QuickLinks -- Click here to rapidly navigate through this documentRegistration No. 333-102993

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PETROLEOS MEXICANOS (MEXICAN PETROLEUM)

PEMEX-EXPLORACION Y PRODUCCION (PEMEX-EXPLORATION AND PRODUCTION)

PEMEX-REFINACION (PEMEX-REFINING)

and

PEMEX-GAS Y PETROQUIMICA BASICA (PEMEX-GAS AND BASIC PETROCHEMICALS)

(Exact names of Registrants as specified in their charters and translations of Registrants' names into English)

United Mexican States

(State or Other Jurisdiction

of Incorporation) | | 1311

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification Number) |

Mexican Petroleum

Avenida Marina Nacional No. 329

Colonia Huasteca

Mexico, D.F. 11311

Mexico

Telephone: (52-55) 5722-2500

(Address, including zip code, and telephone

number, including area code, of registrant's

principal executive offices) | | Pemex Exploration and Production

Avenida Marina Nacional No. 329

Colonia Huasteca

Mexico, D.F. 11311

Mexico

Telephone: (52-55) 5722-2500

(Address, including zip code, and telephone number,including area code, of registrant's principal executive offices) |

Pemex Refining

Avenida Marina Nacional No. 329

Colonia Huasteca

Mexico, D.F. 11311

Mexico

Telephone: (52-55) 5722-2500

(Address, including zip code, and telephone number,including area code, of registrant's principal executive offices) |

|

Pemex Gas and Basic Petrochemicals

Avenida Marina Nacional No. 329

Colonia Huasteca

Mexico, D.F. 11311

Mexico

Telephone: (52-55) 5722-2500

(Address, including zip code, and telephone

number, including area code, of registrant's principal

executive offices) |

| | | Copies to: |

Carlos Caraveo

P.M.I. Holdings North America, Inc.

909 Fannin, Suite 3200

Houston, Texas 77010

(Name, address and telephone number of agent for service) | | Wanda J. Olson

Cleary, Gottlieb, Steen & Hamilton

One Liberty Plaza

New York, New York 10006

Facsimile: 212-225-3999

|

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to be

Registered

| | Proposed Maximum Offering Price Per Unit(1)

| | Proposed Maximum Aggregate Offering Price(1)

| | Amount of

Registration Fee(1)

|

|---|

|

| 6.50% Notes due 2005 | | U.S. $600,000,000 | | 100% | | U.S. $600,000,000 | | U.S. $55,200 |

|

| Guaranties | | U.S. $600,000,000 | | — | | — | | None(2) |

|

- (1)

- The notes being registered are offered (i) in exchange for 6.50% Notes due 2005 previously sold in transactions exempt from registration under the Securities Act of 1933 and (ii) upon certain resales of the notes by broker-dealers. The registration fee has been computed based on the face value of the notes solely for the purpose of calculating the amount of the registration fee, pursuant to Rule 457 under the Securities Act of 1933.

- (2)

- Pursuant to Rule 457(n), no separate fee is payable with respect to the Guaranties.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

PETRÓLEOS MEXICANOS

CROSS REFERENCE SHEET

Pursuant to Item 501(b) of Regulation S-K and Rule 404(a)

| | Form F-4 and Caption

| | Location or Caption in Prospectus

|

|---|

| A. INFORMATION ABOUT THE TRANSACTION |

Item 1 |

|

Forepart of Registration Statement and Outside Front Cover Page of Prospectus |

|

Front Cover Page of Registration Statement; Cross Reference Sheet; Outside Front Cover Page of Prospectus |

| Item 2 | | Inside Front and Outside Back Cover Pages of Prospectus | | Inside Front Cover Page of Prospectus; Outside Back Cover Page of Prospectus; Available Information |

Item 3 |

|

Risk Factors, Ratio of Earnings to Fixed Charges and Other Information |

|

Outside Front Cover Page of Prospectus; Prospectus Summary; Risk Factors; Ratio of Earnings to Fixed Charges; Selected Financial Data; The Exchange Offer; Form 20-F—Item 4—Information on the Company—History and Development |

| Item 4 | | Terms of the Transaction | | Prospectus Summary; The Exchange Offer; Description of the New Notes; Taxation |

| Item 5 | | Pro Forma Financial Information | | * |

| Item 6 | | Material Contacts with the Company Being Acquired | | * |

| Item 7 | | Additional Information Required for Reoffering by Persons and Parties Deemed To Be Underwriters | | * |

| Item 8 | | Interests of Named Experts and Counsel | | * |

| Item 9 | | Disclosure of Commission Position on Indemnification for Securities Act Liabilities | | * |

B. INFORMATION ABOUT THE REGISTRANTS |

| Item 10 | | Information with Respect to F-3 Companies | | * |

| Item 11 | | Incorporation of Certain Information by Reference | | * |

| Item 12 | | Information with Respect to F-2 or F-3 Registrants | | * |

| Item 13 | | Incorporation of Certain Information by Reference | | * |

| Item 14 | | Information with Respect to Foreign Registrants Other than F-2 or F-3 Registrants | | |

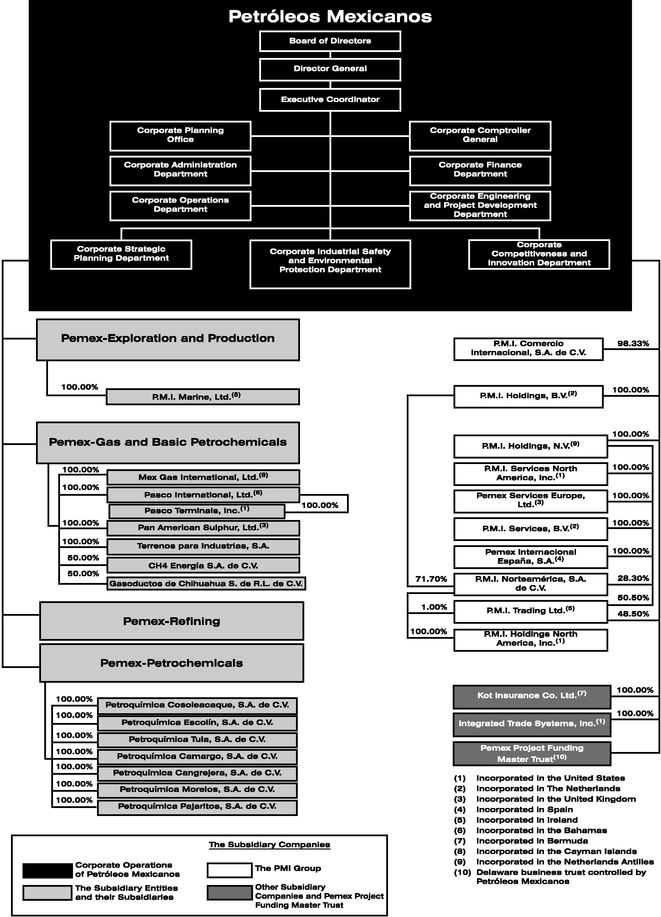

| | | (a) Description of Business | | Prospectus Summary; Form 20-F—Item 4—Information on the Company—History and Development; Form 20-F—

Item 4—Information on the Company—Business Overview;

Form 20-F—Consolidated Structure of PEMEX |

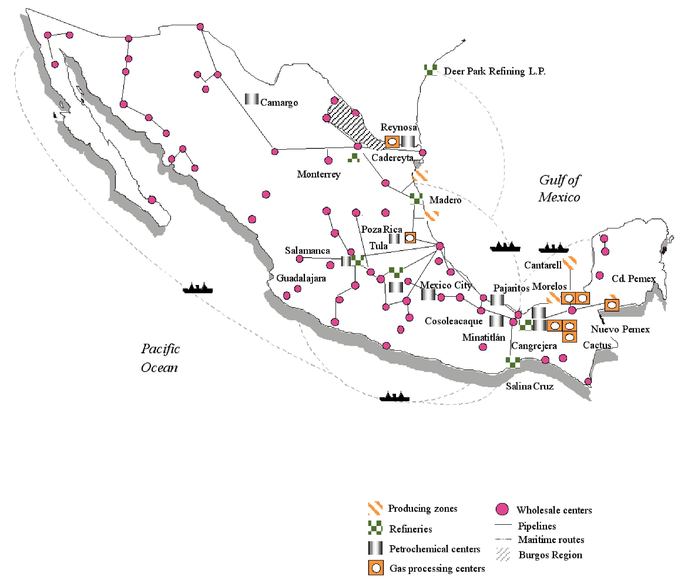

| | | (b) Description of Property | | Form 20-F—Item 4—Information on the Company—Business Overview—Property, Plants and Equipment |

| | | (c) Legal Proceedings | | Form 20-F—Item 8—Financial Information—Legal Proceedings; Recent Developments |

| | | (d) Exchange Controls and Other Limitations Affecting Security Holders | | Form 20-F—Item 3—Key Information—Exchange Rates; Risk Factors; Description of the New Notes |

| | | (e) Taxation | | Taxation |

| | | (f) Selected Financial Data | | Currency of Presentation; Selected Financial Data; Form 20-F —Item 3—Key Information—Exchange Rates |

| | | (g) | | |

| | | (1) Operational and Financial Review | | Form 20-F—Item 5—Operating and Financial Review and Prospects; Form 20-F—Item 4—Information on the Company—Business Overview; Risk Factors; Operating and Financial Review and Prospects; Recent Developments |

| | | (2) Quantitative and Qualitative Disclosures of Market Risk | | Form 20-F—Item 11—Quantitative and Qualitative Disclosures About Market Risk; Risk Factors |

| | | (h) Financial Statements | | Form 20-F—Item 18—Financial Statements; Condensed Consolidated Interim Financial Statements |

C. INFORMATION ABOUT THE COMPANY BEING ACQUIRED |

| Item 15 | | Information with Respect to F-3 Companies | | * |

| Item 16 | | Information with Respect to F-2 or F-3 Companies | | * |

| Item 17 | | Information with Respect to Foreign Companies Other Than F-2 or F-3 Companies | | * |

D. VOTING AND MANAGEMENT INFORMATION |

| Item 18 | | Information if Proxies, Consents or Authorizations Are To Be Solicited | | * |

Item 19 |

|

Information if Proxies, Consents or Authorizations Are Not To Be Solicited in an Exchange Offer |

|

Form 20-F—Item 6—Directors, Senior Management and Employees |

- *

- Omitted because the item is inapplicable or the answer is negative.

Prospectus

Exchange Offer

for

U.S. $600,000,000

6.50% Guaranteed Notes due February 1, 2005

of

Petróleos Mexicanos

Terms of the Exchange Offer

| • | | We are offering to exchange the notes that we sold in a private offering for new registered notes. | | • | | We believe that the exchange of notes will not be a taxable exchange for either U.S. or Mexican federal income tax purposes. |

• |

|

The exchange offer expires at 5:00 p.m., New York City time, March 17, 2003, unless we extend it. |

|

• |

|

We will not receive any proceeds from the exchange offer. |

• |

|

You may withdraw a tender of old notes at any time prior to the expiration date of the exchange offer. |

|

• |

|

The terms of the new notes to be issued are identical to the old notes, except for the transfer restrictions and registration rights relating to the old notes. |

• |

|

All old notes that are validly tendered and not validly withdrawn will be exchanged. |

|

• |

|

Three of our four subsidiary entities will guarantee the new notes. These subsidiary entities are Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals and we refer to them as the guarantors. |

We are not making an offer to exchange securities in any jurisdiction where the offer is not permitted.

Investing in the securities issued in the exchange offer involves certain risks. See "Risk Factors" beginning on page 15.

Neither the Securities and Exchange Commission nor any State securities commission has approved or disapproved the securities to be distributed in the exchange offer, nor have they determined that this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

February 14, 2003

TABLE OF CONTENTS

| About this Prospectus | | 3 |

| Available Information | | 3 |

| Currency of Presentation | | 4 |

| Presentation of Financial Information | | 4 |

| Prospectus Summary | | 5 |

| Selected Financial Data | | 11 |

| Risk Factors | | 15 |

| Use of Proceeds | | 23 |

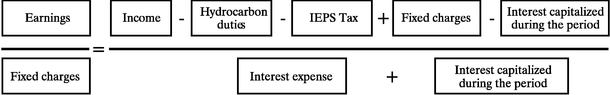

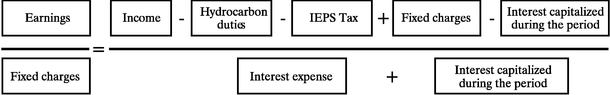

| Ratio of Earnings to Fixed Charges | | 23 |

| Capitalization of Pemex | | 24 |

| Operating and Financial Review and Prospects | | 25 |

| Recent Developments | | 28 |

| The Exchange Offer | | 37 |

| Description of the New Notes | | 47 |

| Book Entry; Delivery and Form | | 62 |

| Taxation | | 65 |

| Plan of Distribution | | 69 |

| Validity of Notes | | 70 |

| Public Official Documents and Statements | | 70 |

| Change in Independent Auditors | | 70 |

| Experts | | 71 |

| General Information | | 72 |

| Annual Report on Form 20-F of Petróleos Mexicanos for its Fiscal Year ended December 31, 2001 | | 74 |

| Unaudited Condensed Consolidated Financial Statements of Petróleos Mexicanos, Subsidiary Entities and Subsidiary Companies as of June 30, 2002 and for the six-month periods ended June 30, 2002 and 2001 | | F/B-1 |

2

We have applied, through our listing agent, to list the new notes on the Luxembourg Stock Exchange.

ABOUT THIS PROSPECTUS

You should rely only on the information provided in this prospectus. We have authorized no one to provide you with different information. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of the document.

We are furnishing this prospectus solely for use by prospective investors in connection with their consideration of participating in the exchange offer. We confirm that:

- •

- the information contained in this prospectus is true and correct in all material respects and is not misleading;

- •

- we have not omitted other material facts, the omission of which would make this prospectus as a whole misleading; and

- •

- we accept responsibility for the information we have provided in this prospectus.

Petróleos Mexicanos will file an application to register the new notes with theSección Especial del Registro Nacional de Valores (the Special Section of the National Registry of Securities) maintained by theComisión Nacional Bancaria y de Valores (National Banking and Securities Commission) of the United Mexican States ("Mexico"). Registration of the new notes with the Special Section of the Registry does not imply any certification as to the investment quality of the new notes, the solvency of the issuer or the guarantors or the accuracy or completeness of the information contained in this prospectus. The new notes may not be publicly offered or sold in Mexico.

AVAILABLE INFORMATION

Petróleos Mexicanos files annual and other information (File No. 0-99) with the Securities and Exchange Commission. You may read and copy any document Petróleos Mexicanos files at the SEC's public reference room in Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms.

We have filed a registration statement with the SEC on Form F-4 covering the new notes. This prospectus does not contain all of the information included in the registration statement. Any statement made in this prospectus concerning the contents of any contract, agreement or other document is not necessarily complete. If we have filed any of those contracts, agreements or other documents as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract, agreement or other document is qualified in its entirety by reference to the actual document.

We are required to file periodic reports and other information with the SEC under the Securities Exchange Act of 1934, as amended. We will also furnish other reports as we may determine appropriate or as the law requires.

You may read and copy the registration statement, including the attached exhibits, and any reports or other information we file, at the SEC's public reference room in Washington, D.C. You can request copies of these documents, upon payment of a duplicating fee, by writing to the SEC's Public Reference Section at Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference rooms. In addition, any filings we make electronically with the SEC will be available to the public over the Internet at the SEC's website at http://www.sec.gov.

3

You may also obtain copies of these documents at the offices of the Luxembourg listing agent, Kredietbank S.A. Luxembourgeoise.

CURRENCY OF PRESENTATION

References in this prospectus to "U.S. dollars", "U.S. $", "dollars" or "$" are to the lawful currency of the United States of America. References in this prospectus to "pesos" or "Ps." are to the lawful currency of Mexico. We use the term "billion" in this prospectus to mean one thousand million.

This prospectus contains translations of certain peso amounts into U.S. dollars at specified rates solely for your convenience. You should not construe these translations as representations that the peso amounts actually represent the actual U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless we indicate otherwise, the U.S. dollar amounts have been translated from pesos at an exchange rate of Ps. 9.1423 to U.S. $1.00, which is the exchange rate that the Ministry of Finance and Public Credit gave to Petróleos Mexicanos on December 31, 2001.

On February 11, 2003 the noon buying rate for cable transfers in New York reported by the Federal Reserve Bank of New York was Ps. 10.9550.

PRESENTATION OF FINANCIAL INFORMATION

The audited consolidated financial statements of PEMEX as of December 31, 2001 and 2000 and for each of the three years in the period ended December 31, 2001 are included in Item 18 of the 2001 Form 20-F (the "Form 20-F") of Petróleos Mexicanos, which is included in this prospectus and the registration statement covering the new notes. We refer to these financial statements as our 2001 financial statements. We also include unaudited condensed consolidated financial statements of PEMEX as of June 30, 2002 and for the six-month periods ended June 30, 2001 and 2002. These consolidated financial statements were prepared in accordance with accounting principles generally accepted in Mexico, or "Mexican GAAP", and as to the recognition of inflation, in accordance with the guidelines established in Financial Reporting Standard NIF-06 BIS "A," section A. Notes 2 b) and 15 to our 2001 financial statements describe the inflation accounting rules that apply to us. Mexican GAAP differs in certain significant respects from United States generally accepted accounting principles, otherwise referred to as "U.S. GAAP." The differences that are material to our 2001 financial statements and to our condensed consolidated interim financial statements are described in Note 19 to our 2001 financial statements and Note 12 to our condensed consolidated interim financial statements. We also include summary financial data for the nine months ended September 30, 2002 of Petróleos Mexicanos, the subsidiary entities and the Pemex Project Funding Master Trust, but excluding the subsidiary companies, which is not audited and was prepared in accordance with Mexican GAAP, and as to the recognition of inflation, in accordance with the guidelines established in NIF-06 BIS "A," section A.

4

PROSPECTUS SUMMARY

The following summary highlights selected information from this prospectus and may not contain all of the information that is important to you. This prospectus includes specific terms of the notes we are offering, as well as information regarding our business and detailed financial data. We encourage you to read this prospectus in its entirety.

PEMEX

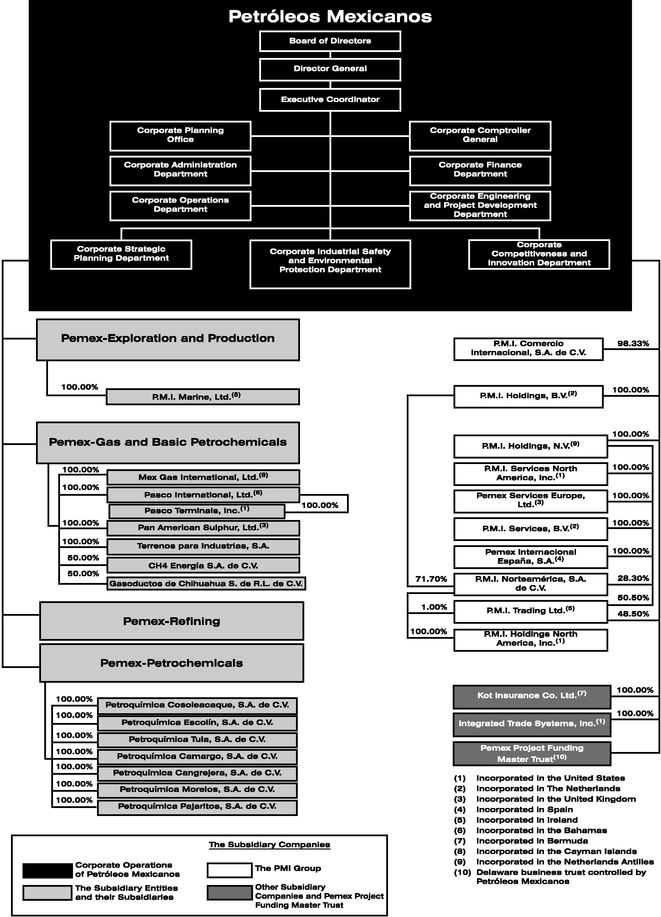

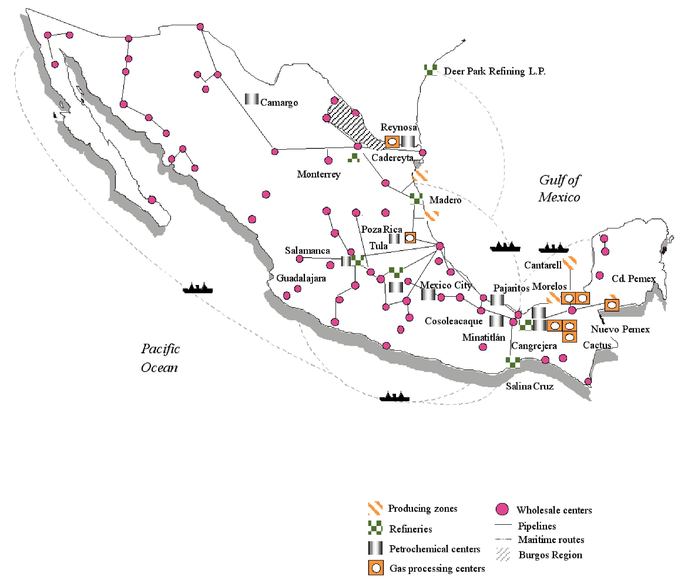

Petróleos Mexicanos is a decentralized public entity of the federal government of the United Mexican States ("Mexico"). We are the largest company in Mexico, and according toPetroleum Intelligence Weekly, we were the seventh largest oil and gas company in the world in 2001. The Mexican Congress established Petróleos Mexicanos on June 7, 1938 in conjunction with the nationalization of the foreign oil companies then operating in Mexico. Since 1938, Mexican federal laws and regulations have entrusted Petróleos Mexicanos with the central planning and management of Mexico's petroleum industry. On July 17, 1992, the Mexican Congress created the subsidiary entities out of operations that had previously been directly managed by Petróleos Mexicanos. Its operations are carried out through four principal subsidiary entities, which are Pemex-Exploración y Producción (Pemex-Exploration and Production), Pemex-Refinación (Pemex-Refining), Pemex-Gas y Petroquímica Básica (Pemex-Gas and Basic Petrochemicals) and Pemex-Petroquímica (Pemex-Petrochemicals). Petróleos Mexicanos and each of the subsidiary entities, are decentralized public entities of Mexico and legal entities empowered to own property and carry on business in their own names. In addition, a number of subsidiary companies, including Pemex Project Funding Master Trust, are incorporated into the consolidated financial statements. We refer to Petróleos Mexicanos, the subsidiary entities and the consolidated subsidiary companies as PEMEX, and together they comprise Mexico's state oil and gas company.

The Exchange Offer

We are offering new, registered notes in exchange for U.S. $600,000,000 aggregate principal amount of unregistered notes, which we issued and sold on August 15, 2001 to Lehman Brothers Inc. and Goldman, Sachs & Co., as initial purchasers. These initial purchasers sold the notes in offshore transactions and to qualified institutional buyers in transactions that were exempt from the registration requirements of the Securities Act of 1933, as amended.

The unregistered notes we issued on August 15, 2001 are called 6.50% Guaranteed Notes due February 1, 2005. In this prospectus, we refer to the unregistered notes that we have already issued as the old notes and the notes that we are now offering as the new notes. The old notes and the new notes are guaranteed by Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals.

Registration Rights Agreement

When we issued the old notes, we also entered into a registration rights agreement with the initial purchasers of the old notes in which we agreed to do our best to complete the exchange offer of the old notes on or prior to October 2, 2002. We were not able to complete the exchange offer by October 2, 2002 and, as a result, the old notes began to earn additional interest at the rate of 0.25% per year on September 3, 2002, and are now earning additional interest at the rate of 0.50% per year. This additional interest will stop when we complete the exchange offer.

The Exchange Offer

Under the terms of the exchange offer, holders of old notes are entitled to exchange old notes for new notes with substantially identical terms.

5

You should read the discussion under the heading "Description of the New Notes" for further information about the new notes and the discussion under the heading "The Exchange Offer" for more information about the exchange process. The old notes may be tendered only in integral multiples of U.S. $10,000. As of the date of this prospectus, U.S. $600,000,000 aggregate principal amount of the old notes is outstanding.

Resale of New Notes

We believe that you may offer the new notes issued in the exchange offer for resale, resell them or otherwise transfer them without compliance with the registration and prospectus delivery provisions of the Securities Act, as long as:

- •

- you are acquiring the new notes in the ordinary course of your business;

- •

- you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the new notes; and

- •

- you are not an "affiliate" of ours, as defined under Rule 405 of the Securities Act.

If any statement above is not true and you transfer any new note without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from the registration requirements of the Securities Act, you may incur liability under the Securities Act. We do not assume responsibility for or indemnify you against this liability.

If you are a broker-dealer and receive new notes for your own account in exchange for old notes that you acquired as a result of market making or other trading activities, you must acknowledge that you will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the new notes. We will make this prospectus available to broker-dealers for use in resales for 180 days after the expiration date of this exchange offer.

Consequences of Failure to Exchange Old Notes

If you do not exchange your old notes for new notes, you will continue to hold your old notes. You will no longer be able to require that we register the old notes under the Securities Act and your old notes will no longer earn additional interest. In addition, you will not be able to offer or sell the old notes unless:

- •

- they are registered under the Securities Act, or

- •

- you offer or sell them under an exemption from the requirements of, or in a transaction not subject to, the Securities Act.

Expiration Date

The exchange offer will expire at 5:00 p.m., New York City time, on March 17, 2003, unless we decide to extend the expiration date.

Interest on the New Notes

The new notes will accrue interest at 6.50% per year, accruing from February 1, 2003, the last date on which we paid interest on the old notes you exchanged. In addition, the new notes will bear additional interest during the period from February 1, 2003 until the date the exchange is completed, at the rate of 0.50% per year. We will pay interest on the new notes on February 1 and August 1 of each year.

6

Conditions to the Exchange Offer

We may terminate the exchange offer and refuse to accept any old notes for exchange if:

- •

- there has been a change in applicable law or the SEC staff's interpretation of applicable law, and the exchange offer is not permitted under applicable law or applicable SEC staff interpretations of law; or

- •

- there is a stop order in effect or threatened with respect to the exchange offer or the indenture governing the notes.

We have not made the exchange offer contingent on holders tendering any minimum principal amount of old notes for exchange.

Procedure for Tendering Old Notes

If you wish to accept the exchange offer, you must:

- •

- complete, sign and date the letter of transmittal, and

- •

- deliver electronically the letter of transmittal together with the old notes through The Depository Trust Company's ("DTC") Automated Tender Offer Program ("ATOP") system.

If you are not a direct participant in DTC, you must, in accordance with the rules of the DTC participant who holds your notes:

- •

- submit a completed, signed and dated letter of transmittal, and

- •

- deliver computerized instructions to that DTC participant so that it may follow the procedures described above before the expiration date.

Withdrawal Rights

You may withdraw the tender of your old notes at any time prior to 5:00 p.m., New York City time, on the expiration date, unless we have already accepted your old notes. To withdraw, you must send a written notice of withdrawal to the exchange agent through the electronic submission of a message in accordance with the procedures of DTC's ATOP system by 5:00 p.m., New York City time, on the expiration date.

Acceptance of Old Notes and Delivery of New Notes

If all of the conditions to the exchange offer are satisfied or waived, we will accept any and all old notes that are properly tendered in the exchange offer prior to 5:00 p.m., New York City time, on the expiration date. We will deliver the new notes as promptly as practicable after the expiration date.

Tax Considerations

We believe that the exchange of old notes for new notes will not be a taxable exchange for U.S. federal and Mexican income tax purposes. You should consult your tax advisor about the tax consequences of this exchange as they apply to your individual circumstances.

Fees and Expenses

We will bear all expenses related to consummating the exchange offer and complying with the registration rights agreement. The initial purchasers have agreed to reimburse us for certain of these expenses.

7

Exchange Agent

Deutsche Bank Trust Company Americas is serving as the exchange agent for the exchange offer. Deutsche Bank Luxembourg S.A. is serving as the exchange agent in Luxembourg. The exchange agents' addresses, telephone numbers and facsimile numbers are included under the heading "The Exchange Offer—The Exchange Agent; Luxembourg Listing Agent."

Description of the New Notes

Issuer

Petróleos Mexicanos.

Guarantors

Each of Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals will, jointly and severally, unconditionally guarantee the payment of principal and interest on the new notes. We call these the guaranties.

New Notes Offered

U.S. $600,000,000 principal amount of 6.50% Guaranteed Notes due February 1, 2005.

The form and terms of the new notes will be the same as the form and terms of the old notes, except that:

- •

- the new notes will be registered under the Securities Act and therefore will not bear legends restricting their transfer,

- •

- holders of the new notes will not be entitled to some of the benefits of the registration rights agreement,

- •

- a new indenture, instead of the fiscal agency agreement, will govern the new notes, and

- •

- we will not issue the new notes under our medium-term note program.

The new notes will evidence the same debt as the old notes.

Maturity Date

February 1, 2005.

Interest Payment Dates

February 1 and August 1 of each year.

Further Issues

We may, without your consent, increase the size of the issue of the new notes or create and issue additional notes with either the same terms and conditions or the same except for the amount of the first payment of interest. These additional notes may be consolidated to form a single series with the new notes.

Withholding Tax; Additional Amounts

We will make all principal and interest payments on the new notes without any withholding or deduction for Mexican withholding taxes, unless we are required by law to do so. In some cases where we are obliged to withhold or deduct a portion of the payment, we will pay additional amounts so that

8

you will receive the amount that you would have received had no tax been withheld or deducted. For a description of when you would be entitled to receive additional amounts, see "Description of the New Notes—Additional Amounts."

Tax Redemption

If, as a result of certain changes in Mexican law, we are obligated to pay additional amounts on interest payments on the new notes at a rate in excess of 10% per year, then we may choose to redeem the new notes. If we redeem any new notes, we will pay 100% of their outstanding principal amount, plus accrued and unpaid interest and any additional amounts payable up to the date of our redemption.

Ranking of the New Notes and the Guaranties

The new notes and the guaranties:

- •

- will be our direct, unsecured and unsubordinated public external indebtedness, and

- •

- will rank equally in right of payment with each other and with all our existing and future unsecured and unsubordinated public external indebtedness.

We are party to certain financial leases which will, with respect to the assets securing those financial leases, rank prior to the new notes and the guaranties.

Negative Pledge

None of Petróleos Mexicanos, the guarantors or their respective subsidiaries will create security interests in our crude oil and crude oil receivables to secure any public external indebtedness. However, we may enter into up to U.S. $4 billion of receivables financings and similar transactions in any year and up to U.S. $12 billion of receivables financings and similar transactions in the aggregate.

We may pledge or grant security interests in any of our other assets or the assets of the guarantors to secure our debts. In addition, we may pledge oil or oil receivables to secure debts payable in pesos or debts which are different than the new notes, such as commercial bank loans.

Indenture

The new notes will be issued pursuant to an indenture to be dated as of February 3, 2003, to be entered into between Petróleos Mexicanos and the trustee.

Trustee

Deutsche Bank Trust Company Americas.

Events of Default

The new notes and the indenture under which the new notes will be issued contain certain events of default. If an event of default occurs, 20% of the holders of the outstanding new notes can require us to pay immediately the principal of and interest on all the new notes. For a description of the events of default and their grace periods, you should read "Description of the New Notes—Events of Default; Waiver and Notice."

Governing Law

The new notes and the indenture will be governed by New York law, except that the laws of Mexico will govern the authorization and execution of these documents by Petróleos Mexicanos.

9

Listing

We will apply to list the new notes on the Luxembourg Stock Exchange.

Use of Proceeds

We will not receive any cash proceeds from the issuance of the new notes.

Forward-Looking Statements

This prospectus contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. We have based these statements on current plans, estimates and projections and you should therefore not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties.

For a discussion of important factors that could cause actual results to differ materially from those contained in any forward-looking statement, you should read "Risk Factors" below.

Principal Executive Offices

Our headquarters are located at:

10

SELECTED FINANCIAL DATA

The selected financial data set forth below should be read in conjunction with, and are qualified in their entirety by reference to, the audited 2001 financial statements and the unaudited condensed consolidated interim financial statements of PEMEX, both included in this prospectus. The selected financial data set forth below as of the five years ended December 31, 2001 and as of June 30, 2002 have been derived from the consolidated financial statements of PEMEX for the years ended December 31, 1997 and 1998 (which are not included herein), the consolidated financial statements of PEMEX for the years ended December 31, 1999, 2000 and 2001 and the condensed consolidated financial statements of PEMEX for the six-month periods ended June 30, 2001 and 2002. The consolidated financial statements of PEMEX for the years ended December 31, 1999 and 2000 were audited by Mancera, S.C. (A Member Practice of Ernst & Young Global), and the consolidated financial statements of PEMEX for the year ended December 31, 2001 were audited by PricewaterhouseCoopers, S.C. See "Change in Independent Auditors" beginning on page 75. The condensed consolidated financial statements of PEMEX as of June 30, 2002 and for the six-month periods ended June 30, 2001 and 2002 have not been audited.

The consolidated financial statements are prepared in accordance with Mexican GAAP and, as to the recognition of inflation, in accordance with the guidelines established in Financial Reporting Standard NIF-06 BIS "A," section A. See Notes 2 b) and 15 to our 2001 financial statements for a discussion of the inflation accounting rules applicable to us. Mexican GAAP differs in certain significant respects from U.S. GAAP. The most important of the material items generating a difference between operating results under U.S. GAAP and Mexican GAAP are the accounting methodologies for the treatment of exploration and drilling costs, pension premiums and post-retirement benefit obligations, financial instruments, inflation, foreign exchange losses, capitalized interest and depreciation and impairment of fixed assets, which are described in Note 19 of our 2001 financial statements and Note 12 to our condensed consolidated interim financial statements and are summarized below.

Under Mexican GAAP, we charge exploration and drilling costs to the equity reserve for exploration and depletion of oil fields. Exploration and drilling costs related to successful oil wells are credited to the equity reserve and recorded as fixed assets. Cost of sales is recognized by recording a charge for each barrel of crude oil extracted in the statement of operations and recording a credit to the equity reserve. Under U.S. GAAP, we initially capitalize the costs of drilling exploratory wells and exploratory-type stratigraphic test wells, which are subsequently charged to expense if proved reserves are not discovered. Development costs, including the costs of drilling development wells and development-type stratigraphic test wells, are capitalized.

Seniority premiums and retirement plans generate a difference between U.S. GAAP and Mexican GAAP due to the different actuarial cost assumptions and implementation dates applied under Mexican GAAP Bulletin D-3, "Labor Obligations," and U.S. GAAP Statement of Financial Accounting Standards (SFAS) No. 87, "Employers Accounting for Pensions."

Under Mexican GAAP, we account for supplemental payments under our Bulletin D-3 calculations. However, we account for other health service benefits on a pay-as-you-go basis under Mexican GAAP. Under U.S. GAAP, we follow the guidelines of SFAS No. 106, "Employers' Accounting for Post-Retirement Benefits Other than Pensions," in accounting for health service and other supplemental payments provided to retirees.

On January 1, 2001, we adopted Bulletin C-2, "Financial Instruments," issued by the Mexican Institute of Public Accountants (MIPA), for Mexican GAAP purposes, and SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities" (as amended by SFAS No. 137, "Accounting for Derivative Instruments and Hedging Activities—Deferral of the Effective Date of FASB Statement No. 133," and SFAS No. 138, "Accounting for Certain Derivative Instruments and Certain Hedging

11

Activities"), for U.S. GAAP purposes. The principal differences between the cumulative effect adjustment and current period income effect under Mexican GAAP and U.S. GAAP relate primarily to the accounting for cross currency swaps, foreign currency embedded derivatives and the accounting for equity swaps contracts related to shares of Repsol YPF, S.A., which we refer to as Repsol, described in Note 10 to our 2001 financial statements.

We apply NIF-06 BIS "A," section A, to our financial statements to reflect the effects of inflation. NIF-06 BIS "A," section A, provides for the restatement of fixed assets, inventories and costs of sales by indexing and/or appraisals. Since NIF-06 BIS "A," section A, does not represent a comprehensive basis of inflation accounting, beginning with our 1992 fiscal year, we have reversed the effects of NIF-06 BIS "A," section A, on our consolidated financial statements from the U.S. GAAP reconciliation of income and equity. Under NIF-06 BIS "A," section A, a devaluation of the peso does not have a negative impact on our income because exchange losses are capitalized into fixed assets. Furthermore, a devaluation of the peso relative to the dollar results in an increase in our income to the extent that our expenses remain relatively stable because they are incurred in pesos, while our revenues, which are mostly denominated in dollars or linked to international dollar-denominated prices, increase in peso terms. In contrast, under U.S. GAAP, a devaluation of the peso has a negative impact on our income because the exchange losses are not capitalized but are charged immediately to income. This one-time charge to income will be gradually offset by lower depreciation as the asset base is reduced. In any particular accounting period, the negative impact of a devaluation is, therefore, greater when the devaluation occurs at or near the end of the accounting period, as occurred with the peso at the end of 1994.

With respect to foreign exchange losses, under Mexican GAAP, exchange losses arising from debt are capitalized as part of fixed assets, and any remaining net exchange differences are reflected in the statement of operations as either a debit to costs and operating expenses or a credit to revenues. Under U.S. GAAP, all exchange gains or losses are recognized in results of operations.

The treatment of capitalized interest for Mexican GAAP purposes differs from the treatment of capitalized interest in the reconciliation of the financial statements to U.S. GAAP. For Mexican GAAP purposes, we capitalize interest to property, plant and equipment based on the total interest cost incurred on loans allocated to construction projects, regardless of whether or not the amounts borrowed have been spent on such projects. For purposes of the U.S. GAAP reconciliation, we capitalize interest based upon total interest incurred in proportion to additions to construction in progress.

Under Mexican GAAP, we depreciate the book value of our fixed assets, which includes amounts capitalized for foreign exchange losses and restatements for inflation. For U.S. GAAP purposes, we have reversed this depreciation expense attributable to foreign exchange losses and restatements for inflation.

We are required to evaluate our long-lived assets for impairment for U.S. GAAP purposes whenever events or circumstances indicate that the carrying amount of an asset may not be recoverable or is permanently impaired. Such impaired assets must be permanently written down to fair value or the present value of expected future cash flows on related assets. This requirement does not exist under Mexican GAAP.

For a further discussion of these and other adjustments, see "Item 5—Operating and Financial Review and Prospects—U.S. GAAP Reconciliation," Note 19 to our 2001 financial statements and Note 12 to our condensed consolidated interim financial statements.

12

Selected Financial Data of PEMEX

| | Year Ended December 31,(1)

| | Six months ended June 30,(1)(2)

| |

|---|

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| | 2002(3)

| |

|---|

| | (in millions of pesos or U.S. dollars)

| |

|---|

| Income Statement Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amounts in accordance with Mexican GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net sales(4) | | Ps. | 264,030 | | Ps. | 256,987 | | Ps. | 334,814 | | Ps. | 468,268 | | Ps. | 445,330 | | Ps. | 227,054 | | Ps. | 222,645 | | $ | 22,361 | |

| | | Total revenues(4) | | | 269,507 | | | 265,749 | | | 344,979 | | | 478,688 | | | 457,385 | | | 236,239 | | | 226,485 | | | 22,747 | |

| | | Total revenues net of the IEPS Tax | | | 231,779 | | | 199,894 | | | 256,630 | | | 409,132 | | | 362,187 | | | 196,366 | | | 166,320 | | | 16,704 | |

| | | Operating income | | | 166,619 | | | 140,299 | | | 187,669 | | | 274,057 | | | 230,703 | | | 134,082 | | | 124,396 | | | 12,494 | |

| | | Income (loss) for the period | | | 7,133 | | | (11,588 | ) | | (21,157 | ) | | (19,710 | ) | | (34,091 | ) | | (6,025 | ) | | (6,361 | ) | | (639 | ) |

| Balance Sheet Data (end of period) | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amounts in accordance with Mexican GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Cash and cash equivalents | | | 17,429 | | | 14,631 | | | 23,987 | | | 27,827 | | | 14,442 | | | N.A. | | | 35,264 | | | 3,542 | |

| | | Total assets | | | 339,452 | | | 416,691 | | | 482,248 | | | 563,468 | | | 556,883 | | | N.A. | | | 613,046 | | | 61,571 | |

| | | Long-term debt | | | 56,339 | | | 87,615 | | | 83,127 | | | 104,370 | | | 123,170 | | | N.A. | | | 159,458 | | | 16,015 | |

| | | Total long-term liabilities | | | 132,814 | | | 206,728 | | | 236,599 | | | 317,096 | | | 362,069 | | | N.A. | | | 415,148 | | | 41,695 | |

| | | Equity | | | 153,123 | | | 167,138 | | | 161,469 | | | 150,605 | | | 122,866 | | | N.A. | | | 121,443 | | | 12,197 | |

| | Amounts in accordance with U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net sales(5) | | | 226,302 | | | 191,132 | | | 246,465 | | | 398,711 | | | 350,131 | | | 187,182 | | | 162,481 | | | 16,319 | |

| | | Operating income(5) | | | 129,595 | | | 73,583 | | | 106,024 | | | 208,862 | | | 142,803 | | | 99,990 | | | 72,971 | | | 7,329 | |

| | | Income (loss) for the period | | | 9,177 | | | (27,364 | ) | | (15,370 | ) | | (16,697 | ) | | (25,444 | ) | | (1,524 | ) | | (4,800 | ) | | (482 | ) |

| | | Total assets | | | 257,251 | | | 283,540 | | | 362,947 | | | 434,743 | | | 432,687 | | | N.A. | | | 474,462 | | | 47,652 | |

| | | Equity (deficit) | | | 59,951 | | | 29,735 | | | 12,904 | | | (13,567 | ) | | (42,331 | ) | | N.A. | | | (51,928 | ) | | (5,215 | ) |

| Other Financial Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amounts in accordance with Mexican GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Depreciation and amortization | | | 11,482 | | | 15,697 | | | 23,941 | | | 26,061 | | | 28,453 | | | 13,963 | | | 14,262 | | | 1,432 | |

| | | Investments at cost(6) | | | 28,109 | | | 43,936 | | | 40,497 | | | 76,233 | | | 51,672 | | | 17,698 | | | 22,029 | | | 2,212 | |

| | Ratio of earnings to fixed charges: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Mexican GAAP(6) | | | 1.54 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | U.S. GAAP(7) | | | 1.81 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Note: N.A. = Not Applicable.

- (1)

- Includes Petróleos Mexicanos, the subsidiary entities and the subsidiary companies. Beginning with the year ended December 31, 1998, we include the financial position and results of the Pemex Project Funding Master Trust. Beginning with the year ended December 31, 2000, we include the financial position and results of Mex Gas International, Ltd. For U.S. GAAP purposes, beginning with the year ended December 31, 2001, we include the financial position and results of Pemex Finance, Ltd.

Each of our financial statements for the five years ended December 31, 2001 and for the six-month periods ended June 30, 2001 and 2002 was prepared according to Mexican GAAP but recognizes the effect of inflation according to Mexican Financial Reporting Standard NIF-06 BIS "A," section A, which is different from Mexican GAAP Bulletin B-10. Mexican GAAP differs from U.S. GAAP. The most important of the material differences between U.S. GAAP and Mexican GAAP affecting PEMEX are the accounting treatment of: (1) exploration and drilling costs, (2) pensions and post-retirement obligations, (3) financial instruments, (4) inflation, (5) foreign exchange losses, (6) capitalized interest, (7) depreciation and (8) impairment of fixed assets. For a further discussion of these and other differences, see Note 19 to our 2001 financial statements and Note 12 to the condensed consolidated interim financial statements.

- (2)

- Unaudited.

- (3)

- Conversions into U.S. dollars of amounts in pesos have been made at the established exchange rate for accounting purposes of Ps. 9.9568= U.S. $1.00 at June 30, 2002. Such conversions should not be construed as a representation that the peso amounts have been or could be converted into U.S. dollar amounts at the foregoing or any other rate.

- (4)

- Includes the IEPS Tax as part of the sales price of the products sold.

13

- (5)

- Figures do not include IEPS Tax as part of the sales price of the products sold.

- (6)

- Includes investments in fixed assets and capitalized interest, and excludes certain expenditures charged to the oil field exploration and depletion reserve. See "Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources" in the Form 20-F included in this prospectus.

- (7)

- Under U.S. GAAP, earnings for the years ended December 31, 1998, 1999, 2000 and 2001, and for the six-month periods ended June 30, 2001 and 2002, were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 21,076 million for 1998, Ps. 5,253 million for 1999, Ps. 624 million for 2000, Ps. 10,857 million for 2001, Ps. 3,833 million for the six-month period ended June 30, 2001 and Ps. 8,023 million for the six-month period ended June 30, 2002. Under Mexican GAAP, earnings for the years ended December 31, 1998, 1999, 2000 and 2001, and for the six-month periods ended June 30, 2001 and 2002, were insufficient to cover fixed charges. The amount by which fixed charges exceeded earnings was Ps. 5,020 million for 1998, Ps. 11,310 million for 1999, Ps. 4,092 million for 2000, Ps. 18,258 million for 2001, Ps. 8,473 million for the six month period ended June 30, 2001 and Ps. 9,107 million for the six month period ended June 30, 2002.

PEMEX does not currently prepare comprehensive price-level adjusted financial statements in accordance with Bulletin B-10, "Recognition of the Effects of Inflation on Financial Information," under Mexican GAAP. For the years ended December 31, 1997 and 1998, Mexico was deemed to be a hyperinflationary economy. Pursuant to Rule 3-20(c) of Regulation S-X promulgated by the U.S. Securities and Exchange Commission, we have included unaudited selected financial data prepared on the basis of price-level adjusted financial information for these years reflecting the impact of U.S. GAAP adjustments and reclassifications. For the years ended December 31, 1999, 2000 and 2001, and for the six-month periods ended June 30, 2001 and 2002, Mexico was not considered a hyperinflationary economy. However, we have continued to provide supplemental unaudited price-level adjusted financial information for these subsequent years in lieu of a comprehensive price-level adjustment that would result from our adoption of Bulletin B-10. In the opinion of PEMEX management, all adjustments that are necessary for a fair presentation of the price-level adjusted financial information have been included herein. This unaudited price-level adjusted financial data is derived from the supplemental price-level adjusted financial information included elsewhere in this prospectus and should also be read in conjunction our 2001 financial statements and condensed consolidated financial statements for the six-month periods ended June 30, 2001 and 2002.

Selected Financial Data of PEMEX (continued)

| | Years Ended December 31,

| | Six months ended June 30,

| |

|---|

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| | (in millions of constant 2001 pesos)

| | (in millions of constant

June 30, 2002 pesos)

| |

|---|

| Unaudited Price-level Adjusted Information Income Statement Data | | | | | | | | | | | | | | | | | | | | | | |

| Amounts in accordance with U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | |

| Net sales(1) | | Ps. | 363,422 | | Ps. | 264,769 | | Ps. | 292,849 | | Ps. | 432,680 | | Ps. | 357,215 | | Ps. | 198,001 | | Ps. | 164,065 | |

| Total revenues(1) | | | 372,747 | | | 275,646 | | | 301,461 | | | 443,037 | | | 372,425 | | | 208,965 | | | 169,374 | |

| Net income (loss) | | | 23,316 | | | (19,843 | ) | | (21,069 | ) | | (36,573 | ) | | (17,251 | ) | | 7,752 | | | (5,871 | ) |

| Balance Sheet Data (end of period) | | | | | | | | | | | | | | | | | | | | | | |

| Amounts in accordance with U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 26,413 | | | 18,694 | | | 27,287 | | | 29,052 | | | 14,488 | | | N.A. | | | 36,056 | |

| Total assets | | | 485,938 | | | 517,330 | | | 555,136 | | | 590,540 | | | 576,220 | | | N.A. | | | 633,529 | |

| Long-term debt | | | 85,380 | | | 111,947 | | | 94,563 | | | 108,966 | | | 162,291 | | | N.A. | | | 200,431 | |

| Total long-term liabilities | | | 202,614 | | | 267,281 | | | 291,081 | | | 357,433 | | | 388,095 | | | N.A. | | | 448,584 | |

| Total equity | | | 190,388 | | | 180,156 | | | 167,970 | | | 132,604 | | | 110,890 | | | N.A. | | | 102,432 | |

Note: N.A. = Not Applicable.

- (1)

- Total revenues and net sales figures do not include the IEPS Tax as part of the sales price of the products sold.

Source: Petróleos Mexicanos.

14

RISK FACTORS

Risk Factors Related to the Operations of PEMEX

Crude oil prices are volatile, and low oil prices negatively affect PEMEX's income

International crude oil prices fluctuate due to many factors, including:

- •

- changes in global supply and demand for crude oil and refined petroleum products;

- •

- availability and price of competing commodities;

- •

- international economic trends;

- •

- currency exchange fluctuations;

- •

- expectations of inflation;

- •

- actions of commodity markets participants;

- •

- domestic and foreign government regulations; and

- •

- political events in major oil producing and consuming nations.

We have no control over these factors. Historically, the weighted average price of the crude oil that we export has fluctuated from a high of U.S. $26.82 per barrel in 1984 to a low of U.S. $15.55 per barrel in 1999. In 2001, the weighted average price of PEMEX crude oil was U.S. $18.57 per barrel, 24.6% lower than the weighted average price during 2000. On February 10, 2003, the weighted average spot price of PEMEX crude oil was U.S. $28.50.

When international crude oil and natural gas prices are low, we earn less export sales revenue, and, therefore, lower income because our costs remain roughly constant. Conversely, when crude oil and natural gas prices are high, we earn more export sales revenue and our income increases. As a result, future fluctuations in international crude oil prices will directly affect our results of operations and financial condition.

Decreases in PEMEX's estimates from time to time of Mexico's hydrocarbon reserves could reduce PEMEX's potential future income

The reserve data set forth in the Form 20-F included in this prospectus represent only estimates. Estimating quantities of proved hydrocarbon reserves and projecting future rates of production and timing of development expenditures is an inexact process and is subject to many factors beyond our control. The accuracy of any reserve estimate depends on the quality of available data and engineering and geological interpretation and judgment. As a result, estimates of different engineers may vary. Additionally, the results of drilling, testing and production subsequent to the date of an estimate may justify revision of an estimate. Therefore, proved reserve estimates may be materially different from the quantities of crude oil and natural gas that we can ultimately recover.

Pemex-Exploration and Production revises its estimates of Mexico's hydrocarbon reserves annually. This process may result in material revisions to our estimates of Mexico's hydrocarbon reserves.

15

PEMEX is an integrated oil and gas company and is exposed to production, equipment and transportation risks

We are subject to production, equipment and transportation risks that are common among oil and gas companies. For example, we encounter:

- •

- production risk—i.e., risk related to fluctuations in production that may be affected by reserve levels, accidents, mechanical difficulties, adverse natural conditions, such as bad weather and other acts of God, as well as the inability to manage unforeseen production costs;

- •

- equipment risk—i.e., risk related to adequacy and condition of the production facilities, including equipment becoming obsolete; and

- •

- transportation risk—i.e., risk related to the condition of pipelines and vulnerability of other modes of transportation.

In particular, our business is subject to the risk of:

- •

- pipeline explosions (oil or natural gas);

- •

- explosions in refineries, petrochemical plants, storage and distribution terminals or buoys and monobuoys;

- •

- hurricanes in the Gulf of Mexico;

- •

- unexpected geological formations or pressures;

- •

- blow outs, which are sudden, violent explosions of oil, natural gas or water from a drilling well, followed by an uncontrolled flow from the well;

- •

- fires and cratering, which is the caving in and collapse of the earth's structure around a blow out well; and

- •

- mechanical failures and collapsed holes, particularly in horizontal wellbores.

The occurrence of any of these events could result in:

- •

- personal injuries or loss of life;

- •

- environmental damage and the necessary clean-up costs and expenses; or

- •

- other damage to our property or the property of others.

In accordance with customary industry practice, we have purchased insurance policies covering some of these risks. However, these policies do not cover all potential liabilities that may result from these risks. In addition, insurance is not available for some of these risks. See "Item 4—Information on the Company—Business Overview—PEMEX Corporate Matters—Insurance" in the Form 20-F included in this prospectus.

PEMEX's compliance with environmental regulations in Mexico could result in material adverse effects on its results of operations

A wide range of general and industry-specific Mexican federal and state environmental laws and regulations apply to our operations. Numerous Mexican Government agencies and departments issue rules and regulations which are often difficult and costly to comply with and which carry substantial penalties for non-compliance. This regulatory burden on us increases our cost of doing business and can:

- •

- require us to make significant capital expenditures on measures to protect the environment, including abandoning and dismantling onshore wells and offshore platforms;

16

- •

- reduce our ability to extract hydrocarbons when extraction endangers the environment;

- •

- reduce our sales revenues if production is reduced to meet environmental regulations;

- •

- increase production costs and make our products relatively more expensive as compared to the hydrocarbon and refined products of our competitors; and

- •

- reduce our profitability through a combination of the above.

At December 31, 2001, our estimated and accrued environmental liabilities totaled Ps. 2,316 million. See "Item 4—Information on the Company—Environmental Regulation—Environmental Liabilities" in the Form 20-F included in this prospectus.

PEMEX publishes less financial information than U.S. companies are required to file with the SEC

We prepare our financial statements according to Mexican GAAP, except as to the recognition of inflation, which is recognized in our financial statements according to the Mexican Financial Reporting Standards applicable to Mexican public sector companies. Mexican GAAP differs in certain significant respects from U.S. GAAP. See "Item 3—Key Information—Selected Financial Data" in the Form 20-F included in this prospectus and Note 19 to our 2001 financial statements. In addition, we generally only prepare U.S. GAAP information on a yearly basis. As a result, there may be less or different publicly available information about us than there is about U.S. issuers.

Risk Factors Related to the Relationship between PEMEX and the Mexican Government

The Mexican Government controls PEMEX, and the Mexican Congress approves the annual budget and financing program of Petróleos Mexicanos and the subsidiary entities

Mexico is the sole owner of Petróleos Mexicanos and the subsidiary entities, and the Mexican Government closely regulates and supervises our operations. Mexican Government ministers control key executive decisions at Petróleos Mexicanos. The Secretary of Energy of Mexico is the Chairman of the Board of Directors of Petróleos Mexicanos. TheSecretaría de la Contraloría y Desarrollo Administrativo (the General Comptroller's Office of the Mexican Government, which we refer to as SECODAM), appoints the external auditors of Petróleos Mexicanos and the subsidiary entities.

The Mexican Government incorporates Petróleos Mexicanos and the subsidiary entities' annual budget and financing program into its consolidated annual budget, which it submits to the Mexican Congress for its approval. The Mexican Congress also designates certain of our largest capital expenditures as long-term productive infrastructure projects (which we refer to as PIDIREGAS). See "Item 4—Information on the Company—History and Development—Capital Expenditures and Investments" in the Form 20-F included in this prospectus.

The Mexican Government has the power to intervene directly or indirectly in our commercial affairs. Such an intervention could have an adverse effect on us and thereby adversely affect our or our subsidiaries' ability to make payments under any securities issued or guaranteed by us. For instance, if the Mexican Government were to cause us to reduce production or limit future capital expenditures, this could reduce our ability to generate the necessary income to support payments on our debt, or to transfer the necessary funds between any of our subsidiaries to make payments on their debts.

The Mexican Government may privatize all or part of Petróleos Mexicanos and the subsidiary entities

The Mexican Government would have the power, if federal law and theConstitución Política de los Estados Unidos Mexicanos (the Political Constitution of the United Mexican States) were amended, to privatize all or a portion of Petróleos Mexicanos and the subsidiary entities or its assets. The Mexican Government could also transfer the activities of PEMEX to another Mexican Government-controlled entity if these changes were made. These types of actions could adversely affect our operations by

17

affecting our workforce, causing an interruption in production that could decrease output and negatively affect our income from operations. In addition, the privatization could cause us to default on our obligations under certain of our indebtedness, including all of our publicly traded debt securities, which could entitle the holders of this indebtedness to declare it immediately due and payable. In this case, investors in debt securities would be entitled to recover their entire investment and their only loss would be that attributable to future interest income. See also "—Considerations Related to Mexico" below.

The Mexican Government has entered into agreements with other nations to limit production

Historically, member countries of the Organization of the Petroleum Exporting Countries, commonly referred to as OPEC, have entered into agreements to reduce their production of crude oil. These agreements have sometimes increased global crude oil prices by decreasing the global supply of crude oil. Although Mexico is not a member of OPEC, it has entered into agreements with OPEC and non-OPEC countries to reduce global crude oil supply.

For example, following OPEC's announcement in January 2001 that it would reduce crude oil production by 1.5 million barrels per day, Mexico announced it would decrease its crude oil exports by 75 thousand barrels per day, beginning on February 1, 2001. Following a March 2001 announcement by OPEC of an additional 1.0 million barrel per day reduction in crude oil production, Mexico announced on March 25, 2001 that it would further reduce its crude oil exports by 40 thousand barrels per day, beginning on April 1, 2001. On January 2, 2002, following an OPEC announcement that it would reduce crude oil production by 1.5 million barrels per day, Mexico announced it would reduce its crude oil exports by 100,000 barrels per day to 1.66 million barrels per day for six months, beginning on January 1, 2002. On January 13, 2003, the Ministry of Energy of Mexico announced that, beginning on February 1, 2003, Mexico would increase its oil exports by 120,000 barrels per day, to 1.88 million barrels per day. Mexico agreed to increase its oil exports in conjunction with production increases by other oil producing countries in order to stabilize oil prices, which had increased significantly in recent weeks.

We do not control the Mexican Government's international affairs and the Mexican Government could agree with OPEC or other countries to reduce our crude oil production or exports in the future. To the extent that such international agreements restrict our exports of crude oil, it is possible that Mexican domestic markets will not be able to consume additional amounts of crude oil that we are not allowed to export as a result of such agreements, thus reducing our revenues.

PEMEX does not own the hydrocarbon reserves in Mexico

A guaranteed source of petroleum and other hydrocarbons is essential to an oil company's production and generation of income. As a result, many oil and gas companies own hydrocarbon reserves. The Political Constitution of the United Mexican States provides that the Mexican nation, not PEMEX, owns the petroleum and other hydrocarbon reserves located in Mexico. Although Mexican law gives Petróleos Mexicanos and the subsidiary entities the exclusive right to exploit Mexico's hydrocarbon reserves, it does not preclude the Mexican Government from changing current law and assigning these rights to another company. If the Mexican Government, by way of an amendment to theLey Reglamentaria del Artículo 27 Constitucional en el Ramo del Petróleo (Regulatory Law to Article 27 of the Political Constitution of the United Mexican States Concerning Petroleum Affairs, which we refer to as the "Regulatory Law"), assigned the rights to exploit its hydrocarbon reserves to another company, our ability to generate income would be adversely affected.

18

Petróleos Mexicanos and the subsidiary entities pay special taxes, duties and dividends to the Mexican Government

Petróleos Mexicanos and the subsidiary entities pay a number of special taxes and duties to the Mexican Government. These taxes and duties totaled Ps. 208,137 million in 1999, Ps. 292,960 million in 2000 and Ps. 262,778 million in 2001. For 2002 and 2003 we expect the sum of these taxes and duties to total approximately 60.8% of the revenue that we derive from sales through our subsidiary, P.M.I. Comercio Internacional, S.A. de C.V. ("PMI"), P.M.I. Trading Ltd. and their affiliates (together, the "PMI Group") and to third parties. In addition to these duties and taxes, the Mexican Government imposes an excess gains tax equal to 39.2% of the portion of Pemex-Exploration and Production's crude oil sales revenue in excess of a threshold price set by the Mexican Government, which in 2002 was U.S. $15.50 per barrel and in 2003 is U.S. $18.35 per barrel. See "Item 4—Information on the Company—Taxes and Duties" and "Item 5—Operating and Financial Review and Prospects—General—IEPS Tax, Excess Gains Duty, Hydrocarbon Duties and Other Taxes" in the Form 20-F included in this prospectus.

The Mexican Government and PEMEX determine the rates of taxes and duties applicable to PEMEX from year to year depending on a variety of factors, including our:

- •

- projected sales revenues;

- •

- operating program;

- •

- capital expenditures program; and

- •

- financing needs.

Petróleos Mexicanos is also obligated to pay minimum guaranteed dividends to the Mexican Government. The minimum guaranteed dividends totaled Ps. 5,138 million in 1999, Ps. 5,564 million in 2000 and Ps. 2,153 million in 2001. For further information on how the minimum guaranteed dividend is determined, see "Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Equity Structure and the Certificates of Contribution "A,"' and "Item 8—Financial Information—Dividends" in the Form 20-F included in this prospectus and Note 13 to our 2001 financial statements.

PEMEX must make significant capital expenditures to maintain its current production levels and increase Mexico's hydrocarbon reserves. Mexican Government budget cuts, reductions in PEMEX's income and inability to obtain financing may limit PEMEX's ability to make capital investments

We invest funds to increase the amount of extractable hydrocarbon reserves in Mexico. We also continually invest capital to enhance our hydrocarbon recovery ratio and improve the reliability and productivity of our infrastructure. We estimate that we will need to make capital expenditures of approximately U.S. $45.3 billion in exploration and production over the next five years and an additional U.S. $16.1 billion to upgrade our refineries over the next ten years, in order to increase production to meet anticipated growth in domestic and international market demand.

Our ability to make these capital expenditures is limited by the substantial taxes that we pay and cyclical decreases in our revenues primarily related to lower oil prices. In addition, budget cuts imposed by the Mexican Government and the availability of financing may also limit our ability to make capital investments. Because the non-PIDIREGAS portion of our investment budget is part of the Mexican Government's annual budget, when the Mexican Government reduces its annual budget, it may also reduce that portion of our investment budget. For example, in 1998, low crude oil prices reduced our income and the amount of taxes and duties that we paid to the Mexican Government. As a result, the Mexican Government imposed federal budget cuts that resulted in an 11.1% decrease in our capital expenditures budget (excluding PIDIREGAS) in 1998.

19

The Mexican Government has recently approved a PIDIREGAS investment budget that we believe will be sufficient to meet a large proportion of our capital expenditure needs for the next five years. However, under the PIDIREGAS program, we are required to obtain financing that can be supported by the project being funded. The availability of this financing is subject to factors beyond our control. Accordingly, we cannot guarantee that we will always have the funds necessary to continue capital investments at their current levels.

PEMEX's debt obligations may be affected by the Mexican Government's agreements with external creditors

Petróleos Mexicanos and the subsidiary entities are decentralized public sector entities under the direct control of the Mexican Government; consequently, the Mexican Government's agreements with international creditors may affect our external debt obligations. Since 1982, Mexico and its commercial bank creditors have concluded four debt restructurings and new money exercises. In these restructurings, Petróleos Mexicanos' external indebtedness was treated on the same terms as the debt of the Mexican Government and other public sector entities. In addition, Mexico has entered into agreements with official bilateral creditors to reschedule public sector external debt. Mexico has not requested restructuring of bonds or debt owed to multilateral agencies.

PEMEX may claim some immunities under the Foreign Sovereign Immunities Act and Mexican law

Petróleos Mexicanos and the subsidiary entities are decentralized public entities of the Mexican Government. Because the Mexican Government is a foreign sovereign, you may not be able to obtain a judgment in a U.S. court against us. In addition, Mexican law specifies that attachment prior to judgment and attachment in aid of execution may not be ordered by Mexican courts against us or our assets and, as a result, your ability to enforce judgments against us in the courts of Mexico may be limited.

Unless we waive our immunity, you could obtain a U.S. court judgment against us only if a U.S. court were to determine that we are not entitled to sovereign immunity under the Foreign Sovereign Immunities Act of 1976 with respect to that action. We also do not know whether Mexican courts would enforce judgments of United States courts based on the civil liability provisions of the federal securities laws of the United States.

Even if you were able to obtain a U.S. judgment against us under the Foreign Sovereign Immunities Act, you might not be able to obtain a judgment in Mexico that is based on that U.S. judgment. Moreover, you may not be able to enforce a judgment against our property in the United States except under the limited circumstances specified in the Foreign Sovereign Immunities Act.

Satisfaction of any judgment in Mexico against PEMEX may be made in pesos

If you were to bring an action in Mexico seeking to enforce our obligations under any of our securities, satisfaction of those obligations may be made in pesos. TheLey Monetaria de los Estados Unidos Mexicanos (Monetary Law of the United Mexican States) entitles us to discharge foreign currency denominated obligations in Mexico with a payment in pesos at the exchange rate determined by Banco de México (Mexico's Central Bank) on the date payment is made. This rate is currently announced by Banco de México each banking day and published the following day in theDiario Oficial de la Federación (the Official Gazette of the Federation).

Considerations Related to Mexico

Petróleos Mexicanos and the subsidiary entities are foreign companies, and as a result holders, of PEMEX securities may not be able to effect service of process on, or enforce a judgment against, PEMEX

Petróleos Mexicanos and the subsidiary entities are organized under the laws of Mexico and all of their directors and officers, as well as some of the experts named in this prospectus, reside outside the

20

United States. Substantially all of our assets and those of most of our directors, officers and experts are located outside the United States. As a result, you may not be able to effect service of process on our directors or officers or those experts within the United States. You also may not be able to enforce in Mexico judgments obtained in the United States against us, our directors or officers or the experts, if those judgments are not consistent with Mexican public policy and procedural rules.

Economic conditions and government policies in Mexico may have a material impact on PEMEX's operations

A deterioration in Mexico's economic conditions, social instability, political unrest or other adverse social developments in Mexico could adversely affect our business and financial condition. Those events could also lead to increased volatility in the foreign exchange and financial markets, thereby affecting our ability to obtain and service foreign debt. In addition, the Mexican Government may cut spending in the future. These cuts could adversely affect our business, financial condition and prospects.

From 1982 to 1987 Mexico experienced several periods of slow or negative economic growth, high inflation, peso devaluations and limited availability of foreign exchange. Beginning in December 1994 and continuing through 1995, Mexico experienced an economic crisis characterized by exchange rate instability, devaluation of the peso, high inflation, high domestic interest rates, negative economic growth, reduced consumer purchasing power and high unemployment. Despite signs of economic recovery following the implementation of broad economic reforms in 1995, a combination of factors led to a slowdown in Mexico's economic growth in 1998. Notably, the decline in the price of crude oil resulted in a reduction of federal revenues, approximately one-third of which derive from petroleum taxes and duties. In addition, the economic crises in Asia and Russia and the financial turmoil in Brazil, Venezuela and elsewhere produced greater volatility in the international financial markets, which further slowed Mexico's recovery. The Mexican Government estimates that real Gross Domestic Product ("GDP") grew 4.9% in 1998, 3.7% in 1999 and 6.6% in 2000 but decreased 0.3% in 2001. The Mexican Government estimates that GDP grew1.7% in 2002.

Despite the slowdown in economic recovery and the significant devaluation of the peso in 1998 and the contraction in 2001, Mexico has managed to maintain a high level of gross international reserves, which totaled U.S. $48,537 million at January 24, 2003. In the future, however, the Mexican economy could continue to suffer from declines in foreign direct and portfolio investment due to international financial crises, inflationary pressures, high short-term interest rates and low oil prices.

Changes in exchange rates or in Mexico's exchange control laws may hamper the ability of PEMEX to service its foreign currency debt

While the Mexican Government does not currently restrict the ability of Mexican companies or individuals to convert pesos into dollars or other currencies, in the future, the Mexican Government could impose a restrictive exchange control policy, as it has done in the past. We cannot assure you that the Mexican Government will maintain its current policies with regard to the peso or that the peso's value will not fluctuate significantly in the future. The peso has been subject to significant devaluations against the U.S. dollar in the past and may be subject to significant fluctuations in the future. Mexican Government policies affecting the value of the peso could prevent us from paying our foreign currency obligations.

As of December 31, 2001, the total debt of PEMEX totaled Ps. 159.4 billion (or Ps. 156.8 billion excluding accrued interest), 84.2% of which was denominated in U.S. dollars. Of this amount, U.S. $7.5 billion (or Ps. 68.7 billion) was attributable to the indebtedness of the Pemex Project Funding Master Trust denominated in U.S. dollars, Euros and other currencies and guaranteed by Petróleos Mexicanos, Pemex-Exploration and Production, Pemex-Refining and Pemex-Gas and Basic Petrochemicals. In addition, Pemex Finance, Ltd., a Cayman Islands company with limited liability established to issue securities backed by PMI crude oil receivables to provide financing for investments in PIDIREGAS, had indebtedness totaling U.S. $5.3 billion at December 31, 2001. We do not

21

guarantee Pemex Finance, Ltd.'s indebtedness. In the future, PEMEX and Pemex Finance, Ltd. may incur additional indebtedness denominated in U.S. dollars or other currencies. Declines in the value of the peso relative to the U.S. dollar or other currencies may increase our interest costs in pesos and result in foreign exchange losses.

From October 1992 to December 21, 1994, Banco de México intervened in foreign exchange markets to maintain the peso-dollar exchange rate within a government-controlled range that widened daily. On December 21, 1994, the Mexican Government suspended Banco de México's foreign exchange market operations and allowed the peso to float freely against the U.S. dollar. The Mexican Government may introduce similar policies in the future that affect the exchange rate between the peso and other currencies.