Balance Sheet.

NOTE 10

INVENTORIES

For purposes of inventory accounting, the market value of inventory is generally deemed equal to the Company’s current cost of replacing the inventory, provided that: (1) the market value of the inventory may not exceed the estimated selling price of such inventory in the ordinary course of business less reasonably predictable costs of completion and disposal, and (2) the market value may not be less than net realizable value reduced by an allowance for a normal profit margin. No adjustments were made to the inventory value in the first six months of 2012 or at December 31, 2011.

The costs of mined PGM inventories as of any date are determined based on combined production costs per ounce and include all inventoriable production costs, including direct labor, direct materials, depreciation and amortization and other overhead costs relating to mining and processing activities incurred as of such date.

The costs of recycled PGM inventories as of any date are determined based on the acquisition cost of the recycled material and include all inventoriable processing costs, including direct labor, direct materials and third party refining costs which relate to the processing activities incurred as of such date.

Inventories reflected in the accompanying balance sheets consisted of the following:

|

| | | | | | | |

| (in thousands) | June 30,

2012 | | December 31,

2011 |

| Metals inventory | | | |

| Raw ore | $ | 1,820 |

| | $ | 1,179 |

|

| Concentrate and in-process | 46,901 |

| | 43,379 |

|

| Finished goods | 49,918 |

| | 66,194 |

|

| | 98,639 |

| | 110,752 |

|

| Materials and supplies | 22,939 |

| | 21,104 |

|

| Total inventory | $ | 121,578 |

| | $ | 131,856 |

|

The Company holds in its possession, materials it processes on a toll basis for customers until the tolled material is transported to a third party refiner.

NOTE 11

EARNINGS PER SHARE

Basic earnings per share is computed by dividing net earnings available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings per share reflect the potential dilution that could occur if the Company’s dilutive outstanding stock options or nonvested shares were exercised or vested and the Company’s convertible debt was converted. Reported net income was adjusted for the interest expense (including amortization expense of deferred debt fees) and the related income tax effect for the convertible debentures for the three- month period ended June 30, 2012 and for the three- and six-month periods ended June 30, 2011. The Company currently has only one class of equity shares outstanding.

A total of 48,919 and 78,418 stock option weighted shares of common stock were included in the computation of diluted earnings per share for the three- month periods ended June 30, 2012 and 2011, respectively. Outstanding options to purchase 63,643 and 96,671 of weighted shares of common stock were included in the computation of diluted earnings per share for the six- month periods ended June 30, 2012 and 2011, respectively. Outstanding options to purchase 123,559 and 54,302 of weighted shares of common stock were excluded from the computation of diluted earnings per share for the three- month periods ended June 30, 2012 and 2011, respectively, and outstanding options to purchase 125,980 and 70,745 of weighted shares of common stock were excluded from the computation of diluted earnings per share for the six- month periods ended June 30, 2012 and 2011, respectively, because the market price at the end of each period was lower than the exercise price, and therefore the effect would have been antidilutive.

The effect of including outstanding nonvested shares was to increase diluted weighted average shares outstanding by 905,205 and 925,254 shares for the three- month periods ended June 30, 2012 and 2011, respectively. A total of 922,280 and 1,057,452 outstanding nonvested shares were included in the computation of diluted earnings per share for the six- month periods ended June 30, 2012 and 2011, respectively.

All 7.1 million shares of common stock applicable to the outstanding convertible debentures were included in the computation of diluted weighted average shares in the three- month period ended June 30, 2012 and in the three- and six- month periods ended June 30, 2011. All 7.1 million shares of common stock applicable to the outstanding convertible debentures were excluded in the computation of diluted weighted average shares in the six- month period ended June 30, 2012, because the net effect of assuming all the debentures were converted would have been antidilutive.

Reconciliations showing the computation of basic and diluted shares and the related impact on income for the three- month period ended June 30, 2012 and the three- and six- month periods ended June 30, 2011 are shown in the following table:

|

| | | | | | | | | | |

| | Three Months Ended |

| (in thousands, except per share amounts) | June 30, 2012 |

| | Income (Numerator) | | Weighted Average Shares (Denominator) | | Per Share Amount |

| Basic EPS | | | | | |

| Net income attributable to common stockholders | 18,200 |

| | 115,819 |

| | $ | 0.16 |

|

| Effect of Dilutive Securities | | | | | |

| Stock options |

|

| | 49 |

| | |

| Nonvested shares | — |

| | 905 |

| | |

| 1.875% Convertible debentures | 994 |

| | 7,082 |

| | |

| Diluted EPS | | | | | |

| Net income attributable to common stockholders + assumed conversions | $ | 19,194 |

| | 123,855 |

| | $ | 0.15 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| (in thousands, except per share amounts) | June 30, 2011 | | June 30, 2011 |

| | Income (Numerator) | | Weighted Average Shares (Denominator) | | Per Share Amount | | Income (Numerator) | | Weighted Average Shares (Denominator) | | Per Share Amount |

| Basic EPS | | | | | | | | | | | |

| Net income attributable to common stockholders | 42,698 |

| | 103,037 |

| | $ | 0.41 |

| | 78,890 |

| | 102,688 |

| | $ | 0.77 |

|

| Effect of Dilutive Securities | | | | | | | | | | | |

| Stock options | — |

| | 79 |

| | | | — |

| | 97 |

| | |

| Nonvested shares | — |

| | 925 |

| | | | — |

| | 1,057 |

| | |

| 1.875% Convertible debentures | 994 |

| | 7,082 |

| | | | 1,987 |

| | 7,082 |

| | |

| Diluted EPS | | | | | | | | | | | |

| Net income attributable to common stockholders + assumed conversions | $ | 43,692 |

| | 111,123 |

| | $ | 0.39 |

| | $ | 80,877 |

| | 110,924 |

| | $ | 0.73 |

|

NOTE 12

FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants and also establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The fair value hierarchy distinguishes three levels of inputs that may be utilized when measuring fair value: Level 1 inputs (using quoted prices in active markets for identical assets or liabilities), Level 2 inputs (using external inputs other than Level 1 prices, such as quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability) and Level 3 inputs (unobservable inputs supported by little or no market activity based on internal assumptions used to measure assets and liabilities). The classification of each financial asset or liability within the above hierarchy is determined based on the lowest level input that is significant to the fair value measurement.

Financial assets and liabilities measured at fair value on a recurring basis at June 30, 2012 and December 31, 2011, consisted of the following:

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | Fair Value Measurements |

| At June 30, 2012 | | Total | | Level 1 | | Level 2 | | Level 3 |

| Mutual funds | | $ | 1,511 |

| | $ | 1,511 |

| | $ | — |

| | $ | — |

|

| Investments | | | | | | | | |

| Federal agency notes | | $ | 24,369 |

| | $ | 24,369 |

| | $ | — |

| | $ | — |

|

| Commercial paper | | $ | 33,584 |

| | $ | 33,584 |

| | $ | — |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | Fair Value Measurements |

| At December 31, 2011 | | Total | | Level 1 | | Level 2 | | Level 3 |

| Mutual funds | | $ | 1,279 |

| | $ | 1,279 |

| | $ | — |

| | $ | — |

|

| Investments | | | | | | | | |

| Federal agency notes | | $ | 18,621 |

| | $ | 18,621 |

| | $ | — |

| | $ | — |

|

| Commercial paper | | $ | 30,912 |

| | $ | 30,912 |

| | $ | — |

| | $ | — |

|

The fair value of mutual funds and investments is based on market prices which are readily available. Unrealized gains or losses on mutual funds and investments are recorded in Accumulated other comprehensive loss on the Consolidated Balance Sheet.

Financial assets and liabilities measured at fair value on a nonrecurring basis at June 30, 2012, and December 31, 2011, consisted of the following:

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | Fair Value Measurements |

| At June 30, 2012 | | Total | | Level 1 | | Level 2 | | Level 3 |

| Convertible debentures | | $ | 164,523 |

| | $ | — |

| | $ | 164,523 |

| | $ | — |

|

| Exempt facility revenue bonds | | $ | 27,900 |

| | $ | — |

| | $ | — |

| | $ | 27,900 |

|

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | Fair Value Measurements |

| At December 31, 2011 | | Total | | Level 1 | | Level 2 | | Level 3 |

| Convertible debentures | | $ | 160,256 |

| | $ | — |

| | $ | 160,256 |

| | $ | — |

|

| Exempt facility revenue bonds | | $ | 27,269 |

| | $ | — |

| | $ | — |

| | $ | 27,269 |

|

The Company used implicit interest rates of comparable unsecured obligations to calculate the fair value of the Company’s $30 million 8% Series 2000 exempt facility industrial revenue bonds at June 30, 2012, and December 31, 2011. The Company used its current trading data to determine the fair value of the Company’s $166.5 million 1.875% convertible debentures at June 30, 2012, and December 31, 2011.

NOTE 13

RELATED PARTIES

The Palladium Alliance International (PAI) promotes palladium in the worldwide jewelry market. Currently, the PAI receives its funding from the Company. In the second quarter of 2012, the Company made contributions of $3.5 million compared to $2.6 million contributed in the same period in 2011. In the first six months of 2012 and 2011, the Company made contributions of $5.7 million and $3.4 million, respectively. The Company records these contributions as marketing expense.

ITEM 2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The commentary that follows should be read in conjunction with the consolidated financial statements included in this quarterly report and with the information provided in the Company's March 31, 2012 Quarterly Report on Form 10-Q and in the Company’s 2011 Annual Report on Form 10-K.

Overview

Stillwater Mining Company (the “Company”) is a Delaware corporation, headquartered in Billings, Montana and is listed on the New York and Toronto Stock Exchanges under the symbols SWC and SWC.U, respectively. The Company mines, processes, refines and markets palladium and platinum ores from two underground mines situated within the J-M Reef, an extensive trend of PGM mineralization located in Stillwater and Sweet Grass Counties in south central Montana. Ore produced from each of the mines is crushed and concentrated in mills located at each mine site. The resulting ore concentrates are then trucked to the Company’s smelting and refining complex in Columbus, Montana which further processes the mine concentrates and also recycles spent catalyst materials received from third parties. A portion of the recycling material is purchased for the Company’s own account and the balance is toll processed on behalf of others. The finished product from the refinery is a PGM-rich filter cake which is shipped to third parties for final refining into finished metal.

In recent years, the Company has taken steps to diversify its position as a primary PGM producer serving a single principal market from production derived solely from the J-M Reef in Montana. In November 2010, the Company completed the acquisition of Marathon PGM Corporation (Marathon). Marathon is a Canadian exploration company with an advanced-stage PGM-copper development project situated near the north shore of Lake Superior in the province of Ontario, Canada. The Marathon project team recently submitted an Environmental Impact Statement (EIS) report and supporting technical documents to the Canadian Environmental Assessment Agency and the Ontario Ministry of the Environment. The environmental assessment and technical analysis will be conducted through a joint panel review with a panel recommendation ultimately going to the Federal and Provincial Ministers of the environment for decision-making. Subsequent to this decision, the Company will continue with detailed engineering work in an effort to support the environmental assessment process and future permitting efforts at the provincial level. Recent changes to the Canadian Environmental Assessment Act are currently being reviewed by management in order to assess regulatory intent and the potential to influence the permitting process.

In a further diversification step, during October 2011, the Company completed the acquisition of Peregrine Metals Ltd., a Canadian exploration company (Peregrine) that owns the Altar copper-gold discovery, located in the San Juan province of Argentina. Altar is an exploration-stage property with initial drilling in place that indicates the presence of a large copper-gold porphyry deposit and an ancillary gold discovery. The Company is conducting further exploratory drilling seasonally on the Altar property to determine its economic potential and the limits of the deposit. Additional years of drilling will likely be needed in order to complete this evaluation.

The Company also is in the midst of developing two new mining areas adjacent to its current operations along the J-M Reef. The larger of the two, the Blitz project, eventually will extend underground access eastward from the existing Stillwater Mine infrastructure by about four-and-a-half miles on two separate levels. One of these development headings will be driven with a new tunnel-boring machine, recently leased and currently being installed in the mine. The other parallel heading will be driven above the first using conventional drill and blast methods. A new surface access intersecting this new development is also planned in order to provide adequate ventilation for the resulting work area. Total cost of the Blitz project is estimated at $180 million, to be spent over a total of about five years (commencing in 2011). The second project, Graham Creek, will extend to the west from the existing East Boulder Mine infrastructure about one-and-a-half miles on a single level. The initial cost of this extension, with associated ventilation, will be about $8 million, to be spent over a total of about four years.

The Company is dependent on cash flow from its PGM activities to sustain ongoing operations, as well as to fund the Montana mine expansion initiatives and the exploration and delineation work associated with the Marathon and Altar projects. The Marathon project, and the Altar project if it ultimately should prove to be commercial, will require substantial capital for the development of mines and corollary infrastructure. In the absence of completed engineering feasibility studies, the cost of these facilities cannot be estimated with precision today. Internally generated cash flows will fund the development of Marathon and Altar, however the Company expects that financing from the capital markets or third parties would also be required to undertake construction of these projects. The availability of such financing will depend on future market conditions and opportunities.

In this regard, the Company recently announced a sale to Mitsubishi Corporation of a 25% interest in the Company's wholly owned subsidiary, Stillwater Canada Inc., which owns the Marathon project and related properties. As a result, Mitsubishi will also assume its commensurate share of future Marathon funding commitments. The Mitsubishi transaction may also facilitate securing future financing for the Marathon development. The Marathon and Altar properties provide the Company with the opportunity and flexibility to pursue one or both of these growth initiatives in the future, as metal prices and market conditions may permit. The Company does not currently expect to commit substantial capital to the Altar project until such time as additional delineation, engineering and feasibility studies are complete. For the first six months of 2012, capital, exploration and cash overhead costs for Marathon activities (100% basis) totaled about $5.5 million. Exploration expenses and cash overhead costs for the Peregrine properties (primarily Altar) totaled $14.3 million in the first six months of 2012.

In accordance with U.S. generally accepted accounting principles, the Company is required to expense all exploration costs as incurred. Previously, the Company had not incurred significant exploration costs but with the onset of significant exploratory activity at Altar and a limited exploration program in the Marathon area, the Company is expensing these costs currently against income. Taking into account the effect of these exploration expenses in reducing net income for the foreseeable future, shareholders should recognize that the Company is seeking to add long term value through its exploration efforts. Nevertheless, in view of the inherently early-stage nature of these efforts, there is no assurance that the Company's exploration programs will lead to economically viable mining operations.

Company Priorities and Financing

The Company's various development projects will require significant commitments of capital over the next several years. Total capital spending planned for 2012 is about $135 million, up from $104.1 million (less $2.2 million in accounts payable) in 2011 and $50 million in 2010. In addition to its capital program, the Company has allocated almost $27 million for 2012 exploration activities at Altar and Marathon. Following a significant rise in commodity prices over the last few years, prices have fallen in recent months. The Company has not been immune, as PGM prices have also decreased. Many companies have announced a reduction in their capital expenditure programs. As discussed below, the Company is monitoring its spending closely. The Company may have to make adjustments such as deferring or extending certain spending commitments. While it is not yet clear whether the Company's 2012 spending in total will reach these budgeted levels, the rate of spending during the first half of the year suggests it may be fairly close. The remaining 2012 spending at Altar will include completing metallurgical analysis related to the 2011-2012 drilling season, along with fourth quarter Altar spending for mobilization and initial drilling costs related to the 2012-2013 drilling season there. Marathon spending will likely accelerate in the second half of 2012. Other capital spending overall is expected to remain fairly level.

The table below shows budgeted spending by project for 2012 and total expenditures by project during the first six months of 2012.

|

| | | | | | | |

| (in millions) | Full Year 2012 Budget | | Six Months Ended June 30, 2012 Actual Expenditures |

| Existing Operations | $ | 90.0 |

| | $ | 42.1 |

|

| Blitz and Graham Creek projects | 23.4 |

| | 14.3 |

|

| Marathon project | 21.3 |

| | 3.2 |

|

| Subtotal – Capital | $ | 134.7 |

| | $ | 59.6 |

|

| All Exploration | 26.6 |

| | 12.1 |

|

| Total | $ | 161.3 |

| | $ | 71.7 |

|

With regard to future spending requirements, the Company has indicated that the total capital cost of the Blitz and Graham Creek projects will be on the order of $188 million to be spent over about a five-year period (commencing in 2011). Preliminary estimates of the total cost to develop the Marathon project and place it into production suggest it will likely be in the range of $550 to $650 million, with major construction spending beginning in the year 2014 and first production currently targeted for mid-year 2016. Note, with the sale of the 25% interest in the Marathon properties to Mitsubishi Corporation, the Company's share of future capital spending at Marathon will be reduced from the 2010 estimated $550 to $650 million range (to first production) down to approximately $400 to $500 million. Exploration at the Altar property has been projected to be on the order of $25 million per year for three years with the first of those being 2012, although continuing at this level of spending will be evaluated following each drill season. The level of sustaining capital for the Company's existing operations is expected to remain in the range of $80 to $90 million per year.

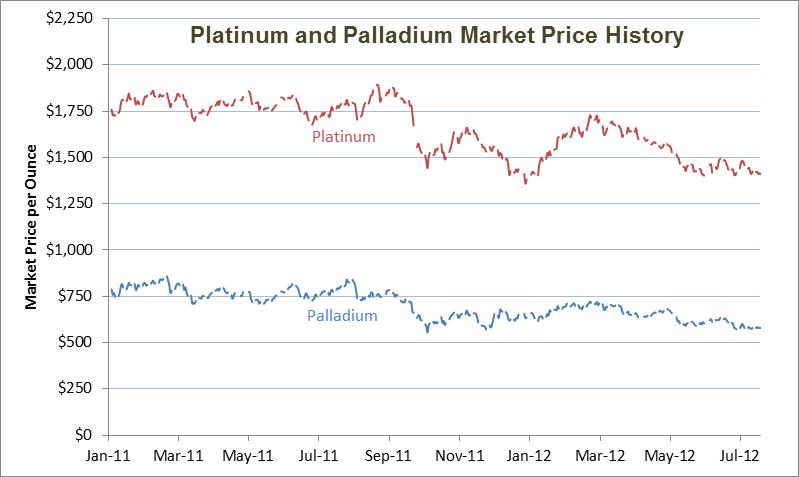

Market prices for palladium and platinum averaged $656 and $1,555 per ounce, respectively, during the first six months of 2012, resulting in EBITDA (before exploration expense) for the first six months of 2012 of about $65.6 million. Sale of a 25% interest in the Marathon property to Mitsubishi during the second quarter generated $94.9 million of additional cash, of which $51.8 million was contributed into Marathon to pre-fund future development activities there; the remaining $43.1 million remains as available cash to the Company. Late in the second quarter, the Company reached an agreement to lease the tunnel-boring machine to be utilized at the Blitz project and was reimbursed $7.2 million to cover progress payments previously paid by the Company. As of June 30, 2012, the Company's consolidated balance of cash and highly liquid short-term securities totaled $255.1 million, including $49.7 million of cash dedicated to the Marathon project and therefore unavailable for other corporate purposes.

The U.S. dollar strengthened significantly during the second quarter of 2012, and consequently market prices for palladium and platinum (along with many other commodities) have declined significantly from their first-half 2012 averages. As of June 29, 2012, palladium was quoted in London at $578 per ounce and platinum at $1,428 per ounce. If these lower prices continue, they will put pressure on the Company to restrain its project spending. With the exception of the Marathon project, which is intended to be financed at least in part externally, all of the Company's near-term capital spending is planned to come out of cash flow from operations. Continued weakness in commodity prices during the second half of 2012 and into 2013 could result in deferral of some of the Company's planned capital and exploration expenditures.

Although the Company currently has a comparatively strong cash position, a number of factors weigh against drawing down cash balances. First, the Company has $166.5 million of outstanding convertible debentures that are likely to be redeemed at par by the holders in March of 2013. While the Company is considering refinancing these debentures, current market conditions are not particularly attractive, and management prefers to preserve the option to pay off the debentures from its cash reserves in the event market conditions do not improve in the interim. Second, several of the Company's projects provide flexibility with regard to the timing of project expenditures if PGM prices decline for an extended period. While reductions in spending for sustaining capital at the existing mines would come last and hopefully be minimal, spending on the Blitz and Altar projects can be tailored to accommodate available cash. The Marathon project would be more difficult to cut back, but spending requirements for the remainder of 2012 and most of 2013 have already been pre-funded. Third, the cyclical nature of the Company's commodity business suggests it is prudent to maintain enough liquidity on hand in an effort to carry the Company through a downturn. In that vein, the Company also maintains a $125 million asset-backed revolving line of credit, some portion of which can be drawn upon to support working capital needs. Available capacity under this line at June 30, 2012, was approximately $64 million.

The sale of the 25% interest in the Marathon properties to Mitsubishi Corporation suggests that the Company's share of future capital spending at Marathon will be reduced from the 2010 estimated $550 to $650 million range (to first production) down to $400 to $500 million. Various financing avenues for Marathon are currently being explored, with the final capital structure decision probably remaining open at least until completion of the Marathon definitive engineering study and the panel review of the project's environmental assessment, both of which are now underway. Financing avenues under consideration include accessing the public debt markets. Project financing including, governmental lending sources, equipment financing, and utilizing internally generated cash flows. The availability and form of any future financing will depend on future market conditions and opportunities. There can be no assurance that the financial markets will be receptive to any offerings or that terms of other financing alternatives will be deemed acceptable. Any determination to proceed with construction and development of the Marathon project is expected to be made only when it is clear that the economics support such steps and commitments are in place with respect to the requisite financing.

Second Quarter 2012

For the second quarter of 2012, the Company reported consolidated net income attributable to common stockholders of $18.2 million, or $0.15 per fully diluted share, a decrease from the $42.7 million, or $0.39 per fully diluted share, reported in the second quarter 2011. The lower earnings reflect lower PGM prices and higher consolidated total cash costs.