-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-08918 | |

HC Capital Trust

(Exact name of Registrant as specified in charter)

Five Tower Bridge, 300 Barr Harbor Drive, 5th Floor, West Conshohocken, PA 19428

(Address of principal executive offices) (Zip code)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 800-242-9596 | |

| Date of fiscal year end: | June 30 | |

| Date of reporting period: | June 30, 2022 | |

Item 1. Reports to Stockholders.

Annual Report

The Value Equity Portfolio

The Growth Equity Portfolio

The Institutional U.S. Equity Portfolio

The Small Capitalization-Mid Capitalization Equity Portfolio

The ESG Growth Portfolio

The Catholic SRI Growth Portfolio

The International Equity Portfolio

The Institutional International Equity Portfolio

The Emerging Markets Portfolio

The Core Fixed Income Portfolio

The Corporate Opportunities Portfolio

The U.S. Government Fixed Income Securities Portfolio

The U.S. Corporate Fixed Income Securities Portfolio

The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio

The Short-Term Municipal Bond Portfolio

The Intermediate Term Municipal Bond Portfolio

The Intermediate Term Municipal Bond II Portfolio

June 30, 2022

HC CAPITAL TRUST | | Annual Report |

June 30, 2022

Table of Contents

| | |

Management Discussion of Portfolio Performance | 1 |

Shareholder Letter | 37 |

Portfolios of Investments | 38 |

Statements of Assets and Liabilities | 275 |

Statements of Operations | 280 |

Statements of Changes in Net Assets | 285 |

Financial Highlights | 291 |

Notes to Financial Statements | 298 |

Report of Independent Registered Public Accounting Firm | 331 |

Additional Information | 333 |

Trustees and Officers | 348 |

Fiscal Year 2022 Summary

General Market

(Unaudited — June 30, 2022)

The Portfolios of the HC Capital Trust provide clients with diversified exposure to multiple asset classes (for both taxable and institutional investors). The Portfolios diversify, where appropriate, across multiple independent investment advisory organizations (“Specialist Managers”) and strategies. The Portfolios enable the construction of custom asset allocation portfolios that best meet clients’ overall investment policies and objectives. Depending upon the objective, each Portfolio will generally seek to deliver performance that exceeds, or is in-line with, the benchmark for the Portfolio as well as a peer universe of mutual funds with similar investment strategies.

Financial markets experienced a great deal of volatility over the course of the Fiscal Year with the MSCI World Index down 13.75%. During 2021, the markets rose steadily on the heels of the economy’s reopening and worldwide fiscal and monetary stimulus. However, this policy-induced euphoria was brought to a halt in the winter of 2022 with Russia’s invasion of the Ukraine. As leading suppliers of oil and wheat to the global economy, the Russia-Ukraine war caused energy and commodity prices to skyrocket, exacerbating already elevated inflation and supply chain constraints. The Consumer Price Index increased by 9.1% year-over-year in June 2022 – the largest 12-month increase in over four decades. The Fed and other Central Banks rapidly increased interest rates to quell inflation expectations, increasing the prospects for a global recession. In June, the Fed increased the Fed Funds Target range to 1.50% - 1.75% and is now projecting a year-end Fed Funds rate of 3.40%.

There were few places to hide, geographically or by asset class. The S&P 500 declined over the twelve months ended June 30, 2022 by 10.62%. Value outperformed Growth stocks as inflation hit record levels. Rising oil and gas prices and higher U.S. Treasury yields caused energy and financial stocks to significantly outperform the rest of the market. The Russell 1000® Value Index declined by 6.82% compared to the Russell 1000® Growth Index which fell 18.77% during the Fiscal Year. The MSCI EAFE Index and the MSCI Emerging Markets Index declined by 17.33% and 25.00% in U.S. Dollar terms, respectively, for the Fiscal Year. The fixed income markets were similarly impacted, as the Fed’s tightening triggered a major adjustment in yields. The U.S. 10-year Treasury yield rose from 1.47% to 3.01% over the year. The Bloomberg U.S. Aggregate Bond Index declined by 10.29% during the year.

1

Each of the Portfolios provided results consistent with their stated objectives over the fiscal year ended June 30, 2022. The performance of each Portfolio is listed in the table below and detailed summaries of the objectives, managers, and results are contained in the subsequent sections.

HC Capital Trust Portfolios | | Fiscal Year

2022 Return | |

The Value Equity Portfolio | | | -13.10 | % |

Russell 1000® Value Index1 | | | -6.82 | % |

The Growth Equity Portfolio . | | | -16.30 | % |

Russell 1000® Growth Index1 | | | -18.77 | % |

The Institutional U.S. Equity Portfolio | | | -15.30 | % |

MSCI USA Index2 | | | -12.80 | % |

The Small Capitalization-Mid Capitalization Equity Portfolio | | | -22.74 | % |

Russell 2000® Index1 | | | -25.20 | % |

The ESG Growth Portfolio | | | -14.80 | % |

MSCI World Index3 | | | -13.94 | % |

The Catholic SRI Growth Portfolio | | | -16.17 | % |

MSCI World Index3 | | | -13.94 | % |

The International Equity Portfolio | | | -15.85 | % |

MSCI EAFE Index4 | | | -17.33 | % |

The Institutional International Equity Portfolio | | | -18.16 | % |

MSCI EAFE Index4 | | | -17.33 | % |

The Emerging Markets Portfolio | | | -23.87 | % |

MSCI EM Index5 | | | -25.00 | % |

The Core Fixed Income Portfolio | | | -11.58 | % |

Bloomberg U.S. Aggregate Bond Index6 | | | -10.29 | % |

The Corporate Opportunities Portfolio | | | -8.03 | % |

Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index7 | | | -12.44 | % |

The U.S. Government Fixed Income Securities Portfolio | | | -9.40 | % |

Bloomberg U.S. Government Bond Index8 | | | -8.82 | % |

The U.S. Corporate Fixed Income Securities Portfolio | | | -12.12 | % |

Bloomberg U.S. Corporate Bond Index9 | | | -14.19 | % |

The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio | | | -8.51 | % |

Bloomberg U.S. Securitized Index10 | | | -8.97 | % |

The Short-Term Municipal Bond Portfolio | | | -3.27 | % |

ICE BofA Merrill Lynch 1-3 Year Municipal Index11 | | | -2.15 | % |

The Intermediate Term Municipal Bond Portfolio | | | -5.98 | % |

Bloomberg 3-10 Year Blend (2-12) Total Return Index Unhedged12 | | | -5.95 | % |

The Intermediate Term Municipal Bond II Portfolio | | | -9.35 | % |

Bloomberg 5-Year General Obligation Municipal Index13 | | | -5.03 | % |

Bloomberg Managed Money Short/Intermediate Index14 | | | -6.14 | % |

In reviewing the table above and the remainder of this report, note that past performance does not guarantee future results. The remainder of this report contains more specific details about the performance, strategy and managers in each of the Portfolios.

2

1 | Each of the Russell indices is a market cap-weighted index of common stocks domiciled in the U.S. Unlike the S&P 500 Stock Index however, the basket of securities included in the various Russell indices is reconstituted each year. The Russell 3000® Index is constructed by ranking U.S. common stocks from largest to smallest market capitalization, and including in the index the top 3,000 stocks. The largest 1,000 stocks become the Russell 1000® Index and the next 2,000 stocks are included in the Russell 2000® Index. The Russell 1000® Growth Index is designed to measure the performance of those companies included in the Russell 1000® Index that have relatively higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Value® Index is designed to measure the performance of those companies included in the Russell 1000® Index that have relatively lower price-to- book ratios and lower forecasted growth values. |

2 | The MSCI USA Index is designed to measure the performance of the large and mid-cap segments of the U.S. market. With 627 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the U.S. |

3 | The MSCI World Index is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country and does not offer exposure to emerging markets. As of June 30, 2022, the MSCI World Index consisted of the following 23 development markets: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. |

4 | The Morgan Stanley Capital International Europe, Australasia, and Far East Index (“MSCI EAFE Index”) is an unmanaged, free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding Canada and the United States. As of June 30, 2022, the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. |

5 | The MSCI Emerging Markets Index (“MSCI EM Index”) is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of June 30, 2022, the MSCI EM Index consisted of the following 24 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, South Korea, Taiwan, Thailand, Turkey and United Arab Emirates. |

6 | The Bloomberg U.S. Aggregate Bond Index covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. |

7 | The Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index is designed to mirror the investable universe of the U.S. dollar denominated high yield debt market. |

8 | The Bloomberg U.S. Government Bond Index is a broad-based index that represents the general performance of U.S. Treasury and U.S. Government agency debt securities. The index includes U.S. dollar-denominated, fixed-rate, nominal U.S. Treasuries, and U.S. agency debentures. |

9 | The Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD- denominated securities publicly issued by U.S. and non-U.S. industrial, utility, and financial issuers. |

10 | The Bloomberg U.S. Securitized Index tracks the performance of mortgage-backed pass-through securities issued by Ginnie Mae, Fannie Mae and Freddie Mac, investment-grade bonds and asset-backed securities. |

11 | The ICE Bank of America (“BofA”) Merrill Lynch 1-3 Year Municipal Index is an equal-weighted index that tracks the total return performance of the domestic U.S. municipal market. The index consists of investment-grade, publicly traded, fixed-rate and coupon bearing municipal securities with a maturity of one to three years. |

12 | The Bloomberg 3-10 Year Blend (2-12) Total Return Index Unhedged is an index composed of bonds with maturities ranging between 2 and 12 years. |

13 | The Bloomberg 5-Year General Obligations Municipal Index is an unmanaged index generally representative of investment grade fixed-rate debt obligations issued by state and local government entities, with maturities of no more than six years. |

14 | The Bloomberg Managed Money Short/Intermediate Index is a rules-based and market-value weighted index that measures the performance of the publicly traded municipal bonds that cover the USD-denominated short/intermediate term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. |

3

The Value Equity Portfolio

(Unaudited)

The Value Equity Portfolio (the “Portfolio”) managed by Parametric Portfolio Associates, LLC (“Parametric”) returned -13.10% for the fiscal year compared to -6.82% for the Russell 1000® Value Index1 and -6.00% for the average manager in the Lipper2 universe of Large Cap Value Funds.3

The Portfolio underperformed its benchmark over the period. The tax-managed strategy run by Parametric focuses on minimizing taxable gains subject to a tracking error constraint. The tracking error generated by tax minimization created modest before-tax underperformance during the period.

The Portfolio is able to diversify across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent an after-tax manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolio expects to attribute some of its performance to this cyclicality of styles.

1 | The Russell 1000® Value Index measures the performance of those companies included in the Russell 1000® Index with lower price-to-book ratios and lower forecasted growth rates. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Echo Street Capital Management LLC, Frontier Capital Management Company, LLC and Mellon Investments Corporation were also under contract to manage the Portfolio but did not have assets allocated to them. |

4

The chart represents historical performance of a hypothetical investment of $10,000 in The Value Equity Portfolio for the 10- year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 1000® Value Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Value Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.22%

HC Advisors Shares 0.47%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

5

The Growth Equity Portfolio

(Unaudited)

The Growth Equity Portfolio (the “Portfolio”) managed by Jennison Associates, LLC (“Jennison”) and Parametric Portfolio Associates, LLC (“Parametric”) returned -16.30% for the fiscal year compared to -18.77% for the Russell 1000® Growth Index1 and -24.50% for the average manager in the Lipper2 universe of Large Cap Growth Funds.3

The Portfolio outperformed its benchmark over the period. The tax-managed strategy run by Parametric focuses on minimizing taxable gains subject to a tracking error constraint. The tracking error generated by tax minimization created before-tax outperformance during the period. Jennison underperformed the benchmark while Parametric outperformed the benchmark. Jennison’s underperformance was driven by manager security selection

The Portfolio is diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolio expects to attribute some of its performance to this cyclicality of styles.

1 | The Russell 1000® Growth Index measures the performance of those companies included in the Russell 1000® Index with higher price-to-book ratios and higher forecasted growth rates. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Echo Street Capital Management LLC and Mellon Investments Corporation were also under contract to manage the Portfolio but did not have assets allocated to them. |

6

The chart represents historical performance of a hypothetical investment of $10,000 in The Growth Equity Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 1000® Growth Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Growth Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.27%

HC Advisors Shares 0.52%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

7

The Institutional U.S. Equity Portfolio

(Unaudited)

The Institutional U.S. Equity Portfolio (the “Portfolio”) managed by Echo Street Capital Management LLC (“Echo Street”), Jennison Associates, LLC (“Jennison”), Mellon Investments Corporation (“Mellon”), Parametric Portfolio Associates, LLC and Wellington Management Company, LLP (“Wellington”) returned -15.30% for the fiscal year compared to -12.80% for the MSCI USA Index1 and -13.94% for the average manager in the Lipper2 universe of Multi-Cap Core Funds.3

The Portfolio modestly underperformed the benchmark primarily due to the performance of Echo Street and Jennison. Echo Street and Jennison’s growth bias resulted in relative underperformance as growth stocks lagged the broad market. Mellon performed in-line with the benchmark and Wellington outperformed the benchmark. Wellington’s outperformance was driven primarily by sector allocation.

The Portfolio is diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolio expects to attribute some of its performance to this cyclicality of styles.

1 | The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the U.S. market. With 627 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the U.S. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Frontier Capital Management Company, LLC and Pacific Investment Management Company, LLC were also under contract to manage the Portfolio but did not have assets allocated to them. |

8

The chart represents historical performance of a hypothetical investment of $10,000 in The Institutional U.S. Equity Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MSCI USA Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Institutional U.S. Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.29%

HC Advisors Shares 0.54%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

9

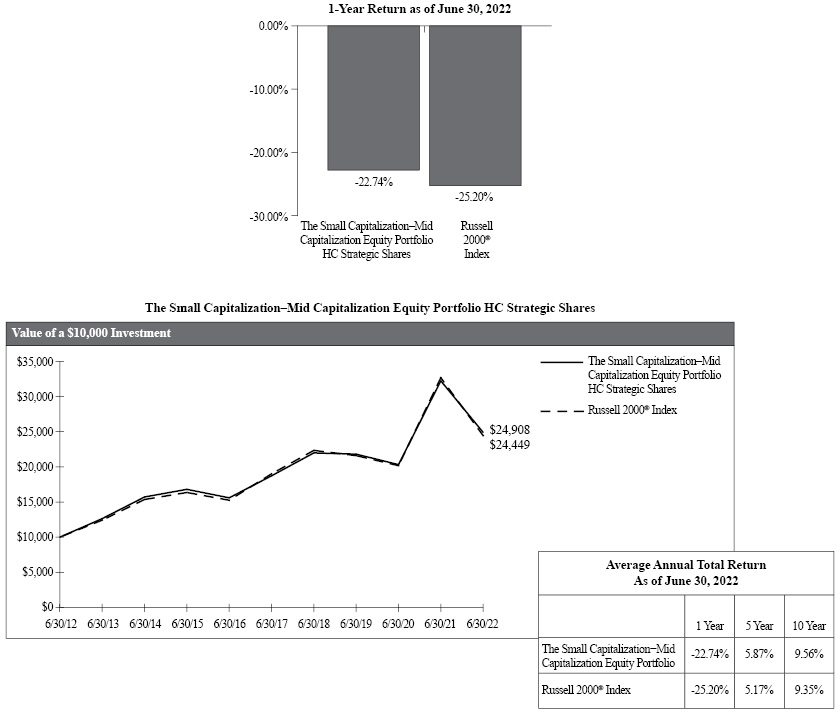

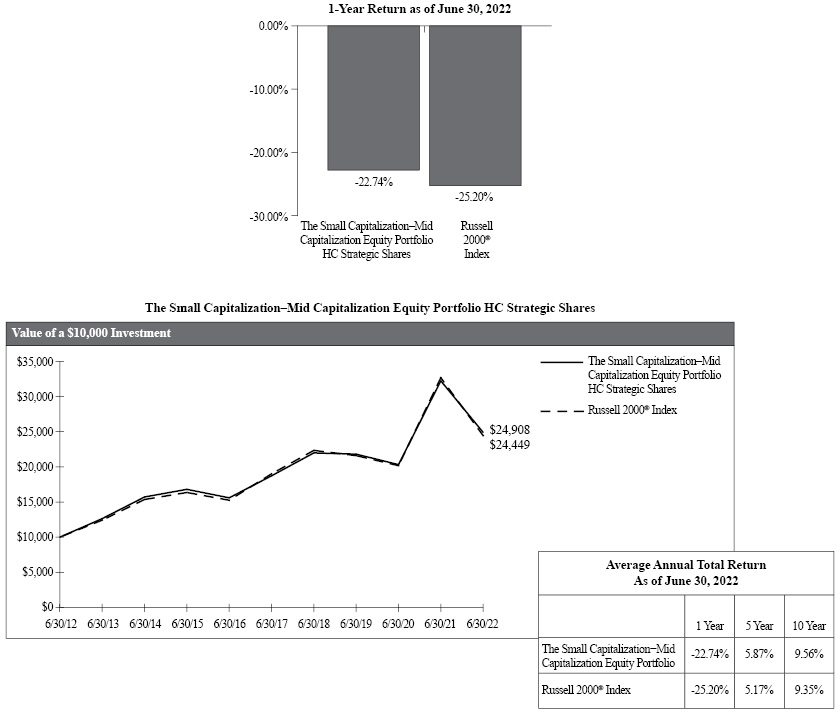

The Small Capitalization-Mid Capitalization Equity Portfolio

(Unaudited)

The Small Capitalization-Mid Capitalization Equity Portfolio (the “Portfolio”) managed by Frontier Capital Management Company, LLC (“Frontier”) and Parametric Portfolio Associates, LLC (“Parametric”) returned -22.74% for the fiscal year compared to -25.20% for the Russell 2000® Index1 and -15.77% for the average manager in the Lipper2 universe of Small Cap Core Funds.3

The Portfolio outperformed its benchmark over the period. The tax-managed strategy run by Parametric focuses on minimizing taxable gains subject to a tracking error constraint. The tracking error generated by tax minimization contributed to before-tax outperformance during the period. Frontier outperformed the benchmark as well as a result of manager security selection. During the period, all securities in the Frontier portfolio were liquidated for tax loss harvesting purposes and the contract was terminated.

The Portfolio is diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some managers and styles will be leading at times, while others are lagging and vice versa. The Portfolio expects to attribute some of its performance to this cyclicality of styles.

1 | The Russell 2000® Index measures the performance of smaller capitalization U.S. companies. The largest 1,000 stocks become the Russell 1000® Index and the next 2,000 stocks become the Russell 2000® Index. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Mellon Investments Corporation was also under contract to manage the Portfolio but did not have assets allocated to it. |

10

The chart represents historical performance of a hypothetical investment of $10,000 in The Small Capitalization–Mid Capitalization Equity Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Russell 2000® Index, which represents the performance of domestically traded common stocks of small to mid-sized companies. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Small Capitalization-Mid Capitalization Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.50%

HC Advisors Shares 0.75%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

11

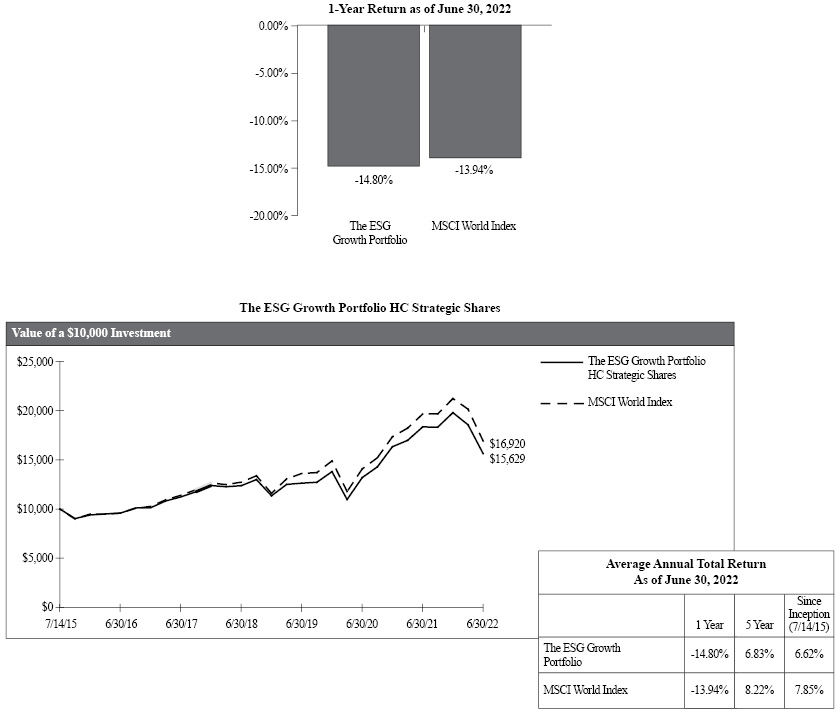

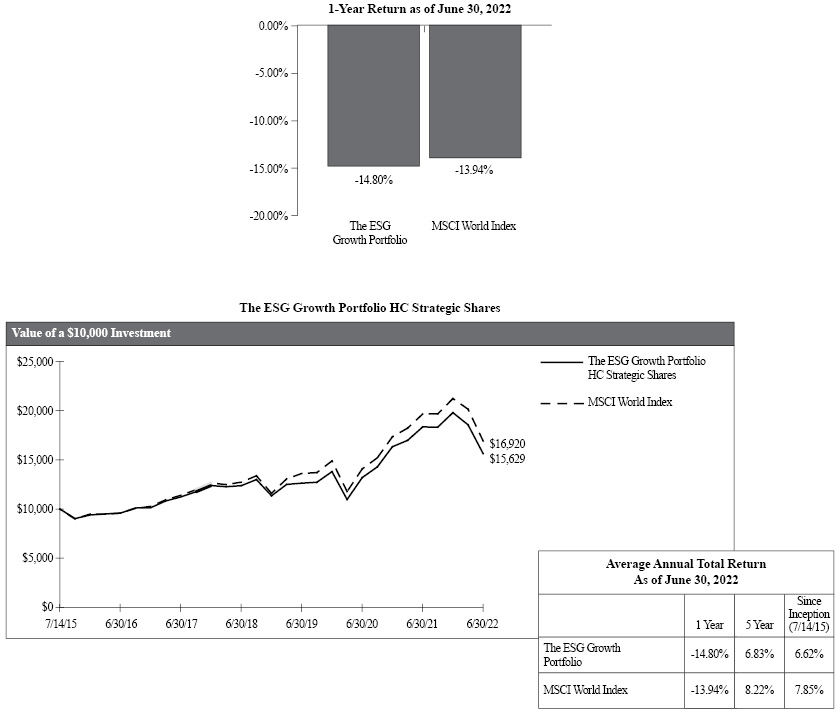

The ESG Growth Portfolio

(Unaudited)

The ESG Growth Portfolio (the “Portfolio”) managed by Mellon Investments Corporation (“Mellon”), Parametric Portfolio Associates, LLC and RBC Global Asset Management (U.K.) Limited (“RBC GAM”) returned -14.80% for the fiscal year compared to -13.94% for the MSCI World Index.1, 2

The Portfolio’s underperformance can be attributed to the RBC GAM strategy. Its strategy expressed a growth bias that contributed to its underperformance over the period, as growth positions generally underperformed the market as a whole. RBC GAM considers each potential investment on the strengths of its business model, opportunity to take market share, end market growth, and management & ESG practices. The Global screening strategy, which was run by Mellon, modestly outperformed.

The Portfolio is diversified across multiple managers and strategies to ensure proper portfolio diversification, with the goal of providing superior long-term returns in as stable and consistent a manner as possible. As a result, it is expected that some styles will be leading at times, while others are lagging and vice versa. The Portfolio expects to attribute some of its performance to this cyclicality of styles.

The Portfolio requires that the underlying managers integrate ESG criteria in their investment selection. Mellon uses third party ESG data to better understand the environmental, social and governance risks and opportunities when making investment decisions.

1 | The MSCI World Index is an unmanaged index that is designed to capture large and mid-cap representation across 23 developed markets countries. The Index covers approximately 85% of the free float-adjusted market capitalization in each of the following countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | During the fiscal year, Agincourt Capital Management, LLC was also under contract to manage the Portfolio but did not have assets allocated to it. |

12

The chart represents historical performance of a hypothetical investment of $10,000 in The ESG Growth Portfolio from 7/14/15 to 6/30/22 and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MCSI World Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The ESG Growth Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.36%

HC Advisors Shares 0.61%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

13

The Catholic SRI Growth Portfolio

(Unaudited)

The Catholic SRI Growth Portfolio (the “Portfolio”) managed by Mellon Investments Corporation (“Mellon”) returned -16.17% for the fiscal year compared to -13.94% for the MSCI World Index.1, 2

The Portfolio’s underperformance can be attributed primarily to the screening that is required to adhere to Catholic values, which is managed by Mellon.

The Portfolio is diversified across securities to ensure proper portfolio diversification, with the goal of providing competitive long-term returns in as consistent a manner as possible. As a result, it is expected that some styles will be leading at times, while others are lagging and vice versa. The Portfolio expects to participate in this cyclicality of styles by maintaining market exposure comparable to MSCI World Index.

The Portfolio requires that the underlying managers integrate Catholic values in their investment selections, which includes negative screens. Mellon uses third party data to implement the negative screens in the Portfolio.

1 | The MSCI World Index is an unmanaged index that is designed to capture large and mid-cap representation across 23 developed markets countries. The Index covers approximately 85% of the free float-adjusted market capitalization in each of the following countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | During the fiscal year, Agincourt Capital Management, LLC and Parametric Portfolio Associates, LLC were also under contract to manage the Portfolio but did not have assets allocated to them. |

14

The chart represents historical performance of a hypothetical investment of $10,000 in The Catholic SRI Growth Portfolio from 1/12/16 to 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MCSI World Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Catholic SRI Growth Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.38%

HC Advisors Shares 0.63%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

15

The International Equity Portfolio

The Institutional International Equity Portfolio

(Unaudited)

The International Equity Portfolio (the “Portfolio”) managed by Parametric Portfolio Associates, LLC (“Parametric”) returned -15.85% for the fiscal year compared to -17.33% for the MSCI EAFE Index1 and -17.45% for the average manager in the Lipper2 universe of International Large-Cap Core Funds.3

The Portfolio outperformed the benchmark and the peer group. The tax-managed strategy run by Parametric focuses on minimizing taxable gains subject to a tracking error constraint. The tracking error generated by tax minimization contributed to before-tax outperformance during the period.

The Institutional International Equity Portfolio (the “Institutional Portfolio”) managed by City of London Investment Management Company, Limited (“City of London”), Mellon Investments Corporation (“Mellon”) and Parametric returned -18.16% for the fiscal year compared to -17.33% for the MSCI EAFE Index1 and -17.45% for the average manager in the Lipper2 universe of International Large-Cap Core Funds.3

The Institutional Portfolio underperformed its benchmark and its peer group. The majority of the assets are managed by Mellon and Parametric with a mandate to provide passive exposure to the benchmark index (MSCI EAFE Index). Parametric replicates the benchmark index using futures. This allows the Portfolio to have cash on hand to meet redemptions and invest opportunistically. City of London underperformed due to an unfavorable environment for its closed-end fund strategy that seeks portfolio appreciation derived from a top-down macro process, bottom-up stock picking, and a narrowing of the closed-end fund discount to net asset value.

1 | The Morgan Stanley Capital International Europe, Australasia, and Far East Index (“MSCI EAFE Index”) is a market value weighted index designed to measure the overall condition of developed overseas equities markets. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, WCM Investment Management LLC was also under contract to manage the Portfolios but did not have assets allocated to it. City of London Investment Management Company, Limited and Mellon Investments Corporation were also under contract to manage the Portfolio but did not have assets allocated to them. Pacific Investment Management Company, LLC was also under contract to manage the Institutional Portfolio but did not have assets allocated to it. |

16

The chart represents historical performance of a hypothetical investment of $10,000 in The International Equity Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MSCI EAFE Index, which represents the performance of the major stock markets in those regions. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The International Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.25%

HC Advisors Shares 0.50%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

17

The chart represents historical performance of a hypothetical investment of $10,000 in The Institutional International Equity Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MSCI EAFE Index, which represents the performance of the major stock markets in those regions. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Institutional International Equity Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.40%

HC Advisors Shares 0.65%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

18

The Emerging Markets Portfolio

(Unaudited)

The Emerging Markets Portfolio (the “Portfolio”) managed by Mellon Investments Corporation (“Mellon”), Parametric Portfolio Associates, LLC (“Parametric”), RBC Global Asset Management (U.K.) Limited (“RBC GAM”) and XY Investments (HK) Limited (“XY Investments”) returned -23.87% for the fiscal year compared to -25.00% for the MSCI EM Index1 and -28.32% for the average manager in the Lipper2 universe of Emerging Markets Funds.3

For the fiscal year 2022, the Portfolio outperformed both the benchmark and the average manager in the industry universe. The outperformance was primarily due to the quantitative strategy run by XY Investments utilizing equity-based total return swaps. During the fiscal year, XY Investment’s style benchmark (MSCI China A Onshore Net Return Index USD) returned -14.00% compared to -25.00% for the MSCI EM Index.

RBC GAM was terminated during the reporting period. Following an extensive review by the investment strategy group, the decision to terminate the manager was made due to lower conviction in the manager’s strategy to add value over the emerging markets equity opportunity set.

The Portfolio provides broad access to international emerging markets equity. The Portfolio is managed with multiple managers to provide diversification of manager style as well as diversification of firm specific risks. Mellon’s strategy provides passive exposure to the MSCI EM Index. The Portfolio diversifies amongst a large number of names and across geographies and sectors. Parametric replicates benchmark index (MSCI Emerging Markets Index) using futures. This allows the Portfolio to have cash on hand to meet redemptions and invest opportunistically.

1 | The Morgan Stanley Capital International Emerging Markets Index (“MSCI EM Index”) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of June 30, 2022, the MSCI EM Index consisted of the following 24 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, South Korea, Taiwan, Thailand, Turkey and United Arab Emirates. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, City of London Investment Management Company, Limited was also under contract to manage the Portfolio but did not have assets allocated to it. |

19

The chart represents historical performance of a hypothetical investment of $10,000 in The Emerging Markets Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the MSCI EM Index, which represents the performance of the major stock markets in those regions. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Emerging Markets Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.52%

HC Advisors Shares 0.77%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

20

The Core Fixed Income Portfolio

(Unaudited)

The Core Fixed Income Portfolio (the “Portfolio”) managed by Agincourt Capital Management, LLC (“Agincourt”) and Mellon Investments Corporation returned -11.58% for the fiscal year compared to -10.29% for the Bloomberg U.S. Aggregate Bond Index1 (“BarCap”) and -11.09% for the average fixed income manager in the Lipper2 universe of Core Bond Funds.3

The Portfolio underperformed due to an overweight allocation to Agincourt’s Corporate Credit strategy which suffered from rising credit spreads as well as rising rates. The U.S. bond market declined over the prior year as intermediate government rates rose from 0.89% to 3.04% (U.S. Government 5-year Note).

The Portfolio is allocated across the three major sectors of the BarCap Index: governments, credit, and asset-backed securities. The government and asset backed sectors are passively managed to provide performance in-line with their respective benchmarks. Actual results for the government and asset-backed portfolios may vary marginally from the underlying benchmarks because of cash flows and because for practical purposes, the portfolios hold a representative group of the securities in the benchmarks and do not seek to fully replicate all of the individual holdings. The credit portfolio has a bit more flexibility to vary from the index by avoiding credits that the manager feels have adverse price risk. The allocations across the three sectors will vary over time based upon the relative attractiveness of the sectors. In general, the Portfolio maintains aggregate characteristics – duration, weighted average yield-to-maturity, and average credit quality comparable to the benchmark.

1 | The Bloomberg U.S. Aggregate Bond Index includes more than 8,000 taxable government, investment-grade corporate and mortgage backed securities. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Pacific Investment Management Company, LLC and Parametric Portfolio Associates, LLC were also under contract to manage the Portfolio but did not have assets allocated to them. |

21

The chart represents historical performance of a hypothetical investment of $10,000 in The Core Fixed Income Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg U.S. Aggregate Bond Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Core Fixed Income Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.34%

HC Advisors Shares 0.59%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

22

The Corporate Opportunities Portfolio

(Unaudited)

The Corporate Opportunities Portfolio (the “Portfolio”) managed by Parametric Portfolio Associates, LLC (“Parametric”) returned -8.03% for the fiscal year compared to -12.44% for the Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index1 and -12.19% for the average manager in the Lipper2 universe of High Yield Funds.3

The Portfolio outperformed the benchmark and its peer group due to the Parametric futures strategy which seeks to replicate the risk profile of the benchmark. Parametric manages a portfolio of futures contracts that reflects the underlying risks of the asset class. In the fiscal year, high yield bonds dramatically underperformed the instruments chosen to replicate the risk exposure of the benchmark. The Adviser also directed the investment of a portion of the Portfolio’s assets in a private loan participation that contributed positively due to a higher yield than the benchmark.

The Portfolio is designed to provide investors with higher returns over time than traditional fixed income investments primarily through investment in a diversified portfolio of high yield bonds. The Portfolio may also opportunistically invest in international bonds, convertible bonds, preferred stocks, treasury inflation bonds, loan participations and fixed and floating rate loans.

The Portfolio has flexibility to vary from the index by avoiding credits that the managers feel have adverse price risk.

1 | The Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index is a market capitalization-weighted index that measures fixed rate non- investment grade debt securities of U.S. and non-U.S. corporations. No single issuer accounts for more than 2% of market cap. The index is calculated on a total return basis. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, City of London Investment Management Company, Limited, Fort Washington Investment Advisors, Inc., Mellon Investments Corporation, Pacific Investment Management Company, LLC and Western Asset Management Company, Ltd. were also under contract to manage the Portfolio but did not have assets allocated to them. |

23

The chart represents historical performance of a hypothetical investment of $10,000 in The Corporate Opportunities Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Corporate Opportunities Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.32%

HC Advisors Shares 0.57%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

24

The U.S. Government Fixed Income Securities Portfolio

(Unaudited)

The U.S. Government Fixed Income Securities Portfolio (the “Portfolio”) managed by Mellon Investments Corporation and Parametric Portfolio Associates, LLC returned -9.40% for the fiscal year compared to -8.82% for the Bloomberg U.S. Government Bond Index1 and -9.02% for the average fixed income manager in the Lipper2 universe of General U.S. Government Funds.

The Portfolio slightly underperformed the benchmark due to a slightly longer duration positioning relative to the Benchmark. As yields moved up, longer duration securities underperformed those with less duration. The Portfolio is structured to perform similarly to the benchmark. As such it uses a sampling methodology to select a subset of the index universe that maintains aggregate characteristics – duration, weighted average yield-to-maturity, and average credit quality in-line with the benchmark. Since the Portfolio owns a subset of securities of the Index, there will necessarily be some tracking error.

The U.S. Government bond market posted weak performance for the fiscal year as the rates normalized from the extreme lows of the COVID crisis, pushing up long rates and concurrently pushing down prices (which move inversely to rates). The rise in global bond yields over the past year is consistent with stronger than expected inflation data and stronger growth.

1 | The Bloomberg U.S. Government Bond Index is a broad-based index that represents the general performance of U.S. Treasury and U.S. Government Agency debt securities. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

25

The chart represents historical performance of a hypothetical investment of $10,000 in The U.S. Government Fixed Income Securities Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg U.S. Government Bond Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The U.S. Government Fixed Income Securities Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.20%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

26

The U.S. Corporate Fixed Income Securities Portfolio

(Unaudited)

The U.S. Corporate Fixed Income Securities Portfolio (the “Portfolio”) managed by Agincourt Capital Management, LLC (“Agincourt”) returned -12.12% for the fiscal year compared to -14.19% for the Bloomberg U.S. Corporate Bond Index1 and -13.79% for the average fixed income manager in the Lipper2 universe of Corporate Debt Funds BBB-Rated Funds.3 Agincourt modestly underperformed the benchmark by 17 basis points while maintaining duration, weighted average yield-to-maturity, and average credit quality in line with the benchmark. The Adviser also directed the investment of a portion of the Portfolio’s assets in private loan participation vehicles that contributed positively to performance.

1 | The Bloomberg U.S. Corporate Bond Index covers USD denominated, investment-grade, fixed-rate, taxable securities sold by industrial, utility and financial issuers. It includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements. Securities in the index roll up to the U.S. Credit and U.S. Aggregate indices. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Mellon Investments Corporation, Pacific Investment Management Company, LLC and Parametric Portfolio Associates, LLC were also under contract to manage the Portfolio but did not have assets allocated to them. |

27

The chart represents historical performance of a hypothetical investment of $10,000 in The U.S. Corporate Fixed Income Securities Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg U.S. Corporate Bond Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The U.S. Corporate Fixed Income Securities Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.22%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

28

The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio

(Unaudited)

The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio (the “Portfolio”) managed by Mellon Investments Corporation returned -8.51% for the fiscal year compared to -8.97% for the Bloomberg U.S. Securitized Index1 and -8.31% for the average fixed income manager in the Lipper2 universe of U.S. Mortgage Funds.3

The bond market posted negative performance for the fiscal year as rates rose from extremely low levels during the fiscal year. The rise in global bond yields over the past year is consistent with stronger inflation trends and stronger growth.

The Portfolio is structured to simulate the performance of the benchmark. As such the Portfolio maintains aggregate characteristics – duration, weighted average yield-to-maturity, and average credit quality in line with the benchmark. The Portfolio holds a subset of the securities represented in the benchmark and as a result the underperformance after fees and expenses is attributable to the tracking error of not holding every security in the index.

1 | The Bloomberg U.S. Securitized Index is an index that tracks the performance of mortgage-backed pass through securities issued by Ginnie Mae, Fannie Mae and Freddie Mac, investment-grade bonds and asset-backed securities. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Pacific Investment Management Company, LLC and Parametric Portfolio Associates, LLC were also under contract to manage the Portfolio but did not have assets allocated to them. |

29

��

The chart represents historical performance of a hypothetical investment of $10,000 in The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg U.S. Securitized Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The U.S. Mortgage/Asset Backed Fixed Income Securities Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.26%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

30

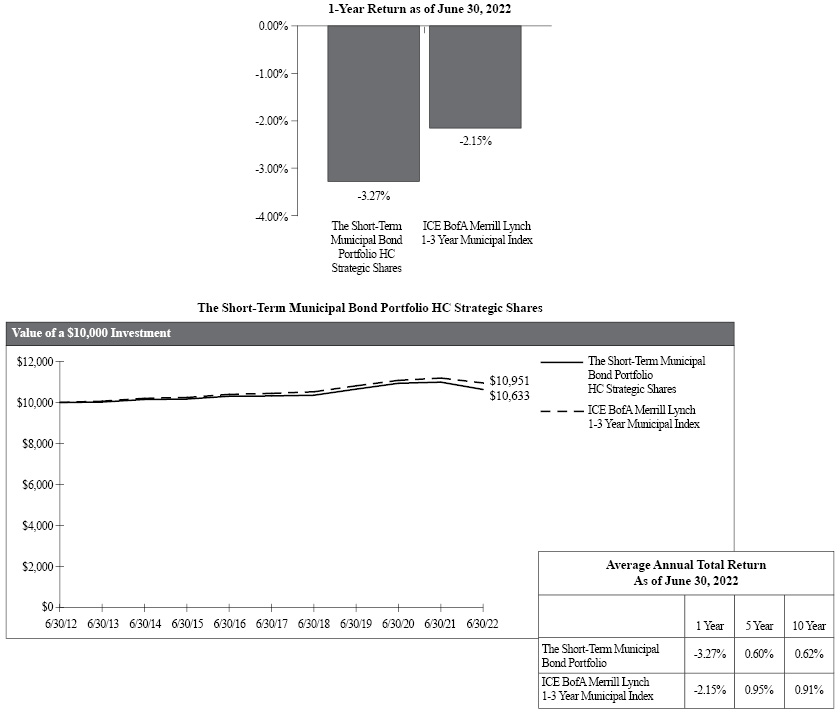

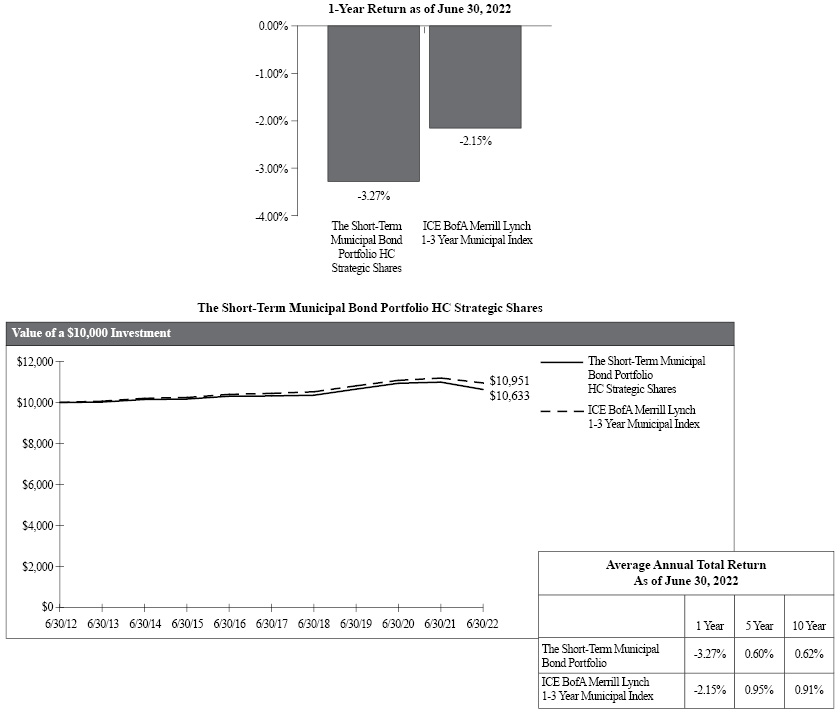

The Short-Term Municipal Bond Portfolio

(Unaudited)

The Short-Term Municipal Bond Portfolio (the “Portfolio”) managed by Breckinridge Capital Advisors, Inc. returned -3.27% for the fiscal year compared to -2.15% for the ICE BofA Merrill Lynch 1-3 Year Municipal Index1 and -2.64% for the average manager in the Lipper2 universe of Short Municipal Debt Funds.

The Portfolio underperformed its benchmark and its peer group due to an intentional overweight to longer duration bonds than the benchmark.

1 | The ICE BofA Merrill Lynch 1-3 Year Municipal Index is an equal-weighted index that tracks the total return performance of the domestic U.S. municipal market. The index consists of investment grade, publicly traded, fixed-rate and coupon bearing municipal securities with a maturity of one to three years. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that organization compiles performance on mutual funds and further categorizes them by investment objective. |

31

The chart represents historical performance of a hypothetical investment of $10,000 in The Short-Term Municipal Bond Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the ICE BofA Merrill Lynch 1-3 Year Municipal Index. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Short-Term Municipal Bond Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.28%

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

32

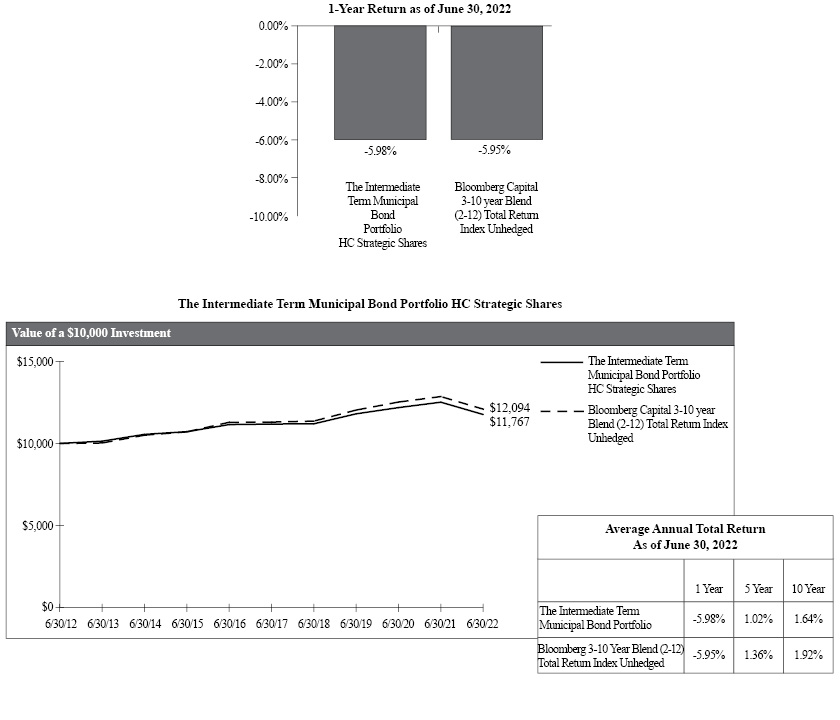

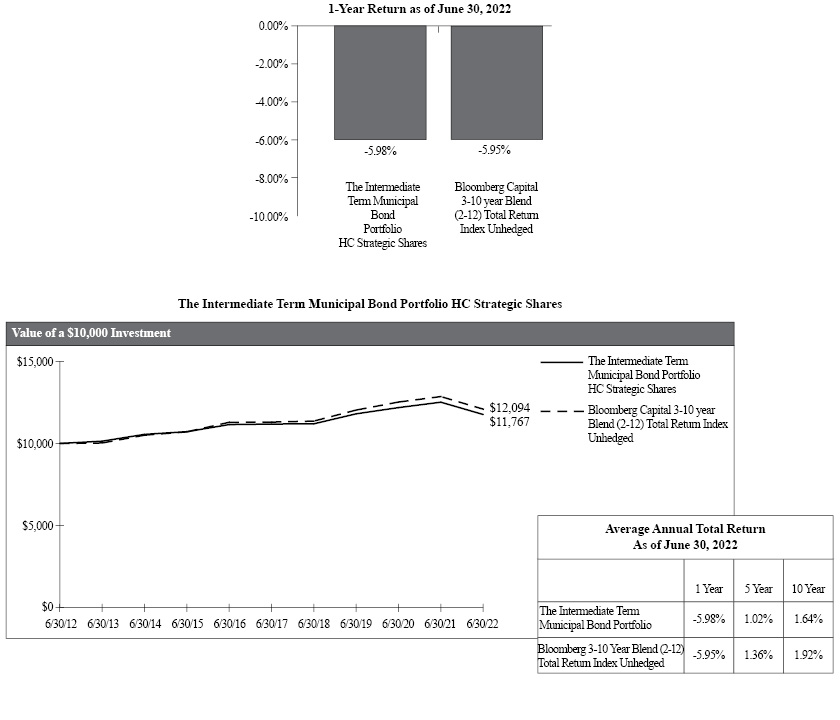

The Intermediate Term Municipal Bond Portfolio

(Unaudited)

The Intermediate Term Municipal Bond Portfolio managed by Insight North America LLC (“Insight”) returned -5.98% for the fiscal year compared to -5.95% for the Bloomberg 3-10 Year Blend (2-12) Total Return Index Unhedged1 and -7.71% for the average manager in the Lipper2 universe of Intermediate Municipal Debt Funds.3

The Insight strategy performed similarly to the benchmark during the twelve-month reporting period. An overweight to revenue bonds compared to general obligation bonds, and an underweight to higher rated issues were detractors contributing to the underperformance during the fiscal year.

1 | The Bloomberg 3-10 Year Blend (2-12) Total Return Index is an index composed of bonds with maturities ranging between 2 and 12 years. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

3 | During the fiscal year, Breckinridge Capital Advisors, Inc., City of London Investment Management Company, Limited and Parametric Portfolio Associates, LLC were also under contract to manage the Portfolio but did not have assets allocated to them. |

33

The chart represents historical performance of a hypothetical investment of $10,000 in The Intermediate Term Municipal Bond Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg 3-10 Year Blend (2-12) Total Return Index Unhedged. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Intermediate Term Municipal Bond Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.29%

HC Advisors Shares 0.54%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

34

The Intermediate Term Municipal Bond II Portfolio

(Unaudited)

The Intermediate Term Municipal Bond II Portfolio (the “Portfolio”) managed by Breckinridge Capital Advisors, Inc. (“Breckinridge”) and City of London Investment Management Company, Limited (“City of London”) returned -9.35% for the fiscal year compared to -5.03% for the Bloomberg 5-Year General Obligation Municipal Index1, -6.14% for the Bloomberg Managed Money Short/Intermediate Index2 and -7.71% for the average manager in the Lipper3 universe of Intermediate Municipal Debt Funds.4

The principal performance detractor was the allocation to City of London’s strategy. City of London manages a portfolio of closed-end funds which each hold underlying portfolios of municipal bonds. The strategy has under-performed dramatically from widening discounts to net asset value and declining net asset values due to levered exposure to duration in the underling funds held in the strategy.

The Breckinridge strategy underperformed the benchmark and outperformed the peer universe. The Portfolio’s higher quality bias modestly detracted from performance, which was offset by a modest contribution from security selection. Breckinridge maintains a diversified portfolio structure invested only in high-grade, intermediate-term municipal bonds.

1 | The Bloomberg 5-Year General Obligation Municipal Index is an index generally representative of investment grade fixed rate debt obligations issued by state and local government entities, with maturities of no more than six years. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

2 | The Bloomberg Managed Money Short/Intermediate Index is a rules-based and market-value weighted index that measures the performance of the publicly traded municipal bonds that cover the USD-denominated short/intermediate term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. This index is unmanaged, thus the index results do not reflect the impact of expenses associated with any investment in securities, such as brokerage commission or other transaction costs. Benchmark performance is shown for comparison purposes only, as it is not possible to invest directly in a securities index. |

3 | Lipper, Inc. is an independent statistical monitoring organization that compiles performance on mutual funds and further categorizes them by investment objective. |

4 | During the fiscal year, Parametric Portfolio Associates, LLC was also under contract to manage the Portfolio but did not have assets allocated to it. |

35

The chart represents historical performance of a hypothetical investment of $10,000 in The Intermediate Term Municipal Bond II Portfolio for the 10-year period ended 6/30/22, and represents the reinvestment of dividends and capital gains in the Portfolio.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call (800) 242-9596.

The Portfolio’s performance above is compared to the Bloomberg 5-Year General Obligation Municipal Index and the Bloomberg Managed Money Short/Intermediate Index. The indices are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees, or the deduction of taxes. An investor cannot invest directly in an index. The performance of The Intermediate Term Municipal Bond II Portfolio reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on the Portfolio’s distributions or redemptions of the Portfolio’s shares.

Expense Ratio

HC Strategic Shares 0.59%

HC Advisors Shares 0.84%1

1 | HC Advisors Shares include Distribution Plan fees of 0.25% which are voluntarily waived by the Adviser. Such waiver is not reflected in the expense ratio shown. |

This information is included in the most current prospectus available to current and prospective shareholders of the Portfolio. Additional information pertaining to the June 30, 2022, expense ratios can be found in the financial highlights.

36

Conclusion

The performance of the Portfolios for the fiscal year was consistent with our expectations. We are maintaining a neutral weight to global equities. While corporate earnings were incredibly strong during the fiscal year, companies face multiple headwinds in the year ahead. Wages and input costs are increasing, interest rates are rising and surveys point to a slowdown in business activities. As the economy slows, earnings expectations are likely to be revised downwards, which could weigh on investor sentiment. However, equity valuations remain attractive as the equity risk premium for U.S., International Developed and Emerging Markets is above its long-term average.