Exhibit 99.1

| | |

| Date: | | February 1, 2007 |

| |

| Subject: | | Baldor Electric Company |

| | 4th Quarter and YTD 2006 Results and Discussion |

| |

| Page: | | 1 of 3 |

Fort Smith, Arkansas – Baldor Electric Company (NYSE:BEZ) markets, designs, and manufactures industrial electric motors, power transmission products, drives, and generators and is based in Fort Smith, Arkansas. Today Baldor announced unaudited results for the fourth quarter and year 2006.

| | | | | | | | | | | | | | | | | | | | |

| | | 4th Quarter | | | % Change | | | Year | | | % Change | |

| (in thousands except per share data) | | 2006 Dec 30 2006 | | 2005 Dec 31 2005 | | | | 2006 Dec 30 2006 | | 2005 Dec 31 2005 | | |

Net Sales | | $ | 200,454 | | $ | 182,662 | | | 10 | % | | $ | 811,280 | | $ | 721,569 | | | 12 | % |

Cost of Sales | | | 147,052 | | | 132,001 | | | | | | | 597,227 | | | 531,415 | | | | |

| | | | | | | | | | | | | | | | | | | | |

Gross Profit | | | 53,402 | | | 50,661 | | | 5 | % | | | 214,053 | | | 190,154 | | | 13 | % |

SG&A | | | 33,038 | | | 30,378 | | | | | | | 132,994 | | | 120,755 | | | | |

| | | | | | | | | | | | | | | | | | | | |

Operating Profit | | | 20,364 | | | 20,283 | | | 0 | % | | | 81,059 | | | 69,399 | | | 17 | % |

Other (Income) Expense | | | 1,613 | | | 499 | | | | | | | 5,339 | | | 2,104 | | | | |

| | | | | | | | | | | | | | | | | | | | |

Earnings Before Income Taxes | | | 18,751 | | | 19,784 | | | -5 | % | | | 75,720 | | | 67,295 | | | 13 | % |

Income Taxes | | | 6,579 | | | 6,657 | | | | | | | 27,602 | | | 24,274 | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net Earnings | | $ | 12,172 | | $ | 13,127 | | | -7 | % | | $ | 48,118 | | $ | 43,021 | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | |

Earnings Per Share - Diluted | | $ | 0.37 | | $ | 0.39 | | | -5 | % | | $ | 1.46 | | $ | 1.28 | | | 14 | % |

Fourth quarter 2005 adjustments | | | | | | (0.05 | ) | | | | | | | | | (0.05 | ) | | | |

| | | | | | | | | | | | | | | | | | | | |

Earnings Per Share - Diluted excluding adjustments

(see note 1) | | $ | 0.37 | | $ | 0.34 | | | 9 | % | | $ | 1.46 | | $ | 1.23 | | | 19 | % |

| | | | | | | | | | | | | | | | | | | | |

Dividends Per Share | | $ | 0.17 | | $ | 0.16 | | | 6 | % | | $ | 0.67 | | $ | 0.62 | | | 8 | % |

Average Shares Outstanding | | | 32,853 | | | 33,675 | | | | | | | 32,953 | | | 33,728 | | | | |

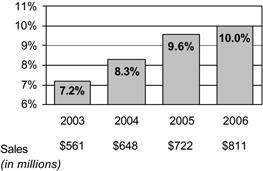

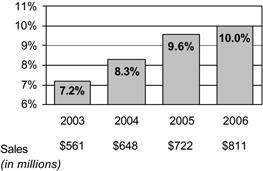

John McFarland, Chairman and CEO, commented on the Company’s results, “Sales, earnings and earnings per share set all time records in 2006. Sales of $811 million and earnings of $48 million both increased 12% over last year. Diluted earnings per share of $1.46 increased 19%, excluding the effects of fourth quarter 2005 adjustments. Operating margin increased to 10.0% from 9.6% a year ago. Sales for fourth quarter 2006 increased 10% and earnings per share increased 9%, excluding the effects of fourth quarter 2005 adjustments. During that quarter, health insurance and tax adjustments benefited earnings by $0.05 per share (see note 1).

“Yesterday, we completed the acquisition of Reliance Electric Company, which includes the Reliance Electric™ and Dodge® brands, bringing together three of the most respected and preferred names in the industrial motor and power transmission marketplace. We believe this acquisition positions us to be a stronger company and a better supplier to the customers and markets we serve.”

Balance Sheet Summary

| | | | | | |

| (in thousands) | | 2006 Dec 30 2006 | | 2005 Dec 31 2005 |

Cash & Marketable Securities | | $ | 35,773 | | $ | 44,066 |

Trade Receivables – net | | | 118,303 | | | 104,488 |

Inventories | | | 116,477 | | | 114,096 |

Working Capital | | | 212,773 | | | 187,252 |

Total Debt | | | 97,025 | | | 95,025 |

Shareholders’ Equity | | | 305,019 | | | 299,455 |

Cash Flow from Operations | | $ | 55,568 | | $ | 53,172 |

Operating Margins

| | | | | | |

| Date: | | February 1, 2007 | | For more information contact |

| | | |

| Subject: | | Baldor Electric Company | | Baldor Electric Company | | Phone: 479-646-4711 |

| | 4th Quarter and YTD 2006 Results | | P O Box 2400 Fort Smith, Arkansas 72902 | | Fax: 479-648-5701 Website: www.baldor.com |

| Page: | | 2 of 3 | | John A. McFarland Ronald E. Tucker Tracy L. Long | | Chairman & CEO President & COO VP Investor Relations & Assistant Secretary |

We have prepared answers to a list of questions often asked by shareholders.

Q … How was your business during the quarter?

The rate of growth slowed during October and November, and picked up strongly during December, a trend which has continued into the new year. Our motor sales increased 12% for the quarter, generator sales improved 5% and drives sales were flat.

We continue to see strength in premium efficient motors and motors over 60 horsepower, with both product lines growing at more than double the rate of the overall business. We have a healthy balance in our customer mix with OEMs making up 52% of our domestic sales and distributors (replacement) making up the remaining 48%. In 2006, motor sales increased 16% and drives sales increased 4%. Generator sales declined 11% due to a decrease in military and hurricane-related sales. All other generator sales increased 18%.

Q … How are incoming orders today?

Incoming orders in January increased at a low double-digit rate.

Q … Why do you think your acquisition of Reliance Electric Company is a good fit for Baldor?

Both Baldor and Reliance have a strategy to produce the highest-quality products and sell them to value-minded customers. Baldor’s strength is in small industrial motors, and Reliance’s strength is in large industrial motors. Combined, we believe we will have approximately 25% market share in North America and 8% worldwide. The acquisition also brings us Dodge, the premier provider of power transmission products in North America. These products make us a more important supplier to our customers and allow us to offer a broader product range. Additionally, Reliance is a well run company with higher operating margins than Baldor.

Q … Explain the final financing structure of your acquisition and the effect on shares outstanding.

We paid $1.75 billion in cash plus approximately 1.6 million shares of Baldor common stock for the company. To finance the purchase, we borrowed $1.0 billion in a term loan at a variable rate of approximately 7.1% at closing, and $550 million in senior notes at a fixed rate of 8.625%. Additionally, we issued 10,294,118 shares of common stock at $34 per share, raising an additional $350 million. Our total number of shares outstanding is now approximately 44 million, and our debt balance as of February 1 is approximately $1.56 billion.

Q … During the quarter you reduced debt by $8 million. What are your plans for cash going forward?

During the quarter we repaid $8 million of debt, bringing the total amount of debt repaid since April to $28 million.

Our top priority for cash going forward will be debt reduction. Our goal in the next three years is to reduce our debt to EBITDA ratio from over five times to three times or less. In the longer term, we expect to reduce that ratio to two times or less.

Q … How does the acquisition impact the cyclicality of your business?

We believe the combined businesses are less cyclical than either one is separately. Dodge power transmission products have been less cyclical in the past while large Reliance motors are involved in many long-term projects. Baldor’s business is evenly split between distributors and OEMs. As a result, we believe the combined businesses are better positioned to handle economic cycles.

| | | | | | |

| Date: | | February 1, 2007 | | For more information contact |

| | | |

| Subject: | | Baldor Electric Company | | Baldor Electric Company | | Phone: 479-646-4711 |

| | 4th Quarter and YTD 2006 Results | | P O Box 2400 Fort Smith, Arkansas 72902 | | Fax: 479-648-5701 Website: www.baldor.com |

| Page: | | 3 of 3 | | John A. McFarland Ronald E. Tucker Tracy L. Long | | Chairman & CEO President & COO VP Investor Relations & Assistant Secretary |

Q … How will the acquisition and integration affect your profits?

We expect the Dodge and Reliance businesses to add approximately $0.10 per share to our earnings during 2007. By the end of the third year, we expect to achieve $30 million in annual pre-tax synergies in the combined operations.

Q … When will your next update be?

We will hold a conference call on Friday, February 2, at 10:00 a.m. CT. You may listen to the discussion through the Company’s website at www.baldor.com or call 1-800-819-9193. A replay will be available from 1:00 p.m. CT through midnight, Friday, February 9th. To access the replay, please call 1-888-203-1112, and use pass code 9439542.

We will also make a presentation at the Gabelli Pump, Valve and Motor Symposium on Thursday, February 8 in New York at 10:30 a.m. ET. The webcast presentation can be accessed through our websitewww.baldor.com.

On Tuesday, March 27, at 10:25 a.m. ET we will make a presentation at the Sidoti Emerging Growth Institutional Investor Forum in New York.

(1)Non-GAAP Financial Measures. Baldor reports its financial results in accordance with generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP performance measures provide financial statement users meaningful comparisons between current and prior period results, as well as important information regarding performance trends. Certain items discussed in this press release are considered non-GAAP measures. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported results.

This document contains statements that are forward-looking, i.e. not historical facts. The forward-looking statements contained in this document (“continue”, “expect”, “will”, “goal”, “believe”) are based on the Company’s current expectations and some of them are subject to risks and uncertainties. Accordingly, you are cautioned that any such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward looking statements as a result of various factors. The factors that might cause such differences include, among others, the following: (i) changes in economic conditions, (ii) developments or new initiatives by our competitors in the markets in which we compete, (iii) fluctuations in the costs of select raw materials, (iv) the success in increasing sales and maintaining or improving the operating margins of the Company, and (v) other factors including those identified in the Company’s filings made from time-to-time with the Securities and Exchange Commission. These statements should be read in conjunction with the Company’s most recent annual report (as well as the Company’s Form 10-K and other reports filed with the Securities and Exchange Commission) containing a discussion of the Company’s business and of various factors that may affect it.