Exhibit 99.E

DESCRIPTION OF THE REPUBLIC OF SOUTH AFRICA

DATED FEBRUARY 15, 2019

INCORPORATION OF DOCUMENTS BY REFERENCE

This document is an exhibit to the Republic of South Africa’s Annual Report on Form 18-K under the Securities Exchange Act of 1934 for the fiscal year ended March 31, 2018. All amendments to such Annual Report on Form 18-K/A filed by South Africa following the date hereof shall be incorporated by reference into this document. Any statement contained in a document, all or a portion of which is incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this document to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this document.

TABLE OF CONTENTS

In this document, the government of the Republic of South Africa is referred to as the “National Government,” “the Government” or the “South African Government”. The currency of the Republic of South Africa (South Africa) is the South African Rand. In this document, all amounts are expressed in South African Rand (R or Rand) or US Dollars (US$, $ or Dollars), except as otherwise specified. See “The External Sector of the Economy—Reserves and Exchange Rates” for the average rates for the Rand against the Dollar for each of the years 2015 through February 11, 2019. On February 12, 2019, the exchange rate, as reported by the South African Reserve Bank (SARB), was R13.7721 per Dollar (or 7.261057 US cents per Rand).

The Republic’s fiscal year begins on April 1 and ends on March 31. For example, the 2018 fiscal year refers to the fiscal year beginning April 1, 2017 and ending March 31, 2018. Economic data presented in this description is presented on a calendar year basis unless reference is made to the relevant fiscal year or the fiscal year is otherwise indicated by the context. For example, economic data referring to the “first quarter” of 2018 refers to data as at, or for the three months ended, June 30, 2018. Economic data referring to the “first three months” of 2018, by contrast, refers to data as at, or for the three months ended, March 31, 2018.

Unless otherwise indicated, references to gross domestic product (GDP) are to real GDP, calculated using constant prices in order to adjust for inflation (with 2010 as a base year), and % changes in GDP refer to changes as compared to the previous year or the same quarter of the previous year, unless otherwise indicated.

Unless otherwise stated herein, references in this description to the 2018-2019 Budget are to the 2018-2019 National Budget as released on February 22, 2018 and not as amended by the Medium-Term Budget Policy Statement (MTBPS) released on October 24, 2018. References to the 2018-2019 Consolidated Government Budget, which includes the 2018-2019 National Budget as part thereof, shall be construed accordingly.

Some figures included in this document have been subject to rounding adjustments. As a result, sum totals of data presented in this document may not precisely equate to the arithmetic sum of the data being totaled.

SUMMARY INFORMATION

The following summary tables do not purport to be complete and are qualified in their entirety by the more detailed information appearing elsewhere in this document.

The following tables set forth certain summary statistics about the economy of South Africa, public finance and debt of the National Government for the periods indicated.

Selected Economic Indicators

| | | As of and for the year ended December 31, | | | As of and for

the nine months

ended September 30,(1) | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | |

| | | | Rand (million) (except percentages) | |

| The Economy | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Domestic Product (GDP) | | | | | | | | | | | | | | | | | | | | | | | | |

| Nominal GDP(2) | | | 3,539,977 | | | | 3,805,350 | | | | 4,051,421 | | | | 4,350,314 | | | | 4,651,785 | | | | 4,804,357 | * |

| Real GDP(3) | | | 2,973,175 | | | | 3,028,090 | | | | 3,066,835 | | | | 3,084,174 | | | | 3,124,785 | | | | 3,133,633 | * |

| Real % change from prior year | | | 2.5 | | | | 1.8 | | | | 1.3 | | | | 0.6 | | | | 1.3 | | | | 0.8 | |

| Unemployment rate (%) | | | 24.7 | % | | | 25.1 | % | | | 25.4 | % | | | 26.7 | % | | | 27.5 | % | | | 27.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance of payments | | | | | | | | | | | | | | | | | | | | | | | | |

| Current account | | | (204,841 | ) | | | (192,966 | ) | | | (186,084 | ) | | | (121,188 | ) | | | (110,495 | ) | | | (96,314 | )** |

| Financial account | | | 209,256 | | | | 207,864 | | | | 171,826 | | | | 161,140 | | | | 135,774 | | | | 105,160 | ** |

| Change in gross gold and other foreign reserves | | | (4,658 | ) | | | (15,134 | ) | | | 14,015 | | | | (40,193 | ) | | | (25,525 | ) | | | (8,966 | )** |

| Rand/Dollar exchange rate (average) | | | 9.65 | | | | 10.84 | | | | 12.76 | | | | 14.71 | | | | 13.31 | | | | 12.89 | |

| Consumer prices (2016/12=100) | | | 82.9 | | | | 88.0 | | | | 92.0 | | | | 97.83 | | | | 104.7 | | | | 109.4 | |

| Producer prices (2016/12=100) | | | 82.1 | | | | 88.1 | | | | 91.31 | | | | 97.78 | | | | 105.2 | | | | 111.3 | |

* Estimate based on first three quarters of 2018, seasonally adjusted and annualized.

** Cumulative numbers up to the third quarter, not seasonally adjusted.

| | | As of and for the fiscal year ended March 31, | |

| | | 2014 | | | 2015 | | | 2016 | | | 2017(5) | | | 2018(6) | |

| | | | | | | | | | | | | | | | |

| Main Government Revenue | | | 887,366.2 | | | | 965,456.9 | | | | 1,076,234.4 | | | | 1,137,896.4 | | | | 1,196,394.0 | |

| % of GDP(2) | | | 24.5 | % | | | 25.0 | % | | | 26.1 | % | | | 25.8 | % | | | 25.3 | % |

| Main Government Expenditure | | | 1,047,758.6 | | | | 1,131,900.1 | | | | 1,244,622.9 | | | | 1,305,486.2 | | | | 1,404,985.9 | |

| % of GDP(2) | | | 29.0 | % | | | 29.3 | % | | | 30.2 | % | | | 29.6 | % | | | 29.8 | % |

| Main Budget Deficit | | | (160,392.4 | ) | | | (166,443.2 | ) | | | (168,388.5 | ) | | | (167,589.80 | ) | | | (208,591.9 | ) |

| % of GDP(2) | | | (4.44 | )% | | | (4.31 | %) | | | (4.08 | %) | | | (3.80 | %) | | | (4.42 | %) |

| Net borrowing requirement | | | 160,392.4 | | | | 166,443.2 | | | | 168,388.5 | | | | 167,589.80 | | | | 208,591.9 | |

| Change in cash and other balances(4) | | | (12,448.4 | ) | | | (8,500.8 | ) | | | 13,020.5 | | | | (25,982.30 | ) | | | (29,027.50 | ) |

Notes:

N/A = not available

| (1) | First half of 2018, seasonally adjusted and annualized. |

| (3) | At constant 2010 prices. |

| (4) | The total debt of National Government (net) is calculated with due account of the bank balances of the National Revenue Fund (balances of National Government’s accounts with the SARB and the Tax and Loans Accounts with commercial banks). |

| (5) | Final outcome for fiscal year 2017, as reflected in the MTBPS (October 2018). |

| (6) | Estimates as revised and reflected in the MTBPS (October 2017). |

Source: National Treasury, SARB and Statistics SA (Stats SA).

The estimates included in this Annual Report are based on the 1993 System of National Accounts (SNA) published by the United Nations in cooperation with other international organizations. This means that the methodology, concepts and classifications are in accordance with the latest guidelines of an internationally agreed system of national accounts. The estimates of real GDP are expressed in terms of a 2010 base year. Revision of the estimates for all components of the national accounts is done from time to time based on the availability of data.

Statistics South Africa (Stats SA), who compiles the expenditure side of national accounts, has rebased certain GDP estimates in the Statistical Release, P0441, Gross Domestic Product, Third Quarter 2014 dated November 25, 2014 in terms of a 2010 base year.

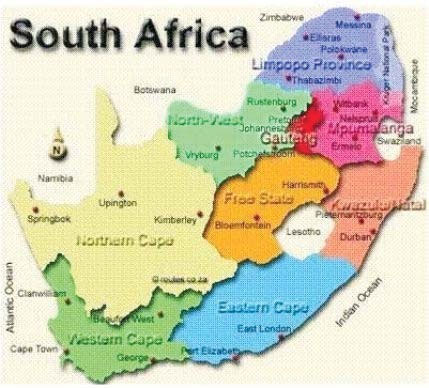

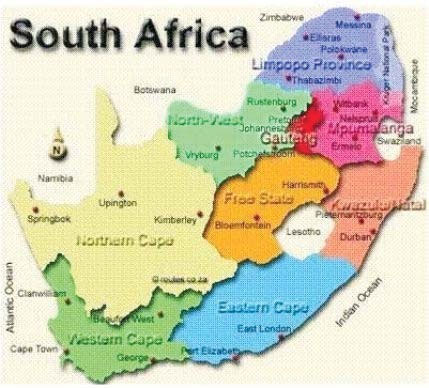

MAP OF THE REPUBLIC OF SOUTH AFRICA

REPUBLIC OF SOUTH AFRICA

Area and Population

South Africa is situated on the southern tip of the African continent, with the Atlantic Ocean to the west and the Indian Ocean to the east. The north of the country shares common borders with Namibia, Botswana and Zimbabwe and, to the north east, the country shares a border with Mozambique. South Africa also shares common borders with the kingdoms of Lesotho and Swaziland. The total surface area of South Africa is approximately 1,219,090 square kilometers, with over 3,000 kilometers of coastline.

South Africa comprises nine provinces, which are the Eastern Cape, Free State, Gauteng, KwaZulu-Natal, Limpopo, Mpumalanga, Northern Cape, North West and Western Cape Provinces.

According to the racial classifications that formed the basis for the apartheid system, “Black” referred to persons of original African indigenous origin, “Asian” to persons of Asian origin, “White” to persons of Caucasian ethnic origin and “Coloured” to persons of mixed race. While the National Government no longer makes any unfair discrimination based on race, the country’s history of racial division and racial and ethnic differences continues to have social and economic significance. This is because social and economic policies are judged partly by their ability to address disparities and discrimination and to equalize opportunities. Therefore, in this document, reference to such racially classified statistics is made occasionally to illustrate those disparities.

South Africa’s population is approximately 57.73 million as at June 30, 2018, of which 29.5 million, representing 51% of the population, are female. Approximately 80.9% are Black African, 8.8% are Coloured, 2.5% are Indian/Asian and 7.8% are White. The most densely populated parts of South Africa are the four major industrialized areas: the Pretoria/Witwatersrand/Vereeniging area of Gauteng (which includes Johannesburg), the Durban/Pinetown/Pietermaritzburg area of KwaZulu-Natal, the Cape Peninsula area of the Western Cape (which includes Cape Town) and the Port Elizabeth/Uitenhage area of the Eastern Cape.

South Africa has a diverse population consisting of Afrikaans and English-speaking Whites, Asians (including Indians), Coloreds, Khoi, Nguni, San, Sotho-Tswana, Tsonga, Venda and persons that have immigrated to South Africa from across the globe. By virtue of the country’s diversity, South Africa has 11 official languages, namely Afrikaans, English, isiNdebele, isiXhosa, isiZulu, Sepedi, Sesotho, Setswana, siSwati, Tshivenda and Xitsonga. According to the results of the census conducted in 2011, isiZulu is the mother tongue of 22.6% of the population, followed by isiXhosa at 15.9%, Sepedi at 9.1%, Afrikaans at 7.9%, and English and Setswana at 8.2% each. IsiNdebele is the least spoken language in South Africa, at 1.5%.

Government and Political Parties

Following the repeal of apartheid legislation, South Africa held its first fully democratic national election on 27 April 1994.

On 10 May 1994, Nelson Mandela, who had previously been elected as president of the ANC, was inaugurated as South Africa’s first black president. Mr. Mandela served until his deputy, Thabo Mbeki succeeded him on 14 June 1999. Mr. Mbeki resigned from the presidency on September 2008, and Kgalema Motlanthe served as interim President between 25 September 2008 and 9 May 2009.

On May 24, 2014, following the ANC’s victory in the elections, Jacob Zuma was inaugurated as the fourth democratically elected President of the Republic, Mr. Cyril Ramaphosa was elected as Deputy President.

In October 2017, the Supreme Court of Appeals ruled that former President Zuma had to face 18 counts of corruption, fraud, racketeering and money laundering. On 13 December 2018, the North Gauteng High Court ruled that former President Zuma would no longer receive state funding for his legal defence. On 14 February 2018 former President Zuma resigned as President of the Republic.

On 15 February 2018, Mr Cyril Ramaphosa was sworn in as the President of the Republic of South Africa.

On 27 February 2018, President Ramaphosa made several appointments to his cabinet, including the following: Mr. Jeffrey Thamsanqa Radebe as Minister of Energy; Mr. Gwede Mantashe as Minister of Mineral Resources; Mr. Pravin Jamnadas Gordhan as Minister of Public Enterprises; Ms. Letsatsi-Duba as Minister of State Security; Dr. Zweli Mkhize as Minister of Cooperative Governance and Traditional Affairs; Mr. Derek Hanekom as Minister of Tourism; General Bheki Cele as Minister of Police; Dr. Nkosazana Clarice Dlamini Zuma as Minister in the Presidency for Planning, Monitoring and Evaluation; Ms. Mmamoloko Kubayi-Ngubane as Minister of Science and Technology; Ms. Lindiwe Sisulu as Minister of International Relations and Cooperation; Ms. Nelandi Pandor as Minister of Higher Education; Ms. Ayanda Dlodlo as Minister of Public Services and Administration; Ms. Maite Nkoana-Mashabane as Minister of Rural and Land Reform; Mr. Gugile Kwinti as Minister of Water and Sanitation; Ms. Susan Shabangu as Minister of Social Development; and Ms. Bathabile Dlamini as Minister of Women in the Presidency.

Constitution

The current Constitution was adopted in 1996 and phased in between 1997 and 1999. The Constitution provides for elections every five years as well as for the separation of powers among the legislative, executive and judicial branches of the National Government. Under the Constitution, the bicameral Parliament, in which the legislative authority of the National Government is vested, is comprised of a National Assembly and a National Council of Provinces (NCOP).

The National Assembly consists of no fewer than 350 and no more than 400 members elected on the basis of proportional representation pursuant to which political parties receive seats in proportion to the votes cast for the parties concerned.

The National Assembly is mandated by the Constitution to choose the President, provide a national forum for public consideration of issues, pass legislation, scrutinise and oversee executive action, maintain oversight of the bodies and institutions established by Chapter 9 of the Constitution, and ensure that Members of Cabinet are accountable collectively and individually to Parliament for the exercise of theirs powers and the performance of their functions.

The NCOP is one of the two Houses of Parliament. The NCOP is constitutionally mandated to ensure that provincial interests are taken into account in the national sphere of government. This is done through participation in the national legislative process and by providing a national forum for consideration of issues affecting provinces.

The NCOP also plays a unique role in the promotion of the principles of Cooperative Government and Intergovernmental Relations. It ensures that the three spheres of government work together in performing their unique functions in terms of the Constitution and that in doing so, they do not encroach in each other’s area of competence.

The NCOP consists of 90 members (namely 54 permanent members and 36 special delegates). Each of the nine provincial legislatures elects ten representatives.

Each province has its own executive authority, the premier. The premiers are elected by each Provincial legislature from among its members. The powers of the premier are exercised in consultation with a provincial executive council, which is constituted in a manner similar to the Cabinet in the National Government. The provinces exercise limited power on a national level, principally through their representatives in the NCOP, and also through their power to block Parliamentary action affecting the constitutional position and status of the provinces. When deciding on bills that amend the constitution, the provincial delegations vote in accordance with the mandate conferred on them by their respective provincial legislature. Each province has one vote and at least six provinces have to vote in favour of the Bill for it to be passed. When deciding on bills that affect the provinces, the provincial delegations vote in accordance with the mandate conferred on them by their respective provincial legislatures. Each province has one vote and at least five provinces need to vote in favour of the bill for it to be approved.

Political Parties

The ANC, which was founded in 1912 and which led the struggle against apartheid, is the ruling party in eight of the nine South African provinces, and the most influential party in South Africa in terms of the size of its electoral constituency support. Following the May 2014 elections, the ANC occupies 249 of the National Assembly’s 400 seats. Every five years the ANC holds a National Conference, which is the highest decision –making body and which decides the policies of the ANC, adopts proposed constitutional amendments and elects the National Executive Committee. The 54th ANC National Conference took place in Johannesburg, Gauteng Province, from December 16 to December 20, 2017, where Mr. Cyril Ramaphosa was elected president of the ANC.

2014 National and Provincial Elections

The official general election results were announced on May 10, 2014. The ruling ANC won the elections, receiving 62% of the votes cast in respect of the national elections. The DA remained the official opposition of the ANC, with 22% of the votes, and the EFF came in third with 6% of the votes.

The table below sets out the National and Provincial Assembly seats secured by political parties following the May 2014 general elections.

| Political Party | | Number of seats in

National Assembly | | | Proportional

Representation seats | |

| | | | | | | | | | | | | |

| ANC | | | 249 | | | | 62.15 | % | | | 118 | | | | 59.0 | % |

| DA | | | 89 | | | | 22.23 | % | | | 45 | | | | 22.5 | % |

| EFF | | | 25 | | | | 6.35 | % | | | 11 | | | | 5.5 | % |

| IFP | | | 10 | | | | 2.4 | % | | | 5 | | | | 2.5 | % |

| NFP | | | 6 | | | | 1.57 | % | | | 3 | | | | 1.5 | % |

| UDM | | | 4 | | | | 1 | % | | | 2 | | | | 1.0 | % |

| VF PLUS | | | 4 | | | | 0.9 | % | | | 3 | | | | 1.5 | % |

| COPE | | | 3 | | | | 0.67 | % | | | 3 | | | | 1.5 | % |

| ACDP | | | 3 | | | | 0.57 | % | | | 3 | | | | 1.5 | % |

| AIC | | | 3 | | | | 0.53 | % | | | 3 | | | | 1.5 | % |

| AGANG SA | | | 2 | | | | 0.28 | % | | | 2 | | | | 1.0 | % |

| PAC | | | 1 | | | | 0.21 | % | | | 1 | | | | 0.5 | % |

| APC | | | 1 | | | | 0.17 | % | | | 1 | | | | 0.5 | % |

| Total | | | 400 | | | | 100.0 | % | | | 200 | | | | 100.0 | % |

Source: IEC.

The table below sets out the NCOP seats secured by political parties following the May 2014 general elections.

Political Party | | Permanent | | | Special | |

| | | | | | | |

| ANC | | | 33 | | | | 27 | |

| DA | | | 13 | | | | 7 | |

| EFF | | | 6 | | | | 1 | |

| IFP | | | 1 | | | | 0 | |

| NFP | | | 0 | | | | 1 | |

| UDM | | | 1 | | | | 0 | |

| Total | | | 54 | | | | 36 | |

Source: Parliament of the Republic of South Africa

2019 National and Provincial Elections

The Independent Electoral Commission (IEC) announced that National and Provincial elections had been scheduled to take place in May of 2019. As of December 31, 2018 there were a total of 26.1 million registered voters.

2016 Municipal Elections

Municipal elections are held every five years. Municipal elections were held on August 3, 2016. The shares of the votes for the major parties were as follows: ANC – 53.9%, DA – 26.9%, EFF – 8.2%, IFP – 4.23%, and COPE – 0.42%. The NFP failed to pay the registration fee to the Independent Electoral Commission and thus did not participate in the elections. The next municipal elections are scheduled to take place in 2021.

Recent Developments

On 9 October 2018, Mr. Tito Titus Mboweni was appointed as Minister of Finance. Mr. Mboweni has previously served as a Governor of the South African Reserve Bank.

On 22 November 2018, additional cabinet appointments were made, including the following: Ms. Nomvula Mokonyane as Minister of Environmental Affairs; Dr. Siyabonga Cyprian Cwele as Minister of Home Affairs; and Ms. Stella Ndabeni-Abrahams as Minister of Communications. On the same date, the Ministry of Communications was merged with the Ministries of Telecommunications and Postal Services.

Mr. Ebrahim Patel continues to serve as Minister of Economic Development, since his appointment in May of 2009.

Legal System

The South African legal system is based upon Roman-Dutch law and incorporates certain elements of English law, subject to the Bill of Rights contained in the Constitution. Judicial authority in South Africa is vested in the courts, which are established pursuant to the Constitution. The Constitution is the supreme law of the land and no other law can supersede the provisions of the Constitution. The Constitutional Court is the supreme court of the land and has jurisdiction as the court of final instance over all matters relating to the interpretation, protection and enforcement of the terms of the Constitution. It is also the court of first instance on matters such as those concerning the constitutionality of an Act of Parliament referred to it by a member of the National Assembly. Decisions of the Constitutional Court are binding upon all persons and upon all legislative, executive and judicial organs of state. Matters not falling within the jurisdiction of the Constitutional Court fall within the jurisdiction of the Supreme Court, which consists of the Supreme Court of Appeal and various High Courts. Judgments of the Supreme Court of Appeal are binding on all courts of a lower order, including the High Courts, and judgments of the High Courts are binding on the lower courts within their respective areas of jurisdiction.

The Chief Justice, currently Justice Mogoeng Mogoeng who was appointed on September 8, 2011, and the Deputy Chief Justice of the Constitutional Court are appointed by the President in consultation with the Judicial Service Commission (the JSC) and the leaders of parties represented in the National Assembly. The Judge President and Deputy President of the Supreme Court of Appeal are appointed by the President after consulting with the JSC only. The remaining judges of the Constitutional Court, the Supreme Court of Appeal and the High Courts are appointed by the President on the advice of the JSC.

Land Reform

Land reform in South Africa is a complex issue, due to both the apartheid era legacy of dispossessing black South Africans of their land and the current development challenges. Through the judicial process and the Constitution’s protection of private property rights, the National Government seeks to facilitate the equitable transfer of land to South Africans who lost their land as a result of the land dispossession policies of the previous regime in South Africa.

The Department of Rural Development and Land Reform had previously set 2014 as the deadline for achieving land reform in South Africa through the redistribution of 30% of white-owned commercial agricultural land to those previously dispossessed of such land. According to the Department of Rural Development and Land Reform, as of 31 March 2018 approximately 8.4 million hectares of land have been transferred to previously disadvantaged South Africans under the restitution and redistribution programs; the initial 30% target was 24.6 million hectares.

The implementation of the land restitution and land reform programs are supported through allocations to the Department. Expenditure grew from R8.9 billion in 2002 to R9.5 billion in 2014, mainly due to the increase in land reform and restitution grants, and remained at R9.5 billion in 2015 due to the tight fiscal environment. Expenditures decreased to R9.1 billion in 2016, increased to R10.1 billion in 2017 and decreased to R9.7 billion in 2018. Expenditures, however, are expected to increase to R11 billion by 2020.

The government is committed to pursuing a comprehensive approach to land and agrarian reform that is supportive of inclusive growth and balances the need for transformation with the need for policy certainty to allow increased agricultural output, growth and food security. To this end an advisory panel on land reform has been appointed and it includes sector experts such as: farmers, policy makers, academics and lawyers to provide concrete measures to achieve a more effective land reform programme. The Commission on Restitution of Land Rights through the Department of Rural Development and Land Reform has also embarked on a parliamentary process to evaluate the constitutionality of land expropriation without compensation. As part of the parliamentary process currently underway to evaluate the constitutionality of land expropriation without compensation, a parliamentary Joint Constitutional Review Committee adopted a resolution calling for the amendment of section 25 of the constitution to allow for expropriation of land without compensation in the public interest. The Committee recommended that it be made explicit that this is one of the means by which unequitable land ownership patterns in South Africa can be addressed. The Committee’s final report and recommendations were tabled in the National Assembly for debate, subsequently forwarded to the NCOP for concurrence. Another parliamentary committee is currently processing the amendment bill that will contain the detail, as well as the precise wording, of how the relevant sections of the constitution would be amended. Additionally, the eventual outcomes of this process would be required to be ratified by the Constitutional Court. The outcomes of this process have to be ratified by the Constitutional Court. Collectively the outcomes of these processes will assist government in mapping a way forward with regard to answering South Africa’s land question.

Broad-Based Black Economic Empowerment

Broad-Based Black Economic Empowerment (B-BBEE) continues to be core tenet of the National Government’s initiative to address the economic exclusion of historically disadvantaged South Africans. As part of this initiative, the National Government enacted the Broad-Based Black Economic Empowerment Act, 2003 (Act No. 53 of 2003) (BBBEE Act), which came into effect in April 2004. For purposes of the B-BBEE Act, “black people” is a generic term which means Africans, Coloureds and Indians who are South African citizens. The BBBEE Act aims to facilitate B-BBEE and promote economic transformation by: incentivizing meaningful participation by black people in the economy; changing the racial composition of ownership and management structures in enterprises; promoting investment programs that lead to BBBEE; enabling access to economic activities, infrastructure and skills for black women and rural and local communities; increasing the extent to which workers, communities and cooperatives own and manage enterprises; and promoting access to finance for black economic empowerment (BEE). The Act requires that every organ of national and local government and every public entity must apply B-BBEE relevant Codes of Good Practice in issuing licenses, implementing procurement policies, determining qualification criteria for the sale of state-owned enterprises and developing criteria for entering into public private partnerships.

The Department of Trade and Industry (DTI), has issued the B-BBEE Codes of Good Practice on Black Economic Empowerment (the Codes). The Codes, which were promulgated in February 2007 and amended in October 2013, set out general principles for measuring ownership, management control, skills development, enterprise and supplier development and socio-economic development, including special guidance for qualifying small enterprises. The Codes also provide guidance on B-BBEE verification, the recognition of contributions toward BEE of multinationals and the treatment of public entities and other enterprises wholly owned by organs of state.

Multinational Companies

The Codes have given multinational companies flexibility in the manner in which they can implement the Codes. A multinational company can retain sole ownership of its South African subsidiary, provided that alternative measures to broaden economic participation by black people, in terms of the Codes, are exercised. So called “equity equivalent” programs focus on skills transfer, empowerment of small-medium-micro-enterprises (SMME) and broader socio-economic empowerment projects.

Public Entities and State Agencies

The BBBEE Act places a legal obligation on state agencies to contribute to B-BBEE, including when developing and implementing their preferential procurement policies. The Preferential Procurement Policy Framework Act, 2000 (Act No. 5 of 2000) (PPPFA) states that all spheres of government must have a mechanism in place that would bring about categories of preference in allocation of contracts when procuring goods and services to advance historically disadvantaged individuals (HDIs). HDIs are South African citizens who, (1) due to the apartheid policy that was in place, had no voting rights in the national elections prior to the introduction of the Constitution of 1983 or 1992, (2) are female, or (3) have a disability. The Regulations to the Act were amended in 2011 to advance the objectives of the B-BBEE Act. In terms of the new regulations, the B-BBEE contributorship level of an enterprise (calculated with reference to the Codes) will account for up to 20.0% of the scorecard in respect of all tenders valued between R30,000 and R1,000,000 and up to 10.0% of the scorecard in respect of tenders exceeding R1,000,000. As of January 20, 2017, the amended PPPFA regulations had been registered by the National Treasury. The effective date of the regulations is April 1, 2017. The amended regulations, increased the threshold from R30,000 up to R50 million. The B-BBEE Status Level contributes 20.0%. Tenders above R50 Million, a total of10% will be contributed to the B-BBEE Status Level. A dispensation has been made for an organ of state and public entities to apply pre-qualifying criteria to advance certain designated groups.

Private Sector

A business’s B-BBEE status is an important factor affecting its ability to tender successfully for Government and public entity tenders and (in certain sectors like mining and gaming) to obtain licenses, as well as trading with other firms in the private sector. The amendments introduced by the DTI and approved by Parliament in 2013 impose penalties in certain circumstances such as fronting or circumvention to the legislation. These amendments became effective as of October 24, 2014. Private sector clients increasingly require their suppliers to have a minimum B-BBEE rating in order to boost their own B-BBEE ratings. B-BBEE is accordingly an important factor to be taken into account by any firm conducting business in South Africa.

The B-BBEE Act provides for the DTI to publish and promote any transformation charter (for later development into industry codes) for a particular sector of the economy, provided that charter (or code) is developed by the major stakeholders in that sector and advances the objectives of the BBBEE Act. These charters/codes set out a blueprint and timeline for the transformation of the relevant economic sectors. Charter can include economic sectors such as tourism, financial services, forestry and construction, among others.

Some of the biggest challenges facing the National Government in relation to the implementation of B-BBEE include educating the South African public on the objectives, opportunities and perceptions relating to B-BBEE, providing certainty as to the requirements of B-BBEE, ensuring that the objectives of B-BBEE are properly adhered to and encouraging investment in South Africa that advances B-BBEE and promotes economic and social transformation.

Mining Industry Reform

Mining in South Africa has historically been undertaken largely by the private sector. As of December 31, 2018 there were approximately 1,700 operating mines and quarries in South Africa. The most important mining houses in South Africa include Anglo American plc, De Beers Corporation, African Mineral Limited, BHP Billiton SA, Gold Fields Limited, Impala Platinum Holdings Limited, Lonmin plc, Kumba Iron Ore Limited, Exxaro Limited, Xstrata plc and Harmony Gold Limited. These corporations, together with their affiliates, are responsible for the majority of the gold, diamond, uranium, zinc, lead, platinum, chrome, iron ore, coal and silver mining in South Africa.

The Mineral and Petroleum Resources Development Act (MPRDA) and the Mining Charter

The Minister of Mineral Resources (previously the Minister of Minerals and Energy) is the competent authority for granting prospecting and mining licenses. In granting rights to HDIs, the DMR’s objective for fiscal year 2015 was to grant 200 such licenses, 760 of which have been granted as of September 30, 2015 . As of that same date, the department has granted approximately 3,800 permits for small-scale mining. As of 31 December 2018, the mining industry employed over 460,000 workers.

The South African Mineral Resources Administration System (SAMRAD), was launched in April 2011 to process mining license applications, which enables the monitoring of the status and improves overall quality of license applications. Through SAMRAD, the general public can view the locality of applications, rights and permits made or held.

The DMR is also responsible for managing environmental impacts from mining-related activities, and by the end of September 2018, had conducted 849 environmental inspections out of a target of 1275 inspections . The Department of Environmental Affairs has transferred some of the functions of the National Environmental Management Act related to mining activities to the DMR, which means the DMR would be the competent authority for environmental impact assessments for the mines and would also be responsible for developing tools and systems for mine environmental management and reporting. The DMR is currently developing measures to streamline the licensing process relating to mining environmental issues to improve turnaround times.

In September, 2018, Mineral Resources Ministry issued a new Mining Charter. The new set of rules aims to distribute mineral wealth more equally among citizens. The new Mining Charter includes the following provisions:

The revised Mining Charter contains significant differences from the existing Mining Charter, including, among others, the following:

(i) existing mining companies have only 12 months to meet most of the new requirements, and the penalty for not meeting such timelines includes criminal sanctions, suspension of operations and/or suspension or withdrawal of the mining right;

(ii) an ownership target of 30% of the equity of mining companies to be held by black shareholders must be achieved and maintained, and black partners must directly and actively control their share of equity interest in the mining company. On procurement, supplier and enterprise development, mining right holders must spend at least 70% of total mining goods procurement spend on locally manufactured goods while a minimum of 80% of services must be procured from South African based companies.

(iii) a holder of a mining right must pay a minimum of 1% of its annual turnover in any given financial year to black shareholders, prior to and over and above any distributions to the shareholders of the company (subject only to the solvency and liquidity requirements); and

(iv) mining companies must achieve the following minimum HDI and HDI female demographic representation: 50% at executive management (board) level (25% of which must be female HDIs), 60% at senior management level (30% of which must be female HDIs), 75% at middle management level (38% of which must be female HDIs), 88% at junior management level (44% of which must be female HDIs) and 60% of the company’s core and critical skills employees.

Other Mining Industry Initiatives and Legislation

The Mineral and Petroleum Resources Royalty Act of 2008 (the Royalty Act) is aimed at ensuring that the country benefits from the exploitation of its mineral resources by imposing a resource rent on holders of rights. It also seeks to stimulate investment in the sector by addressing potential investor needs for regulatory certainty. The Royalty Act recognizes that mineral resources are non-renewable and are part of the common heritage of all South Africans, and thus imposes a royalty on the extraction and transfer of mineral resources.

Health and safety standards within the industry are governed by the Mine Health and Safety Act of 1996 (MHSA). From January to October 2017 , 77 mining accident fatalities were registered, a decreased compared to 78 fatalitites during the same period in 2016.These fatalities are partially attributable to a lack of stringent safety measures. Land slide accidents remain the largest cause of fatalities, followed by transportation and machinery accidents.

In September 2012, the Cabinet approved the moratorium on the acceptance and processing of applications to explore shale gas, allowing normal exploration (excluding the actual hydraulic fracturing) to proceed under the existing regulatory framework.

The Council for Geoscience (CGS) has undertaken a shale gas research project that is aimed at unlocking the unknowns and assumptions about shale gas exploration in the country. The project is also aimed at building scientific skills in the area of shale gas exploration as this is a new concept to the country at large.

The programme is funded by the DMR and will assist the government in making well informed decision about shale gas in South Africa.

The objectives of the programme are to collect and review new geological information of the Karoo Basin, to define an environmental baseline, to assess the amount of recoverable gas mainly from the Whitehill and Prince Albert Formations, to cover various geo-environmental impacts like ground water dynamics with possible contamination, and monitor potential seismic interferences.

The CGS Shale gas project will serve as a baseline study for future shale gas research work and play a vital role in review of Petroleum Exploration and Exploitation Regulations. National Environmental Management Act (NEMA) regulations will be utilized as a framework in identifying shortfalls of the environmental impacts of the shale gas

Internal Security

Criminal Activity

Incidents of murder increased from 17,023 in 2013/2014 to 17,805 in 2014/2015 to 18,673 in 2015/2016, to 19,016 in 2016/2017 to 20,336 in 2017/2018. Between 2016/2017 and 2017/2018 incidents of murder increased by 6.9%.

Incidents of rape decreased from 45,349 in 2013/2014 to 43,195 in 2014/2015, to 41,503 in 2015/2016, to 39,828 in 2016/2018 and increased to 40,035 in 2017/2018. Between 2016/2017 and 2017/2018 incidents of rape increased by 0.5%

Incidents of aggravated robbery which includes carjacking, bank robbery, robbery of cash in transit and robbery at residential and non-residential premises increased from 118,963 in 2013/2014 to 129,045 in 2014/2015 to 132,527 in 2015/2016 to 140,956 in 2016/2017, and decreased to 138,364 in 2017/2018. Between 2016/2017 and 2017/2018 incidents of aggravated robbery decreased by 1.8%,

Incidents of drug-related crime detected as a result of police action increased from 260,596 in 2013/2014 to 266,902 in 2014/2015 then decreased to 259,165 in 2015/2016, and then increased again to 292,689 in 2016/2017 and to 323,547 in 2017/2018. Between 2016/2017 and 2017/2018 incidents of drug-related crime detected as a result of police action increased by 10.5%.

To enhance national security and territorial integrity at ports of entry, the South African Police Service (SAPS) undertook various crime prevention and combating actions at ports of entry during 2017/2018. The actions undertaken in this regard included 322 roadblocks, 44,401 vehicle patrols, 2,018 Vehicle Check Points (VCPs), 60,295 foot patrols and 2 421 vessel patrols.

In 2017/2018, 216,654,278 kg of cannabis, 864,451 Mandrax tablets, 392,945 kg of crystal meth (Tik-Tik), 77,444 kg of cocaine and 546,500 kg of heroin were seized by the SAPS. Furthermore, the South African Narcotics Enforcement Bureau (SANEB) dismantled a total of 53 clandestine laboratories. Overall, the SANEB has succeeded in drug seizures valued at R238.6 million, ranging from cannabis, cocaine, methamphetamine, methaqualone, methacathinone, heroin, nyaope and ecstasy. During 2017/2018, the SAPS confiscated 1,294,076 liters of liquor countrywide. A total number of 59,092 liquor operations were conducted, in order to eradicate the illegal trade in liquor. These operations resulted in the closure of 19,965 identified unlicensed liquor premises and illegal liquor traders were also charged.

In 2017/2018, the Directorate for Priority Crime Investigation (DPCI) executed 1,506 arrests and secured 957 convictions for persons involved in serious commercial crime-related activities. Counterfeit goods were seized to the value of R122.4 million.

In 2017/18, a total of 311 SAPS members were convicted for different types of misconduct, emanating from Independent Police Investigative Directorate (IPID) investigations and recommendations. In addition, a total of 36 SAPS members were dismissed. In terms of criminal convictions, the IPID obtained 99 criminal convictions of SAPS members as at the end of 2017/18. From this, a total of 112 police officers were convicted for various offences committed, of which the sentences included five life sentences for four murders and one rape conviction during 2017/18. In Pretoria, two police officers were sentenced to life and 15 years’ imprisonment for rape. In Limpopo, a policeman was also sentenced to life and 15 years’ imprisonment for murder. Other matters in which life sentences were handed down took place in the Eastern Cape, Western Cape and Gauteng provinces.

During 2017/2018, the IPID concluded a Memorandum of Understanding (MoU) with the Inspector-General for Intelligence (IGI). The MoU has played a significant role in enabling the investigation of the plundering of the Secret Service Account (SSA) by criminal elements in the Crime Intelligence (CI) Division of the SAPS.

Following the 2016 Constitutional Court judgment in which various sections of the IPID Act (2011) were declared to be inconsistent with the Constitution, the IPID commenced the process of reviewing and amending the IPID Act in 2017/18 to align it with the Constitution. In this regard, the IPID collaborated with civil society and jointly hosted two workshops with the African Policing Civilian Oversight Forum to consult with relevant stakeholders on the comprehensive amendment of the IPID Act. The proposed amendments are awaiting Cabinet Approval.

In 2017/18, the Civilian Secretariat for the Police Service (CSP) finalized the policy framework for establishing a homogenized “Single Police Service” in South Africa. The objectives of the framework are to institute systems, structures and processes for the integration and cooperation of the police service; ensure uniformity through the development of norms and standards; clarify and streamline operational command and control; and provide a basis for relevant legislative amendments to fully establish a “Single Police Service”. The aim is to improve efficiencies in law enforcement and policing in the country by maximizing available resources through coordinated planning to reduce crime and violence over the medium to long term. As of 2018/2019, the Single Police Service Joint Task Team was undertaking phase three of the process to establish a “Single Police Service”, with a particular focus on integrating traffic police with the SAPS through norms and standards, and harmonizing processes with the National Traffic Law Enforcement Review Committee.

In 2017/18, the department further produced a Customer Satisfaction Survey Report to provide insight into the perceptions and experiences of individuals who have previously lodged complaints against the SAPS. Participants in the survey were drawn from the SAPS complaints database across all nine provinces. The survey indicated that SAPS had 7,450 service delivery complainants in the database. The monitoring and evaluation of SAPS performance and conduct remains one of the most important functions of the Civilian Secretariat, which will also contribute towards the national development plan goal of having a professionalized police service by 2030. Professionalization of the police service entails the development of a professional, competent, accountable, transparent and highly skilled police service that provides policing in accordance to constitutional imperatives.

Justice

Departments in the Justice, Crime Prevention and Security (JCPS) cluster have continued to implement the 2014-2019 integrated MTSF objectives to ensure that all people in South Africa are and feel safe. In addition, the development and finalization of an Integrated Criminal Justice Strategy (ICJS) by the cluster will assist in addressing challenges and shortcoming across the criminal justice value chain and strengthening the cooperation and integration of law enforcement agencies in realizing the strategic objectives of the National Development Plan (NDP).

The Department of Justice and Constitutional Development leads the implementation of the integrated justice system programme in the JCPS cluster. The objective of this programme is to electronically enable and integrate the end-to-end criminal justice business processes (from the reporting of a crime to the release of a convicted person) through technology solutions and to manage the related inter-departmental information exchanges across the criminal justice system. Through the programme, a digital transformation strategy was prepared that outlines several initiatives to modernize the CJS through technology solutions that enable new technological capabilities, realize cost efficiencies and refocus human capacity towards higher value activities. The strategy is aligned with the ICJS and will be a key focus area for implementation by the cluster through 2024.

Regarding prosecutions, great strides have been made by the National Prosecuting Authority to ensure that high conviction rates are maintained and improved on in all court forums. Performance in high courts fluctuated from 91% in 2014/15, 89.9% in 2015/16, 91% in 2016/17 to 91.7% in 2017/18, while performance in regional courts increased from 76.6% in 2014/15, 78.4% in 2015/16, 80% in 2016/17 to 81% in 2017/18, and in district courts from 94.2% in 2014/15, 94.7% in 2015/16, 95.6% in 2016/17 to 96.1% in 2017/18. A significant improvement was also noted in 2017/18 on the prosecution of specialized crime. In this regard, the Specialized Commercial Crime Unit obtained a conviction rate of 94.1% in relation to complex commercial crime matters against a target of 93%. Organized crime prosecution also achieved a conviction rate of 93.8% and the number of convictions (346) exceeded the annual expectations of 269 convictions. With regard to sexual offences, a conviction rate of 72.7% was achieved in 2017/18, which is an all-time high, and reflects the cluster’s firm commitment to deliver justice for the most vulnerable members of society.

The Asset Forfeiture Unit (AFU) continues to play a critical role in the fight against corruption and has delivered significant returns in the past few years showing that crime does not pay. In its endeavor to curb the increase of corruption, the unit obtained freezing orders to the value of R4.4 billion in 2017/18, and recorded recoveries in terms of the Prevention of Organized Crime Act (1998) to the value of R302.8 million. In line with its operational plan, the unit adopted a strategy that not only seeks to extend the footprint of asset forfeiture in the fight against crime, but one that also seeks to deliver maximum impact in several identified focus areas.

Defence

As a sovereign state, South Africa has a duty to safeguard its borders against the possibility of transnational crime, international crime syndicates and cartels, the illegal flow of undocumented migrants, and illicit economic activities. The SA National Defence Force in conjunction with the Ministry of Defence and and Military Affairs continued borderline protection by deploying 15 sub-units along the borders in Limpopo, Mpumalanga, KwaZulu-Natal, Free State, Eastern Cape, Northern Cape and North West Provinces. Operational successes for borderline protection in 2017/18 includes the confiscation of 34 weapons, 130 stolen vehicles and 1,882 live-stock, the apprehension of 11,316 undocumented foreigners, the arrest of 464 criminals and confiscation of 10,196 kg of dagga (marijuana) and contraband goods valued at of R27 million.

International Relations

South Africa maintains diplomatic relations with 123 countries. South African representation abroad includes 104 embassies, 16 consulates, 97, honorary consulates, 2 liaison offices, 68 non-resident accreditations and 12 representations in international organizations. South Africa hosts 123 embassies, 53 consulates, 79 honorary consulates, 1 liaison office, 18 non-resident accreditations and 35 international organizations.

United Nations

South Africa is one of the 51 founding members of the United Nations (UN) in 1945. South Africa has served as a member of the UN Security Council, the UN Human Rights Council and is a member of the UN General Assembly and the Economic and Social Council of the United Nations.

International Monetary Fund (IMF)

South Africa is a founding member of the IMF. South Africa is also one of 40 participants that have ratified the IMF’s expanded and amended New Arrangements to Borrow (NAB), to which South Africa committed a maximum SDR340 million during the five-year period from 2012 to 2017, and was called upon to lend a total of SDR 90.2 million (R1.4 billion). South Africa has renewed its membership as a participant in the NAB for the five-year period from 2017 until 2022 and has renewed its commitment of SDR340 billion. As of February 22, 2016, South Africa’s quota at the IMF was of 3.1 billion SDRs.

South Africa is one of the 35 participants with commitments to the IMF’s 2012 Bilateral Borrowing Agreements (BBAs). South Africa committed US$2 billion to the 2012 BBAs. In October 2017, South Africa migrated to the IMF’s 2016 BBAs, to which it again committed US$2 billion (SDR2.8 billion).

South Africa also contributes funds to the Poverty Reduction and Growth Trust (PGRT), the IMF’s instrument for financial support to low-income countries (LICs).

On December 18, 2018, the IMF’s managing director and chairwoman, Christine Lagarde, met with President Ramaphosa in South Africa.

World Bank

South Africa is a founding member of the World Bank Group, which comprises the International Bank for Reconstruction and Development (IBRD), the International Development Association (IDA), the International Finance Corporation (IFC) and the Multilateral Investment Guarantee Agency.

General Agreement on Tariffs and Trade

South Africa is a founding member of the General Agreement on Tariffs and Trade (GATT), participated in the Uruguay Round of Multilateral Trade Negotiations and acceded to the Marrakesh Agreement that established the World Trade Organization (WTO) in 1994. It is also part of the generalized system of preferences of Canada, the European Union (EU), Japan, Norway, Russia, Switzerland, Turkey and the US.

South Africa is party to the Economic Partnership Agreement with the European Union, the Southern Africa Customs Union, the Trade, Development and Cooperation Agreement; the EFTA-SACU Free Trade Agreement, the Southern Common Market (Mercosur) PTA and the Trade and Investment Framework Agreement.

Organization for Economic Cooperation and Development

South Africa enjoys a strong partnership with the Organization for Economic Cooperation and Development (OECD) and participates in numerous programs and committees. South Africa is a signatory to the Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, and part of the Mutual Acceptance of Data system and has played a key role in the establishment of the African Tax Administrators Forum.

Group of 20 (G20)

South Africa is a member of the Group of 20 and is also a member of the Financial Stability Board (FSB), a structure responsible for setting standards and monitoring the progress of financial regulation globally.

BRICS

South Africa became a member of BRICS in December 2010, and has participated in all subsequent summits.

Commonwealth

In 1994, South Africa re-joined the Commonwealth. South Africa’s participation is limited to promoting economic, social and cultural cooperation and enhancing democracy through the Commonwealth Heads of States and Ministers’ meetings.

Public Health

South Africa has a well-established health sector which comprises 8.9% of GDP (including private sector expenditure). There are over 4,000 public health facilities, including approximately 400 hospitals throughout the Republic. Public health spending was approximately R206.6 billion in the 2017/18 fiscal year (including the school nutrition program and training of medical professionals), slightly less than private health spending (R211billion).

Minister of Health Dr Aaron Motsoaledi, was appointed in 2009, and has overseen the realization of various achievements in the health sector, including among others, improved life expectancy and reduction in child and maternal mortality. For the period 2013 to 2016, life expectancy has increased from an estimated average of 62.2 years to 63.8, under-five mortality rate declined from 41 deaths to 34 deaths per 1000 live births, infant mortality rates declined from 28 deaths to 25 deaths per 1000 live births, and maternal mortality decreased from 165 deaths to 152 deaths of pregnant women per 100 000 live births. Contributing to the decline in mortality rates are increased access to anti-retroviral treatment through universal test and treat, the introduction of GeneXpert, a new TB diagnostic tool, and the introduction of dual and triple therapy which drastically reduced the mother-to-child HIV transmission rate to 1.3% in 2016/17.

HIV, AIDS and TB

Stats SA estimates the average life expectancy in South Africa for females to be 67.3 years, and for males to be 61.1 years. However, it should be noted that life expectation estimates vary, primarily due to differences in assumptions about the rapidity with which the HIV epidemic will spread and the morbidity and mortality of the disease.

| ● | The socio-economic impact of the HIV and AIDS epidemic on South Africa is significant and the National Government has made the curtailment and treatment of this disease a high priority. This, along with the treatment and prevention of TB, is part of a multi-pronged strategy to improve public health services which also includes hospital revitalization, increasing the number of health professionals in the public sector, the introduction of new generation child vaccines, and improved infectious and non-communicable disease control programs. |

| ● | A multi-sectoral approach aims to improve prevention programs and mitigate the impact of AIDS-related morbidity and mortality. The National Strategic Plan for HIV, TB and STIs 2017-2022 (launched on March 31, 2017, by the then Deputy President Cyril Ramaphosa) aims to build on achievements made in HIV, TB and STI prevention, treatment and care and address social and structural barriers that increase vulnerability to HIV, TB and STI infection and increase protection of human rights. Some of the key objectives of this plan include; |

| ● | Reducing new HIV infections from 270,000 to less than 100,000 per year. |

| ● | Reducing new tuberculosis (TB) infections from 450,000 to less than 315,000 per year. |

| ● | Reaching the 90–90–90 targets—whereby 90% of people living with HIV know their HIV status, 90% of people who know their HIV positive status are accessing treatment and 90% of people on treatment have suppressed viral loads—by 2020. |

Spending on HIV and AIDS has grown rapidly to around R34.9 billion per annum (including foreign donor contributions) in 2017/18, of which R18.1 billion came from the HIV and AIDS conditional grant to provincial departments of health. There is some recent evidence that widespread ART treatment is beginning to turn around national mortality and life expectancy indicators. According to StatSA’s 2018 mid-year population estimates, the number of people living with HIV has increased over the past decade from 5.3 million in 2008 to 7.5 million in 2018 but the number of HIV related deaths has been on a constant decline from 248,208 to 116,110 over the same period.

Quality of care

Increasing focus has been placed on improving the quality of the public health sector through the establishment of Office of Health Standards and Compliance (OHSC). OHSC is mandated to monitor and enforce compliance with health establishments with norms and standards prescribed by the Minister of Health. The Office is also mandated to consider and investigate complaints relating to the quality of the public sector. Other initiatives such as the Ideal Clinic programme aim to raise the standard of primary healthcare facilities in the country.

National Health Insurance (NHI)

NHI is the South African government’s chosen path towards achieving universal coverage, equitable access and improved quality of health care for all. Substantial changes are envisaged in both the public and private health sectors, particularly in terms of the way these are financed. Key to this reform is establishing an NHI Fund, which will pool funding for healthcare and purchase services from both public and private providers on behalf of the whole population.

It is being implemented in phases from 2012 over a 14-year period. The first phase involves improving primary health care services in rural areas and under-served communities through the ideal clinic programme and an expanded programme of hospital construction and revitalization. In the current second phase, the government plans to establish an NHI Fund and the NHI Bill, which establishes this fund is likely to be introduced in Parliament during 2019.

THE SOUTH AFRICAN ECONOMY

Overview

South Africa has the second largest economy in Sub-Saharan Africa in terms of total GDP and accounted for over 20% of the aggregate GDP of Sub-Saharan Africa during 2017. A stable and transparent macroeconomic framework, a well-developed financial sector and resilient institutions have underpinned long-term economic stability.

South Africa has a robust regulatory environment, openness to trade, a floating exchange rate, a credible inflation targeting regime and sound institutions, strong investor protection and an independent judiciary. The country has a mature and accessible legal system, providing certainty and respect for the rule of law.

South Africa is resource rich. It is the world’s largest producer of platinum and chromium and holds the world’s largest known reserves of manganese, platinum group metals, chromium, vanadium and alumino-silicates. The economy includes sophisticated finance, wholesale and retail trade, catering and accommodation sectors, as well as a developed manufacturing sector. Financial markets are liquid and both equities and government bonds are actively traded by domestic and international investors.

The World Economic Forum Global Competitiveness Report 2018 ranks South Africa 67th out of 140, dropping by 5 places from the 2017 survey. South Africa continues to rank favourably for financial market development, large market size and good infrastructure. South Africa has a sophisticated banking sector with major footprint in Africa. It is the continent’s financial hub, with the Johannesburg Stock Exchange (JSE) being Africa’s largest stock exchange by market capitalisation.

With the most developed industrial and financial capabilities on the African continent, South Africa plays an important role in regional policies, markets, finance and infrastructure and has an attractive position as the gateway into Africa. Outwardly oriented South African companies are among the largest sources of foreign direct investment (FDI) in Africa and the country’s development finance institutions are playing an increasing role in the funding of regional infrastructure investments. According to the United Nations Conference on Trade and Development’s (UNCTAD) World Investment Report 2018, outward FDI by South African firms increased by 64% to US$7.4 billion in 2017 as retailers expand to Namibia and one of SA’s largest banks opens more branches across the continent.

The legacy of apartheid era politics and economics is still felt today. South Africa aims to achieve higher levels of inclusive growth that raises employment and reduces inequality. The poor are better off in absolute terms under South Africa’s new constitutional dispensation, thanks in large part to government’s social spending.

The medium-term expenditure framework (MTEF) has committed public resources of R5.9 trillion between 2018 and 2020. Of this amount, R3.3 trillion or 56.2% will be allocated to education, health, the provision of water and electricity services, and social grants. Expenditure on social grants will increase faster than inflation to protect the poor and to compensate partially for an increase in value-added tax. A study published in February 2015 by the World Bank’s Poverty Global Practice found that South Africa’s fiscal system lifted some 3.6 million individuals out of poverty when measured as those living on less than $2.50 per day.

However, income inequality remains high even after progressive fiscal policy, due in large part to high unemployment. The Gini coefficient, which is a measure of economic inequality where 0 indicates no inequality and 1 absolute inequality, was equal to 0.68 for South Africa in 2015, among the highest in the world. The World Bank’s fiscal incidence study estimated that South Africa’s fiscal policy reduced the Gini coefficient by almost a quarter in 2010.

Labor and Employment

Unemployment, and youth unemployment in particular, remains a critical challenge to reducing poverty and inequality. Only 43.1% of the adult population (ages 15 to 64) are employed, either in the formal or informal sector. Although formal sector non-agricultural employment surpassed the levels of employment last seen prior to the global financial crisis of 2008, gains have not kept pace with the growth of the working age population, leaving a structural employment backlog. Youth unemployment is particularly high: as of September 2018, the unemployment rate for 15-24 year olds was 52.8%, with young people below the age of 25 accounting for 22.7% of the unemployed.

Patterns of unemployment reflect the effects of the apartheid system on income, settlements and education. As of September 2018, the unemployment rate among the economically active white population was 7.1% (from 7.6% in September 2017), whereas the unemployment rate among the economically active black population was steady at 31.1%.

The impact of slowing economic growth on employment has been particularly large for vulnerable groups. Unemployment is higher for the less educated, women and individuals from more rural provinces.

The October 2018 Jobs Summit resulted in a major framework agreement setting out 20 action plans aimed at boosting job creation, the retention of jobs and economic growth, underscoring the importance of effective partnerships between the public and private sectors and civil society. The primary aim of the agreement is to create an estimated 275,000 jobs annually. The principle strategies underpinning the process includes investment promotion, upgrading industrial capacity, upgrading skills and education, and developing infrastructure amongst others.

GDP growth is expected to recover slowly, reaching 2.3% by 2021. Agriculture and mining are expected to return to moderate growth, while business and consumer confidence are expected to improve gradually in the medium-term. The resolution of long-standing policy issues in recent months, such as the approval of the new mining charter, will likely support investment particularly in the mining and energy sectors.

The economic stimulus and recovery plan announced by President Ramaphosa in September 2018 seeks to focus public spending in areas that can grow the economy, create jobs, accelerate necessary growth-enhancing reforms, promote infrastructure development, and tackle problems in education and healthcare – whilst maintaining the expenditure ceiling commitments of government and stabilising debt as a percentage of GDP.

Government has reprioritised spending of R15.9 billion towards infrastructure programmes, supporting industrialisation, and the Expanded Public Works Programme. On October 24, 2018, Minister of Finance Tito Mboweni announced that over the next three years, public infrastructure expenditure is estimated to be R855.2 billion, of which state-owned companies alone account for R370.2 billion. To improve the delivery of this spending, Minister Mboweni announced the establishment of an Infrastructure Fund. The Fund will work to support projects with “blended” financing and increase public infrastructure efficiency. An additional R16.5 billion of spending will be allocated to various programmes, including funding to restore capacity at the South African Revenue Service.

Arising from the Presidential Investment Summit, held in October 2018, investment commitments of $35 billion (R516bn) were received as part of the plan to attract $100 billion over the next five years to boost the country’s economy. Approximately $10 billion were pledged by Saudi Arabia, $10 billion by the United Araba Emirates and $15 billion from China. The President also appointed a team of investment envoys - bankers, business people, economists and former ministers - to attract new investors from the world’s financial capitals.

Government is also working on improving governance and financial management in state-owned companies as well as in national, provincial and local government departments.

The National Development Plan 2030 outlines the long-term vision for South Africa. A core element of this vision is a commitment to strong, sustained and inclusive economic growth to sharply reduce unemployment, poverty and inequality. In 2019, Government will publish the MTSF which sets the NDP’s priorities for the next 5 years.

GDP

In the first three quarters of 2018 GDP growth eased to 0.8% compared with 1.3% in the same period the prior year. The economy fell into technical recession in the first half of 2018, as a result of production losses in the agriculture and mining sectors, while investment growth remained subdued and imports accelerated. GDP growth rebounded to 2.2% q/q (saar) in the third quarter, primarily driven by a recovery in the manufacturing, transport, finance and business services sectors. The manufacturing sector was supported by a R13bn increase in inventories.. From the expenditure side, household expenditure growth rebounded, while export growth doubled, attributed to rising mining, manufacturing and agriculture exports.

The primary sector contracted by 1.9% year-on-year in the first three quarters of 2018, following an 8.5% expansion in the comparable period in 2017. The decline in the sector was driven by a contraction in production in both the agricultural and mining sectors. Growth in the agricultural sector contracted by 3.2% in the three quarters of 2018 after expanding by 21.3% in the first three quarters of 2017. The impact of severe drought conditions in the Western Cape and the delayed harvesting of summer crops resulted in an 5.4% year-on-year contraction in the sector in the first half of the year. Agricultural production growth rebounded in 3Q2018 underpinned by later-than-usual harvesting of summer field crops, due to a late start to the planting season earlier in the year. In addition, soft citrus producers reached record export levels in 2018 despite concerns over water availability in key growing regions.

Growth in mining sector output in the first three quarters of 2018 decreased by 1.4% compared to an expansion of 4.5% in the corresponding period in 2017. Global commodity prices and the related fears of US-China trade wars have tempered growth, hitting most mining categories such as Platinum Group Metal’s (PGM), iron-ore, gold, copper and nickel. Gold production has struggled in particular, declining by 13% in the first 10 months of 2018, weighed by long term constraints and more recently strike activity. Recent efforts to reduce regulatory uncertainty are expected to support growth, but structural factors continue to constrain growth as firms contemplate restructuring plans and intentions to retrench workers.

Contrastingly, growth in the tertiary sector has held up well, largely contributing positively to GDP growth in the three quarters of 2018. Output in the financial and business services sector - the largest sector in the economy - was 2.2% higher in the three quarters to September (from 1.8% in the same period in 2017), largely driven higher by increased commercial banking activity. Trade, which is the second largest sector in the economy, rebounded from a 0.9% contraction in the first three quarters of 2017 to expand by 0.4% growth in the corresponding period this year. After contracting in the first half of 2018, the trade sector bounced back to positive growth in the third quarter as wholesale and retail trade sales growth improved.

The real gross value added by the secondary sector slowed to 0.4% in the first three quarters of 2018 from 0.8% in the comparable period in 2018, as the contraction in the construction sector outpaced the modest recovery in manufacturing and utilities growth. The construction sector contracted by 1.2% in the first three quarters of 2018 after registering no growth in the first three quarters of 2017. Output growth in the manufacturing and utilities sectors both recovered to 0.9% from contractions of 1.1% and 0.4% in the first three quarters of 2018. Both sectors rebounded in the third quarter with positive growth in manufacturing production driven by basic iron and steel, metal products and machinery; petroleum and chemicals; wood and paper; and motor vehicles.

Based on the expenditure side, real GDP growth in the first three quarters of 2018 was buoyed by household consumption growth. Growth in consumption moderated to 1.9% year-on-year, after expanding by 2.0% in the same period in 2017. Over the period, household spending was driven by a broad-based expansion in expenditure on goods. However, real expenditure on services slowed from 2.7% in the first three quarters in 2017 to 1.7% in the comparable period in 2018.

Gross fixed capital formation in the first three quarters to September contracted 0.3% year-on-year following a 0.7% expansion in the same period last year. Growth in private sector investment fell by 0.3% compared to a 1.3% expansion in the first three quarters of 2017. Business confidence has improved somewhat, but remains volatile. The /Rand Merchant Bank/Bureau of Economic Research Business Confidence Index (RMB/BER) surged by 11 points from 34 in the fourth quarter of 2017 to 45 in the first quarter of 2018as a result of positive sentiment surrounding changes in political leadership. Sentiment fell back to 39 points in the second quarter and to 38 in the third quarter of 2018 as overall business activity remained weak. The rate of contraction in real fixed investment by government moderated to 0.2% in the first three quarters of 2018, following a 0.7% contraction during the same period in 2017. Public corporation investment had contracted by 0.2% in the first three quarters in 2017, and remained unchanged in the corresponding period in 2018. Weak investment and subdued productivity growth have slowed the potential pace of GDP growth to an estimated range of between 1.2 and 1.5% in 2018, from 3% at the start of the decade.

Annual real growth in consumption expenditure by the government rose to 1.2% in the first three quarters of 2018, after slowing to 0.7% during the same period in 2017, reflecting an increase in purchases of goods and services and compensation of employees.

Overall, net exports contributed negatively to GDP growth in the first three quarters of 2018 as imports grew faster than exports. Real growth in imports accelerated to 4.9% from 0.7% in the corresponding period of 2017, largely driven by increased imports of machinery, electrical equipment, vehicle and transport equipment, as higher exports required increased imports. Export growth was up 2.8% in the first three quarters of 2018, after declining by 1.5% in the same period in 2017, supported by increased exports for vehicles and transport equipment, pearls, precious & semi-precious stones, mineral products and vegetable products.

At the 2018 Medium-Term Budget Policy Statement, the National Treasury projected GDP growth to slow from 1.3% in 2017 to 0.7% in 2018. This projection is a downward revision compared with the Budget 2018 forecast, where GDP growth was projected at 1.5% in 2018. GDP growth is forecast to improve moderately, reaching 2.3% by 2021. The downward revisions to the economic forecast reflect weak outcomes in the first half of the 2018, a slower than expected improvement in domestic investment, and a lower anticipated trade intensity of global growth.

Household consumption expenditure is expected to grow by 1.6 % in 2018, supported by stronger purchasing power in early 2018 and moderate increases in credit extension, despite muted improvements in employment. Over the medium term, growth in household spending is expected to strengthen to 2.6 % by 2021, supported by a modest recovery in wage and employment growth, higher consumer confidence and further improvements in household credit extension.

Growth in gross fixed capital formation has been revised lower from the 2018 Budget, and is now projected to average 1.9 % over the next four years. Low levels of demand and policy uncertainty, as well as low commodity prices have dampened investment. Government has actively worked to improve the investment climate by strengthening governance in state institutions and removing policy bottlenecks in energy and mining.

Elevated policy uncertainty, the financial positions of state-owned enterprises, and the volatility of the rand exchange rate are key domestic downside risks to the economic outlook. However, sustained improvements in confidence, particularly related to the implementation and finalization of outstanding policy issues, may reduce barriers to investment and improve sentiment, presenting an upside risk to the growth outlook. External risks to the growth outlook include rising trade tensions and increased risk aversion, which may prompt capital outflows and exacerbate volatility in financial markets and the exchange rate.

GDP Summary

| | | | | | | | | | | | | | | | | | | |

| | | As of and for the year ended December 31, | | | As of and for

the nine-

month period

ended

September

30, | |

| | | | 2013 | | | | 2014 | | | | 2015 | | | | 2016 | | | | 2017 | | | | 2018(1) | |

| Nominal GDP (millions of Rand) at market prices | | | 3,539,977 | | | | 3,805,350 | | | | 4,051,421 | | | | 4,350,314 | | | | 4,651,785 | | | | 4,804,357 | |

| Real GDP (millions of Rand) at 2010 prices | | | 2,973,175 | | | | 3,028,090 | | | | 3,066,835 | | | | 3,084,174 | | | | 3,124,785 | | | | 3,133,633 | |

| Real GDP Growth (percentages) | | | 2.5 | | | | 1.8 | | | | 1.3 | | | | 0.6 | | | | 1.3 | | | | 0.8 | |

| Population (million) | | | 53.3 | | | | 54.2 | | | | 55.1 | | | | 55.9 | | | | 56.8 | | | | 57.7 | |

| Per Capita GDP (nominal) | | | 66,952 | | | | 71,064 | | | | 74,633 | | | | 79,066 | | | | 83,390 | | | | 252,116 | |

| Per Capita GDP (real) | | | 56,232 | | | | 56,549 | | | | 56,518 | | | | 56,054 | | | | 56,016 | | | | 54,401 | |

��

Note:

(1) First nine months of 2018, seasonally adjusted and annualized.

Sources: SARB and Stats SA

| | | As of and for the year ended December 31, | | | As of and for the nine-month period

ended September 30, | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | |

| Rand (million) | | | | | | | | | | | | | | | | | | | | | | | | |

| Real GDP at market prices | | | 2,973,175 | | | | 3,028,090 | | | | 3,066,835 | | | | 3,084,174 | | | | 3,124,785 | | | | 4,844,415 | |

| Add: Imports of goods and services | | | 921,356 | | | | 916,155 | | | | 965,505 | | | | 929,014 | | | | 943,848 | | | | 979,475 | |

| Total supply of goods and services | | | 3,894,531 | | | | 3,944,245 | | | | 4,032,341 | | | | 4,013,188 | | | | 4,068,632 | | | | 5,823,891 | |

| Less: Exports of goods and services | | | 852,994 | | | | 883,501 | | | | 908,257 | | | | 917,039 | | | | 916,150 | | | | 931,362 | |

| Total goods and services available for domestic expenditure | | | 3,041,537 | | | | 3,060,744 | | | | 3,124,083 | | | | 3,096,148 | | | | 3,152,482 | | | | 4,892,529 | |

| Domestic Expenditure | | | | | | | | | | | | | | | | | | | | | | | | |

| Final consumption expenditure by households | | | 1,803,625 | | | | 1,818,511 | | | | 1,851,399 | | | | 1,864,370 | | | | 1,906,114 | | | | 1,932,412 | |

| Final consumption expenditure by general government(1) | | | 609,383 | | | | 619,681 | | | | 617,713 | | | | 629,495 | | | | 633,445 | | | | 641,957 | |

| | | As of and for the year ended December 31, | | | As of and for the

nine-month period

ended September 30, | |

| | | | 2013 | | | | 2014 | | | | 2015 | | | | 2016 | | | | 2017 | | | | 2018(3) | |

| Total Final consumption expenditure(1) | | | 2,413,008 | | | | 2,438,192 | | | | 2,469,113 | | | | 2,493,864 | | | | 2,539,559 | | | | 2,574,3691 | |