Exhibit 99.D

Medium Term Budget Policy Statement 2018 National Treasury Republic of South Africa 24 October 2018

ISBN: 978-0-621-46859-5RP: RP415/2018The Medium Term Budget Policy Statement is compiled using the latest available information from departmental and other sources. Some of this information is unaudited or subject to revision. To obtain additional copies of this document, please contact: Communications Directorate National Treasury Private Bag X115 Pretoria 0001 South Africa Tel: +27 12 315 5944 Fax: +27 12 407 9055 The document is also available on the internet at: www.treasury.gov.za. ii

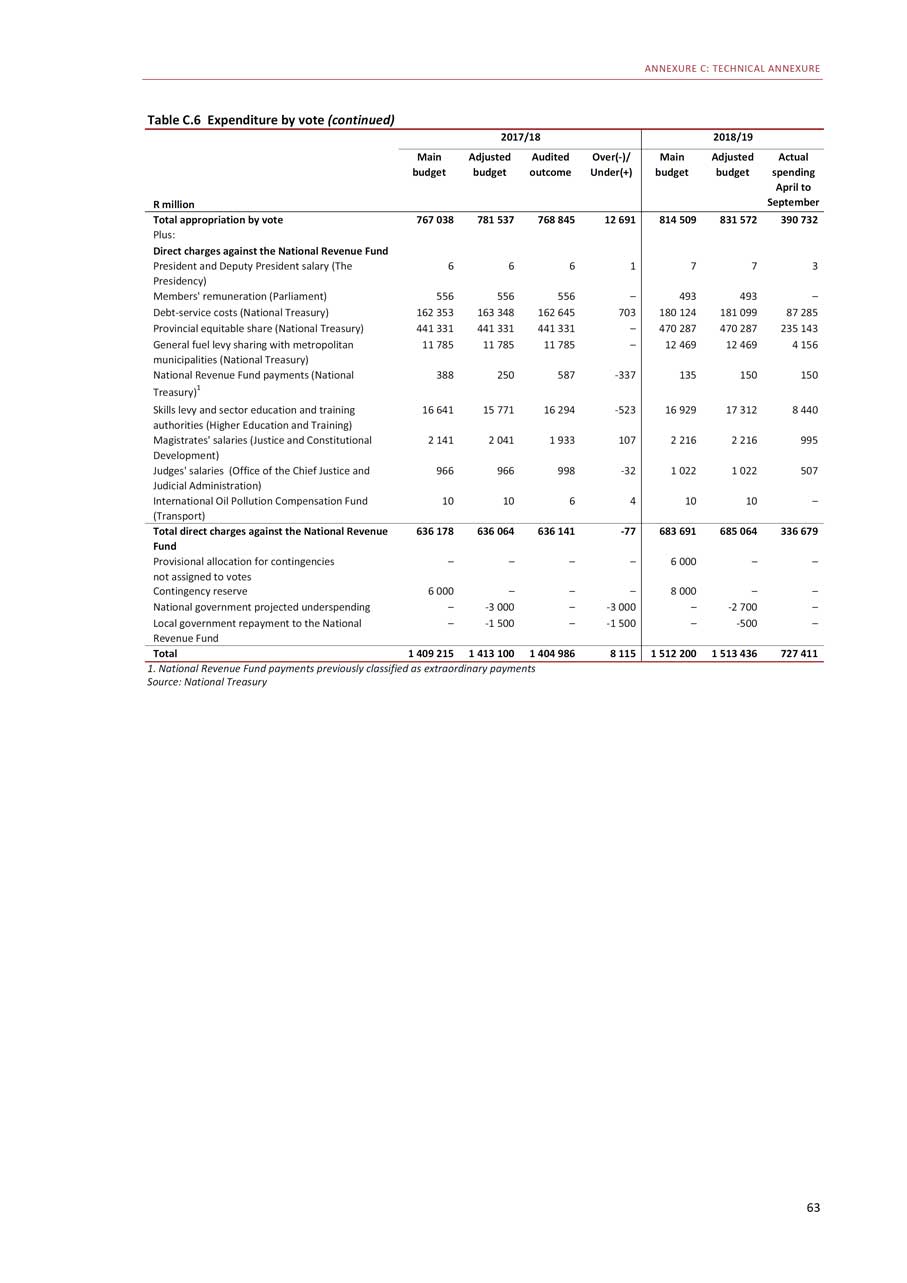

Foreword The South African economy is at a crossroads. Since the presentation of the 2018 Budget, we have experienced a technical recession. Although the outlook for global growth is positive, there are storm clouds on the horizon, with growing risks for developing countries as trade tensions mount and financial conditions tighten. We have been able to avoid the most damaging circumstances that have affected other developing countries owing to our strong macroeconomic framework and prudent debt management. Yet we too have experienced some devaluation of our currency and rising bond yields. The central challenges we confront as a nation are to raise economic growth and reduce unemployment. GDP growth is now expected to average 0.7 per cent in 2018, rising gradually to 2.3 per cent by 2021. At 27 per cent, the unemployment rate remains alarmingly high. Government needs to take some difficult decisions to get the economy on a higher growth path and to encourage job creation. Over the medium term, the President’s plan to support economic recovery provides essential elements needed to bolster confidence. A crucial component of this package is our intention to partner with the private sector to increase investment in public infrastructure. We are establishing an infrastructure fund that provides a clear signal to investors, draws on technical expertise, and supports improved project assessment, planning and implementation. Over the longer term, we require reforms to change the structure of our economy, raise productivity, increase competition and reduce the cost of doing business. We also need to find a way to sustainably manage government’s wage bill, which consumes about 35 per cent of public resources. Despite tax increases announced in February, revenue growth projections have been revised down. As a result, government’s borrowing requirement increases over the next few years. The expenditure ceiling, however, is unchanged from the 2018 Budget. Government remains committed to ensuring fiscal sustainability. The gross debt-to-GDP ratio is expected to stabilise at 59.6 per cent by 2023/24. Nonetheless, public expenditure continues to grow in real terms. Over the next three years, government will spend R5.9 trillion, including R1.9 trillion on health and education, and R911 billion on social development. We must be frank about the challenges we confront. The quality of public expenditure is often poor and governance problems are often severe, particularly in provincial and local government, and state-owned companies. Government is tackling these problems. As reforms take hold, economic activity, revenue collection and public spending efficiency should improve. In the interim, however, distressed institutions at all levels of the public sector are risks to the public finances. I would like to thank my predecessor, former Minister Nhlanhla Nene, as well as Deputy Minister Mondli Gungubele, the Director-General and the staff of the National Treasury for their commitment to the Constitution, and their diligence in protecting the public finances on behalf of all South Africans. I can promise my new colleagues in the National Treasury that much more hard work lies ahead for all of us in the interests of our country. TT Mboweni Minister of Finance iii

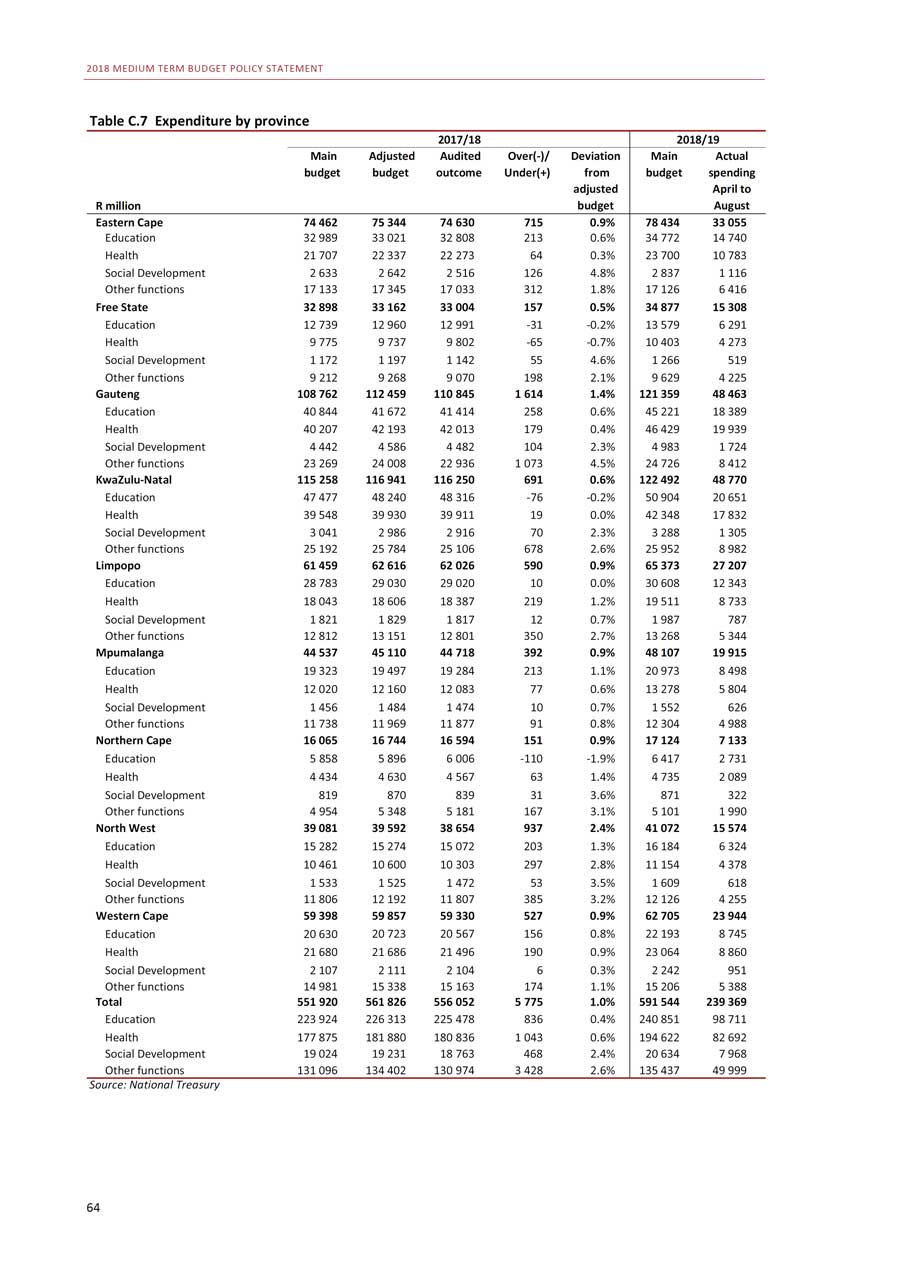

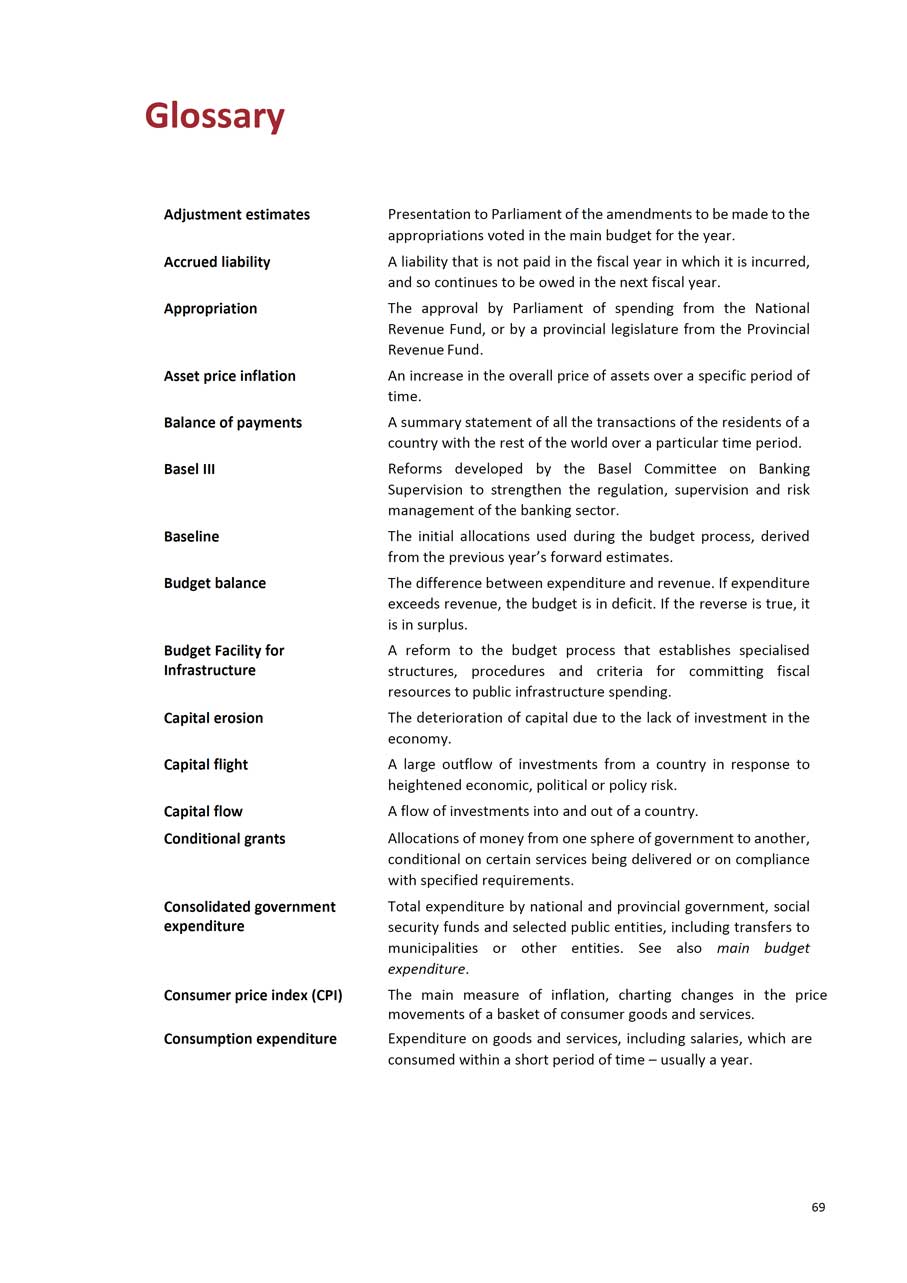

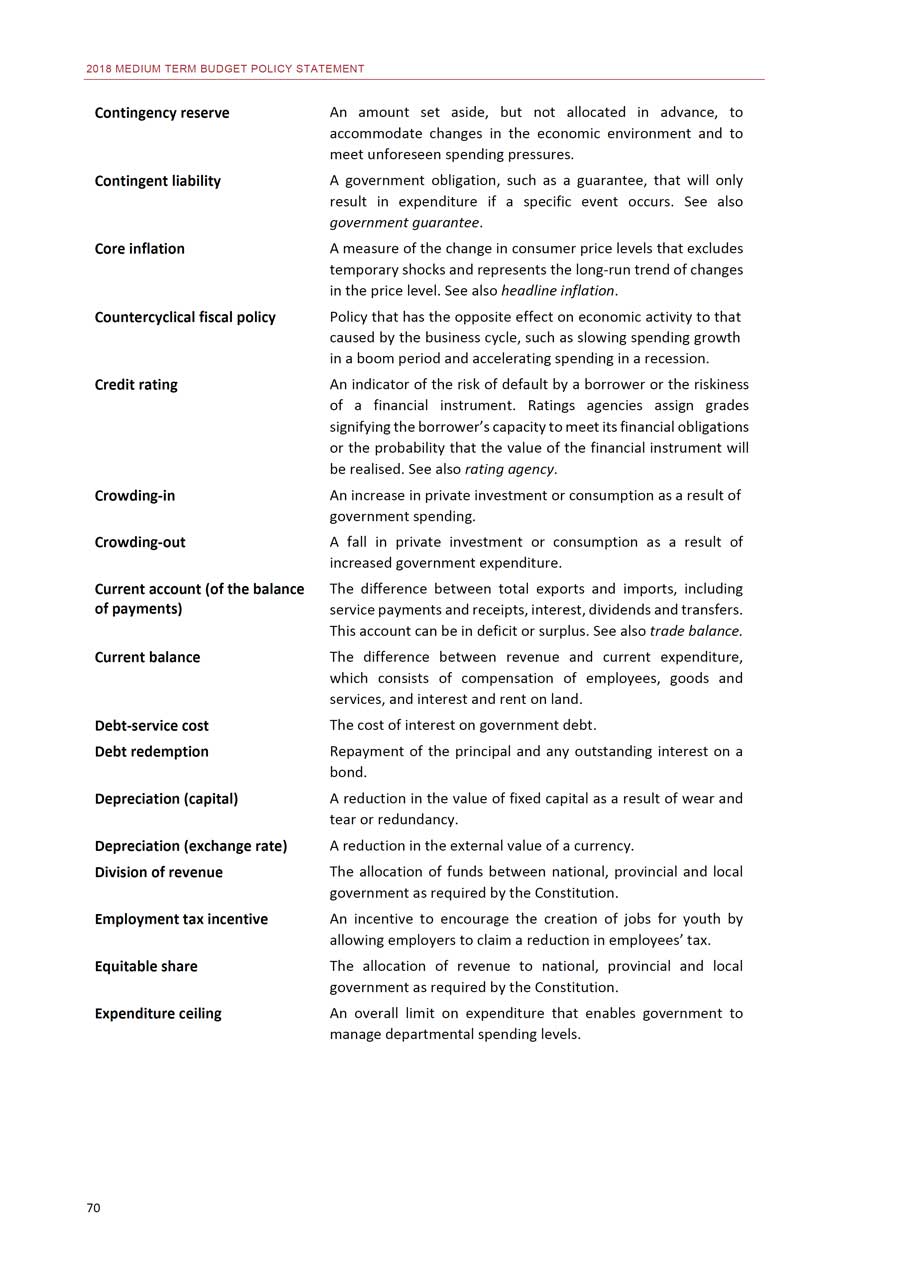

Contents Chapter 1 The economy at a crossroads…………..…………………………………………………. 1Introduction……………………………………………………..…………………………………. 1Restoring confidence and strengthening investment..………………………… 2Rebuilding state institutions.…………………..………………………………………….. 5Overview of the MTBPS.…………………………………..……………………… 6Conclusion …………………………………………..……………………………………………… 8Chapter 2 Economic overview………………………………………..…………….…………………….. 9Boosting growth, investment and job creation……………………………………. 9Global outlook…………………………………………..………………………………………… 10Domestic outlook………………………………………………………………………………… 11Sector performance and outlook…………………………………………………………. 15Implementing growth-enhancing reforms…………………………………………… 16Conclusion…………………………………………………………………………………………… 18Chapter 3 Fiscal policy………………..………………………………..…………………………………….. 19Fiscal resilience in a constrained environment………………..………… 19Revenue performance and outlook……………………………………………………… 20Expenditure performance and outlook………………………………………………… 23Fiscal framework.……………………………………… ……………………………………….. 25Financing and debt management strategy.…………………………………………. 27Risks to the fiscal outlook……………………………………………………………………. 28Conclusion…………………………………………………………………………………………… 28Chapter 4 Expenditure priorities…………………………………………..……………………………. 29Introduction………………………………………………………………………………………… 29Expenditure priorities and pressures….…..…………………………………………… 30In-year spending adjustments……………………………………………………………… 32Spending priorities by function group…………………………………..…………….. 33Division of revenue……….…………………………………………..………………………… 37Conclusion………………………………………………………..…………………………………. 40Annexure A Fiscal risk statement…………………………………………..………………………………. 43Annexure B Compensation data……..……………………………………………………………………… 51Annexure C Technical annexure…………………………………………………………………………….. 57Annexure D Glossary………………………………………………………………………………………..……. 69iv

Tables1.1 Macroeconomic projections..………….1.2 Consolidated government fiscalframework….…………………………………..1.3 Consolidated governmentexpenditure ...…………………………………2.1 Economic growth in selectedcountries…………………………………………2.2 Macroeconomic performance andprojections……………………………………..2.3 Assumptions used in the economicforecast ……………………...………………….3.1 Gross tax revenue…………………………..3.2 Revised revenue projections……….….3.3 Medium-term revenue framework …3.4 Main budget expenditure ceiling…….3.5 Revisions to the 2018/19expenditure ceiling …………………………3.6 Main budget framework ..………………3.7 Consolidated fiscal framework………..3.8 Total national government debt……..3.9 National government grossborrowing requirement and financing…………………………………………4.1 Consolidated expenditure byfunction.…………………………………………4.2 Consolidated expenditure byeconomic classification……………………4.3 Division of revenue framework……….4.4 Changes to division of revenue ………4.5 Provincial equitable share……………….

Figures7 1.1 Growth in fixed-capital stock………….. 31.2 Growth in fixed-capital stock by7 sector……………………………………………… 32.1 Headline, food and administered8 price inflation…………………………………. 143.1 Main budget primary balance..….…… 2011 3.2 Gross debt-to-GDP outlook..…………… 203.3 Real main budget non-interest12 spending growth.……………………………. 244.1 Average nominal growth in spending 3114 4.2 Consolidated government21 expenditure by function…………………. 31 22222324262627283032373838v

1 The economy at a crossroads In brief South Africa finds itself at a crossroads. This Medium Term Budget Policy Statement (MTBPS) highlights the difficult economic and fiscal choices confronting government over the next several years. During 2018, South Africa has faced lower-than-expected economic growth and exchange rate depreciation. The global outlook remains positive, but is characterised by greater risk, particularly for developing economies. State institutions are being repaired and renewed, but serious governance challenges exist across the public sector. Government remains committed to fiscal sustainability, but there has been fiscal slippage since the 2018 Budget. Tax revenues have been revised down, partly due to higher value-added tax refunds. Despite spending pressures materialising, the expenditure ceiling remains intact as the anchor of fiscal policy. The consolidated budget deficit narrows from 4.2 per cent in 2019/20 to 4 per cent in 2021/22. Gross debt is expected to stabilise at 59.6 per cent of GDP in 2023/24. The President’s economic stimulus and recovery plan is intended to address the country’s most pressing challenges: anaemic economic growth and high unemployment. The initiative includes an infrastructure fund to be developed in partnership with the private sector, reforms to enhance economic growth and improve governance, and support for urgent education and health needs.

Introductionhe medium-term expenditure framework (MTEF) commits public resources of R5.9 trillion over the next three years. Of this amount,

R5.9 trillion of spending commitments complemented

R3.3 trillion or 56.2 per cent will be allocated to education, health, by balanced effort to

the provision of water and electricity services, and social grants. At the same time, government intends to consolidate the public finances in a balanced manner by maintaining the spending ceiling and ensuring that debt stabilises over the longer term.In combination, these commitments support economic and social development, and ensure sustainable support to millions of South Africans who live in poverty. Yet the resources available cannot be substantially expanded without faster economic growth and job creation. Poor economic performance in the first half of the year has put additional strain on the public finances. Unemployment remains elevated, and many low-

consolidate public finances1

2018 MEDIUM TERM BUDGET POLICY STATEMENT and middle-income households are contending with higher prices for water, electricity and transport. Governance failures and corruption have harmed public service delivery. Economic recovery requires a substantial improvement in business investment. The President has taken the lead in rebuilding confidence by appointing a team of investment advisors. The October 2018 Investment Conference will help to restore policy certainty.

Focus on reforms that support economic growth, reduceinflationary pressures and improve service deliveryPublic-service wageagreement exceeds budgeted baselines by R30.2 billionInflation targeting, flexible exchange rate and prudent debt management reduced effects of external volatility2

Over the period ahead, government is focusing on reforms that support economic growth, reduce inflationary pressures and improve service delivery. Fiscal options have become increasingly limited, and higher revenues need to flow from a broad-based economic expansion.Accordingly, this MTBPS prioritises three interlinked policy areas:• Implementing the President’s economic stimulus and recovery plan, particularly by encouraging private-sector investment.• Improving governance and financial management in national, provincial and local government departments to support service delivery.• Reforming state-owned companies. Improving the financial health of the major state-owned companies will take time, but measures arebeing taken to strengthen governance.Further steps are being taken to strengthen infrastructure planning and address shortcomings in public administration and finances. This includes the work of commissions investigating corruption and governance failures at several institutions, along with ongoing management training, financial strengthening and organisational renewal across the public sector.Government’s compensation bill accounts for about 35 per cent of consolidated expenditure, and forms the major driver of spending pressures. The 2018 public-service wage agreement exceeds budgeted baselines by about R30.2 billion through 2020/21. National and provincial departments are expected to absorb these costs within their R1.8 trillion compensation baselines over the same period. Government is working on an approach to manage these pressures over the medium term.Restoring confidence and strengthening investmentThe 2018 Budget set out expectations of improved economic performance that proved premature. During the first half of this year, South Africa experienced a technical recession - that is, declining quarter-on-quarter GDP - driven primarily by contractions in agriculture and mining.A strengthening US dollar and rising global interest rates have triggered fiscal crises in several major developing countries. South Africa’s inflation targeting regime, flexible exchange rate and prudent debt management strategy have protected the economy from some of the global fallout. But these events have led to a sharp depreciation of the rand and large increases in government bond yields.To promote a return to faster growth and job creation, the President announced an economic stimulus and recovery plan in September 2018. The initiative focuses on five interventions:

CHAPTER 1: THE ECONOMY AT A CROSSROADS • Implementing growth-enhancing economic reforms • Reprioritising public spending to support economic growth and job creation • Establishing an infrastructure fund • Addressing urgent matters in education and health • Investing in municipal social infrastructure improvement. Boosting infrastructure investment

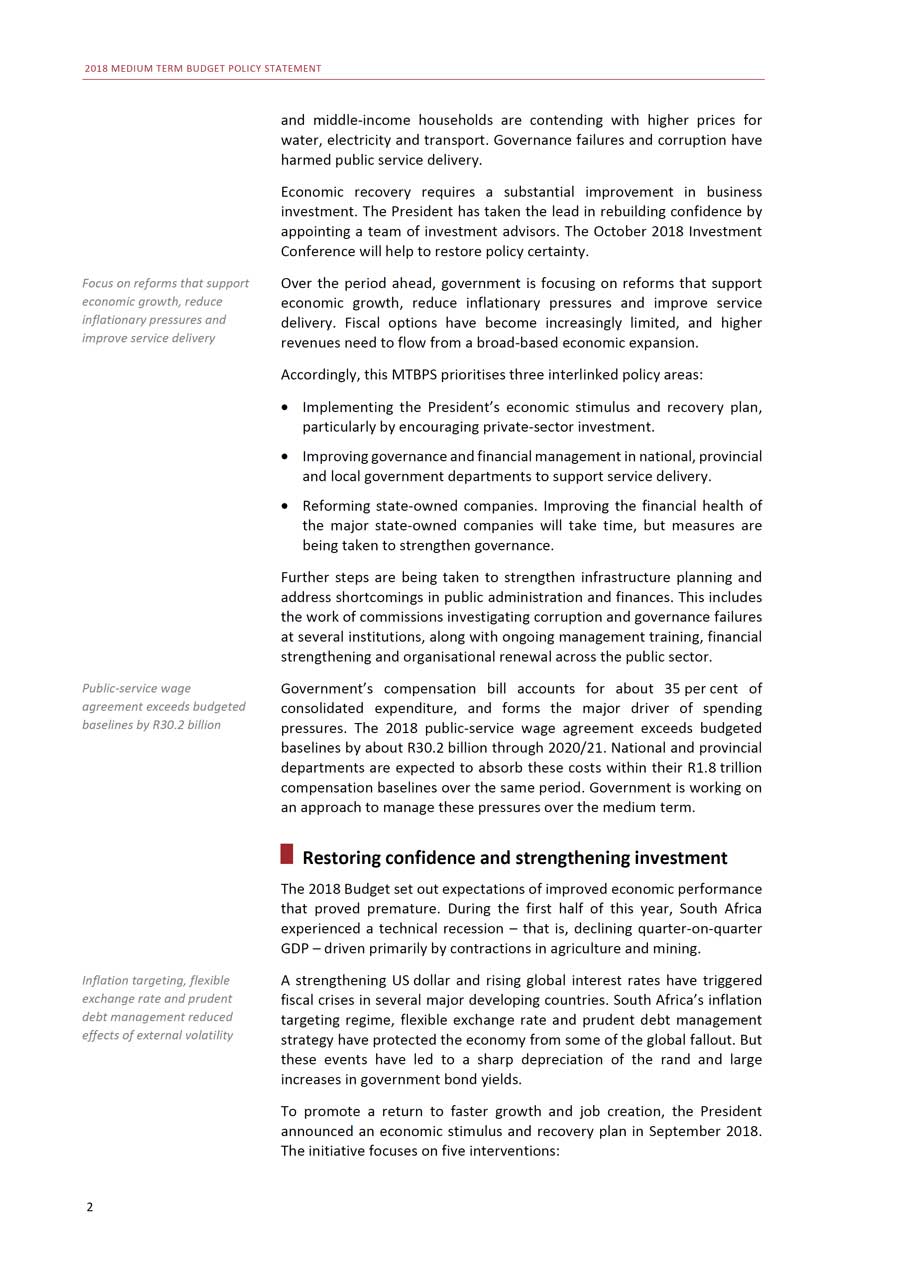

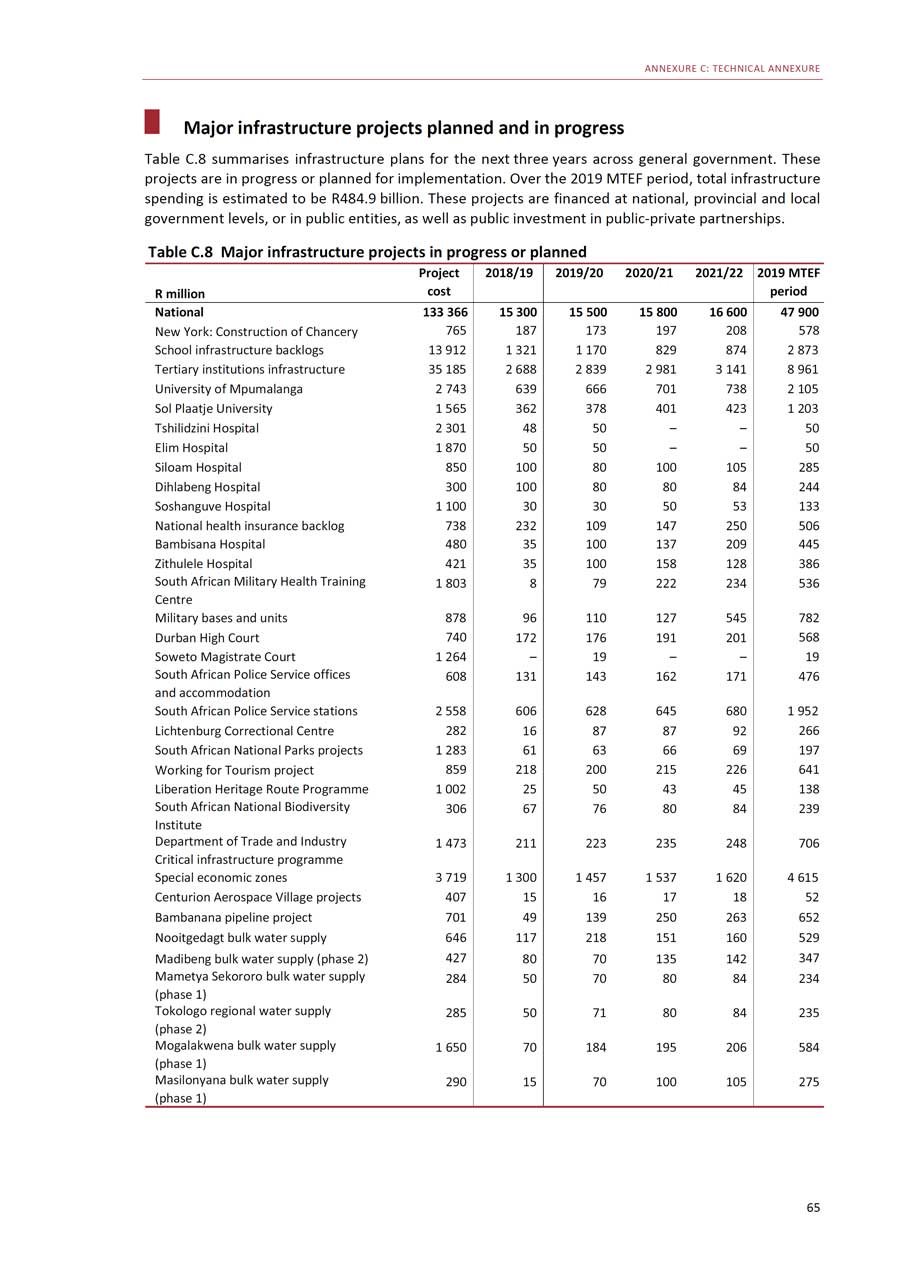

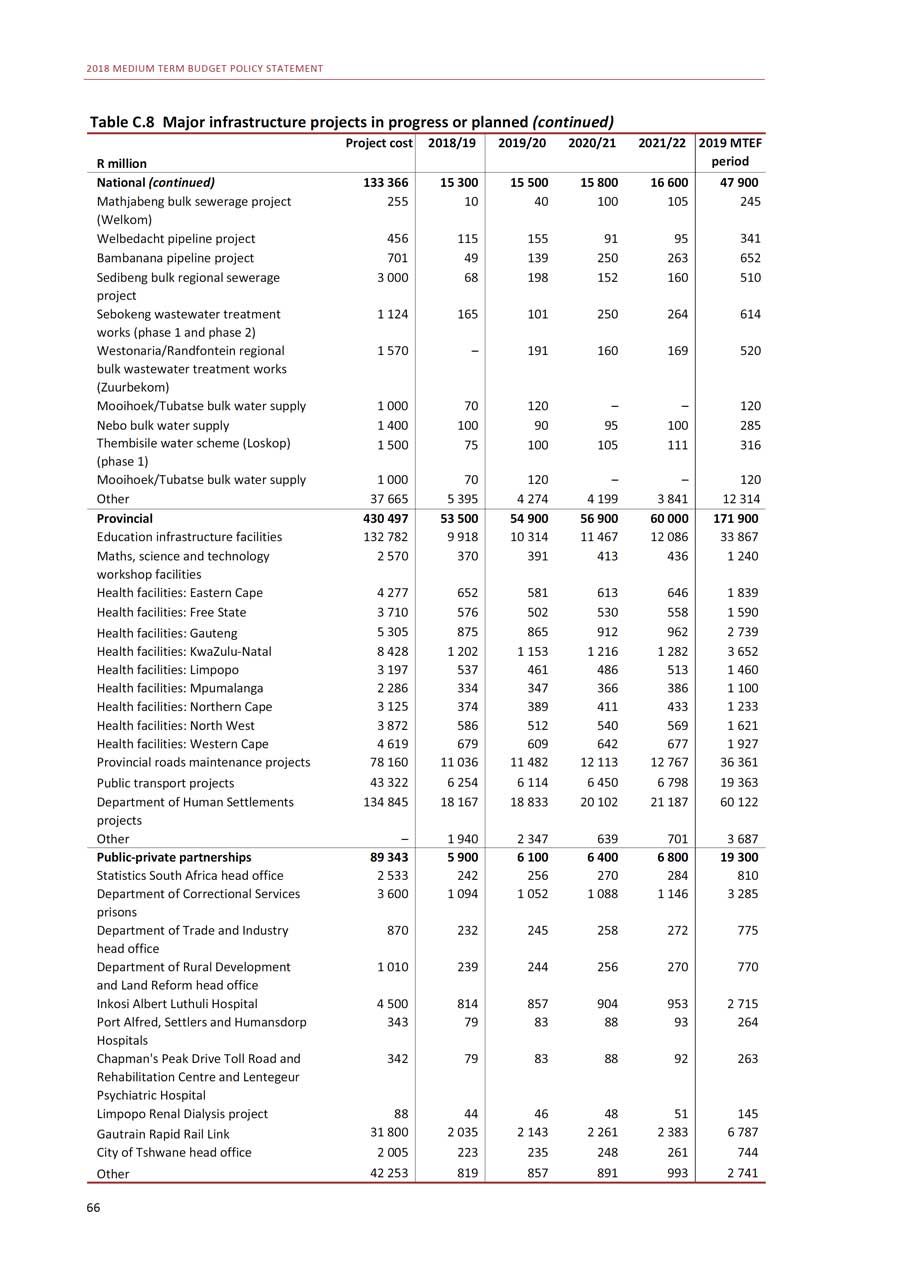

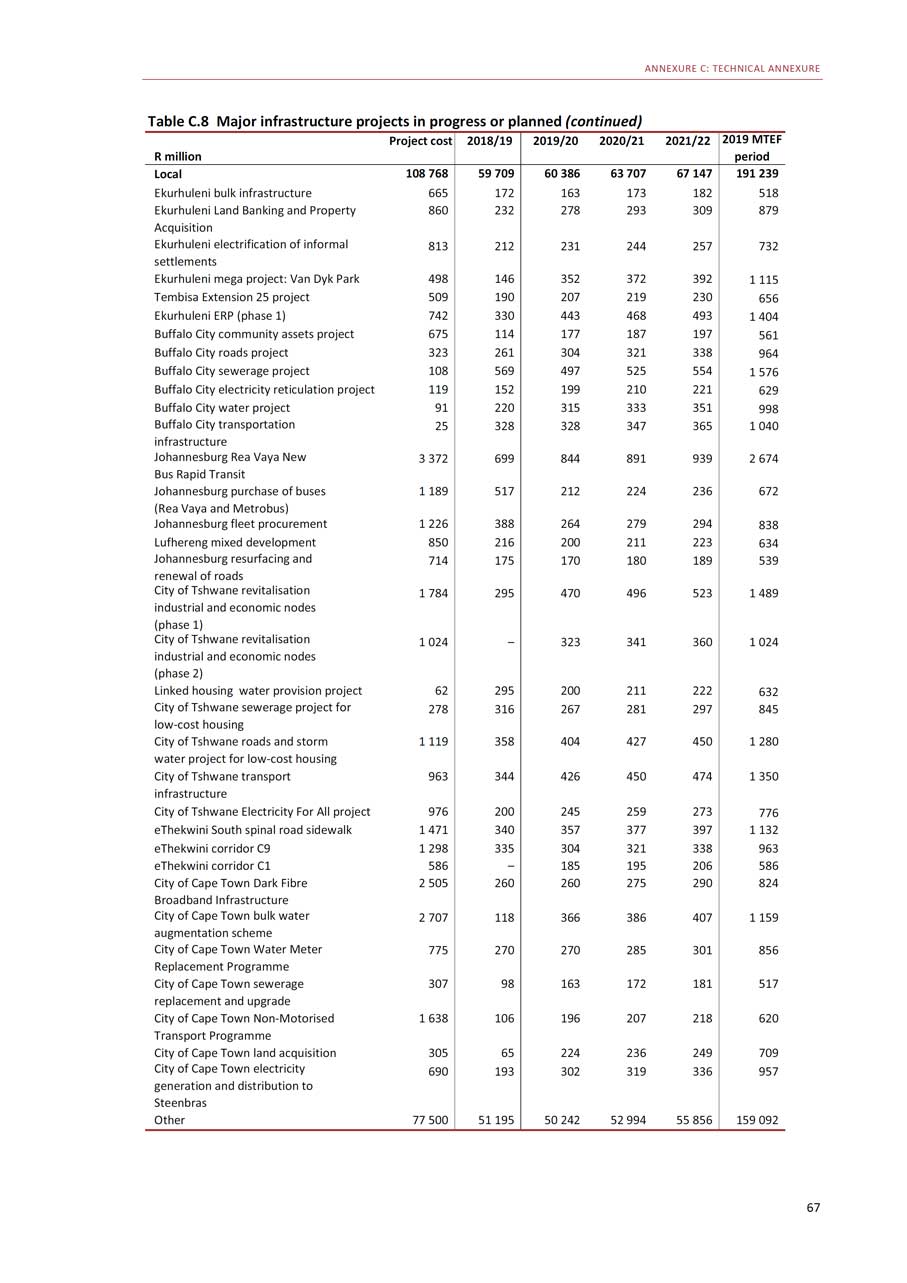

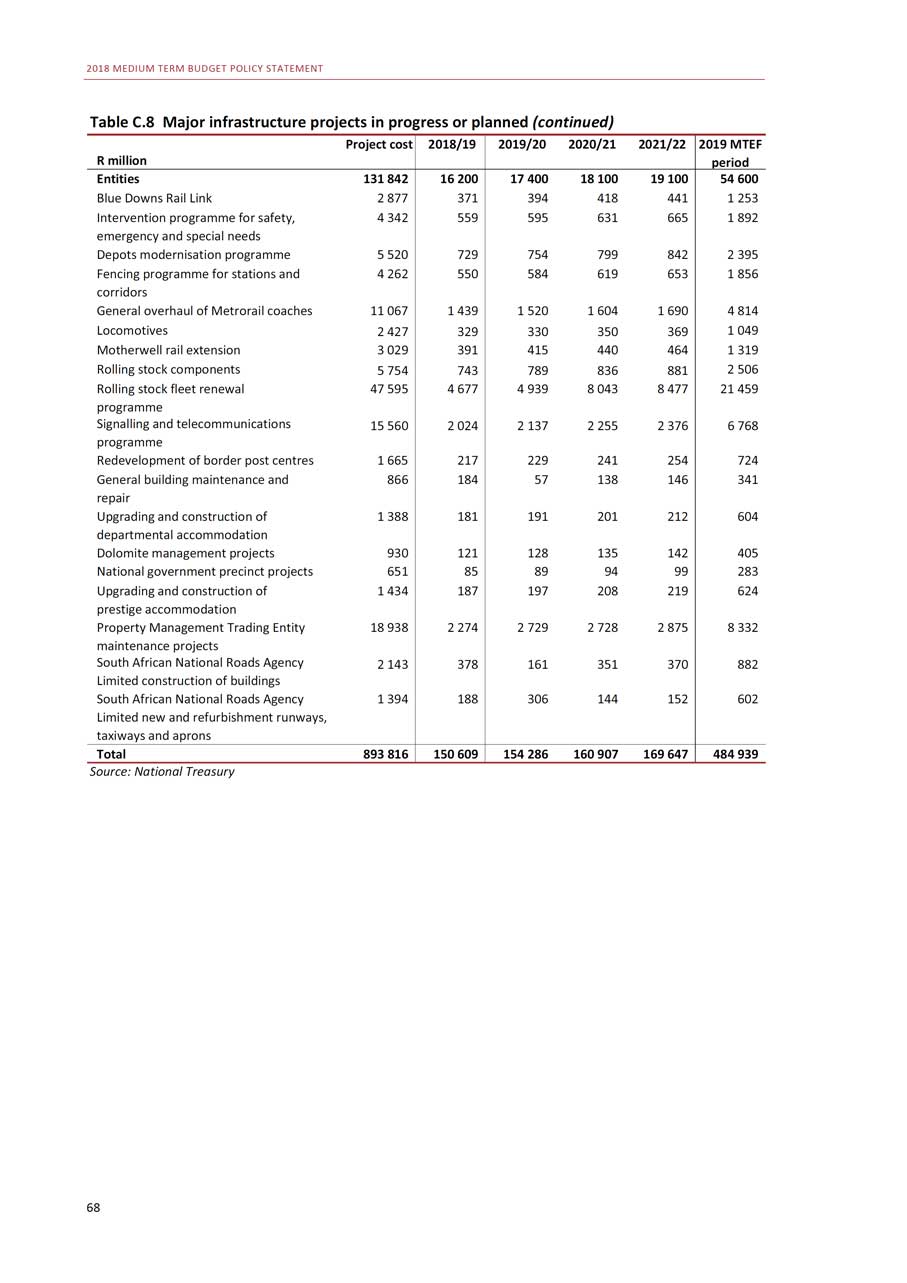

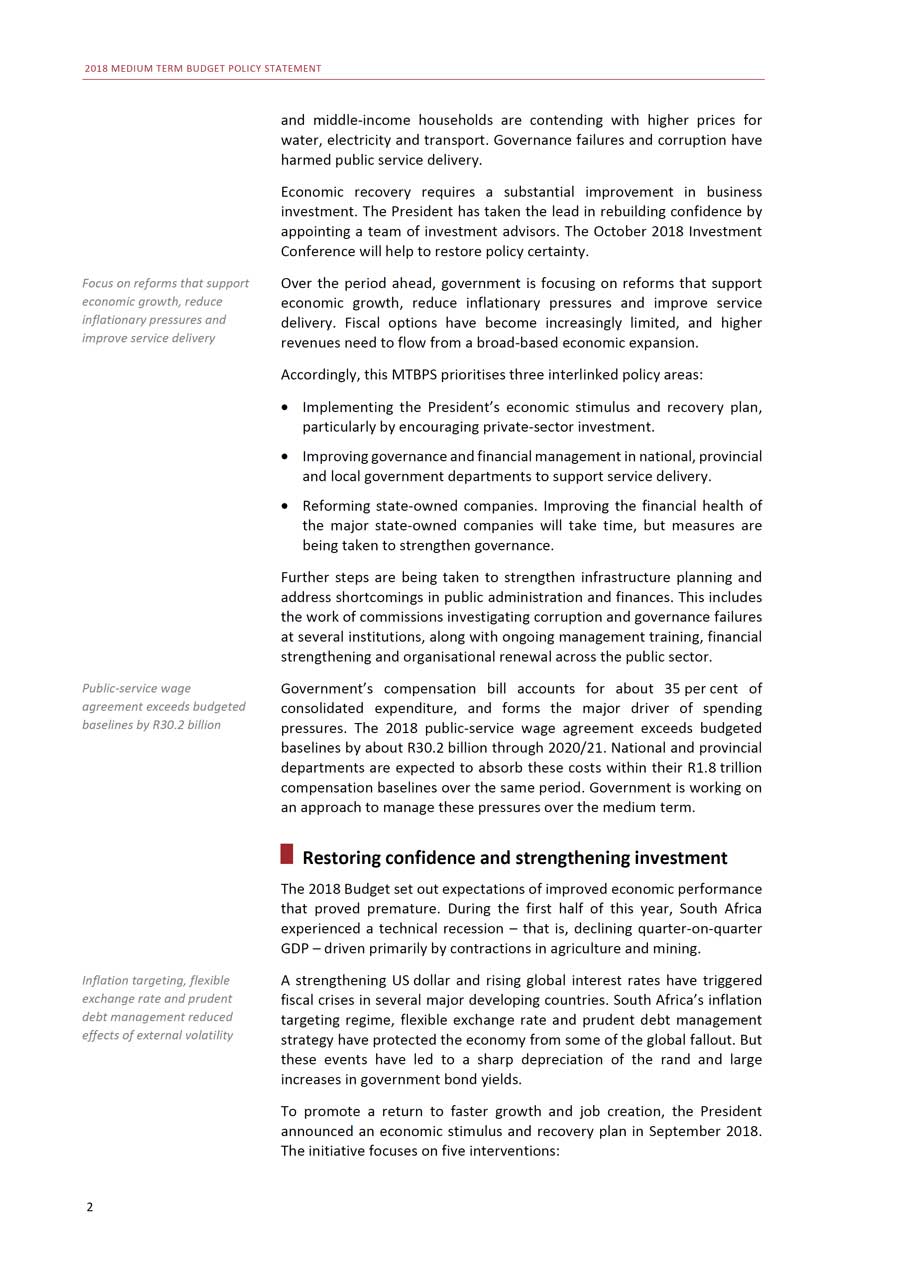

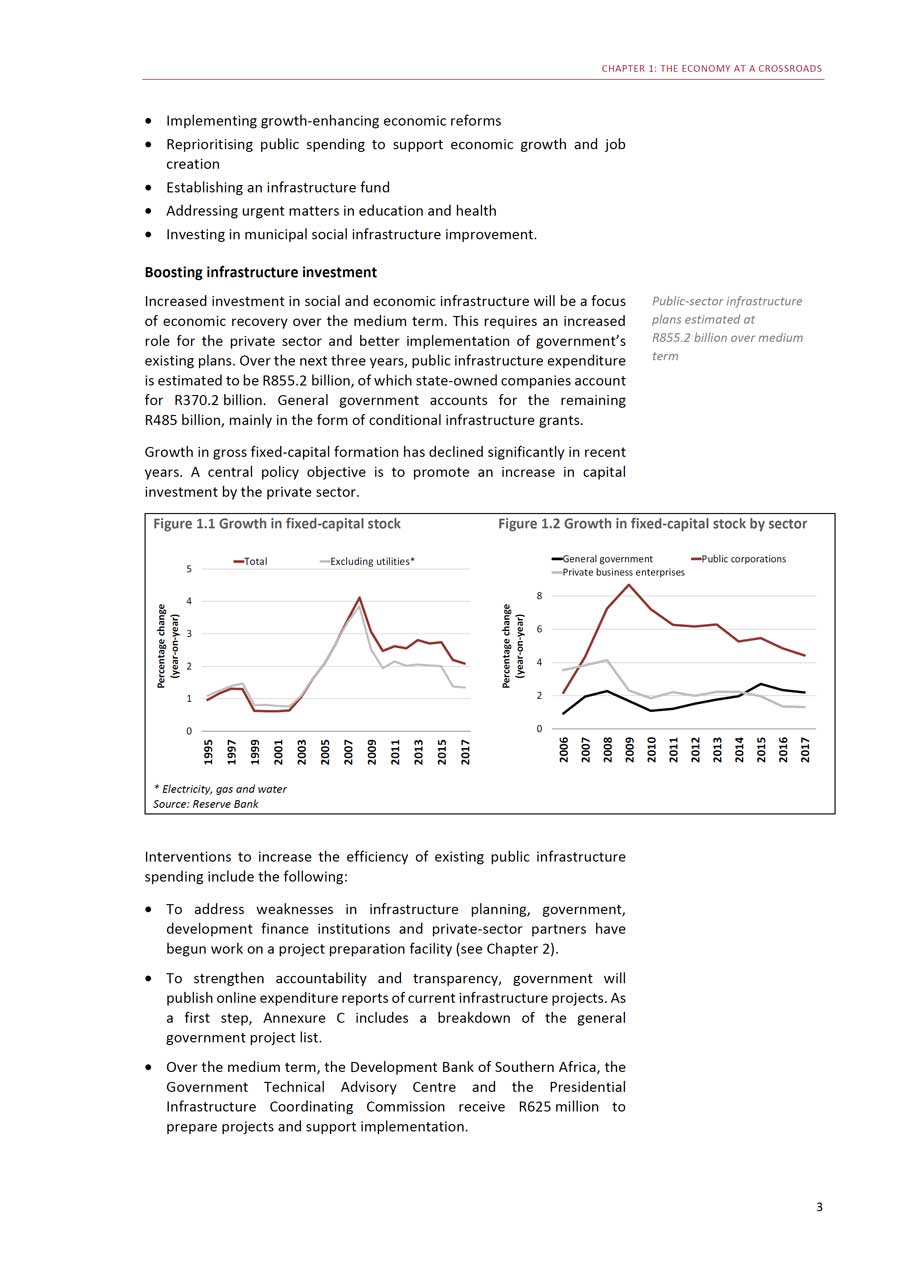

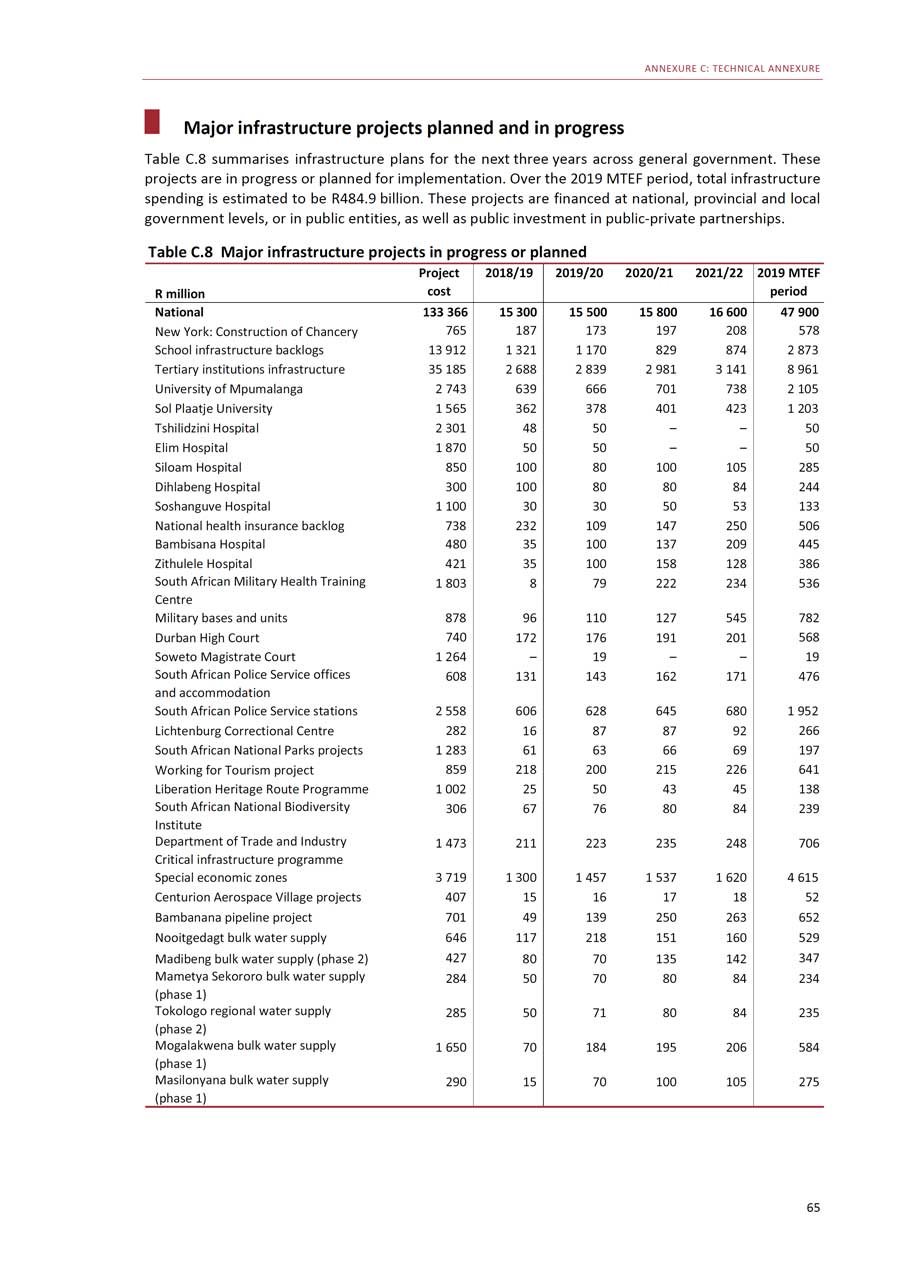

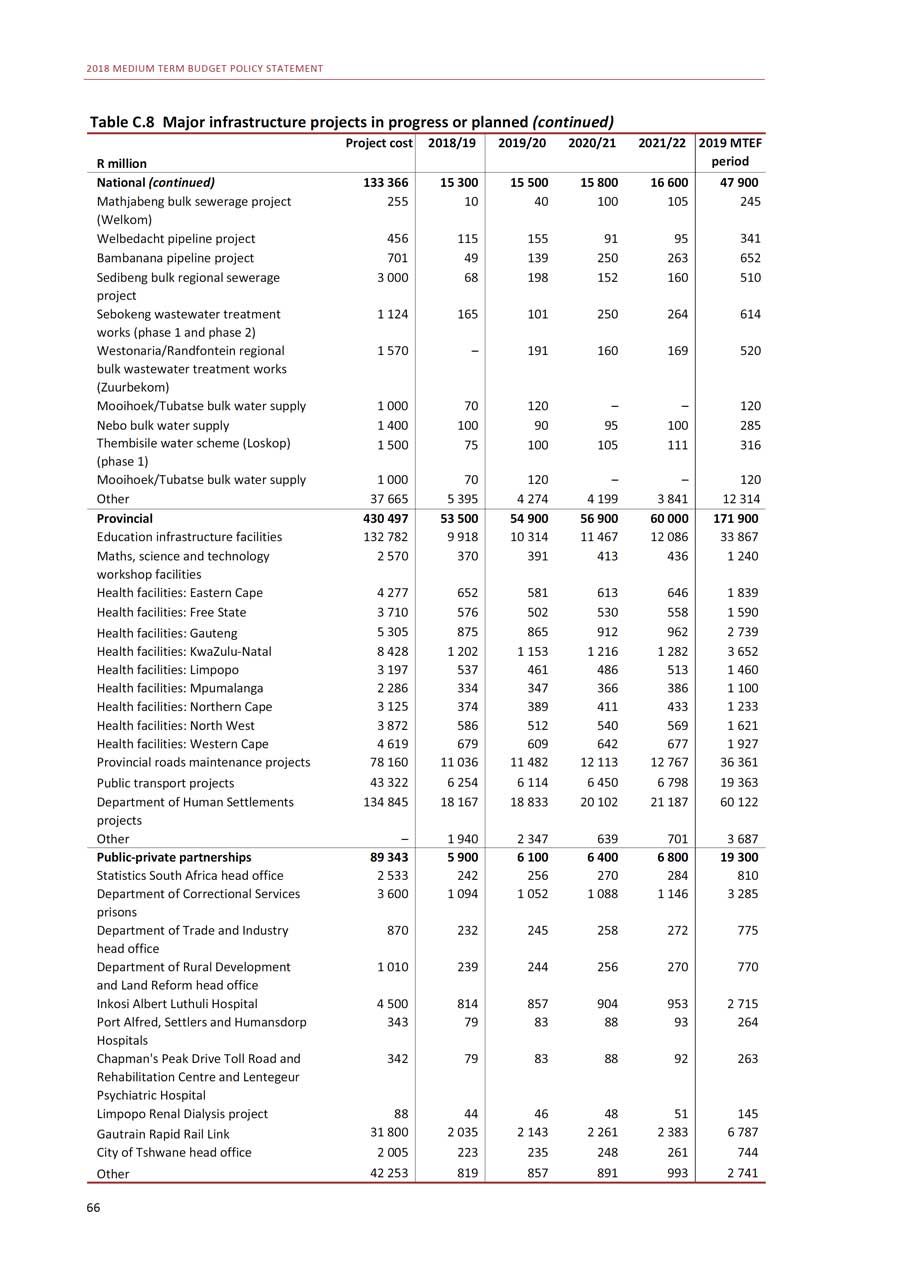

Increased investment in social and economic infrastructure will be a focus of economic recovery over the medium term. This requires an increased role for the private sector and better implementation of government’s existing plans. Over the next three years, public infrastructure expenditure is estimated to be R855.2 billion, of which state-owned companies account for R370.2 billion. General government accounts for the remaining R485 billion, mainly in the form of conditional infrastructure grants.Growth in gross fixed-capital formation has declined significantly in recent years. A central policy objective is to promote an increase in capital investment by the private sector.

Public-sector infrastructure plans estimated atR855.2 billion over medium term

Figure 1.1 Growth in fixed-capital stockTotal Excluding utilities*543210* Electricity, gas and water Source: Reserve Bank

Figure 1.2 Growth in fixed-capital stock by sectorGeneral government Public corporations Private business enterprises86420

Interventions to increase the efficiency of existing public infrastructure spending include the following: • To address weaknesses in infrastructure planning, government, development finance institutions and private-sector partners have begun work on a project preparation facility (see Chapter 2). • To strengthen accountability and transparency, government will publish online expenditure reports of current infrastructure projects. As a first step, Annexure C includes a breakdown of the general government project list. • Over the medium term, the Development Bank of Southern Africa, the Government Technical Advisory Centre and the Presidential Infrastructure Coordinating Commission receive R625 million to prepare projects and support implementation. 3

2018 MEDIUM TERM BUDGET POLICY STATEMENT • Government is negotiating access to infrastructure funding from development finance institutions, multilateral development banks and private banks. These institutions have committed technical resources to help plan, approve, manage and implement projects. • Consideration is being given to scaling up selected urban investment programmes by switching their financing from national government’s balance sheet to development finance institutions, which would facilitate additional technical support. The infrastructure initiative announced by the President builds on efforts to transform public infrastructure provision. It will support projects with “blended” finance, combining capital from the public and private sectors, and development finance institutions. Work to design the fund is under way, with assistance from the private sector and multilateral development banks. Government will report on the progress of these deliberations in the 2019 Budget. Fund design to include The fund is expected to identify innovative financing mechanisms andinnovative financing and allow for accompanying regulatory reforms. An example of this approachregulatory reforms is the Renewable Energy Independent Power Producer Programme, whichinvolved very little public funding, but required offtake agreements guaranteeing future cash flow, and regulatory changes to allow private electricity production. Improved oversight and implementation of the existing capital budget can sharply reduce underspending, which based on recent performance is estimated at R30 billion over the MTEF period. A framework for financing infrastructure Government will develop a framework for investors to assess potential long-term returns on public infrastructure projects. This will support funding from development finance institutions, commercial banks and pension funds. Innovative financing mechanisms (such as initial capital payments, current subsidies or guaranteed offtake agreements) may also be proposed alongside regulatory reforms. Government will publish a list of projects suitable for private-sector and development finance support. Projects will initially be evaluated on the following basis: • Can the project be fully privately funded? Many large infrastructure projects are commercially sustainable. Rather than commit scarce public resources, government will remove regulatory impediments that stand in the way of projects in sectors such as housing, telecommunications and transport (airports, for example). • Is hybrid funding an option? If the project is borderline commercially viable, the fund could support a range of hybrid options, including public-private partnerships, concessional financing, government guarantees, loan subsidies and development finance. • Are there clear social benefits? If the project is not commercially viable and has demonstrated benefits, direct fiscal support may be provided. Reform, reprioritisation, and interventions in health and education The structure of South Africa’s economy is not conducive to high growth or job creation. Network industries - energy, water, transport and telecommunications - need to be modernised. Barriers to entry remain high, making it difficult for small businesses to compete. During 2018, government has initiated reforms in several areas. These include creating policy certainty in the mining and energy sectors by finalising the Mining Charter and updating the Integrated Resource Plan. Growth-enhancing policy initiatives are also under way in the telecommunications, electricity and transport sectors (see Chapter 2). 4

CHAPTER 1: THE ECONOMY AT A CROSSROADS To support these reforms within a constrained fiscal framework, government is proposing reprioritisation of R32.4 billion over the next three years. Of this amount, R15.9 billion goes towards faster-spending infrastructure programmes (including R3.4 billion for school infrastructure and eradicating pit latrines), clothing and textile incentives, and the Expanded Public Works Programme. The remaining R16.5 billion will be allocated to various programmes, including recapitalising the South African Revenue Service (SARS), a minimum wage for community health workers, critical posts and goods and services in health, and streamlining the management of the justice system.

In addition, changes to grant structures amounting to R14.7 billion will promote upgrading of informal settlements in partnership with communities. Housing subsidies amounting to R1 billion will be centralised to better support middle- and lower-income home buyers. In the current year, R1.7 billion is added to infrastructure spending (including funding for fast-spending school building programmes), and R3.4 billion is allocated to drought relief, mostly to upgrade water infrastructure.Rebuilding state institutionsSouth Africa’s budgets for social and economic services are substantial, but the quality of spending is in many areas unacceptably poor, undermining (and in some cases collapsing) service delivery. Poor governance - reflected in inefficiency, corruption and financial mismanagement - reduces the impact of spending and increases pressure on the budget.Government has begun the process of rebuilding important state institutions. The Judicial Commission of Inquiry into Allegations of State Capture, chaired by Deputy Chief Justice Raymond Zondo, and the Commission of Inquiry into Tax Administration and Governance by the South African Revenue Service, chaired by retired Judge Robert Nugent, have both highlighted serious governance failures. These failures are beginning to be addressed. At SARS, for example, reforms under way include regularising VAT refund payments and rebuilding enforcement capacity. This process is supported through the budget, which reprioritises R1.4 billion to SARS over the medium term.Yet serious challenges remain. Some national, provincial and municipal departments are in financial disarray. The Auditor-General’s latest findings raise significant concerns about the level of irregular spending across government. The independent report on VBS Mutual Bank, including the reported large-scale theft of public funds, reinforces those concerns.While the scale of deterioration in the public sector is serious, key institutions established by the Constitution have proven resilient. Parliament, the courts and the Reserve Bank have helped to uncover corruption, with the support of a robust media.The National Treasury’s efforts to strengthen financial management include:• Working with the Auditor-General and law enforcement agencies to reduce irregular expenditure in government, and improving

R14.7 billion for upgrading informal settlements inpartnership with communitiesGovernance failures uncovered in state institutions arebeginning to be addressedWhile deterioration is cause for concern, constitutional institutions have provenresilient5

2018 MEDIUM TERM BUDGET POLICY STATEMENT transparency in expenditure classification to reduce fraud and opportunities for corruption. • Enhancing public finance capacity-building in local government by deploying skilled professionals to manage and recover revenue. • Introducing a strategic framework to support more efficient, cost- effective and transparent procurement efforts, particularly in the health sector. Procurement policy also aims to support small and blackowned businesses. • Developing a framework that will include financial recovery plans to address non-performing departments. Reforming state-owned companies

Reforms under way at Eskom, Transnet, Denel, SA Express and PRASARestructuring of network industries is underconsideration6

The finances of major state-owned companies remain weak. Government has initiated reforms in these entities to improve governance and strengthen financial management:• Over the past year, new boards and executives have been appointed at Denel, Transnet, South African Express Airways and the Passenger RailAgency of South Africa (PRASA).• The Auditor-General is working alongside private firms on the audits of several state-owned companies. To date, previously unreportedirregular expenditure amounting to R27 billion has come to light.• The boards of state-owned companies have initiated forensic investigations into allegations of corruption and are taking actionwhere evidence shows employee involvement in maladministration.• The Eskom board is preparing a long-term turnaround strategy to be presented to government in November 2018, and several other entitieshave updated their turnaround strategies in recent months.Reforms to strengthen network industries, provide sustainable and affordable increases in water and electricity, and reduce the costs of doing business are likely to require major changes in the mandates and operations of state-owned companies. Such changes will build on successes such as the Renewable Energy Independent Power Producer Programme, which has substantially increased private participation in the energy sector, generating 46 000 jobs to date. Government has begun to study long-term reforms in electricity, telecommunications, transport and logistics. Without restructuring, there is a significant risk that the weak financial condition of state-owned companies will put major pressure on the public finances.Government has published a draft Integrated Resource Plan for public comment. Once the plan is final, it will provide long-term certainty on the country’s future energy plans.Overview of the MTBPSEconomic outlookChapter 2 sets out the medium-term economic forecast, together with details of government’s efforts to accelerate economic growth. The GDP

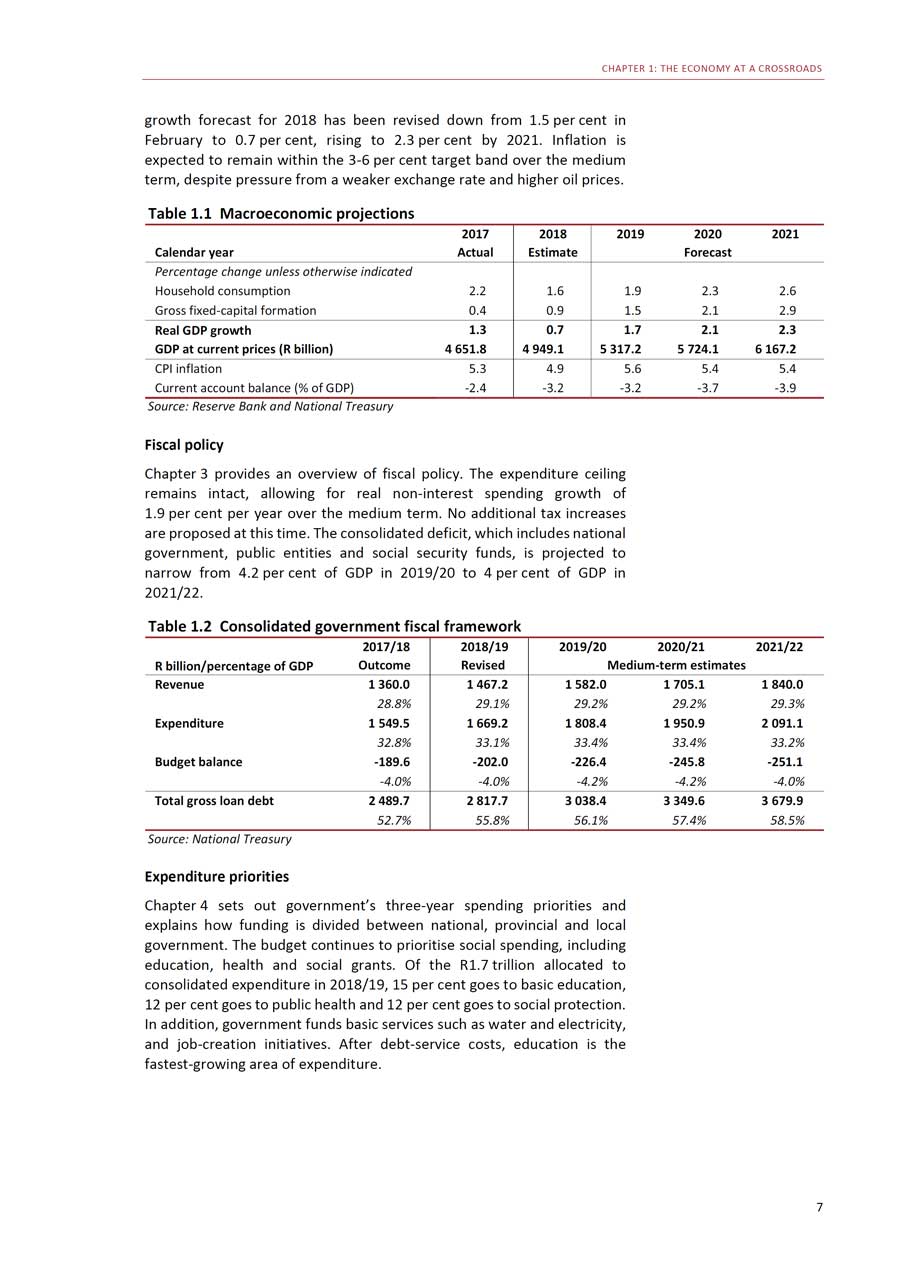

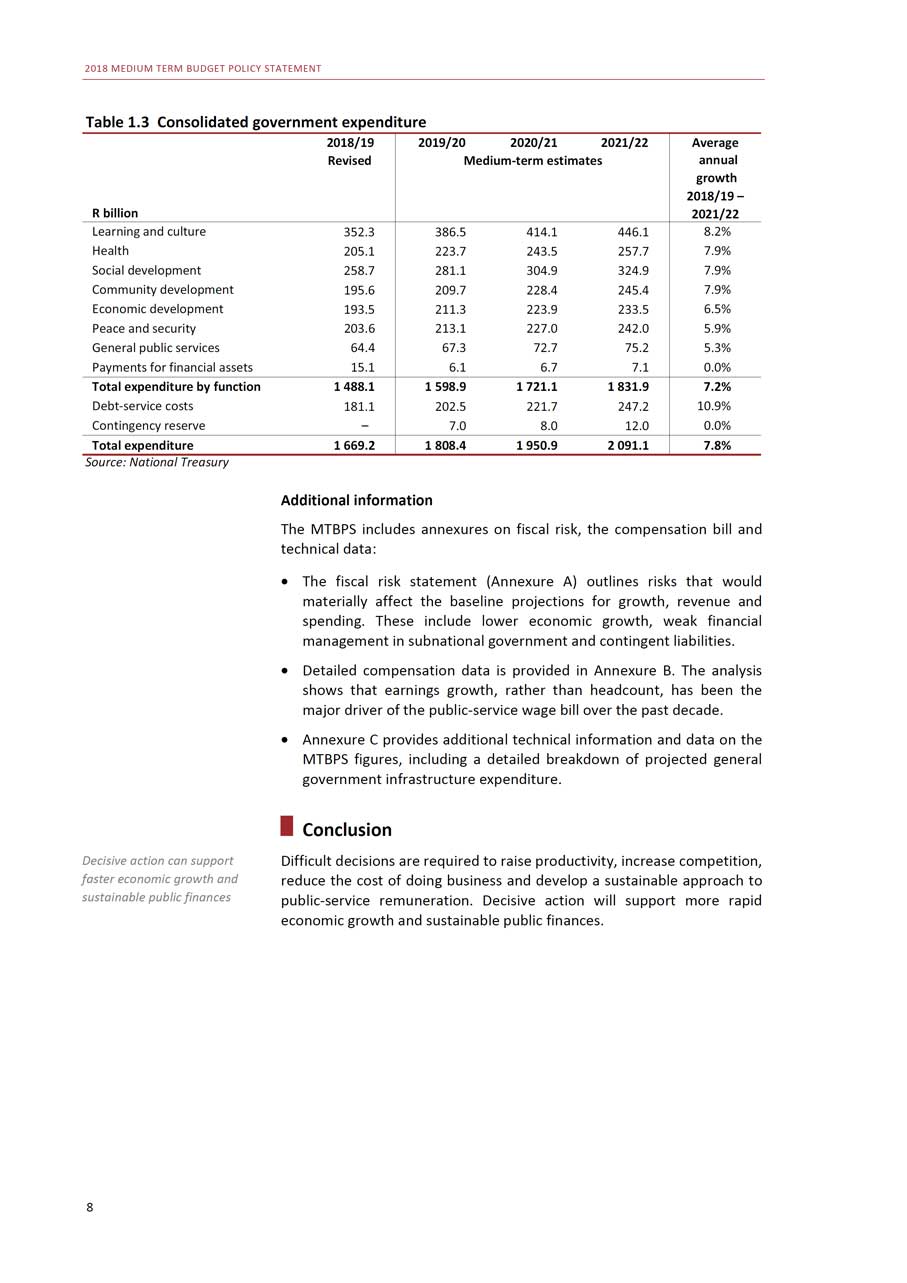

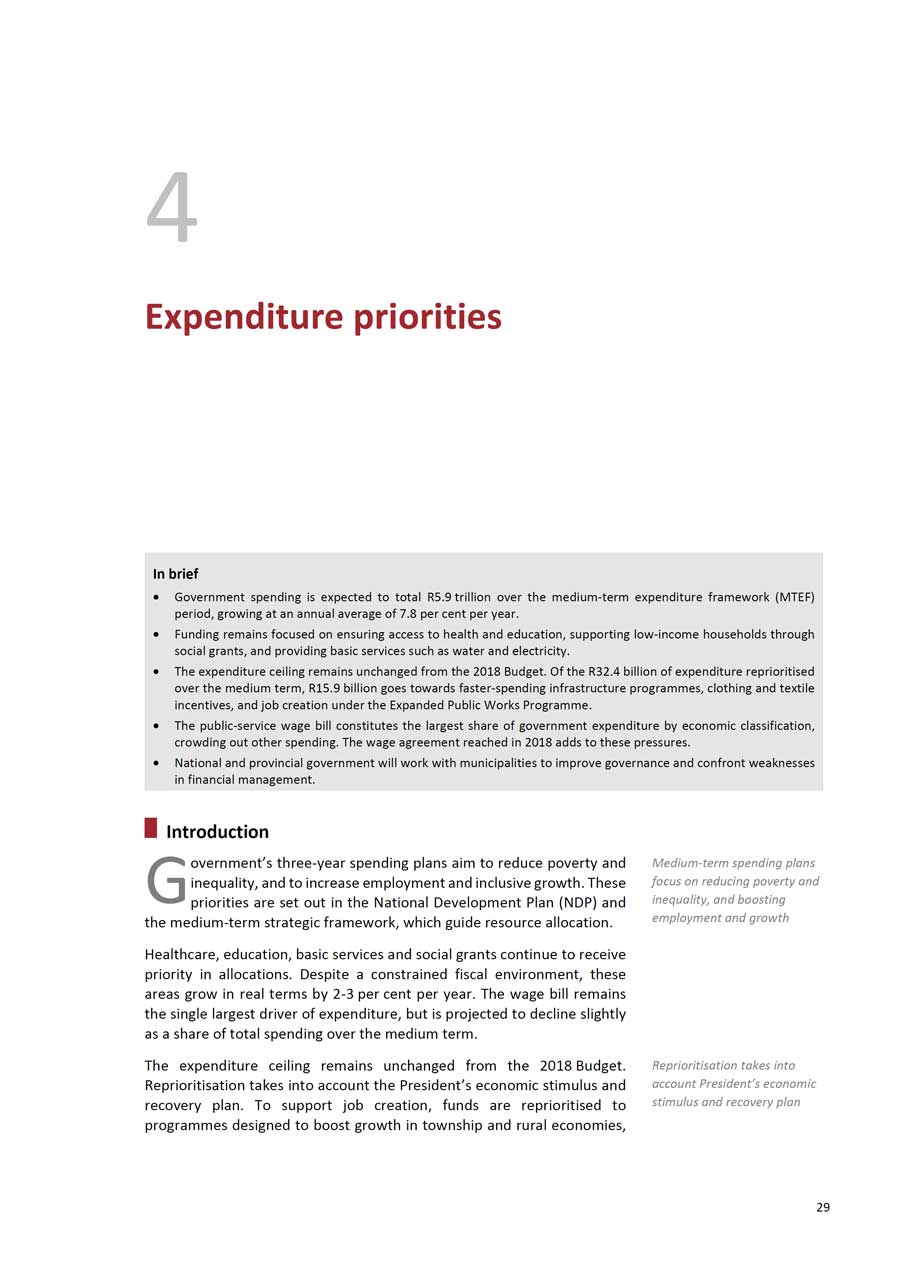

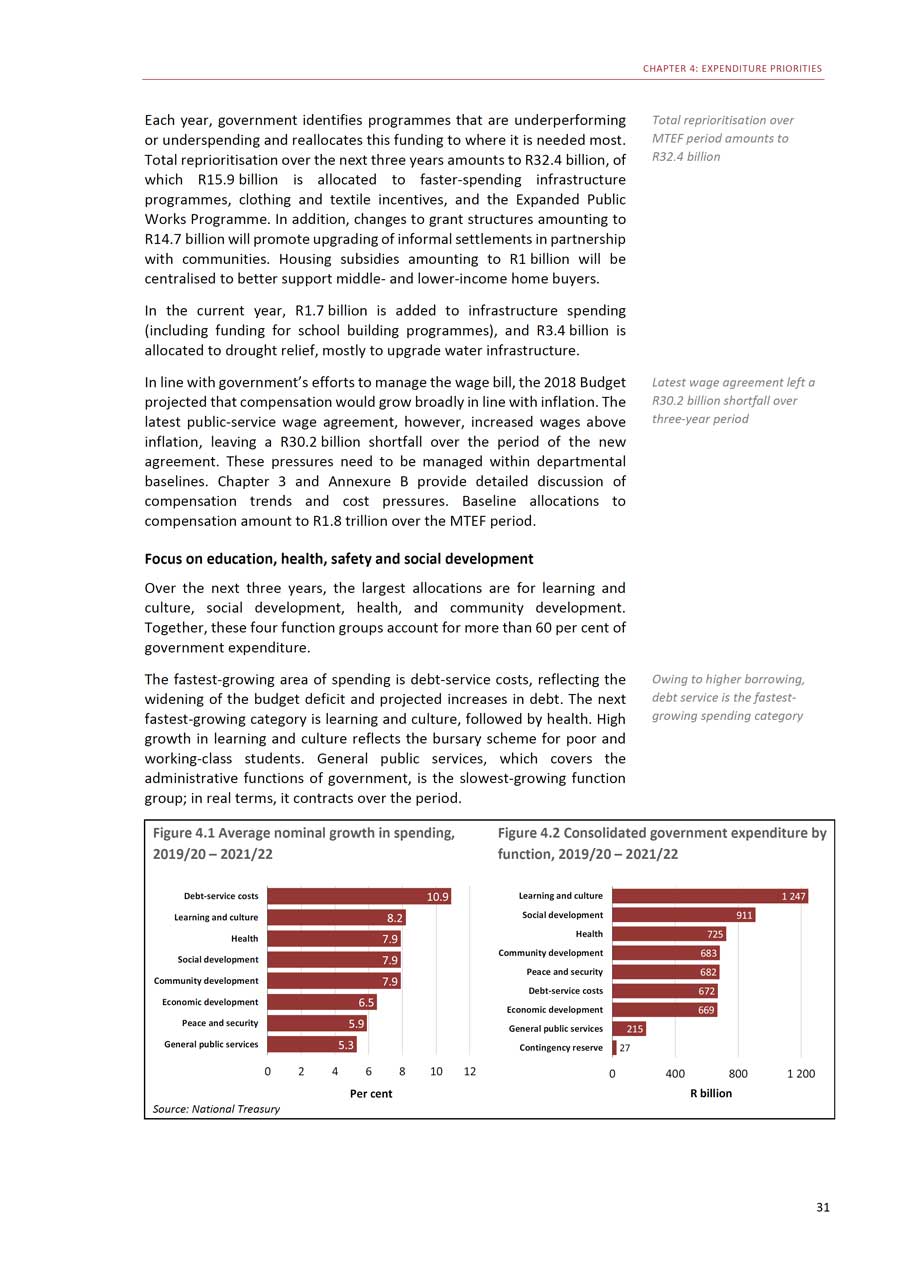

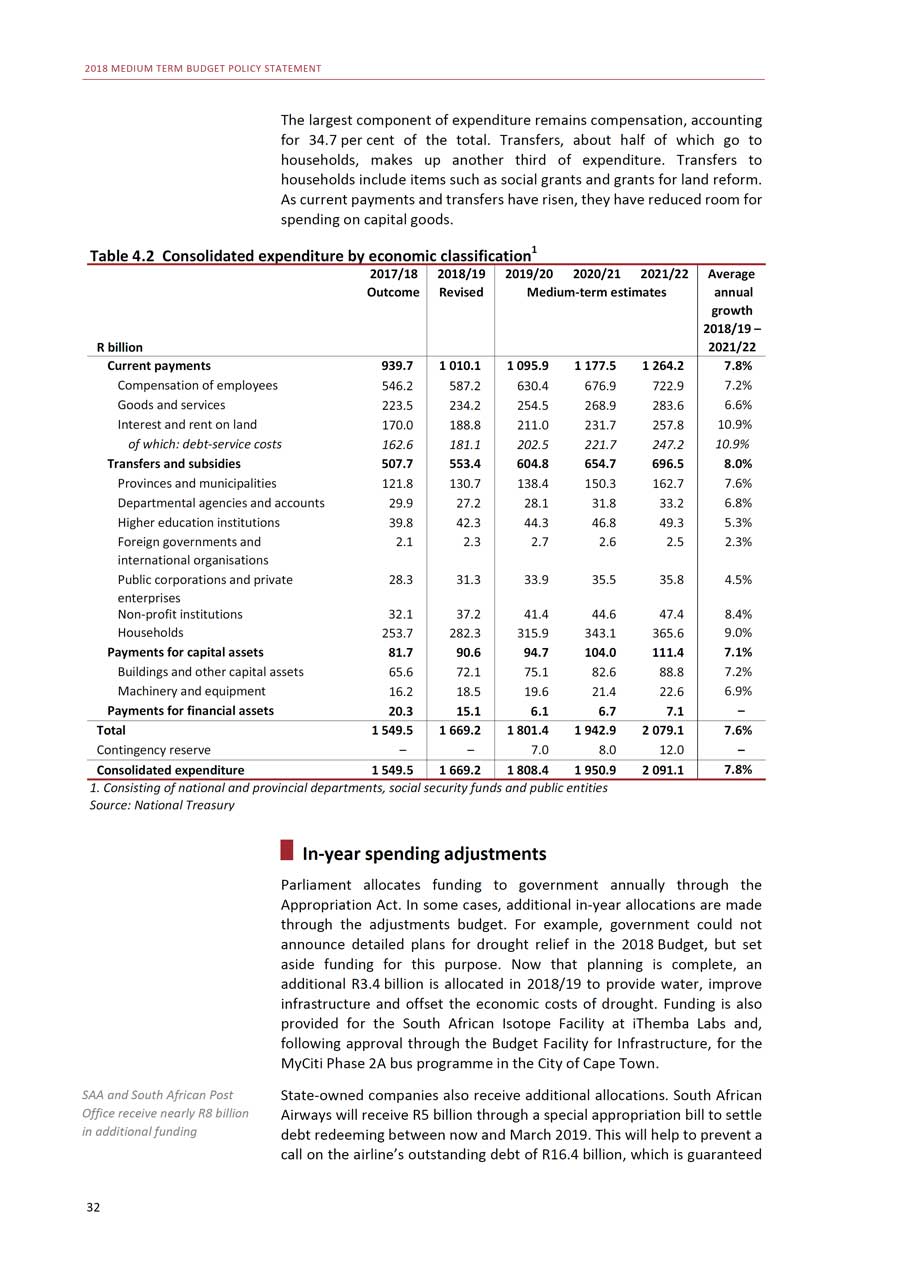

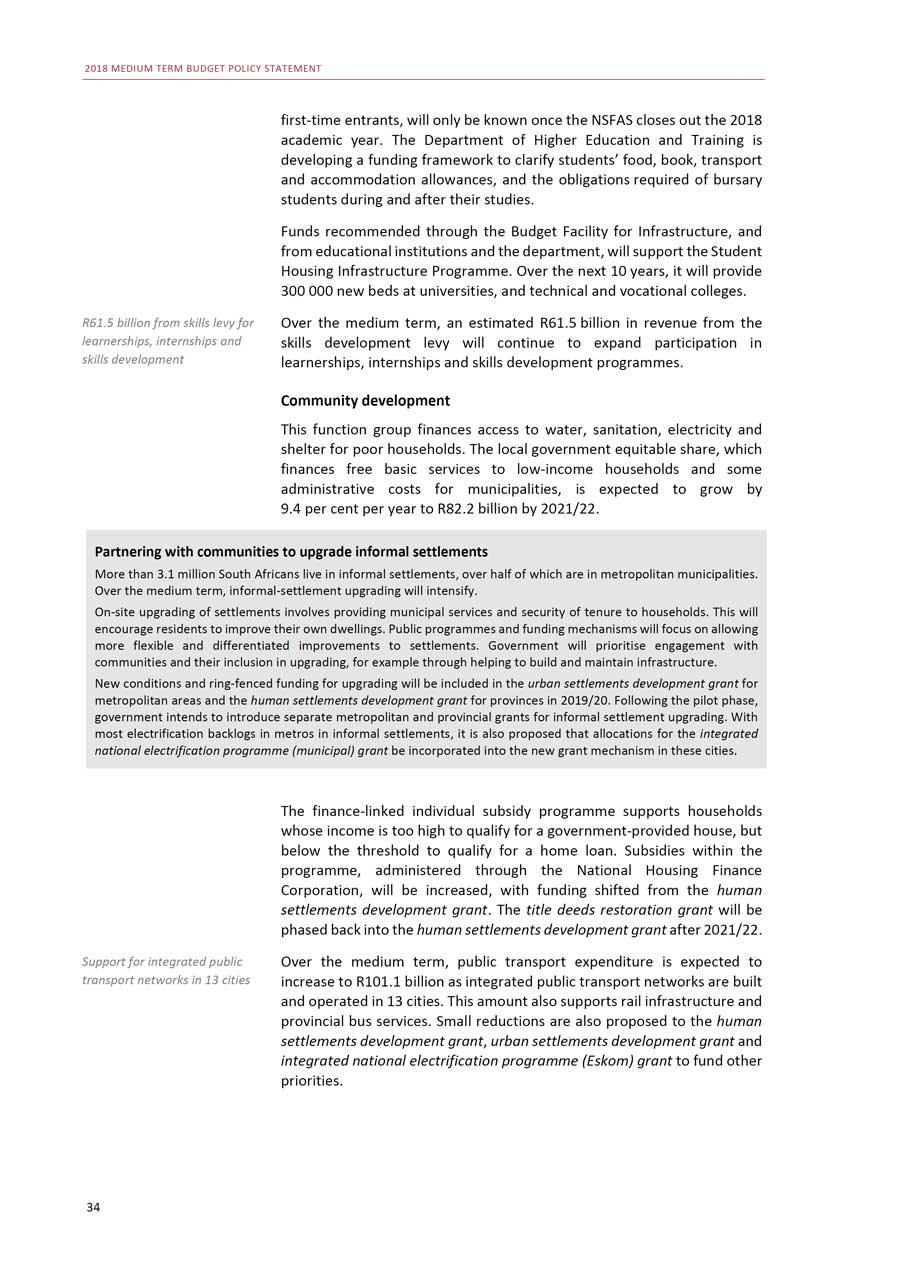

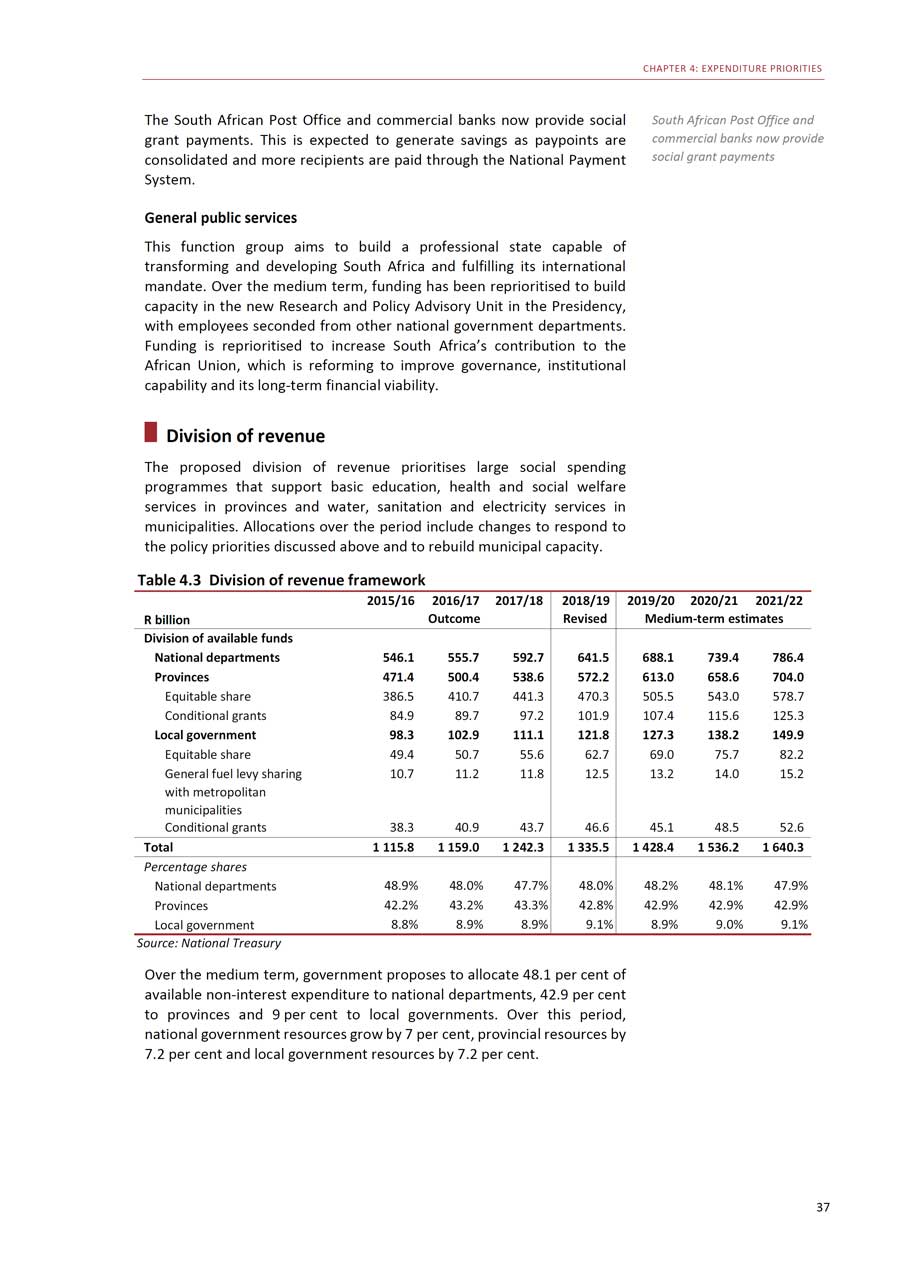

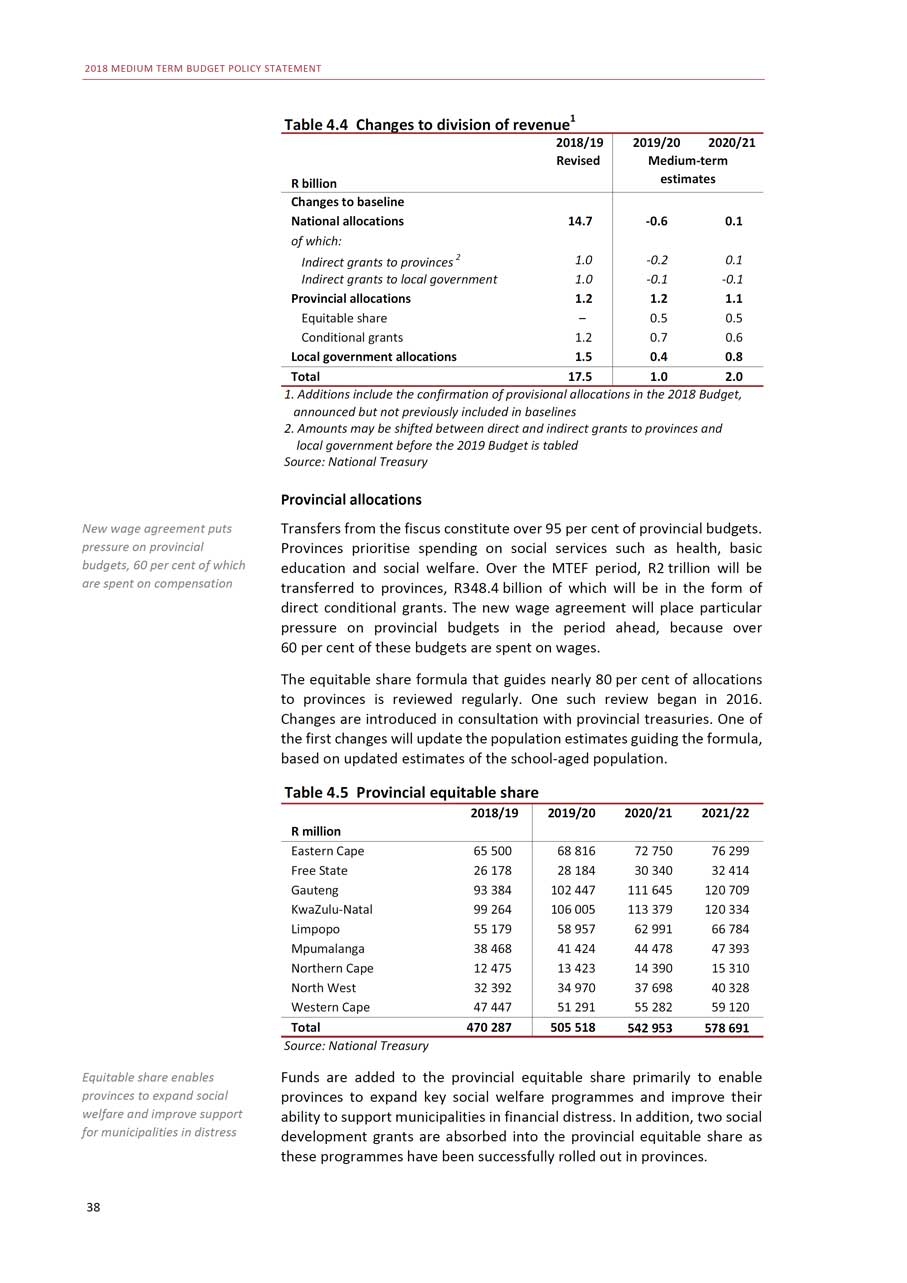

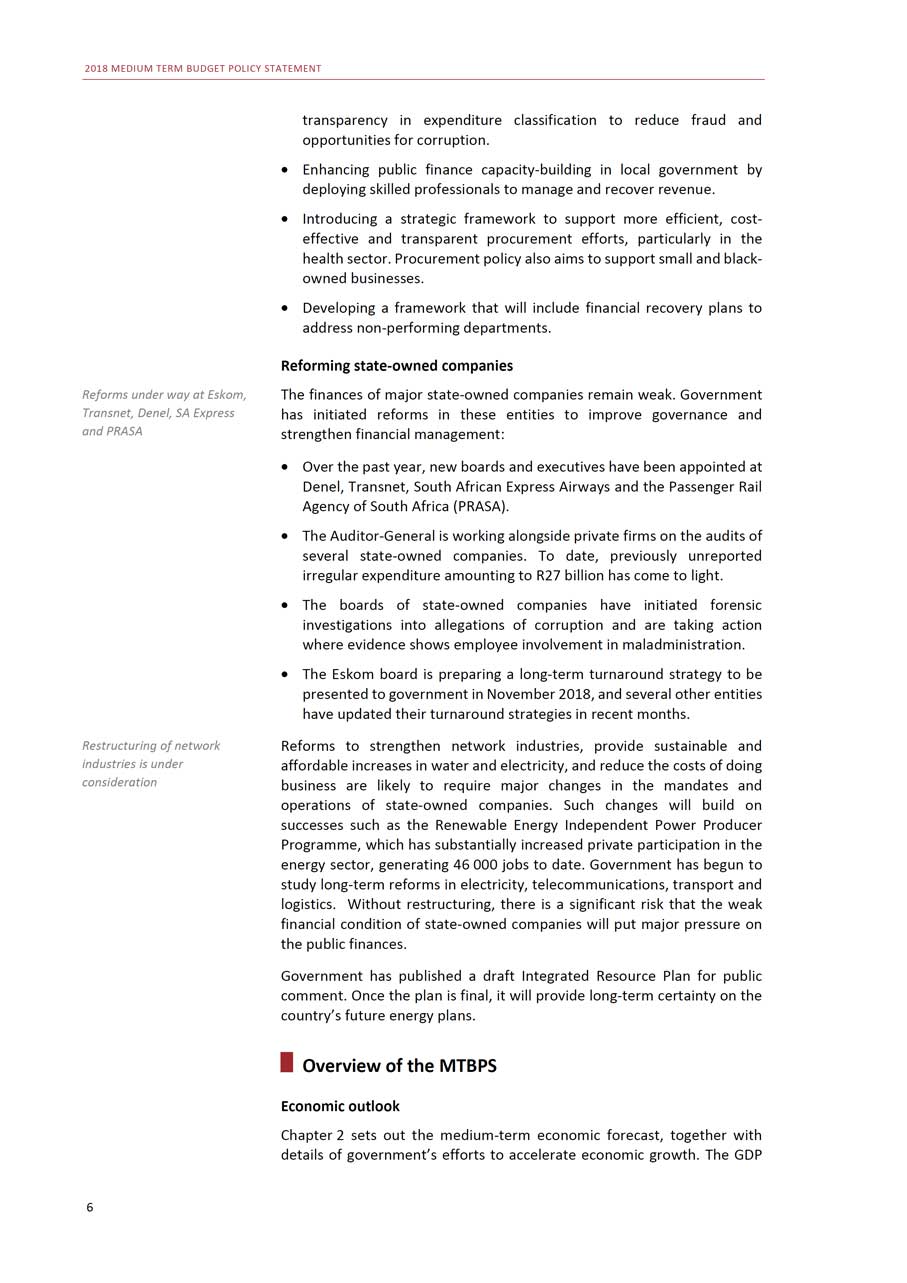

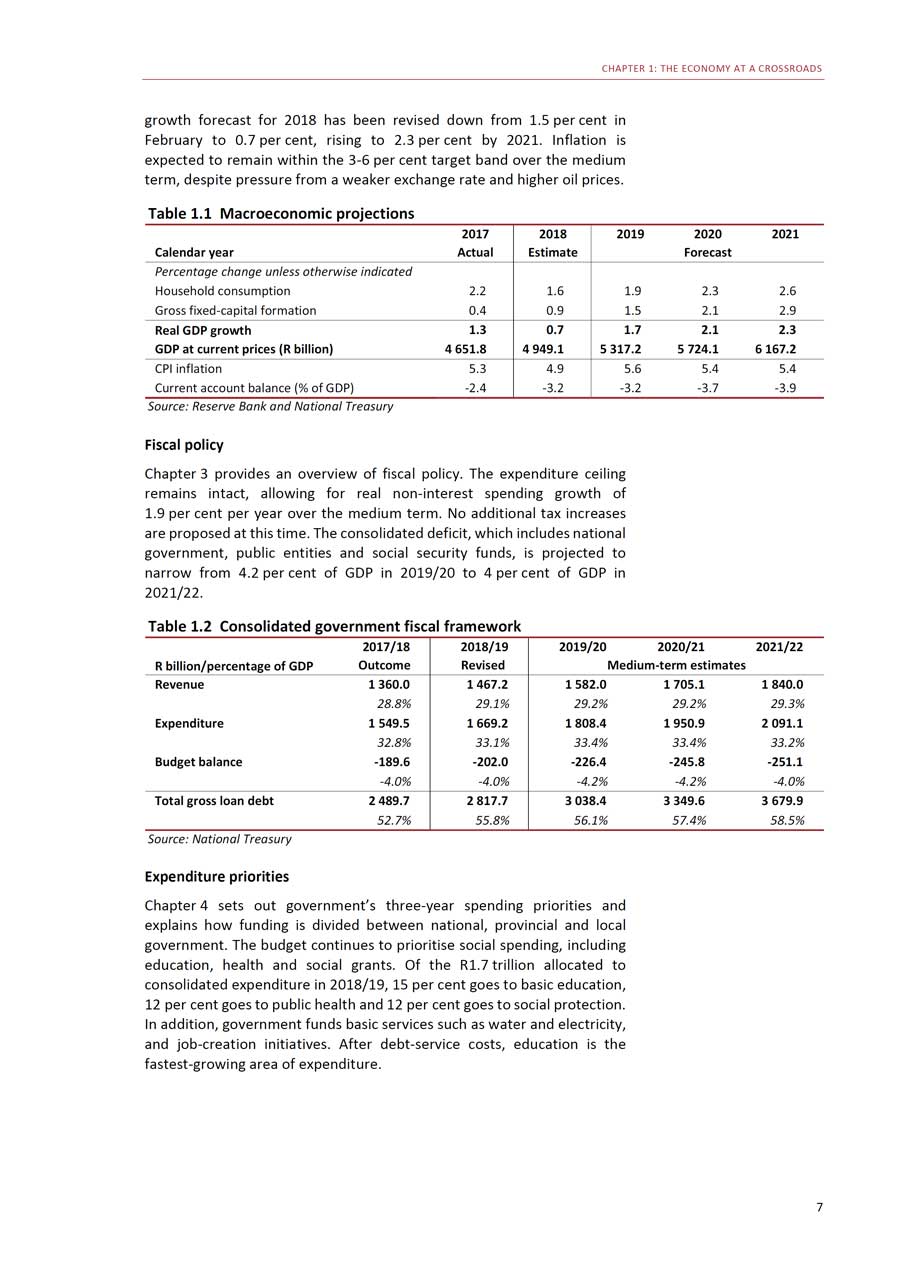

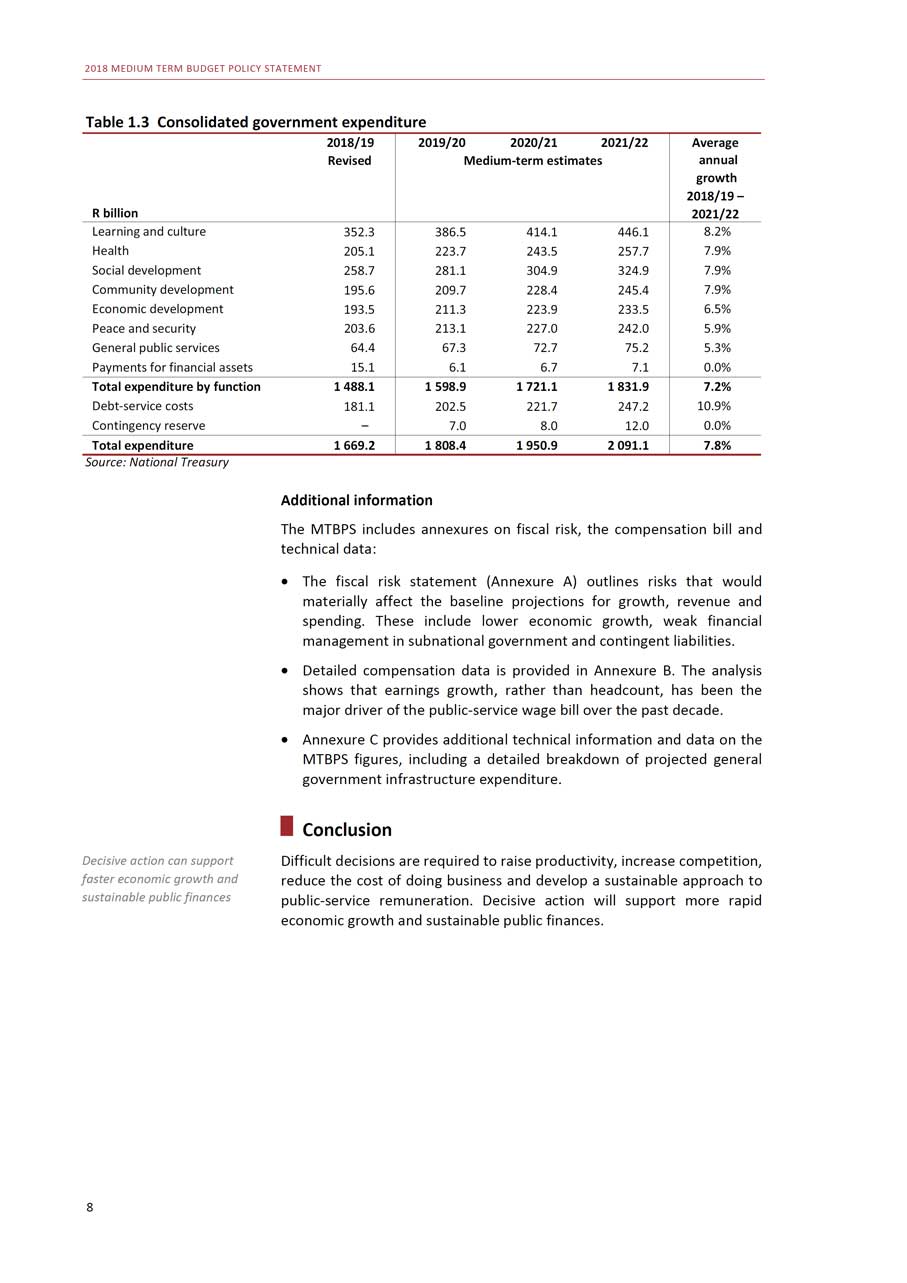

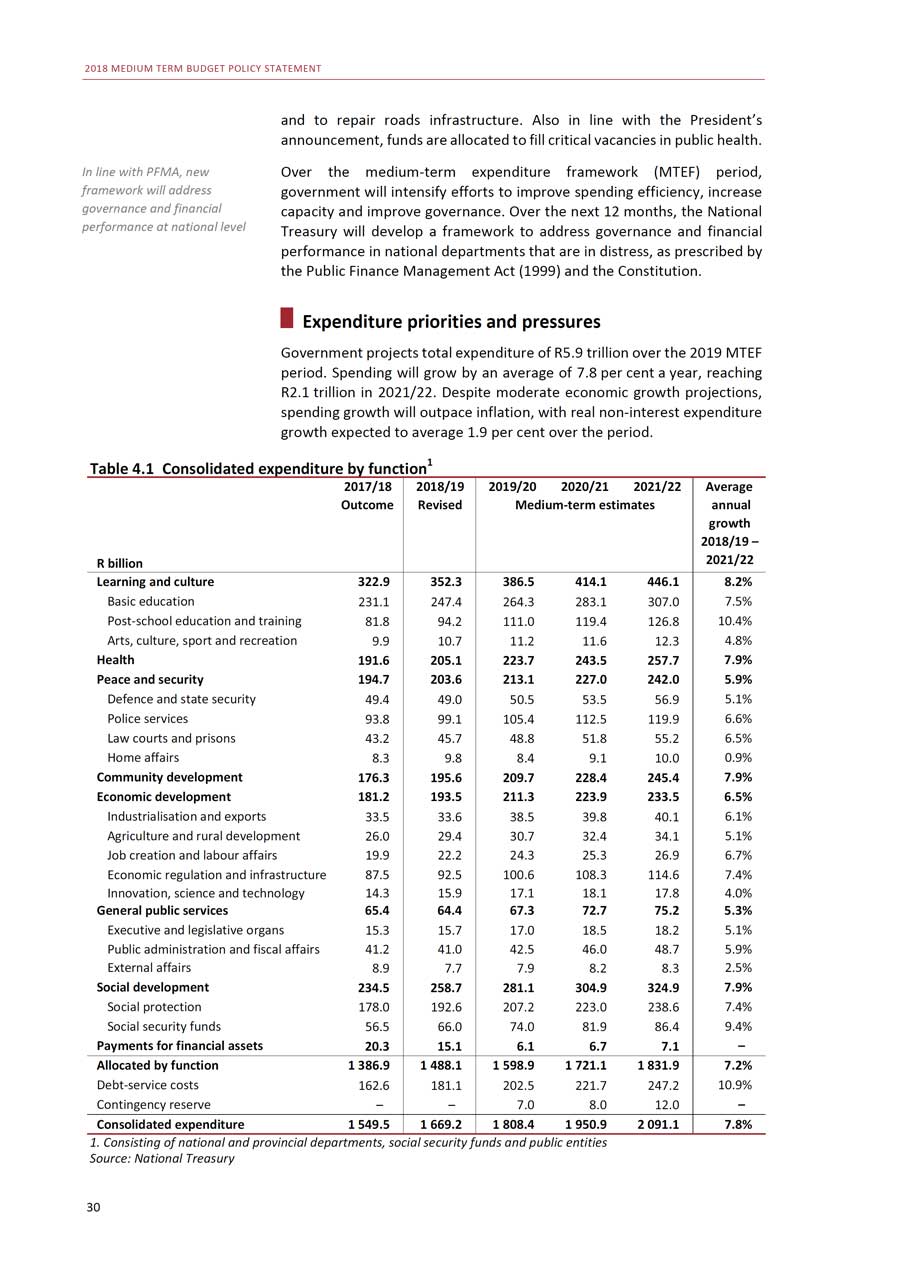

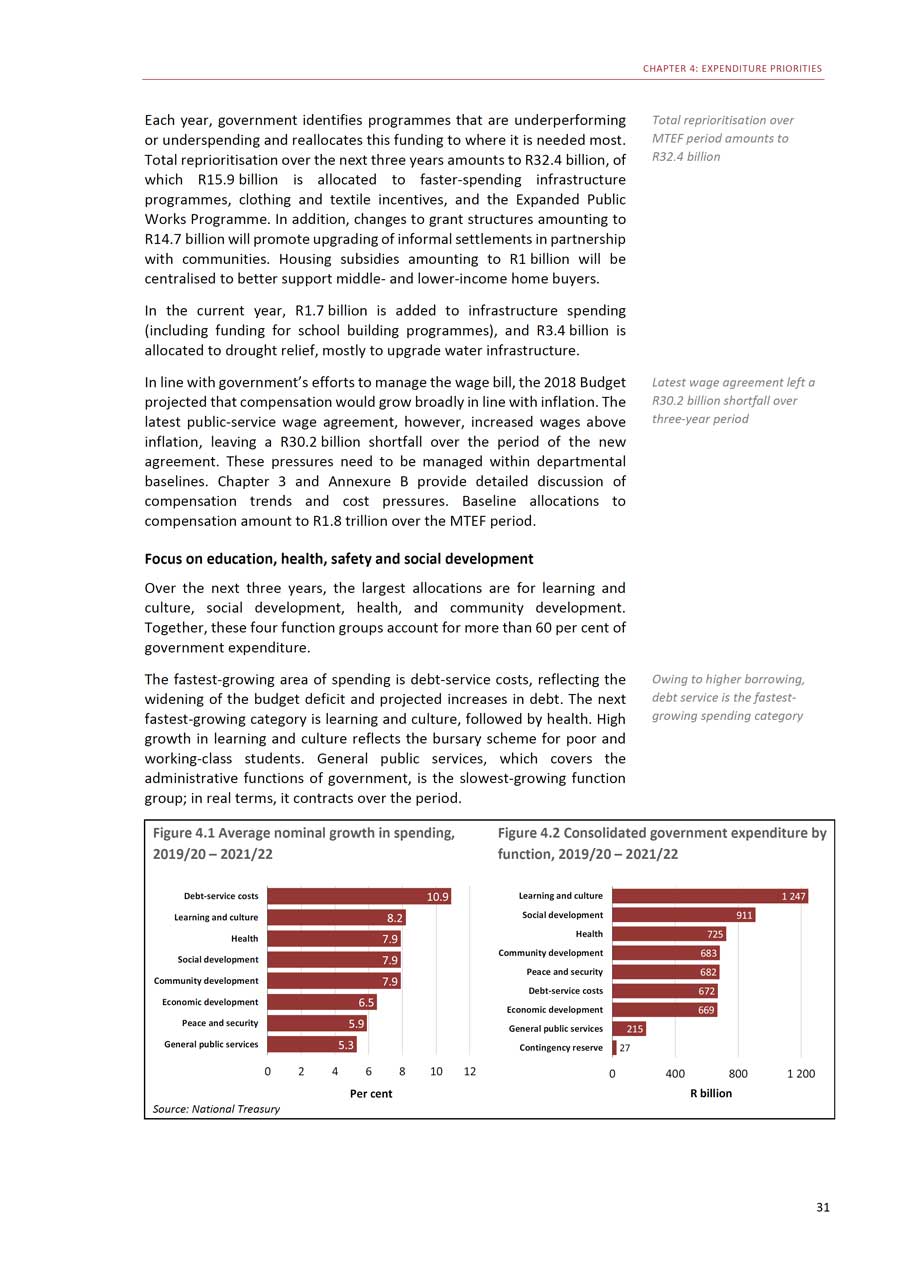

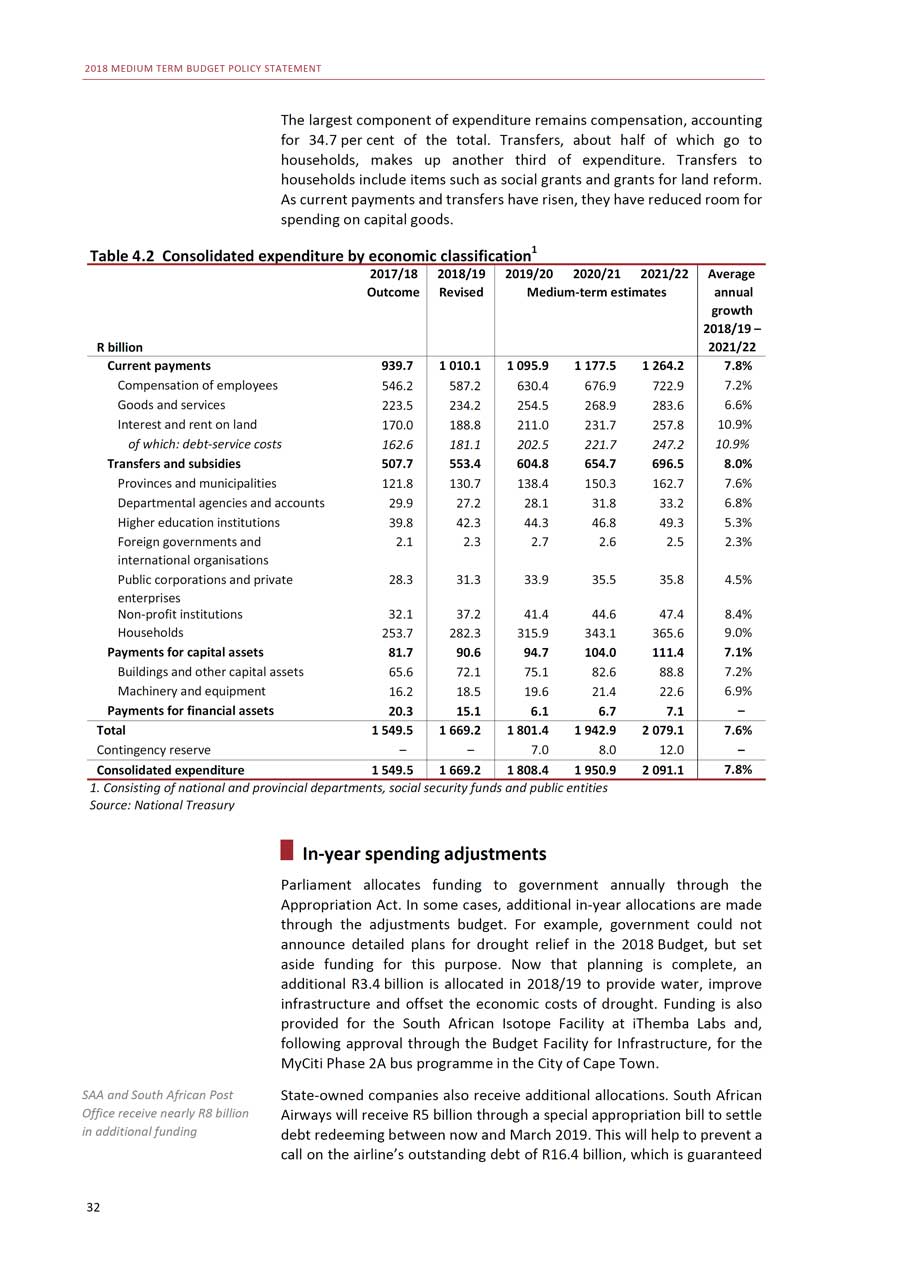

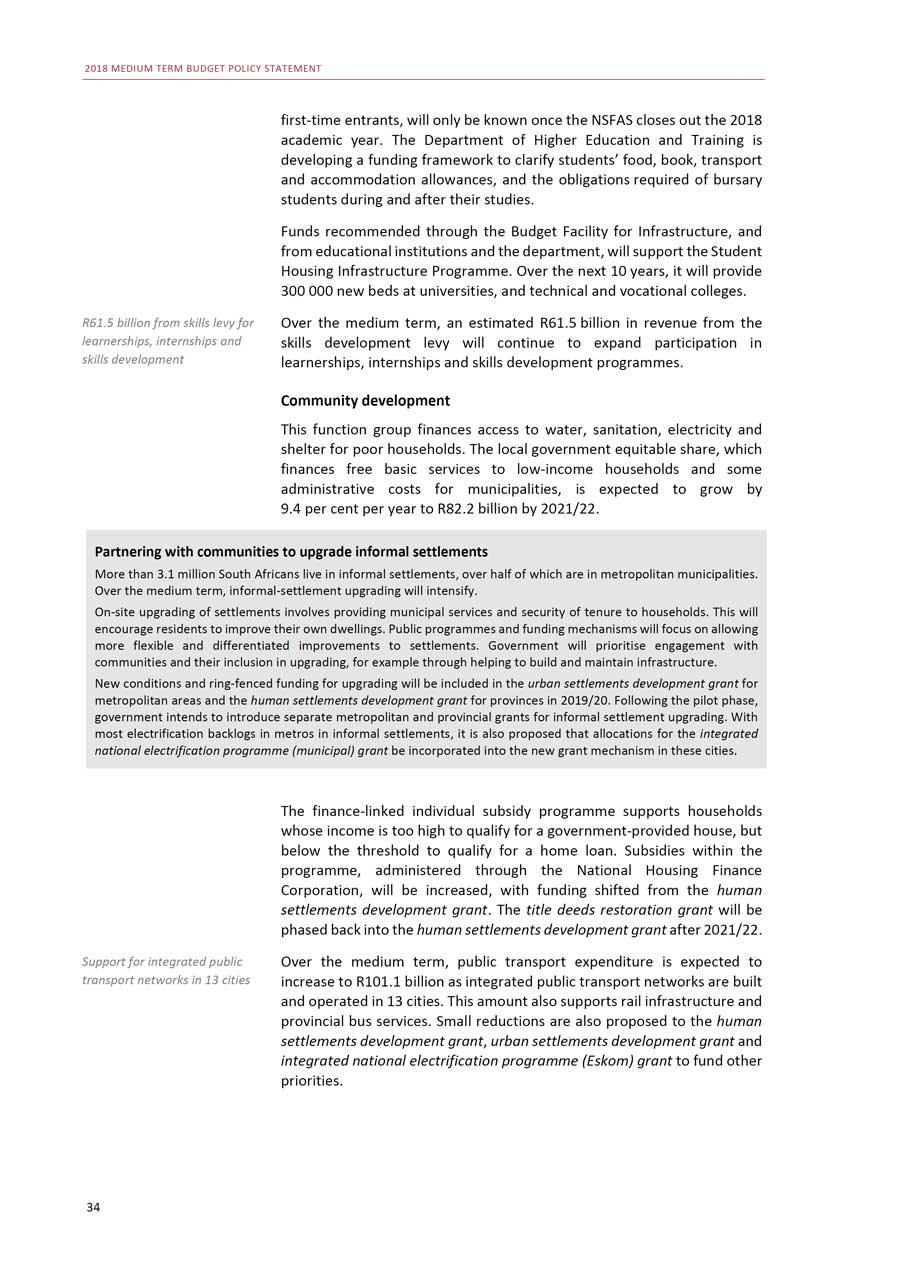

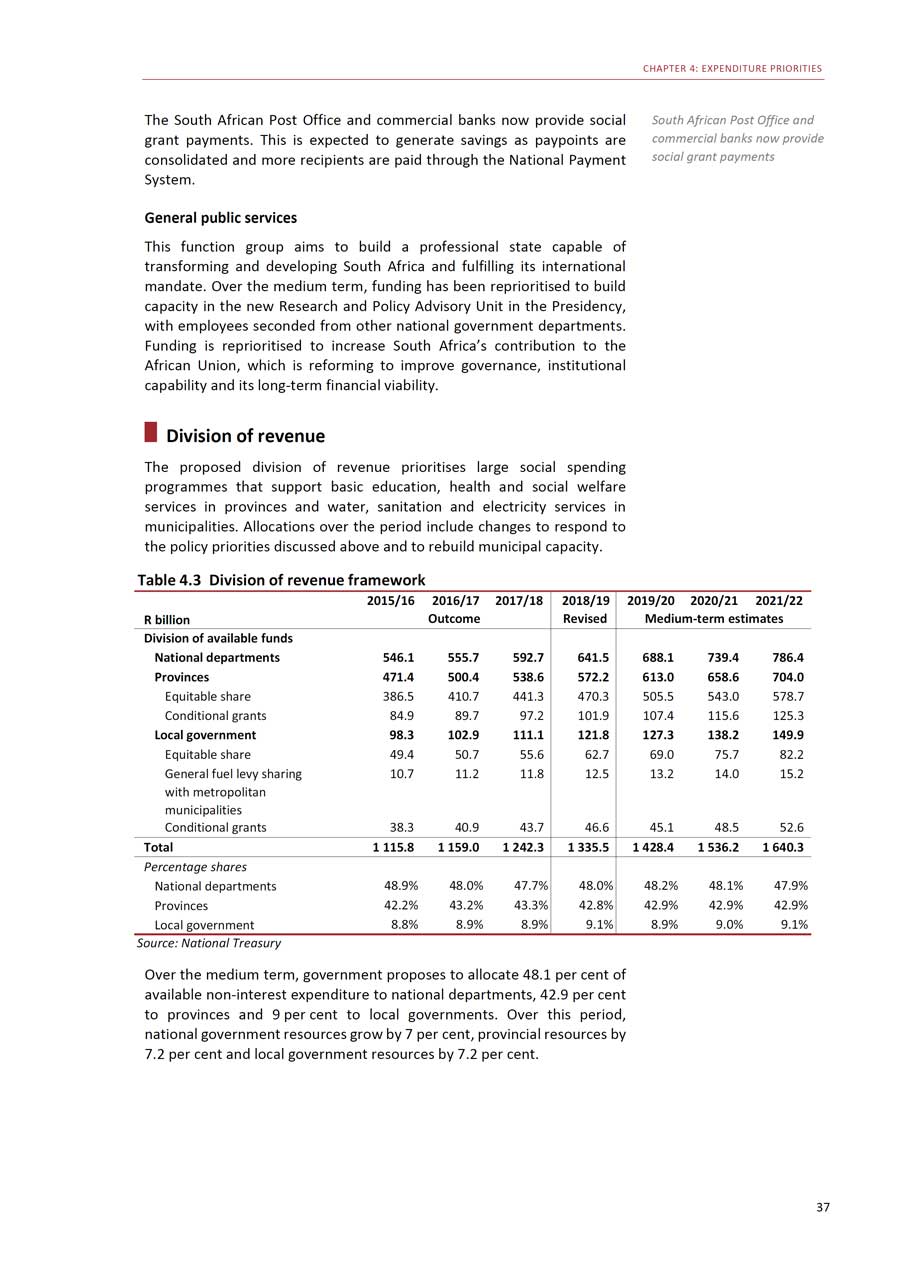

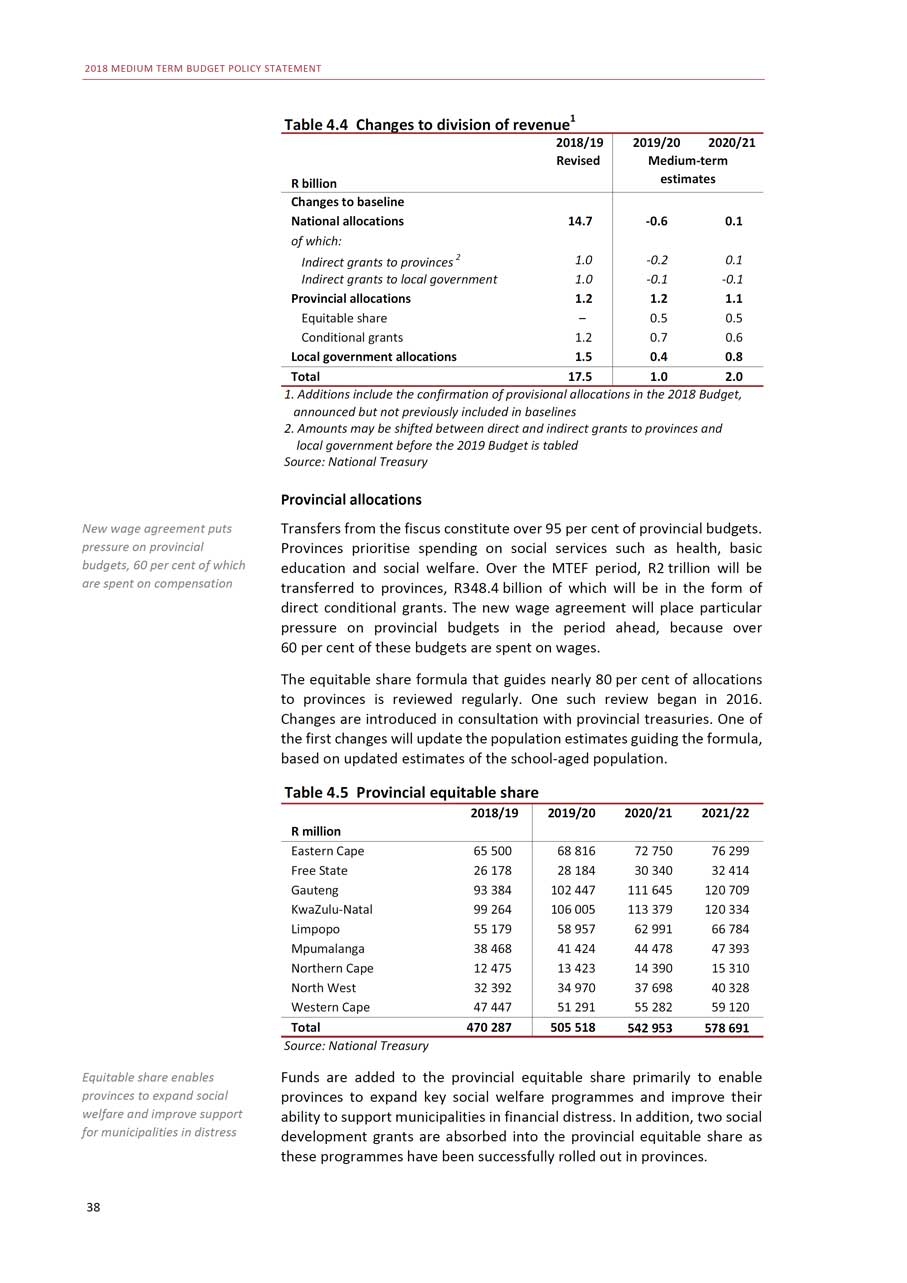

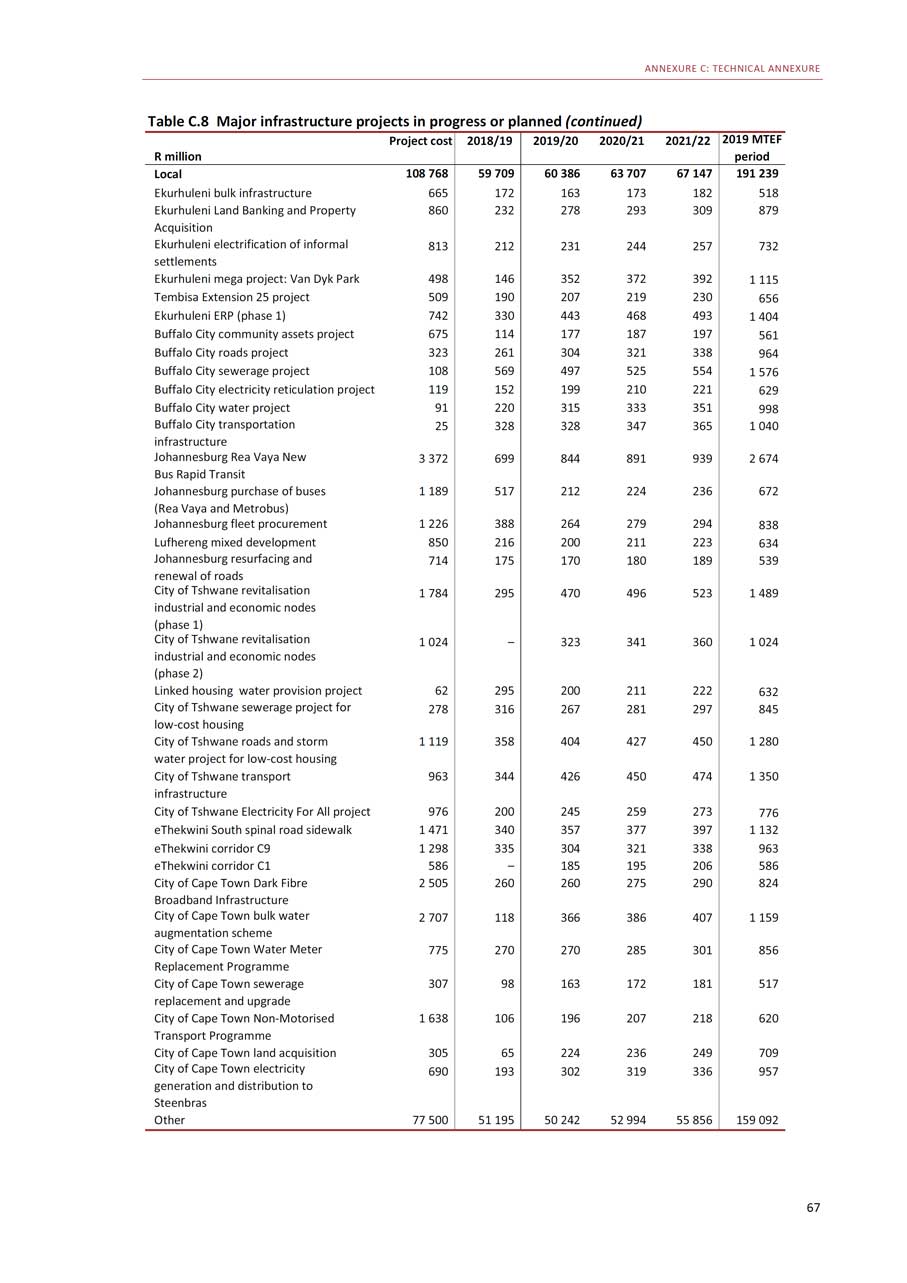

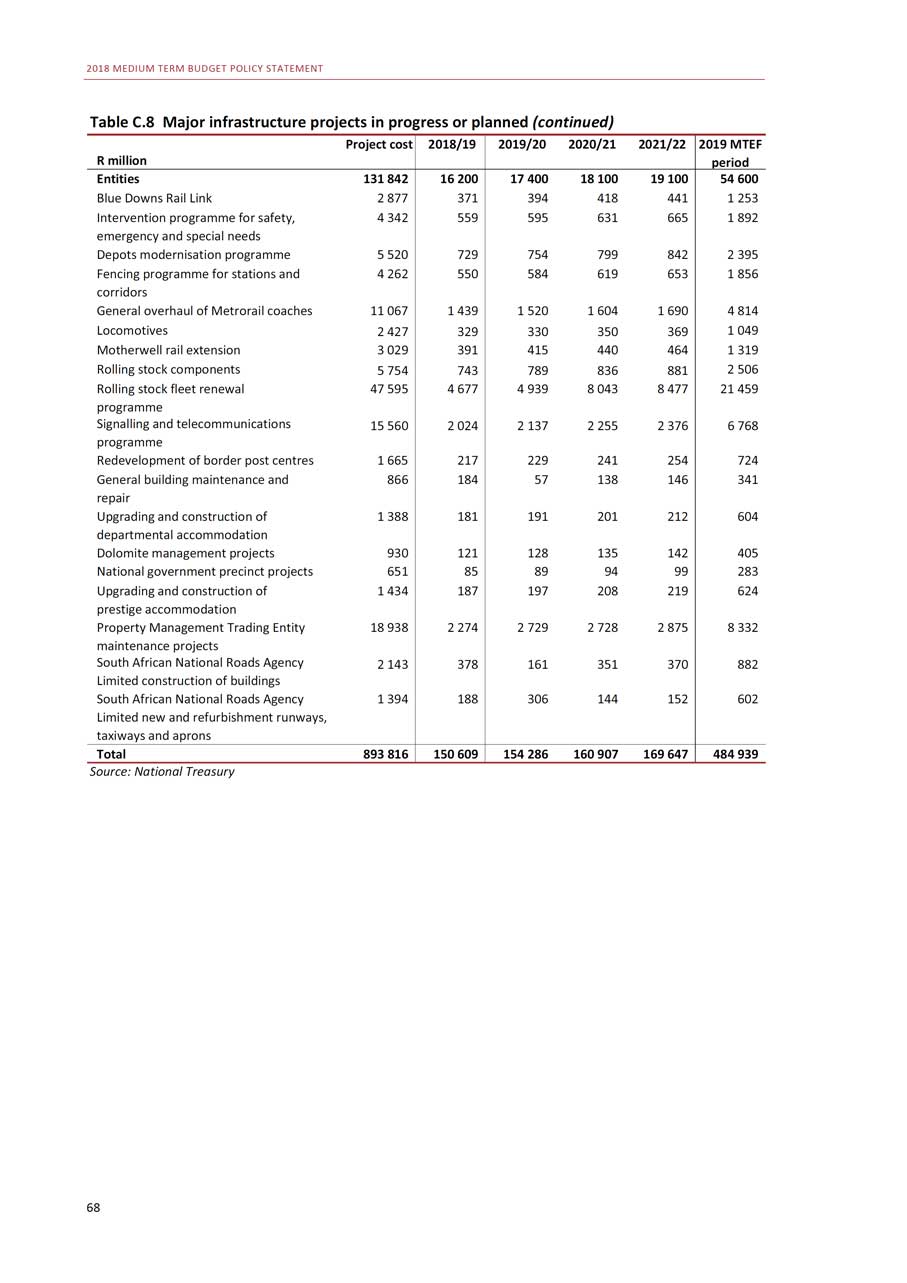

CHAPTER 1: THE ECONOMY AT A CROSSROADS growth forecast for 2018 has been revised down from 1.5 per cent in February to 0.7 per cent, rising to 2.3 per cent by 2021. Inflation is expected to remain within the 3-6 per cent target band over the medium term, despite pressure from a weaker exchange rate and higher oil prices. Table 1.1 Macroeconomic projections 2017 2018 2019 2020 2021Calendar year Actual Estimate ForecastPercentage change unless otherwise indicatedHousehold consumption 2.2 1.6 1.9 2.3 2.6Gross fixed-capital formation 0.4 0.9 1.5 2.1 2.9Real GDP growth 1.3 0.7 1.7 2.1 2.3GDP at current prices (R billion) 4 651.8 4 949.1 5 317.2 5 724.1 6 167.2CPI inflation 5.3 4.9 5.6 5.4 5.4Current account balance (% of GDP) -2.4 -3.2 -3.2 -3.7 -3.9Source: Reserve Bank and National Treasury Fiscal policy Chapter 3 provides an overview of fiscal policy. The expenditure ceiling remains intact, allowing for real non-interest spending growth of 1.9 per cent per year over the medium term. No additional tax increases are proposed at this time. The consolidated deficit, which includes national government, public entities and social security funds, is projected to narrow from 4.2 per cent of GDP in 2019/20 to 4 per cent of GDP in 2021/22. Table 1.2 Consolidated government fiscal framework 2017/18 2018/19 2019/20 2020/21 2021/22R billion/percentage of GDP Outcome Revised Medium-term estimatesRevenue 1 360.0 1 467.2 1 582.0 1 705.1 1 840.028.8% 29.1% 29.2% 29.2% 29.3%Expenditure 1 549.5 1 669.2 1 808.4 1 950.9 2 091.132.8% 33.1% 33.4% 33.4% 33.2%Budget balance -189.6 -202.0 -226.4 -245.8 -251.1-4.0% -4.0% -4.2% -4.2% -4.0%Total gross loan debt 2 489.7 2 817.7 3 038.4 3 349.6 3 679.952.7% 55.8% 56.1% 57.4% 58.5%Source: National Treasury Expenditure priorities Chapter 4 sets out government’s three-year spending priorities and explains how funding is divided between national, provincial and local government. The budget continues to prioritise social spending, including education, health and social grants. Of the R1.7 trillion allocated to consolidated expenditure in 2018/19, 15 per cent goes to basic education, 12 per cent goes to public health and 12 per cent goes to social protection. In addition, government funds basic services such as water and electricity, and job-creation initiatives. After debt-service costs, education is the fastest-growing area of expenditure. 7

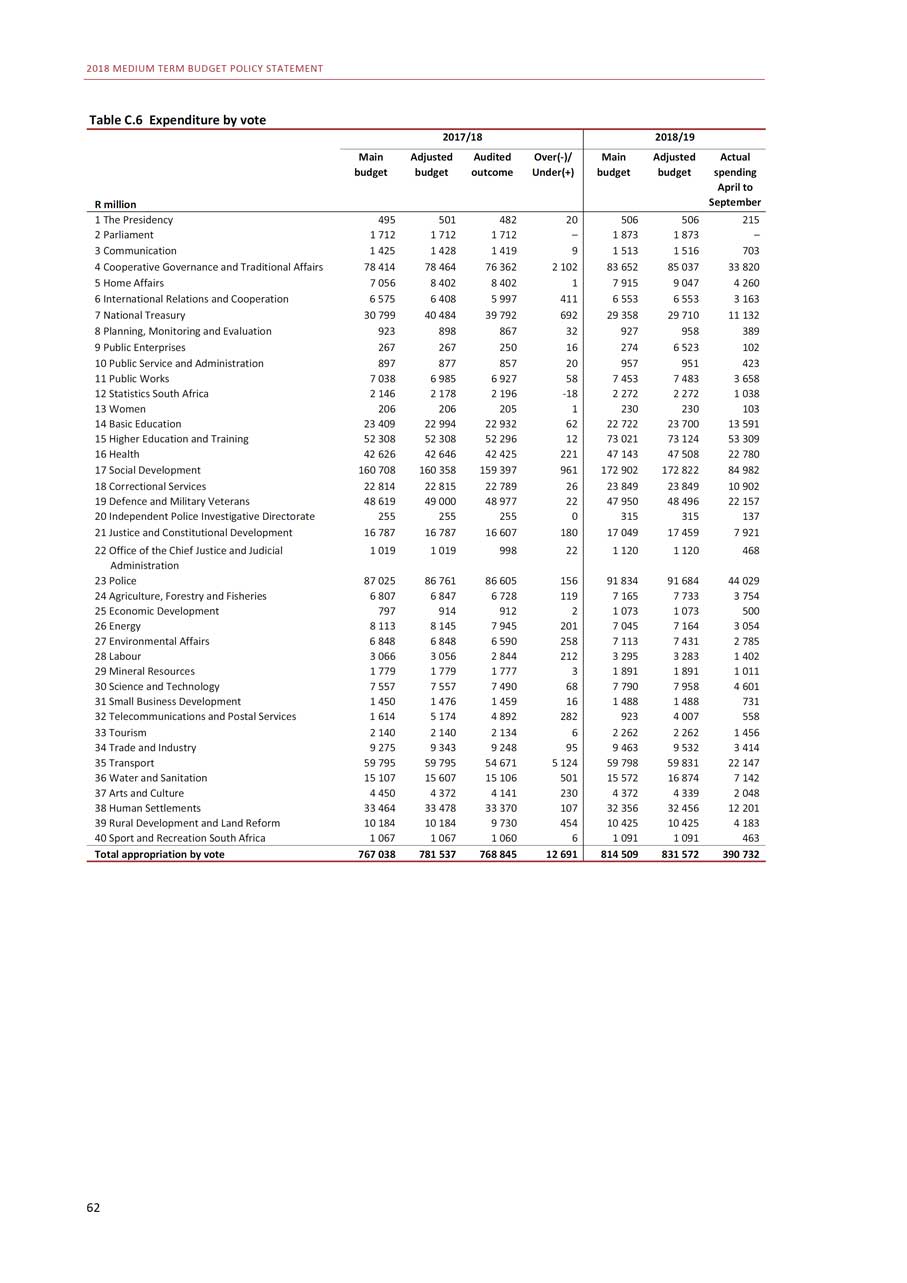

2018 MEDIUM TERM BUDGET POLICY STATEMENT Table 1.3 Consolidated government expenditure 2018/19 2019/20 2020/21 2021/22 AverageRevised Medium-term estimates annualgrowth2018/19 -R billion 2021/22Learning and culture 352.3 386.5 414.1 446.1 8.2%Health 205.1 223.7 243.5 257.7 7.9%Social development 258.7 281.1 304.9 324.9 7.9%Community development 195.6 209.7 228.4 245.4 7.9%Economic development 193.5 211.3 223.9 233.5 6.5%Peace and security 203.6 213.1 227.0 242.0 5.9%General public services 64.4 67.3 72.7 75.2 5.3%Payments for financial assets 15.1 6.1 6.7 7.1 0.0%Total expenditure by function 1 488.1 1 598.9 1 721.1 1 831.9 7.2%Debt-service costs 181.1 202.5 221.7 247.2 10.9%Contingency reserve - 7.0 8.0 12.0 0.0%Total expenditure 1 669.2 1 808.4 1 950.9 2 091.1 7.8%Source: National Treasury Additional information The MTBPS includes annexures on fiscal risk, the compensation bill and technical data: • The fiscal risk statement (Annexure A) outlines risks that would materially affect the baseline projections for growth, revenue and spending. These include lower economic growth, weak financial management in subnational government and contingent liabilities. • Detailed compensation data is provided in Annexure B. The analysis shows that earnings growth, rather than headcount, has been the major driver of the public-service wage bill over the past decade. • Annexure C provides additional technical information and data on the MTBPS figures, including a detailed breakdown of projected general government infrastructure expenditure. Conclusion

Decisive action can support faster economic growth and sustainable public finances8

Difficult decisions are required to raise productivity, increase competition, reduce the cost of doing business and develop a sustainable approach to public-service remuneration. Decisive action will support more rapid economic growth and sustainable public finances.

2 Economic overview In brief • GDP growth has been revised from 1.5 to 0.7 per cent in 2018 following a recession in the first half of the year. The economic outlook is weaker than projected in the 2018 Budget, although GDP growth is expected to recover gradually to 2.3 per cent by 2021 as confidence grows and investment gathers pace. • The global economy is expected to continue growing at 3.7 per cent in 2018 and 2019. Global risks, however, are becoming more pronounced. Small and open developing economies, such as South Africa, are increasingly vulnerable to financial volatility and trade disruption. • Government’s economic stimulus and recovery plan is intended to support a return to higher growth over the medium term. A combination of policy certainty, growth-enabling economic reforms, improved governance, and partnerships with business and labour will be key to restoring confidence and investment. Infrastructure spending will also support economic activity and job creation.

Boosting growth, investment and job creation South Africa needs strong, sustained economic growth to sharply reduce unemployment, and to encourage inclusive development and

Strong, sustained economic growth needed to sharply

transformation. The National Development Plan (NDP) put forward reduce unemployment

the goal of 5.4 per cent GDP growth to support these objectives. Over the past decade, however, GDP growth has averaged 1.8 per cent - well below the level needed to transform the economy. At the time of the February 2018 Budget, a synchronised global recovery was expected, and there was a sense of optimism that confidence and investment would recover on the strength of improved political certainty. This contributed to higher business confidence, a strengthening rand, declining bond yields and a positive outlook. Yet the economy has not performed as expected. GDP grew by 0.6 per cent in the first half of 2018 compared with the same period in 2017. On a quarter-on-quarter basis, however, GDP fell during the first half of 2018, leading to a technical recession. Mining and agricultural production have contracted, import growth has accelerated and investment growth 9

2018 MEDIUM TERM BUDGET POLICY STATEMENT remains muted. Per-capita GDP continues to decline as the economy grows more slowly than the population.

Global concerns include mounting trade disputes and tightening financial conditionsBuilding partnerships that promote investment is central to government’s agendaGlobal growth expected to remain at 3.7 per cent in 2018 and 2019, decelerating thereafter10

Over the medium term, concerns about sharpening global trade disputes, volatile commodity prices and tightening financial conditions will weigh on investor confidence. If these risks materialise, they could prompt renewed risk aversion and financial volatility, leading to a less favourable environment for investment in and exports from developing countries.Confronted by low domestic growth and an uncertain global environment, government is taking steps to bolster economic activity, investment and job creation in the short to medium term. The economic stimulus and recovery plan announced by the President in September 2018 seeks to focus public spending in areas that can grow the economy, create jobs, accelerate necessary growth-enhancing reforms, promote infrastructure development, and tackle problems in education and healthcare.The October 2018 Jobs Summit followed extensive consultation in the National Economic Development and Labour Council, and underscores the importance of effective partnerships between the public and private sectors and civil society. The forthcoming Investment Conference will be complemented by an infrastructure fund being designed to attract private and development-finance capital to well-run public infrastructure projects that contribute to economic growth and development.Policy certainty in areas such as mining and energy is being restored, and the governance of state-owned companies and entities such as Eskom, Transnet and the South African Revenue Service (SARS) is being strengthened.Government is committed to macroeconomic stability and prudent fiscal management. Sustainable public finances, inflation targeting and a flexible exchange rate provide a platform to attract investment and absorb external shocks. To make the most of these macroeconomic building blocks, reforms are needed to transform the structure of the economy - raising productivity, increasing competition and reducing the cost of doing business.Global outlookThe world economy grew by 3.7 per cent in 2017, up from 3.3 per cent in 2016. Stronger growth in developed economies contributed to rising global trade and several developing economies (Russia, Brazil and Nigeria) emerged from recession. The International Monetary Fund (IMF) projects that global growth will remain at 3.7 per cent in 2018 and 2019.US economic growth is expected to slow from 2.9 per cent in 2018 to1.8 per cent by 2020 as the effects of fiscal stimulus wane. In the euro area, growth is expected to ease from 2.4 per cent in 2017 to 1.9 per cent by 2019 in response to reduced external demand. Uncertainty about the arrangements by which the United Kingdom will leave the European Union continues to undermine confidence.World trade volume growth is expected to slow to 4.2 per cent in 2018 and4 per cent in 2019, from 5.2 per cent in 2017, as trade tensions unfold.

CHAPTER 2: ECONOMIC OVERVIEW

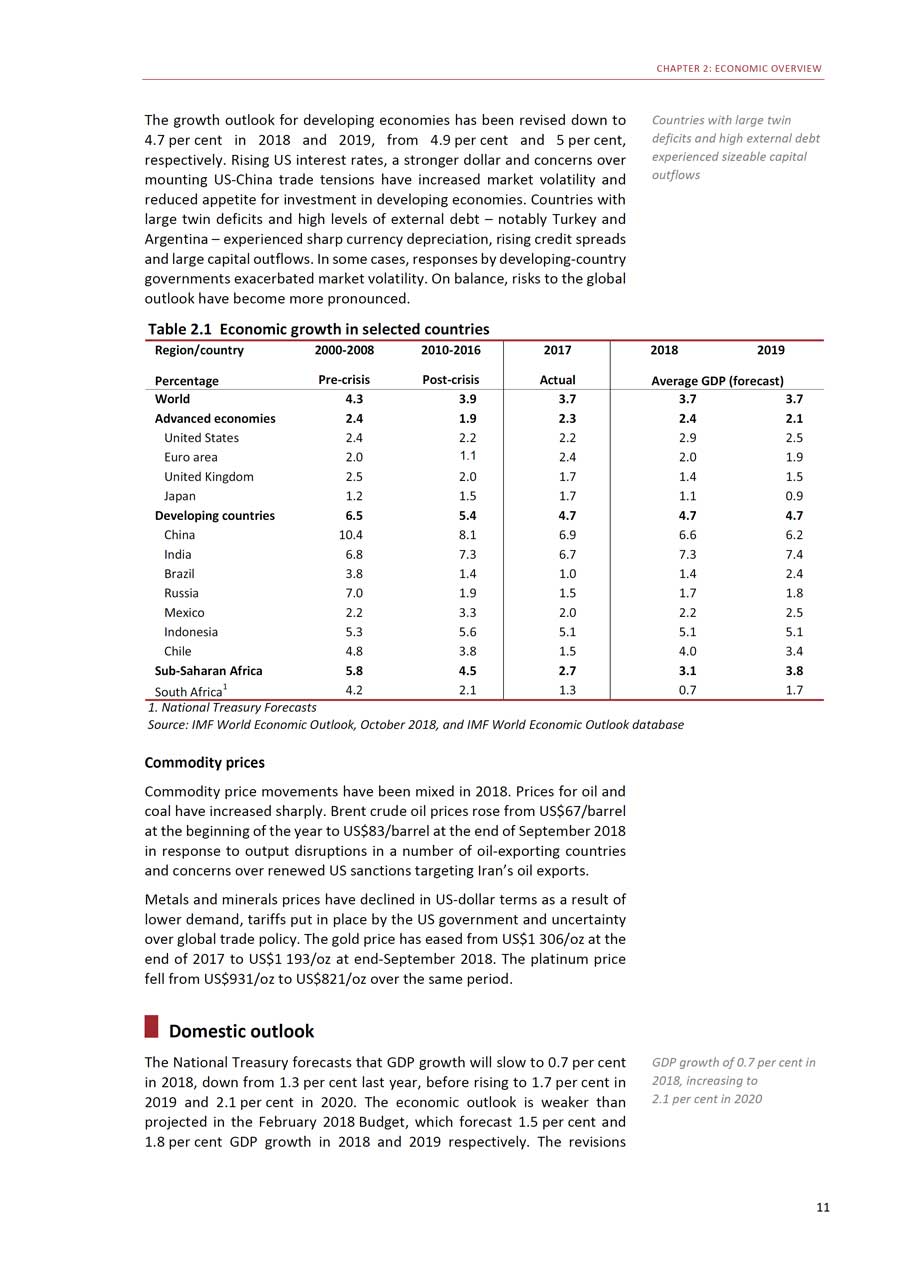

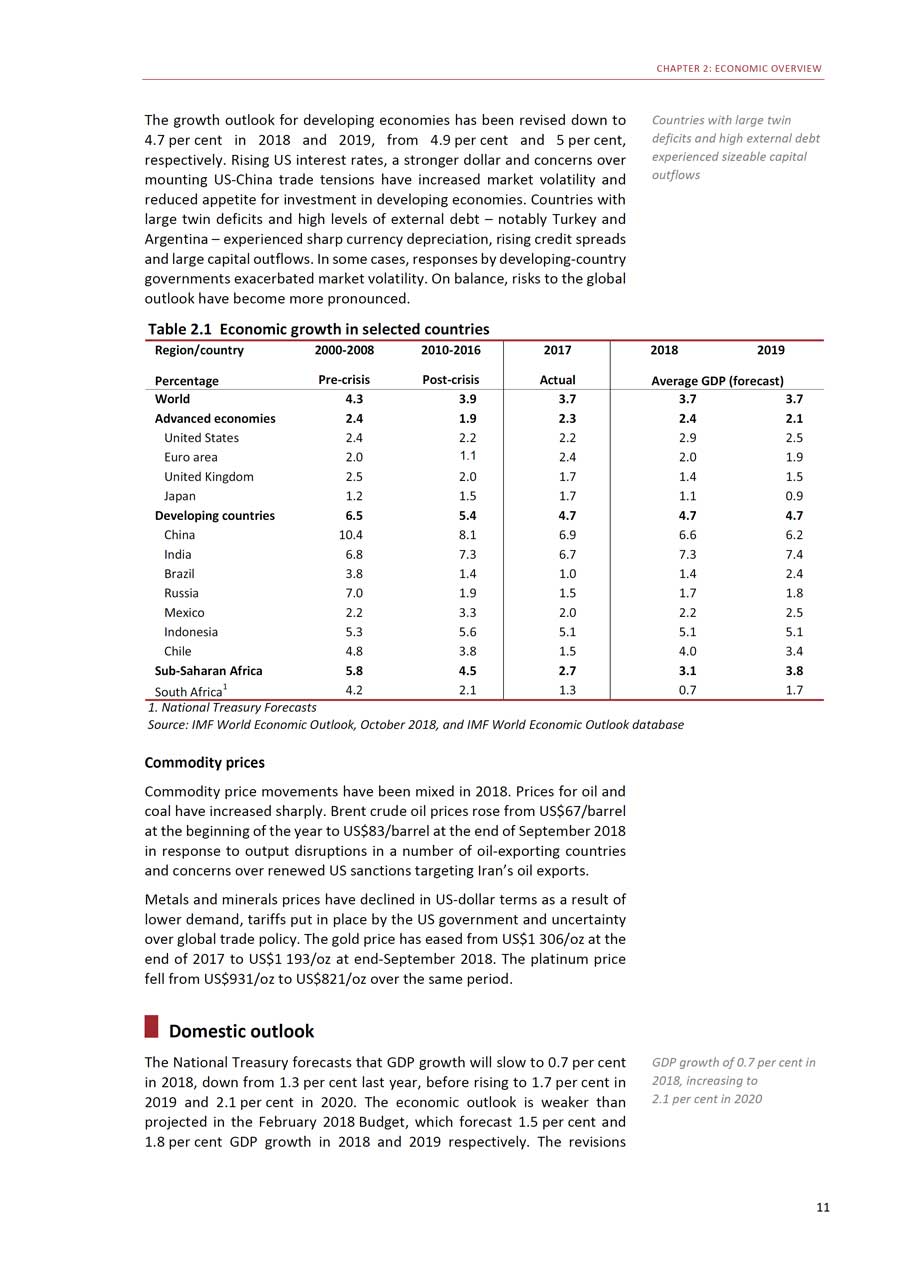

The growth outlook for developing economies has been revised down to4.7 per cent in 2018 and 2019, from 4.9 per cent and 5 per cent, respectively. Rising US interest rates, a stronger dollar and concerns over mounting US-China trade tensions have increased market volatility and reduced appetite for investment in developing economies. Countries with large twin deficits and high levels of external debt - notably Turkey and Argentina - experienced sharp currency depreciation, rising credit spreads and large capital outflows. In some cases, responses by developing-country governments exacerbated market volatility. On balance, risks to the global outlook have become more pronounced.Table 2.1 Economic growth in selected countries

Countries with large twin deficits and high external debt experienced sizeable capital outflows

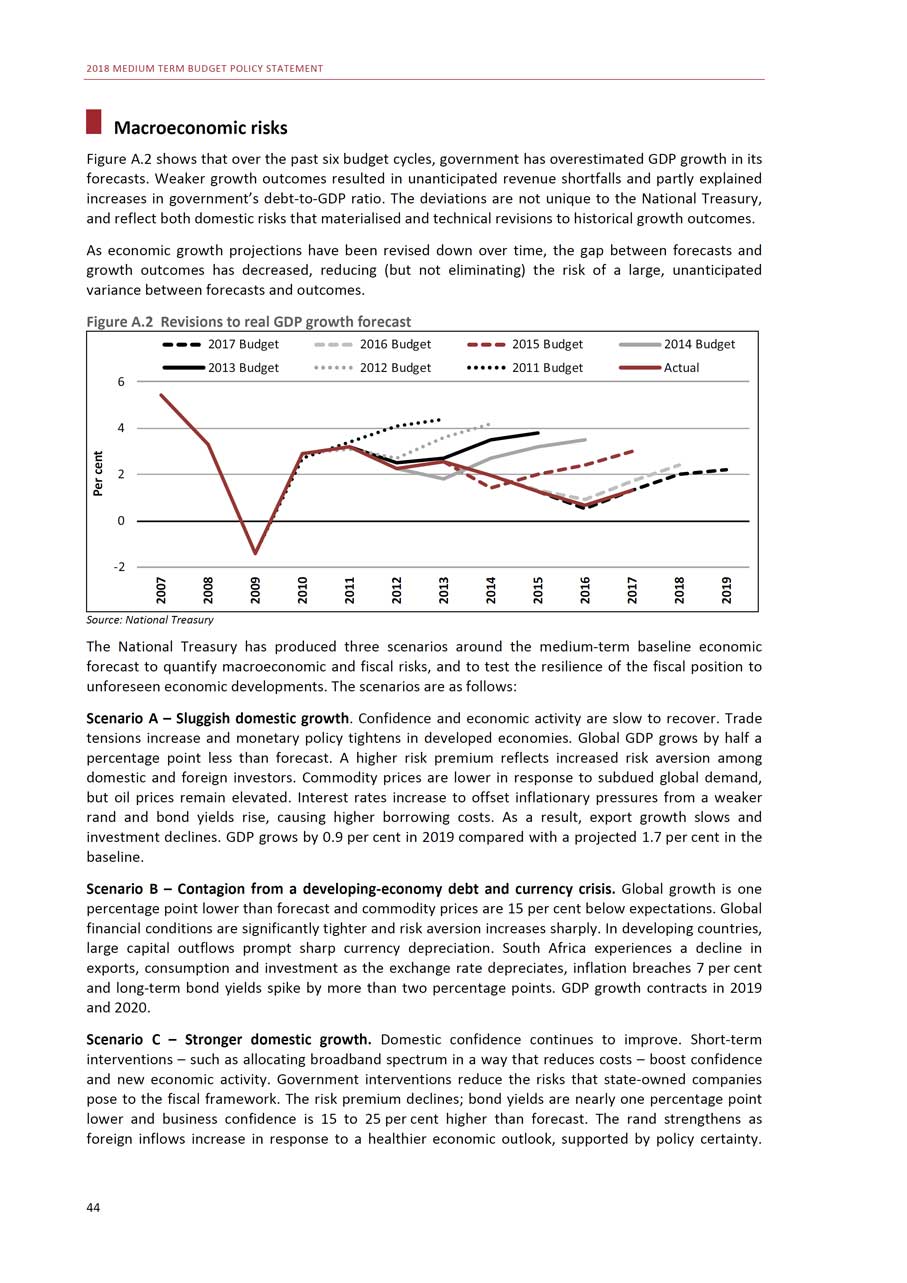

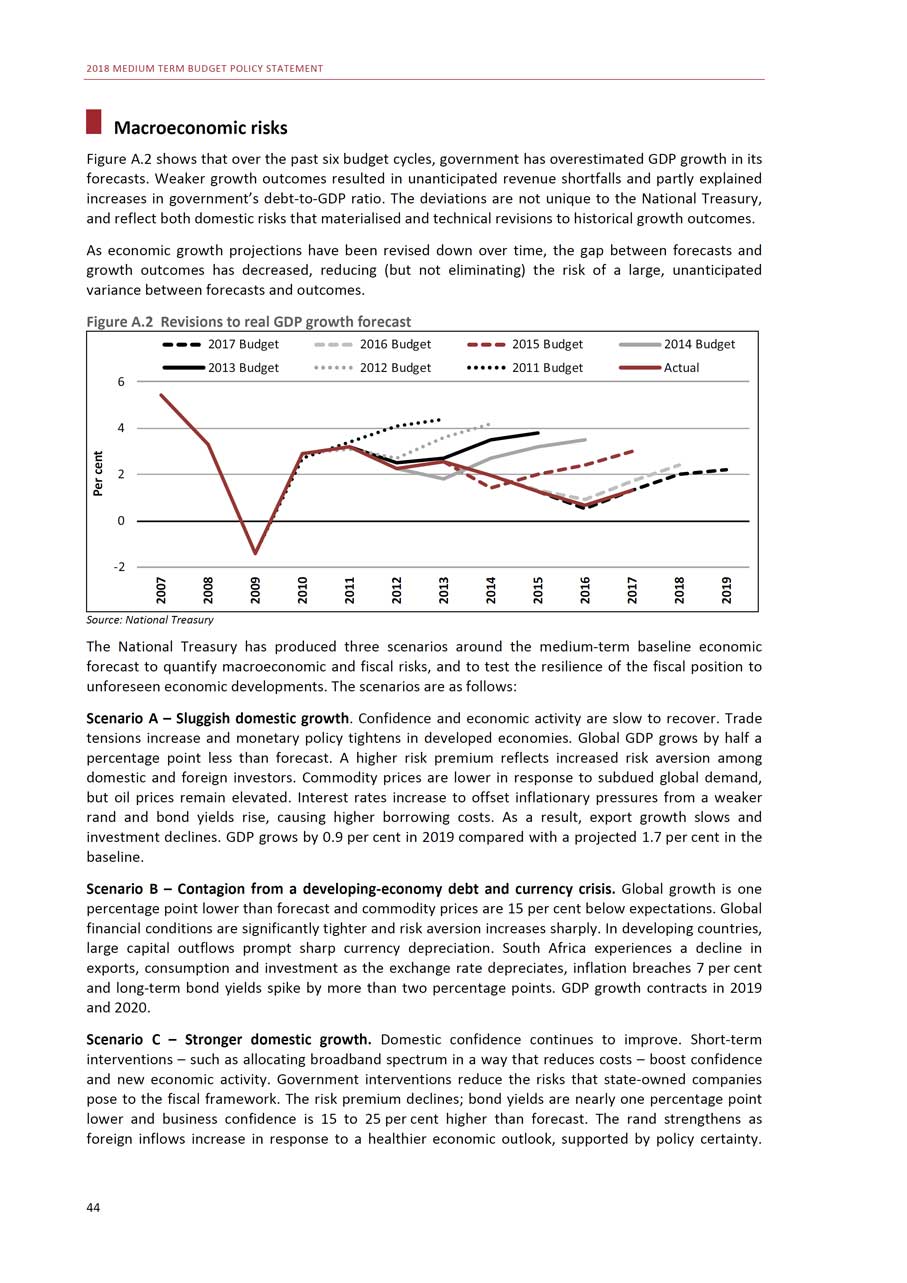

Region/country 2000-2008 2010-2016 2017 2018 2019Percentage Pre-crisis Post-crisis Actual Average GDP (forecast)World 4.3 3.9 3.7 3.7 3.7Advanced economies 2.4 1.9 2.3 2.4 2.1United States 2.4 2.2 2.2 2.9 2.5Euro area 2.0 1.1 2.4 2.0 1.9United Kingdom 2.5 2.0 1.7 1.4 1.5Japan 1.2 1.5 1.7 1.1 0.9Developing countries 6.5 5.4 4.7 4.7 4.7China 10.4 8.1 6.9 6.6 6.2India 6.8 7.3 6.7 7.3 7.4Brazil 3.8 1.4 1.0 1.4 2.4Russia 7.0 1.9 1.5 1.7 1.8Mexico 2.2 3.3 2.0 2.2 2.5Indonesia 5.3 5.6 5.1 5.1 5.1Chile 4.8 3.8 1.5 4.0 3.4Sub-Saharan Africa 5.8 4.5 2.7 3.1 3.8South Africa1 4.2 2.1 1.3 0.7 1.71. National Treasury Forecasts Source: IMF World Economic Outlook, October 2018, and IMF World Economic Outlook database Commodity prices Commodity price movements have been mixed in 2018. Prices for oil and coal have increased sharply. Brent crude oil prices rose from US$67/barrel at the beginning of the year to US$83/barrel at the end of September 2018 in response to output disruptions in a number of oil-exporting countries and concerns over renewed US sanctions targeting Iran’s oil exports. Metals and minerals prices have declined in US-dollar terms as a result of lower demand, tariffs put in place by the US government and uncertainty over global trade policy. The gold price has eased from US$1 306/oz at the end of 2017 to US$1 193/oz at end-September 2018. The platinum price fell from US$931/oz to US$821/oz over the same period. Domestic outlook

The National Treasury forecasts that GDP growth will slow to 0.7 per cent in 2018, down from 1.3 per cent last year, before rising to 1.7 per cent in 2019 and 2.1 per cent in 2020. The economic outlook is weaker than projected in the February 2018 Budget, which forecast 1.5 per cent and1.8 per cent GDP growth in 2018 and 2019 respectively. The revisions

GDP growth of 0.7 per cent in 2018, increasing to2.1 per cent in 202011

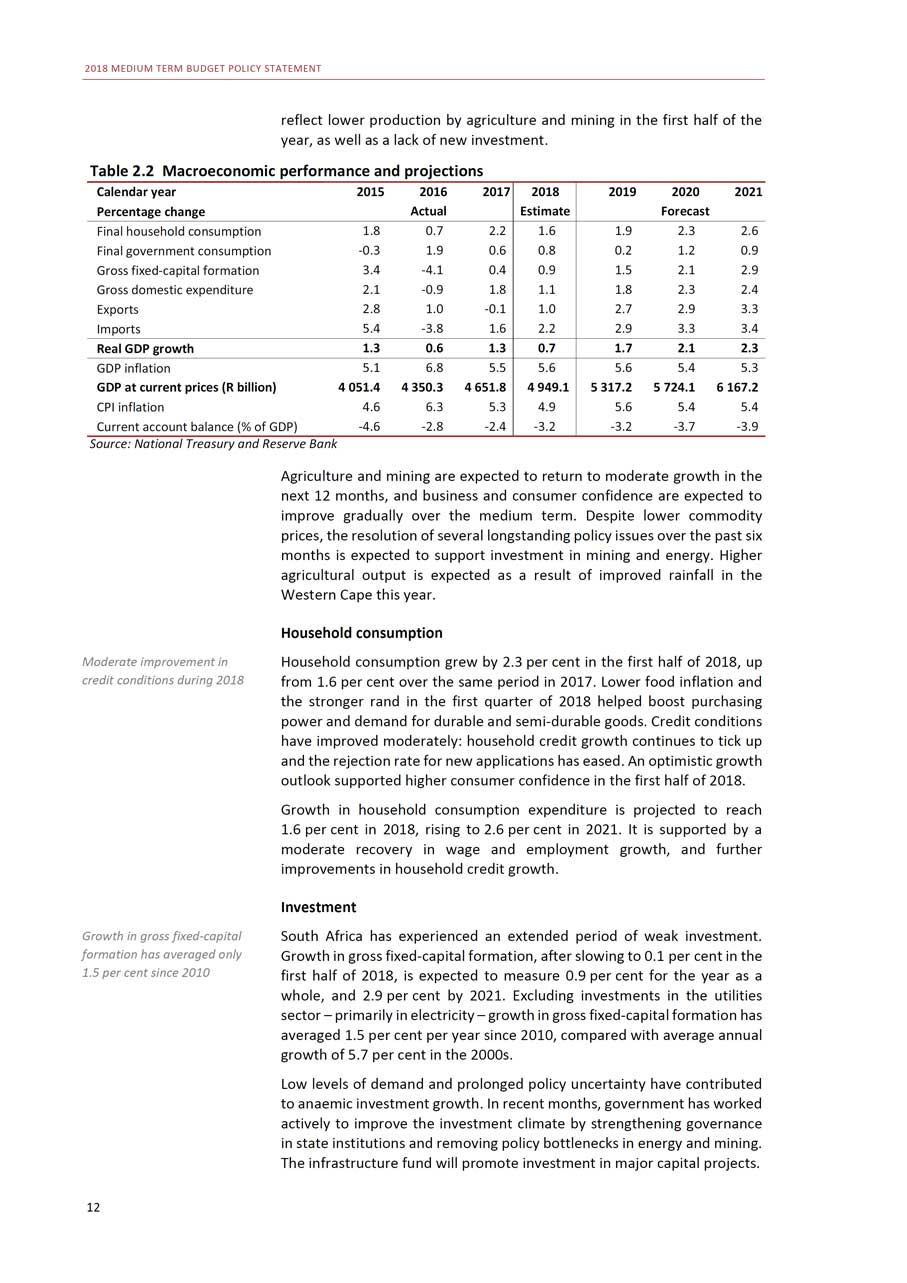

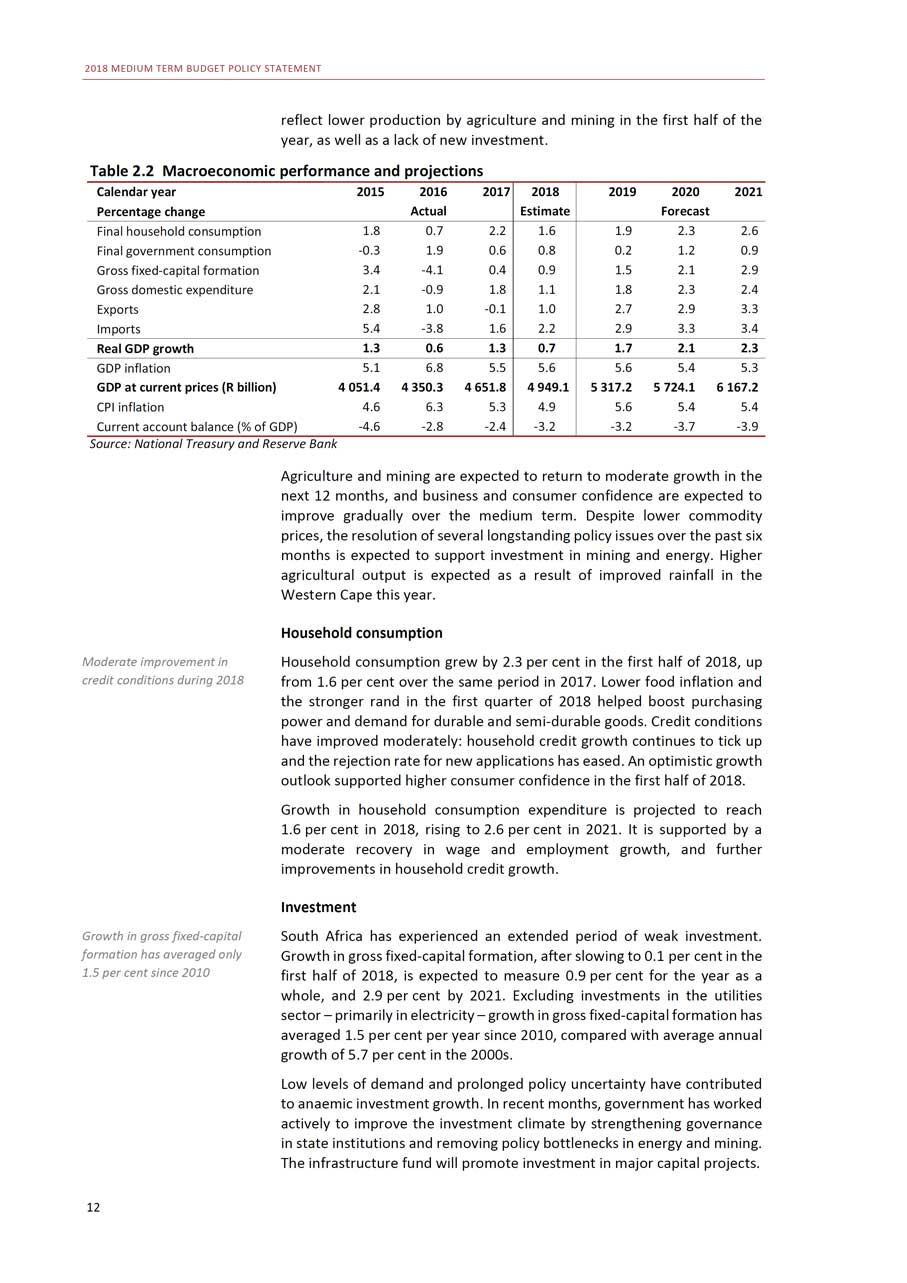

2018 MEDIUM TERM BUDGET POLICY STATEMENT reflect lower production by agriculture and mining in the first half of the year, as well as a lack of new investment. Table 2.2 Macroeconomic performance and projections Calendar year 2015 2016 2017 2018 2019 2020 2021Percentage change Actual Estimate ForecastFinal household consumption 1.8 0.7 2.2 1.6 1.9 2.3 2.6Final government consumption -0.3 1.9 0.6 0.8 0.2 1.2 0.9Gross fixed-capital formation 3.4 -4.1 0.4 0.9 1.5 2.1 2.9Gross domestic expenditure 2.1 -0.9 1.8 1.1 1.8 2.3 2.4Exports 2.8 1.0 -0.1 1.0 2.7 2.9 3.3Imports 5.4 -3.8 1.6 2.2 2.9 3.3 3.4Real GDP growth 1.3 0.6 1.3 0.7 1.7 2.1 2.3GDP inflation 5.1 6.8 5.5 5.6 5.6 5.4 5.3GDP at current prices (R billion) 4 051.4 4 350.3 4 651.8 4 949.1 5 317.2 5 724.1 6 167.2CPI inflation 4.6 6.3 5.3 4.9 5.6 5.4 5.4Current account balance (% of GDP) -4.6 -2.8 -2.4 -3.2 -3.2 -3.7 -3.9Source: National Treasury and Reserve Bank Agriculture and mining are expected to return to moderate growth in the next 12 months, and business and consumer confidence are expected to improve gradually over the medium term. Despite lower commodity prices, the resolution of several longstanding policy issues over the past six months is expected to support investment in mining and energy. Higher agricultural output is expected as a result of improved rainfall in the Western Cape this year. Household consumption

Moderate improvement in credit conditions during 2018Growth in gross fixed-capital formation has averaged only1.5 per cent since 201012

Household consumption grew by 2.3 per cent in the first half of 2018, up from 1.6 per cent over the same period in 2017. Lower food inflation and the stronger rand in the first quarter of 2018 helped boost purchasing power and demand for durable and semi-durable goods. Credit conditions have improved moderately: household credit growth continues to tick up and the rejection rate for new applications has eased. An optimistic growth outlook supported higher consumer confidence in the first half of 2018.Growth in household consumption expenditure is projected to reach1.6 per cent in 2018, rising to 2.6 per cent in 2021. It is supported by a moderate recovery in wage and employment growth, and further improvements in household credit growth.InvestmentSouth Africa has experienced an extended period of weak investment. Growth in gross fixed-capital formation, after slowing to 0.1 per cent in the first half of 2018, is expected to measure 0.9 per cent for the year as a whole, and 2.9 per cent by 2021. Excluding investments in the utilities sector - primarily in electricity - growth in gross fixed-capital formation has averaged 1.5 per cent per year since 2010, compared with average annual growth of 5.7 per cent in the 2000s.Low levels of demand and prolonged policy uncertainty have contributed to anaemic investment growth. In recent months, government has worked actively to improve the investment climate by strengthening governance in state institutions and removing policy bottlenecks in energy and mining. The infrastructure fund will promote investment in major capital projects.

CHAPTER 2: ECONOMIC OVERVIEW Exchange rate

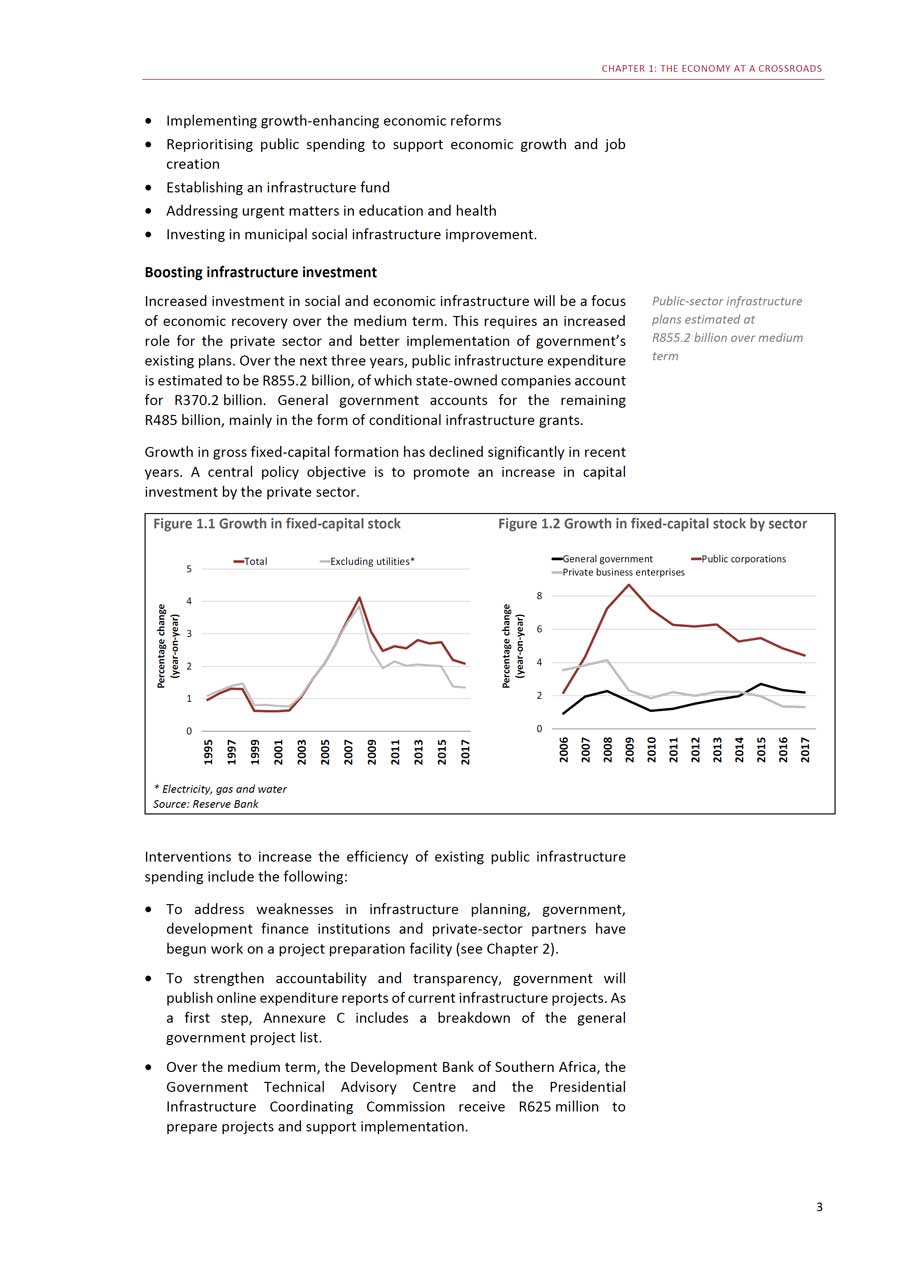

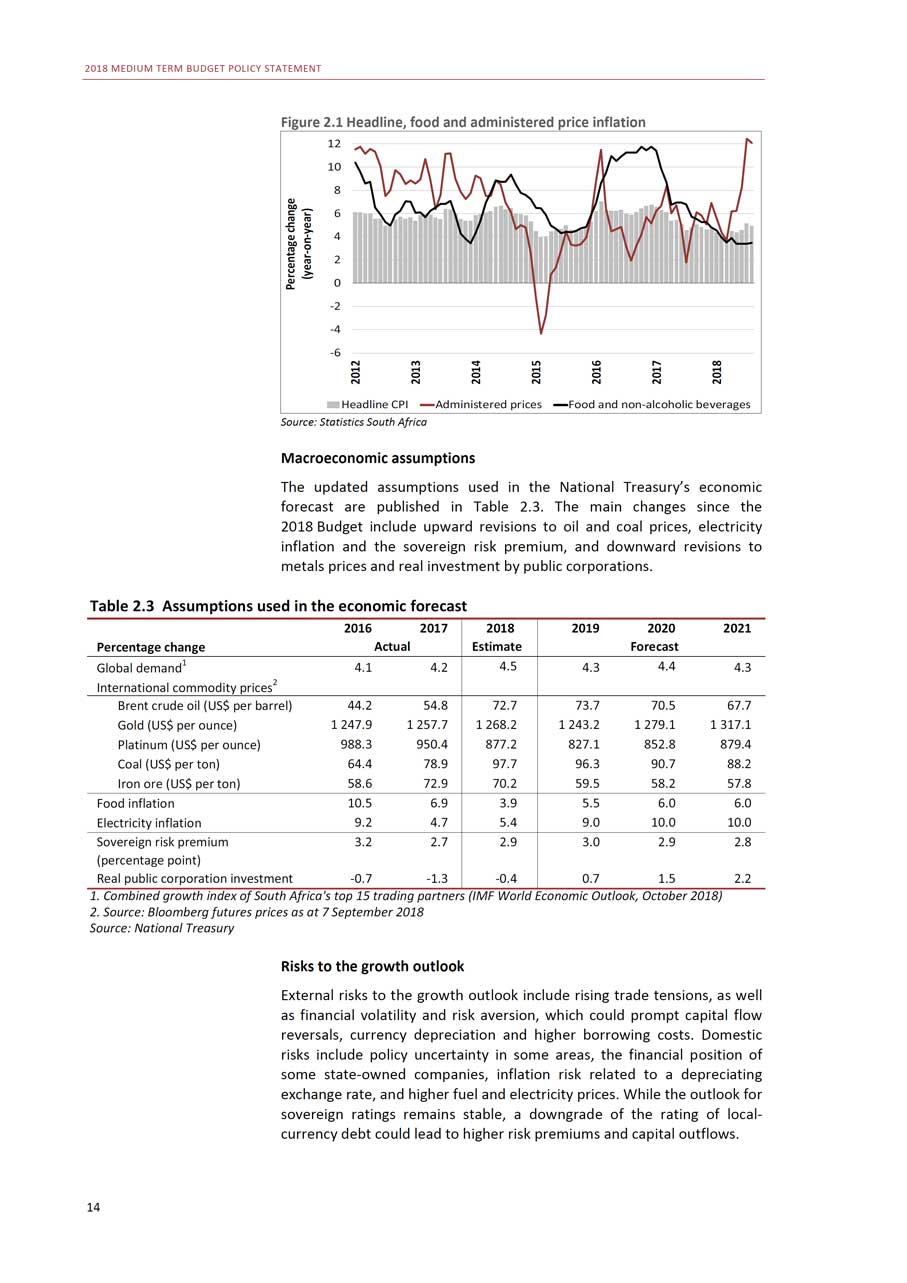

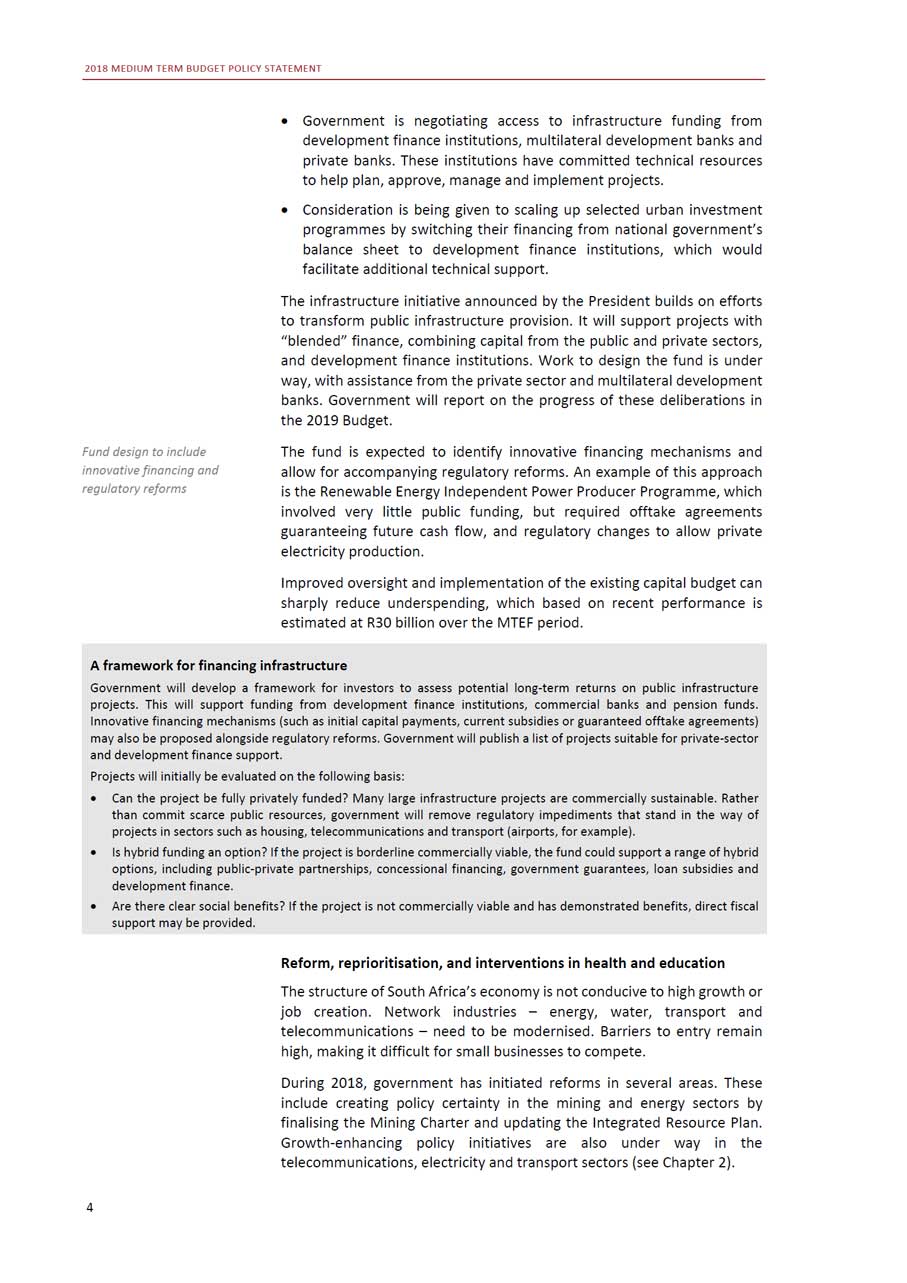

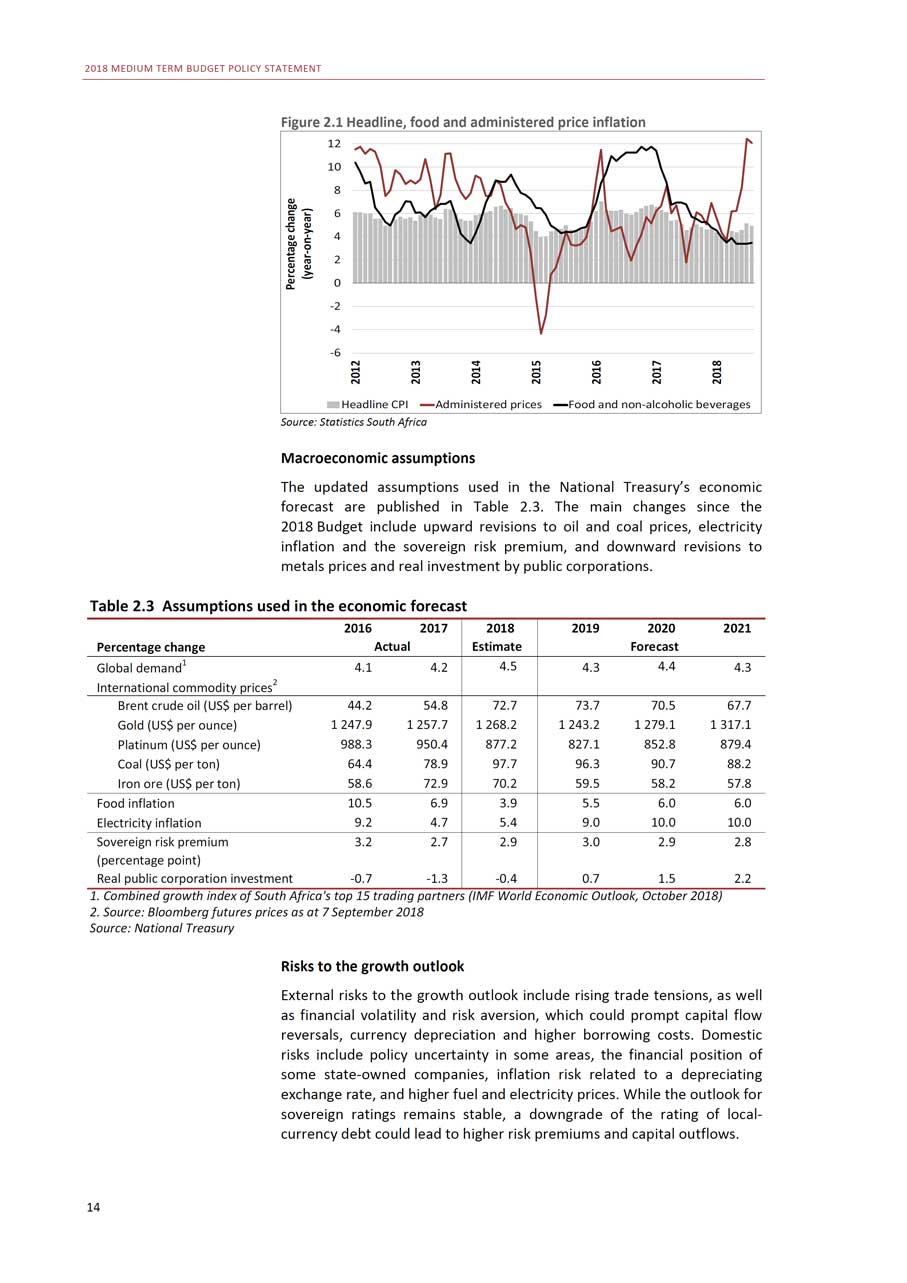

In the first three quarters of 2018, the rand weakened by 12.4 per cent against the US dollar. The currency depreciated largely in response to a strengthening of the dollar, negative investor sentiment induced by market volatility in Turkey and Argentina, and wider concerns about trade tensions. Low levels of domestic economic growth contributed to rand weakness.Balance of paymentsThe current account deficit widened to 4 per cent of GDP during the first half of 2018 from 2.4 per cent over the same period in 2017. This was largely due to a smaller trade surplus, higher net income payments and deteriorating terms of trade. The value of total exports of goods and services rose by 1.3 per cent in the first half of 2018, while that of imports of goods and services rose by 4.4 per cent. The current account deficit is expected to average 3.2 per cent of GDP in 2018, rising to 3.9 per cent over the medium term, as a result of import growth and weaker terms of trade.EmploymentUnemployment remains extremely high. Government recognises the centrality of private-sector job creation in sustainably reducing joblessness. Changes in employment levels over the past year have been marginal, with unemployment at 27.2 per cent in the second quarter of 2018. Formal non-agricultural employment grew by 0.3 per cent in the first half of the year, compared with the same period in 2017. Average employment in the government sector, which accounts for about21 per cent of total formal non-agricultural employment, rose by1.8 per cent in the first half of the year, mostly as a result of temporary employment for voter registration. Employment outside government declined by 0.1 per cent in the first half of 2018.InflationHeadline inflation continued to ease in 2018, averaging 4.5 per cent over the first eight months of the year compared with 5.5 per cent over the same period in 2017. This trend was largely driven by lower food inflation. Core inflation, which excludes food, fuel and electricity prices, slowed from4.9 per cent in the first eight months of 2017 to 4.2 per cent over the same period in 2018. Inflation expectations have eased slightly in 2018 but remain near the upper end of the 3 to 6 per cent target range.Higher inflation is expected during the remainder of 2018 in response to administered price increases. In recent months, rising oil prices and a weaker currency led to a sharp increase in fuel prices. Electricity prices, which rose by 2.1 per cent in August 2017, increased by 7.8 per cent in August 2018.Headline inflation is projected to average 4.9 per cent in 2018, rising to5.4 per cent by 2021 as food price inflation returns to its historic average. The medium-term outlook has adjusted the assumption of electricity price inflation from 8 per cent to 10 per cent.

Rand depreciated by12.4 percent against US dollar in first nine months of 2018Private-sector job creation is central to sustainably reducing unemploymentInflation has eased, but is expected to increase in response to higher oil and administered pricesMedium-term inflation projections remain within targeted range13

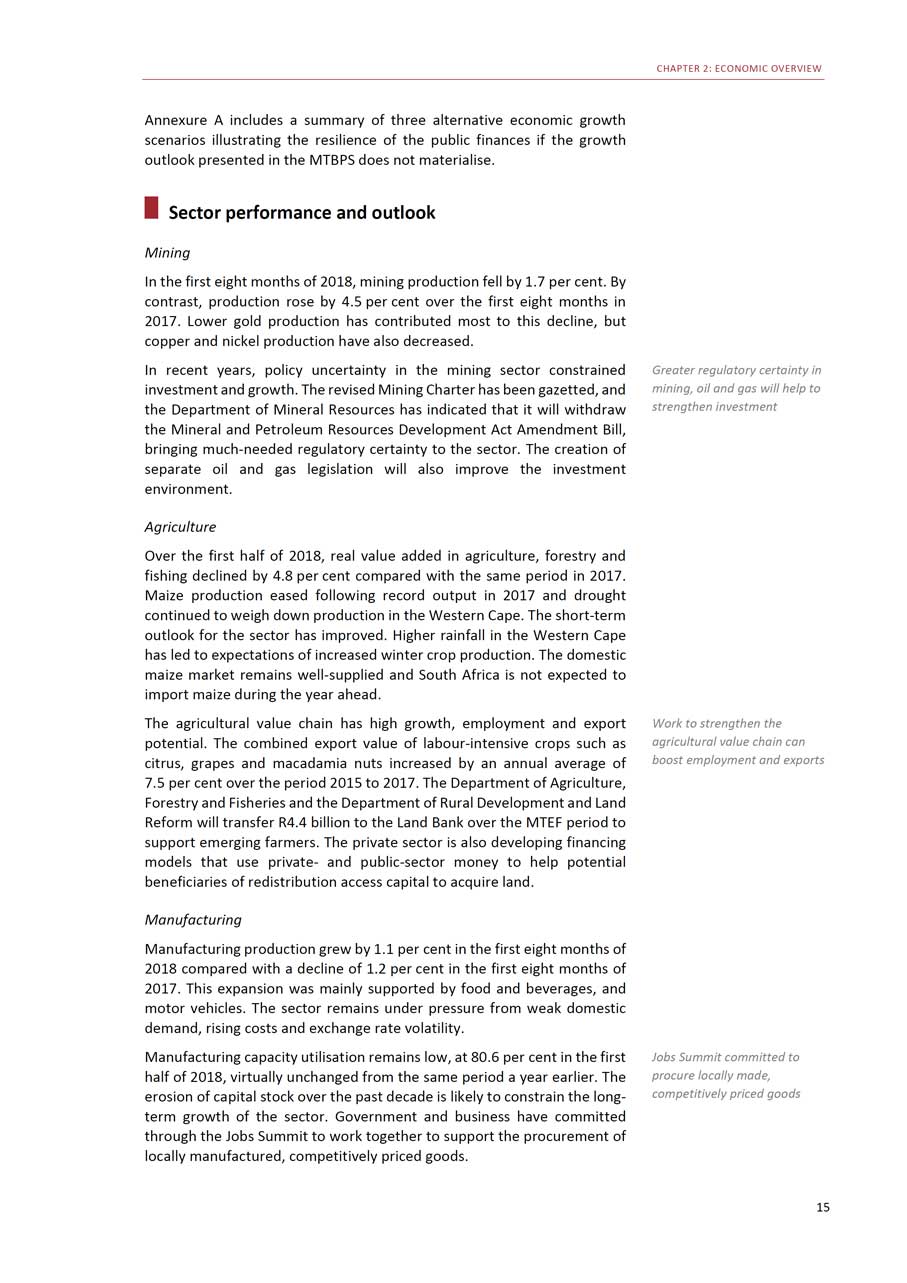

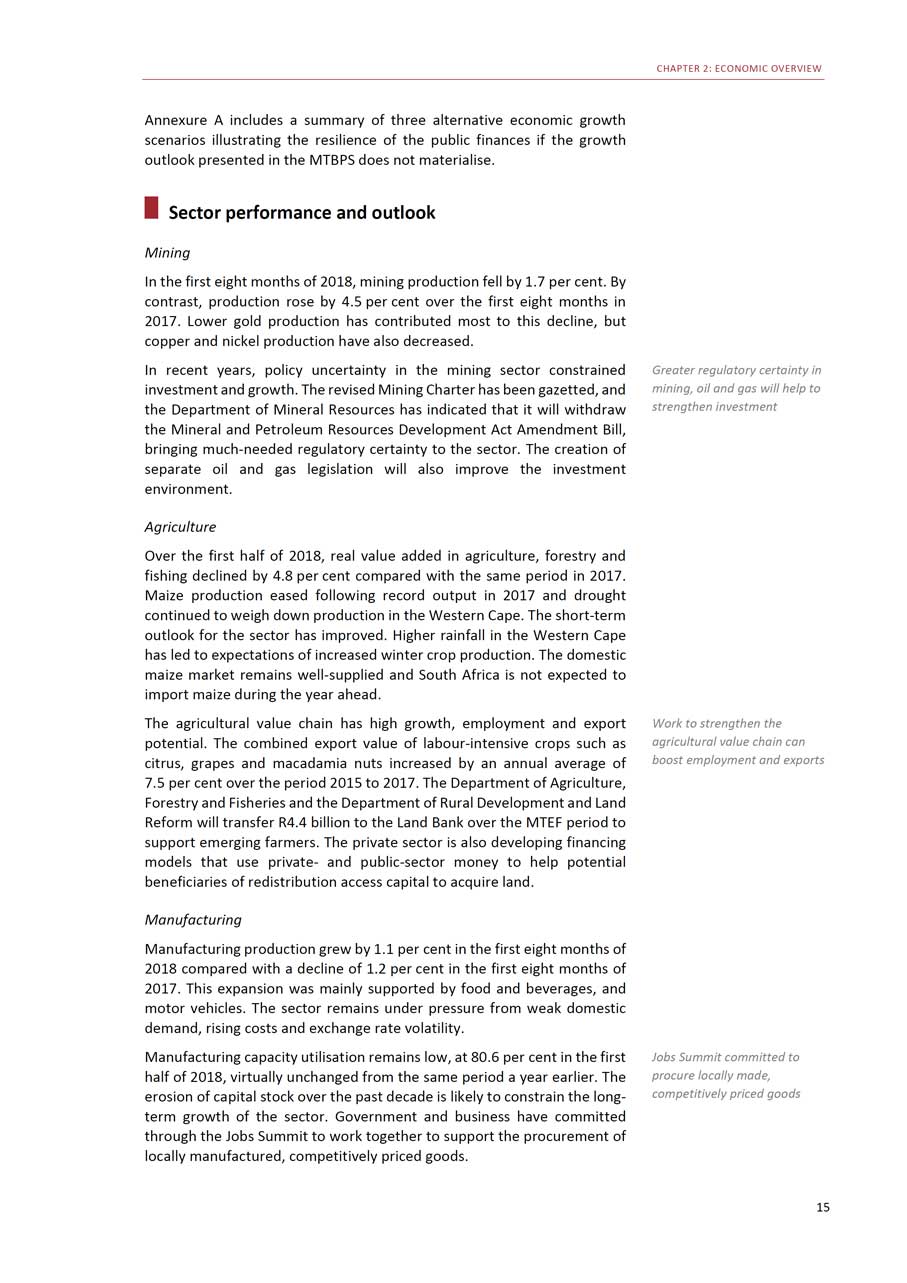

2018 MEDIUM TERM BUDGET POLICY STATEMENT Figure 2.1 Headline, food and administered price inflation 12 10 8 6 4 2 0 -2 -4 -6 Headline CPI Administered prices Food and non-alcoholic beveragesSource: Statistics South Africa Macroeconomic assumptions The updated assumptions used in the National Treasury’s economic forecast are published in Table 2.3. The main changes since the 2018 Budget include upward revisions to oil and coal prices, electricity inflation and the sovereign risk premium, and downward revisions to metals prices and real investment by public corporations. Table 2.3 Assumptions used in the economic forecast 2016 2017 2018 2019 2020 2021Percentage change Actual Estimate ForecastGlobal demand1 4.1 4.2 4.5 4.3 4.4 4.3International commodity prices2Brent crude oil (US$ per barrel) 44.2 54.8 72.7 73.7 70.5 67.7Gold (US$ per ounce) 1 247.9 1 257.7 1 268.2 1 243.2 1 279.1 1 317.1Platinum (US$ per ounce) 988.3 950.4 877.2 827.1 852.8 879.4Coal (US$ per ton) 64.4 78.9 97.7 96.3 90.7 88.2Iron ore (US$ per ton) 58.6 72.9 70.2 59.5 58.2 57.8Food inflation 10.5 6.9 3.9 5.5 6.0 6.0Electricity inflation 9.2 4.7 5.4 9.0 10.0 10.0Sovereign risk premium 3.2 2.7 2.9 3.0 2.9 2.8(percentage point) Real public corporation investment -0.7 -1.3 -0.4 0.7 1.5 2.21. Combined growth index of South Africa’s top 15 trading partners (IMF World Economic Outlook, October 2018) 2. Source: Bloomberg futures prices as at 7 September 2018 Source: National Treasury Risks to the growth outlook External risks to the growth outlook include rising trade tensions, as well as financial volatility and risk aversion, which could prompt capital flow reversals, currency depreciation and higher borrowing costs. Domestic risks include policy uncertainty in some areas, the financial position of some state-owned companies, inflation risk related to a depreciating exchange rate, and higher fuel and electricity prices. While the outlook for sovereign ratings remains stable, a downgrade of the rating of local- currency debt could lead to higher risk premiums and capital outflows. 14

CHAPTER 2: ECONOMIC OVERVIEW Annexure A includes a summary of three alternative economic growth scenarios illustrating the resilience of the public finances if the growth outlook presented in the MTBPS does not materialise. Sector performance and outlook Mining In the first eight months of 2018, mining production fell by 1.7 per cent. By contrast, production rose by 4.5 per cent over the first eight months in 2017. Lower gold production has contributed most to this decline, but copper and nickel production have also decreased.

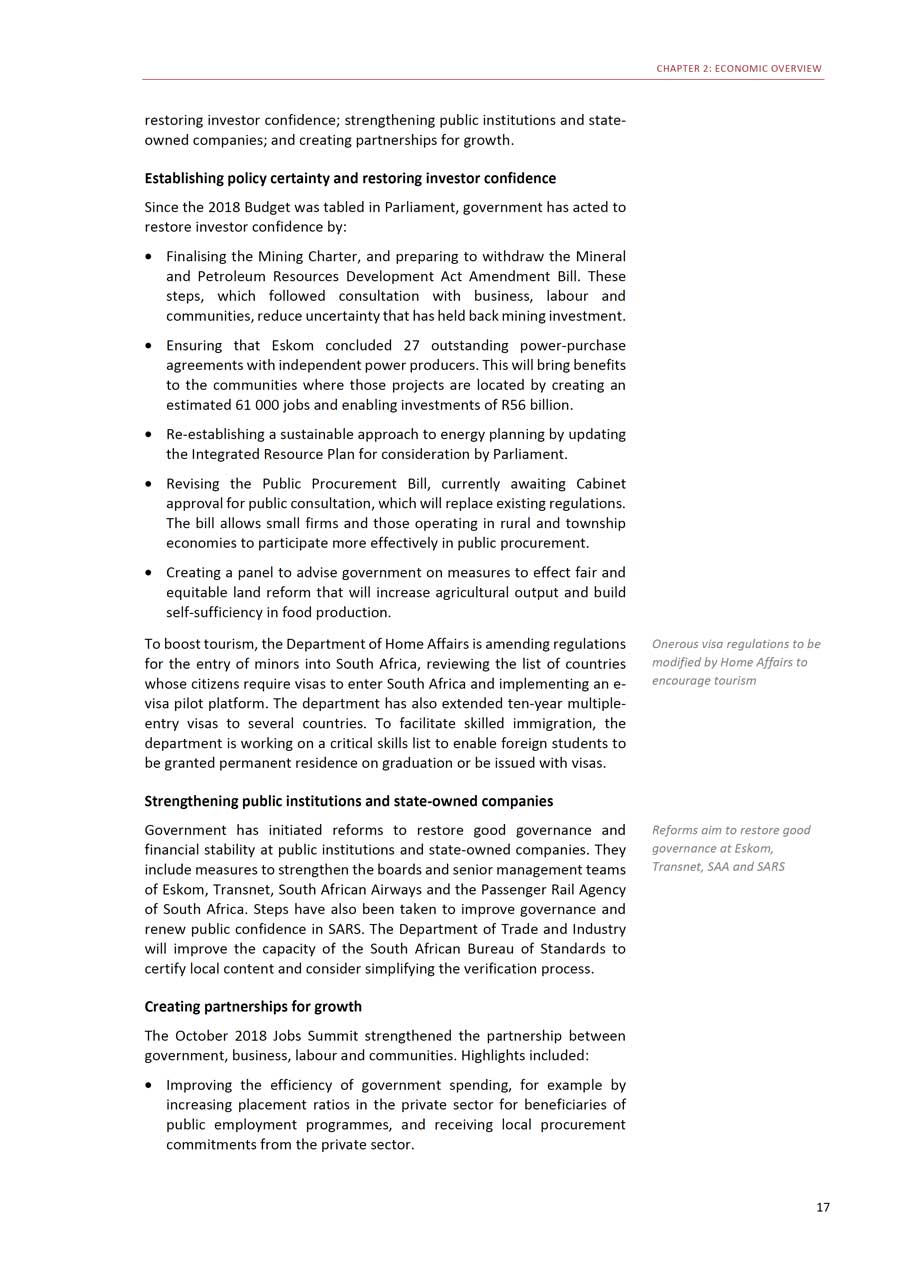

In recent years, policy uncertainty in the mining sector constrained investment and growth. The revised Mining Charter has been gazetted, and the Department of Mineral Resources has indicated that it will withdraw the Mineral and Petroleum Resources Development Act Amendment Bill, bringing much-needed regulatory certainty to the sector. The creation of separate oil and gas legislation will also improve the investment environment.AgricultureOver the first half of 2018, real value added in agriculture, forestry and fishing declined by 4.8 per cent compared with the same period in 2017. Maize production eased following record output in 2017 and drought continued to weigh down production in the Western Cape. The short-term outlook for the sector has improved. Higher rainfall in the Western Cape has led to expectations of increased winter crop production. The domestic maize market remains well-supplied and South Africa is not expected to import maize during the year ahead.The agricultural value chain has high growth, employment and export potential. The combined export value of labour-intensive crops such as citrus, grapes and macadamia nuts increased by an annual average of7.5 per cent over the period 2015 to 2017. The Department of Agriculture, Forestry and Fisheries and the Department of Rural Development and Land Reform will transfer R4.4 billion to the Land Bank over the MTEF period to support emerging farmers. The private sector is also developing financing models that use private- and public-sector money to help potential beneficiaries of redistribution access capital to acquire land.ManufacturingManufacturing production grew by 1.1 per cent in the first eight months of 2018 compared with a decline of 1.2 per cent in the first eight months of 2017. This expansion was mainly supported by food and beverages, and motor vehicles. The sector remains under pressure from weak domestic demand, rising costs and exchange rate volatility.Manufacturing capacity utilisation remains low, at 80.6 per cent in the first half of 2018, virtually unchanged from the same period a year earlier. The erosion of capital stock over the past decade is likely to constrain the long- term growth of the sector. Government and business have committed through the Jobs Summit to work together to support the procurement of locally manufactured, competitively priced goods.

Greater regulatory certainty in mining, oil and gas will help to strengthen investmentWork to strengthen the agricultural value chain can boost employment and exportsJobs Summit committed to procure locally made,competitively priced goods15

2018 MEDIUM TERM BUDGET POLICY STATEMENT Financial and business services Real value added in the finance, insurance, real estate and business services sector rose by 2 per cent in the first half of 2018, compared with 1.8 per cent over the same period in 2017. Formal employment in the sector rose by 0.5 per cent, with most jobs contributed by real estate, and legal and accounting services.

Legislation to assist over- indebted households being considered in ParliamentReforms to change structure of economy could boost growth by three percentage pointsover next decade16

Government has introduced legislation to promote new products and protect consumers of financial services. The National Credit Amendment Bill, which aims to assist over-indebted low-income households, is under consideration in the National Council of Provinces. The Insurance Act (2017), which came into effect in July 2018, introduces a legal framework for the micro-insurance industry and aims to promote formal insurance for low-income households. Cabinet approved the Financial Sector Laws Amendment Bill in September 2018 and has released it for public comment. The bill seeks to strengthen curatorship provisions for financial institutions to protect vulnerable depositors and reduce systemic risk.Implementing growth-enhancing reformsA decade of poor economic performance and high unemployment has reinforced the urgent need for a comprehensive programme of reforms to change the underlying structure of the economy. Necessary structural reforms include modernising the energy, water, transport and telecommunications industries; lowering barriers to entry and addressing distorted patterns of ownership through increased competition and small business growth; enabling growth in labour-intensive sectors such as agriculture and tourism; promoting export competitiveness; harnessing regional growth opportunities; and reducing the cost of doing business.National Treasury modelling suggests that such reforms can raise GDP growth by as much as three percentage points over the next decade. In recent months, progress has been made in these areas. For example:• The Department of Telecommunications and Postal Services hasgazetted a proposed policy for the licensing of high-demand spectrum.The communications regulator plans to auction spectrum for 4G services by April 2019, and simultaneously establish a wholesale open-access network to lower the cost of data.• The departments of Energy and Public Enterprises, and the NationalTreasury, have begun work to determine how a restructured electricitysector can support long-term growth, a secure energy supply, a sustainable electricity utility and higher investment in electricity generation, transmission and distribution.• The Economic Regulation of Transport Bill, now before Parliament, willcontribute to competitive pricing and improved service quality intransport. Administered transport prices will be reviewed to reduce the cost of doing business. Reviews of administered prices in other sectors, such as energy, are under way.Such reforms can boost long-term growth. In the short term, government is focusing its actions in three areas: Establishing policy certainty and

CHAPTER 2: ECONOMIC OVERVIEW restoring investor confidence; strengthening public institutions and stateowned companies; and creating partnerships for growth. Establishing policy certainty and restoring investor confidence Since the 2018 Budget was tabled in Parliament, government has acted to restore investor confidence by: • Finalising the Mining Charter, and preparing to withdraw the Mineral and Petroleum Resources Development Act Amendment Bill. These steps, which followed consultation with business, labour and communities, reduce uncertainty that has held back mining investment. • Ensuring that Eskom concluded 27 outstanding power-purchase agreements with independent power producers. This will bring benefits to the communities where those projects are located by creating an estimated 61 000 jobs and enabling investments of R56 billion. • Re-establishing a sustainable approach to energy planning by updating the Integrated Resource Plan for consideration by Parliament. • Revising the Public Procurement Bill, currently awaiting Cabinet approval for public consultation, which will replace existing regulations. The bill allows small firms and those operating in rural and township economies to participate more effectively in public procurement. • Creating a panel to advise government on measures to effect fair andequitable land reform that will increase agricultural output and buildself-sufficiency in food production.

To boost tourism, the Department of Home Affairs is amending regulations for the entry of minors into South Africa, reviewing the list of countries whose citizens require visas to enter South Africa and implementing an e- visa pilot platform. The department has also extended ten-year multiple- entry visas to several countries. To facilitate skilled immigration, the department is working on a critical skills list to enable foreign students to be granted permanent residence on graduation or be issued with visas.Strengthening public institutions and state-owned companiesGovernment has initiated reforms to restore good governance and financial stability at public institutions and state-owned companies. They include measures to strengthen the boards and senior management teams of Eskom, Transnet, South African Airways and the Passenger Rail Agency of South Africa. Steps have also been taken to improve governance and renew public confidence in SARS. The Department of Trade and Industry will improve the capacity of the South African Bureau of Standards to certify local content and consider simplifying the verification process.Creating partnerships for growthThe October 2018 Jobs Summit strengthened the partnership between government, business, labour and communities. Highlights included:• Improving the efficiency of government spending, for example by increasing placement ratios in the private sector for beneficiaries ofpublic employment programmes, and receiving local procurement commitments from the private sector.

Onerous visa regulations to be modified by Home Affairs to encourage tourismReforms aim to restore good governance at Eskom,Transnet, SAA and SARS17

2018 MEDIUM TERM BUDGET POLICY STATEMENT • Project-specific collaboration, as demonstrated by partnerships between commercial farmers, lenders and black farmers. • Improving policy certainty through consultations that respond to affected groups, evidenced in both the extension of the employment tax incentive as well as changes in the training lay-off scheme.

Business-led youthemployment initiative offers work experience, training and job placement servicesSmall Business and Innovation Fund and CEO Initiative’s SME Fund support entrepreneurship

The Youth Employment Service, a business-led initiative launched in March 2018, offers one-year work experience and training alongside job placement services. Government supports the initiative, which also benefits from the employment tax incentive and enhanced broad-based black economic empowerment recognition.The National Minimum Wage Bill, which introduces a minimum wage of R20/hour, was approved by the National Council of Provinces in August 2018, and awaits ratification. Embedded in the Labour Relations Amendment Act, also awaiting ratification, are reforms aimed at reducing workplace conflict, and the duration and severity of industrial action. The Jobs Summit resulted in an agreement to extend the employment tax incentive, due to lapse in 2019, for 10 years. The incentive, which encourages the hiring of younger workers, supported about 690 000 jobs in the 2016 tax year.The Small Business and Innovation Fund will help entrepreneurs and small businesses to navigate the pre-start-up phase and provide support as they scale up their enterprises. This will complement the work of the CEO Initiative’s SME Fund, which has raised R1.4 billion to date, with about R500 million expected to be committed for debt and equity investments in SMEs by the first quarter of 2019.The financial sector has committed to invest R100 billion over five years in black industrial enterprises and firms. The Financial Sector Transformation Council is working with the Department of Trade and Industry to finalise guidelines for the disbursement of this funding.The infrastructure fund announced as part of the President’s economic stimulus and recovery plan is intended to encourage capital investment by the private sector and development finance institutions in public infrastructure. The fund will build on work under way in government to improve the planning and management of large infrastructure projects.

Strengthening the planning and rollout of public infrastructure projects Many public infrastructure projects have been marred by weak project preparation, planning and execution caused by lack of technical expertise and institutional capacity. These institutional weaknesses often translate into lengthy delays, overor underspending, and quality concerns. Government has established a project preparation facility, with funding set aside over the medium term. The facility will combine the efforts of the National Treasury, the Government Technical Advisory Centre, the Presidential Infrastructure Coordinating Commission, the Development Bank of Southern Africa, the Association for Savings and Investment South Africa, the Banking Association of South Africa, the South Africa Venture Capital and Private Equity Association, and the New Development Bank. It will deploy technical experts to sponsoring departments to support development of investment-ready projects. Conclusion To increase the economy’s ability to grow sustainably at higher levels, South Africa requires a series of reforms that will raise productivity, increase competition and reduce the cost of doing business. 18

3 Fiscal policy In brief • Government remains committed to sustainable public finances. Despite major spending pressures, the expenditure ceiling remains intact. • Gross debt is projected to stabilise at 59.6 per cent of GDP in 2023/24. Currency depreciation accounts for about 70 per cent of the upward revision to gross loan debt in the current year. • Tax revenue has been revised down by R27.4 billion in 2018/19, R24.7 billion in 2019/20 and R33 billion in 2020/21 relative to the 2018 Budget. This mainly reflects higher-than-expected VAT refunds. • The consolidated budget deficit is estimated at 4 per cent in 2018/19, compared with the 2018 Budget projection of 3.6 per cent of GDP. After rising to 4.2 per cent, the deficit stabilises at 4 per cent in the outer year. • Slow economic growth remains the primary risk to the framework. While some state-owned companies receive funding in the current year, their poor financial position could burden the public finances over the medium term. Fiscal resilience in a constrained environment he 2018 Budget Review announced large-scale expenditure reprioritisation and tax increases, notably a one percentage point

increase in the VAT rate. These measures, combined with the

expectation of improved confidence, implied that gross national debt would stabilise at 56.2 per cent of GDP in 2022/23.

In recent months, deteriorating economic performance and revenue shortfalls have contributed to some slippage in fiscal projections. Other risks identified in the 2018 Budget have materialised, including a public- service wage agreement significantly above inflation, and continued decline in the financial condition of some state-owned companies, leading to requests for budget support. Following years of slow spending growth and tax increases, there is little room for large fiscal adjustments.Taking these developments into account, government is maintaining its commitment to fiscal sustainability and debt stabilisation without

Weak economic performance and revenue shortfallscontribute to slippage in fiscal projections 19

2018 MEDIUM TERM BUDGET POLICY STATEMENT introducing fiscal measures that could limit growth. Over the medium-term expenditure framework (MTEF) period, government will: • Maintain the main budget expenditure ceiling. Funds will be reprioritised to manage spending pressures and support the President’s economic stimulus and recovery plan. • Avoid increases in the major tax instruments unless the economic environment requires it. At this stage, revenue projections assume no changes to tax rates, but provide for annual adjustments to personal income tax brackets, levies and excise duties in line with inflation. • Retain national departments’ compensation ceilings. This implies continued restrictions on personnel budgets and public employment.

Consolidated budget deficit expected to decline from 4.2 per cent of GDP in 2019/20 to 4 per cent in 2021/22

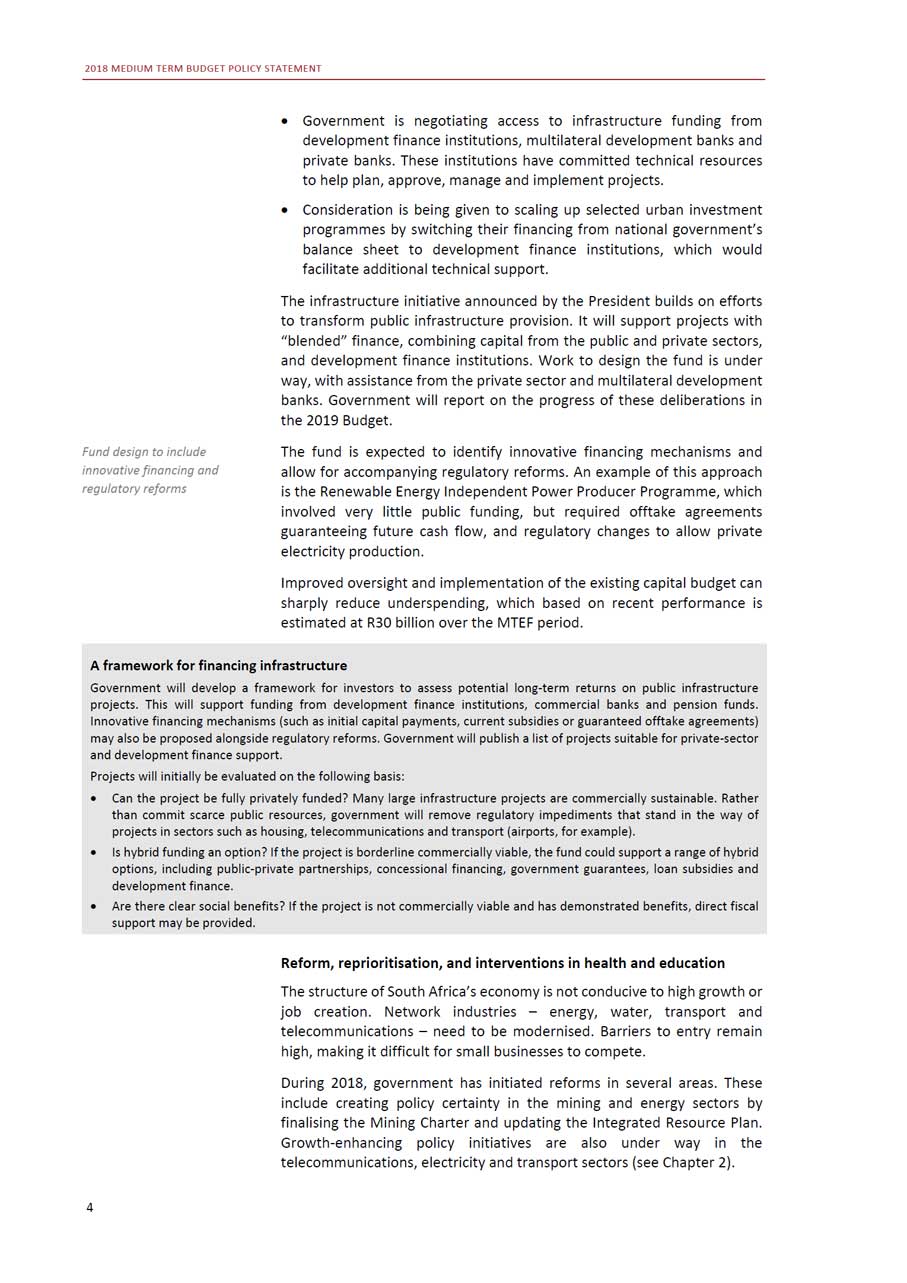

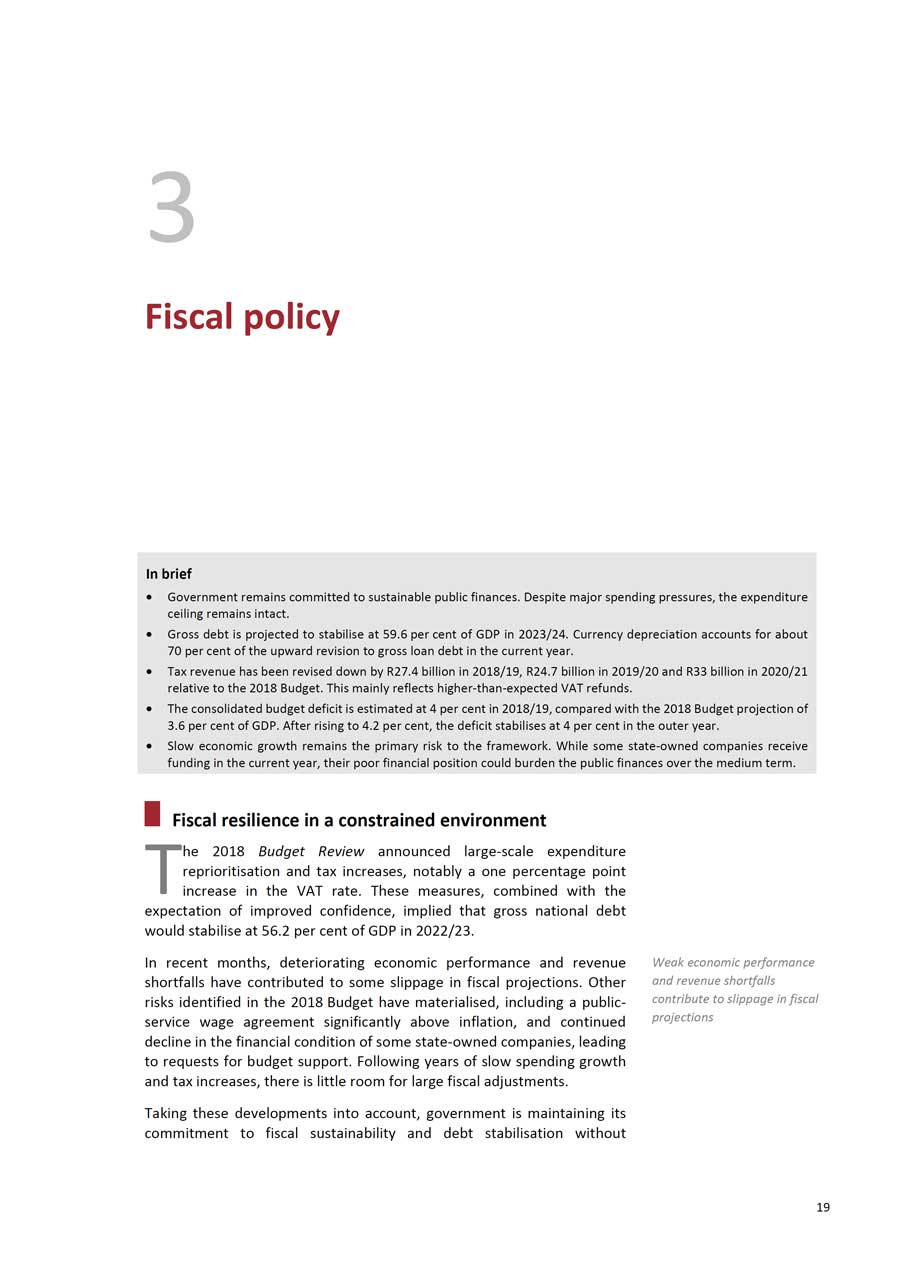

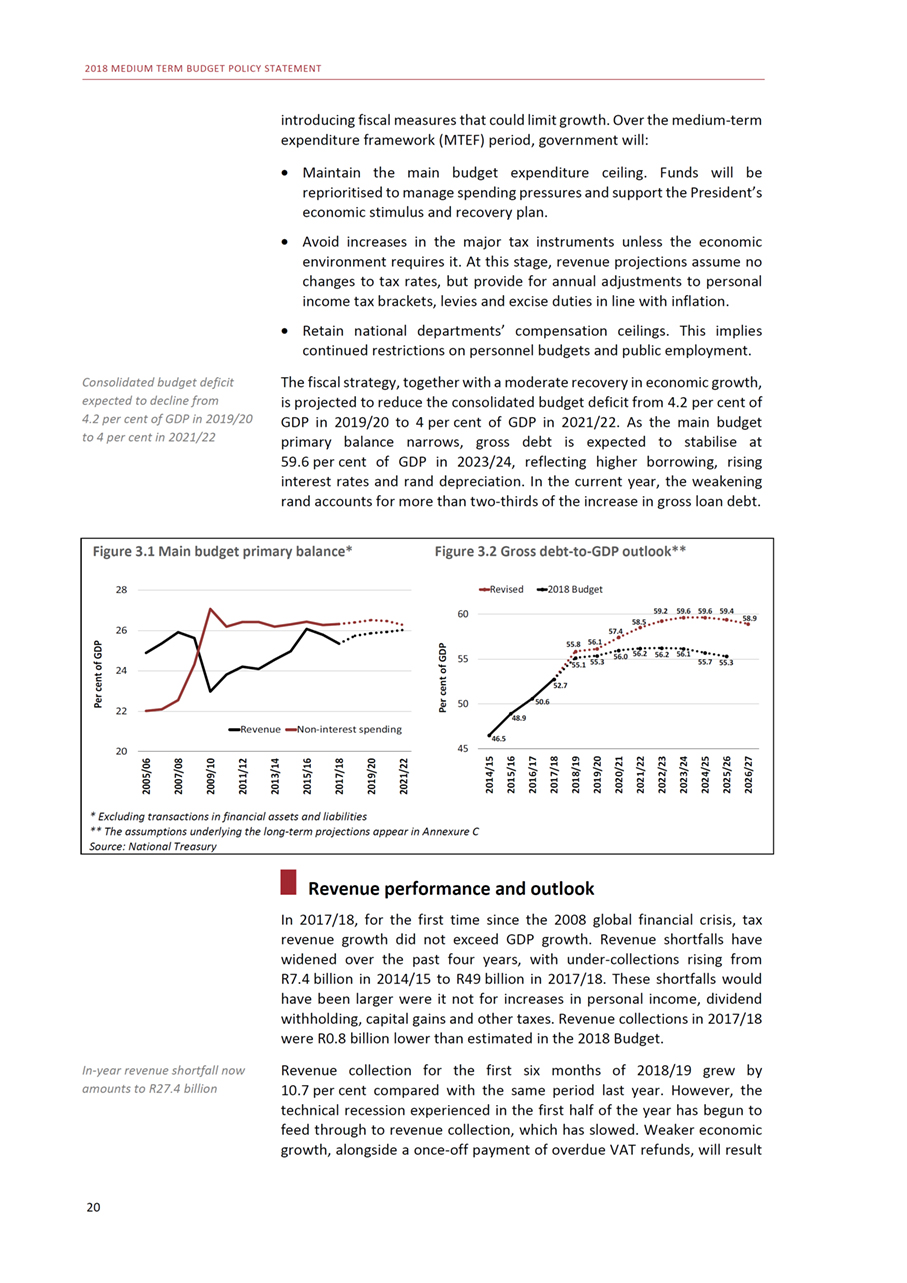

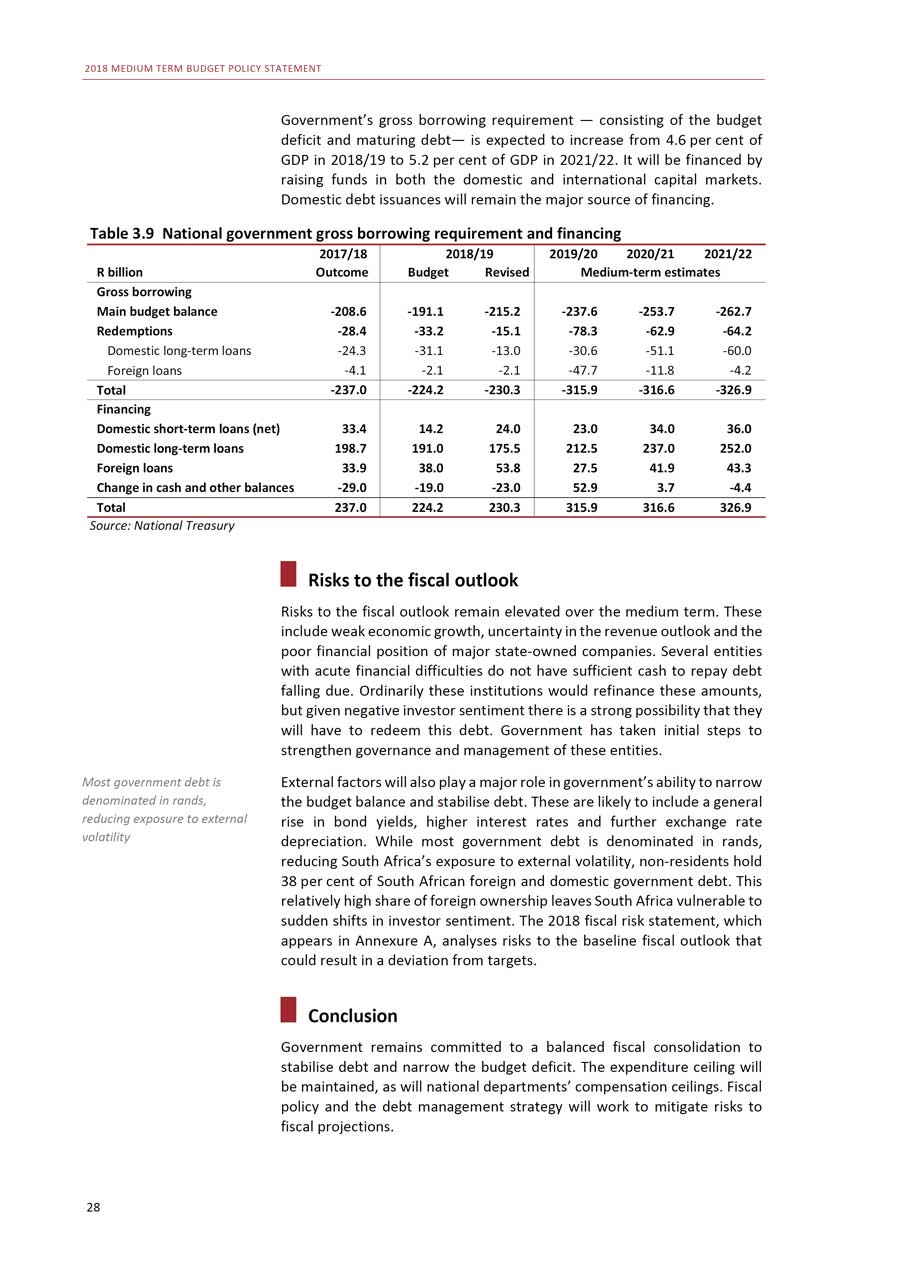

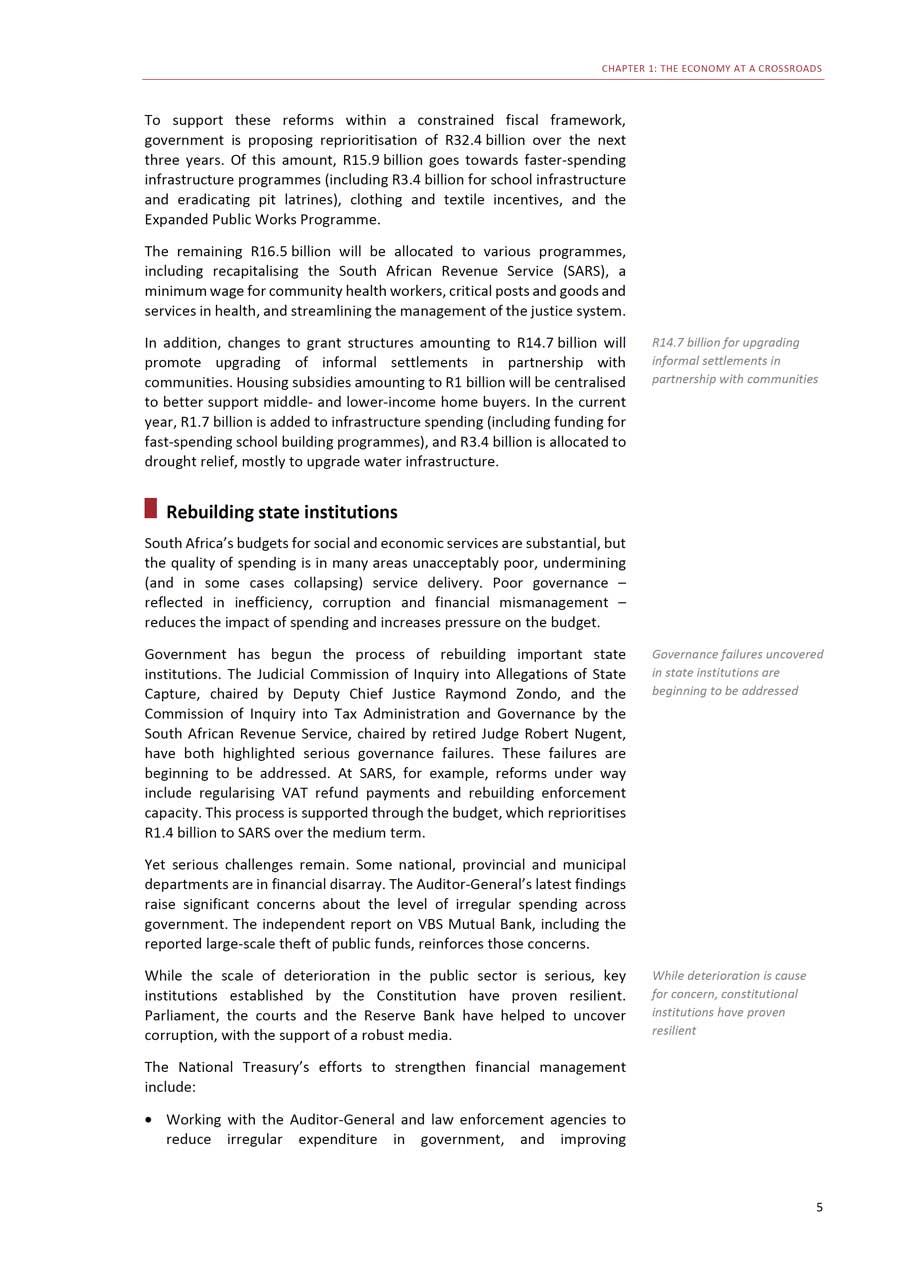

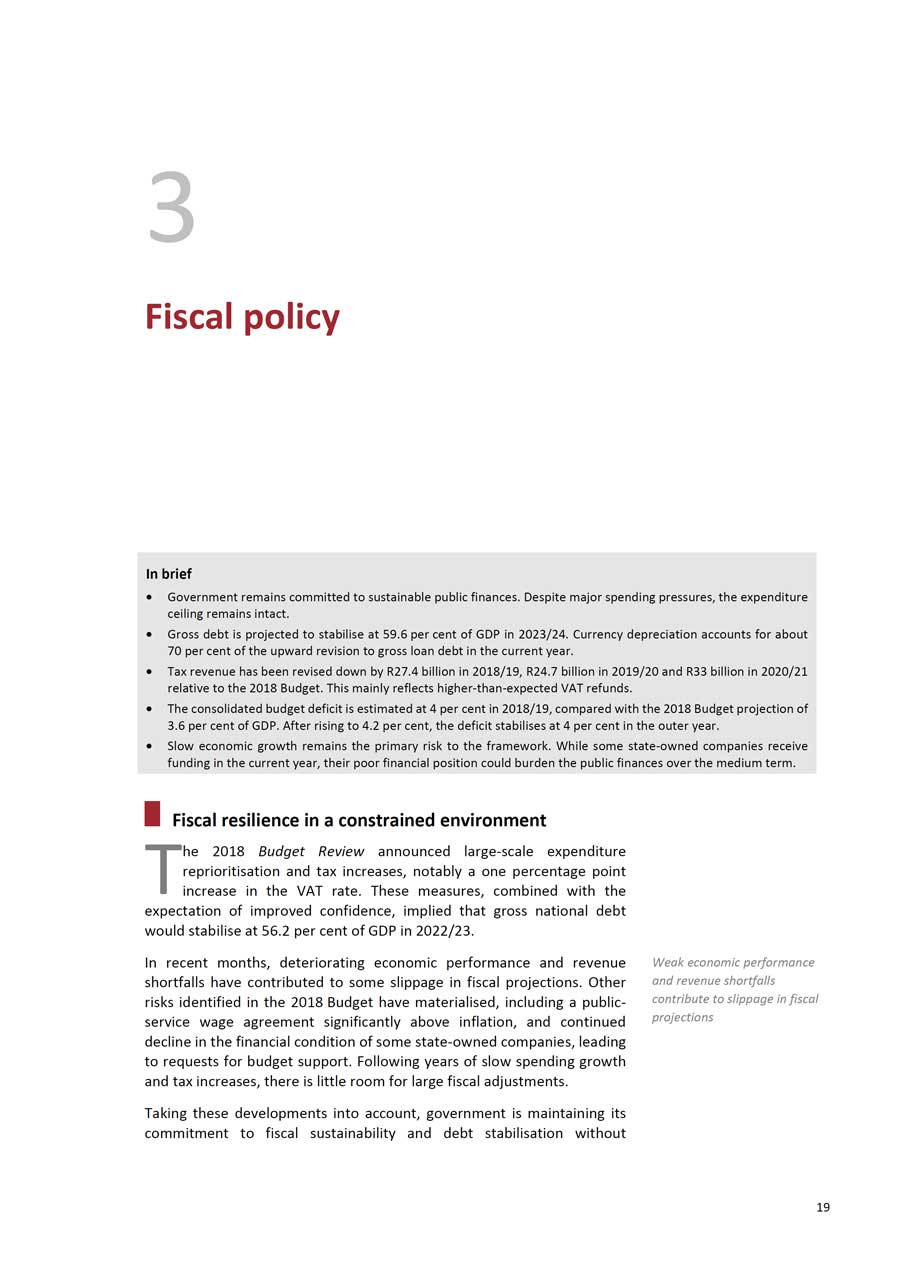

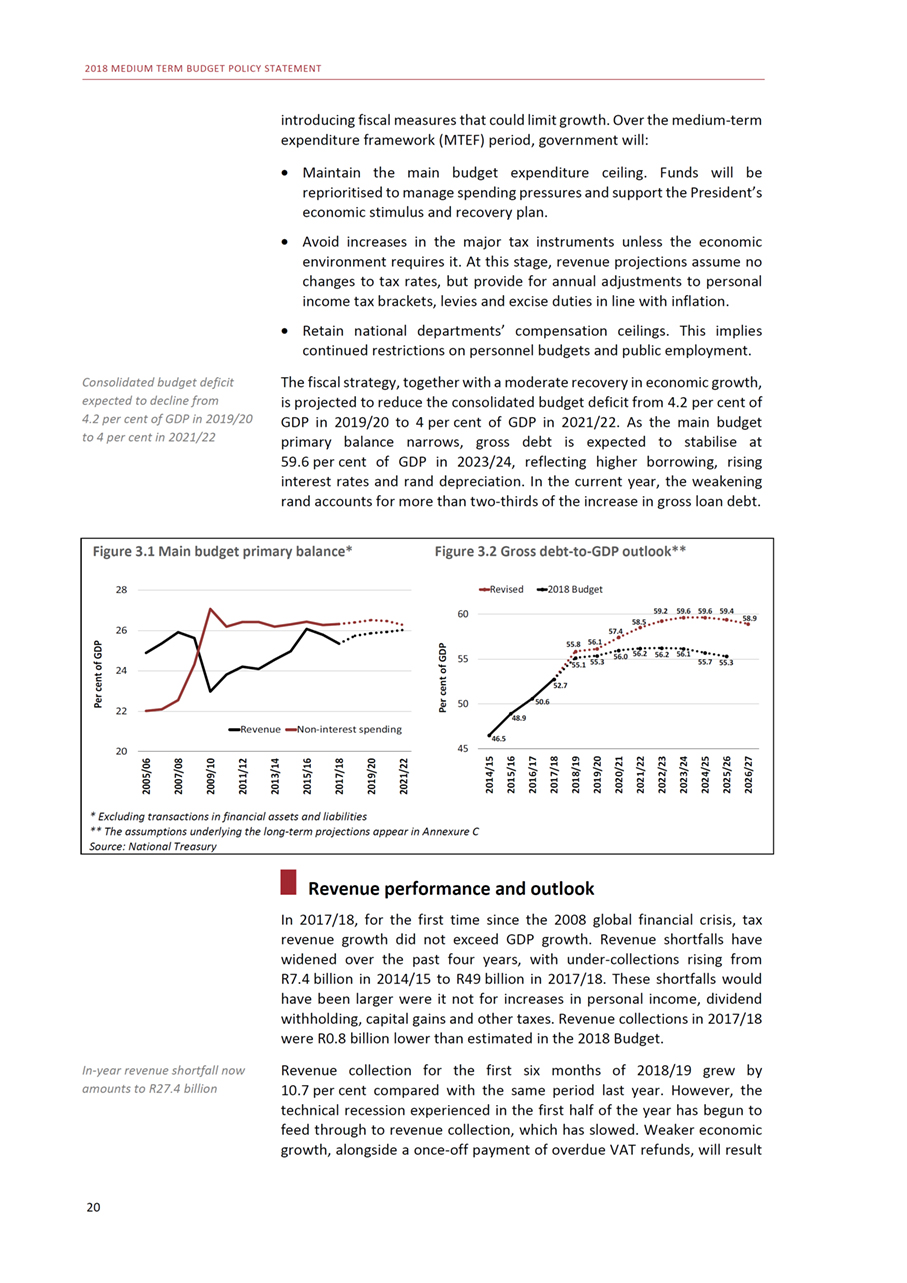

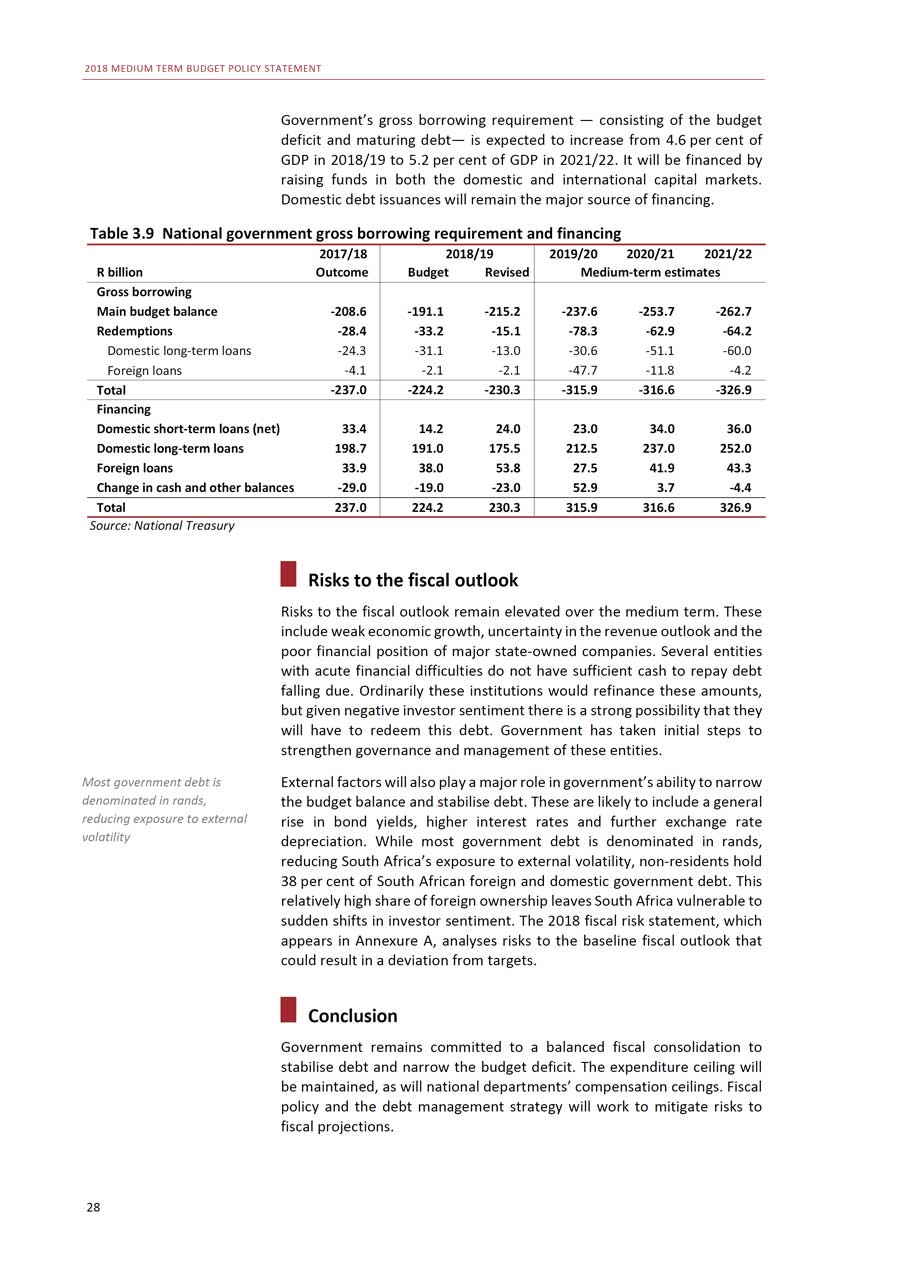

The fiscal strategy, together with a moderate recovery in economic growth, is projected to reduce the consolidated budget deficit from 4.2 per cent of GDP in 2019/20 to 4 per cent of GDP in 2021/22. As the main budget primary balance narrows, gross debt is expected to stabilise at 59.6 per cent of GDP in 2023/24, reflecting higher borrowing, rising interest rates and rand depreciation. In the current year, the weakening rand accounts for more than two-thirds of the increase in gross loan debt.

Figure 3.1 Main budget primary balance* 28

Figure 3.2 Gross debt-to-GDP outlook** Revised 2018 Budget 59.2 59.6 59.6 59.4

26 24 22 Revenue Non-interest spending 20 * Excluding transactions in financial assets and liabilities

60 55 50 50.6 48.9 46.5 45

55.8 55.1 52.7

56.1 55.3

58.5 57.4 56.0 56.2 56.2 56.1

58.9 55.7 55.3

** The assumptions underlying the long-term projections appear in Annexure C Source: National Treasury Revenue performance and outlook In 2017/18, for the first time since the 2008 global financial crisis, tax revenue growth did not exceed GDP growth. Revenue shortfalls have widened over the past four years, with under-collections rising from R7.4 billion in 2014/15 to R49 billion in 2017/18. These shortfalls would have been larger were it not for increases in personal income, dividend withholding, capital gains and other taxes. Revenue collections in 2017/18 were R0.8 billion lower than estimated in the 2018 Budget.

In-year revenue shortfall now amounts to R27.4 billion 20

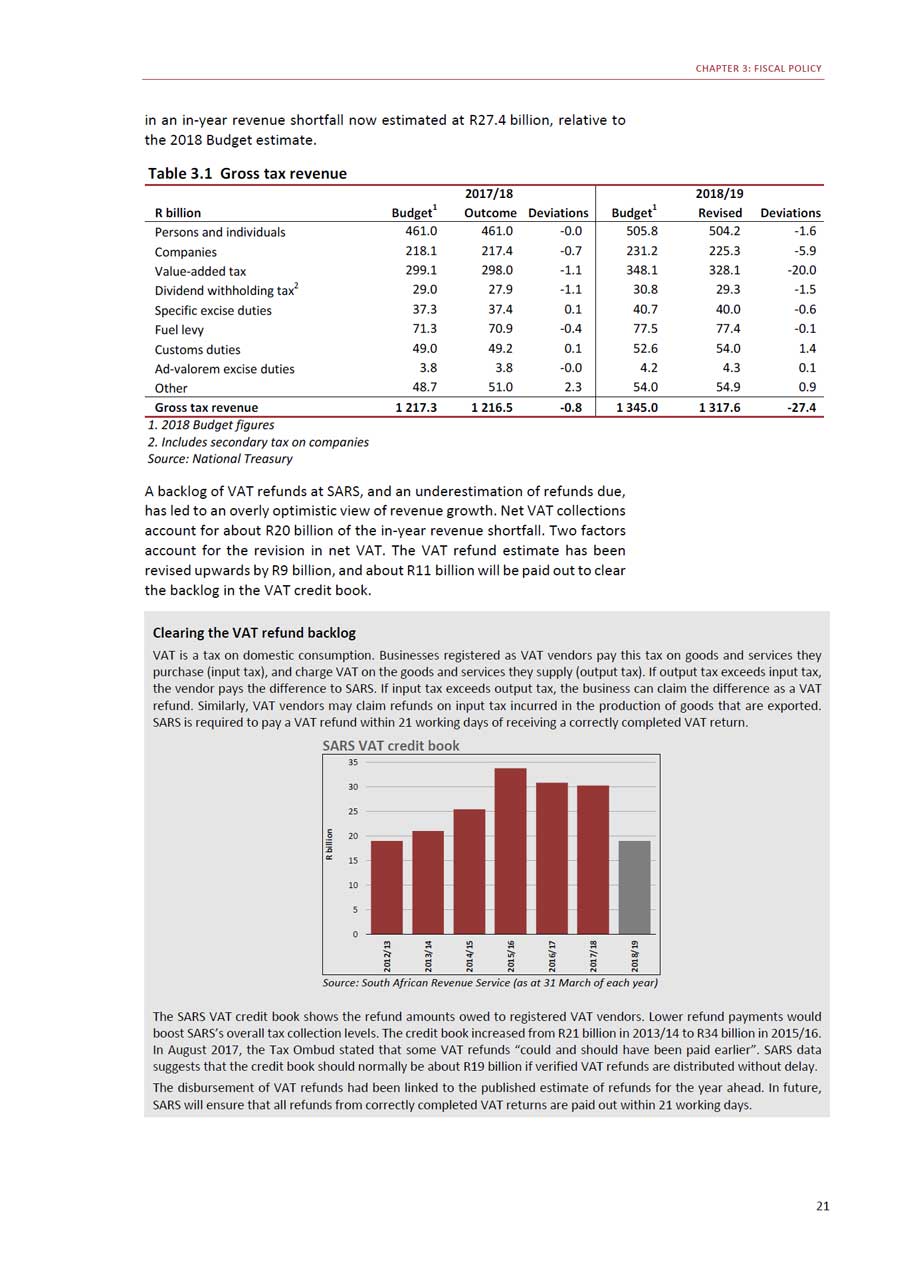

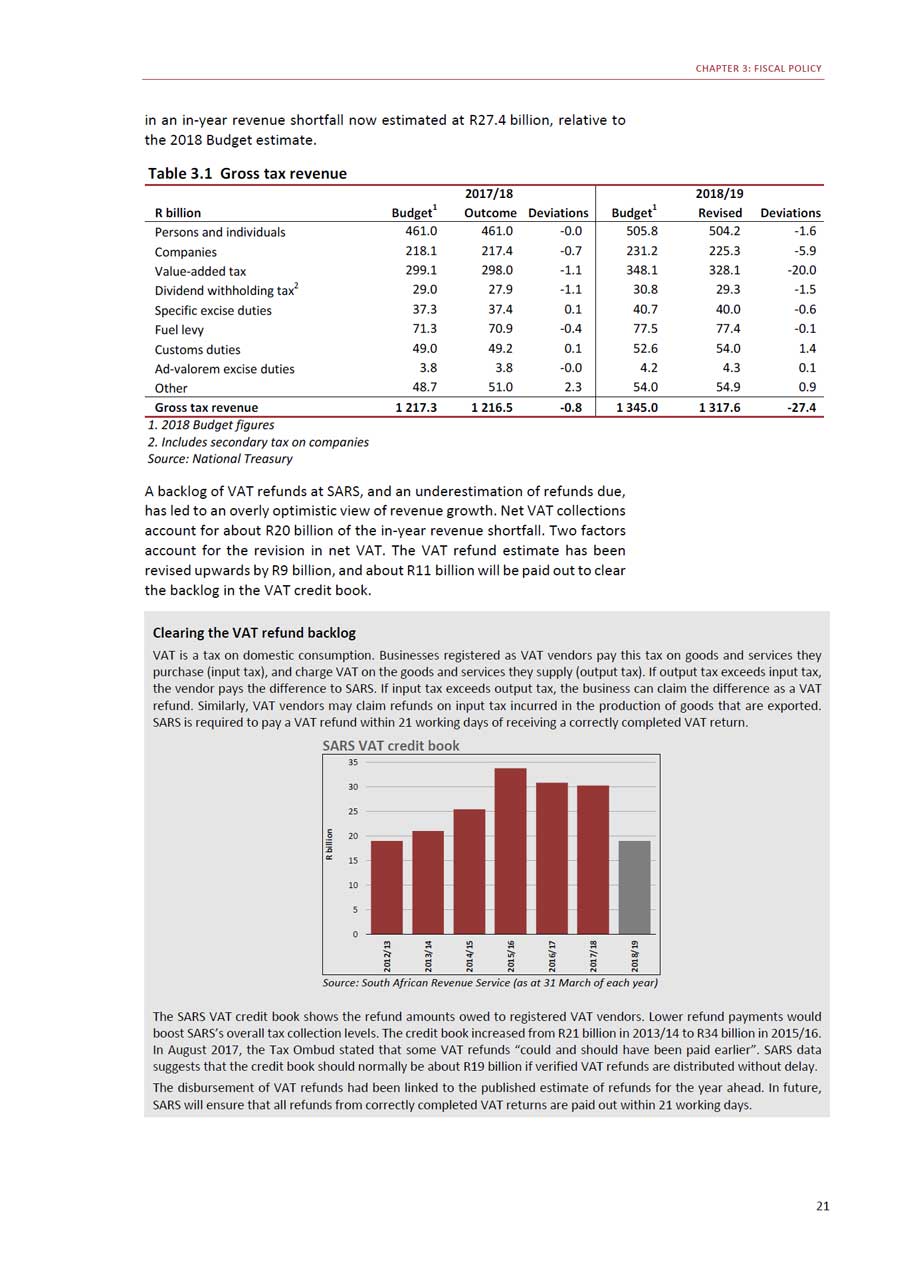

Revenue collection for the first six months of 2018/19 grew by 10.7 per cent compared with the same period last year. However, the technical recession experienced in the first half of the year has begun to feed through to revenue collection, which has slowed. Weaker economic growth, alongside a once-off payment of overdue VAT refunds, will result

CHAPTER 3: FISCAL POLICY in an in-year revenue shortfall now estimated at R27.4 billion, relative to the 2018 Budget estimate. Table 3.1 Gross tax revenue 2017/18 2018/19R billion Budget1 Outcome Deviations Budget1 Revised DeviationsPersons and individuals 461.0 461.0 -0.0 505.8 504.2 -1.6Companies 218.1 217.4 -0.7 231.2 225.3 -5.9Value-added tax 299.1 298.0 -1.1 348.1 328.1 -20.0Dividend withholding tax2 29.0 27.9 -1.1 30.8 29.3 -1.5Specific excise duties 37.3 37.4 0.1 40.7 40.0 -0.6Fuel levy 71.3 70.9 -0.4 77.5 77.4 -0.1Customs duties 49.0 49.2 0.1 52.6 54.0 1.4Ad-valorem excise duties 3.8 3.8 -0.0 4.2 4.3 0.1Other 48.7 51.0 2.3 54.0 54.9 0.9Gross tax revenue 1 217.3 1 216.5 -0.8 1 345.0 1 317.6 -27.41. 2018 Budget figures 2. Includes secondary tax on companies Source: National Treasury A backlog of VAT refunds at SARS, and an underestimation of refunds due, has led to an overly optimistic view of revenue growth. Net VAT collections account for about R20 billion of the in-year revenue shortfall. Two factors account for the revision in net VAT. The VAT refund estimate has been revised upwards by R9 billion, and about R11 billion will be paid out to clear the backlog in the VAT credit book. Clearing the VAT refund backlog VAT is a tax on domestic consumption. Businesses registered as VAT vendors pay this tax on goods and services they purchase (input tax), and charge VAT on the goods and services they supply (output tax). If output tax exceeds input tax, the vendor pays the difference to SARS. If input tax exceeds output tax, the business can claim the difference as a VAT refund. Similarly, VAT vendors may claim refunds on input tax incurred in the production of goods that are exported. SARS is required to pay a VAT refund within 21 working days of receiving a correctly completed VAT return. SARS VAT credit book 35 30 25 20 15 10 5 0 Source: South African Revenue Service (as at 31 March of each year) The SARS VAT credit book shows the refund amounts owed to registered VAT vendors. Lower refund payments would boost SARS’s overall tax collection levels. The credit book increased from R21 billion in 2013/14 to R34 billion in 2015/16. In August 2017, the Tax Ombud stated that some VAT refunds “could and should have been paid earlier”. SARS data suggests that the credit book should normally be about R19 billion if verified VAT refunds are distributed without delay. The disbursement of VAT refunds had been linked to the published estimate of refunds for the year ahead. In future, SARS will ensure that all refunds from correctly completed VAT returns are paid out within 21 working days. 21

2018 MEDIUM TERM BUDGET POLICY STATEMENT The remaining R7.4 billion of the shortfall in the current year mostly reflects slower corporate income tax collections due to weak growth in wholesale and retail trade, manufacturing and transport. Personal income tax continues to be negatively affected by job losses, moderate wage settlements, lower bonus payments and a slower expansion of public- sector employment.

Commission of inquiry has underlined concerns aboutsevere governance weaknesses in SARSTax revenue growth projections lower across medium term

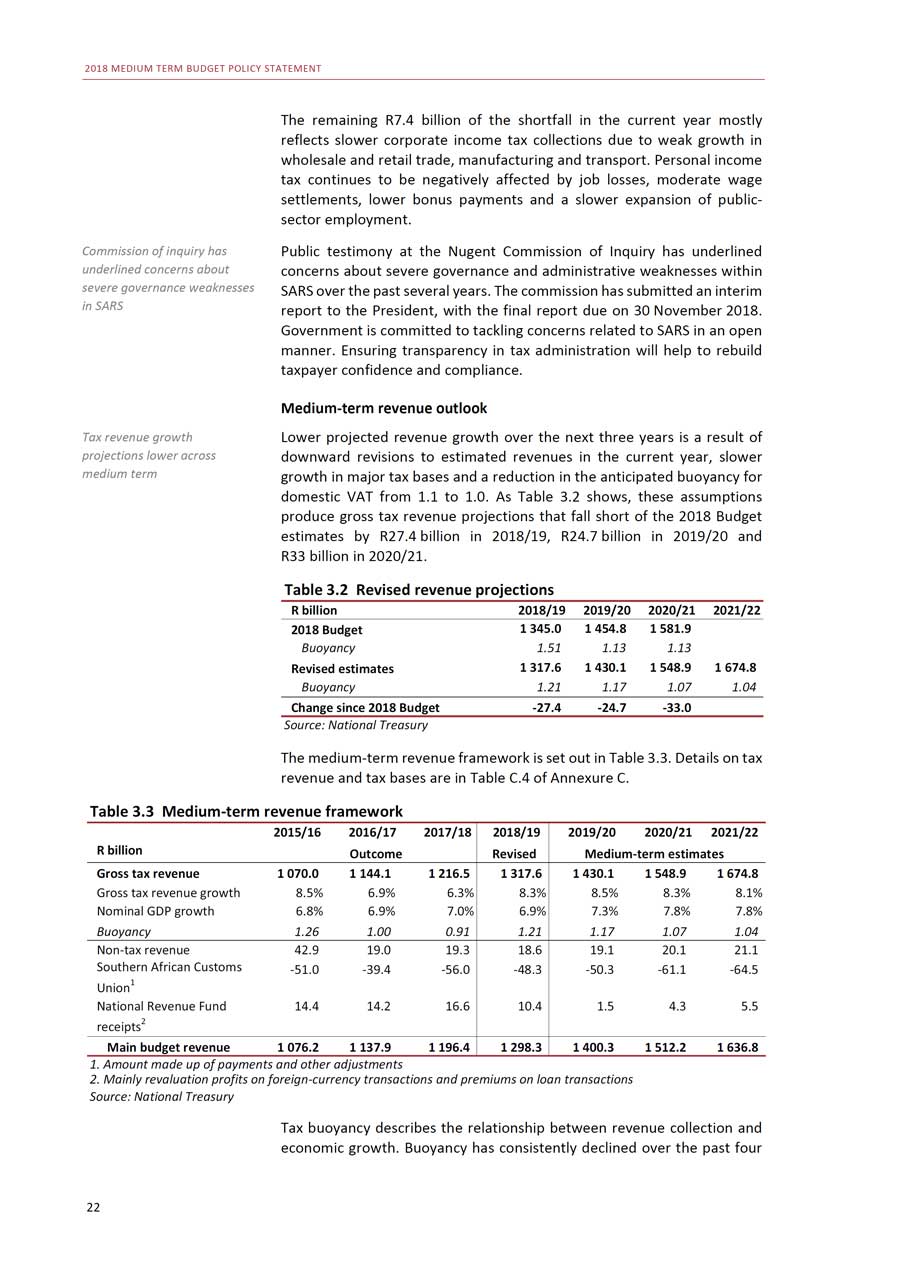

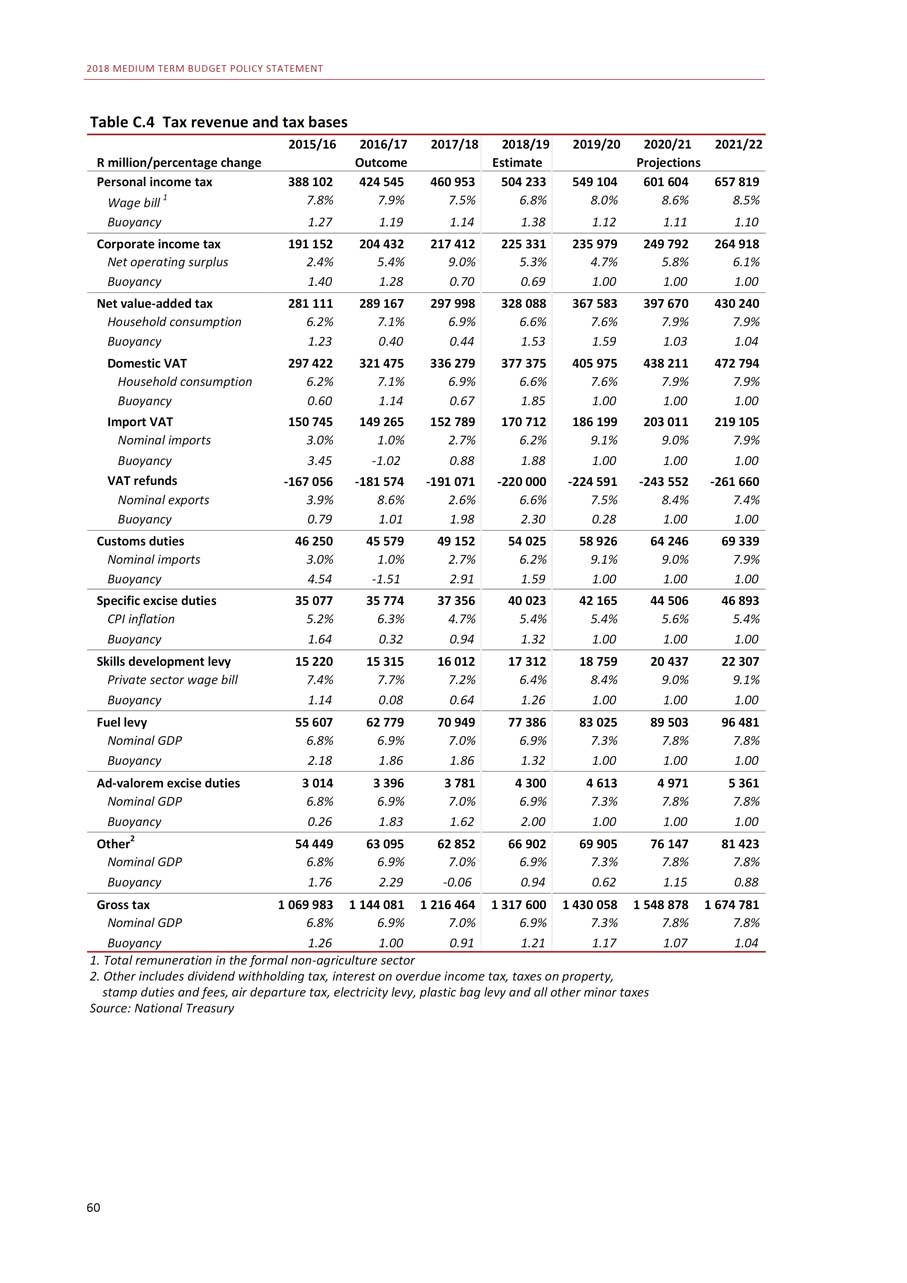

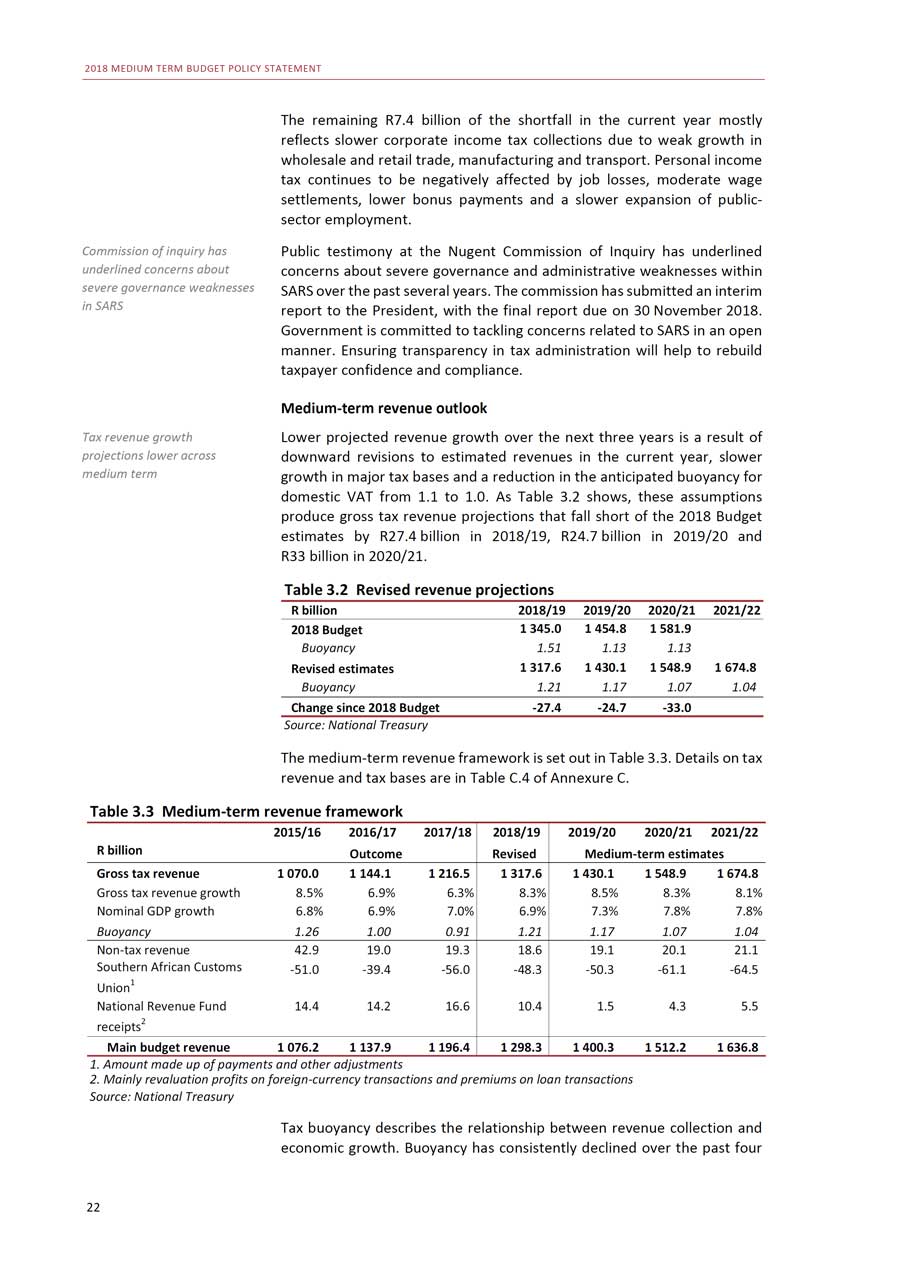

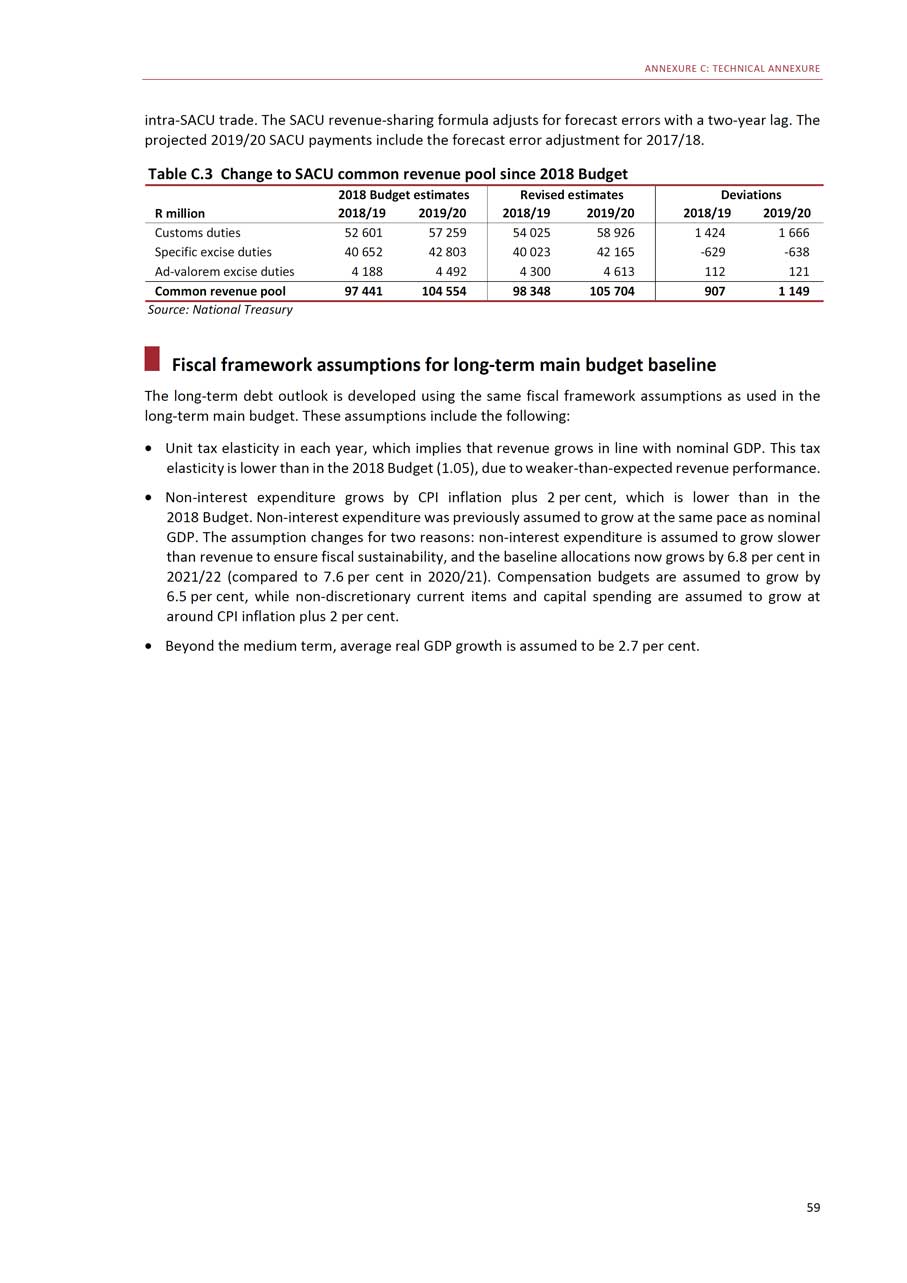

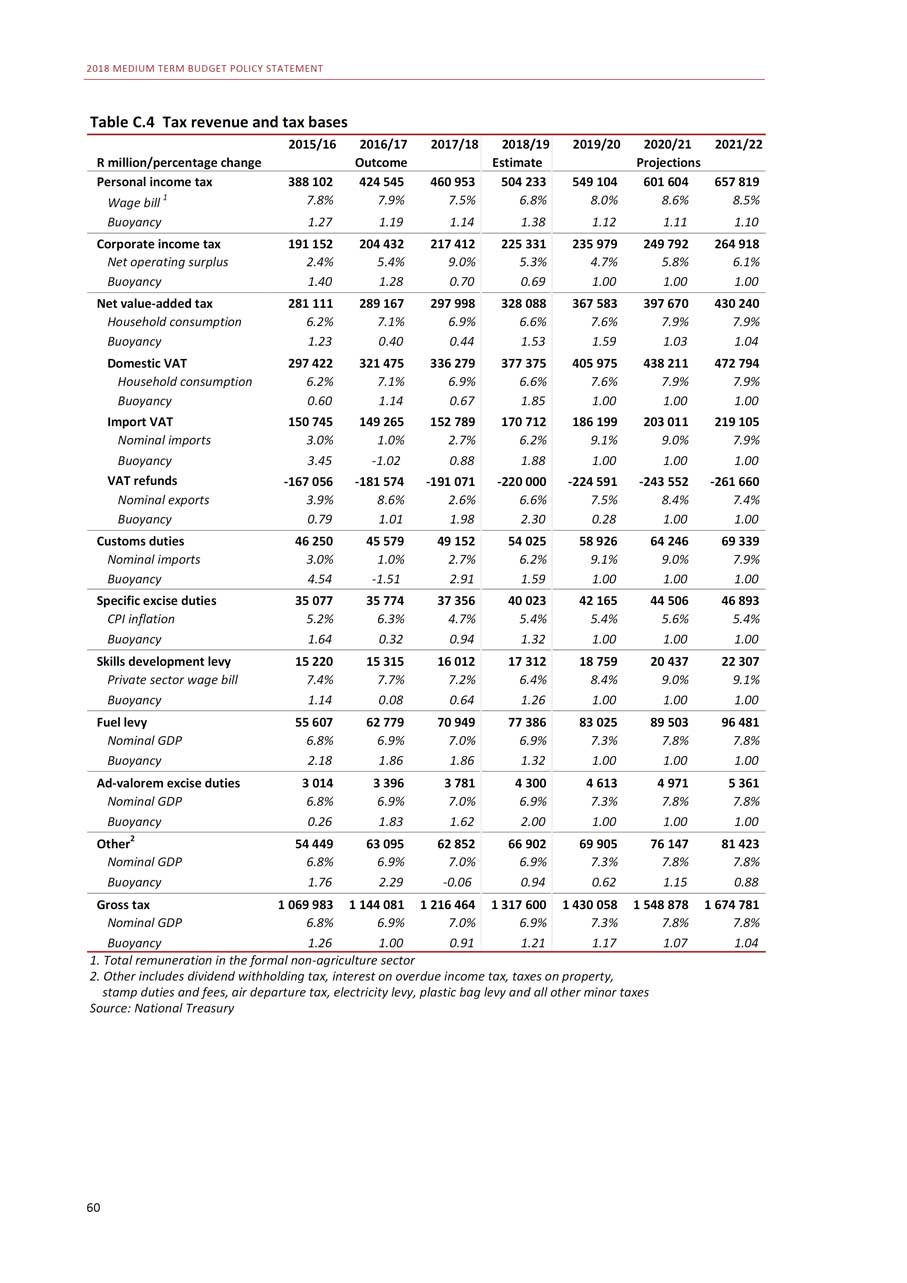

Public testimony at the Nugent Commission of Inquiry has underlined concerns about severe governance and administrative weaknesses within SARS over the past several years. The commission has submitted an interim report to the President, with the final report due on 30 November 2018. Government is committed to tackling concerns related to SARS in an open manner. Ensuring transparency in tax administration will help to rebuild taxpayer confidence and compliance.Medium-term revenue outlookLower projected revenue growth over the next three years is a result of downward revisions to estimated revenues in the current year, slower growth in major tax bases and a reduction in the anticipated buoyancy for domestic VAT from 1.1 to 1.0. As Table 3.2 shows, these assumptions produce gross tax revenue projections that fall short of the 2018 Budget estimates by R27.4 billion in 2018/19, R24.7 billion in 2019/20 and R33 billion in 2020/21.Table 3.2 Revised revenue projectionsR billion 2018/19 2019/20 2020/21 2021/222018 Budget 1 345.0 1 454.8 1 581.9Buoyancy 1.51 1.13 1.13Revised estimates 1 317.6 1 430.1 1 548.9 1 674.8Buoyancy 1.21 1.17 1.07 1.04Change since 2018 Budget -27.4 -24.7 -33.0Source: National TreasuryThe medium-term revenue framework is set out in Table 3.3. Details on tax revenue and tax bases are in Table C.4 of Annexure C.

Table 3.3 Medium-term revenue framework 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22R billion Outcome Revised Medium-term estimatesGross tax revenue 1 070.0 1 144.1 1 216.5 1 317.6 1 430.1 1 548.9 1 674.8Gross tax revenue growth 8.5% 6.9% 6.3% 8.3% 8.5% 8.3% 8.1%Nominal GDP growth 6.8% 6.9% 7.0% 6.9% 7.3% 7.8% 7.8%Buoyancy 1.26 1.00 0.91 1.21 1.17 1.07 1.04Non-tax revenue 42.9 19.0 19.3 18.6 19.1 20.1 21.1Southern African Customs -51.0 -39.4 -56.0 -48.3 -50.3 -61.1 -64.5Union1 National Revenue Fund 14.4 14.2 16.6 10.4 1.5 4.3 5.5receipts2 Main budget revenue 1 076.2 1 137.9 1 196.4 1 298.3 1 400.3 1 512.2 1 636.81. Amount made up of payments and other adjustments 2. Mainly revaluation profits on foreign-currency transactions and premiums on loan transactions Source: National Treasury Tax buoyancy describes the relationship between revenue collection and economic growth. Buoyancy has consistently declined over the past four 22

CHAPTER 3: FISCAL POLICY years. In 2017/18, tax buoyancy fell to 0.91 despite additional tax policy measures designed to add R28 billion to revenue. The 2018 Budget announced measures aimed at raising R36 billion in additional revenue, with an anticipated buoyancy of 1.51. As a result of the higher VAT refund payments and revisions to estimates discussed earlier, the buoyancy is expected to decrease to 1.21.

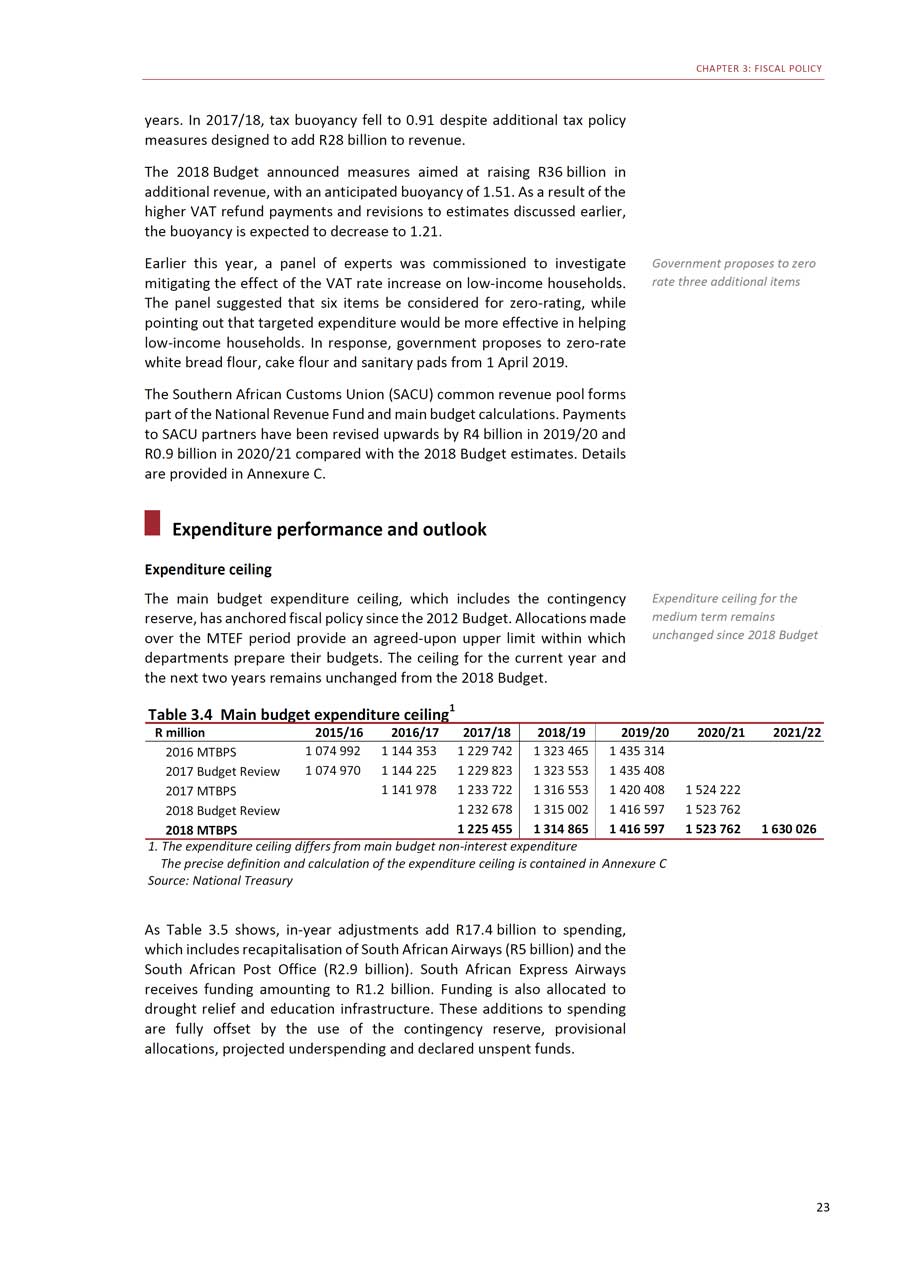

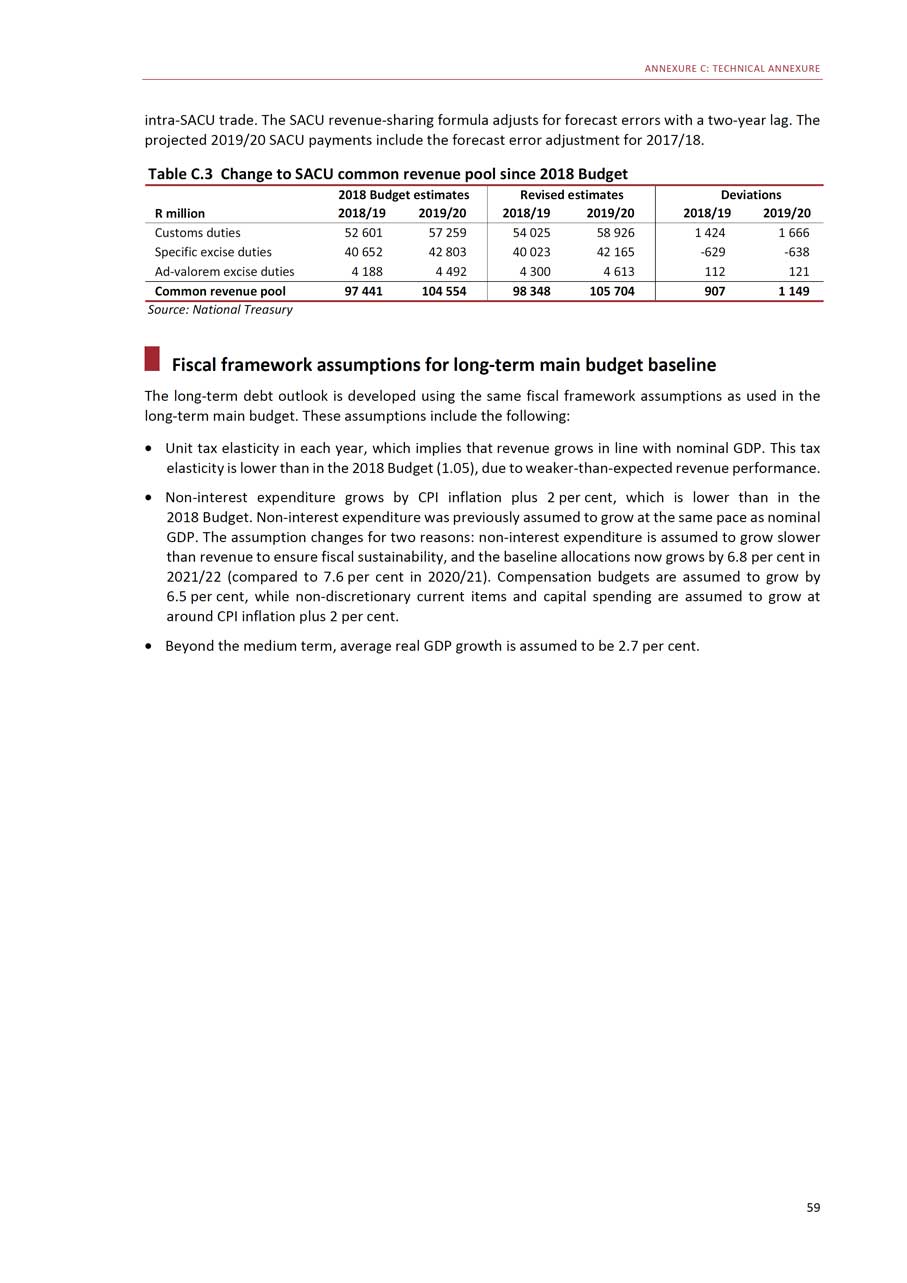

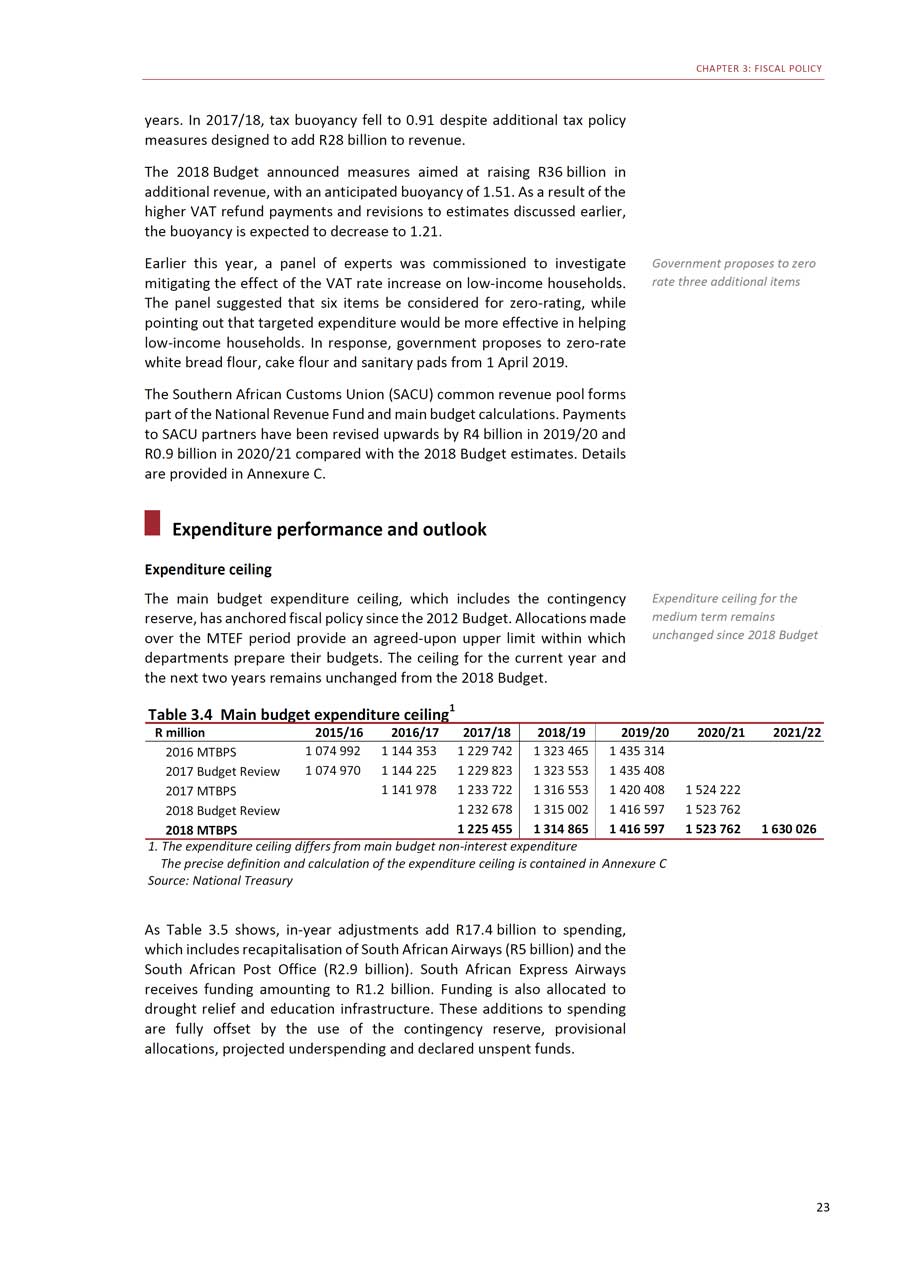

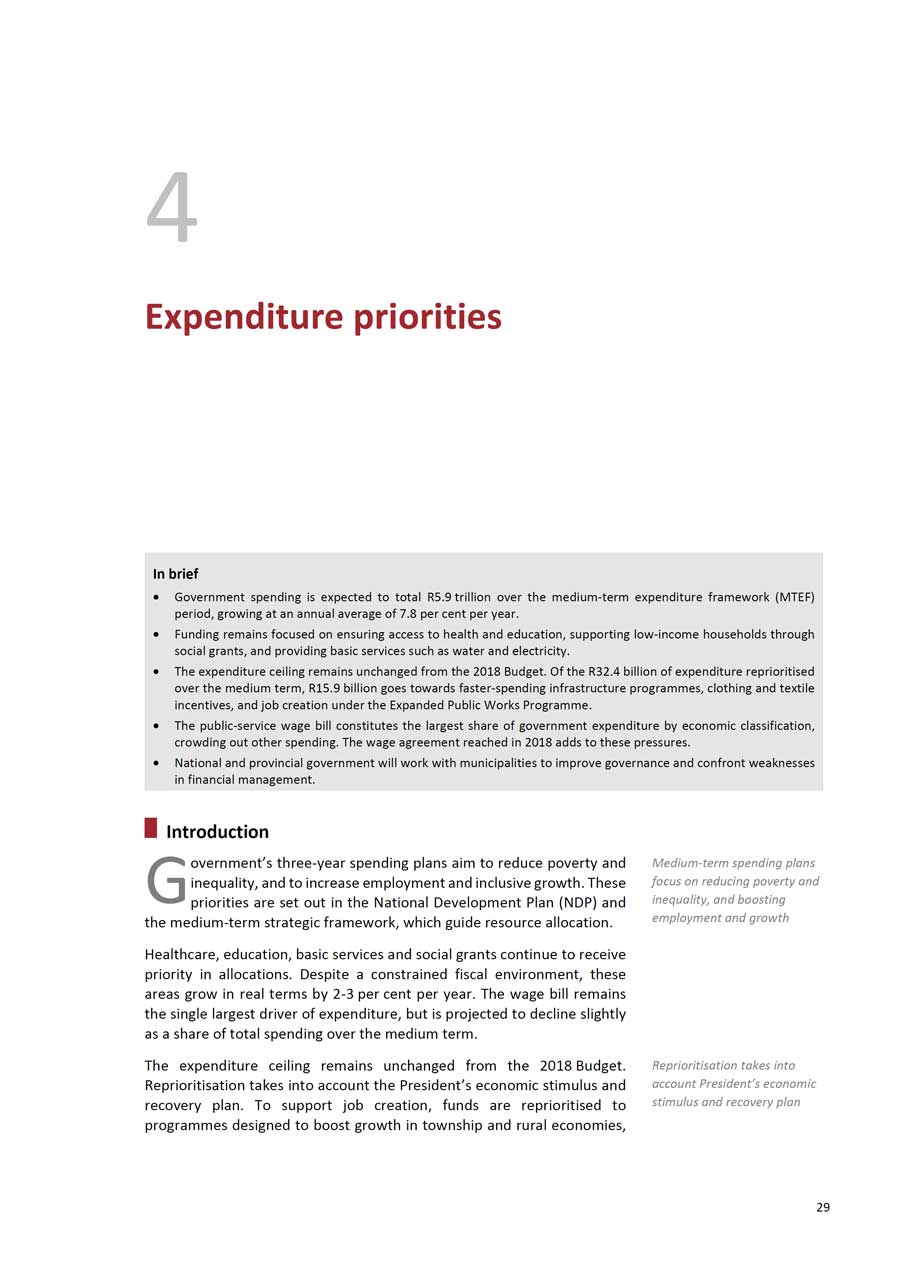

Earlier this year, a panel of experts was commissioned to investigate mitigating the effect of the VAT rate increase on low-income households. The panel suggested that six items be considered for zero-rating, while pointing out that targeted expenditure would be more effective in helping low-income households. In response, government proposes to zero-rate white bread flour, cake flour and sanitary pads from 1 April 2019.The Southern African Customs Union (SACU) common revenue pool forms part of the National Revenue Fund and main budget calculations. Payments to SACU partners have been revised upwards by R4 billion in 2019/20 and R0.9 billion in 2020/21 compared with the 2018 Budget estimates. Details are provided in Annexure C.Expenditure performance and outlookExpenditure ceilingThe main budget expenditure ceiling, which includes the contingency reserve, has anchored fiscal policy since the 2012 Budget. Allocations made over the MTEF period provide an agreed-upon upper limit within which departments prepare their budgets. The ceiling for the current year and the next two years remains unchanged from the 2018 Budget.Table 3.4 Main budget expenditure ceiling1

Government proposes to zero rate three additional itemsExpenditure ceiling for the medium term remainsunchanged since 2018 Budget

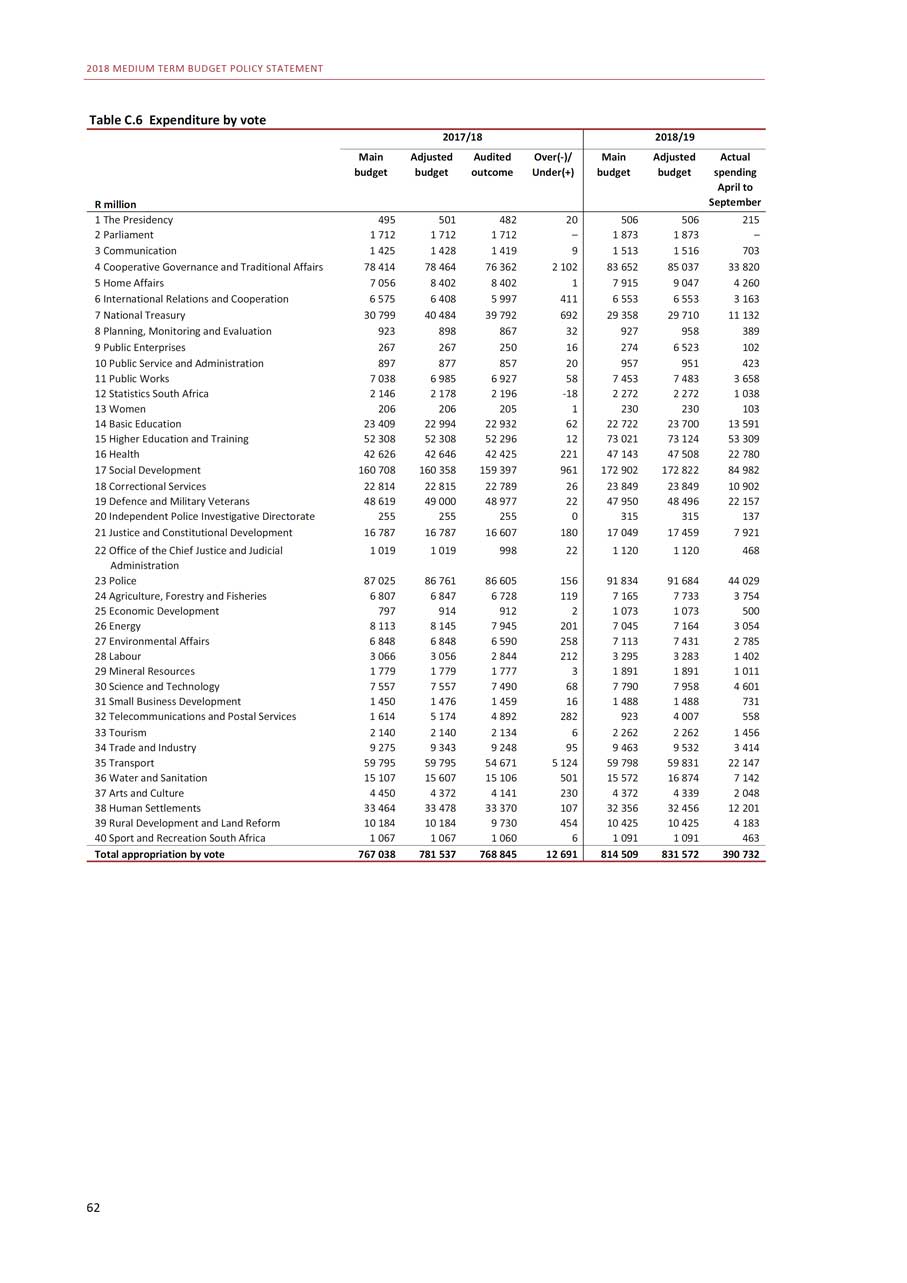

R million 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/222016 MTBPS 1 074 992 1 144 353 1 229 742 1 323 465 1 435 3142017 Budget Review 1 074 970 1 144 225 1 229 823 1 323 553 1 435 4082017 MTBPS 1 141 978 1 233 722 1 316 553 1 420 408 1 524 2222018 Budget Review 1 232 678 1 315 002 1 416 597 1 523 7622018 MTBPS 1 225 455 1 314 865 1 416 597 1 523 762 1 630 0261. The expenditure ceiling differs from main budget non-interest expenditure The precise definition and calculation of the expenditure ceiling is contained in Annexure C Source: National Treasury As Table 3.5 shows, in-year adjustments add R17.4 billion to spending, which includes recapitalisation of South African Airways (R5 billion) and the South African Post Office (R2.9 billion). South African Express Airways receives funding amounting to R1.2 billion. Funding is also allocated to drought relief and education infrastructure. These additions to spending are fully offset by the use of the contingency reserve, provisional allocations, projected underspending and declared unspent funds. 23

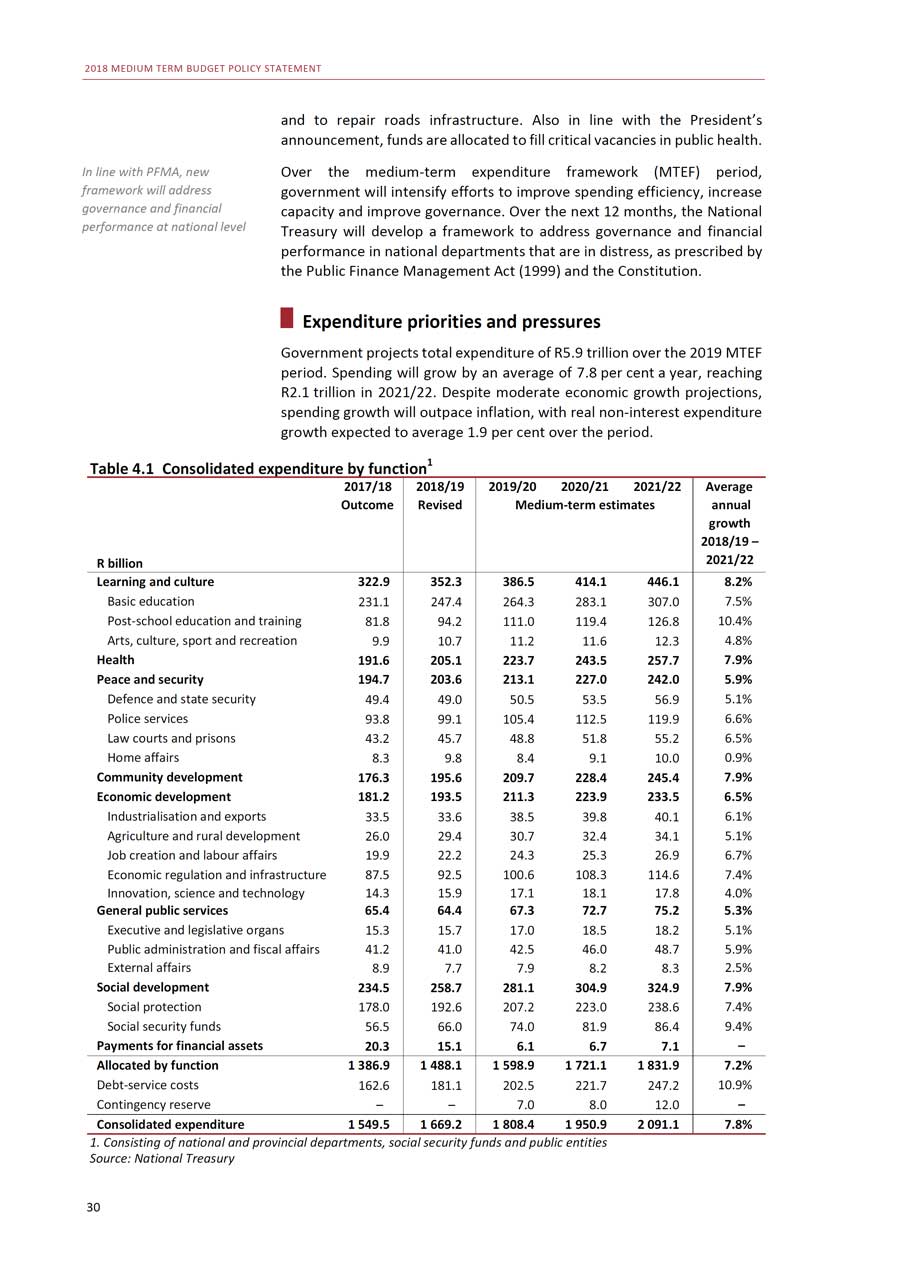

2018 MEDIUM TERM BUDGET POLICY STATEMENT Table 3.5 Revisions to the 2018/19 expenditure ceiling R million Expenditure ceiling: 2018 Budget Review 1 315 002Upward expenditure adjustments 17 392Budget Facility for Infrastructure projects and project preparation 870Schools infrastructure backlogs grant 800Drought relief 3 412Financial support to state-owned companies:Special Appropriation Bill: South African Airways 5 000South African Express Airways 1 249South African Post Office 2 947Commissions of inquiry into tax administration and state capture 409Self-financing1 1 777Roll-overs and unforeseeable and unavoidable expenditure 927Downward expenditure adjustments (17 529)Declared unspent funds (329)Contingency reserve (8 000)Provisional allocation for contingencies not assigned to votes (6 000)National government projected underspending (2 700)Local government repayment to the National Revenue Fund (500)Revised expenditure ceiling 1 314 8651. Spending financed from revenue derived from departments’ specific activitiesSource: National TreasuryMedium-term expenditure outlook

Expenditure ceiling for next two years will be maintained, and grows by 1.5 per cent in real terms in 2021/22

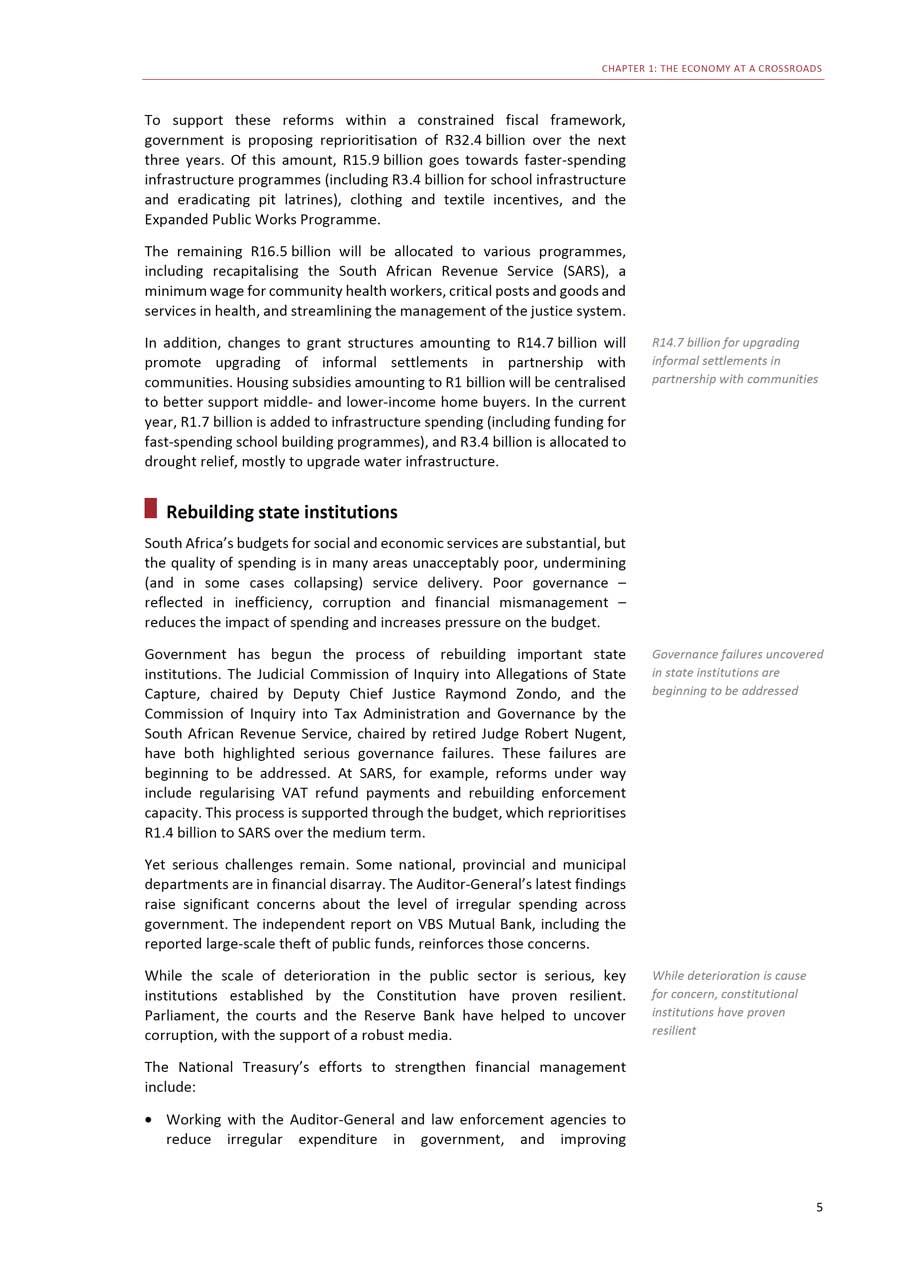

The expenditure ceiling will be maintained for the next two years and is set to grow at 1.5 per cent in real terms in 2021/22 — largely in line with average real GDP growth over the past decade. Non-interest expenditure remains broadly unchanged as a share of GDP over the medium term. In real terms, non-interest spending grows by an average 1.9 per cent per year. This includes a contingency reserve amounting to R7 billion in 2019/20, R8 billion in 2020/21 and R12 billion in 2021/22.Figure 3.3 Real main budget non-interest spending growth*1210.810

8.5 8.486420-2

9.07.24.23.22.2

2.0 1.7 2.0-0.04

2.41.7

2.3

1.9

1.6

*Excluding payments for financial assets Source: National Treasury 24

CHAPTER 3: FISCAL POLICY

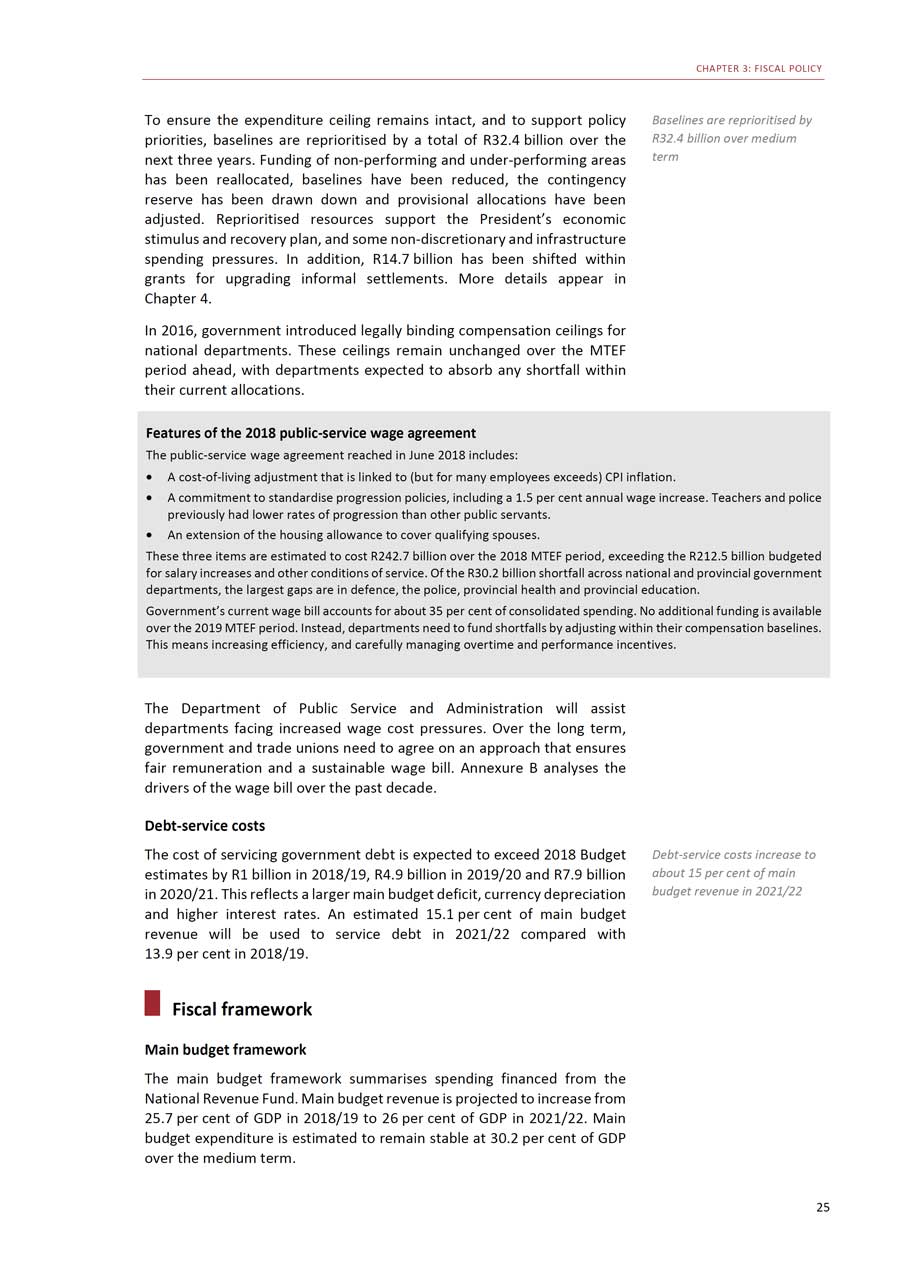

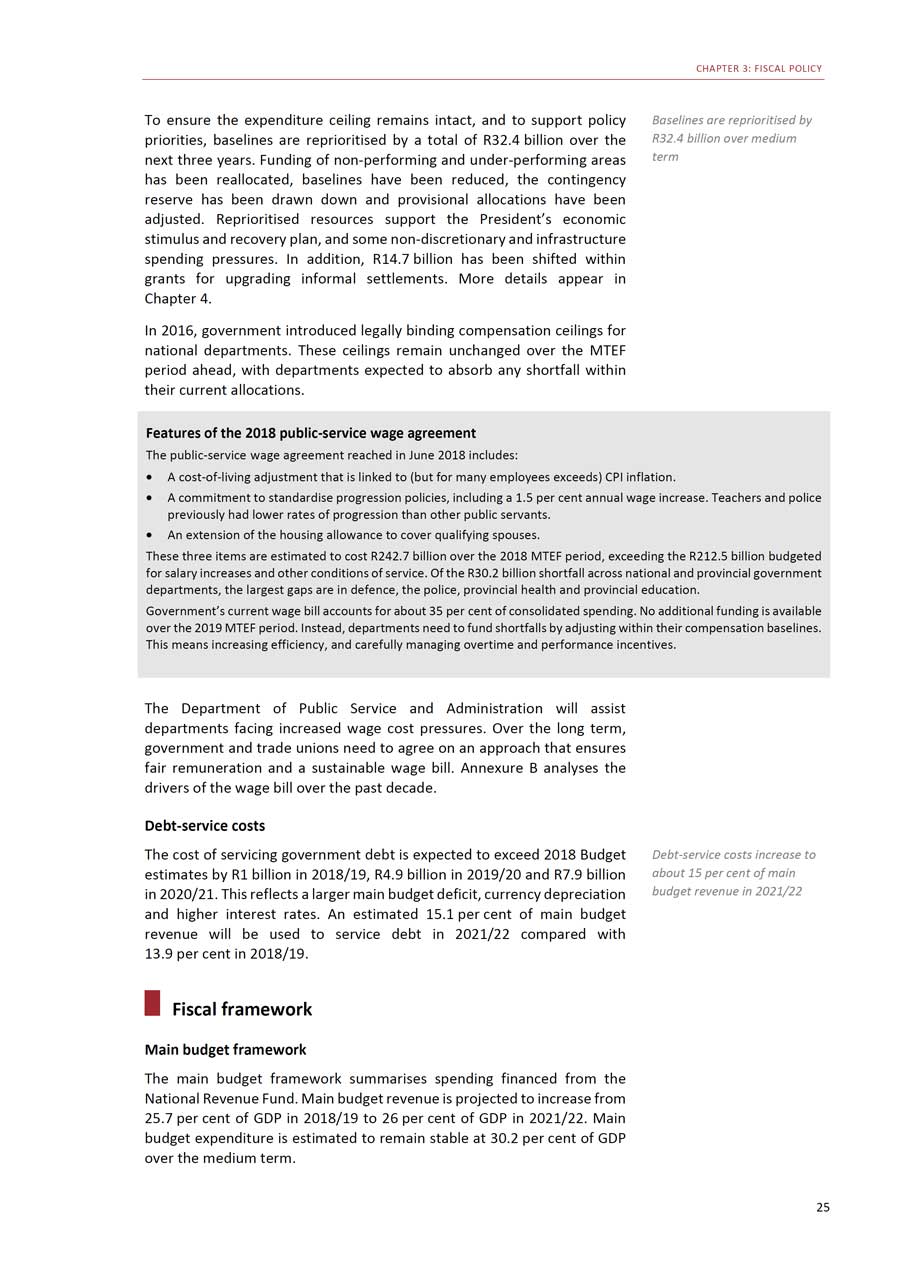

To ensure the expenditure ceiling remains intact, and to support policy priorities, baselines are reprioritised by a total of R32.4 billion over the next three years. Funding of non-performing and under-performing areas has been reallocated, baselines have been reduced, the contingency reserve has been drawn down and provisional allocations have been adjusted. Reprioritised resources support the President’s economic stimulus and recovery plan, and some non-discretionary and infrastructure spending pressures. In addition, R14.7 billion has been shifted within grants for upgrading informal settlements. More details appear in Chapter 4.In 2016, government introduced legally binding compensation ceilings for national departments. These ceilings remain unchanged over the MTEF period ahead, with departments expected to absorb any shortfall within their current allocations.Features of the 2018 public-service wage agreementThe public-service wage agreement reached in June 2018 includes:

Baselines are reprioritised by R32.4 billion over medium term

• A cost-of-living adjustment that is linked to (but for many employees exceeds) CPI inflation. • A commitment to standardise progression policies, including a 1.5 per cent annual wage increase. Teachers and police previously had lower rates of progression than other public servants. • An extension of the housing allowance to cover qualifying spouses. These three items are estimated to cost R242.7 billion over the 2018 MTEF period, exceeding the R212.5 billion budgeted for salary increases and other conditions of service. Of the R30.2 billion shortfall across national and provincial government departments, the largest gaps are in defence, the police, provincial health and provincial education. Government’s current wage bill accounts for about 35 per cent of consolidated spending. No additional funding is available over the 2019 MTEF period. Instead, departments need to fund shortfalls by adjusting within their compensation baselines. This means increasing efficiency, and carefully managing overtime and performance incentives. The Department of Public Service and Administration will assist departments facing increased wage cost pressures. Over the long term, government and trade unions need to agree on an approach that ensures fair remuneration and a sustainable wage bill. Annexure B analyses the drivers of the wage bill over the past decade. Debt-service costs

The cost of servicing government debt is expected to exceed 2018 Budget estimates by R1 billion in 2018/19, R4.9 billion in 2019/20 and R7.9 billion in 2020/21. This reflects a larger main budget deficit, currency depreciation and higher interest rates. An estimated 15.1 per cent of main budget revenue will be used to service debt in 2021/22 compared with13.9 per cent in 2018/19.Fiscal frameworkMain budget frameworkThe main budget framework summarises spending financed from the National Revenue Fund. Main budget revenue is projected to increase from25.7 per cent of GDP in 2018/19 to 26 per cent of GDP in 2021/22. Main budget expenditure is estimated to remain stable at 30.2 per cent of GDP over the medium term.

Debt-service costs increase to about 15 per cent of mainbudget revenue in 2021/2225

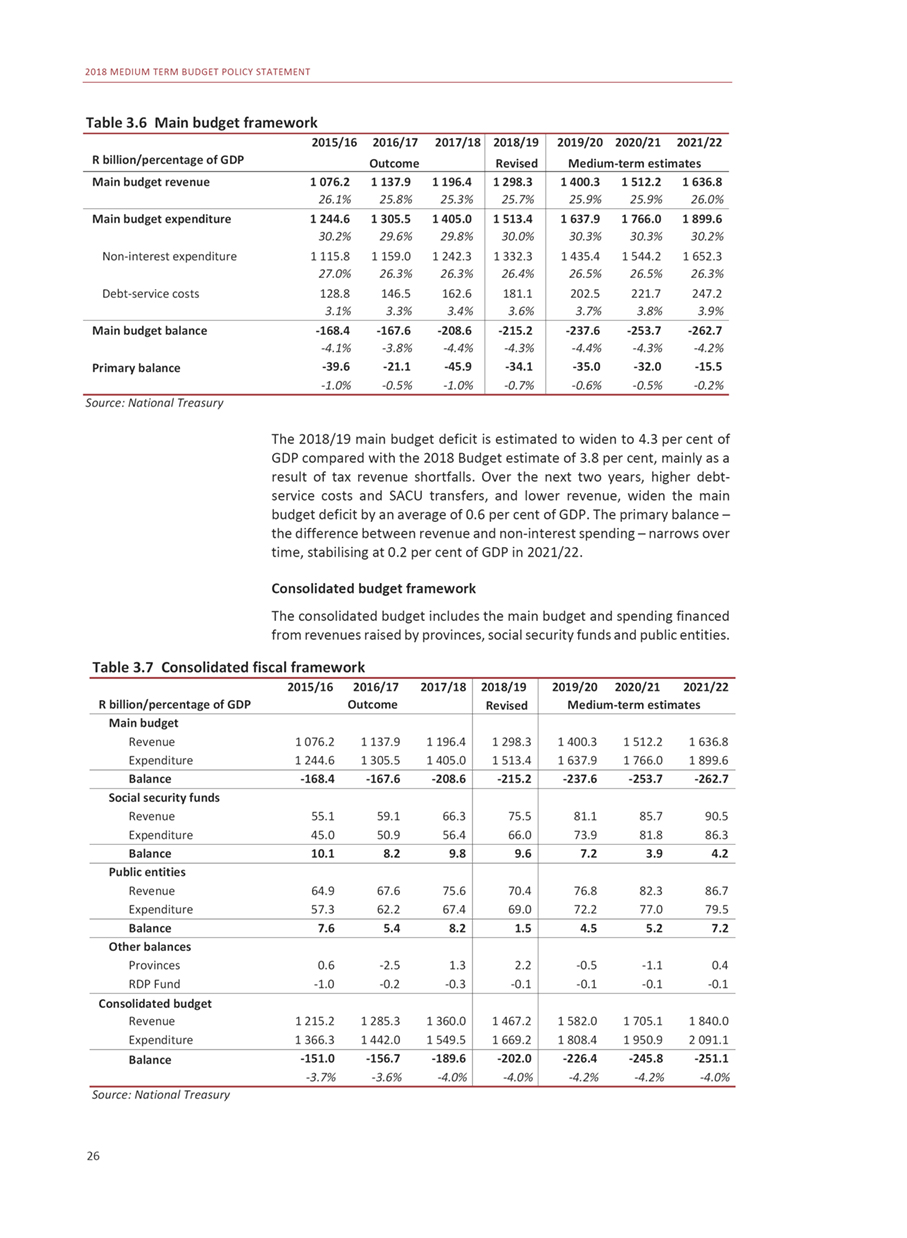

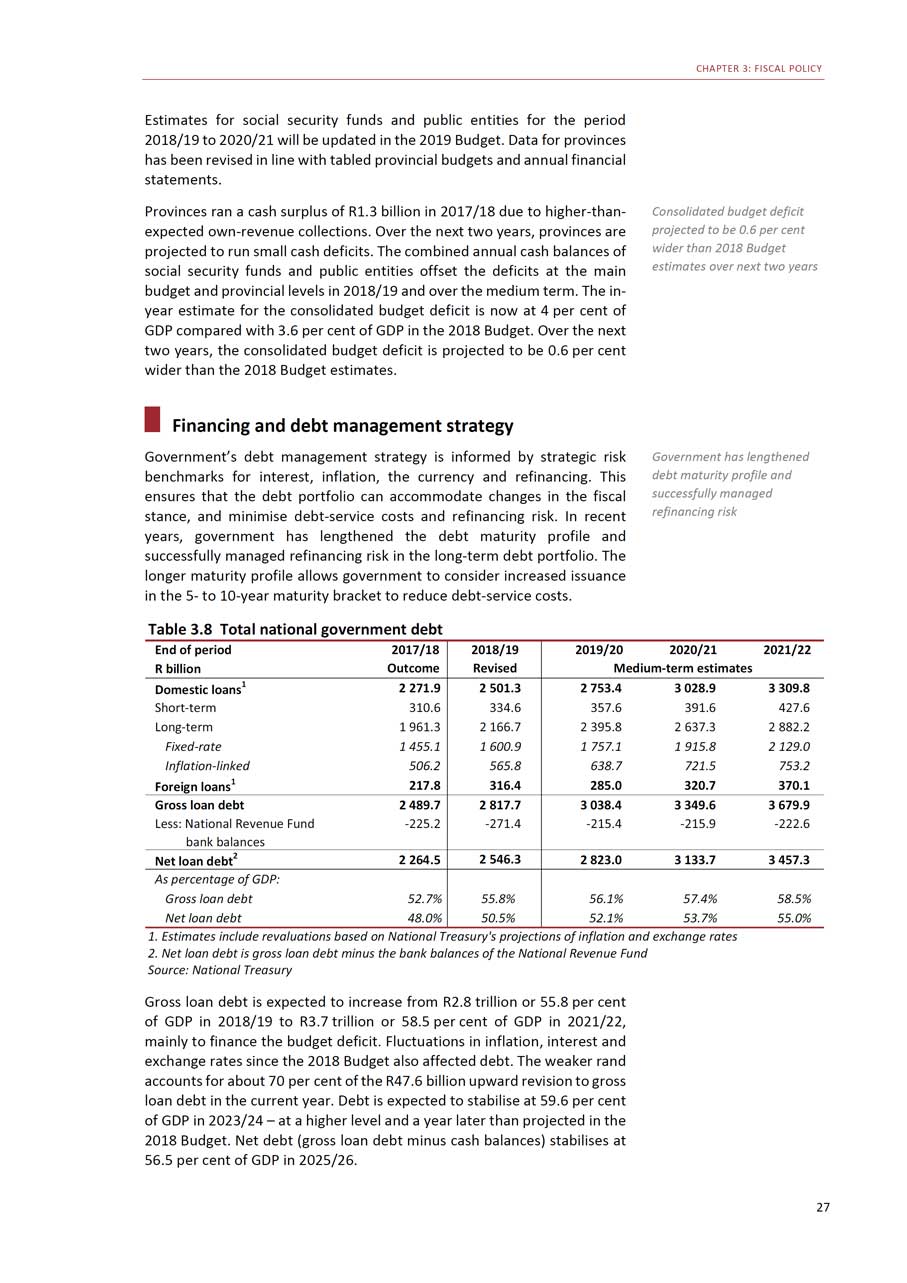

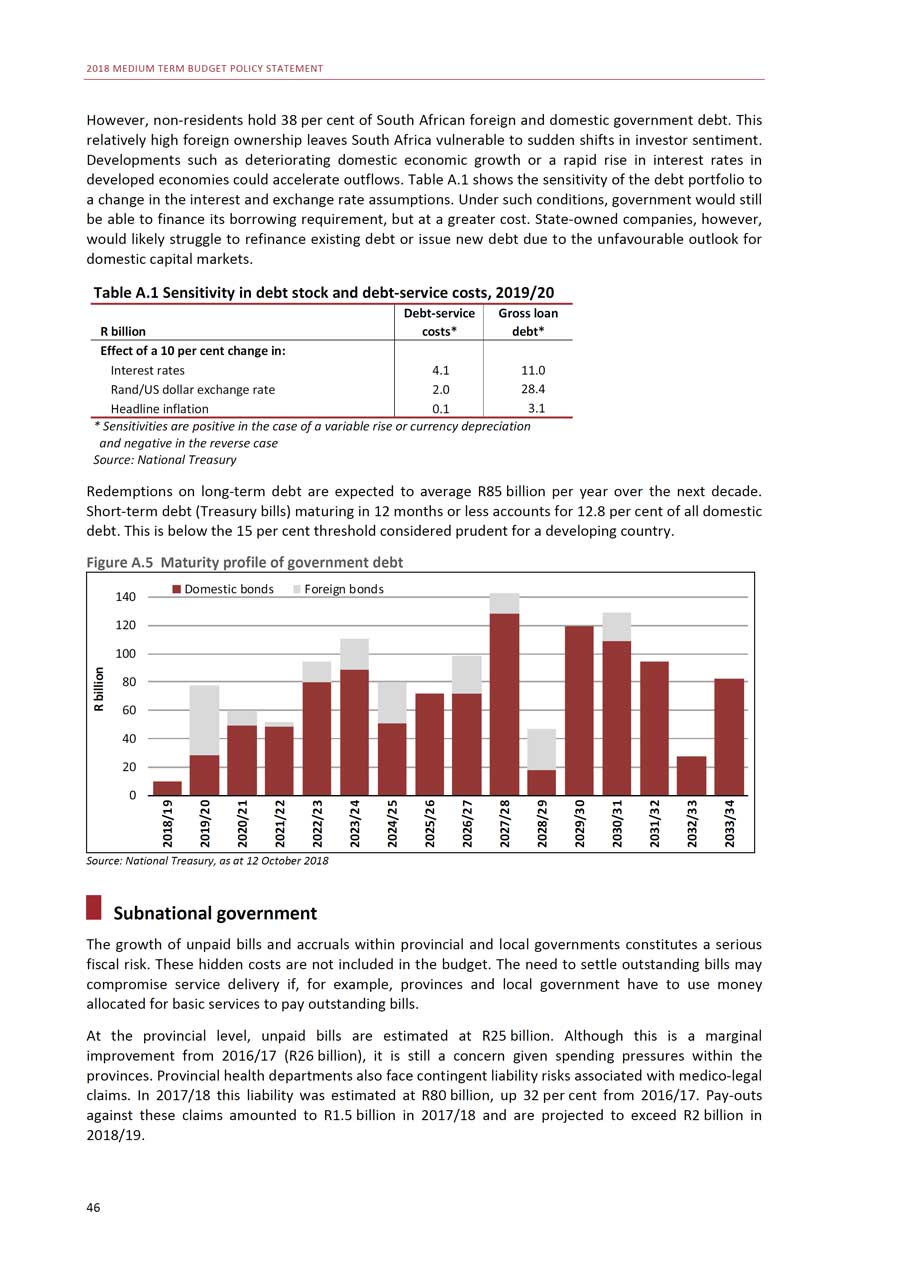

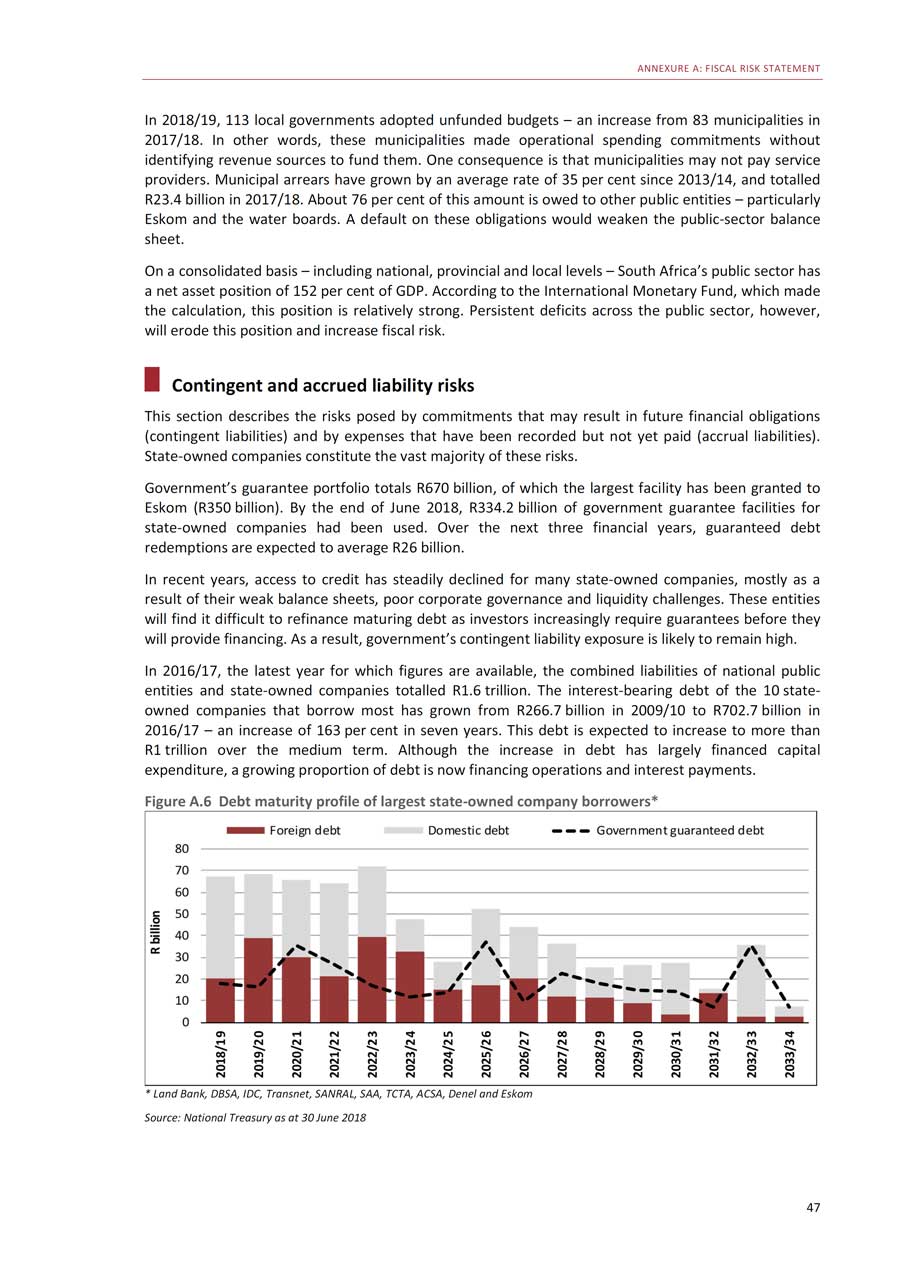

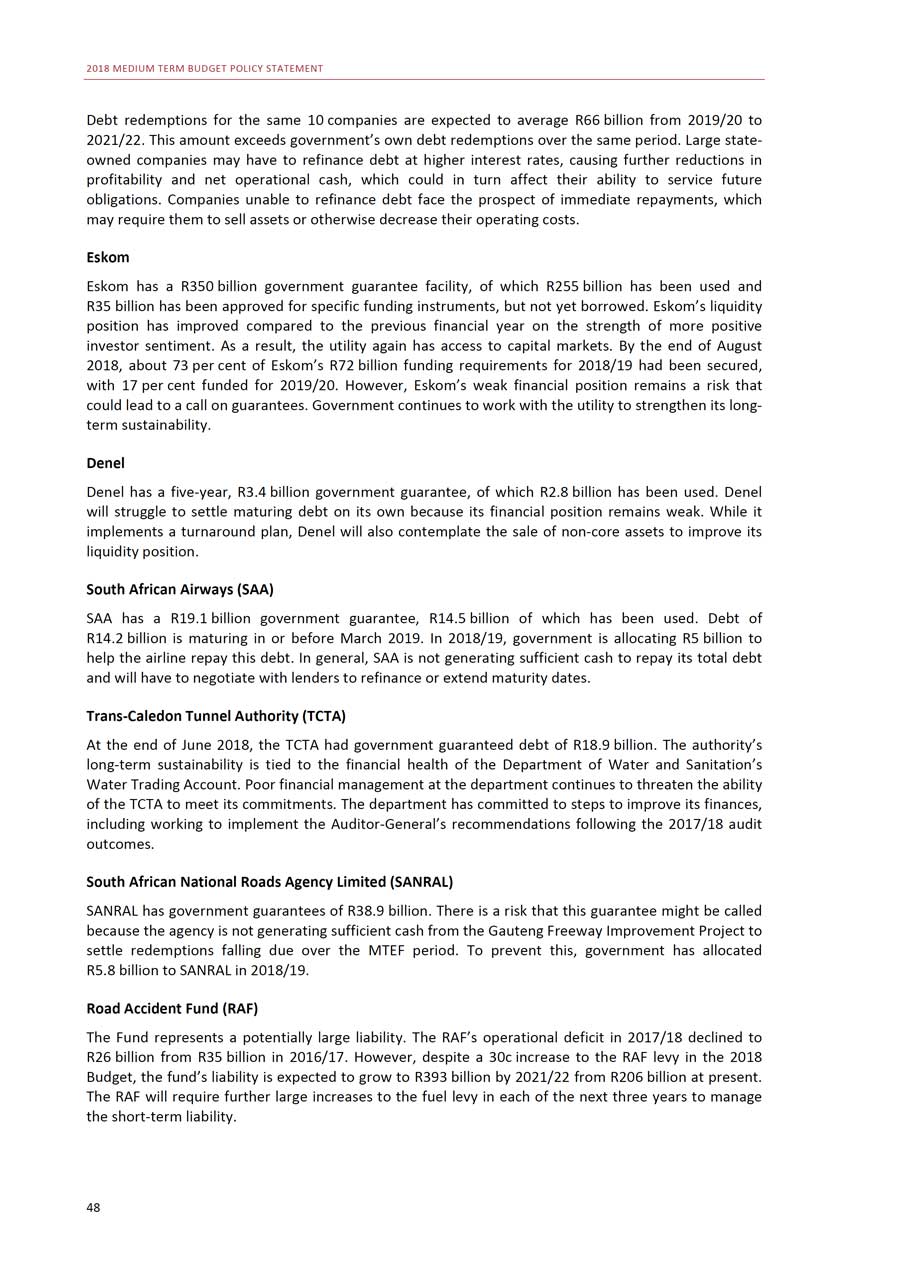

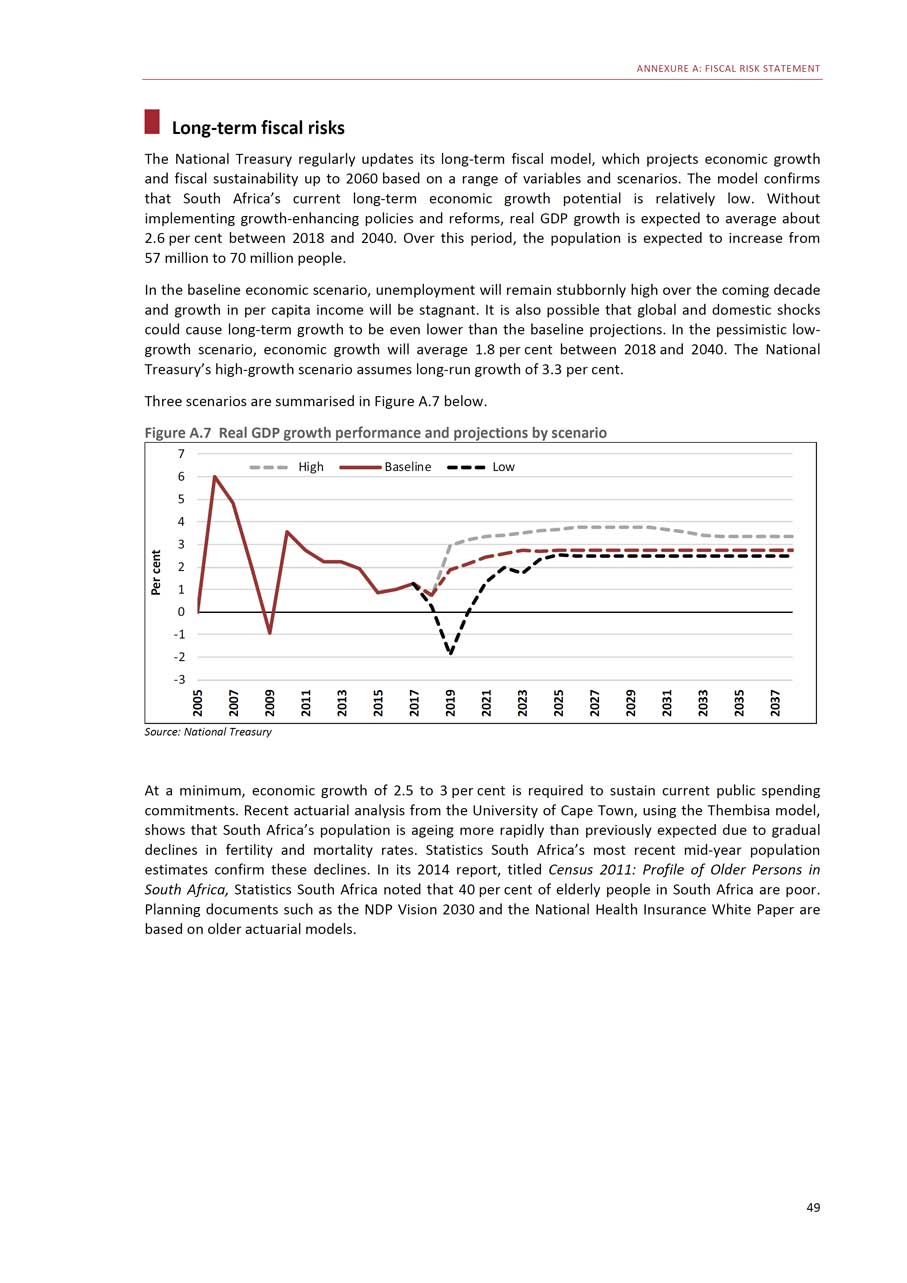

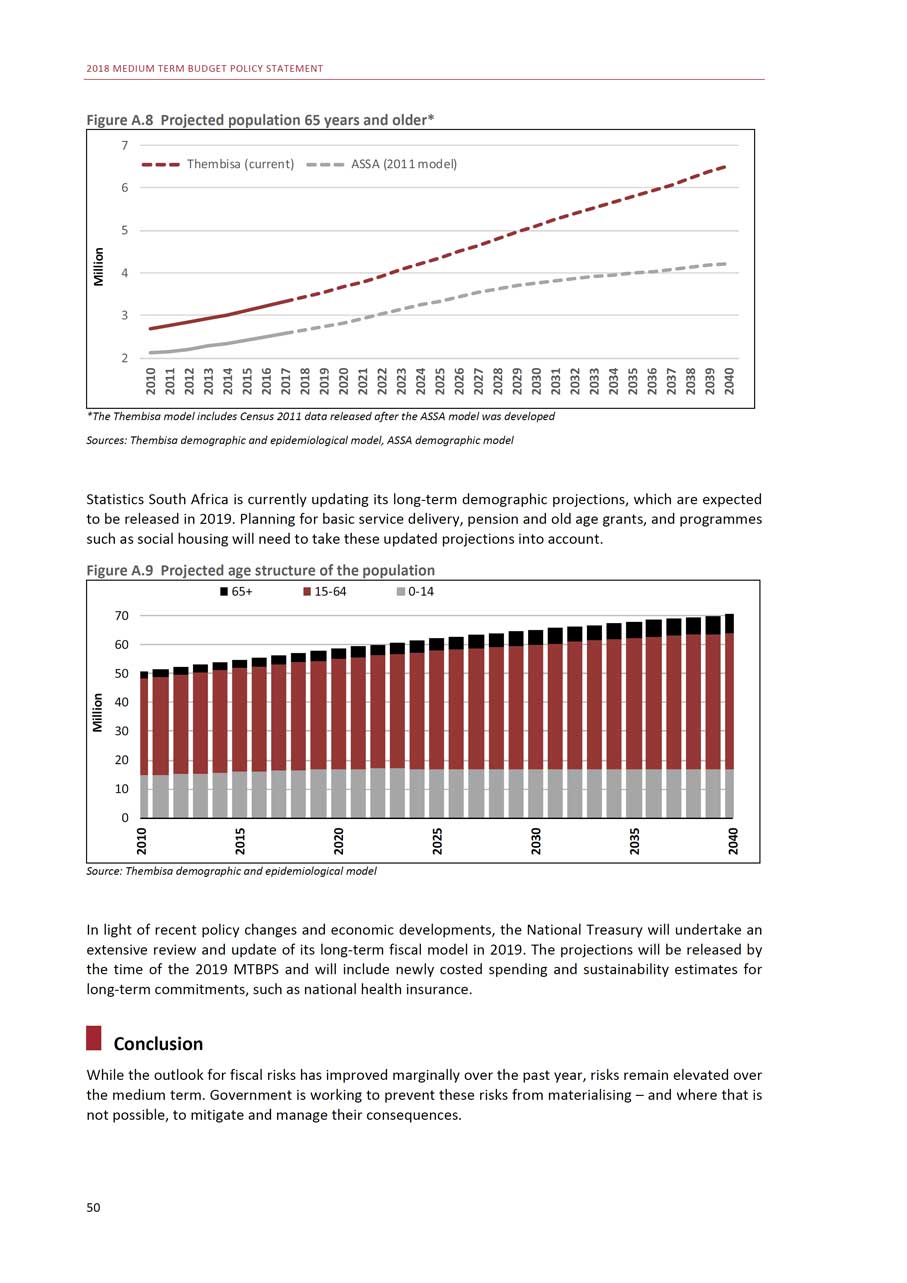

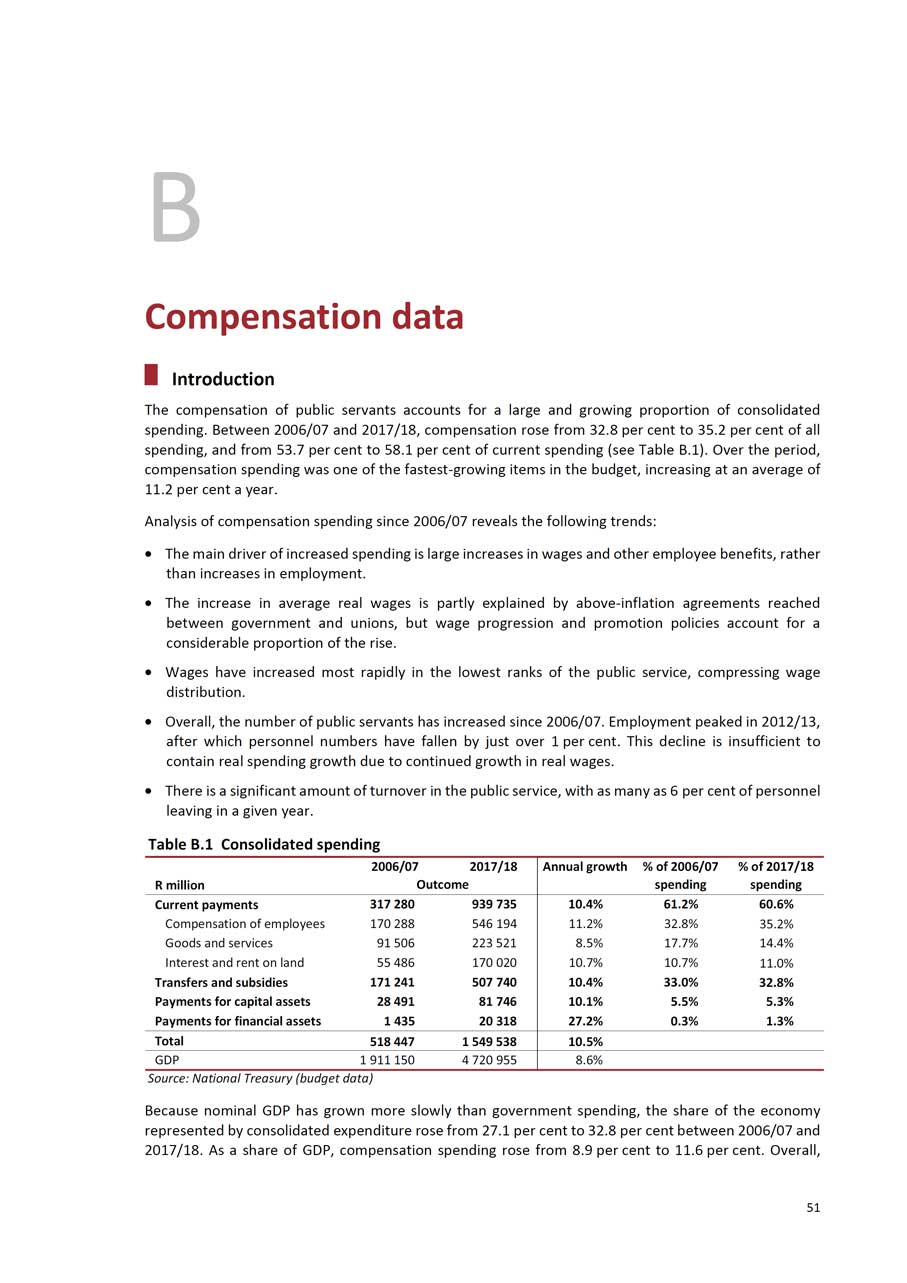

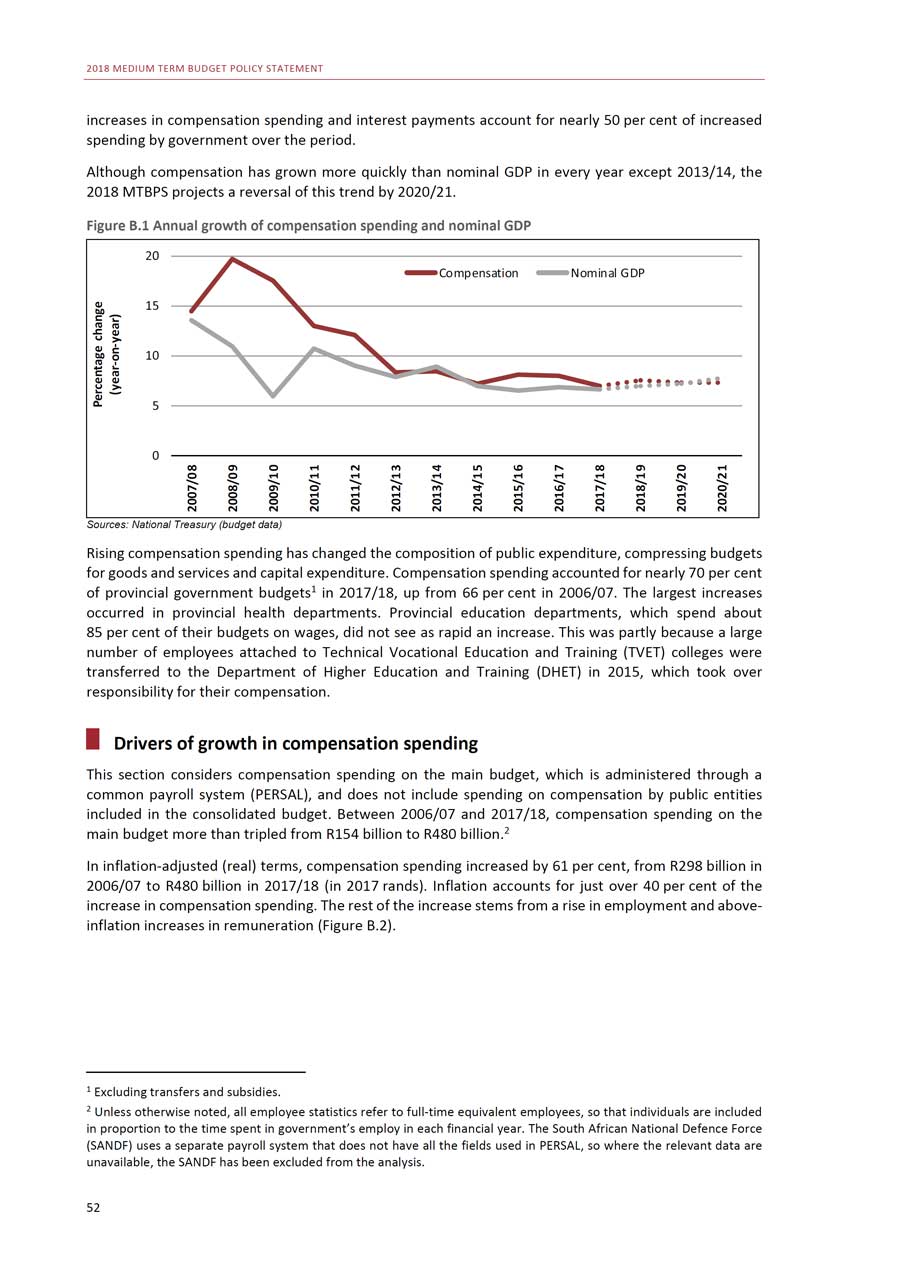

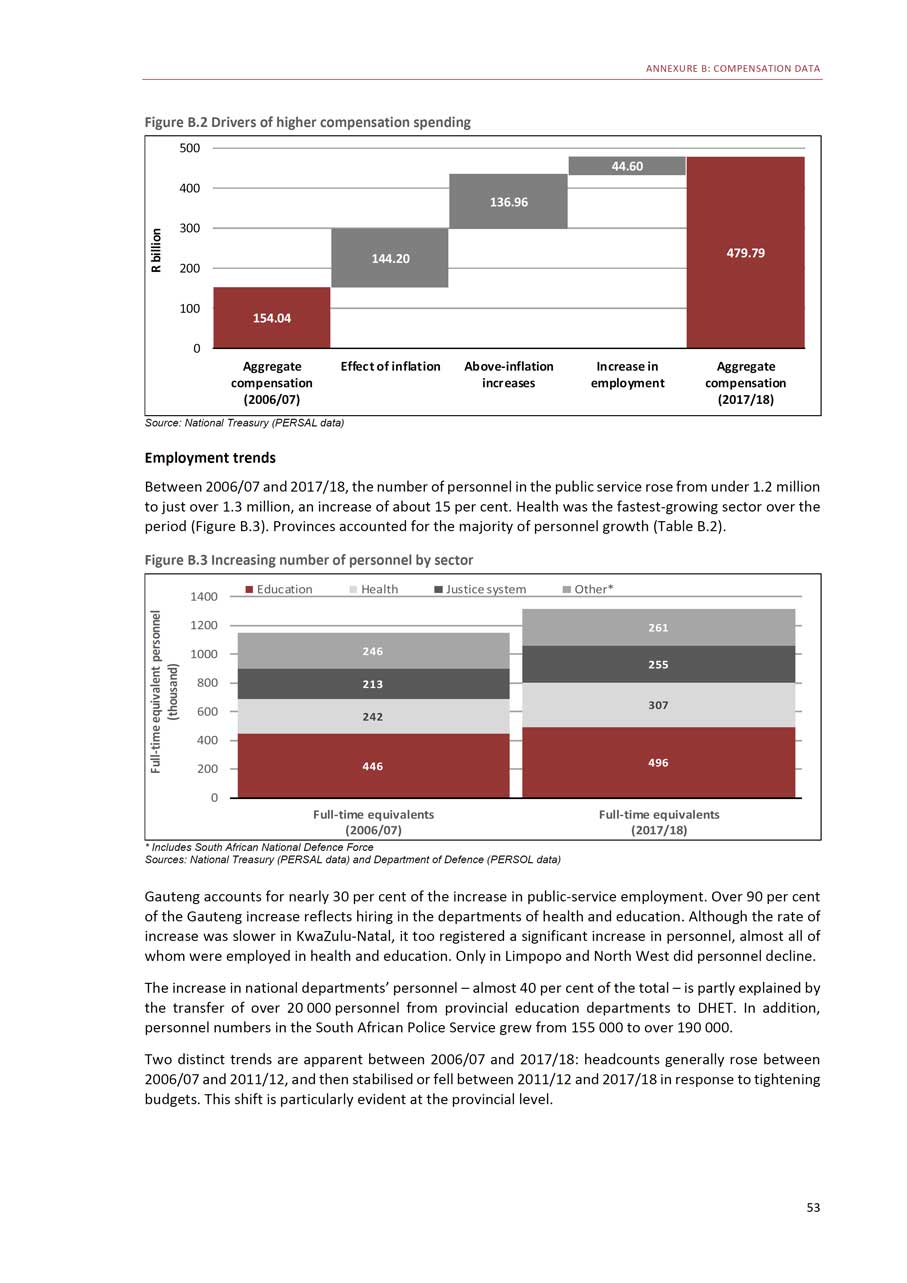

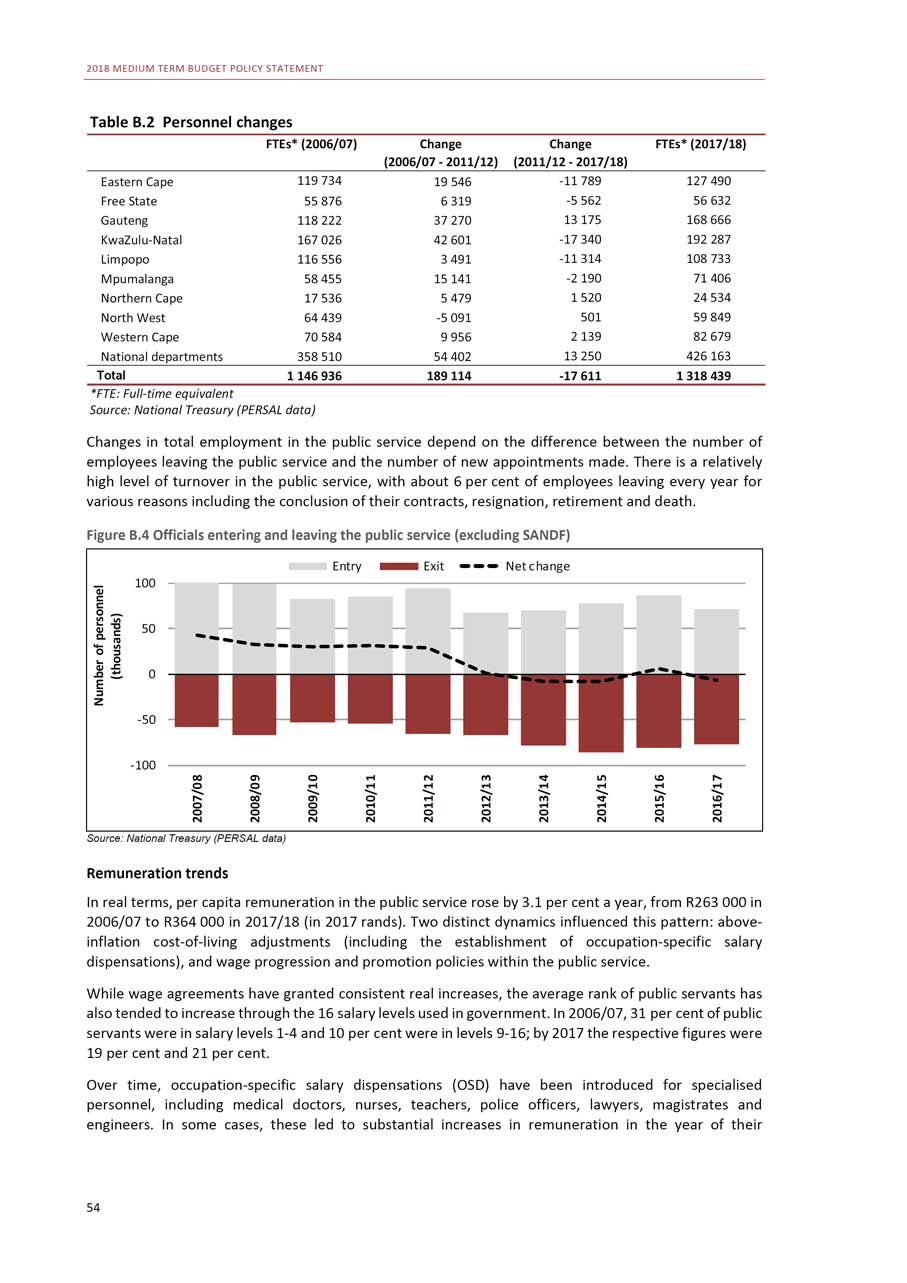

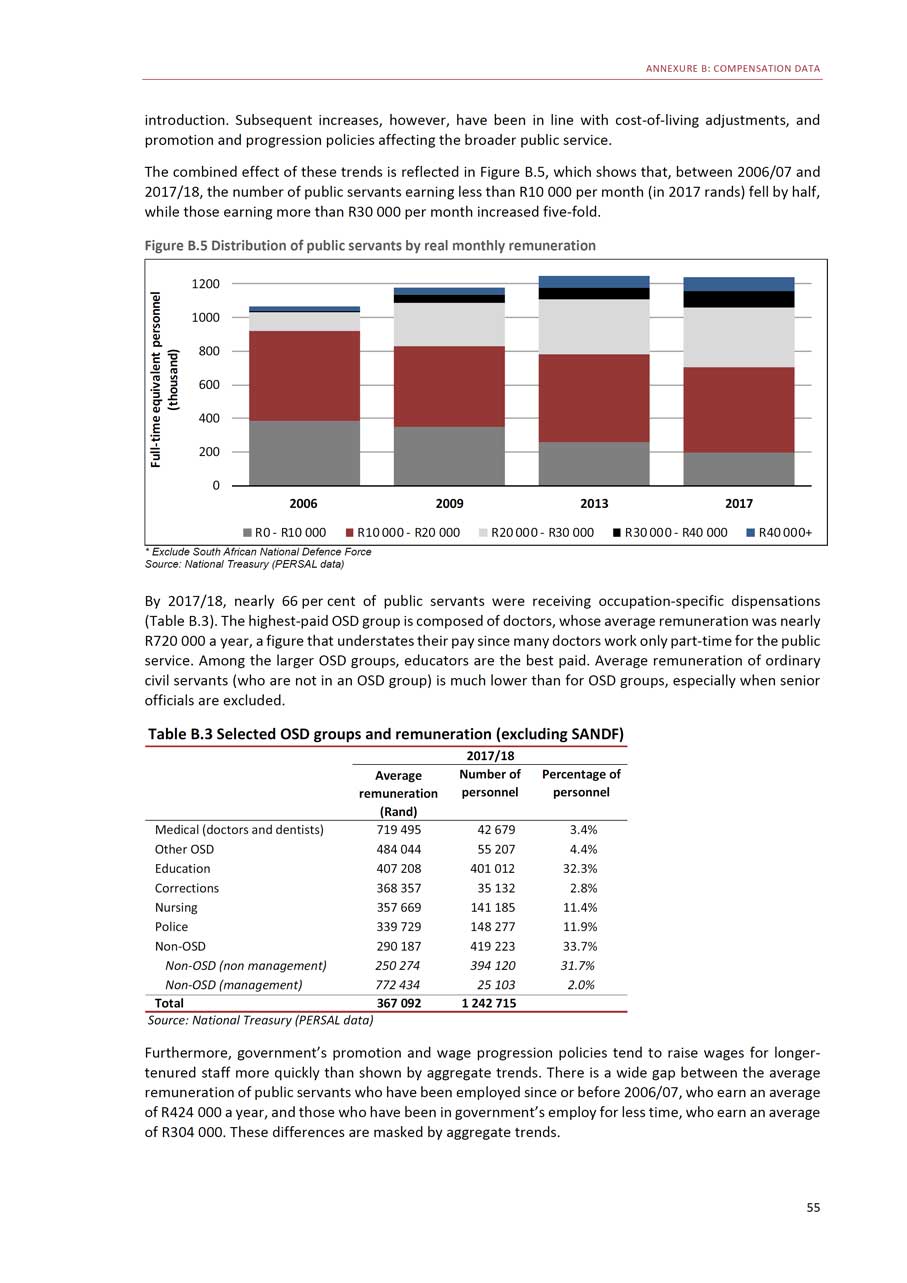

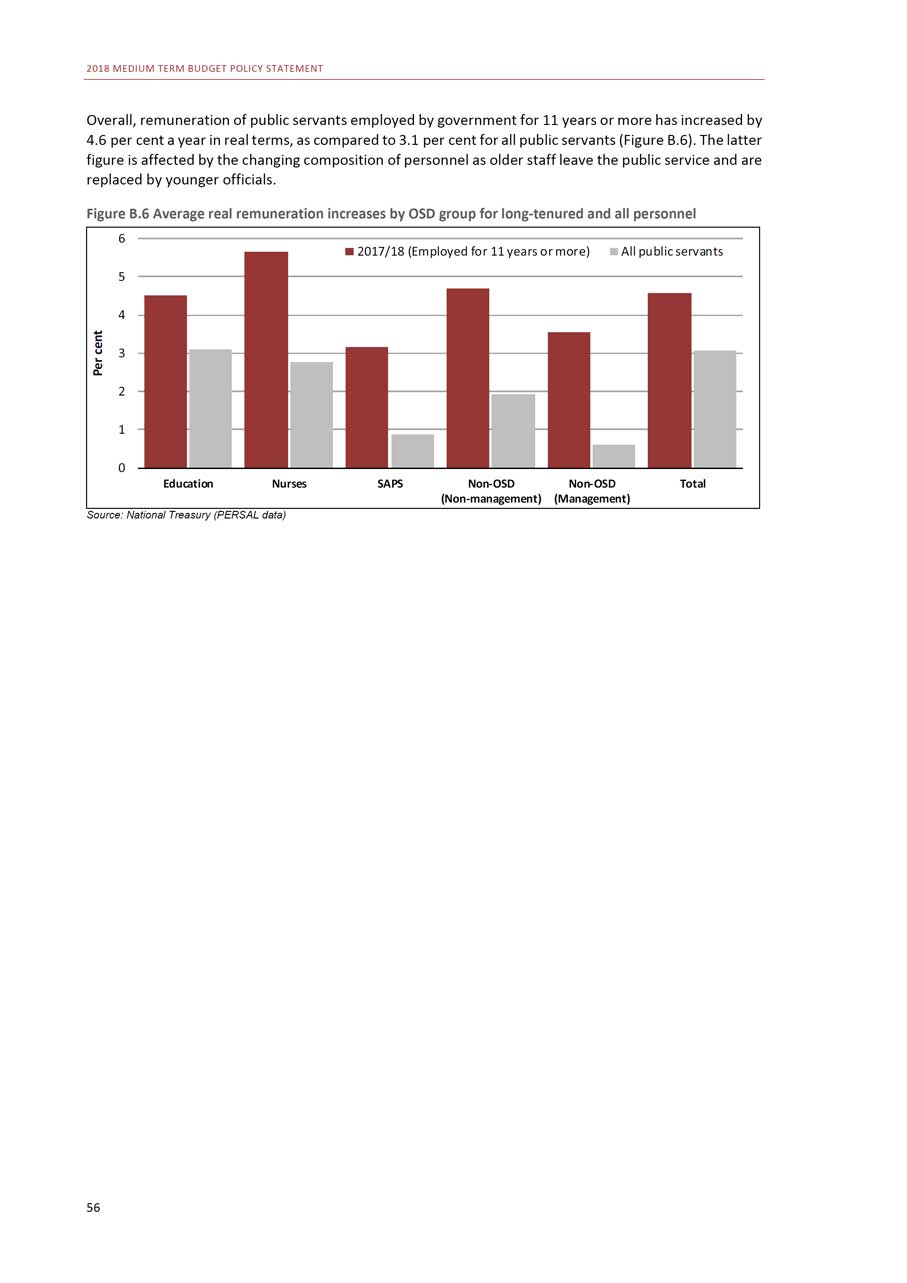

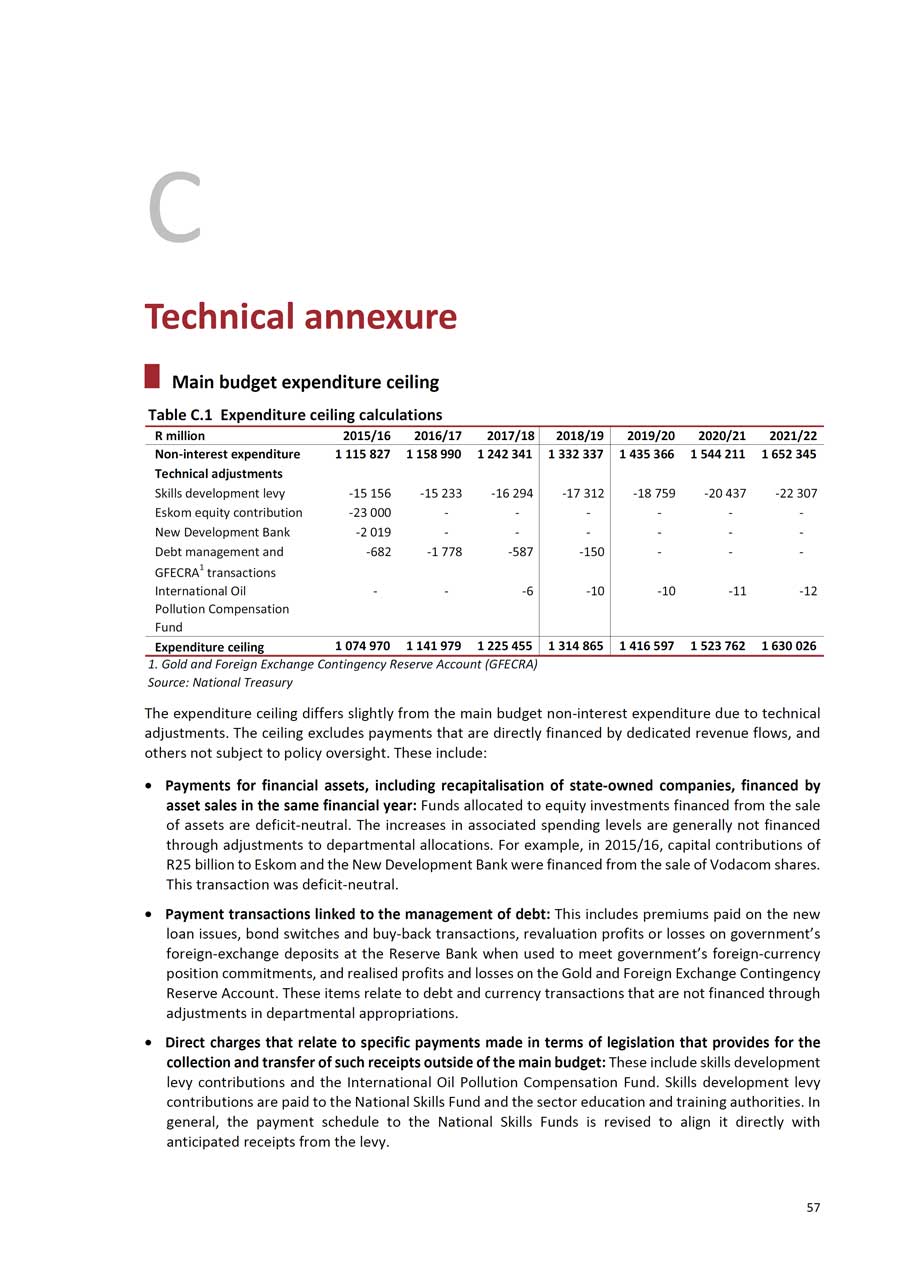

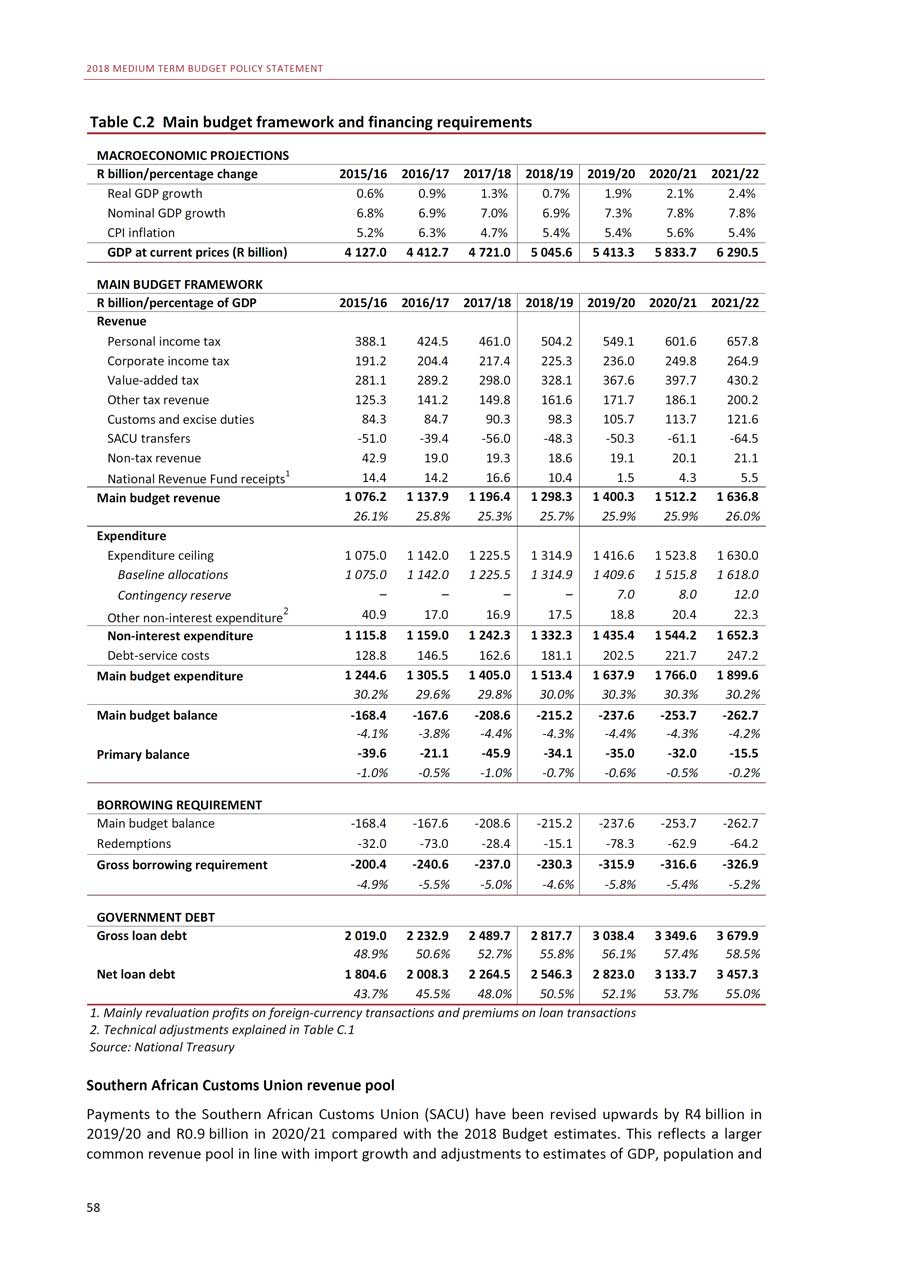

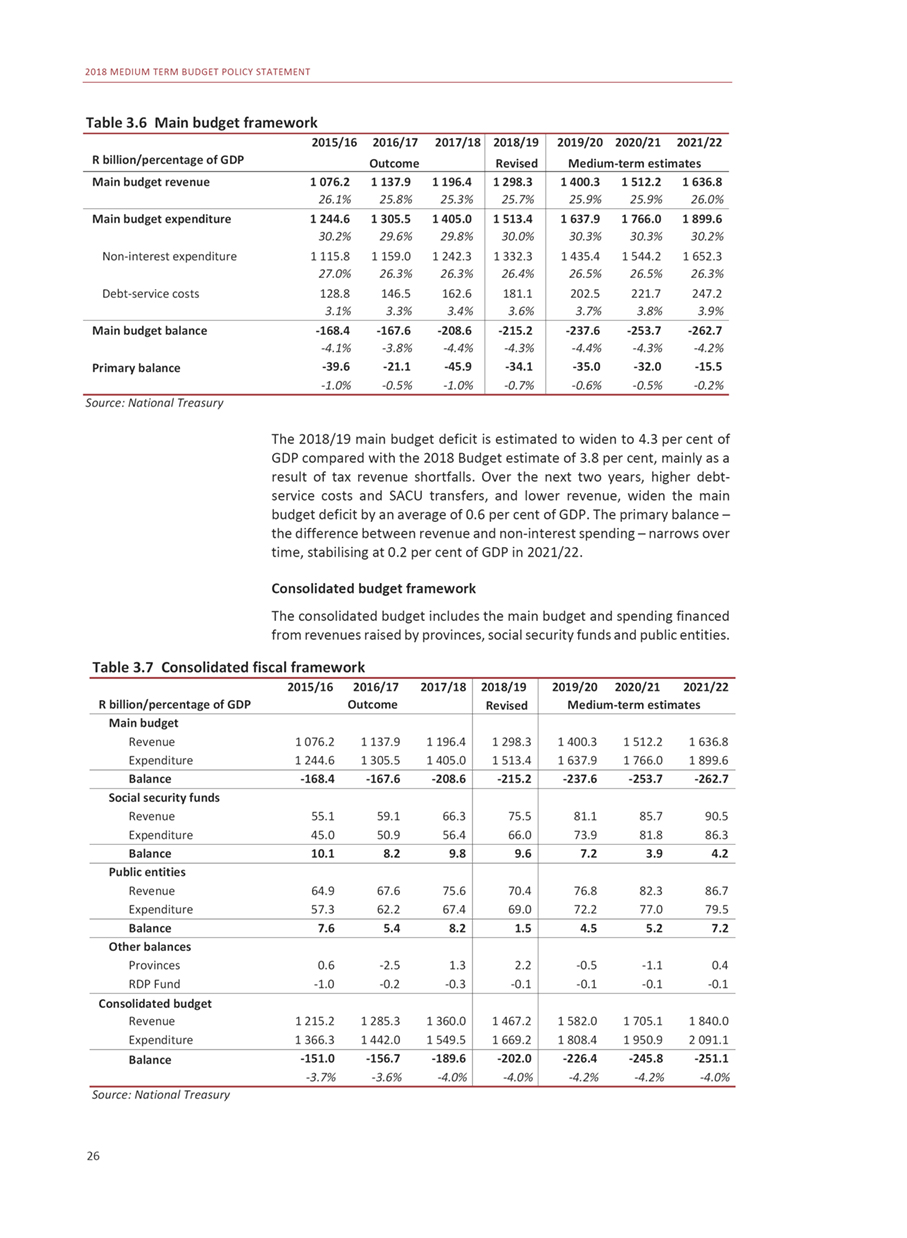

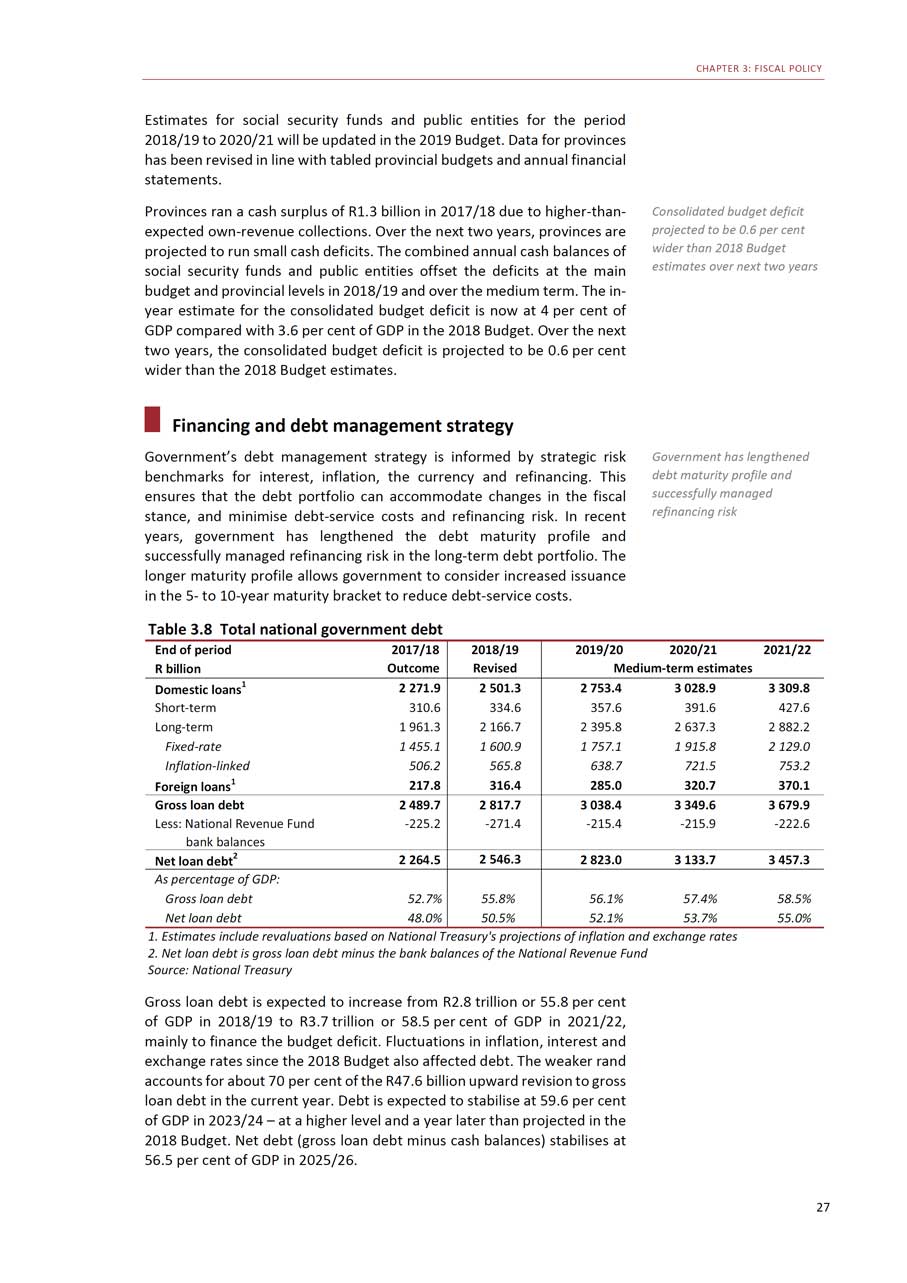

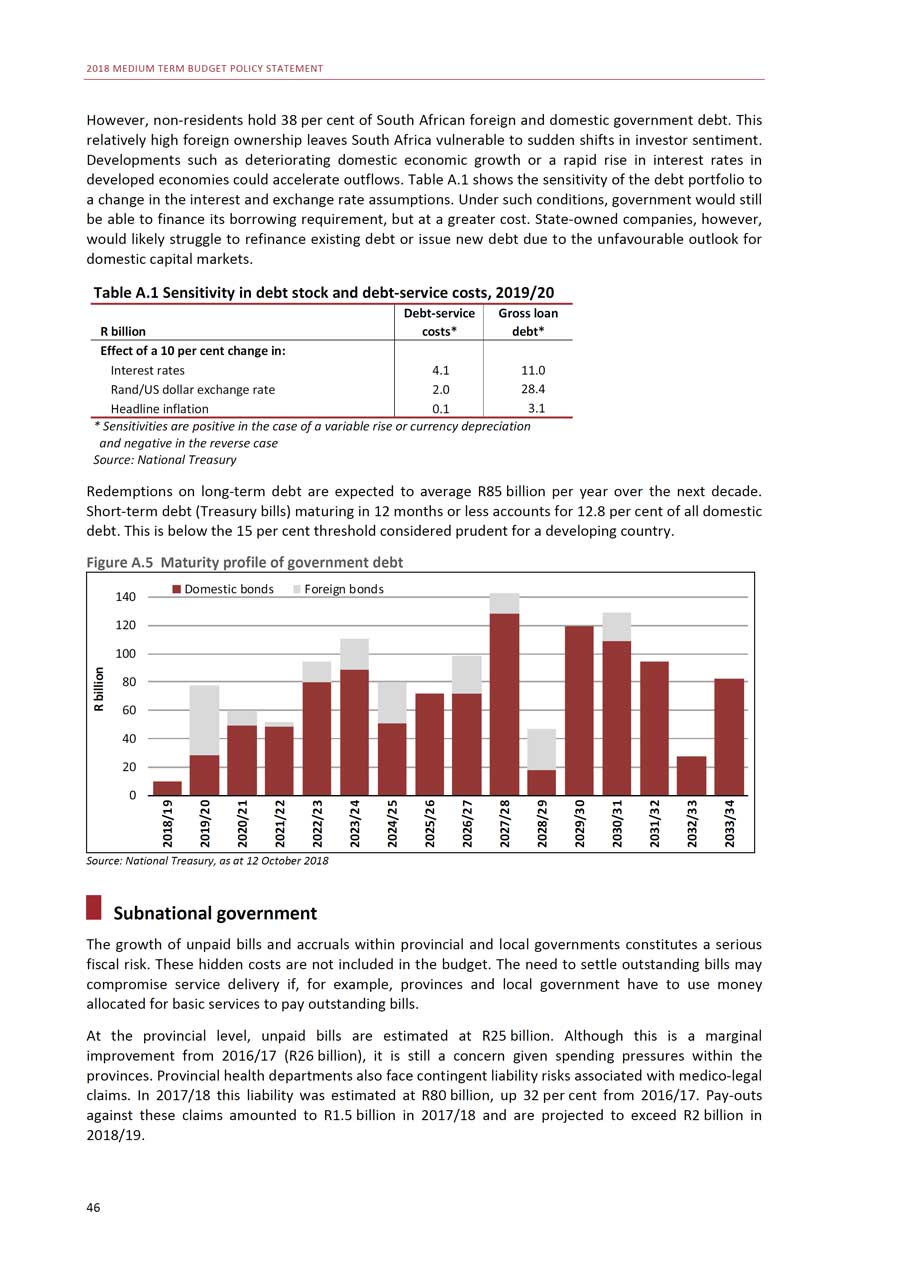

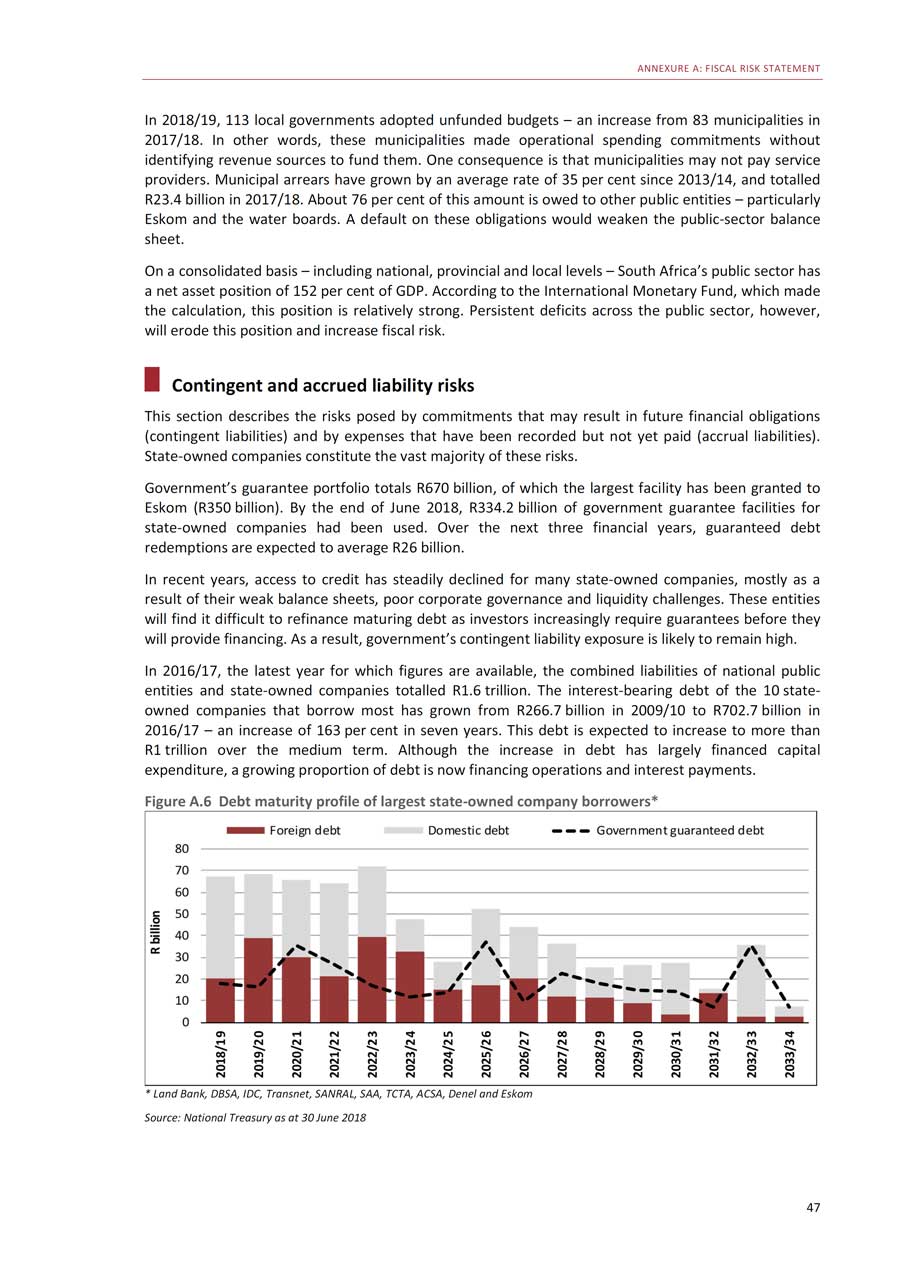

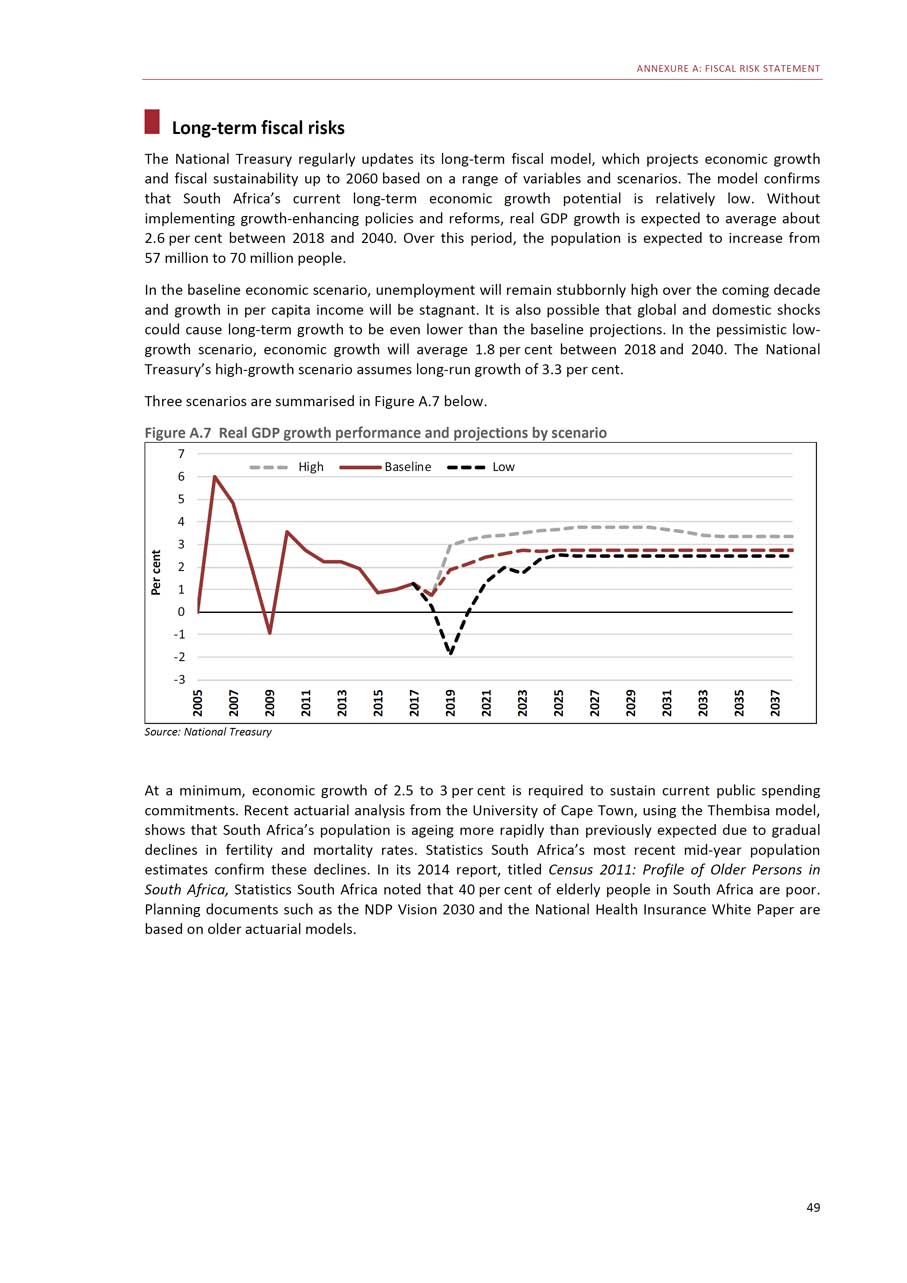

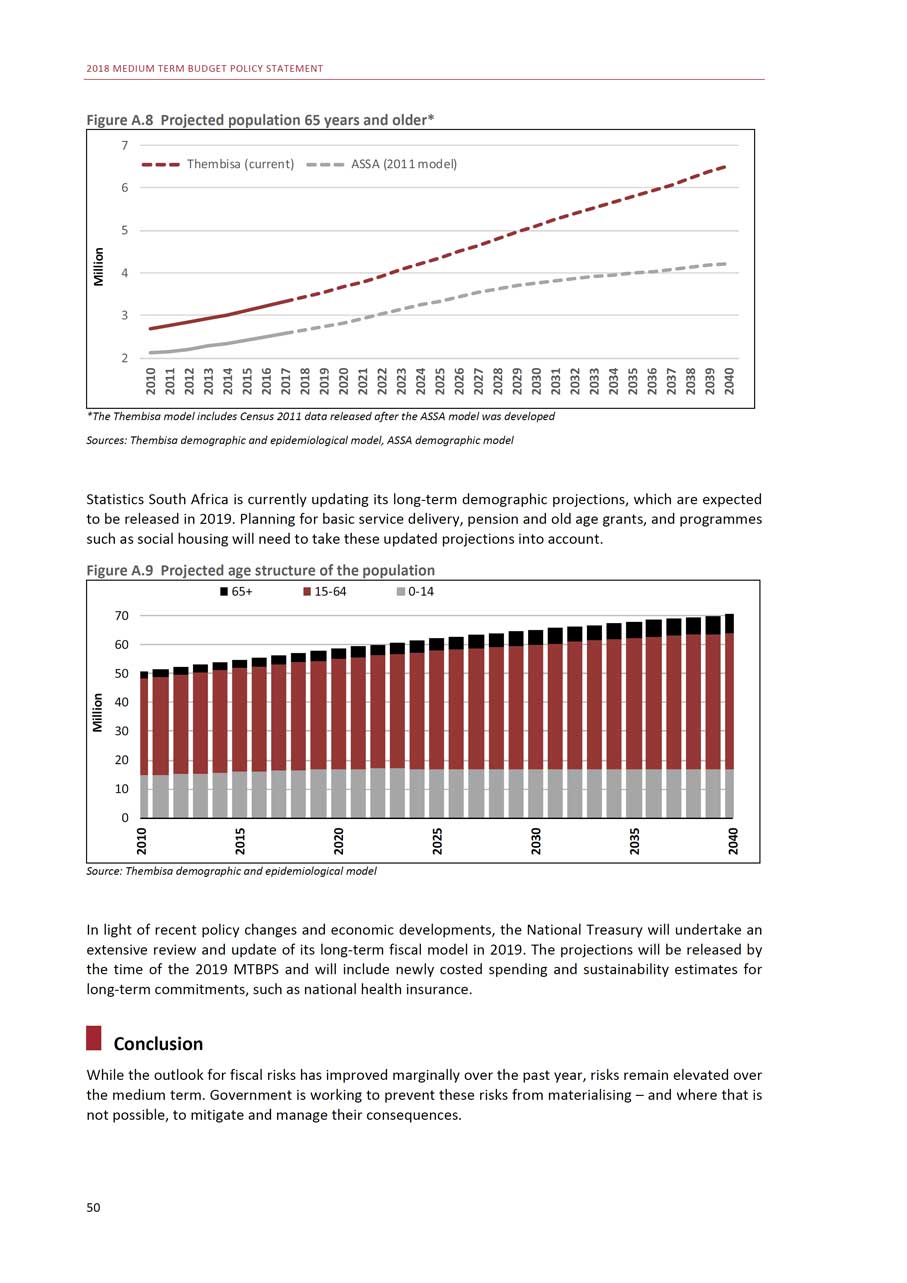

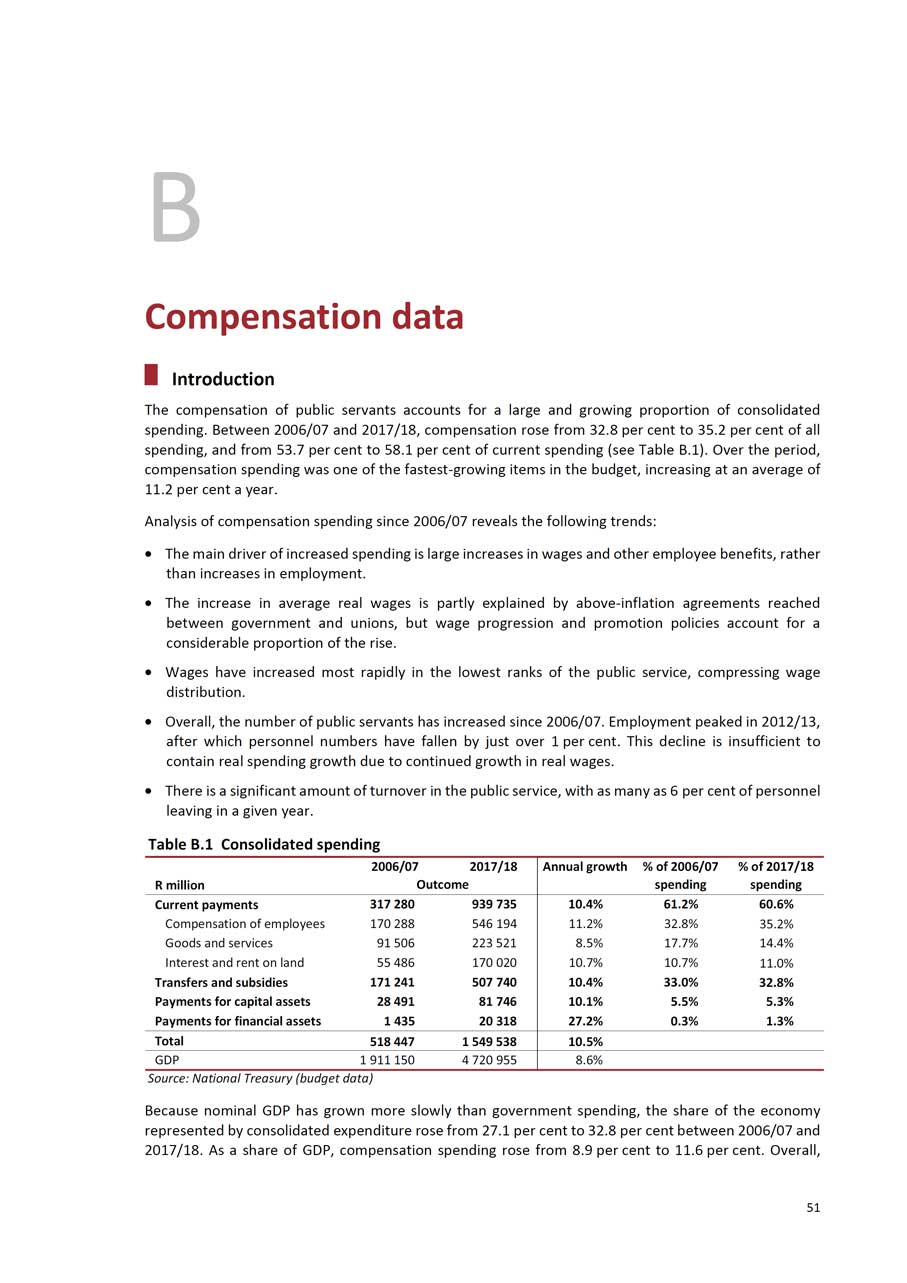

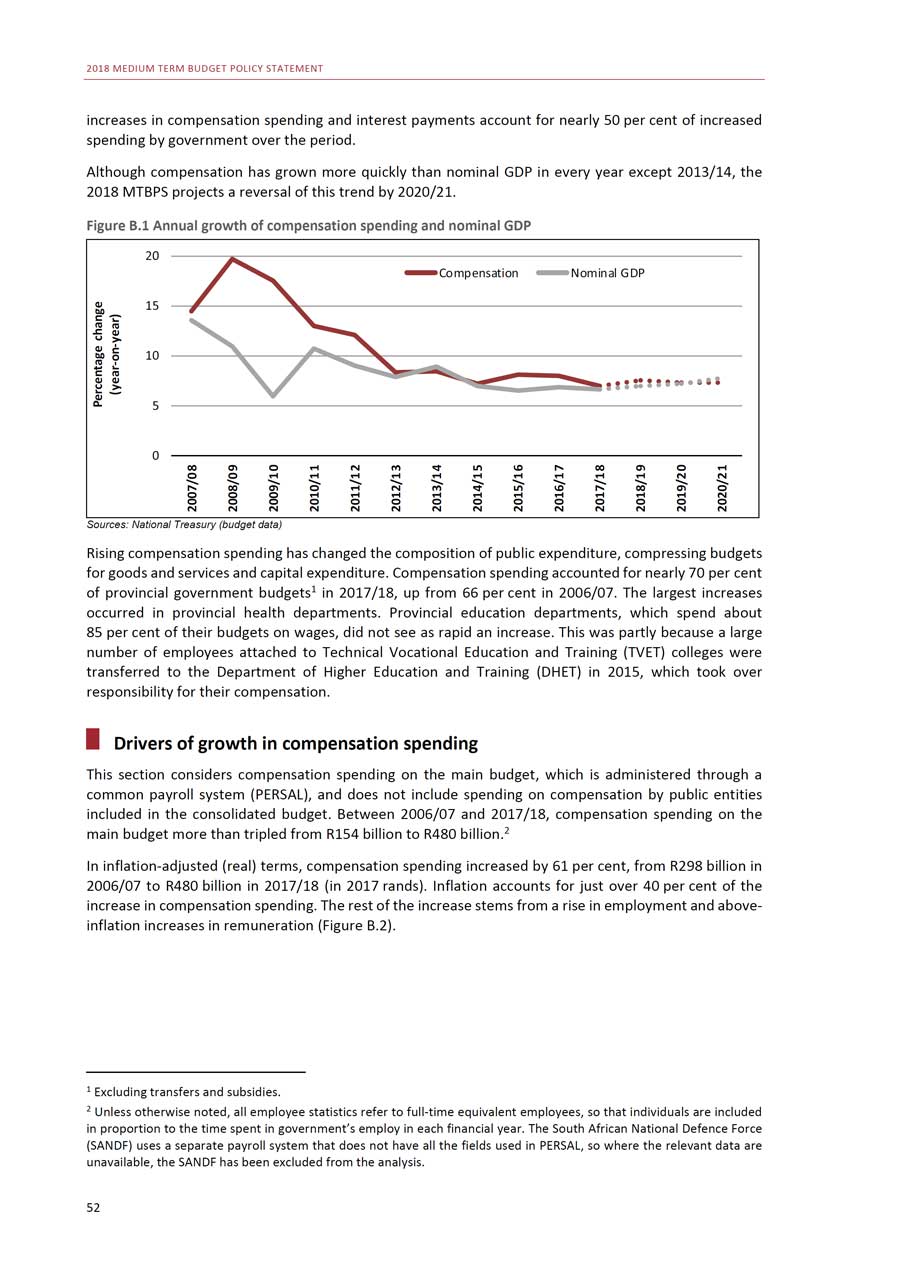

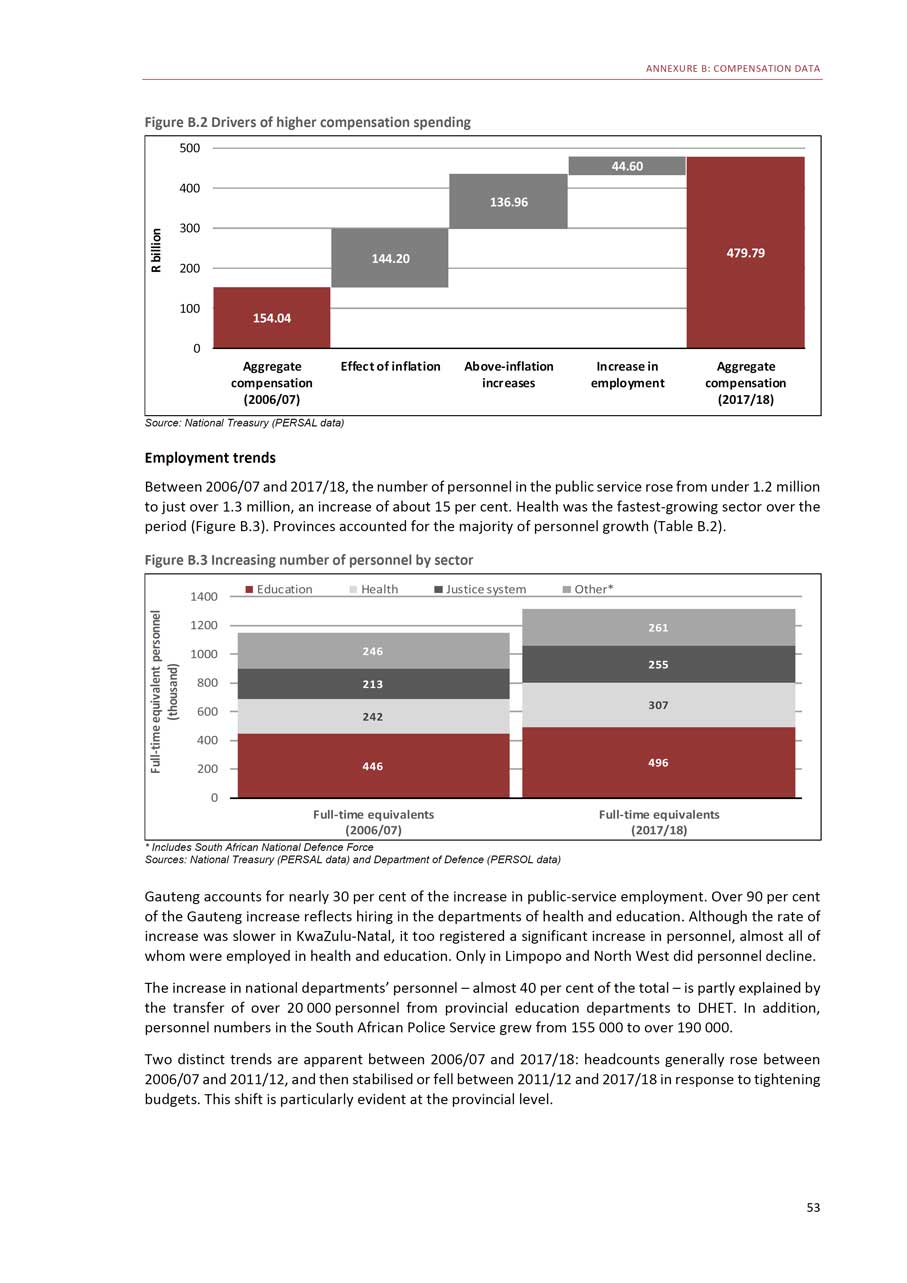

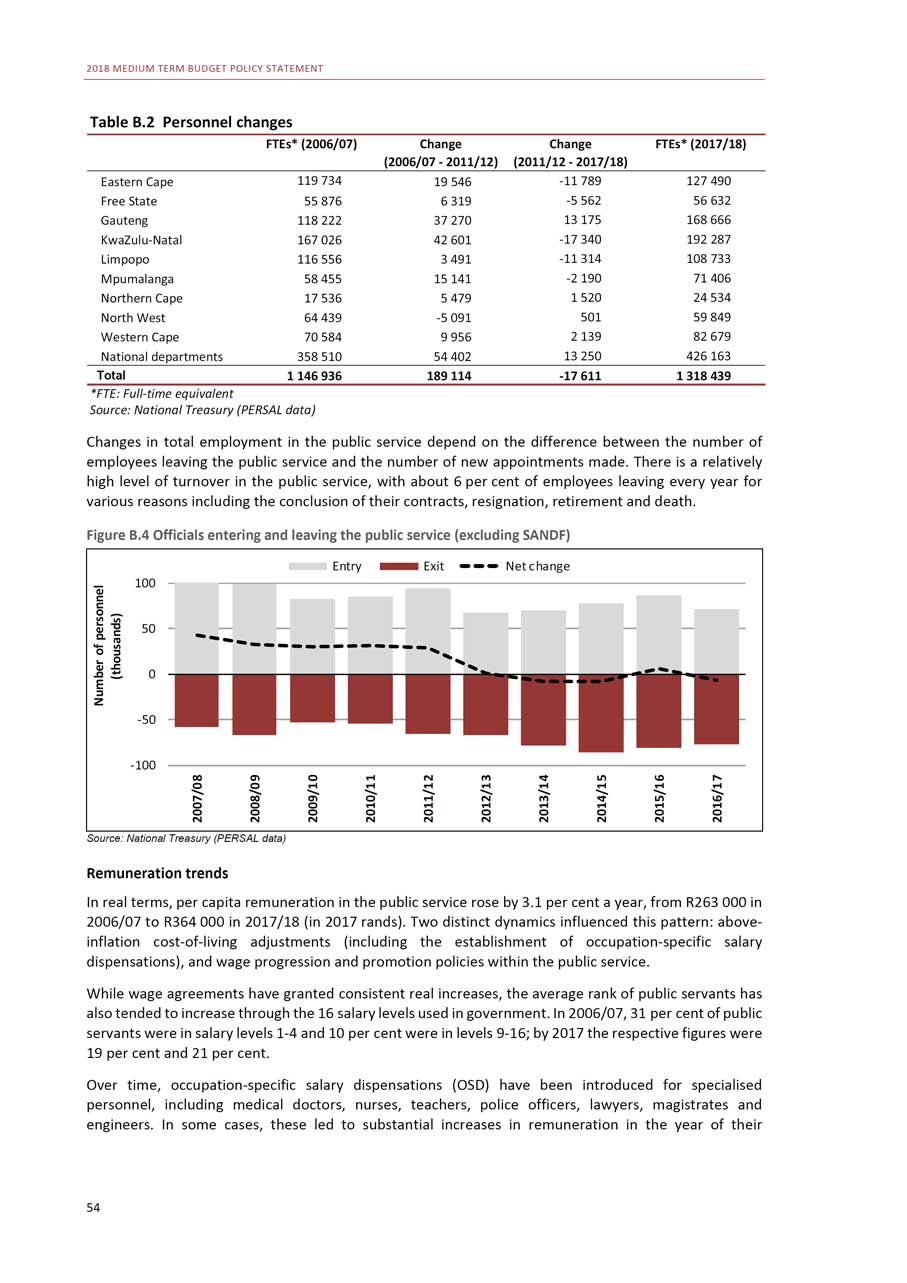

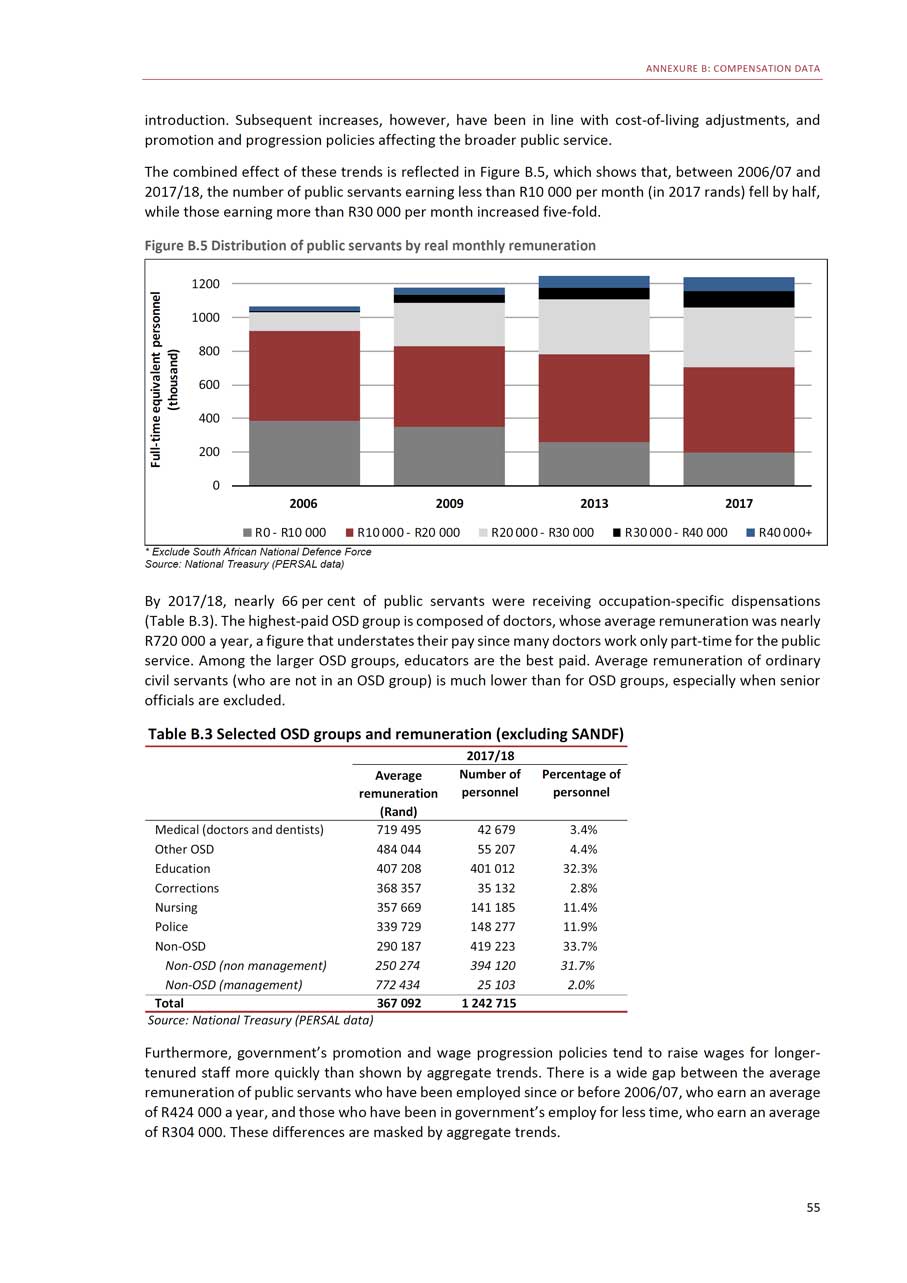

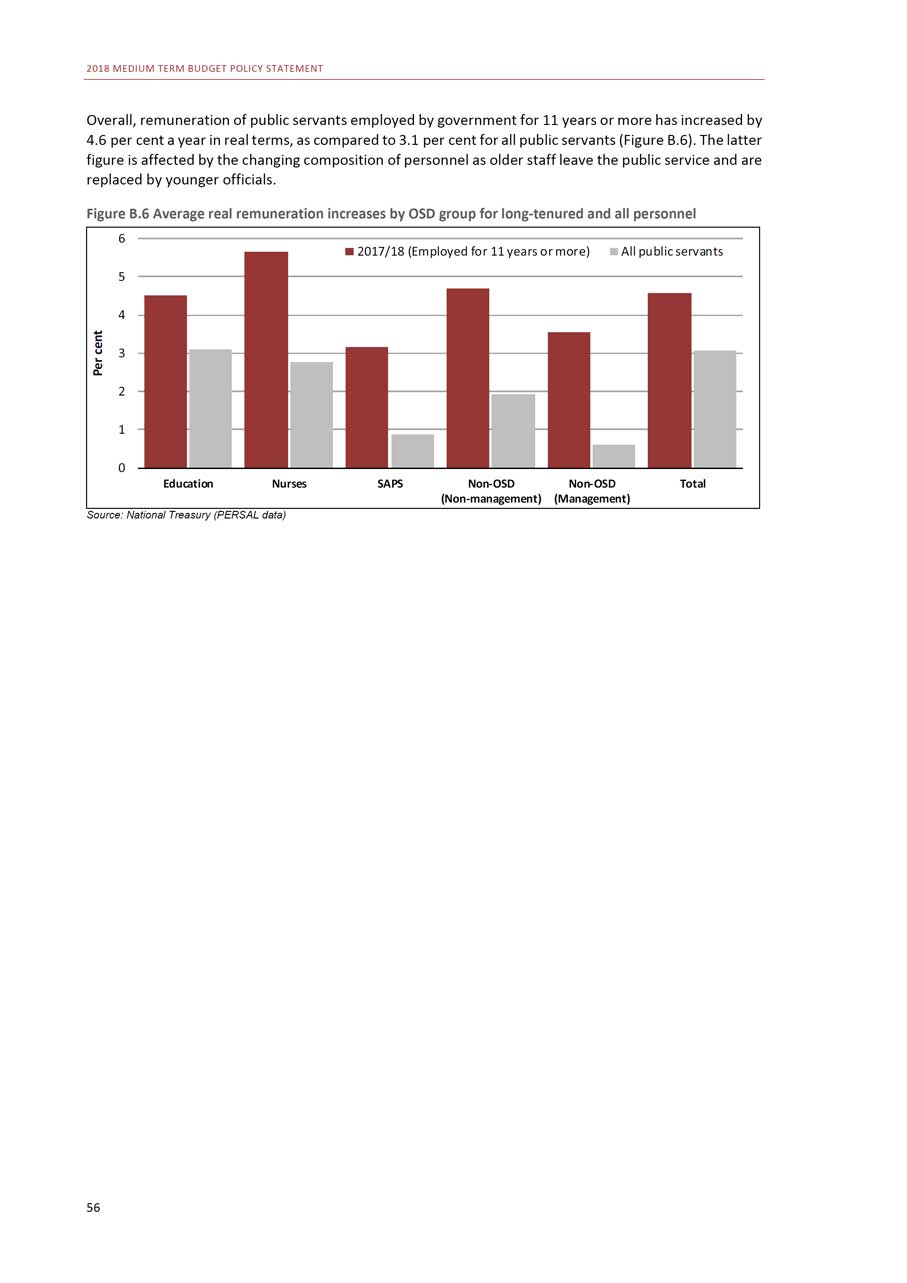

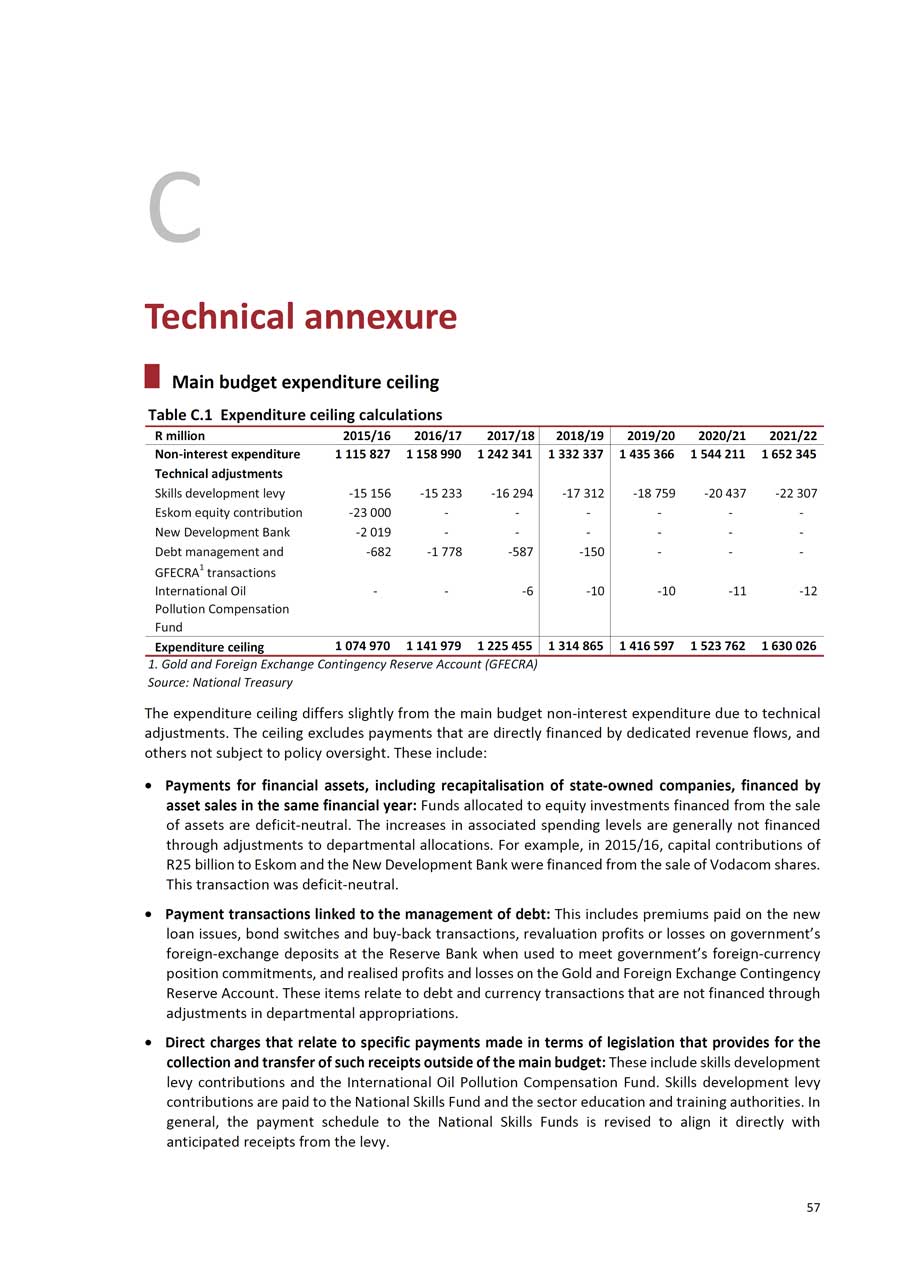

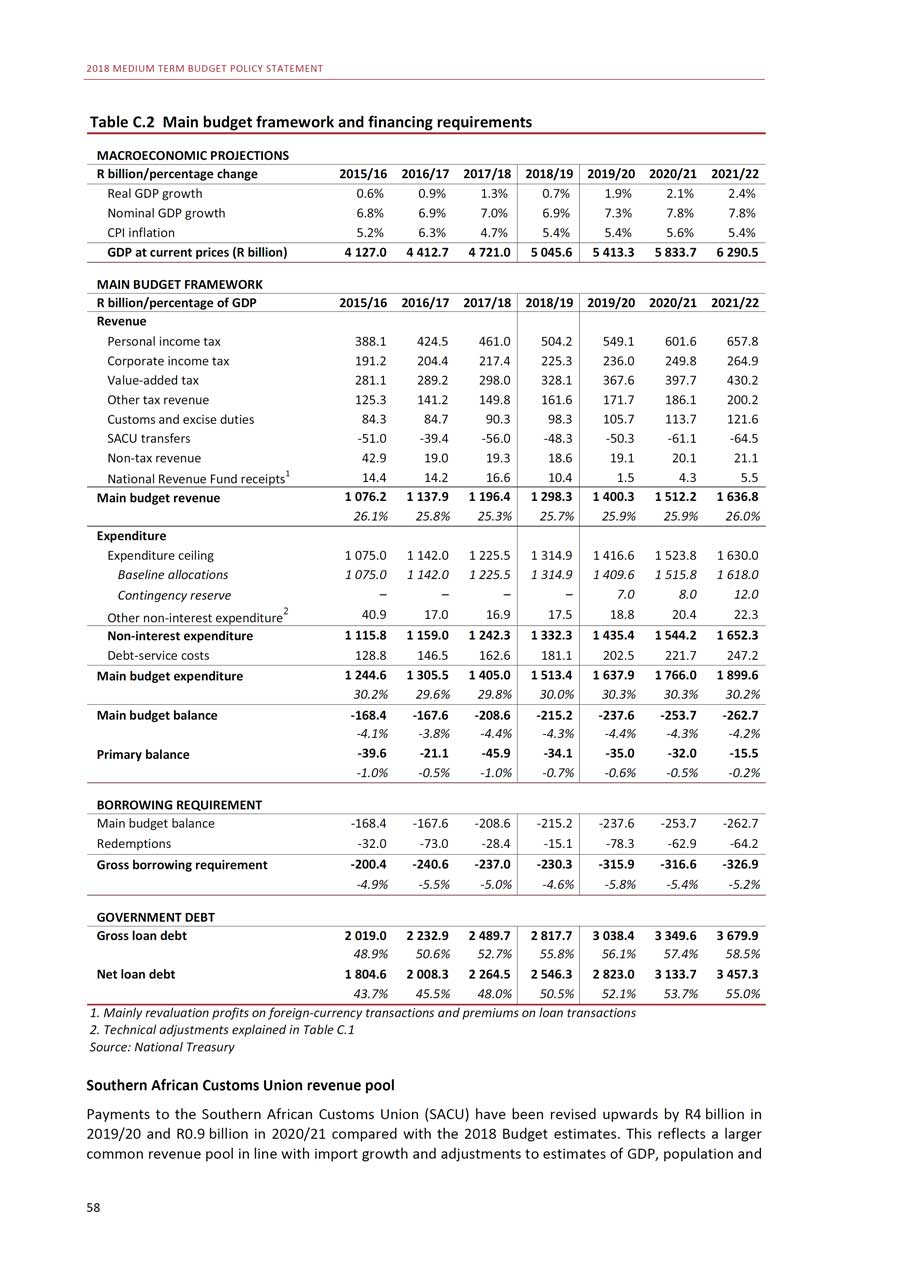

2018 MEDIUM TERM BUDGET POLICY STATEMENT Table 3.6 Main budget framework 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22R billion/percentage of GDP Outcome Revised Medium-term estimatesMain budget revenue 1 076.2 1 137.9 1 196.4 1 298.3 1 400.3 1 512.2 1 636.826.1% 25.8% 25.3% 25.7% 25.9% 25.9% 26.0%Main budget expenditure 1 244.6 1 305.5 1 405.0 1 513.4 1 637.9 1 766.0 1 899.630.2% 29.6% 29.8% 30.0% 30.3% 30.3% 30.2%Non-interest expenditure 1 115.8 1 159.0 1 242.3 1 332.3 1 435.4 1 544.2 1 652.327.0% 26.3% 26.3% 26.4% 26.5% 26.5% 26.3%Debt-service costs 128.8 146.5 162.6 181.1 202.5 221.7 247.23.1% 3.3% 3.4% 3.6% 3.7% 3.8% 3.9%Main budget balance -168.4 -167.6 -208.6 -215.2 -237.6 -253.7 -262.7-4.1% -3.8% -4.4% -4.3% -4.4% -4.3% -4.2%Primary balance -39.6 -21.1 -45.9 -34.1 -35.0 -32.0 -15.5-1.0% -0.5% -1.0% -0.7% -0.6% -0.5% -0.2%Source: National Treasury The 2018/19 main budget deficit is estimated to widen to 4.3 per cent of GDP compared with the 2018 Budget estimate of 3.8 per cent, mainly as a result of tax revenue shortfalls. Over the next two years, higher debtservice costs and SACU transfers, and lower revenue, widen the main budget deficit by an average of 0.6 per cent of GDP. The primary balance - the difference between revenue and non-interest spending - narrows over time, stabilising at 0.2 per cent of GDP in 2021/22. Consolidated budget framework The consolidated budget includes the main budget and spending financed from revenues raised by provinces, social security funds and public entities. Table 3.7 Consolidated fiscal framework 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22R billion/percentage of GDP Outcome Revised Medium-term estimatesMain budgetRevenue 1 076.2 1 137.9 1 196.4 1 298.3 1 400.3 1 512.2 1 636.8Expenditure 1 244.6 1 305.5 1 405.0 1 513.4 1 637.9 1 766.0 1 899.6Balance -168.4 -167.6 -208.6 -215.2 -237.6 -253.7 -262.7Social security fundsRevenue 55.1 59.1 66.3 75.5 81.1 85.7 90.5Expenditure 45.0 50.9 56.4 66.0 73.9 81.8 86.3Balance 10.1 8.2 9.8 9.6 7.2 3.9 4.2Public entitiesRevenue 64.9 67.6 75.6 70.4 76.8 82.3 86.7Expenditure 57.3 62.2 67.4 69.0 72.2 77.0 79.5Balance 7.6 5.4 8.2 1.5 4.5 5.2 7.2Other balancesProvinces 0.6 -2.5 1.3 2.2 -0.5 -1.1 0.4RDP Fund -1.0 -0.2 -0.3 -0.1 -0.1 -0.1 -0.1Consolidated budgetRevenue 1 215.2 1 285.3 1 360.0 1 467.2 1 582.0 1 705.1 1 840.0Expenditure 1 366.3 1 442.0 1 549.5 1 669.2 1 808.4 1 950.9 2 091.1Balance -151.0 -156.7 -189.6 -202.0 -226.4 -245.8 -251.1-3.7% -3.6% -4.0% -4.0% -4.2% -4.2% -4.0%Source: National Treasury 26