EXHIBIT 99

BALDOR ELECTRIC COMPANY ANNOUNCES THIRD QUARTER 2009 RESULTS

Fort Smith, Arkansas – October 29, 2009 - Baldor Electric Company (NYSE:BEZ) markets, designs and manufactures industrial electric motors, mechanical power transmission products, drives and generators. Today, Baldor announced unaudited results for third quarter 2009.

John McFarland, Chairman and CEO, commented on the Company’s results. “In the third quarter of 2009, we had sales of $380.4 million, net earnings of $12.6 million, and diluted earnings per share of $0.27. This compares to third quarter 2008 sales of $506.2 million, net earnings of $25.8 million, and diluted earnings per share of $0.55. While we were disappointed that sales declined 25% in the quarter, we were pleased with the following:

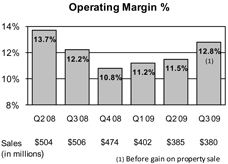

| | • | | Operating margin before gain on property sale(1) improved to 12.8% from one year ago on $126 million less sales |

| | • | | Debt reduction of $35.4 million |

| | • | | Record YTD cash flows from operations of $151.7 million |

| | • | | 10% year-over-year growth in generator sales |

| | • | | New customers gained from the Bounty Hunt program |

| | • | | On track to slightly exceed our cost reduction goal of $92 million for 2009 |

McFarland added, “During the quarter, we saw slight improvement in our sales to distributors compared to second quarter 2009. While our distributor customers are not restocking yet, it does seem that destocking has nearly come to an end. This improvement in sales was offset, however, by further weakness in sales to OEM customers. Recent orders lead us to believe this trend will continue in the fourth quarter with sales expected to be down approximately 20-25% from one year ago. We had good productivity improvement in the quarter, and we expect more in the fourth quarter resulting in year-over-year improvement in our fourth quarter operating margin.”

| | | | | | | | | | | | | | | | | | | | | | |

| | | 3rd Quarter | | | %

Chg | | | Year-To-Date | | | %

Chg | |

| | | 2009 | | | 2008 | | | | 2009 | | | 2008 | | |

| (in thousands except per share data) | | Oct 3, 2009 | | | Sep 27, 2008 | | | | Oct 3, 2009 | | | Sep 27, 2008 | | |

Net sales | | $ | 380,448 | | | $ | 506,154 | | | (25 | )% | | $ | 1,167,660 | | | $ | 1,480,653 | | | (21 | )% |

Cost of sales | | | 265,479 | | | | 359,400 | | | | | | | 827,365 | | | | 1,037,328 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 114,969 | | | | 146,754 | | | (22 | )% | | | 340,295 | | | | 443,325 | | | (23 | )% |

SG&A | | | 66,096 | | | | 84,997 | | | | | | | 202,161 | | | | 245,989 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Operating profit before gain on property sale(1) | | | 48,873 | | | | 61,757 | | | (21 | )% | | | 138,134 | | | | 197,336 | | | (30 | )% |

Gain on property sale | | | 3,721 | | | | — | | | | | | | 3,721 | | | | — | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Operating profit | | | 52,594 | | | | 61,757 | | | | | | | 141,855 | | | | 197,336 | | | | |

Other income (expense), net | | | (44 | ) | | | 1,192 | | | | | | | (377 | ) | | | 2,797 | | | | |

Gain on debt modification | | | — | | | | — | | | | | | | 35,740 | | | | — | | | | |

Debt discount amortization | | | (2,484 | ) | | | — | | | | | | | (4,968 | ) | | | — | | | | |

Interest expense | | | (29,796 | ) | | | (24,456 | ) | | | | | | (80,655 | ) | | | (75,680 | ) | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 20,270 | | | | 38,493 | | | (47 | )% | | | 91,595 | | | | 124,453 | | | (26 | )% |

Income taxes | | | 7,678 | | | | 12,683 | | | | | | | 34,787 | | | | 43,631 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 12,592 | | | $ | 25,810 | | | (51 | )% | | $ | 56,808 | | | $ | 80,822 | | | (30 | )% |

| | | | | | | | | | | | | | | | | | | | | | |

Net earnings per share – diluted | | $ | 0.27 | | | $ | 0.55 | | | (51 | )% | | $ | 1.22 | | | $ | 1.74 | | | (30 | )% |

Less net gain on debt modification | | | — | | | | — | | | | | | | 0.47 | | | | — | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Net earnings per share – diluted excluding gain on debt modification(1) | | $ | 0.27 | | | $ | 0.55 | | | (51 | )% | | $ | 0.75 | | | $ | 1.74 | | | (57 | )% |

| | | | | | | | | | | | | | | | | | | | | | |

Dividends per share | | $ | 0.17 | | | $ | 0.17 | | | 0 | % | | $ | 0.51 | | | $ | 0.51 | | | 0 | % |

Avg shares outstanding – diluted | | | 46,992 | | | | 46,601 | | | | | | | 46,743 | | | | 46,361 | | | | |

BALDOR ELECTRIC COMPANY THIRD QUARTER 2009 RESULTS - Page 2

Q… How was business during the quarter?

Compared to third quarter 2008, motor sales of $241 million were down 27% and mechanical power transmission sales of $111 million were down 21%. Sales to OEMs declined 29% while sales to distributors declined 21%. Sales improved sequentially throughout the quarter with July, August and September sales down 30%, 24%, and 23%, respectively.

Generator sales increased 10% compared to third quarter 2008. This increase was primarily due to new customers earned this year. We expect generator sales to increase during fourth quarter 2009 as well.

International sales of $63 million declined 27% compared to third quarter 2008, with the smallest decline occurring in Asia-Pacific and the largest in Europe.

While sales of Super-E motors declined 4% during the quarter, they increased to 15% of total motor sales. When the 2007 Energy Independence and Security Act (EISA) takes effect in December 2010, we expect sales of these products to be approximately 50% of our total motor sales.

Q… Are you still on track to meet your cost reduction targets?

We are on track to slightly exceed our cost reduction targets of $92 million for 2009 ($115 million on an annual run rate). In addition during the quarter, we realized some benefit from lower material costs compared to the record high costs of third quarter 2008. We do, however, expect to pay more for electrical steel and copper in fourth quarter 2009 than we did this quarter.

Q… How are your inventory and accounts receivable balances?

During the quarter, our accounts receivable balance declined $11.7 million, and our days sales outstanding (DSO) improved two days from second quarter 2009. The aging of our receivables also improved.

We reduced inventories nearly $23 million during the quarter, bringing our year-to-date reduction to $56 million. We believe we have adequate inventories to serve our customers.

| | | | | | |

| Selected Financial Data (unaudited) |

| (in thousands) | | Q3 2009 | | Q2 2009 |

Cash | | $ | 14,122 | | $ | 13,724 |

Net receivables | | | 249,258 | | | 260,908 |

Inventories | | | 288,470 | | | 311,249 |

Total outstanding debt | | | 1,239,182 | | | 1,274,557 |

Shareholders’ equity | | | 920,759 | | | 903,139 |

| | | |

| | | Q3 2009 | | Q3 2008 |

YTD cash flows from operations | | $ | 151,749 | | $ | 62,349 |

Q… Are you on track to meet your debt reduction target?

During the quarter, we reduced debt $35.4 million, bringing our year-to-date reduction to approximately $88 million. Since taking on the additional debt 32 months ago, we have repaid approximately $313 million.

We anticipate reducing debt further in the fourth quarter, allowing us to slightly exceed our 2009 debt reduction goal of $100 million.

Q… What unusual benefits or expenses did you have during the quarter?

As expected, we had approximately $1.5 million of plant consolidation expense during the quarter. In the fourth quarter, we expect an additional $500,000 of consolidation expense.

In addition, we completed a real estate transaction originally initiated in the fall of 2008. Completion of this transaction resulted in a gain of approximately $3.7 million.

As a result of modifying our debt agreement on March 31, 2009, interest expense is based upon the rate we pay, interest rate hedge amortization, and market value fluctuations of our interest rate swap agreements. Compared to second quarter 2009, interest expense increased due to a $1.9 million non-cash decline in the market value of our swap agreements, and interest expense decreased $500,000 as a result of our debt repayments. The net effect was a $1.4 million increase in interest expense over second quarter 2009.

BALDOR ELECTRIC COMPANY THIRD QUARTER 2009 RESULTS - Page 3

Q… What is your outlook for sales during fourth quarter 2009?

Even though daily order trends are improving slightly, we expect fourth quarter 2009 sales to be down approximately 20-25% from one year ago partly because fourth quarter 2008 contained 14 weeks and fourth quarter 2009 contains 13 weeks.

Q… How are you positioning yourself for 2010?

It continues to be difficult to forecast sales for 2010. However, we believe we are positioned to perform better during 2010 because of the improvements we made this year, including:

| | • | | Cost reductions of $115 million (on an annual run rate) |

| | • | | At least $100 million less debt |

| | • | | New customers gained from the Bounty Hunt program |

| | • | | New products introduced this year |

Beginning in December 2010, the implementation of EISA will have a positive impact on our total motor business.

Q… When is your next public update?

A conference call will be held Friday, October 30, 2009, at 10:00 a.m. central time. Participants may listen to the discussion through the Company’s website atwww.baldor.com or by calling 1-800-926-4458. A replay will be available through November 6, 2009, and can be accessed by calling 800-633-8284 (reservation 21439329).

Members of management will meet with investors and make presentations at the Baird 2009 Industrial Conference in Chicago on November 11, 2009 (webcast live) and the Stephens Fall Investment Conference in New York on November 17, 2009.

| | | | |

For more information contact: | | | | |

John McFarland, Chairman and CEO | | Phone: | | 479-648-5769 |

Ron Tucker, President and COO | | Website: | | www.baldor.com |

Tracy Long, Vice President Investor Relations | | Email: | | Investorinfo@baldor.com |

| (1) | Non-GAAP Financial Measures. Baldor reports its financial results in accordance with generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP performance measures provide financial statement users meaningful comparisons between current and prior period results, as well as important information regarding performance trends. Certain items discussed in this press release are considered non-GAAP measures. Non-GAAP financial measure should be viewed in addition to, and not as an alternative for, the Company’s reported results. |

Forward-Looking Statement

This document contains forward-looking statements; in other words, they are not historical facts. The forward-looking statements in this document (which might include but are not limited to “estimate”, “think”, “intend”, “may”, “could”, “would”, “anticipate”, “depend”, “predict”, “can”, “assume”, “optimistic”, “will”, “continue”, “expect”, “believe”, “should”, “forecast”) are based on Baldor’s current expectations, and they are subject to risks and uncertainties. Therefore, please remember that forward-looking statements are not guarantees of future performance and they do involve risks and uncertainties. As a result of many factors, Baldor’s actual results could differ materially from those projected in the forward-looking statements. Some of the factors that might cause such differences include (i) changes in economic conditions, (ii) developments or new initiatives by our competitors in the markets in which we compete, (iii) fluctuations in the costs of select raw materials, (iv) success in increasing sales and maintaining or improving the operating margins of Baldor, and (v) other factors, including those identified in Baldor’s filings made with the Securities and Exchange Commission. Please read these statements in conjunction with Baldor’s most recent Form 10-K and other reports we have filed with the Securities and Exchange Commission. These reports contain discussions of Baldor’s business and of various factors that could affect it.

SOURCE Baldor Electric Company BEZ-G