UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2006

Commission File Number 0-99

PETROLEOS MEXICANOS

(Exact name of registrant as specified in its charter)

MEXICAN PETROLEUM

(Translation of registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

Avenida Marina Nacional No. 329

Colonia Huasteca

Mexico, D.F. 11311

Mexico

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes No X

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

| Investor Relations (5255) 1944 9700 ri@dcf.pemex.com |

March 1, 2006

PEMEX unaudited financial results report as of December 31, 2005

Financial highlights | PEMEX, Mexico’s oil and gas company and the ninth integrated oil company1, headed by Luis Ramírez Corzo, announced its unaudited consolidated financial results as of December 31, 2005. | |

ª Total sales increased 16%, as compared to 2004, reaching Ps. 928.4 billion (US$86.1 billion) | ||

ª Income before taxes and duties increased 13%, as compared to 2004, to Ps. 535.3 billion (US$49.7 billion) | ||

ª Net loss was Ps. 40.5 billion (US$3.8 billion) | ||

Table 1

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Financial results summary

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||||||||

Total sales | 215,650 | 255,392 | 18 | % | 39,742 | 23,696 | 799,368 | 928,448 | 16 | % | 129,079 | 86,145 | ||||||||||||||||||

Domestic sales(1) | 124,155 | 136,476 | 10 | % | 12,321 | 12,663 | 463,977 | 504,865 | 9 | % | 40,888 | 46,844 | ||||||||||||||||||

Exports | 91,495 | 118,916 | 30 | % | 27,421 | 11,034 | 335,392 | 423,583 | 26 | % | 88,191 | 39,302 | ||||||||||||||||||

Income before taxes and duties(1) | 132,458 | 122,781 | -7 | % | (9,676 | ) | 11,392 | 474,615 | 535,317 | 13 | % | 60,702 | 49,669 | |||||||||||||||||

Taxes and duties | 132,642 | 158,305 | 19 | % | 25,663 | 14,688 | 490,142 | 578,261 | 18 | % | 88,119 | 53,653 | ||||||||||||||||||

Net income (loss) | (185 | ) | (37,527 | ) | (37,343 | ) | (3,482 | ) | (26,345 | ) | (40,459 | ) | (14,114 | ) | (3,754 | ) | ||||||||||||||

EBITDA(2) | 145,645 | 139,938 | -4 | % | (5,707 | ) | 12,984 | 514,613 | 618,484 | 20 | % | 103,871 | 57,386 | |||||||||||||||||

EBITDA / Interest expense(3) | 13.1 | 22.9 | 15.7 | 13.2 | ||||||||||||||||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of December 31, 2005. |

| (1) | Includes the Special Tax on Production and Services (IEPS), which was Ps. 7,941 million in fourth quarter of 2004 and Ps. 1,953 million in the fourth quarter of 2005. |

| (2) | Excludes IEPS. |

| (3) | Excludes capitalized interest. |

Note: Numbers may not total due to rounding.

Operational highlights | ª | In 2005, natural gas production reached a historical high averaging 4,818 million cubic feet per day (MMcfd)

| ||

| ª | The number of operating wells reached a historical high of 5,925. Likewise, the number of wells drilled reached a record level of 742 | |||

| ª | With the implementation of the Safety, Health and Environmental Protection Program (SSPA, as abbreviated in Spanish), in 2005 the accident frequency rate decreased 29%, as compared to 2004 | |||

| 1 | Petroleum Intelligence Weekly Ranking, December 2005. |

| PEMEX | Investor Relations |

Operating items

Exploration and production

Crude oil production averaged 3,333 Mbd | During 2005 crude oil production averaged 3,333 thousand barrels per day (Mbd) 1% below the 3,383 Mbd average for the 2004. Light and extra-light crude oil production increased 2% and 7%, respectively. Nevertheless, heavy crude oil production decreased 3%.

| |

| Among the main factors that affected crude oil production during 2005 are: | ||

• Adverse weather conditions, in particular, hurricanes Emily, Katrina, Rita, Stan and Wilma, which caused decreases in production as a result of temporary shut-downs and inventory accumulations (56.3 Mbd) | ||

• Infrastructure works at Ku-Maloob-Zaap (5.8 Mbd) | ||

• The production increase of light and extra-light crude was due to the progress in the completion and workover of wells at the complexes Bellota-Jujo, Samaria-Luna and Litoral de Tabasco

The accumulation of inventories was a consequence of the interruption of crude oil shipments due to the damage sustained by some refineries in the United States of America, with which PEMEX has commercial agreements. It should be highlighted that the hurricanes did not cause any damage to the infrastructure of PEMEX. | ||

Table 2

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Production of liquid hydrocarbons

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mbd) | (Mbd) | |||||||||||||||||||

Liquid hydrocarbons | 3,793 | 3,732 | -2 | % | (61 | ) | 3,834 | 3,769 | -2 | % | (65 | ) | ||||||||

Crude oil | 3,346 | 3,306 | -1 | % | (39 | ) | 3,383 | 3,333 | -1 | % | (50 | ) | ||||||||

Heavy | 2,429 | 2,323 | -4 | % | (105 | ) | 2,458 | 2,387 | -3 | % | (71 | ) | ||||||||

Light | 775 | 818 | 5 | % | 42 | 790 | 802 | 2 | % | 13 | ||||||||||

Extra-light | 141 | 165 | 17 | % | 24 | 135 | 144 | 7 | % | 9 | ||||||||||

Natural gas liquids(1) | 447 | 426 | -5 | % | (21 | ) | 451 | 435 | -3 | % | (15 | ) | ||||||||

| (1) | Includes condensates. |

Note: Numbers may not total due to rounding.

Natural gas production increased 5%, | In 2005, natural gas production increased 5%, as compared to 2004. Non-associated gas production increased 19%, while associated gas production decreased 2%. The annual growth resulted from the addition of new development wells and infrastructure works at the Burgos and Veracruz basins. | |

| Gas flaring | In 2005, gas flaring represented 3.8% of total natural gas production. The increase with respect to the 2004 was due to: | |

• Repairs on a 48 inch natural gas pipeline that runs from the Dos Bocas Marine Terminal to the compression facilities in Cunduacán | ||

• Maintenance works at the Akal-J4 platform in the Cantarell complex | ||

PEMEX financial results report as of December 31, 2005 | 2/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 3

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Production of natural gas and gas flaring

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | ||||||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | ||||||||||||||||||

| (MMcfd) | (MMcfd) | ||||||||||||||||||||||

Total | 4,586 | 4,928 | 7 | % | 342 | 4,573 | 4,818 | 5 | % | 245 | |||||||||||||

Associated | 2,961 | 2,972 | 0.4 | % | 11 | 3,010 | 2,954 | -2 | % | (56 | ) | ||||||||||||

Non-associated | 1,625 | 1,956 | 20 | % | 331 | 1,563 | 1,864 | 19 | % | 301 | |||||||||||||

Natural gas flaring | 132 | 193 | 46 | % | 60 | 153 | 182 | 19 | % | 30 | |||||||||||||

Gas flaring / total production | 2.9 | % | 3.9 | % | 3.3 | % | 3.8 | % | |||||||||||||||

Note: Numbers may not total due to rounding.

Operating wells reached a historical high | During 2005, the number of operating wells reached a historical high of 5,925. Likewise, the number of wells drilled reached a record level of 742.

| |

Total drilling activity increased by 15 wells; development wells increased by 44 while exploratory wells decreased by 29.

| ||

The increase in development wells was mainly due to:

| ||

• Higher availability of drilling equipment in projects like Burgos and Veracruz | ||

• Greater drilling activity in projects like Jujo-Tecominoacan, Ku-Maloob-Zaap and El Golpe-Puerto Ceiba | ||

| The decrease in exploratory wells was mainly attributed to: | ||

• Completion and reclassification of exploratory well as development wells | ||

• Adjustments in the exploratory strategy | ||

• Fewer budgetary resources allocated to this activity | ||

Table 4

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Drilling activity and inventory of wells

Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| �� | 2004 | 2005 | Change | 2004 | 2005 | Change | ||||||||||||||

| (Number of wells) | (Number of wells) | |||||||||||||||||||

Wells drilled | 184 | 181 | -2 | % | (3 | ) | 727 | 742 | 2 | % | 15 | |||||||||

Development | 157 | 159 | 1 | % | 2 | 624 | 668 | 7 | % | 44 | ||||||||||

Exploration | 27 | 22 | -19 | % | (5 | ) | 103 | 74 | -28 | % | (29 | ) | ||||||||

Total operating wells(1) | 5,448 | 5,925 | 9 | % | 477 | |||||||||||||||

Injection | 231 | 254 | 10 | % | 23 | |||||||||||||||

Production | 5,217 | 5,671 | 9 | % | 454 | |||||||||||||||

Crude | 2,986 | 3,128 | 5 | % | 142 | |||||||||||||||

Non-associated gas | 2,231 | 2,543 | 14 | % | 312 | |||||||||||||||

| (1) | As of December 31, 2005. |

Note: Numbers may not total due to rounding.

PEMEX financial results report as of December 31, 2005 | 3/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Seismic studies | In 2005, 2D seismic information was 3,678 km and 3D seismic information totaled 6,843 km2. The decrease in these activities was principally a result of the transition of the projects to the interpretation and analysis phases. | |

New approved locations | In 2005, new approved locations totaled 156. Alike seismic information, the decrease was a result of the transition of the projects to the interpretation and analysis phases. | |

Table 5

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Seismic studies

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Seismic | ||||||||||||||||||||

2D (Km.) | 4,140 | 352 | -92 | % | (3,789 | ) | 11,688 | 3,678 | -69 | % | (8,010 | ) | ||||||||

3D (Km2) | 2,658 | 183 | -93 | % | (2,475 | ) | 26,379 | 6,843 | -74 | % | (19,536 | ) | ||||||||

New approved locations (number) | 139 | 79 | -43 | % | (60 | ) | 238 | 156 | -34 | % | (82 | ) | ||||||||

Note: Numbers may not total due to rounding.

| Discoveries | Our main discoveries in the fourth quarter of 2005 were: |

Table 6

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Main discoveries

Project | 4Q05 | Geologic age | Initial production | Type | ||||

Campeche Oriente | Pit-1 | Cretaceous | 2.2 Mbd | Heavy crude | ||||

Campeche Oriente | Ichalkil-1 | Cretaceous | 1.8 Mbd | Light crude | ||||

Crudo Ligero Marino | Xanab-1 | Cretaceous | 4.3 Mbd | Light crude | ||||

Burgos | Niquel-1 | Oligocene | 3.8 MMcfd | Non-associated natural gas | ||||

Burgos | Antiguo-8 | Paleocene | 4.3 MMcfd | Non-associated natural gas | ||||

Burgos | Caravana-1 | Paleocene | 4.7 MMcfd | Non-associated natural gas | ||||

Veracruz | Huace-1 | Miocene | 5.3 MMcfd | Non-associated natural gas |

PEMEX financial results report as of December 31, 2005 | 4/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

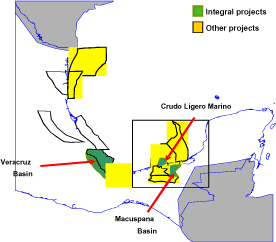

Strategic Gas Program | The objective of the Strategic Gas Program (SGP) is to increase proved natural gas reserves and natural gas production.

| |

The SGP contemplates exploration and production activities, where exploration is focused on high potential regions for their subsequent development and production includes activities aimed at optimizing the development of existing natural gas fields.

| ||

The SGP began operating in the middle of 2001, with an average production of 19 MMcfd of natural gas, and included 20 projects:

| ||

• 3 integral projects – exploration and development – (Veracruz Basin, Macuspana Basin and Crudo Ligero Marino) | ||

• 10 exploratory projects | ||

• 7 development projects | ||

| The SGP includes projects in three of the four operating regions of PEMEX (North Region, South Region, Southwest Marine Region and Northeast Marine Region). | ||

| In the North Region, the SGP has advanced substantially with the development of the Cocuite field and with exploratory discoveries such as Papán, Playuela, Vistoso Apertura, Arquimia, Lizamba and Madera, which are part of the Veracruz Basin project. | ||

| In the South Region, there have been important discoveries such as an additional block at the San Manuel project, and the Shishito, Saramako and Viche fields in the Macuspana Basin. In terms of development, through new investments, PEMEX seeks to overhaul production at the Narváez and Cafeto fields. | ||

| In the Southeast Marine Region, the program includes Crudo Ligero Marino and Ixtal-Manik projects. The former comprises the Sinán, May, Yum, Kab, Citam and Bolontiku fields. The later includes the Ixtal and Manik fields. | ||

| During the 2001 – 2005 period, PEMEX completed the following activities: | ||

• Drilling and completion of 140 exploratory wells and 263 development wells | ||

• 205 major workovers to development wells | ||

• The acquisition of 879 km and 27,857 km of 2D and 3D seismic information | ||

• The construction of 199 infrastructure works (pipelines and facilities) | ||

| In 2005, the SGP reached production of approximately 1,113 MMcfd of natural gas and is currently comprised of 18 projects: | ||

• 3 integral projects – exploration and production – | ||

• 12 exploratory projects | ||

• 3 development projects | ||

PEMEX financial results report as of December 31, 2005 | 5/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Over the long term, the SGP has engaged in the following activities: | ||

• Drilling and completion of 842 exploratory wells and 165 development wells | ||

• 154 well workovers | ||

• The acquisition of 1,600 km and 6,559 km2 of 2D and 3D seismic information | ||

• The construction of development infrastructure | ||

| In 2008, the SGP is expected to reach natural gas production of around 2,000 MMcfd, and in 2015, peak production of 2,800 MMcfd. | ||

| During the period 2006 – 2019, total investment is estimated to be approximately US$27 billion. | ||

Figure 1

Main projects of the Strategic Gas Program

Cantarell project | Studies of the field forecast that 2006 production will be approximately 1,905 Mbd. This volume is 6% lower as compared to 2005. For 2007 and 2008, estimated production is 1,683 and 1,430 Mbd, respectively, if required investment amounts are attained. | |

Multiple Service Contracts | During the first quarter of 2005, PEMEX held public bids for three blocks under its Multiple Service Contracts scheme in the Burgos basin.

| |

• The Pirineo block was awarded for US$645 million

| ||

• The Monclova block contract was not signed due to events beyond PEMEX’s control | ||

• No proposals were submitted for the Ricos block | ||

| PEMEX will examine the utility of participating in future bidding processes for the blocks that were not awarded. | ||

PEMEX financial results report as of December 31, 2005 | 6/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Nitrogen injection plant | During the first quarter of 2005, PEMEX commenced the construction of the nitrogen injection plant for the Antonio J. Bermúdez complex. The project is expected to be completed in 2007 and is designed to help increase hydrocarbon production in this complex. |

Gas and basic petrochemicals

Gas processing and dry gas production | In 2005, sweet wet gas processing increased 18% due to the increase in non-associated natural gas production at the Burgos and Veracruz Basins and to the stable operation of the modular cryogenic plants 1 and 2 at the Burgos Gas Processing Center (GPC).

| |

| On-shore sour wet gas processing decreased 6% as a result of: | ||

• Lower supply of sour wet gas off-shore as a result of production shut-downs caused by high inventories | ||

• Higher volume of natural gas processed at the off-shore gas treatment facility within Akal-C, in the Cantarell complex. Natural gas processed off-shore is re-injected into the wells in order to improve production | ||

| Despite the reduction in supply of sour wet gas, dry gas production increased 1%; nonetheless, the production of natural gas liquids decreased 3%. | ||

Table 7

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Natural gas processed and dry gas production

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (MMcfd) | (MMcfd) | |||||||||||||||||||

On-shore gas processed | 3,968 | 3,862 | -3 | % | (106 | ) | 3,963 | 3,879 | -2 | % | (84 | ) | ||||||||

Sour wet gas | 3,297 | 3,124 | -5 | % | (173 | ) | 3,349 | 3,153 | -6 | % | (196 | ) | ||||||||

Sweet wet gas | 672 | 739 | 10 | % | 67 | 614 | 726 | 18 | % | 112 | ||||||||||

Production | ||||||||||||||||||||

Dry gas | 3,193 | 3,183 | -0.3 | % | (10 | ) | 3,144 | 3,147 | 0.1 | % | 3 | |||||||||

Natural gas liquids (Mbd)(1) | 447 | 426 | -5 | % | (21 | ) | 451 | 435 | -3 | % | (15 | ) | ||||||||

| (1) | Includes condensates. |

| Note: | Numbers may not total due to rounding. |

PEMEX financial results report as of December 31, 2005 | 7/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Infrastructure works | In order to expand sweet wet gas processing capacity in Northern Mexico, two new modular cryogenic plants, plants 3 and 4, at the Burgos Gas Processing Center (GPC) are expected to start operating in the first nine months of 2006. The construction of the cryogenic plants 3 and 4 commenced in late 2004 and early 2005, respectively, and similar to the modular cryogenic plants 1 and 2, plants 3 and 4 will have a processing capacity of 200 MMcfd of sweet wet gas. | |

| By the end of 2005, PEMEX obtained the necessary authorization to build a liquefied petroleum gas (LPG) pipeline, which will transport up to 30 Mbd of LPG from the Burgos GPC to the city of Monterrey. | ||

| Similarly, with the purpose of increasing efficiency in the distribution of dry gas and LPG, PEMEX began the process of updating and modernizing the SCADA (Supervisory, Control and Data Acquisition) System which is used for “real-time” monitoring of the operating conditions of the pipeline system. | ||

| During the first six months of 2006, PEMEX expects to begin the construction of the Emiliano Zapata Compression Station in the State of Veracruz. This compression station will help increase the transportation of dry gas from the South to Central and Northern Mexico. | ||

| In August 2005, the sulfur recovery plant at La Cangrejera Gas Processing Center (GPC) began operations. This plant has a nominal capacity of 10 tons per day and it is designed to recover 96% of the sulfur content of the acid gas stream coming from the sweetening section of the fractionation plant located in La Cangrejera GPC. As a result, maximum dioxide sulfur emissions will be 50kg per ton of sulfur processed. This figure is less than 50% of the maximum amount set by the Mexican Official Norm NOM-137-SEMARNAT-2003 and international standards. | ||

Refining

Crude oil processing decreased 1% | Total crude oil processing decreased 1% in 2005. Heavy currents processing declined 0.2% and light currents processing decreased 2%. The reduction in crude oil processing was mainly a consequence of:

| |

• An increase in pipeline maintenance works as compared to 2004 due to the implementation of the Safety, Health and Environmental Protection Program (SSPA) | ||

• Adverse weather conditions in the Gulf of Mexico | ||

• Supply disruptions in electric power | ||

• Refining maintenance works | ||

PEMEX financial results report as of December 31, 2005 | 8/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 8

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Crude oil processing

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mbd) | (Mbd) | |||||||||||||||||||

Total processed | 1,247 | 1,236 | -1 | % | (12 | ) | 1,303 | 1,284 | -1 | % | (19 | ) | ||||||||

Heavy Currents | 540 | 521 | -3 | % | (18 | ) | 543 | 542 | -0.2 | % | (1 | ) | ||||||||

Light Currents | 708 | 714 | 1 | % | 7 | 760 | 743 | -2 | % | (18 | ) | |||||||||

Note: Numbers may not total due to rounding.

Capacity utilization | Primary distillation capacity utilization rate decreased 1%, from 84.6% in 2004 to 83.4% in 2005. This reduction was the result of a lower processing of heavy currents. | |

Refining production | As a result of the decrease in crude oil processing, in 2005, gasoline, fuel oil and diesel production decreased 3%, 5% and 2%, respectively, as compared to 2004. Other factors that resulted in lower fuel oil production are the stabilization of the coking process in the Madero and the Cadereyta refineries and higher asphalt output. | |

Table 9

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Refining production

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mbd) | (Mbd) | |||||||||||||||||||

Total production | 1,529 | 1,522 | -0.5 | % | (8 | ) | 1,587 | 1,554 | -2 | % | (33 | ) | ||||||||

Gasolines | 451 | 440 | -3 | % | (11 | ) | 468 | 456 | -3 | % | (12 | ) | ||||||||

Fuel oil | 354 | 343 | -3 | % | (11 | ) | 368 | 351 | -5 | % | (17 | ) | ||||||||

Diesel | 316 | 327 | 3 | % | 11 | 325 | 318 | -2 | % | (6 | ) | |||||||||

Liquefied petroleum gas (LPG) | 248 | 239 | -4 | % | (9 | ) | 253 | 246 | -3 | % | (7 | ) | ||||||||

Jet Fuel | 55 | 62 | 13 | % | 7 | 62 | 63 | 2 | % | 1 | ||||||||||

Other(1) | 105 | 111 | 6 | % | 6 | 112 | 120 | 8 | % | 9 | ||||||||||

| (1) | Includes mainly parafines, furfural extract and aeroflex. |

| Note: | Numbers may not total due to rounding. |

Variable refining margin increased72% | The variable refining margin is an estimate of the operating income per barrel of crude oil processed. The operating income is calculated as total revenues minus the cost of:

| |

• Inputs

| ||

• Natural gas and fuel oil used to operate the refineries

| ||

• Electric power, water and catalysts (auxiliary services) | ||

| In 2005 the variable refining margin increased by 72% as compared to 2004, from US$4.27 per barrel to US$7.24 per barrel. This increase was primarily a result of higher prices of refined products. | ||

| Franchises | As of December 31, 2005, the number of franchised gas stations rose 7% to 7,172, from 6,732 as of December 31, 2004. | |

PEMEX financial results report as of December 31, 2005 | 9/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Petrochemicals

| Production | In 2005, petrochemicals production decreased 1% as compared to 2004. The reduction was mainly due to lower production of methane derivatives originated by the high natural gas prices observed in 2005. Even so, low density polyethylene and ethylene production increased as a consequence of: | |

• The expansion of the production lines in the low density polyethylene plant in La Cangrejera Petrochemical Center | ||

• Higher production of vinyl chloride in the Pajaritos Petrochemical Center | ||

| Propylene and derivatives production decreased due to unfavorable conditions in the acrylonitrile market, originated by high propylene prices. | ||

Table 10

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Production of petrochemicals

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

| (Mt) | (Mt) | |||||||||||||||||||

Total production | 2,809 | 2,644 | -6 | % | (165 | ) | 10,731 | 10,603 | -1 | % | (128 | ) | ||||||||

Methane derivatives | ||||||||||||||||||||

Ammonia | 222 | 114 | -48 | % | (108 | ) | 681 | 514 | -25 | % | (168 | ) | ||||||||

Methanol | 38 | — | — | 165 | 81 | -51 | % | (84 | ) | |||||||||||

Ethane derivatives | ||||||||||||||||||||

Ethylene | 243 | 280 | 15 | % | 37 | 1,007 | 1,085 | 8 | % | 78 | ||||||||||

Ethylene oxide | 82 | 62 | -25 | % | (20 | ) | 299 | 321 | 7 | % | 21 | |||||||||

Low density polyethylene | 67 | 83 | 24 | % | 16 | 262 | 296 | 13 | % | 34 | ||||||||||

High density polyethylene | 46 | 45 | -4 | % | (2 | ) | 181 | 169 | -7 | % | (12 | ) | ||||||||

Vinyl chloride | 69 | — | — | 63 | 159 | 151 | % | 96 | ||||||||||||

Aromatics and derivatives | ||||||||||||||||||||

Toluene | 62 | 62 | 0 | % | (0 | ) | 214 | 253 | 18 | % | 38 | |||||||||

Ethylbenzene | 48 | 41 | -15 | % | (7 | ) | 179 | 155 | -13 | % | (24 | ) | ||||||||

Benzene | 44 | 34 | -24 | % | (11 | ) | 136 | 160 | 18 | % | 24 | |||||||||

Propylene and derivatives | ||||||||||||||||||||

Acrylonitrile | 18 | 10 | -45 | % | (8 | ) | 72 | 63 | -12 | % | (9 | ) | ||||||||

Polypropylene | 104 | 92 | -12 | % | (12 | ) | 416 | 380 | -9 | % | (37 | ) | ||||||||

Others(1) | 1,835 | 1,753 | -4 | % | (82 | ) | 7,055 | 6,968 | -1 | % | (87 | ) | ||||||||

| (1) | Includes glycols, heavy reformed, oxygen, hydrogen, nitrogen, clorhidric acid, muriatic acid, hexane, heptanes and others. |

| Note: | Numbers may not total due to rounding. |

| Fénix project | The new scope of the Fénix project includes the expansion of ethylene crackers at La Cangrejera and Morelos Petrochemical Centers from 600 to 875 Mt per year each. The expanded facilities will require natural gasolines, which will be supplied by PEMEX and were previously exported, due to the lack of processing capacity. | |

| The intermediate petrochemicals products derived from the aforementioned expansions will be used as inputs for a polyethylene plant and a new aromatics production line that PEMEX expects to construct in alliance with national and international companies. | ||

PEMEX financial results report as of December 31, 2005 | 10/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

New petrochemical plant | In 2006, PEMEX expects to begin operations of a “swing” plant at the Morelos Petrochemical Center in Coatzacoalcos, Veracruz. The plant will have a production capacity of 300 Mt per year of either low density linear polyethylene or high density polyethylene. Total investment is expected to be Ps. 1.1 billion (US$0.1 billion). | |

Petrochemicals merger | On September 15, 2005, the Ministry of Energy requested a six-months extension to carry out the merger of the seven subsidiaries of Pemex Petroquímica, in accordance with a resolution published in the Official Gazette of the Federation (Diario Oficial de la Federacíon) on September 15, 2004. | |

International trade2

Crude oil exports averaged 1,817 Mbd | In 2005, PEMEX’s crude oil exports averaged 1,817 Mbd, 3% lower than the volume registered in 2004. Approximately 84% of total crude oil exports were heavy crude oil (Maya), while the rest consisted of light and extra-light crude oil (Isthmus and Olmeca).

| |

| In 2005, 78% of the total crude oil exports were delivered to the United States of America, while the remaining 22% were distributed among Europe (11%), the rest of America (9%) and the Far East (2%). | ||

| The weighted average export price of the Mexican crude oil basket was US$42.69 per barrel, as compared to US$31.05 per barrel in 2004. | ||

Exports of refined products and petrochemicals | In 2005, exports of refined products averaged 186 Mbd, 23% higher as compared to 2004. This was due to higher availability of long residue, jet fuel and naphtha. Petrochemicals exports decreased by 7%, or 63 Mt, totaling 853 Mt. This was attributable to higher inventories. | |

Table 11

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Exports(1)

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Crude oil exports (Mbd)(2) | ||||||||||||||||||||

Total | 1,968 | 1,888 | -4 | % | (81 | ) | 1,870 | 1,817 | -3 | % | (53 | ) | ||||||||

Heavy | 1,676 | 1,508 | -10 | % | (168 | ) | 1,622 | 1,520 | -6 | % | (101 | ) | ||||||||

Light | 63 | 172 | 172 | % | 108 | 27 | 81 | 196 | % | 54 | ||||||||||

Extra-light | 229 | 208 | -9 | % | (21 | ) | 221 | 216 | -3 | % | (6 | ) | ||||||||

Average price (US$/b) | 33.45 | 45.54 | 36 | % | 12 | 31.05 | 42.69 | 37 | % | 12 | ||||||||||

Refined products (Mbd) | 136 | 192 | 41 | % | 56 | 152 | 186 | 23 | % | 34 | ||||||||||

Petrochemicals (Mt) | 223 | 174 | -22 | % | (48 | ) | 916 | 853 | -7 | % | (63 | ) | ||||||||

| (1) | Source: PMI. Does not consider third party operations by PMI. |

| (2) | Excludes the volume of crude oil under processing agreements. |

| Note: | Numbers may not total due to rounding. |

| 2 | Source: PMI. |

PEMEX financial results report as of December 31, 2005 | 11/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Imports | In 2005, natural gas imports averaged 480 MMcfd, 37% lower than the average registered during 2004. The decreased was due to higher production and lower domestic demand. | |

| Imports of refined products increased 26%, from 310 Mbd to 392 Mbd. The increase was primarily a result of higher gasoline and diesel imports originated by higher domestic demand. | ||

| Imports of petrochemicals imports increased 92%, as compared to 2004, to 397 Mt. | ||

Table 12

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Imports(1)

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Natural gas (MMcfd) | 801 | 284 | -65 | % | (517 | ) | 766 | 480 | -37 | % | (285 | ) | ||||||||

Refined products (Mbd)(2) | 392 | 450 | 15 | % | 58 | 310 | 392 | 26 | % | 81 | ||||||||||

Petrochemicals (Mt) | 70 | 159 | 127 | % | 89 | 207 | 397 | 92 | % | 191 | ||||||||||

| (1) | Source: PMI except natural gas imports. Does not consider third party operations by PMI. |

| (2) | Includes the volume of imported products under processing agreements. Also, 111 Mbd and 103 Mbd of LPG for the fourth quarter of 2004 and 2005, respectively; and 84 Mbd and 73 Mbd of LPG for the January - December period of 2004 and 2005, respectively. |

Note: Numbers may not total due to rounding.

Industrial Safety

| SSPA | In May 2005, PEMEX began the implementation of the Safety, Health and Environmental Protection Program (SSPA). Through this Program several actions were identified and put into practice to limit the quantity and severity of personal and industrial incidents in PEMEX. | |

| The implementation of the SSPA is expected to last three years. PEMEX plans to achieve zero incidents, injuries, emissions of pollutants and illnesses for all of its work centers. | ||

| The SSPA includes the 12 world best preventive and corrective safety practices, as well as the revision of and adherence to: | ||

• Root-cause analysis | ||

• Process safety management, with strong emphasis on mechanical integrity | ||

• Environment protection | ||

• Occupational health | ||

• Operational discipline | ||

• Effective audits | ||

• Emergency response plans | ||

• Tests of protection and risk analysis systems | ||

PEMEX financial results report as of December 31, 2005 | 12/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Lower accident frequency rate | During 2005, PEMEX’s accident frequency rate decreased as a result of the implementation of the SSPA. The frequency rate decreased by 29% as compared to 2004, from 1.50 to 1.06 per million man hour worked with exposure to risk. | |

| Some of the measures that have helped diminish the accident frequency rate were the 53 immediate assessment trips to PEMEX’s critical facilities. | ||

Financial results as of December 31, 2005

Total sales

| IEPS | In 2005, Petróleos Mexicanos and its subsidiary entities pay taxes and duties equivalent to 60.8% of total sales3, plus an excess gains duty applicable to crude oil exports. This fiscal regime included the special tax on production and services (IEPS) that applies to gasoline and automotive diesel. | |

| The IEPS is paid by the end consumer of gasoline and automotive diesel and PEMEX is an intermediary between the Ministry of Finance (SHCP) and the end consumer: | ||

• The Ministry of Finance determines the retail prices of gasoline and diesel based on the expected level of inflation | ||

• PEMEX’s producer price of gasoline and diesel is referenced to international benchmarks plus logistics | ||

| The difference between the retail price and producer price is: | ||

• IEPS | ||

• Transportation cost to the service station | ||

• Value Added Tax (VAT) | ||

• Service Margin | ||

| With the exception of the IEPS, the VAT, the service margin and the transportation costs are pre-established percentages. Therefore, when crude oil price and the producer price of gasoline and diesel is high, the IEPS decreases and vice versa. | ||

| During 2005, PEMEX could not incorporate the increase of the producer price of gasoline and diesel in their respective retail prices. PEMEX’s total sales would have been Ps. 24.2 billion higher if these changes would have been incorporated. | ||

| 3 | PEMEX’s subsidiary companies that are located in México pay corporate income tax on the same basis as private sector companies in México. |

PEMEX financial results report as of December 31, 2005 | 13/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| The aforementioned will not take place in 2006 given a recent modification to Mexico’s Income Law, starting January 1, 2006, which establishes that when the producer price of gasoline and diesel is higher than the domestic retail price, the amount corresponding to the IEPS will be credited against the other taxes and duties paid by PEMEX. | ||

| Subsidies | PEMEX subsidizes marine and agricultural diesel as well gasoline used in fishing activities, natural gas and liquefied petroleum gas (LPG) | |

Table 13

Impact on sales for not reflecting the cost increase registered in 2005

| Domestic sales | Imports | Retail price(1),(3) | Producer price | Opportunity cost | Accounting loss | |||||||||

| (Mbd) | (Mbd) | (Ps. per liter) | (Ps. per liter) | (Ps. mm) | (Ps. mm) | |||||||||

Gasoline(2) | 671.3 | 163.9 | 4.83 | 5.09 | (10,341 | ) | (2,525 | ) | ||||||

Diesel | 320.1 | 21.4 | 4.32 | 5.06 | (13,841 | ) | (925 | ) | ||||||

LPG | 313.6 | 72.9 | 2.71 | 2.97 | (4,674 | ) | (1,086 | ) | ||||||

| (MMcfd) | (MMcfd) | (US$ per MMBtu) | (US$ per MMBtu) | (Ps. mm) | (Ps. mm) | |||||||||

Natural gas | 2,632.4 | 480.4 | 7.62 | 8.05 | (4,501 | ) | (821 | ) | ||||||

Total | (33,357 | ) | (5,358 | ) | ||||||||||

| (1) | For gasoline and diesel, PEMEX retail price does not include IEPS, value added tax (VAT), service margin and transportation to the service station. |

| (2) | As an estimate, 50% of total imports are Pemex Magna gasoline, 47% Pemex Premium gasoline and the remaining 3% components used in the elaboration of gasoline. |

| (3) | For natural gas, the reference price in Reynosa, Tamaulipas. |

| Total sales | In 2005, total sales including IEPS increased by 16% in constant pesos, from Ps. 799.4 billion in 2004 to Ps. 928.4 billion (US$86.1 billion). | |

| Domestic sales | In 2005, domestic sales, including IEPS, increased 9%, from Ps. 464.0 billion to Ps. 504.9 billion (US$46.8 billion). Domestic sales, net of IEPS, increased 19%, from Ps. 407.4 billion to Ps. 484.9 billion (US$45.0 billion). | |

| If PEMEX had incorporated the increase in the producer price of gasoline and diesel, its domestic sales, net of IEPS, would have increased 25%, or Ps. 101.6 billion. This percent change would have been comparable to the observed on cost of sales, which was 25%. | ||

• Natural gas sales increased 10% to Ps. 81.1 billion (US$7.5 billion) from Ps. 73.5 billion. Natural gas sales volume decreased 4% to 2,632 MMcfd from 2,756 MMcfd. The average sales price of natural gas in 2005 was US$7.62 per million British Thermal Units (MMBtu) as compared to US$6.60 per MMBtu in 2004 | ||

PEMEX financial results report as of December 31, 2005 | 14/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

• Sales of refined products, net of IEPS, grew 21% to Ps. 382.0 billion (US$35.4 billion) from Ps. 314.9 billion. Refined products sales volume increased 3% to 1,772 Mbd, from 1,719 Mbd. The IEPS generated by these sales decreased 65% to Ps. 20.0 billion (US$1.9 billion) from Ps. 56.5 billion. Sales of refined products, including IEPS, increased 8% to Ps. 402.0 billion (US$37.3 billion) from Ps. 371.4 billion | ||

• Petrochemical sales increased 14% to Ps. 21.8 billion (US$2.0 billion) from Ps. 19.1 billion. Petrochemicals sales volume increased 6% to 3,749 Mt from 3,531 Mt | ||

Table 14

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Domestic sales

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||

Domestic sales including IEPS | 124,155 | 136,476 | 10 | % | 12,321 | 12,663 | 463,977 | 504,865 | 9 | % | 40,888 | 46,844 | ||||||||||||

Domestic sales without IEPS | 116,214 | 134,523 | 16 | % | 18,309 | 12,482 | 407,449 | 484,895 | 19 | % | 77,446 | 44,991 | ||||||||||||

Natural gas | 20,521 | 23,585 | 15 | % | 3,064 | 2,188 | 73,495 | 81,082 | 10 | % | 7,587 | 7,523 | ||||||||||||

Refined products including IEPS | 97,854 | 107,005 | 9 | % | 9,151 | 9,928 | 371,425 | 401,964 | 8 | % | 30,540 | 37,296 | ||||||||||||

Refined products | 89,913 | 105,052 | 17 | % | 15,138 | 9,747 | 314,897 | 381,994 | 21 | % | 67,097 | 35,443 | ||||||||||||

IEPS | 7,941 | 1,953 | -75 | % | (5,987 | ) | 181 | 56,528 | 19,970 | -65 | % | (36,558 | ) | 1,853 | ||||||||||

Gasoline | 43,739 | 52,503 | 20 | % | 8,764 | 4,871 | 153,562 | 188,136 | 23 | % | 34,574 | 17,456 | ||||||||||||

Diesel | 19,873 | 21,114 | 6 | % | 1,241 | 1,959 | 65,105 | 80,226 | 23 | % | 15,121 | 7,444 | ||||||||||||

LPG | 12,455 | 13,835 | 11 | % | 1,381 | 1,284 | 44,749 | 49,386 | 10 | % | 4,636 | 4,582 | ||||||||||||

Other | 13,846 | 17,599 | 27 | % | 3,753 | 1,633 | 51,481 | 64,247 | 25 | % | 12,766 | 5,961 | ||||||||||||

Petrochemical products | 5,781 | 5,887 | 2 | % | 106 | 546 | 19,057 | 21,819 | 14 | % | 2,762 | 2,024 | ||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of December 31, 2005. |

Note: Numbers may not total due to rounding.

Table 15

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Volume of domestic sales(1)

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||

| 2004 | 2005 | Change | 2004 | 2005 | Change | |||||||||||||||

Natural gas (MMcfd) | 2,760 | 2,506 | -9 | % | (254 | ) | 2,756 | 2,632 | -4 | % | (124 | ) | ||||||||

Refined products (Mbd) | 1,754 | 1,794 | 2 | % | 41 | 1,719 | 1,772 | 3 | % | 53 | ||||||||||

Gasoline | 663 | 699 | 5 | % | 36 | 636 | 671 | 6 | % | 35 | ||||||||||

Diesel | 315 | 331 | 5 | % | 16 | 303 | 320 | 6 | % | 17 | ||||||||||

LPG | 341 | 330 | -3 | % | (11 | ) | 328 | 314 | -4 | % | (14 | ) | ||||||||

Other | 434 | 434 | -0.1 | % | (0.3 | ) | 452 | 467 | 3 | % | 14 | |||||||||

Petrochemicals (Mt) | 921 | 920 | -0.03 | % | (0.3 | ) | 3,531 | 3,749 | 6 | % | 218 | |||||||||

Note: Numbers may not total due to rounding.

PEMEX financial results report as of December 31, 2005 | 15/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

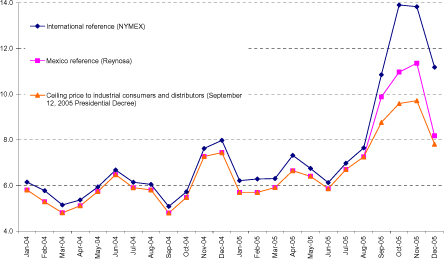

Natural gas prices | In 2005, the average sales price of natural gas was US$7.62 per MMBtu, while in 2004 the average price was US$6.60 MMBtu. | |

| In accordance with a Presidential Decree of September 12, 2005, the price to industrial consumers and distributors was equivalent to the price in Reynosa, Tamaulipas in august 2005 (US$7.253 per MMBtu) plus 21% of the difference between the current Reynosa price and 7.253; 21% was the percentage of natural gas imported. Almost half of the domestic natural gas sales volume was destined to industrial consumers and distributors. | ||

| During the fourth quarter of 2005, the established price was 77% of the actual market price (US$10.17 per MMBtu). | ||

Figure 2

Natural gas prices

(US$ per MMBtu)

PEMEX financial results report as of December 31, 2005 | 16/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| 2005 exports | In 2005, export sales totaled Ps. 423.6 billion (US$39.3 billion), 26% higher than the Ps. 335.4 billion registered in 2004. The distribution of export sales in 2005, as compared to 2004, was as follows: | |

• Crude oil and condensates export sales increased 24% to Ps. 378.9 billion (US$35.2 billion) from Ps. 305.0 billion. Crude oil exports volume fell 3% to 1,817 Mbd from 1,870 Mbd | ||

• Refined products export sales rose 47% to Ps. 40.8 billion (US$3.8 billion) from Ps. 27.7 billion. Refined products exports volume grew 23% to 186 Mbd from 152 Mbd | ||

• Petrochemical products export sales increased 41% to Ps. 3.8 billion (US$0.4 billion) from Ps. 2.7 billion. Petrochemical products exports volume decreased 7% to 853 Mt from 916 Mt | ||

Table 16

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Exports

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||

Total exports | 91,495 | 118,916 | 30 | % | 27,421 | 11,034 | 335,392 | 423,583 | 26 | % | 88,191 | 39,302 | ||||||||||

Crude oil and condensates | 84,144 | 106,104 | 26 | % | 21,961 | 9,845 | 305,007 | 378,949 | 24 | % | 73,942 | 35,160 | ||||||||||

Refined products | 6,659 | 12,040 | 81 | % | 5,381 | 1,117 | 27,680 | 40,815 | 47 | % | 13,134 | 3,787 | ||||||||||

Petrochemical products | 692 | 771 | 11 | % | 79 | 72 | 2,705 | 3,819 | 41 | % | 1,114 | 354 | ||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of December 31, 2005. |

Note: Numbers may not total due to rounding.

Costs and operating expenses

Costs and expenses | In 2005, costs and operating expenses increased 24%, or Ps. 80.4 billion, as compared to 2004, reaching Ps. 409.4 billion (US$38.0 billion). The increase was mainly due to: | |

• A 45% increase, or Ps. 53.3 billion, in imports of products | ||

• A 28% increase, or Ps. 12.1 billion, in depreciation and amortization | ||

• A 15% increase, or Ps. 11.4 billion, in operating expenses | ||

• A 21% increase, or Ps. 9.5 billion, in the cost of the reserve for retirement payments, pensions and indemnities | ||

• A 63% increase, or Ps. 5.2 billion, in exploration and non-successful drilling expenses | ||

• A 108% decrease, or Ps 6.3 billion, in the variation of inventories due to an increase in prices in 2005 as compared to 2004 | ||

• A 15% decrease, or Ps. 5.2 billion, in upkeep and maintenance, mainly in operational maintenance | ||

PEMEX financial results report as of December 31, 2005 | 17/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

| Cost of sales | Cost of sales increased 25%, or Ps. 69.0 billion, to Ps. 341.9 billion (US$31.7 billion). The increase was the result of the following: | |

• A 45% increase, or Ps. 53.3 billion, in imports of products | ||

• A 30% increase, or Ps. 12.2 billion, in depreciation and amortization | ||

• A 14% increase, or Ps. 6.1 billion, in operating expenses | ||

• A 63% increase, or Ps. 5.2 billion, in exploration and non-successful drilling expenses | ||

• A 15% increase, or Ps. 4.0 billion, in the cost of the reserve for retirement payments, pensions and indemnities | ||

• A 108% decrease, or Ps 6.3 billion, in the variation of inventories due to an increase in prices in 2005 as compared to 2004 | ||

• A 17% decrease, or Ps. 5.7 billion, in upkeep and maintenance, mainly in operational maintenance | ||

Distribution expenses | In 2005, transportation expenses increased 13%, from Ps. 18.2 billion to Ps. 20.5 billion (US$1.9 billion). The increase was mainly due to a 15% growth, or Ps. 1.7 billion, in shipping expenses. | |

Administrative expenses | Administrative expenses increased 24%, from Ps. 37.9 billion to Ps. 47.0 billion (US$4.4billion). This was primarily attributable to the impact of the cost of the reserve for retirement payments, pensions and indemnities: | |

• An increase of Ps. 5.0 billion due to the natural growth of the cost of the reserve for retirement payments, pensions and indemnities, mainly due to the incorporation of medical services | ||

• An increase of Ps. 3.6 billion due to reclassifications that modified the proportions allocated of the cost of the reserve for retirement payments, pensions and indemnities | ||

Cost of the reserve for retirement payments | In 2005, the cost of the reserve for retirement payments, pensions and indemnities increased 21%, from Ps. 46.0 billion to Ps. 55.5 billion (US$5.1billion). This increase is mainly explained by:

| |

• An initial effect of approximately Ps. 8.7 billion due to the adoption of new accounting principles in 2004 which incorporated medical services into the reserve in accordance to the Bulletin D-3 “Labor Obligations” | ||

• A increase of Ps. 0.8 billion due to the natural growth of the cost of the reserve for retirement payments, pensions and indemnities | ||

| Similarly, also in accordance to the Bulletin D-3 “Labor Obligations”, starting 2005, PEMEX must have a reserve for the conclusion of labor relations which will be reflected as an initial effect due to the adoption of new accounting principles in 2005 of approximately Ps. 1.5 billion. | ||

Operating income

Operating income increased 10% | In 2005, operating income totaled Ps. 519.1 billion (US$48.2 billion), 10% higher than the registered in 2004 of Ps. 470.4 billion.

| |

| Excluding IEPS, operating income increased 21%, or Ps. 36.6 billion, to Ps. 499.1 billion (US$46.3 billion) from Ps. 413.8 billion. |

PEMEX financial results report as of December 31, 2005 | 18/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Comprehensive financing cost

| Reduction of comprehensive financing cost | In 2005, the comprehensive financing cost decreased Ps. 15.0 billion, from a cost of Ps. 7.3 billion to a revenue of Ps. 7.7 billion (US$0.7 billion). This reduction was caused by:

| |

• An increase of Ps. 3.0 billion in net interest expense | ||

• An increase of Ps. 21.5 billion in the net foreign exchange gain | ||

• A decrease of Ps. 3.5 billion in the monetary gain | ||

Net interest expense | Net interest expense -excluding capitalized interest- increased 13%, from Ps. 23.9 billion to Ps. 26.9 billion (US$2.5 billion). | |

| Interest expense increased Ps. 14.1 billion, while interest income increased Ps. 11.0 billion. | ||

| Since July 1, 2005, interest expense of Pemex Finance, Ltd. is consolidated in the financial statements of Petróleos Mexicanos. | ||

Foreign exchange gain | In 2005, net foreign exchange gain totaled Ps. 17.9 billion (US$1.7 billion) as compared to a net foreign exchange loss of Ps. 3.6 billion in 2004. | |

| This increase was primarily a consequence of the appreciation of the Mexican peso against the US dollar by 4.32% in 2005, as compared to a depreciation of 0.26% in 2004. | ||

| Monetary gain | The monetary gain was Ps. 16.7 billion (US$1.6 billion), representing a 17.1% decrease from the monetary gain of 2004. | |

| The decrease in the monetary gain was due to a decrease in inflation from 5.19% in 2004 to 3.33% in 2005. | ||

Table 17

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Comprehensive financing cost

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||||||||

Comprehensive financing cost | (1,809 | ) | (11,460 | ) | (9,651 | ) | (1,063 | ) | 7,283 | (7,670 | ) | (14,953 | ) | (712 | ) | |||||||||||||||

Interest income | (195 | ) | (5,235 | ) | (5,040 | ) | (486 | ) | (8,929 | ) | (19,956 | ) | (11,027 | ) | (1,852 | ) | ||||||||||||||

Interest expense | 11,136 | 6,116 | -45 | % | (5,020 | ) | 567 | 32,823 | 46,889 | 43 | % | 14,066 | 4,351 | |||||||||||||||||

Foreign exchange loss (gain) | (5,126 | ) | (1,552 | ) | 3,574 | (144 | ) | 3,586 | (17,864 | ) | (21,450 | ) | (1,657 | ) | ||||||||||||||||

Monetary loss (gain) | (7,625 | ) | (10,790 | ) | (3,166 | ) | (1,001 | ) | (20,198 | ) | (16,739 | ) | 3,459 | (1,553 | ) | |||||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of December 31, 2005. |

Note: Numbers may not total due to rounding.

PEMEX financial results report as of December 31, 2005 | 19/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Other revenues

Other net revenues in 2005 | Other net revenues decreased from Ps. 11.5 billion in 2004 to Ps. 8.6 billion (US$0.8 billion) in 2005.

| |

| The decrease was mainly due to higher expenses generated by natural gas hedging positions. |

Income before taxes and duties

Income before taxes in 2005 | Income before taxes and duties was Ps. 535.3 billion (US$49.7 billion), compared to Ps. 474.6 billion in 2004. The 13% increase was principally the result of:

| |

• An increase of Ps. 48.7 billion in operating income

| ||

• A decrease of Ps. 2.9 billion in other net revenues | ||

• A decrease of Ps. 15.0 billion in the comprehensive financing cost | ||

Taxes and duties

18% increase in 2005 | Taxes and duties increased 18%, from Ps. 490.1 billion in 2004 to Ps. 578.3 billion (US$53.7 billion) in 2005. | |

| IEPS | In 2005, the IEPS tax was Ps. 20.0 billion (US$1.9 billion), Ps. 36.6 billion lower than the IEPS registered in 2004. | |

Excess gains duty | In 2005, the excess gains duty replaced the prior duty for exploration, gas, refining and petrochemicals infrastructure (duty for infrastructure or AOI). The excess gains duty was equal to 39.2% of the revenues from crude oil export sales in excess of the threshold price set by the Mexican Government of US$23.00 per barrel. For 2005, the proceeds of this duty paid in excess of US$27.00 per barrel were allocated as follows: | |

• 50% to the investment in infrastructure in exploration, production, gas, refining and petrochemicals that Petróleos Mexicanos and its subsidiary entities undertake | ||

• 50% to programs and investment projects in infrastructure of the Federal States of the Mexican Republic | ||

| In 2005 the excess gains duty paid by PEMEX totaled Ps. 56.4 billion (US$5.2 billion) while in 2004, the duty for infrastructure totaled Ps. 35.6 billion. | ||

| The reimbursement of the excess gains duty in 2005 was Ps. 22.0 billion (US$2.0 billion). The reimbursements corresponding to the first six months of 2005 were used for investments in 2005, whereas the resources collected during the third and fourth quarters will be used in 2006. In addition, in accordance with the 2005 Federations Budget, in 2005 PEMEX received a reimbursement of Ps. 22.6 billion4. | ||

| 4 | Artículo 21 inciso “J” (Capítulo I “Disposiciones Generales”, Título II del Ejercicio por Resultados del Gasto Público en la Disciplina Presupuestaria, del Presupuesto de Egresos de la Federación 2005. |

PEMEX financial results report as of December 31, 2005 | 20/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 18

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Taxes and duties

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||

Total taxes and duties | 132,642 | 158,305 | 19 | % | 25,663 | 14,688 | 490,142 | 578,261 | 18 | % | 88,119 | 53,653 | ||||||||||||

Hydrocarbon extraction duties and other | 112,741 | 139,660 | 24 | % | 26,919 | 12,958 | 398,023 | 501,912 | 26 | % | 103,889 | 46,569 | ||||||||||||

Special Tax on Production and Services (IEPS) | 7,941 | 1,953 | -75 | % | (5,987 | ) | 181 | 56,528 | 19,970 | -65 | % | (36,558 | ) | 1,853 | ||||||||||

Excess gains duty(1) | 11,960 | 16,692 | 40 | % | 4,732 | 1,549 | 35,591 | 56,379 | 58 | % | 20,788 | 5,231 | ||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of December 31, 2005. |

| (1) | For 2004, amount represents the duty for infrastructure. |

Note: Numbers may not total due to rounding.

Net income

Net loss of Ps. 40.5 billion in 2005 | PEMEX registered a net loss of Ps. 40.5 billion (US$3.8 billion), compared to a net loss of Ps. 26.3 billion in 2004. The Ps. 14.1 billion increase in the net loss is explained by:

| |

• An increase of Ps. 48.7 billion in operating income. Excluding the costs of subsidies and the negative IEPS, the increase in operating income would have been Ps. 82.1 billion | ||

• A decrease of Ps. 15.0 billion in the comprehensive financing cost, mainly due to an increase in the foreign exchange gain of Ps. 21.5 billion | ||

• A decrease of Ps. 2.9 billion in other revenues | ||

• An increase of Ps. 88.1 billion in taxes and duties | ||

• An increase of Ps. 13.3 billion in the initial accumulated effect due to the adoption of new accounting principles | ||

PEMEX financial results report as of December 31, 2005 | 21/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

EBITDA

EBITDA increased 20% | In 2005 EBITDA increased 20%, from Ps. 514.6 billion to Ps. 618.5 billion (US$57.4 billion). EBITDA is reconciled to net loss as shown in the following table: |

Table 18

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

EBITDA reconciliation

| Fourth quarter (Oct. - Dec.) | Twelve months ending Dec. 31, | |||||||||||||||||||||||||||||

| 2004 | 2005 | Change | 2005 | 2004 | 2005 | Change | 2005 | |||||||||||||||||||||||

| (Ps. mm) | (US$mm) | (Ps. mm) | (US$mm) | |||||||||||||||||||||||||||

Net income (loss) | (185 | ) | (37,527 | ) | (37,343 | ) | (3,482 | ) | (26,345 | ) | (40,459 | ) | (14,114 | ) | (3,754 | ) | ||||||||||||||

+ Taxes and duties | 132,642 | 158,305 | 19 | % | 25,663 | 14,688 | 490,142 | 578,261 | 18 | % | 88,119 | 53,653 | ||||||||||||||||||

- Special Tax on Production and Services | 7,941 | 1,953 | -75 | % | (5,987 | ) | 181 | 56,528 | 19,970 | -65 | % | (36,558 | ) | 1,853 | ||||||||||||||||

(IEPS) | ||||||||||||||||||||||||||||||

+ Comprehensive financing cost | (1,809 | ) | (11,460 | ) | (9,651 | ) | (1,063 | ) | 7,283 | (7,670 | ) | (14,953 | ) | (712 | ) | |||||||||||||||

+ Depreciation and amortization | 10,345 | 17,758 | 72 | % | 7,413 | 1,648 | 43,249 | 55,331 | 28 | % | 12,082 | 5,134 | ||||||||||||||||||

+ Cost of the reserve for retirement payments | 12,593 | 12,813 | 2 | % | 220 | 1,189 | 45,994 | 55,476 | 21 | % | 9,482 | 5,147 | ||||||||||||||||||

- Initial cumulative effect due to the adoption of new accounting standards | 0.1 | (2,003 | ) | (2,003 | ) | (185.9 | ) | (10,818 | ) | 2,485 | 13,303 | 231 | ||||||||||||||||||

EBITDA | 145,645 | 139,938 | -4 | % | (5,707 | ) | 12,984 | 514,613 | 618,484 | 20 | % | 103,871 | 57,386 | |||||||||||||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of December 31, 2005. |

Note: Numbers may not total due to rounding.

Total assets

| Total assets increased 10% | As of December 31, 2005, total assets were Ps. 1,079.0 billion (US$100.1 billion), representing a 10%, or Ps. 99.9 billion, increase as compared to total assets as of December 31, 2004. The changes in the components of total assets were as follows: | |

• Cash and cash equivalents increased by 30%, or Ps. 26.2 billion | ||

• Accounts receivable increased by 13%, or Ps. 16.1 billion | ||

• The value of inventories increased by 37%, or Ps. 13.6 billion, as a result of higher hydrocarbon prices | ||

• Financial derivative instruments increased Ps. 12.6 billion | ||

• Properties and equipment increased by 6%, or Ps. 34.9 billion, reflecting new investments | ||

• Other assets decreased by 3%, or Ps. 3.4 billion, mainly as a result of the application of the new Bulletin D-3 “Labor Obligations”, which separates pensions from benefits and no longer requires a minimal reserve for benefits in the reserve for retirement payments, pensions and seniority premiums | ||

PEMEX financial results report as of December 31, 2005 | 22/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Total liabilities

Liabilities increased 12% | Total liabilities increased by 12% to Ps. 1,058.4 billion (US$98.2 billion)

| |

• Short-term liabilities increased by 23%, or Ps. 33.8 billion, to Ps. 179.0 billion (US$16.6 billion), primarily as a result of the increase in taxes payable and financial derivative instruments | ||

• Long-term liabilities increased by 10%, or Ps. 79.9 billion, to Ps. 879.4 billion (US$81.6 billion), due to the increase in long-term documented debt | ||

| Total debt is discussed at greater length under “Financing Activities”. | ||

Reserve for retirement payments | The reserve for retirement payments, pensions and seniority premiums increased by 13%, to Ps. 357.9 billion (US$33.2 billion) from Ps. 315.4 billion. The increase mainly resulted from one more year of the payroll seniority; changes in actuarial assumptions; the decrease of one year in the funding period; the difference between actual and expected wage negotiations and a decrease in the pension fund. | |

| As of today, PEMEX has not received the actuarial study to determine the reserve for retirement payments, pensions and seniority premiums. Therefore, its impact on the intangible asset and equity is not known with certainty. | ||

Equity

| Decrease of 40% | PEMEX’s equity decreased by 40%, or Ps. 13.8 billion, from Ps. 34.5 billion to Ps. 20.6 billion (US$1.9 billion). The change in equity was due to: | |

• An offsetting effect of Ps. 44.6 billion due to capitalized proceeds derived from the reimbursement of the Excess Gains Duty and theArtículo 21 inciso “J”5 | ||

• An increase of Ps. 51.2 billion in cumulative net losses | ||

• A decrease of Ps. 6.4 billion due to the application of the Bulletin C-10 “Derivative Financial Instruments and Hedge Operations” | ||

• A decrease of Ps. 0.8 billion due to the restatement of equity | ||

| 5 | Artículo 21 inciso “J” , Capítulo I “Disposiciones Generales”, Título II del Ejercicio por Resultados del Gasto Público en la Disciplina Presupuestaria, del Presupuesto de Egresos de la Federación 2005. |

PEMEX financial results report as of December 31, 2005 | 23/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Results by segment

Operating income | In 2005, the operating income of exploration and production increased Ps. 105 billion as compared to 2004. The operating losses in refining and petrochemicals increased Ps. 21.2 and Ps. 0.8 billion, respectively. The operating income of gas and basic petrochemicals decreased Ps. 4.2 billion. |

Changes in financial position

Funds provided by operating activities | In 2005, funds provided by operating activities totaled Ps. 15.2 billion (US$1.4 billion). The increase of Ps. 23.3 billion is primarily due to favorable variations in accounts receivable, suppliers and other liabilities, generating an increase of Ps. 54.0 billion in working capital. | |

Funds provided by financing activities | Funds provided by financing activities totaled Ps. 101.2 billion (US$9.4 billion). The increase was mainly due to financing activities and capitalized proceeds. | |

Funds used in investing activities | Funds used in investing activities totaled Ps. 90.2 billion (US$8.4 billion) as a result of an increase in fixed assets.

| |

| Taking into account exploration and non-successful drilling expenses, as well as non-capitalized maintenance, funds used in investing activities totaled Ps. 127.3 billion (US$11.8 billion). | ||

Change in functional currency

Functional currency of the Master Trust | As of November 1, 2005, the Pemex Project Funding Master Trust changed its functional currency for financial reporting under Mexican Generally Accepted Accounting Principles (Mexican GAAP) from US dollars to Mexican pesos, due to a recommendation by the external auditor. As of December 31, 2005, the estimated impact of this change totaled US$105 million and was registered in the comprehensive financing cost. |

Amendment of Annual Report on Form 20-F filed with the Securities and Exchange Commission (SEC)

20-F amendment | The United States Securities and Exchange Commission (SEC) periodically makes detailed comments to annual reports filed by companies with the United States and foreign private issuers. In 2005, the SEC commented on PEMEX’s 20-F as of December 31, 2004. As a result of the SEC comments, PEMEX filed two amendments that, among other things, corrected the company’s condensed consolidating financial statements contained in the notes to its consolidated financial statements, including columns for: (i) Petróleos Mexicanos (Corporate), (ii) Subsidiary Entities that guarantee PEMEX’s debt (Pemex Exploración y Producción, Pemex Gas y Petroquímica Básica and Pemex Refinación) and (iii) Pemex Petroquímica. |

PEMEX financial results report as of December 31, 2005 | 24/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Financing activities

Capital expenditure (CAPEX)

| 2005 CAPEX | Capital expenditures for 2005 totaled US$10.8 billion, based on an exchange rate of Ps. 11.6451 per US dollar. The allocation was as follows: | |

• Exploration and Production 89% | ||

• Refining 7% | ||

• Gas and basic petrochemicals 2% | ||

• Petrochemicals 1% | ||

• Others 1% | ||

| 83% of 2005 capital expenditures, i.e. US$9.0 billion, were in the form of PIDIREGAS. | ||

2006 CAPEX projected allocation | In 2006, projected capital expenditure is US$13.1 billion6, based on an exchange rate of Ps. 11.4 per dollar, and is expected to be allocated as follows:

| |

• Exploration and Production 79% | ||

• Refining 14% | ||

• Gas and basic petrochemicals 4% | ||

• Petrochemicals 2% | ||

• Others 1% | ||

| Nearly 84% of 2006 projected capital expenditures, i.e. US$11.0 billion, will be in the form of PIDIREGAS. | ||

Financing needs

Funds raised in 2005 | During 2005, US$10.1 billion were raised as follows:

| |

• US$2.6 billion in foreign capital markets offerings | ||

• US$3.8 billion in debt securities placed in the Mexican capital market | ||

• US$2.1 billion in bank loans | ||

• US$1.6 billion from export credit agencies (ECA’s) | ||

| The funds raised in 2005 exceeded the original 2005 financing program by US$1.6 billion. | ||

| Approximately 62% of this amount was raised in the international markets, and the remainder was raised in the Mexican market. | ||

6 Subject to approval by the Ministry of Finance

PEMEX financial results report as of December 31, 2005 | 25/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

2006 financing program

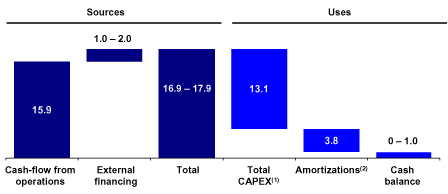

Use of cash flow from operations | For 2006, CAPEX and amortizations are expected to be approximately US$16.6 billion:

| |

PEMEX plans to finance the majority of its CAPEX and amortizations with cash flow from operations.

| ||

| In addition to cash flow from operations, PEMEX expects to obtain between US$1.0 and US$2.0 billion from external financing. The use of cash flow from operations to finance 2006 CAPEX and amortizations depends on: | ||

• Sufficient cash flow generation | ||

• Authorization to accomplish a US$13.1 billion CAPEX program | ||

• Authorization of a scheme to allow the utilization of resources from Petroleos Mexicanos to finance Pidiregas Projects | ||

| Depending on market conditions, PEMEX may enter into other types of operations in the international capital markets in order to refinance its debt. | ||

Figure 3

Financing Activities

MMMUS$

| (1) | Includes PIDIREGAS and Non-PIDIREGAS CAPEX |

| (2) | Includes minimum guaranteed dividends |

| Note: | The exchange rate used was Ps. 11.40 per dollar |

PEMEX financial results report as of December 31, 2005 | 26/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Capital markets

| Master Trust | During 2005, the Pemex Project Funding Master Trust, a Delaware trust controlled by, and whose debt is guaranteed by PEMEX, entered into the following financings: | |

• On February 24, 2005, it issued €1,000 million of notes with a 5.5% coupon due 2025 | ||

• On June 8, 2005, it issued US$1,500 million of notes divided in two tranches: | ||

– US$1,000 million with a 5.75% coupon due in 2015 | ||

– US$500 million with a 6.625% coupon due in 2035 | ||

• On August 31, 2005, it issued US$175 million of notes with a floating interest rate at LIBOR plus 0.425% due in 2008 | ||

• On December 1, 2005, it issued US$750 million of notes with a floating coupon rate at LIBOR plus 0.60% due in 2012 | ||

| On February 2, 2006, the Pemex Project Funding Master Trust issued US$1,500 million notes in a reopening of the two tranches issued on June 8, 2005: | ||

• US$750 million of notes with a 5.75% coupon due in 2015 | ||

• US$750 million of notes with a 6.625% coupon due in 2035 | ||

| F/163 | During 2005, Fideicomiso F/163, a Mexican trust controlled by, and whose debt is guaranteed by PEMEX, entered into the following financings: | |

• On February 1, 2005, it reopened an issuance denominated in UDI’s (Units of Investment or UDI’s) for an amount equivalent to Ps. 6,000 million with a 9.07% interest rate and a 15 year maturity | ||

• On February 11, 2005, it issued notes for Ps. 15,000 million in two tranches: | ||

– Ps. 7,500 million, with a floating coupon rate equal to 91 days CETES plus 0.51%, due in 2010 | ||

– Ps. 7,500 million, with a floating coupon rate equal to 182 days CETES plus 0.57%, due in 2013 | ||

• On May 13, 2005, it reopened the February 2005 issuance for Ps.10,000 million, divided in two tranches: | ||

– Ps. 5,013 million, with a yield equal to 91 days CETES plus 0.49%, due in 2010 | ||

– Ps. 4,987 million, with a yield equal to 182 days CETES plus 0.55%, due in 2013 | ||

• On July 29, 2005, it issued notes for Ps. 5,000 million with stripped coupons at 9.91%, due in 2015 | ||

• On October 21, 2005, it reopened the issuance of July 2005 by issuing Ps. 4,500 million of additional notes due 2015, and Ps.5,500 million of notes with a floating coupon rate equal to 91 days CETES plus 0.35%, due in 2011 | ||

PEMEX financial results report as of December 31, 2005 | 27/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Pemex Finance | On June 27, 2005, Pemex Finance, Ltd. redeemed the following series of its outstanding notes which were financially guaranteed by an insurance policy and therefore were rated AAA. The notes selected for redemption were trading in the secondary market at yields similar to those of the bonds that are not financially guaranteed by an insurance policy, and that are issued by other PEMEX financing vehicles. The approximate principal amount of the redeemed notes was US$994 million: | |

• US$194 million principal amount of 6.55% notes due 2008 | ||

• US$400 million principal amount of 6.30% notes due 2010 | ||

• US$250 million principal amount of 7.33% notes due 2012 | ||

• US$150 million principal amount of 7.80% notes due 2013 | ||

| The notes were redeemed at a price equal to the principal amount thereof plus accrued interest thereon and make-whole premium. The outstanding principal amount of the remaining Pemex Finance, Ltd. notes as of December 31, 2005, was US$2.3 billion with maturities between 2007 and 2018. | ||

Bank loans

Syndicated loan | On March 22, 2005, the Pemex Project Master Trust entered into a syndicated credit facility of US$4,250 million, divided into two tranches: | |

• US$2,177.5 million due 2010 bearing an interest rate of LIBOR plus 0.50% | ||

• US$2,072.5 million due 2012 bearing an interest rate of LIBOR plus 0.65% | ||

| Of the US$4,250 million obtained through this credit facility, US$2,177.5 million was used to refinance current syndicated credit facilities and the rest was used to finance capital expenditures. | ||

| In early March, 2006, PEMEX expects to obtain a new US$5,500 million syndicated credit facility. This facility is currently in the process of syndication and will be divided into a US$4,250 million long term loan and a US$1,250 million revolving facility (which will be discussed in the following section). US$4,250 million will be raised through the Project Funding Master Trust and will be used to refinance the syndicated loan signed on March 22, 2005. The US$4,250 million will be divided into two tranches: | ||

• US$1,500 million maturing in 2011 bearing an interest rate of LIBOR plus 0.40% | ||

• US$2,750 million bearing an interest rate of LIBOR plus 0.55%; US$1,375 million maturing in 2012 and US$1,375 million maturing in 2013 | ||

PEMEX financial results report as of December 31, 2005 | 28/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Revolving facility | On July 18, 2005, PEMEX amended a US$1,250 million revolving syndicated credit facility, which was originally signed in June 2004. The amendment included: | |

– A reduction in the interest rate margins over LIBOR payable | ||

– A reduction in the commitment fee | ||

– An increase of one year in the maturity of the facility | ||

| As mentioned above, PEMEX expects to obtain a new US$1,250 million syndicated credit facility in early March, 2006, under which borrowings may be made by either the Pemex Project Funding Master Trust or Petróleos Mexicanos. The facility will have a three year maturity and an interest rate of LIBOR plus 0.275%. | ||

| With this facility, PEMEX’s revolving credit facilities will total US$2,500 million | ||

Total debt

Total debt of US$49.9 billion | Total consolidated debt including accrued interest was Ps. 537.7 billion (US$49.9 billion). This figure represents an increase of 6%, or Ps.29.7billion, compared to figure registered as of December 31, 2004. Total debt includes:

| |

• Documented debt of Petróleos Mexicanos, the Pemex Project Funding Master Trust, Trust F/163, RepCon Lux S.A. and Pemex Finance, Ltd | ||

• Notes payable to contractors | ||

| On July 1, 2005, PEMEX entered into an option agreement with BNP Paribas Private Bank and Trust Cayman Limited to acquire 100% of the shares of Pemex Finance, Ltd. As a result, the financial results of Pemex Finance, Ltd., under Mexican GAAP, are consolidated into the financial statements of Petróleos Mexicanos. Consequently, sales of accounts receivable by Pemex Finance have been reclassified as documented debt. This option can only be exercised once the remaining debt of Pemex Finance, Ltd., which is approximately US$2.3 billion, has been redeemed. | ||

Net debt of US$39.3 billion | Net debt, or the difference between debt and cash equivalents, increased Ps. 3.5 billion, to Ps. 423.8 billion (US$ 39.3 billion) as of December 31, 2005, from Ps. 420.3 billion. | |

PEMEX financial results report as of December 31, 2005 | 29/55 | |||

| www.pemex.com | ||||

| PEMEX | Investor Relations |

Table 20

Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies

Consolidated total debt

| As of December 31, | ||||||||||||

| 2004 | 2005 | Change | 2005 | |||||||||

| (Ps. mm) | (US$mm) | |||||||||||

Documented debt(1) | 456,332 | 535,839 | 17 | % | 79,507 | 49,717 | ||||||

Short-term | 48,634 | 35,353 | -27 | % | (13,280 | ) | 3,280 | |||||

Long-term | 407,699 | 500,485 | 23 | % | 92,787 | 46,437 | ||||||

Notes payable to contractors | 13,807 | 1,851 | -87 | % | (11,956 | ) | 172 | |||||

Short-term | 2,146 | 744 | -65 | % | (1,402 | ) | 69 | |||||

Long-term | 11,661 | 1,107 | -91 | % | (10,554 | ) | 103 | |||||

Sale of future accounts receivable(2) | 37,857 | — | (37,857 | ) | — | |||||||

Long-term | 37,857 | — | (37,857 | ) | — | |||||||

Total debt | 507,996 | 537,690 | 6 | % | 29,694 | 49,889 | ||||||

Short-term | 50,779 | 36,097 | -29 | % | (14,683 | ) | 3,349 | |||||

Long-term | 457,216 | 501,593 | 10 | % | 44,376 | 46,540 | ||||||

Cash & cash equivalents | 87,701 | 113,892 | 30 | % | 26,191 | 10,567 | ||||||

Total net debt | 420,295 | 423,798 | 1 | % | 3,503 | 39,322 | ||||||

| * | Unaudited consolidated financial statements prepared in accordance with Mexican Generally Accepted Accounting Principles (Mexican GAAP) issued by the Instituto Mexicano de Contadores Públicos. Inflation recognition is also in accordance with Mexican GAAP. Accordingly, peso figures are presented in constant Mexican pesos as of December 31, 2005. |

| (1) | Consistent with debt figures presented in U.S. Securities and Exchange Commission filings. |

| (2) | Represents Pemex Finance debt. |

Note: Numbers may not total due to rounding.

Short-term debt | Total debt with a remaining maturity of less than twelve months was Ps. 36.1 billion (US$3.3 billion), including:

| |

• Ps. 35.4 billion (US$3.3 billion) in documented debt | ||

• Ps. 0.7 billion (US$0.07 billion) in notes payable to contractors | ||

Long-term debt | Total long-term debt was Ps. 501.6 billion (US$46.5 billion). This figure includes:

| |

• Ps. 500.5 billion (US$46.4 billion) in documented debt | ||