SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

o TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO .

Commission File Number 0-26068

ACACIA RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

| DELAWARE | 95-4405754 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation organization) | Identification No.) |

| | |

| 500 NEWPORT CENTER DRIVE, NEWPORT BEACH, CA | 92660 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (949) 480-8300

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days. Yes þ No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark that disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | | Accelerated filer þ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, computed by reference to the last sale price of such stock reported on The NASDAQ Global Market, as of June 30, 2009, was approximately $236,617,000. (All executive officers and directors of the registrant are considered affiliates.)

As of February 23, 2010, 33,148,984 shares of common stock were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its Annual Meeting of Stockholders to be filed with the Commission within 120 days after the close of its fiscal year are incorporated by reference into Part III.

ACACIA RESEARCH CORPORATION

FORM 10-K ANNUAL REPORT

FISCAL YEAR ENDED DECEMBER 31, 2009

TABLE OF CONTENTS

| Item | | Page |

| PART I |

| | | |

| 1. | Business | 1 |

| 1A. | Risk Factors | 7 |

| 1B. | Unresolved Staff Comments | 17 |

| 2. | Properties | 17 |

| 3. | Legal Proceedings | 17 |

| 4. | Submission of Matters to a Vote of Security Holders | 17 |

| | | |

| | | |

| PART II |

| | | |

| 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 18 |

| 6. | Selected Financial Data | 21 |

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 23 |

| 7A. | Quantitative and Qualitative Disclosures About Market Risk | 37 |

| 8. | Financial Statements and Supplementary Data | 38 |

| 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 38 |

| 9A. | Controls and Procedures | 38 |

| 9B. | Other Information | 38 |

| | | |

| | | |

| PART III |

| | | |

| 10. | Directors, Executive Officers and Corporate Governance | 39 |

| 11. | Executive Compensation | 39 |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 39 |

| 13. | Certain Relationships and Related Transactions, and Director Independence | 39 |

| 14. | Principal Accounting Fees and Services | 39 |

| | | |

| | | |

| PART IV |

| | | |

| 15. | Exhibits, Financial Statement Schedules | 40 |

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

As used in this Annual Report on Form 10-K, “we,” “us” and “our” refer to Acacia Research Corporation and/or its wholly and majority-owned operating subsidiaries. All intellectual property acquisition, development, licensing and enforcement activities are conducted solely by certain of our wholly owned operating subsidiaries.

This report contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Reference is made in particular to the description of our plans and objectives for future operations, assumptions underlying such plans and objectives, and other forward-looking statements included in this report. Such statements may be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” or similar terms, variations of such terms or the negative of such terms. Such statements are based on management’s current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements address future events and conditions concerning product development, capital expenditures, earnings, litigation, regulatory matters, markets for products and services, liquidity and capital resources and accounting matters. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, changes in consumer demand, legislative, regulatory and competitive developments in markets in which we and our subsidiaries operate, and other circumstances affecting anticipated revenues and costs, as more fully disclosed in our discussion of risk factors incorporated by reference in Item 1A. of Part I of this report. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Additional factors that could cause such results to differ materially from those described in the forward-looking statements are set forth in connection with the forward-looking statements.

General

Our operating subsidiaries acquire, develop, license and enforce patented technologies. Our operating subsidiaries generate license fee revenues and related cash flows from the granting of licenses for the use of patented technologies that our operating subsidiaries own or control. Our operating subsidiaries assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, if necessary, with the enforcement against unauthorized users of their patented technologies.

We are a leader in licensing patented technologies and have established a proven track record of licensing success with over 740 license agreements executed to date, across 60 of our technology license programs. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to over 140 patent portfolios, which include U.S. patents and certain foreign counterparts, covering technologies used in a wide variety of industries.

CombiMatrix Group Split-Off Transaction and Related Discontinued Operations. In January 2006, our board of directors approved a plan for our former wholly owned subsidiary, CombiMatrix Corporation, or CombiMatrix, the primary component of our life science business, known as the CombiMatrix group, to become an independent publicly-held company. On August 15, 2007, or the Redemption Date, CombiMatrix was split-off from us through the redemption of all outstanding shares of Acacia Research-CombiMatrix common stock in exchange for the distribution of new shares of CombiMatrix common stock, on a pro-rata basis, to the holders of Acacia Research-CombiMatrix common stock on the Redemption Date. We refer to this transaction as the Split-Off Transaction. Subsequent to the Redemption Date, we no longer own any equity interests in CombiMatrix and the CombiMatrix group is no longer one of our business groups. Subsequent to the Split-Off Transaction, our only business is our intellectual property licensing business.

Refer to Note 11 to our consolidated financial statements, included elsewhere herein, for information regarding presentation of the assets, liabilities, results of operations and cash flows for the CombiMatrix group as “Discontinued Operations,” for all periods presented, in accordance with guidance set forth in Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, Topic 205-20 “Discontinued Operations,” or ASC Topic 205-20.

Capital Structure. Pursuant to the terms of the Split-Off Transaction, all outstanding shares of Acacia Research-CombiMatrix common stock were redeemed, and all rights of holders of Acacia Research-CombiMatrix common stock ceased as of the Redemption Date, except for the right, upon the surrender to the exchange agent of shares of Acacia Research-CombiMatrix common stock, to receive new shares of CombiMatrix common stock. As a result of, and immediately following, the consummation of the Split-Off Transaction, our only class of common stock outstanding was our Acacia Research-Acacia Technologies common stock.

On May 20, 2008, our stockholders approved an amendment and restatement of our Certificate of Incorporation to eliminate all references to Acacia Research-CombiMatrix common stock and all provisions relating to the rights and obligations of the Acacia Research-CombiMatrix common stock. In addition, the amendment and restatement changed the name of the “Acacia Research-Acacia Technologies common stock” to “common stock,” and our common stock is the only class of common stock authorized and issuable.

Other

We were originally incorporated in California in January 1993 and reincorporated in Delaware in December 1999. Our website address is www.acaciaresearch.com. We make our filings with the Securities and Exchange Commission, or the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, available free of charge on our website as soon as reasonably practicable after we file these reports. In addition, we post the following information on our website:

| | · | our corporate code of conduct, our code of conduct for our board of directors and our fraud policy; and |

| | · | charters for our audit committee, nominating and corporate governance committee, disclosure committee and compensation committee. |

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

BUSINESS OVERVIEW

Intellectual Property Licensing Business

Our operating subsidiaries acquire, develop, license and enforce patented technologies. Our operating subsidiaries generate license fee revenues and related cash flows from the granting of licenses for the use of patented technologies that our operating subsidiaries own or control. Our operating subsidiaries assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, if necessary, with the enforcement against unauthorized users of their patented technologies. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to over 140 patent portfolios, which include U.S. patents and certain foreign counterparts, covering technologies used in a wide variety of industries. Refer to “Patented Technologies” below for a partial summary of patent portfolios owned or controlled by certain of our operating subsidiaries.

We are a leader in patent licensing and our operating subsidiaries have established a proven track record of licensing success with more than 740 license agreements executed to date. To date, on a consolidated basis, we have generated revenues from 60 of our technology licensing and enforcement programs. Our professional staff includes in-house patent attorneys, licensing executives, engineers and business development executives.

Our partners are primarily individual inventors and small companies who have limited resources and/or expertise to effectively address the unauthorized use of their patented technologies, and also include large companies seeking to effectively and efficiently monetize their portfolio of patented technologies. In a typical partnering arrangement, our operating subsidiary will acquire a patent portfolio, or acquire rights to a patent portfolio, with our partner receiving an upfront payment for the purchase of the patent portfolio or patent portfolio rights, or receiving a percentage of our operating subsidiaries net recoveries from the licensing and enforcement of the patent portfolio, or a combination of the two.

Under U.S. law, an inventor or patent owner has the right to exclude others from making, selling or using their patented invention. Unfortunately, in the majority of cases, infringers are generally unwilling, at least initially, to negotiate or pay reasonable royalties for their unauthorized use of third-party patents and will typically fight any allegations of patent infringement. Inventors and/or patent holders without sufficient financial or expert technical resources to bring legal action may lack credibility in dealing with unwilling licensees and as a result, are often blatantly ignored.

As a result of the common reluctance of patent infringers to negotiate and ultimately take a patent license for the use of third-party patented technologies without at least the threat of legal action, patent licensing and enforcement often begins with the filing of patent enforcement litigation. However, the majority of patent infringement contentions settle out of court, based on the strength of the patent claims, validity, and persuasive evidence and clarity that the patent is being infringed.

We execute patent licensing arrangements with users of our patented technologies through willing licensing negotiations without the filing of patent infringement litigation, or through the negotiation of license and settlement arrangements in connection with the filing of patent infringement litigation.

Business Model and Strategy

Overview

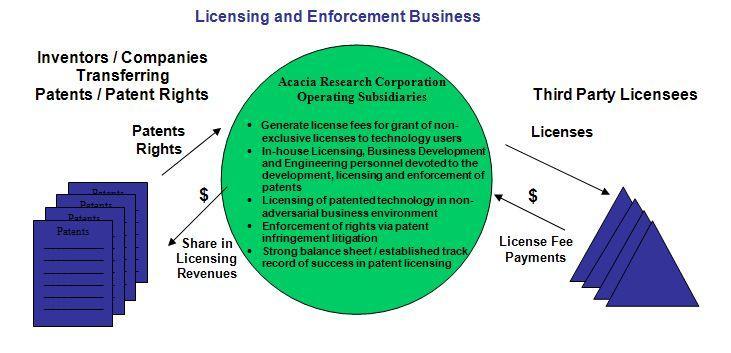

The business model associated with the licensing and enforcement activities conducted by our operating subsidiaries is summarized in the following illustration:

Key Elements of Business Strategy

Our intellectual property acquisition, development, licensing and enforcement business strategy, conducted solely by our operating subsidiaries, includes the following key elements:

| | · | Identify Emerging Growth Areas where Patented Technologies will Play a Vital Role |

The patent process breeds, encourages and sustains innovation and invention by granting a limited monopoly to the inventor in exchange for sharing the invention with the public. Certain technologies, including several of the technologies controlled by our operating subsidiaries, some of which are summarized below, become core technologies in the way products and services are manufactured, sold and delivered by companies across a wide array of industries. Our operating subsidiaries identify core, patented technologies that have been or are anticipated to be widely adopted by third parties in connection with the manufacture or sale of products and services.

| | · | Contact and Form Alliances with Owners of Core, Patented Technologies |

| | Often individual inventors and small companies have limited resources and/or expertise and are unable to effectively address the unauthorized use of their patented technologies. Individual inventors and small companies may lack sufficient capital resources and may also lack in-house personnel with patent licensing expertise and/or experience, which may make it difficult to effectively out-license and/or enforce their patented technologies. |

| | For years, many large companies have earned substantial revenue licensing patented technologies to third parties. Other companies that do not have internal licensing resources and expertise may have continued to record the capitalized carrying value of their core and or non-essential intellectual property in their financial statements, without deriving income from their intellectual property or realizing the potential value of their intellectual property assets. Securities and financial reporting regulations require these companies to periodically evaluate and potentially reduce or write-off these intellectual property assets if they are unable to substantiate these reported carrying values. |

Our operating subsidiaries seek to enter into business agreements with owners of intellectual property that do not have experience or expertise in the areas of intellectual property licensing and enforcement or that do not possess the in-house resources to devote to intellectual property licensing and enforcement activities or that, for any number of strategic business reasons, desire to more efficiently and effectively outsource their intellectual property licensing and enforcement activities.

| | · | Effectively and Efficiently Evaluate Patented Technologies for Acquisition, Licensing and Enforcement |

| | Subtleties in the language of a patent, recorded interactions with the patent office, and the evaluation of prior art and literature can make a significant difference in the potential licensing and enforcement revenue derived from a patent or patent portfolio. Our specialists are trained and skilled in these areas. It is important to identify potential problem areas, if any, and determine whether potential problem areas can be overcome, prior to acquiring a patent portfolio or launching an effective licensing program. We have developed processes and procedures for identifying problem areas and evaluating the strength of a patent portfolio before the decision is made to allocate resources to an acquisition or an effective licensing and enforcement effort. |

| | Patent Portfolio Evaluation. The processes and procedures employed in connection with the evaluation of a specific patent portfolio for acquisition, licensing and enforcement are tailored and unique to each specific situation, and can vary widely, based on the specific facts and circumstances of a specific patent portfolio, technology, related industry and other factors. Some of the key components of our processes and procedures may include: |

| | · | Utilizing our staff of in-house intellectual property business development executives, patent attorneys, intellectual property licensing executives, and technology engineers to conduct our tailored patent acquisition and evaluation processes and procedures. We may also leverage the expertise of external specialists and technology consultants. |

| | · | Identifying emerging growth areas where patented technologies will play a vital role in connection with the manufacture or sale of products and services. |

| | · | Identifying core, patented technologies that have been or are anticipated to be widely adopted by third parties in connection with the manufacture or sale of products and services. |

| | · | Considering the impact of subtleties in the language of a patent, recorded interactions with the patent office, evaluating prior art and literature and considering the impact on the potential licensing and enforcement revenue that can be derived from a patent or patent portfolio. |

| | · | Evaluating the strength of a patent portfolio, including consideration of the types of claims and the number of claims potentially infringed by third parties, before the decision is made to allocate resources to an acquisition or an effective licensing and enforcement effort. |

| | · | Identifying and considering potential problem areas, if any, and determining whether potential problem areas can be overcome prior to acquiring a patent portfolio or launching an effective licensing program. |

| | · | Identifying potential infringers, industries within which the potential infringers exist, longevity of the patented technology, and a variety of other factors that directly impact the magnitude and potential success of a licensing and enforcement program. |

| | · | Purchase or Acquire the Rights to Patented Technologies |

| | After evaluation, our operating subsidiaries may elect to purchase the patented technology, or acquire the exclusive right to license the patented technology in all or in specific fields of use. In either case, the owner of the patent generally retains the rights to a portion of the net revenues generated from a patent portfolio’s licensing and enforcement program. Our operating subsidiaries generally control the licensing and enforcement process and utilize experienced in-house personnel to reduce outside costs and to ensure that the necessary capital and expertise is allocated and deployed in an efficient and cost effective manner. |

| | · | Successfully License and Enforce Patents with Significant Royalty Potential |

| | As part of the patent evaluation process employed by our operating subsidiaries, significant consideration is also given to the identification of potential infringers, industries within which the potential infringers exist, longevity of the patented technology, and a variety of other factors that directly impact the magnitude and potential success of a licensing and enforcement program. Our specialists are trained in evaluating potentially infringing technologies and in presenting the claims of our patents and demonstrating how they apply to companies we believe are using our technologies in their products or services. These presentations can take place in a non-adversarial business setting, but can also occur through the litigation process, if necessary. Ultimately, we execute patent licensing arrangements with users of our patented technologies through willing licensing negotiations without the filing of patent infringement litigation, or through the negotiation of license and settlement arrangements in connection with the filing of patent infringement litigation. |

Patented Technologies

Currently, on a consolidated basis, our operating subsidiaries own or control the rights to over 140 patent portfolios, with patent expiration dates ranging from 2010 to 2029, and covering technologies used in a wide variety of industries, including the following:

| · | Aligned Wafer Bonding | | · | Enterprise Content Management | | · | Optical Switching |

| · | Audio Communications Fraud Detection | | · | Facilities Operation Management System | | · | Parallel Processing with Shared Memory |

| · | Audio Storage and Retrieval System | | · | File Locking in Shared Storage Networks | | · | Peer to Peer Communications |

| · | Audio Video Enhancement & Synchronization | | · | Flash Memory | | · | Physical Access Control |

| · | Authorized Spending Accounts | | · | Fluid Flow Control and Monitoring | | · | Picture Archiving & Communication Systems |

| · | Automated Notification of Tax Return Status | | · | Hearing Aid ECS | | · | Pointing Device |

| · | Automated Tax Reporting | | · | Heated Surgical Blades | | · | Pop-Up Internet Advertising |

| · | Biosensor | | · | High Performance Computer Architecture | | · | Portable Credit Card Processing |

| · | Broadcast Data Retrieval | | · | High Quality Image Processing | | · | Portable Storage Devices with Links |

| · | Child-friendly Secure Mobile Phones | | · | High Resolution Optics | | · | Product Activation |

| · | Chip-Stacking | | · | Image Resolution Enhancement | | · | Projector |

| · | Color Correction for Video Graphics Systems | | · | Improved Anti-Trap Safety Technology for Vehicles | | · | Purifying Nucleic Acids |

| · | Compact Disk | | · | Improved Commercial Print | | · | Radio Communication with Graphics |

| · | Compiler | | · | Improved Lighting | | · | Records Management |

| · | Computer Architecture and Power Management | | · | Improved Memory Manufacturing | | · | Relational Database Access |

| · | Computer Graphics | | · | Improved Printing | | · | Remote Management of Imaging Devices |

| · | Computer Memory Cache Coherency | | · | Information Portal Software | | · | Remote Video Camera |

| · | Computer Simulations | | · | Integrated Access | | · | Resource Scheduling |

| · | Consumer Rewards | | · | Interactive Content in a Cable Distribution System | | · | Rule Based Monitoring |

| · | Continuous TV Viewer Measuring | | · | Interactive Mapping | | · | Shape Memory Alloys |

| · | Copy Protection | | · | Internet Radio Advertising | | · | Software Installation |

| · | Credit Card Fraud Protection | | · | Interstitial Internet Advertising | | · | Software License Management |

| · | Data Encryption | | · | Intraluminal Device Technology | | · | Spreadsheet Automation |

| · | Database Access | | · | Laparoscopic Surgery | | · | Storage Technology |

| · | Database Management | | · | Laptop Connectivity | | · | Surgical Catheter |

| · | Database Retrieval | | · | Lighting Ballast | | · | Telematics |

| · | Digital Newspaper Delivery | | · | Location Based Services | | · | Television Data Display |

| · | Digital Signal Processing Architecture | | · | Manufacturing Data Transfer | | · | Television Signal Scrambling |

| · | Digital Video Enhancement | | · | Medical Image Manipulation | | · | Text Auto-Completion |

| · | Digital Video Production | | · | Medical Image Stabilization | | · | User Programmable Engine Control |

| · | Distributed Data Management and Synchronization | | · | Medical Monitoring | | · | Vehicle Anti-Theft Parking Systems |

| · | DMT® | | · | MEMS | | · | Vehicle Maintenance |

| · | Document Generation | | · | Messaging | | · | Vehicle Occupant Sensing |

| · | Document Retrieval Using Global Word Co-Occurrence Patterns | | · | Micromirror Digital Display | | · | Videoconferencing |

| · | Dynamic Manufacturing Modeling | | · | Microprocessor Enhancement | | · | Virtual Computer Workspaces |

| · | Ecommerce Pricing | | · | Microprocessor Memory Management | | · | Virtual Server |

| · | Electronic Address List Management | | · | Mobile Computer Synchronization | | · | Website Crawling |

| · | Electronic Message Advertising | | · | Multi-Dimensional Database Compression | | · | Wireless Data |

| · | Electronic Securities Trading | | · | Network Monitoring | | · | Wireless Digital Messaging |

| · | Embedded Broadcast Data | | · | Network Remote Access | | · | Wireless LAN |

| · | Encrypted Media & Playback Devices | | · | Online Ad Tracking | | · | Workspace with Moving Viewpoint |

| · | Enhanced DRAM Architecture | | · | Online Auction Guarantees | | | |

| · | Enhanced Internet Navigation | | · | Online Promotion | | | |

Patent Enforcement Litigation

Our operating subsidiaries are often required to engage in litigation to enforce their patents and patent rights. Certain of our operating subsidiaries are parties to ongoing patent enforcement related litigation, alleging infringement by third parties of certain of the patented technologies owned or controlled by our operating subsidiaries.

Competition

We expect to encounter increased competition in the area of patent acquisitions and enforcement. This includes an increase in the number of competitors seeking to acquire the same or similar patents and technologies that we may seek to acquire. Entities including Allied Security Trust, Altitude Capital Partners, Coller IP, Intellectual Ventures, Millennium Partners, Open Innovation Network, RPX Corporation and Rembrandt IP Management compete in acquiring rights to patents, and we expect more entities to enter the market.

We also compete with venture capital firms, strategic corporate buyers and various industry leaders for technology acquisitions and licensing opportunities. Many of these competitors may have more financial and human resources than our operating subsidiaries. As we become more successful, we may find more companies entering the market for similar technology opportunities, which may reduce our market share in one or more technology industries that we currently rely upon to generate future revenue.

Other companies may develop competing technologies that offer better or less expensive alternatives to our patented technologies that we may acquire and/or out-license. Many potential competitors may have significantly greater resources than the resources that our operating subsidiaries possess. Technological advances or entirely different approaches developed by one or more of our competitors could render certain of the technologies owned or controlled by our operating subsidiaries obsolete and/or uneconomical.

Employees

As of December 31, 2009, on a consolidated basis, we had 44 full-time employees. Neither we nor any of our subsidiaries are a party to any collective bargaining agreement. We consider our employee relations to be good.

An investment in our common stock involves a high degree risk. Before making a decision to invest in shares of our common stock, you should carefully consider the following risk factors, as well as the other information contained in this annual report. If any of the following risks actually occur, our business, financial condition, results of operations and prospectus could be materially adversely affected. If this were to occur, the trading price of our common stock could decline significantly and you may lose all or part of your investment in our common stock. All intellectual property acquisition, development, licensing and enforcement activities are conducted solely by certain of our wholly and majority-owned operating subsidiaries.

RISKS RELATED TO OUR BUSINESS

WE HAVE A HISTORY OF LOSSES AND WILL PROBABLY INCUR ADDITIONAL LOSSES IN THE FUTURE.

We have sustained substantial losses since our inception. We may never become profitable, or if we do, we may never be able to sustain profitability. As of December 31, 2009, our accumulated deficit was $120.2 million. As of December 31, 2009, we had approximately $53.9 million in cash and cash equivalents along with investments and working capital of $36.0 million. We expect to incur significant legal, marketing, general and administrative expenses. As a result, it is more likely than not that we will incur losses for the foreseeable future. However, we believe our current cash and investments on hand will be sufficient to finance anticipated capital and operating requirements for at least the next twelve months.

IF WE, OR OUR SUBSIDIARIES, ENCOUNTER UNFORESEEN DIFFICULTIES AND CANNOT OBTAIN ADDITIONAL FUNDING ON FAVORABLE TERMS, OUR BUSINESS MAY SUFFER.

Our consolidated cash and cash equivalents along with investments totaled $53.9 million and $51.5 million at December 31, 2009 and 2008, respectively. To date, we have relied primarily upon selling of equity securities and payments from our licensees to generate the funds needed to finance our operations and the operations of our operating subsidiaries.

We may encounter unforeseen difficulties in the future, including the outside influences identified below, that may deplete our capital resources more rapidly than anticipated. As a result, we and or our subsidiary companies may be required to obtain additional financing in the future through bank borrowings, debt or equity financings or otherwise. If we are required to raise additional capital in the future, such additional financing may not be available on favorable terms, or at all, or may be dilutive to our existing stockholders. If we fail to obtain additional capital as and when needed for our subsidiary companies and ourselves, such failure could have a material adverse impact on our business plans and business.

FAILURE TO EFFECTIVELY MANAGE OUR GROWTH COULD PLACE STRAINS ON OUR MANAGERIAL, OPERATIONAL AND FINANCIAL RESOURCES AND COULD ADVERSELY AFFECT OUR BUSINESS AND OPERATING RESULTS.

Our growth has placed, and is expected to continue to place, a strain on our managerial, operational and financial resources and systems. Further, as our subsidiary companies’ businesses grow, we will be required to manage multiple relationships. Any further growth by us or our subsidiary companies or an increase in the number of our strategic relationships may place additional strain on our managerial, operational and financial resources and systems. Although we may not grow as we expect, if we fail to manage our growth effectively or to develop and expand our managerial, operational and financial resources and systems, our business and financial results will be materially harmed.

OUR FUTURE SUCCESS DEPENDS ON OUR ABILITY TO EXPAND OUR ORGANIZATION TO MATCH THE GROWTH OF OUR SUBSIDIARIES.

As our operating subsidiaries grow, the administrative demands upon us and our operating subsidiaries will grow, and our success will depend upon our ability to meet those demands. These demands include increased accounting, management, legal services, staff support, and general office services. We may need to hire additional qualified personnel to meet these demands, the cost and quality of which is dependent in part upon market factors outside of our control. Further, we will need to effectively manage the training and growth of our staff to maintain an efficient and effective workforce, and our failure to do so could adversely affect our business and operating results.

OUR REVENUES WILL BE UNPREDICTABLE, AND THIS MAY HARM OUR FINANCIAL CONDITION.

From January 2005 to present, certain of our operating subsidiaries have continued to execute our business strategy of acquiring patent portfolios and accompanying patent rights. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to over 140 patent portfolios, which include U.S. patents and certain foreign counterparts, covering technologies used in a wide variety of industries. These acquisitions continue to expand and diversify our revenue generating opportunities. We believe that our cash and cash equivalent balances, anticipated cash flow from operations and other external sources of available credit, will be sufficient to meet our cash requirements through at least March 2011, and for the foreseeable future. However, due to the nature of our licensing business and uncertainties regarding the amount and timing of the receipt of license fees from potential infringers, stemming primarily from uncertainties regarding the outcome of enforcement actions, rates of adoption of our patented technologies, the growth rates of our existing licensees and other factors, our revenues may vary significantly from quarter to quarter, which could make our business difficult to manage, adversely affect our business and operating results, cause our quarterly results to be below market expectations and adversely affect the market price of our common stock.

OUR OPERATING SUBSIDIARIES DEPEND UPON RELATIONSHIPS WITH OTHERS TO PROVIDE TECHNOLOGY-BASED OPPORTUNITIES THAT CAN DEVELOP INTO PROFITABLE ROYALTY-BEARING LICENSES, AND IF THEY ARE UNABLE TO MAINTAIN AND GENERATE NEW RELATIONSHIPS, THEN THEY MAY NOT BE ABLE TO SUSTAIN EXISTING LEVELS OF REVENUE OR INCREASE REVENUE.

Neither we nor our operating subsidiaries invent new technologies or products but instead depend on the identification and acquisition of new patents and inventions through our relationships with inventors, universities, research institutions, and others. If our operating subsidiaries are unable to maintain those relationships and continue to grow new relationships, then they may not be able to identify new technology-based opportunities for growth and sustainable revenue.

Our current or future relationships may not provide the volume or quality of technologies necessary to sustain our business. In some cases, universities and other technology sources may compete against us as they seek to develop and commercialize technologies. Universities may receive financing for basic research in exchange for the exclusive right to commercialize resulting inventions. These and other strategies may reduce the number of technology sources and potential clients to whom we can market our services. If we are unable to maintain current relationships and sources of technology or to secure new relationships and sources of technology, such inability may have a material adverse effect on our operating results and financial condition.

THE SUCCESS OF OUR OPERATING SUBSIDIARIES DEPENDS IN PART UPON THEIR ABILITY TO RETAIN THE BEST LEGAL COUNSEL TO REPRESENT THEM IN PATENT ENFORCEMENT LITIGATION.

The success of our licensing business depends upon our operating subsidiaries’ ability to retain the best legal counsel to prosecute patent infringement litigation. As our operating subsidiaries’ patent enforcement actions increase, it will become more difficult to find the best legal counsel to handle all of our cases because many of the best law firms may have a conflict of interest that prevents their representation of our subsidiaries.

OUR OPERATING SUBSIDIARIES, IN CERTAIN CIRCUMSTANCES, RELY ON REPRESENTATIONS, WARRANTIES AND OPINIONS MADE BY THIRD PARTIES, THAT IF DETERMINED TO BE FALSE OR INACCURATE, MAY EXPOSE US AND OUR OPERATING SUBSIDIARIES TO CERTAIN MATERIAL LIABILITIES.

From time to time, our operating subsidiaries may rely upon representations and warranties made by third parties from whom our operating subsidiaries acquired patents or the exclusive rights to license and enforce patents. We also may rely upon the opinions of purported experts. In certain instances, we may not have the opportunity to independently investigate and verify the facts upon which such representations, warranties, and opinions are made. By relying on these representations, warranties and opinions, our operating subsidiaries may be exposed to liabilities in connection with the licensing and enforcement of certain patents and patent rights which could have a material adverse effect on our operating results and financial condition.

IN CONNECTION WITH PATENT ENFORCEMENT ACTIONS CONDUCTED BY CERTAIN OF OUR SUBSIDIARIES, A COURT MAY RULE THAT WE OR OUR SUBSIDIARIES HAVE VIOLATED CERTAIN STATUTORY, REGULATORY, FEDERAL, LOCAL OR GOVERNING RULES OR STANDARDS, WHICH MAY EXPOSE US AND OUR OPERATING SUBSIDIARIES TO CERTAIN MATERIAL LIABILITIES.

In connection with any of our patent enforcement actions, it is possible that a defendant may request and/or a court may rule that we have violated statutory authority, regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions against us or our operating subsidiaries or award attorney’s fees and/or expenses to a defendant(s), which could be material, and if we or our operating subsidiaries are required to pay such monetary sanctions, attorneys’ fees and/or expenses, such payment could materially harm our operating results and our financial position.

OUR INVESTMENTS IN AUCTION RATE SECURITIES ARE SUBJECT TO RISKS, INCLUDING THE CONTINUED FAILURE OF FUTURE AUCTIONS, WHICH MAY CAUSE US TO INCUR LOSSES OR HAVE REDUCED LIQUIDITY.

At December 31, 2009, our investments in marketable securities included certain auction rate securities. Our auction rate securities are investment grade quality and were in compliance with our investment policy when purchased. Historically, our auction rate securities were recorded at cost, which approximated their fair market value due to their variable interest rates, which typically reset every 7 to 35 days, despite the long-term nature of their stated contractual maturities. The Dutch auction process that resets the applicable interest rate at predetermined calendar intervals is intended to provide liquidity to the holder of auction rate securities by matching buyers and sellers within a market context enabling the holder to gain immediate liquidity by selling such interests at par or rolling over their investment. If there is an imbalance between buyers and sellers the risk of a failed auction exists. Due to recent liquidity issues in the global credit and capital markets, these securities experienced several failed auctions since February 2008. In such case of a failure, the auction rate securities continue to pay interest, at the maximum rate, in accordance with their terms, however, we may not be able to access the par value of the invested funds until a future auction of these investments is successful, the security is called by the issuer or a buyer is found outside of the auction process.

At December 31, 2009, the par value of auction rate securities collateralized by student loan portfolios totaled $2.7 million. As a result of the liquidity issues associated with the failed auctions, we estimate that the fair value of these auction rate securities no longer approximates their par value. Due to the estimate that the market for these student loan collateralized instruments may take in excess of twelve months to fully recover, we have classified these investments as noncurrent in the accompanying December 31, 2009 consolidated balance sheet. In addition, as a result of our analysis of the estimated fair value of our student loan collateralized instruments, as described at Note 7 to the consolidated financial statements included elsewhere herein, we have recorded an other-than-temporary loss of $296,000 and $263,000 for our student loan collateralized instruments in the accompanying consolidated statements of operations for the years ended December 31, 2009 and 2008, respectively.

The capital and credit markets have been experiencing extreme volatility and disruption for more than 12 months, and at times, the volatility and disruption have reached unprecedented levels. In several cases, the markets have exerted downward pressure on stock prices and credit capacity for certain issuers. Given the deteriorating credit markets, and the sustained incidence of failure within the auction market since February 2008, we may be unable to liquidate a particular issue. Furthermore, if these market conditions were to persist despite our ability to hold such investments until maturity, we may be required to record additional impairment charges in a future period. The systemic failure of future auctions for auction rate securities may result in a loss of liquidity, substantial impairment to our investments, realization of substantial future losses, or a complete loss of the investment in the long-term which may have a material adverse effect on our business, results of operations, liquidity, and financial condition. Refer to Note 7 to our accompanying consolidated financial statements, included elsewhere herein, for additional information about our investments in auction rate securities.

RISKS RELATED TO OUR INDUSTRY

OUR EXPOSURE TO UNCONTROLLABLE OUTSIDE INFLUENCES, INCLUDING NEW LEGISLATION, COURT RULINGS OR ACTIONS BY THE UNITED STATES PATENT AND TRADEMARK OFFICE, COULD ADVERSELY AFFECT OUR LICENSING AND ENFORCEMENT BUSINESS AND RESULTS OF OPERATIONS.

Our licensing and enforcement business is subject to numerous risks from outside influences, including the following:

New legislation, regulations or rules related to obtaining patents or enforcing patents could significantly increase our operating costs and decrease our revenue.

Our operating subsidiaries acquire patents with enforcement opportunities and are spending a significant amount of resources to enforce those patents. If new legislation, regulations or rules are implemented either by Congress, the U.S. Patent and Trademark Office, or USPTO, or the courts that impact the patent application process, the patent enforcement process or the rights of patent holders, these changes could negatively affect our expenses and revenue. For example, new rules regarding the burden of proof in patent enforcement actions could significantly increase the cost of our enforcement actions, and new standards or limitations on liability for patent infringement could negatively impact our revenue derived from such enforcement actions.

Trial judges and juries often find it difficult to understand complex patent enforcement litigation, and as a result, we may need to appeal adverse decisions by lower courts in order to successfully enforce our patents.

It is difficult to predict the outcome of patent enforcement litigation at the trial level. It is often difficult for juries and trial judges to understand complex, patented technologies, and as a result, there is a higher rate of successful appeals in patent enforcement litigation than more standard business litigation. Such appeals are expensive and time consuming, resulting in increased costs and delayed revenue. Although we diligently pursue enforcement litigation, we cannot predict with significant reliability the decisions made by juries and trial courts.

More patent applications are filed each year resulting in longer delays in getting patents issued by the USPTO.

Certain of our operating subsidiaries hold and continue to acquire pending patents. We have identified a trend of increasing patent applications each year, which we believe is resulting in longer delays in obtaining approval of pending patent applications. The application delays could cause delays in recognizing revenue from these patents and could cause us to miss opportunities to license patents before other competing technologies are developed or introduced into the market. See the subheading “Competition is intense in the industries in which our subsidiaries do business and as a result, we may not be able to grow or maintain our market share for our technologies and patents,” below.

Federal courts are becoming more crowded, and as a result, patent enforcement litigation is taking longer.

Our patent enforcement actions are almost exclusively prosecuted in federal court. Federal trial courts that hear our patent enforcement actions also hear criminal cases. Criminal cases always take priority over our actions. As a result, it is difficult to predict the length of time it will take to complete an enforcement action. Moreover, we believe there is a trend in increasing numbers of civil lawsuits and criminal proceedings before federal judges, and as a result, we believe that the risk of delays in our patent enforcement actions will have a greater affect on our business in the future unless this trend changes.

Any reductions in the funding of the USPTO could have an adverse impact on the cost of processing pending patent applications and the value of those pending patent applications.

The assets of our operating subsidiaries consist of patent portfolios, including pending patent applications before the USPTO. The value of our patent portfolios is dependent upon the issuance of patents in a timely manner, and any reductions in the funding of the USPTO could negatively impact the value of our assets. Further, reductions in funding from Congress could result in higher patent application filing and maintenance fees charged by the USPTO, causing an unexpected increase in our expenses.

Competition is intense in the industries in which our subsidiaries do business and as a result, we may not be able to grow or maintain our market share for our technologies and patents.

We expect to encounter competition in the area of patent acquisition and enforcement as the number of companies entering this market is increasing. This includes competitors seeking to acquire the same or similar patents and technologies that we may seek to acquire. Entities including Allied Security Trust, Altitude Capital Partners, Coller IP, Intellectual Ventures, Millennium Partners, Open Innovation Network, RPX Corporation and Rembrandt IP Management compete in acquiring rights to patents, and we expect more entities to enter the market. As new technological advances occur, many of our patented technologies may become obsolete before they are completely monetized. If we are unable to replace obsolete technologies with more technologically advanced patented technologies, then this obsolescence could have a negative effect on our ability to generate future revenues.

Our licensing business also competes with venture capital firms and various industry leaders for technology licensing opportunities. Many of these competitors may have more financial and human resources than we do. As we become more successful, we may find more companies entering the market for similar technology opportunities, which may reduce our market share in one or more technology industries that we currently rely upon to generate future revenue.

Our patented technologies face uncertain market value.

Our operating subsidiaries have acquired patents and technologies that are at early stages of adoption in the commercial and consumer markets. Demand for some of these technologies is untested and is subject to fluctuation based upon the rate at which our licensees will adopt our patents and technologies in their products and services. Refer to the related risk factor below.

As patent enforcement litigation becomes more prevalent, it may become more difficult for us to voluntarily license our patents.

We believe that the more prevalent patent enforcement actions become, the more difficult it will be for us to voluntarily license our patents. As a result, we may need to increase the number of our patent enforcement actions to cause infringing companies to license the patent or pay damages for lost royalties. This may increase the risks associated with an investment in our company.

The foregoing outside influences may affect other risk factors described in this annual report.

Any one of the foregoing outside influences may cause our company to need additional financing to meet the challenges presented or to compensate for a loss in revenue, and we may not be able to obtain the needed financing. See the heading “If we, or our subsidiaries, encounter unforeseen difficulties and cannot obtain additional funding on favorable terms, our business may suffer” above.

THE MARKETS SERVED BY OUR OPERATING SUBSIDIARIES ARE SUBJECT TO RAPID TECHNOLOGICAL CHANGE, AND IF OUR OPERATING SUBSIDIARIES ARE UNABLE TO DEVELOP AND ACQUIRE NEW TECHNOLOGIES AND PATENTS, OUR ABILITY TO GENERATE REVENUES COULD BE SUBSTANTIALLY IMPAIRED.

The markets served by our operating subsidiaries’ licensees frequently undergo transitions in which products rapidly incorporate new features and performance standards on an industry-wide basis. Products for communications applications, high-speed computing applications, as well as other applications covered by our operating subsidiaries’ intellectual property, are based on continually evolving industry standards. Our ability to compete in the future will, however, depend on our ability to identify and ensure compliance with evolving industry standards. This will require our continued efforts and success in acquiring new patent portfolios with licensing and enforcement opportunities. While we expect for the foreseeable future to have sufficient liquidity and capital resources needed to maintain the level of acquisitions necessary to keep pace with these technological advances, outside influences may cause the need for greater liquidity and capital resources than expected, as described under the caption “Because our business operations are subject to many uncontrollable outside influences, we may not succeed” above. If we are unable to acquire new technologies and related patent portfolios, or to identify and ensure compliance with evolving industry standards, our ability to generate revenues could be substantially impaired and our business and financial condition could be materially harmed.

THE RECENT FINANCIAL CRISIS AND CURRENT UNCERTAINTY IN GLOBAL ECONOMIC CONDITIONS COULD NEGATIVELY AFFECT OUR BUSINESS, RESULTS OF OPERATIONS, AND FINANCIAL CONDITION

Our revenue-generating opportunities depend on the use of our patented technologies by existing and prospective licensees, the overall demand for the products and services of our licensees, and on the overall economic and financial health of our licensees. The recent financial crisis affecting the banking system and financial markets and the current uncertainty in global economic conditions have resulted in a tightening in the credit markets, a low level of liquidity in many financial markets, and extreme volatility in the credit, equity and fixed income markets. If the current worldwide economic downturn continues, many of our licensees’ customers, which may rely on credit financing, may delay or reduce their purchases of our licensees’ products and services. In addition, the use or adoption of our patented technologies is often based on current and forecasted demand for our licensees’ products and services in the marketplace and may require companies to make significant initial commitments of capital and other resources. If the negative conditions in the global credit markets delay or prevent our licensees’ and their customers’ access to credit, overall consumer spending on the products and services of our licensees may decrease and the adoption or use of our patented technologies may slow, respectively. Further, if the markets in which our licensees’ participate experience further economic downturns, as well as a slow recovery period, this could negatively impact our licensees’ long-term sales and revenue generation, margins and operating expenses, which could impact the magnitude of revenues generated or projected to be generated by our licensees, which could have a material impact on our business, license fee generating opportunities, operating results and financial condition.

In addition, we have significant patent-related intangible assets recorded on our consolidated balance sheet. We will continue to evaluate the recoverability of the carrying amount of our patent-related intangible assets on an ongoing basis, and we may incur substantial impairment charges, which would adversely affect our consolidated financial results. There can be no assurance that the outcome of such reviews in the future will not result in substantial impairment charges. Impairment assessment inherently involves judgment as to assumptions about expected future cash flows and the impact of market conditions on those assumptions. Future events and changing market conditions may impact our assumptions as to prices, costs, holding periods or other factors that may result in changes in our estimates of future cash flows. Although we believe the assumptions we used in testing for impairment are reasonable, significant changes in any one of our assumptions could produce a significantly different result.

RISKS RELATED TO OUR COMMON STOCK

THE AVAILABILITY OF SHARES FOR SALE IN THE FUTURE COULD REDUCE THE MARKET PRICE OF OUR COMMON STOCK.

In the future, we may issue securities to raise cash for operations and acquisitions. We may also pay for interests in additional subsidiary companies by using shares of our common stock or a combination of cash and shares of our common stock. We may also issue securities convertible into our common stock. Any of these events may dilute stockholders’ ownership interests in our company and have an adverse impact on the price of our common stock.

In addition, sales of a substantial amount of our common stock in the public market, or the perception that these sales may occur, could reduce the market price of our common stock. This could also impair our ability to raise additional capital through the sale of our securities.

DELAWARE LAW AND OUR CHARTER DOCUMENTS CONTAIN PROVISIONS THAT COULD DISCOURAGE OR PREVENT A POTENTIAL TAKEOVER OF OUR COMPANY THAT MIGHT OTHERWISE RESULT IN OUR STOCKHOLDERS RECEIVING A PREMIUM OVER THE MARKET PRICE OF THEIR SHARES.

Provisions of Delaware law and our certificate of incorporation and bylaws could make the acquisition of our company by means of a tender offer, proxy contest or otherwise, and the removal of incumbent officers and directors, more difficult. These provisions include:

| | · | Section 203 of the Delaware General Corporation Law, which prohibits a merger with a 15%-or-greater stockholder, such as a party that has completed a successful tender offer, until three years after that party became a 15%-or-greater stockholder; |

| | · | amendment of our bylaws by the stockholders requires a two-thirds approval of the outstanding shares; |

| | · | the authorization in our certificate of incorporation of undesignated preferred stock, which could be issued without stockholder approval in a manner designed to prevent or discourage a takeover; |

| | · | provisions in our bylaws eliminating stockholders’ rights to call a special meeting of stockholders, which could make it more difficult for stockholders to wage a proxy contest for control of our board of directors or to vote to repeal any of the anti-takeover provisions contained in our certificate of incorporation and bylaws; and |

| | · | the division of our board of directors into three classes with staggered terms for each class, which could make it more difficult for an outsider to gain control of our board of directors. |

Together these provisions may make the removal of management more difficult and may discourage transactions that otherwise could involve payment of a premium over prevailing market prices for our common stock.

AS A RESULT OF THE REDEMPTION OF ACACIA RESEARCH-COMBIMATRIX COMMON STOCK FOR THE COMMON STOCK OF COMBIMATRIX CORPORATION, WE MAY BE SUBJECT TO CERTAIN TAX LIABILITY UNDER THE INTERNAL REVENUE CODE.

Our distribution of the common stock of CombiMatrix in the Split-Off Transaction will be tax-free to us if the distribution qualifies under Sections 368 and 355 of the Internal Revenue Code of 1986, as amended, or the Code. If the Split-Off Transaction fails to qualify under Section 355 of the Code, corporate tax would be payable by the consolidated group as of the date of the Split-Off Transaction, of which we are the common parent, based upon the difference between the aggregate fair market value of the assets of CombiMatrix’s business and the adjusted tax bases of such business to us prior to the redemption.

We received a private letter ruling from the Internal Revenue Service, or the IRS, to the effect that, among other things, the redemption would be tax free to us and the holders of Acacia Research-Acacia Technologies common stock and Acacia Research-CombiMatrix common stock under Sections 368 and 355 of the Code. The private letter ruling, while generally binding upon the IRS, was based upon factual representations and assumptions and commitments on our behalf with respect to future operations made in the ruling request. The IRS could modify or revoke the private letter ruling retroactively if the factual representations and assumptions in the request were materially incomplete or untrue, the facts upon which the private letter ruling was based were materially different from the facts at the time of the redemption, or if we do not comply with certain commitments made.

If the Split-Off Transaction fails to qualify under Section 355 of the Code, corporate tax, if any, would be payable by the consolidated group of which we are the common parent, as described above. As such, the corporate level tax would be payable by us. CombiMatrix has agreed however, to indemnify us for this and certain other tax liabilities if they result from actions taken by CombiMatrix. Notwithstanding CombiMatrix’s agreement to indemnify us, under the Code’s consolidated return regulations, each member of our consolidated group, including our company, will be severally liable for these tax liabilities. Further, we may be liable for additional taxes if we take certain actions within two years following the redemption, as more fully discussed in the immediately following risk factor. If we are found liable to the IRS for these liabilities, the resulting obligation could materially and adversely affect our financial condition, and we may be unable to recover on the indemnity from CombiMatrix.

FOLLOWING THE REDEMPTION OF ACACIA RESEARCH-COMBIMATRIX COMMON STOCK FOR THE COMMON STOCK OF COMBIMATRIX, WE MAY BE SUBJECT TO CERTAIN TAX LIABILITIES UNDER THE INTERNAL REVENUE CODE FOR ACTIONS TAKEN BY US OR COMBIMATRIX FOLLOWING THE REDEMPTION.

Even if the distribution qualifies under Section 368 and 355 of the Code, it will be taxable to us if Section 355(e) of the Code applies to the distribution. Section 355(e) will apply if 50% or more of our common stock or CombiMatrix’s common stock, by vote or value, is acquired by one or more persons, other than the holders of Acacia Research-CombiMatrix common stock who receive the common stock of CombiMatrix in the redemption, acting pursuant to a plan or a series of related transactions that includes the redemption. Any shares of our common stock, the Acacia Research-CombiMatrix stock or the common stock of CombiMatrix acquired directly or indirectly within two years before or after the redemption generally are presumed to be part of such a plan unless we can rebut that presumption. To prevent applicability of Section 355(e) or to otherwise prevent the distribution from failing to qualify under Section 355 of the Code, CombiMatrix has agreed that, until two years after the redemption, it will not take any of the following actions unless prior to taking such action, it has obtained, and provided to us, a written opinion of tax counsel or a ruling from the IRS to the effect that such action will not cause the redemption to be taxable to us, which we refer to in this report collectively as Disqualifying Actions:

| | · | merge or consolidate with another corporation; |

| | · | liquidate or partially liquidate; |

| | · | sell or transfer all or substantially all of its assets; |

| | · | redeem or repurchase its stock (except in certain limited circumstances); or |

| | · | take any other action which could reasonably be expected to cause Section 355(e) to apply to the distribution. |

Further, if we take any Disqualifying Action, we may be subject to additional tax liability. Many of our competitors are not subject to similar restrictions and may issue their stock to complete acquisitions, expand their product offerings and speed the development of new technology. Therefore, these competitors may have a competitive advantage over us. Substantial uncertainty exists on the scope of Section 355(e), and we may have undertaken, may contemplate undertaking or may otherwise undertake in the future transactions which may cause Section 355(e) to apply to the redemption notwithstanding our desire or intent to avoid application of Section 355(e). Accordingly, we cannot provide you any assurance that we will not be liable for taxes if Section 355(e) applies to the redemption.

WE MAY FAIL TO MEET MARKET EXPECTATIONS BECAUSE OF FLUCTUATIONS IN QUARTERLY OPERATING RESULTS, WHICH COULD CAUSE THE PRICE OF OUR COMMON STOCK TO DECLINE.

Our reported revenues and operating results have fluctuated in the past and may continue to fluctuate significantly from quarter to quarter in the future. It is possible that in future periods, revenues could fall below the expectations of securities analysts or investors, which could cause the market price of our common stock to decline. The following are among the factors that could cause our operating results to fluctuate significantly from period to period:

| | · | the dollar amount of agreements executed in each period, which is primarily driven by the nature and characteristics of the technology being licensed and the magnitude of infringement associated with a specific licensee; |

| | · | the specific terms and conditions of agreements executed in each period and the periods of infringement contemplated by the respective payments; |

| | · | fluctuations in the total number of agreements executed; |

| | · | fluctuations in the sales results or other royalty-per-unit activities of our licensees that impact the calculation of license fees due; |

| | · | the timing of the receipt of periodic license fee payments and/or reports from licensees; |

| | · | fluctuations in the net number of active licensees period to period; |

| | · | costs related to acquisitions, alliances, licenses and other efforts to expand our operations; |

| | · | the timing of payments under the terms of any customer or license agreements into which our operating subsidiaries may enter; and |

| | · | expenses related to, and the timing and results of, patent filings and other enforcement proceedings relating to intellectual property rights, as more fully described in this section. |

TECHNOLOGY COMPANY STOCK PRICES ARE ESPECIALLY VOLATILE, AND THIS VOLATILITY MAY DEPRESS THE PRICE OF OUR COMMON STOCK.

The stock market has experienced significant price and volume fluctuations, and the market prices of technology companies have been highly volatile. We believe that various factors may cause the market price of our common stock to fluctuate, perhaps substantially, including, among others, the following:

| | · | announcements of developments in our patent enforcement actions; |

| | · | developments or disputes concerning our patents; |

| | · | our or our competitors’ technological innovations; |

| | · | developments in relationships with licensees; |

| | · | variations in our quarterly operating results; |

| | · | our failure to meet or exceed securities analysts’ expectations of our financial results; |

| | · | a change in financial estimates or securities analysts’ recommendations; |

| | · | changes in management’s or securities analysts’ estimates of our financial performance; |

| | · | changes in market valuations of similar companies; |

| | · | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures, capital commitments, new technologies, or patents; and |

| | · | failure to complete significant transactions. |

For example, the NASDAQ Computer Index had a range of $585.69 - $1,183.34 during the 52-weeks ended December 31, 2009 and the NASDAQ Composite Index had a range of $1,265.52 - $2,295.80 over the same period. Over the same period, our common stock fluctuated within a range of $2.14 - $9.64.

The financial crisis affecting the banking system and financial markets and the current uncertainty in global economic conditions, which began in late 2007 and continued throughout 2009 and into 2010, have resulted in a tightening in the credit markets, a low level of liquidity in many financial markets, and extreme volatility in the credit, equity and fixed income markets. As noted above, our stock price, like many other stocks, has fluctuated significantly recently and if investors have concerns that our business, operating results and financial condition will be negatively impacted by a continuing worldwide economic downturn, our stock price could continue to fluctuate significantly in future periods.

In addition, we believe that fluctuations in our stock price during applicable periods can also be impacted by court rulings and or other developments in our patent licensing and enforcement actions. Court rulings in patent enforcement actions are often difficult to understand, even when favorable or neutral to the value of our patents and our overall business, and we believe that investors in the market may overreact, causing fluctuations in our stock prices that may not accurately reflect the impact of court rulings on our business operations and assets.

In the past, companies that have experienced volatility in the market price of their stock have been the objects of securities class action litigation. If our common stock was the object of securities class action litigation, it could result in substantial costs and a diversion of management’s attention and resources, which could materially harm our business and financial results.

WE DO NOT ANTICIPATE DECLARING ANY CASH DIVIDENDS ON OUR COMMON STOCK.

We have never declared or paid cash dividends on our common stock and do not plan to pay any cash dividends in the near future. Our current policy is to retain all funds and any earnings for use in the operation and expansion of our business. If we do not pay dividends, our stock may be less valuable to you because a return on your investment will only occur if our stock price appreciates.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

Our corporate, administrative and operational headquarters are located in Newport Beach, California where we lease approximately 18,302 square feet of office space, under a lease agreement that expires in February 2012. Certain of our operating subsidiaries also maintain additional leased office space in Frisco, Texas, Northbrook, Illinois, San Francisco, California, Atlanta, Georgia, San Diego, California, Brooklyn, New York and Santa Clara, California. Presently, certain of our operating subsidiaries are seeking additional office facilities in Texas. We believe that our facilities are adequate, suitable and of sufficient capacity to support our immediate needs.

In the ordinary course of business, we are the subject of, or party to, various pending or threatened legal actions, including various counterclaims in connection with our intellectual property enforcement activities. We believe that any liability arising from these actions will not have a material adverse effect on our consolidated financial position, results of operations or cash flows.

In connection with any of our patent enforcement actions, it is possible that a defendant may request and/or a court may rule that we have violated statutory authority, regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions against us or our operating subsidiaries or award attorney’s fees and/or expenses to a defendant(s), which could be material, and if required to be paid by us or our operating subsidiaries, could materially harm our operating results and our financial position.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None.

PART II

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Price Range of Common Stock

Our common stock commenced trading on The NASDAQ Global Market on December 16, 2002, under the symbol “ACTG.” Prior to December 16, 2002, our only class of common stock began trading under the symbol “ACRI” on the NASDAQ National Market System on July 8, 1996.

Prior to the Split-Off Transaction. Prior to the Split-Off Transaction described above, we had two classes of common stock outstanding, our Acacia Research-Acacia Technologies common stock and our Acacia Research-CombiMatrix common stock. As a result of the Split-Off Transaction, all outstanding shares of Acacia Research-CombiMatrix common stock were redeemed, and all rights of holders of Acacia Research-CombiMatrix common stock ceased as of August 15, 2007. As a result of the consummation of the Split-Off Transaction, our only class of common stock outstanding is our common stock.

The markets for securities such as our common stock have historically experienced significant price and volume fluctuations during certain periods. These broad market fluctuations and other factors, such as new product and technology developments, business or regulatory trends in our industry and the investment markets generally, as well as economic conditions and quarterly variations in the results of our licensing and enforcement activities and our results of operations, may adversely affect the market price of our common stock.

The high and low bid prices for our common stock as reported by The NASDAQ Global Market for the periods indicated are shown in the table below. Such prices are inter-dealer prices without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

| | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| High | $9.64 | | $9.59 | | $7.90 | | $4.50 | | $3.18 | | $5.20 | | $6.70 | | $9.30 |

| Low | $6.81 | | $6.77 | | $3.82 | | $2.14 | | $1.87 | | $2.98 | | $4.20 | | $4.58 |

STOCK PRICE PERFORMANCE GRAPH

The following stock price performance graph shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any of our filings under the Securities Act of 1933, as amended.

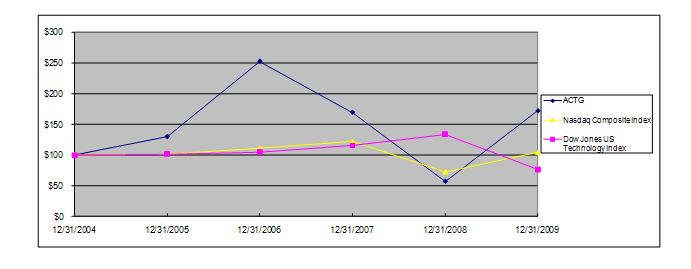

The Stock Performance Graph depicted below compares the yearly change in our cumulative total stockholder return for the last five fiscal years with the cumulative total return of The NASDAQ Stock Market (U.S.) Composite Index.

| | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

| | | | | | | | | | | | | | | |

| Acacia Research Corporation common stock | $130 | | | $252 | | | $169 | | | $57 | | | $172 | |

| Nasdaq Composite Index | $101 | | | $111 | | | $122 | | | $72 | | | $104 | |

| Dow Jones U.S. Technology Index | $102 | | | $105 | | | $116 | | | $134 | | | $ 77 | |

The graph covers the period from December 31, 2004 to December 31, 2009. Cumulative total returns are calculated assuming that $100 was invested on December 31, 2004, in our common stock, in the NASDAQ Composite Index, and in the Dow Jones U.S. Technology Index, and that all dividends, if any, were reinvested. Refer to our Dividend Policy below. Stockholder returns over the indicated period should not be considered indicative of future stock prices or shareholder returns.

On February 23, 2010, there were approximately 120 owners of record of our common stock. The majority of the outstanding shares of our common stock are held by a nominee holder on behalf of an indeterminable number of ultimate beneficial owners.

Repurchase of Restricted Common Stock

In May 2009, our board of directors approved a restricted stock vesting net issuance program. Under the program, upon the vesting of unvested shares of restricted common stock, we withhold from fully vested shares of common stock otherwise deliverable to any employee-participant in our equity compensation programs, a number of whole shares of common stock having a fair market value (as determined by us as of the date of vesting) equal to the amount of tax required to be withheld by law, in order to satisfy our tax withholding obligations in connection with the vesting of such shares. Of a total of 580,600 shares of restricted stock vested between June 2009 and September 2009, 174,628 shares of common stock were withheld by us, in satisfaction of $1.1 million in required withholding tax liability. Additional repurchases under the net issuance program are not anticipated at this time.

Dividend Policy

To date, we have not declared or paid any cash dividends with respect to our common stock, and the current policy of the board of directors is to retain earnings, if any, to provide for our growth and the growth of our operating subsidiaries. Consequently, we do not expect to pay any cash dividends in the foreseeable future. Further, there can be no assurance that our proposed operations will generate revenues and cash flow needed to declare a cash dividend or that we will have legally available funds to pay dividends.

Equity Compensation Plan Information

The following table provides information with respect to shares of our common stock issuable under our equity compensation plans as of December 31, 2009:

| | (a) Number of securities to be issued upon exercise of outstanding options | | | (b) Weighted-average exercise price of outstanding options | | | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| Equity compensation plans approved by security holders | | | | | | | | | |