New Notes, unless the U.S. Holder (i) is a corporation or other exempt recipient and, when required, establishes this exemption or (ii) provides its correct taxpayer identification number, certifies that it is not currently subject to backup withholding tax and otherwise complies with applicable requirements of the backup withholding tax rules. A U.S. Holder that does not provide its correct taxpayer identification number may be subject to penalties imposed by the IRS. Backup withholding tax is not an additional tax; any amounts so withheld may be credited against the U.S. Holder’s federal income tax liability. If backup withholding tax results in an overpayment of U.S. federal income taxes, a refund may be obtained from the IRS, provided that the required information is timely furnished.

Treatment of Non-U.S. Holders

Any gain realized on the sale or exchange of Eligible Notes pursuant to the Invitation, or any sale or exchange of New Notes, by a Non-U.S. Holder will not be subject to United States federal income tax, including withholding tax, unless (i) the gain is effectively connected with the conduct by the holder of a trade or business in the United States or (ii) in the case of gain realized by an individual holder, the holder is present in the United States for 183 days or more in the taxable year of the sale, and either (A) the gain or income is attributable to an office or other fixed place of business maintained in the United States by the holder or (B) the holder has a tax home in the United States.

A Non-U.S. Holder will not be subject to United States federal income taxes, including withholding taxes, on any amounts received that are attributable to accrued but unpaid interest, and on interest paid in respect of the New Notes, unless:

The payment of the gross proceeds from the Tender or Exchange of an Eligible Note pursuant to the Invitation, as well as payments of principal and interest on, and the proceeds of sale or other disposition of New Notes, may be subject to information reporting and possibly backup withholding unless the Non-U.S. Holder certifies as to its non-U.S. status under penalties of perjury or otherwise establishes an exemption. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded or credited against the Non-U.S. Holder’s U.S. federal income tax liability, provided that the required information is timely provided to the Internal Revenue Service.

A Holder whose Notes are not tendered for sale or exchanged pursuant to the Invitation will not incur any U.S. federal income tax liability as a result of the consummation of the Global Note Offering.

The following is a summary of certain material South African income tax consequences of the acquisition, ownership and disposition of a New Note and, if applicable, the exchange of an Eligible Note for a New Note or the tender of an Eligible Note for cash. This discussion assumes that you hold Eligible Notes and, if applicable, will hold New Notes as capital assets. The discussion does not cover all aspects of South African income taxation that may be relevant to, or the actual tax effect that any of the matters described herein will have on particular investors, and does not address other tax laws.

If you tender an Eligible Note for cash, the transaction will result in a capital gain or loss if the Eligible Notes were held as capital assets. The capital gain would be equal to the difference between

Table of Contents(1) the amount of cash received for such Eligible Note, other than the portion of such amount that is properly allocable to accrued interest, which will be treated as a payment of interest for South African income tax purposes to the extent not previously included in income, and (2) the holder’s ‘‘adjusted tax basis’’ for such Eligible Note at the time of sale. Generally, the holder’s ‘‘adjusted tax basis’’ for an Eligible Note will be equal to the price paid for the Eligible Note by such holder, reduced by any amortizable bond premium deducted with respect to the Eligible Note, and increased by any discount with respect to the Eligible Note that has previously been taken into income as interest by the holder.

However, if the holder of the Eligible Note is not a South African tax resident, the capital gain or loss would not be subject to South African capital gains tax, unless the Eligible Notes are attributable to a permanent establishment of the holder situated in the Republic of South Africa.

Acquisition of New Notes

If you purchase a New Note for cash, your ‘‘tax basis’’ in that New Note (used to measure the capital gain or loss on a subsequent sale or other disposition) will be the amount of cash you paid for that New Note.

Your ‘‘tax basis’’ of a New Note received in exchange for an Eligible Note will be the market value of that New Note.

Treatment of Premium and/or Discount as well as coupon interest on New Notes

To the extent that the holder acquired the New Notes at a discount, i.e. where the issue price of the New Notes was less than the principal amount, such discount would be regarded as ‘‘interest’’ for purposes of the South African Income Tax Act, of 1962 (section 24J of the Income Tax Act).

Similarly, where the issue price of the New Notes is greater than the principal amount, the holder will be considered to have purchased the New Note at a premium.

Section 24J of the South African Income Tax Act requires that the holder of a New Note spread the coupon interest and any premium or discount over the term of the New Note, using a predetermined rate referred to as the yield to maturity.

However, under existing South African law, all the amounts of ‘‘interest’’ as determined for purposes of section 24J will be exempt from any taxes, levies, imposts, duties, deductions, withholdings or other charges, of whatsoever nature, imposed, levied, collected, withheld or assessed by the South African government or any political subdivision or taxing authority thereof or therein (all of which are referred to herein as ‘‘South African Taxes’’) so long as the beneficial owner of the relevant debt security is either:

|  |  |

| (1) | a natural person who is not a tax resident in South Africa as defined in the South African Income Tax Act, unless: |

|  |  |

| • | that person carries on business in South Africa through a permanent establishment; or |

|  |  |

| • | that person was physically present in South Africa for a period exceeding 183 days in aggregate during the relevant year of assessment; or |

|  |  |

| (2) | a company, incorporated association, corporation or other body corporate which is not a resident as defined in the South African Income Tax Act, who does not carry on business in South Africa through a permanent establishment. |

A company, incorporated association, corporation or other body corporate will be a resident of South Africa if it is incorporated, established or formed in South Africa or if it is effectively managed in South Africa, unless it is considered exclusively a resident of another country for purposes of the application of any agreement entered into between the governments of the Republic of South Africa and that other country for the avoidance of double taxation.

Sale or Retirement of New Notes

If you sell or otherwise dispose of a New Note that was held as a capital asset, you will realise a capital gain or loss on the transaction. The capital gain would be equal to the difference between

S-32

Table of Contents(1) the amount of cash received for such New Note, other than the portion of such amount that is properly allocable to accrued interest, which will be treated as a payment of interest for South African income tax purposes to the extent not previously included in income, and (2) the holder’s ‘‘adjusted tax basis’’ for such New Note at the time of sale. Generally, the holder’s ‘‘adjusted tax basis’’ for the New Note will be equal to the price paid for the New Note, reduced by any amortizable bond premium deducted with respect to the New Note, and increased by any discount with respect to the New Note that has previously been taken into income as interest by the holder.

However, please note that if the holder of the New Note is not a South African tax resident, the capital gain or loss would not be subject to South African capital gains tax, unless the New Notes are attributable to a permanent establishment of the holder situated in the Republic of South Africa.

Exchange of Eligible Notes for New Notes

If you acquire a New Note in exchange for an Eligible Note, such exchange will be considered as a disposal of the Eligible Note and would therefore trigger a capital gain or loss.

If you exchange an Eligible Note for a New Note, the capital gain determined in respect of the disposal of the Eligible Note would be equal to the difference between:

|  |  |

| • | the market value of the New Note at the date of the exchange, plus any cash consideration received; and |

|  |  |

| • | the holder’s ‘‘adjusted tax basis’’ for the Eligible Note at the time of the exchange. Generally, the holder’s ‘‘adjusted tax basis’’ for the Eligible Note will be equal to the price paid for the Eligible Note by such holder, reduced by any amortizable bond premium deducted with respect to the Eligible Note, and increased by any discount with respect to the Eligible Note that has previously been taken into income as interest by the holder. |

Please note that if the holder of the Eligible Note is not a South African tax resident, the capital gain or loss would not be subject to South African capital gains tax, unless the Eligible Notes are attributable to a permanent establishment of the holder situated in the Republic of South Africa.

EU Directive on Taxation of Savings Income

Under EC Council Directive 2003/48/EC on the taxation of savings income (the ‘‘EU Savings Tax Directive’’), each Member State of the European Union is required, from July 1, 2005, to provide to the tax authorities of another Member State details of payments of interest or other similar income paid by a person within its jurisdiction to, or collected by such a person for, an individual resident in that other Member State; however, for a transitional period, Austria, Belgium and Luxembourg may instead apply a withholding system in relation to such payments, deduction tax at rates rising over time to 35%. The transitional period is to terminate at the end of the first full fiscal year following agreement by certain non-EU countries to the exchange of information relating to such payments.

Also with effect from July 1, 2005, a number of non-EU countries and certain dependent or associated territories of certain Member States, have agreed to adopt measures (either provision of information or transitional withholding) in relation to payments made by a person within its jurisdiction to, or collected by such a person for, an individual resident in a Member State. In addition, the Member States have entered into reciprocal provision of information or transitional withholding arrangements with certain of those dependent or associated territories in relation to payments made by a person in a Member State to, or collected by such a person for, an individual resident in one of those territories.

Grand Duchy of Luxembourg

The following summary is of a general nature and is included herein solely for information purposes. It is based on the laws presently in force in Luxembourg, though it is not intended to be, nor should it be construed to be, legal or tax advice. Prospective investors in the New Notes should therefore consult their own professional advisers as to the effects of state, local or foreign laws, including Luxembourg tax law, to which they may be subject.

S-33

Table of ContentsWithholding Tax

Non-resident holders of New Notes Under Luxembourg general tax laws currently in force and subject to the laws of June 21, 2005 (the ‘‘Laws’’) mentioned below, there is no withholding tax on payments of principal, premium or interest made to non-resident holders of New Notes, nor on accrued but unpaid interest in respect of the New Notes, nor is any Luxembourg withholding tax payable upon redemption or repurchase of the New Notes held by non-resident holders of New Notes.

Under the Laws implementing the EC Council Directive 2003/48/EC of June 3, 2003 on taxation of savings income in the form of interest payments and ratifying the treaties entered into by Luxembourg and certain dependent and associated territories of EU Member States (the ‘‘Territories’’), payments of interest or similar income made or ascribed by a paying agent established in Luxembourg to or for the immediate benefit of an individual beneficial owner or a residual entity, as defined by the Laws, which is a resident of, or established in, an EU Member State (other than Luxembourg) or one of the Territories will be subject to a withholding tax unless the relevant recipient has adequately instructed the relevant paying agent to provide details of the relevant payments of interest or similar income to the fiscal authorities of his/her/its country of residence or establishment, or, in the case of an individual beneficial owner, has p rovided a tax certificate issued by the fiscal authorities of his/her country of residence in the required format to the relevant paying agent.

Where withholding tax is applied, it will be levied at a rate of 15 percent during the first three-year period starting July 1, 2005, at a rate of 20 percent for the subsequent three-year period and at a rate of 35 percent thereafter. Responsibility for the withholding of the tax will be assumed by the Luxembourg Paying Agent. Payments of interest under the New Notes coming within the scope of the Laws would at present be subject to withholding tax of 15 percent.

Resident holders of New Notes

Under Luxembourg general tax laws currently in force and subject to the law of December 23, 2005 (the ‘‘Law’’) mentioned below, there is no withholding tax on payments of principal, premium or interest made to Luxembourg resident holders of New Notes, nor on accrued but unpaid interest in respect of New Notes, nor is any Luxembourg withholding tax payable upon redemption or repurchase of New Notes held by Luxembourg resident holders of New Notes.

Under the Law payments of interest or similar income made or ascribed by a paying agent established in Luxembourg to or for the immediate benefit of an individual beneficial owner who is a resident of Luxembourg will be subject to a withholding tax of 10 percent. Such withholding tax will be in full discharge of income tax if the beneficial owner is an individual acting in the course of the management of his/her private wealth. Responsibility for the withholding of the tax will be assumed by the Luxembourg Paying Agent. Payments of interest under the New Notes coming within the scope of the Law would be subject to withholding tax of 10 percent.

S-34

Table of ContentsJOINT DEALER MANAGERS AND JOINT BOOK RUNNERS; PLAN OF DISTRIBUTION

The Republic has entered into a dealer managers agreement (‘‘Dealer Managers Agreement’’) with Citigroup Global Markets Inc. and Barclays Capital Inc., as the Joint Dealer Managers for the Invitation. Citigroup Global Markets Inc. and Barclays Capital Inc., as dealer managers under the Dealer Managers Agreement, are referred to in this Prospectus Supplement as the ‘‘Joint Dealer Managers.’’ Pursuant to the Dealer Managers Agreement, the Republic has:

|  |  |

| • | retained the Joint Dealer Managers to act, directly or through affiliates, on behalf of the Republic as Joint Dealer Managers in connection with the Invitation; |

|  |  |

| • | agreed to pay the Joint Dealer Managers a fee of US$1.50 per US$1,000 of principal amount of New Notes issued pursuant to the Global Note Offering; and |

|  |  |

| • | agreed to indemnify the Joint Dealer Managers against certain liabilities, including liabilities under the U.S. Securities Act of 1933, as amended. |

The obligations of the Joint Dealer Managers under the Dealer Managers Agreement are subject to certain conditions. At any given time, the Joint Dealer Managers may trade the Eligible Notes or other debt securities of the Republic for their own accounts or for the accounts of customers and may accordingly hold a long or short position in the Eligible Notes or other securities of the Republic.

The Republic and Barclays Capital Inc. and Citigroup Global Markets Inc., acting as the ‘‘Joint Book Runners’’ have entered into an underwriting agreement, dated as of May 16, 2007, relating to the offering and sale of the New Notes in the Cash Offering. In the underwriting agreement, the Republic has agreed to sell to each Joint Book Runner, and each Joint Book Runner has agreed, severally and not jointly, to purchase from the Republic, the principal amount of New Notes that appears opposite the name of such underwriter in the table below:

|  |  |  |

| Barclays Capital Inc. |  |  | US$222,228,000 |

| Citigroup Global Markets Inc. |  |  | US$222,228,000 |

| Total |  |  | US$444,456,000 |

|

Pursuant to the underwriting agreement, subject to certain terms and conditions, the Republic has agreed:

|  |  |

| • | to sell to the Joint Book Runners, acting severally and not jointly, at the issue price for the New Notes, the principal amount of New Notes set forth in the table above; and |

|  |  |

| • | to indemnify the Joint Book Runners against certain liabilities, including liabilities under the U.S. Securities Act of 1933, as amended. |

The obligations of the Joint Book Runners under the underwriting agreement, including their agreement to purchase New Notes from the Republic, will be several and not joint. These obligations are subject to the satisfaction of certain conditions in the underwriting agreement. The Joint Book Runners have agreed to purchase all of the New Notes to be sold in the Cash Offering if any of them are purchased.

The Joint Book Runners have advised us that they propose to offer the New Notes to the public at the issue price of US$996.35 per US$1,000 principal amount of New Notes. The Joint Book Runners may offer the New Notes to selected dealers at the public offering price minus an underwriting discount of up to 0.15% of the principal amount. After the initial public offering, the Joint Book Runners may change the public offering price and any other selling terms.

If any of the Joint Dealer Managers or the Joint Book Runners acquire any New Notes pursuant to the Global Note Offering, they may resell those New Notes from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices to be determined at the time of sale. Any such New Notes may be offered to the public (to the extent permitted by applicable law) either through an underwriting syndicate represented by the Joint Book Runners or directly by the Joint Book Runners. Any public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be varied from time to time by the Joint Book Runners.

S-35

Table of ContentsIn connection with the Global Note Offering, the Joint Dealer Managers and/or the Joint Book Runners may purchase and sell New Notes or Eligible Notes in the open market. These transactions may include over-allotment and stabilizing transactions and purchases to cover short positions created by the Joint Dealer Managers or the Joint Book Runners, for themselves or a syndicate, if there is a syndicate, in connection with the Global Note Offering in accordance with Regulation M under the Securities Exchange Act of 1934, as amended. Overallotment involves sales in excess of the offering size, which would create a short position for the Joint Book Runners in the Cash Offering. Stabilizing transactions consist of certain bids or purchases for the purpose of preventing or retarding a decline in the market price of the securities. Short positions created by the Joint Dealer Managers or the Joint Book Runners, for themselves or a syndicate, if there is a syndicate, invo lve the sale by the Joint Dealer Managers or the Joint Book Runners of a greater number of securities than they own or have a right to purchase. Syndicate covering transactions involve purchases of securities in the open market after the distribution has been completed in order to cover short positions. These activities may stabilize, maintain or otherwise affect the market prices of the New Notes or Eligible Notes, which may be higher than the price that might otherwise prevail in the open market. These activities, if commenced, may be discontinued at any time. These transactions may be effected on the Luxembourg Stock Exchange, in the over-the-counter market or otherwise.

In the ordinary course of their activities, the Joint Dealer Managers and their respective affiliates may purchase and sell the New Notes and/or Eligible Notes in the open market or otherwise, may at any time hold long or short positions, and may trade or otherwise effect transactions, for their own account or the accounts of customers, in securities of the Republic.

In the ordinary course of their respective businesses, the Joint Dealer Managers, the Joint Book Runners and their respective affiliates have engaged, and may engage in the future, in investment and commercial banking transactions with the Republic, for which they have received customary fees.

The Joint Book Runners have informed the Republic that they do not intend to confirm sales of New Notes in the Cash Offering to any accounts over which they exercise discretionary authority, and the Joint Dealer Managers have informed the Republic that they do not intend to submit Offers to exchange Eligible Notes for any accounts over which they exercise discretionary authority.

The Joint Dealer Managers and the Joint Book Runners are relying on an exemption obtained from the SEC pursuant to Rule 101 of Regulation M under the Securities Exchange Act of 1934, as amended, with respect to the trading activities of the Joint Dealer Managers, the Joint Book Runners and certain of their affiliates in connection with the Global Note Offering.

The Republic estimates that its share of the total expenses of the Global Note Offering, excluding fees and commissions, will be approximately US$510,000.

The Republic has retained Bondholder Communications Group to act as Information and Exchange Agent and Deutsche Bank Luxembourg S.A. to act as Luxembourg Exchange Agent in connection with the Invitation.

The Republic has agreed to:

|  |  |

| • | pay the Information and Exchange Agent and the Luxembourg Exchange Agent customary fees for their services; |

|  |  |

| • | reimburse the Information and Exchange Agent and the Luxembourg Exchange Agent for certain of their out-of-pocket expenses in connection with the Invitation; and |

|  |  |

| • | indemnify the Information and Exchange Agent and the Luxembourg Exchange Agent against certain liabilities, including liabilities under the U. S. Securities Act of 1933, as amended. |

S-36

Table of ContentsJURISDICTIONAL RESTRICTIONS

The distribution of the Global Note Offering materials and the transactions contemplated by the Global Note Offering materials may be restricted by law in certain jurisdictions. Persons into whose possession the Global Note Offering materials come are required by the Republic to inform themselves of and to observe any of these restrictions.

The Global Note Offering materials do not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which an offer or solicitation is not authorized or in which the person making an offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make an offer or solicitation.

In any jurisdiction in which the Global Note Offering is required to be made by a licensed broker or dealer and in which a Joint Dealer Manager or a joint book runner, or any affiliate of a Joint Dealer Manager or joint book runner is so licensed, it shall be deemed to be made by such Joint Dealer Manager or joint book runner or such affiliate on behalf of the Republic.

Restrictions in connection with the Invitation

The Invitation is not being made in the Republic of Italy. The Invitation and this Prospectus Supplement have not been submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (CONSOB) pursuant to Italian laws and regulations. Accordingly, holders of Eligible Notes are hereby notified that, to the extent such holders of Eligible Notes are persons resident and/or located in the Republic of Italy, no Invitation is available to them and they may not offer to exchange Eligible Notes pursuant to this Invitation and, as such, any offer received from such persons shall be ineffective and void, and neither this Prospectus Supplement nor any other offering material relating to this Invitation or the Eligible Notes may be distributed or made available in the Republic of Italy.

The New Notes are only being offered to Exchange Offer Qualifying Eligible Holders and the Cash Equivalent Amount is only available to Tender Offer Qualifying Holders in each case who are Authorized Holders.

An ‘‘Authorized Holder’’ is a holder of Eligible Notes who is resident in any of the following ‘‘approved jurisdictions’’.

|  |  |

| 1. | the United States of America; |

|  |  |

| 2. | any state in the EEA (other than Italy, France and Belgium) which has implemented in full the Prospectus Directive, including the United Kingdom, Germany, Spain, Portugal, Greece, The Netherlands, Luxembourg, Ireland, Denmark, Finland and Austria; |

|  |  |

| 3. | Belgium, to the extent that the holder (i) is a qualifying professional investor within the meaning of Article 3,2° of the Belgian Royal Decree of 2 July 1999 (the ‘‘Royal Decree’’) on the public nature of financial transactions acting for its own account, or (ii) wishes to tender Eligible Notes for a consideration which is the equivalent in US$ of €250,000, or (iii) you have not been informed about the Exchange Offer through information published in Belgian media or through documentation sent (whether on paper or electronically) or telephone calls made to you, in each case by or for the account of the Republic or the Joint Dealer Managers and you are not aware, and do not have any reason to believe, that the Exchang e Offer would have been of a public nature within the meaning of Article 2 of the Royal Decree; |

|  |  |

| 4. | France, to the extent that the holder is a provider of investment services relating to portfolio management for the account of third parties or a qualified investor (investisseur qualifio) acting for its own account as defined in Article L. 411-2 and D.LHI-1 of the French Code monetaire et financier. This Prospectus Supplement has not been submitted and will not be submitted to the clearance provisions of the Aubrité des Marchés financiers in France; |

S-37

Table of Contents |  |  |

| 6. | Hong Kong, to the extent that the holder is a ‘‘professional investor’’ as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; |

|  |  |

| 7. | Singapore, to the extent that the holder is (i) an institutional investor pursuant to Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the ‘‘SFA’’), (ii) an accredited investor or other relevant person, or any person pursuant to Section 275(1 A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA or (iii) is otherwise permitted, and in accordance with the conditions of, any other applicable provision of the SFA; |

|  |  |

| 8. | Guernsey, to the extent that the holder is a person who holds a license under the Protection of Investors (Bailiwick of Guernsey) Law, 1987; the Insurance Business (Bailiwick of Guernsey) Law, 2002; the Banking Supervision (Bailiwick of Guernsey) Law, 1994 or the Regulation of Fiduciaries, Administration Businesses and Company Directors, etc (Bailiwick of Guernsey) Law, 2000; |

|  |  |

| 12. | Canada, to the extent that the holder is a resident of the province of Ontario or Quebec and can make the representations set out in ‘‘Representations of Purchasers’’ under the heading ‘‘Canada’’ below; and |

|  |  |

| 13. | any other state, to the extent that the holder is able to satisfy us that it is a person who can properly receive the New Notes or, as the case may be, the Cash Equivalent Amount. |

Restrictions in connection with the Cash Offering

Canada

Information for Canadian Investors

No securities commission or similar authority in Canada has reviewed or in any way passed upon this Prospectus Supplement or the accompanying Prospectus or the merits of the securities described herein and any representation to the contrary is an offence.

Representations of Purchasers

The New Notes are being offered in Canada only in the provinces of Ontario and Quebec.

Each Canadian investor who purchases New Notes will be deemed to have represented to the Republic, the Joint Dealer Managers and any dealer who sells New Notes to such purchaser that: (a) the offer and sale of the New Notes was made exclusively through this Prospectus Supplement to the Prospectus and was not made through an advertisement of the New Notes in any printed media of general and regular paid circulation, radio, television or telecommunications, including electronic display, or any other form of advertising in Canada; (b) such purchaser has reviewed and acknowledges the terms referred to below under ‘‘Resale Restrictions’’; (c) where required by law, such purchaser is purchasing as principal for its own account and not as agent; and (d) such purchaser, or any ultimate purchaser for which such purchaser is acting as agent, is entitled under applicable Canadian securities laws to purchase such New Notes without the benefit of a Prospectus qualified under such securities laws, and without limiting the generality of the foregoing: (i) in the case of a purchaser resident in Quebec, such purchaser is an ‘‘accredited investor’’ as defined in section 1.1 of National Instrument 45-106 Prospectus and Registration Exemptions (‘‘NI 45-106’’) and without the dealer having to be registered, (ii) in the case of a purchaser resident in Ontario, such purchaser, or any ultimate purchaser for which such purchaser is acting as agent (1) is an ‘‘accredited investor’’, other than an individual, as defined in NI 45-106, and is a person to which a dealer registered as an

S-38

Table of Contentsinternational dealer in Ontario may sell New Notes or (2) is an ‘‘accredited investor’’, including an individual, as defined in NI 45-106 and is purchasing New Notes from a registered investment dealer within the meaning of section 98 of the Regulation to the Securities Act (Ontario).

In addition, each purchaser of New Notes resident in Ontario who receives a purchase confirmation, by the purchaser’s receipt thereof, will be deemed to have represented to the Republic, the Joint Dealer Managers and the dealer from whom such purchase confirmation was received, that such purchaser: (a) has been notified by the Republic (i) that the Republic is required to provide information (‘‘personal information’’’) pertaining to the purchaser as required to be disclosed in Schedule I of Form 45-106F1 under NI 45-106 (including its name, address, telephone number and the number and value of any New Notes purchased), which Form 45-106F1 is required to be filed by the Republic under NI 45-106; (ii) that such personal information will be delivered to the Ontario Securities Commission (the ‘‘OSC’’) in accordance with NI 45-106; (iii) that such personal information is being collected indirectly by the OSC under the authority granted to it under the securities legislation of Ontario; (iv) that such personal information is being collected for the purposes of the administration and enforcement of the securities legislation of Ontario; and (iv) that the public official in Ontario who can answer questions about the OSC’s indirect collection of such personal information is the Administrative Assistant to the Director of Corporate Finance at the OSC, Suite 1903, Box 5520 Queen Street West, Toronto, Ontario M5H 3S8, Telephone: (416) 593-8086; and (b) by purchasing New Notes, such purchaser has authorized the indirect collection of the personal information by the OSC. Further, the purchaser acknowledges that its name, address, telephone number and other specified information, including the number of New Notes it has purchased and the aggregate purchase price to the purchaser, may be disclosed to other Canadian securities regulatory authorities and may become available to the public in accordance with the requir ements of applicable laws. By purchasing the New Notes, the purchaser consents to the disclosure of such information.

Resale Restrictions

The distribution of the New Notes in Canada is being made on a private placement basis only and is exempt from the requirement that the Republic prepare and file a Prospectus with the relevant Canadian regulatory authorities. Accordingly, any resale of the New Notes must be made in accordance with applicable securities laws which may require resales to be made in accordance with exemptions from registration and Prospectus requirements. Canadian purchasers are advised to seek legal advice prior to any resale of the New Notes. Canadian investors should also refer to the restrictions listed hereunder for additional restrictions on resales under securities laws applicable to holders of the New Notes.

The Republic is not a ‘‘reporting issuer’’, as such term is defined under applicable Canadian securities legislation, in any province or territory of Canada in which the New Notes will be offered. Under no circumstances will the Republic be required to file a Prospectus or similar document with any securities regulatory authority in Canada qualifying the resale of the New Notes to the public in any province or territory of Canada. Canadian investors are advised that the Republic currently does not intend to file a Prospectus or similar document with any securities regulatory authority in Canada qualifying the resale of the New Notes to the public in any province or territory of Canada.

Taxation and Eligibility for Investment

Any discussion of taxation and related matters contained in this Prospectus Supplement to the Prospectus does not purport to be a comprehensive description of all the tax considerations that may be relevant to a decision to purchase the New Notes. Canadian investors should consult their own legal and tax advisers with respect to the tax consequences of an investment in the New Notes in their particular circumstances and with respect to the eligibility of the New Notes for investment by such investor under relevant Canadian legislation and regulations.

Canadian investors should consult with their own legal and tax advisers regarding the Canadian federal income tax consequences of an investment in the New Notes and should refer to ‘‘Taxation’’ contained in this Prospectus Supplement to the Prospectus for additional general information.

S-39

Table of ContentsRights of Action for Damages or Rescission

Securities legislation in certain of the Canadian private placement provinces provides purchasers of securities pursuant to this Prospectus Supplement and the accompanying Prospectus with a remedy for damages or rescission, or both, in addition to any other rights they may have at law, where this Prospectus Supplement and the accompanying Prospectus and any amendment to it contains a ‘‘Misrepresentation’’. Where used herein, ‘‘Misrepresentation’’ means an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make any statement not misleading in light of the circumstances in which it was made. These remedies, or notice with respect these remedies, must be exercised or delivered, as the case may be, by the purchaser within the time limits prescribed by applicable securities legislation.

Ontario

Section 130.1 of the Securities Act (Ontario) provides that every purchaser of securities pursuant to an offering memorandum (such as this Prospectus Supplement and the accompanying Prospectus) shall have a statutory right of action for damages or rescission against the issuer and any selling security holder in the event that the offering memorandum contains a Misrepresentation. A purchaser who purchases securities offered by the offering memorandum during the period of distribution has, without regard to whether the purchaser relied upon the Misrepresentation, a right of action for damages or, alternatively, while still the owner of the securities, for rescission against the issuer and any selling security holder provided that:

|  |  |

| (a) | if the purchaser exercises its right of rescission, it shall cease to have a right of action for damages as against the issuer and the selling security holders, if any; |

|  |  |

| (b) | the issuer and the selling security holders, if any, will not be liable if they prove that the purchaser purchased the securities with knowledge of the Misrepresentation; |

|  |  |

| (c) | the issuer and the selling security holders, if any, will not be liable for all or any portion of damages that it proves do not represent the depreciation in value of the securities as a result of the Misrepresentation relied upon; and |

|  |  |

| (d) | in no case shall the amount recoverable exceed the price at which the securities were offered. |

Section 138 of the Securities Act (Ontario) provides that no action shall be commenced to enforce these rights more than:

|  |  |

| (a) | in the case of an action for rescission, 180 days from the day of the transaction that gave rise to the cause of action; or |

|  |  |

| (b) | in the case of an action for damages, the earlier of: |

|  |  |

| (i) | 180 days from the day that the purchaser first had knowledge of the facts giving rise to the cause of action; or |

|  |  |

| (ii) | three years from the day of the transaction that gave rise to the cause of action. |

The rights referred to in section 130.1 of the Securities Act (Ontario) do not apply in respect of an offering memorandum (such as this Prospectus Supplement to the Prospectus) delivered to a prospective purchaser in connection with a distribution made in reliance on the exemption from the Prospectus requirement in section 2.3 of National Instrument 45-106 (the ‘‘accredited investor’’ exemption) if the prospective purchaser is:

|  |  |

| (a) | a Canadian financial institution or a Schedule III bank, |

|  |  |

| (b) | the Business Development Bank of Canada incorporated under the Business Development Bank of Canada Act (Canada), or |

|  |  |

| (c) | a subsidiary of any person referred to in paragraphs (a) and (b), if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary. |

Language of Documents

By its receipt of this document, each Canadian investor confirms that it has expressly requested that all documents evidencing or relating in any way to the sale of the securities described herein

S-40

Table of Contents(including for greater certainty any purchase confirmation or any notice) be drawn up in the English language only. Par la reception de ce document, chaque investisseur canadien confirme par les presentes qu’il a expressement exige que tous les documents faisant foi ou se rapportant de quelque maniere que ce soit a la vente des valeurs mobilieres decrites aux presentes (incluant, pour plus de certitude, toute confirmation d’achat ou tout avis) soient rediges en anglais seulement.

France

Each of the Joint Dealer Managers has represented and agreed that it has not offered or sold, and will not offer or sell, directly or indirectly, the New Notes to the public in France and that offers and sales of the New Notes in France will be made only to providers of investment services relating to portfolio management for the account of third parties and/or to qualified investors (investisseurs qualifiés), as defined in Articles L.411-2 and D.411-1 to D.411-3 of the French Code monétaire et financier, but excluding individuals referred to in Article D.411-1 II 2°.

In addition, each of the Joint Dealer Managers has represented and agreed that it has not distributed or caused to be distributed and will not distribute or cause to be distributed in France this Prospectus Supplement and the accompanying Prospectus or any other offering material relating to the New Notes other than to investors to whom offers and sales of New Notes in France may be made as described above.

Guernsey

The New Notes may not be offered, sold, transferred or delivered in the Bailiwick or Guernsey as part of their initial distribution or at any time thereafter, directly or indirectly, other than to persons who hold a license under the Protection of Investors (Bailiwick of Guernsey) Law, 1987; the Insurance Business (Bailiwick of Guernsey) Law, 2002; the Banking Supervision (Bailiwick of Guernsey) Law, 1994 or the Regulation of Fiduciaries, Administration Businesses and Company Directors, etc (Bailiwick of Guernsey) Law, 2000.

Hong Kong

Each of the Joint Dealer Managers has represented and agreed that it has not issued or had in its possession for the purposes of issue, and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the New Notes or the Cash Offering, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the New Notes subject to the terms of the Cash Offering which are or are intended to be disposed of only to persons outside Hong Kong or only to ‘‘professional investors’’ as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance.

Italy

Each of the Joint Dealer Managers represents that it has not offered, sold or delivered, and will not offer, sell or deliver any New Notes or distribute copies of the Prospectus Supplement, the accompanying Prospectus or any other document relating to the New Notes in the Republic of Italy except to ‘‘Professional investors’’, as defined in Article 31.2 of CONSOB Regulation No. 11522 of 1st July 1998 (‘‘Regulation No. 11522’’), as amended, pursuant to Articles 30.2 and 100 of Legislative Decree No. 58 of 24th February 1998 (‘‘Decree No. 58’’), or in any other circumstances where an express exemption from compliance with the solicitation restrictions provided by Decree No. 58 or CONSOB Regulation No. 11971 of 14th May 1999, as amended, applies, provided however, that any such offer, sale or delivery of the New Notes or distribution of copies of the Prospectus Supplement, the accompanying Prospectus or any other document relating to the New Notes in the Republic of Italy must be:

|  |  |

| (a) | made by investment firms, banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with Legislative Decree No. 385 of 1st September 1993 (‘‘Decree No. 385’’), Decree No. 58, Regulation No. 11522 and any other applicable laws and regulations: |

S-41

Table of Contents |  |  |

| (b) | in compliance with Article 129 of Decree No. 385 and the implementing instructions of the Bank of Italy, pursuant to which the issue or placement of securities in Italy is subject to prior notification to the Bank of Italy, unless an exemption, depending inter alia, on the amount of the issue and the characteristics of the securities, applies; and |

|  |  |

| (c) | No. 385 and the implementing regulations and decrees; and |

|  |  |

| (d) | in compliance with any other applicable notification requirement or limitation which may be imposed by CONSOB or the Bank of Italy. |

Transfer Restriction in Italy

Article 100-bis of Legislative Decree No. 58 of 24 February 1998 (as amended) affects the transferability of the New Notes in Italy to the extent that an offer of New Notes (or any part of such offer) is made solely to professional investors and such New Notes are then transferred in Italy during the period of 12 months from the date of issue of the New Notes. Where this occurs, professional investors will be liable to purchasers of the New Notes who are non-professional investors for any default by The Republic in its payment obligations under the New Notes if the Republic is or becomes insolvent, even where the sale by the professional investor took place at the express request of the purchaser. The above provisions will not apply where the professional investor, prior to any such transfer of New Notes, delive red to the purchaser an information document containing all such information as is required by CONSOB. As at the date of this letter, CONSOB has not implemented any regulations specifying the content of such information document.

Singapore

This Prospectus Supplement and the accompanying Prospectus have not been registered as a Prospectus with the Monetary Authority of Singapore. Accordingly, this Prospectus Supplement and the accompanying Prospectus and any other document or material in connection with the Cash Offering or sale of the New Notes may not be circulated or distributed, nor may the New Notes be offered or sold, whether directly or indirectly, to any person in Singapore other than (i) to an institutional investor pursuant to Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the ‘‘SFA’’), (ii) to an accredited investor or other relevant person, or any person pursuant to Section 275(1 A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Republic of South Africa

South African residents are subject to exchange controls and are obliged, in connection with any issue of New Notes, to comply with the exchange control regulations promulgated by the South African Reserve Bank from time to time.

United Kingdom

Each of the Joint Dealer Managers has represented and agreed that it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to any New Notes in, from or otherwise involving the United Kingdom.

S-42

Table of ContentsLEGAL MATTERS

Certain legal matters will be passed upon for the Republic by the Chief Law Adviser of the Republic of South Africa. The validity of the New Notes will be passed upon for the Joint Dealer Managers by Linklaters LLP, counsel to the Joint Dealer Managers. All statements in this Prospectus Supplement with respect to matters of South African law have been passed upon for the Republic by the Chief State Law Adviser, and for the Joint Dealer Managers by Edward Nathan Sonnenbergs Inc. In rendering their opinions, Linklaters LLP will rely as to all matters of South African law upon Edward Nathan Sonnenbergs Inc.

GENERAL INFORMATION

Litigation

Neither the Republic nor any governmental agency of the Republic is involved in any litigation, arbitration or administrative proceeding relating to claims or amounts that are material in the context of the Invitation or issue of the New Notes and that would materially and adversely affect the Republic’s ability to meet its obligations under the New Notes or the Fiscal Agency Agreement with respect to the New Notes. The Republic is not aware of any such litigation, arbitration or administrative proceeding that is pending or threatened.

Public Finance and Trade

The Republic confirms that since the end of its last fiscal year, there have not been any significant changes to the Republic’s tax and budgetary systems, gross public debt, foreign trade and balance of payment figures, foreign exchange reserves, financial position or income and expenditure figures.

Acceptance by Clearing Systems

The New Notes have been accepted for clearance and settlement through DTC, Euroclear and Clearstream Banking Luxembourg (CUSIP number 836205AL8, ISIN number US836205AL88, Common Code 030226798). The address of DTC is 55 Water Street, New York, NY 10041-0099, United States of America. The address of Euroclear is Boulevard du Roi Albert II, B — 1210 Brussels. The address of Clearstream Banking Luxembourg is 42 Avenue JF Kennedy L-1855 Luxembourg.

S-43

Table of ContentsDOCUMENTS INCORPORATED BY REFERENCE

The table below sets out the page references containing the information incorporated by reference, as required by Article 11 of Directive 2003/7 I/EC, from (i) the Annual Report on the Form 18-K for the Republic (for the purposes of this section, the ‘‘Issuer’’) for the fiscal year ended March 31, 2006 filed with the SEC on December 6, 2006 and provided to the Luxembourg Stock Exchange, which contains the economic, financial and statistical information for fiscal years ended March 31, 2006, March 31, 2005, March 31, 2004, March 31, 2003 and March 31, 2002, (ii) the Amendment to the Annual Report on the Form 18-K/A, filed with the SEC on March 20, 2007 and provided to the Luxembourg Stock Exchange (‘‘Amendment No.1) and (iii) the Amendment to the Annual Report on the Form 18-K/A, filed with the SEC on May 8, 2007 and provided to the Luxemb ourg Stock Exchange (‘‘Amendment No. 2’’).

For purposes of Commission Regulation (EC) No. 809/2004, any information not listed in the table below but included in the documents incorporated by reference is given for information purposes only.

|  |  |  |

| EC No. 809/2004 Item |  |  | Annual Report on Form 18-K for 2006 and the

Amendments to the Annual Report |

| Annex XVI, 3.1: Issuer’s position within the governmental framework |  |  | ‘‘Republic of South Africa — Government and Political Parties’’ on page 7 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report |

| Annex XVI, 3.2: Geographic location and legal form of the issuer |  |  | ‘‘Republic of South Africa — Area and Population’’ on page 7 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report |

| Annex XVI, 3.4(a): Structure of the issuer’s economy |  |  | ‘‘The South African Economy’’ on pages 21 to 47 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report |

| Annex XVI, 3.4(b): Gross domestic product |  |  | ‘‘Summary Information — The Economy’’ on page 1 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report; ‘‘Republic of South Africa — 2007 Budget Review — Economic Policy and Outlook’’ on pages 21 to 41 of Exhibit 99.C (Budget Review 2007) to Amendment No. 1 to the Annual Report on Form 18-K/A; ‘‘Quarterly Economic Review — March 2007 — Domestic economic developments — Domestic output’’ on pages 4 to 7 of Exhibit 99.E (Quarterly Bulletin) to Amendment No. 2 to t he Annual Report on Form 18-K/A |

| Annex XVI, 3.5 South Africa’s political system and government |  |  | ‘‘Republic of South Africa — Government and Political Parties’’ on pages 7 to 11 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report |

| Annex XVI, 4(a): Tax and budgetary systems of the issuer |  |  | ‘‘Public Finance — The National Budget Process’’ on pages 76 to 77 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report |

|

S-44

Table of Contents

|  |  |  |

| EC No. 809/2004 Item |  |  | Annual Report on Form 18-K for 2006 and the

Amendments to the Annual Report |

| Annex XVI, 4(b) Gross public debt of the issuer |  |  | ‘‘Tables and Supplementary Information’’ on pages 96-102 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report; ‘‘Republic of South Africa — 2007 Budget Review — Asset and liability management’’ on page 16 of Exhibit 99.C (Budget Review 2007) to Amendment No. 1 to the Annual Report on Form 18-K/A; ‘‘Quarterly Economic Review — March 2007 — Public finance’’ on pages 43 to 52 of Exhibit 99.E (Quarterly Bulletin) to Amendment No. 2 to the Annual Report on Form 18-K/A |

| Annex XVI,4(c) Foreign Trade balance and balance of payments |  |  | ‘‘The External Sector of the Economy — Foreign Trade’’ on pages 63-66 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report; ‘‘Republic of South Africa — 2007 Budget Review — Economic policy and outlook — Balance of payments’’ on page 26 of Exhibit 99.C (Budget Review 2007) to Amendment No. 1 to the Annual Report on Form 18-K/A; ‘‘Quarterly Economic Review — March 2007 — Foreign trade and payments’’ on pages 19 to 27 and ‘‘Quarterly Economic Review — March 2007 — Foreign trade and payments — International economic developments’’ on pages 19 to 20 of Exhibit 99.E (Quarterly Bulletin) to Amendment No. 2 to the Annual Report on Form 18-K/A |

| Annex XVI, 4(d) Foreign exchange reserves |  |  | ‘‘The External Sector of the Economy — Reserves and Exchange Rates’’ on page 72 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report; ‘‘Quarterly Economic Review — March 2007 — Foreign trade and payments — International economic developments’’ on pages 25 to 26; ‘‘Quarterly Economic Review — March 2007 — Foreign trade and payments — International economic developments’’ on pages 19 to 20 of Exhibit 99.E (Quarterly Bulletin) to Amendment No. 2 to th e Annual Report on Form 18-K/A |

| Annex XVI, 4(e): Financial position and resources |  |  | ‘‘National Government Debt — Total Debt of National Government’’ on page 91 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report; ‘‘Republic of South Africa — 2007 Budget Review — Overview of the 2007 Budget’’ on pages 1 to 19 of Exhibit 99.C (Budget Review 2007) to Amendment No. 1 to the Annual Report on Form 18-K/A; ‘‘Quarterly Economic Review — March 2007 — Domestic economic developments’’ on pages 4 to 18 and ‘‘Quarterly Economic Review — Marc h 2007 — Foreign trade and payments’’ on pages 19 to 27 of Exhibit 99.E (Quarterly Bulletin) to Amendment No. 2 to the Annual Report on Form 18-K/A |

|

S-45

Table of Contents

|  |  |  |

| EC No. 809/2004 Item |  |  | Annual Report on Form 18-K for 2006 and the

Amendments to the Annual Report |

| Annex XVI, 4(f): Income and expenditure figures |  |  | ‘‘Public Finance — Consolidated Government Revenue’’ on pages 85 to 86 of Exhibit 99.D (Description of the Republic of South Africa) to the Annual Report; ‘‘Republic of South Africa — 2007 Budget Review — Overview of the 2007 Budget’’ on pages 1 to 7 of Exhibit 99.C (Budget Review 2007) to Amendment No. 1 to the Annual Report on Form 18-K/A; ‘‘Quarterly Economic Review — March 2007 — Foreign trade and payments — Domestic economic developments’’ on pages 4 to 18 and ‘‘Quarterly Economic Review — March 2007 — Foreign trade and payments’’ on pages 19 to 27 of Exhibit 99.E (Quarterly Bulletin) to Amendment No. 2 to the Annual Report on Form 18-K/A |

|

The Prospectus Supplement and accompanying Prospectus including the documents containing the information incorporated by reference will be published on the website of the Luxembourg Stock Exchange which is http://www.bourse.lu.

S-46

Table of ContentsANNEX A

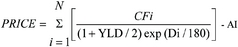

FORMULA TO PRICE USD ELIGIBLE NOTES AND NEW NOTES

Whenever in this Prospectus Supplement there is a reference to a price per U.S.$1,000 principal amount of securities intended to result in a specified yield to maturity on the Settlement Date, that price will be determined in accordance with market convention pursuant to the following formula:

Definitions

|  |  |  |  |  |  |

| PRICE |  |  | = |  |  | The price per U.S.$1,000 principal amount of the securities. PRICE will be rounded to three decimal places, with U.S.$0.005 rounded to U.S.$0.01. |

| N |  |  | = |  |  | The number of remaining cash payment dates for the securities from (but excluding) the Settlement Date to (and including) the maturity date for securities. |

| CFi |  |  | = |  |  | The aggregate amount of cash per U.S.$1,000 principal amount scheduled to be paid in respect of the securities on the ‘‘ith’’ out of the N cash payment dates for securities. Scheduled payments of cash include interest and, on the maturity date for the security to be priced, principal. |

| YLD |  |  | = |  |  | Specified yield to maturity of the securities (expressed as a decimal number). |

| Di |  |  | = |  |  | The number of days from (and including) the Settlement Date to (but excluding) the ‘‘ith’’ out of the N remaining cash payment dates for securities. The number of days is computed using the 30/360 day count method. |

| / |  |  | = |  |  | Divide. The term immediately to the left of the division symbol is divided by the term immediately to the right of the division symbol before any other addition or subtraction operations are performed. |

| Exp |  |  | = |  |  | Exponentiate. The term to the left of the exponentiation symbol is raised to the power indicated by the term to the right of the exponentiation symbol. |

| AI |  |  | = |  |  | Accrued interest on the securities from and including the most recent interest payment date to but excluding the Settlement Date. |

N

Σ

i=1 |  |  | = |  |  | Summate. The term in the brackets to the right of the summation symbol is separately calculated ‘‘N’’ times (substituting for ‘‘i’’ in that term each whole number between 1 and N, inclusive), and the separate calculations are then added together. |

|

Formula to Determine Price of Securities

S-47

Table of ContentsANNEX B

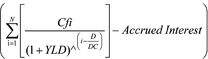

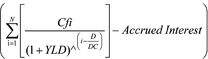

FORMULA TO PRICE EURO ELIGIBLE NOTES

The Repurchase Price for the Euro Eligible Notes will be calculated in accordance with the formula below. The Dealer Managers, acting as independent experts, will calculate the relevant prices in a manner intended to result in a yield to maturity of such securities equal to the sum of (a) the relevant Reference Rate and (b) the Repurchase Spread:

|  |  |  |  |  |  |

| Relevant price: |  |  | = |  |  |  |

| Where |  |  | |  |  | |

|  |  | = |  |  | Summate. The term to the right of the summation symbol is separately calculated ‘‘N’’ times (substituting for the ‘‘i’’ in that term each whole number between 1 and N, inclusive) and the separate calculations are then added together. |

| Accrued Interest |  |  | = |  |  | Interest accrued, expressed as a percentage, on the Eligible Notes in accordance with its terms and conditions from and including the last interest payment date in respect of such securities up to but excluding the Settlement Date of the Invitation. |

| Cash Payment Date |  |  | = |  |  | Each date on which payments of interest and principal thereof are to be made in accordance with the terms and conditions of the relevant securities subsequent to the Settlement Date up to and including the scheduled maturity date of the relevant securities. |

| Cfi |  |  | = |  |  | The aggregate amount of cash, expressed as a percentage, scheduled to be paid on the relevant securities on the ‘‘ith’’ out of the N remaining Cash Payment Dates up to the maturity date. Scheduled payments of cash include interest and, on the maturity date, principal. |

| D |  |  | = |  |  | The number of days from and including the immediately preceding interest payment date for the relevant securities up to but excluding the Settlement Date (Actual / Actual day count). |

| DC |  |  | = |  |  | 365 unless settlement occurs within an interest period which includes a leap year (29 February), in which case 366 (Actual / Actual day count). |

| N |  |  | = |  |  | The number of all remaining Cash Payment Dates for the relevant securities subsequent to the Settlement Date up to and including the maturity date of the relevant securities. |

| YLD |  |  | = |  |  | The yield to maturity of the relevant securities, expressed as a decimal number, being the sum of (i) the applicable benchmark rate (rounded to 0.001 per cent.) and (ii) the applicable credit spread. |

|

S-48

Table of ContentsANNEX C

HYPOTHETICAL EXAMPLE FOR EXCHANGE AND TENDER

May 30, 2007

Assumed Settlement Date

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | A |  |  | B |  |  | A+B |  |  | D |  |  | |  |  | |  |  | E |  |  | D+E |  |  | D-H+E |

| |  |  | |  |  | |  |  | |  |  | |  |  | |  |  | |  |  | |  |  | Tender Cash |  |  | Exchange Cash |

| |  |  | Reference

Rate1 |  |  | Repurchase

Spread2 |  |  | Repurchase

Yield |  |  | Repurchase

Price3 |  |  | Days of Accrued

Interest |  |  | Coupon

Rate |  |  | Accrued Interest

Per 1,000 of

Eligible Notes4 |  |  | Payment per

1,000 of Old

Bonds |  |  | Component per

1,000 of Old

Bonds5 |

| 2009 Notes |  |  | 4.675% |  |  |  |  | 0.28 | % |  |  |  |  | 4.955 | % |  |  |  | $ | 1,077.31 |  |  |  |  |  | 11 |  |  |  |  |  | 9.125 | % |  |  |  | $ | 2.79 |  |  |  |  | $ | 1,080.09 |  |  |  |  | $ | 85.62 |  |

| 2008 Notes |  |  | 4.380% |  |  |  |  | −0.15 | % |  |  |  |  | 4.230 | % |  |  | € 1,022.74 |  |  |  |  | 50 |  |  |  |  |  | 7.000 | % |  |  | € 9.56 |  |  | € 1,032.30 |  |  |  |  | NA |  |

| 2017 Notes |  |  | 4.640% |  |  |  |  | 0.74 | % |  |  |  |  | 5.380 | % |  |  |  | $ | 1,239.97 |  |  |  |  |  | 157 |  |  |  |  |  | 8.500 | % |  |  |  | $ | 37.07 |  |  |  |  | $ | 1,277.04 |  |  |  |  | $ | 282.57 |  |

| 2013 Notes |  |  | 4.387% |  |  |  |  | 0.23 | % |  |  |  |  | 4.617 | % |  |  | € 1,032.30 |  |  |  |  | 14 |  |  |  |  |  | 5.250 | % |  |  | € 2.01 |  |  | € 1,034.31 |  |  |  |  | NA |  |

| 2012 Notes |  |  | 4.550% |  |  |  |  | 0.66 | % |  |  |  |  | 5.210 | % |  |  |  | $ | 1,092.54 |  |  |  |  |  | 35 |  |  |  |  |  | 7.375 | % |  |  |  | $ | 7.17 |  |  |  |  | $ | 1,099.71 |  |  |  |  | $ | 105.24 |  |

| 2014 Notes |  |  | 4.550% |  |  |  |  | 0.74 | % |  |  |  |  | 5.290 | % |  |  |  | $ | 1,070.07 |  |  |  |  |  | 178 |  |  |  |  |  | 6.500 | % |  |  |  | $ | 32.14 |  |  |  |  | $ | 1,102.21 |  |  |  |  | $ | 107.73 |  |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | F |  |  | G |  |  | F+G |  |  | |  |  | H |

| |  |  | Reference |  |  | New Issue |  |  | New Issue |  |  | Coupon |  |  | New Issue

Exchange Value

Per $1,000 of |

| |  |  | Rate1 |  |  | Spread2 |  |  | Yield |  |  | Rate6 |  |  | New Issue7 |

| New Issue |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| 2022 Notes |  |  |  |  | 4.640 | % |  |  |  |  | 1.30 | % |  |  |  |  | 5.940 | % |  |  |  |  | 5.875 | % |  |  |  | $ | 994.48 |  |

|

| (1) | As defined in ‘‘Reference Rates’’ |

| (3) | Price which results using calculation in Annexes A and B using the discount yield in the column immediately to the left. |

| (4) | Number of days of accrued interest times 1,000 times the coupon rate divided by 360 days (or 366 days). |

| (5) | As stated in the ‘‘Exchange Consideration’’ section of the document. |

| (6) | As defined in the ‘‘Terms of the Global Note Offering’’. |

| (7) | Price which results using calculation in Annexes A and B using the discount yield in the column ‘‘New Issue Yield’’ |

S-49

(This page intentionally left blank)

Table of ContentsPROSPECTUS

Republic of South Africa

Debt Securities

and/or

Warrants to Purchase Debt Securities

By this Prospectus, the Republic of South Africa may offer debt securities and warrants to purchase debt securities with a total maximum offering price of US$3,000,000,000 (or the equivalent in other currencies or composite currencies).

The Republic of South Africa may offer from time to time as separate issues one or more series of unsecured debt securities or warrants to purchase debt securities which will rank equally with its present and future unsecured and unsubordinated general obligations for moneys borrowed.

The Republic of South Africa will provide specific terms of these securities in supplements to this Prospectus. You should read this Prospectus, any prospectus supplement and the documents incorporated by reference into this Prospectus or into any prospectus supplement, carefully before you make any decision to invest in the debt securities or warrants to purchase debt securities. This Prospectus may not be used to make offers or sales of debt securities or warrants to purchase debt securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is August 20, 2003.

Table of ContentsINCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Republic of South Africa files annual reports on Form 18-K with the U.S. Securities and Exchange Commission on a voluntary basis. The Republic’s Annual Report on Form 18-K for the fiscal year ended March 31, 2002 filed with the SEC on December 18, 2002 is hereby incorporated by reference into this Prospectus and any accompanying prospectus supplement. Each Annual Report on Form 18-K (including all exhibits to the Annual Report) and any amendments to the Form 18-K on Form 18-K/A (including all exhibits) filed with the Commission by the Republic on or subsequent to the date of this Prospectus and prior to the termination of any offering of the debt securities and/or warrants to purchase debt securities will be deemed to be incorporated by reference into this Prospectus and into any accompanying prospectus supplement and to be a part of this Prospectus and of any prospectus supplement from the date of the filing of the Form 18-K or For m 18-K/A and will supersede and replace any prior Form 18-K. As used in this Prospectus, the term ‘‘Annual Report’’ will refer to any Form 18-K incorporated in this Prospectus not superseded or replaced by operation of the preceding sentence.

Any statement in this Prospectus or contained in a document that is incorporated by reference into this Prospectus will be deemed to be modified or superseded for purposes of this Prospectus or any accompanying prospectus supplement to the extent that a statement contained in the accompanying prospectus supplement or in any other subsequently filed document that is deemed to be incorporated by reference into this Prospectus modifies or supersedes the statement. Any statement modified or superseded will not be deemed, except as modified or superseded by a document incorporated by reference into this Prospectus, to constitute a part of this Prospectus or any accompanying prospectus supplement.

Any person receiving a copy of this Prospectus may obtain, without charge, upon request, a copy of any of the documents incorporated by reference into this Prospectus, except for the exhibits to documents incorporated by reference into this Prospectus (other than exhibits expressly incorporated by reference into those documents). Requests for documents incorporated by reference into this Prospectus should be directed to Professor Thandabantu Nhlapo, Chargé d’Affaires, Embassy of the Republic of South Africa, 3051 Massachusetts Avenue, Washington, D.C. 20008.

USE OF PROCEEDS

Unless otherwise specified in an applicable prospectus supplement, the net proceeds from the sale of the debt securities and warrants to purchase debt securities will be used for the general purposes of the National Government.

DESCRIPTION OF DEBT SECURITIES

The following description sets forth certain general terms and provisions common to all series of the debt securities and the Fiscal Agency Agreement (copies of which are or will be filed as exhibits to the registration statement). This summary does not purport to be complete and is qualified in its entirety by reference to these exhibits and all provisions of the Fiscal Agency Agreement and the debt securities.

General

The South African government may issue one or more series of debt securities as it chooses to authorize.

The accompanying prospectus supplement will describe the following terms of the debt securities:

|  |  |

| • | the price or prices at which we will issue the debt securities; |

|  |  |

| • | any limit on the aggregate principal amount of the debt securities or the series of which they are a part; |

2

Table of Contents |  |  |

| • | the currency or currency units for which the debt securities may be purchased and in which payments of principal and interest will be made; |

|  |  |

| • | the date or dates on which principal and interest will be payable; |

|  |  |

| • | the rate or rates at which any of the debt securities will bear interest, the date or dates from which any interest will accrue, and the record dates and interest payment dates; |

|  |  |

| • | the place or places where principal and interest payments will be made; |

|  |  |

| • | the time and price limitations on redemption of the debt securities; |

|  |  |

| • | our obligation, if any, to redeem or purchase the debt securities at the option of the holder; |

|  |  |

| • | whether the debt securities will be in bearer form (which may or may not be registrable as to principal) with interest coupons, if any, or in fully registered form, or both, and restrictions on the exchange of one form for another; |

|  |  |

| • | if the amount of principal or interest on any of the debt securities is determinable according to an index or a formula, the manner in which these amounts will be determined; |

|  |  |

| • | whether and under what circumstances the South African government will issue the debt securities as global debt securities; |

|  |  |

| • | whether the debt securities will be designated to be collective action securities (as described below in ‘‘Collective Action Securities’’); and |

|  |  |

| • | any other specific terms of the debt securities. |

Any debt securities offered by the South African government that are exchangeable for other debt securities or for equity securities of entities owned by South Africa will be described in the prospectus supplement relating to such debt securities. Any special United States federal income tax and other considerations applicable to any debt securities (i) issued with original issue discount, (ii) denominated in a currency other than the U.S. dollar or (iii) payments on which are determined by reference to any index also will be described in the prospectus supplement relating to such debt securities.

There will be a fiscal agent or agents for the South African government in connection with the debt securities whose duties will be governed by the Fiscal Agency Agreement. The South African government will appoint a fiscal agent for each series of debt securities, which may or may not be the same fiscal agent. So long as no conflict of interest arises, the fiscal agent may engage or be interested in any financial or other transaction with the South African government. The fiscal agent is the agent of the South African government. The fiscal agent is not a trustee for the holders of debt securities and does not have a trustee’s responsibilities or duties to act for the holders of debt securities.

The South African government may issue debt securities that bear no interest or interest at a rate which at the time of issuance is below market rates to be sold at a substantial discount below their stated principal amount. Special considerations applicable to any debt securities sold at a discount will be described in the prospectus supplement relating to the debt securities.

The South African government will make payments of principal of (and premium, if any) and interest on the debt securities at the place or places and in the currency or currencies it designates and sets forth in the applicable prospectus supplement. Unless otherwise set forth in the applicable prospectus supplement, interest on fully registered debt securities will be paid by check mailed to the persons in whose names the debt securities are registered at the close of business on the record dates designated in the applicable prospectus supplement at the person’s address that appears on the register of the debt securities.

Currency Transfer Guarantee

Unless otherwise provided in the applicable prospectus supplement, the debt securities will benefit from a currency transfer guarantee of the South African Reserve Bank, under which the South

3

Table of ContentsAfrican Reserve Bank, in its capacity as the agent for the Minister of Finance for purposes of enforcement of South African Exchange Control Regulations, will irrevocably and unconditionally guarantee that the transfer to the fiscal agent of all sums in the amount and in the currency required for the fulfillment of the financial obligations arising from the debt securities and the Fiscal Agency Agreement will be authorized in good time, under all circumstances and without any limitations, notwithstanding any restrictions that may be in force at that time in South Africa and without any obligation of a holder of debt securities or the fiscal agent to submit an affidavit or to comply with any other formality.

Nature of the Obligations of the South African Government

The debt securities will constitute the direct, unconditional, general and (subject to the provisions below) unsecured obligations of the South African government and will rank equally, without any preference among themselves, with all present and future unsecured and unsubordinated general obligations of the South African government for moneys borrowed. The full faith and credit of the South African government will be pledged for the due and punctual payment of, and the due and timely performance of all the South African government’s obligations relating to, the debt securities. Amounts payable in respect of principal of and interest on the debt securities will be charged upon and be payable out of the National Revenue Fund of the South African government, where the public revenues of the South African government are deposited, equally and ratably with all other amounts so charged and amounts payable in respect of all other general loan obligations of the South African government.

Negative Pledge

So long as any debt security remains outstanding, the South African government will not create any mortgage, pledge, lien or other arrangement creating security upon any of its present or future revenues or assets to secure any present or future debt of the South African government, including:

|  |  |

| • | moneys borrowed by the South African government, and |

|  |  |

| • | guarantees given by the South African government of debts incurred by other parties which are denominated or payable in a currency other than the South African rand |

without equally and rateably securing the outstanding debt securities. The South African government may, however, create security on goods or other assets provided to or acquired by it and securing a sum not greater than the purchase price, including interest and other related charges, of these goods or assets and related services.

South African Taxation

Under existing South African law, all payments of principal and interest in respect of the debt securities will be exempt from any taxes, levies, imposts, duties, deductions, withholdings or other charges, of whatsoever nature, imposed, levied, collected, withheld or assessed by the South African government or any political subdivision or taxing authority thereof or therein (all of which are referred to herein as ‘‘South African Taxes’’) so long as the beneficial owner of the relevant debt security is either

|  |  |

| (1) | a natural person who: |

|  |  |

| • | is not ordinarily resident in South Africa, Botswana, Lesotho, Namibia or Swaziland, and |

|  |  |

| • | does not carry on business in South Africa and was physically absent from South Africa for at least 183 days during the relevant year of assessment, or |

|  |  |

| (2) | a company, incorporated association, corporation or other body corporate which is incorporated, registered, effectively managed or controlled outside South Africa, Botswana, Lesotho, Namibia and Swaziland, provided that: |

|  |  |

| • | such company does not carry on business in South Africa. |

4

Table of ContentsWithout prejudice to the foregoing, if any payment of principal or interest is not exempt as aforesaid, the South African government has agreed to pay, to the extent permitted by law, such additional amounts as are necessary in order that the net payment, after the imposition of any South African Taxes, will not be less than the amount the holder would have received in the absence of South African Taxes, except that no such additional amounts shall be payable in respect of

|  |  |

| (a) | any South African Taxes that are imposed by reason of the failure of the holder or beneficial owner of the debt security to make a declaration of nonresidence or other similar claim for exemption to the relevant tax authority; or |

|  |  |

| (b) | any Debt Security presented for payment more than 30 days after |

|  |  |

| (i) | the date on which such payment first becomes due, or |

|  |  |