UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2011. |

OR

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission File Number 1-13053

STILLWATER MINING COMPANY

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 81-0480654 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1321 DISCOVERY DRIVE, BILLINGS, MONTANA 59102

(Address of principal executive offices and zip code)

(406) 373-8700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

TITLE OF EACH CLASS | | NAME OF EACH EXCHANGE ON WHICH REGISTERED |

| Common Stock, $0.01 par value | | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). x YES ¨ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ YES x NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x YES ¨ NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). ¨ YES x NO

As of June 30, 2011, assuming a price of $22.01 per share, the closing sale price on the New York Stock Exchange, the aggregate market value of shares of voting and non-voting common equity held by non-affiliates was approximately $2.2 billion.

As of February 14, 2012, the Company had outstanding 115,559,388 shares of common stock, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required in Part III of this Annual Report on Form 10-K is incorporated herein by reference to the registrant’s Proxy Statement for its 2012 Annual Meeting of Stockholders.

TABLE OF CONTENTS

GLOSSARY OF SELECTED MINING TERMS

The following is a glossary of selected mining terms used in the United States and Canada and referenced in the Form 10-K that may be technical in nature:

| | |

| Adit | | A horizontal tunnel or drive, open to the surface at one end, which is used as an entrance to a mine. |

| |

| Anorthosite | | Igneous rock composed almost wholly of the mineral plagioclase feldspar. |

| |

| Assay | | The analysis of the proportions of metals in ore, or the testing of an ore or mineral for composition, purity, weight, or other properties of commercial interest. |

| |

| Base metal refinery | | A processing facility designed to extract base metals such as copper and nickel from the product stream. The Company’s base metal refinery receives PGM-rich matte material from the smelter, chemically extracts copper, nickel, residual iron and small amounts of other minerals as by-products from the matte, and then ships the remaining filtercake material to third-party precious metal refiners for final processing. |

| |

| Catalysts | | Catalysts are materials that facilitate one or more chemical reactions without being consumed in the reaction themselves. As referenced in this report, platinum group metals serve as catalysts within the catalytic converters used in automotive exhaust and pollution control systems and, where so indicated, within similar applications in petroleum refining or other chemical processes. |

| |

| Close-spaced drilling | | The drilling of holes designed to extract representative samples (“cores”) of rock and assess the mineralization in a target area. |

| |

| Concentrate | | A mineral processing product that generally describes the material that is produced after crushing and grinding ore, effecting significant separation of gangue (waste) minerals from the metal and/or metal minerals, and discarding the waste and minor amounts of metal and/or metal minerals. The resulting “concentrate” of metal and/or metal minerals typically has an order of magnitude higher content of metal and/or metal minerals than the beginning ore material. |

| |

| Crystallize | | Process by which matter becomes crystalline (solid) from a gaseous, fluid or dispersed state. The separation, usually from a liquid phase on cooling, of a solid crystalline phase. |

| |

| Cut-off grade | | The lowest grade of mineralized material that qualifies as ore in a given deposit. The grade above which minerals are considered economically mineable considering the following parameters: estimates over the relevant period of mining costs, ore treatment costs, smelting and refining costs, process and refining recovery rates, royalty expenses, by-product credits, general and administrative costs, and PGM prices. |

| |

| Decline | | A gently sloped underground excavation constructed for purposes of moving mobile equipment, materials, supplies or personnel from surface openings to deeper mine workings or as an alternative to hoisting in a shaft for mobilization of equipment and materials between mine levels. |

| |

| Dilution | | An estimate of the amount of waste or low-grade mineralized rock which will be mined with the ore as part of normal mining practices in extracting an ore body. |

| |

| Diamond Drilling | | Diamond Drilling is a specialized form of boring holes typically used in defining a mineral deposit which allows for the recovery of core for support of geologic characterization, grade determination and metallurgical testing. |

| |

| Drift | | A major horizontal access tunnel used for the transportation of ore or waste. |

| |

| Ductility | | Property of a solid material that undergoes more or less plastic deformation before it ruptures. The ability of a material to stretch without fracturing. |

| |

| Fault | | A geologic fracture or a zone of fractures along which there has been displacement of the sides relative to one another parallel to the fracture. |

| |

| Filter cake | | The PGM-bearing product that is shipped from the Company’s base metal refinery to a third-party toll refinery for the final extractive stages in the refining process. |

2

| | |

Footwall | | The underlying side of a fault, ore body, or mine working; especially the wall rock beneath an inclined vein, fault, or reef. |

| |

Gabbro rocks (See Mafic/Ultramafic) | | A group of dark-colored igneous rocks composed primarily of the minerals plagioclase feldspar and clinopyroxene, with minor orthopyroxene. |

| |

Gangue material | | The non-metalliferous or waste metalliferous mineral in the ore. |

| |

Grade | | The average metal content, as determined by assay of a volume of ore. For precious metals, grade is normally expressed as troy ounces per ton of ore or as grams per metric tonne of ore. |

| |

Gram | | A metric unit measure of mass. Grades of precious metals for palladium, platinum, gold and silver outside the United States usually are reported in grams/tonne. A gram is equal to about 0.032 troy ounces. |

| |

Hanging wall | | The overlying side of a fault, ore body, or mine working; especially the wall rock above an inclined vein, fault, or reef. (Compare “footwall.”) |

| |

Hectare | | A metric unit measure of area. One hectare is equivalent to about 2.47 acres. |

| |

Hoist | | See shaft. |

| |

Jackleg drill | | A manually operated rock drill, generally powered by compressed air, used to drill holes for blasting rock and to install ground support hardware. |

| |

Kilometer | | A metric unit measure of distance. One kilometer is equivalent to about 0.62 statute miles. |

| |

Lenticular-shaped | | Resembling in shape the cross section of a double-convex lens. |

| |

Load-haul-dump | | A vehicle used underground to scoop up mined material and move it to a central collection or discharge point. Generally called an “LHD” by miners. |

| |

Lode claims | | Claims to the mineral rights along a lode (vein) structure of mineralized material on Federal land; typically in the U.S. lode claims are 1,500 feet in length and 600 feet wide along the trend of the mineralized material. |

| |

Mafic rocks | | Igneous rocks composed chiefly of dark, ferromagnesian minerals in addition to lighter-colored feldspars. |

| |

Matte | | See “PGM-rich matte”. |

| |

Matrix | | The finer-grained material between the larger particles of a rock or the material surrounding mineral particles. |

| |

Meter | | A metric unit measure of length. One meter is equivalent to about 3.28 feet. |

| |

Mill | | A processing plant that produces a concentrate of the valuable minerals or metals contained in an ore. The concentrate must then be treated in some other type of plant, such as a smelter, to effect recovery of the pure metal. Term used interchangeably with concentrator. |

| |

Mill site claims | | Claiming of Federal land for mill site purposes or other operations connected with mining lode claims. Used for non-mineralized land not necessarily contiguous with the vein or lode. |

| |

Mineral beneficiation | | A treatment process separating the valuable minerals from the host material. |

| |

Mineral deposit | | Geologic term measuring an aggregate of a mineral or metal in an unusually high concentration. The term deposit does not distinguish whether the mineral can be extracted economically. |

| |

Mineralization | | The concentration of metals and their compounds in rocks, and the processes involved therein. |

3

| | |

Mineralized material | | A mineralized body which has been delineated by appropriately spaced drilling and/or underground sampling to support a general estimate of available tonnage and average grade of metals. Such a deposit does not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility. |

| |

Mouat Agreement | | Mining and Processing Agreement dated March 16, 1984 regarding the Mouat family. The Mouat royalty stems back to the formation of Stillwater Mining Company at which time claims staked by the Mouats’ forebears in 1876 were leased to Stillwater Mining Company. |

| |

Net Smelter Return (NSR) | | A payment made by a producer of metals based on the value of the gross metal production from the property, less deduction of certain limited costs including smelting, refining, transportation and insurance costs. |

| |

Net smelter royalty | | A share of revenue paid by the Company to the owner of a royalty interest generally calculated based on the imputed value of the PGM concentrate delivered to the smelter. For Stillwater Mining Company’s Montana operations, royalties are calculated on the mineral production subject to each royalty as a percentage of the revenue received by the Company after deducting treatment, refining and transportation charges paid to third parties, and certain other costs incurred in connection with processing the concentrate at the Columbus smelter. |

| |

Norite | | Coarse-grained igneous rock composed of the minerals plagioclase feldspar and orthopyroxene. |

| |

Ore | | That part of a mineral deposit which could be economically and legally extracted or produced at the time of reserve determination. |

| |

Outcrop | | The part of a rock formation that appears at the earth’s surface often protruding above the surrounding ground. |

| |

PGM | | The platinum group metals collectively and in any combination of palladium, platinum, rhodium, ruthenium, osmium, and iridium. Reference to PGM grades for the Company’s mine operations include measured quantities of palladium and platinum only. References to PGM grades associated with recycle materials typically include palladium, platinum and rhodium. |

| |

PGM-rich matte | | Matte is an intermediate product of smelting; an impure metallic sulfide mixture made by melting sulfide ore concentrates. PGM rich matte is a matte with an elevated level of platinum group metals. |

| |

Porphyry | | A copper porphyry is igneous rock containing large crystals known as phenocrysts embedded in a fine-grained matrix containing copper, copper sulfides, and potential lesser amounts of other metals and minerals. Porphyry copper deposits contain disseminated mineralization meaning that a large volume of shattered rock contains a branching network of tiny quartz veins, spaced only a few centimeters apart, in which grains of the copper ore minerals chalcopyrite and bomite occur with pyrite. Commercial copper porphyry deposits typically are low grade (1% copper or less), but can be very large. The majority of all copper mined today is produced from porphyry deposits. |

| |

Probable (indicated) reserves | | Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| |

Proven (measured) reserves | | Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established. |

| |

Recovery | | The percentage of contained metal actually extracted from ore in the course of processing such ore. |

4

| | |

Reef | | A layer precipitated within the Stillwater Layered Igneous Complex enriched in platinum group metal-bearing minerals, chalcopyrite, pyrrhotite, pentlandite, and other sulfide materials. The J-M Reef, which the Company mines, occurs at a regular stratigraphic position within the Stillwater Complex. Note: this use of “reef” is uncommon and originated in South Africa where it is used to describe the PGM-bearing Merensky, UG2, and other similar layers in the Bushveld Complex. |

| |

Refining | | The final stage of metal production in which residual impurities are removed from the metal. |

| |

Reserves | | That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

| |

Recycling materials | | Spent PGM-bearing materials collected for reprocessing from automotive, petroleum, chemical, medical, food and other catalysts. Additionally, PGMs for recycling may be sourced from scrap electronics and thermocouples, old jewelry and materials used in manufacturing glass. |

| |

Scrubber | | A treatment system for industrial waste gases that extracts environmentally deleterious components prior to venting to the atmosphere. The Company’s scrubber system at the smelter and base metal refinery primarily removes sulfur dioxide – which is converted in the scrubber into environmentally benign gypsum (calcium sulfate) – and captures any particulates in the stack gas. |

| |

Shaft | | A vertical or steeply inclined excavation for the purposes of opening and servicing an underground mine. It is usually equipped with a hoist at the top which lowers and raises a conveyance for handling personnel and materials. |

| |

Slag | | Slag is a nonmetallic product resulting from the mutual dissolution of flux and nonmetallic impurities during smelting. A silica rich slag is a smelting slag that contains a relatively high level of silica. |

| |

Sill | | (1) With respect to a mine opening, the base or floor of the excavated area (stope); (2) With respect to intrusive rock, a tabular intrusive unit that is conformable with surrounding rock layers. |

| |

Slusher | | (1) An electric double-drum winch with two steel ropes attached to an open-bottomed scoop that transports (drags) ore from the rock face to a loading point, where the ore is discharged. (2) A very selective mining method in which small ore stopes are mined using a slusher. |

| |

Smelting | | Heating ore or concentrate material with suitable flux materials at high temperatures creating a fusion of these materials to produce a melt consisting of two layers, with a slag of the flux and gangue (waste) minerals on top and molten impure metals below. This generally produces an unfinished product (matte) requiring refining. |

| |

Sponge | | A granular (shot) form of PGM. Commonly, the form required for manufacture of many PGM-based chemicals and catalysts. |

| |

Stope | | A localized area of underground excavation from which ore is extracted. |

| |

Strike | | The course, direction or bearing of a vein or a layer of rock. |

| |

Tailings | | That portion of the mined material that remains after the valuable minerals have been extracted. |

| |

TBRC | | A “top-blown rotary converter,” a rotating furnace vessel which processes PGM-rich matte received from the smelter furnace, removing iron from the molten material by injecting a stream of oxygen. This process converts iron sulfides into an iron oxide slag which floats to the surface for separation. |

| |

Tonne | | A metric unit measure used in the mining industry. One tonne is equal to 1,000 kilograms, about 1.102 short tons or 2204.6 pounds. Production volumes outside the United States usually are reported in tonnes. |

| |

Tolling | | Processing of material owned by others for a fee without taking title to the material. |

5

| | |

Troy ounce | | A unit measure used in the precious metals industry. A troy ounce is equal to about 31.103 grams. The amounts of palladium and platinum produced and/or sold by the Company are reported in troy ounces. There are 12 troy ounces to a troy pound and 32,150.7 troy ounces in a metric tonne. |

| |

Tunnel Boring Machine (TBM) | | A machine that is typically used to excavate tunnels with a circular cross section through a variety of rock strata over long relatively straight horizontal distances. The TBM bores through anything from hard rock to sand. |

| |

Ultramafic rocks | | Igneous rocks composed chiefly of dark, ferromagnesian minerals in the absence of significant lighter-colored feldspars. |

| |

Vein | | A mineralized zone having regular development in length, width and depth that clearly separates it from neighboring rock. |

| |

Wall rock | | The rock adjacent to, enclosing, or including a vein, layer, or dissemination of ore minerals. See “Hanging wall” and “Footwall” above. |

6

PART I

ITEMS 1, 1A, AND 2

BUSINESS, RISK FACTORS AND PROPERTIES

INTRODUCTION

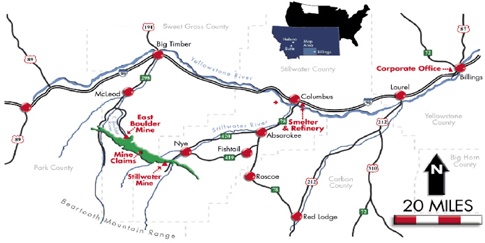

Stillwater Mining Company (the Company) is engaged in the development, extraction, processing, smelting, refining and marketing of palladium, platinum and associated metals (platinum group metals or PGMs) from a geological formation in south-central Montana known as the J-M Reef and from the recycling of spent catalytic converters. The Company is also engaged in expanding its mining operations on the J-M Reef, developing its Marathon PGM/copper property adjacent to Lake Superior in the province of Ontario, Canada and advancing the exploration of its Altar copper/gold property in the province of San Juan Argentina.

The J-M Reef is the only known significant primary source of platinum group metals inside the United States and one of the significant resources outside South Africa and the Russian Federation. Associated by-product metals at the Company’s operations include significant amounts of nickel and copper and minor amounts of gold, silver and rhodium. The J-M Reef is a narrow but extensive mineralized zone containing PGMs, which has been traced over a strike length of approximately 28 miles.

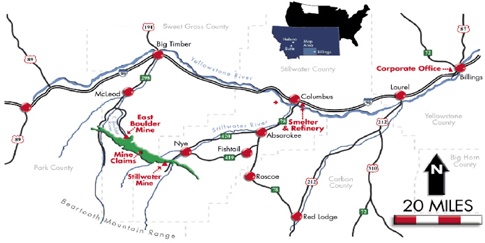

The Company conducts mining operations at the Stillwater Mine near Nye, Montana and at the East Boulder Mine southeast of Big Timber, Montana. Ore extraction at both mines takes place within the J-M Reef. The Company operates concentrating plants at each mining operation to upgrade the mined production into a concentrate form. The Company operates a smelter and base metal refinery at Columbus, Montana which further upgrades the mined concentrates into a PGM-rich filter cake. The filter cake is shipped to third-party custom refiners for final refining before the contained PGMs are sold to third parties.

In the fourth quarter of 2010, the Company announced two new expansion projects along the J-M Reef. The first of these, known as the Blitz project, will develop new underground drifts on two levels from the current Stillwater Mine toward the eastern extremity of the reef. The other project, known as Graham Creek, will develop about 8,200 feet toward the west from the existing East Boulder Mine infrastructure, using a tunnel-boring machine (TBM).

Besides processing mine concentrates, the Company also recycles spent catalyst material acquired from third parties at the smelter and base metal refinery to recover the contained PGMs – palladium, platinum and rhodium. The Company currently has catalyst sourcing arrangements with various suppliers who ship spent catalysts to the Company for processing. The Company smelts and refines the spent catalysts within the same process stream as the mine concentrates. The Company both purchases recycling materials for its own account and processes them on behalf of others for a fee.

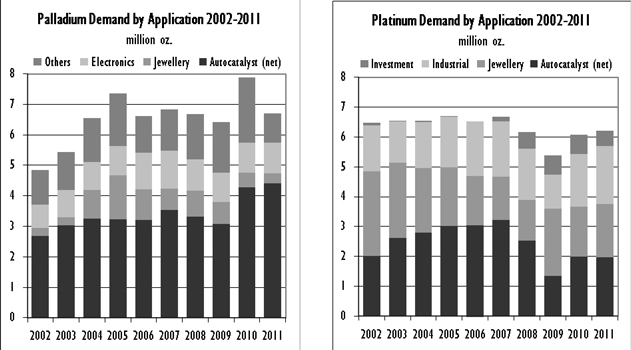

PGMs are rare precious metals with unique physical properties that are used in diverse industrial applications and in jewelry. The largest use for PGMs currently is in the automotive industry for the production of catalytic converters that reduce harmful automobile emissions. Besides being used in automotive applications, palladium is used in jewelry, in the production of electronic components for personal computers, cellular telephones and facsimile machines, as well as in dental applications and in petroleum and industrial catalysts. Platinum’s largest use after catalytic converters is for jewelry. Industrial uses for platinum, in addition to automobile and industrial catalysts, include the manufacturing of data storage disks, fiberglass, paints, nitric acid, anti-cancer drugs, fiber optic cables, fertilizers, unleaded and high-octane gasoline and fuel cells. Rhodium, produced in the Company’s recycling operations and to a limited extent as a by-product from mining, also is used in automotive catalytic converters to reduce nitrogen oxides and in jewelry as a plating agent to provide brightness.

In an effort to address its singular risk profile as a primary PGM producer serving one principal market from production derived solely from the J-M Reef in Montana, in November 2010 the Company completed the acquisition of Marathon PGM Corporation (Marathon). Marathon is a Canadian exploration company with an advanced-stage PGM development project situated near the north shore of Lake Superior in the province of Ontario, Canada. The Marathon project has anticipated annual production potential of about 200,000 ounces of PGMs and 37 million pounds of copper.

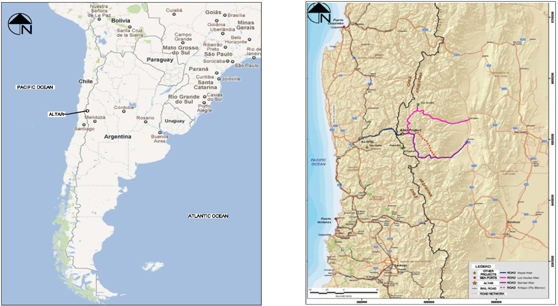

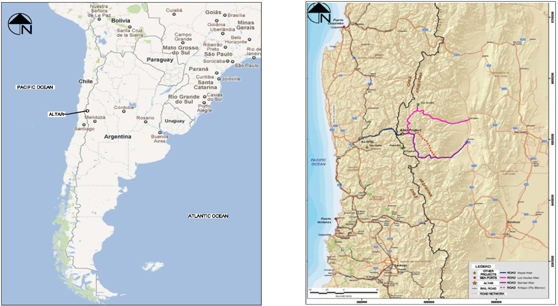

In a further diversification move, on October 4, 2011, the Company completed the acquisition of Peregrine Metals Ltd., a Canadian exploration company (Peregrine) that owns the Altar copper-gold discovery, located in the San Juan province of Argentina. In completing the acquisition, the Company paid a total of $166.4 million (net of cash acquired) in cash and issued 12.03 million Stillwater common shares. Altar is an exploration-stage property with initial drilling in place that indicates the presence of a large copper-gold porphyry deposit and an ancillary gold discovery. The Company intends to expand delineation drilling on the property by spending about $25.0 million per year for three drilling seasons in order to better define the resource. Once the drilling is completed, the Company plans to undertake a detailed engineering study addressing how best to develop the deposit should the economics at that point support proceeding.

7

Despite Peregrine’s endowment of copper and gold, the central importance of PGM’s to the Company should not change for the foreseeable future. The Company is dependent on cash flow from its PGM activities to sustain ongoing operations, as well as to fund the Montana mine expansion initiatives and the delineation work associated with the Marathon and Altar projects. If the Marathon and Altar projects ultimately prove to be commercial, they will require substantial capital for the development of mines and corollary infrastructure. The cost of these facilities cannot be estimated today with precision. While internally generated cash flows would play an important part in the development of Marathon and Altar, the Company expects that financing from the capital markets or third parties would also be required and the availability of such financing will depend on future market conditions and opportunities. The Marathon and Peregrine properties provide the Company with the opportunity and flexibility to pursue one or both of these growth initiatives in the future, depending on prices and market conditions. The Company does not currently expect to commit substantial capital to these assets until such time as additional delineation, engineering and feasibility studies are completed.

At December 31, 2011, the Company had proven and probable ore reserves at its Montana operations, of approximately 42.5 million tons with an average grade of 0.47 ounces of palladium and platinum per ore ton, containing approximately 20.0 million ounces of palladium and platinum at a ratio of about 3.57 parts palladium to one part platinum. At December 31, 2011, the Company had proven and probable ore reserves at the Marathon Development Project in Ontario, Canada, of approximately 91.4 million tonnes with an average in-situ grade of 0.832 grams of palladium and 0.237 grams of platinum per ore tonne and 0.247% copper, containing approximately 2.4 million ounces of palladium, 0.7 million ounces of platinum and 498.0 million pounds of copper. See “Business, Risk Factors, and Properties – Proven and Probable Ore Reserves”.

2011 – YEAR IN REVIEW:

| • | | The Company reported net income of $144.3 million, or $1.30 per diluted share, for the year ended December 31, 2011, compared to $50.4 million, or $0.51 per diluted share, in 2010. Contributing to the net income in 2011 were higher PGM prices and strong recycling sales volumes, along with continued attention to controlling costs. Revenues from the sale of mined production increased 39% to $528.0 million from $381.0 million in 2010, a direct result of higher PGM prices and increased production. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Year Ended December 31, 2011 Compared to Year Ended December 31, 2010.” |

| • | | In 2011, the Company’s mining operations produced a total of 517,900 ounces of palladium and platinum, a 6.8% increase over the 485,100 ounces produced in 2010. Stronger productivities and improved ore grades benefitted production during 2011. Total consolidated cash cost per ounce (a non-GAAP measure of extraction efficiency) averaged $420 in 2011, compared with $397 per ounce in 2010, as cash costs in 2011 included growth in tax and royalty expense associated with increased PGM realizations, as well as higher labor and materials costs. See Part II, Item 6 “Selected Financial Data” for further discussion of non-GAAP measures. |

The Company’s revenues for 2011, 2010 and 2009 totaled $906.0 million, $555.9 million and $394.4 million respectively. Detail of revenues and volumes sold is shown in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31, (in thousands) | | Sales Revenues | | | Troy Ounces Sold | |

| | Palladium | | | Platinum | | | Rhodium | | | Other (1) | | | Total | | | Palladium | | | Platinum | | | Rhodium | | | Other (3) | | | Total | |

2011 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mine production | | $ | 297,251 | | | $ | 194,794 | | | $ | 7,213 | | | $ | 28,749 | | | $ | 528,007 | | | | 402 | | | | 114 | | | | 5 | | | | 15 | | | | 536 | |

PGM recycling | | | 124,267 | | | | 201,195 | | | | 47,326 | | | | 4,032 | | | | 376,820 | | | | 169 | | | | 114 | | | | 23 | | | | — | | | | 306 | |

Other(2) | | | 7 | | | | 954 | | | | 181 | | | | — | | | | 1,142 | | | | — | | | | 1 | | | | — | | | | — | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 421,525 | | | $ | 396,943 | | | $ | 54,720 | | | $ | 32,781 | | | $ | 905,969 | | | | 571 | | | | 229 | | | | 28 | | | | 15 | | | | 843 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mine production | | $ | 186,749 | | | $ | 166,313 | | | $ | 3,880 | | | $ | 24,102 | | | $ | 381,044 | | | | 377 | | | | 112 | | | | 2 | | | | 14 | | | | 505 | |

PGM recycling | | | 36,893 | | | | 95,911 | | | | 30,470 | | | | 5,338 | | | | 168,612 | | | | 81 | | | | 62 | | | | 13 | | | | — | | | | 156 | |

Other(2) | | | 6,222 | | | | — | | | | — | | | | — | | | | 6,222 | | | | 13 | | | | — | | | | — | | | | — | | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 229,864 | | | $ | 262,224 | | | $ | 34,350 | | | $ | 29,440 | | | $ | 555,878 | | | | 471 | | | | 174 | | | | 15 | | | | 14 | | | | 674 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

2009 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mine production | | $ | 143,514 | | | $ | 139,733 | | | $ | 6,453 | | | $ | 17,192 | | | $ | 306,892 | | | | 393 | | | | 123 | | | | 4 | | | | 15 | | | | 535 | |

PGM recycling | | | 14,947 | | | | 45,736 | | | | 18,666 | | | | 2,439 | | | | 81,788 | | | | 53 | | | | 40 | | | | 9 | | | | — | | | | 102 | |

Other(2) | | | 2,679 | | | | 3,028 | | | | 45 | | | | — | | | | 5,752 | | | | 12 | | | | 3 | | | | — | | | | — | | | | 15 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 161,140 | | | $ | 188,497 | | | $ | 25,164 | | | $ | 19,631 | | | $ | 394,432 | | | | 458 | | | | 166 | | | | 13 | | | | 15 | | | | 652 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | “Other” column includes gold, silver, nickel and copper by-product sales from mine production and revenue from processing recycling materials on a toll basis. |

| (2) | “Other” row includes sales of metal purchased in the open market. |

| (3) | “Other” column includes gold and silver by-product ounces and recycled ounces sold. Not reflected in the “other” ounce column in the table above are approximately 1.3 million pounds, 1.2 million pounds and 0.9 million pounds of nickel sold in 2011, 2010 and 2009, respectively, and approximately 0.8 million pounds of copper sold in each of the three years 2011, 2010 and 2009. |

8

Revenues from PGM recycling grew by 123.5% during 2011, increasing to $376.8 million from $168.6 million in 2010, a direct result of higher PGM prices and an increase in volumes processed. Recycled ounces sold in 2011 totaled 306,200 ounces, an increase of 96.2% over the 156,100 ounces sold in 2010. The Company’s combined average realization on recycling sales (which include palladium, platinum and rhodium) increased to $1,218 per ounce in 2011 from $1,046 per ounce in 2010, reflecting higher market prices for palladium and platinum. In addition to purchased material, the Company processed 171,600 ounces of PGMs on a tolling basis in 2011, a decrease from the 235,900 tolled ounces in 2010. Recycled volumes fed to the smelter totaled 486,700 ounces of PGMs in 2011, up 21.9% from 399,400 ounces in 2010, the result of higher availability of recycling materials in the market in 2011. Working capital associated with recycling activities in the form of inventories and advances was $64.5 million and $41.5 million at December 31, 2011 and 2010, respectively. Total outstanding procurement advances to recycling suppliers totaled $2.6 million at December 31, 2011, and $6.1 million at December 31, 2010.

Effective January 1, 2011, the Company entered into a new three-year supply agreement with General Motors Corporation (“GM”) that commits the Company to deliver fixed quantities of palladium to GM each month. The new agreement does not include price floors or caps, but provides for monthly pricing at a small discount to a trailing market price. The Company also has a one-year market-based supply agreement with Tiffany & Co. One-year agreements with Johnson Matthey and Ford Motor Company (Ford) are pending, and are proceeding on a month-to-month basis pending finalization. In total, the four agreements commit the Company to deliver up to 350,000 ounces of palladium and 81,000 ounces of platinum during 2012. The Company expects to sell any remaining mine production under month-to-month and spot sales agreements.

Until the contract expired at the end of 2010, the Company was party to a ten-year sales agreement signed in 2000 with Ford that in recent years committed 80% of the Company’s mined palladium and 70% of its mined platinum for delivery to Ford. The expired Ford supply agreement included certain price floors and caps designed to limit the parties’ exposure to fluctuations in PGM market prices; outside of the floors and caps, sales to Ford were priced at a small discount to market. Similarly, until July of 2009, the Company had a supply agreement with GM that committed the Company to deliver 20% of its mined palladium each month to GM. The GM agreement also included a floor price and provided for a small discount to market on deliveries not affected by the floor price.

The Company’s 2011 capital expenditures totaled $104.1 million, more than twice the $50.3 million in 2010. Capital spending in 2011 included $69.2 million in development and infrastructure work at the Montana mines (including $15.7 million for the Blitz project development), $20.9 million in facilities and equipment, $7.1 million to acquire the Bermuda property from Benton Resources Corp., and $6.9 million of project spending at Marathon. Capital expenditures in 2010 included $32.2 million for mine development and infrastructure and $18.0 million for equipment and facilities. Major infrastructure projects completed during 2010 included the new recycling crushing and sampling facility in Columbus and the Kiruna electric truck system at the Stillwater Mine. In addition, during 2011, the Company spent $262.8 million in net cash and shares to acquire Peregrine. For a discussion of certain risks associated with the Company’s business, see “Business, Risk Factors and Properties – Introduction”,and“– Risk FactorsandManagement’s Discussion and Analysis of Financial Condition and Results of Operations”.

The Company’s exploration expenditures during 2011 totaled about $2.5 million, of which $0.5 million was spent on the Marathon properties in Canada and $2.0 million on drilling at the Altar property in Argentina. There were no funds expended on exploration on these properties during 2010. The Company has budgeted to spend $27.0 million on exploration during 2012, of which about $25.0 million is slated for the Altar property and the balance on efforts in Canada. The Company expenses exploration costs as incurred.

In early September of 2011, the Company attempted to market a $300.0 million issuance of high-yield public debt. The issuance was intended to provide additional liquidity in support of the Company’s ongoing capital projects. At the time, the financial markets were in the throes of addressing potential European defaults and related credit issues, creating a very difficult environment for sub-investment grade issuers. The Company ultimately concluded not to proceed with the debt issuance at that time.

SAFETY

Mining operations are conducted at the Stillwater Mine and at the East Boulder Mine and involve the use of heavy machinery and drilling and blasting in confined spaces. The pursuit of safety excellence at the Company continues with the utilization since 2001 of the Company’s “G.E.T. (Guide, Educate and Train) Safe” safety and health management systems. Efforts are focused on accident prevention, continually seeking safer methods of mining and increased employee awareness and training. Areas of specific focus include enhanced work place examinations, on-going education in hazard recognition, safety audits with a focus of continual improvement and sustaining of our best practices, consistent safety standards adherence, accident/incident investigations, near miss reporting and analysis and use of focus teams who are part of the mining workforce. Salary and hourly focus teams have been successful in proactively solving many safety related challenges. The Company continues to use focus teams to address specific safety and health related issues. One of these areas in particular has been in the area of compliance with the Mine Safety

9

and Health Administration’s (MSHA) diesel particulate matter (DPM) standards. At year-end 2011, the Company believes all underground operations are in compliance with these stringent standards through the use of blended bio-diesel fuels, post exhaust treatments, power train advances and high secondary ventilation standards.

For the year ended December 31, 2011, none of the Company’s mines received written notice from MSHA of (i) a flagrant violation under section 110(b)(2) of the Mine Act; (ii) a pattern of violations of mandatory health or safety standards that are of such nature as could have significantly and substantially contributed to the cause and effect of other mine health or safety hazards under section 104(e) of the Mine Act; or (iii) the potential to have such a pattern. During the year ended December 31, 2011, the Company experienced one fatality at the Stillwater Mine. The Company is awaiting the final report on the fatality investigation.

During 2011, the overall Company reportable accident incidence rate (measured as reportable incidents per 200,000 man hours worked) improved to 3.34 versus 3.70 at the end of 2010. The 2011 results represent a 73% reduction in incidence rates for Company employees and contractors since the inception of the “G.E.T. Safe” safety and health management systems in 2001. The metallurgical complex in Columbus, Montana, continued to maintain a low incidence rate while being recognized by the Montana Department of Labor and Occupational Safety and Health Administration (OSHA) as a leader in workplace safety.

The smelter, base metal refinery and analytical laboratory continue to participate in and support the Montana Department of Labor’s Safety and Health Achievement Recognition Program (SHARP). These facilities have all received SHARP recognition numerous times. The smelter received a three year SHARP recognition in June of 2010. The base metal refinery and laboratory received SHARP recognition in 2009 and completed the application process in 2010 for a 2010 award; however, the facility is still awaiting the results.

The SHARP program recognizes employers who have demonstrated exemplary achievements in workplace safety and health. By meeting the SHARP inspection requirements, these facilities may be exempt from general OSHA inspections for a period of time. During 2011, employee participation and involvement was further enhanced through the external continuous improvement audits and regular internal safety inspections conducted by salary and hourly inspection teams.

2012 – LOOKING FORWARD

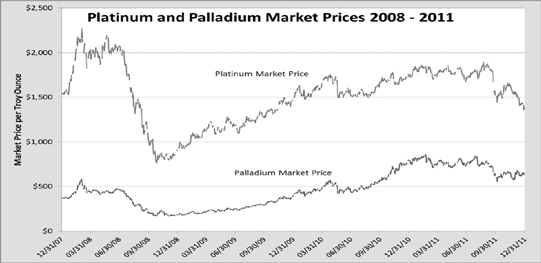

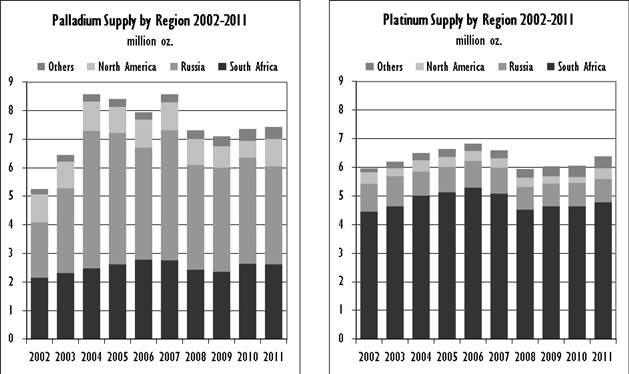

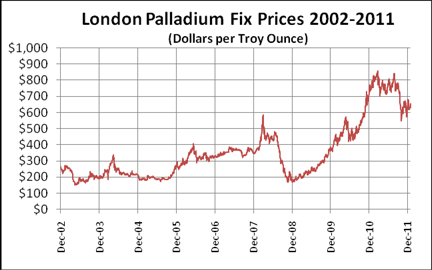

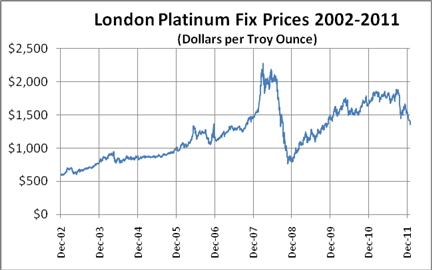

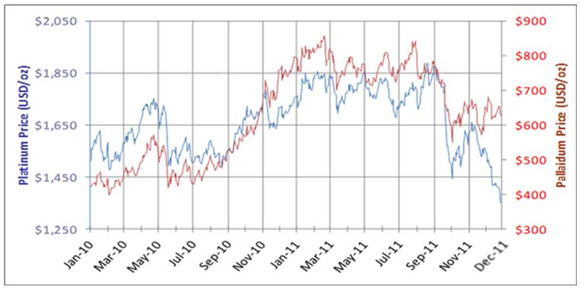

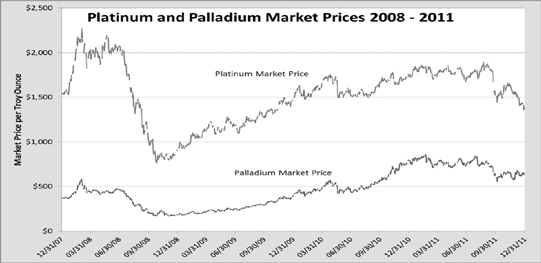

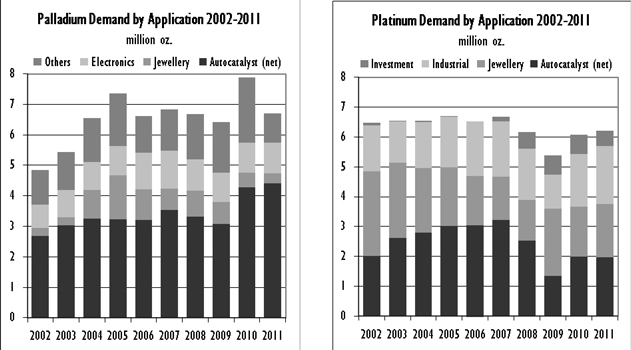

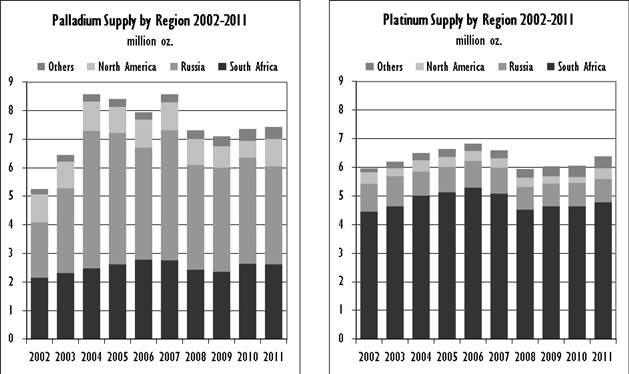

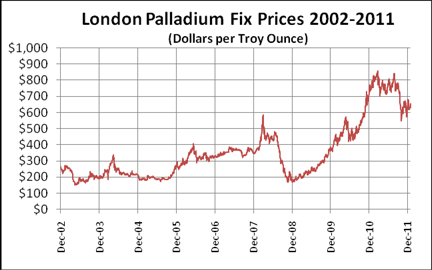

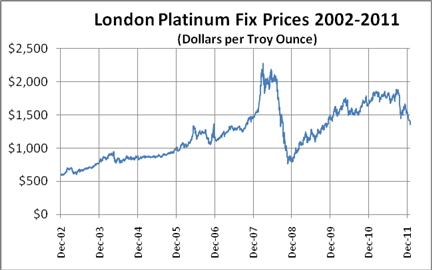

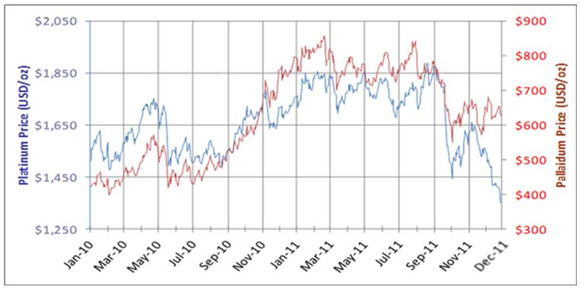

Following a steep decline in commodity prices accompanying the economic recession in late 2008 and early 2009 demand (and prices) for the Company’s principal metals, palladium and platinum, increased throughout 2009, 2010 and the first half of 2011. PGM prices declined beginning in September of 2011, as European debt problems and restrictive credit policies in China took their toll on the markets. As shown on the chart below the price of palladium, which had traded as low as $164 per ounce in December 2008, was quoted in London through August 2011 at prices above $800 per ounce; thereafter palladium traded lower and ended the year at $630 per ounce. Similarly, platinum consistently trended upward following its October 2008 low of $763 per ounce, was quoted in London at prices above $1,800 per ounce through August; thereafter traded lower to end 2011 at a price of $1,354 per ounce. The growth in PGM prices between 2008 and early 2011 appears to have been the result of gradual recovery in automotive demand in the Western economies, coupled with continued strong growth in automotive production in China and certain other emerging economies. Slower growth in Chinese auto demand during 2011, coupled with the damage to Japanese infrastructure from the devastating earthquake and tsunami in March 2011, impeded auto sales growth and therefore PGM demand during much of the year. On top of this, the threat of a Greek default in the late summer of 2011 created a flight to dollars, which strengthened the U.S. currency, putting downward pressure on commodity prices that was accentuated by heavy liquidation of PGM holdings within exchange-traded funds.

10

While the absolute level of PGM prices is important for the Company, an equally critical consideration is the level of the palladium price relative to the price of platinum. Because the Company’s mines produce about 3.455 times as much saleable palladium as platinum, the Company has benefitted as the price of palladium has converged upward toward the price of platinum. The price of palladium relative to platinum was about 22% during 2008 and has increased to between 40% and 45% recently. To illustrate the importance of this move, an analysis of the Company’s financial results for 2011 demonstrates that, had the price of palladium been lower and only averaged 22% of the price of platinum (assuming a steady platinum price) in 2011 instead of the actual average ratio of 43.5%, the Company’s EBITDA for 2011 would have been reduced by about $130.0 million.

From an operating perspective, the Company’s ability to increase production in response to higher prices is very limited, as is generally the case throughout the PGM industry. Production is constrained primarily by the developed state of the mines (i.e., the number and quality of working faces available for mining) and by limits on the availability of skilled manpower and equipment. The Company’s mine plans for 2012 contemplate production out of existing operations of about 500,000 ounces of palladium and platinum, a little lower than actual production in 2011. Total cash costs per ounce (a non-GAAP measure of mining efficiency) are projected to average $500 per ounce in 2012, higher than the $420 per ounce experienced in 2011, reflecting anticipated cost inflation in materials and supplies, increased labor costs associated with new labor agreements at the Montana operations, expanded and enhanced miner training efforts, increased growth in tax and royalty expense associated with increased PGM realizations and slightly lower mine production than in 2011. Prices for key consumables (steel, fuel and explosives) used in mine production continue to experience upward pressure.

Capital spending in 2012 is budgeted at about $135.0 million, which anticipates higher spending on equipment replacement and mine development, plus improvements at the smelter in Columbus, development spending for the Blitz and Graham Creek projects along the J-M Reef in Montana, and continuing work at the Company’s Marathon PGM property in Canada. The Company has budgeted to spend $27.0 million on exploration during 2012, of which about $25.0 million is slated for the Altar property and the balance on efforts in Canada. Exploration costs are expensed as incurred and are reflected separately in the Company’s consolidated statement of operations. Lower metal prices, higher mining costs and the need to expense exploration costs are expected to affect net income.

In response to the Company’s expectation of robust longer-term market fundamentals for palladium and platinum and the constraints on increasing production from the Company’s existing mines, during the fourth quarter of 2010 the Company announced two new development and potential expansion projects along the J-M Reef. The first of these, known as the Blitz project, will develop new underground drifts on two levels from the current Stillwater Mine toward the eastern extremity of the reef, ultimately involving about 20,000 feet of new development on each level. As now contemplated, this development project will take about five years to complete and is estimated to cost about $180.0 million. The Company expects to take delivery on a refurbished TBM for the Blitz project during the second quarter of 2012 and will place this machine into operation later in 2012. The other project on the J-M Reef, known as Graham Creek, will develop another 7,000 feet toward the west from the existing East Boulder Mine infrastructure, using a TBM that is already in place underground. This also is designed as about a five-year project but, in view of the single drift and shorter distance, is only expected to cost about $8.0 million. During 2011, the TBM at Graham Creek developed about 1,200 feet of new drift, after which it was idled for a time to allow for definitional drilling behind it. This limited drilling program to date has indicated mineable PGM grades along the new Graham Creek development. Definition drilling as these new drifts progress should provide valuable information about these regions of the J-M Reef. Future ore production from these new areas will be contingent on developing new ventilation raises to the surface to adequately support mining activities there.

During 2012, considerable effort also will be devoted to advancing the Marathon assets in Canada. Work on the principal Marathon resource will include submitting and participating in a panel review of the Company’s environmental assessment of the Marathon project. The Company plans to submit its environmental assessment in April of 2012 and expects review of the document to consume about another year. Once the environmental assessment has been reviewed and approved, the formal permitting process should be able to proceed. With the permitting process further advanced and depending on financing, it is now estimated that first production from Marathon will be in 2016. Earlier the Company had estimated production might begin by late 2014 or early 2015. The Company’s most recent preliminary estimate of capital costs is in the range of $550 million to $650 million.

The Company tentatively intends to allocate about $25.0 million per year for three drilling seasons in order to complete a full resource assessment of its Altar copper-gold project, located in the San Juan province of Argentina. The drilling season in the Andes mountain range runs from December until May, and the Company currently has four drill rigs on the Altar property for the 2011-2012 drilling season. The focus of the drilling this season will be to better define the perimeter of the primary copper porphyry and to probe it at depth, to further evaluate the ancillary gold discovery at Quebrada de la Mina, and to assess certain other mineral targets on the property. This project is not yet sufficiently advanced to include any proven or probable ore reserves. These drilling costs will be expensed as incurred and recorded as exploration expense on the Company’s Consolidated Statements of Operations and Comprehensive Income (Loss).

11

Having completed the second electric smelter furnace, the automated analytical laboratory and the recycle crushing and sampling facilities over the past several years at the Company’s processing facilities in Columbus, Montana, the Company now expects during 2012 to move ahead with the conversion of its idled electric furnace into a slag cleaning facility. This will entail installing chutes (launders) that will allow slag periodically to be gravity drained out of the new primary furnace into the slag cleaning furnace, where the additional residence time is expected to improve PGM recoveries. The newly refurbished furnace should also serve as a hot backup for the primary furnace, reducing risk of lost production and increasing total capacity of the system.

During 2012, the Company will continue to advance its palladium marketing program, seeking to coordinate with others in the industry to promote palladium for jewelry applications and other uses. Palladium is already well established as a jewelry metal in many Asian markets, and it is increasingly recognized among European and North American consumers. Marketing programs in 2011 reached out to these markets to broaden familiarity and strengthen palladium’s image in the retail arena. The Company expensed $11.8 million in marketing efforts in 2011 and it anticipates spending about the same amount during 2012.

HISTORY OF THE COMPANY

Mineral exploration in the Stillwater Complex dates from at least the late nineteenth century, with early mining activities – primarily for chromium – beginning in the 1920s. Palladium and platinum were discovered within the Stillwater Complex by geologists from Johns Manville Corporation (Manville) in the early 1970s, in what then became known as the J-M Reef. In 1979, a Manville subsidiary entered into a partnership agreement with Chevron U.S.A. Inc. (Chevron) to develop PGMs discovered in the J-M Reef. Manville and Chevron explored and developed the Stillwater property, and commenced commercial underground mining at the Stillwater Mine in 1986.

Stillwater Mining Company was incorporated in 1992, and on October 1, 1993, Chevron and Manville transferred substantially all assets, liabilities and operations at the Stillwater property into the Company, with Chevron and Manville each receiving a 50% ownership interest in the Company’s stock. In September 1994, the Company redeemed Chevron’s entire 50% ownership. The Company subsequently completed an initial public offering in December 1994 and Manville sold a portion of its shares through the offering, reducing its ownership percentage to approximately 27%. In August 1995, Manville sold its remaining ownership interest in the Company to a group of institutional investors. The Company’s common stock is publicly traded on the New York Stock Exchange (NYSE) under the symbol “SWC” and on the Toronto Stock Exchange under the symbol “SWC.U”.

On June 23, 2003, the Company completed a stock transaction with MMC Norilsk Nickel (Norilsk Nickel), whereby a subsidiary of Norilsk Nickel became a majority stockholder of the Company. On that date, the parties entered into a Stockholders Agreement governing the terms of Norilsk Nickel’s investment in the Company. As of December 31, 2009, Norilsk Nickel controlled approximately 51.5% of the Company’s outstanding common shares and held $80.0 million of the Company’s $166.5 million outstanding 1.875% convertible debentures maturing in 2028. In December 2010, Norilsk Nickel announced that it had disposed of its entire equity interest in the Company through an underwritten offering to the public of its Stillwater shares of common stock.

In November 2010, the Company completed the acquisition of the PGM assets of Marathon. The principal asset acquired in the transaction was a significant PGM-copper resource position in Ontario near the north shore of Lake Superior. In February 2011, the Company further consolidated its position in this district through the purchase of some adjacent mineral properties held by Benton Resources Corp., another Canadian exploration company.

In October 2011 the Company completed the acquisition of all the outstanding shares of Peregrine. The principal asset of Peregrine is the Altar copper-gold property in the San Juan Province of Argentina. The Company intends to conduct an extensive drilling program over three drilling seasons at Altar to assess the magnitude and character of the resources there.

THE STILLWATER COMPLEX AND J-M REEF

LOCATION

The Stillwater Complex, which hosts the J-M Reef ore deposit, is located in the Beartooth Mountains in south central Montana. It is situated along the northern edge of the Beartooth Uplift and Plateau, which rise to elevations in excess of 10,000 feet above sea level. The plateau and Stillwater Complex have been deeply incised by the major drainages and tributaries of the Stillwater and Boulder Rivers down to elevations at the valley floor of approximately 5,000 feet.

GEOLOGY of the J-M REEF

Geologically, the Stillwater Layered Igneous Complex is composed of a succession of ultramafic to mafic rocks derived from a large complex magma body emplaced deep in the Earth’s crust an estimated 2.7 billion years ago. The molten mass was

12

sufficiently large and fluid at the time of emplacement to allow its chemical constituents to crystallize slowly and sequentially, with the heavier mafic minerals settling more rapidly toward the base of the cooling complex. The lighter, more siliceous suites crystallized more slowly and also settled into layered successions of norite, gabbroic and anorthosite suites. This systematic process resulted in mineral segregations being deposited into extensive and relatively uniform layers of varied mineral concentrations.

The uniquely PGM-enriched J-M Reef and its characteristic host rock package represent one such layered sequence. The geosciences community believes that the PGM-enriched suite and other minerals characterizing the J-M Reef accumulated at the same time and by the same mechanisms of formation as the rocks enclosing them. Over time, the orientation of a portion of the original horizontal reef and layered igneous complex was faulted an estimated 20,000 feet to the northeast and was tilted upward at angles of 50 to 90 degrees to the north by the Beartooth Uplift. Localized faulting and intrusive mafic dikes are also evident along the 28-mile strike length of exposed Stillwater Complex. The impact of these structural events is localized along the J-M Reef and affects the percent mineable tonnage in an area, creates additional dilution, or results in below cut-off grade and barren zones within the reef. The impacts on ore reserves of these events are quantified in the percent mineable discussion under “Proven and Probable Ore Reserves.” The upper portion and exposed edge of the uplifted reef complex were eroded forming the lenticular-shaped surface exposure of the Stillwater Complex and J-M Reef package evident today.

The J-M Reef package has been traced at its predictable geologic position and with unusual overall uniformity over considerable distances within the uplifted portion of the Stillwater Complex. The surface outcrops of the reef have been examined, mapped and sampled for approximately 28 miles along its east-southeasterly course and over a known expression of over 8,200 feet vertically. The predictability of the J-M Reef has been further confirmed in subsurface mine workings of the Stillwater and East Boulder Mines and by over 38,000 drill hole penetrations.

The PGMs in the J-M Reef consist primarily of palladium, platinum and a minor amount of rhodium. The reef also contains significant amounts of nickel and copper and trace amounts of gold and silver. Five-year production figures from the Company’s mining operations on the J-M Reef are summarized in Part II, Item 6, “Selected Financial Data.”

The Company’s original long-term development strategy and certain elements of its current planning and mining practices on the J-M Reef ore deposit were founded upon initial feasibility and engineering studies conducted in the 1980’s. Initial mine designs and practices were established in response to available technologies and the particular characteristics and challenges of the J-M Reef ore deposit. The Company’s current development plans, mining methods and ore extraction schedules are designed to provide systematic access to, and development of, the ore deposit within the framework of current and forecast economic, regulatory and technological considerations as well as the specific characteristics of the J-M Reef ore deposit. Some of the challenges inherent in the development of the J-M Reef include:

| • | | Surface access limitations (property ownership and environmental sensitivity); |

| • | | Topographic and climatic extremes involving rugged mountainous terrain and substantial elevation differences; |

| • | | Specific configuration of the mineralized zone (narrow – average width 5 feet, depth – up to 1.5 miles of vertical extent, and long – approximately 28 miles in length), dipping downward at an angle varying from near vertical to 38 degrees; |

| • | | A deposit which extends both laterally and to depth from available mine openings, with travel distances underground from portal to working face of up to six miles; and |

| • | | Proven and probable ore reserves extending for a lateral distance of approximately 32,000 feet at the Stillwater Mine and approximately 12,500 feet at the East Boulder Mine – a combined extent underground of approximately 8.4 miles, with active underground travelways and ramps on multiple levels totaling more than 100 miles in extent that must be maintained and supported logistically. |

ORE RESERVE DETERMINATION METHODOLOGY

The Company utilizes statistical methodologies to calculate ore reserves based on interpolation between and projection beyond sample points. Interpolation and projection are limited by certain modifying factors including geologic boundaries, economic considerations and constraints imposed by safe mining practices. Sample points consist of variably spaced drill core intervals through the J-M Reef obtained from drill sites located on the surface and in underground development workings. Results from all sample points within the ore reserve area are evaluated and applied in determining the ore reserve.

For proven ore reserves, distances between samples range from 25 to 100 feet but are typically spaced at 50-foot intervals both horizontally and vertically. The sample data for proven ore reserves consists of survey data, lithologic data and assay results. Quality Assurance/Quality Control (QA/QC) protocols are in place at both mine sites to test the sampling and analysis procedures. To test assay accuracy and reproducibility, pulps from core samples are resubmitted and compared. To test for sample label errors or cross-contamination, blank core (waste core) samples are submitted with the mineralized sample lots and compared. The

13

QA/QC protocols are practiced on both resource development and production samples. The resulting data is entered into a 3-dimensional modeling software package and is analyzed to produce a 3-dimensional solid block model of the resource. The assay values are further analyzed by a geostatistical modeling technique (kriging) to establish a grade distribution within the 3-dimensional block model. Dilution is then applied to the model and a diluted tonnage and grade are calculated for each block. Ore and waste tons, contained ounces and grade are then calculated and summed for all blocks. A percent mineable factor based on historic geologic unit values is applied and the final proven reserve tons and grade are calculated.

Two types of cut-off grades are recognized for the J-M Reef, a geologic cut-off boundary and an economic cut-off grade. The geologic cut-off grade for both the Stillwater and East Boulder Mines falls in the range of 0.2 to 0.3 troy ounces of palladium plus platinum (Pd+Pt) per ton. The economic cut-off grade is lower than the geologic cut-off and can vary between the mines based on cost and efficiency factors. The determination of the economic cut-off grade is completed on a round by round basis and is driven primarily by excess mill capacity and geologic character encountered at the face. See“Business, Risk Factors and Properties – Proven and Probable Ore Reserves – Discussion” for reserve sensitivity to metal pricing.

Probable ore reserve estimations are based on longer projections, up to a maximum radius of 1,000 feet beyond the limit of existing drill hole sample intercepts of the J-M Reef obtained from surface and underground drilling. Statistical modeling and the established continuity of the J-M Reef as determined from results of 25 years of mining activity to date support the Company’s technical confidence in estimates of tonnage and grade over this projection distance. Where appropriate, projections for the probable ore reserve determination are constrained by any known or anticipated restrictive geologic features.

The Company reviews its methodology for calculating ore reserves on an annual basis. Conversion, an indicator of the success in upgrading probable ore reserves to proven ore reserves, is evaluated annually as part of the reserve process. The annual review examines the effect of new geologic information, changes implemented or planned in mining practices and mine economics on factors used for the estimation of probable ore reserves. The review includes an evaluation of the Company’s rate of conversion of probable reserves to proven reserves.

The proven and probable ore reserves are then modeled as a long-term mine plan and additional factors including mining methods, process recoveries, metal prices, mine operating productivities and costs and capital estimates are applied to determine the overall economics of the ore reserves. The Company has made available on its website (www.stillwatermining.com) in the Investor Relations section a report entitled “Technical Report for the Mining Operations at Stillwater Mining Company”, dated as of March 2011 and furnished to the United States Securities and Exchange Commission (SEC) on Form 8-K on June 23, 2011, that discusses the Company’s ore reserve methodology in greater detail.

SEC ORE RESERVE GUIDELINES

The SEC has established guidelines contained in Industry Guide No. 7 to assist registered companies as they estimate ore reserves. These guidelines set forth technical, legal and economic criteria for determining whether the Company’s ore reserves can be classified as proven and probable.

The SEC’s economic guidelines historically have not constrained the Company’s ore reserves, and did not constrain the ore reserves at December 31, 2011. Under these guidelines, ore may be classified as proven or probable if extraction and sale result in positive cumulative undiscounted cash flow. The Company utilizes both the historical trailing twelve-quarter average combined PGM market price and the current PGM market price in ascertaining these cumulative undiscounted cash flows.

The Company believes that it is appropriate to use a long-term average price for measuring ore reserves, as such a price better matches the period over which the reserves will ultimately be mined. However, should metal prices decline substantially from their present level for an extended period, the twelve-quarter trailing average price might also decline and could result in a reduction of the Company’s reported ore reserves.

The Company’s Ore Reserve Committee, a committee of the Board, met twice during 2011 with management and third party independent outside experts to review ore reserve methodology, to identify best practices in the industry and to receive reports on the progress and results of the Company’s mine development efforts. The Committee has reviewed the Company’s ore reserves as reported at December 31, 2011, having met with management and with the Company’s independent consultant on ore reserves.

RESULTS

The December 31, 2011, ore reserves were reviewed by Behre Dolbear & Company, Inc. (Behre Dolbear), third party independent consultants, who are experts in mining, geology and ore reserve determination. The Company has utilized Behre Dolbear to carry out independent reviews and inventories of the Company’s ore reserves since 1990. Behre Dolbear has consented to be a named expert herein. See “Business, Risk Factors and Properties – Risk Factors – Ore Reserves Are Very Difficult to Estimate and Ore Reserve Estimates May Require Adjustment in the Future; Changes in Ore Grades, Mining Practices and Economic Factors Could Materially Affect the Company’s Production and Reported Results.”

14

PROVEN AND PROBABLE ORE RESERVES

The Company’s proven ore reserves are generally expected to be extracted utilizing existing mine infrastructure. However, additional infrastructure development will be required to extract the Company’s probable ore reserves. Based on the 2012 mining plans at each mine, the year-end 2011 proven ore reserves of 2.8 million tons at the Stillwater Mine and 2.2 million tons at the East Boulder Mine represent an adequate level of proven ore reserves to support planned mining activities.

The grade of the Company’s J-M Reef ore reserves, measured in combined palladium and platinum ounces per ton, is a composite average of samples in all reserve areas. As is common in underground mines, the grade mined and the recovery rate achieved varies depending on the area being mined. In particular, mill head grade varies significantly between the Stillwater and East Boulder mines, as well as within different areas of each mine. During 2011, 2010 and 2009, the average mill head grade for all tons processed from the Stillwater Mine was 0.53, 0.50 and 0.56 PGM ounces per ton of ore, respectively. During 2011, the average mill head grade for all tons processed from the East Boulder Mine was about 0.35 PGM ounces per ton of ore compared to an average mill head grade of 0.37 PGM ounces per ton of ore in 2010 and 0.38 PGM ounces per ton of ore in 2009. Concentrator feeds at both mines typically include, along with the ore, some PGM-bearing material that is below the cut-off grade for reserves (reef waste) but that is economic to process so long as there is capacity available in the concentrator.

As of December 31, 2011, 2010 and 2009 the Company’s proven and probable ore reserves in the J-M Reef were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | STILLWATER MINE | | | EAST BOULDER MINE | | | TOTAL MONTANA MINES | |

| | | ORE

TONS

(000’s) | | | AVERAGE

GRADE

(OZ/TON) | | | CONTAINED

OUNCES

(000’S) | | | SALEABLE

OUNCES

(000’S) | | | ORE

TONS

(000’s) | | | AVERAGE

GRADE

(OZ/TON) | | | CONTAINED

OUNCES

(000’S) | | | SALEABLE

OUNCES

(000’S) | | | ORE

TONS

(000’s) | | | AVERAGE

GRADE

(OZ/TON) | | | CONTAINED

OUNCES

(000’S) | | | SALEABLE

OUNCES

(000’S) | |

| | | | | | | | | | | | |

As of December 31, 2011 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proven Reserves | | | 2,782 | | | | 0.62 | | | | 1,711 | | | | 1,401 | | | | 2,228 | | | | 0.41 | | | | 907 | | | | 767 | | | | 5,010 | | | | 0.51 | | | | 2,618 | | | | 2,168 | |

Palladium | | | | | | | 0.48 | | | | 1,335 | | | | 1,087 | | | | | | | | 0.32 | | | | 710 | | | | 595 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.14 | | | | 376 | | | | 314 | | | | | | | | 0.09 | | | | 197 | | | | 172 | | | | | | | | | | | | | | | | | |

Probable Reserves | | | 12,262 | | | | 0.60 | | | | 7,374 | | | | 6,039 | | | | 25,207 | | | | 0.40 | | | | 9,988 | | | | 8,449 | | | | 37,469 | | | | 0.46 | | | | 17,362 | | | | 14,488 | |

Palladium | | | | | | | 0.47 | | | | 5,753 | | | | 4,684 | | | | | | | | 0.31 | | | | 7,817 | | | | 6,551 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.13 | | | | 1,621 | | | | 1,355 | | | | | | | | 0.09 | | | | 2,171 | | | | 1,898 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Proven and Probable Reserves (1) | | | 15,044 | | | | 0.60 | | | | 9,085 | | | | 7,440 | | | | 27,435 | | | | 0.40 | | | | 10,895 | | | | 9,216 | | | | 42,479 | | | | 0.47 | | | | 19,980 | | | | 16,656 | |

Palladium | | | | | | | 0.47 | | | | 7,087 | | | | 5,770 | | | | | | | | 0.31 | | | | 8,527 | | | | 7,146 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.13 | | | | 1,997 | | | | 1,669 | | | | | | | | 0.09 | | | | 2,368 | | | | 2,070 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

As of December 31, 2010 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proven Reserves | | | 2,559 | | | | 0.64 | | | | 1,648 | | | | 1,354 | | | | 2,059 | | | | 0.41 | | | | 848 | | | | 713 | | | | 4,618 | | | | 0.54 | | | | 2,496 | | | | 2,067 | |

Palladium | | | | | | | 0.50 | | | | 1,285 | | | | 1,050 | | | | | | | | 0.32 | | | | 664 | | | | 553 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.14 | | | | 363 | | | | 304 | | | | | | | | 0.09 | | | | 184 | | | | 160 | | | | | | | | | | | | | | | | | |

Probable Reserves | | | 13,116 | | | | 0.62 | | | | 8,176 | | | | 6,717 | | | | 23,064 | | | | 0.40 | | | | 9,199 | | | | 7,736 | | | | 36,180 | | | | 0.49 | | | | 17,375 | | | | 14,453 | |

Palladium | | | | | | | 0.49 | | | | 6,376 | | | | 5,207 | | | | | | | | 0.31 | | | | 7,200 | | | | 5,998 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.14 | | | | 1,800 | | | | 1,510 | | | | | | | | 0.09 | | | | 1,999 | | | | 1,738 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Proven and Probable Reserves (1) | | | 15,675 | | | | 0.63 | | | | 9,824 | | | | 8,071 | | | | 25,123 | | | | 0.40 | | | | 10,047 | | | | 8,449 | | | | 40,798 | | | | 0.49 | | | | 19,871 | | | | 16,520 | |

Palladium | | | | | | | 0.49 | | | | 7,661 | | | | 6,257 | | | | | | | | 0.31 | | | | 7,864 | | | | 6,551 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.14 | | | | 2,163 | | | | 1,814 | | | | | | | | 0.09 | | | | 2,183 | | | | 1,898 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

As of December 31, 2009 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proven Reserves | | | 2,606 | | | | 0.66 | | | | 1,712 | | | | 1,407 | | | | 2,036 | | | | 0.43 | | | | 867 | | | | 707 | | | | 4,642 | | | | 0.56 | | | | 2,579 | | | | 2,114 | |

Palladium | | | | | | | 0.51 | | | | 1,334 | | | | 1,090 | | | | | | | | 0.34 | | | | 679 | | | | 548 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.15 | | | | 378 | | | | 317 | | | | | | | | 0.09 | | | | 188 | | | | 159 | | | | | | | | | | | | | | | | | |

Probable Reserves | | | 13,748 | | | | 0.63 | | | | 8,688 | | | | 7,139 | | | | 22,607 | | | | 0.41 | | | | 9,347 | | | | 7,621 | | | | 36,355 | | | | 0.50 | | | | 18,035 | | | | 14,760 | |

Palladium | | | | | | | 0.49 | | | | 6,770 | | | | 5,530 | | | | | | | | 0.32 | | | | 7,315 | | | | 5,909 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.14 | | | | 1,918 | | | | 1,609 | | | | | | | | 0.09 | | | | 2,032 | | | | 1,712 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Proven and Probable Reserves (1) | | | 16,354 | | | | 0.64 | | | | 10,400 | | | | 8,546 | | | | 24,643 | | | | 0.41 | | | | 10,214 | | | | 8,328 | | | | 40,997 | | | | 0.50 | | | | 20,614 | | | | 16,874 | |

Palladium | | | | | | | 0.50 | | | | 8,104 | | | | 6,619 | | | | | | | | 0.32 | | | | 7,994 | | | | 6,457 | | | | | | | | | | | | | | | | | |

Platinum | | | | | | | 0.14 | | | | 2,296 | | | | 1,927 | | | | | | | | 0.09 | | | | 2,220 | | | | 1,870 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Reserves are defined as that part of a mineral deposit that could be economically and legally extracted or produced at the time of the reserve determination. Proven ore reserves are defined as ore reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of ore reserves are well-established. Probable ore reserves are defined as ore reserves for which quantity and grade and/or quality are computed from information similar to that used for proven ore reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven ore reserves, is high enough to assume continuity between points of observation. The proven and probable ore reserves reflect variations in the PGM content and structural impacts on the J-M Reef. These variations are the result of localized depositional and structural influences on the distributions of economic PGM mineralization. Geologic domains within the reserve boundaries of the two mines include areas where as little as 0% and up to 100% of the J-M Reef is economically mineable. The ore reserve estimate gives effect to these assumptions. See“Business, Risk Factors and Properties – Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors That May Affect Future Results and Financial Condition.” |

15

DISCUSSION

The Company’s mine development efforts over the past several years have focused on converting probable reserves to proven reserves, rather than on adding new probable reserves. As of December 31, 2011, the Company’s totalproven palladium and platinum ore reserves in the J-M Reef were 5.0 million tons at an average grade of 0.51 ounces per ton, containing 2.6 million ounces of palladium and platinum. This represented a net increase of 4.9% in proven contained ounces compared to the proven ore reserves reported as of December 31, 2010. The Company’s totalprobable palladium and platinum ore reserves at December 31, 2011, were 37.5 million tons at an average grade of 0.46 ounces per ton, containing 17.4 million ounces of palladium and platinum. Probable reserve contained ounces were unchanged from those reported at December 31, 2010. Combined, the Company’s total proven and probable palladium and platinum ore reserves as of December 31, 2011, were 42.5 million tons at an average grade of 0.47 ounces per ton, containing 20.0 million ounces of palladium plus platinum – a net increase of 0.5% in total proven and probable contained ounces from the 19.9 million ounces reported as of December 31, 2010.

In 2011, proven and probable ore tons increased 4.1% and contained ounces increased by 0.5% from those reported December 31, 2010. In 2010, proven and probable ore tons decreased 0.5% while contained ounces decreased by 3.6% from those reported December 31, 2009. The Company’s total proven and probable ore reserve tonnage in the J-M Reef at December 31, 2011, increased by about 3.6% or 1.5 million tons over the past two years. However, total contained ounces in proven and probable reserves decreased by about 3.0% from those reported December 31, 2009.

The Stillwater Mine proven and probable ore reserves at year-end 2011 decreased by 4.0% in terms of ore tons from those reported at year-end 2010. The East Boulder Mine proven and probable ore reserves at year-end 2011 increased by 9.2% in ore tons from those reported at year-end 2010. Overall, the Company’s estimated proven and probable ore reserves based on ore tons increase by 4.1% in 2011. The Company’s ore reserve determination for 2011, calculated at December 31, 2011, was limited by geologic certainty and not by economic constraints

Changes in proven and probable ore reserves are due to the net effect of: