| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-07237) |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | July 31, 2013 |

| | |

| Date of reporting period: | August 1, 2012 — January 31, 2013 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Research

Fund

Semiannual report

1 | 31 | 13

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio manager | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 12 | | |

| | |

| Terms and definitions | 14 | | |

| | |

| Other information for shareholders | 15 | | |

| | |

| Financial statements | 16 | | |

| | |

Consider these risks before investing: Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. The prices of stocks in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific company or industry.

Message from the Trustees

Dear Fellow Shareholder:

Stock markets around the world have continued to show strength into 2013, with the S&P 500 Index delivering its best January return since 1997. Investors witnessed several positive developments, including the U.S. fiscal cliff bill that Congress passed on January 1, 2013; the improving employment and housing situations; a more stable Europe; and China’s “soft landing” and positive growth.

Today’s market environment is one of slow and steady improvement, but uncertainties linger. Questions remain about potential economic fallout from the upcoming debt ceiling and budget sequestration debates in the United States. And the sovereign debt situation in Europe, while stabilized, is far from resolved.

At Putnam, our investment team is focused on actively managing risk and pursuing returns in today’s volatile global market. As always, it is important to rely on the guidance of your financial advisor to help you manage your investment portfolio in accordance with your goals and risk tolerance.

We would also like to extend a welcome to new shareholders of the fund and to thank all of our investors for your continued confidence in Putnam.

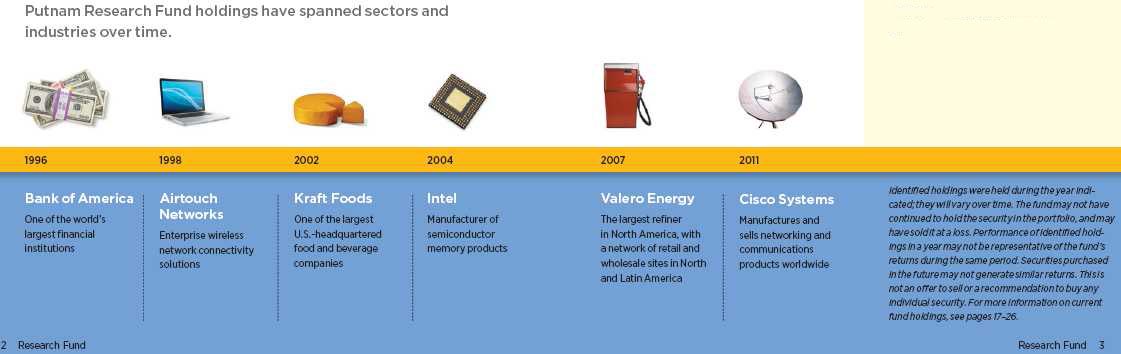

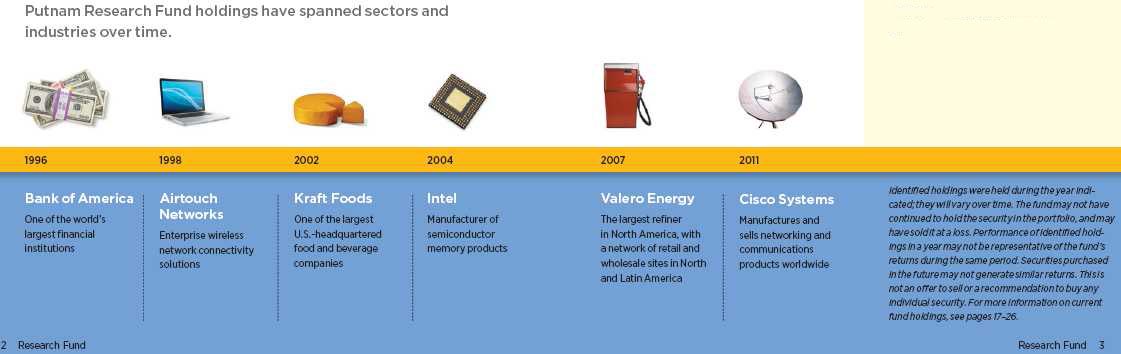

About the fund

Building a portfolio of best ideas

Research is at the heart of investing. Whether it is undertaken by Wall Street firms or by Putnam’s in-house analysts, research is used by investment managers to assess whether a company’s stock is undervalued, overvalued, or on target at its current price.

One approach to determining a company’s worth is to measure its tangible assets, such as physical plants or inventory. Other measures of worth are less quantifiable and may involve the evaluation of the company’s long-term competitive advantage, the expertise of its management team, or the success of its research and development efforts.

Analysts consider these factors along with financial yardsticks such as the price-to-earnings ratio and earnings growth. By digging deep into the information available, analysts work to develop a set of expectations about the financial and competitive health of a specific company versus other firms in the industry — both in the United States and across the broader global marketplace. Of course, there is no foolproof way to uncover all information about a company, and surprises can always occur.

Putnam’s equity analysts gather information from on-site interviews with company management and through meetings with sources who are able to provide additional information about the company’s true worth and likely future direction.

By including Putnam Research Fund as part of a diversified portfolio, you are investing in what we like to call a “best ideas” fund: It represents the select stock picks of Putnam’s large-cap equity analysts, incorporated into a single portfolio that can include both growth- and value-style stocks.

Putnam’s research analysts specialize in sectors and industries

Consumer staples Broadcasting, lodging/tourism, department stores, retail, electronics, food, household goods, homebuilding, restaurants

Energy Integrated oil and gas, drilling, exploration, equipment, services

Financials Banking, brokerage, consumer finance, insurance, real estate investment trusts, mortgage finance

Health care Biotechnology, equipment, pharmaceuticals, services

Industrials Aerospace and defense, construction and farm machinery, electrical components, office services

Technology Computer hardware/software, semiconductors, services

Materials Gold, metals, paper products/packaging, specialty chemicals, steel

Telecommunications Alternative carriers, wireless services

Utilities Electric utilities, gas utilities, independent power producers

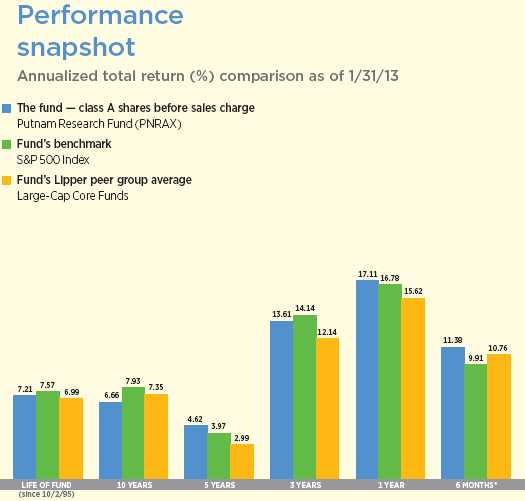

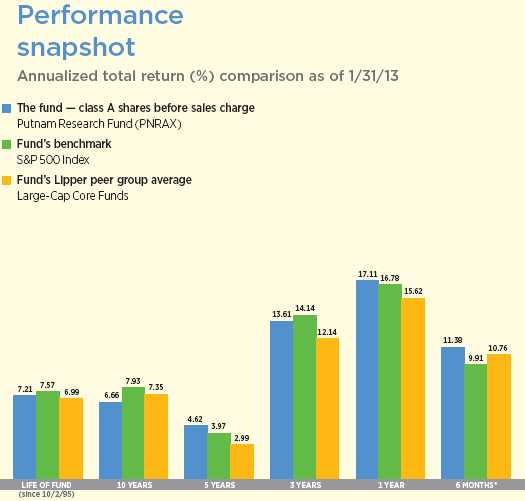

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. A short-term trading fee of 1.00% may have applied to redemptions (including exchanges into another fund) of shares purchased before January 2, 2013, and held for 7 days or less. No short-term trading fee applies to shares purchased on or after January 2, 2013. To obtain most recent month-end performance, visit putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

Interview with your fund’s portfolio manager

Putnam Research Fund surpassed its benchmark for the six-month period ended January 31, 2013. What was the primary factor driving this result?

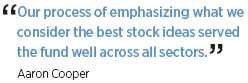

Nearly all of the fund’s outperformance relative to its benchmark, the S&P 500 Index, came from stock selection. While nearly every sector in the broad equity market experienced positive performance, our process of emphasizing what we consider the best stock ideas served the fund well across all sectors.

Did the fund’s performance benefit from any notable market trends?

As the period progressed, stocks of some of the largest “mega-cap” U.S. companies — companies with market capitalizations of around $200 billion — began to underperform large-, midsize-, and small-company stocks. This marked a shift in investor sentiment from a bias toward “safety-trade” stocks to a greater level of comfort with investments with higher perceived risk. This development was broadly positive for the fund because it holds benchmark-relative underweights to some of the largest-company stocks.

In addition, valuation played a positive role for the fund, as cheaper stocks — which the fund favors — began to outperform more expensive stocks. While this is generally true over the long term, it had not been the case for sustained periods over the past few years.

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 1/31/13. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on page 14.

Lastly, over the past year and longer we have seen a gradual lessening of uncertainty regarding Europe’s sovereign debt situation, and this trend continued through the semi-annual period. A positive development for global markets has been Europe’s significant fiscal healing, as the deficits for some of the most indebted eurozone countries were halved between 2010 and 2013.

In addition, labor markets in Europe outside Germany have become more competitive, which we believe has improved the prospects for economic growth in a number of European countries and offset some of the impact of fiscal austerity on the general populace. As Europe’s outlook continued to brighten during the period, equities around the globe tended to perform better.

What is your assessment of U.S. corporate health?

Our outlook is quite positive, particularly in the wake of fourth-quarter 2012 earnings strength. Notably, earnings were weak in the third quarter, but in October and November we believed that many companies were poised for an earnings reacceleration by year-end. That largely played out as we expected. In addition, corporate outlooks for 2013 are generally optimistic, particularly as companies hope to capitalize on pent-up demand and typically appear more willing to make capital expenditures to expand their businesses.

Another factor that we believe supports stronger U.S. corporate health is the lessening of concerns over the economic climate in Europe and economic growth in China. With strong corporate fundamentals and improving macroeconomic data, we think U.S. companies may be in a good position to perform well over the course of 2013.

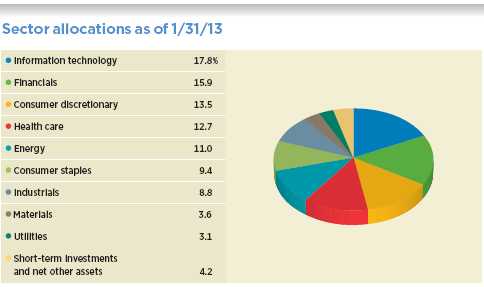

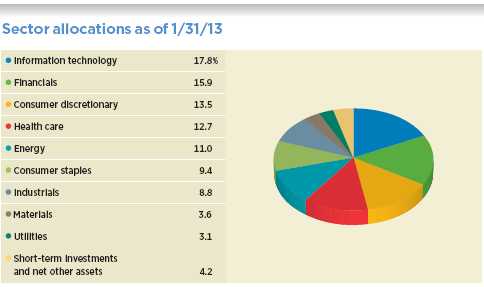

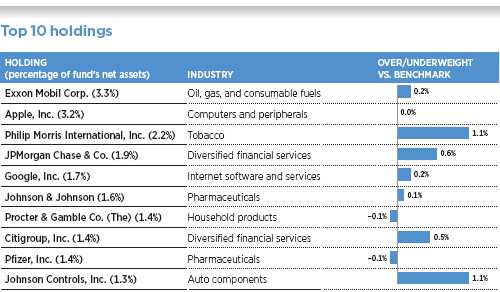

Allocations are represented as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

Which holdings or strategies were top contributors to the fund’s performance?

The top contributor for the period was the stock of solar-facility maker First Solar, which in the fund’s prior fiscal year had been the largest detractor from returns. We maintained a meaningful exposure to the company, however, on the strength of our positive assessment of its prospects for a turnaround. Indeed, we thought the company’s pipeline of projects was promising enough to suggest that the market had drastically underestimated the stock’s potential. Toward period-end, we trimmed this position, locking in profits for the fund.

The second-largest contributor was our underweight position in Coca-Cola relative to the benchmark. As I mentioned earlier, the market began to move away from more defensive, higher-quality, mega-cap companies during the past six months, and Coca-Cola shares lost value due to that trend.

Other contributors included the fund’s positions in Citigroup and JPMorgan. Overall, the financials sector performed well during the period. Many large banks continued to repair their balance sheets, even as they saw a resumption of loan growth and a decline in the amount of their non-performing loans. Consequently, earnings in the sector began to normalize while perceived risks declined in intensity.

Which holdings or strategies held fund performance back?

The fund had an underweight position in financial bellwether Goldman Sachs, which did not help the fund relative to the benchmark as the company performed well. In general, our analysis of opportunities in the

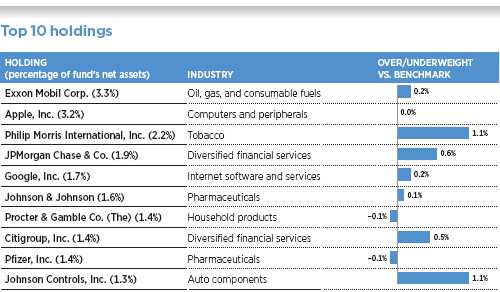

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 1/31/13. Short-term holdings are excluded. Holdings will vary over time.

financials sector led us to emphasize other companies, in this case at the expense of the size of our exposure to Goldman Sachs.

Our decision not to hold the stock of Home Depot also hurt the fund’s benchmark-relative performance. We have a positive assessment of the housing market’s potential — where we see signs that a rebound is already underway — and the fund is exposed to the housing sector through investment in other companies. However, we missed out on what proved to be a strong improvement in Home Depot’s stock price as the housing market made steps toward recovery during the period and businesses tied to home renovations grew.

Software and professional health-care services provider Allscripts Healthcare Solutions was the third-largest detractor from returns. The company is one of the largest players in the area of digital medical records, but had experienced turmoil in its management ranks and downward pressure on earnings over the course of 2012. During the fund’s reporting period, the market eagerly received news that the company was considering a leveraged buyout with private equity firms, but hopes were dashed and the stock sold off when those plans were abandoned. We sold the stock before period-end.

What is your outlook for equities?

As of the start of February 2013, some market observers wonder whether the stock market has reached a peak. The S&P 500 Index is in the neighborhood of 1500, a key confidence level last seen in 2007 and 2000. In other words, we are at the top of a trading range that is more than a decade long, and some are wondering, where do we go from here? We feel positive about the market’s ability to climb higher for a couple of reasons. First, company earnings per share have grown substantially since 2007 and 2000.

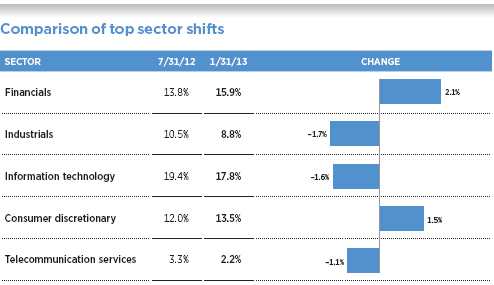

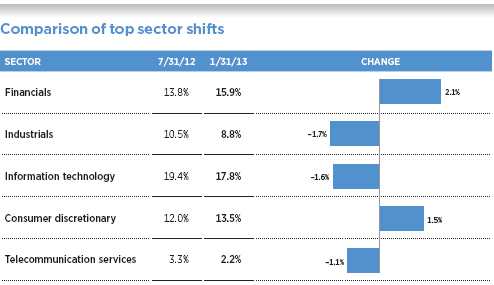

This chart shows the fund’s largest allocation shifts, by percentage, over the past six months. Allocations are represented as a percentage of the fund’s net assets. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

Second, price-to-earnings ratios have largely compressed relative to these earlier periods, which suggests that stocks are generally cheaper than they were during the market’s prior peaks.

On the plus side, we note that a number of economic indicators are below their peak levels and, we believe, may be poised for sustained improvement. Housing and autos as a percentage of U.S. GDP, capital expenditures, employment, and inventories are all at or below what we consider mid-cycle levels, which suggests the possibility for continued expansion. Combined with unsteady but gradual improvements in Europe (Italy, for example, still presents certain unique risks), we feel the outlook for improving economic fundamentals in the United States suggests we could be facing a multi-year period of healthy economic growth, which would bode well for stocks.

Having said that, we do not expect market strength to progress in a straight line. Eventually, the United States will need to make its advance with less Federal Reserve easing and may face an environment of higher interest rates. In addition, the threat of geopolitical conflict hovers over certain flash points around the globe. For these reasons, the one- to two-year outlook looks good to us, though we expect volatility from different sources to occasionally cause market unease.

Thank you, Aaron, for bringing us up to date.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Aaron M. Cooper is Director of Global Equity Research at Putnam. He holds an A.B. from Harvard University. A CFA charterholder, he joined Putnam in 2011 and has been in the investment industry since 1999.

In addition to Aaron, your fund’s managers are Kelsey Chen, Ph.D.; Steven W. Curbow; Neil P. Desai; Ferat Ongoren; and Walter D. Scully.

IN THE NEWS

Mixed signals are coming from the U.S. economy. On the positive side, the unemployment rate continues to tick down, the housing sector is recovering, and the stock market has reached multi-year highs. But uncertainty remains. The nation’s GDP was essentially flat in the fourth quarter of 2012, after several consecutive quarters of expansion. A precipitous drop in military spending contributed to the slowdown, and many questions remain about government spending and its impact on GDP going forward. Consumer confidence recently dropped following the tax increases resulting from the fiscal cliff resolution, as people anticipate the pinch of less take-home pay. The next few months should provide clearer direction for the markets on government spending and the resilience of the recovery.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2013, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 1/31/13

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (10/2/95) | (6/15/98) | (2/1/99) | (6/15/98) | (1/21/03) | (4/4/00) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.21% | 6.84% | 6.37% | 6.37% | 6.40% | 6.40% | 6.67% | 6.45% | 6.94% | 7.41% |

|

| 10 years | 90.60 | 79.65 | 76.58 | 76.58 | 76.59 | 76.59 | 81.18 | 74.91 | 85.88 | 95.21 |

| Annual average | 6.66 | 6.03 | 5.85 | 5.85 | 5.85 | 5.85 | 6.12 | 5.75 | 6.40 | 6.92 |

|

| 5 years | 25.31 | 18.08 | 20.55 | 18.55 | 20.63 | 20.63 | 22.12 | 17.81 | 23.71 | 26.80 |

| Annual average | 4.62 | 3.38 | 3.81 | 3.46 | 3.82 | 3.82 | 4.08 | 3.33 | 4.35 | 4.86 |

|

| 3 years | 46.65 | 38.21 | 43.26 | 40.26 | 43.36 | 43.36 | 44.33 | 39.30 | 45.45 | 47.68 |

| Annual average | 13.61 | 11.39 | 12.73 | 11.94 | 12.76 | 12.76 | 13.01 | 11.68 | 13.30 | 13.88 |

|

| 1 year | 17.11 | 10.37 | 16.17 | 11.17 | 16.14 | 15.14 | 16.45 | 12.41 | 16.74 | 17.31 |

|

| 6 months | 11.38 | 4.96 | 10.95 | 5.95 | 10.93 | 9.93 | 11.05 | 7.17 | 11.21 | 11.53 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

Recent performance may have benefited from one or more legal settlements.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

A short-term trading fee of 1.00% may have applied to redemptions (including exchanges into another fund) of shares purchased before January 2, 2013, and held for 7 days or less. No short-term trading fee applies to shares purchased on or after January 2, 2013.

Comparative index returns For periods ended 1/31/13

| | |

| | | Lipper Large-Cap Core |

| | S&P 500 Index | Funds category average* |

|

| Annual average (life of fund) | 7.57% | 6.99% |

|

| 10 years | 114.48 | 104.62 |

| Annual average | 7.93 | 7.35 |

|

| 5 years | 21.51 | 16.23 |

| Annual average | 3.97 | 2.99 |

|

| 3 years | 48.71 | 41.15 |

| Annual average | 14.14 | 12.14 |

|

| 1 year | 16.78 | 15.62 |

|

| 6 months | 9.91 | 10.76 |

|

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 1/31/13, there were 957, 937, 860, 755, 496, and 151 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 1/31/13

| | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.189 | $0.056 | $0.067 | $0.103 | $0.154 | $0.233 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.189 | $0.056 | $0.067 | $0.103 | $0.154 | $0.233 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $16.35 | $17.35 | $15.34 | $15.38 | $15.74 | $16.31 | $16.26 | $16.45 |

|

| 1/31/13 | 18.01 | 19.11 | 16.96 | 16.99 | 17.37 | 18.00 | 17.92 | 18.10 |

|

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/12

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (10/2/95) | (6/15/98) | (2/1/99) | (6/15/98) | (1/21/03) | (4/4/00) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 6.95% | 6.59% | 6.12% | 6.12% | 6.15% | 6.15% | 6.42% | 6.20% | 6.69% | 7.16% |

|

| 10 years | 76.12 | 65.99 | 63.25 | 63.25 | 63.31 | 63.31 | 67.48 | 61.56 | 71.91 | 80.62 |

| Annual average | 5.82 | 5.20 | 5.02 | 5.02 | 5.03 | 5.03 | 5.29 | 4.91 | 5.57 | 6.09 |

|

| 5 years | 11.52 | 5.13 | 7.32 | 5.32 | 7.37 | 7.37 | 8.81 | 5.03 | 10.16 | 12.92 |

| Annual average | 2.20 | 1.01 | 1.42 | 1.04 | 1.43 | 1.43 | 1.70 | 0.99 | 1.95 | 2.46 |

|

| 3 years | 34.74 | 26.97 | 31.63 | 28.63 | 31.65 | 31.65 | 32.70 | 28.05 | 33.75 | 35.74 |

| Annual average | 10.45 | 8.28 | 9.59 | 8.75 | 9.60 | 9.60 | 9.89 | 8.59 | 10.18 | 10.72 |

|

| 1 year | 17.60 | 10.85 | 16.70 | 11.70 | 16.66 | 15.66 | 17.06 | 12.94 | 17.28 | 17.87 |

|

| 6 months | 7.76 | 1.59 | 7.38 | 2.38 | 7.36 | 6.36 | 7.56 | 3.82 | 7.70 | 7.92 |

|

See the discussion following the Fund performance table on page 10 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses | | | | | | |

| for the fiscal year ended 7/31/12 | 1.25% | 2.00% | 2.00% | 1.75% | 1.50% | 1.00% |

|

| Annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13 | 1.21% | 1.96% | 1.96% | 1.71% | 1.46% | 0.96% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from August 1, 2012, to January 31, 2013. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.45 | $10.42 | $10.42 | $9.10 | $7.77 | $5.12 |

|

| Ending value (after expenses) | $1,113.80 | $1,109.50 | $1,109.30 | $1,110.50 | $1,112.10 | $1,115.30 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended January 31, 2013, use the following calculation method. To find the value of your investment on August 1, 2012, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.16 | $9.96 | $9.96 | $8.69 | $7.43 | $4.89 |

|

| Ending value (after expenses) | $1,019.11 | $1,015.32 | $1,015.32 | $1,016.59 | $1,017.85 | $1,020.37 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2012, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of January 31, 2013, Putnam employees had approximately $364,000,000 and the Trustees had approximately $87,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

The fund’s portfolio 1/31/13 (Unaudited)

| | |

| COMMON STOCKS (97.9%)* | Shares | Value |

|

| Aerospace and defense (5.2%) | | |

| Boeing Co. (The) | 10,024 | $740,473 |

|

| Embraer SA ADR (Brazil) | 25,569 | 843,010 |

|

| General Dynamics Corp. | 22,560 | 1,495,728 |

|

| Honeywell International, Inc. | 41,766 | 2,850,112 |

|

| L-3 Communications Holdings, Inc. | 20,400 | 1,548,768 |

|

| Northrop Grumman Corp. S | 17,497 | 1,138,005 |

|

| Precision Castparts Corp. | 2,480 | 454,832 |

|

| Raytheon Co. | 6,283 | 330,988 |

|

| Rockwell Collins, Inc. | 4 | 236 |

|

| United Technologies Corp. S | 23,933 | 2,095,813 |

|

| | | 11,497,965 |

| Air freight and logistics (0.6%) | | |

| FedEx Corp. S | 4,839 | 490,917 |

|

| United Parcel Service, Inc. Class B | 10,211 | 809,630 |

|

| | | 1,300,547 |

| Auto components (1.4%) | | |

| American Axle & Manufacturing Holdings, Inc. † S | 13,171 | 153,837 |

|

| BorgWarner, Inc. † | 1,220 | 90,500 |

|

| Johnson Controls, Inc. | 92,413 | 2,873,120 |

|

| | | 3,117,457 |

| Automobiles (0.5%) | | |

| Ford Motor Co. | 70,939 | 918,660 |

|

| General Motors Co. † | 1,713 | 48,118 |

|

| Tesla Motors, Inc. † S | 5,850 | 219,434 |

|

| | | 1,186,212 |

| Beverages (1.2%) | | |

| Beam, Inc. | 14,899 | 913,905 |

|

| Coca-Cola Enterprises, Inc. | 52,701 | 1,837,684 |

|

| | | 2,751,589 |

| Biotechnology (1.5%) | | |

| Amgen, Inc. | 9,407 | 803,922 |

|

| Celgene Corp. † S | 18,557 | 1,836,401 |

|

| Gilead Sciences, Inc. † | 19,888 | 784,582 |

|

| | | 3,424,905 |

| Building products (0.6%) | | |

| Fortune Brands Home & Security, Inc. † | 33,219 | 1,087,590 |

|

| Owens Corning, Inc. † | 8,195 | 341,486 |

|

| | | 1,429,076 |

| Capital markets (1.9%) | | |

| Ameriprise Financial, Inc. | 4,833 | 320,525 |

|

| Apollo Global Management, LLC Class A | 2,990 | 66,587 |

|

| BlackRock, Inc. | 884 | 208,872 |

|

| Blackstone Group LP (The) | 7,625 | 141,063 |

|

| Charles Schwab Corp. (The) S | 32,179 | 531,919 |

|

| Franklin Resources, Inc. | 2,706 | 370,397 |

|

| Goldman Sachs Group, Inc. (The) | 2,698 | 398,926 |

|

| Invesco, Ltd. | 11,183 | 304,737 |

|

| KKR & Co. LP | 9,834 | 165,998 |

|

| Morgan Stanley | 43,312 | 989,679 |

|

| State Street Corp. | 11,763 | 654,611 |

|

| | | 4,153,314 |

| | |

| COMMON STOCKS (97.9%)* cont. | Shares | Value |

|

| Chemicals (2.4%) | | |

| Agrium, Inc. (Canada) | 3,200 | $363,168 |

|

| Albemarle Corp. S | 3,180 | 194,966 |

|

| Celanese Corp. Ser. A | 5,070 | 237,682 |

|

| Dow Chemical Co. (The) | 26,200 | 843,640 |

|

| Eastman Chemical Co. | 7,994 | 568,773 |

|

| FMC Corp. | 3,820 | 234,815 |

|

| Intrepid Potash, Inc. S | 7,600 | 177,080 |

|

| LyondellBasell Industries NV Class A | 12,750 | 808,605 |

|

| Monsanto Co. | 12,650 | 1,282,078 |

|

| Mosaic Co. (The) | 5,551 | 339,999 |

|

| Tronox, Ltd. Class A S | 11,187 | 211,994 |

|

| | | 5,262,800 |

| Commercial banks (2.2%) | | |

| Comerica, Inc. | 2,072 | 71,194 |

|

| Fifth Third Bancorp | 20,251 | 329,889 |

|

| PNC Financial Services Group, Inc. | 3,489 | 215,620 |

|

| Regions Financial Corp. | 37,151 | 289,035 |

|

| U.S. Bancorp | 48,625 | 1,609,488 |

|

| Wells Fargo & Co. | 69,305 | 2,413,893 |

|

| | | 4,929,119 |

| Commercial services and supplies (0.9%) | | |

| ADT Corp. (The) | 8,955 | 425,363 |

|

| Iron Mountain, Inc. | 1,774 | 60,689 |

|

| Republic Services, Inc. | 13,027 | 415,431 |

|

| Tyco International, Ltd. | 39,845 | 1,204,514 |

|

| | | 2,105,997 |

| Communications equipment (1.8%) | | |

| Cisco Systems, Inc. | 71,103 | 1,462,589 |

|

| F5 Networks, Inc. † | 6,047 | 634,209 |

|

| Qualcomm, Inc. | 30,270 | 1,998,728 |

|

| | | 4,095,526 |

| Computers and peripherals (5.4%) | | |

| Apple, Inc. | 15,798 | 7,192,987 |

|

| EMC Corp. † | 98,194 | 2,416,554 |

|

| Hewlett-Packard Co. S | 38,703 | 638,987 |

|

| NetApp, Inc. † S | 9,209 | 331,524 |

|

| SanDisk Corp. † S | 26,738 | 1,336,633 |

|

| | | 11,916,685 |

| Construction and engineering (0.1%) | | |

| KBR, Inc. | 6,369 | 198,840 |

|

| | | 198,840 |

| Consumer finance (0.5%) | | |

| American Express Co. | 5,466 | 321,455 |

|

| Capital One Financial Corp. | 4,734 | 266,619 |

|

| Discover Financial Services | 12,992 | 498,763 |

|

| SLM Corp. | 1,235 | 20,859 |

|

| | | 1,107,696 |

| Containers and packaging (0.1%) | | |

| Sealed Air Corp. | 6,880 | 128,794 |

|

| | | 128,794 |

| | |

| COMMON STOCKS (97.9%)* cont. | Shares | Value |

|

| Diversified financial services (5.0%) | | |

| Bank of America Corp. | 212,973 | $2,410,854 |

|

| Citigroup, Inc. | 74,517 | 3,141,637 |

|

| CME Group, Inc. S | 7,415 | 428,884 |

|

| IntercontinentalExchange, Inc. † | 664 | 92,130 |

|

| JPMorgan Chase & Co. | 88,820 | 4,178,981 |

|

| Moody’s Corp. | 11,363 | 622,920 |

|

| Nasdaq OMX Group, Inc. (The) | 5,504 | 155,873 |

|

| | | 11,031,279 |

| Diversified telecommunication services (2.2%) | | |

| AT&T, Inc. | 64,085 | 2,229,517 |

|

| Verizon Communications, Inc. | 58,548 | 2,553,278 |

|

| | | 4,782,795 |

| Electric utilities (2.1%) | | |

| American Electric Power Co., Inc. S | 15,904 | 720,292 |

|

| Duke Energy Corp. | 8,592 | 590,614 |

|

| Edison International | 13,679 | 659,191 |

|

| FirstEnergy Corp. | 21,281 | 861,668 |

|

| NextEra Energy, Inc. S | 15,661 | 1,128,375 |

|

| PPL Corp. | 18,371 | 556,458 |

|

| Southern Co. (The) | 2,472 | 109,337 |

|

| | | 4,625,935 |

| Electrical equipment (0.2%) | | |

| Eaton Corp PLC | 9,313 | 530,375 |

|

| | | 530,375 |

| Electronic equipment, instruments, and components (0.1%) | | |

| TE Connectivity, Ltd. | 5,094 | 198,055 |

|

| | | 198,055 |

| Energy equipment and services (2.8%) | | |

| Cameron International Corp. † | 11,400 | 721,734 |

|

| Halliburton Co. | 37,100 | 1,509,228 |

|

| McDermott International, Inc. † S | 15,120 | 184,010 |

|

| Nabors Industries, Ltd. † | 35,700 | 595,119 |

|

| Oil States International, Inc. † | 3,600 | 279,288 |

|

| Petrofac, Ltd. (United Kingdom) | 25,597 | 664,976 |

|

| Schlumberger, Ltd. | 27,500 | 2,146,375 |

|

| | | 6,100,730 |

| Food and staples retail (1.5%) | | |

| Costco Wholesale Corp. | 4,623 | 473,118 |

|

| CVS Caremark Corp. | 9,550 | 488,960 |

|

| Kroger Co. (The) | 23,413 | 648,540 |

|

| Wal-Mart Stores, Inc. S | 20,304 | 1,420,265 |

|

| Walgreen Co. S | 8,497 | 339,540 |

|

| | | 3,370,423 |

| Food products (1.8%) | | |

| Archer Daniels-Midland Co. S | 12,900 | 368,037 |

|

| Dean Foods Co. † | 3,039 | 55,644 |

|

| General Mills, Inc. | 9,951 | 417,345 |

|

| H.J. Heinz Co. | 605 | 36,681 |

|

| Hershey Co. (The) S | 5,252 | 417,271 |

|

| Hillshire Brands Co. | 7,167 | 222,034 |

|

| Hormel Foods Corp. | 2,298 | 79,534 |

|

| | |

| COMMON STOCKS (97.9%)* cont. | Shares | Value |

|

| Food products cont. | | |

| JM Smucker Co. (The) | 1,898 | $168,220 |

|

| Kellogg Co. | 1,853 | 108,401 |

|

| Kraft Foods Group, Inc. | 10,868 | 502,319 |

|

| McCormick & Co., Inc. Class A (Non Voting Shares) | 1 | 62 |

|

| Mead Johnson Nutrition Co. S | 6,161 | 468,236 |

|

| Mondelez International, Inc. Class A | 33,138 | 920,905 |

|

| Tyson Foods, Inc. Class A | 4,831 | 106,862 |

|

| WhiteWaves Foods Co. Class A † | 2,946 | 47,696 |

|

| | | 3,919,247 |

| Health-care equipment and supplies (2.0%) | | |

| Abbott Laboratories | 20,163 | 683,122 |

|

| Baxter International, Inc. | 13,166 | 893,181 |

|

| Boston Scientific Corp. † | 28,626 | 213,836 |

|

| CareFusion Corp. † | 11,076 | 343,799 |

|

| Covidien PLC | 12,446 | 775,884 |

|

| Intuitive Surgical, Inc. † | 340 | 195,289 |

|

| Medtronic, Inc. | 6,047 | 281,790 |

|

| St. Jude Medical, Inc. S | 12,744 | 518,681 |

|

| Zimmer Holdings, Inc. S | 6,249 | 466,175 |

|

| | | 4,371,757 |

| Health-care providers and services (2.3%) | | |

| Aetna, Inc. S | 12,425 | 599,258 |

|

| Air Methods Corp. S | 10,663 | 466,186 |

|

| Catamaran Corp. † | 11,664 | 605,245 |

|

| CIGNA Corp. | 2,661 | 155,243 |

|

| Express Scripts Holding Co. † | 17,417 | 930,416 |

|

| Humana, Inc. | 10,492 | 780,185 |

|

| Tenet Healthcare Corp. † | 9,350 | 363,061 |

|

| UnitedHealth Group, Inc. | 22,948 | 1,266,959 |

|

| | | 5,166,553 |

| Hotels, restaurants, and leisure (2.0%) | | |

| Las Vegas Sands Corp. | 5,847 | 323,047 |

|

| McDonald’s Corp. | 21,227 | 2,022,721 |

|

| Norwegian Cruise Line Holdings, Ltd. † | 8,170 | 215,443 |

|

| Penn National Gaming, Inc. † S | 9,057 | 440,714 |

|

| Starbucks Corp. | 12,527 | 703,015 |

|

| Wyndham Worldwide Corp. | 14,096 | 786,416 |

|

| | | 4,491,356 |

| Household durables (0.4%) | | |

| M.D.C. Holdings, Inc. | 6,186 | 243,234 |

|

| M/I Homes, Inc. † S | 8,058 | 219,500 |

|

| PulteGroup, Inc. † S | 15,883 | 329,413 |

|

| | | 792,147 |

| Household products (1.6%) | | |

| Colgate-Palmolive Co. | 4,034 | 433,131 |

|

| Procter & Gamble Co. (The) | 42,644 | 3,205,123 |

|

| | | 3,638,254 |

| Independent power producers and energy traders (0.6%) | | |

| Calpine Corp. † | 37,474 | 739,362 |

|

| NRG Energy, Inc. S | 22,904 | 549,696 |

|

| | | 1,289,058 |

| | |

| COMMON STOCKS (97.9%)* cont. | Shares | Value |

|

| Insurance (4.0%) | | |

| ACE, Ltd. S | 6,970 | $594,750 |

|

| Aflac, Inc. S | 14,111 | 748,730 |

|

| Allstate Corp. (The) | 11,910 | 522,849 |

|

| American International Group, Inc. † | 24,882 | 941,286 |

|

| Aon PLC S | 6,491 | 374,790 |

|

| Assured Guaranty, Ltd. | 23,231 | 421,178 |

|

| Berkshire Hathaway, Inc. Class B † | 15,996 | 1,550,492 |

|

| Chubb Corp. (The) | 6,154 | 494,228 |

|

| Hartford Financial Services Group, Inc. (The) S | 18,993 | 471,026 |

|

| Marsh & McLennan Cos., Inc. S | 12,290 | 436,049 |

|

| MetLife, Inc. | 23,819 | 889,401 |

|

| Prudential Financial, Inc. | 6,366 | 368,464 |

|

| Travelers Cos., Inc. (The) | 8,040 | 630,818 |

|

| XL Group PLC S | 14,448 | 400,499 |

|

| | | 8,844,560 |

| Internet and catalog retail (1.4%) | | |

| Amazon.com, Inc. † | 7,429 | 1,972,400 |

|

| HomeAway, Inc. † S | 10,856 | 260,218 |

|

| Priceline.com, Inc. † | 1,351 | 926,070 |

|

| | | 3,158,688 |

| Internet software and services (2.6%) | | |

| eBay, Inc. † | 28,075 | 1,570,235 |

|

| Facebook, Inc. Class A † | 18,456 | 571,582 |

|

| Google, Inc. Class A † | 4,851 | 3,665,852 |

|

| | | 5,807,669 |

| IT Services (2.9%) | | |

| Alliance Data Systems Corp. † | 489 | 77,066 |

|

| Cognizant Technology Solutions Corp. † | 8,848 | 691,737 |

|

| Computer Sciences Corp. | 15,137 | 632,727 |

|

| Fidelity National Information Services, Inc. | 20,599 | 764,429 |

|

| IBM Corp. | 9,545 | 1,938,303 |

|

| Visa, Inc. Class A | 14,440 | 2,280,220 |

|

| | | 6,384,482 |

| Leisure equipment and products (0.4%) | | |

| Hasbro, Inc. S | 21,289 | 795,570 |

|

| | | 795,570 |

| Life sciences tools and services (0.5%) | | |

| Agilent Technologies, Inc. S | 8,062 | 361,016 |

|

| Thermo Fisher Scientific, Inc. | 10,081 | 727,243 |

|

| | | 1,088,259 |

| Machinery (0.8%) | | |

| Joy Global, Inc. | 7,863 | 496,706 |

|

| Navistar International Corp. † S | 12,860 | 335,517 |

|

| Pall Corp. | 1,394 | 95,210 |

|

| Parker Hannifin Corp. S | 2,306 | 214,389 |

|

| Stanley Black & Decker, Inc. | 6,485 | 498,243 |

|

| Xylem, Inc. | 2,797 | 78,120 |

|

| | | 1,718,185 |

| Media (3.8%) | | |

| Comcast Corp. Class A | 64,617 | 2,460,615 |

|

| DIRECTV † | 4,215 | 215,555 |

|

| | |

| COMMON STOCKS (97.9%)* cont. | Shares | Value |

|

| Media cont. | | |

| DISH Network Corp. Class A | 38,449 | $1,432,994 |

|

| News Corp. Class A | 43,826 | 1,215,733 |

|

| Time Warner, Inc. | 23,324 | 1,178,328 |

|

| Viacom, Inc. Class B | 14,368 | 867,109 |

|

| Walt Disney Co. (The) | 19,821 | 1,067,955 |

|

| | | 8,438,289 |

| Metals and mining (0.7%) | | |

| Barrick Gold Corp. (Canada) | 4,361 | 139,203 |

|

| Freeport-McMoRan Copper & Gold, Inc. Class B (Indonesia) | 19,225 | 677,681 |

|

| Kinross Gold Corp. (Canada) | 12,462 | 102,562 |

|

| Newmont Mining Corp. | 1,433 | 61,562 |

|

| Nucor Corp. S | 7,007 | 322,392 |

|

| Pretium Resources, Inc. (Canada) † | 3,701 | 41,300 |

|

| Walter Energy, Inc. S | 2,815 | 105,703 |

|

| Xstrata PLC (United Kingdom) | 3,672 | 68,808 |

|

| | | 1,519,211 |

| Multi-utilities (0.3%) | | |

| Dominion Resources, Inc. | 4,139 | 223,961 |

|

| PG&E Corp. | 5,190 | 221,302 |

|

| Sempra Energy | 3,172 | 238,059 |

|

| | | 683,322 |

| Multiline retail (1.4%) | | |

| Dollar General Corp. † | 15,308 | 707,536 |

|

| Macy’s, Inc. | 19,975 | 789,212 |

|

| Nordstrom, Inc. S | 13,553 | 748,532 |

|

| Target Corp. | 12,615 | 762,072 |

|

| | | 3,007,352 |

| Oil, gas, and consumable fuels (8.3%) | | |

| Anadarko Petroleum Corp. | 21,642 | 1,731,793 |

|

| CONSOL Energy, Inc. | 4,736 | 148,426 |

|

| EXCO Resources, Inc. S | 17,041 | 109,233 |

|

| Exxon Mobil Corp. | 81,558 | 7,337,773 |

|

| Marathon Oil Corp. | 50,385 | 1,693,440 |

|

| Noble Energy, Inc. | 11,988 | 1,292,187 |

|

| Occidental Petroleum Corp. | 15,585 | 1,375,688 |

|

| PBF Energy, Inc. † S | 4,800 | 160,320 |

|

| Royal Dutch Shell PLC ADR (United Kingdom) | 17,324 | 1,221,688 |

|

| Southwestern Energy Co. † S | 40,465 | 1,387,950 |

|

| Spectra Energy Corp. | 20,800 | 577,824 |

|

| Suncor Energy, Inc. (Canada) | 39,782 | 1,353,384 |

|

| | | 18,389,706 |

| Paper and forest products (0.5%) | | |

| International Paper Co. | 15,120 | 626,270 |

|

| MeadWestvaco Corp. | 12,069 | 378,363 |

|

| | | 1,004,633 |

| Pharmaceuticals (6.4%) | | |

| AbbVie, Inc. † | 41,937 | 1,538,669 |

|

| Actavis, Inc. † | 10,003 | 864,159 |

|

| Auxilium Pharmaceuticals, Inc. † | 31,535 | 580,244 |

|

| Bristol-Myers Squibb Co. | 11,953 | 431,981 |

|

| Eli Lilly & Co. | 32,911 | 1,766,992 |

|

| | |

| COMMON STOCKS (97.9%)* cont. | Shares | Value |

|

| Pharmaceuticals cont. | | |

| Johnson & Johnson S | 48,625 | $3,594,360 |

|

| Merck & Co., Inc. | 53,550 | 2,316,038 |

|

| Pfizer, Inc. | 110,057 | 3,002,355 |

|

| Zoetis, Inc. † | 3,380 | 87,880 |

|

| | | 14,182,678 |

| Professional services (0.1%) | | |

| Verisk Analytics, Inc. Class A † | 5,690 | 313,860 |

|

| | | 313,860 |

| Real estate investment trusts (REITs) (2.3%) | | |

| American Tower Corp. Class A R | 16,137 | 1,228,833 |

|

| Apartment Investment & Management Co. Class A R | 2,371 | 64,681 |

|

| AvalonBay Communities, Inc. R | 1,825 | 236,867 |

|

| Boston Properties, Inc. R | 2,461 | 259,094 |

|

| Equity Residential Trust R | 5,240 | 290,244 |

|

| HCP, Inc. R | 7,375 | 342,126 |

|

| Health Care REIT, Inc. R | 4,170 | 262,043 |

|

| Host Hotels & Resorts, Inc. R | 11,798 | 198,088 |

|

| Kimco Realty Corp. R S | 6,644 | 137,996 |

|

| Plum Creek Timber Co., Inc. R | 2,650 | 127,677 |

|

| Prologis, Inc. R | 7,548 | 301,165 |

|

| Public Storage R | 2,355 | 362,505 |

|

| Simon Property Group, Inc. R | 4,959 | 794,333 |

|

| Ventas, Inc. R | 4,829 | 320,114 |

|

| Vornado Realty Trust R | 2,765 | 233,532 |

|

| | | 5,159,298 |

| Real estate management and development (—%) | | |

| CBRE Group, Inc. Class A † | 4,938 | 106,562 |

|

| | | 106,562 |

| Semiconductors and semiconductor equipment (2.1%) | | |

| ASML Holding NV ADR (Netherlands) S | 3,829 | 287,520 |

|

| Broadcom Corp. Class A | 2,145 | 69,605 |

|

| First Solar, Inc. † S | 5,479 | 154,398 |

|

| Intel Corp. S | 56,202 | 1,182,490 |

|

| Lam Research Corp. † | 13,089 | 538,481 |

|

| Texas Instruments, Inc. S | 43,676 | 1,444,802 |

|

| Xilinx, Inc. | 24,683 | 900,683 |

|

| | | 4,577,979 |

| Software (3.0%) | | |

| Microsoft Corp. | 94,931 | 2,607,755 |

|

| Oracle Corp. | 62,585 | 2,222,393 |

|

| Red Hat, Inc. † | 4,832 | 268,466 |

|

| Salesforce.com, Inc. † | 2,527 | 434,973 |

|

| Symantec Corp. † | 20,068 | 436,880 |

|

| VMware, Inc. Class A † S | 9,675 | 739,944 |

|

| | | 6,710,411 |

| Specialty retail (1.6%) | | |

| AutoZone, Inc. † S | 1,353 | 500,204 |

|

| Bed Bath & Beyond, Inc. † S | 21,042 | 1,235,165 |

|

| Best Buy Co., Inc. S | 5,925 | 96,341 |

|

| CarMax, Inc. † | 4,037 | 159,139 |

|

| Lowe’s Cos., Inc. | 13,978 | 533,820 |

|

| | |

| COMMON STOCKS (97.9%)* cont. | Shares | Value |

|

| Specialty retail cont. | | |

| Staples, Inc. S | 12,141 | $163,661 |

|

| TJX Cos., Inc. (The) | 20,520 | 927,094 |

|

| | | 3,615,424 |

| Textiles, apparel, and luxury goods (0.6%) | | |

| Coach, Inc. | 11,377 | 580,227 |

|

| Michael Kors Holdings, Ltd. (Hong Kong) † | 5,385 | 302,260 |

|

| NIKE, Inc. Class B | 6,665 | 360,243 |

|

| | | 1,242,730 |

| Tobacco (3.2%) | | |

| Altria Group, Inc. S | 56,154 | 1,891,267 |

|

| Lorillard, Inc. | 6,549 | 255,869 |

|

| Philip Morris International, Inc. | 56,002 | 4,937,131 |

|

| | | 7,084,267 |

| Water utilities (0.1%) | | |

| American Water Works Co., Inc. | 7,040 | 269,491 |

|

| | | 269,491 |

| | | |

| Total common stocks (cost $197,448,310) | | $217,017,112 |

| |

| |

| CONVERTIBLE PREFERRED STOCKS (0.2%)* | Shares | Value |

|

| United Technologies Corp. $3.75 cv. pfd. | 6,584 | $374,893 |

|

| Total convertible preferred stocks (cost $329,200) | | $374,893 |

| | | |

| PURCHASED EQUITY OPTIONS | Expiration | Contract | |

| OUTSTANDING (—%)* | date/strike | amount | Value |

|

| General Dynamics Corp. (Call) | Feb-13/$75.00 | 46,310 | $2 |

|

| Total purchased equity options outstanding (cost $17,598) | | $2 |

| | |

| SHORT-TERM INVESTMENTS (15.9%)* | Principal amount/shares | Value |

|

| U.S. Treasury Bills with effective yields ranging from 0.158% | | |

| to 0.159%, February 7, 2013 | $419,000 | $418,989 |

|

| U.S. Treasury Bills with effective yields ranging from 0.128% | | |

| to 0.131%, January 9, 2014 # | 160,000 | 159,795 |

|

| Putnam Cash Collateral Pool, LLC 0.18% d | 30,491,811 | 30,491,811 |

|

| Putnam Money Market Liquidity Fund 0.10% L | 4,247,665 | 4,247,665 |

|

| Total short-term investments (cost $35,318,266) | | $35,318,260 |

| |

| |

| TOTAL INVESTMENTS | | |

|

| Total investments (cost $233,113,374) | | $252,710,267 |

Key to holding’s abbreviations

| |

| ADR | American Depository Receipts: represents ownership of foreign securities on deposit with a custodian bank |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from August 1, 2012 through January 31, 2013 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures and references to “OTC”, if any, represent over-the-counter.

* Percentages indicated are based on net assets of $221,700,609.

† Non-income-producing security.

# This security, in part or in entirety, was pledged and segregated with the broker to cover margin requirements for futures contracts at the close of the reporting period.

d Affiliated company. See Note 1 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

L Affiliated company (Note 6). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

R Real Estate Investment Trust.

S Security on loan, in part or in entirety, at the close of the reporting period (Note 1).

At the close of the reporting period, the fund maintained liquid assets totaling $46,509 to cover certain derivatives contracts.

FORWARD CURRENCY CONTRACTS at 1/31/13 (aggregate face value $1,884,291) (Unaudited)

| | | | | |

| | Contract | Delivery | | Aggregate | Unrealized |

| Counterparty | Currency | type | date | Value | face value | (depreciation) |

|

| Credit Suisse International | | | | | |

|

| Euro | Sell | 2/20/13 | $1,931,379 | $1,884,291 | $(47,088) |

|

| Total | | | | | $(47,088) |

FUTURES CONTRACTS OUTSTANDING at 1/31/13 (Unaudited)

| | | | | |

| | Number of | | | Expiration | Unrealized |

| | contracts | Value | | date | appreciation |

|

| S&P 500 Index (Long) | 5 | $1,866,625 | | Mar-13 | $60,106 |

|

| Total | | | | | $60,106 |

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | | |

| | | | | Valuation inputs | |

|

| Investments in securities: | | Level 1 | Level 2 | Level 3 |

|

| Common stocks: | | | | |

|

| Consumer discretionary | | $29,845,225 | $— | $— |

|

| Consumer staples | | 20,763,780 | — | — |

|

| Energy | | 24,490,436 | — | — |

|

| Financials | | 35,331,828 | — | — |

|

| Health care | | 28,234,152 | — | — |

|

| Industrials | | 19,094,845 | — | — |

|

| Information technology | | 39,690,807 | — | — |

|

| Materials | | 7,915,438 | — | — |

|

| Telecommunication services | | 4,782,795 | — | — |

|

| Utilities | | 6,867,806 | — | — |

|

| Total common stocks | | 217,017,112 | — | — |

| | | | | |

| Convertible preferred stocks | | 374,893 | — | — |

|

| Purchased equity options outstanding | | — | 2 | — |

|

| Short-term investments | | 4,247,665 | 31,070,595 | — |

|

| Totals by level | | $221,639,670 | $31,070,597 | $— |

| | | | | |

| | | | | Valuation inputs | |

|

| Other financial instruments: | | Level 1 | Level 2 | Level 3 |

|

| Forward currency contracts | | $— | $(47,088) | $— |

|

| Futures contracts | | 60,106 | — | — |

|

| Totals by level | | $60,106 | $(47,088) | $— |

The accompanying notes are an integral part of these financial statements.

Statement of assets and liabilities 1/31/13 (Unaudited)

| |

| ASSETS | |

|

| Investment in securities, at value, including $29,831,920 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $198,373,898) | $217,970,791 |

| Affiliated issuers (identified cost $34,739,476) (Notes 1 and 6) | 34,739,476 |

|

| Foreign currency (cost $4) (Note 1) | 3 |

|

| Dividends, interest and other receivables | 272,685 |

|

| Receivable for shares of the fund sold | 65,889 |

|

| Receivable for investments sold | 3,474,974 |

|

| Total assets | 256,523,818 |

| |

| LIABILITIES | |

|

| Payable for investments purchased | 3,692,818 |

|

| Payable for shares of the fund repurchased | 148,709 |

|

| Payable for compensation of Manager (Note 2) | 105,494 |

|

| Payable for custodian fees (Note 2) | 15,213 |

|

| Payable for investor servicing fees (Note 2) | 50,323 |

|

| Payable for Trustee compensation and expenses (Note 2) | 127,600 |

|

| Payable for administrative services (Note 2) | 2,136 |

|

| Payable for distribution fees (Note 2) | 59,581 |

|

| Payable for variation margin (Note 1) | 2,500 |

|

| Unrealized depreciation on forward currency contracts (Note 1) | 47,088 |

|

| Collateral on securities loaned, at value (Note 1) | 30,491,811 |

|

| Other accrued expenses | 79,936 |

|

| Total liabilities | 34,823,209 |

| | |

| Net assets | $221,700,609 |

|

| |

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $318,838,909 |

|

| Distributions in excess of net investment income (Note 1) | (529,746) |

|

| Accumulated net realized loss on investments and foreign currency transactions (Note 1) | (116,218,518) |

|

| Net unrealized appreciation of investments and assets and liabilities in foreign currencies | 19,609,964 |

|

| Total — Representing net assets applicable to capital shares outstanding | $221,700,609 |

(Continued on next page)

Statement of assets and liabilities (Continued)

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| Net asset value and redemption price per class A share | |

| ($186,332,825 divided by 10,348,229 shares) | $18.01 |

|

| Offering price per class A share (100/94.25 of $18.01)* | $19.11 |

|

| Net asset value and offering price per class B share ($10,136,956 divided by 597,688 shares)** | $16.96 |

|

| Net asset value and offering price per class C share ($10,988,848 divided by 646,724 shares)** | $16.99 |

|

| Net asset value and redemption price per class M share ($3,769,889 divided by 216,979 shares) | $17.37 |

|

| Offering price per class M share (100/96.50 of $17.37)* | $18.00 |

|

| Net asset value, offering price and redemption price per class R share | |

| ($163,461 divided by 9,121 shares) | $17.92 |

|

| Net asset value, offering price and redemption price per class Y share | |

| ($10,308,630 divided by 569,429 shares) | $18.10 |

|

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

Statement of operations Six months ended 1/31/13 (Unaudited)

| |

| INVESTMENT INCOME | |

|

| Dividends (net of foreign tax of $6,930) | $2,494,128 |

|

| Interest (including interest income of $2,818 from investments in affiliated issuers) (Note 6) | 20,947 |

|

| Securities lending (Note 1) | 68,433 |

|

| Total investment income | 2,583,508 |

| |

| EXPENSES | |

|

| Compensation of Manager (Note 2) | 612,489 |

|

| Investor servicing fees (Note 2) | 311,001 |

|

| Custodian fees (Note 2) | 20,668 |

|

| Trustee compensation and expenses (Note 2) | 11,147 |

|

| Distribution fees (Note 2) | 347,887 |

|

| Administrative services (Note 2) | 3,724 |

|

| Other | 77,232 |

|

| Total expenses | 1,384,148 |

| | |

| Expense reduction (Note 2) | (6,817) |

|

| Net expenses | 1,377,331 |

| | |

| Net investment income | 1,206,177 |

|

| |

| Net realized gain on investments (Notes 1 and 3) | 9,817,494 |

|

| Net realized gain on futures contracts (Note 1) | 146,033 |

|

| Net realized loss on foreign currency transactions (Note 1) | (111,256) |

|

| Net realized gain on written options (Notes 1 and 3) | 17,615 |

|

| Net unrealized depreciation of assets and liabilities in foreign currencies during the period | (66,548) |

|

| Net unrealized appreciation of investments and futures contracts during the period | 12,153,701 |

|

| Net gain on investments | 21,957,039 |

| | |

| Net increase in net assets resulting from operations | $23,163,216 |

|

The accompanying notes are an integral part of these financial statements.

Statement of changes in net assets

| | |

| INCREASE (DECREASE) IN NET ASSETS | Six months ended 1/31/13* | Year ended 7/31/12 |

|

| Operations: | | |

| Net investment income | $1,206,177 | $1,602,400 |

|

| Net realized gain on investments | | |

| and foreign currency transactions | 9,869,886 | 7,250,915 |

|

| Net unrealized appreciation of investments and assets | | |

| and liabilities in foreign currencies | 12,087,153 | 3,762,180 |

|

| Net increase in net assets resulting from operations | 23,163,216 | 12,615,495 |

|

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

|

| Class A | (1,963,228) | (1,593,744) |

|

| Class B | (35,048) | — |

|

| Class C | (43,464) | (17,573) |

|

| Class M | (22,486) | (15,382) |

|

| Class R | (1,696) | (1,057) |

|

| Class Y | (122,596) | (63,770) |

|

| Increase in capital from settlement payments | — | 24,032 |

|

| Redemption fees (Note 1) | 13 | 297 |

|

| Decrease from capital share transactions (Note 4) | (9,588,999) | (19,769,035) |

|

| Total increase (decrease) in net assets | 11,385,712 | (8,820,737) |

| |

| NET ASSETS | | |

|

| Beginning of period | 210,314,897 | 219,135,634 |

|

| End of period (including distributions in excess of net | | |

| investment income of $529,746 and undistributed net | | |

| investment income of $452,595, respectively) | $221,700,609 | $210,314,897 |

|

* Unaudited

The accompanying notes are an integral part of these financial statements.

|

| This page left blank intentionally. |

Financial highlights (For a common share outstanding throughout the period)

| | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | LESS DISTRIBUTIONS: | | | | | | RATIOS AND SUPPLEMENTAL DATA: | |

|

| | | | | | | | | | | | | | | Ratio | |

| | Net asset | | Net realized | | | | | | | | | | Ratio | of net investment | |

| | value, | | and unrealized | Total from | From | | | | | | Total return | Net assets, | of expenses | income (loss) | |

| | beginning | Net investment | gain (loss) | investment | net investment | From | Total | Redemption | Non-recurring | Net asset value, | at net asset | end of period | to average | to average | Portfolio |

| Period ended | of period | income (loss) a | on investments | operations | income | return of capital | distributions | fees e | reimbursements | end of period | value (%) b | (in thousands) | net assets (%) c | net assets (%) | turnover (%) |

|

| Class A | | | | | | | | | | | | | | | |

| January 31, 2013 ** | $16.35 | .10 | 1.75 | 1.85 | (.19) | — | (.19) | — | — | $18.01 | 11.38 * | $186,333 | .61 * | .60 * | 45 * |

| July 31, 2012 | 15.51 | .13 | .85 | .98 | (.14) | — | (.14) | — | — e,h | 16.35 | 6.37 | 178,021 | 1.26 | .85 | 108 |

| July 31, 2011 | 13.08 | .08 | 2.41 | 2.49 | (.08) | — | (.08) | — | .02 f | 15.51 | 19.24 | 183,969 | 1.23 | .53 | 99 |

| July 31, 2010 | 11.59 | .07 | 1.53 | 1.60 | (.10) | (.01) | (.11) | — | — | 13.08 | 13.80 | 184,136 | 1.26 d | .53 d | 106 |

| July 31, 2009 | 13.99 | .11 | (2.41) g | (2.30) | (.10) | — | (.10) | — | — | 11.59 | (16.26) g | 179,816 | 1.18 d | 1.04 d | 130 |

| July 31, 2008 | 16.74 | .08 | (2.78) | (2.70) | (.05) | — | (.05) | — | — | 13.99 | (16.16) | 271,560 | 1.24 d | .51 d | 119 |

|

| Class B | | | | | | | | | | | | | | | |

| January 31, 2013 ** | $15.34 | .04 | 1.64 | 1.68 | (.06) | — | (.06) | — | — | $16.96 | 10.95 * | $10,137 | .99 * | .22 * | 45 * |

| July 31, 2012 | 14.54 | .01 | .79 | .80 | — | — | — | — | — e,h | 15.34 | 5.50 | 10,441 | 2.01 | .11 | 108 |

| July 31, 2011 | 12.28 | (.03) | 2.27 | 2.24 | — | — | — | — | .02 f | 14.54 | 18.40 | 14,078 | 1.98 | (.21) | 99 |

| July 31, 2010 | 10.87 | (.02) | 1.43 | 1.41 | — e | — e | — e | — | — | 12.28 | 12.99 | 18,522 | 2.01 d | (.20) d | 106 |

| July 31, 2009 | 13.09 | .03 | (2.25) g | (2.22) | — | — | — | — | — | 10.87 | (16.96) g | 27,769 | 1.93 d | .31 d | 130 |

| July 31, 2008 | 15.73 | (.04) | (2.60) | (2.64) | — | — | — | — | — | 13.09 | (16.78) | 65,767 | 1.99 d | (.24) d | 119 |

|

| Class C | | | | | | | | | | | | | | | |

| January 31, 2013 ** | $15.38 | .04 | 1.64 | 1.68 | (.07) | — | (.07) | — | — | $16.99 | 10.93 * | $10,989 | .99 * | .22 * | 45 * |

| July 31, 2012 | 14.60 | .01 | .79 | .80 | (.02) | — | (.02) | — | — e,h | 15.38 | 5.51 | 10,525 | 2.01 | .10 | 108 |

| July 31, 2011 | 12.33 | (.03) | 2.28 | 2.25 | — | — | — | — | .02 f | 14.60 | 18.41 | 11,443 | 1.98 | (.22) | 99 |

| July 31, 2010 | 10.94 | (.03) | 1.45 | 1.42 | (.03) | — e | (.03) | — | — | 12.33 | 12.97 | 10,736 | 2.01 d | (.22) d | 106 |

| July 31, 2009 | 13.17 | .03 | (2.26) g | (2.23) | — | — | — | — | — | 10.94 | (16.93) g | 10,874 | 1.93 d | .29 d | 130 |

| July 31, 2008 | 15.83 | (.04) | (2.62) | (2.66) | — | — | — | — | — | 13.17 | (16.80) | 16,486 | 1.99 d | (.24) d | 119 |

|

| Class M | | | | | | | | | | | | | | | |

| January 31, 2013 ** | $15.74 | .06 | 1.67 | 1.73 | (.10) | — | (.10) | — | — | $17.37 | 11.05 * | $3,770 | .86 * | .35 * | 45 * |

| July 31, 2012 | 14.94 | .05 | .81 | .86 | (.06) | — | (.06) | — | — e,h | 15.74 | 5.78 | 3,692 | 1.76 | .35 | 108 |

| July 31, 2011 | 12.59 | — e | 2.34 | 2.34 | (.01) | — | (.01) | — | .02 f | 14.94 | 18.77 | 4,084 | 1.73 | .03 | 99 |

| July 31, 2010 | 11.17 | — e | 1.47 | 1.47 | (.05) | — e | (.05) | — | — | 12.59 | 13.19 | 3,961 | 1.76 d | .03 d | 106 |

| July 31, 2009 | 13.44 | .05 | (2.30) g | (2.25) | (.02) | — | (.02) | — | — | 11.17 | (16.69) g | 4,254 | 1.68 d | .54 d | 130 |

| July 31, 2008 | 16.11 | — e | (2.67) | (2.67) | — | — | — | — | — | 13.44 | (16.57) | 7,030 | 1.74 d | .01 d | 119 |

|

| Class R | | | | | | | | | | | | | | | |

| January 31, 2013 ** | $16.26 | .08 | 1.73 | 1.81 | (.15) | — | (.15) | — | — | $17.92 | 11.21 * | $163 | .73 * | .47 * | 45 * |

| July 31, 2012 | 15.44 | .09 | .84 | .93 | (.11) | — | (.11) | — | — e,h | 16.26 | 6.06 | 176 | 1.51 | .60 | 108 |

| July 31, 2011 | 13.02 | .04 | 2.42 | 2.46 | (.06) | — | (.06) | — | .02 f | 15.44 | 19.06 | 143 | 1.48 | .28 | 99 |

| July 31, 2010 | 11.55 | .04 | 1.52 | 1.56 | (.08) | (.01) | (.09) | — | — | 13.02 | 13.47 | 102 | 1.51 d | .28 d | 106 |

| July 31, 2009 | 13.92 | .09 | (2.40) g | (2.31) | (.06) | — | (.06) | — | — | 11.55 | (16.51) g | 103 | 1.43 d | .77 d | 130 |

| July 31, 2008 | 16.65 | .04 | (2.76) | (2.72) | (.01) | — | (.01) | — | — | 13.92 | (16.34) | 101 | 1.49 d | .27 d | 119 |

|

| Class Y | | | | | | | | | | | | | | | |

| January 31, 2013 ** | $16.45 | .12 | 1.76 | 1.88 | (.23) | — | (.23) | — | — | $18.10 | 11.53 * | $10,309 | .48 * | .71 * | 45 * |

| July 31, 2012 | 15.62 | .17 | .83 | 1.00 | (.17) | — | (.17) | — | — e,h | 16.45 | 6.54 | 7,461 | 1.01 | 1.10 | 108 |

| July 31, 2011 | 13.16 | .12 | 2.44 | 2.56 | (.12) | — | (.12) | — | .02 f | 15.62 | 19.66 | 5,418 | .98 | .77 | 99 |

| July 31, 2010 | 11.66 | .10 | 1.54 | 1.64 | (.13) | (.01) | (.14) | — | — | 13.16 | 14.05 | 3,802 | 1.01 d | .78 d | 106 |

| July 31, 2009 | 14.10 | .14 | (2.43) g | (2.29) | (.15) | — | (.15) | — | — | 11.66 | (16.04) g | 3,838 | .93 d | 1.30 d | 130 |

| July 31, 2008 | 16.88 | .12 | (2.80) | (2.68) | (.10) | — | (.10) | — | — | 14.10 | (15.96) | 5,026 | .99 d | .76 d | 119 |

|

See notes to financial highlights at the end of this section.

The accompanying notes are an integral part of these financial statements.

| | | |

| 32 | Research Fund | Research Fund | 33 |

Financial highlights (Continued)

* Not annualized.

** Unaudited.

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

c Includes amounts paid through expense offset and brokerage/service arrangements (Note 2).

d Reflects an involuntary contractual expense limitation in effect during the period. For periods prior to July 31, 2010 certain fund expenses were waived in connection with the fund’s investment in Putnam Prime Money Market Fund.

As a result of such limitation and/or waivers, the expenses of each class reflect a reduction of the following amounts:

| |

| | Percentage of |

| | average net assets |

|

| July 31, 2010 | 0.03% |

|

| July 31, 2009 | 0.27 |

|

| July 31, 2008 | 0.03 |

|

e Amount represents less than $0.01 per share.

f Reflects a non-recurring reimbursement related to restitution amounts in connection with a distribution plan approved by the Securities and Exchange Commission (the SEC), which amounted to $0.02 per share outstanding on July 21, 2011. Also reflects a non-recurring reimbursement related to short-term trading related lawsuits, which amounted to less than $0.01 per share outstanding on May 11, 2011.