Table of ContentsFiled pursuant to Rule 424(b)(5)

Registration No. 333-107393

PROSPECTUS SUPPLEMENT

(to Prospectus, dated August 20, 2003)

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION.

NOT FOR DISTRIBUTION TO ANY ITALIAN PERSON OR TO ANY PERSON OR ADDRESS IN THE REPUBLIC OF ITALY.

This prospectus supplement does not constitute an invitation to participate in the Global Note Offering in or from any jurisdiction in or from which, or to or from any person to or from whom, it is unlawful to make such offer under applicable securities laws or otherwise. The distribution of this document in certain jurisdictions (in particular, Belgium, Italy and the United Kingdom) may be restricted by law. See ‘‘Jurisdictional Restrictions’’ below. Persons into whose possession this document comes are required by each of the Republic of South Africa and the Joint Dealer Managers to inform themselves about, and to observe, any such restrictions.

REPUBLIC OF SOUTH AFRICA

invites the holders of

the series of notes listed below (the ‘‘USD Eligible Notes’’) to submit offers to exchange USD

Eligible Notes for an equal principal amount of U.S. Dollar-Denominated Notes due 2022

(the ‘‘New Notes’’) and a U.S. dollar amount of cash

and/or

offers to sell USD Eligible Notes for a U.S. dollar amount of cash, subject to the acceptance

priority levels and series repurchase caps described herein

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series of Notes |  |  | Outstanding

Principal Amount |  |  | CUSIP |  |  | Acceptance

Priority

Level |  |  | Series

Repurchase

Caps |  |  | Reference Rates |  |  | Repurchase

Spread/Ranges

(bps) |

| 9 1/8% Notes due 5/19/2009 |  |  | $1,500,000,000 |  |  | 836205AE4 |  |  | 1 |  |  | N/A |  |  | UST 4.5% due 3/31/09 |  |  | +28 |

| 8½% Notes due 6/23/2017 |  |  | $237,000,000 |  |  | 836205AD6 |  |  | 3 |  |  | N/A |  |  | UST 4.625% due 2/15/17 |  |  | +74 to +64 |

| 7 3/8% Notes due 4/25/2012 |  |  | $1,000,000,000 |  |  | 836205AG9 |  |  | 5 |  |  | $250,000,000 |  |  | UST 4.5% due 4/30/12 |  |  | +66 to +61 |

| 6½% Notes due 6/2/2014 |  |  | $1,000,000,000 |  |  | 836205AJ3 |  |  | 6 |  |  | $250,000,000 |  |  | UST 4.5% due 4/30/12 |  |  | +74 to +69 |

|

(this transaction, as contemplated by this prospectus supplement, the accompanying prospectus and, if applicable,

the related letters of transmittal, is referred to as the ‘‘Tender and Exchange’’);

the series of notes listed below (the ‘‘Euro Eligible Notes’’) to submit offers to sell

Euro Eligible Notes for a Euro cash amount, subject to the acceptance

priority levels and series repurchase caps described herein

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series of Notes |  |  | Outstanding

Principal Amount |  |  | ISIN |  |  | Acceptance

Priority

Level |  |  | Series

Repurchase

Caps |  |  | Reference Rates |  |  | Repurchase

Spread/Ranges

(bps) |

| 7% Notes due 4/10/2008 |  |  | €500,000,000 |  |  | XS0127518933 |  |  | 2 |  |  | N/A |  |  | 1 Year Euribor |  |  | −15 |

| 5¼% Notes due 5/16/2013 |  |  | €1,250,000,000 |  |  | XS0168670478 |  |  | 4 |  |  | €250,000,000 |  |  | 6 Year Swaps |  |  | +23 to +18 |

|

(this transaction, as contemplated by this prospectus supplement, the accompanying prospectus and, if applicable,

the related letters of transmittal, is referred to as the ‘‘Tender Only’’, and together with the Tender and Exchange, the ‘‘Invitation’’).

Offering for Cash of New Notes

(the offering for cash is referred to as the ‘‘Cash Offering’’ and, together with the Invitation, as the ‘‘Global Note Offering’’).

THE INVITATION WILL COMMENCE ON MAY 8, 2007, AND EXPIRE AT 3:00 P.M. (NEW YORK CITY TIME) ON MAY 15, 2007, UNLESS EXTENDED OR EARLIER TERMINATED. THE REPUBLIC OF SOUTH AFRICA REFERS TO THIS DATE,

AS SO EXTENDED OR EARLIER TERMINATED, AS THE ‘‘EXPIRATION DATE.’’

In relation to the application to the Luxembourg Stock Exchange for the New Notes to be admitted to trading on the Luxembourg Stock Exchange’s regulated market (which is a regulated market for the purpose of the Market and Financial Instruments Directive 2004/39/EC) and to be listed on the official list of the Luxembourg Stock Exchange, application has been made to the Commission de Surveillance du Secteur Financier of the Grand Duchy of Luxembourg, as competent authority under Directive 2003/71/EC (the ‘‘Prospectus Directive’’), to approve this prospectus supplement (the ‘‘Prospectus Supplement’’) together with the accompanying prospectus dated August 20, 2003 and the addendum dated March 27, 2006 (together with the accompanying prospectus dated August 20, 2003, the ‘‘Prospectus’’) as a prospectus for the purposes of the Prospectus Directive. The Commission de Surveillance d u Secteur Financier has not approved this Prospectus Supplement and the accompanying Prospectus in relation to the Global Note Offering or in relation to the admission to trading of the New Notes on the Luxembourg Stock Exchange’s regulated market and their listing on the official list of the Luxembourg Stock Exchange.

A notice or supplemental prospectus will be published in relation to the total amount of New Notes to be admitted to trading on the Luxembourg Stock Exchange’s ergulated market (which is a regulated market for the purpose of the Market and Financial Instruments Directive 2004/39/EC) and to be listed on the official list of the Luxembourg Stock Exchange and the New Issue Price on www.bourse.lu.

Application has been made to the Luxembourg Stock Exchange for the New Notes to be admitted to trading on the Luxembourg Stock Exchange’s regulated market (which is a regulated market for the purpose of the Market and Financial Instruments Directive 2004/39/EC) and to be listed on the official list of the Luxembourg Stock Exchange.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

See ‘‘Risk Factors’’ beginning on page S-21 to read about certain risks you should consider before investing in the New Notes.

The Joint Dealer Managers for the Invitation and the Joint Book Runners for the Cash Offering are:

The date of this Prospectus Supplement is May 8, 2007

Table of Contents(continuation of cover page)

The New Notes will contain provisions regarding acceleration and future modifications to their terms that differ from those applicable to South Africa’s outstanding external debt issued prior to May 16, 2003. Under these provisions, which are described beginning on page 7 of the Prospectus. South Africa may amend the payment provisions of the New Notes with the consent of the holders of 75% of the aggregate principal amount of the outstanding New Notes.

The New Notes will be issued with a minimum denomination of US$100,000 and therefore offers to exchange will only be accepted for submissions of US$100,000 or greater and provided any issued amounts are greater than US$100,000 after any pro-ration. The aggregate amount of New Notes issued pursuant to the Global Note Offering will not be less than US$750,000,000 (‘‘Minimum Issue Size’’), and the repurchase of any Eligible Notes pursuant to Tender Offers will be subject to financing. The amount of Eligible Notes repurchased pursuant to the Invitation will not be less than US$750,000,000 (the ‘‘Repurchase Amount’’).

Any questions regarding the Global Note Offering or requests for additional copies of this Prospectus Supplement, the Prospectus or related documents, which may be obtained free of charge, may be directed to Bondholder Communications Group (the ‘‘Information and Exchange Agent’’) or Deutsche Bank Luxembourg S.A. (the ‘‘Luxembourg Exchange Agent’’) at the telephone numbers provided on the back cover of this Prospectus Supplement. Holders may also contact Barclays Capital Inc. or Citigroup Global Markets Inc. (the ‘‘Joint Dealer Managers’’) at the telephone numbers provided on the back cover of this Prospectus Supplement for information concerning the Global Note Offering.

Custodians, direct participants and clearing systems might have deadlines prior to the Expiration Date for receiving instructions and should be contacted by you as soon as possible to ensure proper and timely delivery of instructions. Holders who hold Eligible Notes through Euroclear or Clearstream Banking Luxembourg are urged to submit the Note Instructions (as defined below) for their USD Eligible Notes and Euro Eligible Notes (together, the ‘‘Eligible Notes’’) at least one day in advance of the Expiration Date to avoid delays that might affect the valid exchange and/or sale of their Eligible Notes.

S-1

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

S-2

Table of ContentsINTRODUCTION

This Prospectus Supplement supplements the attached Prospectus relating to the debt securities and warrants of the Republic of South Africa (the ‘‘Republic’’ or ‘‘South Africa’’). You should read this Prospectus Supplement along with the attached Prospectus, which together constitute a prospectus within the meaning of article 5 of directive 2003/71/EC. Both documents contain information you should consider when making your investment decision. Certain other documents are incorporated by reference into this Prospectus Supplement and the Prospectus. Please see ‘‘Documents Incorporated by Reference’’ in this Prospectus Supplement and ‘‘Incorporation of Certain Documents by Reference’’ in the Prospectus. If the information in this Prospectus Supplement differs from the information contained in the Prospectus, you should rely on the information in this Prospectus Supplemen t.

Offers to exchange or sell Eligible Notes pursuant to the Invitation (‘‘Offers’’) may be withdrawn pursuant to the procedures described below at any time prior to the Expiration Date, but not thereafter. In the event of a termination of the Invitation, Eligible Notes delivered pursuant to Offers pursuant to the terms of the Invitation will be returned promptly to their respective holders. In no event may Offers of Eligible Notes be withdrawn after the Expiration Date.

Questions and requests for assistance may be directed to the Information Agent or the Joint Dealer Managers at their respective addresses and telephone numbers set forth on the back cover of this Prospectus Supplement. Additional copies of this Prospectus Supplement, the Prospectus and related materials may be obtained free of charge from the Information and Exchange Agent or the Luxembourg Exchange Agent.

No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained in this Prospectus Supplement and the accompanying Prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by the Republic, the Joint Dealer Managers, the Information and Exchange Agent or the Luxembourg Exchange Agent. This Prospectus Supplement and the accompanying Prospectus do not constitute an offer to buy or a solicitation of an offer to sell any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Neither the delivery of this Prospectus Supplement and the accompanying Prospectus nor any exchange, purchase or sale made hereunder shall, under any circumstances, create any implication that the information in this Prospectus Supplement and the accompanying Prospectus is correct as of any time subsequent to the date hereof or that there has been no change in the affairs of the Republic since such date.

The Republic accepts responsibility for the information it has provided in this Prospectus Supplement and the Prospectus and, after having taken all reasonable care and to the best of its knowledge, confirms that:

|  |  |

| • | the information contained in this Prospectus Supplement and the Prospectus is true and correct in all material respects and is not misleading, and |

|  |  |

| • | it has not omitted other facts the omission of which makes this Prospectus Supplement and the Prospectus as a whole misleading. |

The New Notes are debt securities of the Republic, which are being offered under the Republic’s registration statement no. 333-107393 filed with the U.S. Securities and Exchange Commission (the ‘‘Commission’’) under the U.S. Securities Act of 1933, as amended. This Prospectus Supplement and the Prospectus are part of the registration statement. The Prospectus provides you with a general description of the securities that the Republic may offer, and this Prospectus Supplement contains specific information about the terms of the Global Note Offering. This document also adds, updates or changes information provided or incorporated by reference in the Prospectus. Consequently, before you decide to participate in the Global Note Offering, you should read this Prospectus Supplement together with the Prospectus as well as the documents incorporated by reference in the Prospectus Supplement and Prospectus.

The Republic will cancel the Eligible Notes it acquires pursuant to the Invitation. Accordingly, this transaction will reduce the aggregate principal amount of Eligible Notes that otherwise might

S-3

Table of Contentstrade in the market, which could adversely affect the liquidity and market value of the remaining Eligible Notes that the Republic does not acquire.

A decision to participate or not participate in the Invitation will involve certain risks. It is important that you read ‘‘Risk Factors’’ beginning on page S-21 of this document.

None of the Republic, the Joint Dealer Managers, the Information and Exchange Agent or the Luxembourg Exchange Agent has expressed any opinion as to whether the terms of the Global Note Offering are fair. None of the Republic, the Joint Dealer Managers, the Information and Exchange Agent or the Luxembourg Exchange Agent makes any recommendation that you offer to exchange Eligible Notes for New Notes, sell Eligible Notes for cash, purchase New Notes or refrain from doing so pursuant to the Global Note Offering and no one has been authorized by the Republic, the Joint Dealer Managers, the Information and Exchange Agent or the Luxembourg Exchange Agent to make any such recommendation. You must make your own decision as to whether to offer to exchange Eligible Notes for New Notes, offer to sell Eligible Notes for cash, purchase New Notes or refrain from doing so.

You must comply with all laws that apply to you in any place in which you possess this Prospectus Supplement and the accompanying Prospectus. You must also obtain any consents or approvals that you need in order to submit Offers and deliver Eligible Notes. None of the Republic, the Joint Dealer Managers, the Information and Exchange Agent or the Luxembourg Exchange Agent is responsible for your compliance with these legal requirements. It is important that you read ‘‘Jurisdictional Restrictions’’ beginning on page S-62 of this Prospectus Supplement.

The Republic has prepared the Global Note Offering and is solely responsible for its contents. You are responsible for making your own examination of the Republic and your own assessment of the merits and risks of submitting an Offer to exchange or sell Eligible Notes and offering to purchase New Notes pursuant to the Cash Offering. By making an Offer of your Eligible Notes or offering to purchase New Notes, you will be deemed to have acknowledged that:

|  |  |

| • | you have reviewed the Global Note Offering; |

|  |  |

| • | you have had an opportunity to request and review any additional information that you may need; and |

|  |  |

| • | the Joint Dealer Managers are not responsible for, and are not making any representation to you concerning, the accuracy or completeness of the Global Note Offering. |

The Republic and the Joint Dealer Managers are not providing you with any legal, business, tax or other advice in the Global Note Offering. You should consult with your own advisors as needed to assist you in making your investment decision and to advise you whether you are legally permitted to submit Offers to exchange or sell Eligible Notes or purchase New Notes.

As used in this Prospectus Supplement, ‘‘business day’’ means any day other than a Saturday, a Sunday or a legal holiday or a day on which banking institutions or trust companies are authorized or obligated by law to close in New York City or London.

In this Prospectus Supplement, all amounts are expressed in South African rand (‘‘R’’, ‘‘Rand’’ or ‘‘rand’’), Euro (‘‘€’’) or U.S. dollars (‘‘US$’’, ‘‘$’’ or ‘‘dollars’’), except as otherwise specified. On May 4, 2007 the noon buying rate for cable transfers of rand, as reported by the Federal Reserve Bank of New York, was 6.9250 rand per dollar (or 0.1444 dollars per rand). On May 4, 2007 the Euro foreign exchange reference rate for the rand as at 2:15 p.m. Central European Time was 9.4745 rand per Euro (or 0.1055 Euro per rand).

The distribution of this Prospectus Supplement and the accompanying Prospectus and the offering of the New Notes in certain jurisdictions is restricted by law. Persons who acquire this Prospectus Supplement and the accompanying Prospectus are required by the Republic, the Joint Dealer Managers, the Information and Exchange Agent and the Luxembourg Exchange Agent to inform themselves about, and to observe, any such restrictions. See ‘‘Jurisdictional Restrictions’’ in this Prospectus Supplement.

S-4

Table of ContentsFORWARD-LOOKING STATEMENTS

This Prospectus Supplement and the Prospectus contain certain forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933. Statements that are not historical facts, including statements with respect to certain of the expectations, plans and objectives of South Africa and the economic, monetary and financial conditions of the Republic, are forward-looking in nature. These statements are based on current plans, estimates and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date that they are made, and South Africa undertakes no obligation to publicly update any of them in light of new information or future events.

Forward-looking statements involve inherent risks and uncertainties. South Africa cautions you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to:

|  |  |

| • | external factors, such as interest rates in financial markets outside South Africa and social and economic conditions in South Africa’s neighbors and major export markets; and |

|  |  |

| • | internal factors, such as general economic and business conditions in South Africa, present and future exchange rates of the rand, foreign currency reserves, the ability of the South African government to enact key reforms, the level of domestic debt, domestic inflation, the level of foreign direct and portfolio investment and the level of South African domestic interest rates. |

CERTAIN LEGAL RESTRICTIONS

The distribution of materials relating to the Global Note Offering, including this Prospectus Supplement and the Prospectus, and the transactions contemplated by the Global Note Offering, may be restricted by law in certain jurisdictions. The Republic is making the Global Note Offering only in those jurisdictions where it is legal to do so. The Global Note Offering is void in all jurisdictions where it is prohibited. If materials relating to the Global Note Offering come into your possession, you are required by the Republic to inform yourself of and to observe all of these restrictions. The materials relating to the Global Note Offering do not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. If a jurisdiction requires that the Global Note Offering be made by a licensed broker or dealer and a Joint Dealer Manager or any affiliate of a Joint Dealer Manager is a licens ed broker or dealer in that jurisdiction, the Global Note Offering shall be deemed to be made by the Joint Dealer Manager or such affiliate on behalf of the Republic in that jurisdiction. For more information, see ‘‘Jurisdictional Restrictions.’’

This Prospectus Supplement and the Prospectus have been sent to you in an electronic form. You are reminded that documents transmitted via this medium may be altered or changed during the process of electronic transmission and consequently none of the Republic, the Joint Dealer Managers, the Information and Exchange Agent or the Luxembourg Exchange Agent or any person who controls a Joint Dealer Manager, the Information and Exchange Agent or the Luxembourg Exchange Agent or any director, officer, employee or agent of the Joint Dealer Managers, the Information and Exchange Agent or the Luxembourg Exchange Agent or any affiliate of such person will accept any liability or responsibility whatsoever in respect of any difference between the Prospectus Supplement and the Prospectus distributed to you in electronic format and the Prospectus Supplement and the Prospectus in their original form.

S-5

Table of ContentsSUMMARY

This Prospectus Supplement and the accompanying Prospectus contain information that should be read carefully before any decision is made with respect to the Global Note Offering. Any decision to invest in the New Notes by an investor should be based on consideration of the Prospectus Supplement and the accompanying Prospectus as a whole. You should read the entire Prospectus Supplement and the accompanying Prospectus carefully. The following summary is qualified in its entirety by reference to, and should be read in connection with, the information appearing elsewhere or incorporated by reference in this Prospectus Supplement and the Prospectus. Each of the capitalized terms used in this summary and not defined herein has the meaning set forth elsewhere in this Prospectus Supplement. Following the implementation of the relevant provisions of the Prospectus Directive in each member state of the European Economic Area (each a ‘‘Member State’’), no civil liability will attach to the Republic in any such Member State solely on the basis of this summary, including any translation thereof, unless it is misleading, inaccurate or inconsistent when read together with other parts of this Prospectus Supplement and the Prospectus. Where a claim relating to the information contained in the Prospectus Supplement or the accompanying Prospectus is brought before a court in a Member State, the plaintiff may, under the national legislation of the Member State where the claim is brought, be required to bear the costs of translating the Prospectus Supplement and the accompanying Prospectus before the legal proceedings are initiated.

|  |  |

| Issuer: |  | Republic of South Africa. |

| | |

|  |  |

| General: |  | The Republic is inviting Exchange Offer Qualifying Eligible Holders (as defined below) of each series of USD Eligible Notes specified on the cover of this Prospectus Supplement to offer to exchange such notes of such series for newly issued New Notes, on the terms and subject to the conditions set forth in this Prospectus Supplement, the accompanying Prospectus and related electronic letters of transmittal (the ‘‘Exchange’’). The Republic is also inviting Tender Offer Qualifying Holders (as defined below) of USD Eligible Notes to offer to tender for purchase such notes of such series on the terms and subject to the conditions set forth in this Prospectus Supplement, the accompanying Prospectus and, if relevant, the related electronic letters of transmittal (the ‘&lsq uo;Tender’’, and together with the Exchange, the ‘‘Tender and Exchange’’). |

| | |

|  |  |

|  | The Republic is, in addition, inviting Tender Offer Qualifying Holders (as defined below) of Euro Eligible Notes specified on the cover of this Prospectus Supplement to offer to tender for purchase such notes of such series on the terms and subject to the conditions set forth in this Prospectus Supplement (the ‘‘Tender Only’’ and, together with the Tender and Exchange, the ‘‘Invitation’’). |

| | |

|  |  |

|  | In addition, the Republic may offer New Notes for cash in an underwritten offering with Barclays Capital Inc. and Citigroup Global Markets Inc. as Joint Book Runners. This offering is referred to as the ‘‘Cash Offering’’ and, together with the Invitation, as the ‘‘Global Note Offering.’’ |

| | |

S-6

Table of Contents |  |  |

| Purpose of the Global Note Offering: |  | The Global Note Offering is part of a broader program implemented by the Republic in an effort to manage its external liabilities. The Republic may, in the future, exchange, repurchase or redeem the Eligible Notes not exchanged or purchased pursuant to the Invitation, or exchange, repurchase or redeem other public debt. |

| | |

|  |  |

| Risk Factors: |  | The Global Note Offering is subject to certain risks: |

| | |

|  |  |  |

|  | • | Risks associated with the New Notes generally include: (1) the trading market for debt securities may be volatile and may be adversely impacted by many events; (2) there could be no active trading market for the New Notes; (3) the New Notes may not be a suitable investment for all investors; (4) the New Notes are unsecured; (5) the terms of the New Notes may be modified, waived or substituted without the consent of all of the holders; (6) there can be no assurance that New York law in effect as at the date of this Prospectus Supplement will not be modified; and (7) there may be certain legal restraints in relation to investment in the New Notes with regard to your particular circumstances. |

| | |

|  |  |  |

|  | • | Risks associated with the Global Note Offering generally include: (1) if the Invitation is completed, the trading market for the Eligible Notes not exchanged may become illiquid, which may adversely affect the market value of the Eligible Notes; (2) noteholders submitting Offers may suffer losses if the market prices of their Eligible Notes decline while the Invitation is pending; (3) the Republic may engage in other liability management transactions with respect to the Eligible Notes, on terms that may be more or less favorable than the Invitation; (4) you will not be able to determine certain pricing information before you make your decision whether to participate in the Invitation; (5) the decision to exchange your USD Eligible Notes for New Notes exposes you to the risk of nonpayment f or a longer period of time; and (6) the consummation of the transaction may not occur due to the non-fulfillment of the financing condition (explained below). |

| | |

|  |  |  |

|  | • | Risks associated with the Republic generally include: (1) the Republic is a foreign sovereign state and accordingly it may be difficult to obtain or enforce judgments against it; (2) certain economic risks are inherent in any investment in an emerging market country such as the Republic; (3) there can be no assurance that the Republic’s credit rating will not change. |

| | |

S-7

Table of Contents |  |  |

|  | For further information, see ‘‘Risk Factors’’ commencing on page S-21 of this Prospectus Supplement. |

| | |

|  |  |

| Repurchase Amount: |  | A US dollar equivalent amount greater than or equal to US$750,000,000 to be specified by the Republic in its sole discretion. |

| | |

|  |  |

| Invitation: |  | The Invitation commences on May 8, 2007, and expires at 3:00 P.M., New York City time, on May 15, 2007, unless the Republic, in its sole and absolute discretion, extends it or terminates it earlier. We refer to the date on which the Invitation expires as the ‘‘Expiration Date.’’ |

| | |

|  |  |

| Exchange Offers: |  | If you are an Exchange Offer Qualifying Eligible Holder (as defined below) you may submit an ‘‘Exchange Offer’’ which specifies the aggregate principal amount of USD Eligible Notes that you would offer for exchange into an equal principal amount of New Notes, plus a cash payment as described herein based on the Repurchase Price and New Issue Price described herein, plus an amount equal to accrued interest from and including the immediately preceding coupon day and excluding the Settlement Date (as defined below). |

| | |

|  |  |

|  | Exchange Offer Qualifying Eligible Holders (as defined below) may offer USD Eligible Notes of a particular series for exchange only in authorized denominations of US$1,000, with a minimum offer requirement of US$100,000 of the aggregate principal amount of any such series. Any submission of US$100,000 or greater of a series of USD Eligible Notes will be deemed to be on behalf of an Exchange Offer Qualifying Eligible Holder. A holder of less than an aggregate principal amount of US$100,000 of a series of USD Eligible Notes will only be able to be submit such USD Eligible Notes pursuant to a Tender Offer. |

| | |

|  |  |

|  | In the case of any Exchange Offer that as a result of proration falls below the minimum offer requirement of US$100,000 of aggregate principal amount of any series of USD Eligible Notes, such USD Eligible Notes will not be deemed to be accepted by the Republic and will be returned to the holder that made any such Exchange Offer. |

| | |

|  |  |

|  | An ‘‘Exchange Offer Qualifying Eligible Holder’’ is a holder who is submitting for exchange USD Eligible Notes of a series in an aggregate principal amount equal to, or greater than, US$100,000 and who is an ‘‘authorized holder’’ as described under Jurisdictional Restrictions below. |

| | |

|  |  |

|  | There are Series Repurchase Caps (as described below) for certain Eligible Notes and certain Offers may be subject to proration, as described below in ‘‘Terms of the Global Note Offering — Acceptance Priority Levels and Proration.’’ |

| | |

S-8

Table of Contents |  |  |

| Tender Offers: |  | If you are a Tender Offer Qualifying Holder (as defined below) you may submit a ‘‘Tender Offer’’ which specifies the aggregate principal amount of USD Eligible Notes or Euro Eligible Notes that you would accept for repurchase for the Repurchase Price per $1,000 or €1,000 principal amount of Eligible Notes described below plus an amount equal to accrued interest from and including the immediately preceding coupon day to and excluding the Settlement Date (as defined below) (together, the ‘‘Cash Equivalent Amount’’). |

| | |

|  |  |

|  | A ‘‘Tender Offer Qualifying Holder’’ means a holder of Eligible Notes resident in a jurisdiction for which Tender Offer submissions are legal. For more information, see ‘‘Jurisdictional Restrictions’’ commencing on page S-62 of this Prospectus Supplement. |

| | |

|  |  |

|  | There are Series Repurchase Caps (as described below) for certain Eligible Notes and certain Offers may be subject to proration, as described below in ‘‘Terms of the Global Note Offering — Acceptance Priority Levels and Proration.’’ |

| | |

|  |  |

| Calculation of Repurchase Prices: |  | The ‘‘Repurchase Price’’ for a series of USD Eligible Notes will be calculated as follows in accordance with standard market practice: |

| | |

|  |  |

|  | A price per US$1,000 principal amount of such series of USD Eligible Notes (rounded to the nearest cent, with $0.005 being rounded to a full cent) intended to result in a yield to maturity (on a semi-annual bond equivalent basis) of that series of notes on the Settlement Date equal to the sum of: |

| | |

|  |  |  |

|  | (a) | the Reference U.S. Treasury Yield for such series of notes, plus |

| | |

|  |  |  |

|  | (b) | the applicable Repurchase Spread. |

| | |

|  |  |

|  | The ‘‘Repurchase Price’’ for a series of Euro Eligible Notes will be calculated as follows in accordance with standard market practice: |

| | |

|  |  |

|  | A price per €1,000 principal amount of such series of Euro Eligible Notes (rounded to the nearest cent, with €0.005 being rounded to a full cent) intended to result in a yield to maturity (on an annual bond equivalent basis) of that series of notes on the Settlement Date equal to the sum of: |

| | |

|  |  |  |

|  | (a) | the Reference Euro Swap Rate for such series of notes, plus |

| | |

|  |  |  |

|  | (b) | the applicable Repurchase Spread. |

| | |

|  |  |

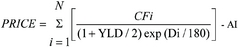

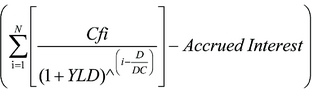

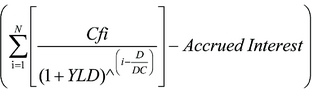

|  | The Republic will calculate the price of the USD Eligible Notes and the New Notes in accordance with the formula |

| | |

S-9

Table of Contents |  |  |

|  | in Annex A and the price of the Euro Eligible Notes in accordance with the formula in Annex B, which underlie the hypothetical calculations in Annex C. |

| | |

|  |  |

| Repurchase Spreads and Repurchase Spread Ranges: |  | The Repurchase Spreads for the following Eligible Notes will be fixed at the following levels: |

| | |

|  |  |  |

|  | 9 1/8% Notes due 2009: | +0.28% |

| | |

|  |  |

|  | The Repurchase Spread Ranges for the following Eligible Notes will be within the ranges specified below, with the applicable level fixed by or as soon as possible after 3:00 PM New York Time on the day prior to the Expiration Date. The Republic will set the Repurchase Spread Ranges in its sole discretion. |

| | |

|  |  |  |

|  | 8½% Notes due 2017: | +0.74% to +0.64% |

| | |

|  |  |  |

|  | 5¼% Notes due 2013: | +0.23% to +0.18% |

| | |

|  |  |  |

|  | 7 3/8% Notes due 2012: | +0.66% to +0.61% |

| | |

|  |  |  |

|  | 6½% Notes due 2014: | +0.74% to +0.69% |

| | |

|  |  |

|  | The spreads above can be decreased by the Republic at its sole discretion at any time prior to the Expiration Date. |

| | |

|  |  |

| Series Repurchase Caps: |  | No more than the Series Repurchase Caps listed below for each series of Eligible Notes will be repurchased via the Invitation: |

| | |

|  |  |  |

|  | 9 1/8% Notes due 2009: | N.A. |

| | |

|  |  |  |

|  | 5¼% Notes due 2013: | Euro 250,000,000 |

| | |

|  |  |  |

|  | 7 3/8% Notes due 2012: | USD 250,000,000 |

| | |

|  |  |  |

|  | 6½% Notes due 2014: | USD 250,000,000 |

| | |

|  |  |

|  | For the avoidance of doubt, the Series Repurchase Caps listed above for USD Eligible Notes apply to the aggregate nominal principal amount of each series of such notes offered for tender and exchange pursuant to the Invitation. |

| | |

|  |  |

| Exchange Consideration: |  | Investors whose Exchange Offers are accepted will receive: |

| | |

|  |  |  |

|  | (a) | an amount of New Notes equal to the nominal principal amount of USD Eligible Notes offered for such exchange, plus |

| | |

|  |  |  |

|  | (b) | an amount of U.S. dollars per $1,000 nominal principal amount equal to the difference between the Repurchase Price and the New Issue Price, plus |

| | |

|  |  |  |

|  | (c) | an amount of U.S. dollars per $1,000 nominal principal |

| | |

S-10

Table of Contents |  |  |  |

|  | | amount equal to interest accrued from and including the immediately preceding coupon payment date up to and excluding the Settlement Date. |

| | |

|  |  |

| New Issue Price and Note Coupon: |  | The ‘‘New Issue Price’’ for the New Notes will be calculated as follows in accordance with standard market practice: |

| | |

|  |  |

|  | A price per US$1,000 principal amount of New Notes (rounded to the nearest cent, with $0.005 being rounded to a full cent) intended to result in a yield to maturity (on a semi-annual bond equivalent basis) of the New Notes on the Settlement Date equal to the sum of: |

| | |

|  |  |  |

|  | (a) | the Reference U.S. Treasury Yield for such series of notes, plus |

| | |

|  |  |  |

|  | (b) | the applicable New Issue Spread. |

| | |

|  |  |

|  | The Republic will, in its sole discretion, determine the ‘‘Note Coupon’’ which is the interest rate on the New Notes, on the Announcement Date. The Note Coupon will be selected so that it is the highest percentage that is an increment of 1/8th of 1% that results in a price for the New Notes that is equal to or less than US$1,000 per US$1,000 principal amount of New Notes. |

| | |

|  |  |

|  | The Republic will calculate the price of the USD Eligible Notes and the New Notes in accordance with the formula in Annex A, which underlies the hypothetical calculations in Annex C. |

| | |

|  |  |

| New Issue Spread: |  | The New Issue Spread will be specified by or as soon as possible after 3:00 PM New York Time on the day prior to expiration. The Republic will set the New Issue Spread in its sole discretion. |

| | |

|  |  |

| Reference Rates: |  | The Reference U.S. Treasury Notes will be: |

| | |

|  |  |  |

|  | 9 1/8% Notes due 2009: | U.S. 4.5% Treasury Notes due 4/30/2009 |

| | |

|  |  |  |

|  | 7 3/8% Notes due 2012: | U.S. 4.5% Treasury Notes due 4/30/2012 |

| | |

|  |  |  |

|  | 6¼% Notes due 2014: | U.S. 4.5% Treasury Notes due 4/30/2012 |

| | |

|  |  |  |

|  | 8½% Notes due 2017: | U.S. 4.625% Treasury Notes due 2/15/2017 |

| | |

|  |  |  |

|  | New Notes: | 10yr U.S. Treasury Notes, the details of which will be confirmed in the announcement released at or around 3:00 P.M. New York City time on the day prior to the Expiration Date. |

| | |

S-11

Table of Contents |  |  |

|  | The Reference U.S. Treasury Yield means the yield to maturity (calculated in accordance with standard market practice) corresponding to the bid-side price as reported on Page PX1 of the Bloomberg U.S. Treasury Pricing Monitor, or any recognized quotation source selected by the Republic in its sole discretion if the Bloomberg U.S. Treasury Pricing Monitor is not available or is manifestly erroneous, as of approximately 10:00 A.M. New York City time on the Announcement Date for the Reference U.S. Treasury Notes. |

| | |

|  |  |

|  | The Reference Euro Swap Rate will be: |

| | |

|  |  |

|  | The Mid-Market Euro Swap Rate of the 1 Year Euribor as quoted on Reuters Screen ICAPEURO, or any recognized quotation source selected by the Republic in its sole discretion if the Reuters Screen ICAPEURO is not available or manifestly erroneous at the pricing time on the Announcement Date. |

| | |

|  |  |

|  | The Mid-Market Euro Swap Rate of the 6 Year Swap Rate as quoted on Reuters Screen ICAPEURO, or any recognized quotation source selected by the Republic in its sole discretion if the Reuters Screen ICAPEURO is not available or manifestly erroneous at the pricing time on the Announcement Date. |

| | |

|  |  |

|  | The Mid-Market Euro Swap Rate is the rate corresponding to the arithmetic mean between the bid and the offer as reported on the Reuters Screen ICAPEURO. |

| | |

|  |  |

| Acceptance Priority Levels and Proration: |  | Exchange Offers and Tender Offers will be accepted in accordance with, and in the order of, the Acceptance Priority Levels, subject to applicable Series Repurchase Caps specified for the Eligible Notes. |

| | |

|  |  |

|  | If the aggregate amount of Eligible Notes tendered and exchanged exceeds the Repurchase Amount, only up to the Repurchase Amount of principal amount of Eligible Notes will be accepted for purchase. Each series of Eligible Notes will be accepted for purchase in accordance with, and in the order of, the Acceptance Priority Levels set forth in the table below (with one being the highest Acceptance Priority Level). For example, the series of Eligible Notes tendered or exchanged with the Acceptance Priority Level of one will be accepted before the series with the Acceptance Priority of two, and so forth through the Eligible Notes series with the Acceptance Priority Level of six. In addition, for each series of Eligible Notes, not more than the Series Repurchase Cap will be accepted for purchase.& nbsp;Once a series of Eligible Notes tendered in a |

| | |

S-12

Table of Contents |  |  |

|  | certain Acceptance Priority Level have been accepted up to the Series Repurchase Cap for that series, the series of Eligible Notes with the next Acceptance Priority Level may be accepted up to the Series Repurchase Cap for such series. If the Repurchase Amount is adequate to purchase some but not all of a series of Eligible Notes offered for tender or exchange in an Acceptance Priority Level, up to any applicable Series Repurchase Cap, the amount of Eligible Notes that will be purchased in that series will be prorated based on the aggregate principal amount tendered or exchanged with respect to that series of Eligible Notes. In that event, the Eligible Notes of any other series with an Acceptance Priority Level below the prorated series of Eligible Notes will not be accepted for tender or exchange. The Republic may, in its sole discretion, also opt to apply a different proration factor to Tender Offers and Exchange Offers for a given series of Eligible Notes favoring a larger acceptance rate f or Exchange Offers than Tender Offers. |

| | |

|  |  |

|  | Acceptance Priority Level: Series of Eligible Notes: |

| | |

|  |  |  |

| Acceptance Priority Level: |  |  | Series of Eligible Notes: |

| 1 |  |  | 9 1/8% Notes due 2009 |

| 2 |  |  | 7% Notes due 2008 |

| 3 |  |  | 8½% Notes due 2017 |

| 4 |  |  | 5¼% Notes due 2013 |

| 5 |  |  | 7 3/8% Notes due 2012 |

| 6 |  |  | 6½% Notes due 2014 |

|

|  |  |

| Condition to the Global Note Offering: |  | The acceptance of any Eligible Notes for tender will be subject to the financing condition whereby the Republic is able to issue New Notes to finance any Tenders Offers on terms acceptable to the Republic. This financing condition may be waived by the Republic. |

| | |

|  |  |

| Submitting Offers: |  | Offers may be submitted only by direct participants in The Depository Trust Company, Inc. (‘‘DTC’’), Euroclear Bank S.A./N.V. (‘‘Euroclear’’) and Clearstream Banking Luxembourg, sociéte anonyme (‘‘Clearstream Banking Luxembourg’’) (each, a ‘‘Direct Participant’’). The Direct Participant through which you hold your Eligib le Notes must submit your Offer at or prior to 3:00 p.m., New York City time, on the Expiration Date, by means of an electronic letter of transmittal at the following website: http://www.bondcom.com/rsa (the ‘‘Invitation Website’’). |

| | |

|  |  |

|  | In addition, the Direct Participant must deliver Note Instructions with respect to each of the Eligible Notes you wish to exchange or sell. A description of ‘‘Note Instructions’’ and the procedures for submitting them can be found under ‘‘The Invitation — Invitation Procedures — Procedures for Submitting Note Instructions.’’ You |

| | |

S-13

Table of Contents |  |  |

|  | should submit your Note Instructions before submitting your electronic letter of transmittal, and, in the case of Direct Participants in DTC or Euroclear, you should use the reference code that you receive from your clearing system in the confirmation of your Note Instructions as the reference code in your electronic letter of transmittal. In the case of Offers submitted by Direct Participants in Clearstream Banking Luxembourg, you must create your own reference code as described under ‘‘The Invitation — Invitation Procedures — Reference Code.’’ Your electronic letter of transmittal must be delivered no later than 3:00 p.m., New York City time, on the Expiration Date and your Note Instructions must also be submitted no later than 3:00 p.m., New York City time, on the Expiration Date, and in any case in accordance with any deadlines established by DTC, Euroclear or Clearstream Banking Luxembourg. |

| | |

|  |  |

|  | If you hold your Eligible Notes through a custodian, you may not submit an Offer directly. You should contact your custodian to instruct your custodian to submit Offers on your behalf. In the event that your custodian is unable to submit an Offer on your behalf by one of the methods described herein, you should contact the Information and Exchange Agent for assistance in submitting your Offer. There can be no assurance that the Information and Exchange Agent will be able to assist you in successfully submitting your Offer. |

| | |

|  |  |

|  | If you are in Luxembourg, you may contact the Luxembourg Exchange Agent and ask it to assist you in submitting your Offer according to one of the procedures described herein. |

| | |

|  |  |

| Irrevocability; Withdrawal Rights: |  | Your Offer will become irrevocable upon expiration of the Invitation on the Expiration Date, which unless extended or earlier terminated by the Republic shall be at 3:00 P.M., New York City time, on May 15, 2007. However, any Offers may be revised or withdrawn prior to the expiration of the Invitation on the Expiration Date in accordance with the procedures described below under ‘‘Terms of the Global Note Offering — Irrevocability; Withdrawal Rights’’ in this Prospectus Supplement. |

| | |

|  |  |

| Certain Deemed Representations, Warranties and Undertakings: |  | If you submit an Offer with respect to Eligible Notes and thereby offer them for exchange or purchase pursuant to the Invitation, you will be deemed to have made certain acknowledgments, representations, warranties and undertakings (including with respect to your status as a ‘‘Exchange Offer Qualifying Eligible Holder’’ or a ‘‘Tender Offer Qualifying Holder’’) to the Republic, the Information and Exchange Agent, the Luxembourg Exchange Agent and the Joint Dealer Managers. See |

| | |

S-14

Table of Contents |  |  |

|  | ‘‘Terms of the Global Note Offering — Holders’ Representations, Warranties and Undertakings.’’ |

| | |

|  |  |

|  | Custodians, direct participants and clearing systems might have deadlines prior to the Expiration Date for receiving instructions and should be contacted as soon as possible to ensure the proper and timely delivery of instructions. |

| | |

|  |  |

| Settlement: |  | Once the Republic has announced the final results by means of the news media in accordance with applicable law and the acceptance of Offers in accordance with the terms of the Invitation, the Republic’s acceptance will be irrevocable. Offers, as so accepted, will constitute binding obligations of the submitting holders and the Republic to settle the Invitation, in the manner described under ‘‘Terms of the Global Note Offering — Settlement.’’ |

| | |

|  |  |

|  | The Settlement Date is expected to be May 30, 2007. |

| | |

|  |  |

| Announcement Date: |  | At or around 8:00 A.M., New York City time, on the Announcement Date, or as soon as practicable thereafter, the Republic will announce the expected amount of Eligible Notes to be repurchased, the specific series of Eligible Notes expected to be accepted and the expected proration factors. |

| | |

|  |  |

|  | At or around 10:00 A.M., New York City time, on the Announcement Date or as soon as practicable thereafter, the Republic will set the Reference Rates. |

| | |

|  |  |

|  | At or around 11:00 A.M., New York City time, on the Announcement Date, or as soon as practicable thereafter, the Republic will announce: |

| | |

|  |  |  |

|  | • | the amount of Eligible Notes to be repurchased; |

| | |

|  |  |  |

|  | • | The Repurchase Price for each series of Eligible Notes; |

| | |

|  |  |  |

|  | • | The total cash payment for each series of USD Eligible Notes accepted for exchange; |

| | |

|  |  |  |

|  | • | The aggregate amount of New Notes issued in exchange and for new cash (if any); and |

| | |

|  |  |  |

|  | • | The aggregate amount of each of the USD Eligible Notes and Euro Eligible Notes to be repurchased pursuant to the Invitation. |

| | |

|  |  |

| Income Tax Consequences: |  | Please see ‘‘Taxation’’ in this Prospectus Supplement for important information regarding the possible South African and U.S. federal income tax consequences to |

| | |

S-15

Table of Contents |  |  |

|  | holders who exchange Eligible Notes for New Notes or whose Eligible Notes are purchased for cash. |

| | |

|  |  |

| Jurisdictions: |  | The Republic is making the Global Note Offering only in those jurisdictions where it is legal to make such offers. See ‘‘Joint Dealer Managers and Joint Book Runners; Plan of Distribution’’ and ‘‘Jurisdictional Restrictions’’. |

| | |

|  |  |

| Securities Offered: |  | Notes due 2022. |

| | |

|  |  |

| Maturity Date: |  | May 30, 2022. |

| | |

|  |  |

| Issue Date: |  | The New Notes are expected to be issued on or about May 30, 2007, unless the Invitation is extended or earlier terminated in accordance with the terms of the Invitation. |

| | |

|  |  |

| Interest Payment Dates: |  | May 30 and November 30 of each year, commencing November 30, 2007. |

| | |

|  |  |

| Minimum Issue Size: |  | The amount of New Notes issued via the Global Note Offering will not be less than US$750,000,000. |

| | |

|  |  |

| Status and Ranking: |  | Upon issuance, the New Notes will be our direct unconditional and general obligations and will rank equally with our other external debt denominated in currencies other than Rand which is (i) payable to a person or entity not resident in South Africa and (ii) not owing to a South African citizen. See ‘‘Debt Securities — Status of the Debt Securities’’ and ‘‘Debt Securities — Negative Pledge’’ in the accompanying Prospectus. |

| | |

|  |  |

| Markets: |  | The New Notes are offered for sale in those jurisdictions where it is legal to make such offers. See ‘‘Joint Dealer Managers and Joint Book Runners; Plan of Distribution’’ and ‘‘Jurisdictional Restrictions’’. |

| | |

|  |  |

| Listing and admission to trading: |  | Application has been made to list and trade the New Notes on the regulated market ‘‘Marché Officiel’’ of the Luxembourg Stock Exchange. |

| | |

|  |  |

| Form: |  | The New Notes will be book-entry securities in fully registered form, without coupons, registered in the names of investors or their nominees in denominations of $100,000 and integral multiples of $1,000 in excess thereof. |

| | |

|  |  |

| Clearance and Settlement: |  | Beneficial interests in the New Notes will be shown on, and transfer thereof will be effected only through, records maintained by DTC and its participants, unless certain contingencies occur, in which case the New Notes will be issued in definitive form. Investors may elect to hold |

| | |

S-16

Table of Contents |  |  |

|  | interests in the New Notes through DTC, Euroclear or Clearstream Banking Luxembourg, if they are participants in such systems, or indirectly through organizations that are participants in such systems. See ‘‘Global Clearance and Settlement’’. |

| | |

|  |  |

| Paying Agent in Luxembourg: |  | Deutsche Bank Luxembourg S.A. |

| | |

|  |  |

| Payment of Principal and Interest: |  | Principal and interest on the New Notes will be payable in U.S. dollars or other legal tender of the United States of America. As long as the New Notes are in the form of a book-entry security, payments of principal and interest to investors shall be made through the facilities of the DTC. See ‘‘Description of the New Notes — Payments of Principal and Interest’’ and ‘‘Global Clearance and Settlement — Ownership of New Notes through DTC, Euroclear and Clearstream Banking Luxembourg’’. |

| | |

|  |  |

| Default: |  | The New Notes will contain events of default, the occurrence of which may result in the acceleration of our obligations under the New Notes prior to maturity. See ‘‘Debt Securities — Default’’ and ‘‘— Acceleration of Maturity’’ in the accompanying Prospectus. |

| | |

|  |  |

| Collective Action Securities: |  | The New Notes will be designated collective action securities under the Amended and Restated Fiscal Agency Agreement, dated as of May 15, 2003, between the Republic and Deutsche Bank Trust Company Americas (the ‘‘Fiscal Agency Agreement’’). The New Notes will contain provisions regarding acceleration and voting on amendments, modifications, changes and waivers that differ from those applicable to certain other series of U.S. dollar denominated debt securities issued by the Republic and described in the accompanying Prospectus. The provisions described in this Prospectus Supplement will govern the New Notes. These provisions are commonly referred to as ‘‘collective action clauses.’’ Under these provisions, we may amend certain key terms of the New No tes, including the maturity date, interest rate and other payment terms, with the consent of the holders of not less than 75% of the aggregate principal amount of the outstanding New Notes. Additionally, if an event of default has occurred and is continuing, the New Notes may be declared to be due and payable immediately by holders of not less than 25% of the aggregate principal amount of the outstanding New Notes. These provisions are described in the sections entitled ‘‘Description of the New Notes — Default; Acceleration of Maturity’’ and ‘‘— Amendments and Waivers’’ in this Prospectus Supplement and ‘‘Collective Action Securities’’ in the accompanying Prospectus. |

| | |

S-17

Table of Contents |  |  |

| Prescription Period: |  | None. |

| | |

|  |  |

| Fiscal Agency Agreement: |  | The New Notes will be issued pursuant to the Fiscal Agency Agreement. |

| | |

|  |  |

| Taxation: |  | For a discussion of United States, South African and Luxembourg tax consequences associated with the New Notes, see ‘‘Taxation’’ in this Prospectus Supplement. Investors should consult their own tax advisors in determining the foreign, U.S. federal, state, local and any other tax consequences to them of the purchase, ownership and disposition of the New Notes. |

| | |

|  |  |

| Governing Law: |  | The New Notes will be governed by the laws of the State of New York, except with respect to the authorization and execution of the New Notes, which will be governed by the laws of the Republic of South Africa. |

| | |

|  |  |

| Trading: |  | The New Notes are expected to begin trading on a when-and-if-issued basis following the announcement of the results of the Global Note Offering. |

| | |

|  |  |

| Eligible Notes: |  | The Eligible Notes constitute direct, general, unsecured and unconditional external indebtedness of the Republic. With the exception of the 8½% Notes due 2017, which are not listed, the Eligible Notes are listed on the Luxembourg Stock Exchange. |

| | |

|  |  |

|  | For further information, refer to page S-43 of this Prospectus Supplement. |

| | |

S-18

Table of ContentsSUMMARY TIME SCHEDULE FOR THE GLOBAL NOTE OFFERING

The following summarizes the anticipated time schedule for the Global Note Offering assuming, among other things, that the Expiration Date or time is not extended. This summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this Prospectus Supplement. All references are to New York City time unless otherwise noted.

|  |  |

|  | Announcement of the terms of the Global Note Offering. |

| | |

|  |  |

|  | Commencement of the Invitation. |

| | |

|  |  |

|  | Announcement of Repurchase Spreads and Repurchase Spread Ranges. |

| | |

|  |  |

|  | The Invitation will open for Tender Offers or Exchange Offers. The period from the commencement of the Invitation to its expiration is referred to in this Prospectus Supplement as the ‘‘Submission Period.’’ |

| | |

|  |  |

| At or around 3:00 P.M., May 14, 2007: |  | Announcement of New Issue Spread and 10yr U.S. Treasury Note Details |

| | |

|  |  |

|  | Announcement of the applicable Repurchase Spreads for Eligible Notes for which a Repurchase Spread Range was announced. |

| | |

|  |  |

|  | The Republic will confirm the details of the 10yr U.S. Treasury Notes, the Reference Rate for the New Notes. |

| | |

|  |  |

| At or around 3:00 P.M., May 15, 2007: |  | Expiration Date; Submission Period Ends |

| | |

|  |  |

|  | The Submission Period ends and the Invitation expires, unless the Republic extends it or terminates it earlier in its sole and absolute discretion. After expiration, you may no longer submit, modify or withdraw your Offer, unless the Submission Period is extended by the Republic. |

| | |

|  |  |

| At or around 8:00 A.M., May 16, 2007: |  | Announcement Date |

| | |

|  |  |

|  | The Republic will announce the expected amount of Eligible Notes to be repurchased, the specific series of Eligible Notes expected to be accepted and the expected proration factors. |

| | |

|  |  |

| At or around 10:00 A.M., May 16, 2007: |  | The Republic sets the Reference Rates. |

| | |

|  |  |

| At or around 11:00 A.M., May 16, 2007: |  | The Republic announces: |

| | |

|  |  |  |

|  | • | The amount of Eligible Notes to be repurchased; |

| | |

|  |  |  |

|  | • | The Repurchase Price for each series of Eligible Notes; |

| | |

S-19

Table of Contents |  |  |  |

|  | • | The total cash payment for each series of USD Eligible Notes accepted for exchange; |

| | |

|  |  |  |

|  | • | The aggregate amount of New Notes issued in exchange and for new cash (if any); and |

| | |

|  |  |  |

|  | • | The aggregate amount of each of the USD Eligible Notes and Euro Eligible Notes to be repurchased pursuant to the Invitation. |

| | |

|  |  |

|  | Trading in the New Notes on a when-and-if-issued basis will commence following this announcement. |

| | |

|  |  |

| May 30, 2007 |  | Settlement Date |

| | |

|  |  |

|  | Settlement of the Global Note Offering. Delivery of New Notes against good delivery of USD Eligible Notes, or cash payment for Euro Eligible Notes or USD Eligible Notes, as appropriate. We refer to the date on which the Global Note Offering settles as the ‘‘Settlement Date.’’ |

| | |

S-20

Table of ContentsRISK FACTORS

You should read this entire Prospectus Supplement and the accompanying Prospectus carefully. Words and expressions defined elsewhere in this Prospectus Supplement and the accompanying Prospectus have the same meanings in this section. Investing in the New Notes involves certain risks. In addition, the purchase of the New Notes may involve substantial risks and be suitable only for investors who have the knowledge and experience in financial and business matters to enable them to evaluate the risks and merits of an investment in the New Notes. You should make your own inquiries as you deem necessary without relying on the Republic, any Joint Dealer Manager or any Joint Book Runner and should consult with your financial, tax, legal, accounting and other advisers, prior to deciding whether to make an investment in the New Notes. You should consider, among other things, the following:

Risks Relating to the New Notes

The trading market for debt securities may be volatile and may be adversely impacted by many events

The market for the New Notes issued by the Republic is influenced by economic and market conditions and, to varying degrees, interest rates, currency exchange rates and inflation rates in the United States and European and other industrialized countries. There can be no assurance that events in South Africa, the United States, Europe or elsewhere will not cause market volatility or that such volatility will not adversely affect the price of the New Notes or that economic and market conditions will not have any other adverse effect.

There could be no active trading market for the New Notes

The New Notes are a new issue of securities with no established trading market. There can be no assurance that an active trading market for the New Notes will develop, or, if one does develop, that it will be maintained. If an active trading market for the New Notes does not develop or is not maintained, the market or trading price and liquidity of the New Notes may be adversely affected. If the New Notes are traded after their initial issuance, they may trade at a discount to their initial offering price, depending upon prevailing interest rates, the market for similar securities, general economic conditions and the financial condition of the Republic. Although an application has been made to list and trade the New Notes on the Regulated Market ‘‘Marché Officiel’’ of the Luxembourg Sto ck Exchange, there is no assurance that such application will be accepted or that an active trading market will develop.

The New Notes may not be a suitable investment for all investors

You must determine the suitability of investment in the New Notes in the light of your own circumstances. In particular, you should:

|  |  |

| (i) | have sufficient knowledge and experience to make a meaningful evaluation of the New Notes and the merits and risks of investing in the New Notes; |

|  |  |

| (ii) | have access to, and knowledge of, appropriate analytical tools to evaluate, in the context of its particular financial situation, an investment in the New Notes and the impact the New Notes will have on your overall investment portfolio; |

|  |  |

| (iii) | have sufficient financial resources and liquidity to bear all of the risks of an investment in the New Notes, including where the currency for principal or interest payments is different from your currency; |

|  |  |

| (iv) | understand thoroughly the terms of the New Notes and be familiar with the behavior of any relevant indices and financial markets; and |

|  |  |

| (v) | be able to evaluate (either alone or with the help of a financial adviser) possible scenarios for economic, interest rate and other factors that may affect your investment and your ability to bear the applicable risks. |

S-21

Table of ContentsThe New Notes are unsecured

The New Notes constitute unsecured obligations of the Republic.

The New Notes contain provisions that permit the Republic to amend the payment terms without the consent of all holders

The New Notes contain provisions regarding acceleration and voting on amendments, modifications, changes and waivers, which are commonly referred to as ‘‘collective action clauses’’. Under these provisions, certain key provisions of the New Notes may be amended, including the maturity date, interest rate and other payment terms, with the consent of the holders of 75% of the aggregate principal amount of the outstanding New Notes. See ‘‘Description of the New Notes — Default; Acceleration of Maturity’’ and ‘‘—Amendments and Waivers’’ in this Prospectus Supplement and ‘‘Collective Action Securities’’ in the accompanying Prospectus.

There can be no assurance that the laws of the State of New York in effect as at the date of this Prospectus will not be modified

The conditions of the New Notes are based on the laws of the State of New York in effect as at the date of this Prospectus Supplement. No assurance can be given as to the impact of any possible judicial decision or change to New York law or administrative practice after the date of this Prospectus Supplement.

Legal investment considerations may restrict certain investments

The investment activities of certain investors are subject to legal investment laws and regulations, or review or regulation by certain authorities. You should consult your legal advisers to determine whether and to what extent (1) the New Notes are legal investments for you, (2) the New Notes can be used as collateral for various types of borrowing and (3) other restrictions apply to your purchase or pledge of any New Notes. Financial institutions should consult their legal advisors or the appropriate regulators to determine the appropriate treatment of New Notes under any applicable risk-based capital or similar rules.

Risks Relating to the Global Note Offering

If the Global Note Offering is completed, the trading market for the Eligible Notes not exchanged or purchased for cash may become illiquid, which may adversely affect the market value of the Eligible Notes

Eligible Notes not exchanged or purchased for cash pursuant to the Global Note Offering will remain outstanding. The exchange or purchase of Eligible Notes pursuant to the Global Note Offering and the cancellation of such Eligible Notes will reduce the aggregate principal amount of Eligible Notes that otherwise might trade in the market, which could adversely affect the liquidity and market value of any Eligible Notes not exchanged or purchased.

Noteholders submitting Offers may suffer losses if the market prices of their Eligible Notes decline while the Invitation is pending

Prior to the Expiration Date, no assurance can be given that the Invitation will be completed. Notwithstanding the right to withdraw Eligible Notes that have been tendered up to the Expiration Date, Eligible Notes will not be capable of being transferred if submitted for exchange and not validly withdrawn. Upon giving a blocking instruction relating to the securities accounts where such Eligible Notes are held in the relevant clearing system, noteholders will not be able to transfer title to the Eligible Notes to other persons and may suffer losses if the market price of the Eligible Notes declines and the noteholder’s Offer is not accepted or the Invitation is not completed.

The Republic may engage in other liability management transactions with respect to the Eligible Notes, on terms that may be more or less favorable than the Invitation.

Whether or not the Invitation is consummated, the Republic may continue to acquire, from time to time during the Invitation or thereafter, Eligible Notes other than pursuant to the Invitation,

S-22

Table of Contentsincluding through open market purchases, privately negotiated transactions, tender offers, exchange offers or otherwise (and may redeem or defease the Eligible Notes in accordance with the Eligible Notes and the Fiscal Agency Agreement under which they were issued), upon such terms and at such prices as the Republic may determine, which may be more or less than the terms of the Invitation and could be for cash or other consideration.

You will not be able to determine certain pricing information before you make your decision whether to participate in the Invitation.

You will not be able to determine the Repurchase Price for any series of Eligible Notes prior to the time that you make your decision whether to participate in the Invitation.

The decision to exchange your USD Eligible Notes for New Notes exposes you to the risk of nonpayment for a longer period of time.

The maturity date of the New Notes will be significantly later that that of the Eligible Notes. A longer maturity date exposes you to increased risk of nonpayment by the Republic.

The consummation of the transaction may not occur due to the nonfulfillment of the financing condition.

The Global Note Offering is subject to a financing condition. The acceptance of any Eligible Notes for tender will be subject to the financing condition whereby the Republic is able to issue New Notes to finance any Tenders Offers on terms acceptable to the Republic.

Risks Relating to the Republic

The Republic is a foreign sovereign state and accordingly it may be difficult to obtain or enforce judgments against it.

The Republic is a sovereign state. Consequently, your ability to sue the Republic may be limited. See ‘‘Description of Debt Securities — Governing Law; Consent to Service’’ in the accompanying Prospectus.

The Republic has not consented to service or waived sovereign immunity with respect to actions brought against it under United States federal securities laws or any State securities laws. In the absence of a waiver of immunity by the Republic with respect to these actions, it would not be possible to obtain judgment in such an action brought against the Republic in a court in the United States unless the court were to determine that the Republic is not entitled under the Foreign Sovereign Immunities Act to sovereign immunity with respect to such action. Further, even if a United States judgment could be obtained in such an action, it may not be possible to enforce in the Republic a judgment based on such a United States judgment. Execution upon property of the Republic located in the United States to enforce a United States judgment may not be possible except under the limited circumstances specified in the Foreign Sovereign Immunities Act.

Certain economic risks are inherent in any investment in an emerging market country such as South Africa.

Investing in an emerging market country such as South Africa carries economic risks. These risks include economic instability that may affect South Africa’s economic results. Economic instability in South Africa in the past and in other emerging market countries has been caused by many different factors, including the following:

|  |  |

| • | general economic and business conditions; |

|  |  |

| • | changes in currency values; |

S-23

Table of Contents |  |  |

| • | high levels of inflation; |

|  |  |

| • | wage and price controls; |

|  |  |

| • | foreign currency reserves; |

|  |  |

| • | changes in economic or tax policies; |

|  |  |

| • | the imposition of trade barriers; and |

|  |  |

| • | internal security issues. |

Any of these factors, as well as volatility in the markets for securities similar to the New Notes, may adversely affect the value or liquidity of the New Notes.

There can be no assurance that South Africa’s credit rating will not change.

Long-term foreign currency debt of South Africa is currently rated BBB+ by Fitch Ratings and Standard & Poor’s and Baa1 by Moody’s. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to suspension, reduction or withdrawal at any time by the assigning rating agency. Any adverse change in South Africa’s credit rating could adversely affect the trading price of the New Notes.

S-24

Table of ContentsTHE ISSUER

South Africa has been an established constitutional democracy since 1994, when it held its first fully democratic national elections. Mr. Thabo Mbeki was elected to his second term as President in South Africa’s third fully democratic national elections in April 2004.

South Africa has the most developed economy in sub-Saharan Africa, with a gross domestic product (‘‘GDP’’) equal to more than five times that of its six immediate neighbors combined and which comprised one third of the combined GDP of Sub-Saharan Africa in 2005. The major strengths of the South African economy are its manufacturing sector, its strong physical and economic infrastructure and its abundant natural resources, including gold, platinum metals and coal.

South Africa’s current economic expansion, which began in September 1999 and is the longest business cycle upswing on record, gathered further momentum in 2006. South Africa’s economy continued to expand at a robust pace in 2006, generating new jobs, broadening the consumer base and providing impetus for rapid growth in investment.

The 2007 National Budget presented to Parliament on February 21, 2007 provided for the first main budget surplus in South African history. Economic growth of 4.8% is projected in 2007, down slightly from an estimated 4.9% achieved in 2006.

The benign interest rate climate has supported a broad-based economic expansion, with exceptional growth in the construction, finance, transport and communication sectors. The manufacturing sector has grown by more than 4% a year since 2004. Conversely, poor performances by agriculture and mining weighed on growth in 2006.

Investment across the economy underpins the positive outlook. Investment increased by 11.7% in the first nine months of 2006, and as a percentage of GDP rose to 18.4%. Private-sector investment, accounting for 72.6% of total investment, has responded to lower interest rates, buoyant demand conditions and the South African National Government’s (‘‘National Government’’) infrastructure program. Investment growth was strongest in the transport, storage and communications sector at 18.5%, as Transnet (the state - owned transport utility) significantly accelerated capital spending. Over the same period, investment in the financial and manufacturing sectors grew by 14.8% and 10.2% respectively. Investment in the electricity, gas and water sector grew by 9.2% as utilities expanded capacity.

Robust investment growth is expected over the medium term as the National Government maintains its focus on the extension and improvement of transportation links, increasing electricity supply and provision of housing close to places of employment. Strong investment spending by the private sector linked to the Gautrain rail link between Johannesburg and Pretoria and 2010 FIFA World Cup stadiums is projected over the medium term expenditure framework period.

Household consumption, which rose an estimated 7% in 2006, remains robust. Some dampening of consumption growth is expected in 2007 in response to interest rate increases in 2006.

Elevated import levels, high oil prices and an increase in Southern African Customs Union payments contributed to a widening of the deficit on the current account of the balance of payments in 2006. The current account deficit is expected to remain significant, in line with capital goods imports associated with investment spending. However, a range of factors may act to moderate the deficit, including improved export performance, lower oil prices and slower growth in imports of consumer goods. Exports have benefited from record commodity prices. Further gains are expected as the result of a more competitive exchange rate and a rebound in mining production. Moderate growth in unit labor costs, policy reforms and improved efficiencies in network industries may also support competitiveness.

The global economic environment remains supportive of a sustained expansion of the domestic economy, although there are risks associated with global imbalances. Capital inflows are expected to cover the current account deficit as rand-denominated assets remain attractive to foreign investors. Net capital inflows (including unrecorded transactions) reached R96.3 billion in the first nine months of 2006.

S-25

Table of ContentsThe trade-weighted exchange rate eased by 15.5% over the course of 2006, as commodity prices retreated from all-time highs and investor sentiment shifted mildly away from emerging markets. The South African Reserve Bank continued the prudent accumulation of reserves, with gross gold and other foreign exchange reserves reaching US$25.9 billion at the end of January 2007. Consumer inflation (excluding mortgage interest costs) has remained within the inflation target band set by the South African Reserve Bank, averaging 4.6% in 2006, compared to 3.9% in 2005.

The National Government believes that further proposed reforms to South Africa’s social security system will boost participation in the economy and provide greater stability in household incomes and spending over the long term.

The fiscal stance taken by the National Government creates space for further reforms and enables rising funding levels for public sector infrastructure spending, improvements within the education system and other government priorities such as HIV and AIDS as well as crime prevention, while enhancing the competitiveness of the economy and sustaining the current growth trajectory.

S-26

Table of ContentsRECENT DEVELOPMENTS

This section provides information that supplements the information about South Africa corresponding to the headings below that is included in South Africa’s Annual Report on Form 18-K, as amended, which was filed with the Commission on December 6, 2006. To the extent that the information in this section differs from the information contained in South Africa’s Annual Report, you should rely on the information in this section.

On March 22, 2007, the South African Reserve Bank released its Quarterly Bulletin. South Africa filed the Quarterly Bulletin with the Commission on May 8, 2007 under cover of Form 18-K/A, which is incorporated by reference into this Prospectus Supplement and the Prospectus. You should read the Quarterly Bulletin in conjunction with the other information appearing elsewhere in this Prospectus Supplement and the Prospectus.

Republic of South Africa

Broad Based Black Economic Empowerment

In February 2007, the long awaited Codes of Good Practice (the ‘‘Codes’’), were gazetted in accordance with the Broad Based Black Economic Empowerment Act. The Codes are intended to provide generic standards and a framework for the implementation of Black Economic Empowerment (‘‘BEE’’) throughout the South African economy in order to redress historical economic imbalances created under the apartheid system.