UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08918

HC Capital Trust

(Exact name of registrant as specified in charter)

|

| Five Tower Bridge, 300 Barr Harbor Drive, Suite 500, West Conshohocken, PA 19428 |

| (Address of principal executive offices) (Zip code) |

Citi Fund Services Ohio, Inc., 3435 Stelzer Road, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-242-9596

Date of fiscal year end: June 30

Date of reporting period: June 30, 2015

Item 1. Reports to Stockholders.

Annual Report

The Value Equity Portfolio

The Institutional Value Equity Portfolio

The Growth Equity Portfolio

The Institutional Growth Equity Portfolio

The Small Capitalization–Mid Capitalization Equity Portfolio

The Institutional Small Capitalization–Mid Capitalization Equity Portfolio

The Real Estate Securities Portfolio

The Commodity Returns Strategy Portfolio

The International Equity Portfolio

The Institutional International Equity Portfolio

The Emerging Markets Portfolio

The Core Fixed Income Portfolio

The Fixed Income Opportunity Portfolio

The U.S. Government Fixed Income Securities Portfolio

The Inflation Protected Securities Portfolio

The U.S. Corporate Fixed Income Securities Portfolio

The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio

The Short-Term Municipal Bond Portfolio

The Intermediate Term Municipal Bond Portfolio

The Intermediate Term Municipal Bond II Portfolio

June 30, 2015

June 30, 2015

We are pleased to present the June 30, 2015 Annual Report for the HC Capital Trust (the “Trust”).

The Trust is an open-end management investment company. As of June 30, 2015, the Trust consisted of twenty separate investment portfolios (the “Portfolios”). Day-to-day portfolio management services are provided to each of the Trust’s Portfolios by one or more independent money management organizations (“Specialist Managers”). Each Specialist Manager is subject to the supervision of HC Capital Solutions, an operating division of Hirtle Callaghan & Co., LLC, which serves as the Trust’s primary investment adviser and to the general oversight of the Trust’s Board of Trustees.

The Value Equity Portfolio, seeks total return by investing in a diversified portfolio of equity securities of large companies with relatively low price-earnings ratios and high dividend yields.

The Institutional Value Equity Portfolio, seeks total return by investing in a diversified portfolio of equity securities of large companies with relatively low price-earnings ratios and high dividend yields.

The Growth Equity Portfolio, seeks capital appreciation by investing in a diversified portfolio of equity securities of large and mid-capitalization companies with superior prospects for earnings growth.

The Institutional Growth Equity Portfolio, seeks capital appreciation by investing in a diversified portfolio of equity securities of large and mid-capitalization companies with superior prospects for earnings growth.

The Small Capitalization–Mid Capitalization Equity Portfolio, seeks long-term capital appreciation by investing in a diversified portfolio of equity securities of small-capitalization companies.

The Institutional Small Capitalization–Mid Capitalization Equity Portfolio, seeks long-term capital appreciation by investing in a diversified portfolio of equity securities of small-capitalization companies.

The Real Estate Securities Portfolio, seeks to provide a total return consisting of both capital appreciation and current income.

The Commodity Returns Strategy Portfolio, seeks capital appreciation by investing in a diversified portfolio of commodity-related instruments.

The International Equity Portfolio, seeks total return by investing in a diversified portfolio of equity securities of companies based in countries other than the United States of America.

The Institutional International Equity Portfolio, seeks total return by investing in a diversified portfolio of equity securities of companies based in countries other than the United States of America.

The Emerging Markets Portfolio, seeks total return by investing in a diversified portfolio of securities issued by companies domiciled, or doing a substantial portion of their business, in countries with a developing or emerging economy or securities market.

The Core Fixed Income Portfolio, seeks current income, consistent with the preservation of capital, by investing in a diversified portfolio of debt securities, including U.S. and non-U.S. government securities, corporate debt securities, and asset-backed issues.

The Fixed Income Opportunity Portfolio, seeks to achieve above-average total return by investing in high yield securities (commonly referred to as “junk bonds”).

The U.S. Government Fixed Income Securities Portfolio, seeks to provide a moderate and sustainable level of current income, consistent with the preservation of capital by investing primarily in a diversified portfolio of U.S. Treasury and government related fixed income securities.

The Inflation Protected Securities Portfolio, seeks to provide inflation protection and income consistent with investment in inflation-indexed securities.

The U.S. Corporate Fixed Income Securities Portfolio, seeks to provide a moderate and sustainable level of current income, consistent with the preservation of capital by investing primarily in a diversified portfolio of investment grade fixed income securities issued by U.S. corporations.

The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio, seeks to provide a moderate and sustainable level of current income, consistent with the preservation of capital by investing primarily in a diversified portfolio of publicly issued mortgage and asset backed securities.

The Short-Term Municipal Bond Portfolio, seeks current income exempt from Federal income tax, consistent with preservation of capital, by investing primarily in securities issued by municipalities and related securities.

The Intermediate Term Municipal Bond Portfolio, seeks current income, consistent with the preservation of capital, exempt from Federal income tax by investing in securities issued by municipalities and related entities.

The Intermediate Term Municipal Bond II Portfolio, seeks current income, consistent with the preservation of capital, exempt from Federal income tax by investing in securities issued by municipalities and related entities.

[THIS PAGE INTENTIONALLY LEFT BLANK]

| | | | |

| HC CAPITAL TRUST | | | | Annual Report |

June 30, 2015

Table of Contents

[THIS PAGE INTENTIONALLY LEFT BLANK]

Fiscal Year 2015 Summary

General Market

(Unaudited — June 30, 2015)

The several portfolios of the HC Capital Trust provide clients with distinct, broadly diversified, cost-effective exposure to multiple asset class funds (for both taxable and institutional investors). The Portfolios are structured as multi-manager, multi strategy vehicles that may be used by or clients of Hirtle Callaghan & Co., LLC. The Portfolios enable HC Capital Solutions (the advisor) to construct independent, custom asset allocation portfolios to best meet such clients’ overall investment policies and objectives. The absolute performance of each Portfolio over the period is designed to reflect the absolute performance of the asset class as reflected by the portfolio benchmark. Depending upon the objective, each Portfolio will generally seek to deliver performance that exceeds, or is in-line with the benchmark for the Portfolio as well as a peer universe of mutual funds with similar investment strategies.

Financial returns in the overall markets were broadly positive during the Trust’s fiscal year ended June 30, 2015, but were punctuated by bouts of volatility. The turbulence stemmed from a series of exogenous shocks related to the U.S. Dollar, the oil market, the U.S. Federal Reserve’s posture and the geopolitical tensions. The surprising strength of the U.S. Dollar (U.S. Federal Reserve’s trade weighted Dollar index +15.51%) impaired returns on foreign holdings for U.S. dollar-based investors. The U.S. Dollar’s strength was a consequence of (1) heightened geo-political concerns and (2) the perception of differential monetary policy between the U.S. and the rest of the world. Russia’s annexation of Crimea and interference in Ukraine, the territorial gains of ISIS in Syria and Iraq and China’s belligerence in the South China Sea heightened risk aversion in financial markets. The most impactful exogenous event was the decision by the Saudis in November to continue crude oil production in spite of the rising global inventories caused by the influx of North American shale oil. The Saudi refusal to cede market share caused a massive dislocation in the oil market. Prices fell from a high of $105 per barrel of West Texas Intermediate to a low of $43 per barrel in March. The industry adjusted rapidly to curtail supply – straining the more leveraged balance sheets of producers and oil service companies. The relief of lower oil prices to consumers failed to manifest itself. So the first order impact of lower employment and capital expenditure in the oil fields seems to outweigh the positive impact on consumption.

During this period, real activity generally accelerated around the world. The U.S. economy continued to gain strength – despite a severe winter that disrupted activity. Employment in the U.S. steadily improved as the housing and auto sectors rebounded. The European economy – particularly in the most troubled peripheral economies – appeared to have reached the inflection point in activity. The stronger U.S. Dollar and the European Central Bank’s commitment to quantitative easing appeared to have a positive influence on European corporate earnings and consumer confidence. Chinese growth continued to slow marginally, but the People’s Bank of China (“PBOC”) took steps to lower interest rates to stimulate lending activity, and the decline in real estate activity seen in the first half of the year appeared to level off.

U.S. equities appreciated modestly over the twelve months ended June 30, 2015 (7.43% for the S&P 500). Growth stocks outperformed value stocks (Russell 1000® Value Index 7.42% versus Russell 1000® Growth Index 10.47%). International developed market equities rose (MSCI EAFE 12.30%) in local currency terms, but declined 4.18% in U.S. Dollar terms. The MSCI Emerging Markets index lagged the developed markets, falling 5.19% in U.S. Dollar terms. Fixed income asset classes rebounded from the selloff related to the Federal Reserve’s tapering of quantitative easing. The U.S. 10 year Treasury yield decreased from 2.53% to 2.36% over the year. Interest sensitive sectors like real estate securities (REITs) and utilities outperformed as rates declined.

Each of the Portfolios provided results consistent with their stated objectives over the fiscal year ended June 30, 2015. The performance of each Portfolio is listed in the table below and detailed summaries of the objectives, managers, and results are contained in the subsequent sections.

1

The table below summarizes the performance of each Portfolio in the HC Capital Trust. Note that benchmark performance is shown for comparison purposes only; it is not possible to invest directly in a securities index. All of the referenced benchmark indices are unmanaged, which means that the indices results do not reflect the impact of expenses associated with investing in securities, such as fees, brokerage commission and transactions costs.

| | | | |

HC Capital Trust Portfolios | | Fiscal Year

2015 Return | |

The Value Equity Portfolio | | | 5.27%(a) | |

Russell 1000® Value Index1 | | | 4.12% | |

The Institutional Value Equity Portfolio | | | 5.05%(a) | |

Russell 1000® Value Index1 | | | 4.12% | |

The Growth Equity Portfolio | | | 11.27%(a) | |

Russell 1000® Growth Index1 | | | 10.56% | |

The Institutional Growth Equity Portfolio | | | 11.14%(a) | |

Russell 1000® Growth Index1 | | | 10.56% | |

The Small Capitalization–Mid Capitalization Equity Portfolio | | | 6.91%(a) | |

Russell 2000® Index1 | | | 6.49% | |

The Institutional Small Capitalization–Mid Capitalization Equity Portfolio | | | 7.43%(a) | |

Russell 2000® Index1 | | | 6.49% | |

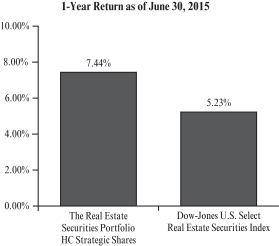

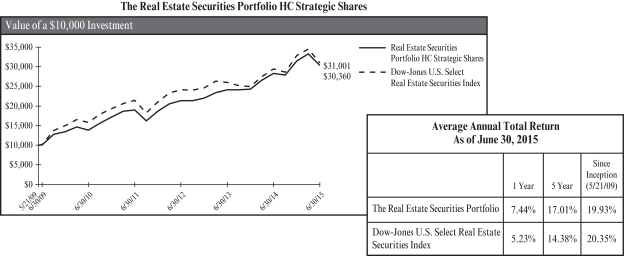

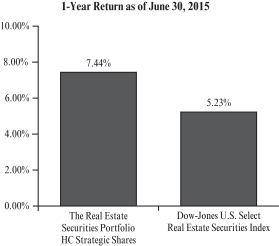

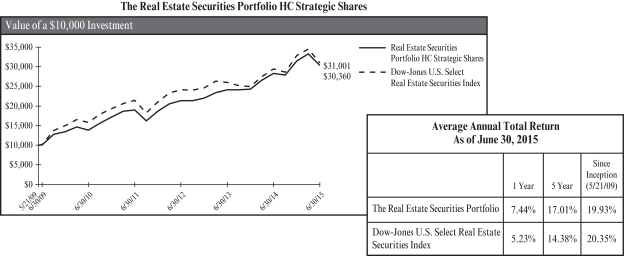

The Real Estate Securities Portfolio | | | 7.44%(a) | |

Dow-Jones U.S. Select Real Estate Securities Index2 | | | 5.23% | |

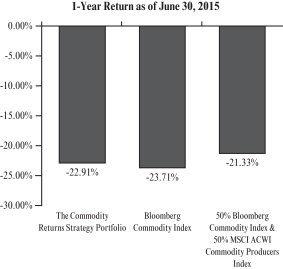

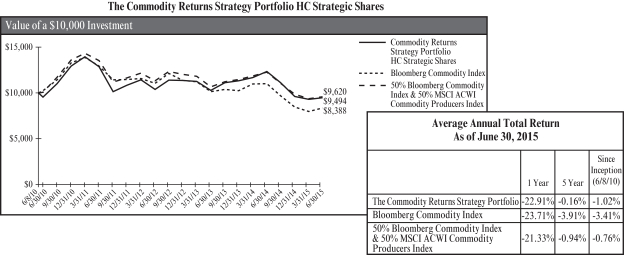

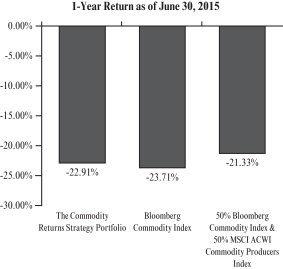

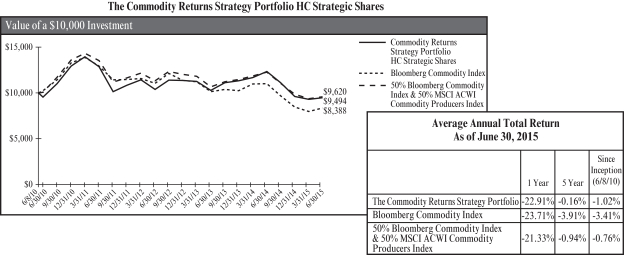

The Commodity Returns Strategy Portfolio | | | -22.91%(a) | |

Bloomberg Commodity Index3 | | | -23.71% | |

HC Commodities Benchmark4 | | | -21.33% | |

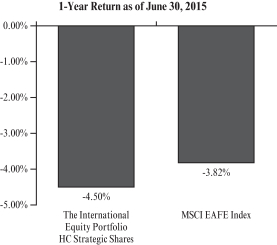

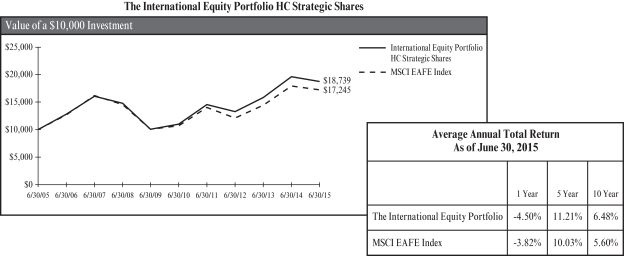

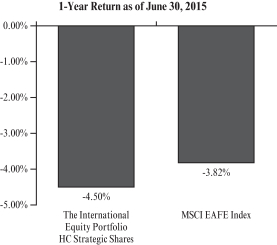

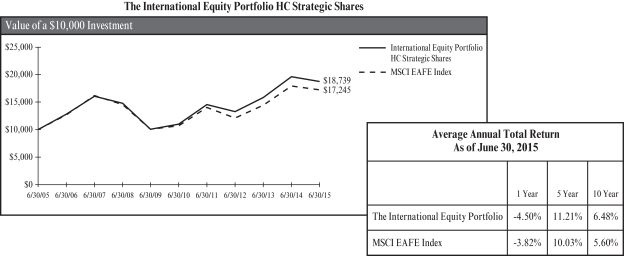

The International Equity Portfolio | | | -4.50%(a) | |

MSCI EAFE Index5 | | | -3.82% | |

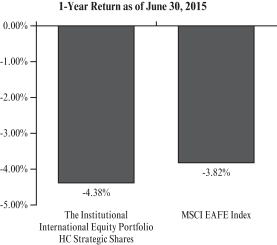

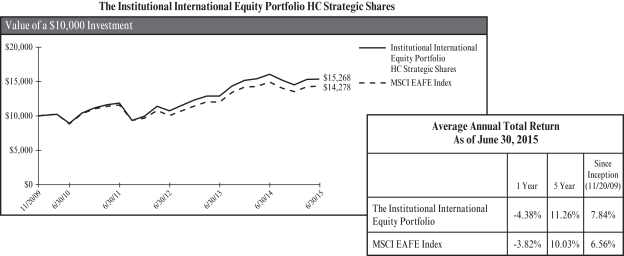

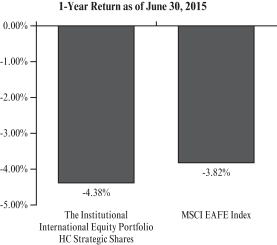

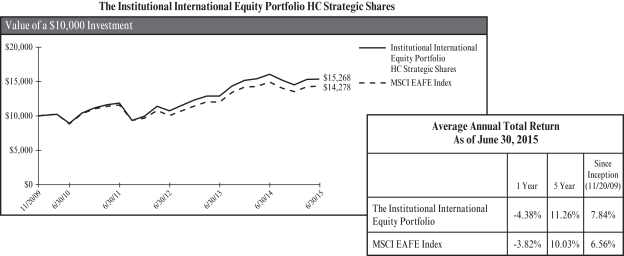

The Institutional International Equity Portfolio | | | -4.38%(a) | |

MSCI EAFE Index5 | | | -3.82% | |

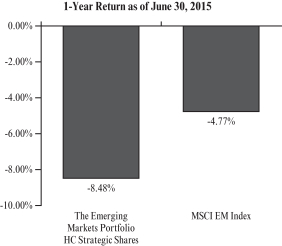

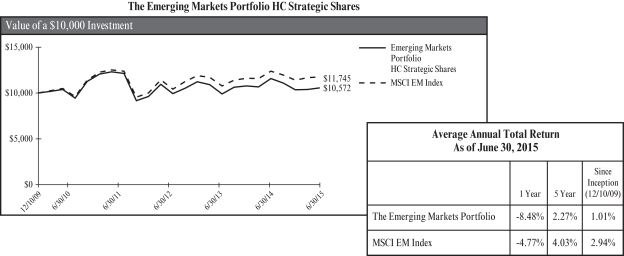

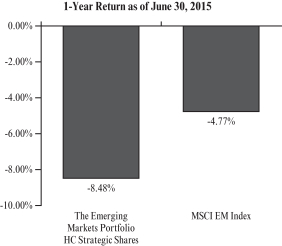

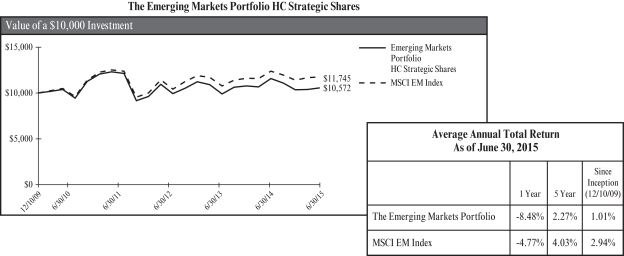

The Emerging Markets Portfolio | | | -8.48%(a) | |

MSCI EM Index6 | | | -4.77% | |

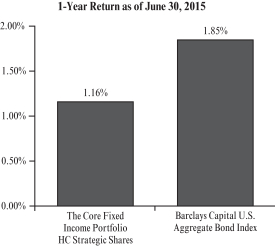

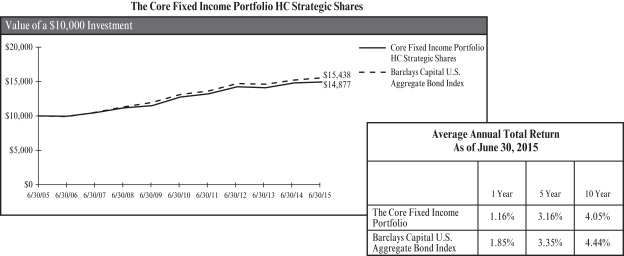

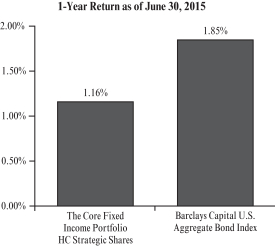

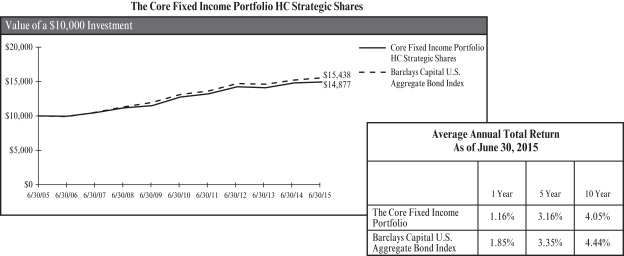

The Core Fixed Income Portfolio | | | 1.16%(a) | |

Barclays Capital U.S. Aggregate Bond Index7 | | | 1.85% | |

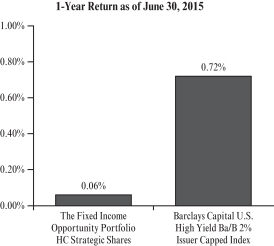

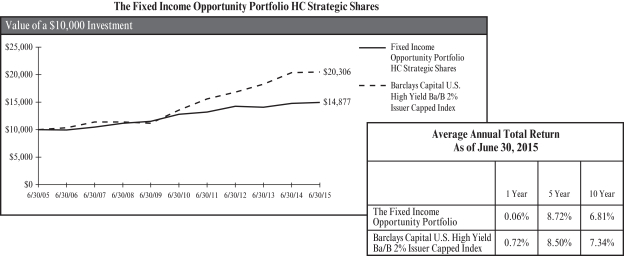

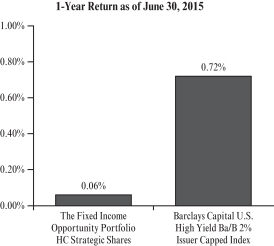

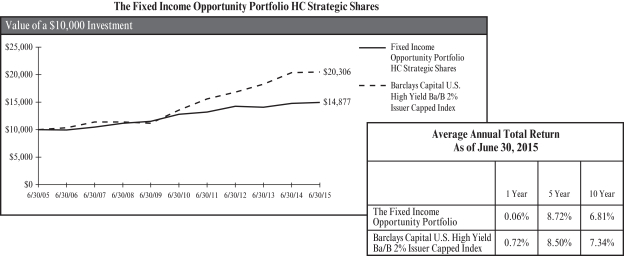

The Fixed Income Opportunity Portfolio | | | 0.06%(a) | |

Barclays Capital U.S. High Yield Ba/B 2% Issuer Capped Index8 | | | 0.72% | |

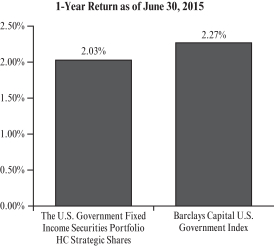

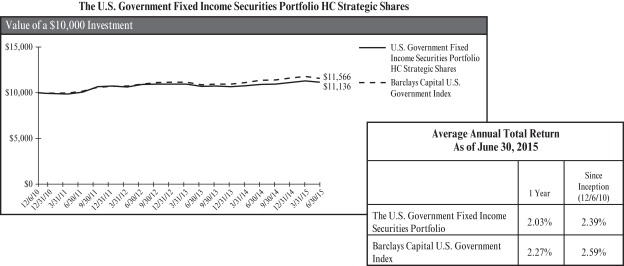

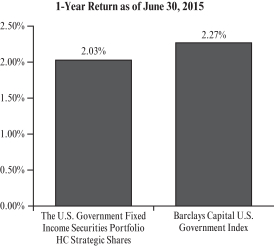

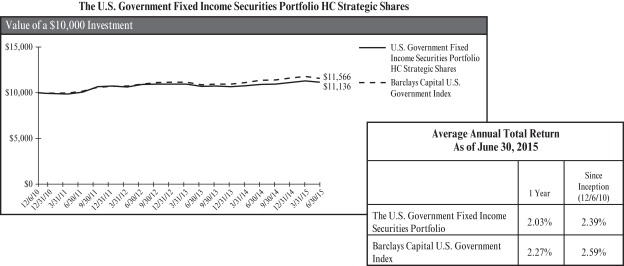

The U.S. Government Fixed Income Securities Portfolio | | | 2.03% | |

Barclays Capital U.S. Government Bond Index9 | | | 2.27% | |

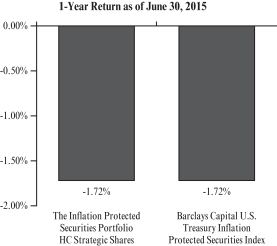

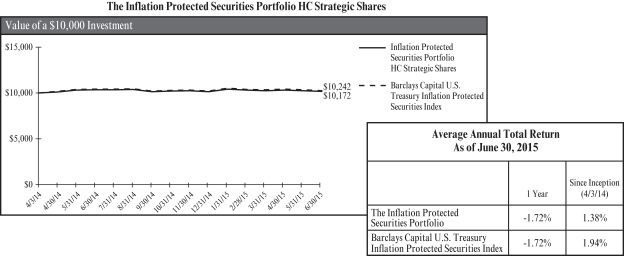

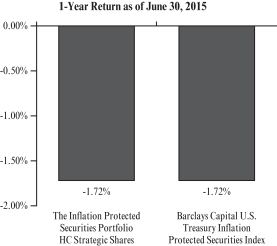

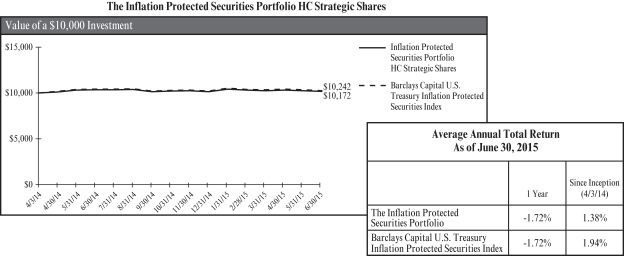

The Inflation Protected Securities Portfolio | | | -1.72%(a) | |

Barclays Capital U.S. Treasury Inflation Protected Securities Index10 | | | -1.72% | |

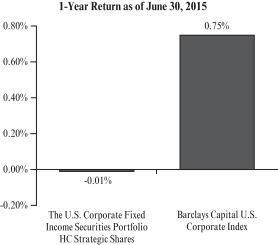

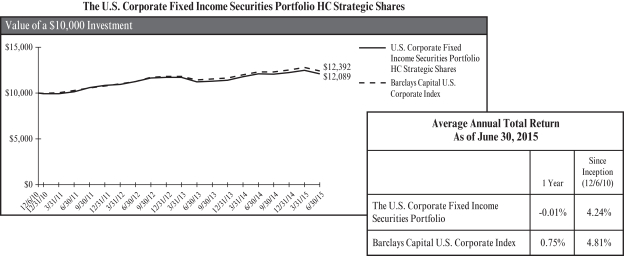

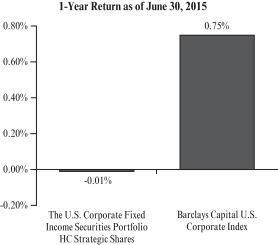

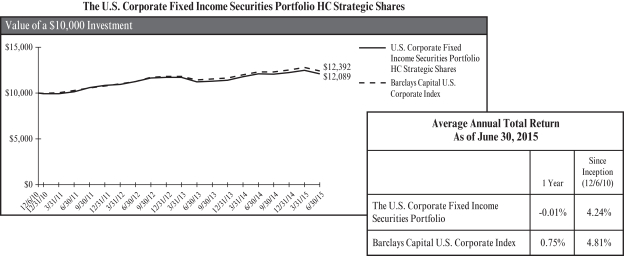

The U.S. Corporate Fixed Income Securities Portfolio | | | -0.01% | |

Barclays Capital U.S. Corporate Index11 | | | 0.75% | |

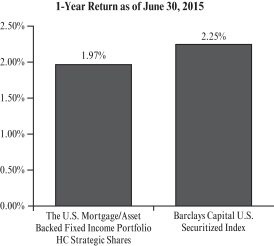

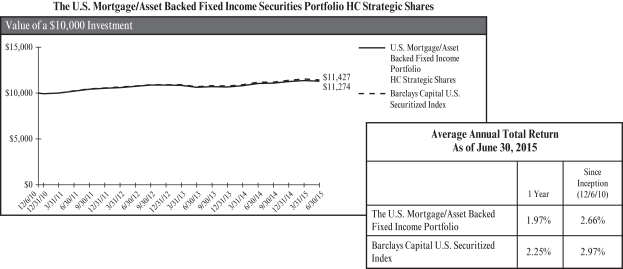

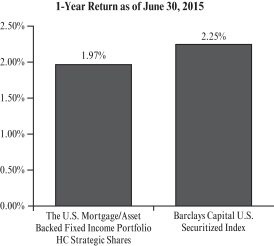

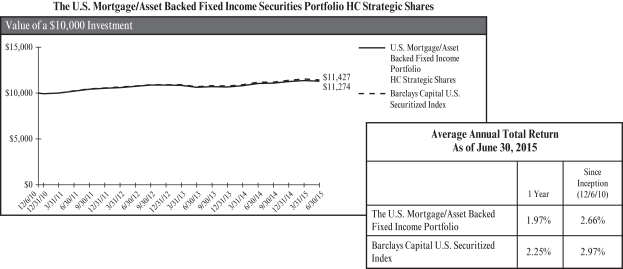

The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio | | | 1.97% | |

Barclays Capital U.S. Securitized Index12 | | | 2.25% | |

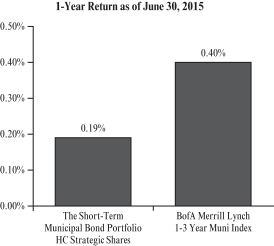

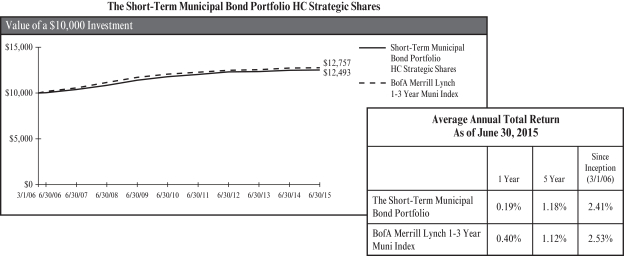

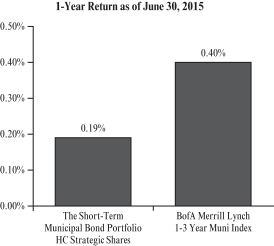

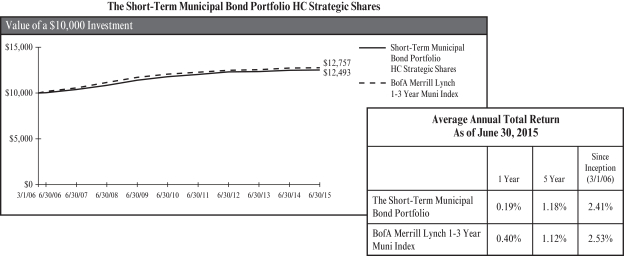

The Short-Term Municipal Bond Portfolio | | | 0.19% | |

BofA Merrill Lynch 1-3 Year Municipal Index13 | | | 0.40% | |

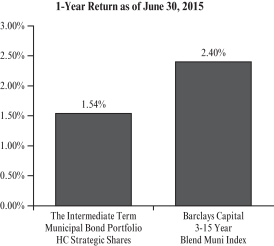

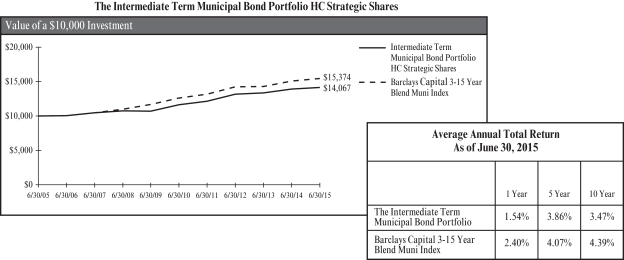

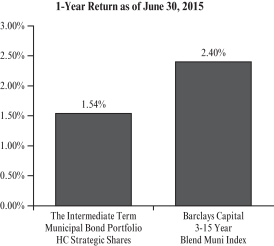

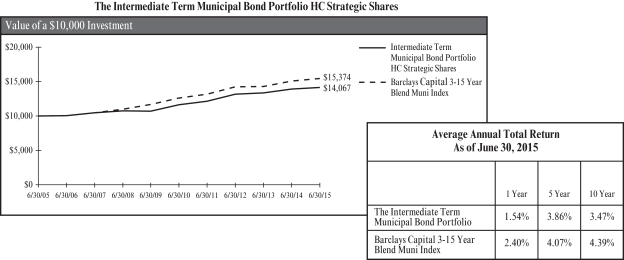

The Intermediate Term Municipal Bond Portfolio | | | 1.54% | |

Barclays Capital 3-15 Year Blend Muni Index14 | | | 2.40% | |

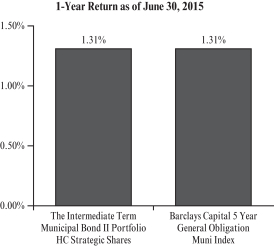

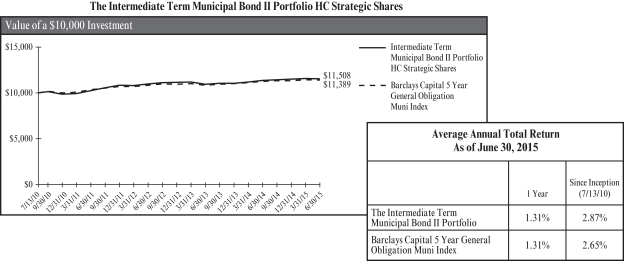

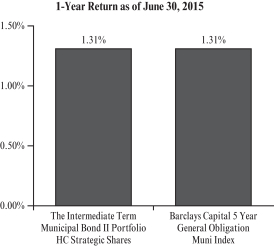

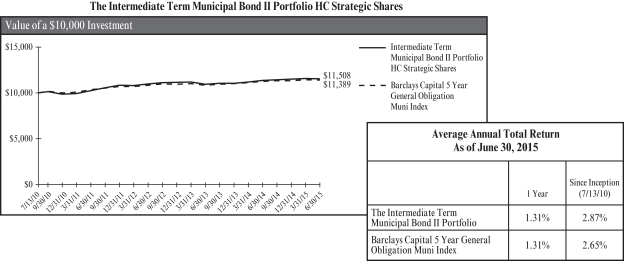

The Intermediate Term Municipal Bond II Portfolio | | | 1.31% | |

Barclays Capital 5-Year General Obligation Muni Index15 | | | 1.31% | |

In reviewing the table above and the remainder of this report, note that past performance does not guarantee future results. The remainder of this report contains more specific details about the performance, strategy and managers in each of the portfolios.

2

| (a) | The return shown is that of HC Strategic Shares and has not been adjusted to reflect HC Advisors Shares expenses, which may be higher. |

| 1 | Each of the Russell indices is a market cap-weighted index of common stocks domiciled in the U.S. Unlike the S&P 500 Stock Index however, the basket of securities included in the various Russell indices is reconstituted each year. The Russell 3000® Index is constructed by ranking U.S. common stocks from largest to smallest market capitalization, and including in the index the top 3,000 stocks. The largest 1,000 stocks become the Russell 1000® Index and the next 2,000 stocks are included in the Russell 2000® Index. The Russell 1000® Growth Index is designed to measure the performance of those companies included in the Russell 1000 Index that have relatively higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Value® Index is designed to measure the performance of those companies included in the Russell 1000® Index that have relatively lower price-to-book ratios and lower forecasted growth values. |

| 2 | Dow-Jones U.S. Select Real Estate Securities Index – is a broad measure of the performance of publicly traded global real estate securities, such as Real Estate Investment Trusts (“REITs”) and Real Estate Operating Companies (“REOCs”). The index is capitalization-weighted. The global index is an expansion of the original U.S. index, developed in 1991. |

| 3 | The Bloomberg Commodity Index is a broadly diversified index that allows investors to track commodity futures through a single, simple measure. The index is designed to minimize concentration in one commodity or sector. It currently includes 19 commodity futures in five groups. No one commodity can comprise less than 2% or more than 15% of the index, and no group can represent more than 33% of the index (as of the annual re-weightings of the components). |

| 4 | The HC Commodities Benchmark is comprised 50% of the Bloomberg Commodity Index and 50% of the MSCI ACWI Commodity Producers Index. The MSCI ACWI Commodity Producers Index captures the global opportunity set of commodity produces in the energy, metal and agricultural sectors. Constituents are selected from the equity universe of MSCI ACWI, the parent index, which covers mid and large cap securities across 24 Developed Markets (DM) and 21 Emerging Markets (EM) countries. All index constituents are categorized in one of twelve sub industries according to the Global Industry Classification Standard (GICS), including: integrated oil & gas, oil & gas exploration & production, gold, steel, aluminum, precious metals & minerals, agricultural products, paper products, and forest products. |

| 5 | The Morgan Stanley Capital International Europe, Australasia, and Far East Index (“MSCI EAFE Index”). The MSCI EAFE Index (Europe, Australasia, Far East) is an unmanaged, free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of June 2015, the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. |

| 6 | MSCI Emerging Markets Index (“MSCI EM Index”) – is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of June 2015, the MSCI EM Index consisted of the following 22 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. |

| 7 | The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index that includes more than 5,000 taxable government, investment-grade corporate and mortgage backed securities. |

| 8 | Barclays Capital U.S. High Yield Ba/B 2% Issuer Capped Index is an unmanaged index designed to mirror the investable universe of the U.S. dollar denominated high yield debt market. |

| 9 | The Barclays Capital U.S. Government Index is a broad-based index that represents the general performance of U.S. Treasury and U.S. Government agency and debt securities. |

| 10 | The Barclays Capital U.S. Treasury Inflation Protected Securities Index consists of Inflation-Protection securities issued by the U.S. Treasury. |

| 11 | The Barclays Capital U.S. Corporate Index is an unmanaged index that covers USD-denominated, investment-grade, fixed-rate and taxable securities sold by industrial, utility and financial issuers. It includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements. |

| 12 | The Barclays Capital U.S. Securitized Index is an unmanaged index that tracks the performance of mortgage-backed pass-through securities issued by Ginnie Mae, Fannie Mae and Freddie Mac, investment-grade bonds and asset-backed securities. |

| 13 | The Bank of America (“BofA”) Merrill Lynch 1-3 Year Municipal Index is an equal-weighted index that tracks the total return performance of the domestic U.S. municipal market. The index consists of investment-grade, publicly traded, fixed-rate and coupon bearing municipal securities with a maturity of one to three years. |

| 14 | Barclays Capital 3-15 Year Blend Muni Index is an index composed of tax-exempt bonds with maturities ranging between 2 and 17 years. |

| 15 | Barclays Capital 5-Year General Obligations Muni Index is an unmanaged index generally representative of investment grade fixed rate debt obligations issued by state and local government entities, with maturities of no more than six years. |

3

The Value Equity Portfolio

The Institutional Value Equity Portfolio

(Unaudited)

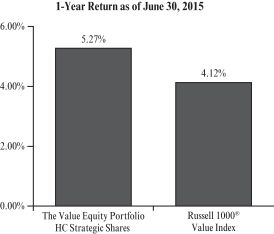

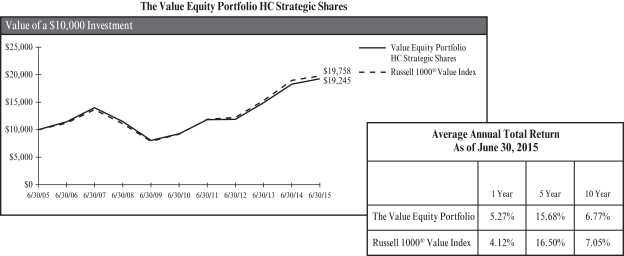

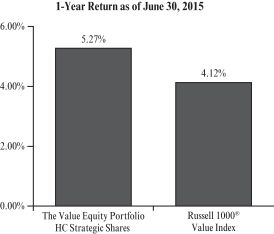

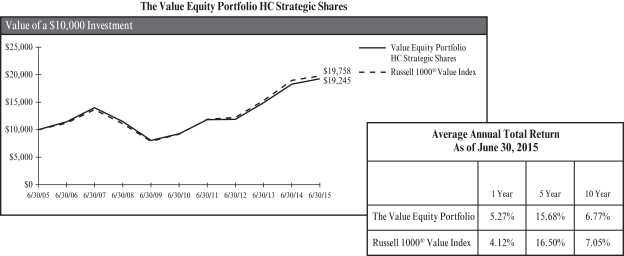

The Value Equity Portfolio (the “Portfolio”) managed by AllianceBernstein, L.P., Cadence Capital Management, LLC and Parametric Portfolio Associates, LLC returned 5.27% for the fiscal year compared to 4.12% for the Russell 1000® Value Index1 and 4.27% for the average manager in the Lipper2 universe of Large Cap Value Funds.3

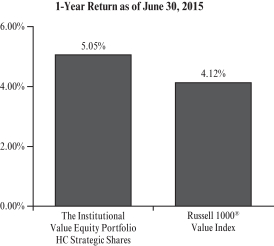

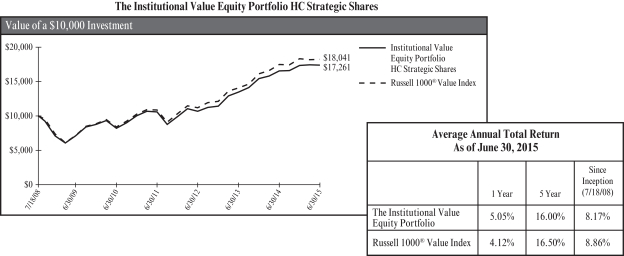

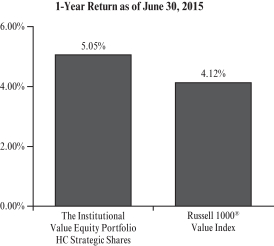

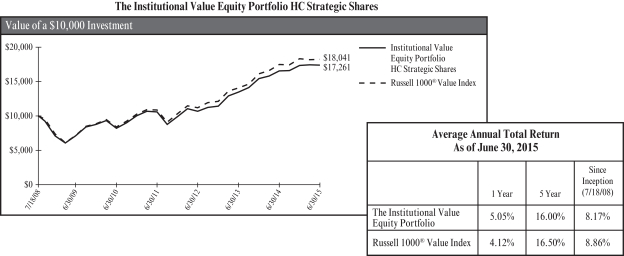

The Institutional Value Equity Portfolio (the “Institutional Portfolio”) managed by AllianceBernstein, L.P., Cadence Capital Management LLC and Parametric Portfolio Associates, LLC returned 5.05% for the fiscal year compared to 4.12% for the Russell 1000® Value Index1 and 4.27% for the average manager in the Lipper2 universe of Large Cap Value Funds.3

The Portfolio outperformed both its benchmark and peer group over the period. The Portfolio benefited from its allocation to traditional value strategies employed by Alliance Bernstein. The Traditional value managers tend to have higher beta relative to benchmark and tend to select stocks with price/book, price/earnings, and price/cash flow measures at a substantial discount to the overall market. The Portfolio also benefited from overweights to the health services and retail trade sectors which outperformed the index. This style tended to outperform the Russell 1000® Value Index, as the market gained confidence in the traction of the U.S. recovery and valuations for cyclical stocks and financials rose.

The Portfolio’s cash positions, however, detracted as markets rallied. The Portfolio’s cash position serves two purposes. First, it is intended to provide protection in the event of a market correction. Second, it allows the portfolio to take overweight positions in more volatile strategies without increasing the Portfolio’s overall sensitivity to the market, or beta.

Both Portfolios are diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolios expect to capitalize on this cyclicality of manager styles by reducing exposure to investment managers whose strategy and style realize exceptional excess returns and allocating to good long-term managers whose investment strategy and style have been out of favor in the short-term. An example of this during the period is the termination of Institutional Capital, LLC., a relative value manager, and reallocation of those assets to Quality Value style managers.

| 1 | The Russell 1000® Value Index measures the performance of those companies included in the Russell 1000® Stock Index with lower price-to-book ratios and lower forecasted growth rates. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

| 3 | During the fiscal year, Mellon Capital Management Corporation and Pacific Investment Management Company, LLC (Institutional Portfolio only) were also under contract to manage the Portfolios but did not have assets allocated to them. |

4

The chart represents historical performance of a hypothetical investment of $10,000 in The Value Equity Portfolio for the 10-year period ended 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 1000® Value Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Value Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.33%

HC Advisors Shares 0.58%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

5

The chart represents historical performance of a hypothetical investment of $10,000 in The Institutional Value Equity Portfolio from 7/18/08 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 1000® Value Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Institutional Value Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.32%

HC Advisors Shares 0.57%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

6

The Growth Equity Portfolio

The Institutional Growth Equity Portfolio

(Unaudited)

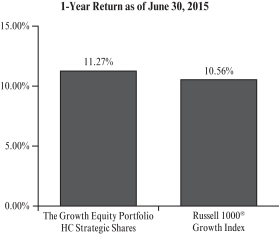

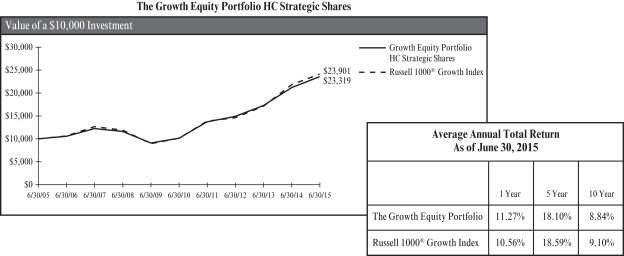

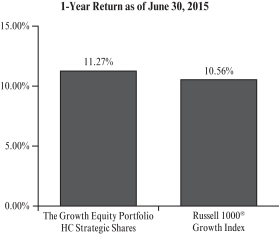

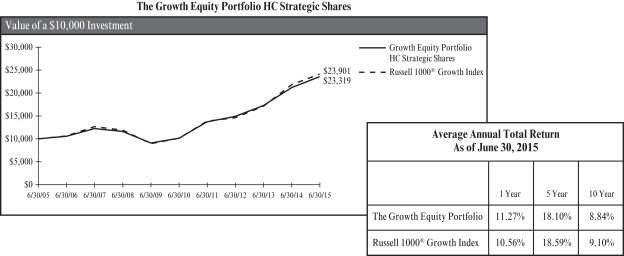

The Growth Equity Portfolio (the “Portfolio”) managed by Jennison Associates LLC, Mellon Capital Management Corporation, Sustainable Growth Advisers, LP and Parametric Portfolio Associates LLC, returned 11.27% for the fiscal year compared to 10.56% for the Russell 1000® Growth Index1 and 10.60% for the average manager in the Lipper2 universe of Large Cap Growth Funds.3

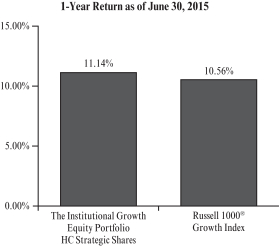

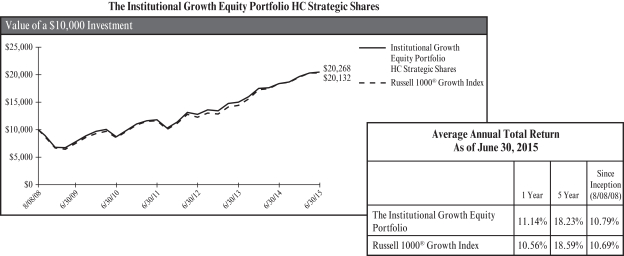

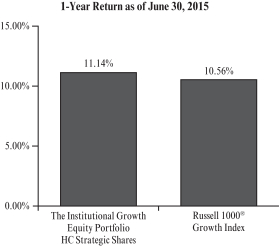

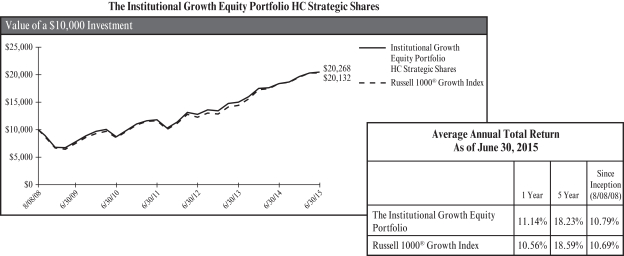

The Institutional Growth Equity Portfolio (the “Institutional Portfolio”) managed by Jennison Associates LLC, Mellon Capital Management Corporation, Sustainable Growth Advisers, LP and Parametric Portfolio Associates LLC returned 11.14% for the fiscal year compared to 10.56% for the Russell 1000® Growth Index1 and 10.60% for the average manager in the Lipper2 universe of Large Cap Growth Funds.3

The Portfolios outperformed their benchmark and peer group because of higher allocations to earnings momentum growth style strategies. Momentum growth managers favor companies with current or near-term superior earnings growth potential on both an absolute and relative basis, which are also reasonably priced. The resulting portfolio includes relatively large companies with dominant market positions and, frequently, multinational exposure. Over the period higher quality stocks posted weaker performance as investors bid up stocks with more cyclical or momentum characteristics. As valuations in domestic markets have risen, the Portfolios have been intentionally positioned more defensively.

Both Portfolios are diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolios expect to capitalize on this cyclicality of manager styles by reducing exposure to investment managers whose strategy and style realize extraordinary excess returns and allocating to good long-term managers whose investment strategy and style have been out of favor in the short-term. An example of this is the elimination of the previous allocation in the Institutional Portfolio to Pacific Investment Management Company, LLC during the period and the reallocation of those assets to Quality Growth style managers.

| 1 | The Russell 1000® Growth Index measures the performance of those companies included in the Russell 1000® Index with higher price-to-book ratios and higher forecasted growth rates. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

| 3 | During the fiscal year, Cadence Capital Management was also under contract to manage the Portfolios but did not have assets allocated to it. |

7

The chart represents historical performance of a hypothetical investment of $10,000 in The Growth Equity Portfolio for the 10-year period ended 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 1000® Growth Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Growth Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.31%

HC Advisors Shares 0.56%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

8

The chart represents historical performance of a hypothetical investment of $10,000 in The Institutional Growth Equity Portfolio from 8/8/08 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 1000® Growth Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Institutional Growth Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.30%

HC Advisors Shares 0.55%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

9

The Small Capitalization–Mid Capitalization Equity Portfolio

The Institutional Small Capitalization–Mid Capitalization Equity Portfolio

(Unaudited)

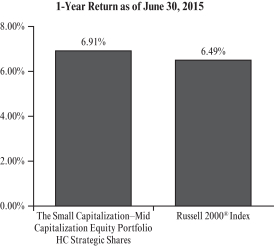

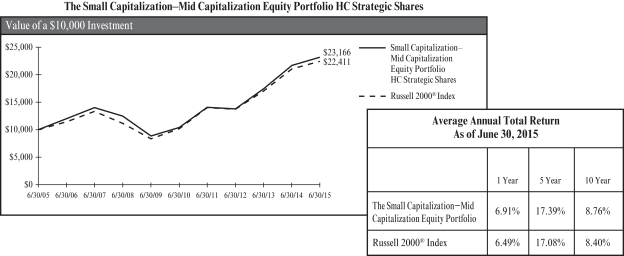

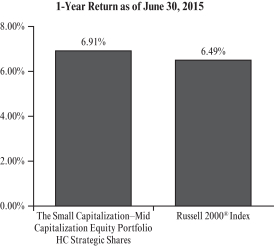

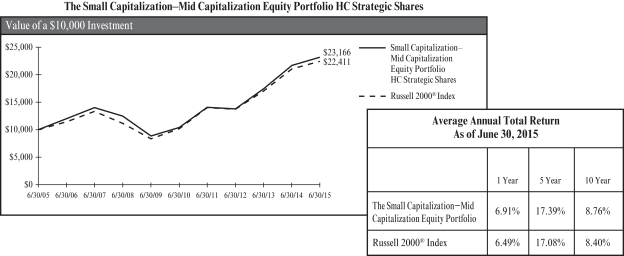

The Small Capitalization–Mid Capitalization Equity Portfolio (the “Portfolio”) managed by Ariel Investments, LLC, Frontier Capital Management Company, LLC, IronBridge Capital Management LP, Mellon Capital Management Corporation, Pzena Investment Management, LLC (“Pzena”), Cupps Capital Management, LLC and Parametric Portfolio Associates, LLC returned 6.91% for the period compared to 6.49% return for the Russell 2000® Index1 and 5.26% for the average manager in the Lipper2 universe of Small Cap Core Funds.3

The Portfolio outperformed its peer group and the benchmark for the period. The Portfolio benefited from allocations to (1) a Growth at a Reasonable Price or “GARP” style managed by Frontier and (2) a traditional value style particularly managed by Pzena (3) a core growth style managed by Ironbridge. Small capitalization equities performed well as investor confidence in the U.S. economy improved.

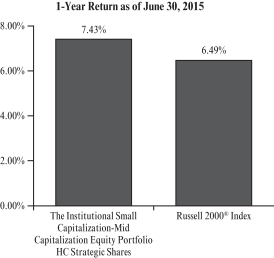

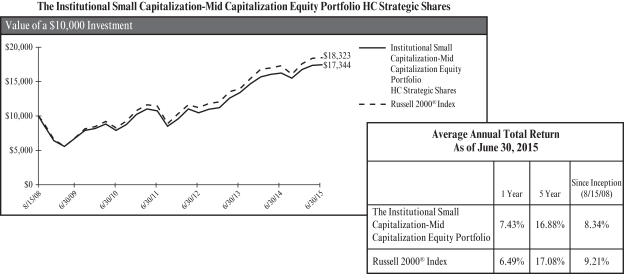

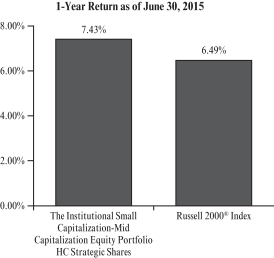

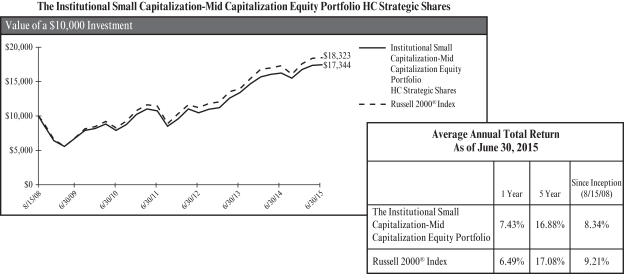

The Institutional Small Capitalization–Mid Capitalization Equity Portfolio (the “Institutional Portfolio”) managed by Cupps Capital Management, LLC, Frontier Capital Management Company, LLC, IronBridge Capital Management LP, Mellon Capital Management Corporation and Pzena Investment Management, LLC returned 7.43% for the period compared to a 6.49% return for the Russell 2000® Index1 and 5.26% for the average manager in the Lipper2 universe of Small Cap Core Funds.3

The Institutional Portfolio benefited from allocations to (1) a Growth at a Reasonable Price or “GARP” style managed by Frontier and (2) a traditional value style particularly managed by Pzena (3) a core growth style managed by Ironbridge. Small capitalization equities performed well as investor confidence in the U.S. economy improved. The performance difference between the Institutional Portfolio and the Portfolio was primarily driven by the inclusion of Ariels’s deep value style which HC Capital Solution (“the Adviser”) deemed inappropriate for tax-sensitive investors. Ariel uses the market’s short-term focus to uncover mispriced companies whose true value will be realized over time. Cupps Capital Management was added to the portfolio during the period.

Both Portfolios are diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolios expect to capitalize on this cyclicality of manager styles by reducing exposure to investment managers whose strategy and style realize extraordinary excess returns and allocating to good long-term managers whose investment strategy and style have been out of favor in the short-term.

| 1 | Russell 2000® Index measures the performance of smaller capitalization U.S. companies. The largest 1,000 stocks become the Russell 1000® Index and the next 2,000 stocks become the Russell 2000® Index. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

| 3 | During the fiscal year, Cadence Capital Management was also under contract to manage the Portfolios but did not have assets allocated to it. |

10

The chart represents historical performance of a hypothetical investment of $10,000 in The Small Capitalization–Mid Capitalization Equity Portfolio for the 10-year period ended 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 2000® Index, which represents the performance of domestically traded common stocks of small to mid-sized companies. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Small Capitalization–Mid Capitalization Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.76%

HC Advisors Shares 1.01%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

11

The chart represents historical performance of a hypothetical investment of $10,000 in The Institutional Small Capitalization–Mid Capitalization Equity Portfolio from 8/15/08 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 2000® Index, which represents the performance of domestically traded common stocks of small to mid-sized companies. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Institutional Small Capitalization–Mid Capitalization Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.80%

HC Advisors Shares 1.05%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

12

The Real Estate Securities Portfolio

(Unaudited)

The Real Estate Securities Portfolio (the “Portfolio”) was managed by Wellington Management Company LLP (“Wellington”) and Parametric Portfolio Associates LLC (“Parametric”) returned 7.44% for the year compared to 5.23% for the Dow-Jones U.S. Select Real Estate Securities Index1 and 4.34% for the average manager in the Lipper2 universe of Real Estate funds.3 The U.S. Real Estate Market benefitted from improving fundamentals in most sectors-declining vacancies, rent growth and constrained supply.

The Portfolio outperformed its peer group and the benchmark for the period. The Portfolio benefited from relative allocations to the warehouse, real estate technology and specialty finance sectors. The outperformance was also driven by strong security selection in healthcare, lodging and retail centers.

| 1 | The Dow-Jones U.S. Select Real Estate Securities Index is a broad measure of the performance of publicly traded global real estate securities, such as Real Estate Investment Trust (REITs) and Real Estate Operating Companies (REOCs). The index is capitalization-weighted. The global index is an expansion of the original U.S. index, developed in 1991. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

| 3 | During the fiscal year, Mellon Capital Management Corporation and Cadence Capital Management were also under contract to manage the Portfolio but did not have assets allocated to them. |

13

The chart represents historical performance of a hypothetical investment of $10,000 in The Real Estate Securities Portfolio from 5/21/09 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio. The Real Estate Securities Portfolio was redeemed in full on June 30, 2013 and recommenced operations on September 12, 2013.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Dow-Jones U.S. Select Real Estate Securities Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Real Estate Securities Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.78%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

14

The Commodity Returns Strategy Portfolio

(Unaudited)

The Commodity Returns Strategy Portfolio (the “Portfolio”) managed by Wellington Management Company, LLP, Pacific Investment Management Company, LLC, Mellon Capital Management Corporation and Parametric Portfolio Associates LLC returned -22.91% for the year compared to -21.33% for the HC Commodities Benchmark1, -23.71% for the Bloomberg Commodity Index2 and -24.95% for the average manager in the Lipper3 universe of Natural Resources Funds.4

The portfolio slightly underperformed the HC Commodities Benchmark but outperformed both the Bloomberg Commodity Index and the peer group. The modest underperformance was primarily due to the fund’s overweight in commodity-linked equities, which typically exhibit slightly higher sensitivity to the commodity spot markets that sold off during the latter half of 2014. We continue to hold more commodity-linked equities than futures in the fund to capture better risk/return characteristics and high cash flow yields.

The managers of the futures strategies use derivatives – including futures, options, forwards, and swaps – to gain exposure to the underlying physical commodities. The returns generated by those strategies are predominantly a function of the change in the value of the derivatives held. To a lesser extent, the performance of the strategies reflects the change in the value of investments – primarily short dated fixed income – required to collateralize the derivative strategies.

The Portfolio is diversified across multiple managers and strategies, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. Over the period the Portfolio outperformed the Bloomberg Commodity Index, driven primarily by an over-weight to commodities equities rather than futures.

| 1 | The HC Commodities Benchmark is composed of 50% of the Bloomberg Commodity Index2 and 50% of the MSCI ACWI Commodity Producers Index.5 |

| 2 | The Bloomberg Commodity Index is a broadly diversified index that allows investors to track commodity futures through a single, simple measure. The index is designed to minimize concentration in one commodity or sector. It currently includes 19 commodity futures in five groups. No one commodity can comprise less than 2% or more than 15% of the index, and no group can represent more than 33% of the index (as of the annual re-weightings of the components). This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

| 3 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

| 4 | During the fiscal year, Cadence Capital Management was also under contract to the Portfolio but did not have any assets allocated to it. |

| 5 | The MSCI Commodity Producers Index captures the global opportunity set of commodity producers in the energy, metal and agricultural sectors. Constituents are selected from the equity universe of MSCI, the parent index, which covers mid and large cap securities across 24 Developed Markets (DM) and 21 Emerging Markets (EM) countries. All index constituents are categorized in one of twelve sub industries according to the Global Industry Classification Standard (GICS), including: integrated oil & gas, oil & gas exploration & production, gold, steel, aluminum, precious metals & minerals, agricultural products, paper products, and forest products. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

15

The Commodity Returns Strategy Portfolio HC Strategic Shares

The chart represents historical performance of a hypothetical investment of $10,000 in The Commodity Returns Strategy Portfolio from 6/8/10 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg Commodity Index and the 50% Bloomberg Commodity Index & 50% MSCI ACWI Commodity Producers Index. The Dow-Jones UBS Commodity Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. The MSCI ACWI Commodity Producers Index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. An investor cannot invest directly in an index. The performance of The Commodity Returns Strategy Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.60%

HC Advisors Shares 0.85%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

16

The International Equity Portfolio

The Institutional International Equity Portfolio

(Unaudited)

The International Equity Portfolio (the “Portfolio”) managed by Artisan Partners Limited Partnership, Capital Guardian Trust Company, Causeway Capital Management LLC, Cadence Capital Management, LLC, Mellon Capital Management Corporation and Parametric Portfolio Associates, LLC returned -4.50% for the period compared to -3.82% for the MSCI EAFE Index1 and -3.53% for the average manager in the Lipper2 universe of International Large-Cap Core Funds.3

The Institutional International Equity Portfolio (the “Institutional Portfolio”) managed by Artisan Partners Limited Partnership, Capital Guardian Trust Company, Causeway Capital Management LLC, Lazard Asset Management LLC and Cadence Capital Management, LLC and Mellon Capital Management Corporation returned -4.38% for the fiscal year compared to -3.82% for the MSCI EAFE Index1 and -3.53% for the average manager in the Lipper2 universe of International Large-Cap Core Funds.3

The strength of the U.S. Dollar was a headwind for the performance of the benchmark and the Portfolios. In local currency terms, the MSCI EAFE benchmark returned 11.73% for the period versus -4.21% in U.S. Dollar terms.

In February 2015, the Portfolios were shifted slightly to emphasize the value-oriented strategies managed by Cadence Capital and Causeway Capital, and de-emphasize the better-performing growth strategies. The shift was intended to focus on companies that have strong balance sheets, good value characteristics, and high relative dividend yields. This orientation was mildly discounted by the marketplace during the second half of the fiscal year and it, along with a relatively small exposure to Emerging Markets, drove the Portfolio’s modest underperformance.

Both Portfolios are diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolios expect to capitalize on this cyclicality of manager styles by reducing exposure to investment managers whose strategy and style realize extraordinary excess returns and allocating to good long-term managers whose investment strategy and style have been out of favor in the short-term.

| 1 | The Morgan Stanley Capital International Europe, Australasia, and Far East Index (“MSCI EAFE Index”), which covers Europe, Australia, and the Far East, is an unmanaged, market value weighted index designed to measure the overall condition of developed overseas equities markets. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

| 3 | During the fiscal year, City of London Investment Management Company Ltd was also under contract to manage the Portfolios but did not have assets allocated to them. |

17

The chart represents historical performance of a hypothetical investment of $10,000 in The International Equity Portfolio for the 10-year period ended 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MSCI EAFE Index, which represents the performance of the major stock markets in those regions. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The International Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.41%

HC Advisors Shares 0.66%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

18

The chart represents historical performance of a hypothetical investment of $10,000 in The Institutional International Equity Portfolio from 11/20/09 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MSCI EAFE Index, which represents the performance of the major stock markets in those regions. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Institutional International Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.38%

HC Advisors Shares 0.63%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

19

The Emerging Markets Portfolio

(Unaudited)

The Emerging Markets Portfolio (the “Portfolio”) managed by Mellon Capital Management Corporation, Boston Company Asset Management, LLC and Parametric Portfolio Associates, LLC returned -8.48% compared to -4.77% for the MSCI EM Index1 and -6.80% for the average manager in the Lipper2 universe of Emerging Markets Funds.3

For the period, the Portfolio underperformed the benchmark and the average manager in the industry universe. The underperformance is primarily due to the Portfolio’s value bias. Over this period traditional valuation metrics like low price/book and low price/cash flow were ineffective, and the Portfolio’s high exposure to those types of companies drove underperformance. During the fiscal year, strong-performing companies in the Emerging Markets were characterized by high growth and momentum, two factors to which the fund is relatively under-exposed.

The Emerging Markets have exhibited a good deal of dispersion of late. High growth industries such as biotechnology and internet/software services have been the drivers of performance and have reached lofty valuations. On the other hand, energy, industrials, and utilities flagged and are priced quite cheaply. Throughout the fiscal year, the Fund maintained its allocation to the better-valued companies with higher prospective returns, and remains well-positioned to capture the rewards of a valuation-driven rally.

The Portfolio provides broad access to international emerging markets equity. The Portfolio is managed with multiple managers to provide diversification of manager style as well as diversification of firm specific risks. Mellon Capital Management Corporation employs a quantitatively driven investment process that seeks to identify companies paying high dividends relative to the benchmark while maintaining quality balance sheets. The portfolio diversifies amongst a large number of names and across geographies and sectors to capture its specified factor. Boston Company Asset Management, LLC employs a fundamentally driven investment process to identify attractive value companies within the international emerging markets equity universe and then constructs a diversified portfolio of those companies in accordance with industry and individual company allocation guidelines.

| 1 | The Morgan Stanley Capital International Emerging Markets Index (“MSCI EM Index”) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of June 30, 2015 the MSCI EM Index consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

| 3 | During the fiscal year, City of London Investment Management Company Ltd and Cadence Capital Management were also under contract to manage the Portfolio but did not have assets allocated to them. |

20

The chart represents historical performance of a hypothetical investment of $10,000 in The Emerging Markets Portfolio from 12/10/09 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MSCI EM Index, which represents the performance of the major stock markets in those regions. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Emerging Markets Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.62%

HC Advisors Shares 0.87%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

21

The Core Fixed Income Portfolio

(Unaudited)

The Core Fixed Income Portfolio (the “Portfolio”) managed by Mellon Capital Management Corporation (“Mellon”) and Agincourt Capital Management, LLC returned 1.16% for the fiscal year compared to 1.85% for the Barclays Capital U.S. Aggregate Bond Index1 (“BarCap”) and 1.11% for the average fixed income manager in the Lipper2 universe of Core Bond Funds.

Within the U.S. Fixed Income markets, longer-duration fixed income indices tended to outperform shorter duration indices as the curve flattened during the first half of the fiscal year. The major U.S. indices representing government, securitized and corporate securities generated positive returns. Fixed income returns were meager during the second half of the fiscal year as investors tried to determine when the Federal Reserve may start to raise rates. The short-end of the curve remained relatively unchanged while the long-end moved higher in May and June contributing to losses. Lower-quality credits delivered positive results as investors continued to reach for yield. The BarCap Index, a broad measure of the U.S. bond market, gained 1.85% for the fiscal year end.

The Portfolio is allocated across the three major sectors of the BarCap Index: governments, credit, and asset backed securities. The government and asset backed sectors are passively managed to provide performance in-line with their respective benchmarks. Actual results may vary marginally from the underlying benchmarks because of cash flows and because for practical purposes, the portfolios hold a representative group of the securities in the benchmarks and do not seek to fully replicate all of the individual holdings. The credit portfolio has a bit more flexibility to vary from the index by avoiding credits that the manager feels have adverse price risk. The allocations across the three sectors will vary over time based upon the relative attractiveness of the sectors. In general, the portfolio maintains aggregate characteristics – duration, weighted average yield-to-maturity, and average credit quality comparable to the benchmark.

During the second half of the fiscal year we terminated Seix Investment Advisors LLC. Agincourt Capital Management, LLC assumed investment management responsibilities of those assets. Agincourt’s investment process yields a higher quality portfolio at a more favorable fee rate, relative to Seix.

For the fiscal year the corporate strategy negatively contributed to overall portfolio performance relative to the benchmark. Prior to termination in March of 2015, Seix’s underperformance relative to their benchmark was primarily due to sector selection. Over weights in Metals & Mining, Oil Field Services and an underweight to Integrated Energy sectors negatively impacted performance. Since it assumed management responsibility for the corporate strategy, Agincourt has performed in line with the Portfolio’s benchmark.

| 1 | The Barclays Capital U.S. Aggregate Bond Index includes more than 8,000 taxable government, investment-grade corporate and mortgage backed securities. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

22

The chart represents historical performance of a hypothetical investment of $10,000 in The Core Fixed Income Portfolio for the 10-year period ended 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Barclays Capital U.S. Aggregate Bond Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Core Fixed Income Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.23%

HC Advisors Shares 0.48%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

23

The Fixed Income Opportunity Portfolio

(Unaudited)

For the fiscal year, the Fixed Income Opportunity Portfolio (the “Portfolio”), managed by Fort Washington Investment Advisors, Inc., Western Management Company, City of London Investment Management Company Ltd. and Parametric Portfolio Associates, LLC had a return of 0.06% compared to 0.72% for the Barclays Capital U.S. High Yield Ba/B 2% Issuer Capped Index1 and -1.29% for the average manager in the Lipper2 High Current Yield Fund universe.

The Portfolio is designed to provide investors with higher returns over time than traditional fixed income investments primarily through investment in a diversified portfolio of high yield bonds. The Portfolio may also opportunistically invest in international bonds, convertible bonds, preferred stocks, treasury inflation bonds, loan participations and fixed and floating rate loans.

Within the U.S. Fixed Income markets, longer-duration fixed income indices tended to outperform shorter duration indices as the curve flattened during the first half of the fiscal year. The major U.S. indices representing government, securitized and corporate securities generated positive returns. The sharp drop in oil prices was a notable contributor to the sell-off in high yield market indices, where nearly 15% of the high yield market is comprised of Energy issues. During the second half of the fiscal year fixed income returns were meager as investors tried to determine when the Federal Reserve may start to raise rates. The short-end of the curve remained relatively unchanged while the long-end moved higher in May and June contributing to losses. Lower-quality credits delivered positive results as investors continued to reach for yield. As a result, high yield markets managed to post positive results for fiscal year end.

During the first half of the fiscal year we opportunistically added two strategies to the portfolio. Western Asset Management Company’s opportunistic mortgage strategy seeks to add incremental value by exploiting inefficiencies across the structured product market. City of London’s strategy seeks to provide a high-level of current income by investing in high-yield fixed income securities via closed-end funds at a discount to published net asset value.

During the fiscal year ended June 30, 2015, The Fort Washington Investment Advisors high yield strategy underperformed its benchmark. The strategy largely underperformed due to negative attribution from sector allocation, primarily due to an overweight to Energy. The sharp drop in the price of crude oil caused significant spread widening in Energy. The overweight allocation to Energy detracted from returns with the price of oil falling from $105/barrel to $60/barrel.

City of London’s exposure contributed negatively to overall Portfolio performance for the fiscal year. The strategy gave back initial gains as closed-end fund discounts in the taxable bond space widened sharply in the last six weeks of the fiscal year end.

Western Asset’s opportunistic mortgage strategy performed in line with their stated benchmark. Exposure over the fiscal year was neither a contributor nor a detractor to overall portfolio performance.

| 1 | The Barclays Capital U.S. High Yield Ba/B 2% Issuer Capped Index is a market capitalization-weighted index that measures fixed rate non-investment grade debt securities of U.S. and non-U.S. corporations. No single issuer accounts for more than 2% of market cap. The index is calculated on a total return basis. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

24

The chart represents historical performance of a hypothetical investment of $10,000 in The Fixed Income Opportunity Portfolio for the 10-year period ended 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Barclays Capital U.S. High Yield Ba/B 2% Issuer Capped Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Fixed Income Opportunity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.37%

HC Advisors Shares 0.62%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

25

The U.S. Government Fixed Income Securities Portfolio

(Unaudited)

The U.S. Government Fixed Income Securities Portfolio (the “Portfolio”) managed by Mellon Capital Management Corporation returned 2.03% compared to 2.27% for the Barclays Capital U.S. Government Bond Index1 and 1.45% for the average fixed income manager in the Lipper2 universe of General U.S. Government Funds.

Within the U.S. Fixed Income markets, longer-duration fixed income indices tended to outperform shorter duration indices as the curve flattened during the first half of the fiscal year. The major U.S. indices representing government, securitized and corporate securities generated positive returns. Fixed income returns were meager during the second half of the fiscal year as investors tried to determine when the Federal Reserve may start to raise rates. The short-end of the curve remained relatively unchanged while the long-end moved higher in May and June contributing to losses. Lower-quality credits delivered positive results as investors continued to reach for yield. The BarCap Index, a broad measure of the U.S. bond market, gained 1.85% for the fiscal year end.

The Portfolio is structured to perform similarly to the benchmark. As such it uses a sampling methodology to select a subset of the index universe that maintains aggregate characteristics – duration, weighted average yield-to-maturity, and average credit quality in line with the benchmark. Since the Portfolio owns a subset of securities of the Index, there will necessarily be some tracking error.

| 1 | The Barclays Capital U.S. Government Bond Index is a broad-based unmanaged index that represents the general performance of U.S. Treasury and U.S. Government Agency debt securities. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

26

The chart represents historical performance of a hypothetical investment of $10,000 in The U.S. Government Fixed Income Securities Portfolio from 12/6/10 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Barclays Capital U.S. Government Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The U.S. Government Fixed Income Securities Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.18%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2015, expense ratios can be found in the financial highlights.

27

The Inflation Protected Securities Portfolio

(Unaudited)

The Inflation Protected Securities Portfolio (the “Portfolio”) managed by Mellon Capital Management Corporation returned -1.72% compared to -1.72% for the Barclays Capital U.S. Treasury Inflation Protected Securities Index1 and -2.92% for the average fixed income manager in the Lipper2 universe of Inflation Protected Bond Funds.

Within the U.S. Fixed Income markets, longer-duration fixed income indices tended to outperform shorter duration indices as the curve flattened during the first half of the fiscal year. The major U.S. indices representing government, securitized and corporate securities generated positive returns. Fixed income returns were meager during the second half of the fiscal year as investors tried to determine when the Federal Reserve may start to raise rates. The short-end of the curve remained relatively unchanged while the long-end moved higher in May and June contributing to losses. Lower-quality credits delivered positive results as investors continued to reach for yield. The BarCap Index, a broad measure of the U.S. bond market, gained 1.85% for the fiscal year end.

The Portfolio is currently structured to perform similarly to the benchmark. As such it utilizes a full replication approach to duplicate the fundamental characteristics and performance of the Barclays Capital U.S. Treasury Inflation Protected Securities Index.

| 1 | The Barclays Capital U.S. Treasury Inflation Protected Securities Index is an unmanaged index generally consisting of all inflation-protection securities issued by the U.S. Treasury. |

| 2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

28

The chart represents historical performance of a hypothetical investment of $10,000 in The U.S. Inflation Protected Securities Portfolio from 4/3/14 to 6/30/15, and represents the reinvestment of dividends and capital gains in the Portfolio.