UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08932

Artisan Funds, Inc.

(Exact name of registrant as specified in charter)

875 East Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

(Address of principal executive offices) (Zip Code)

| | |

| Janet D. Olsen | | Kevin J. McCarthy |

| Artisan Funds, Inc. | | Bell, Boyd & Lloyd LLC |

| 875 East Wisconsin Avenue, #800 | | Three First National Plaza, #3100 |

| Milwaukee, Wisconsin 53202 | | Chicago, IL 60602 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (414) 390-6100

Date of fiscal year end: 09/30/06

Date of reporting period: 09/30/06

Item 1. Reports to Shareholders.

ANNUAL

R E P O R T

SEPTEMBER 30, 2006

ARTISAN INTERNATIONAL FUND

ARTISAN INTERNATIONAL SMALL CAP FUND

ARTISAN INTERNATIONAL VALUE FUND

ARTISAN MID CAP FUND

ARTISAN MID CAP VALUE FUND

ARTISAN OPPORTUNISTIC VALUE FUND

ARTISAN SMALL CAP FUND

ARTISAN SMALL CAP VALUE FUND

ARTISAN FUNDS, INC.

INVESTOR SHARES

ARTISAN FUNDS

P.O. BOX 8412

BOSTON, MA 02266-8412

This report and the audited financial statements contained herein are provided for the general information of the shareholders of Artisan Funds. Investors should consider carefully before investing each Fund’s investment objective, risks and charges and expenses. For a prospectus, which contains that information and more information about each Fund, please call 800.344.1770 or visit our website at www.artisanfunds.com. Read it carefully before you invest or send money.

Company discussions are for illustration only and are not intended as recommendations of individual stocks. The discussions present information about the companies believed to be accurate, and the views of the portfolio managers, as of September 30, 2006. That information and those views may change, and the Funds disclaim any obligation to advise shareholders of any such changes. Artisan International Fund and Artisan Mid Cap Fund offer institutional classes of shares for institutional investors meeting certain minimum investment requirements. A report on each institutional class is available under separate cover.

Artisan Funds offered through Artisan Distributors LLC, member NASD.

TABLE OF CONTENTS

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/06)

| | | | | | | | | | | | | | | |

| | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan International Fund (inception 12/28/95) | | 19.84 | % | | 21.55 | % | | 12.33 | % | | 12.82 | % | | 13.97 | % |

Artisan International Small Cap Fund (inception 12/21/01) | | 21.63 | | | 28.47 | | | NA | | | NA | | | 25.37 | |

Artisan International Value Fund (inception 9/23/02) | | 25.38 | | | 26.90 | | | NA | | | NA | | | 30.62 | |

Artisan Mid Cap Fund (inception 6/27/97) | | 7.42 | | | 12.75 | | | 10.09 | | | NA | | | 16.98 | |

Artisan Mid Cap Value Fund (inception 3/28/01) | | 5.87 | | | 20.78 | | | 18.87 | | | NA | | | 15.12 | |

Artisan Opportunistic Value Fund (inception 3/27/06) | | NA | | | NA | | | NA | | | NA | | | 4.10 | |

Artisan Small Cap Fund (inception 3/28/95) | | 0.74 | | | 14.24 | | | 11.10 | | | 7.07 | | | 9.37 | |

Artisan Small Cap Value Fund (inception 9/29/97) | | 11.40 | | | 21.26 | | | 18.62 | | | NA | | | 13.51 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in a Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The performance information shown for Artisan International Fund, Artisan International Small Cap Fund and Artisan International Value Fund does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. Artisan International Small Cap Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future. The performance shown for Artisan Opportunistic Value Fund is not annualized and may vary greatly over short periods, and current performance may be materially lower or higher than the performance data quoted. That Fund’s performance information reflects Artisan Partners’ undertaking to limit the Fund’s expenses, which may be terminated at any time, has been in effect since the Fund’s inception and has had a material impact on the Fund’s performance. In addition, the outside directors of Artisan Funds have waived that portion of their fees allocable to Artisan Opportunistic Value Fund for the first six months of the fiscal year ended September 30, 2006. Absent that expense waiver, the Fund’s performance would have been lower.

Artisan International Fund, International Small Cap Fund, International Value Fund & Opportunistic Value Fund: International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems and higher transaction costs. These risks typically are greater in emerging markets. Artisan International Fund and International Small Cap Fund invest in growth stocks, which may underperform other asset types during a given period. Artisan International Small Cap Fund invests in the stocks of smaller companies, which tend to be more volatile and less liquid than those of larger companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies. Artisan International Value Fund invests in value stocks, which may underperform other asset types during a given period. In addition, the Fund may invest a significant portion of its assets in small and medium-sized companies, which tend to be more volatile and less liquid than those of large companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies.

Artisan Mid Cap Fund, Mid Cap Value Fund & Opportunistic Value Fund: Stocks of medium-sized companies tend to be more volatile than those of larger companies and have underperformed the stocks of small and large companies during some periods. Artisan Mid Cap Fund invests primarily in growth stocks, which may underperform other asset types during a given period. Artisan Mid Cap Value Fund and Artisan Opportunistic Value Fund invest primarily in value stocks, which may underperform other asset types during a given period.

Artisan Small Cap Fund & Small Cap Value Fund: Stocks of smaller companies tend to be more volatile and less liquid than those of larger companies, have underperformed the stocks of larger companies during some periods and tend to have a shorter history of operations than larger companies. Artisan Small Cap Fund invests primarily in growth stocks, which may underperform other asset types during a given period. Artisan Small Cap Value Fund invests primarily in value stocks, which may underperform other asset types during a given period.

ARTISAN INTERNATIONAL FUND (ARTIX)

| | |

| INVESTMENT PROCESS HIGHLIGHTS | | |

Artisan International Fund uses a fundamental stock selection process focused on identifying long-term growth opportunities. Themes. The investment team’s thematic approach identifies catalysts for change and develops investment themes with the objective of capitalizing on them globally. Changing demographics, developing technology, privatization of economic resources and outsourcing are among the long-term catalysts for change that currently form the basis for the team’s investment themes. The team incorporates these catalysts along with sector and regional fundamentals into a long-term global framework for investment analysis and decision-making. Sustainable Growth. The team applies a fundamental approach to identifying the long-term, sustainable growth characteristics of potential investments. The team seeks high quality companies that are well managed, have a dominant or improving market position and competitive advantages compared to industry and regional peers. Valuation. The team assesses the relationship between its estimate of a company’s sustainable growth prospects and its stock price. The team uses multiple valuation metrics to establish price targets. The Fund primarily invests in non-U.S. growth companies of all market capitalizations in developed and emerging markets. |

| | |

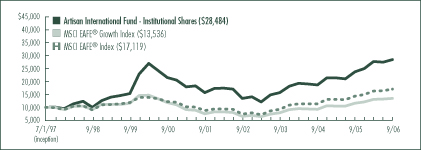

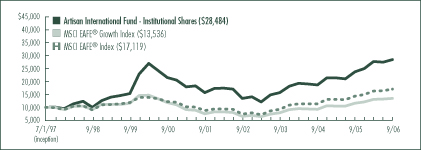

| PERFORMANCE HISTORY | | |

|

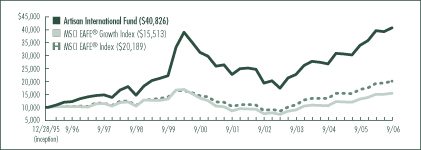

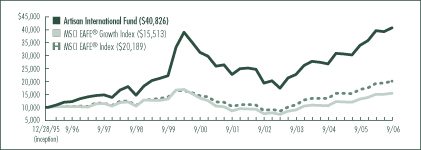

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/28/95 to 9/30/06)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/06)

| | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan International Fund | | 19.84 | % | | 21.55 | % | | 12.33 | % | | 12.82 | % | | 13.97 | % |

MSCI EAFE® Growth Index | | 16.68 | | | 19.38 | | | 12.38 | | | 4.18 | | | 4.17 | |

MSCI EAFE® Index | | 19.16 | | | 22.32 | | | 14.26 | | | 6.82 | | | 6.75 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 89 for a description of each index.

2

TWO

INVESTING ENVIRONMENT

The fiscal year ended September 30, 2006, was, on the whole, a good period for international equities. Taken in parts, the first half of the year was strong, while the second half was characterized by a fair amount of volatility.

During the first half of the fiscal year, the growth of the global economy and strong corporate profits created a fair amount of optimism in international markets. In early May, however, concerns that inflation and higher interest rates would stifle global growth, caused a steep decline among international equities. At the end of the period, concerns somewhat subsided as a more moderate inflation outlook, lower energy prices and still robust earnings growth bolstered confidence.

Weakness in the U.S. dollar generally added to the returns of U.S. dollar based investors, but the performance of currencies vis-à-vis the dollar varied quite substantially. Though the U.S. dollar was weak versus many major currencies, it strengthened against the Japanese yen. This was a key reason that Japan was among the laggards during the fiscal year in U.S. dollar terms.

PERFORMANCE DISCUSSION

The Fund performed well during the fiscal year as it returned 19.84%, outgaining the MSCI EAFE® Index, which advanced 19.16%. A number of our leading performers could be found in our energy and infrastructure, communications and global financials themes. Our holdings in the consumer staples sector also performed very well. The consumer discretionary sector was a source of weakness compared to the Index.

With expectations for capital spending high, there was high demand for our energy infrastructure providers: Italy-based Saipem S.p.A., Singapore-based Keppel Corporation Limited and Norwegian energy companies Acergy SA (formerly Stolt Offshore SA) and SeaDrill Ltd. Russian oil producer LUKOIL also performed well.

Canadian natural gas provider EnCana Corp fell roughly 20% during the period. EnCana struggled as natural gas prices fell and stayed at low levels.

Our valuation discipline led us to do some trimming in LUKOIL, EnCana, Saipem and Acergy.

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | 9/30/06 | |

UBS AG | | Switzerland | | 3.8 | % |

RWE AG | | Germany | | 3.0 | |

Credit Saison Co., Ltd. | | Japan | | 2.8 | |

Allianz AG | | Germany | | 2.4 | |

Nestle SA | | Switzerland | | 2.3 | |

Mizuho Financial Group, Inc. | | Japan | | 2.2 | |

ORIX Corporation | | Japan | | 2.2 | |

Kookmin Bank | | South Korea | | 2.1 | |

ASML Holding N.V. | | Netherlands | | 2.1 | |

Fortum Oyj | | Finland | | 2.0 | |

Total | | | | 24.9 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

Chinese wireless provider China Mobile Ltd. was a leading contributor among our communications holdings. China Mobile generated strong subscriber growth and was solidifying its market position ahead of potential new entrants to the market by cutting prices.

European financials Fortis and UBS AG, Korean financials Kookmin Bank and Shinhan Financial Group Co., Ltd., and Japanese financial ORIX Corporation were leading gainers in our global financials theme.

Japanese credit card company Credit Saison Co., Ltd., and Japanese consumer finance company, AIFUL CORPORATION were two stocks in our global financials theme that underperformed. Both stocks struggled most of the year as the industry awaited the LDP’s (Liberal Democratic Party) decision on new consumer lending regulations, which could negatively impact revenues.

British grocer William Morrison Supermarkets PLC, Mexican retailer Wal-Mart de Mexico SA de CV (Walmex) and French food retailer Carrefour SA were three standouts among our consumer staples holdings. Morrison reported strong sales performance and was ahead of schedule with its 3-year optimization plan to improve margins. Walmex reported consistent same store sales growth, and floor space expansion. Carrefour sold its Korean business, which was expected to add to earnings, and

3

THREE

reported sales that indicated a recovery in its French supermarket business.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/05 | | | 9/30/06 | |

Consumer Discretionary | | 23.6 | % | | 11.8 | % |

Consumer Staples | | 9.8 | | | 9.8 | |

Energy | | 8.7 | | | 6.5 | |

Financials | | 30.4 | | | 37.3 | |

Healthcare | | 4.1 | | | 5.7 | |

Industrials | | 8.0 | | | 10.9 | |

Information Technology | | 6.8 | | | 4.8 | |

Materials | | — | | | 0.0(1 | ) |

Telecommunication Services | | 6.1 | | | 4.8 | |

Utilities | | 1.2 | | | 7.7 | |

Other assets less liabilities | | 1.3 | | | 0.7 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

(1) Represents less than 0.1% of total net assets.

In the consumer discretionary sector, we were hurt by weakness in Japanese video game manufacturer SEGA SAMMY HOLDINGS, INC., and Japanese cable and internet service provider Jupiter Telecommunications Co., Ltd. Late in the period, Sega Sammy reported a decline in profits and increased development expenses in its consumer business. Jupiter Telecom suffered most early in the period due in part to concerns about competition from satellite providers and the potential for a decline in profitability. The price of its stock recovered some as the fiscal year wore on.

FUND CHANGES

During the fiscal year ended September 30, 2006, a large portion of our selling could be found in the consumer discretionary sector, mainly the media industry. We used proceeds from that selling in part to buy or add to a number of stocks in the utilities sector.

In the consumer discretionary sector, two of our most recent sales were retailer and luxury goods manufacturer PPR S.A. and French phone directories publisher PagesJaunes S.A. PPR benefited in part from good sales growth in its core Gucci brand and improvements in French retail. PagesJaunes is majority owned by France Telecom, which recently announced exclusive negotiations to sell its majority stake to a private equity company. We took the opportunity to sell our position.

The largest purchase in the utilities sector during the fiscal year was Finland-based Fortum Oyj, which provides a full range of energy-related services including generation, distribution and the sale of electricity. Fortum had been achieving power prices that were less than the continental averages, potentially creating a large growth opportunity if its realized power prices converge to the averages.

A few of our larger transactions outside of those sectors were the purchases of Bouygues SA and GlaxoSmithKline plc and the sales of Commerzbank AG and Siemens AG.

Bouygues is an industrial conglomerate involved in the telecom and construction industries. It is the world leader in road construction and it recently purchased a large stake in construction services firm Alstom. GlaxoSmithKline is a market leader in the vaccine industry, which has had high barriers to entry because of the research investment and knowledge required to produce vaccines.

Commerzbank, a German bank focused on retail customers and small to mid-sized enterprises, benefited from optimism about Germany’s economy and the acquisition of Eurohypo AG. Siemens is a German conglomerate that manufactures a wide range of industrial and consumer products. Recently it became clear that restructuring efforts were going to take longer than anticipated and we were concerned about weakness in Siemens’ end markets.

REGION ALLOCATION

| | | | | |

| Region | | 9/30/05 | | | 9/30/06 |

Europe | | 55.0 | % | | 55.4% |

Pacific Basin | | 25.2 | | | 29.0 |

Emerging Markets | | 15.3 | | | 14.0 |

Americas | | 3.2 | | | 0.9 |

As a percentage of total net assets.

4

FOUR

ARTISAN INTERNATIONAL SMALL CAP FUND (ARTJX)

| | |

| INVESTMENT PROCESS HIGHLIGHTS | | |

Artisan International Small Cap Fund uses a fundamental stock selection process focused on identifying long-term growth opportunities among small non-U.S. companies. Themes. The investment team’s thematic approach identifies catalysts for change and develops investment themes with the objective of capitalizing on them globally. Changing demographics, developing technology, privatization of economic resources and outsourcing are among the long-term catalysts for change that currently form the basis for the team’s investment themes. The team incorporates these catalysts along with sector and regional fundamentals into a long-term global framework for investment analysis and decision-making. Sustainable Growth. The team applies a fundamental approach to identifying the long-term, sustainable growth characteristics of potential investments. The team seeks high quality companies that are well managed, have a dominant or improving market position and competitive advantages compared to industry and regional peers. Valuation. The team assesses the relationship between its estimate of a company’s sustainable growth prospects and its stock price. The team uses multiple valuation metrics to establish price targets. The Fund primarily invests in non-U.S. small-cap growth companies in developed and emerging markets with market capitalizations less than $3 billion at the time of investment. |

| | |

| PERFORMANCE HISTORY | | |

|

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/21/01 to 9/30/06)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/06)

| | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan International Small Cap Fund | | 21.63 | % | | 28.47 | % | | 25.37 | % |

MSCI EAFE® Small Cap Index | | 15.16 | | | 26.21 | | | 22.92 | |

MSCI EAFE® Index | | 19.16 | | | 22.32 | | | 13.95 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future. See page 89 for a description of each index.

5

FIVE

INVESTING ENVIRONMENT

The fiscal year ended September 30, 2006, was a solid period for international small-cap stocks as the MSCI EAFE® Small Cap Index posted a gain of 15.16%. During the first half of the fiscal year, the growth of the global economy and strong corporate profits created a fair amount of optimism in the markets. In early May, however, concerns that inflation and higher interest rates would stifle global growth, caused a steep decline among international equities. At the end of the period, concerns somewhat subsided as a more moderate inflation outlook, lower energy prices and still robust earnings growth bolstered confidence.

Most sectors in the MSCI EAFE® Small Cap Index advanced during the period. The leading areas were the materials, energy and financial sectors, each of which increased more than 20%. From a regional perspective, stocks in Europe and in emerging markets posted solid returns. The U.S. dollar weakened during the period, and as a result, the MSCI EAFE® Small Cap Index had a local return of 14.03%, and a U.S. dollar-based return of 15.16%.

PERFORMANCE DISCUSSION

The Fund outperformed relative to the MSCI EAFE® Small Cap Index, primarily because of solid gains from our stocks in the industrial sector and holdings in our energy and consumer themes. On the downside, our results were hindered by weakness in our technology holdings.

Two of our leading contributors in the industrial sector were Swiss pumps manufacturer Sulzer AG and Mexican engineering and construction company Empresas ICA S.A. de C.V. Sulzer experienced strong order growth in three of its core divisions. Empresas reported solid revenue growth in its civil and industrial construction divisions, which was driven in part by airport and highway projects. As the need for more infrastructure continued to grow in Mexico, Empresas’ long-term growth prospects remained attractive as the company was expected to benefit from new projects.

In our energy theme, expectations for capital spending were high due to tight industry capacity, an aging fleet of oil rigs and a shortage of offshore oil rigs, all of which we believed contributed to ongoing pricing power. We think this greatly benefited our energy holdings during the period. Three of our leading performers were Petroleum Geo-Services ASA (Norway), Sibir Energy PLC (United Kingdom) and SeaDrill Ltd. (Norway).

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | 9/30/06 | |

Empresas ICA S.A. de C.V. | | Mexico | | 3.2 | % |

Buhrmann NV | | Netherlands | | 3.1 | |

Fraser & Neave Limited | | Singapore | | 2.6 | |

Sibir Energy PLC | | United Kingdom | | 2.6 | |

CREED CORPORATION | | Japan | | 2.2 | |

Korea Investment Holdings Co. Ltd. | | South Korea | | 2.2 | |

Elekta AB | | Sweden | | 2.1 | |

Geodis SA | | France | | 2.0 | |

Banco Latinoamericano de Exportaciones, S.A. | | Panama | | 1.9 | |

Commercial International Bank | | Egypt | | 1.9 | |

Total | | | | 23.8 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

Petroleum Geo-Services is one of the world’s largest providers of oilfield-mapping services. The seismic market continued to improve and the company announced plans to spin off its oil-production unit. The spin-off was expected to provide the company increased flexibility to pursue growth opportunities within its seismic business. We sold Petroleum Geo-Services at a gain. Sibir Energy, a British independent oil and gas production company, benefited from operational progress at its Salym Field project and increases in both production and reserves at its Magma Field. Drilling services provider SeaDrill benefited from strong demand for its rigs and it completed the acquisition of Smedvig ASA (a holding we sold in January), another Norwegian driller.

One of our energy-related holdings that partially offset these results was gas distributor Panva Gas Holdings Limited. The company was hurt in part by a slowdown in gas connections. We continued to like Panva’s growth potential due to the development of new projects and growing power demand in China.

6

SIX

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/05 | | | 9/30/06 | |

Consumer Discretionary | | 12.8 | % | | 7.3 | % |

Consumer Staples | | 4.4 | | | 7.1 | |

Energy | | 10.7 | | | 10.1 | |

Financials | | 24.6 | | | 31.5 | |

Healthcare | | 6.4 | | | 2.9 | |

Industrials | | 22.6 | | | 29.4 | |

Information Technology | | 5.4 | | | 0.1 | |

Materials | | 2.8 | | | 3.2 | |

Telecommunication Services | | 3.1 | | | 1.3 | |

Utilities | | 2.0 | | | 2.2 | |

Other assets less liabilities | | 5.2 | | | 4.9 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

In our consumer theme, standout performers included Hengan International Group Company Limited (HongKong) and real estate developers Cyrela Brazil Realty S.A. (Brazil) and JM AB (Sweden). Hengan International is one of the leading brands in personal hygiene products in China. It benefited from strong sales growth in each of its primary divisions—tissue paper, feminine hygiene products and disposable diapers. Cyrela Brazil benefited from good sales growth, increased backlog and strong demand conditions, while JM experienced sales growth due in part to a high level of production starts and increased housing prices. We sold our positions in Cyrela Brazil and JM.

Other strong performers included copper producer Aur Resources Inc. (Canada) and several holdings in our global financial theme including Hong Kong Exchanges & Clearing Limited (Hong Kong) and Indiabulls Financial Services Ltd. (India). Aur Resources benefited from a strong rise in copper prices during the period. Hong Kong Exchanges & Clearing benefited from increased trading volume. The stock of securities company Indiabulls Ltd. increased late in the fiscal year when the company joined the bidding process to acquire an Indian bank.

In the technology sector, weakness in Q-Free ASA hindered the Fund’s performance. Norway-based Q-Free, a leading supplier of electronic toll collection systems, declined early in the fiscal year due to downward pressure on earnings, which was driven in part by higher costs, despite an increase in revenue. We sold our position.

Other technology holdings that suffered declines were Japanese internet services company Sammy NetWorks Co., Ltd. and Norwegian enterprise software vendor Fast Search & Transfer ASA.

U.K.-based NETeller PLC, an online money transfer service, was another negative contributor to performance. It experienced higher staffing costs at its Canadian business due to wage inflation and increased hiring. Despite increased cost pressure, the company attracted more than half a million new customers. We purchased additional shares on weakness.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/05 | | | 9/30/06 | |

Europe | | 49.2 | % | | 43.8 | % |

Emerging Markets | | 22.0 | | | 24.9 | |

Pacific Basin | | 22.4 | | | 24.0 | |

Americas | | 1.2 | | | 2.4 | |

As a percentage of total net assets.

FUND CHANGES

The largest changes to the composition of the portfolio over the fiscal year were an increase in our financial weight and a reduction in our consumer discretionary holdings. In the financial sector our purchases included Singapore Exchange Limited (Singapore), Postal Savings Bank (Greece), Korea Investment Holdings Co. Ltd. (South Korea), Indiabulls Financial Services (India), Tian An China Investments Company Limited (Hong Kong), Queen’s Walk Investment Ltd. (United Kingdom) and Azimut Holding SpA (Italy).

In the consumer discretionary sector, we sold Nexity (French real estate developer), John Fairfax Holdings Limited (Australian newspaper publisher), Fadesa Inmobiliaria S.A. (Spanish residential real estate developer) and Gruppo Editoriale L’Espresso S.p.A. (Italian publishing firm), in addition to the previously mentioned sales of Cyrela Brazil and JM.

7

SEVEN

ARTISAN INTERNATIONAL VALUE FUND (ARTKX)

| | |

| INVESTMENT PROCESS HIGHLIGHTS | | |

Artisan International Value Fund uses a bottom-up investment process focused on identifying what the investment team believes are high quality, undervalued businesses that offer the potential for superior risk/reward outcomes. Undervaluation. Determining the intrinsic value of the business is the heart of the team’s research process. As long-term investors, it is the team’s core belief that valuation is the most crucial determinant of stock market return over the long-term. Business quality. The team seeks to invest in companies with a history of generating strong free cash flow, improving returns on capital and strong competitive positions in their industries. This criteria helps rule out businesses that are statistically cheap, but whose values are deteriorating over time. Financial strength. The team believes that investing in companies with strong balance sheets helps to reduce the potential for capital risk and provides company management the ability to build value when attractive opportunities are available. Shareholder-oriented management. The team’s research process attempts to identify management teams with a history of building value for shareholders. The Fund primarily invests in undervalued, non-U.S. companies of all market capitalizations in developed and emerging markets. |

| | |

| PERFORMANCE HISTORY | | |

|

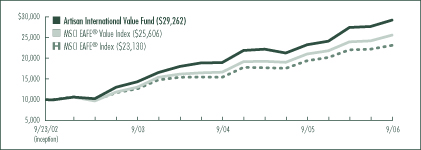

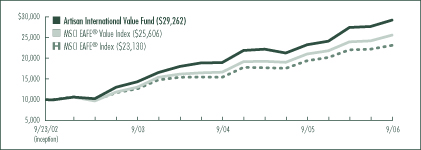

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/23/02 to 9/30/06)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/06)

| | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan International Value Fund | | 25.38 | % | | 26.90 | % | | 30.62 | % |

MSCI EAFE® Value Index | | 21.63 | | | 25.23 | | | 26.36 | |

MSCI EAFE® Index | | 19.16 | | | 22.32 | | | 23.20 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 89 for a description of each index.

8

EIGHT

INVESTING ENVIRONMENT

During the fiscal year ended September 30, 2006, global stock markets continued to advance, as they have since this equity bull market began in 2003. In U.S. dollar terms a number of European markets advanced well in excess of 20%. Near the end of the period we started to see a slowdown in many of the growth drivers that have characterized the global economic expansion of the last several years.

PERFORMANCE DISCUSSION

Artisan International Value Fund increased 25.38% during the twelve months ended September 30, 2006, outpacing the MSCI EAFE® Index, which increased 19.16%.

The share prices of the following companies had a meaningful positive impact on the portfolio during our fiscal year:

| • | | Euronext NV, which operates several European stock exchanges and the London International Financial Futures Exchange, advanced more than 120%. During the period, there were many merger discussions surrounding Euronext and other listed European exchanges. We significantly reduced our position. |

| • | | Countrywide PLC is the leading residential real estate broker in the U.K. Countrywide’s share price has benefited from signs of recovery in the real estate market as well as a recently announced takeover approach from private equity group 3i Group plc. Countrywide has no debt and has historically been a cash generating business. As of the end of the period, we were awaiting the specific terms of the offer. |

| • | | Pfeiffer Vacuum Technology AG’s price per share increased by more than 30% during the period. Pfeiffer is a German company that designs, manufactures and services a range of vacuum pumps used in a wide variety of applications including optical glass coating, semiconductor manufacturing, and scientific research. During the period, the company produced solid operating profit growth and announced a significant increase in its dividend. |

| • | | Cementir S.p.A., an Italian cement company, saw its share price increase roughly 56%. During the period, Cementir won the auction of a significant collection of cement assets in Turkey. The company also announced that its Italian cement operations had started to recover. |

| • | | Diageo PLC is the leading premium drinks provider in the world. It increased nearly 23% due in part to solid organic growth and sizeable dividends and share repurchases. |

TOP 10 HOLDINGS

| | | | | |

| Company Name | | Country | | 9/30/06 | |

Diageo PLC | | United Kingdom | | 5.0 | % |

Tyco International Ltd. | | United States | | 4.8 | |

Countrywide PLC | | United Kingdom | | 4.7 | |

Wolters Kluwer NV | | Netherlands | | 4.3 | |

Vodafone Group PLC | | United Kingdom | | 3.8 | |

Pfeiffer Vacuum Technology AG | | Germany | | 3.6 | |

Central Japan Railway Company | | Japan | | 3.2 | |

MEITEC CORPORATION | | Japan | | 3.0 | |

Benfield Group PLC | | United Kingdom | | 2.9 | |

Givaudan SA | | Switzerland | | 2.9 | |

Total | | | | 38.2 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

Three stocks that detracted from the performance of the portfolio during the period were Premiere AG, CanWest Global Communications Corp. and Vodafone Group PLC.

| • | | Premiere is the leading provider of pay television in Germany and Austria. At the time of initial purchase, the company dominated the ownership of premium content, such as movies and sporting events, which is a key competitive advantage in this business. Unfortunately, during an auction, management made what looked to be a miscalculation and lost a bid for arguably its most important content, the German Bundesliga soccer matches. We sold our shares at a loss. |

| • | | CanWest is a holding company. It owns one of Canada’s television networks, which has been in a ratings slump, and a number of different publicly traded assets. CanWest has incurred higher programming costs in an effort to restore ratings of its free-to-air business, which has negatively impacted the company’s earnings. |

9

NINE

| • | | Vodafone, the world’s largest mobile phone company, slumped at the beginning of the fiscal year due to profit pressures. These pressures were the result of market saturation, regulatory intervention, competition and heavy investment in broadening the company’s third generation (3G) technology presence. In Spain and several emerging markets, growth prospects were such that the business overall continued to grow modestly. The investment case was supported by share repurchase activity, a dividend and a healthy balance sheet. |

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/05 | | | 9/30/06 | |

Consumer Discretionary | | 21.1 | % | | 26.3 | % |

Consumer Staples | | 14.4 | | | 17.0 | |

Financials | | 24.3 | | | 18.4 | |

Healthcare | | 2.6 | | | — | |

Industrials | | 12.5 | | | 16.5 | |

Information Technology | | 1.6 | | | 2.8 | |

Materials | | 10.8 | | | 4.4 | |

Telecommunication Services | | 4.7 | | | 5.1 | |

Utilities | | 1.6 | | | 1.1 | |

Other assets less liabilities | | 6.4 | | | 8.4 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

FUND CHANGES

We exited twelve companies during the fiscal year. Our most recent sales were: Clariant AG, Tim Participaçóes S.A., Tandberg ASA and People’s Food Holdings Limited.

Proceeds from our sales were used in part to purchase shares in Grupo Televisa S.A., SK Telecom Co., Ltd., Lancashire Holdings Ltd., Red Eléctrica de Espana and Honam Petrochemical Corporation. As of September 30, 2006, those companies represented 1.2%, 1.2%, 1.1%, 1.1% and 0.5% of the portfolio, respectively.

Grupo Televisa is the largest media company in the Spanish-speaking world. Based in Mexico, it has dominated the production of content, has had a near monopoly on free-to-air broadcasting, and has been the largest pay TV operator in the country through cable platforms. It has been highly profitable and has had a very healthy balance sheet with virtually no debt.

SK Telecom is the leading operator in the South Korean wireless market. Facing competitive pressures from an aggressive rival, it was selling at a significant discount to our estimate of its intrinsic value. In addition, we believed the company’s balance sheet was underutilized and offered tremendous value creation through share buy backs and dividends.

Lancashire Holdings is a start-up specialty insurance underwriter. The main target of the company’s underwriting strategy is retrocession (a form of reinsurance involving the assumption of risk from other reinsurers) and energy insurance in hurricane-affected areas. The company’s CEO has a good reputation, premium rates had risen significantly and we believed its valuation could prove cheap in a benign hurricane environment.

Red Eléctrica operates the Spanish electricity system. Thanks to solid growth in the demand for electricity in Spain, the business is undergoing an investment boom. When combined with an attractive regulatory regime, we believe the company has the potential for continued double-digit growth in earnings and dividends over the next five years.

Honam Petrochemical is one of the largest petrochemical companies in Korea. Honam is located close to the growing Chinese market. Our attraction to Honam was based primarily on valuation and the company’s strong balance sheet. In terms of the balance sheet, the company had net cash plus investments in public and non-public entities worth about half of the market capitalization at our initial purchase. In terms of valuation at the time of purchase, we estimated that the shares traded at a meaningful discount to book value.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/05 | | | 9/30/06 | |

Europe | | 64.4 | % | | 54.3 | % |

Pacific Basin | | 17.4 | | | 14.0 | |

Americas | | 5.7 | | | 12.5 | |

Emerging Markets | | 6.1 | | | 10.8 | |

As a percentage of total net assets.

10

TEN

ARTISAN MID CAP FUND (ARTMX)

| | |

| INVESTMENT PROCESS HIGHLIGHTS | | |

Artisan Mid Cap Fund uses a bottom-up investment process to construct a diversified portfolio of U.S. mid-cap growth companies. Security Selection. The team’s investment process begins by identifying companies possessing franchise characteristics (strong competitive positions), selling at attractive valuations and benefiting from an accelerating trend. The investment team looks for companies that are well positioned for long-term growth, driven by demand for their products and services, at an early enough stage in their profit cycle to benefit from the increased cash flows produced by the profit cycle. Capital Allocation. Based on the investment team’s fundamental analysis of a company’s profit cycle, portfolio holdings develop through three stages. GardenSM investments are small positions in the early part of their profit cycle that will warrant a more sizeable allocation once their profit cycle accelerates. CropSM investments are positions that are being increased to a full weight because they are moving through the strongest part of their profit cycle. HarvestSM investments are positions that are being reduced as they near the team’s estimate of full valuation or their profit cycle begins to decelerate. Broad Diversification. The team looks for investment opportunities across the entire economy so that it can find sustainable growth regardless of the sector or industry. The Fund primarily invests in medium-sized U.S. growth companies. The Fund generally maintains median and weighted average market capitalizations of less than $10 billion. |

| | |

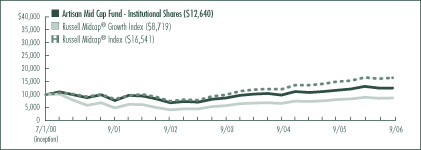

| PERFORMANCE HISTORY | | |

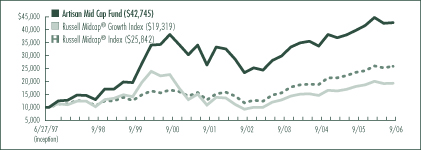

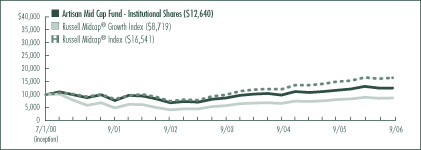

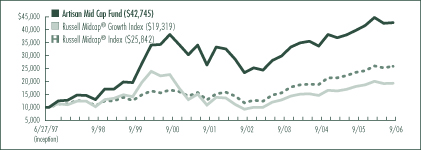

GROWTH OF AN ASSUMED $10,000 INVESTMENT (6/27/97 to 9/30/06)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/06)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan Mid Cap Fund | | 7.42 | % | | 12.75 | % | | 10.09 | % | | 16.98 | % |

Russell Midcap® Growth Index | | 7.03 | | | 14.53 | | | 12.01 | | | 7.37 | |

Russell Midcap® Index | | 9.57 | | | 18.22 | | | 14.81 | | | 10.80 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 89 for a description of each index.

11

ELEVEN

INVESTING ENVIRONMENT

During the fiscal year ended September 30, 2006, stocks of all sizes generally performed well, though large-caps were the leaders. During the period, the market continued to show a preference for value.

In the early part of the fiscal year stock gains were fairly strong. As the period wore on, the risks of inflation weighed on equity returns. A fall in energy prices and an end to the Federal Reserve’s string of interest rate hikes contributed to improved sentiment near the end of the period.

The best performing sectors in the Russell Midcap® Index were materials, transportation, financials and consumer staples which generated strong double-digit gains. The energy sector recorded a loss, as investors sold energy stocks with the declines in the prices of oil and natural gas. The producer durables sector also underperformed, but managed to eke out a small gain.

PERFORMANCE DISCUSSION

The Fund returned 7.42% during its fiscal year ended September 30, 2006, outperforming the Russell Midcap® Growth Index, which returned 7.03%, but coming up short of the 9.57% gain for the Russell Midcap® Index. Two key sources of strength in the portfolio relative to the benchmarks were our energy and infrastructure related holdings. Our performance in the technology sector was mixed. We were hurt by the relative weakness of our stocks in the consumer discretionary sector.

Our energy related investments have generally been centered around those companies that we believed were poised to benefit from a lengthy cycle of renewed global spending on energy development and infrastructure. This positioning helped the portfolio in two ways. First, it kept our allocation to crude producers low and crude producers generally declined during the period. Second, it led us to a number of energy infrastructure providers that generated solid gains. McDermott International, Inc., Cameron International Corporation and Smith International, Inc., were three of our best performers.

Worldwide energy services company McDermott International benefited from

TOP 10 HOLDINGS

| | | |

| Company Name | | 9/30/06 | |

Fisher Scientific International Inc. | | 3.8 | % |

Electronic Arts Inc. | | 2.6 | |

Allergan, Inc. | | 2.5 | |

Freescale Semiconductor, Inc. | | 2.5 | |

McDermott International, Inc. | | 2.2 | |

Juniper Networks, Inc. | | 2.2 | |

MGIC Investment Corporation | | 2.0 | |

Precision Castparts Corp. | | 1.9 | |

NII Holdings, Inc. | | 1.8 | |

Equifax Inc. | | 1.8 | |

Total | | 23.3 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer

strong growth in backlog due to resurgence in drilling activity, solid operating margin performance and improving cash flows. Cameron International, a leading manufacturer of pressure control systems, equipment and services for oil and gas drilling and production, benefited from positive trends in the subsea market. Smith International is a worldwide supplier of premium products and services to the oil and gas exploration and production industry and is a dominant market player in both drill bits and drilling fluids. It benefited from higher oil rig activity and better pricing.

Logistics company Expeditors International of Washington, Inc. (EXPD) and cleaning products and services provider Ecolab Inc. were two leaders among our infrastructure holdings. We believed that EXPD was a well-managed company exposed to the development of the transportation market in Asia. Market share gains and a strong international freight environment drove solid growth at EXPD. During the period, revenue trends at Ecolab were solid due in part to evolving sanitation standards and increased awareness of infection control.

Student loan outsourcer The First Marblehead Corporation (FMD) was another top performer. FMD moved strongly higher as growth in tuition costs and enrollments rates contributed to demand for FMD’s services—loan disbursement processing, student

12

TWELVE

applications processing and securitization volumes. We sold our position.

In the technology sector, our leading contributor was Freescale Semiconductor, Inc. It advanced strongly in the latter part of the fiscal year after it reached an agreement with a consortium of private equity firms to be purchased at a price that valued the company at $40 per share. This represented a significant premium to the share price at the time of the announcement and it was very close to our private market value estimate.

On the downside, we were hurt by weakness in Juniper Networks, Inc., a leading provider of internet protocol (IP) routers and security solutions. It experienced a slowdown in demand as the market prepared for next generation IP networks. Widespread concern over options backdating also weighed on Juniper. We elected to reserve judgment on Juniper until we had all of the facts at hand.

In the consumer discretionary sector, a good portion of our security selection weakness was in stocks that we would identify as sensitive to ad spending. Two of our largest negative contributors in the sector were internet media company Yahoo! Inc. and stock photography company Getty Images, Inc. Yahoo! was experiencing a slowdown in ad spending in the auto and financial services industries and expected a delayed contribution from its new paid search platform. Getty was pressured by heightened competition and fears that its core business would be cannibalized by lower cost alternatives.

Private label women’s clothing retailer Chico’s FAS, Inc. was one of our more traditional consumer businesses that did not perform well during the fiscal year. Sales slowed due to poor merchandising and a reduction in store traffic.

FUND CHANGES

During the fiscal year ended September 30, 2006, we continued to apply our time-tested process to the portfolio. We seeded the portfolio with new GardenSM investments that we estimated were in the early stages of a positive profit cycle. We committed additional capital to our highest conviction ideas and harvested names where we felt the profit cycle had run its course or where we believed the valuation no longer made economic sense. At fiscal year-end, we had over 52% of portfolio assets in our top 30 holdings.

Recent GardenSM investments included Patterson Companies, Inc., a distributor of dental, veterinary and rehabilitation supplies; Amazon.com, Inc., an online retailer; Supervalu Inc., a grocery retailer; CIGNA Corporation, a healthcare benefits provider; Hospira, Inc., a specialty pharmaceutical and medication delivery company and Dresser-Rand Group Inc., a provider of rotating equipment solutions to the energy sector.

In addition to the sale of First Marblehead, we funded those purchases in part with the sales of AmerisourceBergen Corporation, Marvell Technology Group Ltd., Genzyme Corporation, Hewitt Associates, Inc. and Agilent Technologies, Inc., among others.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/05 | | | 9/30/06 | |

Auto & Transportation | | 0.9 | % | | 2.1 | % |

Consumer Discretionary | | 17.8 | | | 16.6 | |

Consumer Staples | | 2.8 | | | 2.2 | |

Financial Services | | 11.3 | | | 16.2 | |

Healthcare | | 19.6 | | | 17.5 | |

Materials & Processing | | 7.0 | | | 6.1 | |

Other | | 3.8 | | | 3.1 | |

Other Energy | | 6.8 | | | 4.8 | |

Producer Durables | | 6.7 | | | 5.5 | |

Technology | | 19.0 | | | 19.9 | |

Utilities | | 1.7 | | | 3.5 | |

Other assets less liabilities | | 2.6 | | | 2.5 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

13

THIRTEEN

ARTISAN MID CAP VALUE FUND (ARTQX)

|

| INVESTMENT PROCESS HIGHLIGHTS |

Artisan Mid Cap Value Fund uses a bottom-up investment process to construct a diversified portfolio of U.S. mid-cap value companies that the investment team believes are undervalued, in sound financial condition and have attractive business economics. Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range. Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interests of the companies’ shareholders. Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle. The team believes companies with these characteristics are less likely to experience eroding values over the long-term. The Fund primarily invests in U.S. securities with market capitalizations between $1.5 billion and $10 billion at the time of purchase. |

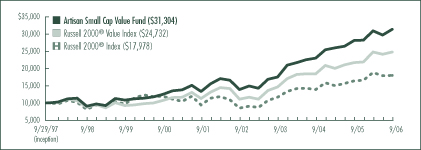

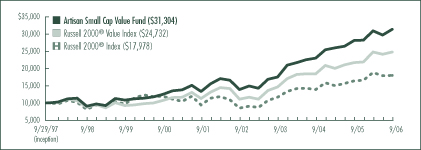

| PERFORMANCE HISTORY |

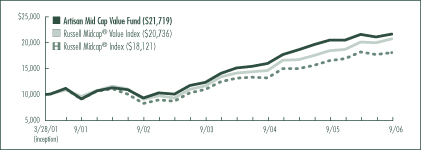

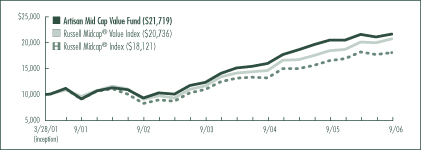

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/01 to 9/30/06)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/06)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan Mid Cap Value Fund | | 5.87 | % | | 20.78 | % | | 18.87 | % | | 15.12 | % |

Russell Midcap® Value Index | | 12.27 | | | 21.17 | | | 16.63 | | | 14.15 | |

Russell Midcap® Index | | 9.57 | | | 18.22 | | | 14.81 | | | 11.39 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 89 for a description of each index.

14

FOURTEEN

INVESTING ENVIRONMENT

The fiscal year ended September 30, 2006, was a strong period for mid-cap stocks as the Russell Midcap® Value and Russell Midcap® indices increased 12.27% and 9.57%, respectively. During the period, market participants priced most sectors in the Russell Midcap® Value Index higher, but the overall gain was held back by weakness in energy stocks. The last three months of the fiscal year were particularly detrimental to energy stocks as oil prices declined considerably.

The Fund was generally supported by the returns of our consumer discretionary and technology stocks during the period. Conversely, our holdings in the financial sector and our outsized investment in energy stocks dragged down returns.

PERFORMANCE DISCUSSION

Ryder System, Inc., Rent-A-Center, Inc., BEA Systems, Inc., Marvel Entertainment, Inc. and Claire’s Stores, Inc. were stocks that had a significant positive impact on the portfolio over the fiscal year ended September 30, 2006.

Ryder System advanced over 50% during the period. The company offers transportation services, including truck leasing and supply chain management. Our attraction to Ryder was our belief that the company’s high quality management team would move it through a turnaround phase and into a period of strong cash flow production. After a period of investment, Ryder’s core leasing business generated solid results, which contributed to a fair amount of optimism in the company’s shares.

Rent-A-Center is the largest rent-to-own operator in the United States. The company had strong cash flow generation, an aggressive share repurchase program and a low valuation compared to its peers. During the period, Rent-A-Center experienced improved sales trends and benefited from its store consolidation plan.

Infrastructure software company BEA Systems benefited from strong sales of its AquaLogicTM platform and double-digit gains in license revenue. BEA Systems is a technology leader in its market and continued to introduce new products as a means to stimulate sales. We sold our position in September as the stock reached our target selling range.

Marvel Entertainment is a globally recognized character franchise with a library of over 5,000 characters. Its high-margin licensing business has enabled Marvel to generate strong cash flow. During the period, Marvel regained the movie rights to Hulk, its second-largest character franchise behind Spider-Man licensing, and experienced an increase in publishing and toy sales.

Teenage fashion accessories retailer Claire’s Stores benefited from strong jewelry sales in North America. We began accumulating shares after the price decline in May and continued to pick up additional shares later in the period. Claire’s had no debt and it has participated in a large teen demographic space with considerable spending power.

Our outsized investment in energy names worked against us over the past twelve months. Pioneer Natural Resources Company and Cimarex Energy Co. were two of our holdings that were clipped by the sell-off in energy stocks. Pioneer Natural Resources had been in a transition period as it worked to improve its asset base through the sale of its deepwater Gulf of Mexico assets in order to focus mainly on North American onshore drilling. Pioneer suffered in the short-term during this transition process. Cimarex Energy experienced a production shortfall at its Gulf Coast operations, which put pressure on its stock price. We continued to hold Cimarex during the period in part because of its ability to generate free cash flow. We also liked its experienced management team and strong balance sheet.

Within the financials sector, our underperformance can be partly attributed to our minimal investment in real estate investment trusts (REITs) and to weakness in guaranteed student loan originator The Student Loan Corporation and check printing company Deluxe Corporation.

At Student Loan Corp., managed loan assets expanded, but lower net income left earnings below expectations. Deluxe Corp. experienced price competition for checks and its financial

15

FIFTEEN

position weakened. Having a strong financial condition is a key component of our discipline. We sold out of our position as the risk/reward scenario for Deluxe Corp. no longer fit the process we are committed to following.

Elsewhere in the portfolio, our trucking companies—Con-way Inc. and YRC Worldwide Inc.—hindered the Fund’s relative performance. Trucking companies in general came under pressure in the last few months of our fiscal year. Market participants have tended to trade these names on cyclical hopes and fears instead of investing based on their normalized earnings power as we do. Both of these companies have been among the leaders within the trucking industry and have been in strong financial shape.

TOP 10 HOLDINGS

| | | |

| Company Name | | 9/30/06 | |

The Student Loan Corporation | | 4.2 | % |

Alleghany Corporation | | 3.5 | |

Avnet, Inc. | | 3.4 | |

Pioneer Natural Resources Company | | 2.8 | |

Claire’s Stores, Inc. | | 2.8 | |

Zale Corporation | | 2.7 | |

Ingram Micro Inc. | | 2.6 | |

The Lubrizol Corporation | | 2.6 | |

Leggett & Platt, Incorporated | | 2.4 | |

Liz Claiborne Inc. | | 2.4 | |

Total | | 29.4 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

FUND CHANGES

We made several purchases and sales during the fiscal year. Three of our largest purchases were Fidelity National Financial, Inc., Arthur J. Gallagher & Co. and Analog Devices, Inc. Fidelity National is the largest title insurer in the United States. The company paid an attractive dividend, traded at a large discount to its sum-of-the-parts valuation at the time of purchase and produced a solid return on equity in recent years. Arthur J. Gallagher is one of the world’s largest insurance brokers and risk management services companies. It recently generated solid returns on equity and has benefited from market share gains in its brokerage segment. Analog Devices is a leading supplier of analog, mixed signal and digital signal processors. We were attracted to the company’s huge cash position, no debt and attractive valuation. Its core businesses—analog converters and amplifiers—were solid, and the company is committed to the restructuring of its Digital Signal Processors business and the improvement of its operating margins.

Other recent purchases included Nabors Industries Ltd. (land drilling contractor), Allied World Assurance Holdings, Ltd. (specialty insurer/reinsurer), USG Corporation (building materials manufacturer), Chico’s FAS, Inc. (women’s clothing retailer) and Cognos Incorporated (business intelligence software developer).

In addition to the sales of BEA Systems and Deluxe Corporation, our purchases were funded in part by the sales of The Sherwin-Williams Company, Torchmark Corporation, Lexmark International, Inc., Old Republic International Corporation, Westar Energy, Inc. and Lear Corporation. We sold life insurance provider Torchmark and paint retailer Sherwin-Williams as their stocks reached our target selling ranges. The shares of printer manufacturer Lexmark International came under pressure due in part to increased competition and an aggressive pricing environment. The company had a strong financial position, but we concluded that we had misjudged the economics of the business and sold our position.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/05 | | | 9/30/06 | |

Auto & Transportation | | 2.9 | % | | 6.0 | % |

Consumer Discretionary | | 28.7 | | | 31.0 | |

Consumer Staples | | — | | | 4.2 | |

Financial Services | | 27.1 | | | 26.9 | |

Materials & Processing | | 7.0 | | | 4.3 | |

Other Energy | | 14.8 | | | 15.0 | |

Producer Durables | | 3.6 | | | 1.1 | |

Technology | | 7.9 | | | 8.6 | |

Utilities | | 1.0 | | | — | |

Other assets less liabilities | | 7.0 | | | 2.9 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

16

SIXTEEN

ARTISAN OPPORTUNISTIC VALUE FUND (ARTLX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Opportunistic Value Fund uses a bottom-up investment process to construct a flexible portfolio of value-oriented companies that the team believes are undervalued, in solid financial condition and have attractive business economics.

Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range.

Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interests of the companies’ shareholders.

Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle. The team believes companies with these characteristics are less likely to experience eroding values over the long-term.

The Fund primarily invests in securities with market capitalizations greater than $1.5 billion at the time of initial purchase.

The Fund can invest up to 25% of its assets in non-U.S. securities.

PERFORMANCE HISTORY

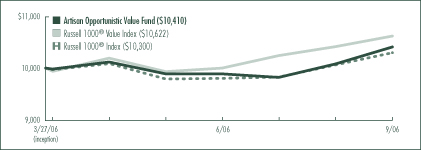

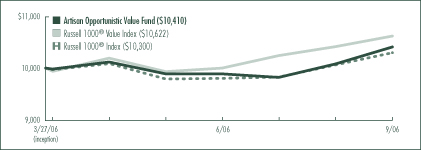

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/27/06 to 9/30/06)

TOTAL RETURNS (as of 9/30/06)

| | | |

| Fund / Index | | Since

Inception(1) | |

Artisan Opportunistic Value Fund | | 4.10 | % |

Russell 1000® Value Index | | 6.22 | |

Russell 1000® Index | | 3.00 | |

| (1) | For the period from commencement of operations (March 27, 2006) through September 30, 2006; not annualized. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. The Fund’s performance may vary greatly over short periods and current performance may be materially lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The Fund’s performance information reflects Artisan Partners’ undertaking to limit the Fund’s expenses, which may be terminated at any time, has been in effect since the Fund’s inception and has had a material impact on the Fund’s performance. In addition, the outside directors of Artisan Funds have waived that portion of their fees allocable to the Fund for the first six months of the fiscal year ended September 30, 2006. Absent that expense waiver, the Fund’s performance would have been lower. See page 89 for a description of each index.

17

SEVENTEEN

INVESTING ENVIRONMENT

From March 27, 2006 (the Fund’s inception) through September 30, 2006, equity markets made modest advances. Market participants showed a preference for defensive stocks amid a fair amount of uncertainty about the prospects for inflation and the economy. Large-cap stocks outperformed both small- and mid-cap companies during the period, and our list of leading performers included a number of large-cap stocks.

PERFORMANCE DISCUSSION

Consumer stocks rallied in the last two months of the period, as consumers welcomed a meaningful drop in gas prices and the Federal Reserve kept interest rates steady at two consecutive meetings. However, the group struggled in the period since the Fund’s inception. We were able to outperform in that environment with good stock selection. Carnival Corporation, EchoStar Communications Corporation and News Corporation each recorded solid gains.

TOP 10 HOLDINGS

| | | |

| Company Name | | 9/30/06 | |

NIKE, Inc. | | 5.1 | % |

Wal-Mart Stores, Inc. | | 5.0 | |

Apache Corporation | | 5.0 | |

American International Group, Inc. | | 4.8 | |

Microsoft Corporation | | 4.8 | |

Avnet, Inc. | | 4.4 | |

The Student Loan Corporation(1) | | 4.4 | |

Carnival Corporation | | 4.2 | |

Royal Bank of Scotland Group plc | | 3.9 | |

Citigroup Inc.(1) | | 3.8 | |

Total | | 45.4 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.

(1) Citibank, N.A., an indirect wholly-owned subsidiary of Citigroup Inc., is the primary shareholder of The Student Loan Corporation, with an ownership of 80% of The Student Loan Corporation’s outstanding common stock.

Cruise ship operator Carnival Corp. is the clear market leader in its segment of the leisure industry. We took the opportunity to purchase Carnival Corp. as market participants were concerned about fuel costs. We liked its strong financial condition, solid long-term growth potential, superior business economics and the high barriers to entry of the industry. During the period, the company experienced strong demand for its Alaskan and European trips, despite weak booking trends in its Caribbean markets. Fuel cost pressure moderated later in the period.

Satellite operator EchoStar Communications and media company News Corp. were two holdings that we sold as their stocks advanced strongly during the period. EchoStar Communications’ stock moved higher in July on rumors about a potential buyout from a competitor, The DIRECTV Group, Inc. It was reported that the motivation for the potential deal was possible cost savings for both companies. News Corp. benefited from advertising sales at its cable networks and the success of American Idol® at its Fox™ television network.

Other stocks that had a significant positive impact on the portfolio during the period were Ryder System, Inc., Royal Bank of Scotland Group plc and Bank of America Corporation.

Ryder System offers transportation services, including truck leasing and supply chain management. Our attraction to Ryder was our belief that the company’s high quality management team would move it through a turnaround phase and into a period of strong cash flow production. After a period of investment, Ryder’s core leasing business generated solid results, which contributed to a fair amount of optimism in the company’s shares.

Based in the United Kingdom, Royal Bank of Scotland is one of Europe’s leading financial services groups. By market cap, it is the second-largest bank in the United Kingdom and Europe and ranks fifth globally. We were attracted to the company’s strategy of providing a full range of services in many diverse product areas across multiple geographies, which has successfully created value in the past. At the time of purchase, the stock traded at a low price-to-earnings valuation relative to its peers, the company was financially strong, and management had announced a stock repurchase program and increased its dividend.

Bank of America is one of the largest banks in the U.S. It is also the leading issuer of consumer credit cards in the U.S., with a

18

EIGHTEEN

growing presence in certain international markets. Management has had a history of creating shareholder value through dividends and share repurchases, and its stock has traded at a significant discount to most large-cap banks. Its stock price advanced during the period, as the company benefited from strong loan growth and cost savings related to synergies created from its acquisition of MBNA Corporation. The company announced a 12% increase in its quarterly dividend in July.

The Fund’s largest detractors during the period included Dell Inc., The Student Loan Corporation and Avnet, Inc. Dell, the world’s largest computer maker, lowered its earnings outlook late in the period due to multiple factors, including ending its exclusive relationship with Intel Corporation. From a process standpoint, we often find investments that have had poor recent results or are in the process of change, so it is not uncommon for it to take some time for the stocks we buy to produce results. For Dell, we were willing to wait until the underlying fundamentals came closer to our normalized view. We used the weakness in Dell’s stock price to purchase additional shares as we continued to like its efficient business model, strong brand and cash generation ability.

Student Loan is one of the nation’s largest originators and holders of insured student loans. During the period, the company reported solid financial results primarily due to gains from the securitization of student loans. The recent decline in stock price was due in part to downward pressure on consumer finance companies in general and concerns about the November 2006 elections.

Electronic components distributor Avnet operates in a cyclical business and a perceived or possible peak in the cycle drove the company’s stock price down. On the positive side, the integration of Avnet’s acquisition of Memec, Inc. was tracking ahead of plan, which was generating meaningful cost synergies.

FUND CHANGES

In addition to the sales noted above, we also exited HCA Inc., SunTrust Banks, Inc. and Liberty Media Corporation during the period. Our most recent purchases included Valero Energy Corporation, Analog Devices, Inc. and YRC Worldwide Inc.

Valero Energy Corp. is the largest independent petroleum refiner in the United States. The company was exposed to the continued growth in refined product demand and refining capacity remained tight.

Analog Devices is a leading supplier of analog, mixed signal and digital signal processors. We liked the company’s huge cash position and lack of debt. Its core businesses—analog converters and amplifiers—were solid, and the company is committed to the restructuring of its Digital Signal Processors business and the improvement of its operating margins.

YRC Worldwide is the third largest North American trucking company, primarily offering less-than-truckload (LTL) services. The trucking industry has been pegged as a highly cyclical group and the prospect of a slowing economy put pressure on the stocks of trucking companies. We used that as our chance to establish a position in YRC Worldwide. The company has a broad network of customer relationships and has positioned itself well to gain share in the growing regional LTL market. YRC has more consistently generated free cash flow in recent years and authorized a $100 million share repurchase program in April. Its stock also traded at a low price-to-earnings valuation and a discount to its peers at the time of purchase.

SECTOR DIVERSIFICATION

| | | |

| Sector | | 9/30/06 | |

Auto & Transportation | | 2.1 | % |

Consumer Discretionary | | 24.2 | |

Financial Services | | 31.7 | |

Healthcare | | 3.6 | |

Integrated Oils | | 2.4 | |

Materials & Processing | | 2.8 | |

Other | | 3.8 | |

Other Energy | | 10.0 | |

Technology | | 16.7 | |

Other assets less liabilities | | 2.7 | |

Total | | 100.0 | % |

As a percentage of total net assets.

19

NINETEEN

ARTISAN SMALL CAP FUND (ARTSX)

| | |

| INVESTMENT PROCESS HIGHLIGHTS | | |

Artisan Small Cap Fund uses a bottom-up investment process to construct a diversified portfolio of U.S. small-cap growth companies. Competitive advantages. A sustainable competitive advantage is critical to producing above average growth and profitability. Identifying the source of a company’s competitive advantage lends confidence to the team’s assessment of intrinsic value. Return on invested capital. The team believes that, over time, a company with improving returns on its invested capital will be rewarded with a higher valuation. The team determines how much capital investment is needed to achieve a company’s continued growth and analyzes management’s ability to use that capital in the most effective way to support that growth. Intrinsic value. The team estimates a company’s intrinsic value—the value it thinks a buyer would pay to buy the entire company. The team bases its buy and sell targets for a company’s stock on its intrinsic value estimates. The Fund primarily invests in companies with market capitalizations between $200 million and $1.5 billion that meet its standards for earnings growth and sustainable growth prospects. |

| | |

| PERFORMANCE HISTORY | | |

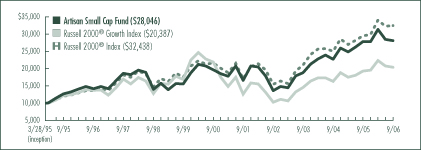

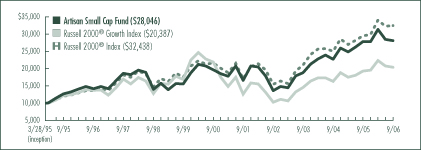

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/95 to 9/30/06)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/06)

| | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Small Cap Fund | | 0.74 | % | | 14.24 | % | | 11.10 | % | | 7.07 | % | | 9.37 | % |

Russell 2000® Growth Index | | 5.88 | | | 11.81 | | | 10.15 | | | 4.03 | | | 6.38 | |

Russell 2000® Index | | 9.92 | | | 15.48 | | | 13.78 | | | 9.06 | | | 10.76 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 89 for a description of each index.

20

TWENTY

INVESTING ENVIRONMENT

The fiscal year ended September 30, 2006 was a volatile period for small-cap stocks. In the first half of the fiscal year, market participants responded positively to indications of strong economic growth and relatively benign inflation. However, as the year wore on, sentiment shifted and investors generally became more anxious about whether the Federal Reserve would be able to successfully limit the risks of inflation without stifling economic growth.

Without the benefit of perfect hindsight, it has been nearly impossible to determine whether or not the Federal Reserve successfully navigated an economic “soft landing” (a period of slower, yet still positive economic growth), but at the end of the fiscal year there were several indications that the economic backdrop had improved.

In the Russell 2000® and Russell 2000® Growth indices, performance varied widely across sectors during the period. The financials, materials and consumer staples sectors generated double-digit gains in both benchmarks. A decline in natural gas and oil prices left energy as the only sector to post losses in both benchmarks. The healthcare sector was another laggard.

PERFORMANCE DISCUSSION

The Fund performed well relative to the benchmarks in the transportation sector and had several winners in the financial sector. The technology, healthcare and energy sectors were areas of weakness compared to the indices.

The two largest contributors to performance among our transportation holdings were aftermarket car parts distributor Keystone Automotive Industries, Inc. and aftermarket aviation parts distributor Aviall, Inc. Keystone Automotive experienced increased usage of its aftermarket parts by insurers. This was an important long-term growth catalyst for Keystone Automotive because the insurance industry’s utilization of generic and aftermarket parts was very low. Aviall received a takeout offer from The Boeing Company. We sold our position.

TOP 10 HOLDINGS

| | | |

| Company Name | | 9/30/06 | |

Avocent Corporation | | 2.2 | % |

Interline Brands, Inc. | | 2.0 | |

ESCO Technologies Inc. | | 1.9 | |

Carter’s, Inc. | | 1.8 | |

HealthExtras, Inc. | | 1.8 | |

Guitar Center, Inc. | | 1.7 | |

Bright Horizons Family Solutions, Inc. | | 1.7 | |

Open Solutions Inc. | | 1.7 | |

Strayer Education, Inc. | | 1.7 | |

CRA International, Inc. | | 1.7 | |

Total | | 18.2 | % |

As a percentage of total net assets. Top 10 Holdings are determined by issuer.