calculations beginning the month after the asset is placed into service. Until December 31, 2002, PEMEX calculated the depreciation beginning the year after the asset was placed into service.

Related gains or losses from the sale or disposal of fixed assets are recognized in income. PEMEX amortizes its well assets using the units-of-production (“UOP”) method. The amount to be recognized as amortization expense is calculated based upon the number of equivalent crude oil barrels extracted from each specific field as compared to the field’s total proved reserves.

Until December 31, 2002, estimated dismantlement and abandonment costs were taken into account in determining amortization and depreciation rates. PEMEX recognized the costs related to currently producing and temporarily closed wells based on the UOP method. In the case of the non-producing wells subject to abandonment and dismantlement, the full dismantlement and abandonment cost had been recognized at the end of each period. All estimates were based on the life of the field, and taking into consideration current cost estimates on an undiscounted basis. No salvage value was considered when determining such rates because salvage values have traditionally been zero. The estimated dismantlement and abandonment costs were reflected within accumulated depreciation and amortization.

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

Effective January 1, 2003, PEMEX adopted Bulletin C-9, “Liabilities, Provisions, Contingent Assets and Liabilities and Commitments” (“Bulletin C-9”). As a result, PEMEX changed the method of accruing the costs related to wells subject to abandonment and dismantlement. The fair values of these costs are recorded as liabilities on a discounted basis when incurred, which is typically at the time the wells are put into service. The amounts recorded for these obligations are initially recorded by capitalizing the respective costs. Over time the liabilities will be accreted for the change in their present value and the initial capitalized costs will be depreciated over the useful lives of the related assets based on the UOP method. In the case of the non-producing wells subject to abandonment and dismantlement, the full dismantlement and abandonment cost had been recognized at the end of each period.

The adoption of Bulletin C-9 resulted for PEMEX in the recognition of a benefit of Ps. 2,012,782 related to the provision for dismantlement and abandonment, as of January 1, 2003.

i) Liabilities, provisions, contingent assets and liabilities and commitments

PEMEX’s liabilities represent present obligations and the liability provisions recognized in the balance sheet represent present obligations whose settlement will probably require the use of an estimate of economic resources. These provisions have been recorded, based on management’s best estimate of the amount needed to settle present liability; however, actual results could differ from the provisions recognized.

Beginning January 1, 2003, Bulletin C-9 went into effect. This Bulletin establishes general rules for the valuation, presentation and disclosure of liabilities, provisions and contingent assets and liabilities, as well as for the disclosure of commitments entered into by a company as a part of its normal operations. See Note 2h) for a discussion of the impact of Bulletin C-9 related to the provision for dismantlement and abandonment costs.

j) Foreign currency balances and transactions

Transactions denominated in foreign currency are recorded at the respective exchange rates prevailing on the day that the transactions are entered into and the related asset or liability is recorded. Assets and liabilities in foreign currencies are stated in pesos at the rates in effect at the balance sheet date and published by the Ministry of Finance and Public Credit (SHCP). Foreign exchange losses and gains are charged and credited, respectively, to income. This resulted in net exchange losses charged to income of Ps. 25,506,359 and Ps. 4,431,231 in 2003 and 2002, respectively, and in net exchange gain credited to income of Ps. 4,371,304 in 2001.

F-13

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

k) Retirement benefits and seniority premiums

PEMEX has established a pension plan for retirement and seniority premiums to be paid to its employees. The liability is computed by an independent actuary, based upon the projected unit-credit method. PEMEX has recorded the results of the actuarial valuation in accordance with Mexican GAAP Bulletin D-3, “Labor Obligations.”

Payments for indemnities to dismissed personnel are charged to income as and when the expense is incurred.

l) Equity

The Certificates of Contribution “A”, the specific oil-field exploration and depletion reserve and the accumulated losses represent the value of these items stated in terms of purchasing power of the most recent balance sheet date, and are determined by applying factors derived from the NCPI to the historical amounts.

m) Surplus in restatement of equity

The surplus in the restatement of equity is composed of the cumulative results from the initial net monetary position, as well as the effects of restating non-monetary items, such as inventory and property and equipment, above or below inflation, the translation effect of foreign subsidiaries and, for 2003, the cumulative inflationary restatement of construction-in-progress and certain refinery assets that were not previously inflation-indexed.

n) Result on monetary position

The result on monetary position represents the gain or loss, measured in terms of the NCPI, on net monthly monetary assets and liabilities for the year, expressed in Mexican pesos of purchasing power as of the most recent balance sheet date. The inflation rates were 4.0%, 5.7% and 4.4%, in 2003, 2002 and 2001, respectively.

o) Comprehensive financing cost

Comprehensive financing cost includes all types of financial gains or costs, such as interest income and expense, net foreign exchange gains or losses and effects on valuation of financial instruments, in addition to gains or losses on monetary position.

F-14

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

p) Cost of sales

Cost of sales is determined by adding to inventories at the beginning of the year the increase in the specific oil-field exploration and depletion reserve (a fixed charge per extracted barrel), the operating cost of oil fields, refineries and plants (including internally-consumed products), the purchase cost of refined and other products, and deducting the value of inventories at the end of the year. Cost of sales also includes a portion of the depreciation and amortization expense associated with assets used in operations as well as the expense associated with the reserve for future dismantlement and abandonment costs.

q) Taxes and federal duties

Petróleos Mexicanos and the Subsidiary Entities are subject to special tax laws, which are based upon petroleum revenues and do not generate temporary differences or deferred income taxes. Petróleos Mexicanos and the Subsidiary Entities are not subject to the Ley del Impuesto Sobre la Renta (“Income Tax Law”) or the Ley del Impuesto al Activo (“Asset Tax Law”). Some of the Subsidiary Companies are subject to the Income Tax Law and Asset Tax Law; however, such Subsidiary Companies do not generate significant deferred income taxes.

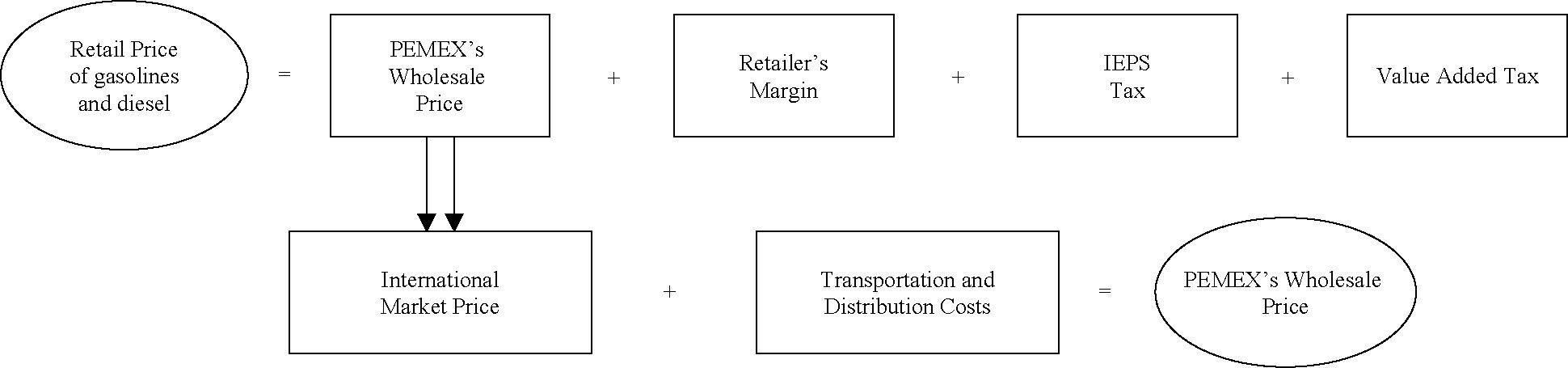

Petróleos Mexicanos and the Subsidiary Entities are subject to the following duties and taxes: Hydrocarbon Extraction Duties, Hydrocarbon Income Tax and the Special Tax on Production and Services (“IEPS Tax”). Petróleos Mexicanos and the Subsidiary Entities are also subject to the Value Added Tax (“VAT”).

Hydrocarbon extraction duties are calculated at a rate of 52.3% on the net cash flow difference between crude oil sales and extraction costs and expenses. Extraordinary and additional hydrocarbon extraction duties are calculated at a rate of 25.5% and 1.1%, respectively, on the same basis. The hydrocarbon income tax is equivalent to the regular income tax applied to all Mexican corporations, a tax to which Petróleos Mexicanos and the Subsidiary Entities are not subject; the rate of this tax was 35% for all periods presented.

The sum of the above duties and taxes must equal 60.8% of Petróleos Mexicanos and the Subsidiary Entities’ annual sales revenues to third parties. In addition, PEMEX pays a 39.2% duty on excess gains revenues, i.e., the portion of revenues in respect of crude oil sales at prices in excess of 18.35 U.S. dollars, 15.50 U.S. dollars and 18.00 U.S. dollars per barrel for 2003, 2002 and 2001, respectively. Therefore, to the extent that the sum of hydrocarbon extraction duties is less than 60.8% of sales to third parties, additional taxes are paid to reach that level.

F-15

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

r) Special Tax on Production and Services (IEPS Tax)

The special tax on production and services charged to customers is a tax on the domestic sales of gasoline and diesel. The applicable rates depend on, among other factors, the product, producer’s price, freight costs, commissions and the region in which the respective product is sold. For financial statement purposes, the special tax on production and services collected from customers is presented as part of “Net domestic sales” and the payment to the Government is deducted after “Income before hydrocarbon extraction duties and other, special tax on production and services, and cumulative effect of adoption of new accounting standards”.

s) Revenue recognition

For all export products, risk of loss and ownership title is transferred upon shipment, and thus PEMEX records sales revenue upon shipment to customers abroad. In the case of certain domestic sales in which the customer takes product delivery at a PEMEX facility, sales revenues are recorded upon product pick-up. For domestic sales in which PEMEX is responsible for product delivery, risk of loss and ownership is transferred at the delivery point, and PEMEX records sales revenue upon delivery.

t) Financial instruments

PEMEX enters into derivative financial instruments to manage its exposures to foreign currency risk, interest rate risk, oil and natural gas price risk, counterparty risk and investment portfolio risk. Derivative financial instruments designated as hedge instruments are recorded in the balance sheet and valued using the same valuation criteria used to value the hedged asset or liability. Derivative financial instruments not designated as hedge instruments are recorded at fair value. Subsequent fair value adjustments are reflected in the statement of operations.

As a result of the adoption of Bulletin C-2, “Financial Instruments” (“Bulletin C-2”) as of January 1, 2001, PEMEX recognized a charge to earnings totaling Ps. 1,495,307 which has been reflected as a cumulative effect of adopting a new accounting standard. The adjustment was primarily the result of the accounting for the equity swap related to Repsol YPF, S.A. (“Repsol”) shares (see additional discussion in Note 10). At December 31, 2001, PEMEX had three outstanding equity swaps involving Repsol shares. As Bulletin C-2 has no provision for hedging forecasted transactions, nor does it permit the equity swap to be treated as a hedge since the Repsol shares were considered to have been sold for Mexican GAAP purposes in prior years, the entire fair value at January 1, 2001 related to the equity swaps, which totaled Ps. 1,394,515, was recognized as part of the cumulative effect adjustment. The remainder of the cumulative effect adjustment related to interest rate and cross currency swaps entered into to hedge borrowings in currencies other than the U.S. dollar. These swaps are entered into at or near inception of the debt and carry similar terms and conditions, thus forming a “highly effective” financial hedge.

F-16

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

u) Use of estimates

The preparation of the financial statements in accordance with Mexican GAAP requires the use of estimates. PEMEX’s management makes estimates and assumptions that affect the amounts and the disclosures presented as of the date of the consolidated financial statements. Actual results could differ from those estimates.

v) Comprehensive loss

Comprehensive loss is represented by the net loss plus the effect of restatement, the net increase in the specific oil-field exploration and depletion reserve, and items required by specific accounting standards to be reflected in equity but which do not constitute equity contributions, reductions or distributions (see Note 12).

w) Convenience translation

United States dollar (“U.S. dollar”) amounts shown in the balance sheets, the statements of operations, the statements of changes in equity and the statements of changes in financial position have been included solely for the convenience of the reader. Such amounts are translated from pesos, as a matter of arithmetic computation only, at an exchange rate for the settlement of obligations in foreign currencies provided by Banco de México and the SHCP at December 31, 2003. Translations herein should not be construed as a representation that the peso amounts have been or could be converted into U.S. dollars at the foregoing rate or any other rate.

x) Reclassifications

Certain reclassifications have been made to 2002 and 2001 amounts presented in the consolidated financial statements and related notes to conform such amounts and disclosures to the current year presentation.

y) Recently issued accounting standards

In 2003, the MIPA issued new Bulletin C-12, “Financial Instruments with Characteristics of Liabilities, Capital or Both”, which highlights the differences between liabilities and capital from the viewpoint of the issuer, as a basis for identifying, classifying and accounting for the liability and capital components of combined financial instruments at the date of issuance.

The new Bulletin establishes the methodology for separating the liabilities and capital components from the proceeds of the issuance of combined financial instruments. That methodology is based on the residual nature of stockholders’ equity and avoids the use of fair values affecting stockholders’ equity in initial transactions. Additionally, it establishes that beginning on January 1, 2004, the

F-17

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

initial costs incurred in connection with the issuance of combined instruments should be assigned to liabilities and stockholders’ equity in proportion to the amounts of the components recognized as liabilities and stockholders equity, that the profits and losses related to financial instrument components classified as liabilities should be recorded in comprehensive financing cost and that distributions to owners of financial instrument components classified as capital should be charged directly to a stockholders’ equity account other than the net income for the year.

Although this Bulletin became effective on January 1, 2004, there is no requirement to restate information of prior periods or recognize an initial effect of adopting in the income for the year it is adopted, in accordance with the transitory provisions of the Bulletin. PEMEX is currently evaluating the impact the adoption of this Bulletin will have on its consolidated financial statements.

In 2003, the MIPA issued new Bulletin C-15, “Impairment of the Value of Long-Lived Assets and their Disposal,” which became effective on January 1, 2004. For a description of Bulletin C-15, see Note 18 below.

3. Accounts, notes receivable and other

At December 31, accounts, notes receivable and other amounts are as follows:

| | | 2003 | | 2002 | |

| | |

|

| |

|

| |

| Trade-domestic | | Ps. | 22,171,699 | | Ps. | 24,756,657 | |

| Trade-foreign | | | 11,294,430 | | | 7,248,986 | |

| Pemex Finance, Ltd. | | | 8,147,107 | | | 7,779,464 | |

| Mexican Government (Note 13) advance payments on minimum guaranteed dividends | | | 10,175,024 | | | 10,098,227 | |

| Employees and officers | | | 2,307,111 | | | 2,085,881 | |

| Other accounts receivable | | | 18,209,940 | | | 7,592,816 | |

| Less: | | | | | | | |

| Allowance for doubtful accounts | | | (2,092,479 | ) | | (1,987,854 | ) |

| | |

|

| |

|

| |

| | | Ps. | 70,212,832 | | Ps. | 57,574,177 | |

| | |

|

| |

|

| |

F-18

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

4. Inventories

At December 31, inventories are as follows:

| | | 2003 | | 2002 | |

| | |

|

| |

|

| |

| Crude oil, refined products, derivatives and petrochemical products | | Ps. | 23,981,779 | | Ps. | 21,903,277 | |

| Materials and supplies in stock | | | 4,166,261 | | | 4,664,164 | |

| Materials and products in transit | | | 1,177,830 | | | 979,514 | |

| Less: | | | | | | | |

| Allowance for slow-moving inventory and obsolescence reserve | | | (1,848,216 | ) | | (2,144,767 | ) |

| | |

|

| |

|

| |

| | | Ps. | 27,477,654 | | Ps. | 25,402,188 | |

| | |

|

| |

|

| |

5. Properties and equipment

At December 31, components of properties and equipment are as follows:

| | | 2003 | | 2002 | |

| | |

|

| |

|

| |

| Plants | | Ps. | 277,970,288 | | Ps. | 238,873,955 | |

| Pipelines | | | 217,598,977 | | | 203,340,674 | |

| Wells and field assets | | | 213,018,173 | | | 168,296,187 | |

| Perforation equipment | | | 20,341,501 | | | 19,267,114 | |

| Buildings | | | 35,759,620 | | | 35,368,777 | |

| Offshore platforms | | | 69,344,986 | | | 45,911,342 | |

| Furniture and fixtures | | | 22,877,084 | | | 21,091,437 | |

| Transportation equipment | | | 12,274,215 | | | 12,225,200 | |

| | |

|

| |

|

| |

| | | | 869,184,844 | | | 744,374,686 | |

| Less: | | | | | | | |

| Depreciation and amortization | | | (453,501,524 | ) | | (425,315,442 | ) |

| | |

|

| |

|

| |

| | | | 415,683,320 | | | 319,059,244 | |

| | | | | | | | |

| Land | | | 37,763,303 | | | 38,076,892 | |

| Construction in progress | | | 84,023,226 | | | 145,355,060 | |

| Fixed assets pending disposition | | | 1,601,725 | | | 823,622 | |

| Construction spares | | | 147,817 | | | 185,158 | |

| | |

|

| |

|

| |

| Total | | Ps. | 539,219,391 | | Ps. | 503,499,976 | |

| | |

|

| |

|

| |

F-19

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

| a) | At December 31, 2003, the value of properties and equipment was restated using factors computed from the NCPI, and at December 31, 2002, by applying specific factors based on technical studies. |

| | |

| b) | At December 31, 2003, 2002 and 2001, interest costs associated with fixed assets in the phase of construction or installation are capitalized as part of the cost of those assets. Interest capitalized totaled Ps. 7,246,308, Ps. 5,468,205 and Ps. 4,153,866, respectively. |

| | |

| c) | Depreciation and amortization expense recorded in operating expenses for the years ended December 31, 2003, 2002 and 2001 was Ps. 40,544,191, Ps. 33,814,503 and Ps. 31,959,891, respectively, which included Ps. 455,930, Ps. 1,400,821 and Ps. 1,584,506, respectively, related to dismantlement and abandonment costs. |

| | |

| d) | Until December 31, 2002, the total estimated future costs related to dismantlement and abandonment activities (determined on an undiscounted basis) was Ps. 12,257,893. The accrued amounts were included in accumulated depreciation and amortization. As a result of the adoption of Bulletin C-9 (see Note 2h) and i)), PEMEX’s calculation at December 31, 2003, of the total estimated future costs related to dismantlement and abandonment activities (determined on a discounted basis) was Ps. 12,274,000 and was reclassified as a liability in the “Reserve for dismantlement and abandonment activities, sundry creditors and others.” |

6. Intangible asset derived from the actuarial computation of labor obligations and other assets

At December 31, the intangible and other assets amount consists of:

| | | 2003 | | 2002 | |

| | |

|

| |

|

| |

| Intangible asset derived from the actuarial computation of labor obligations (Note 11) | | Ps. | 119,309,221 | | Ps. | 120,065,003 | |

| Long-term investments and other assets | | | 15,916,309 | | | 15,557,506 | |

| | |

|

| |

|

| |

| | | Ps. | 135,225,530 | | Ps. | 135,622,509 | |

| | |

|

| |

|

| |

Included in long-term investments are 18,557,219 shares in Repsol which are held by Petróleos Mexicanos and not under any equity swap arrangement (see Note 10). The carrying value at December 31, 2003 and 2002 was Ps. 4,063,288 and Ps. 4,619,646, respectively.

F-20

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

PMI NASA has a joint venture with Shell Oil Company, in which it owns a 50% interest in a petroleum refinery located in Deer Park, Texas. The investment is accounted for under the equity method and amounts to Ps. 2,806,455 and Ps. 2,440,448, respectively, at December 31, 2003 and 2002. During 2003, 2002 and 2001, PEMEX recorded Ps. 889,726, (Ps. 262,906) and Ps. 596,382 of earnings (losses) respectively, relative to its interest in the joint venture which has been reflected in the line item “Other revenues” in the statements of operations. During 2003, 2002 and 2001, PEMEX paid the joint venture Ps. 4,661,482, Ps. 2,690,088 and Ps. 4,175,822, respectively, for the processing of petroleum.

7. Sale of future accounts receivable

On December 1, 1998, Petróleos Mexicanos, Pemex-Exploration and Production, PMI and P.M.I. Services B.V. entered into several agreements with Pemex Finance, Ltd. (“Pemex Finance”), a limited liability company which was organized under the laws of the Cayman Islands. Under these agreements, Pemex Finance purchases certain existing accounts receivable for crude oil, as well as certain accounts receivable to be generated in the future by Pemex-Exploration and Production and PMI related to crude oil. The current and future accounts receivables sold are those generated or to be generated by the sale of Maya crude oil to designated customers in the United States, Canada, and Aruba. The net resources obtained by Pemex-Exploration and Production from the sale of such receivables under the agreements are utilized for PIDIREGAS (see Note 2d)). At December 31, 2003 and 2002, the sales under these agreements were Ps. 122,006,841 and Ps. 78,826,689, respectively.

The “Sale of future accounts receivable” relates to the purchase of rights to certain accounts receivable that will be generated based on existing commitments and is therefore treated as a liability to PEMEX. Sale of future accounts receivable has been classified as a long-term liability as of December 31, 2003 and 2002. The agreements between Petróleos Mexicanos, Pemex-Exploration and Production, PMI, P.M.I. Services B.V. and Pemex Finance establish short-term repayments; however, such agreements are evergreen and it is not expected that current resources will be used in repayments as the agreements do not bear a re-financing risk. Pemex Finance has a proven continuous ability to contract debt in the international market sufficient to sustain the acquisition of accounts receivable from PEMEX.

F-21

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

8. Notes payable to contractors

At December 31, the notes payable to contractors consisted of:

| | | 2003 | | 2002 | |

| | |

|

| |

|

| |

| Total notes payable to contractors (a) (b) (c) | | Ps. | 15,026,739 | | Ps. | 30,150,012 | |

| Less: Current portion of notes payable to contractors | | | 1,887,150 | | | 1,640,274 | |

| | |

|

| |

|

| |

| Notes payable to contractors (long-term) | | Ps. | 13,139,589 | | Ps. | 28,509,738 | |

| | |

|

| |

|

| |

| (a) | On November 26, 1997, Petróleos Mexicanos and Pemex-Refining entered into a financed public works contract and a unit-price public works contract with Consorcio Proyecto Cadereyta Conproca, S. A. de C. V. The related contracts are for the reconfiguration and modernization of the “Ing. Héctor R. Lara Sosa” refinery in Cadereyta, N.L. |

| | |

| | The original amount of the financed public works contract was U.S. $1,618,352, plus a financing cost of U.S. $805,648, due in twenty semi-annual payments of U.S. $121,200. The original amount of the unit-price public works contract was U.S. $80,000, including a financing cost of U.S. $47,600 payable monthly based on the advancement of the project. At December 31, 2003 and 2002, the outstanding balance was Ps. 13,480,564 and Ps. 14,298,491, respectively. |

| | |

| (b) | On June 25, 1997, PEMEX entered into a 10-year service agreement, with a different contractor, for a daily fee of U.S. $82.50 for the storage and loading of stabilized petroleum by means of a floating system (“FSO”). At December 31, 2003 and 2002, the outstanding balance was Ps. 1,167,132 and Ps. 1,245,132, respectively. |

| | |

| (c) | During 2003, PEMEX recorded a liability of Ps. 379,043 for the upgrade of the refinery located in Minatitlán, Veracruz. Additionally, during 2003, PEMEX paid Ps. 14,606,389 to various contractors with proceeds from financing activities that the Master Trust undertook, which was recorded as a liability to various contractors relating to the upgrade of the refineries located in Salamanca, Guanajuato, and Madero City, Tamaulipas in 2002. |

F-22

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

9. Debt

As of December 31, 2003, revolving lines of credit contracted by PEMEX (credit acceptance facilities and commercial paper) and of partial availability, amounted to Ps. 54,030,425. At December 31, 2003 the unused portion of those credit lines amounted to Ps. 9,870,861, which included Ps. 2,898,888 of revolving lines and Ps. 6,971,973 of lines granted by export credit agencies. These credit lines bear fixed interests from 3.32% to 7.77% and LIBOR plus 0.03% to 2.25%.

During 2003, significant financing operations were as follows:

| a. | Petróleos Mexicanos obtained loans to finance foreign trade operations totaling U.S. $125,000 (Ps. 1,404,500). The loans are repayable during 2004 and bear interest at LIBOR plus 0.585% to 0.65%. |

| | |

| b. | Petróleos Mexicanos obtained unsecured loans of U.S. $440,000 (Ps. 4,943,840), which bear interest at LIBOR plus 0.55% to 0.695% and are repayable during 2004. |

| | |

| c. | Petróleos Mexicanos reutilized U.S. $432,000 (Ps. 4,853,952) under its commercial paper program. This commercial paper bears interest at the discount rate of 1.085% to 1.11%, which are the prevailing rates in the market at the date of each issuance. |

| | |

| d. | Petróleos Mexicanos utilized U.S. $540,000 (Ps. 6,067,440) from two acceptance credit facilities from foreign banks consisting of U.S. $405,000 (Ps. 4,550,580) and U.S. $135,000 (Ps. 1,516,860). The acceptance credit facilities bear interest at LIBOR plus 0.6% and will expire in 2004. |

| | |

| e. | Petróleos Mexicanos obtained U.S. $152,340 (Ps. 1,711,692) for purchasing loans and project financing, granted by various export credit agencies. The project financing credits bear fixed interest from 3.32% to 5.04% and LIBOR plus 0.0625% to 1.5%. |

During 2003, the Master Trust undertook the following financing activities:

| a. | The Master Trust obtained commercial bank loans totaling U.S. $1,173,583 (Ps. 13,186,379). These loans bear fixed interest of 5.44%, LIBOR plus 0.6% to 1.9% and variable plus 0.2% to 0.4%, and are repayable in installments until 2018. |

| | |

| b. | The Master Trust obtained loans to finance foreign trade operations totaling U.S. $1,700,000 (Ps. 19,101,200). These loans are repayable in 2004 and 2006 and bear interest at LIBOR plus 0.4% and 0.6%. |

F-23

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

| c. | On January 27, 2003, the Master Trust issued £250,000 (Ps. 5,023,050) of 7.50% Notes due 2013; the notes were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| d. | On February 6, 2003, the Master Trust issued U.S. $750,000 (Ps. 8,427,000) of 6.125% Notes due 2008; the notes were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| e. | On March 21, 2003, the Master Trust issued U.S. $500,000 (Ps. 5,618,000) of 8.625% Bonds due 2022; the bonds were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| f. | On April 4, 2003, the Master Trust issued €750,000 (Ps. 10,622,250) of 6.625% Notes due 2010; the notes are guaranteed by Petróleos Mexicanos. |

| | |

| g. | On June 4, 2003, the Master Trust issued U.S. $750,000 (Ps. 8,427,000) of 7.375% Notes due 2014; the notes were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| h. | On August 5, 2003, the Master Trust issued €500,000 (Ps. 7,081,500) of 6.25% Guaranteed Notes due 2013; the notes are guaranteed by Petróleos Mexicanos. |

| | |

| i. | On October 15, 2003, the Master Trust issued U.S. $500,000 (Ps. 5,618,000) of Guaranteed Floating Rate Notes due 2009; the notes bear interest at a rate of LIBOR plus 1.80% and are guaranteed by Petróleos Mexicanos. |

| | |

| j. | On November 5, 2003, the Master Trust issued £150,000 (Ps. 3,013,830) of 7.5% Notes due 2013. The notes were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| k. | At various dates during 2003, the Master Trust obtained U.S. $2,096,154 (Ps. 23,552,386) in project financing at fixed interest rates from 3.23% to 6.64% and at LIBOR plus 0.03% to 2.25% with various settlements until 2014. |

During 2003, Fideicomiso F/163 undertook the following financing activities:

| a. | On October 24, 2003, Fideicomiso F/163 issued Ps. 6,500,000 (in nominal terms) of certificates at a fixed rate of 8.38% and a variable rate plus 0.65% and 0.67% with various settlements until 2010. |

F-24

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

| b. | On December 18, 2003, Fideicomiso F/163 obtained a bank loan of Ps. 2,500,000 (in nominal terms), which bears a variable rate plus 0.36% and has several settlements until 2008. |

| | |

| c. | On December 23, 2003, Fideicomiso F/163 obtained a syndicated bank loan of Ps. 7,000,000 (in nominal terms), which bears a variable rate plus 0.35% and a fixed rate of 8.4% and is repayable in 2007 and 2008. |

During 2002, significant financing operations were as follows:

| a. | Petróleos Mexicanos obtained loans from export credit agencies totaling U.S. $225,000 (Ps. 2,412,579). The loans are repayable during 2003 and bear interest at LIBOR plus 0.55% to 0.65%. |

| | |

| b. | Petróleos Mexicanos obtained unsecured loans of U.S. $650,000 (Ps. 6,969,675) from domestic banks. The unsecured loans bear interest at LIBOR plus 0.625% to 0.760% and are repayable during 2003. |

| | |

| c. | Petróleos Mexicanos reutilized U.S. $962,500 (Ps. 10,320,480) under the commercial paper program. This commercial paper bears interest at the discount rate of 1.345% to 1.42%, which are the prevailing rates in the market at the date of each issuance. The program expires in 2004. |

| | |

| d. | Petróleos Mexicanos reutilized U.S. $785,000 (Ps. 8,417,222) from acceptance credit facilities. These facilities bear interest at LIBOR plus 0.6%. These facilities were contracted in 2001 and will expire in 2004. |

| | |

| e. | Petróleos Mexicanos obtained U.S. $146,442 (Ps. 1,570,235) for purchasing loans and project financing, granted by various export credit agencies. These credits bear fixed interest from 4.14% to 5.51% and LIBOR plus 0.0625% to 0.225%. The purchasing loans and project financing are repayable from 2003 through 2010. |

| | |

| f. | P.M.I. Trading Ltd. obtained U.S. $10,000 (Ps. 107,226) in a bank loan from a financial institution. The bank loan bears a fixed interest rate of 2.2345% and is due in January 2003. |

During 2002, the Master Trust undertook the following financing activities:

| a. | The Master Trust obtained commercial bank loans totaling U.S. $650,000 (Ps. 6,969,675). These loans bear interest at LIBOR plus 0.9% and are repayable in 2004. In addition, the Master Trust obtained commercial bank loans for Ps. 11,957,298. These loans bear interest at domestic rate of 8.3% and 8.13% and are repayable from 2003 through 2005. |

F-25

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

| b. | On January 7, 2002, the Master Trust issued U.S. $500,000 (Ps. 5,361,288) of Floating Rate Notes due 2005; the notes bear interest at a rate of LIBOR plus 1.5%, were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| c. | On February 1, 2002, the Master Trust issued U.S. $1,000,000 (Ps. 10,722,577) of 7.875% Notes due 2009; the notes were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| d. | On February 1, 2002, the Master Trust issued U.S. $500,000 (Ps. 5,361,288) of 8.625% Bonds due 2022; the bonds were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| e. | On December 3, 2002, the Master Trust increased its Medium-Term Note program, Series A, from U.S. $6,000,000 (Ps. 64,335,459) to U.S. $11,000,000 (Ps. 117,948,342). |

| | |

| f. | On December 5, 2002, the Master Trust issued ¥30,000,000 (Ps. 2,710,667) of 3.50% Notes due 2023; the notes are guaranteed by Petróleos Mexicanos. |

| | |

| g. | On December 12, 2002, the Master Trust issued U.S. $1,000,000 (Ps. 10,722,577) of 7.375% Notes due 2014; the notes were issued under the Master Trust’s Medium-Term Note program, Series A, and are guaranteed by Petróleos Mexicanos. |

| | |

| h. | The Master Trust obtained U.S. $2,042,500 (Ps. 21,900,862) in project financing from several financial institutions, of which U.S. $300,000 (Ps. 3,216,773) relates to foreign trade financing and U.S. $742,500 (Ps. 7,961,513) to financing guarantee by export credit agencies, which include ¥ 13,962,623 (Ps. 1,261,601) and U.S. $1,000,000 (Ps. 10,722,577) to a syndicated facility. The project financing bears fixed interest at rates between 4.14% and 5.74% and variable rates of LIBOR plus 0.05% to 2.25% and the Yen Prime rate. The project financing is repayable between 2003 and 2013. |

In 1983, 1985, 1987, and 1990, Petróleos Mexicanos, together with the Mexican Government, entered into various covenants with the international banking community for restructuring its debt. As a result of the final agreement, the remaining balance of the restructured Mexican Government debt retained, principally, the same interest rate conditions as had been negotiated in 1987.

The agreed-upon periods of amortization including a provision for division of the debt into two main portions with amortization over 52 and 48 quarters, respectively. The first amortization period began in 1994 and the second began in 1995, with both scheduled to end in December 2006.

F-26

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

Each year, SHCP approves Petróleos Mexicanos and Subsidiary Entities’ annual budget and its annual financing program. The Mexican Government incorporates Petróleos Mexicanos and Subsidiary Entities’ annual budget and annual financing program into the budget of the Mexican Government, which the Federal Congress of Mexico must approve each year. PEMEX’s debt is not an obligation of, or guaranteed by, the Mexican Government. However, under the Ley General de Deuda Pública (the “General Law of Public Debt”), Petróleos Mexicanos and Subsidiary Entities’ foreign debt obligations must be approved by and registered with the SHCP and are considered Mexican external public debt. Although Petróleos Mexicanos’ debt is not guaranteed by the Mexican Government, Petróleos Mexicanos’ external debt has received pari passu treatment in previous debt restructurings.

Various credit facilities require compliance with various operating covenants which, among other things, place restrictions on the following types of transactions:

| • | Sale of substantial assets essential for the continued operations of the business; |

| | |

| • | Liens against its assets; and |

| | |

| • | Transfers, sales or assignments of rights to payment under contracts for the sale of crude oil or gas not yet earned, accounts receivable or other negotiable instruments. |

F-27

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

As of December 31, 2003 and 2002, long-term debt was as follows:

| | | | | | | December 31, 2003 | | December 31, 2002 |

| | | | | | |

| |

|

| | | Rate of interest (4) | | Maturity | | Pesos

(thousands) | | Foreign

currency

(thousands) | | Pesos

(thousands) | | Foreign

currency

(thousands) |

| | |

| |

| |

|

| |

| |

|

| |

|

U.S. dollars: | | | | | | | | | | | | | | |

| Unsecured loans (1) | | Variable and LIBOR plus

0.8125% | | Various to 2006 | | Ps. | 1,683,161 | | 149,801 | | Ps. | 2,369,194 | | 220,954 |

| | | | | | | | | | | | | | | |

| Unsecured loans | | Variable and LIBOR plus

0.55 to 0.8125% | | Various to 2006 | | | 4,780,975 | | 425,505 | | | 10,177,021 | | 949,121 |

| Acceptance lines | | LIBOR plus 0.6% | | 2004 | | | 6,067,440 | | 540,000 | | | 8,417,223 | | 785,000 |

| | | | | | | | | | | | | | | |

| Bonds | | Fixed of 6.125%

to.9.5% and LIBOR plus

1.5% to 1.8% | | Various to 2027 | | | 136,497,625 | | 12,148,240 | | | 103,453,992 | | 9,648,240 |

| | | | | | | | | | | | | | | |

| Financing assigned to PIDIREGAS | | Fixed of 3.23% to 7.69% and LIBOR plus 0.03% to 2.25% | | Various to 2014 | | | 41,369,085 | | 3,681,834 | | | 60,123,966 | | 5,607,231 |

| | | | | | | | | | | | | | | |

| Purchasing loans and project financing | | Fixed of 3.32% to7.77% and LIBOR plus 0.0625% to 2% | | Various to 2012 | | | 5,038,346 | | 448,411 | | | 4,589,066 | | 427,982 |

| | | | | | | | | | | | | | | |

| Leasing contracts | | Fixed of 8.05% to 10.34% | | Various to 2012 | | | 2,857,871 | | 254,350 | | | 2,987,949 | | 278,660 |

| Commercial paper | | Various from 1.085% to 1.11% | | Various to 2004 | | | 4,853,952 | | 432,000 | | | 4,637,514 | | 432,500 |

| External trade loans | | LIBOR plus 0.4% to 1.125% | | Various to 2007 | | | 37,340,973 | | 3,323,333 | | | 2,412,580 | | 225,000 |

| | | | | | | | | | | | | | | |

| Bank loans | | Fixed of 5.44% to 5.58% LIBOR plus 0.6% to 1.9% | | Various to 2018 | | | 27,813,879 | | 2,475,425 | | | 107,720 | | 10,046 |

| | | | | | |

|

| |

| |

|

| |

|

| Total financing in U.S. dollars | | | | | | | 268,303,307 | | 23,878,899 | | | 199,276,225 | | 18,584,734 |

| | | | | | |

|

| |

| |

|

| |

|

| Euros: | | | | | | | | | | | | | | |

| Bonds | | Fixed of 6.25% to 7.75%, floating, and LIBOR plus 1.65% | | Various to 2013 | | | 34,294,203 | | 2,421,394 | | | 15,145,600 | | 1,346,394 |

| Unsecured loans, banks and project financing | | Fixed of 2% LIBOR plus 0.8125 | | Various to 2016 | | | 75,823 | | 5,354 | | | 89,790 | | 7,982 |

| | | | | | |

|

| |

| |

|

| |

|

| Total financing in Euros | | | | | | | 34,370,026 | | 2,426,748 | | | 15,235,390 | | 1,354,376 |

| | | | | | |

|

| |

| |

|

| |

|

| Pesos: | | | | | | | | | | | | | | |

| Certificates | | Fixed of 8.38% and variable plus 0.65% to 0.67% | | Various to 2010 | | | 6,500,000 | | | | | | | |

| Project financing and bank loans | | Fixed of 8.4% and variable plus 0.62% to 0.64% | | Various to 2008 | | | 19,000,000 | | | | | 11,957,296 | | |

| | | | | | |

|

| |

| |

|

| |

|

| Total financing in pesos | | | | | | | 25,500,000 | | | | | 11,957,296 | | |

| | | | | | |

|

| |

| |

|

| |

|

Japanese yen: | | | | | | | | | | | | | | |

| Bonds | | Fixed of 3.5% | | 2023 | | | 3,144,000 | | 30,000,000 | | | 2,710,667 | | 30,000,000 |

| Project financing | | Fixed 2.9% and Prime in yen | | Various to 2015 | | | 15,592,863 | | 148,786,858 | | | 15,273,229 | | 169,034,706 |

| | | | | | |

|

| |

| |

|

| |

|

| Total financing in Yen | | | | | | | 18,736,863 | | 178,786,858 | | | 17,983,896 | | 199,034,706 |

| | | | | | |

|

| |

| |

|

| |

|

Other currencies (2) | | Fixed rate of 7.5% and 14.5% and LIBOR plus 0.8125% | | Various to 2013 | | | 9,045,633 | | Various | | | 2,170,580 | | Various |

| | | | | | |

|

| |

| |

|

| |

|

| Total principal in pesos (3) | | | | | | | 355,955,829 | | | | | 246,623,387 | | |

| Plus: Accrued interest | | | | | | | 5,160,738 | | | | | 3,486,757 | | |

| | | | | | |

|

| | | |

|

| | |

| Total principal and interest | | | | | | | 361,116,567 | | | | | 250,110,144 | | |

| Less: Short-term maturities | | | | | | | 57,503,476 | | | | | 51,465,139 | | |

| | | | | | |

|

| | | |

|

| | |

| Long-term debt | | | | | | Ps. | 303,613,091 | | | | Ps. | 198,645,005 | | |

| | | | | | |

|

| | | |

|

| | |

F-28

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 and

thereafter | | Total | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Maturities (in thousands of pesos) | | Ps. | 52,342,738 | | Ps. | 41,347,653 | | Ps. | 42,291,744 | | Ps. | 42,074,201 | | Ps. | 42,056,092 | | Ps. | 135,843,401 | | Ps. | 355,955,829 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Notes to table:

| (1) | Unsecured loans remain from a debt restructuring in 1987. This restructuring extended maturities to new periods through 2006. |

| | |

| (2) | Balance includes market operations, unsecured loans, loans denominated in Pounds sterling and Swiss francs, all carrying different interest rates. |

| | |

| (3) | Includes financing from foreign banks for Ps. 323,367,487 and Ps. 239,068,285 as of December 31, 2003 and 2002, respectively. |

| | |

| (4) | As of December 31, 2003 and 2002 the rates were as follows: LIBOR, 1.22% and 1.38%, respectively; and the Prime rate in Japanese yen, 1.7% and 1.375%, respectively. |

10. Financial instruments

During the normal course of business, PEMEX is exposed to foreign currency risk and interest rate risk, among other risks. These risks create volatility in earnings, equity, and cash flows from period to period. PEMEX makes use of derivative instruments in various strategies to eliminate or limit many of these risks.

PEMEX has enacted general risk management guidelines for the use of derivative instruments, which form a comprehensive framework for PEMEX.

The Risk Management Committee of PEMEX, comprised of representatives of PEMEX, the Central Bank of Mexico, SHCP, and PMI, authorizes PEMEX’s hedging strategies and submits the risk management policies for the approval of the Board of Directors of Petróleos Mexicanos (the “Board of Directors”).

During 2001, the Board of Directors approved a restructuring of the risk management area and created the Risk Management Deputy Direction, whose objective is to develop the financial and operational risk management strategy for PEMEX and to establish institutional regulations consistent with a consolidated risk management approach.

F-29

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

(i) Credit risk

PEMEX is subject to credit risk through trade receivables and derivative financial instruments. To monitor this risk, PEMEX has established an internal credit committee to monitor credit policies and procedures. However, PEMEX closely monitors extensions of credit and has never experienced significant credit losses. Also, most foreign sales are made to large, well-established companies. PEMEX invests excess cash in low-risk, liquid instruments, which are placed with a wide array of institutions.

(ii) Counterparty risk from the use of derivative financial instruments

PEMEX is exposed to credit (or repayment) risk and market risk through the use of derivative instruments. If the counterparty fails to fulfill its performance obligations under a derivative contract, PEMEX’s credit risk will equal the positive fair value of the derivative. Currently, when the fair value of a derivative contract is positive, this indicates that the counterparty owes PEMEX, thus creating a repayment risk for PEMEX. When the fair value of a derivative contract is negative, PEMEX owes the counterparty and, therefore, assumes no repayment risk.

In order to minimize the credit risk in derivative instruments, PEMEX enters into transactions with high quality counterparties, which include financial institutions and commodities exchanges that satisfy PEMEX’s established credit approval criteria. Normally, these counterparties have higher credit standing than that of PEMEX.

Derivative transactions are generally executed on the basis of standard agreements. In general, collateral for financial derivative transactions are neither provided nor received. However in energy derivative transactions, counterparties require collateral when the negative fair value of the position exceeds the credit threshold.

(iii) Interest rate risk management

PEMEX’s interest rate risk hedging strategy allows the volatility of the financial risk to be reduced in the operating cash flows of PEMEX for the long-term debt commitments and guaranteed minimum dividends. Interest rate derivatives allow PEMEX to contract long-term loans at fixed or variable rates and to select the appropriate mix of the debt at variable versus fixed rates.

PEMEX’s hedging strategy against interest rate volatility has allowed it to change effectively the characteristics of its liabilities. At December 31, 2003, the effective interest rate on approximately 56% (57% in 2002) of PEMEX’s debt is at fixed rate. Derivative financial instruments used in hedging transactions of PEMEX are mainly interest rate swaps, in which PEMEX has the rights to receive payments based on LIBOR at three and six months.

F-30

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

(iv) Exchange rate risk management

As a currency exchange rate risk hedging policy, PEMEX contracts cross-currency swaps in order to hedge against adverse changes in currency exchange rates. Since a significant amount of PEMEX’s revenues is denominated in U.S. dollars, PEMEX generally contracts loans in U.S. dollars.

However, PEMEX also contracts debt in currencies other than the U.S. dollar to take advantage of the financing terms available in these foreign currencies. These foreign currency financial derivatives have been established to translate the amounts relative to various bonds issued in other currencies into U.S. dollars.

In December 2002, PEMEX entered into a cross-currency swap with a termination date in 2023 to hedge its exposure in Japanese yen, given the long term nature of this obligation, the swap used to hedge this risk includes an option to rescind the contract linked to a defined set of credit default events by PEMEX. In case such an event occurs, the swap terminates without any additional obligation to any of the parties. This swap has a notional amount of U.S. $241.4 million and accounts for 5.2% of the total outstanding cross-currency swap position.

(v) Commodity price risk management

Crude oil:

PEMEX’s exports and domestic sales are related to international hydrocarbon prices, thus exposing PEMEX to fluctuations in international markets. Currently, PEMEX does not enter into any long-term hedge against fluctuations in crude oil prices. However, in order to lessen the effect of a decline in hydrocarbon prices, since 1998, the Mexican Government, along with PEMEX, agreed to reduce the volume of crude oil exports in conjunction with the major international oil producers to improve international oil prices. Notwithstanding, during December 2002 PEMEX entered into a short-term crude oil price hedge through the use of options for approximately 6% of the PEMEX total production.

Petroleum products:

PEMEX balances its overall petroleum product supply and demand through PMI Trading Ltd., managing only those exposures associated with the immediate operational program. To this end, PEMEX uses the full range of conventional oil price-related financial and commodity derivatives available in the oil markets. PEMEX’s benchmark for petroleum product commercial activities is the prevailing market price.

F-31

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

Natural gas:

PEMEX offers its customers financial instruments as a value added service and provides various hedging contracts to its customers in order to give them the option of protecting against fluctuations in the price of PEMEX’s products. In 2001 PEMEX entered into a number of three-year agreements with Mexican industrial consumers to sell natural gas at a fixed reference price of 4.00 U.S. dollars per million BTUs, covering a period from January 1, 2001 through December 31, 2003. As part of PEMEX’s risk management strategy, PEMEX has also entered into a number of derivative instruments, primarily swaps and futures, to hedge these fixed price sales under the three-year agreements, while locking in a profit margin. PEMEX entered into these derivative instruments for approximately 91% of the total volume of natural gas sold under these three-year fixed price agreements. The risk management strategy used to hedge these fixed price sales left PEMEX with an exposure to basis risk arising from the difference between the index used to hedge the natural gas sales at a fixed price and the index used as reference to mark to market these fixed-price contracts. This basis risk is treated as an inefficiency of the transaction and may impact PEMEX’s earnings in a period other than the one during which the transaction was realized.

During the fourth quarter of 2003, the Ministry of Energy announced a new natural gas pricing program for its domestic sales for the years 2004 through 2006. Under this program, customers may purchase natural gas from PEMEX at a fixed price of either (1) 4.50 U.S. dollars per million BTUs (for purchases up to 10 million cubic feet per day) and 4.55 U.S. dollars per million BTUs (for larger requirements up to 20 million cubic feet per day) over the period from January 1, 2004 through December 31, 2006 or (2) 4.425 U.S. dollars per million BTUs plus any excess of the average spot price over 6.00 U.S. dollars per million BTUs, for the period from January 1, 2004 through December 31, 2004, subject to certain conditions. This program applies to approximately 20% of PEMEX’s total domestic sales of natural gas to third parties. This program is designated to change PEMEX’s traditional risk profile with respect to natural gas in order to mitigate the volatility of the revenues derived from the sales of this product. This strategy does not leave PEMEX with an exposure to basis risk, due to the fact that the derivatives are priced using the same market indices as the ones used to price the natural gas sales.

(vi) Investment portfolio risk management

At December 31, 2003, PEMEX held two equity swaps with respect to shares of Repsol. In 1994, PEMEX entered into an equity swap, which was restructured in March 2000, resulting in a swap with respect to 26,427,781 Repsol shares divided in three tranches, having one-, two- and three-year maturities. In addition, in January 2000, PEMEX entered into a second equity swap with respect to 13,679,704 Repsol shares maturing in three years. Upon the maturity of the two swaps, PEMEX has continuously renewed these swaps for periods up to three months. As of December 31, 2003 the market value of the Repsol shares was U.S. $19.47 per share. These swaps matured in January 2004 and they were not renewed.

F-32

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

(vii) Fair value of derivative financial instruments

The fair value of derivative instruments is sensitive to movements in the underlying market rates and variables. PEMEX monitors the fair value of derivative financial instruments on a periodic basis. The fair value of foreign currency, commodity and interest rate financial derivatives is monitored on a periodic basis ranging from daily to at least quarterly. Fair values are calculated for each derivative financial instrument, which is the price at which one party would assume the rights and duties of another party. Fair values of financial derivatives have been calculated using common market valuation methods with reference to available market data as of the balance sheet date.

Fair value for instruments designated as non-market interest rate hedging instruments was calculated discounting the future cash flows at its present value, using the market interest rate for the remaining period of the instrument. Cash flows discounted for interest rate swaps are determined for each individual transaction at the balance sheet date.

The following is a summary of the methods and assumptions for the valuation of utilized derivative financial instruments.

| | • | Currency, gas and product swaps are valued separately at future rates or market prices as of the balance sheet date. The fair values of spot and forward contracts are based on spot prices that consider forward premiums or discounts from quoted prices in the relevant markets when possible. |

| | | |

| | • | Market prices for currency and gas options are valued using standard option-pricing models commonly used in the market. |

| | | |

| | • | The fair values of existing instruments to hedge interest rate risk were determined by discounting future cash flows using market interest rates over the remaining term of the instrument. Discounted cash values are determined for interest rate and cross-currency swaps for each individual transaction as of the balance sheet date. Interest exchange amounts are considered with an effect on current results at the date of payment or accrual. Market values for interest rate options are determined on the basis of quoted market prices or on calculations based on option pricing models. |

| | | |

| | • | Energy future contracts are valued individually at daily settlement prices determined on the futures markets that are published by their respective clearing houses. |

F-33

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

The following table indicates the types of current swaps, their notional amount and fair value at December 31:

| | | 2003 | | 2002 | |

| | |

| |

| |

| | | Notional amount | | Fair value | | Notional amount | | Fair value | |

| | |

|

| |

|

| |

|

| |

|

| |

| Interest rate swaps | | Ps. | 4,112,960 | | Ps. | (225,736 | ) | Ps. | 4,332,558 | | Ps. | (350,371 | ) |

| Equity swaps | | | 8,173,190 | | | 598,006 | | | 6,851,222 | | | (1,208,844 | ) |

The following table indicates the types of cross-currency swaps and their respective notional amounts and fair values at December 31:

| | | 2003 | | 2002 | |

| | |

| |

| |

| | | Notional amount | | Fair value | | Notional amount | | Fair value | |

| | |

|

| |

|

| |

|

| |

|

| |

| British pounds to U.S. dollars | | Ps. | 8,195,089 | | Ps. | 830,026 | | Ps. | 2,104,037 | | Ps. | 28,524 | |

| Japanese yen to U.S. dollars | | | 14,825,716 | | | 1,844,856 | | | 15,707,986 | | | (57,673 | ) |

| Euro to U.S. dollars | | | 29,116,726 | | | 5,171,162 | | | 14,975,024 | | | (1,056,648 | ) |

The following table indicates the commodity derivative instruments, and their fair value at December 31, in thousands of U.S. dollars:

| | | 2003 | | 2002 | |

| | |

| |

| |

| | | Fair value | | Fair value | |

| | |

| |

| |

| Swaps | | US$ | (113,800) | | US$ | 166,234 | |

| Options | | | 6,380 | | | (8,781 | ) |

| Futures | | | 1,589 | | | (3,649 | ) |

Fair value of derivative financial instruments presented in the previous schedules is presented for information purposes only.

F-34

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

(viii) Fair value of financial instruments other than derivatives

The estimated fair value of financial instruments other than derivatives, for which it is practicable to estimate its value, as of December 31, 2003 and 2002 is as follows:

| | | 2003 | | 2002 | |

| | |

| |

| |

| | | Carrying value | | Fair value | | Carrying value | | Fair value | |

| | |

|

| |

|

| |

|

| |

|

| |

| Assets: | | | | | | | | | | | | | |

| Cash and cash equivalents | | Ps. | 73,336,397 | | Ps. | 73,336,397 | | Ps. | 45,621,193 | | Ps. | 45,621,193 | |

| Accounts receivable, notes and other | | | 70,212,832 | | | 70,212,832 | | | 70,212,832 | | | 70,212,832 | |

| | |

|

| |

|

| |

|

| |

|

| |

Liabilities:

Suppliers | | Ps. | 33,541,237 | | Ps. | 33,541,237 | | Ps. | 30,434,568 | | Ps. | 30,434,568 | |

| Accounts payable | | | 7,339,932 | | | 7,339,932 | | | 7,000,103 | | | 7,000,103 | |

| Sale of future accounts receivable | | | 40,457,075 | | | 40,457,075 | | | 45,166,232 | | | 45,166,232 | |

| Taxes payable | | | 36,643,996 | | | 36,643,996 | | | 27,778,263 | | | 27,778,263 | |

| Short-term debt | | | 57,503,476 | | | 57,503,476 | | | 51,465,139 | | | 51,465,139 | |

| Notes payable to contractors short-term | | | 1,887,150 | | | 1,887,150 | | | 1,640,274 | | | 1,640,274 | |

| Notes payable to contractors long-term | | | 13,139,589 | | | 15,639,257 | | | 28,509,738 | | | 32,295,581 | |

| Long-term debt | | | 303,613,091 | | | 325,338,757 | | | 198,645,005 | | | 211,724,375 | |

| | |

|

| |

|

| |

|

| |

|

| |

The reported carrying value of financial instruments such as cash equivalents, accounts receivable and payable, taxes payable and short-term debt approximate fair value because of their short maturities.

The fair value of long-term debt is determined by reference to market quotes, and, where quotes are not available, is based on discounted cash flow analyses. Because assumptions significantly affect the derived fair value and they are inherently subjective in nature, the estimated fair values cannot be substantiated by comparison to independent market quotes and, in many cases, the estimated fair values would not necessarily be realized in an immediate sale or settlement of the instrument.

11. Reserve for retirement payments, pensions and seniority premiums

PEMEX has labor obligations for seniority premiums and pensions, according to regulations established by the Ley Federal del Trabajo (the “Federal Labor Law”), and provisions in the individual and collective labor contracts. This compensation is only payable after the worker or employee has worked a certain number of years. Benefits are based on the employee’s compensation as of his retirement date, as well as the number of years of service. PEMEX has established a reserve for retirement and seniority premium benefits, determined by independent actuaries. The reserve is calculated by independent third party actuaries using the projected unit-credit method.

F-35

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

In 2003, PEMEX amended its pension and other post retirement benefits plans. The net cost of the plan recorded in the consolidated statements of operations amounted to Ps. 38,938,604, Ps. 39,711,998 and Ps. 38,020,657 in 2003, 2002 and 2001, respectively.

The amount of benefits projected for pensions and seniority premiums, determined by independent actuaries, is as follows:

| | | 2003 | | 2002 | |

| | |

|

| |

|

| |

| Obligation for current benefits | | Ps. | 298,918,138 | | Ps. | 272,046,398 | |

| Additional amount for projected benefits | | | 14,443,993 | | | 7,303,724 | |

| | |

|

| |

|

| |

| Projected benefit obligation | | | 313,362,131 | | | 279,350,122 | |

| Less: | | | | | | | |

| Plan assets (trust funds) | | | 13,148,657 | | | 6,865,808 | |

| | |

|

| |

|

| |

| | | | 300,213,474 | | | 272,484,314 | |

| Transition liability to be amortized over the following 15 years, actuarial gains or losses, prior service costs and plan amendments | | | 133,753,206 | | | 127,368,263 | |

| | |

|

| |

|

| |

| Net projected liability | | | 166,460,268 | | | 145,116,051 | |

| Additional minimum liability | | | 119,309,221 | | | 120,065,003 | |

| | |

|

| |

|

| |

| Accumulated obligation | | Ps. | 285,769,489 | | Ps. | 265,181,054 | |

| | |

|

| |

|

| |

Net cost for the year is comprised as follows:

| | | 2003 | | 2002 | | 2001 | |

| | |

|

| |

|

| |

|

| |

| Service cost | | Ps. | 7,493,503 | | Ps. | 7,061,838 | | Ps. | 6,432,943 | |

| Financial cost | | | 23,058,739 | | | 25,793,820 | | | 25,198,747 | |

| Gain of plan assets | | | (1,029,529 | ) | | (715,319 | ) | | (1,124,603 | ) |

| Amortization of transition obligation | | | 7,638,880 | | | 1,233,101 | | | 1,380,737 | |

| Prior services and plan changes | | | 344,877 | | | 5,350,289 | | | 1,693,537 | |

| Actuarial (gains) losses | | | (54,950 | ) | | 988,269 | | | 4,439,296 | |

| Inflation adjustment | | | 1,487,084 | | | | | | | |

| | |

|

| |

|

| |

|

| |

| Net cost for the year | | Ps. | 38,938,604 | | Ps. | 39,711,998 | | Ps. | 38,020,657 | |

| | |

|

| |

|

| |

|

| |

F-36

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

Actuarial assumptions used in the calculation of net seniority premium and pension plan cost for the years 2003 and 2002, are the following:

| Expected long-term rate of return on assets | | 5.50 | % |

| Interest rate | | 4.59 | % |

| Rate of increase in compensation levels | | 0.92 | % |

12. Comprehensive loss

Comprehensive loss for the years ended December 31, 2003, 2002 and 2001 is analyzed as follows:

| | | 2003 | | 2002 | | 2001 | |

| | |

|

| |

|

| |

|

| |

| Net loss for the year | | Ps. | (40,644,363 | ) | Ps. | (24,574,040 | ) | Ps. | (30,395,660 | ) |

| Effect of restatement of the year, net | | | 5,635,367 | | | (4,195,728 | ) | | (5,653,186 | ) |

| (Application) increase in specific oil-field exploration and depletion reserve, net | | | (13,053,826 | ) | | 1,817,371 | | | 3,942,596 | |

| Other equity movements (1) | | | | | | 42,243 | | | 598,284 | |

| | |

|

| |

|

| |

|

| |

| Comprehensive loss for the year | | Ps. | (48,062,822 | ) | Ps. | (26,910,154 | ) | Ps. | (31,507,966 | ) |

| | |

|

| |

|

| |

|

| |

(1) Represents primarily translation adjustments from non-Mexican subsidiaries.

13. Equity

On December 31, 1990, certain debt owed by Petróleos Mexicanos to the Mexican Government was capitalized as equity. This capitalization amounted to Ps. 22,334,195 in nominal terms (U.S. $7,577,000) and was authorized by the Board of Directors. The capitalization agreement between Petróleos Mexicanos and the Mexican Government stipulates that the Certificates of Contribution “A” constitute permanent capital.

As a condition of this capitalization, Petróleos Mexicanos agreed to pay a minimum guaranteed dividend to the Mexican Government equal to the debt service for the capitalized debt. The minimum guaranteed dividend consists of the payment of principal and interest in the same terms and conditions as those originally agreed upon with international creditors until the year 2006, at the exchange rates in effect as of the date payments are made. Such payments must be approved annually by the Board of Directors.

F-37

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

In December 1997, the Board of Directors and the Mexican Government agreed to an equity reduction of the Certificates of Contribution “A” in exchange for a cash payment to the Mexican Government of Ps. 12,118,050 in nominal terms (U.S. $1,500,000). Petróleos Mexicanos and SHCP agreed upon a corresponding reduction in the future payments of the minimum guaranteed dividend. As a result, the Certificates of Contribution “A” are as follows:

| Certificates of Contribution “A” (nominal value) | | Ps. | 10,222,463 | |

| Inflation restatement increase | | | 72,397,776 | |

| | |

|

| |

| Certificates of Contribution “A” in Mexican pesos of December 31, 2003 purchasing power | | Ps. | 82,620,239 | |

| | |

|

| |

During 2003, Petróleos Mexicanos paid Ps. 10,175,024 (Ps. 10,098,227 during 2002) to the Mexican Government in advance on account of the minimum guaranteed dividend. These payments will be applied to the final amount that the Board of Directors approves as the total annual dividend, which is usually in the following fiscal year.

14. Foreign currency position

PEMEX has the following assets and liabilities denominated in foreign currencies, which are stated in thousands of Mexican pesos at the exchange rate prevailing at December 31, 2003 and 2002:

| | | Amounts in foreign currency

(Thousands) | | | | | |

| | |

| | | | | |

| | | Assets | | Liabilities | | Long (short)

position | | Exchange

rate | | Amounts in pesos | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

2003: | | | | | | | | | | | | | | | | |

| U.S. dollars | | | 5,779,829 | | | 29,843,201 | | | (24,063,372 | ) | | 11.2360 | | Ps. | (270,376,048 | ) |

| | |

|

| |

|

| |

|

| | | | | | | |

| Japanese yen | | | | | | 194,226,518 | | | (194,226,518 | ) | | 0.1048 | | | (20,354,939 | ) |

| | |

|

| |

|

| |

|

| | | | | | | |

| Pounds sterling | | | 260 | | | 452,718 | | | (452,458 | ) | | 20.0922 | | | (9,090,877 | ) |

| | |

|

| |

|

| |

|

| | | | | | | |

| Euros | | | 279,441 | | | 2,670,519 | | | (2,391,078 | ) | | 14.1630 | | | (33,864,838 | ) |

| | |

|

| |

|

| |

|

| | | | |

|

| |

| Net-short position, before foreign-currency hedging (Note 10) | | | | | | | | | | | | | | Ps. | (333,686,702 | ) |

| | | | | | | | | | | | | | |

|

| |

2002: | | | | | | | | | | | | | | | | |

| U.S. dollars | | | 12,969,633 | | | 32,372,228 | | | (19,402,595 | ) | | 10.3125 | | Ps. | (200,089,261 | ) |

| | |

|

| |

|

| |

|

| | | | | | | |

| Japanese yen | | | 102,593,907 | | | 204,882,010 | | | (102,288,103 | ) | | 0.0869 | | | (8,888,836 | ) |

| | |

|

| |

|

| |

|

| | | | | | | |

| Pound sterling | | | 125,208 | | | 125,479 | | | (271 | ) | | 16.6217 | | | (4,504 | ) |

| | |

|

| |

|

| |

|

| | | | | | | |

| Swiss francs | | | | | | 669 | | | (669 | ) | | 7.4572 | | | (4,989 | ) |

| | |

|

| |

|

| |

|

| | | | | | | |

| Dutch guilders | | | 40 | | | | | | 40 | | | 4.9044 | | | 196 | |

| | |

|

| |

|

| |

|

| | | | | | | |

| Euros | | | 1,318,788 | | | 1,369,405 | | | (50,617 | ) | | 10.8188 | | | (547,615 | ) |

| | |

|

| |

|

| |

|

| | | | |

|

| |

| Net-short position, before foreign-currency hedging (Note 10) | | | | | | | | | | | | | | Ps. | (209,535,009 | ) |

| | | | | | | | | | | | | | |

|

| |

F-38

PETRÓLEOS MEXICANOS, SUBSIDIARY ENTITIES AND SUBSIDIARY COMPANIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS

ENDED DECEMBER 31, 2003, 2002 AND 2001

(Amounts expressed in thousands of Mexican pesos of December 31, 2003

purchasing power and thousands of U.S. dollars or other currency units)

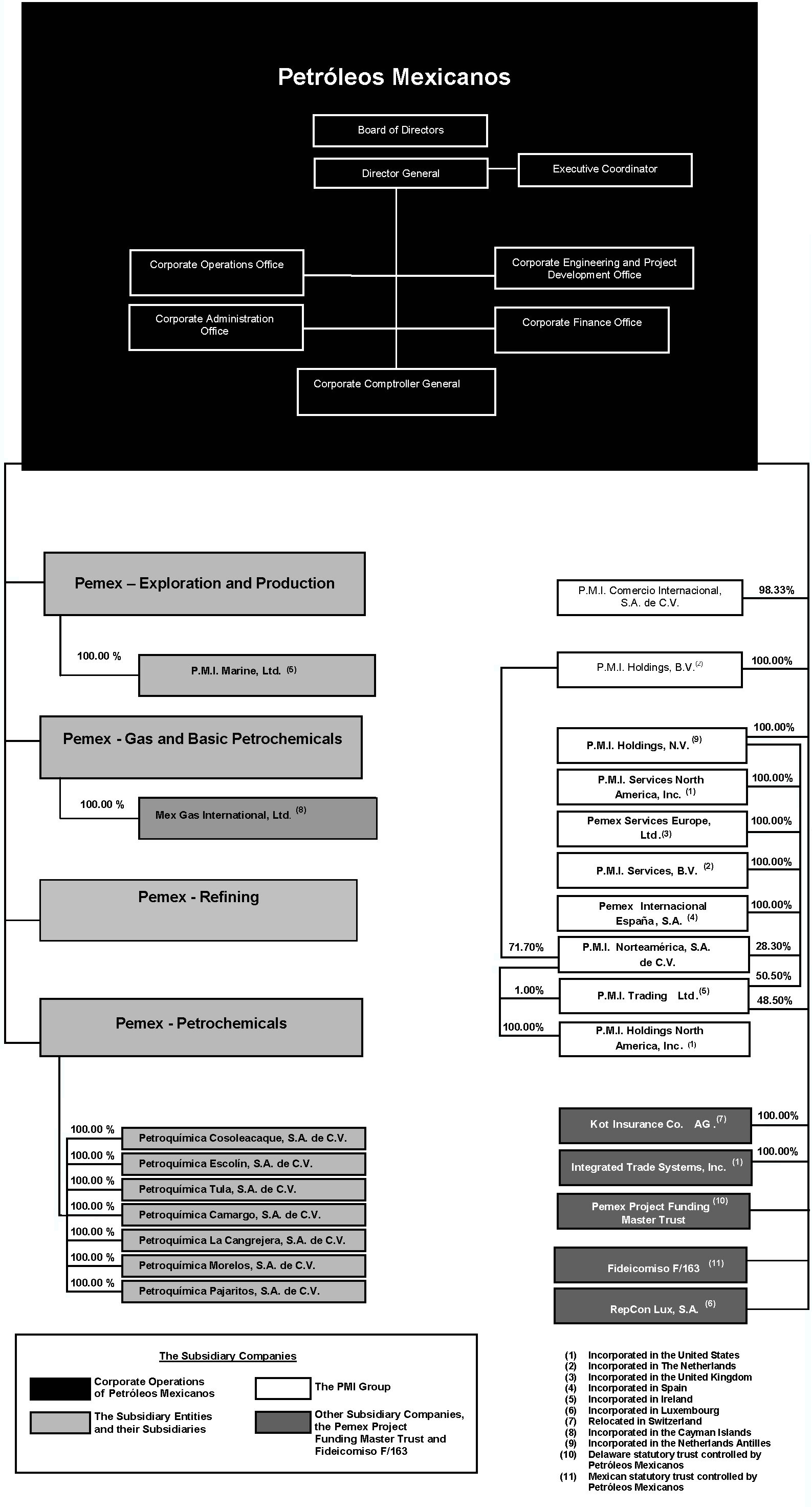

15. Segment financial information

PEMEX’s primary business is the exploration for and production of the crude oil and natural gas and the refining and marketing of petroleum products conducted through four business segments: Pemex-Exploration and Production, Pemex-Refining, Pemex-Gas and Basic Petrochemicals and Pemex-Petrochemicals. Management makes decisions related to the operations of the consolidated business along these four strategic lines.

The primary sources of revenue for the segments are as described below:

Pemex-Exploration and Production earns revenues from domestic crude oil sales, as well as, from the export of crude oil, through PMI, to international markets. Export sales are made through PMI to approximately 25 major customers in various foreign markets. Less than half (approximately 45%) of PEMEX crude is sold domestically; however, these amounts are in large part sufficient to satisfy Mexican domestic demand.

| • | Pemex-Refining earns revenues from sales of refined petroleum products and derivatives. Most of Refining’s sales are to third parties and occur within the domestic market. The entity supplies the Comisión Federal de Electricidad (“CFE”) with a significant portion of its fuel oil production. Pemex-Refining’s most profitable products are gasolines. |

| | |