SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006

OR

o TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM __________ TO __________ .

Commission File Number 0-26068

____________

ACACIA RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

DELAWARE | 95-4405754 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation organization) | Identification No.) |

| | |

500 NEWPORT CENTER DRIVE, NEWPORT BEACH, CA | 92660 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (949) 480-8300

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Acacia Research - Acacia Technologies Common Stock, $0.001 par value Acacia Research - CombiMatrix Common Stock, $0.001 par value | The NASDAQ Stock Market LLC The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

____________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days. Yes þ No £

Indicate by check mark that disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | | Accelerated filer þ | | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the registrant’s Acacia Research - Acacia Technologies common stock and Acacia Research - CombiMatrix common stock held by non-affiliates of the registrant, computed by reference to the last sales prices of such stocks reported on The Nasdaq Stock Market, as of June 30, 2006, was approximately $382,094,000 and $64,467,000, respectively. (All executive officers and directors of the registrant are considered affiliates.)

As of March 6, 2007, 28,255,628 shares of Acacia Research-Acacia Technologies common stock were issued and outstanding. As of March 6, 2007, 52,365,810 shares of Acacia Research-CombiMatrix common stock were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its Annual Meeting of Stockholders to be filed with the Commission within 120 days after the close of its fiscal year are incorporated by reference into Part III.

ACACIA RESEARCH CORPORATION

FORM 10-K ANNUAL REPORT

FISCAL YEAR ENDED DECEMBER 31, 2006

TABLE OF CONTENTS

Item | | Page |

| | PART I | |

| | | |

| 1. | Business | 1 |

| 1A. | Risk Factors | 25 |

| 1B. | Unresolved Staff Comments | 50 |

| 2. | Properties | 50 |

| 3. | Legal Proceedings | 50 |

| 4. | Submission of Matters to a Vote of Security Holders | 50 |

| | | |

| | | |

| | PART II | |

| | | |

| 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer | |

| | Purchases of Equity Securities | 51 |

| 6. | Selected Financial Data | 54 |

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 58 |

| 7A. | Quantitative and Qualitative Disclosures About Market Risk | 87 |

| 8. | Financial Statements and Supplementary Data | 87 |

| 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 87 |

| 9A. | Controls and Procedures | 87 |

| | | |

| | | |

| | PART III | |

| | | |

| 10. | Directors, Executive Officers and Corporate Governance | 88 |

| 11. | Executive Compensation | 88 |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 88 |

| 13. | Certain Relationships and Related Transactions, and Director Independence | 88 |

| 14. | Principal Accounting Fees and Services | 88 |

| | | |

| | | |

| | PART IV | |

| | | |

| 15. | Exhibits and Financial Statement Schedules | 89 |

PART I

CAUTIONARY STATEMENT

This report contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Reference is made in particular to the description of our plans and objectives for future operations, assumptions underlying such plans and objectives, and other forward-looking statements included in this report. Such statements may be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” or similar terms, variations of such terms or the negative of such terms. Such statements are based on management’s current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements address future events and conditions concerning product development, capital expenditures, earnings, litigation, regulatory matters, markets for products and services, liquidity and capital resources and accounting matters. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, changes in consumer demand, legislative, regulatory and competitive developments in markets in which we and our subsidiaries operate, and other circumstances affecting anticipated revenues and costs, as more fully disclosed in our discussion of risk factors incorporated by reference in Item 1.A of Part I of this report. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Additional factors that could cause such results to differ materially from those described in the forward-looking statements are set forth in connection with the forward-looking statements.

As used in this Form 10-K, “we,” “us” and “our” refer to Acacia Research Corporation and its subsidiary companies.

Item 1. BUSINESS

Overview

Acacia Research Corporation is comprised of two operating groups.

Acacia Technologies Group

The Acacia Technologies group, a division of Acacia Research Corporation, develops, acquires, licenses and enforces patented technologies. The Acacia Technologies group is primarily comprised of certain of Acacia Research Corporation’s wholly owned subsidiaries and limited liability companies including:

· Acacia Global Acquisition Corporation · Acacia Media Technologies Corporation · Acacia Patent Acquisition Corporation · Acacia Technologies Services Corporation · AV Technologies LLC · Broadcast Data Retrieval Corporation · Broadcast Innovation LLC · Computer Acceleration Corporation · Computer Cache Coherency Corporation · Computer Docking Station Corporation · Credit Card Fraud Control Corporation · Database Structures Inc. · Data Encryption Corporation · Data Innovation LLC · Diagnostic Systems Corporation · Disc Link Corporation · Financial Systems Innovation LLC · Fluid Dynamics Corporation · High Resolution Optics Corporation · Information Technology Innovation LLC | · InternetAd LLC · IP Innovation LLC · KY Data Systems LLC · Location Based Services Corporation · Micromesh Technology Corporation · Microprocessor Enhancement Corporation · Mobile Traffic Systems Corporation · New Medium LLC · Peer Communications Corporation · Product Activation Corporation · Remote Video Camera Corporation · Resource Scheduling Corporation · Safety Braking Corporation · Screentone Systems Corporation · Soundview Technologies Inc. · Spreadsheet Automation Corporation · TechSearch LLC · Telematics Corporation · VData LLC |

The Acacia Technologies group also includes all corporate assets, liabilities, and related transactions of Acacia Research Corporation attributed to Acacia Research Corporation’s intellectual property licensing and enforcement business.

The Acacia Technologies group currently owns or controls the rights to 62 patent portfolios, covering technologies used in a wide variety of industries, including the following:

· Aligned Wafer Bonding · Audio Communications Fraud Detection · Audio Video Enhancement & Synchronization · Broadcast Data Retrieval · Color Correction For Video Graphics Systems · Compact Disk · Computer Memory Cache Coherency · Computing Device Performance · Continuous TV Viewer Measuring · Credit Card Fraud Protection · Database Management · Data Encryption · Digital Video Production · DMT® · Document Generation · Dynamic Manufacturing Modeling · Electronic Address List Management · Enhanced Internet Navigation · File Locking In Shared Storage Networks · Fluid Flow Control And Monitoring · Hearing Aid ECS · High Quality Image Processing · High Resolution Optics · Image Resolution Enhancement | · Information Monitoring · Interactive Television · Laptop Connectivity · Location Based Services · Medical Image Stabilization · Micromesh Laminate · Micromirror Digital Display · Microprocessor Enhancement · Multi-dimensional Bar Codes · Picture Archiving & Communication Systems · Pointing Device · Pop-Up Advertising · Portable Storage Devices With Links · Product Activation · Remote Video Camera · Resource Scheduling · Software License Management · Spreadsheet Automation · Storage Technology · Telematics · User Activated Internet Advertising · Vehicle Anti-Theft Parking System · Vehicle Magnetic Braking · Web Personalization · Wireless Traffic Information |

CombiMatrix Group

Our life sciences business, referred to as the “CombiMatrix group,” a division of Acacia Research Corporation, is comprised of our wholly owned subsidiary, CombiMatrix Corporation and CombiMatrix Corporation’s wholly owned subsidiary, CombiMatrix Molecular Diagnostics, Inc. and includes all corporate assets, liabilities and transactions related to Acacia Research Corporation’s life sciences business.

The CombiMatrix group is seeking to become a broadly diversified biotechnology business, through the development of proprietary technologies, products and services in the areas of drug development, genetic analysis, molecular diagnostics, nanotechnology research, defense and homeland security markets, as well as other potential markets where its products and services could be utilized. The technologies that the CombiMatrix group has developed include a platform technology to rapidly produce customizable, in-situ synthesized, oligonucleotide arrays for use in identifying and determining the roles of genes, gene mutations and proteins. This technology has a wide range of potential applications in the areas of genomics, proteomics, biosensors, drug discovery, drug development, diagnostics, combinatorial chemistry, material sciences and nanotechnology. The CombiMatrix group has also developed the capabilities of producing arrays that utilize bacterial artificial chromosomes on its arrays, also enabling genetic analysis. Other technologies include proprietary molecular synthesis and screening methods for the discovery of potential new drugs.

Through the year ended December 31, 2005, the CombiMatrix group’s life sciences business included two subsidiaries, CombiMatrix Molecular Diagnostics, Inc. and CombiMatrix K.K. CombiMatrix Molecular Diagnostics, Inc., a wholly owned subsidiary located in Irvine, California, is exploring opportunities for the CombiMatrix group’s arrays in the field of molecular diagnostics. CombiMatrix K.K. is a Japanese corporation located in Tokyo, Japan, and has existed for the purposes of exploring opportunities for the CombiMatrix group’s array system with pharmaceutical and biotechnology companies in the Asian market. In January of 2006, the CombiMatrix group sold 67% of its ownership interest in CombiMatrix K.K. to a third party, and continued to retain a 33% ownership interest. Based upon the annual financial statements for the year ended December 31, 2005, this sale did not constitute the sale of a "significant subsidiary" as that term is defined by the Commission in Rule 1-02 of Regulation S-X.

In January 2006, Acacia Research Corporation’s board of directors approved a plan for its wholly owned subsidiary, CombiMatrix Corporation, to become an independent public company. The transaction is expected to be completed no sooner than the second quarter of 2007, subject, however, to completing the required filings with the Securities and Exchange Commission (“SEC”). We have received a private letter ruling from the IRS addressing certain tax implications of the transaction and have received a tax opinion from counsel. CombiMatrix Corporation filed a registration statement on Form S-1 on December 26, 2006, which has not been declared effective. If CombiMatrix Corporation’s registration statement on Form S-1 is declared effective by the SEC, Acacia Research Corporation will redeem all of the issued and outstanding shares of AR-CombiMatrix common stock for all of the common stock of CombiMatrix Corporation, which will register its common stock under the Securities and Exchange Act of 1934. Following the redemption, CombiMatrix Corporation will apply to list its shares for trading on a national exchange.

Capital Structure

Acacia Research Corporation has two classes of common stock called Acacia Research-Acacia Technologies common stock (“AR-Acacia Technologies stock”) and Acacia Research-CombiMatrix common stock (“AR-CombiMatrix stock”). AR-Acacia Technologies stock is intended to reflect separately the performance of Acacia Research Corporation’s Acacia Technologies group. AR-CombiMatrix stock is intended to reflect separately the performance of Acacia Research Corporation’s CombiMatrix group. Although the AR-Acacia Technologies stock and the AR-CombiMatrix stock are intended to reflect the performance of our different business groups, they are both classes of common stock of Acacia Research Corporation and are not stock issued by the respective groups. As a result, holders of Acacia Research-Acacia Technologies stock and Acacia Research-CombiMatrix stock continue to be subject to all of the risks of an investment in Acacia Research Corporation and all of its businesses, assets and liabilities. The assets Acacia Research Corporation attributes to one group could be subject to the liabilities of the other group. Included in Acacia Research Corporation’s operating groups are certain wholly owned subsidiaries that are not material, quantitatively or qualitatively, either individually or in the aggregate, to either group, or to Acacia Research Corporation as a whole.

Other

Acacia Research Corporation, a Delaware corporation, was originally incorporated in California in January 1993 and reincorporated in Delaware in December 1999. Our website address is www.acaciaresearch.com. We make our filings with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, available free of charge on our website as soon as reasonably practicable after we file these reports. In addition, we post the following information on our website:

· our corporate code of conduct, our board of directors - code of conduct and our fraud policy;

| | · | charters for our audit committee, nominating and corporate governance committee, disclosure committee and compensation committee; |

The public may read and copy any materials that Acacia Research Corporation files with the SEC at the SEC’s Public Reference Room at 450 Fifth Street N.W., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including the Acacia Research Corporation, that file electronically with the SEC. The public can obtain any documents that Acacia Research Corporation files with the SEC at http://www.sec.gov.

BUSINESS GROUPS

ACACIA TECHNOLOGIES GROUP

(A Division of Acacia Research Corporation)

Intellectual Property Licensing Business

The Acacia Technologies group, a division of Acacia Research Corporation, develops, acquires, licenses and enforces patented technologies. The Acacia Technologies group generates license fee revenues and related cash flows from the granting of licenses for the use of its patented technologies. The Acacia Technologies group assists patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, if necessary, with the enforcement against unauthorized users of their patented technologies. The Acacia Technologies group’s subsidiary companies currently own or control the rights to more than 60 patent portfolios and have established a track record of licensing success with more than 500 license agreements executed to date. Our professional staff includes in-house patent attorneys, licensing executives, engineers and business development executives.

The Acacia Technologies group’s clients are primarily individual inventors and small companies who have limited resources and/or expertise to effectively address the unauthorized use of their patented technologies, and also include large companies seeking to effectively and efficiently monetize their portfolio of patented technologies. In a typical client arrangement, the Acacia Technologies group will acquire the patent portfolio or acquire rights to the patent portfolio, with our client receiving an upfront payment for the purchase of the patent portfolio or patent portfolio rights, or receiving a percentage of our net recoveries from the licensing and enforcement of the patent portfolio, or a combination of the two.

The Acacia Technologies group is primarily comprised of certain of Acacia Research Corporation’s wholly owned subsidiaries and limited liability companies, as described earlier, and also includes all corporate assets, liabilities, and related transactions of Acacia Research Corporation attributed to Acacia Research Corporation’s intellectual property licensing and enforcement business.

On January 28, 2005, Acacia Global Acquisition Corporation acquired substantially all of the assets of Global Patent Holdings, LLC, a privately held patent holding company based in Northbrook, Illinois, which owned 11 patent licensing companies (“GPH Acquisition”). The acquisition provided the Acacia Technologies group 100% ownership of companies that own or control the rights to 27 patent portfolios, which included 120 U.S. patents and certain foreign counterparts, and cover technologies used in a wide variety of industries. Refer to Note 8 in the accompanying Acacia Research Corporation consolidated financial statements for additional information regarding the GPH Acquisition.

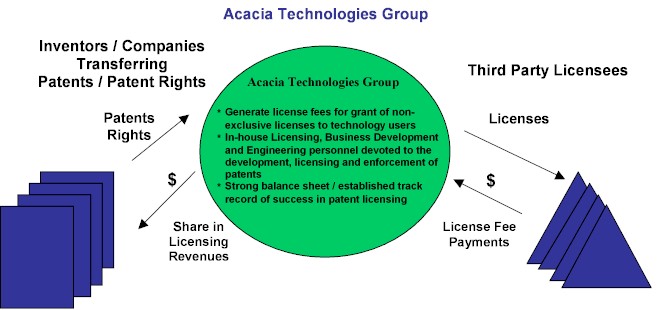

The Acacia Technologies Group’s Business Model and Strategy

The Acacia Technologies group’s business model is summarized in the following diagram:

The Acacia Technologies group’s business strategy includes the following key elements:

| | · | Identify Emerging Growth Areas where Patented Technologies will Play a Vital Role |

The patent process breeds innovation and invention by granting a limited monopoly to the inventor in exchange for sharing the invention with the public. Certain technologies, including several of the technologies controlled by the Acacia Technologies group described below, become core technologies in the way products and services are manufactured, sold and delivered. The Acacia Technologies group identifies core, patented technologies that have been or are anticipated to be widely adopted by third parties in connection with the manufacture or sale of products and services.

| | · | Contact and Form Alliances with Owners of Core, Patented Technologies |

Often individual inventors and small companies have limited resources and/or expertise and are unable to effectively address the unauthorized use of their patented technologies. Individual inventors and small companies may lack sufficient capital resources and may also lack in-house personnel with patent licensing expertise and/or experience, which may make it difficult to effectively out-license and/or enforce their patented technologies.

For years, many large companies have earned substantial revenue licensing patented technologies to third parties. Other companies that do not have internal licensing resources and expertise have continued to record the estimated value of intellectual property on their financial statements without deriving income from their intellectual property. Securities and financial reporting regulations require these companies to evaluate and potentially reduce or write-off these intellectual property assets if they are unable to substantiate these reported values.

The Acacia Technologies group seeks to enter into business agreements with owners of intellectual property that do not have experience or expertise in the areas of intellectual property licensing and enforcement or that do not possess the in-house resources to devote to licensing and enforcement activities.

| | · | Effectively and Efficiently Evaluate Patented Technologies for Acquisition, Licensing and Enforcement |

Subtleties in the language of a patent, recorded interactions with the patent office, and the evaluation of prior art and literature can make a significant difference in the potential licensing and enforcement revenue derived from a patent or patent portfolio. The Acacia Technologies group’s specialists are trained and skilled in these areas. It is important to identify potential problem areas prior to commercialization and determine whether potential problem areas can be overcome, before launching a licensing program. We have developed processes and procedures for identifying problem areas and evaluating the strength of a patent before the decision is made to allocate resources to a licensing and enforcement effort.

| | · | Purchase or Acquire the Rights to Patented Technologies |

After evaluation, the Acacia Technologies group may elect to purchase the patented technology, or become the exclusive licensing agent for the patented technology in all or in specific fields of use. In either case, the owner of the patent generally retains the rights to a portion of the revenues generated from a patent’s licensing and enforcement program. The Acacia Technologies group generally controls the licensing and enforcement process and utilizes its experienced in-house personnel to reduce outside costs and to ensure that the Acacia Technologies group’s capital is allocated and utilized in an efficient and cost effective manner.

| | · | Successfully License and Enforce Patents with Significant Royalty Potential |

As part of our patent evaluation process, significant consideration is also given to the identification of potential infringers, industries within which the potential infringers exist, longevity of the patented technology, and a variety of other factors that directly impact the magnitude and potential success of a licensing and enforcement program. Acacia Technologies group’s specialists are trained in evaluating potentially infringing technologies and in presenting the claims of our patents and demonstrating how they apply to companies we believe are using our technologies in their products or services. These presentations generally take place in a non-adversarial business setting, but can also occur through the litigation process, if necessary.

Acacia Technologies Group - Patented Technologies

Currently, the Acacia Technologies group owns or controls the rights to 62 patent portfolios, with patent expiration dates ranging from 2007 to 2020, and covering technologies used in a wide variety of industries, including the following:

This patented technology generally relates to the precision alignment and bonding of micromechanical, electrical and optical structures. This technology can be used for the bonding of surface features in the fabrication of Micro Electromechanical Systems (“MEMS”) and semiconductors.

| | · | Audio Communications Fraud Detection |

The patents and applications generally relate to methods for determining and preventing fraud when using telephonic, computer network, or other communication services to complete a sale. The claims cover methods for preventing fraud during the purchase of services for entertainment or technical support, such as psychic readings and computer software support. These methods help protect vendors from credit card charge-backs and help protect customers whose credit card numbers may have been stolen.

| | · | Audio/Video Enhancement and Synchronization |

The Audio/Video Enhancement and Synchronization technologies generally relate to the use of an adaptive noise reduction filtering system for analog and digital video signals, especially those used in video compression systems and for video displays, and for synchronizing video and audio signals utilized in systems where the audio and video components are stored, transmitted or otherwise processed separately.

| | · | Broadcast Data Retrieval |

This patented technology generally relates to a system for broadcasting and receiving programming content together with supplemental data such as the title of a song, artist, or a catalog number, that can be stored and recalled for later viewing. This technology can be used in satellite radio and other broadcasting where data is transmitted along with the content.

| | · | Color Correction For Video Graphics Systems |

This patented technology generally relates to methods for altering the colors of isolated objects in a video graphics system. The technology can be used to efficiently and accurately change colors of objects in a video frame or digital picture without affecting the entire image.

The patent, currently being reexamined by the United States Patent and Trademark Office, covers certain systems for recording and playing compact disks containing compressed audio data utilizing certain data-compression methods. The CD player technology, consisting in part of a CD drive that reads MPEG Layer-3 (“MP3”) compressed digital audio data recorded on a CD, and an integrated circuit chip which decompresses the data and produces a non-compressed audio output, is commonly found in DVD and CD players.

| | · | Computer Memory Cache Coherency |

This patented technology generally relates to interface circuits used by intelligent peripheral devices with cache memory to communicate with the main computer memory. By synchronizing main computer memory and main cache memory, peripheral devices such as graphics processors can operate at much higher speeds, without costs associated with their own memory. This technology can be used in desktop, notebook, and server computer systems.

| | · | Computing Device Performance Technology |

The patents relate to technology to improve the startup and use of desktop and portable computers and other computing devices, including those that access software and information from mass storage devices, such as CD-ROM's and magnetic hard drives. The use of the patented technology results in a significant reduction in the startup time and improvement in the performance of applications running on computing devices.

| | · | Continuous Television Viewer Measuring Technology |

The patented technology, unlike prior systems that take snapshots of tuning to assess viewership, relates to uninterrupted and passive continuous monitoring and measuring of television viewers' actions. Measurements include channel changes, channel surfing, video-on-demand and DVR viewership captured through the set-top box, stored and transmitted to a remote location for aggregation.

| | · | Credit Card Fraud Protection |

This patented technology generally relates to a computerized system for protecting retailers and consumers engaged in credit card, check card, and debit transactions. The system includes an electronic card reader, and the generation and use of a transaction number, which specifically identifies each transaction processed within the system. As a result, the retailer does not necessarily have to print detailed information concerning the cardholder’s identity or account number on the customer’s receipt.

This patented technology generally relates to the improved combination, display, and coordination of certain information from data tables in a relational database software program. The user is able to easily track the impact of a change to one table, on other tables in the program through various tools including a graphical representation.

This patented technology generally relates to the use of an operating system to transparently create encrypted file storage subsystem to fully secure user files from access by anyone other than the user.

| | · | Digital Video Production |

These patented technologies generally relate to features that can be found in production video processing equipment. They cover improved methods of equipment interconnection, aspects of graphical user interface displays, and automation of video processing. These features allow ease of equipment interconnection, clearer information display, and automation of video production tasks previously performed manually. Other aspects of the technologies generally relate to automatic color correction, commonly used when transferring film to video, and certain 3D effects, commonly used in video scene transitions.

| | · | Digital Media Transmission (“DMT®”) Technology |

This patented technology generally relates to the transmission and receipt of digital audio and/or audio video content via a variety of means including the internet, cable, satellite, and local area networks. Elements of the DMT® transmission process include a source material library, identification encoding process, format conversion, sequence encoding, compressed data storage, and transmission. Elements of the DMT® receiving process include a transceiver, format conversion, storage, decompression, and playback. Acacia Technologies group has entered into 315 DMT® licensing agreements to date, including cable TV licenses, licenses for online entertainment, movies, news, sports, e-learning and corporate websites and licenses with companies that provide over 90% of video-on-demand TV entertainment to the hotel industry in the United States.

This patented technology generally relates to storing data in databases such that it could be used to quickly populate multiple document templates. This technology can be used in medical applications such as Electronic Medical Records (“EMR”) and Electronic Health Records (“EHR”), as well as document generation applications in the financial, legal, and insurance industries.

| | · | Dynamic Manufacturing Modeling |

This patented technology generally relates to a modeling and control process used to decrease costs and increase production for factory operations. Such simulation modeling can include a variety of parameters such as products, fabrication sequences, collections of job sets, scheduling rules, and machine reliability standards. This technology can be used for exacting manufacturing processes such as semiconductor fabrication.

| | · | Electronic Address List Management |

This patented technology can allow a user to manage an address list on a computer and transfer the list to an electronic device such as a cell phone.

| | · | Enhanced Internet Navigation |

These patented technologies generally relate to enhanced Internet navigation by retrieving a page from a hyper-linked website for retrieval offline on a personal computer. This enables certain website content to be saved, retrieved, and accessed locally, without the need for Internet connectivity. Other aspects of the technologies generally relate to information distribution and processing via the use of a linking reference to access sets of data. These technologies can be used in email transmissions with links to websites, special offers, and other information.

| | · | File Locking In Shared Storage Networks |

The patent relates to a file locking system for use in shared storage networks such as iSCSI. The use of the patented technology removes a single point of failure for companies migrating existing Storage Area Network (“SAN”) implementations to iSCSI or for those creating new shared storage networks.

| | · | Fluid Flow Control and Monitoring |

The patent relates to systems used in the remote control and monitoring of fluid flow, both gas and liquid. This technology can be used in heating/ventilation/air conditioning (“HVAC”), plumbing and other industrial, commercial and residential fluid flow systems.

This patented technology shields hearing aids from electromagnetic interference produced by portable electronic devices such as cell phones, cordless phones, wireless headphones and headsets, and WIFI and Bluetooth enabled devices.

| | · | High Quality Image Processing |

This patented technology generally relates to methods for improving print image quality through the use of advanced signal processing techniques for transforming continuous toned images into high quality half toned images. This technology can be used in printing products such as high end laser printers and image setters.

These patents generally relate to refractive and diffractive systems and methods for improving imaging capabilities in multi-element optical systems by using fewer elements. The patented systems and techniques have direct applications in military imaging systems such as thermal weapon sites, as well as commercial products like camera lenses and optical printers.

| | · | Image Resolution Enhancement |

This patented technology generally relates to the modification of images to be displayed on a video or printed display to improve the perceived image quality beyond the basic pixel resolution of the display original image.

| | · | Information Monitoring Technology |

This patented technology, which can be incorporated into software products, can be used to monitor infrastructure components such as hardware, servers, networks, and operating systems, and can also be used for information monitoring and other information databases.

These patented technologies generally relate to various aspects of interactive television including receivers such as set-top boxes and certain televisions used in digital satellite and digital cable systems that permit television viewers to access interactive television features supplied by their satellite and cable providers as part of their digital programming packages. Data, which is associated with the interactive television features and is broadcast along with the video signal, is extracted and processed by components within the receivers, and is then made available to viewers who choose to access the interactive television features through their remote control. Examples of such data include sports scores, weather information, stock updates, interactive games, and movie listings. Other aspects of the technologies generally relate to the scrambling or encrypting of broadcast signals whereby the unscrambling or decryption is accomplished through a removable card, commonly known as a “smart card.”

This patented technology is used to connect a laptop or other portable computer to multiple external devices such as a keyboard, monitor, printer, or mouse, through a single connector from the laptop to the docking station. The use of a single connector for multiple devices makes it easier to remove the laptop from the devices when it is used remotely, and to reconnect the laptop to the devices when it is returned to the docking station.

This patented technology generally relates to locating mobile units, such as cell phones and embedded vehicle radios, within a cellular network and using the position information to provide services to the mobile user. It covers various means of accurately locating a mobile unit, including GPS and cell site triangulation. This technology is applicable to wireless emergency services (“E911”), vehicle tracking, vehicle assistance services and many other services that rely on knowing the location of a mobile user.

| | · | Medical Image Stabilization |

This patented technology can be used in stabilizing medical images for interventional procedures such as cardiac catheters and stents, and for diagnostics procedures such as visualization of arterial lesions.

This patented technology can be used in fabrics to maximize moisture transport and increase breathability and is often used in sports apparel.

| | · | Micromirror Digital Display |

This patented technology generally relates to techniques for using micromirrors to display a color image having gray scale gradations and is utilized in large screen televisions and projectors.

| | · | Microprocessor Enhancement |

This patented technology generally relates to an architecture employed in advanced pipeline microprocessors. This architecture allows for conditional execution of microprocessor instructions, and a later determination of whether the instructions executed should be written back to memory. By conditionally executing instructions in this architecture, significant improvements in microprocessor speed can be achieved. Certain pipelined processor manufacturers are adopting this method of processing to improve processor speed.

| | · | Multi-dimensional Bar Codes |

This patented technology generally relates to encoding and reading a data matrix consisting of an array of data cells with a border. The data matrix can contain a variety, amount, and depth of information that would not fit on to an ordinary bar code. This patented technology can have many applications in the manufacturing, distribution, operations, accounting, and security industries such as tracking the movement of products, collection of data, improved production capabilities and anti-counterfeiting.

| | · | Picture Archiving & Communication Systems (“PACS”) |

PACS enable multiple, remote users to simultaneously access image data from remote display terminals over common phone and data networks, such as the Internet. PACS are commonly used by hospitals to acquire, store, archive and transmit patient image data for remote access by their physicians, at their homes, offices or within the hospital at the point of care.

This patented technology generally relates to hand held devices that include pointing devices, such as a joy stick, capable of carrying out multiple user selectable functions.

This patented technology generally relates to user activated displays on a website, most commonly known as Pop-Ups or Pop-Unders. The displays can include advertising, surveys, messages, sound, video, applets and any other graphic or textual content.

| | · | Portable Storage Devices With Links |

This patented technology generally relates to products sold or distributed on CDs or DVDs that include a link to retrieve additional data via the Internet. This technology can be used by companies that distribute their products on CDs or DVDs and provide links for software upgrades, user manuals, audio files, and other purposes.

These patented technologies generally relate to accessing data through the submission of a product identification and computer specific information to a remote station. The remote station sends an encrypted key that is stored on the computer and provides access to the data. This technology can be used by software and other products to help deter the distribution of illegal copies. Other aspects of the technologies generally relate to accessing clear data, and encrypted data via an identification label. Once decrypted, the clear and decrypted data are combined to activate software programs, and other files.

These patents relate to remote control of video cameras and other devices used in areas such as videoconferencing and surveillance systems. The uses of the patented technology include improved remote management of video camera functions such as pan, tilt, and focus, and improved device control in a networked videoconferencing system.

This patented technology generally relates to the creation and maintenance of a schedule through the periodic management and monitoring of interrelated and interdependent resources from a database. These resource management tools can be part of scheduling software used to plan and monitor the use of facilities, the allocation of manpower, and the use and scheduling of other resources.

| | · | Software License Management |

This patented technology generally relates to technology for monitoring and tracking the use of software applications across a network. This technology can be used to provide a system for managing software license compliance in an enterprise environment as well as metering actual usage levels in a Software-as-a-Service (“SaaS”) environment.

This patented technology generally relates to automating the production of worksheet files for use by electronic spreadsheet programs. Specifically, the patented technology permits the efficient retrieval of data from external databases by allowing the user to select specific data from a database and import the specified data into a spreadsheet program through uniquely streamlined spreadsheet commands. The adaptive quality of the technology permits, among other things, the user to retrieve updated information from an external database without creating formatting issues in the user’s spreadsheet program.

This patented technology generally relates to diverse aspects of storage devices and related technology. The patented technologies relate generally to data transfer, fault tolerance, caching, data integrity and error correction.

This patented technology generally relates to technology for displaying mobile vehicle information on a map. This technology can be used in navigation and fleet management systems that combine wireless communication with GPS tracking and map displays.

| | · | User Activated Internet Advertising |

This patented technology generally relates to the display of certain advertising, informational, and branding messages that appear between or outside web pages when the user is conducting a search, by storing the message prior to being displayed. This technology is most commonly used by travel based and other reservation based websites.

| | · | Vehicle Anti-Theft Parking System |

This patented technology generally relates to methods of automatically identifying a vehicle through a characteristic, such as a license plate number, in order to deter vehicle theft. This technology is applicable to airports, hotels, shopping centers and other parking areas that employ access control.

| | · | Vehicle Magnetic Braking |

This patent generally relates to technology for smooth, reliable braking and acceleration of vehicles on parallel rails.

This patented technology generally relates to technology for learning user preferences and automatically personalizing a user's online experience. The technology is applicable to web sites that use categories plus attributes to identify items, and where individual attributes apply to multiple categories.

| | · | Wireless Traffic Information |

This patented technology generally relates to transmitting, receiving and displaying traffic information on portable handheld and mobile displays. It covers a variety of wireless distribution methods, such as FM radio and satellite, as well as the devices used to display the traffic maps. This technology enables users to identify traffic congestion and can be used with in-vehicle navigation displays and portable handheld units such as cell phones and PDA's.

Patent Enforcement Litigation

Companies comprising the Acacia Technologies group are often required to engage in litigation to enforce their patents and patent rights. In the litigation listed below, certain companies comprising the Acacia Technologies group are parties to ongoing litigation alleging infringement of certain of our patented technologies by the companies listed. Current patent enforcement litigation, by related patented technology, is as follows:

Audio/Video Enhancement and Synchronization Technology -

Image Resolution Enhancement Technology

| | · | New Medium Technologies, LLC and AV Technologies, LLC v. Barco NV, Miranda Technologies, LG Philips LCD, Toshiba Corporation, Toshiba America Consumer Products, LLC., and Syntax-Brillian Corporation. United States District Court for the Northern District of Illinois. Filed 9/29/05. Case No. 1:05-cv-05620. |

Computer Memory Cache Coherency Technology

| | · | Computer Cache Coherency Corporation v. VIA Technologies, Inc., Via Technologies, Inc. (USA) and Intel Corporation. United States District Court for the Northern District of California. Filed 12/2/04. Case No. 5:05-cv-01668. |

Credit Card Fraud Protection Technology

| | · | Financial Systems Innovation LLC and Paul N. Ware v. The Kroger Company. United States District Court for the Northern District of Georgia. Filed 3/3/04. Case No. 4:04-cv-00065. |

| | · | Financial Systems Innovation LLC and Paul N. Ware v. Williams-Sonoma, Inc., and Costco Wholesale Corporation. United States District Court for the Northern District of Texas. Filed 6/30/04. Case No. 4:04-cv-00479. |

| | · | Financial Systems Innovation LLC and Paul N. Ware v. Circuit City Stores, Inc., Officemax Incorporated, Staples, Inc., Cracker Barrel Old Country Store, Inc., Fry’s Electronics, Inc., and Rite Aid Corporation. United States District Court for the Northern District of Georgia. Filed 7/19/05. Case No. 4:05-cv-00156. |

| | · | Reinalt-Thomas Corporation, dba Discount Tire Corporation, v. Acacia Research Corporation, Paul N. Ware and Financial Systems Innovation LLC. United States District Court for the District of Arizona. Filed 10/27/05. Case No. 2:05-cv-03459. |

| | · | Financial Systems Innovation LLC and Paul Ware v. Discount Tire Company of Georgia, Inc. and Reinalt-Thomas Corporation, dba Discount Tire Company. United States District Court for the Northern District of Georgia. Filed 11/21/05. Case No. 4:05-cv-00252. |

| | · | Lone Star Steakhouse and Saloon, Inc. v. Acacia Technologies group and Financial Systems Innovation LLC. United States District Court for the District of Kansas. Filed 8/5/05. Case No. 6:05-cv-01249. |

Computing Device Performance Technology

| | · | Computer Acceleration Corporation vs. Microsoft Corporation. United States District Court for the Eastern District of Texas. Filed 7/6/06. Case No. 9:06-cv-0140. |

Data Encryption Technology

| | · | Data Encryption Corporation v. Microsoft Corporation and Dell Computer Corporation. United States District Court for the Central District of California. On appeal to the U.S. Court of Appeals for the Federal Court. Lower Court Case No. 2:05-cv-05531. |

Digital Media Transmission Technology

In accordance with the Transfer Order issued February 24, 2005, by the Judicial Panel on Multidistrict Litigation, all of the following Digital Media Transmission Technology cases have been transferred to the Northern District of California. The lead case number is 5:05-cv-01114.

| | · | Acacia Media Technologies Corporation v. Comcast Cable Communications, LLC, Charter Communications, Inc., The DirectTV Group, Inc., Echostar Communications Corporation, Cox Communications, Inc., Hospitality Network, Inc. (a wholly owned subsidiary of Cox that supplies hotel on-demand TV services), Mediacom, LLC, Armstrong Group, Arvig Communication Systems, Block Communications, Inc., Cable America Corporation, Cable One, Inc., Cannon Valley Communications, Inc., East Cleveland Cable TV and Communications, LLC, Loretel Cablevision, Massillon Cable TV, Inc., Mid-Continent Media, Inc., NPG Cable, Inc., Savage Communications, Inc., Sjoberg's Cablevision, Inc., US Cable Holdings LP, and Wide Open West, LLC, Time Warner Cable, Cablevision Systems Corporation, Insight Communications Company, Cebridge Communications and Bresnan Communications. |

| | · | Acacia Media Technologies Corporation v. New Destiny Internet Group, Inc., Audio Communications Inc., VS Media Inc., Ademia Multimedia, LLC, International Web Innovations, Inc., Offendale Commercial BV, Ltd., Adult Entertainment Broadcast Network, Cybertrend, Inc., Lightspeed Media Corporation, Adult Revenue Services, Innovative Ideas International, AskCS.com, Game Link, Inc., Club Jenna, Inc., Cybernet Ventures, Inc., ACMP, LLC, Global AVS, Inc. d/b/a DrewNet, and National A-1 Advertising. |

High Quality Image Processing

| | · | Lexmark International, Inc. v. Acacia Research Corporation, dba Acacia Technologies Group and Acacia Patent Acquisition Corp. United States District Court for the Eastern District of Kentucky. Filed 2/13/07. Case No. 5:07-cv-00047. |

High Resolution Optics Technology

| | · | Theodore Whitney and High Resolution Optics Corporation v. The United States. United States Court of Federal Claims. Filed 8/23/06. Case No. 1:06-cv-00601. |

Information Monitoring Technology

| | · | Diagnostic Systems Corporation v. Symantec Corporation; CA, Inc., F-Secure, Inc., NetIQ Corporation, Quest Software Inc., NetScout Systems, Inc., and Motive, Inc. United States District Court for the Central District of California. Filed 12/14/06. Case No. 806-cv-01211. |

Interactive Television Technology

| | · | Broadcast Innovation, LLC and IO Research, Ltd. v. Charter Communications, Inc. United States District Court for the District of Colorado. Case No. 1:03-cv-02223. On appeal to the U.S. Court of Appeals for the Federal Court from 9/28/04 to 11/21/05. Remanded to the U. S. District Court for further proceedings on 11/21/05. |

| | · | Broadcast Innovation, LLC v. Echostar Communications Corporation. United States District Court for the District of Colorado. Filed 11/9/01. Case No. 1:01-cv-02201. |

Laptop Connectivity Technology

| | · | Computer Docking Station Corporation v. Dell, Inc., Gateway, Inc., Toshiba America, Inc., and Toshiba America Information Systems, Inc. On appeal to the U.S. Court of Appeals for the Federal Court. Lower Court Case No. 06-c-0032-c. |

Micromesh Technology

| | · | Micromesh Technology Corporation v. American Recreation Productions, Inc. and American Recreation Products, Inc., dba Kelty. United States District Court for the Northern District of California. Filed 9/27/06. Case No. 3:06-cv-06030. |

| | · | Micromesh Technology Corporation v. Columbia Sportswear Company. United States District Court for the Northern District of California. Filed 9/27/06. Case No. 3:06-cv-06031. |

| | · | Micromesh Technology Corporation v. Red Wing Shoe Company and Red Wing Shoe Company, dba Vasque. United States District Court for the Eastern District of Texas. Filed 10/4/06. Case No. 2:06-cv-00421. |

| | · | Micromesh Technology Corporation v. VF Corporation, VF Corporation, dba JanSport, VF Outdoor, Inc., dba The North Face. United States District Court for the Eastern District of Texas. Filed 10/4/06. Case No. 2:06-cv-00422. |

Microprocessor Enhancement Technology

| | · | Microprocessor Enhancement Corporation and Michael H. Branigin v. Texas Instruments, Incorporated. United States District Court for the Central District of California. Filed 4/7/05. Case No. 8:05-cv-00323. Appeal pending. |

| | · | Microprocessor Enhancement Corporation and Michael H. Branigin v. Intel Corporation. United States District Court for the Central District of California. Filed 8/3/05. Case No. 2:05-cv-05667. |

Multi-Dimensional Bar Code Technology

| | · | Cognex Corporation v. VCode Holdings, Inc., VData LLC, Acacia Research Corporation, dba Acacia Technologies Group, and Veritec Inc. United States District Court for the District of Minnesota. Filed 3/13/06. Case No. 0:06-cv-01040. |

| | · | VData LLC and VCode Holdings, Inc. v. Aetna, Inc., PNY Technologies Inc., A144 and Merchant’s Credit Guide Co. United States District Court for the District of Minnesota. Filed 5/8/06. Case No. 0:06-cv-01701. |

Peer to Peer Communications Technology

| | · | Peer Communications Corporation v. Skype Technologies SA, Skype, Inc., and eBay, Inc. United States District Court for the Eastern District of Texas. Filed 8/22/06. Case No. 6:06-cv-00370. |

Portable Storage Devices With Links Technology

| | · | Disc Link Corporation v. H&R Block, Inc., McAfee, Inc., Riverdeep, Inc. and Sage Software SB, Inc. United States District Court for the Eastern District of Texas. Filed 12/27/06. Case No. 5:06-cv-00295. |

Resource Scheduling Technology

| | · | Epic Systems Corporation v. Resource Scheduling Corporation. United States District Court for the District of Delaware. Filed 4/19/06. Case No. 1:06-cv-00255. |

Telematics Technology

| | · | Telematics Corporation v. United Parcel Service Co., @Road, Inc., Motorola Inc., Ryder System, Inc., Sprint Nextel Corporation, Teletrac, Inc., Verizon Communications, Inc., and Xata Corporation. United States District Court for the Northern District of Georgia. Filed 1/16/07. Case No. 1:07-cv-00105. |

User Activated Internet Advertising Technology

| | · | InternetAd Systems, LLC v. Turner Broadcasting System, Inc., Freerealtime.com, Inc., Knight Ridder Digital, Homestore, Inc., Condenet, Inc., Tribune Company. United States District Court for the Northern District of Texas. Filed 6/15/06. Case No. 3:06-cv-01063. |

| | · | InternetAd Systems, LLC v. Opodo Limited, Amadeus Global Travel Distribution S.A., and Amadeus North America, LLC. United States District Court for the Northern District of Texas. Filed 6/19/06. Case No. 3:06-cv-01084. |

Vehicle Magnetic Braking Technology

| | · | Safety Braking Corporation, Magnetar Technologies Corp., and G&T Conveyor Co. v. Six Flags, Inc., Six Flags Theme Parks Inc., SF Partnership, Tierco Maryland, Inc., Busch Entertainment Corp., Cedar Fair LP, Paramount Parks, Inc., NBC Universal, Inc., Universal Studios, Inc., Blackstone Group L.P., The Walt Disney Co., and Walt Disney Parks and Resorts, LLC. United States District Court for the District of Delaware. Filed 3/1/07. Case No. 1:07-cv-00127. |

Competition

The Acacia Technologies group expects to encounter competition in the area of patent acquisition and enforcement as the number of companies entering this market is increasing. This includes competitors seeking to acquire the same or similar patents and technologies that we may seek to acquire. Companies such as British Technology Group, Rembrandt Management Group, and Intellectual Ventures LLC are already in the business of acquiring the rights to patents for the purpose of enforcement, and we expect more companies to enter the market. As new technological advances occur, many of our patented technologies may become obsolete before they are completely monetized. If we are unable to replace obsolete technologies with more technologically advanced patented technologies, then this obsolescence could have a negative effect on our ability to generate future revenues.

The Acacia Technologies group also competes with venture capital firms and various industry leaders for technology licensing opportunities. Many of these competitors may have more financial and human resources than our company. As we become more successful, we may find more companies entering the market for similar technology opportunities, which may reduce our market share in one or more technology industries that we currently rely upon to generate future revenue.

Other companies may develop competing technologies that offer better or less expensive alternatives to our patented technologies that we may acquire or out-license. Many potential competitors may have significantly greater resources. Technological advances or entirely different approaches developed by one or more of its competitors could render Acacia Technologies group’s technologies obsolete or uneconomical.

Employees

As of December 31, 2006, the Acacia Technologies group had 33 full-time employees. None of the companies included in the Acacia Technologies group is a party to any collective bargaining agreement. The Acacia Technologies group considers its employee relations to be good.

COMBIMATRIX GROUP

(A Division of Acacia Research Corporation)

Life Sciences Business

The CombiMatrix group is comprised of our wholly owned subsidiary, CombiMatrix Corporation and CombiMatrix Corporation’s wholly owned subsidiary, CombiMatrix Molecular Diagnostics, Inc. The CombiMatrix group is seeking to become a broadly diversified biotechnology business, through the development of proprietary technologies, products and services in the areas of drug development, genetic analysis, molecular diagnostics, nanotechnology research, defense and homeland security markets, as well as other potential markets where its products and services could be utilized. The technologies that the CombiMatrix group has developed include a platform technology to rapidly produce customizable, in-situ synthesized, oligonucleotide arrays for use in identifying and determining the roles of genes, gene mutations and proteins. This technology has a wide range of potential applications in the areas of genomics, proteomics, biosensors, drug discovery, drug development, diagnostics, combinatorial chemistry, material sciences and nanotechnology. The CombiMatrix group has also developed the capabilities of producing arrays that utilize bacterial artificial chromosomes, also enabling genetic analysis. Other technologies include proprietary molecular synthesis and screening methods for the discovery of potential new drugs.

Technologies

· Semiconductor Based Array.

The CombiMatrix group’s semiconductor based array technology enables the rapid, parallel synthesis, immobilization and detection of molecules and materials at discrete electrodes on a semiconductor chip. These chips, also known as microelectrode arrays, are used in multiple applications in the areas described above. The CombiMatrix group’s technology integrates semiconductor micro fabrication, proprietary software, chemistry and hardware into systems that it believes will enable it, its customers and its partners to design and fabricate arrays for biological, diagnostic, material sciences and nanotechnology applications, typically within a few days. The CombiMatrix group’s system should enable researchers to conduct rapid, iterative experiments in each of these fields.

The primary use of this technology is the fabrication of oligonuceotide arrays. Oligonucleotides are short sequences of DNA, which when synthesized in an array format, can be used to perform several types of genetic analysis. The most common types of analyses using these arrays are the evaluation of gene expression or the identification of mutations. Gene expression is the term used to describe the identification of genes in cell that are expressed or not expressed or “active” or “inactive.” By evaluating the expression patterns of normal cells versus suspected diseased cells (for example a growth) one may be able to diagnose that disease and also provide information on how to address that disease. Abnormal expression patterns have been implicated for a number of diseases.

Mutation analysis is the identification of specific changes the sequence of DNA that may be linked to particular diseases or drug responses. By identifying a specific mutation in an individual’s genome, it may be possible to identify a disease, pre-disposition to disease or potential drug response.

· Bacterial Artificial Chromosome Arrays (or “BAC” Arrays)

The CombiMatrix group’s BAC Arrays enable us to perform comparative genomic hybridization (or “CGH”) studies to evaluate gross genetic anomalies in genomes. These arrays incorporate BACs, which are fragments of DNA that have been cloned or manufactured in a bacteria. These fragments can be placed on a substrate, in the CombiMatrix group’s case a chemically modified glass slide. These BACs are either developed by us or obtained through other sources. The CombiMatrix group utilizes these arrays to perform CGH analysis in a diagnostic and research setting to identify genetic imbalances in the form of copy number differences. CGH analysis allows us to compare the genomic DNA of a normal individual with that of an individual who may have a disease. This type of analysis evaluates the genes rather than the expression of those genes. CGH analysis is useful in evaluating gross defects in an individual’s genome, such as copy number differences. Copy number differences are situations where a gene or a large portion of a gene is missing or an extra copy exists.

Utilizing these array technologies, the CombiMatrix group is engaged in three strategic business areas:

| 1. | The development of services and products in the field of molecular diagnostics; |

| 2. | The development, manufacture and sale of research tools and services to life sciences researchers; and |

| 3. | The development, manufacture and sale of biosensor systems and technology for national defense and homeland security. |

· Technologies and Compound Libraries for Oncological Drug Development

Through the CombiMatrix group’s minority ownership of Leuchemix, Inc., we have access to proprietary compounds that have been shown to be cytotoxic towards certain cancers in-vitro and in vivo. Many of these compounds were discovered through combinatorial chemistry, natural product chemistry and certain cellular screening assays. Leuchemix, Inc. has access to state of the art laboratories and equipment, which includes flow cytometry, molecular biology and cell culture facilities. In addition, Leuchemix, Inc. has access to a bank of over 150 primary leukemia specimens and a panel of 15 leukemia and lymphoma cell lines as well as several xenogenic animal model systems. Leuchemix also has licensed proprietary compounds and compound libraries, which are being developed as drugs against a number of oncology indications including hematological disorders as well as solid tumors.

Market Overview

The markets for the CombiMatrix group’s products and services include pharmaceutical and biotechnology markets (also referred to as life sciences), molecular diagnostics, national defense and homeland security applications. In the future, if the CombiMatrix group is successful in developing approved drugs either internally or through its investments in companies such as Leuchemix, Inc., the CombiMatrix group’s market opportunities will expand to include pharmacies, physicians, hospitals, patients and other consumers of therapeutics. In addition, there may be opportunities for the CombiMatrix group’s products and services to address consumer-based genetic analysis as that market develops. At this time, the majority of the CombiMatrix group’s commercial efforts are focused on developing and marketing molecular diagnostics services.

General Overview of Molecular Diagnostics, Life Sciences and Pharmaceutical Industries

The molecular diagnostics market is a sub-segment of the overall diagnostics market. Molecular diagnostics, within the context of this discussion, refers to the use of genetic analysis of individuals to make medical decisions in the diagnosis of disease as well as the management of patients. The sequencing of the human genome and associated research as well as advances in technology are enabling the growth of this market. Most experts believe that over the next few decades, the use of molecular diagnostics will grow rapidly and will have a revolutionary impact on the way medicine is practiced.

Additionally, the pharmaceutical and biotechnology industries continue to face increasing costs and risks in the drug discovery, development and commercialization process. A primary component of the cost is the effort expended on drugs that failed to meet clinical and regulatory requirements due to a poor safety profile, efficacy in a small fraction of the patient population, or other similar reasons. By identifying patients who are more likely to respond favorably to a drug (and excluding those that will either not respond or have an adverse response), the potential market for the drug is decreased but the chance of achieving regulatory approval is increased. Stratification of patient populations can be performed by analysis of blood or tissue of patients for genetic biomarkers or expression patterns that are characteristic of responders and non-responders.

While there are multiple technologies being developed to address the noted molecular diagnostic applications, the CombiMatrix group feels that its technology and products are ideally suited to aid in many of these market segments.

Genes and Proteins

The human body is composed of billions of cells each containing DNA that encodes the basic instructions for cellular function. The complete set of an individual’s DNA is called the genome, and is organized into 23 pairs of chromosomes, which are further divided into smaller regions called genes. Each gene is composed of a strand of four types of nucleotide bases, referred to as A, C, G and T. The bases of one DNA strand bind to the bases of the other strand in a specific fashion to form base pairs: the base A always binds with the base T and the base G always binds with the base C.

The human genome has approximately 3.0 billion nucleotides and their precise order is known as the DNA sequence. When a gene is turned on, or expressed, the genetic information encoded in the DNA is copied to a specific type of RNA, called messenger RNA, or mRNA. The mRNA provides instructions for the synthesis of proteins. Proteins direct cellular function and the development of individual traits and are involved in many diseases. Abnormal variations in the sequence of a gene, in the level of gene expression, or large anomalies (such as deletions, extra genes, etc.) can interfere with the normal physiology of particular cells and lead to a disease, a predisposition to a disease or an adverse response to drugs.

Genes and Molecular Diagnostics

There are a number of types of genetic analysis that can be useful in a diagnostic context. They include (i) gene expression profiling, (ii) comparative genomic hybridization, (iii) and mutation analysis. For many diagnostic applications using the above paradigms, it is only necessary to analyze either only one or a small number of genetic factors. For such situations, there are a number of ubiquitous techniques to perform the analysis. However, when a larger number of genetic factors need to be analyzed to make a medical decision, the most efficient method of analysis is a microarray. The CombiMatrix group feels that its microarrays provide advantages over other microarrays for molecular diagnostic applications.

Gene Expression Profiling

Gene expression profiling is the process of determining which genes are active in a specific cell or group of cells and is accomplished by measuring mRNA, the intermediary between genes and proteins. By comparing gene expression patterns between cells from normal tissue and cells from diseased tissue, researchers may identify specific genes or groups of genes that play a role in the presence of disease. Studies of this type, used in drug discovery, require monitoring thousands, and preferably tens of thousands, of mRNAs in large numbers of samples. As the correlation between gene expression patterns and specific diseases is determined, the CombiMatrix group believes that gene expression profiling will have an increasingly important role as a diagnostic tool. Diagnostic use of expression profiling tools is anticipated to grow rapidly with the combination of the sequencing of various genomes and the availability of more cost-effective technologies.

The CombiMatrix group’s gene expression arrays utilize sequences of genes that can hybridize or bind to their complementary sequences. By analyzing the amount of bound material, the CombiMatrix group is able to identify whether a particular gene has been expressed and what level of expression exists. By exposing a suitably processed genetic sample from a tissue or tissues, one is able to monitor the expression pattern and compare that pattern to previously validated patterns that are characteristic of disease.

Array Comparative Genomic Hybridization (or “CGH”)

CGH is the study at the gene level of gross level anomalies such as copy number polymorphisms. Array CGH is the use of an array that multiplexes the analysis of a large portion of the genome. Unlike, gene expression, which monitors the activity of genes, CGH analysis studies and identifies defects at the gene level that are characteristic of disease, predisposition to disease or response to drugs. The CombiMatrix group’s CGH arrays utilize probes, cloned or manufactured in bacteria, which are referred to as bacterial artificial chromosomes, or BACs. Recent studies have shown that copy number polymorphisms are the cause of many diseases, susceptibility to disease, and response to therapy.

Genetic Mutations

The most common form of genetic variation occurs as a result of a difference in a single nucleotide in the DNA sequence, commonly referred to as a single nucleotide polymorphism, or SNP. The human genome is estimated to contain between three and six million SNPs. SNPs are believed to be associated with a large number of human diseases, although most SNPs are believed to be benign and not to be associated with disease. It is believed that the genetic component of most major diseases is associated with a combination of SNPs.

Array Based Analysis

Traditional technologies for analyzing genetic or protein variation and function generally perform experiments individually, or serially, and often require relatively large sample volumes, adding significantly to the cost of conducting experiments. Arrays were developed to overcome the limitations of traditional technologies and enable the parallel evaluation of large numbers of genetic factors.

An array is a collection of miniaturized test sites arranged in a manner that permits many tests to be performed simultaneously, or in parallel, in order to achieve higher throughput. The average size of test sites in an array and the spacing between them defines the array’s density. Higher density increases parallel processing throughput. In addition to increasing the throughput, higher density reduces the required volume for the sample being tested, and thereby lowers costs. Principal commercially available ways to produce arrays include mechanical deposition, bead immobilization, inkjet printing and photolithography.

While current array technologies have revolutionized drug discovery and development and are poised to enter the molecular diagnostics markets, the CombiMatrix group believes that its advanced array technologies provide characteristics, including flexibility, superior cost metrics, and increased performance, which address certain needs not addressed by conventional arrays.

The CombiMatrix Solution

The CombiMatrix group believes that its microarrays will offer several important advantages over competing arrays. These advantages include flexibility, cost, performance, and other capabilities. Also, the CombiMatrix group is the only company that utilizes both in-situ synthesized oligomer arrays and spotted BAC arrays.

Products and Services

CustomArrayTM

The CombiMatrix group’s primary product for genetic studies is marketed under the trade name CustomArray, which is a highly flexible custom oligonucleotide array that addresses researchers’ specific requirements for high-performance arrays that can interrogate small sets of target genes or whole genomes at a low cost. CustomArrays currently come in two density formats: first are the medium-density CustomArray 12K and the 4 X 2K CustomArray. The CustomArray 12K enables analysis of up to 12,000 genes, whereas the 4 X 2K array enables the analysis of four separate experiments of up to 2,000 genes each. Second is the CustomArray 90K, which enables the analysis of approximately 90,000 genes in one experiment. This enables analysis of the full human genome, or that of other species with redundant probes for better performance and reliability.

CustomArray is an advanced tool used to understand gene expression by measuring mRNA activity within a cell type or groups of cells, enabling users to understand and diagnose disease, predisposition to disease, drug response as well as provide information regarding drug development. CustomArray can also be used as a SNP genotyping tool providing statistics on the effect of a SNP or groups of SNPs, giving rise to data that is important in diagnostic testing. Because of the product’s flexibility, researchers have utilized and are evaluating the use of CustomArrays for other applications such as gene assembly, sequencing, protein translation and others. CustomArrays can also be read on most commercially available scanners, thus enabling many researchers to perform assays without requiring additional capital expenditures for scanning equipment that several competing technologies require.

CatalogArraysTM

The CombiMatrix group has also launched several dozen CatalogArrays, which are pre-designed arrays built using the CombiMatrix group’s platform that can be used for gene expression studies, mutation analysis, and other studies. These arrays include several human genome sets, mouse, rat, dog and several other organisms including plants, animals, bacteria and viruses. These arrays are updated as new genetic or sequence information is published. In addition, similar to CustomArrays, the CombiMatrix group’s CatalogArrays can be read on most commercially available scanners and do not require additional capital investment or start-up fees by the customer.

Micro-RNA Arrays

The CombiMatrix group also offers a series of arrays that can be used to study micro-RNA molecules, which are relatively small strands of RNA molecules in cells that appear to have significant regulatory control over cell function. Until recently, micro-RNA molecules were thought to be oddities and perhaps superfluous genetic material. However, recent research indicates that these molecules play a significant role in the physiology of the cell. The CombiMatrix group offers Micro-RNA arrays for human, mouse, rat and other organisms. These arrays are updated as new information is published. In addition, similar to CustomArrays, the CombiMatrix group’s Micro-RNA Arrays can be read on most commercially available scanners and do not require additional capital investment or start-up fees by the customer.

DNA Array Synthesizer

The CombiMatrix group’s DNA Array Synthesizer is a bench-top instrument that enables researchers to fabricate DNA arrays to their exact specifications with complete control over the content that is synthesized onto the array. The system consists of a synthesizer instrument that is operated by a personal computer that is connected to a cabinet that contains reagents necessary for array synthesis. The system is able to fabricate up to eight, 12K arrays within a 24-hour period, or up to thirty-two, 2K sectored arrays in the same period of time. The synthesizer’s flexibility enables researchers to synthesize multiple designs or the same design in each synthesis run. To operate the synthesizers, researchers must purchase blank microarray slides (i.e., slides on which no DNA synthesis has been performed) from the CombiMatrix group and reagents from either the CombiMatrix group or other vendors.

Stripping Reagents

The CombiMatrix group has created the first commercially available array stripping kit. The kit allows researchers to re-use the CombiMatrix group’s CustomArrays up to four times. The ability to re-use CustomArray reduces the cost per CustomArray to the researcher while eliminating problems associated with chip-to-chip reproducibility.

EC Reader-Electrochemical Scanning Instrument

The EC Reader is a compact scanner for CombiMatrix arrays. The EC Reader was developed to provide the market with a compact, inexpensive and easy to use scanner for performing array experiments. Current arrays, including those manufactured by the CombiMatrix group, are designed to be analyzed using optical scanning instruments. While these scanners are quite functional, they are also relatively expensive, bulky, and can be difficult to use. Due to the electrochemical nature of the CombiMatrix group’s arrays, it is possible to scan them using an electrochemical scanner as well as an optical scanner. The advantages of the electrochemical scanner arise out of the fact that the EC Reader does not have any optical components (such as lasers, lenses and optical detectors). By eliminating these components, the EC Reader is more compact, cost efficient and easier to use than most optical scanners. The EC Reader is designed to read only CombiMatrix arrays.

Comparative Genomic Hybridization Arrays