UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08932

Artisan Funds, Inc.

(Exact name of registrant as specified in charter)

875 East Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

(Address of principal executive offices) (Zip Code)

| | |

| Janet D. Olsen | | Kevin J. McCarthy |

| Artisan Funds, Inc. | | Bell, Boyd & Lloyd LLC |

| 875 East Wisconsin Avenue, #800 | | Three First National Plaza, #3100 |

| Milwaukee, Wisconsin 53202 | | Chicago, IL 60602 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (414) 390-6100

Date of fiscal year end: 09/30/05

Date of reporting period: 09/30/05

Item 1. | Reports to Shareholders. |

ANNUAL

R E P O R T

SEPTEMBER 30, 2005

ARTISAN INTERNATIONAL FUND

ARTISAN INTERNATIONAL SMALL CAP FUND

ARTISAN INTERNATIONAL VALUE FUND

ARTISAN MID CAP FUND

ARTISAN MID CAP VALUE FUND

ARTISAN SMALL CAP FUND

ARTISAN SMALL CAP VALUE FUND

ARTISAN FUNDS, INC.

INVESTOR SHARES

ARTISAN FUNDS

P.O. BOX 8412

BOSTON, MA 02266-8412

This report and the audited financial statements contained herein are provided for the general information of the shareholders of Artisan Funds. Investors should consider carefully before investing each Fund’s investment objective, risks and charges and expenses. For a prospectus, which contains that information and more information about each Fund, please call 800.344.1770 or visit our website at www.artisanfunds.com. Read it carefully before you invest or send money.

Company discussions are for illustration only and are not intended as recommendations of individual stocks. The discussions present information about the companies believed to be accurate, and the views of the portfolio managers, as of September 30, 2005. That information and those views may change, and the Funds disclaim any obligation to advise shareholders of any such changes. Artisan International Fund and Artisan Mid Cap Fund offer institutional classes of shares for institutional investors meeting certain minimum investment requirements. A report on each institutional class is available under separate cover.

Artisan Funds offered through Artisan Distributors LLC, member NASD.

TABLE OF CONTENTS

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/05)

| | | | | | | | | | | | | | | |

| | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

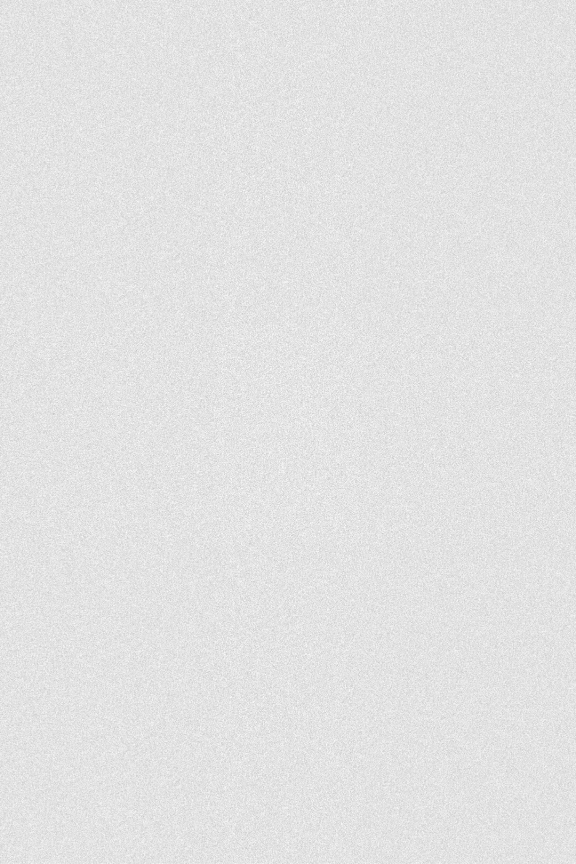

Artisan International Fund (inception 12/28/95) | | 26.97 | % | | 20.48 | % | | 1.68 | % | | NA | | | 13.38 | % |

Artisan International Small Cap Fund (inception 12/21/01) | | 42.13 | | | 38.61 | | | NA | | | NA | | | 26.38 | |

Artisan International Value Fund (inception 9/23/02) | | 22.71 | | | 33.00 | | | NA | | | NA | | | 32.41 | |

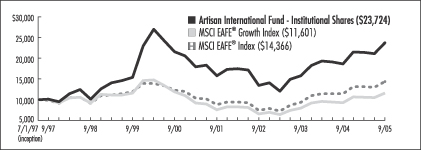

Artisan Mid Cap Fund (inception 6/27/97) | | 18.06 | | | 19.39 | | | 0.87 | | | NA | | | 18.20 | |

Artisan Mid Cap Value Fund (inception 3/28/01) | | 28.42 | | | 30.03 | | | NA | | | NA | | | 17.27 | |

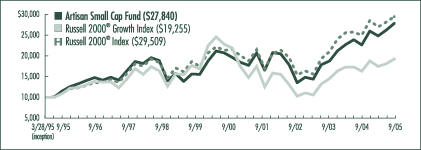

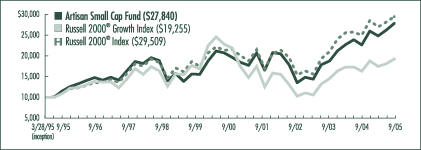

Artisan Small Cap Fund (inception 3/28/95) | | 22.64 | | | 27.05 | | | 7.18 | | | 8.21 | % | | 10.23 | |

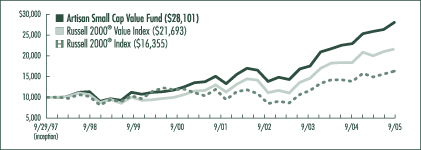

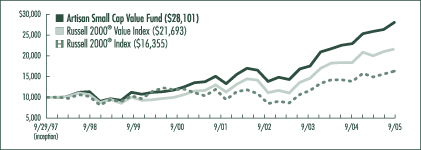

Artisan Small Cap Value Fund (inception 9/29/97) | | 22.42 | | | 26.58 | | | 17.56 | | | NA | | | 13.78 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in a Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The performance information shown for Artisan International Fund, Artisan International Small Cap Fund and Artisan International Value Fund does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. Artisan International Small Cap Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future.

Artisan International Fund, International Small Cap Fund & International Value Fund: International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems and higher transaction costs. These risks typically are greater in emerging markets. Artisan International Fund and International Small Cap Fund invest in growth stocks, which may underperform other asset types during a given period. Artisan International Small Cap Fund invests in the stocks of smaller companies, which tend to be more volatile and less liquid than those of larger companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies. Artisan International Value Fund invests in value stocks, which may underperform other asset types during a given period. In addition, the Fund may invest a significant portion of its assets in small and medium-sized companies, which tend to be more volatile and less liquid than those of large companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies.

Artisan Mid Cap Fund & Mid Cap Value Fund: Stocks of medium-sized companies tend to be more volatile than those of larger companies and have underperformed the stocks of small and large companies during some periods. Artisan Mid Cap Fund invests primarily in growth stocks, which may underperform other asset types during a given period. Artisan Mid Cap Value Fund invests primarily in value stocks, which may underperform other asset types during a given period.

Artisan Small Cap Fund & Small Cap Value Fund: Stocks of smaller companies tend to be more volatile and less liquid than those of larger companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies. Artisan Small Cap Fund invests primarily in growth stocks, which may underperform other asset types during a given period. Artisan Small Cap Value Fund invests primarily in value stocks, which may underperform other asset types during a given period.

ARTISAN INTERNATIONAL FUND (ARTIX)

| | |

| HIGHLIGHTS | | |

• For the twelve months ended September 30, 2005, Artisan International Fund outperformed the MSCI EAFE® and MSCI EAFE® Growth indices. • The Fund benefited from the performance of its energy and financials stocks relative to both benchmarks. On a regional basis, the Fund received a strong relative contribution versus the benchmarks from its emerging markets holdings. | | • One area of weakness relative to the benchmarks for the Fund was the consumer discretionary sector. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to construct a portfolio of international growth companies of all market capitalizations. The investment team conducts its own fundamental analysis with particular emphasis on: | | 1) well-managed companies focused on increasing shareholder value; 2) sustainable growth prospects; 3) reasonable valuations; or 4) dominant or increasing market shares or direct exposure to an identified theme. |

| | | |

| PERFORMANCE REVIEW | | |

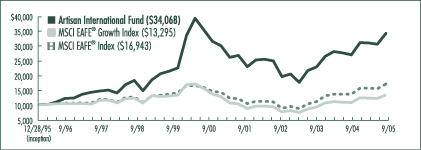

| For the trailing one- and five-year periods and since the Fund’s inception, Artisan International Fund has outpaced the MSCI EAFE® Growth Index. |

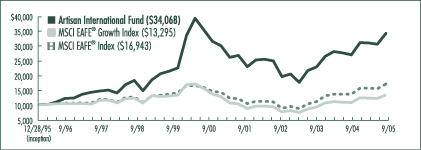

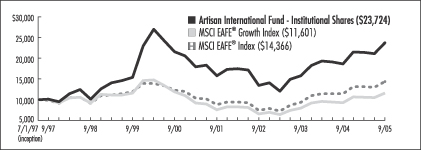

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/28/95 to 9/30/05)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/05)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan International Fund | | 26.97 | % | | 20.48 | % | | 1.68 | % | | 13.38 | % |

MSCI EAFE® Growth Index | | 25.01 | | | 20.91 | | | -0.47 | | | 2.96 | |

MSCI EAFE® Index | | 25.79 | | | 24.61 | | | 3.16 | | | 5.55 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 80 for a description of each index.

2

TWO

INVESTING ENVIRONMENT

International equities had a strong performance run during our fiscal year ended September 30, 2005. In developed markets, a few of the leading gainers were Spain, Germany, France and Japan—each of which advanced over 25%. Japan was particularly strong late in the fiscal year as mounting evidence of renewed economic growth attracted equity investors. The U.K. and U.S. markets were among the weakest performers. The U.K. economy struggled with higher interest rates, inflation concerns and a soft housing market. Those same issues started to creep up in the U.S., though to a lesser degree.

Many sectors in the MSCI EAFE® Index turned in gains in excess of 20%. Even technology, which was the worst performing sector, advanced nearly 13%. The leading performers were energy and materials, which notched returns in excess of 37%.

The U.S. dollar, which was a large contributing factor to performance for U.S.-based international investors in recent periods, had a small negative impact on absolute returns for investors. Two items that remained consistent with recent periods were the outperformance of small-cap stocks compared to large-cap stocks and emerging markets stocks compared to developed market stocks. Value stocks outperformed growth stocks for the full period, but in the second half of our fiscal year growth stocks held a slight edge.

PERFORMANCE DISCUSSION

The Fund benefited from the performance of stocks in our financials and energy themes. Our stocks in the consumer discretionary sector were the primary source of relative weakness in the portfolio. Regionally, our emerging markets and Japanese holdings turned in good gains compared to the benchmarks, while our French and U.K. positions weighed on our relative results.

SECTOR REVIEW

We invest on a stock-by-stock basis, but most of the stocks we own fall into one of our identified global investment themes derived from our understanding of changes in demographics, technology, restructuring and outsourcing. Traditional definitions of sectors can play a powerful role in the performance of a stock in the short-term, but over the long-term we think that inflection points due to long-term structural changes can create investment opportunities. Our global themes attempt to capture these opportunities.

During the fiscal year, our global financials theme was the Fund’s largest contributor to performance. Within the theme, our Japanese and Korean stocks were among the leading gainers. In Japan, Credit Saison Co., Ltd. (a Japanese credit card issuer), Mizuho Financial Group, Inc. (Japan’s largest bank) and Orix Corp. (Japan’s top non-bank financing company based on operating assets) all recorded returns in excess of 40%, with a good portion of those returns coming late in the period. Credit Saison’s business profited from new cardholder growth and growing shopping and cash advance volumes. Mizuho benefited from a mandate won by Prime Minister Koizumi to break up and sell Japan’s postal system, which is really a diversified financial services company that holds $3 trillion worth of individuals’ financial assets. Orix benefited from increased real estate sales and a strong increase in earnings. Two stocks in Japan that lagged were consumer finance company Promise Co., Ltd. and brokerage firm Nomura Holdings, Inc. We sold our positions in both stocks.

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | 9/30/05 | |

Credit Saison Co., Ltd. | | Japan | | 3.4 | % |

China Mobile (Hong Kong) Limited | | China | | 3.2 | |

Telefonaktiebolaget LM Ericsson | | Sweden | | 3.2 | |

UBS AG | | Switzerland | | 3.1 | |

Sega Sammy Holdings, Inc. | | Japan | | 3.0 | |

Fortis | | Netherlands | | 2.9 | |

LUKOIL | | Russia | | 2.8 | |

Nestle S.A. | | Switzerland | | 2.4 | |

Mizuho Financial Group, Inc. | | Japan | | 2.3 | |

EnCana Corporation | | Canada | | 2.2 | |

Total | | | | 28.5 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

Korean banks Kookmin Bank, Hana Bank and Shinhan Financial Group Co., Ltd. were our leading performers in that country. All three

3

THREE

companies delivered on positive expectations for earnings growth. In addition, net interest margins improved and default ratios fell, which helped the banks reduce bad debt provisions. Other winners in our global financials theme, with their countries noted in parentheses, included Julius Baer Holding, Ltd. (Switzerland), Allianz AG (Germany), Commerzbank AG (Germany) and Fortis (Netherlands).

The investments in our energy theme were based on our assessment that the long-term imbalance between demand for energy, in particular oil, and the worldwide supply creates the potential for sustainable growth. Demand continued to grow, as emerging countries such as China continued to become major consumers and industry infrastructure continued to be under pressure due to a decade long period of under-investment. Our energy theme investments were limited because of concerns about valuation.

During the fiscal year, our average energy stock outgained those in both benchmarks, resulting in a strong performance contribution. Three of the leading contributors to performance were Canadian natural gas company EnCana Corporation, Russian oil producer LUKOIL and Italian oil services company Saipem S.p.A. EnCana’s share price more than doubled, LUKOIL increased over 80% and Saipem moved more than 50% higher. Among the factors that influenced EnCana’s appreciation were the announced sale of its natural gas storage business and positive expectations for earnings growth as oil and natural gas prices remained at historically high levels. LUKOIL reported a substantial increase in profits, and like EnCana, was expected to produce solid earnings growth in the future. Saipem benefited from strong demand for rigs, which led to a pick up in rig utilization, driving better pricing.

Across the rest of our themes there were two strong individual gainers of note. China Mobile (Hong Kong) Limited, the world’s largest mobile phone company by number of users, reported a strong increase in profits, which was partly driven by a surge in subscriber numbers and growth in wireless data, such as picture messages and ring tones. Roche Holding AG, which has strong franchises in oncology, virology and infectious diseases, released solid financial results as earnings growth was driven by good sales growth in pharmaceuticals. Roche is the world’s largest maker of diagnostic tests, owns more than 50% of U.S.-based biotechnology company Genentech, Inc. and expected future growth in sales of several of its drugs.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/04 | | | 9/30/05 | |

Consumer Discretionary | | 23.9 | % | | 23.6 | % |

Consumer Staples | | 11.9 | | | 9.8 | |

Energy | | 8.2 | | | 8.7 | |

Financials | | 26.8 | | | 30.4 | |

Healthcare | | 4.5 | | | 4.1 | |

Industrials | | 4.7 | | | 8.0 | |

Information Technology | | 6.4 | | | 6.8 | |

Materials | | 4.8 | | | — | |

Telecommunication Services | | 6.9 | | | 6.1 | |

Utilities | | 0.7 | | | 1.2 | |

Other assets less liabilities | | 1.2 | | | 1.3 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

Collectively our consumer discretionary stocks moved higher, but as a group they trailed the returns of the indices. A good portion of the Fund’s relative weakness in the sector stemmed from the underperformance of stocks in our media theme. One of our best performers in the theme was Grupo Televisa S.A., the largest media company in the Spanish-speaking world. Its gain was due in part to a solid increase in earnings due to higher revenues from its satellite television unit. Two of our weaker stocks were British broadcasting company ITV PLC and French outdoor advertiser JC Decaux S.A. ITV was negatively impacted by concerns related to its loss of audience share and the potential for weaker revenues in the future. We significantly pared back our holdings. A key factor in JC Decaux’s decline was the failure to win a contract with New York City (offset partially by a contract win in Kobe, Japan) and softer advertising conditions in France.

Our worst individual performer in the consumer discretionary sector was home improvement retailer Kingfisher PLC. It has

4

FOUR

struggled due to the considerable strain on the consumer in its core U.K. market.

In the consumer staples sector, Wal-Mart de Mexico S.A. de C.V. (Walmex), Latin America’s largest retailer, partially offset those losses by posting a solid gain. Walmex’s sales were better than those of its competitors, it gained market share and it demonstrated an ability to successfully adapt new formats to its geographic and demographic environment.

COUNTRY REVIEW

Economic growth around the globe was generally healthy during the fiscal year, but the pace slowed in many economies and expectations were for additional cooling. Nevertheless, returns for most international markets were strong. We benefited from the strength of our holdings in Japan and in emerging markets.

In Japan, deflation was still a concern during the fiscal year, but it appeared that the government was taking the right steps to sustain economic growth. Consumer spending improved during the year, investment spending was strong and corporate profit margins rose. Plus, for the first time since 1991, economic expansion in Japan was being fueled by consumer and capital spending versus exports and the government. The combination of these effects supported equity prices in our Japanese financials as well as other holdings in Japan such as Sega Sammy Holdings, Inc. and Mitsubishi Corp.

South Korea, Mexico and Russia turned in eye-popping gains in excess of 57%, 64% and 56%, respectively, and were among the best performing emerging markets. In the portfolio, we participated in those gains with our Korean banks, Walmex and Grupo Televisa (Mexico) and LUKOIL (Russia).

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/04 | | | 9/30/05 | |

Europe | | 65.6 | % | | 58.2 | % |

Asia/Pacific | | 25.0 | | | 33.7 | |

Latin America | | 5.3 | | | 3.6 | |

North America | | 2.9 | | | 3.2 | |

As a percentage of total net assets.

TOP 5 COUNTRY ALLOCATIONS

| | | |

| Country | | 9/30/05 | |

Japan | | 21.0 | % |

Germany | | 8.9 | |

United Kingdom | | 8.7 | |

Switzerland | | 8.5 | |

France | | 7.2 | |

As a percentage of total net assets.

FUND CHANGES

We had a fair amount of transaction activity, as represented by new buys and sales, during the fiscal year. As always, our decisions were based on our bottom-up fundamental research. Outside of an increase in our global financials theme early in the fiscal year, there were no specific trends worth noting across sectors. Regionally, the combined effect of our transactions was an increase in emerging markets and a reduction in Europe. We continue to find value in European companies, but the opportunities we found elsewhere were greater. The majority of the increase in emerging markets was due to our previously mentioned investments in Korean banks.

Our largest purchases during the fiscal year included Mitsubishi Corp. (a Japanese general trading company), Jupiter Telecommunications Co., Ltd. (a Japanese cable television provider), Commerzbank AG (a German bank), Banco Comercial Portugues, S.A. (a Portugese bank), Deutsche Post AG (a German retail banker and postal service company), Bayerische Hypo-und Vereinsbank AG (a German bank), Novartis AG (a Swiss pharmaceutical company) and PPR S.A. (a French retailer).

In addition to those already noted, we funded the purchases of those stocks through the sales of Credit Suisse Group, Telefonica, S.A., Clariant AG, Cesky Telecom, A.S., Telenor ASA, Nikko Cordial Corp. and The Bank of Yokohama, Ltd., among others.

FUND STATISTICS

| | | |

Net Assets | | $ 11.7 billion | |

Number of Holdings | | 99 | |

Weighted Average Market Cap | | $ 35.9 billion | |

Weighted Average Growth Rate (3-5 yr) | | 11.0 | % |

Weighted Harmonic Average P/E (2005E) | | 16.1X | |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/05. Net Assets includes Investor Shares and Institutional Shares.

5

FIVE

ARTISAN INTERNATIONAL SMALL CAP FUND (ARTJX)

| | |

| HIGHLIGHTS | | |

• For the twelve months ended September 30, 2005, Artisan International Small Cap Fund outperformed the MSCI EAFE® Small Cap Index. • Strong stock selection in the consumer discretionary and technology sectors was the primary driver of the outperformance. | | • The telecommunications and utilities sectors were positive contributors to our return, but our average stock in those sectors underperformed those sectors’ returns for the benchmark. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to construct a portfolio of smaller international growth companies. The investment team conducts its own fundamental analysis with particular emphasis on: | | 1) well-managed companies focused on increasing shareholder value; 2) sustainable growth prospects; 3) reasonable valuations; and 4) strong or increasing market shares or direct exposure to an identified theme. |

| | | |

| PERFORMANCE SUMMARY | | |

| Artisan International Small Cap Fund has slightly outperformed the MSCI EAFE® Small Cap Index since its inception, which generally has been a favorable period for international small cap stocks. |

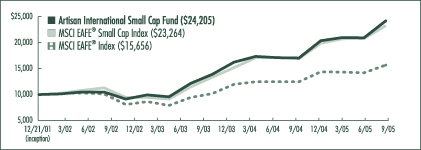

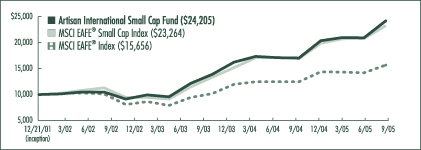

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/21/01 to 9/30/05)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/05)

| | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan International Small Cap Fund | | 42.13 | % | | 38.61 | % | | 26.38 | % |

MSCI EAFE® Small Cap Index | | 37.61 | | | 35.03 | | | 25.06 | |

MSCI EAFE® Index | | 25.79 | | | 24.61 | | | 12.61 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future. See page 80 for a description of each index.

6

SIX

INVESTING ENVIRONMENT

During the twelve months ended September 30, 2005, international small capitalization stocks, measured by the MSCI EAFE® Small Cap Index, posted strong gains with a return of 37.6%, outpacing the return of the larger cap MSCI EAFE® Index, which was up 25.8%. For much of the fiscal year, international small-cap equities held a sizeable advantage compared to their domestic counterparts, and the margin would have been wider were it not for an increase in the U.S. dollar versus currencies such as the euro, yen and pound.

Within the MSCI EAFE® Small Cap Index, energy stocks, utilities and financials were among the best performing groups. The technology and consumer discretionary sectors were the worst performers, though every sector recorded double-digit gains. Regionally, Norway and Sweden were among the leaders in Europe, and Japan showed signs of strong growth.

PERFORMANCE DISCUSSION

Our strongest gains compared to the MSCI EAFE® Small Cap Index were found in the consumer discretionary and technology sectors, where our security selection was particularly good. Our financials and energy stocks also performed well. The telecommunications sector weighed on our relative performance. By country, we benefited most from our stock selection in Japan, while our returns in the United Kingdom were not as good as the Index.

SECTOR REVIEW

Many of our consumer discretionary stocks posted solid gains during the fiscal year ended September 30, 2005. Among the leading performers were Fadesa Inmobiliaria, S.A., Findexa Ltd. and Submarino S.A. Fadesa is the leading developer of residential housing in Spain. The company generated strong pre-sales orders and was expected to take advantage of expansion opportunities in Eastern Europe and Morocco. Low interest rates and strong employment creation in Spain also were beneficial to Fadesa. Findexa is one of the leading media companies in Norway. It received an acquisition offer from Eniro AB, the largest Nordic yellow pages publisher. The acquisition was expected to strengthen the combined companies’ position in the Nordic region, create cost synergies from combined sales and production functions and enhance cash flow generation. Submarino is the largest Internet retailer in Brazil. The company posted strong sales results for its second fiscal quarter, in addition to accelerating earnings and expanding margins. We sold Findexa and Submarino as their share prices increased.

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | 9/30/05 | |

Nexity | | France | | 3.5 | % |

Buhrmann NV | | Netherlands | | 3.2 | |

Banco Latinoamericano de Exportaciones, S.A. | | Panama | | 3.2 | |

Petroleum Geo-Services ASA | | Norway | | 3.1 | |

Elekta AB | | Sweden | | 3.0 | |

Creed Corporation | | Japan | | 2.7 | |

Sulzer AG | | Switzerland | | 2.6 | |

Japan Petroleum Exploration Company, Ltd. | | Japan | | 2.6 | |

Fraser & Neave Limited | | Singapore | | 2.5 | |

Bank Sarasin & Cie, AG | | Switzerland | | 2.1 | |

Total | | | | 28.5 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

In the technology sector, our standout performers were FINETEC Corporation and Logitech International S.A. FINETEC develops cryogenic insulation materials, products that carry and store liquefied natural gas and rigid polyurethane foam to utilize as refrigerants. The company benefited from favorable contract terms with customers that allowed it to pass on raw material price increases. A surge in Korean shipbuilding orders and large volume orders for parts makers were also expected to fuel FINETEC’s future growth. Logitech, the world’s largest producer of computer mice, benefited from rising demand for wireless computer accessories. Logitech’s product innovation continued to serve as a catalyst for growth.

Our strongest contributors in the financials sector were French property developer Nexity and Japanese real estate advisory firm Creed Corporation. Nexity surged in the months following its initial public offering in October

7

SEVEN

due in part to a growing commercial property order backlog and the most favorable lending environment in France in a half-century. The company made further advances after it announced strong profit gains for the first half of its fiscal year and gave positive forward guidance. Creed posted a significant increase in operating profits as assets under management nearly doubled over the past fiscal year, driving up asset management fees. On the negative side, Malaysian bank AMMB Holdings Berhad posted its first quarterly net loss since the 1997/1998 Asian financial crisis. The loss was partly a result of the company writing off some of its non-performing loans. We trimmed our position.

Petroleum Geo-Services ASA, Smedvig ASA and Stolt Offshore S.A. were among the leading performers in our energy theme. Petroleum Geo-Services, a Norwegian company that uses soundwaves to map potential underground oil, and drilling company Smedvig generated strong profits during their second fiscal quarters. Stolt, a Norwegian oil service company, was expected to make progress in its market with the help of a newly restructured management team. Performance in its core business was strong, and the company was expected to benefit from a continuation of global spending on exploration and development.

Our weakness in the telecommunications sector was primarily the result of Brazilian wireless provider Telesp Celular Participacoes S.A. As competition intensified in the Brazilian cellular market, Telesp Celular’s costs of acquiring new subscribers increased, which caused declining average revenue per user. We trimmed our position.

Another area of relative weakness compared to the MSCI EAFE® Small Cap Index was the industrials sector. Unimpressive results from Austrian brickmaker Wienerberger AG and U.K. product testing company Intertek Group PLC overshadowed solid performance from companies such as Sulzer AG, Metso Oyi and Shanghai Electric Group Company Limited. Soft construction demand in Germany and Eastern Europe put pressure on Wienerberger’s stock price as profit expectations were called into question. Intertek’s first half results came in below expectations as a result of weakness in one of its primary divisions where margins have been under pressure in part due to expansion and restructuring costs.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/04 | | | 9/30/05 | |

Consumer Discretionary | | 27.6 | % | | 12.8 | % |

Consumer Staples | | 11.6 | | | 4.4 | |

Energy | | 5.2 | | | 10.7 | |

Financials | | 13.9 | | | 24.6 | |

Healthcare | | 8.0 | | | 6.4 | |

Industrials | | 13.1 | | | 22.6 | |

Information Technology | | 3.3 | | | 5.4 | |

Materials | | 3.1 | | | 2.8 | |

Telecommunication Services | | 5.8 | | | 3.1 | |

Utilities | | 1.8 | | | 2.0 | |

Other assets less liabilities | | 6.6 | | | 5.2 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

COUNTRY REVIEW

In Europe, the Scandinavian countries of Norway, Denmark and Sweden were among the strongest performing areas of the MSCI EAFE® Small Cap Index. Spain and France also posted solid returns during the period. The United Kingdom was among the laggards due to rising inflation, pressures on the consumer and signs of an economic slowdown. The Bank of England cut interest rates in response to these factors. Our Norwegian holdings were a leading source of strength in the portfolio due to the performance of Petroleum-Geo Services, Smedvig, Findexa, and Stolt Offshore (all discussed above).

In the Pacific Basin, Japan’s economic expansion was fueled by consumer and capital spending versus exports and government spending for the first time since 1991. Our Japanese stocks collectively outpaced those in the benchmark with exceptional performance from Creed (discussed above), Japan Petroleum Exploration Company, Ltd., and Komeri Company, Ltd.

Emerging markets were generally strong this fiscal year, although there were a few pockets of weakness. Among the leaders were South Korea, Brazil and Russia, which turned in gains

8

EIGHT

of over 57%, 89% and 56%, respectively. In the portfolio, we participated in those gains with FINETEC (South Korea), Natura Cosmeticos S.A. (Brazil) and AO VimpelCom (Russia).

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/04 | | | 9/30/05 | |

Europe | | 56.5 | % | | 51.2 | % |

Asia/Pacific | | 25.1 | | | 33.3 | |

Latin America | | 8.3 | | | 7.2 | |

North America | | 3.5 | | | 1.2 | |

Africa | | — | | | 1.8 | |

Middle East | | — | | | 0.1 | |

As a percentage of total net assets.

TOP 5 COUNTRY ALLOCATIONS

| | | |

| Country | | 9/30/05 | |

Japan | | 11.8 | % |

Switzerland | | 9.9 | |

France | | 8.9 | |

Norway | | 7.8 | |

Hong Kong | | 6.1 | |

As a percentage of total net assets.

FUND CHANGES

Notable purchases in the portfolio included Geodis S.A. (France), Shanghai Electric Group (China), Q-Free ASA (Norway) and SBM Offshore NV (Netherlands).

| • | | Geodis is a worldwide provider of shipping and postal services. The company offers parcel and express delivery, large load services, air and sea freight forwarding and warehousing services. The company’s first half fiscal year results showed improvement as it benefited from an increase in new contracts. Furthermore, Geodis has demonstrated its ability to improve upon the performances of its businesses as the company continued to implement its restructuring plan. |

| • | | Shanghai Electric Group is China’s largest manufacturer of coal-fired power equipment. We believed the company was well positioned to benefit from the growing power market in China, the world’s largest electricity consumer after the U.S. |

| • | | We also had some success with Norway-based Q-Free, which is a leading supplier of electronic toll collection systems. Its products include systems for tolling, traffic information, parking and ticketing. Q-Free has a strong market position as a technology leader in delivering those systems. We believed Q-Free stood to benefit from growing demand for road infrastructure and updated systems in several countries. |

| • | | SBM Offshore designs and manufactures offshore floating crude oil loading and unloading systems. The company reported strong results for the first half of its fiscal year and stood to benefit from potential developments of offshore oil fields. |

In addition to the previously mentioned sale of Findexa, we sold several other media stocks over the course of the fiscal year including Corus Entertainment, Inc., RCS MediaGroup S.p.A. and Impresa S.G.P.S., S.A. Canadian media company Corus posted solid earnings due to strong results in its TV and radio units. RCS MediaGroup, the leading publisher of national and sports newspapers in Italy, benefited from increased spending on publicity in television and print media, and we sold our position during the period. We also sold Impresa, one of the leading media companies in Portugal. While the company led the television audience share race in the first quarter, we became concerned with its second quarter earnings outlook as its position eroded in April and May. Additionally, we believed that Portuguese media companies would face a difficult environment in subsequent quarters as the budget crisis and personal consumption might negatively affect advertising spending, the core of media companies’ businesses.

FUND STATISTICS

| | | |

Net Assets | | $ 781.1 million | |

Number of Holdings | | 84 | |

Median Market Cap | | $ 1.5 billion | |

Weighted Average Market Cap | | $ 2.0 billion | |

Weighted Average Growth Rate (3-5 yr) | | 12.2 | % |

Weighted Harmonic Average P/E (2005E) | | 17.0X | |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/05.

9

NINE

ARTISAN INTERNATIONAL VALUE FUND (ARTKX)

| | |

| HIGHLIGHTS | | |

• For the twelve months ended September 30, 2005, Artisan International Value Fund returned 22.71% compared to a 25.79% gain for the MSCI EAFE® Index. • Coming off what we estimated were depressed valuations, investments in branded consumer goods companies Diageo PLC and Unilever PLC provided a significant contribution to our return. | | • Weak economic conditions in the U.K. contributed to poor operating trends and stock price performance from U.K. retailers Carpetright PLC and Signet Group PLC, which negatively impacted portfolio returns during the fiscal year. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to construct a portfolio of undervalued non-U.S. companies. We conduct our own in-depth fundamental research with the goal of investing in companies at prices that reflect a significant discount to our estimate of | | economic value. Attention is also given to a company’s balance sheet, historic returns on its capital and management team. Assessing the tradeoffs among these factors is at the heart of our investment process. |

| | | |

| PERFORMANCE REVIEW | | |

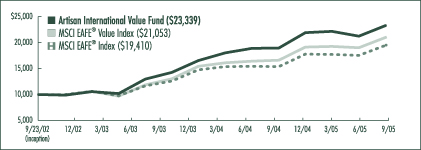

| Since inception, which generally has been a favorable period for international value stocks, Artisan International Value Fund has advanced a cumulative 133.39% or 32.41% on an annualized basis, outperforming the returns of both benchmarks. |

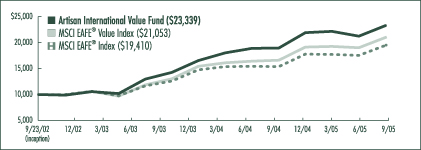

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/23/02 to 9/30/05)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/05)

| | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan International Value Fund | | 22.71 | % | | 33.00 | % | | 32.41 | % |

MSCI EAFE® Value Index | | 26.59 | | | 28.32 | | | 27.96 | |

MSCI EAFE® Index | | 25.79 | | | 24.61 | | | 24.57 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 80 for a description of each index.

10

TEN

INVESTING ENVIRONMENT

Over the twelve months ended September 30, 2005, non-U.S. equity markets earned a return well above what we would consider normal. After years of increasingly correlated performance, equity returns of U.S. and non-U.S. markets diverged during the fiscal year. We can only speculate as to the reasons for this, but we think rising interest rates and rising inflation, as well as record trade and budget deficits, dampened enthusiasm for U.S. assets. Arguably more attractive valuations and an improved economic growth outlook in Japan also might have motivated investors to find international equities more attractive. Currency had a modestly negative impact on performance during the period as the major European currencies and the Japanese Yen weakened.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/04 | | | 9/30/05 | |

Europe | | 70.1 | % | | 64.4 | % |

Asia/Pacific | | 20.2 | | | 21.1 | |

North America | | 2.0 | | | 5.7 | |

Latin America | | 1.8 | | | 1.8 | |

Middle East | | — | | | 0.6 | |

As a percentage of total net assets.

TOP 5 COUNTRY ALLOCATIONS

| | | |

| Country | | 9/30/05 | |

United Kingdom | | 31.9 | % |

Japan | | 12.4 | |

Switzerland | | 9.5 | |

France | | 8.5 | |

Germany | | 7.3 | |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

We are value investors and our primary task is the purchase of shares of companies that are selling at a meaningful discount to our estimate of intrinsic value. As a result, our efforts are centered around monitoring the economic success or failure of the businesses owned in the portfolio and the consequent impact on intrinsic value. Therefore, our thoughts about performance are always focused on the fundamentals of the companies owned in the portfolio.

The share prices of the following companies had a meaningful positive impact on the portfolio during our fiscal year:

| • | | Euronext N.V. owns the French, Dutch, Belgian and Portuguese stock exchanges. Euronext also owns the London International Financial Futures Exchange. In mid-December 2004, the London Stock Exchange (LSE) received a bid from Deutsche Boerse AG, operator of the German stock exchange. Shortly thereafter, Euronext also approached the LSE with an offer to purchase the company. After a complex series of events, Deutsche Boerse withdrew its offer leaving Euronext as the sole bidder. During this process, the share price of Euronext increased significantly in anticipation of either a successful bid for the LSE or simply due to the increased attention on its own relatively attractive valuation. The bull market in European equities and a pick-up in the IPO market helped Euronext report solid growth in profits, which generated additional investor interest in the company. |

| • | | Zinifex Ltd., based in Australia, is an integrated zinc and lead production company. Though we only began purchasing shares in the company in October 2004, an increase in the price of zinc has caused a dramatic increase in the company’s share price. Zinifex’s earnings are leveraged to the price of zinc and any change in that price has a tremendous impact on the company’s cash flows. Unlike many other commodities, which have long since broken out of their historical trading ranges, zinc began to approach the upper end of its historical price range at the end of our fiscal year. Zinc had remained within its historical range due to the presence of significant excess zinc stockpiles. These excess inventories appeared to be working down, which created a much tighter supply of zinc. |

| • | | Diageo PLC is the world’s largest premium spirits company and has generally been one of the largest holdings in the Fund since inception. We purchased shares in the company because it has a stable of top tier brands and we believed, and still believe, that it is one of the best managed packaged goods companies in the world, as evidenced by the company’s attractive returns, strong cash |

11

ELEVEN

| | flow and modest but steady revenue growth. Over the last twelve months, its share price increased by over 15%. We also received two dividends during the fiscal year, which amounted to almost 4% of the share price as of September 30, 2005. Finally, the company announced a proposal to use its strong balance sheet to repurchase shares amounting to £1.4 billion, or nearly 6% of the company’s market capitalization as of September 30, 2005. |

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | 9/30/05 | |

Countrywide PLC | | United Kingdom | | 5.0 | % |

Diageo PLC | | United Kingdom | | 4.9 | |

Euronext N.V. | | France | | 4.0 | |

Pfeiffer Vacuum Technology AG | | Germany | | 3.9 | |

Wolters Kluwer N.V. | | Netherlands | | 3.8 | |

Meitec Corporation | | Japan | | 3.7 | |

Heidelberger Druckmaschinen AG | | Germany | | 3.5 | |

Signet Group PLC | | United Kingdom | | 3.4 | |

Vodafone Group PLC (ADR) | | United Kingdom | | 3.3 | |

Benfield Group PLC | | United Kingdom | | 3.3 | |

Total | | | | 38.8 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

| • | | Unilever PLC is an Anglo-Dutch consumer products company. After falling significantly during the months leading up to September 30, 2004, the share price rebounded during the period under review. Though the company has reported a mixed set of results, a number of management and operational changes have been made that created expectations for an improvement in results over the long-term. Unilever has long been known for a cumbersome management structure, and recent simplifications, including a single CEO and a review of the dual corporate structure, have done much to convince investors that the company is serious about addressing its underperformance. |

During our fiscal year, three of our securities that had the largest negative impact on the Fund’s performance were Meitec Corporation, Carpetright PLC and Signet Group PLC.

| • | | Meitec is a Japanese provider of outsourcing services primarily in the engineering industry. The company has a long list of clients who pay a significant premium to gain access to the talent and training of Meitec’s staff. Over the last year, Meitec has run into stumbling blocks. First, in its core business, the company has found it difficult to expand its employee base due to increased competition for a short supply of university graduates. Second, the company made an acquisition that now appears to have eroded shareholder value. Although both of those outcomes lowered our estimate of intrinsic value, our estimate of intrinsic value remained meaningfully above the stock price and we increased our position. |

| • | | Both Carpetright and Signet Group are suffering from recent declines in retail sales and consumer sentiment. Carpetright PLC is a U.K.-based retailer of carpet. Signet Group is a U.K.-based company that owns chains of jewelry stores both in the U.S. and in the U.K., though the U.S. generates the majority of its profits. Following several interest rate increases by the Bank of England, the U.K. economy began to slow in the latter half of 2004. As a result, Carpetright and Signet reported declines in their U.K. revenues and their share prices fell with the whole U.K. retail industry. |

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/04 | | | 9/30/05 | |

Consumer Discretionary | | 18.2 | % | | 21.1 | % |

Consumer Staples | | 17.1 | | | 14.4 | |

Energy | | 0.4 | | | — | |

Financials | | 23.0 | | | 24.3 | |

Healthcare | | 2.6 | | | 2.6 | |

Industrials | | 10.8 | | | 12.5 | |

Information Technology | | — | | | 1.6 | |

Materials | | 14.5 | | | 10.8 | |

Telecommunication Services | | 6.5 | | | 4.7 | |

Utilities | | 1.0 | | | 1.6 | |

Other assets less liabilities | | 5.9 | | | 6.4 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

12

TWELVE

FUND CHANGES

We made a number of significant new investments during the fiscal year. We discussed four in our last semiannual report—Zinifex, Heidelberger Druckmaschinen AG, Willis Group Holdings Limited and Renault S.A. In this report, we will review three additional purchases from the second half of our fiscal year: Uni-Charm Corporation, Sekisui House, Ltd. and Tim Participacoes S.A.

Uni-Charm is Japan’s leading manufacturer of branded diapers, feminine care and other sanitary products. The company also has very strong market positions in Thailand, Indonesia and China. In our view, Uni-Charm had strong profitability and a cash-rich balance sheet, which it has used historically to repurchase its own shares. During our fiscal year, strong competition from rival manufacturers generated earnings pressure. The market’s unwillingness to look through to a more normal earnings environment allowed us to purchase a great business, with a shareholder-oriented capital allocation, at what we consider to be a cheap valuation.

Sekisui House is one of Japan’s largest homebuilders. The Japanese market for new homes has been depressed since the mid-1990s. Volumes of pre-fabricated homes, Sekisui’s core business, fell from 76,000 units in 1997 down to 56,000 units in 2004. During that time period, Sekisui’s management was able to maintain the company’s operating profits, which were somewhat offset by losses on land inventory. After years of retrenchment, the company finally started to invest again through a combination of increased marketing programs and increased commitments to land purchases. We invested because we expected a significant improvement in returns and profitability from the current levels through a combination of stabilizing land prices and better utilization of the company’s factories. We were also attracted to the company’s balance sheet strength, management’s material ownership of shares in the company, and most importantly, the market’s willingness to make shares available at close to book value when we initiated our position.

Tim Participacoes S.A. (TIM) is a Brazilian holding company for Telecom Italia Mobile’s investments in wireless telecom operators in the south and northeast of Brazil. According to third quarter 2005 company data, TIM has an estimated 37% of the market in the northeast and 46% share in the south. The company’s subscriber base has grown over the past several years, as penetration rates in Brazil historically have been significantly lower than in many developed parts of the world. That said, an increase in the competitive environment put pressure on companies across the industry. At the time of purchase, backing out the company’s significant net cash position, we estimated that the shares were trading at an enormous discount to valuations of both emerging market and developed market cellular operations elsewhere in the world.

As markets have appreciated, we sold shares in a number of companies as they approached or exceeded our estimate of intrinsic value, including NIPPONKOA Insurance Company, Ltd., Henkel KGaA, PubliGroupe S.A., Koninklijke Numico N.V., Caltagirone Editore S.p.A., Grupo Aeroportuario del Sureste S.A. de C.V. (Grupo Asur), Telecom Corporation of New Zealand, Ltd. and Rinker Group, Ltd. We also sold our shares in Asia Satellite Telecommunications Holdings, Ltd. due in part to our frustration over the slow recovery in demand for AsiaSat’s services. Although the business was strongly cash generative even during the current doldrums, we thought the company may have large expenditures and we felt disinclined to stick around.

We view this level of selling activity to be almost frenetic given our historical experience, though we are not surprised. The strong performance of international equity markets over the last three years offered us very attractive prices on a number of our investments, and we were happy to take the offers. Just as we insist on buying stocks at significant discounts to our estimates of intrinsic value, we also insist on selling them when they approach those targets.

FUND STATISTICS

| | |

Net Assets | | $ 601.2 million |

Number of Holdings | | 41 |

Median Market Cap | | $ 1.7 billion |

Weighted Average Market Cap | | $ 13.5 billion |

Median P/B Value | | 2.1X |

Weighted Harmonic Average P/E (2005E) | | 15.5X |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/05.

13

THIRTEEN

ARTISAN MID CAP FUND (ARTMX)

| | |

| HIGHLIGHTS | | |

• For the twelve months ended September 30, 2005, Artisan Mid Cap Fund trailed the Russell Midcap® and the Russell Midcap® Growth indices. • The technology and healthcare sectors were the Fund’s largest positive return contributors. | | • Two sources of weakness versus the benchmarks were the Fund’s low investment in the utilities and energy (particularly crude producers) sectors and weak security selection in the financials sector. |

| | | |

| INVESTMENT APPROACH | | |

| We use a bottom-up investment process to identify well-managed mid-sized companies whose growth and profit potential are not yet fully recognized by investors. Specifically, we spend most of our time answering three questions about a company before we will invest in it: | | 1) Does the company exhibit franchise characteristics? 2) Is the company positioned for long-term growth and at an early stage in its profit cycle? 3) Is the stock of the company trading at a reasonable discount to our estimate of its private market value? |

| | | |

| PERFORMANCE REVIEW | | |

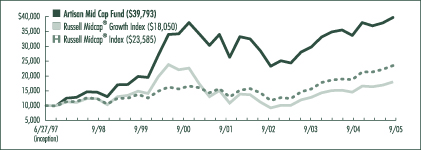

| Artisan Mid Cap Fund has outperformed the Russell Midcap® and Russell Midcap® Growth indices on an annualized basis since inception. |

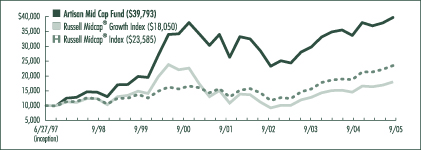

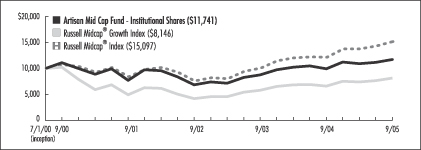

GROWTH OF AN ASSUMED $10,000 INVESTMENT (6/27/97 to 9/30/05)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/05)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan Mid Cap Fund | | 18.06 | % | | 19.39 | % | | 0.87 | % | | 18.20 | % |

Russell Midcap® Growth Index | | 23.47 | | | 24.92 | | | -4.50 | | | 7.41 | |

Russell Midcap® Index | | 25.10 | | | 25.99 | | | 7.17 | | | 10.95 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 80 for a description of each index.

14

FOURTEEN

INVESTING ENVIRONMENT

Mid-cap stocks held a wide advantage when compared to small- and large-cap stocks during our fiscal year. Within the mid-cap space, value stocks were preferred to growth. All major sectors within the Russell Midcap® and Russell Midcap® Growth indices recorded double-digit advances, but energy stocks were significantly ahead of most. The other sectors that performed well were technology, healthcare and utilities.

It was interesting to see technology and healthcare outperform when growth stocks generally seemed to be out of favor (they both carried a large weight in the Russell Midcap® Growth Index). Utilities likely outperformed as a result of persistently low long-term interest rates, despite the series of short-term interest rate hikes by the Federal Reserve during our fiscal year. Excluding technology, other traditionally cyclical sectors such as materials, producer durables, transportation and consumer discretionary were among the list of laggards. The consumer discretionary sector was under the most strain late in our fiscal year as a combination of record high gasoline prices, a softening housing sector and the threat of huge increases in home heating bills during the coming winter seemed to put a damper on discretionary spending.

PERFORMANCE DISCUSSION

The Fund generated a solid absolute return, but trailed the benchmark indices for the fiscal year ended September 30, 2005. The healthcare and technology sectors were the largest contributors to the Fund’s return. The portfolio also had several notable positive performers from a variety of other sectors. The performance of our financial stocks and our low weight in utilities and energy stocks (particularly crude producers) were key reasons for our underperformance versus the Russell Midcap® and Russell Midcap® Growth indices.

Arguably the largest shift in demographics that will be occurring over the coming years and decades is the retirement of baby boomers. We have used our thoughts about “Shifting Demographics” to focus our research on finding the companies that we believed were best positioned to benefit from the long-term cost burdens that we thought would be placed on the U.S. healthcare system by aging baby boomers. Examples include demand for pharmaceuticals (Allergan, Inc.), benefit management services (Aetna Inc., Caremark Rx, Inc. and Coventry Health Care, Inc.) and automation tools (Cerner Corporation). During our fiscal year, all five of those stocks generated strong absolute returns.

TOP 10 HOLDINGS

| | |

| Company Name | | 9/30/05 |

Constellation Brands, Inc. | | 2.8% |

Smith International, Inc. | | 2.7 |

Danaher Corporation | | 2.2 |

Precision Castparts Corp. | | 2.2 |

ITT Industries, Inc. | | 2.2 |

Allergan, Inc. | | 2.1 |

Varian Medical Systems, Inc. | | 2.0 |

Coventry Health Care, Inc. | | 1.8 |

Ecolab Inc. | | 1.7 |

Juniper Networks, Inc. | | 1.7 |

Total | | 21.4% |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

Allergan, Inc. benefited from the strength of its Botox® franchise. Botox is primarily known as an anti-wrinkle treatment, but it is also used to treat eye crossing, severe muscle and neck contractions, uncontrollable eye blinking, and excessive sweating, and may have application for headaches and bladder disorders. Aetna, Caremark and Coventry Health Care all released good financial results during our fiscal year. In addition, Aetna announced an acquisition that was expected to enhance earnings and showed good growth in enrollment; Caremark used its strong balance sheet to fund share buybacks and started to realize the true earnings potential of its AdvancePCS merger; and Coventry was on track with the integration of its recently acquired First Health business. Cerner illustrated the strength of its hospital systems automation profit cycle by announcing increases in bookings, earnings and guidance.

In the technology sector, the largest contributor to our performance was Broadcom Corporation, a leading developer of integrated circuits that enable the connectivity of voice, video and data to the consumer and business enterprise. It advanced over 70%. During the fiscal year, Broadcom demonstrated the strength of its profit cycle by reporting sales results well ahead

15

FIFTEEN

of expectations as several product lines (Bluetooth®, WiFi and personal video recorders) posted strong gains.

Other winners in the sector included Marvell Technology Group Ltd., which makes semiconductors, Macromedia, Inc., which develops software tools for the delivery of content across the Internet, and Corning Incorporated, a global technology company that derives the majority of its earnings from display technologies, such as liquid crystal displays (LCDs). Marvell benefited from solid earnings and a favorable outlook based on its increased focus on consumer applications, including hard disk drives and wireless LAN. Macromedia received a premium acquisition offer from Adobe Systems Incorporated, another portfolio holding. Corning has a technological edge over its competitors and benefited from solid LCD sales volumes. NCR Corporation, the world’s largest maker of ATM’s, was one laggard in the sector. It declined in part due to news that CEO Mark Hurd would be leaving to become CEO of Hewlett-Packard Company.

FUND STATISTICS

| | | |

Net Assets | | $ 5.9 billion | |

Number of Holdings | | 100 | |

Median Market Cap | | $ 6.7 billion | |

Weighted Average Market Cap | | $ 9.7 billion | |

Weighted Average Growth Rate (3-5 yr) | | 17.4 | % |

Weighted Harmonic Average P/E (2005E) | | 22.8X | |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/05. Net assets includes Investor Shares and Institutional Shares.

Across the rest of the portfolio a few standout performers were Constellation Brands, Inc., Precision Castparts Corp. and Chico’s FAS, Inc.—all were top twenty holdings as of September 30, 2005.

| • | | Constellation Brands, Inc. is the world’s largest winemaker. It announced several acquisitions during our fiscal year, but the most notable was probably Robert Mondavi Corp. That acquisition closed in the first half of our fiscal year and results reported in the second half showed that it helped the company improve earnings and profitability. |

| • | | Precision Castparts Corp. is a worldwide manufacturer of complex metal components and castings serving the aerospace and industrial gas turbine markets. It announced a strong increase in sales and earnings. In addition, Precision gained market share and announced that it agreed to buy a maker of nickel-based alloys. The deal allowed the company to vertically integrate its forging business, which had the potential to result in significant margin expansion. |

| • | | Chico’s FAS, Inc. is a specialty retailer of women’s apparel targeting middle-aged women. It continued to benefit from its brand position with women baby boomers, which translated into strong organic sales growth, and from the growth of its White House Black Market concept. |

One of our weakest performers in the financials sector was student loan outsourcer The First Marblehead Corporation. Its shares were under pressure as one of its customers indicated that it would start marketing a private student loan product of its own. CapitalSource Inc., a lender to small and medium-sized businesses, Willis Group Holdings Limited, an insurance broker, and MGIC Investment Corporation, the U.S.’s leading provider of private mortgage insurance, also underperformed. CapitalSource was negatively impacted by some concerns about certain credit quality metrics. Willis Group reported weak earnings stemming from a regulatory settlement and related costs. These were a result of the company’s transition, with the rest of the industry, to a more transparent revenue model after the increased regulatory scrutiny of the industry. MGIC’s shares were under pressure due to the continued use of piggyback home equity loans, which negate the need for private mortgage insurance. We kept all three positions.

The global supply/demand imbalance, geopolitical uncertainty and speculation all contributed to record prices for crude oil and corresponding price appreciation for crude oil producers, which advanced more than 80% in our benchmarks during the fiscal year. We understood these trends, but crude producers did not meet the fundamental standards of our process. We seek out companies that possess franchise characteristics, such as a proprietary asset, a defensible brand or cost or market share advantages. By definition, commodity- driven earnings streams do not possess any of these traits. Because they did not meet the standards of our investment process, we had a relatively low weight in crude producers,

16

SIXTEEN

which weighed on performance compared to the Russell Midcap® and Russell Midcap® Growth indices.

Longer term, we believed that the growing demand for energy would have an impact that extended beyond the price of crude. Accordingly, we invested in service companies or what we defined as “infrastructure” providers. Examples include Smith International, Inc., Cooper Cameron Corporation, Noble Corporation, Kinder Morgan, Inc., Joy Global Inc. and McDermott International, Inc. We anticipated a lengthy cycle of renewed spending, aimed at increasing the capacity of traditional energy sources as well as developing alternatives. In fact, in the third quarter, Congress passed an energy bill that created incentives for such spending here in the United States.

FUND CHANGES

Our largest positions are those companies where our conviction is highest and throughout our fiscal year we took the opportunity to focus capital in the portfolio when opportunities presented themselves. Our

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/04 | | | 9/30/05 | |

Auto & Transportation | | 4.0 | % | | 0.9 | % |

Consumer Discretionary | | 24.9 | | | 17.8 | |

Consumer Staples | | 2.1 | | | 2.8 | |

Financial Services | | 10.3 | | | 11.3 | |

Healthcare | | 16.6 | | | 19.6 | |

Integrated Oils | | — | | | — | |

Materials & Processing | | 8.1 | | | 7.0 | |

Other | | 2.4 | | | 3.8 | |

Other Energy | | 5.0 | | | 6.8 | |

Producer Durables | | 8.1 | | | 6.7 | |

Technology | | 14.9 | | | 19.0 | |

Utilities | | 0.9 | | | 1.7 | |

Other assets less liabilities | | 2.7 | | | 2.6 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

top 10 holdings as a percentage of portfolio assets increased from 14% of the portfolio as of September 30, 2004 to 21% as of September 30, 2005. Over that same period, our top 20 holdings increased from 27% to nearly 37% of portfolio assets.

The largest change in our sector weights during the fiscal year was a reduction in consumer discretionary. It fell from about 25% of portfolio assets to approximately 18%. We believed that companies sensitive to consumer spending were facing headwinds, which put pressure on their ability to accelerate profits (a key tenet of our process). The waning effects of fiscal stimuli, an extended series of interest rate hikes by the Federal Reserve and the impact of record high gasoline prices were among the factors that were clearly starting to create strain on the consumer.

The retail industry was the group within the consumer discretionary sector to experience the most selling activity. Of the stocks we held at the beginning of the fiscal year, we sold American Eagle Outfitters, Inc., CarMax, Inc., Nordstrom, Inc., Staples, Inc., Ross Stores, Inc., Bed Bath & Beyond Inc., CDW Corporation, Costco Wholesale Corporation and Linens ‘n Things, Inc. We bought three securities in the retail industry during the fiscal year. Of those three, the only security we held at the end of the fiscal year was office supplies retailer Office Depot, Inc. Other recent sales of note in the consumer discretionary sector included Lamar Advertising Company, Univision Communications Inc. and Corinthian Colleges, Inc.

Our weight in the healthcare sector increased, which partially offset the drop in our consumer discretionary weight. The purchases we made in healthcare included Genzyme Corporation (one of the largest U.S. biotechnology companies), AmerisourceBergen Corporation (the third largest U.S. drug wholesaler), St. Jude Medical, Inc. (a maker of implantable cardiac defibrillators) and the previously mentioned Coventry Health Care. The largest sale in the sector was Boston Scientific Corporation.

17

SEVENTEEN

ARTISAN MID CAP VALUE FUND (ARTQX)

| | |

| HIGHLIGHTS | | |

• For the twelve months ended September 30, 2005, Artisan Mid Cap Value Fund outperformed the Russell Midcap® Value and Russell Midcap® indices. • The strongest contributors to our relative performance were our outsized investment in energy stocks and our security selection in the financial services sector. | | • Relative returns were hurt by our selections in the consumer discretionary sector when compared to the Russell Midcap® Value Index. |

| | | |

| INVESTMENT APPROACH | | |

| Our goal is to invest in companies that are priced below our estimate of the value of the business and that provide a controlled level of risk. It is important to complement stock price value with a company that is financially strong and possesses favorable economics. Our focus is on individual companies, rather than on economic or market trends. | | The Fund often finds investment opportunities in companies that are in the midst of a turnaround, are in transition, are experiencing declining earnings and/or have earnings short-falls. |

| | | |

| PERFORMANCE REVIEW | | |

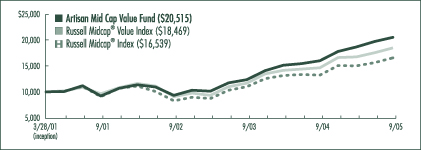

| Artisan Mid Cap Value Fund has outperformed the Russell Midcap® Value and Russell Midcap® indices over the trailing one- and three-year periods ended September 30, 2005 and from the Fund’s inception through September 30, 2005. |

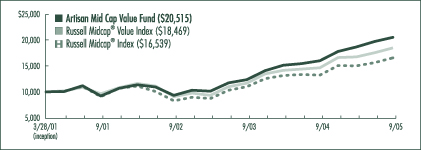

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/01 to 9/30/05)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/05)

| | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan Mid Cap Value Fund | | 28.42 | % | | 30.03 | % | | 17.27 | % |

Russell Midcap® Value Index | | 26.13 | | | 26.68 | | | 14.57 | |

Russell Midcap® Index | | 25.10 | | | 25.99 | | | 11.80 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 80 for a description of each index.

18

EIGHTEEN

INVESTING ENVIRONMENT

All sectors in the Russell Midcap® Value Index posted double digit gains during the twelve months ended September 30, 2005. The energy sector was the strongest performer bar none, as investors reacted to the surge in gas and oil prices. The technology, healthcare and utilities sectors also generated returns that outpaced the overall Index. Financial stocks posted moderate results comparatively, but due to the substantial weight of that sector in the Index, they materially contributed to the overall performance of the Index. With the expectation that the rise in energy prices would pinch the pocketbooks of consumers, it is no surprise that consumer-oriented companies lagged other sectors.

The Fund benefited not only from our outsized investment in energy stocks but also from good stock selection in several sectors. Our relative performance was also strong in the financials and materials and processing sectors. The weakest area of the portfolio when compared to the Russell Midcap® Value Index was the consumer discretionary sector.

PERFORMANCE DISCUSSION

All of our holdings in the energy sector positively impacted returns and several were among our best performers for the fiscal year. EOG Resources, Inc., XTO Energy Inc., Pioneer Natural Resources Company and Noble Energy, Inc. were among the leaders in the group. The solid performance of EOG was the result of strong production growth coupled with increased enthusiasm for its Barnett Shale operation. As the stock became more optimistically valued, we responded by selling our shares and eventually exited our position as it reached our target selling range. XTO’s gains were primarily the result of stronger than expected production volumes, which drove excellent cash flows and earnings. In addition, XTO increased its dividend payout and announced a stock split during the period. Pioneer announced plans to sell a portion of its assets, primarily those located in the Gulf of Mexico, in order to focus more closely on its onshore assets. Noble increased production and reserves through its acquisition of Patina Oil & Gas Corp. and shifted to a lower-risk exploration and development strategy. Additional projects in the Gulf of Mexico, an area of competency for the company, were expected to provide additional benefits. Noble has a seasoned management team committed to maintaining a financially disciplined organization.

TOP 10 HOLDINGS

| | | |

| Company Name | | 9/30/05 | |

The Student Loan Corporation | | 4.6 | % |

Pioneer Natural Resources Company | | 4.5 | |

Nuveen Investments, Inc. | | 3.2 | |

Alleghany Corporation | | 3.1 | |

Lexmark International, Inc. | | 2.9 | |

Apache Corporation | | 2.7 | |

The Sherwin-Williams Company | | 2.5 | |

The Lubrizol Corporation | | 2.5 | |

White Mountains Insurance Group, Ltd. | | 2.5 | |

BEA Systems, Inc. | | 2.3 | |

Total | | 30.8 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

While our minimal investments in the bank and REIT industries helped relative performance, it was our strong stock selection that was the true driver of performance within the financials sector. The Student Loan Corporation, SunGard Data Systems Inc. and Nuveen Investments, Inc. were our leading contributors, returning 67%, 51% and 33%, respectively. Student Loan, which was our largest single holding as of September 30, 2005, was positioned well to benefit from several long-term demographic trends. The market continued to recognize the company’s financial strength and its attractiveness compared to industry leader Sallie Mae. SunGard Data Systems’ stock price surged when the company announced that it had agreed to be acquired by a group of private equity investment firms. Nuveen’s municipal bond franchise has contributed to an industry leading level of profitability. The company also benefited from good quarterly earnings and strong net asset flows.

We also had good performance among our technology stocks. Avnet, Inc. is one of the largest distributors of electronic components and computer products in the world. Our

19

NINETEEN

initial attraction to the company was based on the potential for an improvement in profitability. We also liked the continued prospects for improving Avnet’s balance sheet, including a declining debt burden and its strong cash flow generation. Furthermore, Avnet announced the strategic acquisition of another distributor (Memec Group Holdings Limited), which excited the market because it was expected to create many synergies and add distribution in Japan. The share price of BMC Software, Inc., which provides infrastructure systems software, declined earlier in the year when it announced slower than expected sales growth. The stock subsequently rebounded upon news that the company was going to implement a new restructuring plan to help lower costs and improve profitability, which helped mitigate investor concerns. The company also reported strong year-over-year license revenue and better than expected earnings, due in part to solid performance from its mainframe and service management segments. Cash flow from operations was strong and BMC repurchased shares as a part of its buyback program.

FUND STATISTICS

| | |

Net Assets | | $ 2.8 billion |

Number of Holdings | | 51 |

Median Market Cap | | $3.5 billion |

Weighted Average Market Cap | | $5.0 billion |

Median P/B Value | | 1.9X |

Weighted Harmonic Average P/E (2005E) | | 14.5X |

Source: FactSet/Artisan Partners. All statistics are as of 9/30/05.

Our consumer-oriented stocks were the main area of weakness in the portfolio this year. The share prices of Furniture Brands International, Inc. and Rent-A-Center, Inc. declined during the fiscal year, with additional weakness in some other holdings. Furniture Brands, the largest home furnishings manufacturer in the U.S., continued to generate strong cash flows and to buy back stock aggressively, but reported a decline in profitability. The company was dealing with a difficult industry environment that was characterized by strong competitive pressures and weak demand. The company’s strategy of closing domestic factories and sourcing product offshore may be an effective way to address challenges it faced within the industry. Rent-A-Center, the largest U.S. rent-to-own retailer, reported a decline in profits resulting from lower sales and higher costs related to new stores and acquisitions. The company’s strategy to sell, merge or close underperforming stores may prove to be beneficial.

Although our consumer-oriented stocks were generally weak during the fiscal year, we had pockets of solid performance from names such as Reebok International Ltd., Darden Restaurants, Inc., and Marvel Entertainment, Inc. Reebok International’s stock rose sharply when Adidas-Salomon AG, the number two athletic-shoe and apparel maker in the world, announced plans to acquire Reebok in order to more effectively challenge the market leader, Nike Inc. Casual dining company Darden continued to benefit from the strength of the Olive Garden® brand and a recovery in its Red Lobster® brand. Marvel Entertainment, a globally recognized character franchise, generated strong cash flows and solid financial returns in its licensing business.

FUND CHANGES

We had a fair amount of activity in the portfolio this fiscal year as we added several new positions while trimming or exiting a good number of names. Some of our newer additions included Lexmark International, Inc., The Lubrizol Corporation and Mohawk Industries, Inc. Lexmark is a leading manufacturer of computer printers. We were attracted to the company’s strong business model defined by consistent revenue generation and limited competitors. The company has also produced strong cash flows and has a history of share repurchases. We liked diversified chemical company Lubrizol for its ability to generate free cash flow and reduce debt from the sale of non-core businesses. We were attracted to Mohawk, the largest provider of floor coverings in the U.S., because of its leadership position in the industry, its breadth of product selection, and its pricing advantage. Other purchases made during the period included Pogo Producing Company (oil and gas exploration and production company), Ryder System, Inc. (logistics and supply chain solutions provider), Leggett & Platt, Incorporated (component

20

TWENTY

manufacturer), Torchmark Corporation (life insurance provider) and Cimarex Energy Co. (independent oil and gas exploration and production company).

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/04 | | | 9/30/05 | |

Auto & Transportation | | 3.5 | % | | 2.9 | % |

Consumer Discretionary | | 22.9 | | | 28.7 | |

Consumer Staples | | 1.3 | | | — | |

Financial Services | | 29.3 | | | 27.1 | |

Healthcare | | 5.7 | | | — | |

Integrated Oils | | — | | | — | |

Materials & Processing | | 5.0 | | | 7.0 | |

Other | | 0.3 | | | — | |

Other Energy | | 18.3 | | | 14.8 | |

Producer Durables | | — | | | 3.6 | |

Technology | | 6.0 | | | 7.9 | |

Utilities | | 1.5 | | | 1.0 | |