File No. 333-218722

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 26, 2017

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. 2 [X]

Post-Effective Amendment No. [ ]

JNL Series Trust

(Exact Name of Registrant as Specified in Charter)

1 Corporate Way

Lansing, Michigan 48951

(Address of Principal Executive Offices)

(517) 381-5500

(Registrant’s Area Code and Telephone Number)

225 West Wacker Drive

Suite 1200

Chicago, Illinois 60606

(Mailing Address)

With copies to:

EMILY J. BENNETT, ESQ. JNL Series Trust 1 Corporate Way Lansing, Michigan 48951 | PAULITA PIKE, ESQ. Ropes & Gray LLP 191 North Wacker Drive Chicago, Illinois 60606 |

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this Registration Statement will become effective on July 21, 2017, pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of securities being registered: Class A and Class I Shares of beneficial interest in the series of the registrant designated as the JNL/Harris Oakmark Global Equity Fund.

No filing fee is required because the registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares (File Nos. 033-87244 and 811-8894).

JNL SERIES TRUST

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following papers and documents:

Cover Sheet

Contents of Registration Statement

Letter to Contract Owners

Notice of Special Meeting

Contract Owner Voting Instructions

Part A - Proxy Statement/Prospectus

Part B - Statement of Additional Information

Part C - Other Information

Signature Page

Exhibits

JACKSON NATIONAL LIFE INSURANCE COMPANY

JACKSON NATIONAL LIFE INSURANCE COMPANY OF NEW YORK

1 Corporate Way

Lansing, Michigan 48951

July 21, 2017

Dear Contract Owner:

Enclosed is a notice of a Special Meeting of Shareholders of the JNL/Red Rocks Listed Private Equity Fund (the “Red Rocks” or the “Acquired Fund”), a series of JNL Series Trust (the “Trust”). The Special Meeting of Shareholders of the Acquired Fund is scheduled to be held at the offices of Jackson National Life Insurance Company, 1 Corporate Way, Lansing, Michigan, 48951, on August 23, 2017, at 9:00 a.m., Eastern Time (the “Meeting”). At the Meeting, the shareholders of the Acquired Fund will be asked to approve the proposal described below.

The Trust’s Board of Trustees (the “Board”) called the Meeting to request shareholder approval of the reorganization (the “Reorganization”) of the Acquired Fund into the JNL/Harris Oakmark Global Equity Fund, also a series of the Trust (the “Acquiring Fund”).

The Board has approved this proposal.

Both the Acquired Fund and the Acquiring Fund are managed by Jackson National Asset Management, LLC (“JNAM”), and each is sub-advised by an investment sub-adviser. If the Reorganization is approved and implemented, each person that invests indirectly in the Acquired Fund will automatically become an investor indirectly in the Acquiring Fund.

Pending shareholder approval, effective as of the close of business on September 22, 2017, or on such later date as may be deemed necessary in the judgment of the Board in accordance with the Plan of Reorganization (the “Closing Date”), you will invest indirectly in shares of the Acquiring Fund in an amount equal to the dollar value of your interest in the Acquired Fund on the Closing Date. No sales charge, redemption fees, or other transaction fees will be imposed in the Reorganization. The Reorganization will not cause any fees or charges under your contract to be greater after the Reorganization than before the Reorganization, and the Reorganization will not alter your rights under your contract or the obligations of the insurance company that issued the contract.

You may wish to take actions relating to your future allocation of premium payments under your insurance contract to the various investment divisions (the “Divisions”) of the separate account. You may execute certain changes prior to the Reorganization, in addition to participating in the Reorganization with regard to the Acquiring Fund, such as allocating your premium payments to other Divisions.

All actions with regard to the Acquired Fund need to be completed by the Closing Date. In the absence of new instructions prior to the Closing Date, future premium payments previously allocated to the Acquired Fund Division will be allocated to the Acquiring Fund Division. The Acquiring Fund Division will be the Division for future allocations under the Dollar Cost Averaging, Earnings Sweep, and Rebalancing Programs (together, the “Programs”). In addition to the Acquiring Fund Division, there are other Divisions investing in mutual funds that seek capital appreciation. If you want to transfer all or a portion of your Contract value out of the Acquired Fund Division prior to the Reorganization, you may do so and that transfer will not be treated as a transfer for the purpose of determining how many subsequent transfers may be made in any period or how many may be made in any period without charge. In addition, if you want to transfer all or a portion of your Contract value out of the Acquiring Fund Division after the Reorganization, you may do so within 60 days following the Closing Date and that transfer will not be treated as a transfer for the purpose of determining how many subsequent transfers may be made in any period or how many may be made in any period without charge. You will be provided with an additional notification of this free-transfer policy on or about September 25, 2017.

If you want to change your allocation instructions as to your future premium payments or the Programs or if you require summary descriptions of the other underlying funds and Divisions available under your contract or additional copies of the prospectuses for other funds underlying the Divisions, please contact:

For Jackson variable annuity policies:

| Annuity Service Center |

| P.O. Box 30314 |

| Lansing, Michigan 48909-7814 |

| 1-800-644-4565 |

| www.jackson.com |

For Jackson variable universal life policies:

Jackson® Service Center |

| P.O. Box 30502 |

| Lansing, Michigan 48909-8002 |

| 1-800-644-4565 |

| www.jackson.com |

For Jackson New York variable annuity policies:

| Jackson of NY Service Center |

| P.O. Box 30313 |

| Lansing, Michigan 48909-7813 |

| 1-800-599-5651 |

| www.jackson.com |

An owner of a variable annuity contract or certificate that participates in the Acquired Fund through the Divisions of separate accounts established by Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York (each, an “Insurance Company”) is entitled to instruct the applicable Insurance Company how to vote the Acquired Fund shares related to the ownership interest in those accounts as of the close of business on June 30, 2017. The attached Notice of Special Meeting of Shareholders and Proxy Statement and Prospectus concerning the Meeting describe the matters to be considered at the Meeting.

You are cordially invited to attend the Meeting. Because it is important that your vote be represented whether or not you are able to attend, you are urged to consider these matters and to exercise your right to vote your shares by completing, dating, signing, and returning the enclosed voting instruction card in the accompanying return envelope at your earliest convenience or by relaying your voting instructions via telephone or the Internet by following the enclosed instructions. Of course, we hope that you will be able to attend the Meeting, and if you wish, you may vote your shares in person, even if you may have already returned a voting instruction card or submitted your voting instructions via telephone or the Internet. At any time prior to the Meeting, you may revoke your voting instructions by providing the Insurance Company with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone, or the Internet, or appearing and voting in person at the Meeting. Please respond promptly in order to save additional costs of proxy solicitation and to make sure you are represented.

| Very truly yours, |

| | |

| |

| Mark D. Nerud Trustee, President, and Chief Executive Officer JNL Series Trust |

JNL SERIES TRUST

JNL/Red Rocks Listed Private Equity Fund

1 Corporate Way

Lansing, Michigan 48951

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 23, 2017

To the Shareholders:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders of the JNL/Red Rocks Listed Private Equity Fund (the “Red Rocks Fund” or the “Acquired Fund”), a series of JNL Series Trust (the “Trust”), will be held on August 23, 2017 at 9:00 a.m., Eastern Time, at the offices of Jackson National Life Insurance Company, 1 Corporate Way, Lansing, Michigan 48951 (the “Meeting”).

The Meeting will be held to act on the following proposals:

| 1. | To approve the Plan of Reorganization, adopted by the Trust’s Board of Trustees (the “Board”), which provides for the reorganization of the Red Rocks Fund into the JNL/Harris Oakmark Global Equity Fund, also a series of the Trust. |

| 2. | To transact other business that may properly come before the Meeting or any adjournments thereof. |

Please note that owners of variable life insurance policies or variable annuity contracts or certificates (the “Contract Owners”) issued by Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York (each, an “Insurance Company”) who have invested in shares of the Acquired Fund through the investment divisions of a separate account or accounts of an Insurance Company (“Separate Account”) will be given the opportunity, to the extent required by law, to provide the applicable Insurance Company with voting instructions on the above agenda items.

You should read the Proxy Statement and Prospectus attached to this notice prior to completing your proxy or voting instruction card. The record date for determining the number of shares outstanding, the shareholders entitled to vote, and the Contract Owners entitled to provide voting instructions at the Meeting and any adjournments thereof has been fixed as the close of business on June 30, 2017. If you attend the Meeting, you may vote or give your voting instructions in person.

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY CARD OR VOTING INSTRUCTION CARD PROMPTLY.

Regardless of whether you plan to attend the Meeting, you should vote or give voting instructions by promptly completing, dating, signing, and returning the enclosed proxy or voting instruction card for the Acquired Fund in the enclosed postage-paid envelope. You also can vote or provide voting instructions through the Internet or by telephone using the 14-digit control number that appears on the enclosed proxy or voting instruction card and following the simple instructions. At any time prior to the Meeting, you may revoke your voting instructions by providing the Insurance Company with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone, or the Internet, or appearing and voting in person at the Meeting. If you are present at the Meeting, you may change your vote or voting instructions, if desired, at that time. The Board recommends that you vote or provide voting instructions to vote FOR the proposal.

| | By order of the Board, |

| | |

| | |

| | Mark D. Nerud Trustee, President, & Chief Executive Officer |

July 21, 2017

Lansing, Michigan

JACKSON NATIONAL LIFE INSURANCE COMPANY

JACKSON NATIONAL LIFE INSURANCE COMPANY OF NEW YORK

CONTRACT OWNER VOTING INSTRUCTIONS

REGARDING A SPECIAL MEETING OF SHAREHOLDERS OF

JNL/RED ROCKS LISTED PRIVATE EQUITY FUND

A SERIES OF THE JNL SERIES TRUST

TO BE HELD ON AUGUST 23, 2017

DATED: JULY 21, 2017

GENERAL

These Contract Owner voting instructions are being furnished by Jackson National Life Insurance Company (“Jackson National”), or Jackson National Life Insurance Company of New York (each, an “Insurance Company” and, together, the “Insurance Companies”), to owners of their variable life insurance policies or variable annuity contracts or certificates (the “Contracts”) (the “Contract Owners”) who, as of June 30, 2017 (the “Record Date”), had net premiums or contributions allocated to the investment divisions of their separate accounts (the “Separate Accounts”) that are invested in shares of the JNL/Red Rocks Listed Private Equity Fund (the “Red Rocks Fund” or “Acquired Fund”), a series of JNL Series Trust (the “Trust”).

The Trust is a Massachusetts business trust registered with the Securities and Exchange Commission (the “SEC”) as an open-end management investment company.

Each Insurance Company is required to offer Contract Owners the opportunity to instruct it, as the record owner of all of the shares of beneficial interest in the Acquired Fund (the “Shares”) held by its Separate Accounts, as to how it should vote on the reorganization proposal (the “Proposal”) to be considered at the Special Meeting of Shareholders of the Acquired Fund referred to in the preceding Notice and at any adjournments (the “Meeting”). The enclosed Proxy Statement and Prospectus, which you should retain for future reference, concisely sets forth information about the proposed reorganization involving the Acquired Fund and a corresponding series of the Trust that a Contract Owner should know before completing the enclosed voting instruction card.

These Contract Owner Voting Instructions and the accompanying voting instruction card are being mailed to Contract Owners on or about July 28, 2017.

HOW TO INSTRUCT AN INSURANCE COMPANY

To instruct an Insurance Company as to how to vote the Shares held in the investment divisions of its Separate Accounts, Contract Owners are asked to promptly complete their voting instructions on the enclosed voting instruction card(s) and sign, date, and mail the voting instruction card(s) in the accompanying postage-paid envelope. Contract Owners also may provide voting instructions by phone at 1-866-298-8476 or by Internet at our website at www.proxy-direct.com.

If a voting instruction card is not marked to indicate voting instructions but is signed, dated, and returned, it will be treated as an instruction to vote the Shares in favor of the Proposal.

The number of Shares held in the investment division of a Separate Account corresponding to the Acquired Fund for which a Contract Owner may provide voting instructions was determined as of the Record Date by dividing (i) a Contract’s account value (minus any Contract indebtedness) allocable to that investment division by (ii) the net asset value of one Share of the Acquired Fund. At any time prior to an Insurance Company’s voting at the Meeting, a Contract Owner may revoke his or her voting instructions with respect to that investment division by providing the Insurance Company with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone or the Internet, or appearing and voting in person at the Meeting.

HOW AN INSURANCE COMPANY WILL VOTE

An Insurance Company will vote the Shares for which it receives timely voting instructions from Contract Owners in accordance with those instructions. Shares in each investment division of a Separate Account for which an Insurance Company receives a voting instruction card that is signed, dated, and timely returned but is not marked to indicate voting instructions will be treated as an instruction to vote the Shares in favor of the Proposal. Shares in each investment division of a Separate Account for which an Insurance Company receives no timely voting instructions from a Contract Owner, or that are attributable to amounts retained by an Insurance Company or its affiliate as surplus or seed money, will be voted by the applicable Insurance Company either for or against approval of the Proposal, or as an abstention, in the same proportion as the Shares for which Contract Owners (other than the Insurance Company) have provided voting instructions to the Insurance Company. Similarly, the Insurance Companies and their affiliates will vote their own shares and will vote shares of the regulated investment companies (also known as “RICs”) that are held by the Fund of Funds whose shares are held by a Separate Account in the same proportion as voting instructions timely given by Contract Owners for those respective regulated investment companies. As a result of proportionate voting, a small number of Contract Owners could determine the outcome of the Proposal. Please see “Additional Information about the Acquiring Fund – Tax Status” below for further information regarding regulated investment companies.

OTHER MATTERS

The Insurance Companies are not aware of any matters, other than the Proposal, to be acted on at the Meeting. If any other matters come before the Meeting, an Insurance Company will vote the Shares upon such matters in its discretion. Voting instruction cards may be solicited by employees of Jackson National or its affiliates as well as officers and agents of the Trust. The principal solicitation will be by mail, but voting instructions may also be solicited by telephone, fax, personal interview, the Internet, or other permissible means.

If the necessary quorum to transact business is not established or the vote required to approve or reject the Proposal is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting in accordance with applicable law to permit further solicitation of voting instructions. The persons named as proxies will vote in favor of such adjournment with respect to those Shares for which they received voting instructions in favor of the Proposal and will vote against any such adjournment those Shares for which they received voting instructions against the Proposal.

It is important that your Contract be represented. Please promptly mark your voting instructions on the enclosed voting instruction card; then sign, date, and mail the voting instruction card in the accompanying postage-paid envelope. You may also provide your voting instructions by telephone at 1-866-298-8476 or by Internet at our website at www.proxy-direct.com.

PROXY STATEMENT

for

JNL/Red Rocks Listed Private Equity Fund, a series of JNL Series Trust

and

PROSPECTUS

for

JNL/Harris Oakmark Global Equity Fund, a series of JNL Series Trust

Dated

July 21, 2017

1 Corporate Way

Lansing, Michigan 48951

(517) 381-5500

This Proxy Statement and Prospectus (the “Proxy Statement/Prospectus”) is being furnished to owners of variable life insurance policies or variable annuity contracts or certificates (the “Contracts”) (the “Contract Owners”) issued by Jackson National Life Insurance Company (“Jackson National”) or Jackson National Life Insurance Company of New York (each, an “Insurance Company” and together, the “Insurance Companies”) who, as of June 30, 2017, had net premiums or contributions allocated to the investment divisions of an Insurance Company’s separate accounts (the “Separate Accounts”) that are invested in shares of beneficial interest in the JNL/Red Rocks Listed Private Equity Fund (the “Red Rocks Fund” or the “Acquired Fund”), a series of JNL Series Trust (the “Trust”), an open-end management investment company registered with the Securities and Exchange Commission (“SEC”). The purpose of this Proxy Statement/Prospectus is for shareholders of the Red Rocks Fund to vote on a Plan of Reorganization, adopted by the Trust’s Board of Trustees (the “Board”), which provides for the reorganization of the Red Rocks Fund into the JNL/Harris Oakmark Global Equity Fund (the “Harris Fund” or the “Acquiring Fund”), also a series of the Trust.

This Proxy Statement/Prospectus also is being furnished to the Insurance Companies as the record owners of shares and to other shareholders that were invested in the Acquired Fund as of June 30, 2017. Contract Owners are being provided the opportunity to instruct the applicable Insurance Company to approve or disapprove the proposal contained in this Proxy Statement/Prospectus in connection with the solicitation by the Board of proxies to be used at the Special Meeting of Shareholders of the Acquired Fund to be held at 1 Corporate Way, Lansing, Michigan 48951, on August 23, 2017, at 9:00 a.m., Eastern Time, or any adjournment or adjournments thereof (the “Meeting”).

THE SEC HAS NOT APPROVED OR DISAPPROVED THE SECURITIES DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR DETERMINED IF THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The proposal described in this Proxy Statement/Prospectus is as follows:

| Proposal | Shareholders Entitled to Vote on the Proposal |

| 1. To approve the Plan of Reorganization, adopted by the Trust’s Board, which provides for the reorganization of the Red Rocks Fund into the Harris Fund. | Shareholders of the Red Rocks Fund |

The reorganization referred to in the above proposal is referred to herein as the “Reorganization.”

This Proxy Statement/Prospectus, which you should retain for future reference, contains important information regarding the proposal that you should know before voting or providing voting instructions. Additional information about the Trust has been filed with the SEC and is available upon oral or written request without charge. This Proxy Statement/Prospectus is being provided to the Insurance Companies and mailed to Contract Owners on or about July 28, 2017. It is expected that one or more representatives of each Insurance Company will attend the Meeting in person or by proxy and will vote shares held by the Insurance Company in accordance with voting instructions received from its Contract Owners and in accordance with voting procedures established by the Trust.

The following documents have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Prospectus and Statement of Additional Information of the Trust, each dated April 24, 2017, as supplemented, with respect to the Acquired Fund (File Nos. 033-87244 and 811-8894); |

| 2. | The Annual Report to Shareholders of the Trust with respect to the Acquired Fund for the fiscal year ended December 31, 2016 (File Nos. 033-87244 and 811-8894); |

| 3. | The Statement of Additional Information dated July 21, 2017, relating to the Reorganization (File No. 333-218722). |

For a free copy of any of the above documents, please call or write to the phone numbers or address below.

Contract Owners can learn more about the Acquired Fund and the Acquiring Fund in any of the documents incorporated into this proxy statement/prospectus, including the Annual Report listed above, which have been furnished to Contract Owners. Contract Owners may request a copy thereof, without charge, by calling 1-800-644-4565 ( Jackson Service Center) or 1-800-599-5651 ( Jackson NY Service Center), by writing the JNL Series Trust, P.O. Box 30314, Lansing, Michigan 48909-7814, or by visiting www.jackson.com.

The Trust is subject to the informational requirements of the Securities Act of 1933, as amended (the “1933 Act”), the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”). Accordingly, it must file certain reports and other information with the SEC. You can copy and review proxy materials, reports, and other information about the Trust at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. Proxy materials, reports, and other information about the Trust are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following E-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, SEC Office of Consumer Affairs and Information Services, 100 F Street, N.E., Washington, DC 20549-1520.

TABLE OF CONTENTS

| 1 |

| 1 |

| 2 |

| 4 |

Expense Examples | |

| 5 |

| 5 |

| 5 |

| 7 |

| 9 |

| 10 |

| 12 |

| 13 |

| 13 |

| 13 |

| 13 |

| 15 |

| 16 |

| 16 |

| 16 |

| 16 |

| 16 |

| 16 |

| 17 |

| 19 |

| 20 |

| 20 |

| 20 |

| 21 |

| 21 |

| 22 |

| 23 |

| 23 |

| 23 |

| 24 |

| 26 |

| 26 |

| 26 |

| 26 |

| 26 |

| 27 |

| 27 |

| 27 |

| 28 |

| A-1 |

| B-1 |

| C-1 |

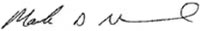

Red Rocks Fund (Class A) – Calendar Year Total Returns

Best Quarter (ended 6/30/2009): 45.51%; Worst Quarter (ended 9/30/2011): -26.77%

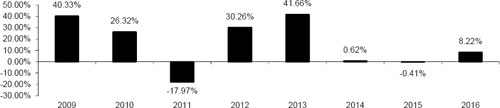

Red Rocks Fund (Class B) – Calendar Year Total Returns

Best Quarter (ended 6/30/2009): 45.73%; Worst Quarter (ended 9/30/2011): -26.74%

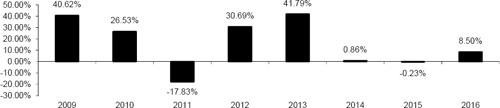

Harris Fund – Calendar Year Total Returns

Best Quarter (ended 9/30/2016): 12.23%; Worst Quarter (ended 6/30/2016): -5.49%

| Acquired Fund – Average Annual Total Returns as of December 31, 2016 |

| | 1 year | 5 year | Life of Fund (October 6, 2008) |

| Red Rocks Fund (Class A) | 8.22% | 14.88% | 6.88% |

| Red Rocks Fund (Class B) | 8.50% | 15.14% | 7.10% |

S&P Listed Private Equity Index (reflects no deduction for fees, expenses or taxes) | 15.39% | 15.35% | 6.74% |

| Acquiring Fund – Average Annual Total Returns as of December 31, 2016 |

| | 1 year | Life of Fund (April 27, 2015) |

| Harris Fund (Class A) | 12.45% | -0.22% |

| MSCI World Index | 7.51% | 0.30% |

The following table shows the capitalization of each Fund as of December 31, 2016, and of the Harris Fund on a pro forma combined basis as of December 31, 2016 after giving effect to the proposed Reorganization. The actual net assets of the Red Rocks Fund and the Harris Fund on the Closing Date will differ due to fluctuations in net asset values, subsequent purchases, and redemptions of shares. No assurance can be given as to how many shares of the Harris Fund will be received by shareholders of Red Rocks Fund on the Closing Date, and the following table should not be relied upon to reflect the number of shares of the Harris Fund that will actually be received.

| | Net Assets | Net Asset Value Per Share | Shares Outstanding |

| Red Rocks Fund – Class A | $460,116,714 | $8.81 | 52,207,446 |

| Harris Fund – Class A | $64,915,778 | $9.87 | 6,575,060 |

| Adjustments | $(296,615)(a) | — | (5,619,797)(b) |

Pro forma Harris Fund – Class A (assuming the Reorganization is approved) | $524,735,877 | $9.87 | 53,162,709 |

| Red Rocks Fund – Class B | $488,382 | $8.90 | 54,876 |

Harris Fund – Class I (c) | $- | $9.87(d) | — |

| Adjustments | $315(a) | — | (5,426)(b) |

Pro forma Harris Fund – Class I (assuming the Reorganization is approved) | $488,067 | $9.87 | 49,450 |

| (a) | The costs and expenses associated with the Reorganization relating to the solicitation of proxies, including preparing, filing, printing, and mailing of the proxy statement and related disclosure documents, and the related legal fees, including the legal fees incurred in connection with the analysis under the Code of the tax treatment of this transaction as well as the costs associated with the preparation of the tax opinion and obtaining a consent of independent registered public accounting firm, will all be borne by JNAM, and no sales or other charges will be imposed on Contract Owners in connection with the Reorganization. Each Fund will bear its proportionate share of the Transaction Costs associated with the Reorganization. Such Transaction Costs are estimated to be $153,472 attributed to the Red Rocks Fund and $299,166 attributed to the Harris Fund. The proposed Reorganization would result in an increase of $155,708 in management fees had the Reorganization occurred on January 1, 2016. |

| (b) | The adjustment to the pro forma shares outstanding number represents a decrease in shares outstanding of the Harris Fund to reflect the exchange of shares of the Red Rocks Fund. |

| (c) | Effective September 25, 2017, the Harris Fund will have two share classes, Class A shares and Class I shares. |

| (d) | Because the Harris Fund currently has only one share class (Class A), the net asset value of Class A shares was used for calculation purposes to determine the pro forma capitalization with respect to Class I shares of the Harris Fund |

The Reorganization provides for the acquisition of all the assets and all the liabilities of the Red Rocks Fund by the Harris Fund. If the Reorganization had taken place on December 31, 2016, the Red Rocks Fund would have received 46,587,649 and 49,450 Class A and Class I shares, respectively, of the Harris Fund.

After careful consideration, the Board unanimously approved the Plan of Reorganization with respect to the Red Rocks Fund. Accordingly, the Board has submitted the Plan of Reorganization for approval by the Red Rocks Fund’s shareholders. The Board recommends that you vote “FOR” this Proposal.

* * * * *

ADDITIONAL INFORMATION ABOUT THE REORGANIZATION

Terms of the Plan of Reorganization

The terms of the Plan of Reorganization are summarized below. For additional information, you should consult the Plan of Reorganization, a copy of which is attached as Appendix A.

If shareholders of the Acquired Fund approve the Plan of Reorganization, then the assets of the Acquired Fund will be acquired by, and in exchange for, Class A and Class I shares, respectively, of the Acquiring Fund and the liabilities of the Acquired Fund will be assumed by the Acquiring Fund. The Acquired Fund will then be terminated by the Trust, and the Class A and Class I shares of the Acquiring Fund distributed to the Class A and Class B shareholders, respectively, of the Acquired Fund in the redemption of the Class A and Class B Acquired Fund shares. Immediately after completion of the Reorganization, the number of shares of the Acquiring Fund then held by former shareholders of the Acquired Fund may be different than the number of shares of the Acquired Fund that had been held immediately before completion of the Reorganization, but the total investment will remain the same (i.e., the total value of the Acquiring Fund shares held immediately after the completion of the Reorganization will be the same as the total value of the Acquired Fund shares formerly held immediately before completion of the Reorganization).

It is anticipated that the Reorganization will be consummated as of the close of business on September 22, 2017, or on such later date as may be deemed necessary in the judgment of the Board and in accordance with the Plan of Reorganization, subject to the satisfaction of all conditions precedent to the closing. It is not anticipated that the Acquired Fund will hold any investment that the Acquiring Fund would not be permitted to hold (“non-permitted investments”).

Description of the Securities to Be Issued

The shareholders of the Acquired Fund will receive Class A or Class I shares of the Acquiring Fund in accordance with the procedures provided for in the Plan of Reorganization. Each such share will be fully paid and non-assessable by the Trust when issued and will have no preemptive or conversion rights.

The Trust may issue an unlimited number of full and fractional shares of beneficial interest of the Acquiring Fund and divide or combine such shares into a greater or lesser number of shares without thereby changing the proportionate beneficial interests in the Trust. Each share of the Acquiring Fund represents an equal proportionate interest in that Fund with each other share. The Trust reserves the right to create and issue any number of Fund shares. In that case, the shares of the Acquiring Fund would participate equally in the earnings, dividends, and assets of the Fund. Upon liquidation of the Acquiring Fund, shareholders are entitled to share pro rata in the net assets of the Fund available for distribution to shareholders. The Acquiring Fund is a series of the Trust.

For certain Funds, the Trust currently offers two classes of shares, Class A and Class B; however, the Harris Fund currently only has one share class. However, effective September 25, 2017, the Harris Fund will have two share classes, Class A shares and Class I shares. The Trust has adopted, in the manner prescribed under Rule 12b-1 under the 1940 Act, a plan of distribution pertaining to the Class A shares of the Acquiring Fund. The maximum distribution and/or service (12b-1) fee for the Acquiring Fund's Class A shares is equal to an annual rate of 0.20% of the average daily net assets attributable to those shares. At a meeting of shareholders held on June 22, 2017, shareholders adopt ed an amended and restated Distribution Plan (the "Amended Plan"). The Class A shares will be charged a Rule 12b-1 fee at the annual rate of 0.30% of the average daily net assets attributable to the Class A shares of the Acquiring Fund. Because these distribution/service fees are paid out of the Acquiring Fund's assets on an ongoing basis, over time these fees will increase your cost of investing and may cost more than paying other types of charges.

At a meeting of the Board held on June 1-2, 2017, JNAM recommended that the Board consider and approve the proposed Reorganization. In connection with the proposed Reorganization, the Board, including the Trustees who are not “interested persons” (as that term is defined in the 1940 Act) of the Trust (“Independent Trustees”), considered written memoranda and other supporting materials provided by JNAM and discussed the potential benefits to the

shareholders of the Acquired Fund under the proposed Reorganization. The Board considered that the Reorganization is part of an overall rationalization of the Trust’s offerings and is designed to eliminate inefficiencies arising from offering overlapping funds with similar investment objectives and investment strategies that serve as investment options for the Contracts issued by the Insurance Companies and certain nonqualified plans. The Board also considered that the Reorganization also seeks to increase assets under management in the Acquiring Fund and seeks to achieve additional economies of scale. The objective of the Reorganization is to seek to ensure that a consolidated family of investments offers a streamlined, complete, and competitive set of underlying investment options to serve the interests of shareholders and Contract Owners. The Board noted that approval of the Reorganization requires the affirmative vote of a majority of the outstanding voting securities of the Acquired Fund. In determining whether to recommend approval of the Reorganization, the Board considered many factors, including:

| · | Investment Objectives and Investment Strategies. The Board considered that the Reorganization will permit the Contract Owners with beneficial interest in the Acquired Fund to continue to invest in a professionally managed fund with similar investment goals, noting that the Acquired Fund’s investment objective is to seek to maximum total return, and the Acquiring Fund’s investment objective is to seek capital appreciation. The Board considered the Acquired Fund’s unique investment process and strategies, and management’s assertion that the Acquiring Fund offers two similar key characteristics of the Acquired Fund: its global equity composition and its large allocation to the financials sector. The Board also considered management’s statement that it has stronger conviction in the portfolio management for the Acquiring Fund and believes that the Acquiring Fund represents exposure to a quality portfolio management team who has delivered strong long-term risk adjusted performance relative to both its peers and its benchmark. The Board considered how the Acquired Fund’s shareholders will benefit from the Reorganization. For a full description of the investment objectives and investment strategies of the Acquired Fund and Acquiring Fund, see “Comparison of Investment Objectives and Principal Investment Strategies.” |

| · | Operating Expenses. The Board considered that, if approved by the Acquired Fund’s shareholders, the Reorganization will result in a combined Fund with a total annual fund operating expense ratio that is lower than those of the Acquired Fund currently, but higher management fees. The Board also considered that, as of its most recent fiscal year end of December 31, 2016, the Acquired Fund had total annual operating expense ratios that were higher than that of the Acquiring Fund. See “Comparative Fee and Expense Tables.” |

| · | Larger Asset Base. The Board noted that the Reorganization may benefit Contract Owners and others with beneficial interests in the Acquired Fund by allowing them to invest in the Combined Fund that has a much larger asset base than that of the Acquired Fund currently. The Board noted that as of December 31, 2016, the Acquired Fund had assets of $460.61 million as compared to assets of $64.92 million for the Acquiring Fund. The Board considered that reorganizing the Acquired Fund into the Acquiring Fund is the best way to offer Contract Owners and other investors the ability to benefit from economies of scale. |

| · | Performance. The Board considered that the Acquiring Fund has had better performance than the Acquired Fund for the 3 month and 1-year periods ended March 31, 2017. The Board also noted that, during calendar year 2016, the Acquiring Fund returned 12.45% while Class A shares and Class B shares of the Acquired Fund returned 8.22% and 8.50%, respectively. |

| · | Investment Adviser and Other Service Providers. The Board considered that the Funds currently have the same investment adviser and administrator, JNAM, and many of the same service providers, with the exception of having different sub-advisers. It considered that the Acquired Fund will have the same investment adviser and other service providers after the Reorganization as it has currently. Specifically, it noted that the transfer agent for the Acquiring Fund is the same as for the Acquired Fund and will remain the same after the Reorganization. It further noted that the distributor for shares of the Acquiring Fund, Jackson National Life Distributors LLC, is the same as for the Acquired Fund and will remain the same after the Reorganization. The Board considered that the custodian for the Acquired Fund, J.P. Morgan Chase Bank, N.A., is different from the custodian for the Acquiring Fund, State Street Bank and Trust Company, but that the custodian for the Acquiring Fund will remain the same after the Reorganization. The Board noted that the Acquired Fund is sub-advised by Red Rocks Capital LLC and the Acquiring Fund is sub-advised by Harris Associates L.P., and it considered that after the Reorganization, the Combined Fund will be sub-advised by Harris Associates L.P. The Board discussed how this |

| change may benefit the Acquired Fund’s shareholders, considering management’s general concerns about the Acquired Fund. It took into account those concerns about the Acquired Fund’s sub-adviser (e.g., overall concerns about the portfolio management team). The Board discussed whether it would benefit the shareholders to replace the Fund’s sub-adviser rather than merging it into the Acquiring Fund and how such a replacement would affect the Fund’s fees. The Board considered management’s high level of conviction in the Acquiring Fund, as well as management’s confidence in the Acquiring Fund’s sub-adviser. See “Comparison of Investment Adviser and Sub-Adviser.” |

| · | Federal Income Tax Consequences. The Board took into account that Contract Owners are not expected to have adverse tax consequences as a result of the Reorganization. It considered that the Reorganization is expected to be a tax-free reorganization under Section 368(a)(1) of the Code for the Funds and is not expected to result in any material adverse federal income tax consequences to shareholders of the Acquired Fund. |

| · | Costs of Reorganization. The Board considered that the costs and expenses associated with the Reorganization relating to the solicitation of proxies, including preparing, filing, printing, and mailing of the proxy statement and related disclosure documents, and the related legal fees, including the legal fees incurred in connection with the analysis under the Code of the tax treatment of this transaction, as well as the costs associated with the preparation of the tax opinion and obtaining a consent of independent registered public accounting firm will all be borne by JNAM, and no sales or other charges will be imposed on Contract Owners in connection with the Reorganization. The Board also considered that each Fund will bear its proportionate share of the Transaction Costs associated with the Reorganization and that such Transaction Costs are estimated to be $153,472 attributed to the Red Rocks Fund and $299,166 attributed to the Harris Fund. Please see “Additional Information about the Reorganization” below for more information. |

In summary, in determining whether to recommend approval of the Reorganization, the Board considered factors including (1) the terms and conditions of the Reorganization and whether the Reorganization would result in dilution of the Acquired Fund’s and Acquiring Fund’s shareholders’, Contract Owners’, and plan participants’ interests; (2) the compatibility of the Funds’ investment objectives, investment strategies and investment restrictions, as well as shareholder services offered by the Funds; (3) the expense ratios and information regarding the fees and expenses of the Funds; (4) the advantages and disadvantages to the Acquired Fund’s and Acquiring Fund’s shareholders, Contract Owners, and plan participants of having a larger asset base in the Combined Fund; (5) the relative historical performance of the Funds; (6) the management of the Funds; (7) the federal income tax consequences of the Reorganization; and (8) the costs of the Reorganization. No one factor was determinative and each Trustee may have attributed different weights to the various factors.

For the reasons described above, the Board, including the Independent Trustees, determined that the Reorganization would be in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of the Acquired Fund’s and the Acquiring Fund’s Contract Owners and other investors would not be diluted as a result of the Reorganization. At the Board meeting held on June 1-2, 2017, the Board voted unanimously to approve the Reorganization and recommended its approval by Contract Owners and others with beneficial interests in the Acquired Fund.

Description of Risk Factors

A Fund’s performance may be affected by one or more risk factors. For a detailed description of each Fund’s risk factors, please see “More Information on Strategies and Risk Factors” in Appendix B.

Federal Income Tax Consequences of the Reorganization

The federal income tax treatment of the Reorganization depends upon several factors, including the extent to which the Acquired Fund disposes of assets prior to the completion of the Reorganization. It is expected that the Reorganization will qualify as a tax-free reorganization under Section 368(a)(1) of the Code, in which event no gain or loss will be recognized by the Acquired Fund or its shareholders. As a condition to the closing of the Reorganization, the Funds will receive an opinion from tax counsel substantially to the effect that, on the basis of existing provisions of the Code, U.S. Treasury Regulations promulgated thereunder, current administrative rules, pronouncements and court decisions, and subject to certain qualifications, the Reorganization is more likely than not to qualify as a tax-free reorganization under Section 368(a)(1) of the Code.

The Acquired Fund may dispose of a portion or all of its portfolio securities in connection with and prior to the Reorganization. The Acquired Fund will recognize gain or loss upon such dispositions; any such gains will be distributed to Acquired Fund shareholders or the Acquired Fund will otherwise be eligible to claim, and will claim, a dividends-paid deduction for such amounts.

Contract Owners with premiums or contributions allocated to the investment divisions of the Separate Accounts as well as others that are invested in Acquired Fund shares generally will not recognize gain or loss for federal income tax purposes as a result of the Reorganization.

Contract Owners and other investors are urged to consult their tax advisers as to the specific consequences to them of the Reorganization, including the applicability and effect of state, local, foreign, and other taxes.

If the Reorganization is not approved by shareholders, the Funds will continue to operate as they currently do and the Board will consider what actions are appropriate and in the best interests of Contract Owners that have assets invested in the Acquired Fund.

ADDITIONAL INFORMATION ABOUT THE ACQUIRING FUND

This section provides information about the Trust, the Adviser, and the Sub-Adviser for the Acquiring Fund.

The Trust is organized as a Massachusetts business trust and is registered with the SEC as an open-end management investment company. Under Massachusetts law and the Trust’s Agreement and Declaration of Trust (the “Declaration of Trust”) and By-Laws, the management of the business and affairs of the Trust is the responsibility of its Board. The Acquiring Fund is a series of the Trust. For purposes of this section, references to “Fund” and “Funds” refer to the series of the Trust.

Jackson National Asset Management, LLC is located at 1 Corporate Way, Lansing, Michigan 48951, serves as the investment adviser to the Trust and provides the Funds with professional investment supervision and management. JNAM is registered with the SEC under the Investment Advisers Act of 1940, as amended. JNAM is a wholly owned subsidiary of Jackson National, a U.S. based financial services company. Jackson National is an indirect wholly owned subsidiary of Prudential plc, a publicly traded company incorporated in the United Kingdom. Prudential plc is not affiliated in any manner with Prudential Financial Inc., a company whose principal place of business is in the United States of America.

JNAM acts as investment adviser to the Trust pursuant to an Investment Advisory and Management Agreement. Under the Investment Advisory and Management Agreement, JNAM is responsible for managing the affairs and

overseeing the investments of the Acquiring Fund and determining how voting and other rights with respect to securities owned by the Acquiring Fund will be exercised. JNAM also provides recordkeeping, administrative and exempt transfer agent services to the Acquiring Fund and oversees the performance of services provided to the Acquiring Fund by other service providers, including the custodian and shareholder servicing agent.

JNAM is authorized to delegate certain of its duties with respect to the Acquiring Fund to a sub-adviser, subject to the approval of the Board, and is responsible for overseeing that sub-adviser’s performance. JNAM is solely responsible for payment of any fees to the Acquiring Fund’s Sub-Adviser (the “Sub-Adviser”). JNAM plays an active role in advising and monitoring the Acquiring Fund and the Sub-Adviser. JNAM monitors the Sub-Adviser’s Fund management team to determine whether its investment activities remain consistent with the Acquiring Fund’s investment strategies and objective. JNAM also monitors changes that may impact the Sub-Adviser’s overall business, including the Sub-Adviser’s operations and changes in investment personnel and senior management, and regularly performs due diligence reviews of the Sub-Adviser. In addition, JNAM obtains detailed, comprehensive information concerning the Acquiring Fund’s and Sub-Adviser’s performance and Fund operations. JNAM is responsible for providing regular reports on these matters to the Board.

The Investment Advisory and Management Agreement continues in effect for each Fund from year to year after its initial two-year term so long as its continuation is approved at least annually by (i) a majority of the Trustees who are not parties to such agreement or interested persons of any such party except in their capacity as Trustees of the Trust, and (ii) the shareholders of the affected Fund or the Board. It may be terminated at any time upon 60 days’ notice by JNAM, or by a majority vote of the outstanding shares of a Fund with respect to that Fund, and will terminate automatically upon its assignment. The Investment Advisory and Management Agreement provides that JNAM shall not be liable for any error of judgment, or for any loss suffered by any Fund in connection with the matters to which the agreement relates, except a loss resulting from willful misfeasance, bad faith or gross negligence on the part of JNAM in the performance of its obligations and duties, or by reason of its reckless disregard of its obligations and duties under the agreement. As compensation for its services, the Trust pays JNAM a fee in respect of each Fund as described in that Fund’s Prospectus.

As compensation for its advisory services, JNAM receives a fee from the Trust computed separately for the Acquiring Fund, accrued daily and payable monthly. The fee JNAM receives from the Acquiring Fund is set forth below as an annual percentage of the net assets of the Acquiring Fund.

The table below shows the advisory fee rate schedule for the Acquiring Fund as set forth in the Investment Advisory and Management Agreement and the aggregate annual fee the Acquiring Fund paid to JNAM for the fiscal year ended December 31, 2016. The Acquiring Fund’s advisory fee rate schedule is subject to contractual breakpoints that reduce the advisory fee rate should the Acquiring Fund’s average daily net assets exceed specified amounts.

| Acquiring Fund | Assets | Advisory Fee (Annual Rate Based on

Average Daily Net

Assets of the Fund) | Aggregate Annual Fee

Paid to Adviser for the

Fiscal Year Ended

December 31, 2016 (Annual Rate Based on

Average Net Assets of the

Fund) |

| Harris Fund | $0 to $1 billion Over $1 billion | 0.85% 0.80% | 0.85% |

JNAM has engaged another investment adviser to serve as a sub-adviser to the Acquiring Fund under a separate Sub-Advisory Agreement between the Sub-Adviser and JNAM. JNAM selects, contracts with, and compensates the Sub-Adviser to manage the investment and reinvestment of the assets of the Acquiring Fund. JNAM monitors the compliance of the Sub-Adviser with the investment objectives and related policies of the Acquiring Fund, reviews the performance of the Sub-Adviser, and reports periodically on such performance to the Board. Under the terms of the

Sub-Advisory Agreement, the Sub-Adviser is responsible for supervising and managing the investment and reinvestment of the assets of the Acquiring Fund and for directing the purchase and sale of the Acquiring Fund’s investment securities, subject to the oversight and supervision of JNAM and the Board. The Sub-Adviser formulates a continuous investment program for the Acquiring Fund consistent with its investment strategies, objectives and policies outlined in its Prospectus. The Sub-Adviser implements such program by purchases and sales of securities and regularly reports to JNAM and the Board with respect to the implementation of such program. As compensation for its services, the Sub-Adviser receives a fee from JNAM, computed separately for the Acquiring Fund, stated as an annual percentage of the Acquiring Fund’s net assets. JNAM currently is obligated to pay the Sub-Adviser out of the advisory fee it receives from the Acquiring Fund.

JNAM and the Trust, together with other investment companies of which JNAM is investment adviser, have received an exemptive order (the “Order”) that allows JNAM to hire, replace or terminate unaffiliated sub-advisers or materially amend a sub-advisory agreement with an unaffiliated sub-adviser with the approval of the Board, but without the approval of shareholders. However, any amendment to an advisory agreement between JNAM and the Trust that would result in an increase in the management fee rate specified in that agreement (i.e., the aggregate management fee) charged to a Fund will be submitted to shareholders for approval. Under the terms of the Order, if a new sub-adviser is hired by JNAM, the affected Fund will provide shareholders with information about the new sub-adviser and the new sub-advisory agreement within ninety (90) days of the change. The Order allows the Funds to operate more efficiently and with greater flexibility. At a shareholder meeting of the Trust held on October 26, 2000, the shareholders of all Funds approved this multi-manager structure. JNAM provides oversight and evaluation services to the Funds, including, but not limited to the following services: performing initial due diligence on prospective sub-advisers for the Funds; monitoring the performance of sub-advisers; communicating performance expectations to the sub-advisers; and ultimately recommending to the Board whether a sub-adviser’s contract should be renewed, modified or terminated.

JNAM does not expect to recommend frequent changes of sub-advisers. Although JNAM will monitor the performance of the Sub-Adviser, there is no certainty that the Sub-Adviser or Acquiring Fund will obtain favorable results at any given time.

As compensation for its services for the Acquiring Fund, the Sub-Adviser, Harris Associates L.P., receives a sub-advisory fee that is payable by JNAM. The current sub-advisory fee schedule is set forth below:

| Acquiring Fund | Average Daily Net Assets | Sub-Advisory Fee (Annual Rate Based on

Average Net Assets) |

| Harris Fund | $0 to $100 million Over $100 million | 0.60% 0.50% |

A revised sub-advisory fee schedule, effective July 1, 2017, is set forth below:

| Acquiring Fund | Average Daily Net Assets | Sub-Advisory Fee

(Annual Rate Based on

Average Net Assets) |

| Harris Fund | $0 to $100 million $100 to $200 million Over $200 million | 0.60% 0.50% 0.45% |

A discussion of the basis for the Board’s approval of the investment advisory and sub-advisory agreements is available in the Trust’s Annual Report to shareholders for the year ended December 31, 2016.

In addition to the investment advisory fee, the Acquiring Fund currently pays to JNAM (the “Administrator”) an administrative fee as an annual percentage of the average daily net assets of the Acquiring Fund, accrued daily and paid monthly, as set forth below.

| Acquiring Fund | Assets | Administrative Fee (Annual Rate Based on Average Net Assets) |

| Harris Fund | $0 to $3 billion Assets over $3 billion | 0.15% 0.13% |

In return for the administrative fee, the Administrator provides or procures all necessary administrative functions and services for the operation of the Acquiring Fund. In addition, the Administrator, at its own expense, provides or procures routine legal, audit, fund accounting, custody (except overdraft and interest expense), printing and mailing, a portion of the Chief Compliance Officer costs and all other administrative services necessary for the operation of the Acquiring Fund. The Acquiring Fund is responsible for trading expenses, including brokerage commissions, interest and taxes, and other non-operating expenses. The Acquiring Fund is also responsible for nonrecurring and extraordinary legal fees, interest expenses, registration fees, licensing costs, a portion of the Chief Compliance Officer costs, directors and officers insurance, and the fees and expenses of the Independent Trustees and of independent legal counsel to the Independent Trustees (categorized as “Other Expenses” in the fee tables).

The Acquiring Fund’s investments are selected by Harris Associates L.P., the Sub-Adviser (“Harris”). Harris is a limited partnership managed by its general partner, Harris Associates, Inc. (“HAI”). As of December 31, 2016, Harris had $108 billion in assets under management. Harris and HAI are wholly-owned subsidiaries of Natixis Global Asset Management, L.P., an indirect subsidiary of Natixis Global Asset Management S.A. (“NGAM”), an international asset management group based in Paris, France. NGAM is owned by Natixis, a French investment banking and financial services firm that is principally owned by BPCE, France’s second largest banking group. Together with its predecessor firms, Harris has advised and managed mutual funds since 1970.

The following table describes the Acquiring Fund’s sub-adviser, portfolio managers, and each portfolio manager’s business experience. Information about the portfolio managers’ compensation, other accounts they manage and their ownership of securities of the Acquiring Fund is available in the Trust’s Statement of Additional Information dated April 24, 2017, as supplemented.

| Acquiring Fund | Sub-Adviser & Portfolio Managers | Business Experience |

| Harris Fund | Harris Associates L.P. 111 South Wacker Drive Suite 4600 Chicago, IL 60606 Portfolio Managers Anthony P. Coniaris, CFA David G. Herro, CFA Michael L. Manelli, CFA | The Fund’s portfolio is managed by Anthony P. Coniaris, CFA, David G. Herro, CFA, and Michael L. Manelli, CFA, who are primarily responsible for the day-to-day management of the Acquiring Fund’s investments. Mr. Herro and Mr. Manelli have each been a portfolio manager of the Acquiring Fund since its inception. Mr. Coniaris became a portfolio manager of the Fund in January 2017. Anthony P. Coniaris is the Co-Chairman, Portfolio Manager and an Analyst at Harris. He joined Harris in 1999. Mr. Coniaris has a MBA from Northwestern University and a BA from Wheaton College. David G. Herro, CFA, is the Deputy Chairman, Chief Investment Officer of International Equities and a Portfolio Manager at Harris. He joined Harris in 1992. Mr. Herro has |

| Acquiring Fund | Sub-Adviser & Portfolio Managers | Business Experience |

| | | an MA from the University of Wisconsin-Milwaukee and a BS from the University of Wisconsin-Platteville. Michael L. Manelli, CFA, is a Vice President, a Portfolio Manager and an Analyst at Harris. He joined Harris in 2005. Mr. Manelli has a BBA from the University of Iowa. |

The Statement of Additional Information provides additional information about each portfolio manager’s compensation, other accounts managed, and ownership of securities in the Acquiring Fund.

The Trust has adopted a multi-class plan pursuant to Rule 18f-3 under the 1940 Act. Under the multi-class plan, the Acquiring Fund has two classes of shares, Class A and Class B. Effective September 25, 2017, Class B shares will become Class I shares.

As discussed in "Distribution Arrangements" below, effective September 25, 2017, the Class A shares of the Acquiring Fund will be subject to a Rule 12b-1 fee equal to 0.30% of the Fund's average daily net assets attributable to Class A shares. Class I shares will not be subject to a Rule 12b-1 fee.

Class A shares (and Class I shares, effective September 25, 2017) of the Acquiring Fund represent interests in the same portfolio of securities and will be substantially the same except for “class expenses.” The expenses of the Acquiring Fund will be borne by each Class of shares based on the net assets of the Fund attributable to each Class, except that class expenses will be allocated to each Class. “Class expenses” will include any distribution or administrative or service expense allocable to the appropriate Class and any other expense that JNAM determines, subject to ratification or approval by the Board, to be properly allocable to that Class, including: (i) printing and postage expenses related to preparing and distributing to the shareholders of a particular Class (or Contract Owners funded by shares of such Class) materials such as Prospectuses, shareholder reports and (ii) professional fees relating solely to one Class.

Distribution Arrangements

Jackson National Life Distributors LLC (the “Distributor”), 7601 Technology Way, Denver, Colorado 80237, a wholly owned subsidiary of Jackson National, is the principal underwriter of the Funds of the Trust and is responsible for promoting sales of the Funds’ shares. The Distributor also is the principal underwriter of the variable annuity insurance products issued by Jackson National and its subsidiaries. In addition, the Distributor acts as distributor of the Contracts issued by the Insurance Companies. On behalf of certain Funds, including the Acquiring Fund, the Trust has adopted, in accordance with the provisions of Rule 12b-1 under the 1940 Act, a Distribution Plan (the “Plan”). The Board, including all of the Independent Trustees, must approve, at least annually, the continuation of the Plan. Under the Plan, each Fund that has adopted the Plan will pay a Rule 12b-1 fee at an annual rate of up to 0.20% of the Fund’s average daily net assets attributed to Class A shares, to be used to pay or reimburse distribution and administrative or other service expenses with respect to Class A shares. Because these fees are paid out of the Acquiring Fund’s assets on an on-going basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. To the extent consistent with existing law and the Plan, the Distributor, as principal underwriter, may use the Rule 12b-1 fee to reimburse fees or to compensate broker-dealers, administrators, or others for providing distribution, administrative or other services. At a meeting of shareholders held on June 22, 2017, shareholders adopt ed the Amended Plan. The Class A shares will be charged a Rule 12b-1 fee at the annual rate of 0.30% of the average daily net assets attributable to the Class A shares of the applicable Fund to compensate the Distributor for shareholder servicing and distribution services.

The Distributor and/or an affiliate have the following relationships with one or more of the sub-advisers of the Trust and/or their affiliates:

| · | The Distributor receives payments from certain of these sub-advisers to assist in defraying the costs of certain promotional and marketing meetings in which they participate. The amounts paid depend on the nature of the |

meetings, the number of meetings attended, the costs expected to be incurred, and the level of a sub-adviser’s participation.

| · | A brokerage affiliate of the Distributor participates in the sales of shares of retail mutual funds advised by certain of these sub-advisers and receives commissions and other compensation from them in connection with those activities, as described in the prospectus or statement of additional information for those funds. |

Payments to Broker-Dealers and Financial Intermediaries

Only Separate Accounts, registered investment companies, and certain non-qualified plans of the Insurance Companies may purchase shares of the Acquiring Fund. If an investor invests in the Acquiring Fund under a Contract or a plan that offers a Contract as a plan option through a broker-dealer or other financial intermediary (such as a bank), the Acquiring Fund and its related companies may pay the intermediary for the sale of Acquiring Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and the salesperson to recommend the Acquiring Fund over another investment. Ask your salesperson or visit your financial intermediary’s web-site for more information.

Investment in Trust Shares

Shares of the Trust are presently offered only to Separate Accounts of the Insurance Companies to fund the benefits under certain Contracts, to certain unqualified retirement plans, and to other regulated investment companies that in turn are sold to Separate Accounts. The Separate Accounts, through their various sub-accounts that invest in designated Funds, purchase the shares of the Funds at their net asset value (“NAV”) using premiums received on Contracts issued by the insurance company. Purchases are effected at NAV next determined after the purchase order is received by JNAM as the Funds’ transfer agent in proper form. There is no sales charge.

Shares of the Acquiring Fund are not available to the general public directly.

The Acquiring Fund is managed by a sub-adviser who also may manage publicly available mutual funds having similar names and investment objectives. While the Acquiring Fund may be similar to or modeled after publicly available mutual funds, Contract purchasers should understand that the Acquiring Fund is not otherwise directly related to any publicly available mutual fund. Consequently, the investment performance of any such publicly available mutual funds and the Acquiring Fund may differ substantially.

The price of the Acquiring Fund’s shares is based on its NAV. The NAV per share of the Acquiring Fund is determined by JNAM at the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern time) on each day that the NYSE is open for regular trading. However, calculation of the Acquiring Fund’s NAV may be suspended on days determined by the Board in times of emergency or market closure as determined by the SEC. The NAV per share is calculated by adding the value of all securities and other assets of a Fund, deducting its liabilities, and dividing by the number of shares outstanding. Generally, the value of exchange-listed or -traded securities is based on their respective market prices, bonds are valued based on prices provided by an independent pricing service and short-term debt securities are valued at amortized cost, which approximates market value.

The Board has adopted procedures pursuant to which JNAM may determine, subject to Board oversight, the “fair value” of a security for which a current market price is not available or the current market price is considered unreliable or inaccurate. Under these procedures, the “fair value” of a security generally will be the amount, determined by JNAM in good faith, that the owner of such security might reasonably expect to receive upon its current sale.

The Board has established a pricing committee to review fair value determinations pursuant to the Trust’s “Pricing Guidelines.” The pricing committee will also review the value of restricted and illiquid securities, securities and assets for which a current market price is not readily available, and securities and assets for which there is reason to believe that the most recent market price does not accurately reflect current value (e.g., disorderly market transactions).

The Acquiring Fund may invest in securities primarily listed on foreign exchanges and that trade on days when the Acquiring Fund does not price its shares. As a result, the Acquiring Fund’s NAV may change on days when shareholders are not able to purchase or redeem the Acquiring Fund’s shares.

Because the calculation of a Fund’s NAV does not take place contemporaneously with the determination of the closing prices of the majority of foreign portfolio securities used in the calculation, there exists a risk that the value of foreign portfolio securities will change after the close of the exchange on which they are traded, but before calculation of the Fund’s NAV (“time-zone arbitrage”). Accordingly, the Trust’s procedures for pricing of portfolio securities also authorize JNAM, subject to oversight by the Board, to determine the “fair value” of such foreign securities for purposes of calculating a NAV. JNAM will “fair value” foreign securities held by a Fund if it determines that a “significant event” has occurred subsequent to the close of trading in such securities on the exchanges or markets on which they principally are traded, but prior to the time of the Fund’s NAV calculation. A significant event is one that can be expected materially to affect the value of such securities. Certain specified percentage movements in U.S. equity market indices are deemed under the Trust’s pricing procedures to be a “significant event.” A “significant event” affecting multiple issuers might also include, but is not limited to, a substantial price movement in other securities markets, an announcement by a governmental, regulatory or self-regulatory authority relating to securities markets, political or economic matters, or monetary or credit policies, a natural disaster such as an earthquake, flood or storm, or the outbreak of civil strife or military hostilities. Accordingly, on any day when such specified percentage movements in U.S. equity market indices occur, when fair valuing such foreign securities, JNAM will adjust the closing prices of all foreign securities held in a Fund’s portfolio, based upon an adjustment factor for each such security provided by an independent pricing service, in order to reflect the “fair value” of such securities for purposes of determining a Fund’s NAV. When fair-value pricing is employed, the foreign securities prices used to calculate a Fund’s NAV may differ from quoted or published prices for the same securities.

These procedures seek to minimize the opportunities for time zone arbitrage in Funds that invest all or substantial portions of their assets in foreign securities, thereby seeking to make those Funds significantly less attractive to “market timers” and other investors who might seek to profit from time zone arbitrage and seeking to reduce the potential for harm to other Fund investors resulting from such practices. However, these procedures may not completely eliminate opportunities for time zone arbitrage because it is not possible to predict in all circumstances whether post-closing events will have a significant impact on securities prices.

All investments in the Trust are credited to the shareholder’s account in the form of full and fractional shares of the designated Fund (rounded to the nearest 1/1000 of a share). The Trust does not issue share certificates.

The interests of the Acquiring Fund’s long-term shareholders may be adversely affected by certain short-term trading activity by other Contract Owners invested in the Separate Accounts. Such short-term trading activity, when excessive, has the potential to, among other things, compromise efficient portfolio management, generate transaction and other costs, and dilute the value of Acquiring Fund shares held by long-term shareholders. This type of excessive short-term trading activity is referred to herein as “market timing.” The Acquiring Fund is not intended to serve as a vehicle for market timing. The Board has adopted policies and procedures with respect to market timing.

The Acquiring Fund, directly and through its service providers, and the insurance company and retirement plan service providers (collectively, “service providers”) takes various steps designed to deter and curtail market timing with the cooperation of the Insurance Companies. For example, in the event of a round trip transfer, complete or partial redemptions by a shareholder from a sub-account investing in the Acquiring Fund is permitted; however, once a complete or partial redemption has been made from a sub-account that invests in the Acquiring Fund, through a sub-account transfer, shareholders will not be permitted to transfer any value back into that sub-account (and the Acquiring Fund) within fifteen (15) calendar days of the redemption. The Acquiring Fund will treat as short-term trading activity any transfer that is requested into a sub-account that was previously redeemed within the previous fifteen (15) calendar days, whether the transfer was requested by the shareholders or a third party authorized by the shareholder. The Insurance Companies have entered into agreements with the Trust to provide upon request certain information on the trading activities of Contract Owners in an effort to help curtail market timing.

In addition to identifying any potentially disruptive trading activity, the Acquiring Fund’s Board has adopted a policy of “fair value” pricing to discourage investors from engaging in market timing or other excessive trading strategies for international Funds. The Funds’ “fair value” pricing policy is described under “Investment in Trust Shares” above and will apply to the Underlying Funds in which the Acquiring Fund invests.

The policies and procedures described above are intended to deter and curtail market timing in the Acquiring Fund. However, there can be no assurance that these policies, together with those of the Insurance Companies, and any other insurance company that may invest in the Acquiring Fund in the future, will be totally effective in this regard. The Acquiring Fund relies on the Insurance Companies to take the appropriate steps, including daily monitoring of separate account trading activity, to further deter market timing. If they are ineffective, the adverse consequences described above could occur.

A description of Jackson National’s anti-market timing policies and procedures can be found in the appropriate variable insurance contract Prospectus (the “Separate Account Prospectus”). The rights of the Separate Accounts to purchase and redeem shares of a Fund are not affected by any Fund’s anti-market timing policies if they are not in violation of the Separate Accounts’ anti-market timing policies and procedures.

A Separate Account redeems shares to make benefit or withdrawal payments under the terms of its Contracts. Redemptions typically are processed on any day on which the Trust and the NYSE are open for business and are effected at net asset value next determined after the redemption order is received by JNAM, the Fund’s transfer agent, in proper form.

The Trust may suspend the right of redemption only under the following circumstances:

| · | When the NYSE is closed (other than weekends and holidays) or trading is restricted; |

| · | When an emergency exists, making disposal of portfolio securities or the valuation of net assets not reasonably practicable; or |

| · | During any period when the SEC has by order permitted a suspension of redemption for the protection of shareholders. |

Dividends and Other Distributions

The Funds generally distribute most or all of their net investment income and their net realized gains, if any, no less frequently than annually. Dividends and other distributions by a Fund are automatically reinvested at net asset value in shares of the distributing class of that Fund.

The Acquiring Fund intends to continue to qualify and be eligible for treatment as a “regulated investment company” (also known as a “RIC”) under Subchapter M of the Code. As a regulated investment company, the Acquiring Fund intends to distribute all its net investment income and net capital gains to shareholders no less frequently than annually and, therefore, does not expect to be required to pay any federal income or excise taxes. The interests in the Acquiring Fund are owned by one or more Separate Accounts that hold such interests pursuant to Contracts and by various funds of the Trust and Jackson Variable Series Trust, which are partnerships for U.S. federal income tax purposes.

The Acquiring Fund is treated as a corporation separate from the Trust for purposes of the Code. Therefore, the assets, income, and distributions of the Acquiring Fund are considered separately for purposes of determining whether or not the Acquiring Fund qualifies for treatment as a regulated investment company under Subchapter M of the Code.

Because the shareholders of the Acquiring Fund are Separate Accounts of variable insurance contracts and certain other partnerships, the owners of which are Separate Accounts, there are no tax consequences to those shareholders from buying, holding, exchanging and selling shares of the Acquiring Fund, provided certain requirements are met. Distributions from the Acquiring Fund are not

taxable to those shareholders. However, owners of Contracts should consult the applicable Separate Account Prospectus for more detailed information on tax issues related to the Contracts.

The Acquiring Fund intends to comply with the diversification requirements currently imposed by the Code and U.S. Treasury regulations thereunder, on separate accounts of insurance companies as a condition of maintaining the tax-advantaged status of the Contracts issued by Separate Accounts. The Investment Advisory and Management Agreement requires the Acquiring Fund to be operated in compliance with these diversification requirements. The Adviser may depart from the investment strategy of the Acquiring Fund only to the extent necessary to meet these diversification requirements.

The financial highlights table is intended to help you understand the financial performance of the Acquired Fund and the Acquiring Fund for the past five years or, if shorter, the period of the Fund’s operations. The following table provides selected per share data for one share of each Fund. The total returns in the financial highlights table represent the rate that an investor would have earned (or lost) on an investment in the Acquired Fund or the Acquiring Fund (assuming reinvestment of all dividends and distributions) held for the entire period. The information does not reflect any charges imposed under a Contract. If charges imposed under a variable contract were reflected, the returns would be lower. You should refer to the appropriate Contract prospectus regarding such charges.