| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-07237) |

| | |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | August 31, 2021 |

| | |

| Date of reporting period: | September 1, 2020 — February 28, 2021 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam PanAgora

Market Neutral

Fund

Semiannual report

2 | 28 | 21

Message from the Trustees

April 7, 2021

Dear Fellow Shareholder:

Optimism about society emerging from the Covid-19 pandemic remains tempered by concern about newer, more aggressive strains of the virus. On the plus side, the U.S. infection rate has declined and the pace of vaccinations is accelerating. The economy registered growth above 4% in the fourth quarter of 2020, and recent employment data is encouraging.

Investors must keep in mind that when the bond market sees stronger economic growth and the chance of inflation ahead, bond prices typically fall and yields rise. In such conditions, stock prices might also weaken as investors consider how rising yields could change borrowing costs.

No matter how markets move, Putnam remains active with strategies that seek superior investment performance. The portfolio managers and analysts keep their focus on research and potential risks, a discipline intended to serve you through changing conditions.

As always, thank you for investing with Putnam.

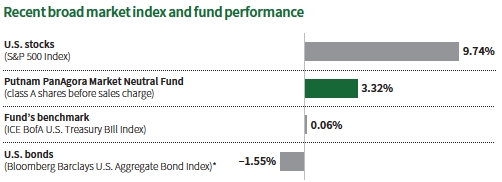

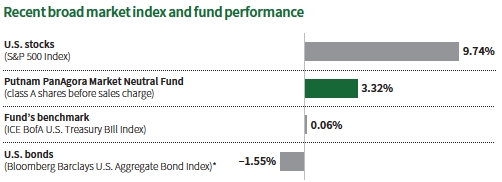

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See below and pages 7–8 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* Source: Lipper, a Refinitiv company.

† Returns for the six-month period are not annualized, but cumulative.

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 2/28/21. See above and pages 7–8 for additional fund performance information. Index descriptions can be found on pages 12–13.

* Source: Bloomberg Index Services Limited.

|

| 2 PanAgora Market Neutral Fund |

Please describe the global investing environment for the reporting period.

Global equity markets made a remarkable comeback, recouping losses sustained during the pandemic-driven downturn in early 2020. During the six-month reporting period, the global economic recovery was bolstered by promising vaccine-development news and U.S. election results. The removal of political uncertainty in the United States renewed demand for equities, and stock markets rallied strongly in November 2020. Equity investors also were encouraged by a U.K.–European trade deal in late 2020, which solidified the United Kingdom’s exit from the European Union [EU]. Similarly, after seven years of talks, the EU and China agreed to an investment treaty that resulted in mutually improved access to select markets.

Sentiment continued to improve in 2021 when the Biden administration announced an increase in the supply of Covid-19 vaccinations, and investors saw progress toward ending the pandemic. Across the Atlantic, Eurostat, the EU’s statistics office, confirmed that consumer prices across 19 EU-member countries had risen 0.90% year-over-year in January 2021. This brought inflation back to the eurozone for the first time in months. An increase in the prices of commodities, such as copper and aluminum, also aided certain emerging-market countries,

|

| PanAgora Market Neutral Fund 3 |

The table shows the fund’s long and short exposures in each country or region and the percentage of the fund’s net assets that each represented as of 2/28/21. Allocations will not total 100% because the table reflects the notional value of derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

including Argentina and the world’s leading exporter of copper, Chile.

Within the United States, small-cap equities largely outperformed the broader stock market. The Russell 2000 Index posted a return of 41.69% compared with 9.74% for the S&P 500 Index for the period. Emerging markets also reported gains, with the MSCI Emerging Markets Index [ND] returning 22.32% for the period. International developed-market equities also posted a solid increase, with the MSCI World ex-U.S. Index [ND] returning 14.23% for the period.

Investor demand for safe-haven assets persisted toward the end of 2020, against concerns over rising global Covid-19 infection rates. As the rollout of Covid-19 vaccines improved, the global economic recovery quickened and triggered inflationary concerns. Bonds began to broadly sell off in January and February 2021. Better-than-expected U.S. economic data, along with plans for more fiscal stimulus, helped push bond yields back up to pre-pandemic levels. The yield on the benchmark 10-year U.S. Treasury note rose 72 basis points to close the period at 1.44%. As prices fell, yields for developed-market government debt also rose. For the period, the FTSE World Government Bond ex-U.S. [Hedged] Index declined 0.80% compared with a decline of 3.43% for the Bloomberg Barclays U.S. Treasury Index. Investment-grade credit fared somewhat better as spreads continued to tighten during the period. For the period, the Bloomberg Barclays U.S. Credit Index reported a loss of 0.47%.

Inflationary concerns and the prospects of an accelerated global economic recovery proved to be a boon for commodities, particularly energy. The price of West Texas Intermediate crude oil rose by more than 45% to $62.40 per barrel at period-end — its highest level since December 2019. Each of the main commodity sectors, with the exception of safe-haven precious metals, posted gains over the six-month period. Commodity prices also were boosted by a weaker U.S. dollar, which depreciated against other major currencies. The more heavily energy-weighted S&P GSCI reported a gain of 28.03%, while the more balanced Bloomberg Commodity Index increased 16.32% for the period.

|

| 4 PanAgora Market Neutral Fund |

How did the fund perform during the reporting period? Could you discuss some detractors and contributors to results?

On an absolute basis, Putnam PanAgora Market Neutral Fund returned 3.32% for the reporting period. Intermediate-term strategies were a top contributor to positive performance, largely from the special purpose acquisition company strategy. U.S. merger arbitrage-related trades also contributed to the fund’s positive performance. In addition, short-term strategies benefited results, particularly our analyst-day strategies.

The long-term portfolio detracted from performance due to poor stock selection within the United States. The alpha model had negative performance in the U.S. region. Growth, quality, and momentum factors struggled, and value metrics performed poorly, particularly in large-cap stocks. Within U.S. sectors, consumer staples and information technology were detractors from performance, and healthcare was the top contributor. The alpha model within the health-care sector benefited from the positive performance of top quintile names within the large-cap industry-specific model.

International positions slightly detracted from performance for the six-month period due to stock selection within developed regions. Positions in the euro region, most notably the United Kingdom and Germany, detracted the most. Emerging-market positions were positive for the period. The Asia-Pacific region was a bright spot for the fund, with strong performance from our stock selections in China and Taiwan.

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one purpose: to take long or short positions in equity securities.

For example, the fund’s managers might use derivatives, such as total return swaps, to take long or short positions in equity securities. The fund may also use derivatives as a substitute for a direct investment in the securities of one or more issuers.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. PanAgora monitors the counterparty risks we assume. For example, PanAgora often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

|

| PanAgora Market Neutral Fund 5 |

How did the fund use derivatives during the reporting period?

We used total return swaps to take long or short positions in equity securities.

What is your outlook and portfolio strategy for the coming months?

The fund is designed to generate attractive, absolute returns under different market conditions and over different time horizons. The fund uses a diversified set of strategies that have low correlation to one another. We believe their combination can result in more stable returns over time than any individual strategy in and of itself.

A majority of the fund’s allocation is within the long-term portfolio, which utilizes fundamental-based signals applied across a broad universe of stocks. The long-term portfolio also is likely to generate the majority of return over a market cycle. Intermediate-and short-term strategies provide additional alpha based on the number of corporate and market events.

Thank you, George and Richard, for your time and insights today.

Past performance is not a guarantee of future results.

The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication, are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this article has been developed internally and/or obtained from sources believed to be reliable; however, PanAgora Asset Management, Inc. (PanAgora) does not guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after the date indicated. As with any investment there is a potential for profit as well as the possibility of loss.

Any forward-looking statements speak only as of the date they are made, and PanAgora assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. Any investments to which this material relates are available only to or will be engaged in only with investment professionals.

|

| 6 PanAgora Market Neutral Fund |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 28, 2021, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R6, and Y shares are not available to all investors. See the Terms and definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 2/28/21

| | | | | | |

| | Life of fund | Annual average | 3 years | Annual average | 1 year | 6 months |

| Class A (9/21/17) | | | | | | |

| Before sales charge | –16.00% | –4.94% | –15.07% | –5.30% | 2.82% | 3.32% |

| After sales charge | –20.83 | –6.57 | –19.95 | –7.15 | –3.10 | –2.62 |

| Class B (9/21/17) | | | | | | |

| Before CDSC | –18.10 | –5.64 | –16.85 | –5.97 | 1.99 | 3.02 |

| After CDSC | –20.56 | –6.47 | –19.35 | –6.92 | –3.01 | –1.98 |

| Class C (9/21/17) | | | | | | |

| Before CDSC | –18.10 | –5.64 | –16.85 | –5.97 | 1.99 | 3.02 |

| After CDSC | –18.10 | –5.64 | –16.85 | –5.97 | 0.99 | 2.02 |

| Class R (9/21/17) | | | | | | |

| Net asset value | –16.70 | –5.18 | –15.60 | –5.50 | 2.46 | 3.22 |

| Class R6 (9/21/17) | | | | | | |

| Net asset value | –15.30 | –4.71 | –14.44 | –5.07 | 3.04 | 3.42 |

| Class Y (9/21/17) | | | | | | |

| Net asset value | –15.30 | –4.71 | –14.44 | –5.07 | 3.04 | 3.42 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A shares reflect the deduction of the maximum 5.75% sales charge levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R6, and Y shares have no initial sales charge or CDSC.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

|

| PanAgora Market Neutral Fund 7 |

Comparative index returns For periods ended 2/28/21

| | | | | | |

| | Life of fund | Annual average | 3 years | Annual average | 1 year | 6 months |

| ICE BofA U.S. | | | | | | |

| Treasury Bill Index | 5.36% | 1.53% | 4.86% | 1.59% | 0.44% | 0.06% |

| Lipper Alternative | | | | | | |

| Equity Market | | | | | | |

| Neutral Funds | –7.78 | –3.36 | –8.78 | –3.90 | –3.88 | –1.36 |

| category average* | | | | | | |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, and life-of-fund periods ended 2/28/21, there were 55, 52, 49, and 49 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 2/28/21

| | | | | | | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| | Before | After | Net | Net | Net | Net | Net |

| | sales | sales | asset | asset | asset | asset | asset |

| Share value | charge | charge | value | value | value | value | value |

| 8/31/20 | $8.13 | $8.63 | $7.95 | $7.95 | $8.07 | $8.19 | $8.19 |

| 2/28/21 | 8.40 | 8.91 | 8.19 | 8.19 | 8.33 | 8.47 | 8.47 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

The fund made no distributions during the period.

Fund performance as of most recent calendar quarter Total return for periods ended 3/31/21

| | | | | | |

| | Life of fund | Annual average | 3 years | Annual average | 1 year | 6 months |

| Class A (9/21/17) | | | | | | |

| Before sales charge | –12.60% | –3.74% | –10.08% | –3.48% | 8.03% | 6.07% |

| After sales charge | –17.63 | –5.35 | –15.25 | –5.37 | 1.82 | –0.03 |

| Class B (9/21/17) | | | | | | |

| Before CDSC | –14.80 | –4.44 | –11.98 | –4.17 | 7.30 | 5.84 |

| After CDSC | –17.36 | –5.26 | –14.62 | –5.13 | 2.30 | 0.84 |

| Class C (9/21/17) | | | | | | |

| Before CDSC | –14.80 | –4.44 | –11.98 | –4.17 | 7.30 | 5.84 |

| After CDSC | –14.80 | –4.44 | –11.98 | –4.17 | 6.30 | 4.84 |

| Class R (9/21/17) | | | | | | |

| Net asset value | –13.30 | –3.96 | –10.71 | –3.71 | 7.84 | 5.99 |

| Class R6 (9/21/17) | | | | | | |

| Net asset value | –11.80 | –3.49 | –9.35 | –3.22 | 8.35 | 6.27 |

| Class Y (9/21/17) | | | | | | |

| Net asset value | –11.80 | –3.49 | –9.35 | –3.22 | 8.35 | 6.27 |

See the discussion following the fund performance table on page 7 for information about the calculation of fund performance.

|

| 8 PanAgora Market Neutral Fund |

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| Net expenses for the fiscal year | | | | | | |

| ended 8/31/20* | 1.83% | 2.58% | 2.58% | 2.08% | 1.59% | 1.58% |

| Total annual operating expenses for the | | | | | | |

| fiscal year ended 8/31/20 | 3.77% | 4.52% | 4.52% | 4.02% | 3.53% | 3.52% |

| Annualized expense ratio for the | | | | | | |

| six-month period ended 2/28/21 | 1.79% | 2.54% | 2.54% | 2.04% | 1.55% | 1.54% |

Fiscal year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Prospectus expense information also includes the impact of acquired fund fees and expenses of 0.04%, which is not included in the financial highlights or annualized expense ratios. Expenses are shown as a percentage of average net assets.

* Reflects Putnam Management’s contractual obligation to limit certain fund expenses through 12/30/21.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 9/1/20 to 2/28/21. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| Expenses paid per $1,000*† | $9.02 | $12.79 | $12.79 | $10.28 | $7.82 | $7.77 |

| Ending value (after expenses) | $1,033.20 | $1,030.20 | $1,030.20 | $1,032.20 | $1,034.20 | $1,034.20 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/21. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

|

| PanAgora Market Neutral Fund 9 |

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 2/28/21, use the following calculation method. To find the value of your investment on 9/1/20, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class R | Class R6 | Class Y |

| Expenses paid per $1,000*† | $8.95 | $12.67 | $12.67 | $10.19 | $7.75 | $7.70 |

| Ending value (after expenses) | $1,015.92 | $1,012.20 | $1,012.20 | $1,014.68 | $1,017.11 | $1,017.16 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/21. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

|

| 10 PanAgora Market Neutral Fund |

Consider these risks before investing

There can be no assurance that the fund’s strategies will achieve any particular level of return. The fund’s allocation of assets may hurt performance, and efforts to generate returns under different market conditions and over different time horizons may be unsuccessful. Quantitative models or data may be incorrect or incomplete, and reliance on those models or data may not produce the desired results. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political, or financial market conditions; investor sentiment and market perceptions; government actions; geopolitical events or changes; and factors related to a specific issuer, asset class, geography, industry, or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments in which the fund invests (or has exposure to) are subject to interest-rate risk and credit risk. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Risks associated with derivatives (including “short” derivatives) include losses caused by unexpected market movements (which are potentially unlimited), imperfect correlation between the price of the derivative and the price of the underlying asset, increased investment exposure (which may be considered leverage), the potential inability to terminate or sell derivatives positions, the potential need to sell securities at disadvantageous times to meet margin or segregation requirements, the potential inability to recover margin or other amounts deposited from a counterparty, and the potential failure of the other party to the instrument to meet its obligations. Leveraging can result in volatility in the fund’s performance and losses in excess of the amounts invested. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Exposure to REITs subjects the fund to the risks associated with direct ownership in real estate, including economic downturns that have an adverse effect on real estate markets. By investing in open-end or closed-end investment companies and ETFs, the fund is indirectly exposed to the risks associated with direct ownership of the securities held by those investment companies or ETFs. Certain investments are not as readily traded as conventional securities, and the fund may be unable to sell these investments when it considers it desirable to do so. Frequent trading may cause the fund to experience increased brokerage commissions and other transaction costs, and the fund may be more likely to realize capital gains that must be distributed to shareholders as taxable ordinary income. Our investment techniques, analyses, and judgments may not produce the outcome we intend. The investments we select for the fund may not perform as well as other securities that we do not select for the fund. We, or the fund’s other service providers, may experience disruptions or operating errors that could have a negative effect on the fund. You can lose money by investing in the fund.

|

| PanAgora Market Neutral Fund 11 |

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are closed to new investments and are only available by exchange from another Putnam fund or through dividend and/or capital gains reinvestment. They are not subject to an initial sales charge and may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class R shares are not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R6 shares are not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to employer-sponsored retirement plans, corporate and institutional clients, and clients in other approved programs.

Class Y shares are not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Bloomberg Barclays U.S. Credit Index is an unmanaged index of U.S. dollar-denominated, investment-grade, fixed-rate, taxable corporate and government-related bonds.

Bloomberg Barclays U.S. Treasury Index is an unmanaged index of U.S.-dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

Bloomberg Commodity Index is a broadly diversified index that measures the prices of commodities.

FTSE World Government Bond Index ex-U.S. (Hedged) is an unmanaged index that represents the world bond market, excluding the United States.

ICE BofA (Intercontinental Exchange Bank of America) U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

MSCI Emerging Markets Index (ND) is a free float-adjusted market capitalization index that

|

| 12 PanAgora Market Neutral Fund |

is designed to measure equity market performance in global emerging markets. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

MSCI World ex-U.S. Index (ND) is an unmanaged index of equity securities from developed countries, excluding the United States. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

Russell 2000 Index is an unmanaged index comprised of approximately 2,000 of the smallest companies in the Russell 3000 Index as measured by their market capitalization.

S&P 500 Index is an unmanaged index of common stock performance.

S&P GSCI is a composite index of commodity sector returns that represents a broadly diversified, unleveraged, long-only position in commodity futures.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or limited, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

ICE Data Indices, LLC (“ICE BofA”), used with permission. ICE BofA permits use of the ICE BofA indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

FTSE Russell is the source and owner of the trademarks, service marks, and copyrights related to the FTSE Indexes. FTSE® is a trademark of FTSE Russell.

Lipper, a Refinitiv company, is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

|

| PanAgora Market Neutral Fund 13 |

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2020, are available in the Individual Investors section of putnam.com and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Prior to its use of Form N-PORT, the fund filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2021, Putnam employees had approximately $555,000,000 and the Trustees had approximately $78,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

|

| 14 PanAgora Market Neutral Fund |

Financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

|

| PanAgora Market Neutral Fund 15 |

The fund’s portfolio 2/28/21 (Unaudited)

| | |

| UNITS (10.0%)* † | Units | Value |

| 10X Capital Venture Acquisition Corp. | 1,281 | $15,782 |

| ACON S2 Acquisition Corp. | 2,000 | 21,920 |

| AEA-Bridges Impact Corp. (Cayman Islands) | 2,562 | 29,207 |

| Aequi Acquisition Corp. | 2,566 | 27,585 |

| Alpha Healthcare Acquisition Corp. | 900 | 11,808 |

| Altimar Acquisition Corp. II | 278 | 2,863 |

| Altimeter Growth Corp. | 269 | 3,629 |

| Apollo Strategic Growth Capital | 2,422 | 26,860 |

| Astrea Acquisition Corp. | 1,377 | 13,866 |

| Athlon Acquisition Corp. | 138 | 1,421 |

| Atlas Crest Investment Corp. | 1,293 | 17,132 |

| Avanti Acquisition Corp. (Cayman Islands) | 2,576 | 29,289 |

| BlueRiver Acquisition Corp. | 278 | 2,866 |

| Broadscale Acquisition Corp. | 278 | 2,891 |

| Brookline Capital Acquisition Corp. | 1,613 | 18,566 |

| Carney Technology Acquisition Corp. II | 1,493 | 15,677 |

| Cascade Acquisition Corp. | 2,563 | 28,065 |

| Consonance-HFW Acquisition Corp. | 2,107 | 22,903 |

| Duddell Street Acquisition Corp. (Hong Kong) | 400 | 4,652 |

| Empower, Ltd. | 801 | 8,370 |

| EQ Health Acquisition Corp. | 278 | 2,813 |

| Eucrates Biomedical Acquisition Corp. | 1,980 | 21,780 |

| G Squared Ascend I, Inc. | 278 | 2,905 |

| Genesis Park Acquisition Corp. | 2,563 | 28,270 |

| Global Synergy Acquisition Corp. | 274 | 2,850 |

| Golden Falcon Acquisition Corp. | 270 | 2,930 |

| Gores Holdings VI, Inc. | 161 | 3,059 |

| HIG Acquisition Corp. | 2,571 | 27,844 |

| Horizon Acquisition Corp. II | 2,571 | 28,230 |

| Hudson Executive Investment Corp. II | 274 | 2,863 |

| IG Acquisition Corp. | 2,381 | 26,429 |

| Ignyte Acquisition Corp. | 689 | 7,235 |

| Jack Creek Investment Corp. | 322 | 3,317 |

| KINS Technology Group, Inc. | 1,605 | 17,206 |

| L&F Acquisition Corp. (IL) | 2,126 | 23,046 |

| Legato Merger Corp. | 1,607 | 16,488 |

| LightJump Acquisition Corp. | 1,370 | 14,166 |

| Mallard Acquisition Corp. | 2,570 | 27,268 |

| Marlin Technology Corp. | 269 | 2,798 |

| Motion Acquisition Corp. | 2,563 | 27,501 |

| NextGen Acquisition Corp. | 481 | 5,801 |

| North Mountain Merger Corp. | 2,321 | 25,160 |

| Petra Acquisition, Inc. | 2,583 | 28,645 |

| Progress Acquisition Corp. | 2,352 | 23,708 |

| Qell Acquisition Corp. | 2,391 | 30,748 |

| Recharge Acquisition Corp. | 2,381 | 25,381 |

| Roth CH Acquisition II Co. | 1,760 | 20,240 |

| SCP & CO Healthcare Acquisition Co. | 321 | 3,274 |

| Senior Connect Acquisition Corp. I | 269 | 2,833 |

|

| 16 PanAgora Market Neutral Fund |

| | |

| UNITS (10.0%)* † cont. | Units | Value |

| Social Leverage Acquisition Corp. I | 279 | $2,969 |

| Sports Entertainment Acquisition Corp. | 2,408 | 26,488 |

| Thimble Point Acquisition Corp. | 278 | 2,877 |

| TLG Acquisition One Corp. | 2,312 | 23,212 |

| Vector Acquisition Corp. | 2,172 | 23,544 |

| VG Acquisition Corp. | 1,211 | 14,883 |

| Viveon Health Acquisition Corp. | 674 | 7,272 |

| Yellowstone Acquisition Co. | 2,563 | 28,116 |

| Total units (cost $840,350) | | $889,501 |

| | |

| COMMON STOCKS (6.1%)* | Shares | Value |

| Capital markets (0.2%) | | |

| Morgan Stanley | 219 | $16,835 |

| | | 16,835 |

| Diversified financial services (5.9%) | | |

| 5:01 Acquisition Corp. Class A † | 2,563 | 27,193 |

| Alussa Energy Acquisition Corp. Class A (Cayman Islands) † | 428 | 4,708 |

| Amplitude Healthcare Acquisition Corp. Class A † | 2,946 | 30,152 |

| Ascendant Digital Acquisition Corp. Class A † | 334 | 3,570 |

| BCTG Acquisition Corp. † | 1,936 | 22,632 |

| Brilliant Acquisition Corp. (Rights) (China) † | 2,626 | 1,129 |

| Broadstone Acquisition Corp. Class A (United Kingdom) † | 2,560 | 26,496 |

| Capstar Special Purpose Acquisition Corp. Class A † | 2,526 | 25,892 |

| Churchill Capital Corp. IV Class A † | 641 | 19,711 |

| CM Life Sciences, Inc. Class A † | 961 | 19,230 |

| Dragoneer Growth Opportunities Corp. Class A † | 165 | 1,742 |

| E.Merge Technology Acquisition Corp. Class A † | 2,553 | 25,938 |

| East Resources Acquisition Co. Class A † | 2,546 | 25,766 |

| EDOC Acquisition Corp. (Rights) † | 2,576 | 1,275 |

| EDOC Acquisition Corp. Class A † | 2,576 | 26,172 |

| Executive Network Partnering Corp. Class A † | 435 | 10,932 |

| Fortress Value Acquisition Corp. II Class A † | 1,282 | 13,153 |

| FTAC Olympus Acquisition Corp. Class A † | 646 | 7,623 |

| HealthCor Catalio Acquisition Corp. Class A † | 2,219 | 22,989 |

| Highcape Capital Acquisition Corp. Class A † | 1,290 | 18,473 |

| Jiya Acquisition Corp. Class A † | 1,672 | 17,589 |

| LGL Systems Acquisition Corp. Class A † | 1,284 | 13,289 |

| LifeSci Acquisition II Corp. † | 2,126 | 23,407 |

| NavSight Holdings, Inc. Class A † | 2,566 | 26,866 |

| Omega Alpha SPAC Class A † | 137 | 1,436 |

| Peridot Acquisition Corp. Class A † | 1,258 | 15,096 |

| Property Solutions Acquisition Corp. † | 636 | 8,961 |

| Software Acquisition Group, Inc. II Class A † | 1,406 | 16,042 |

| Starboard Value Acquisition Corp. Class A † | 1,293 | 13,202 |

| TWC Tech Holdings II Corp. Class A † | 2,478 | 25,821 |

| Yucaipa Acquisition Corp. Class A † | 2,586 | 27,153 |

| Yunhong International (Rights) (China) † | 452 | 189 |

| | | 523,827 |

|

| PanAgora Market Neutral Fund 17 |

| | |

| COMMON STOCKS (6.1%)* cont. | Shares | Value |

| Software (—%) | | |

| Tenable Holdings, Inc. † | 86 | $3,514 |

| | | 3,514 |

| Total common stocks (cost $473,948) | | $544,176 |

| | | | |

| | Expiration | Strike | | |

| WARRANTS (3.0%)*† | date | price | Warrants | Value |

| Alussa Energy Acquisition Corp. Class A | | | | |

| (Cayman Islands) | 10/31/26 | $11.50 | 214 | $610 |

| Amplitude Healthcare Acquisition Corp. Class A | 12/1/26 | 11.50 | 1,473 | 2,607 |

| Ascendant Digital Acquisition Corp. Class A | 12/31/25 | 11.50 | 167 | 284 |

| Aspirational Consumer Lifestyle Corp. | | | | |

| Class A (Singapore) | 9/19/25 | 11.50 | 1,678 | 3,331 |

| Atlantic Avenue Acquisition Corp. Class A | 12/31/25 | 11.50 | 3,843 | 5,188 |

| Big Cypress Acquisition Corp. Class A | 12/7/25 | 11.50 | 2,027 | 2,513 |

| BowX Acquisition Corp. Class A | 12/31/25 | 11.50 | 3,448 | 6,137 |

| Brilliant Acquisition Corp. (China) | 12/31/25 | 11.50 | 5,252 | 4,779 |

| Broadstone Acquisition Corp. Class A | | | | |

| (United Kingdom) | 9/15/28 | 11.50 | 1,280 | 1,574 |

| Capstar Special Purpose Acquisition | | | | |

| Corp. Class A | 7/9/27 | 11.50 | 1,263 | 1,756 |

| CC Neuberger Principal Holdings II Class A | 7/29/25 | 11.50 | 2,420 | 4,719 |

| Chardan Healthcare Acquisition 2 Corp. | 3/5/25 | 11.50 | 7,956 | 8,911 |

| CHP Merger Corp. Class A | 11/22/24 | 11.50 | 4,119 | 6,055 |

| Churchill Capital Corp. IV Class A | 9/18/25 | 11.50 | 128 | 2,003 |

| CITIC Capital Acquisition Corp. Class A (China) | 1/17/27 | 11.50 | 339 | 712 |

| CM Life Sciences, Inc. Class A | 9/24/27 | 11.50 | 320 | 2,333 |

| D8 Holdings Corp. Class A (Hong Kong) | 8/5/27 | 11.50 | 3,807 | 4,849 |

| DFP Healthcare Acquisitions Corp. Class A | 4/1/25 | 11.50 | 2,747 | 5,879 |

| Dragoneer Growth Opportunities Corp. Class A | 8/14/25 | 11.50 | 66 | 152 |

| E.Merge Technology Acquisition Corp. Class A | 7/30/25 | 11.50 | 851 | 1,438 |

| East Resources Acquisition Co. Class A | 7/1/27 | 11.50 | 1,273 | 1,846 |

| EDOC Acquisition Corp. Class A | 11/30/27 | 11.50 | 2,576 | 1,430 |

| Empower, Ltd. Class A | 11/30/27 | 11.50 | 1,069 | 1,368 |

| Executive Network Partnering Corp. Class A | 9/25/28 | 11.50 | 652 | 1,935 |

| Fast Acquisition Corp. Class A | 8/25/27 | 11.50 | 2,023 | 4,228 |

| FinServ Acquisition Corp. Class A | 12/31/26 | 11.50 | 623 | 2,492 |

| Fortress Value Acquisition Corp. II Class A | 8/10/27 | 11.50 | 256 | 392 |

| FTAC Olympus Acquisition Corp. Class A | 8/28/25 | 11.50 | 215 | 550 |

| Fusion Acquisition Corp. Class A | 6/1/27 | 11.50 | 1,905 | 3,391 |

| Galileo Acquisition Corp. | 10/31/26 | 11.50 | 1,776 | 1,776 |

| GO Acquisition Corp. Class A | 8/31/27 | 11.50 | 3,400 | 5,100 |

| Good Works Acquisition Corp. | 10/22/25 | 11.50 | 3,723 | 5,324 |

| Gores Holdings V, Inc. Class A | 8/10/27 | 11.50 | 1,536 | 2,611 |

| Greencity Acquisition Corp. (China) | 8/28/21 | 11.50 | 13,431 | 8,730 |

| Greenrose Acquisition Corp. | 5/11/24 | 11.50 | 7,240 | 11,186 |

| Highcape Capital Acquisition Corp. Class A | 9/30/27 | 11.50 | 470 | 2,374 |

| Holicity, Inc. Class A | 8/4/27 | 11.50 | 1,724 | 6,405 |

| Horizon Acquisition Corp. Class A | 8/19/25 | 11.50 | 3,428 | 6,170 |

| HPX Corp. Class A | 7/14/25 | 11.50 | 3,831 | 5,402 |

| Industrial Tech Acquisitions, Inc. Class A | 6/8/27 | 11.50 | 5,174 | 7,658 |

|

| 18 PanAgora Market Neutral Fund |

| | | | |

| | Expiration | Strike | | |

| WARRANTS (3.0%)*† cont. | date | price | Warrants | Value |

| Kismet Acquisition One Corp. (Russia) | 8/6/25 | $11.50 | 2,086 | $2,128 |

| LGL Systems Acquisition Corp. Class A | 11/12/26 | 11.50 | 2,568 | 5,008 |

| Lionheart Acquisition Corp. II Class A | 2/14/26 | 11.50 | 3,864 | 5,410 |

| LIV Capital Acquisition Corp. Class A (Mexico) | 1/10/25 | 11.50 | 5,644 | 7,337 |

| Malacca Straits Acquisition Co., Ltd. Class A | | | | |

| (Hong Kong) | 6/30/27 | 11.50 | 3,807 | 5,406 |

| NavSight Holdings, Inc. Class A | 1/1/30 | 11.50 | 1,283 | 2,091 |

| NewHold Investment Corp. Class A | 3/10/25 | 11.50 | 3,831 | 5,095 |

| One Class A | 8/17/25 | 11.50 | 1,225 | 3,859 |

| Osprey Technology Acquisition Corp. Class A | 10/30/24 | 11.50 | 652 | 1,800 |

| Peridot Acquisition Corp. Class A | 11/30/27 | 11.50 | 629 | 1,705 |

| PMV Consumer Acquisition Corp. Class A | 8/31/27 | 11.50 | 3,738 | 4,747 |

| Prime Impact Acquisition I Class A | 10/1/30 | 11.50 | 3,456 | 5,704 |

| Property Solutions Acquisition Corp. | 8/28/27 | 11.50 | 636 | 2,315 |

| PTK Acquisition Corp. | 12/31/25 | 11.50 | 7,581 | 6,747 |

| RedBall Acquisition Corp. Class A | 8/17/22 | 11.50 | 1,300 | 2,431 |

| Roman DBDR Tech Acquisition Corp. Class A | 10/31/25 | 11.50 | 3,849 | 5,042 |

| Sandbridge Acquisition Corp. Class A | 9/14/27 | 11.50 | 1,861 | 2,593 |

| SCVX Corp. Class A | 1/24/25 | 11.50 | 6,357 | 12,333 |

| Software Acquisition Group, Inc. II Class A | 3/17/27 | 11.50 | 703 | 1,301 |

| Spartacus Acquisition Corp. Class A | 10/31/27 | 11.50 | 3,857 | 4,918 |

| Starboard Value Acquisition Corp. Class A | 9/10/27 | 11.50 | 215 | 430 |

| Tailwind Acquisition Corp. Class A | 9/7/27 | 11.50 | 1,011 | 1,982 |

| Turmeric Acquisition Corp. Class A | 10/8/25 | 11.50 | 3,428 | 5,793 |

| Tuscan Holdings Corp. II | 7/16/25 | 11.50 | 660 | 1,129 |

| TWC Tech Holdings II Corp. Class A | 9/15/27 | 11.50 | 826 | 1,503 |

| Union Acquisition Corp. II | 4/1/25 | 11.50 | 8,063 | 10,079 |

| Vistas Media Acquisition Co., Inc. Class A | 8/1/26 | 11.50 | 5,108 | 4,968 |

| Yellowstone Acquisition Co. Class A | 10/21/25 | 11.50 | 4,042 | 6,629 |

| Yucaipa Acquisition Corp. Class A | 8/6/25 | 11.50 | 862 | 1,866 |

| Yunhong International Class A (China) | 1/31/27 | 11.50 | 678 | 671 |

| Total warrants (cost $188,488) | | | | $269,218 |

| | | |

| | Principal amount/ | |

| SHORT-TERM INVESTMENTS (38.8%)* | | shares | Value |

| State Street Institutional U.S. Government Money Market Fund, | | | |

| Investor Class 0.01% | Shares | 1,898,545 | $1,898,545 |

| U.S. Treasury Bills with an effective yield of 0.083%, 4/15/21 | | $1,536,000 | 1,535,923 |

| Total short-term investments (cost $3,434,386) | | | $3,434,468 |

| |

| TOTAL INVESTMENTS | |

| Total investments (cost $4,937,172) | $5,137,363 |

Key to holding’s abbreviations

| |

| ADR | American Depository Receipts: represents ownership of foreign securities on deposit with a custodian bank |

| ETF | Exchange Traded Fund |

| GDR | Global Depository Receipts: represents ownership of foreign securities on deposit with a custodian bank |

| NVDR | Non-voting Depository Receipts |

| OTC | Over-the-counter |

| PJSC | Public Joint Stock Company |

| SPDR | S&P Depository Receipts |

|

| PanAgora Market Neutral Fund 19 |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from September 1, 2020 through February 28, 2021 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures.

* Percentages indicated are based on net assets of $8,859,063.

† This security is non-income-producing.

The dates shown on debt obligations are the original maturity dates.

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) | | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC | | | | |

| $35,403 | $32,402 | $— | 1/28/25 | (Federal Funds | 1Life Healthcare | $(3,009) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 2,905 | — | — | 1/28/25 | (Federal Funds | Achillion | (2,905) |

| | | | | Effective Rate US plus | Pharmaceuticals | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 18,311 | 17,893 | — | 1/28/25 | (Federal Funds | Abivax SA — | (423) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 10,473 | 10,111 | — | 1/28/25 | (Federal Funds | Acuity Brands | (355) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 15,772 | 14,587 | — | 1/28/25 | (Federal Funds | Adaptimmune | (1,188) |

| | | | | Effective Rate US plus | Therapeutics PLC | |

| | | | | 0.25%) — Monthly | ADR — Monthly | |

| 4,719 | 4,636 | — | 1/28/25 | (Federal Funds | Adesso SE — | (84) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 11,417 | 10,605 | — | 1/28/25 | (Federal Funds | Adient PLC — | (815) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 10,372 | 10,435 | — | 1/28/25 | (Federal Funds | Advanced Info | 292 |

| | | | | Effective Rate US plus | Service PCL | |

| | | | | 0.75%) — Monthly | NVDR — Monthly | |

| 2,702 | 2,478 | — | 1/28/25 | (Federal Funds | AeroGrow | (224) |

| | | | | Effective Rate US plus | International | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 34,949 | 34,659 | — | 1/28/25 | (Federal Funds | Aerojet | (300) |

| | | | | Effective Rate US plus | Rocketdyne | |

| | | | | 0.25%) — Monthly | Holdings Inc — | |

| | | | | | Monthly | |

| 13,727 | 13,017 | — | 1/28/25 | (Federal Funds | Affiliated | (710) |

| | | | | Effective Rate US plus | Managers Group | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 51,358 | 53,236 | — | 1/28/25 | (Federal Funds | Affimed NV — | 1,864 |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 36,224 | 34,664 | — | 1/28/25 | (Federal Funds | Agenus Inc — | (1,568) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

|

| 20 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) cont. | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $21,893 | $21,732 | $— | 1/28/25 | (Federal Funds | Airtac | $(170) |

| | | | | Effective Rate US plus | International | |

| | | | | 0.35%) — Monthly | Group — Monthly | |

| 4,111 | 3,893 | — | 1/28/25 | (Federal Funds | Akatsuki Inc — | (218) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 12,785 | 12,491 | — | 1/28/25 | (Federal Funds | Akzo Nobel NV — | (297) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 20,977 | 20,221 | — | 1/28/25 | (Federal Funds | Alaska Air Group | (760) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 35,135 | 34,816 | — | 1/28/25 | (Federal Funds | Alaska | (328) |

| | | | | Effective Rate US plus | Communications | |

| | | | | 0.25%) — Monthly | Systems Group | |

| | | | | | Inc — Monthly | |

| 61,313 | 57,931 | — | 1/28/25 | (Federal Funds | Alexander & | (3,395) |

| | | | | Effective Rate US plus | Baldwin Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 68,594 | 67,821 | — | 1/28/25 | (Federal Funds | Alexion | (789) |

| | | | | Effective Rate US plus | Pharmaceuticals | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 52,422 | 51,447 | — | 1/28/25 | (Federal Funds | Allegiant Travel | (984) |

| | | | | Effective Rate US plus | Co — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 20,416 | 20,748 | — | 1/28/25 | (Federal Funds | Alliance Data | 373 |

| | | | | Effective Rate US plus | Systems Corp — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 19,476 | 19,415 | — | 1/28/25 | (Federal Funds | Allison | 30 |

| | | | | Effective Rate US plus | Transmission | |

| | | | | 0.25%) — Monthly | Holdings Inc — | |

| | | | | | Monthly | |

| 31,877 | 30,475 | — | 1/28/25 | (Federal Funds | Alpha & Omega | (1,409) |

| | | | | Effective Rate US plus | Semiconductor | |

| | | | | 0.25%) — Monthly | Ltd — Monthly | |

| 27,090 | 26,285 | — | 1/28/25 | (Federal Funds | Alphabet Inc — | (811) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 15,355 | 14,436 | — | 1/28/25 | (Federal Funds | Alteryx Inc — | (920) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 19,438 | 19,378 | — | 1/28/25 | (Federal Funds | Amada Co Ltd — | (65) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 22,117 | 21,651 | — | 1/28/25 | (Federal Funds | Amazon.com | (472) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 11,769 | 11,841 | — | 1/28/25 | (Federal Funds | American Axle & | 70 |

| | | | | Effective Rate US plus | Manufacturing | |

| | | | | 0.25%) — Monthly | Holdings Inc — | |

| | | | | | Monthly | |

|

| PanAgora Market Neutral Fund 21 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) cont. | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $11,777 | $10,905 | $— | 1/28/25 | (Federal Funds | American | $(875) |

| | | | | Effective Rate US plus | Outdoor Brands | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 9,554 | 9,480 | — | 1/28/25 | (Federal Funds | American Public | (76) |

| | | | | Effective Rate US plus | Education Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 22,978 | 21,903 | — | 1/28/25 | (Federal Funds | Ameriprise | (977) |

| | | | | Effective Rate US plus | Financial Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 75,744 | 75,397 | — | 1/28/25 | (Federal Funds | Amkor | (234) |

| | | | | Effective Rate US plus | Technology Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 2,829 | 2,840 | — | 1/28/25 | (Federal Funds | AnGes Inc — | 10 |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 31,565 | 32,242 | — | 1/28/25 | (Federal Funds | AngioDynamics | 670 |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 43,644 | 41,404 | — | 1/28/25 | (Federal Funds | Antares Pharma | (2,252) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 36,389 | 36,080 | — | 1/28/25 | (Federal Funds | Anthem Inc — | (313) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 36,741 | 36,631 | — | 1/28/25 | (Federal Funds | AO World PLC — | (116) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 18,050 | 17,461 | — | 1/28/25 | (Federal Funds | Apple Inc — | (565) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 18,232 | 16,297 | — | 1/28/25 | (Federal Funds | ARCA biopharma | (1,939) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 73,613 | 73,738 | — | 1/28/25 | (Federal Funds | ArcBest Corp — | 210 |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 67,940 | 67,805 | — | 1/28/25 | (Federal Funds | Arcus Biosciences | (152) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 8,538 | 8,263 | — | 1/28/25 | (Federal Funds | Argo Graphics | (278) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 59,108 | 56,858 | — | 1/28/25 | (Federal Funds | Artisan | (733) |

| | | | | Effective Rate US plus | Partners Asset | |

| | | | | 0.25%) — Monthly | Management | |

| | | | | | Inc — Monthly | |

| 5,467 | 5,382 | — | 1/28/25 | (Federal Funds | As One Corp — | (85) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 47,644 | 45,029 | — | 1/28/25 | (Federal Funds | Ashtead Group | (2,544) |

| | | | | Effective Rate US plus | PLC — Monthly | |

| | | | | 0.25%) — Monthly | | |

|

| 22 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) cont. | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $3,398 | $3,307 | $— | 1/28/25 | (Federal Funds | ASKUL Corp — | $(92) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 80,628 | 79,856 | — | 1/28/25 | (Federal Funds | ASM International | (791) |

| | | | | Effective Rate US plus | NV — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 41,697 | 40,726 | — | 1/28/25 | (Federal Funds | ASOS PLC — | (979) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 11,675 | 10,516 | — | 1/28/25 | (Federal Funds | Assembly | (1,162) |

| | | | | Effective Rate US plus | Biosciences Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 6,653 | 6,282 | — | 1/28/25 | (Federal Funds | Astellas Pharma | (373) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 10,473 | 9,063 | — | 1/28/25 | (Federal Funds | Astra | (1,414) |

| | | | | Effective Rate US plus | International Tbk | |

| | | | | 0.75%) — Monthly | PT — Monthly | |

| 22,478 | 22,735 | — | 1/28/25 | (Federal Funds | Asustek | 250 |

| | | | | Effective Rate US plus | Computer Inc — | |

| | | | | 0.35%) — Monthly | Monthly | |

| 35,426 | 33,831 | — | 1/28/25 | (Federal Funds | AT&T Inc — | (1,596) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 8,758 | 8,141 | — | 1/28/25 | (Federal Funds | Atacadao SA — | (622) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.65%) — Monthly | | |

| 8,216 | 8,186 | — | 1/28/25 | (Federal Funds | Atkore Inc — | (32) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 52,845 | 53,663 | — | 1/28/25 | (Federal Funds | Atlantic Capital | 805 |

| | | | | Effective Rate US plus | Bancshares Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 11,980 | 11,432 | — | 1/28/25 | (Federal Funds | Atlanticus | (551) |

| | | | | Effective Rate US plus | Holdings Corp — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 4,920 | 5,028 | — | 1/28/25 | (Federal Funds | Atresmedia Corp | 108 |

| | | | | Effective Rate US plus | de Medios de | |

| | | | | 0.25%) — Monthly | Comunicacion | |

| | | | | | SA — Monthly | |

| 13,722 | 12,861 | — | 1/28/25 | (Federal Funds | Aurizon Holdings | (864) |

| | | | | Effective Rate US plus | Ltd — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 5,019 | 4,856 | — | 1/28/25 | (Federal Funds | Australian | (165) |

| | | | | Effective Rate US plus | Pharmaceutical | |

| | | | | 0.25%) — Monthly | Industries Ltd — | |

| | | | | | Monthly | |

| 77,840 | 75,302 | — | 1/28/25 | (Federal Funds | Avaya Holdings | (2,553) |

| | | | | Effective Rate US plus | Corp — Monthly | |

| | | | | 0.25%) — Monthly | | |

|

| PanAgora Market Neutral Fund 23 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) cont. | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $36,465 | $35,392 | $— | 1/28/25 | (Federal Funds | Avery Dennison | $(1,077) |

| | | | | Effective Rate US plus | Corp — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 10,560 | 10,060 | — | 1/28/25 | (Federal Funds | AVI Ltd — Monthly | (506) |

| | | | | Effective Rate US plus | | |

| | | | | 0.60%) — Monthly | | |

| 5,454 | 5,444 | — | 1/28/25 | (Federal Funds | Avnet Inc — | (11) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 18,305 | 17,874 | — | 1/28/25 | (Federal Funds | B&M European | 207 |

| | | | | Effective Rate US plus | Value Retail SA — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 21,338 | 21,241 | — | 1/28/25 | (Federal Funds | Balfour Beatty | (102) |

| | | | | Effective Rate US plus | PLC — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 10,097 | 9,858 | — | 1/28/25 | (Federal Funds | Banco | (80) |

| | | | | Effective Rate US plus | Latinoamericano | |

| | | | | 0.25%) — Monthly | de Comercio | |

| | | | | | Exterior SA — | |

| | | | | | Monthly | |

| 64,773 | 61,641 | — | 1/28/25 | (Federal Funds | Bancorp Inc/ | (3,145) |

| | | | | Effective Rate US plus | The — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 28,595 | 27,282 | — | 1/28/25 | (Federal Funds | Bank of America | (1,319) |

| | | | | Effective Rate US plus | Corp — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 10,475 | 10,772 | — | 1/28/25 | (Federal Funds | Bank of | 295 |

| | | | | Effective Rate US plus | Commerce | |

| | | | | 0.25%) — Monthly | Holdings — | |

| | | | | | Monthly | |

| 36,471 | 35,224 | — | 1/28/25 | (Federal Funds | Bank of Marin | (1,037) |

| | | | | Effective Rate US plus | Bancorp — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 19,828 | 18,888 | — | 1/28/25 | (Federal Funds | Bank of New York | (869) |

| | | | | Effective Rate US plus | Mellon Corp/ | |

| | | | | 0.25%) — Monthly | The — Monthly | |

| 1,630 | 1,649 | — | 1/28/25 | (Federal Funds | Barings BDC Inc — | 18 |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 43,407 | 42,930 | — | 1/28/25 | (Federal Funds | BayCom Corp — | (487) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 18,411 | 18,675 | — | 1/28/25 | (Federal Funds | BBX Capital Inc — | 261 |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 12,341 | 11,839 | — | 1/28/25 | (Federal Funds | Beazer Homes | (506) |

| | | | | Effective Rate US plus | USA Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 14,093 | 13,955 | — | 1/28/25 | (Federal Funds | Bechtle AG — | (142) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

|

| 24 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) cont. | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $24,113 | $23,040 | $— | 1/28/25 | (Federal Funds | BeiGene Ltd | $(1,079) |

| | | | | Effective Rate US plus | ADR — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 3,485 | 3,222 | — | 1/28/25 | (Federal Funds | Bell System24 | (229) |

| | | | | Effective Rate US plus | Holdings Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 10,589 | 10,201 | — | 1/28/25 | (Federal Funds | Bergenbio ASA — | (390) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 18,745 | 17,392 | — | 1/28/25 | (Federal Funds | Berkeley Group | (1,358) |

| | | | | Effective Rate US plus | Holdings PLC — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 13,048 | 11,540 | — | 1/28/25 | (Federal Funds | Best Buy Co Inc — | (1,508) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 5,562 | 5,464 | — | 1/28/25 | (Federal Funds | BGSF Inc — | (21) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 9,451 | 8,786 | — | 1/28/25 | (Federal Funds | Biglari Holdings | (667) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 13,806 | 14,720 | — | 1/28/25 | (Federal Funds | Bilia AB — | 910 |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 17,281 | 16,831 | — | 1/28/25 | (Federal Funds | Bill.com Holdings | (453) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 44,076 | 43,680 | — | 1/28/25 | (Federal Funds | Biohaven | (407) |

| | | | | Effective Rate US plus | Pharmaceutical | |

| | | | | 0.25%) — Monthly | Holding Co Ltd — | |

| | | | | | Monthly | |

| 50,536 | 50,921 | — | 1/28/25 | (Federal Funds | BJ’s Restaurants | 534 |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 17,690 | 16,930 | — | 1/28/25 | (Federal Funds | Blackbaud Inc — | (760) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 71,847 | 71,312 | — | 1/28/25 | (Federal Funds | Blackline Inc — | (550) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 2,038 | 2,029 | — | 1/28/25 | (Federal Funds | BlackRock | 1 |

| | | | | Effective Rate US plus | Floating Rate | |

| | | | | 0.25%) — Monthly | Income Strategies | |

| | | | | | Fund Inc — | |

| | | | | | Monthly | |

| 559 | 558 | — | 1/28/25 | (Federal Funds | BlackRock | 2 |

| | | | | Effective Rate US plus | Floating Rate | |

| | | | | 0.25%) — Monthly | Income Trust — | |

| | | | | | Monthly | |

|

| PanAgora Market Neutral Fund 25 |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) cont. | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $636 | $632 | $— | 1/28/25 | (Federal Funds | BlackRock | $(4) |

| | | | | Effective Rate US plus | Limited Duration | |

| | | | | 0.25%) — Monthly | Income Trust — | |

| | | | | | Monthly | |

| 443 | 445 | — | 1/28/25 | (Federal Funds | BlackRock Muni | 1 |

| | | | | Effective Rate US plus | Intermediate | |

| | | | | 0.25%) — Monthly | Duration Fund | |

| | | | | | Inc — Monthly | |

| 272 | 272 | — | 1/28/25 | (Federal Funds | BlackRock | — |

| | | | | Effective Rate US plus | MuniHoldings | |

| | | | | 0.25%) — Monthly | New Jersey | |

| | | | | | Quality Fund | |

| | | | | | Inc — Monthly | |

| 691 | 690 | — | 1/28/25 | (Federal Funds | BlackRock | 4 |

| | | | | Effective Rate US plus | MuniVest Fund | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 608 | 606 | — | 1/28/25 | (Federal Funds | BlackRock | 3 |

| | | | | Effective Rate US plus | MuniYield Fund | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 2,253 | 2,242 | — | 1/28/25 | (Federal Funds | BlackRock | (1) |

| | | | | Effective Rate US plus | Taxable Municipal | |

| | | | | 0.25%) — Monthly | Bond Trust — | |

| | | | | | Monthly | |

| 1,534 | 1,540 | — | 1/28/25 | (Federal Funds | Blackstone/GSO | 24 |

| | | | | Effective Rate US plus | Strategic Credit | |

| | | | | 0.25%) — Monthly | Fund — Monthly | |

| 22,905 | 21,462 | — | 1/28/25 | (Federal Funds | Bloomin’ Brands | (1,447) |

| | | | | Effective Rate US plus | Inc — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 47,811 | 46,751 | — | 1/28/25 | (Federal Funds | Bluegreen | (1,070) |

| | | | | Effective Rate US plus | Vacations | |

| | | | | 0.25%) — Monthly | Holding Corp — | |

| | | | | | Monthly | |

| 1,712 | 1,696 | — | 1/28/25 | (Federal Funds | BNY Mellon High | (17) |

| | | | | Effective Rate US plus | Yield Strategies | |

| | | | | 0.25%) — Monthly | Fund — Monthly | |

| 526 | 530 | — | 1/28/25 | (Federal Funds | BNY Mellon | 7 |

| | | | | Effective Rate US plus | Strategic | |

| | | | | 0.25%) — Monthly | Municipal Bond | |

| | | | | | Fund Inc — | |

| | | | | | Monthly | |

| 362 | 361 | — | 1/28/25 | (Federal Funds | BNY Mellon | (1) |

| | | | | Effective Rate US plus | Strategic | |

| | | | | 0.25%) — Monthly | Municipals Inc — | |

| | | | | | Monthly | |

| 10,308 | 10,274 | — | 1/28/25 | (Federal Funds | Bogota Financial | (37) |

| | | | | Effective Rate US plus | Corp — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 10,777 | 10,487 | — | 1/28/25 | (Federal Funds | Boise Cascade | (271) |

| | | | | Effective Rate US plus | Co — Monthly | |

| | | | | 0.25%) — Monthly | | |

|

| 26 PanAgora Market Neutral Fund |

| | | | | | |

| OTC TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 2/28/21 (Unaudited) cont. | |

| Swap | | Upfront | Termina- | Payments | Total return | Unrealized |

| counterparty/ | | premium | tion | received (paid) | received by | appreciation/ |

| Notional amount | Value | received (paid) | date | by fund | or paid by fund | (depreciation) |

| Morgan Stanley & Co. International PLC cont. | | | | |

| $13,469 | $13,193 | $— | 1/28/25 | (Federal Funds | Bollore SA — | $(279) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 4,886 | 4,772 | — | 1/28/25 | (Federal Funds | Bonava AB — | (114) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 37,644 | 36,916 | — | 1/28/25 | (Federal Funds | boohoo Group | (733) |

| | | | | Effective Rate US plus | PLC — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 2,555 | 2,356 | — | 1/28/25 | (Federal Funds | Boot Barn | (199) |

| | | | | Effective Rate US plus | Holdings Inc — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 11,466 | 11,340 | — | 1/28/25 | (Federal Funds | Booz Allen | (76) |

| | | | | Effective Rate US plus | Hamilton Holding | |

| | | | | 0.25%) — Monthly | Corp — Monthly | |

| 14,214 | 13,905 | — | 1/28/25 | (Federal Funds | BorgWarner Inc — | (258) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 54,702 | 52,444 | — | 1/28/25 | (Federal Funds | Box Inc — Monthly | (2,272) |

| | | | | Effective Rate US plus | | |

| | | | | 0.25%) — Monthly | | |

| 47,611 | 46,256 | — | 1/28/25 | (Federal Funds | Boyd Gaming | (1,365) |

| | | | | Effective Rate US plus | Corp — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 18,244 | 17,402 | — | 1/28/25 | (Federal Funds | bpost SA — | (847) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 11,826 | 11,711 | — | 1/28/25 | (Federal Funds | Bridgestone | 38 |

| | | | | Effective Rate US plus | Corp — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 18,954 | 17,833 | — | 1/28/25 | (Federal Funds | Brinker | (1,124) |

| | | | | Effective Rate US plus | International | |

| | | | | 0.25%) — Monthly | Inc — Monthly | |

| 18,089 | 17,724 | — | 1/28/25 | (Federal Funds | Bristol-Myers | (227) |

| | | | | Effective Rate US plus | Squibb Co — | |

| | | | | 0.25%) — Monthly | Monthly | |

| 1,708 | 1,700 | — | 1/28/25 | (Federal Funds | Brookfield Real | 54 |

| | | | | Effective Rate US plus | Assets Income | |

| | | | | 0.25%) — Monthly | Fund Inc — | |

| | | | | | Monthly | |

| 8,152 | 7,854 | — | 1/28/25 | (Federal Funds | Brother Industries | (300) |

| | | | | Effective Rate US plus | Ltd — Monthly | |

| | | | | 0.25%) — Monthly | | |

| 22,427 | 21,282 | — | 1/28/25 | (Federal Funds | Bruker Corp — | (1,150) |

| | | | | Effective Rate US plus | Monthly | |

| | | | | 0.25%) — Monthly | | |

| 28,212 | 26,246 | — | 1/28/25 | (Federal Funds | Brunswick Corp/ | (1,893) |

| | | | | Effective Rate US plus | DE — Monthly | |

| | | | | 0.25%) — Monthly | | |

|

| PanAgora Market Neutral Fund 27 |