Exhibit 99.E

© South African Reserve Bank

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without fully acknowledging the Quarterly Bulletin of the South African Reserve Bank as the source. The contents of this publication are intended for general information only and are not intended to serve as financial or other advice. While every precaution is taken to ensure the accuracy of information, the South African Reserve Bank shall not be liable to any person for inaccurate information or opinions contained in this publication.

| | | | |

Enquiries relating to this Bulletin should be addressed to: | | | | |

| |

Head: Research Department | | | | |

South African Reserve Bank | | | | |

P O Box 427 | | | | |

Pretoria 0001 | | | | |

Tel. +27 12 313-3668/3676 | | | | |

| |

http://www.reservebank.co.za | | | ISSN 0038-2620 | |

| | |

| | Quarterly Bulletin September 2014 |

Contents

Quarterly Economic Review

| | | | |

Introduction | | | 1 | |

Domestic economic developments | | | 4 | |

Domestic output | | | 4 | |

Real gross domestic expenditure | | | 8 | |

Factor income | | | 14 | |

Gross saving | | | 15 | |

Employment | | | 16 | |

Labour cost and productivity | | | 21 | |

Prices | | | 23 | |

Foreign trade and payments | | | 31 | |

International economic developments | | | 31 | |

Current account | | | 34 | |

Financial account | | | 40 | |

Foreign debt | | | 42 | |

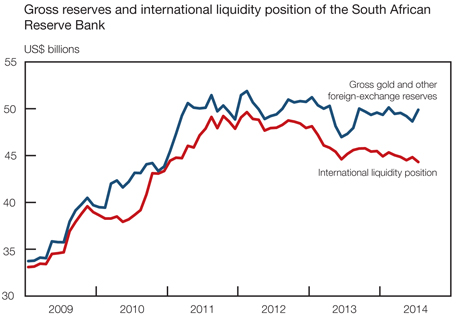

International reserves and liquidity | | | 45 | |

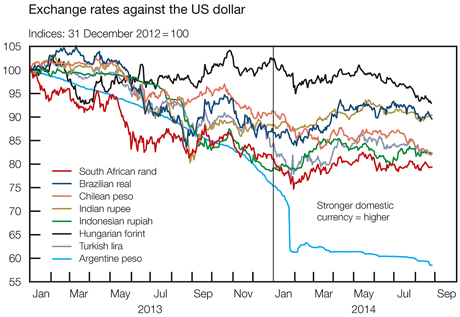

Exchange rates | | | 46 | |

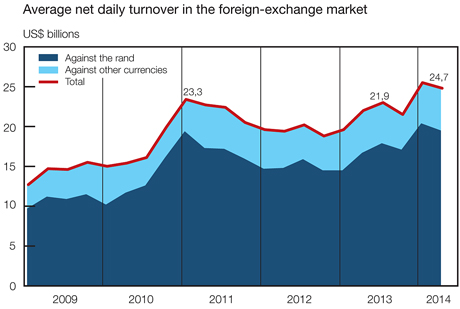

Monetary developments, interest rates and financial markets | | | 49 | |

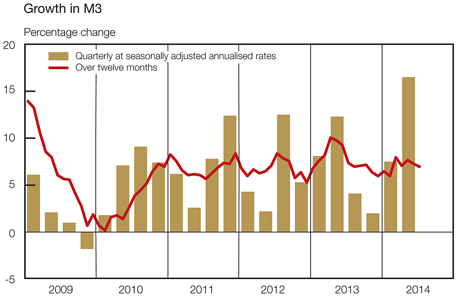

Money supply | | | 49 | |

Credit extension | | | 52 | |

Interest rates and yields | | | 55 | |

Money market | | | 60 | |

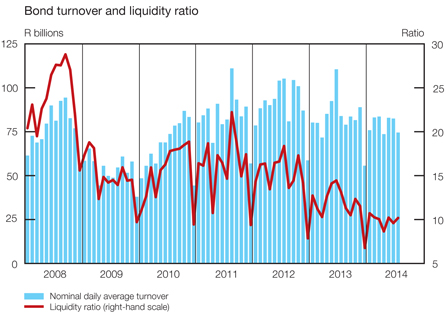

Bond market | | | 62 | |

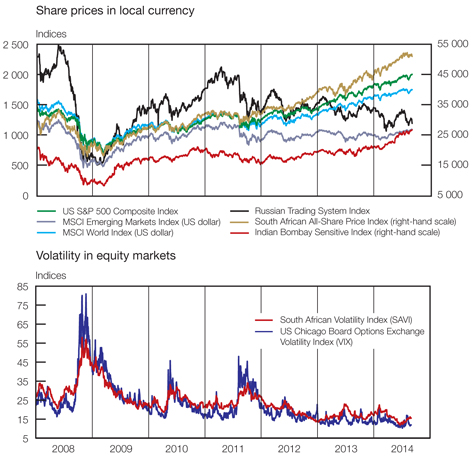

Share market | | | 65 | |

Market for exchange-traded derivatives | | | 66 | |

Real-estate market | | | 67 | |

Non-bank financial intermediaries | | | 68 | |

Flow of funds | | | 69 | |

Public finance | | | 71 | |

Non-financial public-sector borrowing requirement | | | 71 | |

Budget comparable analysis of national government finance | | | 74 | |

| |

Statement issued by Gill Marcus, Governor of the South African Reserve Bank | | | | |

| |

Statement of the Monetary Policy Committee 17 July 2014 | | | 81 | |

| |

Note | | | | |

| |

A brief preview of the forthcoming revision of South Africa’s national accounts and balance-of-payments statistics | | | 86 | |

| |

Notes to tables | | | 90 | |

| |

Statistical tables | | | | |

| |

Contents | | | S–0 | |

Statistical tables | | | S–2 | |

Key information | | | S–144 | |

| | |

| Quarterly Bulletin September 2014 | |  |

Quarterly Economic Review

Introduction

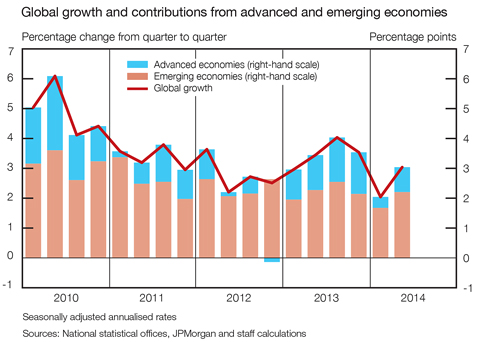

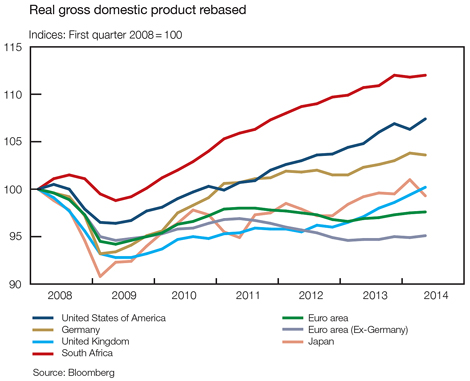

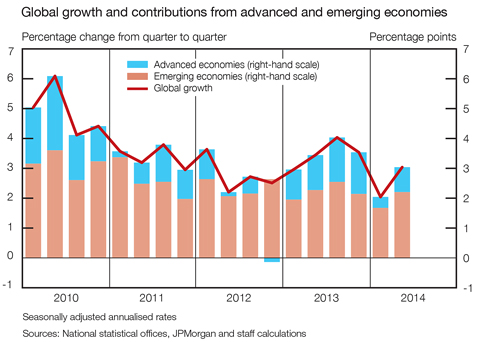

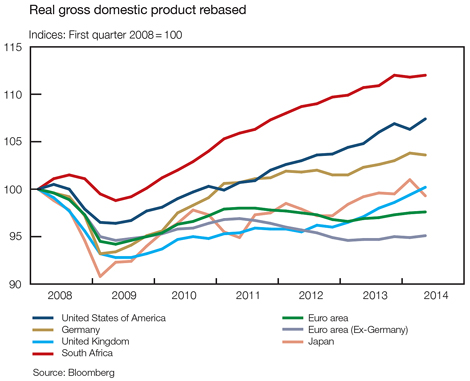

The global recovery remained uneven and fragile in the first half of 2014, with monetary policies in key economies continuing to support economic activity despite the gradual downscaling of quantitative easing in the United States (US). Overall activity in both developed and emerging-market economies regained momentum in the second quarter of 2014 as conditions improved following the weak first quarter that was induced by temporary obstructions to growth. Activity in the US picked up as the extreme weather conditions encountered in the first quarter normalised, while growth in China responded positively to a mini-stimulus package. Expectations for economic growth in 2014 in sub-Saharan Africa continued to be relatively upbeat. However, activity in Japan contracted following the introduction of a higher rate of sales tax while persistent weak growth and declining inflation in the euro area prompted the European Central Bank (ECB) to further loosen its monetary policy stance by reducing its main refinancing rate by 10 basis points to 0,15 per cent in June 2014.

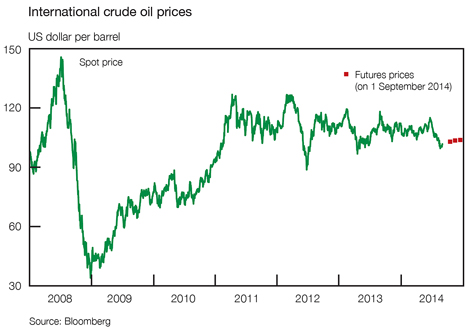

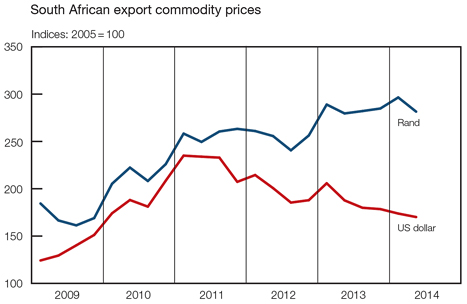

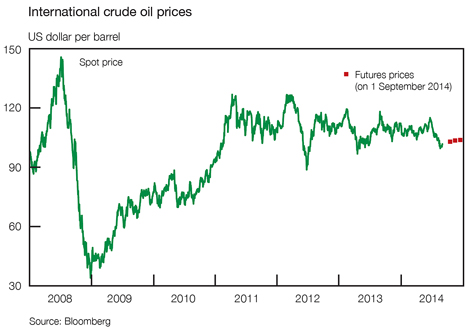

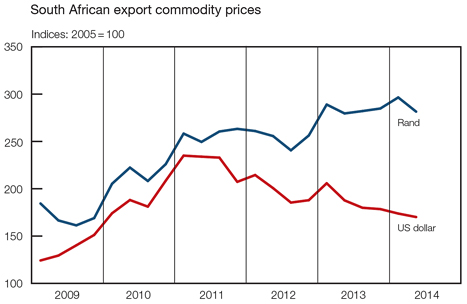

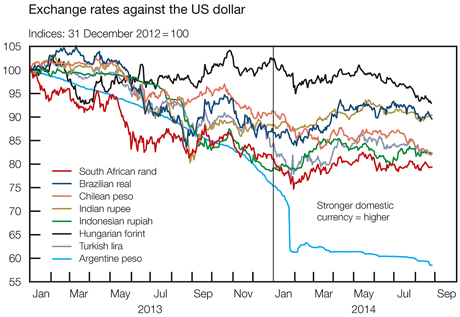

The international prices of South African export commodities on average declined somewhat in the second quarter of 2014. While the price of crude oil fluctuated higher up to June 2014, driven by concerns about the geopolitical tension in Iraq and the Russian–Ukrainian crisis, the price subsequently receded as oil supply remained robust whereas estimates for global oil demand were revised downwards. Global inflation remained well contained although it was higher in the emerging economies than in the advanced economies.

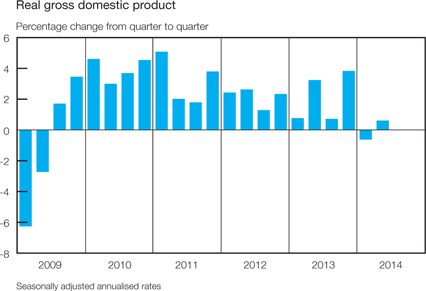

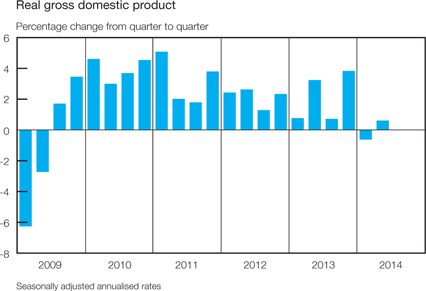

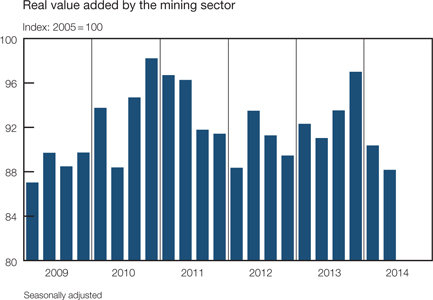

Following the negative growth rate recorded in the first quarter of 2014, the South African economy escaped a further contraction in the second quarter as real domestic production rose at an annualised rate of 0,6 per cent. This barely positive growth rate was extremely disappointing given the country’s development needs, and was mainly brought about by the drawn-out industrial action in the platinum-mining subsector which started on 23 January 2014 and only came to an end five months later. The strike activity, which resulted in a sharp contraction in mining output in the first quarter of the year, led to a further but less drastic decline in real mining production in the second quarter of 2014 as the real output of platinum group metals registered a pronounced decline. Given the backward and forward linkages of the mining sector, real value added by and utilisation of capacity in the manufacturing sector also declined in the second quarter of the year. The subdued conditions extended to the electricity sector, where weakness in demand was amplified by a relatively mild winter and a higher real price of electricity. By contrast, the agricultural sector registered stronger growth in real output over the period, supported by a bumper maize crop.

In the services industries, the pace of increase in real value added recorded in the first quarter of 2014 was maintained in the second quarter. A decline in activity in the commerce sector and slower growth in the real value added by the financial services sector were fully offset by firmer growth in the transport and general government services sectors in the second quarter of the year.

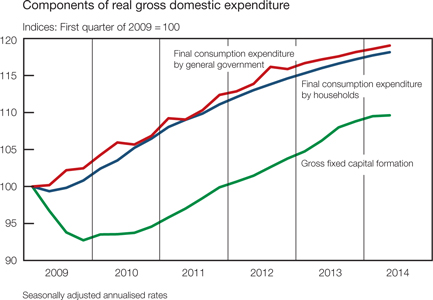

Real gross domestic expenditure lost some of its earlier momentum in the second quarter of 2014. Growth in real final consumption expenditure by households decelerated further in the second quarter of the year, consistent with the deceleration in the real disposable income of the household sector as industrial action detracted from striking workers’ earnings. The slower growth in household spending was particularly evident in expenditure on durable and semi-durable goods and on services; the pace of increase in real spending on non-durable goods accelerated over the period.

As household consumption expenditure decelerated slightly more than disposable income, and given the subdued home-loan activity, the ratio of household debt to disposable income declined somewhat further in the second quarter of 2014. At the same time the household sector’s net wealth rose firmly over the period, driven mainly by brisk increases in share prices.

| | |

| Quarterly Bulletin September 2014 | |  |

Growth in general government’s real final consumption expenditure accelerated slightly in the second quarter of 2014, partly on account of additional expenditure incurred with the national and provincial elections held in May.

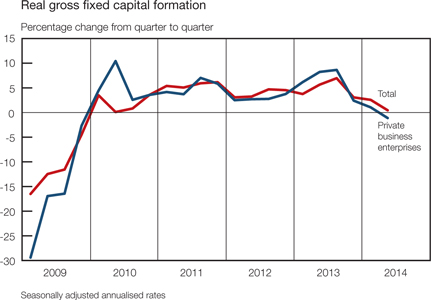

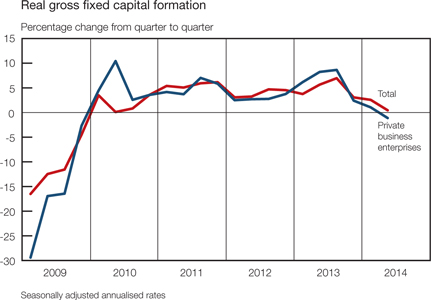

Against a background of industrial action and strife, growth in real fixed capital expenditure decelerated abruptly in the second quarter of 2014 to a barely positive rate of increase. Real capital outlays by both private business enterprises and public corporations declined over the period, but those by general government accelerated. In the private sector, most industries reduced their capital outlays, but the most pronounced declines were registered in the mining, trade, construction, transport and personal services sectors. These declines were partially offset by higher capital outlays in the manufacturing sector. Public corporations in the electricity and transport subsectors reduced their real capital spending somewhat compared with the preceding quarter. At the same time, however, general government raised its level of capital spending as all three levels of government prioritised infrastructure provision.

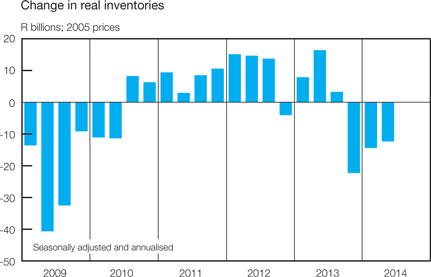

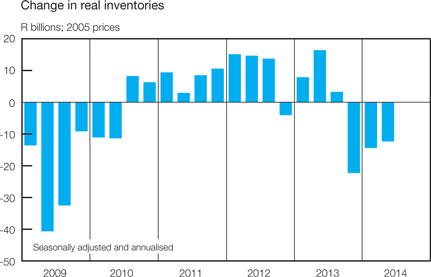

Real inventory holdings registered a further decline in the second quarter of 2014, with the mining sector in particular working down stock levels in order to continue supplying markets despite the industrial action. The pace of destocking was somewhat slower than in the preceding quarter.

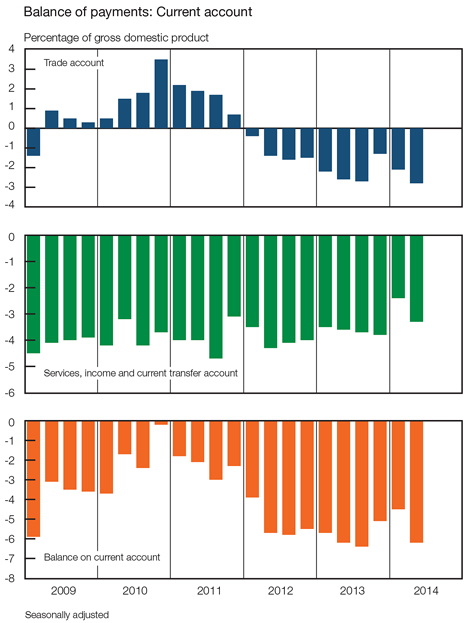

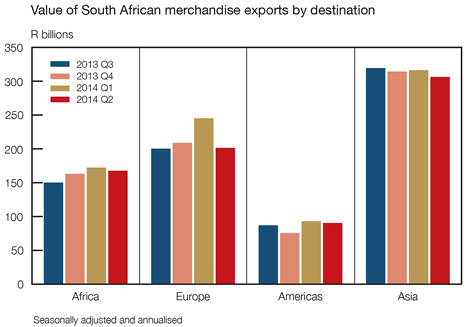

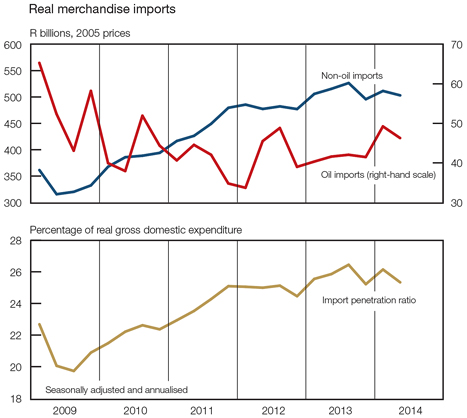

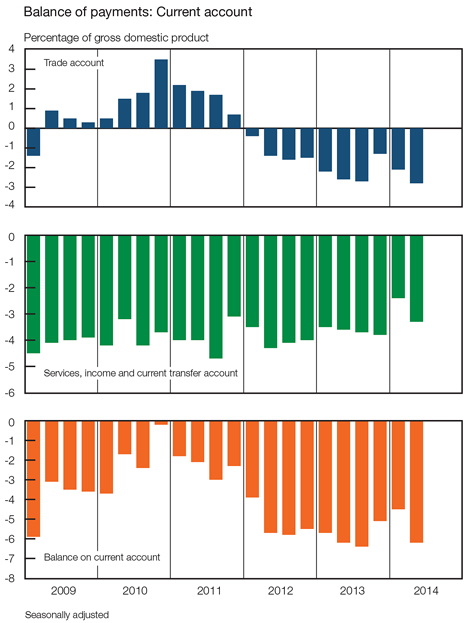

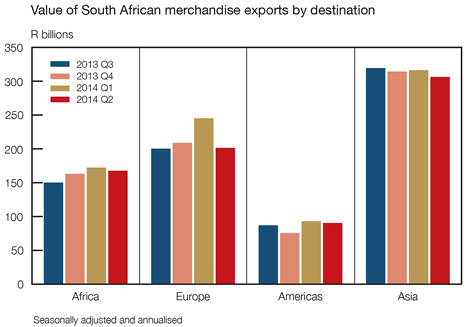

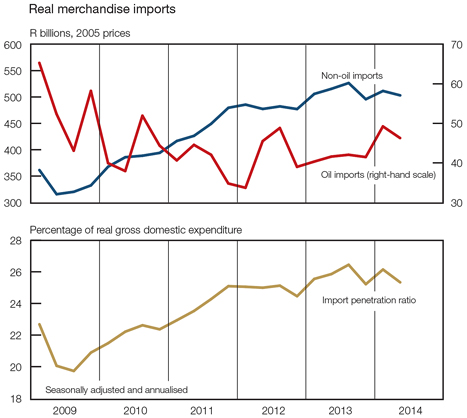

South Africa’s export performance in the second quarter of 2014 was inhibited by the prolonged industrial action, logistical and energy constraints, a moderation in global demand, and a decline in some commodity prices. The value of merchandise imports also contracted over the period, but to a lesser extent. The larger trade deficit coincided with a widening in the shortfall on the services, income and current transfer account with the rest of the world as South African institutions made higher net income payments to non-resident investors. With both sub-accounts deteriorating, the current-account deficit widened substantially to 6,2 per cent of gross domestic product in the second quarter of 2014, from 4,5 per cent in the first quarter of the year.

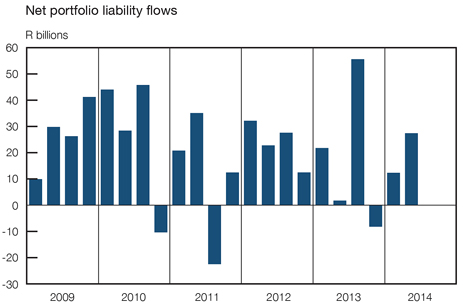

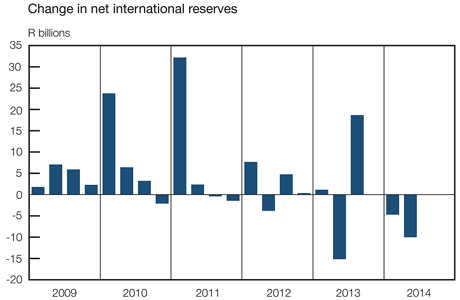

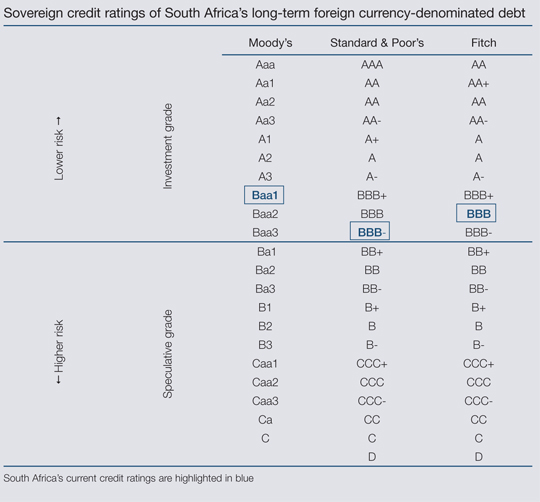

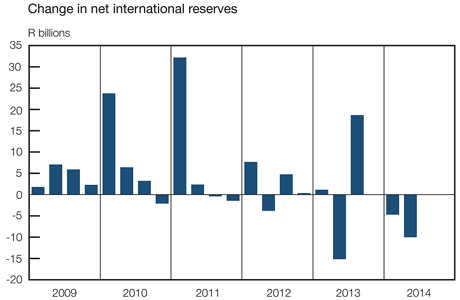

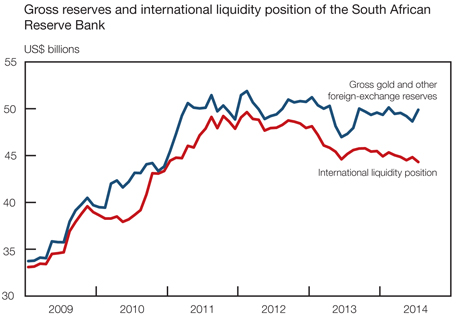

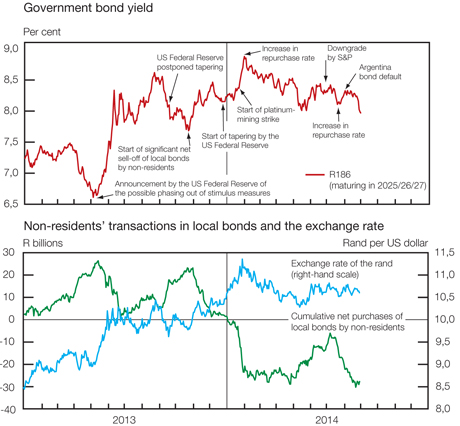

The deficit in the second quarter was financed through a combination of direct, portfolio and, to a lesser extent, other investment flows. Inward foreign direct investment was concentrated in manufacturing and telecommunication enterprises while portfolio investment consisted mainly of the net acquisition of government debt securities by non-residents and, to a somewhat lesser extent, of equities. A small decline in the official gross gold and other foreign-exchange reserves in the second quarter of 2014 was offset by reserve increases in July and August 2014. The nominal effective exchange rate of the rand fluctuated broadly sideways in the period from the end of March 2014 to the end of August, notwithstanding industrial action and a downward rerating of South Africa’s long-term sovereign debt.

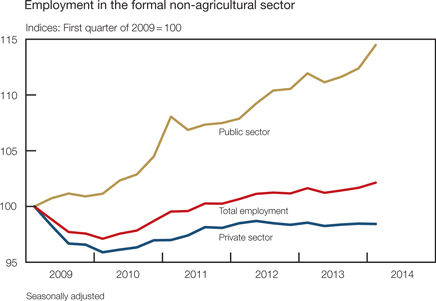

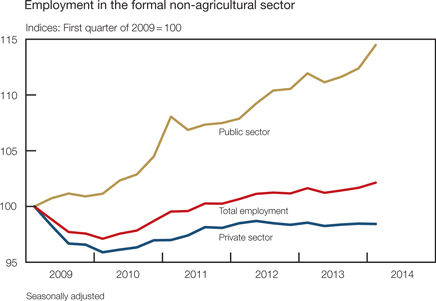

Employment trends reflected the generally subdued growth in economic activity. Enterprise-surveyed employment in the formal non-agricultural sector rose somewhat over the most recently available four quarters to the first quarter of 2014, but all the job creation took place in the public sector. Household-surveyed employment statistics suggest more vigorous increases in employment in the year to the second quarter of 2014.

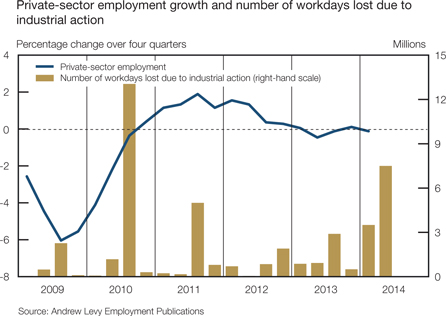

The number of workdays lost to industrial action have escalated since the beginning of 2014. Average wage settlements increased moderately over the past year although a number of high-profile settlements were in double-digit territory. Allowing for productivity improvements, unit labour cost increases recently decelerated to less than 6 per cent – the upper limit of the inflation target range. However, industrial action and restructuring in the workplace make it necessary to interpret such statistics with circumspection.

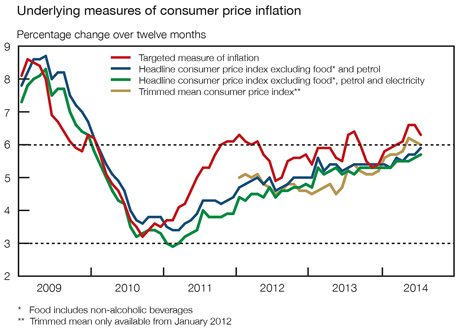

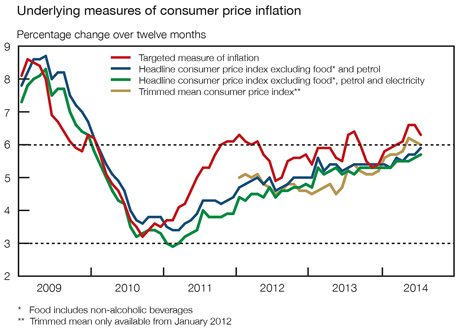

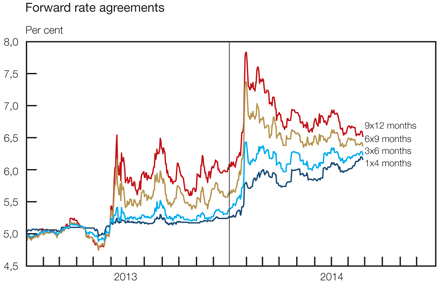

Twelve-month consumer price inflation gained momentum and exceeded 6 per cent most recently, pushed higher by the prices of especially petrol, food and education. Most measures of underlying inflation edged higher over the past year. Given the risk of inflation remaining above the target range for a protracted period, the Monetary Policy Committee (MPC) at its July 2014 meeting decided to raise the repurchase rate by 25 basis points to 5,75 per cent per annum. That followed an earlier increase from 5,00 per cent to 5,50 per cent, announced in January 2014.

| | |

| | Quarterly Bulletin September 2014 |

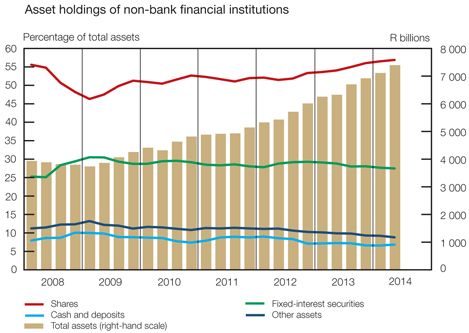

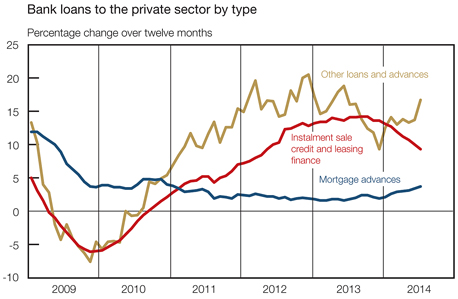

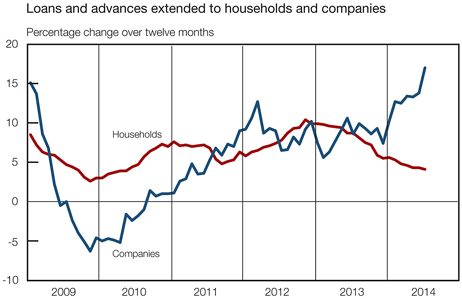

The domestic financial markets continued to be characterised by orderly conditions and adequate liquidity in the second quarter of 2014 and the subsequent two months. The broad money supply continued to register subdued growth. However, growth in bank advances to the domestic private sector recorded a moderate acceleration in the first seven months of 2014 – notably in the advances to companies, not to individuals, since the household sector’s unsecured borrowing ran out of steam. Growth in mortgage advances, though still subdued, inched slightly higher, while some other indicators of property-market activity registered an improvement.

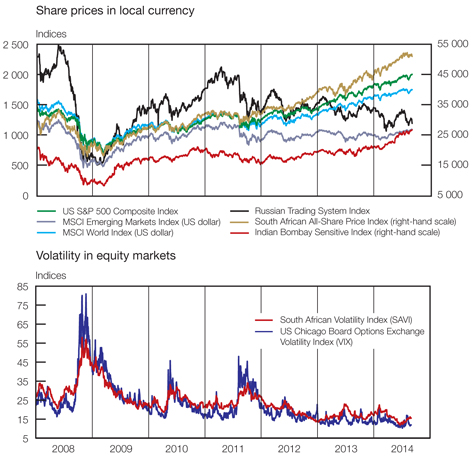

Share prices rose to successive record highs over the past year, supported by companies’ earnings growth and constrained alternative investment opportunities.

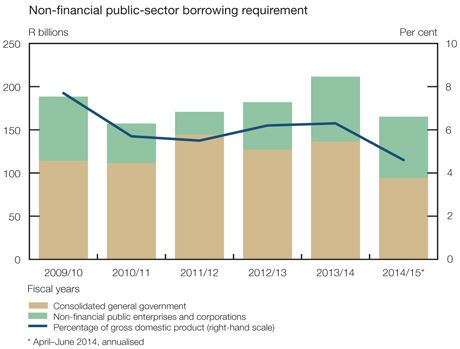

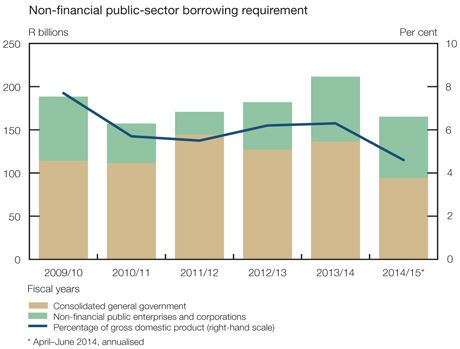

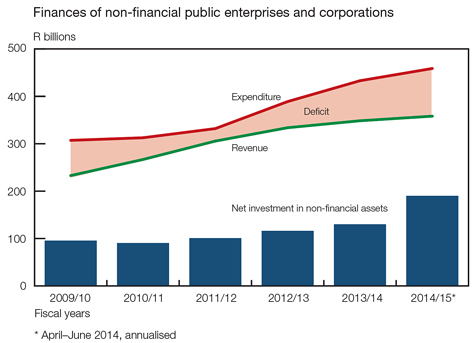

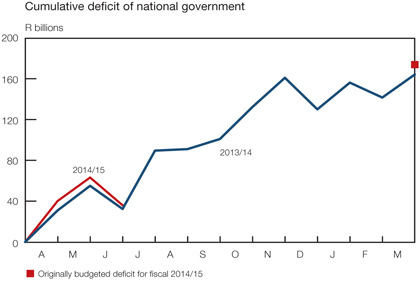

Fiscal policy continued to provide support to the economic recovery: the public-sector borrowing requirement amounted to 4,6 per cent of gross domestic product in April–June 2014, slightly higher than a year earlier. Both general government and the non-financial public corporations continued to incur more expenditure than their current revenue as they aligned their infrastructure and other programmes with the targets set out in the National Development Plan (NDP). In the most recent quarter, however, general government raised its share of the borrowing requirement whereas public corporations decreased theirs.

| | |

| Quarterly Bulletin September 2014 | |  |

Domestic economic developments

Domestic output1

Following a contraction in real domestic economic activity at an annualised rate of 0,6 per cent in the first quarter of 2014, real economic growth turned positive in the second quarter, with output expanding at a rate of 0,6 per cent. The real value added by the goods-producing sectors of the economy declined further in the second quarter of 2014, whereas the real value added by the services sector expanded at a pace broadly similar to that registered in the first quarter. Recent movements in the composite leading business cycle indicator suggest a continuation of the modest pace of output growth in the domestic economy.

Despite the contraction in the first quarter of 2014, the level of real gross domestic production in the first half of 2014 was still 1,3 per cent higher than in the corresponding period in 2013. Excluding the primary sector, growth in real gross domestic product accelerated from an annualised rate of 0,7 per cent in the first quarter of 2014 to 1,2 per cent in the second quarter.

| | |

| | Quarterly Bulletin September 2014 |

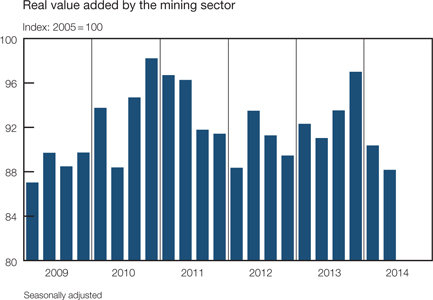

The decline in the real value added by the primary sector moderated substantially from an annualised 17,2 per cent in the first quarter of 2014 to 5,1 per cent in the second quarter. The real value added by the agricultural sector gained further momentum while the real output of the mining sector declined at a much slower pace in the second quarter.

Growth in the real value added by the agricultural sector accelerated from an annualised rate of 2,5 per cent in the first quarter of 2014 to 4,9 per cent in the second quarter. The expansion largely reflected firm growth in field crop production, particularly maize, following favourable weather conditions in the first quarter of 2014. Livestock production also improved over the period.

Real gross domestic product

Percentage change at seasonally adjusted annualised rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | |

| Sector | | 1st qr | | | 2nd qr | | | 3rd qr | | | 4th qr | | | Year | | | 1st qr | | | 2nd qr | |

Primary sector | | | 7,5 | | | | -4,7 | | | | 8,9 | | | | 12,8 | | | | 2,9 | | | | -17,2 | | | | -5,1 | |

Agriculture | | | -4,4 | | | | -3,0 | | | | 3,6 | | | | 6,4 | | | | 2,3 | | | | 2,5 | | | | 4,9 | |

Mining | | | 13,4 | | | | -5,4 | | | | 11,4 | | | | 15,7 | | | | 3,1 | | | | -24,7 | | | | -9,4 | |

Secondary sector | | | -5,9 | | | | 9,6 | | | | -4,5 | | | | 9,2 | | | | 1,0 | | | | -2,7 | | | | -0,9 | |

Manufacturing | | | -7,9 | | | | 11,7 | | | | -6,6 | | | | 12,3 | | | | 0,8 | | | | -4,4 | | | | -2,1 | |

Tertiary sector | | | 2,0 | | | | 2,2 | | | | 1,3 | | | | 1,5 | | | | 2,0 | | | | 1,8 | | | | 1,8 | |

Non-primary sector | | | 0,0 | | | | 4,0 | | | | -0,1 | | | | 3,3 | | | | 1,8 | | | | 0,7 | | | | 1,2 | |

Total | | | 0,8 | | | | 3,2 | | | | 0,7 | | | | 3,8 | | | | 1,9 | | | | -0,6 | | | | 0,6 | |

The Crop Estimate Liaison Committee has estimated the size of the expected maize crop for the 2013/14 production season to be roughly 14,0 million tons, that is 21,1 per cent more than the 11,8 million tons harvested in the 2012/13 production season and close to the previous record high of 14,4 million tons harvested in 1981.

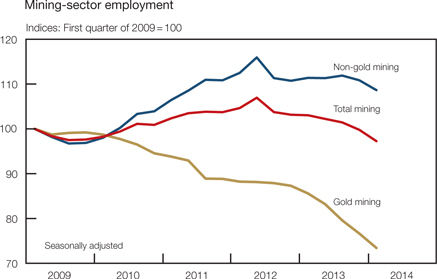

Mining production contracted further in the second quarter of 2014 although at a much slower pace than in the preceding quarter. Owing largely to the five-month labour strike in the platinum-mining sector, the real output of the mining sector shrank at an annualised rate of 9,4 per cent in the second quarter of 2014 following a marked contraction of 24,7 per cent in the first quarter. Apart from a pronounced decline in the real output of platinum group metals, the production of gold also receded in the second quarter of 2014. Gold-mining production was adversely affected by an increase in safety-related production stoppages, but these production losses were partly neutralised by a recovery in the production of iron ore following operational difficulties experienced at a prominent iron-ore mine in 2013 and early 2014. Overall, mining production subtracted 0,4 of a percentage point from total economic growth in the second quarter of 2014 after subtracting 1,3 percentage points in the first quarter of the year.

Industrial action in the platinum-mining sector, which lasted from 23 January 2014 to 24 June 2014, turned out to be the longest and most costly in the history of South Africa. Industry sources have estimated the loss in platinum production at 424 000 ounces; a further 16 000 ounces were lost during the start-up of operations due to medical and safety measures and procedures that the affected platinum mines had to adhere to. The platinum-mining sector was further affected by a loss of roughly 44 000 ounces over the period due to the consolidation of mining activities following the restructuring in the industry in 2013.

| | |

| Quarterly Bulletin September 2014 | |  |

In the secondary sector, real output contracted at an annualised rate of 0,9 per cent in the second quarter of 2014 following a decline of 2,7 per cent in the preceding quarter. In the second quarter, the pace of decline in manufacturing slowed considerably, alongside a broadly unchanged rate of growth in the real value added by the construction sector; real output of the electricity, gas and water sector, however, contracted over the period.

Following a quarter-to-quarter annualised decline of 4,4 per cent in the first quarter of 2014, real manufacturing output shrank at a rate of 2,1 per cent in the second quarter, thereby subtracting 0,3 of a percentage point from the overall rate of growth over the period. With business confidence weak and demand sluggish in the second quarter, real output declined in the subsectors producing petroleum and chemical products; glass and non-metallic mineral products; textiles and clothing; electrical machinery; and motor vehicles and parts. These decreases were partially countered by higher production of wood and wood products; basic iron and steel, non-ferrous metal products and machinery; and radio, television and communication apparatus and professional equipment.

The decline in the real value added by the motor vehicles, parts and accessories and other transport equipment subsector reflected, in part, the adverse impact of the platinum strike in reducing supplies of locally manufactured goods to the motor vehicle manufacturing industry. Apart from the spill-over effects unsettling the supply of chemical products, building materials and machinery, production volumes were also affected by subdued domestic demand in a low business confidence environment.

Despite the slower pace of decline in the real value added by the manufacturing sector in the second quarter of 2014, the level of real manufacturing output was still 0,8 per cent lower than in the corresponding period in 2013. Consistent with the lower level of production, capacity utilisation in the manufacturing sector edged lower, from 82,1 per cent in the first quarter of 2014 to 80,6 per cent in the second quarter, with respondents indicating sluggish demand as the most important reason for the decline.

| | |

| | Quarterly Bulletin September 2014 |

Having increased at an annualised rate of 0,1 per cent in the first quarter of 2014, the real value added by the sector supplying electricity, gas and water contracted at a rate of 0,7 per cent in the second quarter. This decline was mainly evident in the electricity-generating sector, reflecting the effect on demand of a relatively moderate winter and cumulatively higher real electricity prices alongside electricity supply constraints exacerbated by scheduled maintenance and unplanned power outages. Incidences of unplanned outages during the quarter stemmed from a fire and an explosion at two different power stations while planned maintenance involved the refuelling of Koeberg Unit 2 during the period. The domestic supply of electricity was augmented by higher electricity imports following the reparation of the transmission line from the Cahora Bassa hydroelectric scheme in May 2014.

Real economic activity in the construction sector sustained its relatively firm performance in the second quarter of 2014. The real value added by the construction sector advanced at an annualised rate of 5,0 per cent in the second quarter of 2014 following an increase of 4,9 per cent in the preceding quarter. Capital expenditure by public corporations was well supported by increased civil construction activity in the run-up to the national and provincial elections in the second quarter of 2014. By contrast, private sector construction activity dwindled on account of weak business conditions in the country. Capital spending on residential and non-residential building projects moderated over the same period.

The pace of increase in real value added by the tertiary sector was maintained at an annualised rate of 1,8 per cent in both the first and the second quarters of 2014. A decline in trade activity and slower growth in the real value added by the financial services sector were fully offset by firmer growth in the transport and general government services sectors over the period.

The real output of the commerce sector declined at an annualised rate of 0,2 per cent in the second quarter of 2014 following an increase of 2,1 per cent in the preceding quarter. Retailers and wholesalers suffered a setback as rising input costs, higher prices and a lustreless pace of increase in the real disposable income of households affected consumer spending. By contrast, the real value added by the motor-trade subsector advanced, albeit from a low base in the first quarter of 2014. Apart from an increase in domestic demand, the motor-trade subsector also benefited from increased foreign demand.

Growth in the real value added by the transport, storage and communication sector accelerated notably from 1,7 per cent in the first quarter of 2014 to 4,0 per cent in the second quarter. The higher growth was mainly evident in the land transport subsector following increases in both freight and passenger transportation over the period. Freight transportation advanced from a relatively low base in the first quarter of 2014 following a decrease in mining production and subsequent transportation of these products. Conversely, growth in the telecommunications subsector continued to benefit from a steady increase in the number of subscribers and the higher demand for data, aided by price competition between service providers.

Growth in the real value added by the finance, insurance, real-estate and business services sector slowed to an annualised rate of 1,5 per cent in the second quarter of 2014 following an increase of 2,0 per cent in the first quarter. The somewhat slower growth could be explained by reduced activity in the domestic securities market as trading activity on the JSE Limited (JSE) lost some momentum. The real output of the banking sector, however, increased in the second quarter of 2014.

The real value added by general government increased at annualised rates of 1,7 per cent and 2,9 per cent in the first and second quarters of 2014 respectively. The increase in real value added in the second quarters could largely be attributed to additional workers that were temporarily employed to assist with the national and provincial elections in May 2014.

| | |

| Quarterly Bulletin September 2014 | |  |

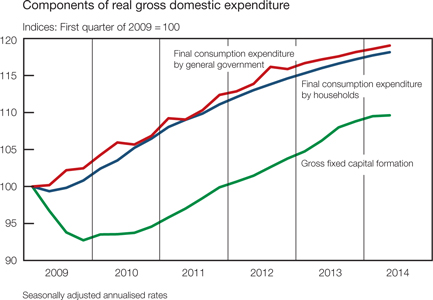

Real gross domestic expenditure

Growth in real gross domestic expenditure slowed from an annualised rate of 2,7 per cent in the first quarter of 2014 to 1,8 per cent in the second quarter. The slower growth resulted from a deceleration in real final demand; a moderation in real final consumption expenditure by households and real gross fixed capital formation more than neutralised a slower de-accumulation in real inventory holdings and an acceleration in final consumption expenditure by general government over the period.

Real final consumption expenditure by households and the change in real inventory investment made the largest contributions to growth in real gross domestic product in the second quarter of 2014 – together adding 1,4 percentage points to total economic growth. Real net exports subtracted 1,3 percentage points from growth over the period.

Contribution of expenditure components to growth in real gross domestic product

Percentage points

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | |

| Component | | 1st qr | | | 2nd qr | | | 3rd qr | | | 4th qr | | | Year | | | 1st qr | | | 2nd qr | |

Final consumption expenditure | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Households | | | 1,6 | | | | 1,6 | | | | 1,4 | | | | 1,3 | | | | 1,7 | | | | 1,2 | | | | 1,0 | |

General government | | | 0,6 | | | | 0,4 | | | | 0,3 | | | | 0,4 | | | | 0,5 | | | | 0,3 | | | | 0,3 | |

Gross fixed capital formation | | | 0,7 | | | | 1,1 | | | | 1,4 | | | | 0,6 | | | | 0,9 | | | | 0,5 | | | | 0,1 | |

Change in inventories | | | 2,4 | | | | 1,7 | | | | -2,6 | | | | -5,2 | | | | -0,4 | | | | 1,6 | | | | 0,4 | |

Net exports | | | -4,8 | | | | -0,2 | | | | 1,6 | | | | 7,8 | | | | -0,5 | | | | -3,4 | | | | -1,3 | |

Residual | | | 0,2 | | | | -1,4 | | | | -1,4 | | | | -1,2 | | | | -0,3 | | | | -0,8 | | | | 0,1 | |

Gross domestic product | | | 0,8 | | | | 3,2 | | | | 0,7 | | | | 3,8 | | | | 1,9 | | | | -0,6 | | | | 0,6 | |

| | |

| | Quarterly Bulletin September 2014 |

Real gross domestic expenditure

Percentage change at seasonally adjusted annualised rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | |

| Component | | 1st qr | | | 2nd qr | | | 3rd qr | | | 4th qr | | | Year | | | 1st qr | | | 2nd qr | |

Final consumption expenditure | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Households | | | 2,4 | | | | 2,5 | | | | 2,1 | | | | 2,0 | | | | 2,6 | | | | 1,8 | | | | 1,5 | |

General government | | | 2,8 | | | | 1,7 | | | | 1,5 | | | | 2,0 | | | | 2,4 | | | | 1,4 | | | | 1,6 | |

Gross fixed capital formation | | | 3,8 | | | | 5,6 | | | | 7,0 | | | | 3,1 | | | | 4,7 | | | | 2,6 | | | | 0,5 | |

Domestic final demand | | | 2,7 | | | | 2,9 | | | | 2,9 | | | | 2,2 | | | | 2,9 | | | | 1,9 | | | | 1,3 | |

Change in inventories (R billions)* | | | 7,9 | | | | 16,4 | | | | 3,3 | | | | -22,3 | | | | 1,3 | | | | -14,4 | | | | -12,3 | |

Gross domestic expenditure | | | 5,3 | | | | 3,2 | | | | -0,8 | | | | -3,6 | | | | 2,2 | | | | 2,7 | | | | 1,8 | |

Real final consumption expenditure by households slowed for the fourth consecutive quarter in the second quarter of 2014. Real spending by households increased at an annualised rate of 1,5 per cent in the second quarter of 2014, having advanced at a rate of 1,8 per cent in the first quarter. This slower pace of spending was consistent with a moderation in growth in the disposable income of households. The slower growth in household spending was particularly evident in the slower pace of expenditure on durable and semi-durable goods and on services, whereas spending on non-durable goods accelerated over the period.

Real final consumption expenditure by households

Percentage change at seasonally adjusted annualised rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | |

| Category | | 1st qr | | | 2nd qr | | | 3rd qr | | | 4th qr | | | Year | | | 1st qr | | | 2nd qr | |

Durable goods | | | 5,9 | | | | 12,6 | | | | 9,4 | | | | 6,9 | | | | 7,9 | | | | 2,8 | | | | 1,4 | |

Semi-durable goods | | | 7,6 | | | | 8,5 | | | | 7,1 | | | | 3,1 | | | | 6,7 | | | | 6,1 | | | | 2,0 | |

Non-durable goods | | | 2,4 | | | | 2,7 | | | | 0,5 | | | | 0,2 | | | | 2,2 | | | | -0,4 | | | | 0,7 | |

Services | | | 0,1 | | | | -2,1 | | | | 0,1 | | | | 1,7 | | | | 0,3 | | | | 2,2 | | | | 2,0 | |

Total | | | 2,4 | | | | 2,5 | | | | 2,1 | | | | 2,0 | | | | 2,6 | | | | 1,8 | | | | 1,5 | |

| | |

| Quarterly Bulletin September 2014 | |  |

Household spending on durable goods lost further momentum in the second quarter of 2014 as real outlays slowed from an annualised rate of 2,8 per cent in the first quarter to 1,4 per cent in the second quarter. Expenditure on recreational and entertainment goods decelerated significantly in the second quarter, offsetting increased spending on furniture and appliances, and transport and computer equipment. As a result of the relatively weak external value of the rand, the declining trend in the prices of certain components of recreational and entertainment goods was arrested; in many instances, prices registered increases for the first time since the second quarter of 2009. The slower pace of spending on recreational and entertainment goods coincided with a deceleration in credit extended to the household sector. In the category for transport equipment, the decrease in expenditure on new motor vehicles was outdone by the household sector’s sustained appetite for used vehicles. The lower purchases of motor vehicles in the second quarter of 2014 were corroborated by slower growth in instalment loans, accounting for the bulk of loans utilised for the acquisition of motor vehicles. Furthermore, an increasing number of consumers extended the monthly redemption schedule for the financing of both new and used motor vehicles.

According to the First National Bank/Bureau for Economic Research (FNB/BER) Consumer Confidence Index, an increasing number of consumers continued to postpone the purchases of durable goods in anticipation of further increases in interest rates as well as escalating consumer price inflation. In addition, the subdued pace of spending on durable goods could be ascribed to low consumer confidence levels, high levels of consumer indebtedness, increases in energy and transport costs, and weak employment prospects for the remainder of the year.

Having expanded briskly at an annualised rate of 6,1 per cent in the first quarter of 2014, spending on semi-durable goods slowed to a rate of 2,0 per cent in the second quarter. Growth in household expenditure on motorcar tyres, parts and accessories receded while spending on clothing and footwear moderated over the period.

Subsequent to a decline of 0,4 per cent in the first quarter of 2014, household spending on non-durable goods increased at an annualised rate of 0,7 per cent in the second quarter. The increase could mainly be ascribed to higher spending on food, beverages and tobacco; household consumer goods; petroleum products; and medical and pharmaceutical products. By contrast, household spending on fuel and power declined over the period.

Real spending on services, constituting the largest part of total consumption expenditure by households, maintained its underlying momentum and increased at annualised rates of 2,2 per cent and 2,0 per cent in the first and second quarters of 2014 respectively. Higher real outlays on rent, household services, transport and communication services as well as miscellaneous services were partly countered by lower expenditure on medical services.

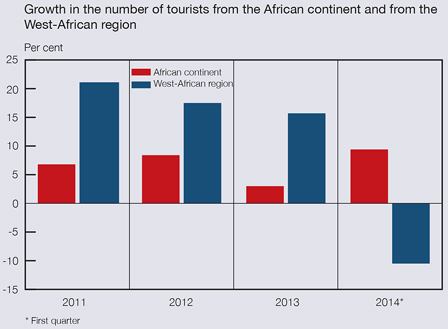

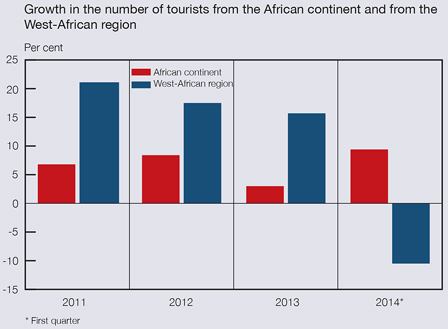

Growth in income from accommodation, restaurant and bar sales across all accommodation categories increased over the period, suggesting that the increased number of foreign tourists to South Africa had partly boosted domestic retail sales. The tourism industry continued to benefit from competitive holiday packages being offered, made possible in part by the depreciation in the exchange value of the rand. New regulations regarding the issuance of visa permits that were implemented in May 2014 could, however, temporarily delay the arrival of foreign tourists.

Following an increase of 1,7 per cent in the first quarter of 2014, growth in the real disposable income of households moderated to 1,3 per cent in the second quarter. As growth in nominal disposable income outpaced growth in household debt, the ratio of household debt to disposable income edged lower from 74,4 per cent in the first quarter of 2014 to 73,5 per cent in the second quarter. The cost of servicing household debt remained fairly low at 7,9 per cent of household disposable income in both the first and the second quarters of 2014.

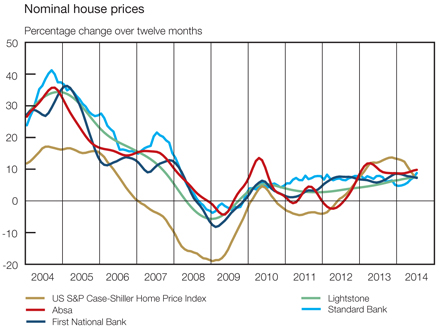

A moderation in the pace of increase in the value of the housing stock during the second quarter of 2014 was largely offset by firm increases in the value of households’ equity holdings, resulting in an improvement in the net wealth of households and in the ratio of net wealth to disposable income in the second quarter of 2014.

| | |

| | Quarterly Bulletin September 2014 |

Real final consumption expenditure by general government advanced at an annualised rate of 1,6 per cent in the second quarter of 2014 following an increase of 1,4 per cent in the first quarter. The faster pace of increase could be attributed to an increase in real compensation of employees and spending on non-wage goods and services; additional salaries and other expenses were mainly associated with the national and provincial elections in May 2014. Higher government spending on non-wage goods and services in the second quarter of 2014 reflected government’s commitment to improve the quality of the education and health systems. The level of real government spending in the first half of 2014 was 1,6 per cent higher than in the corresponding period in 2013.

Growth in real gross fixed capital formation lost further momentum, decelerating from an annualised rate of 2,6 per cent in the first quarter of 2014 to 0,5 per cent in the second quarter. Discouragingly, capital outlays by both private business enterprises (which constitute the bulk of total capital investment) and public corporations declined over the period. By contrast, growth in real fixed capital spending by general government accelerated at the same time.

Real gross fixed capital formation by private business enterprises declined at a rate of 1,1 per cent in the second quarter of 2014. This contraction could be ascribed to lower capital outlays by most private-sector industries although more pronounced declines were registered in the mining, trade, construction, transport and personal services sectors. These declines were partially offset by higher capital outlays in the manufacturing sector. While capital outlays in most mining subsectors were relatively subdued, substantially lower capital spending in the platinum group metals industry weighed on aggregate capital investment in the mining sector. The decrease in capital spending by the construction sector could in part be explained by the low levels of business confidence being experienced in the country.

The Independent Power Producers Procurement Programme continued to gain momentum in the second quarter of 2014. Capital investment on construction works by these producers accelerated as a growing number of projects progressed towards completion during the period. In addition, the Square Kilometre Array project assembled its first antenna in the second quarter of 2014, thereby contributing to the increased construction work activity by private business enterprises over the period.

| | |

| Quarterly Bulletin September 2014 | |  |

Real gross fixed capital formation

Percentage change at seasonally adjusted annualised rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | |

| Sector | | 1st qr | | | 2nd qr | | | 3rd qr | | | 4th qr | | | Year | | | 1st qr | | | 2nd qr | |

Private business enterprises | | | 6,2 | | | | 8,2 | | | | 8,6 | | | | 2,4 | | | | 5,5 | | | | 1,0 | | | | -1,1 | |

Public corporations | | | -1,6 | | | | 0,1 | | | | 0,4 | | | | 0,8 | | | | 3,1 | | | | 6,0 | | | | -0,7 | |

General government | | | 1,5 | | | | 2,6 | | | | 9,0 | | | | 9,2 | | | | 3,5 | | | | 4,6 | | | | 8,9 | |

Total | | | 3,8 | | | | 5,6 | | | | 7,0 | | | | 3,1 | | | | 4,7 | | | | 2,6 | | | | 0,5 | |

Following an increase of 6,0 per cent in the first quarter of 2014, real fixed capital expenditure by public corporations declined at a rate of 0,7 per cent in the second quarter reflecting lower capital outlays by the electricity and transport subsectors. Eskom reduced its spending on construction works on ongoing projects compared with the first quarter of 2014. Capital outlays by Transnet on locomotives and wagons, as part of its expansion project on rail, were also tapered over the period. The South African National Roads Agency Limited (SANRAL) continued with the upgrading, strengthening, improvement and building of new facilities, although at a substantially slower pace.

Growth in real capital expenditure by general government accelerated from an annualised rate of 4,6 per cent in the first quarter of 2014 to 8,9 per cent in the second quarter. The faster pace of increase in real gross fixed capital expenditure by general government could be attributed to firm levels of capital spending by all three levels of government. Capital spending by general government focused on water supply and water treatment facilities, the building and refurbishing of schools, hospitals and other healthcare facilities, and the construction of mainly electrical substations. Spending on public works, roads and transport also featured prominently in government spending programmes over the period.

Box 1: The Infrastructure Development Act

The Infrastructure Development Act No. 23 of 2014 was signed into law by the President of South Africa on 30 May 2014, and became operational on 10 July 2014. The Act has been adopted to facilitate and co-ordinate public infrastructure development, to ensure that infrastructure development is given priority, to promote the development goals of the state through infrastructure development, and to improve the management of infrastructure during all life-cycle phases.

The Act also establishes the co-ordination structures of the Presidential Infrastructure Coordinating Commission (PICC), which ensures that all three spheres of government are part of the PICC and that all the main executive authorities across the public sector meet on a regular basis to drive the implementation of infrastructure development plans.

In establishing the PICC and its subsidiary structures as legally defined organs of the state, the Act endeavours to address the lack of co-ordination across the state to ensure common priorities and the management of trade-offs around infrastructure projects, to ensure a sufficiently strong level of public investment, and to improve capacity for managing all phases involved in the development of infrastructure.

Through the Act, the PICC acquired powers to expropriate land in line with the Constitution of South Africa and other relevant laws. The PICC is responsible for developing and maintaining the National Infrastructure Plan, which sets priorities and secures alignment across state agencies around infrastructure. The PICC is also required to assess the impact of infrastructure projects on economic and social development and inclusion. The structures of the PICC include representatives of local and provincial government, a Management Committee that is similarly representative but able to meet more often, and a secretariat, which is chaired by the Minister of Economic Development and is composed of ministers and deputy ministers. The requirements and stipulations of the Act, if successfully implemented, will contribute to enhanced levels of infrastructure development in the country.

| | |

| | Quarterly Bulletin September 2014 |

The Act empowers the PICC Council to designate Strategic Integrated Projects (SIPs), which essentially incorporate several linked projects through the National Infrastructure Plan. This approach should increase co-ordination and prove advantageous in terms of a shared drive towards the completion of projects. It requires all agencies of the state to align their infrastructure plans with the SIPs. For a project to be classified as an SIP, it should be included in the National Infrastructure Plan, be of significant economic or social importance to the country or a province, and be above a certain rand value as set by the Minister of Economic Development. This approach should ensure that a proper evaluation is done before a project is classified as an SIP.

The Act will set time frames for the approval of regulatory decisions affecting the implementation of infrastructure projects. Instead of sequential approval processes, the Act provides for processes to run concurrently wherever possible to ensure that the state works to a common deadline and that this time frame provides for the incorporation of public consultation processes. The Act:

| • | | establishes in law the co-ordination structures of the PICC. This is done to ensure that all three spheres of government are part of the commission and that all the main executive authorities across the public sector are mandated to meet on a regular basis to drive the implementation of infrastructure. |

| • | | provides for SIPs that bring together a number of catalytic projects which together make up the National Infrastructure Plan. These allow for better integration of connected projects and improved monitoring of implementation. |

| • | | sets time frames for the approval of regulatory decisions affecting the implementation of infrastructure projects. Instead of sequential approval processes, it provides for processes to run concurrently wherever possible. This ensures that the state works to a common deadline and that this time frame provides for public consultation processes. |

| • | | sets out processes of co-ordination that require regulatory authorities and cross-cutting departments to work closely together through steering committees for each SIP which will co-ordinate efforts to speed up the implementation of infrastructure construction and completion. |

| • | | provides for the PICC to expropriate land required for infrastructure development but subjects these powers to the Constitution of South Africa and any Act of Parliament specifically dealing with expropriation which is passed by Parliament after the Act came into law. |

| • | | sets out the mechanism through which developmental targets can be set for each major infrastructure project, covering areas such as youth employment targets, greening the economy, skills development and broad-based empowerment. |

The Act does not change the responsibilities of accounting officers or authorities, and does not change the route for fiscal flows. Line departments and public entities will continue to receive money for specific infrastructure projects, and they will remain accountable to Parliament for the spending of these funds.

The National Development Plan, which led to the promulgation of the Infrastructure Development Act, setting the framework for the PICC implies that, for the first time since 1994, South Africa has established a clear policy basis from which infrastructure development can be undertaken. Government’s allocation of R1,5 trillion to infrastructure projects over the next five years is a critical step in clearing the backlog and underspending on critical infrastructure projects that South Africa urgently requires. If this investment is to yield effective results, rapid progress has to be made in converting the policy frameworks and legislation embedded in the New Growth Path, the National Development Plan and the Infrastructure Development Act into tangible projects to be implemented expeditiously.

Real inventory de-accumulation slowed marginally from R14,4 billion in the first quarter of 2014 to R12,3 billion in the second quarter. This slower pace of destocking was largely due to an accumulation of inventories in the electricity, gas and water as well as commerce sectors, while inventories in the mining sector continued to decline, albeit at a slower pace.

| | |

| Quarterly Bulletin September 2014 | |  |

The accumulation of inventories in the electricity subsector in the second quarter of 2014 resulted primarily from an increase in the stocks of coal. With less electricity being produced at coal-powered plants in the second quarter of 2014 following subdued demand, increased market participation by key industrial customers and the growing availability of wind, gas and solar power, less coal was needed over the period. In the mining sector, the level of inventories at platinum mines in particular declined further over the period as these mining companies tried to fulfil export obligations as far as possible. However, the extent of the decline was moderated by an accumulation of iron-ore inventories made possible by higher production and lower sales volumes of this metal.

Stock levels in the commerce sector rose due to a build-up of agricultural stocks-in-trade, particularly maize and sunflower seeds. Industry sources expect that the maize crop for the current production year could be the largest in 33 years, with the harvested maize initially added to stocks-in-trade before being consumed or exported.

The level of industrial and commercial inventories as a percentage of non-agricultural gross domestic product edged higher, from 13,2 per cent in the first quarter of 2014 to 13,3 per cent in the second quarter.

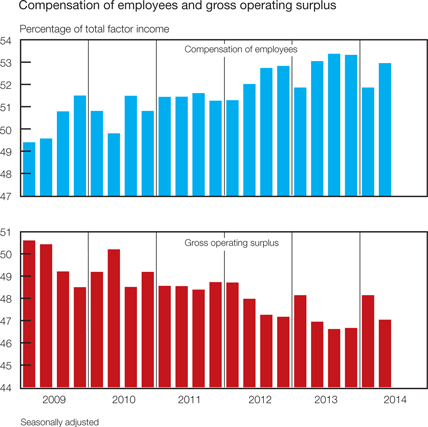

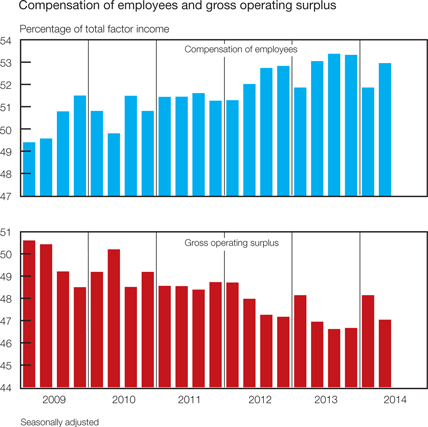

Factor income

Year-on-year growth in total nominal factor income slowed from 7,3 per cent in the first quarter of 2014 to 6,4 per cent in the second quarter. The slightly lower growth resulted from weaker growth in both the gross operating surpluses of business enterprises and the total remuneration of employees over the period.

Measured over four quarters, growth in the total compensation of employees slowed from 7,2 per cent in the first quarter of 2014 to 6,5 per cent in the second quarter. The moderation in growth in salaries and wages could primarily be attributed to a slower pace of increase in the remuneration paid to employees in general government. In addition, remuneration in the mining sector contracted again in the second quarter of 2014 due to the no-work-no-pay principle during strikes, exacerbated by job losses in the industry following the closure of unprofitable shafts. However, the share of total remuneration of employees to total factor income increased from 51,9 per cent in the first quarter of 2014 to 53,0 per cent in the second quarter. In addition, the average wage settlement rate inched higher to 8,0 per cent in the second quarter of 2014 compared with 7,9 per cent recorded for the same period in 2013.

| | |

| | Quarterly Bulletin September 2014 |

Alongside input cost pressures and above-inflation wage increases, the pace of increase in the total gross operating surplus of business enterprises, measured over four quarters, decelerated from 7,4 per cent in the first quarter of 2014 to 6,3 per cent in the second quarter. Although slower growth was evident in most sectors of the economy, it was most pronounced in the mining and finance sectors. Platinum-mining companies suffered significant losses in revenue and profits as the protracted industrial action weighed on activity in the subsector over the period. As a result, the gross operating surplus relative to total factor income decreased from 48,1 per cent in the first quarter of 2014 to 47,0 per cent in the second quarter.

Gross saving

South Africa’s national saving ratio or gross saving as a percentage of gross domestic product decreased from 14,6 per cent in the first quarter of 2014 to 13,2 per cent in the second quarter. Lower levels of saving by the corporate sector and general government, combined with a stable saving ratio for the household sector, resulted in the deterioration in the national saving performance over the period. The moderation in the saving ratio gave rise to an increase in the country’s dependency on foreign capital to finance gross capital formation. The foreign financing ratio subsequently increased from 23,6 per cent in the first quarter of 2014 to 32,0 per cent in the second quarter.

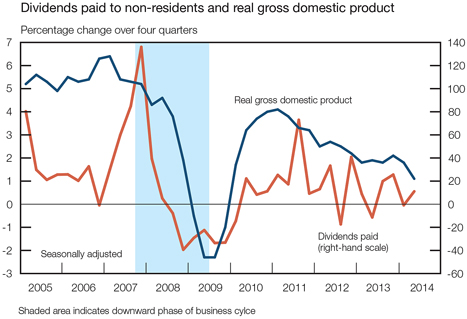

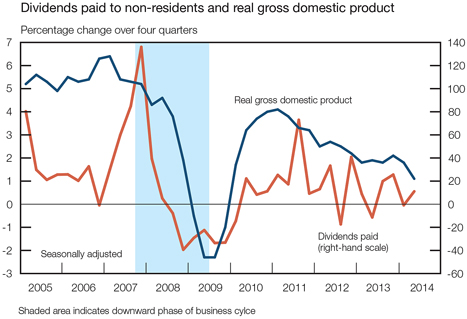

Gross saving by the corporate sector relative to gross domestic product decreased from 14,9 per cent in the first quarter of 2014 to 13,8 per cent in the second quarter. The moderation in the saving ratio followed increased year-on-year growth in dividend payments of 11,9 per cent while corporate tax payments advanced at a rate of 9,1 per cent in the second quarter.

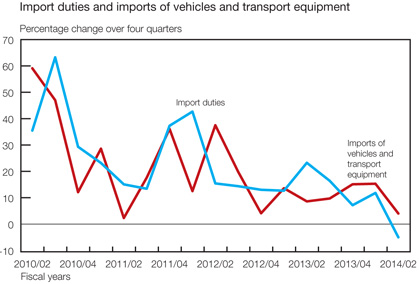

Gross dissaving by general government rose from 1,9 per cent of gross domestic product in the first quarter of 2014 to 2,2 per cent in the second quarter. Growth in government income moderated mainly on account of slightly lower growth in tax revenues, especially from customs duties.

| | |

| Quarterly Bulletin September 2014 | |  |

The gross saving rate of the household sector remained unchanged at 1,6 per cent in the first and second quarters of 2014 as private consumption expenditure remained broadly in step with households’ disposable income.

Employment

Notwithstanding the marginal contraction in real output in the South African economy in the first quarter of 2014 and a severely strained labour relations environment, formal non-agricultural employment increased somewhat over the period, entirely due to employment gains in the public sector. According to the Quarterly Employment Statistics (QES) survey published by Statistics South Africa (Stats SA), the number of people formally employed in the non-agricultural sector of the economy increased by 1,8 per cent on a seasonally adjusted and annualised basis in the first quarter of 2014, representing 38 500 additional job opportunities.2 This brought the level of formal non-agricultural employment to almost 8,52 million in the first quarter of 2014, for the first time surpassing the level reached at the previous peak in the employment cycle in the third quarter of 2008.

The pickup in formal non-agricultural employment in the first quarter of 2014 resulted from a marked acceleration in public-sector employment to an annualised rate of 7,7 per cent, as an additional 40 300 employment opportunities were created in the quarter. Apart from a decrease in employment at public-sector enterprises, all other public-sector tiers recorded employment gains. In particular, employment at local government level increased notably by some 28 400 job opportunities – largely related to government’s expanded public works programme.

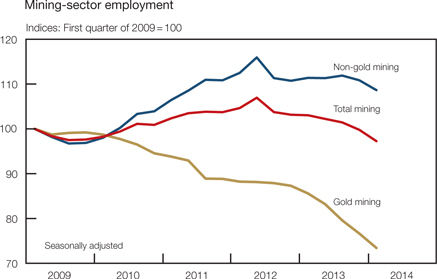

Disappointingly, private-sector employment decreased by 1 800 job opportunities in the first quarter of 2014. Job losses during this quarter occurred in the gold-mining sector (recording the highest rate of decline); the private transport, storage and communication sector; the non-gold mining sector; and the manufacturing sector. Conversely, jobs were created in the construction sector (which registered the strongest pace); the private community, social and personal services sector; the finance, insurance, real-estate and business services sector; and the trade, catering and accommodation services sector.

| | |

| | Quarterly Bulletin September 2014 |

Change in enterprise-surveyed formal non-agricultural employment by sector*

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Change over

one quarter | | | Change over four | | | | | | | |

| Sector | | 2013 | | | 2014 | | | quarters to

1st qr 2014 | | | Cumulative job

losses (-) gains (+) | |

| | 2nd qr | | | 3rd qr | | | 4th qr | | | 1st qr | | | Number | | | Per

cent | | | 4th qr

2008 to

1st qr 2010 | | | 2nd qr

2010 to

1st qr 2014 | |

Finance, insurance, real-estate and business services | | | 1 900 | | | | 4 000 | | | | 400 | | | | 6 600 | | | | 12 900 | | | | 0,7 | | | | -182 200 | | | | 112 000 | |

Manufacturing | | | -4 000 | | | | 600 | | | | 4 600 | | | | -3 400 | | | | -2 100 | | | | -0,2 | | | | -113 000 | | | | -40 900 | |

Trade, catering and accommodation services | | | -4 400 | | | | 5 600 | | | | 6 300 | | | | 3 000 | | | | 10 600 | | | | 0,6 | | | | -76 300 | | | | 69 400 | |

Construction | | | -4 600 | | | | -1 700 | | | | -7 500 | | | | 5 100 | | | | -8 500 | | | | -2,0 | | | | -48 300 | | | | 5 300 | |

Total mining | | | -4 100 | | | | -3 900 | | | | -8 300 | | | | -12 600 | | | | -28 900 | | | | -5,6 | | | | -40 700 | | | | 4 900 | |

Gold mining | | | -3 900 | | | | -5 800 | | | | -4 700 | | | | -5 200 | | | | -19 600 | | | | -14,2 | | | | -9 600 | | | | -40 900 | |

Other mining | | | -200 | | | | 1 900 | | | | -3 500 | | | | -7 400 | | | | -9 300 | | | | -2,5 | | | | -31 100 | | | | 35 900 | |

Private transport, storage and communication services | | | -1 300 | | | | -1 100 | | | | 1 400 | | | | -5 200 | | | | -6 200 | | | | -2,4 | | | | -2 000 | | | | -3 600 | |

Community, social and personal services | | | -2 800 | | | | 4 700 | | | | 8 200 | | | | 4 700 | | | | 14 800 | | | | 3,5 | | | | 13 400 | | | | 25 700 | |

Total private sector | | | -19 100 | | | | 8 200 | | | | 5 300 | | | | -1 800 | | | | -7 400 | | | | -0,1 | | | | -449 100 | | | | 162 900 | |

National departments | | | -2 500 | | | | -700 | | | | 1 600 | | | | 900 | | | | -700 | | | | -0,1 | | | | -2 500 | | | | 44 000 | |

Provinces | | | 9 000 | | | | 5 500 | | | | 1 900 | | | | 15 800 | | | | 32 200 | | | | 3,0 | | | | 51 600 | | | | 109 600 | |

Local governments | | | 3 300 | | | | 3 000 | | | | 8 200 | | | | 28 400 | | | | 42 900 | | | | 15,9 | | | | 15 200 | | | | 72 400 | |

Public transport, storage and communication services | | | -2 900 | | | | 600 | | | | -200 | | | | 2 200 | | | | -300 | | | | -0,2 | | | | -4 900 | | | | 17 800 | |

Other public-sector enterprises including electricity | | | -22 200 | | | | 1 100 | | | | 3 000 | | | | -7 000 | | | | -25 000 | | | | -11,1 | | | | -6 900 | | | | 13 000 | |

Total public sector | | | -15 300 | | | | 9 600 | | | | 14 500 | | | | 40 300 | | | | 49 100 | | | | 2,3 | | | | 52 500 | | | | 256 900 | |

Grand total | | | -34 400 | | | | 17 800 | | | | 19 800 | | | | 38 500 | | | | 41 700 | | | | 0,5 | | | | -396 600 | | | | 419 900 | |

| * | Components may not add to totals due to rounding |

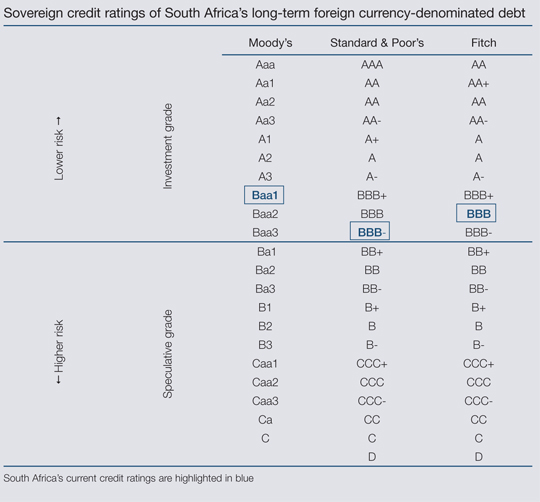

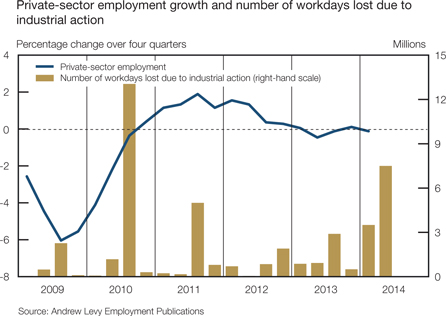

Employment creation in the domestic private sector has been sluggish since the 2008/09 economic recession. In fact, the table above shows that of the 449 100 private-sector jobs lost during the recession, only 162 900 – roughly 36 per cent – were recovered up to the first quarter of 2014. Although the private sector’s ability to create employment has been hampered by a number of factors (such as weak economic growth, low business and investor confidence, and electricity supply constraints) these factors have undoubtedly been exacerbated by South Africa’s adversarial labour relations environment in recent years. The first graph on the next page shows private-sector employment growth alongside the number of workdays lost due to industrial action. The number of workdays lost has risen steadily since the second half of 2011 while private-sector employment growth has moderated notably over the period. Apart from impeding employment growth, the turbulent labour relations environment has damaged investor confidence and probably contributed to the recent downgrade of South Africa’s sovereign credit rating by an international credit-rating agency.

| | |

| Quarterly Bulletin September 2014 | |  |

Following the Marikana tragedy in August 2012, employment in the mining sector decreased for seven consecutive quarters up to the first quarter of 2014. Roughly 48 400 employment opportunities were lost in this sector between the third quarter of 2012 and the first quarter of 2014, – reflecting the destruction of 9,1 per cent of total mining-sector employment. Labour paring was most pronounced in the gold-mining sector over this period, but nevertheless also occurred in the non-gold mining sector. The pace of job shedding accelerated in both the gold-mining and the non-gold mining sectors in the first quarter of 2014, amid the protracted platinum-mining strike. After 103 days, the strike – the longest in South African history – was eventually terminated at the end of June 2014. It could take years before workers recover the wages they had forgone during the five-month strike, particularly in light of the final wage settlement not differing materially from offers made in the first few weeks of the strike. Furthermore, restructuring by some large platinum producers following the strike could result in further job losses in coming quarters. The antagonistic labour relations environment, coupled with the depth of many South African mines and the associated rise in overall cost pressures, could boost the pace of mechanisation in the mining sector over the next few years, particularly at new-generation mines.

| | |

| | Quarterly Bulletin September 2014 |

While employment levels in the manufacturing sector are still below those recorded before the 2008/09 recession, the pace of job shedding appears to have bottomed out over the past two years. However, following two successive quarters of moderate employment growth, manufacturing employment decreased again by 1,2 per cent in the first quarter of 2014 as manufacturing output and confidence were dented by the lengthy industrial action in the platinum sector. Furthermore, from early July 2014 – only a few days after the protracted platinum-mining strike ended – the National Union of Metalworkers of South Africa (NUMSA) embarked on a month-long countrywide strike involving more than 200 000 workers in the steel and engineering industry.

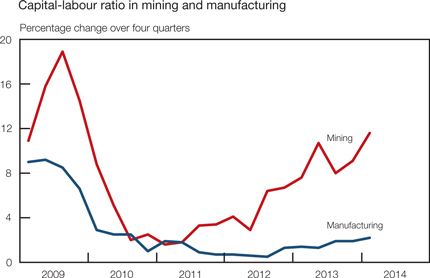

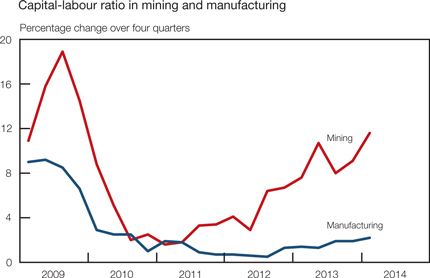

Business confidence in manufacturing, as reported in the Manufacturing Survey of the BER, fell sharply from 41 index points in the first quarter of 2014 to 25 in the second quarter – its lowest level since the start of the cyclical upswing in September 2009. Most of the underlying activity indicators deteriorated sharply, with the domestic demand and output indicators falling to levels last reported in the wake of the 2009 recession, while employment indicators remained subdued in the second quarter of 2014. The sharp drop in sentiment in the manufacturing sector was most likely exacerbated by the labour unrest in the platinum-mining sector as well as the looming NUMSA strike, which most manufacturers would have anticipated at the time of the second-quarter survey. The month-long NUMSA strike, which was characterised by numerous incidents of intimidation, violence and vandalism, was resolved at the end of July when the union signed a new three-year wage agreement with the Steel and Engineering Industries Federation of South Africa (SEIFSA), representing larger companies. However, citing unaffordability, the agreement was not signed by the National Employers’ Association of South Africa (NEASA), representing around 3 000 small- and medium-sized manufacturers. Some employers have indicated that the recent industrial action and resultant high wage increases could bring about further job losses and increased mechanisation in the manufacturing sector. The accompanying graph shows year-on-year growth in the capital-labour ratio in the mining and manufacturing sectors, with the capital intensity of both sectors rising in recent years.

Employment levels increased somewhat in the services sectors of the economy in recent quarters. Employment growth in the finance, insurance, real-estate and business services sector accelerated to 1,4 per cent in the first quarter of 2014, following three successive quarters of fairly muted employment gains. Similarly, employment in the trade, catering and accommodation services sector increased marginally by 0,7 per cent in the first quarter of 2014 – its third successive quarterly increase. The BER’s Retail Survey for the second quarter of 2014 showed

| | |

| Quarterly Bulletin September 2014 | |  |

that business confidence among retailers had improved from 39 index points in the first quarter of 2014 to 49 in the second quarter, despite underlying indices suggesting that business conditions in the trade sector remained tough.

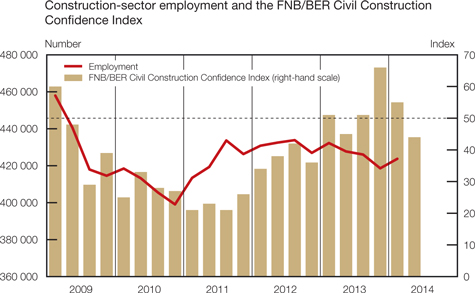

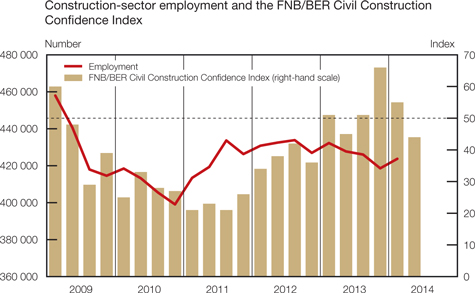

Notwithstanding uncertain employment prospects in the construction sector, the sector increased its job complement by 5,0 per cent in the first quarter of 2014, following three successive quarters of labour paring. Having fallen by 11 index points to 55 in the first quarter of 2014, the FNB/BER Civil Confidence Index shed a further 11 points to 44 in the second quarter of 2014. Confidence levels receded despite a marked increase in construction activity, with the mismatch between activity and confidence likely due to the spread of construction work which seemed concentrated among only a few firms and provinces. The drawn-out strike in the platinum-mining sector and weak economic growth prospects may also have made respondents more concerned about the current business environment. The FNB/BER Building Confidence Index fell below the key 50-index mark in the first quarter of 2014, decreasing by 11 index points to 41 in the second quarter of 2014. According to the BER, the decline in building confidence was largely due to a sharp decline in the confidence levels of manufacturers of building material, reflecting weaker domestic demand. The lower confidence levels were corroborated by a decrease in the real value of building plans passed in the second quarter of 2014.

According to the Quarterly Labour Force Survey (QLFS) conducted by Stats SA, the number of persons employed in South Africa increased by 39 000 from the first quarter of 2014 to the second quarter, raising the total level of employment to 15,09 million persons. Although total employment increased by 403 000 in the year to the second quarter of 2014, the year-on-year growth rate nevertheless moderated further from 3,4 per cent in the first quarter of 2014 to 2,7 per cent in the second quarter. The majority of employment opportunities was created in the formal non-agricultural sector of the economy and by private households, recording increases of 381 000 and 75 000 respectively in the year to the second quarter of 2014. Only 19 000 additional people were employed in the informal sector, while the agriculture, hunting, forestry and fishing sector shed a further 73 000 employment opportunities over the same period. Employment in this sector had decreased for five consecutive quarters up to the second quarter of 2014, with a cumulative 94 000 jobs lost, representing a reduction in employment of 12,3 per cent over the period.

| | |

| | Quarterly Bulletin September 2014 |

Disconcertingly, the number of unemployed persons increased by a further 87 000 from the first quarter of 2014 to the second quarter, bringing the total number of unemployed South Africans to 5,15 million – its highest level since the inception of the QLFS in the first quarter of 2008. Consequently, the official unemployment rate edged up further to 25,5 per cent in the second quarter of 2014 from 25,3 per cent a year earlier and 25,2 per cent in the preceding quarter. The seasonally adjusted unemployment rate also rose marginally, from 25,0 per cent in the first quarter of 2014 to 25,2 per cent in the second quarter. The youth unemployment rate receded somewhat, from 53,2 per cent in the first quarter of 2014 to a still high 51,8 per cent in the second quarter.

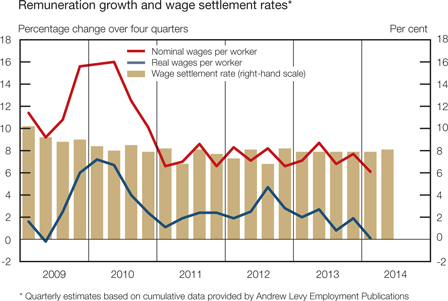

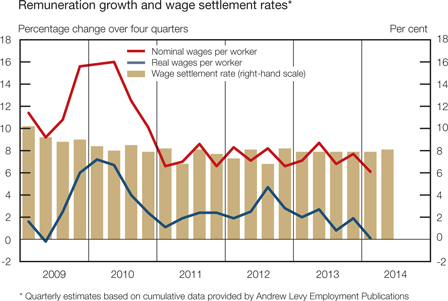

Labour cost and productivity

The year-on-year pace of increase in nominal remuneration per worker in the formal non-agricultural sector of the economy decelerated notably from 7,7 per cent in the fourth quarter of 2013 to 6,1 per cent in the first quarter of 2014, entirely due to a marked slowdown in private-sector remuneration growth. Growth in real salaries and wages per worker in the formal non-agricultural sector of the economy accordingly moderated from 1,9 per cent in the year to the fourth quarter of 2013 to only 0,1 per cent in the year to the first quarter of 2014.

Private-sector remuneration per worker increased at a rate of 6,2 per cent in the year to the first quarter of 2014, notably slower than the rate of increase of 8,7 per cent recorded in the fourth quarter of 2013. Although remuneration growth slowed in all the private subsectors, the slowdown was most pronounced in the mining sector where the year-on-year rate slowed from 11,6 per cent in the fourth quarter of 2013 to 0,8 per cent in the first quarter of 2014. Growth in salaries and wages per worker in the gold-mining sector decelerated from 23,2 per cent to 11,3 per cent, while remuneration growth in the non-gold mining sector slowed from 7,8 per cent to -2,7 per cent over the same period, largely due to the majority of platinum-mining workers not being remunerated for the duration of the protracted labour strike while still being counted as employees. The highest wage increases per worker were recorded in the gold-mining sector (11,3 per cent); the trade, catering and accommodation services sector (9,4 per cent); the manufacturing sector (7,2 per cent); and the finance, insurance, real-estate and business services sector (6,6 per cent).

| | |

| Quarterly Bulletin September 2014 | |  |

Public-sector remuneration growth quickened marginally from 5,2 per cent in the year to the fourth quarter of 2013 to 5,3 per cent in the year to the first quarter of 2014. The highest year-on-year increase in public-sector remuneration per worker in the first quarter of 2014 was recorded by public enterprises (15,1 per cent), followed by provinces (5,3 per cent) and national departments (3,8 per cent).

According to Andrew Levy Employment Publications, the average wage settlement rate in collective bargaining agreements amounted to 8,0 per cent in the first half of 2014, marginally up from 7,9 per cent in the year 2013 as a whole. Disconcertingly, the number of workdays lost due to strike action rose notably from 1,8 million in the first half of 2013 to 7,5 million in the first half of 2014. The marked increase was largely due to the prolonged strike in the platinum-mining sector, which alone resulted in 7,2 million workdays lost. The countrywide NUMSA strike could furthermore add significantly to the number of workdays lost in the third quarter of 2014, considering that it lasted a month and involved roughly three times the number of workers that were involved in the recent platinum-mining strike.

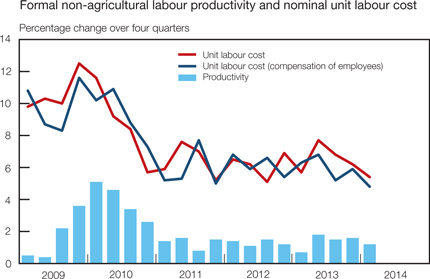

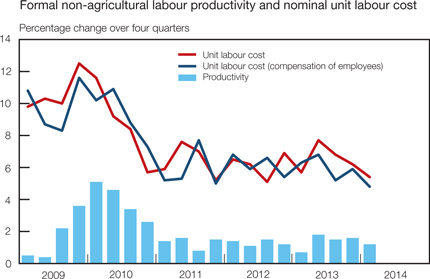

Year-on-year growth in labour productivity decelerated from 1,6 per cent in the fourth quarter of 2013 to 1,2 per cent in the first quarter of 2014 as employment growth remained unchanged while output growth moderated notably in the year to the first quarter of 2014. However, nominal remuneration growth slowed more than output growth in the year to the first quarter of 2014, resulting in nominal unit labour cost in the formal non-agricultural sector of the economy decelerating from 5,9 per cent in the fourth quarter of 2013 to 4,8 per cent in the first quarter of 2014. Similarly, labour productivity growth in the manufacturing sector slowed from 1,2 per cent in the fourth quarter of 2013 to 0,6 per cent in the first quarter of 2014, and nominal unit labour cost in this sector moderated from 7,1 per cent to 6,5 per cent over the same period.

| | |

| | Quarterly Bulletin September 2014 |

Prices

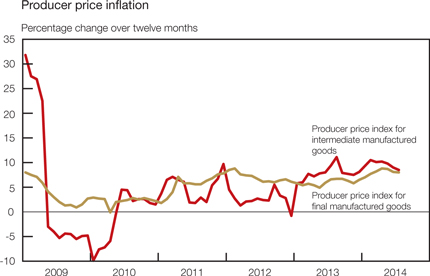

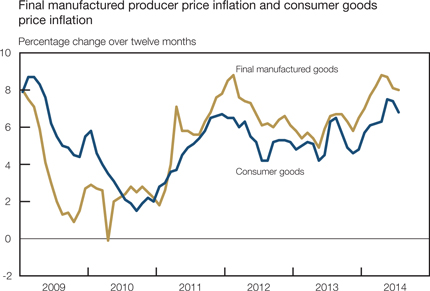

Despite lacklustre output growth, domestic inflationary pressures intensified further in recent months, largely due to an acceleration in petrol and food price inflation and broader exchange rate pass-through to producer and consumer prices. Encouragingly, however, producer price inflation has moderated somewhat since April 2014. Headline twelve-month consumer price inflation accelerated gradually to its highest level since July 2009 when it amounted to 6,6 per cent in both May and June 2014, before moderating to 6,3 per cent in July,3 thereby breaching the upper limit of the inflation target range of 6 per cent for a fourth successive month.

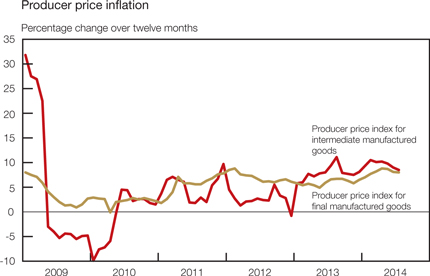

Most measures of producer price inflation accelerated sharply in the opening months of 2014 before moderating towards the middle months of the year. Producer price inflation for intermediate manufactured goods accelerated to 10,5 per cent in February 2014 but slowed gradually thereafter to 8,5 per cent in July as price inflation moderated across a fairly broad spectrum of intermediate manufactured goods. Similarly, producer price inflation for final manufactured goods accelerated to 8,8 per cent in April 2014 as price inflation accelerated across most subcategories. It subsequently moderated to 8,0 per cent in July 2014 on account of a slower pace of increase in the prices of food products, electrical machinery and transport equipment.

| | |

| Quarterly Bulletin September 2014 | |  |

Despite fairly subdued increases in international commodity prices, producer price inflation for mining products quickened from -0,2 per cent in October 2013 to 6,6 per cent in April 2014, affected mainly by the depreciation in the exchange value of the rand. Producer price inflation for mining commodities slowed thereafter to 5,8 per cent in June. Likewise, producer price inflation for agriculture, forestry and fishing products accelerated to 11,7 per cent in March 2014 before moderating to 3,9 per cent in July. Over the same period, producer price inflation for electricity and water also moderated from 14,6 per cent to 7,8 per cent due to a slower pace of increase in both electricity and water prices. The deceleration in all measures of producer price inflation in recent months could possibly be indicative of the diminishing impact and partial reversal of the depreciation in the exchange value of the rand.

Owing in part to the steady depreciation in the exchange value of the rand up to the end of January 2014, the twelve-month rate of increase in the unit value index for imported commodities4 accelerated to 21,0 per cent in January 2014 and roughly maintained the pace of increase in the ensuing five months. Price increases for imported commodities were fairly pervasive among the various subcategories, with the main contributors to the annual increase of 21,5 per cent in June 2014 being textile products, coke oven and other refined petroleum products, pharmaceutical and other chemical products, machinery for mining, quarrying and construction as well as radio, television and communication equipment and apparatus.

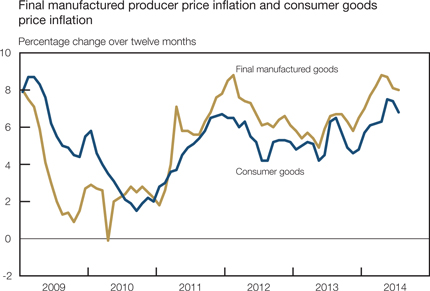

Subsequent to the acceleration in producer price inflation, headline consumer price inflation quickened from a recent low of 5,3 per cent in November 2013 to 6,6 per cent in May and June 2014, before moderating to 6,3 per cent in July. This acceleration could largely be attributed to consumer goods price inflation which accelerated from 4,6 per cent in November 2013 to 7,4 per cent in June 2014; non-durable goods price inflation in particular quickened from 5,4 per cent to 8,4 per cent over the period due to higher food and petrol prices. In addition, further exchange rate pass-through gave rise to an acceleration in semi-durable goods price inflation from 2,9 per cent in October 2013 to 5,1 per cent in July 2014, and in durable goods price inflation from 1,9 per cent to 4,6 per cent over the same period. In particular, price inflation for clothing and footwear quickened to 5,2 per cent in July 2014 while that for new vehicles accelerated to 7,8 per cent in June 2014 – its highest level in almost five years – before slowing to 7,4 per cent in July.

| | |

| | Quarterly Bulletin September 2014 |

Consumer services price inflation remained sticky at the upper limit of the inflation target range; accelerating gradually from 5,7 per cent in February 2014 to 6,0 per cent in both June and July. The marginal pickup in consumer services price inflation in recent months resulted primarily from a quickening in price inflation for housing and utilities, household content and services, restaurants and hotels as well as health and transport insurance services. Conversely, price inflation for communication services moderated further to -0,9 per cent in July 2014. Thus far, the recent marked acceleration in consumer goods price inflation does not appear to have spilled over to consumer services price inflation.

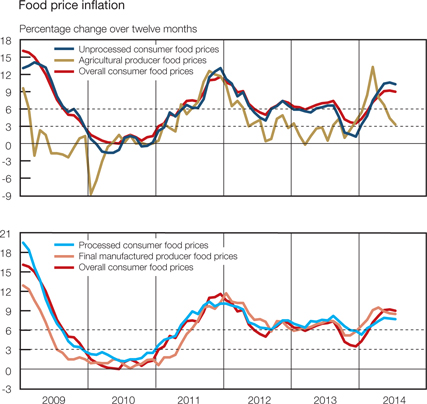

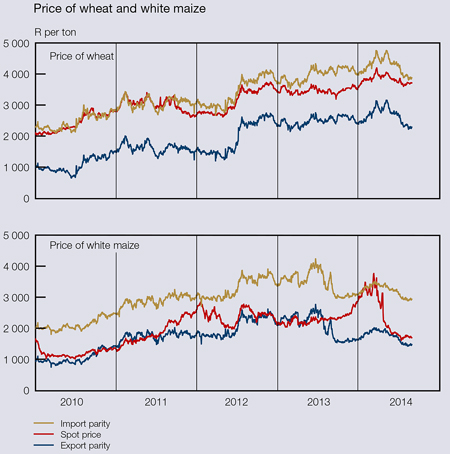

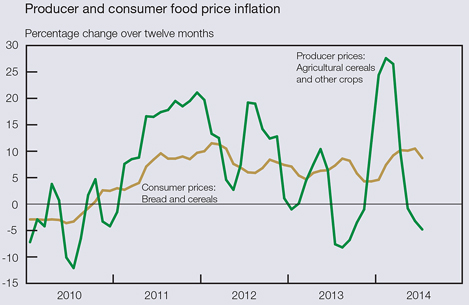

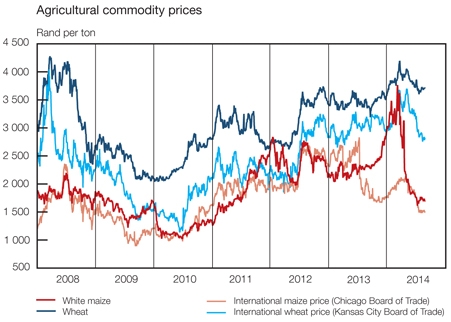

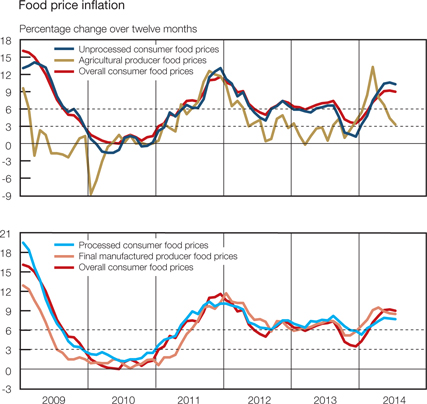

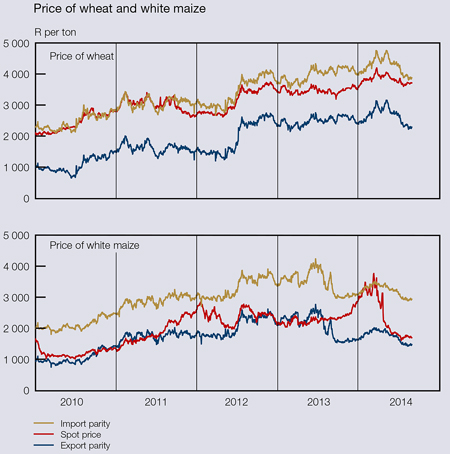

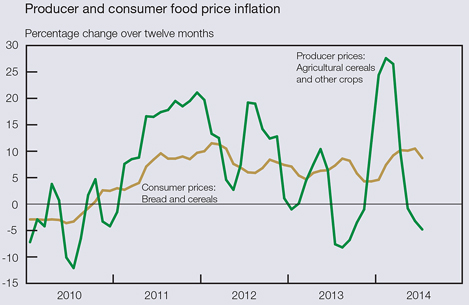

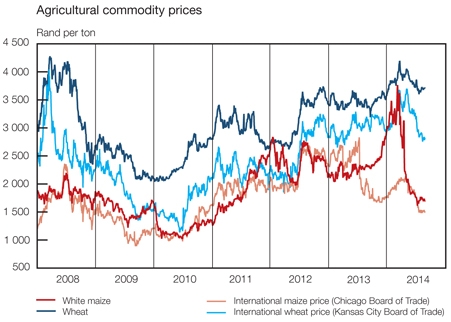

Notwithstanding an environment of slowing global food price inflation, the recent acceleration in domestic inflation could largely be ascribed to a build-up of domestic food price pressure. Agricultural producer price inflation accelerated notably from 1,0 per cent in October 2013 to 13,3 per cent in March 2014 as price inflation quickened among a broad spectrum of agricultural commodities. In particular, producer price inflation for cereals and crops accelerated sharply to 27,6 per cent in February 2014 as domestic maize prices rose significantly on account of drought conditions in the North West Province and fears of maize inventory depletion. Producer price inflation for live animals responded with a slight lag, accelerating to 8,9 per cent in May 2014 on account of rising feed costs and farmers restocking their herds following the drought. Encouragingly, agricultural producer price inflation moderated to 3,9 per cent in July 2014, largely due to a significantly slower pace of increase in the prices of cereals and crops as it became clear that the maize crop would be of near-record size. Producer food prices at the manufactured level responded to higher agricultural producer food prices with a slight lag, accelerating from 5,2 per cent in November 2013 to 9,5 per cent in April 2014, slowing somewhat to 8,5 per cent in July. The upward trend in final manufactured producer food price inflation was fairly pervasive among the various food subcategories.

| | |

| Quarterly Bulletin September 2014 | |  |

The acceleration in agricultural producer food price inflation led to a quickening in unprocessed consumer food price inflation from 1,2 per cent in December 2013 to 10,6 per cent in June 2014. Similarly, processed consumer food price inflation picked up pace and amounted to 7,9 per cent in May 2014 on account of the acceleration in final manufactured producer food price inflation. Accordingly, overall consumer food price inflation accelerated markedly from 3,5 per cent in December 2013 to 9,2 per cent in June 2014 – the highest rate of increase in 28 months. The faster pace of increase in consumer food prices was broad-based among the various consumer food subcategories as seven of the nine food categories – with a combined weight of 94 per cent in the consumer food price basket – registered twelve-month rates of increase in excess of the upper limit of the inflation target range in June 2014. Consumer food price inflation moderated marginally to 9,0 per cent in July 2014, suggesting that consumer food price inflation was nearing a peak as falling agricultural commodity prices were expected to be passed on to consumers.

Consumer food prices

Percentage change over twelve months

| | | | | | | | | | | | | | | | |

| | | Weights | | | 2014 | |

| | | | May | | | Jun | | | Jul | |

Bread and cereals | | | 3,55 | | | | 10,1 | | | | 10,5 | | | | 8,7 | |

Meat | | | 4,56 | | | | 8,2 | | | | 8,7 | | | | 8,7 | |

Fish | | | 0,37 | | | | 8,1 | | | | 8,3 | | | | 8,0 | |

Milk, cheese and eggs | | | 1,74 | | | | 9,9 | | | | 10,1 | | | | 11,7 | |

Oils and fats | | | 0,55 | | | | 4,2 | | | | 3,3 | | | | 2,7 | |

Fruit | | | 0,23 | | | | 5,7 | | | | 1,5 | | | | 2,3 | |

Vegetables | | | 1,61 | | | | 13,3 | | | | 12,3 | | | | 11,8 | |

Sugar, sweets and desserts | | | 0,65 | | | | 6,4 | | | | 6,3 | | | | 7,7 | |

Other foods | | | 0,94 | | | | 8,1 | | | | 7,1 | | | | 8,6 | |

All food items | | | 14,20 | | | | 9,1 | | | | 9,2 | | | | 9,0 | |

Following a pickup in the opening months of 2014, the international food price index (denominated in US dollar) of the Food and Agriculture Organization (FAO) receded in the four months to July, largely due to a marked decrease in cereal and vegetable oil prices. As a result, international food prices were 1,7 per cent lower in July 2014 than a year earlier. At the same time, the international cereals price index decreased notably due to falling maize and wheat prices reflecting, inter alia, favourable weather conditions, good supply prospects for 2014/15 and diminishing concerns over disruptions of shipments from Ukraine. Encouragingly, international cereals prices remained 16,6 per cent below their level twelve months earlier, suggesting muted international food price pressure on domestic food price inflation in the months ahead.

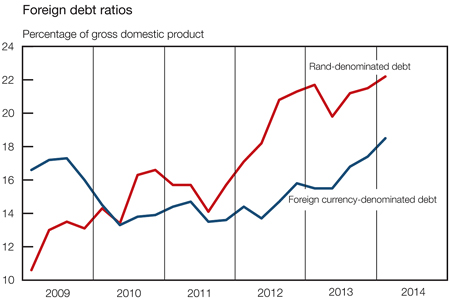

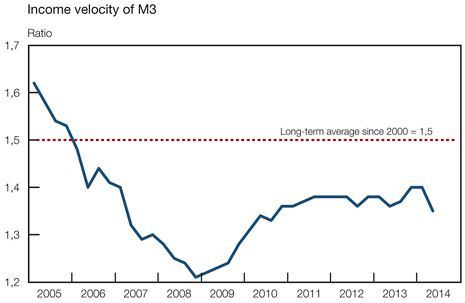

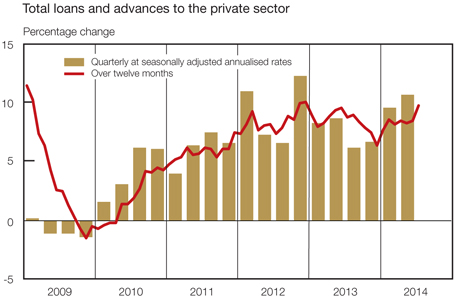

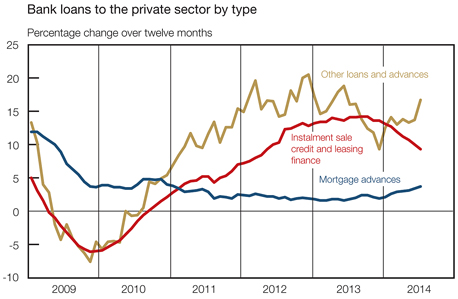

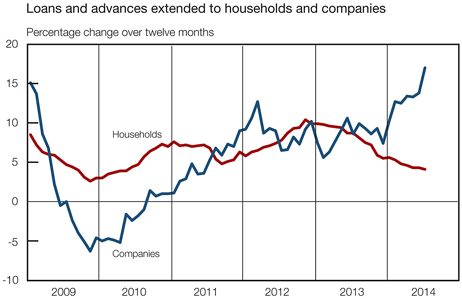

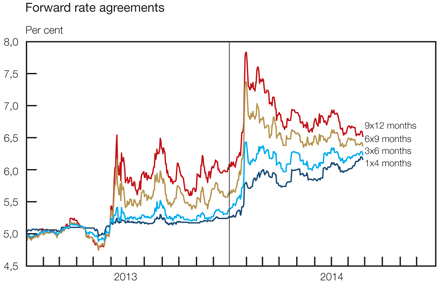

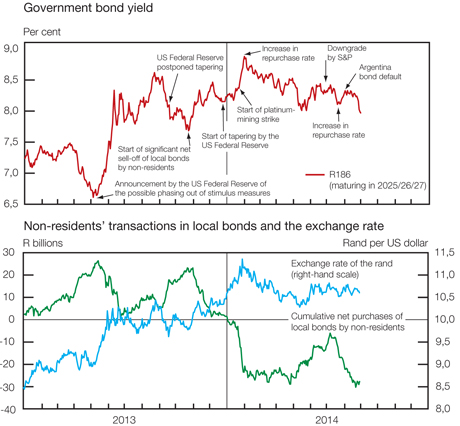

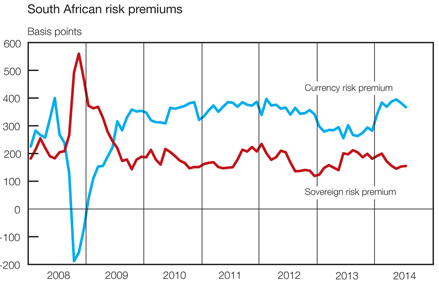

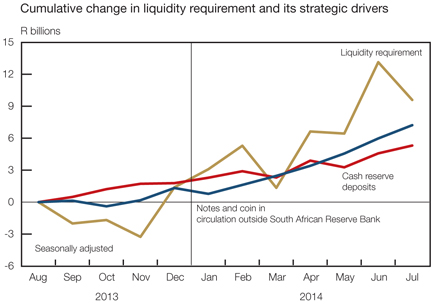

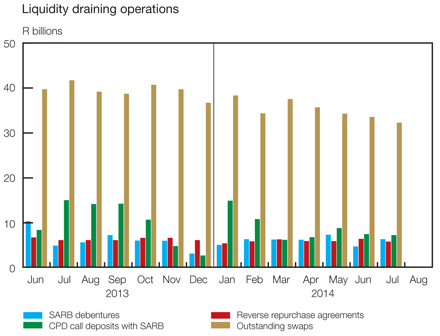

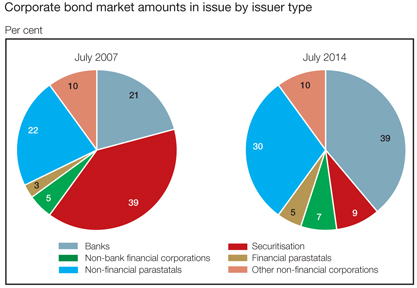

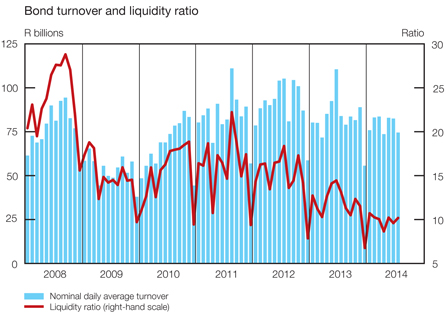

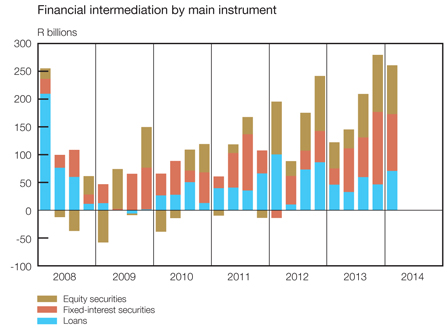

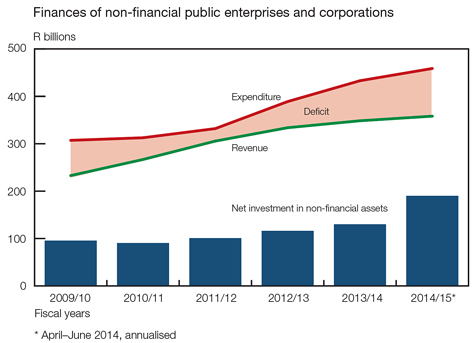

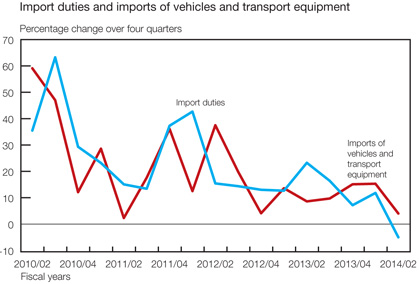

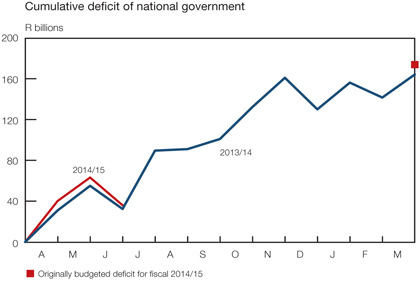

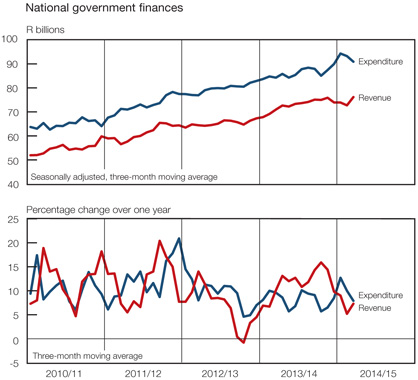

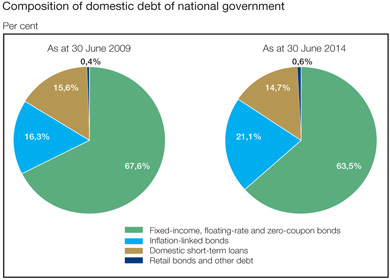

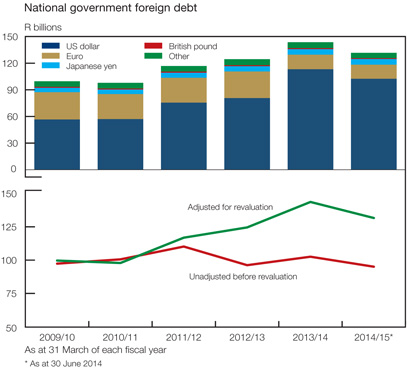

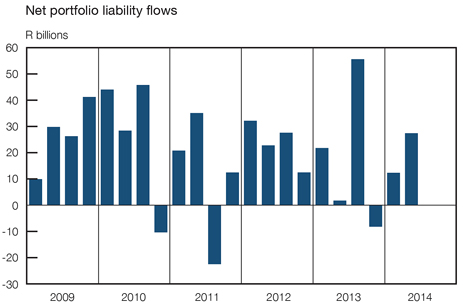

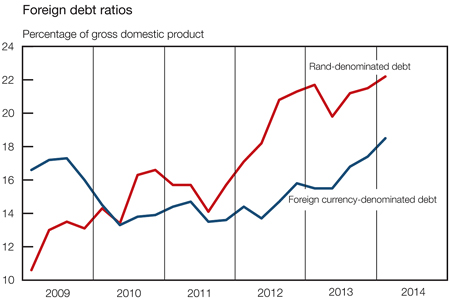

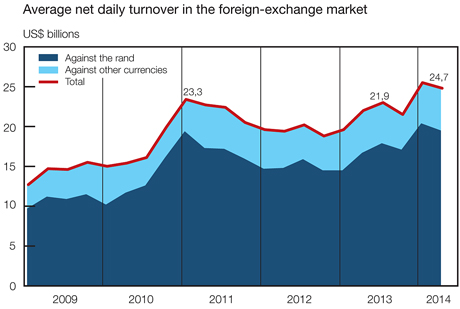

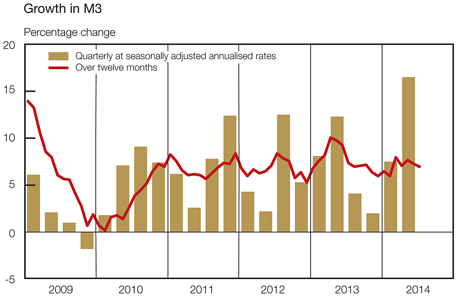

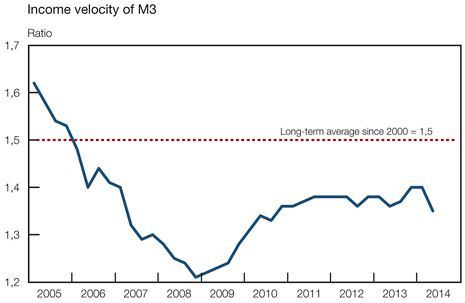

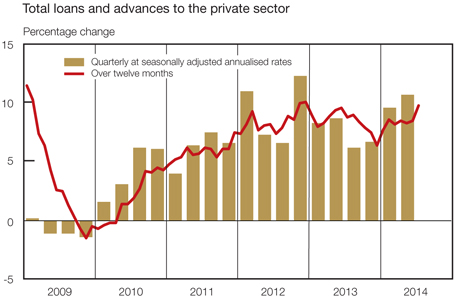

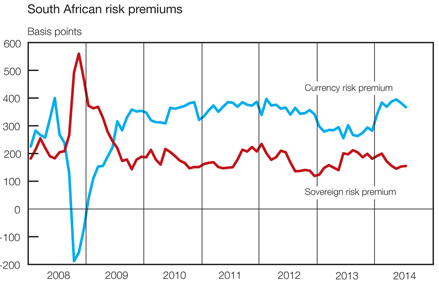

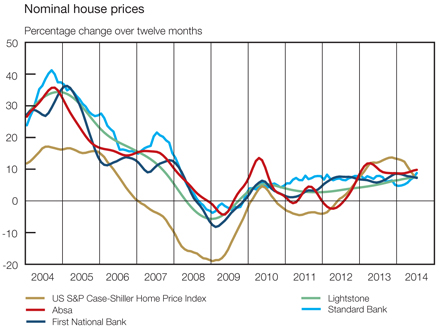

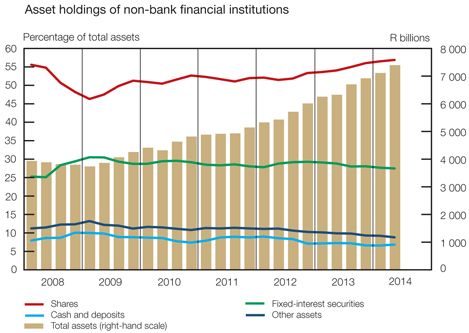

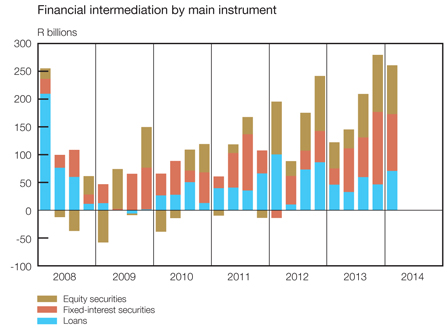

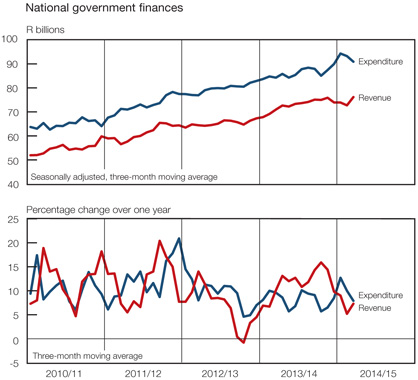

Box 2: Recent maize and wheat price dynamics and their effect on expected food price inflation outcomes