UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08932

Artisan Funds, Inc.

(Exact name of registrant as specified in charter)

875 East Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

(Address of principal executive offices) (Zip Code)

| | |

| Janet D. Olsen | | Alyssa Albertelli |

| Artisan Funds, Inc. | | Ropes & Gray LLP |

| 875 East Wisconsin Avenue, Suite 800 | | One Metro Center |

| Milwaukee, Wisconsin 53202 | | 700 12th Street, N.W., Suite 900 |

| | Washington, D.C. 20005-3948 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (414) 390-6100

Date of fiscal year end: 9/30/09

Date of reporting period: 9/30/09

| Item 1. | | Reports to Shareholders. |

A N N U A L

R E P O R T

SEPTEMBER 30, 2009

ARTISAN GLOBAL VALUE FUND

ARTISAN INTERNATIONAL FUND

ARTISAN INTERNATIONAL SMALL CAP FUND

ARTISAN INTERNATIONAL VALUE FUND

ARTISAN MID CAP FUND

ARTISAN MID CAP VALUE FUND

ARTISAN OPPORTUNISTIC GROWTH FUND

ARTISAN OPPORTUNISTIC VALUE FUND

ARTISAN SMALL CAP FUND

ARTISAN SMALL CAP VALUE FUND

ARTISAN

ARTISAN FUNDS, INC.

INVESTOR SHARES

ARTISAN FUNDS

P.O. BOX 8412

BOSTON, MA 02266-8412

This report and the audited financial statements contained herein are provided for the general information of the shareholders of Artisan Funds. Before investing, investors should consider carefully each Fund’s investment objective, risks and charges and expenses. For a prospectus, which contains that information and more information about each Fund, please call 800.344.1770 or visit our website at www.artisanfunds.com. Read it carefully before you invest or send money.

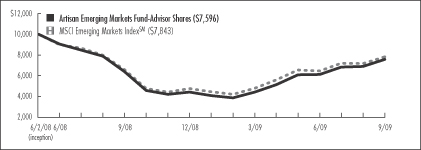

Company discussions are for illustration only and are not intended as recommendations of individual stocks. The discussions present information about the companies believed to be accurate, and the views of the portfolio managers, as of September 30, 2009. That information and those views may change, and the Funds disclaim any obligation to advise shareholders of any such changes. Artisan Emerging Markets Fund, Artisan International Fund, Artisan International Value Fund and Artisan Mid Cap Fund offer other classes of shares. Reports on each of the other classes are available under separate cover.

Artisan Funds offered through Artisan Distributors LLC, member FINRA.

TABLE OF CONTENTS

ARTISAN GLOBAL VALUE FUND (ARTGX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Global Value Fund employs a bottom-up investment process to construct a diversified portfolio of securities of undervalued U.S. and non-U.S. companies. The Fund’s investment process is focused on identifying what the investment team considers to be high quality, undervalued businesses that offer the potential for superior risk/reward outcomes. The team’s in-depth research process focuses on four key investment characteristics:

Undervaluation. Determining the intrinsic value of the business is the heart of the team’s research process. The team believes that intrinsic value represents the amount that a buyer would pay to own a company’s future cash flows. The team seeks to invest at a significant discount to the team’s estimate of the intrinsic value of a business.

Business quality. The team seeks to invest in companies with histories of generating strong free cash flow, improving returns on capital and strong competitive positions in their industries.

Financial strength. The team believes that investing in companies with strong balance sheets helps to reduce the potential for capital risk and provides company management the ability to build value when attractive opportunities are available.

Shareholder-oriented management. The team’s research process attempts to identify management teams with a history of building value for shareholders.

The Fund primarily invests in common stocks and other equity securities, both within and outside the U.S., with market capitalizations of at least $2 billion at the time of initial purchase.

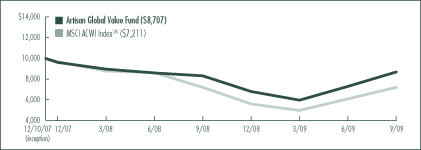

PERFORMANCE HISTORY

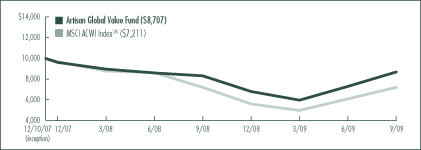

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/10/2007 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | |

| Fund / Index | | 1-Year | | | Since

Inception | |

Artisan Global Value Fund | | 4.65 | % | | -7.37 | % |

MSCI ACWI (All Country World Index) IndexSM | | -0.11 | | | -16.54 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. The Fund’s return may vary greatly over short periods, and current performance may be materially lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s performance information reflects Artisan Partners’ agreement to limit the Fund’s expenses to no more than 1.50%, which has been in effect since the Fund’s inception and has had a material impact on the Fund’s performance, which would have been lower in its absence. In addition, the outside directors of Artisan Funds waived that portion of their fees allocable to the Fund through September 30, 2008. Absent that expense waiver, the Fund’s performance would have been lower. See page 91 for a description of each index.

2

INVESTING ENVIRONMENT

Global equities, as measured by the MSCI All Country World IndexSM, posted sharp losses in the first part of the fiscal year and reached a low in early March. From that point, equity markets dramatically recovered, led by financials, materials and industrials, though all sectors and all regions posted positive returns for the twelve months ended September 30, 2009. One of the main drivers of market returns was improvement (or more accurately, less of a decline) in the underlying economy.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 26.7 | % | | 21.5 | % |

Consumer Staples | | 10.4 | | | 14.2 | |

Energy | | — | | | 2.3 | |

Financials | | 19.4 | | | 22.6 | |

Healthcare | | 15.6 | | | 9.3 | |

Industrials | | 11.0 | | | 14.5 | |

Information Technology | | 11.1 | | | 9.1 | |

Materials | | — | | | 2.4 | |

Telecommunication Services | | 1.8 | | | — | |

Other assets less liabilities | | 4.0 | | | 4.1 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

The Fund gained 4.65% during the twelve-month period ended September 30, 2009, outperforming the MSCI All Country World IndexSM, which decreased -0.11% over the same period.

Performance of the following stocks had a positive impact on the portfolio during the year: Experian PLC, a U.K. credit information firm; Signet Jewelers Ltd., a jewelry retailer in the U.S. and U.K.; Publicis Groupe, a French advertising services company; and Google Inc., a search engine provider.

Notable detractors to performance included: International Speedway Corporation, a motorsports activities promoter in the U.S.; Mohawk Industries, Inc., a floor coverings provider in the U.S.; Marsh & McLennan Companies, Inc., an insurance broker; and Julius Baer Holding AG, a Swiss bank, which we sold during the period.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/08 | | | 9/30/09 | |

Europe | | 38.5 | % | | 45.2 | % |

Americas | | 47.3 | | | 43.0 | |

Pacific Basin | | 7.2 | | | 6.4 | |

Emerging Markets | | 3.0 | | | 1.3 | |

As a percentage of total net assets.

FUND CHANGES

We remained focused on the intersection of balance sheet strength, business quality and valuation during the past year. Some of the larger additions made to the portfolio included flavor and fragrance maker Givaudan SA, contract caterers Sodexo and Compass Group PLC, medical products maker Covidien plc and low-cost airline Ryanair Holdings PLC. We exited our positions in previously mentioned Google Inc. and wireless operator SK Telecom Co., Ltd.

3

ARTISAN INTERNATIONAL FUND (ARTIX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan International Fund employs a fundamental stock selection process focused on identifying long-term growth opportunities.

Themes. The investment team’s thematic approach identifies catalysts for change and develops investment themes with the objective of capitalizing on them globally. Changing demographics, developing technology, privatization of economic resources and outsourcing are among the long-term catalysts for change that currently form the basis for the team’s investment themes. The team incorporates these catalysts along with sector and regional fundamentals into a long-term global framework for investment analysis and decision-making.

Sustainable Growth. The team applies a fundamental approach to identifying the long term, sustainable growth characteristics of potential investments. The team seeks high quality companies that are well managed, have a dominant or improving market position and competitive advantages compared to industry and regional peers.

Valuation. The team assesses the relationship between its estimate of a company’s sustainable growth prospects and the company’s stock price. The team uses multiple valuation metrics to establish price targets.

The Fund primarily invests in non-U.S. growth companies of all market capitalizations in developed markets and emerging and less developed markets.

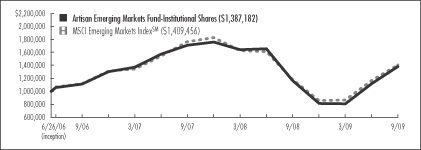

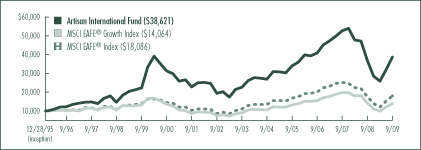

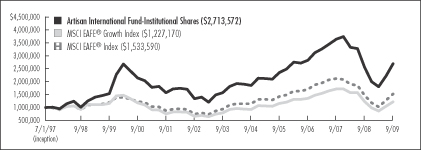

PERFORMANCE HISTORY

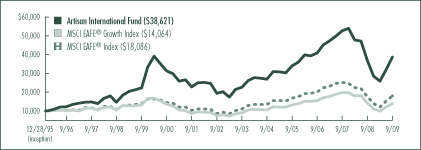

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/28/1995 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan International Fund | | 5.00 | % | | -1.83 | % | | 7.56 | % | | 5.63 | % | | 10.32 | % |

MSCI EAFE® Growth Index | | -0.78 | | | -3.22 | | | 5.75 | | | 0.56 | | | 2.51 | |

MSCI EAFE® Index | | 3.23 | | | -3.60 | | | 6.07 | | | 2.55 | | | 4.40 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 91 for a description of each index.

4

INVESTING ENVIRONMENT

The MSCI EAFE® Index trended lower for the first part of the fiscal year to a low in early March. Stocks subsequently rebounded sharply, ending the twelve-month reporting period up 3.23%. Emerging markets, as measured by the MSCI Emerging Markets IndexSM, led the recovery from March lows amid stimulus spending and the prospect of a return to economic growth. Similarly, financial stocks rallied off their steep lows, although the sector remains in the red on a trailing twelve-month basis.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 11.2 | % | | 12.1 | % |

Consumer Staples | | 9.8 | | | 14.2 | |

Energy | | 9.1 | | | 4.5 | |

Financials | | 14.2 | | | 30.7 | |

Healthcare | | 7.9 | | | 10.1 | |

Industrials | | 17.4 | | | 11.2 | |

Information Technology | | 4.7 | | | 6.4 | |

Materials | | 7.4 | | | 6.6 | |

Telecommunication Services | | 3.1 | | | 1.6 | |

Utilities | | 9.4 | | | 1.5 | |

Other assets less liabilities | | 5.8 | | | 1.1 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

The Fund ended the period ahead of the MSCI EAFE® Index with a return of 5.00%. Our outperformance was primarily the result of strong stock selection in the technology, consumer discretionary and financial sectors. ASML Holding N.V. was our key source of strength in the technology sector. Our top performers in the consumer discretionary sector included our retailers (Industria de Diseno Textil, S.A., LVMH Moet Hennessy Louis Vuitton SA and Kingfisher PLC) and automobile companies (SUZUKI MOTOR COPORATION, DENSO CORPORATION and Daimler AG). Within the financial sector, China Resources Land Limited, China Construction Bank Corporation and China Life Insurance Co. were some of our strongest performers.

On the downside, our underweight positions in the telecommunications and energy sectors, two of the better performing sectors over the last twelve months, worked against us. Our positions in the utilities, energy and materials sectors also weighed on performance. RAO Unified Energy System (equity-linked participation certificate) which we sold during the period, was our biggest detractor in the utilities sector. The losses of SeaDrill Ltd., Technip SA and Gazprom hurt our performance in the energy sector. We sold SeaDrill Ltd. and Technip SA during the period.

Regionally, our European holdings outperformed those in the Index and our investments in emerging markets, particularly in China, proved positive. While our underweight position in Japan added relative value, the poor performance of our holdings in Japan and our low exposure to the strong yen outweighed the benefit.

FUND CHANGES

We look to invest in companies with attractive growth rates, trading at reasonable valuations, with exposure to the long-term themes we have identified. Our larger purchases during the period included several financial companies, as well as a number of companies in more defensive sectors. We added Societe Generale, HSBC Holdings plc, Credit Suisse Group AG and ING Groep N.V. in the financial sector, Pernod Ricard SA, Imperial Tobacco Group plc and Heineken NV in the consumer staples sector, and Covidien plc and Novartis AG in the health care sector.

Sales during the period included Alstom S.A., Bouygues SA, Fortum Oyj, LVMH Moet Hennessy Louis Vuitton SA and Redecard SA.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/08 | | | 9/30/09 | |

Europe | | 61.0 | % | | 68.7 | % |

Emerging Markets | | 15.5 | | | 13.9 | |

Pacific Basin | | 15.0 | | | 9.5 | |

Americas | | 2.2 | | | 6.8 | |

Middle East | | 0.5 | | | — | |

As a percentage of total net assets.

5

ARTISAN INTERNATIONAL SMALL CAP FUND (ARTJX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan International Small Cap Fund employs a fundamental stock selection process focused on identifying long-term growth opportunities among small non-U.S. companies.

Themes. The investment team’s thematic approach identifies catalysts for change and develops investment themes with the objective of capitalizing on them globally. Changing demographics, developing technology, privatization of economic resources and outsourcing are among the long-term catalysts for change that currently form the basis for the team’s investment themes. The team incorporates these catalysts along with sector and regional fundamentals into a long-term global framework for investment analysis and decision-making.

Sustainable Growth. The team applies a fundamental approach to identifying the long term, sustainable growth characteristics of potential investments. The team seeks high quality companies that are well managed, have a dominant or improving market position and competitive advantages compared to industry and regional peers.

Valuation. The team assesses the relationship between its estimate of a company’s sustainable growth prospects and the company’s stock price. The team uses multiple valuation metrics to establish price targets.

The Fund primarily invests in non-U.S. small-cap growth companies in developed and emerging and less developed markets with market capitalizations less than $3 billion at the time of investment.

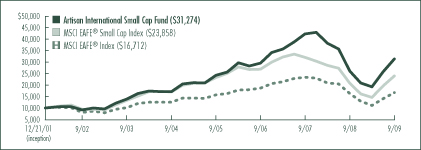

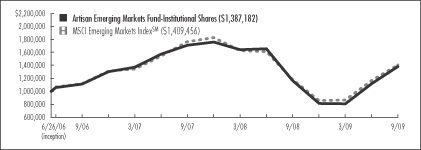

PERFORMANCE HISTORY

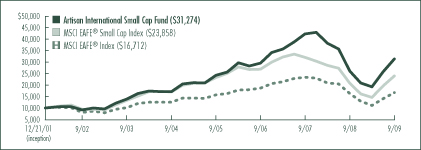

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/21/2001 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan International Small Cap Fund | | 20.59 | % | | 2.03 | % | | 12.92 | % | | 15.79 | % |

MSCI EAFE® Small Cap Index | | 15.46 | | | -3.79 | | | 7.13 | | | 11.83 | |

MSCI EAFE® Index | | 3.23 | | | -3.60 | | | 6.07 | | | 6.83 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future. See page 91 for a description of each index.

6

INVESTING ENVIRONMENT

International equities, as measured by the MSCI EAFE® Index, trended lower for the first part of the fiscal year to a low in early March. Stocks subsequently rebounded sharply, recovering the steep losses suffered over the first six months of the fiscal year. Small cap stocks were standouts, outpacing their mid- and large-cap peers, as the MSCI EAFE® Small Cap Index ended the twelve-month reporting period up 15.46%. Almost all sectors in the MSCI EAFE® Small Cap Index ended the period up by double digits. Technology led the way by a considerable margin, gaining almost 30%. Regionally, small-cap emerging markets, up 41% during the period, far outpaced developed markets, although returns varied considerably at the country level.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 8.5 | % | | 21.8 | % |

Consumer Staples | | 15.8 | | | 20.7 | |

Energy | | 6.1 | | | — | |

Financials | | 22.4 | | | 17.2 | |

Healthcare | | 1.6 | | | 8.4 | |

Industrials | | 21.3 | | | 16.8 | |

Information Technology | | 9.9 | | | 8.8 | |

Materials | | 2.6 | | | 3.5 | |

Other assets less liabilities | | 11.8 | | | 2.8 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

The Fund outpaced the MSCI EAFE® Small Cap Index over the last twelve months with a return of 20.59%. Our outperformance was the result of strong stock selection, most notably in the industrials, technology and consumer staples sectors. Tech holdings Wirecard AG, Aixtron AG and Ebay Gmarket Co Ltd. all added substantially to returns. Rail and mass transport systems supplier Ansaldo STS SpA was a key source of strength in the industrials sector and Hengan International Group Company Limited, a leading consumer products company in China, was our top contributor in the consumer staples sector.

On the downside, our holdings in the energy and financial sectors did not keep pace with those in the Index. Sibir Energy PLC and SeaDrill Ltd. were the biggest detractors among our energy positions (we completely sold out of each position during the period), while Spazio Investment NV, which we also sold, was responsible for the majority of our weakness in the financial sector.

Regionally, our European holdings outperformed those in the Index and our investments in emerging markets, particularly China, proved positive. Our underweight to the strong Japanese yen and the performance of our holdings in Hong Kong and Singapore held back returns in the Far East region.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/08 | | | 9/30/09 | |

Europe | | 50.0 | % | | 61.4 | % |

Emerging Markets | | 24.8 | | | 23.3 | |

Pacific Basin | | 12.3 | | | 10.2 | |

Americas | | 1.1 | | | 2.3 | |

As a percentage of total net assets.

FUND CHANGES

We seek companies with attractive growth rates, trading at reasonable valuations, with exposure to the long-term themes we have identified. Our larger purchases during the period included food manufacturer Premier Foods PLC, health care group SSL International plc, luxury products manufacturer Bulgari S.p.A., online dating services provider Meetic and property developer The Berkeley Group Holdings PLC.

Two of our holdings were acquired during the period, however, we sold our positions prior to the completion of those acquisitions. Gmarket Inc. (now EBay Gmarket Co Ltd.) was acquired by eBay Inc. and USJ Co., Ltd. was bought out by its primary shareholder, The Goldman Sachs Group, Inc. Other sales during the period included Aixtron AG, Empresas ICA S.A.B. de C.V., Spazio Investment NV and Tod’s S.p.A.

7

ARTISAN INTERNATIONAL VALUE FUND (ARTKX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan International Value Fund employs a bottom-up investment process to construct a diversified portfolio of stocks of undervalued non-U.S. companies. The Fund’s investment process is focused on identifying what the investment team believes are high quality, undervalued businesses that offer the potential for superior risk/reward outcomes. The team’s in-depth research process focuses on four key investment characteristics:

Undervaluation. Determining the intrinsic value of the business is the heart of the team’s research process. The team believes that intrinsic value represents the amount that a buyer would pay to own a company’s future cash flows. The team seeks to invest at a significant discount to its estimate of the intrinsic value of a business.

Business quality. The team seeks to invest in companies with histories of generating strong free cash flow, improving returns on capital and strong competitive positions in their industries.

Financial strength. The team believes that investing in companies with strong balance sheets helps to reduce the potential for capital risk and provides company management the ability to build value when attractive opportunities are available.

Shareholder-oriented management. The team’s research process attempts to identify management teams with a history of building value for shareholders.

The Fund primarily invests in common stocks and other equity securities of non-U.S. companies of all market capitalizations in developed and emerging markets.

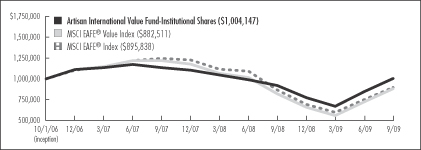

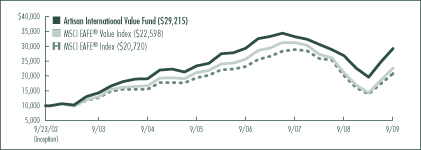

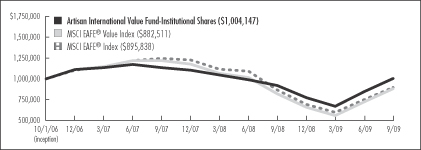

PERFORMANCE HISTORY

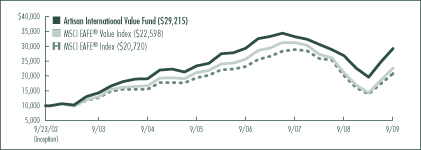

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/23/2002 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan International Value Fund | | 8.95 | % | | -0.05 | % | | 8.96 | % | | 16.50 | % |

MSCI EAFE® Value Index | | 7.35 | | | -4.08 | | | 6.32 | | | 12.32 | |

MSCI EAFE® Index | | 3.23 | | | -3.60 | | | 6.07 | | | 10.94 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 91 for a description of each index.

8

INVESTING ENVIRONMENT

International equities, as measured by the MSCI EAFE® Index, posted sharp losses in the first part of the fiscal year and reached a low in early March. From that point, equity markets dramatically recovered. Financials, materials and industrials led the way, though all sectors and all regions posted positive returns for the twelve months ended September 30, 2009. One of the main drivers of market returns was improvement (or more accurately, less of a decline) in the underlying economy.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 22.3 | % | | 23.4 | % |

Consumer Staples | | 13.0 | | | 10.0 | |

Energy | | — | | | 4.7 | |

Financials | | 19.0 | | | 17.9 | |

Healthcare | | 13.5 | | | 8.8 | |

Industrials | | 15.1 | | | 14.6 | |

Information Technology | | 8.3 | | | 6.1 | |

Materials | | 2.2 | | | 3.2 | |

Telecommunication Services | | 1.6 | | | 1.4 | |

Other assets less liabilities | | 5.0 | | | 9.9 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

The Fund gained 8.95% during the twelve-month period ended September 30, 2009, outperforming the MSCI EAFE® Index, which increased 3.23% over the same period. Our outperformance in the first half of the fiscal year was the key driver of strength.

Performance of the following stocks had a positive impact on the portfolio during the year: Publicis Groupe, a French advertising services company; Experian PLC, a U.K. credit information firm; Signet Jewelers Ltd., a jewelry retailer in the U.S. and U.K.; and Panalpina Welttransport Holding AG, a Swiss logistics provider. Notable detractors included Julius Baer Holding AG, a Swiss bank, which we sold during the period; Covidien plc, a medical products maker; MEITEC CORPORATION, a Japanese engineering outsourcing firm; and Kimberly-Clark de Mexico, S.A.B. de C.V., a paper products manufacturer.

FUND CHANGES

We remained focused on the intersection of balance sheet strength, business quality and valuation during the past year. Some of the more recent additions to the portfolio were contract caterer Compass Group PLC, technology services provider Accenture PLC and packaged food company Nestle SA. We exited our positions in memory chip manufacturer Samsung Electronics Co., Ltd., cosmetics maker L’Oreal SA, dental implant manufacturer Nobel Biocare Holding AG, financial services provider IGM Financial, Inc. and residential property website operator Rightmove PLC.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/08 | | | 9/30/09 | |

Europe | | 63.8 | % | | 64.2 | % |

Americas | | 10.7 | | | 13.0 | |

Pacific Basin | | 14.2 | | | 10.2 | |

Emerging Markets | | 6.3 | | | 2.7 | |

As a percentage of total net assets.

9

ARTISAN MID CAP FUND (ARTMX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Mid Cap Fund employs a bottom-up investment process to construct a diversified portfolio of primarily U.S. mid-cap growth companies. The Fund’s investment process focuses on two distinct areas – security selection and capital allocation.

The Fund’s investment team attempts to identify companies that possess franchise characteristics that are selling at attractive valuations and benefiting from an accelerating profit cycle.

Franchise characteristics. These are characteristics that the team believes help to protect a company’s stream of cash flow from the effects of competition. The team looks for companies with at least two of the following characteristics: low cost production capability, possession of a proprietary asset, dominant market share or a defensible brand name.

Attractive valuations. Through its own fundamental research, the team estimates the amount a buyer would pay to buy the entire company (the company’s “intrinsic value” or “private market value”) and considers whether to purchase a stock if it sells at a discount to that estimate.

Accelerating profit cycle. The team tries to invest in companies that are well positioned for long-term growth, at an early enough stage in their profit cycle to benefit from the increased cash flows produced by the profit cycle.

Based on the investment team’s fundamental analysis of a company’s profit cycle, portfolio holdings develop through three stages. GardenSM investments are small positions in the early part of their profit cycle that will warrant a more sizeable allocation once their profit cycle accelerates. CropSM investments are positions that are being increased to a full weight because they are moving through the strongest part of their profit cycle. HarvestSM investments are positions that are being reduced as they near the team’s estimate of full valuation or their profit cycle begins to decelerate.

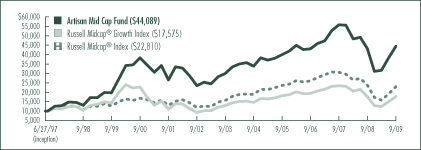

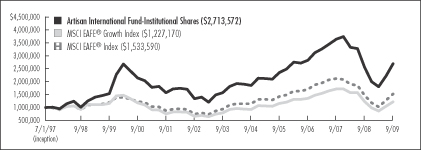

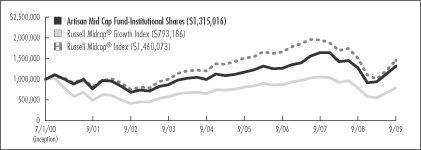

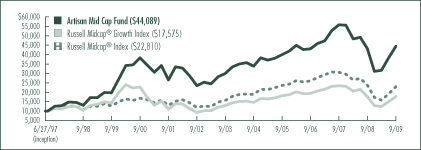

PERFORMANCE HISTORY

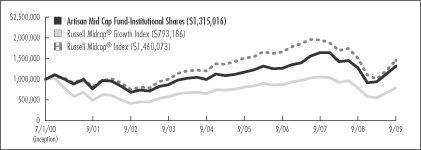

GROWTH OF AN ASSUMED $10,000 INVESTMENT (6/27/1997 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Mid Cap Fund | | 2.47 | % | | 1.04 | % | | 5.52 | % | | 8.44 | % | | 12.86 | % |

Russell Midcap® Growth Index | | -0.40 | | | -3.10 | | | 3.75 | | | 2.18 | | | 4.71 | |

Russell Midcap® Index | | -3.55 | | | -4.07 | | | 3.89 | | | 6.05 | | | 6.96 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 91 for a description of each index.

10

INVESTING ENVIRONMENT

During the fiscal year ended September 30, 2009, the performance of mid-cap stocks was fairly volatile. Through early March, mid-cap stocks sank along with the broader market amid worsening economic conditions and turmoil in the financial sector. Mid-cap stocks then rebounded sharply on increasing signs of stabilization in the financial system and economy. The Russell Midcap® Index declined -3.55% over the full fiscal year. Growth stocks held up better than value names as the Russell Midcap® Growth Index was almost unchanged at -0.40%, while its value counterpart fell -7.12%. Within the Growth Index, sector returns diverged. Some sectors advanced, including technology, consumer discretionary and materials, while financial and telecommunications stocks were down by double-digit percentages.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 7.7 | % | | 16.0 | % |

Consumer Staples | | 4.8 | | | 3.0 | |

Energy | | 4.0 | | | 2.1 | |

Financials | | 8.0 | | | 6.5 | |

Healthcare | | 25.4 | | | 17.8 | |

Industrials | | 14.9 | | | 13.2 | |

Information Technology | | 28.5 | | | 34.7 | |

Materials | | 1.6 | | | 2 .4 | |

Telecommunication Services | | 0.4 | | | — | |

Utilities | | 2.0 | | | — | |

Exchange Traded Funds | | — | | | 0.7 | |

Other assets less liabilities | | 2.7 | | | 3.6 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

The Fund returned 2.47% in the period, outperforming the Russell Midcap® and Russell Midcap® Growth indices. Relative to the benchmarks, the Fund benefited from strong security selection, particularly among our health care, consumer discretionary and industrials holdings, although our leading performers came from a variety of sectors. Our outsized position in the technology sector was also beneficial. Our positive results in the health care sector were driven by Cerner Corporation, a health care information technology company, specialty pharmaceuticals company Allergan, Inc. and Intuitive Surgical, Inc., a maker of minimally invasive robotic surgical systems. Department store operator Kohl’s Corporation and Precision Castparts Corp., a manufacturer of complex metal components, were leading contributors to our return in the consumer discretionary and industrials sectors, respectively. Other standout performers included Broadcom Corporation, Red Hat, Inc. and NVIDIA Corporation.

Among the largest sources of weakness compared to the benchmarks were our utilities and energy holdings. Independent power producers Calpine Corporation and Dynegy Inc. and energy equipment and service provider Smith International, Inc. were among our worst performing utilities and energy holdings.

FUND CHANGES

The most notable changes to the portfolio during the period were increased exposure to the consumer discretionary and information technology sectors and a reduced weighting in the health care sector. In the consumer discretionary sector, we added to our position in Kohl’s Corporation and purchased several new holdings including Dick’s Sporting Goods, Inc., O’Reilly Automotive Inc. and Coach, Inc. In the information technology sector, new purchases included Agilent Technologies, Inc., Citrix Systems, Inc. and ANSYS, Inc., among others.

Our reduced weighting in the health care sector was due in part to the sales of Thermo Fisher Scientific, Inc., Gen-Probe Incorporated and Celgene Corporation. In addition to those sales in health care, our new purchases were funded with the sales of Cooper Industries, Ltd., AGCO Corporation, Intermec, Inc. and Calpine Corporation, among others.

11

ARTISAN MID CAP VALUE FUND (ARTQX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Mid Cap Value Fund employs a bottom-up investment process to construct a diversified portfolio of stocks of medium-sized U.S. companies that the investment team believes are undervalued, in solid financial condition and have attractive business economics. The team believes companies with these characteristics are less likely to experience eroding values over the long term.

Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range.

Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interests of the companies’ shareholders.

Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle.

The Fund generally will not initiate a position in a company unless it has a market capitalization between $2 billion and $15 billion.

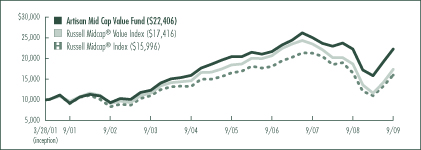

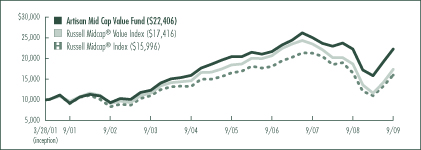

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/2001 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan Mid Cap Value Fund | | 0.21 | % | | 1.04 | % | | 7.00 | % | | 9.94 | % |

Russell Midcap® Value Index | | -7.12 | | | -5.65 | | | 3.53 | | | 6.74 | |

Russell Midcap® Index | | -3.55 | | | -4.07 | | | 3.89 | | | 5.68 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 91 for a description of each index.

12

INVESTING ENVIRONMENT

For the twelve-month period ended September 30, 2009, the Russell Midcap® Value and Russell Midcap® indices returned -7.12% and -3.55%, respectively. The past year has been a tale of two halves. In the first half, markets continued to decline amidst the recessionary environment and both indices declined more than -40% through March 9, 2009. Mid-cap equities subsequently began to rebound and rallied more than 75% from March 10, 2009 through September 30, 2009. The sectors that suffered the biggest losses in the first half, such as financials, consumer discretionary, materials and industrials, were among those that rebounded the most in the latter half of the period. The traditionally defensive utilities and consumer staples sectors held up the best through the decline, but rallied the least.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 18.3 | % | | 12.3 | % |

Consumer Staples | | 0.8 | | | 6.9 | |

Energy | | 4.4 | | | 10.3 | |

Financials | | 19.4 | | | 13.9 | |

Healthcare | | 2.0 | | | 6.8 | |

Industrials | | 27.6 | | | 22.9 | |

Information Technology | | 20.5 | | | 16.4 | |

Utilities | | 0.8 | | | 3.1 | |

Other assets less liabilities | | 6.2 | | | 7.4 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

The Fund returned 0.21% during the twelve-month period ended September 30, 2009 outperforming the Russell Midcap® Value and Russell Midcap® indices. Our holdings in the financials sector were among our worst absolute performers. However, our stocks in that sector held up considerably better than those in the Russell Midcap® Value Index and contributed to our relative outperformance. In particular, we benefited from positive stock selection in the insurance industry. Our results were also helped by our lack of investment in banks and our minimal investment in REITs, as both industries suffered losses in excess of -25%.

We had a similar experience in the industrials sector, where we were not immune to the market weakness, but our losses were smaller than those of the Russell Midcap® Value Index. Strong stock selection in the consumer discretionary and technology sectors contributed positively to our performance during the period.

From an individual stock perspective, our leading performers included LCD glass manufacturer Corning Incorporated, automotive powertrain systems manufacturer BorgWarner Inc., design software developer Autodesk, Inc., mortgage REIT Annaly Capital Management, Inc. and cruise line operator Carnival Corporation. Our biggest decliners during the period included insurance provider White Mountains Insurance Group, Ltd., trucking companies Con-way Inc. and Ryder System, Inc., student loan originator The Student Loan Corporation and floor coverings manufacturer Mohawk Industries, Inc.

FUND CHANGES

The most recent additions to the portfolio included surgical and medical products manufacturer Stryker Corporation, supermarket operator The Kroger Co., prime system contractor L-3 Communications Holdings, Inc., fast food restaurant chain operator Burger King Holdings, Inc. and soup and food manufacturer Campbell Soup Company. On the sale side, we exited our positions in Corning Incorporated, recreational vehicles manufacturer Thor Industries, Inc., defense company General Dynamics Corporation, White Mountains Insurance Group, Ltd. and energy-related utility holding company TECO Energy, Inc.

13

ARTISAN OPPORTUNISTIC GROWTH FUND (ARTRX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Opportunistic Growth Fund employs a bottom-up investment process to construct a diversified portfolio of growth companies across a broad capitalization range. The Fund’s investment process focuses on two distinct areas – security selection and capital allocation.

The Fund’s investment team attempts to identify companies that possess franchise characteristics that are selling at attractive valuations and benefiting from an accelerating profit cycle.

Franchise characteristics. These are characteristics that the team believes help to protect a company’s stream of cash flow from the effects of competition. The team looks for companies with at least two of the following characteristics: low cost production capability, possession of a proprietary asset, dominant market share or a defensible brand name.

Attractive valuations. Through its own fundamental research, the team estimates the amount a buyer would pay to buy the entire company (the company’s “intrinsic value” or “private market value”) and considers whether to purchase a stock if it sells at a discount to that estimate.

Accelerating profit cycle. The team tries to invest in companies that are well positioned for long-term growth, at an early enough stage in their profit cycle to benefit from the increased cash flows produced by the profit cycle.

Based on the investment team’s fundamental analysis of a company’s profit cycle, portfolio holdings develop through three stages. GardenSM investments are small positions in the early part of their profit cycle that will warrant a more sizeable allocation once their profit cycle accelerates. CropSM investments are positions that are being increased to a full weight because they are moving through the strongest part of their profit cycle. HarvestSM investments are positions that are being reduced as they near the team’s estimate of full valuation or their profit cycle begins to decelerate.

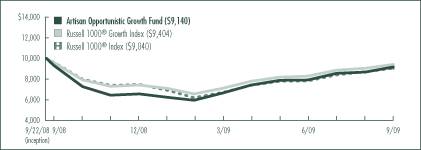

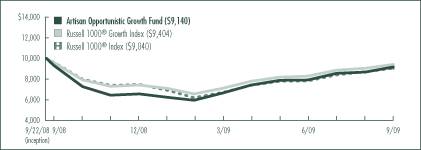

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/22/2008 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | |

| Fund / Index | | 1-Year | | | Since

Inception | |

Artisan Opportunistic Growth Fund | | -1.93 | % | | -8.42 | % |

Russell 1000® Growth Index | | -1.85 | | | -5.84 | |

Russell 1000® Index | | -6.14 | | | -9.41 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. The Fund’s return may vary greatly over short periods, and current performance may be materially lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The table above does not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The Fund’s performance information reflects Artisan Partners’ agreement to limit the Fund’s expenses to no more than 1.50%, which has been in effect since the Fund’s inception and has had a material impact on the Fund’s performance, which would have been lower in its absence. In addition, the outside directors of Artisan Funds have waived that portion of their fees allocable to the Fund until September 30, 2009. Absent that expense waiver, the Fund’s performance would have been lower. See page 91 for a description of each index.

14

INVESTING ENVIRONMENT

During the fiscal year ended September 30, 2009, the performance of stocks was fairly volatile. Through early March, stocks sank amid worsening economic conditions and turmoil in the financial sector. Stocks then rebounded sharply on increasing signs of stabilization in the financial system and the broader economy. The Russell 1000® Index declined -6.14% over the full fiscal year. Growth stocks held up better than value names as the Russell 1000® Growth Index fell -1.85%, while its value counterpart lost -10.62%. Within the Russell 1000® Index, most sectors finished lower, although there was a fair amount of dispersion in returns. The financials sector, which has been at the center of the credit crisis, dropped more than -20%, while the information technology and consumer discretionary sectors managed to notch gains.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 6.4 | % | | 15.1 | % |

Consumer Staples | | 10.2 | | | — | |

Energy | | 2.0 | | | 4.3 | |

Financials | | 12.2 | | | 7.8 | |

Healthcare | | 19.2 | | | 12.6 | |

Industrials | | 10.2 | | | 10.9 | |

Information Technology | | 31.3 | | | 41.8 | |

Materials | | 1.9 | | | 1.4 | |

Telecommunication Services | | 1.1 | | | — | |

Other assets less liabilities | | 5.5 | | | 6.1 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

For the one-year period ended September 30, 2009, the Fund returned -1.93%. Our top performers were consumer electronics company Apple Inc., semiconductor company Broadcom Corporation, specialty coffee retailer Starbucks Corporation, Brazilian energy company Petroleo Brasileiro S.A. and auto components producer Johnson Controls, Inc. The Fund’s largest decliners were video game publisher Electronic Arts Inc., money transfer company The Western Union Company, credit card issuer Discover Financial Services, scientific equipment and consumables provider Thermo Fisher Scientific, Inc. and derivatives exchange operator CME Group Inc.

FUND CHANGES

The investment team seeks companies that possess franchise characteristics that are selling at attractive valuations and benefiting from an accelerating profit cycle. During the twelve-month period ended September 30, 2009, our purchases included EMC Corporation, Apple Inc., eBay Inc., Johnson Controls, Inc. and Citrix Systems, Inc.

Those purchases were partially funded with sales of Electronic Arts Inc., Philip Morris International Inc., Thermo Fisher Scientific, Inc., The Western Union Company and Microsoft Corporation, among others.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/08 | | | 9/30/09 | |

Americas | | 89.5 | % | | 79.8 | % |

Europe | | 3.9 | | | 12.2 | |

Emerging Markets | | 1.1 | | | 1.9 | |

As a percentage of total net assets.

15

ARTISAN OPPORTUNISTIC VALUE FUND (ARTLX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Opportunistic Value Fund employs a bottom-up investment process to construct a diversified portfolio of stocks that the team believes are undervalued, in solid financial condition with attractive business economics. The team believes companies with these characteristics are less likely to experience eroding values over the long term.

Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range.

Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interest of the companies’ shareholders.

Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle.

The Fund will invest in U.S. companies with market capitalizations of at least $2 billion at the time of initial purchase, and may invest up to 25% of its net assets at market value at the time of purchase in non-U.S. securities.

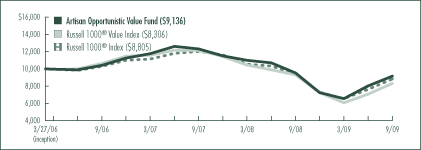

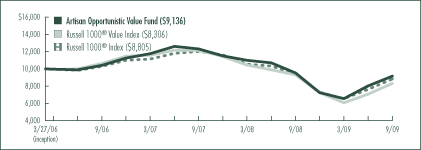

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/27/2006 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan Opportunistic Value Fund | | -4.10 | % | | -4.26 | % | | -2.54 | % |

Russell 1000® Value Index | | -10.62 | | | -7.87 | | | -5.15 | |

Russell 1000® Index | | -6.14 | | | -5.10 | | | -3.56 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 91 for a description of each index.

16

INVESTING ENVIRONMENT

For the twelve-month period ended September 30, 2009, the Russell 1000® Value and Russell 1000® indices returned -10.62% and -6.14%, respectively. The past year has been a tale of two halves. In the first half, markets continued to decline amidst the recessionary environment and both indices declined more than -40% through March 9, 2009. Large-cap equities subsequently began to rebound and rallied more than 59% from March 10, 2009 through September 30, 2009. The sectors that suffered the biggest losses in the first half, such as financials, industrials, materials and consumer discretionary, were those that rebounded the most in the latter half of the period. The traditionally defensive consumer staples, health care and utilities sectors held up the best through the declines, but were among those that rallied the least.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 11.9 | % | | 12.6 | % |

Consumer Staples | | 0.8 | | | 14.2 | |

Energy | | 4.7 | | | 5.8 | |

Financials | | 18.0 | | | 18.9 | |

Healthcare | | 2.6 | | | 10.8 | |

Industrials | | 13.8 | | | 8.3 | |

Information Technology | | 44.0 | | | 26.5 | |

Other assets less liabilities | | 4.2 | | | 2.9 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

For the twelve-month period ended September 30, 2009, the Fund returned -4.10%, outperforming the Russell 1000® Value and Russell 1000® indices. Our strongest positive contributors to performance included energy company Apache Corporation, mortgage REIT Annaly Capital Management, Inc., entertainment company The Walt Disney Company, tobacco company Philip Morris International Inc. and staffing firm Manpower Inc. The Fund’s biggest decliners during the period included investment management firm AllianceBernstein Holding LP, insurance company The Allstate Corporation, floor coverings manufacturer Mohawk Industries, Inc., electronic components distributor Arrow Electronics, Inc. and oil refiner Valero Energy Corporation.

FUND CHANGES

The most recent additions to the portfolio included global security company Lockheed Martin Corporation, discount retailer Wal-Mart Stores, Inc., supermarket operator The Kroger Co., fast food restaurant chain operator McDonald’s Corporation and multinational food company Nestle SA. On the sale side, we exited our positions in Valero Energy Corporation, defense company General Dynamics Corporation, Manpower Inc., commercial aircraft manufacturer The Boeing Company and data networking solutions provider Cisco Systems, Inc.

REGION ALLOCATION

| | | | | | |

| Region | | 9/30/08 | | | 9/30/09 | |

Americas | | 88.5 | % | | 89.4 | % |

Europe | | 4.4 | | | 7.7 | |

Emerging Markets | | 2.9 | | | — | |

As a percentage of total net assets.

17

ARTISAN SMALL CAP FUND (ARTSX)

INVESTMENT PROCESS HIGHLIGHTS

During the period Artisan Small Cap Fund employed the following bottom-up investment process to construct a diversified portfolio of U.S. small-cap growth companies.

Competitive advantages. A sustainable competitive advantage is critical to producing above-average growth and profitability. Identifying the source of a company’s competitive advantage lends confidence to the team’s assessment of intrinsic value.

Return on invested capital. The team believes that, over time, a company with improving returns on its invested capital will be rewarded with a higher valuation. The team determines how much capital investment is needed to achieve a company’s continued growth and analyzes management’s ability to use that capital in the most effective way to support that growth.

Intrinsic value. The team estimates a company’s intrinsic value—the value it thinks a buyer would pay to buy the entire company. The team bases its buy and sell targets for a company’s stock on its intrinsic value estimates.

The Fund will not initiate a position in a company unless it has a market capitalization of less than $2.5 billion and meets the team’s standards for earnings growth and sustainable growth prospects.

Effective October 1, 2009, Artisan Small Cap Fund will be managed by Craigh Cepukenas, Andrew Stephens and James Hamel. Mr. Stephens and Mr. Hamel also manage Artisan Mid Cap Fund and Artisan Opportunistic Growth Fund.

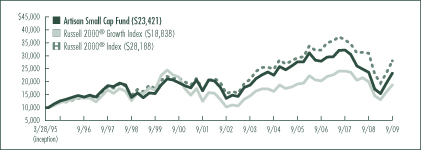

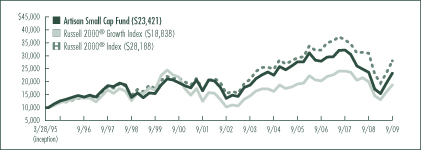

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/1995 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Small Cap Fund | | -1.73 | % | | -5.83 | % | | 0.63 | % | | 4.19 | % | | 6.04 | % |

Russell 2000® Growth Index | | -6.32 | | | -2.60 | | | 2.91 | | | 1.10 | | | 4.46 | |

Russell 2000® Index | | -9.55 | | | -4.57 | | | 2.41 | | | 4.88 | | | 7.40 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 91 for a description of each index.

18

INVESTING ENVIRONMENT

During the fiscal year ended September 30, 2009, the performance of small-cap stocks was fairly volatile. Through early March, small-cap stocks sank along with the market generally amid worsening economic conditions and turmoil in the financial sector. Small-cap stocks then rebounded sharply on increasing signs of stabilization in the financial system and the broader economy. Small-cap stocks underperformed mid- and large-cap stocks for the year, as the Russell 2000® and Russell 2000® Growth indices dropped -9.55% and -6.32%, respectively. Within the Russell 2000® Growth Index, most sectors finished lower, although there was a fair amount of dispersion in returns. The energy, industrials and financials sectors each fell by double-digit percentages. The information technology sector was the standout, appreciating more than 10%.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 10.6 | % | | 10.1 | % |

Consumer Staples | | 2.7 | | | 3.7 | |

Energy | | 7.1 | | | 7.4 | |

Financials | | 5.4 | | | 7.4 | |

Healthcare | | 18.0 | | | 14.8 | |

Industrials | | 25.8 | | | 20.6 | |

Information Technology | | 23.6 | | | 28.9 | |

Materials | | 0.6 | | | 1.3 | |

Telecommunication Services | | 0.7 | | | — | |

Utilities | | 1.2 | | | 1.4 | |

Other assets less liabilities | | 4.3 | | | 4.4 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

The Fund returned -1.73% in the period, outperforming the Russell 2000® and Russell 2000® Growth indices. Compared with the Russell 2000® Growth Index, the Fund benefited from strong security selection, particularly in the information technology and industrials sectors. Digital entertainment solutions developer Rovi Corporation, electronic payments provider Euronet Worldwide, Inc. and Internet exchange services provider Equinix, Inc. were among the Fund’s best performers in the technology sector. Stocks that contributed to our outperformance in the industrials sector included ship refueling services company Aegean Marine Petroleum Network Inc., less-than-truckload provider Old Dominion Freight Line, Inc. and correctional facilities operator Corrections Corporation of America. Other leading performers during the period were gaming machine designer WMS Industries, offshore drilling contractor Atwood Oceanics, Inc. and business development company Ares Capital Corporation.

The health care sector was the primary area of relative weakness. Detracting from our performance in the sector were ICON PLC, a global clinical research services contractor, Wright Medical Group, Inc., an orthopedic device company, and minimally invasive surgical device company ArthroCare Corporation. Other major detractors to performance were oil services contractor Hercules Offshore, Inc., commodity risk management company FCStone Group, Inc. and specialty retailer Tween Brands, Inc.

FUND CHANGES

Record levels of volatility in the period created many new purchase opportunities. The biggest portfolio shifts occurred in the information technology and industrials sectors, which increased and decreased in weight, respectively. In the technology sector we added previously mentioned Equinix, Inc., information technology national security company ManTech International Corporation and design software company ANSYS, Inc.

Our exposure in the industrials sector declined due to sales of Interline Brands, Inc., Healthcare Services Group, Inc., Innerworkings, Inc. and Ladish Co., Inc., among others.

19

ARTISAN SMALL CAP VALUE FUND (ARTVX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Small Cap Value Fund employs a bottom-up investment process to construct a diversified portfolio of small-cap U.S. companies that the team believes are undervalued, in solid financial condition and have attractive business economics. The team believes companies with these characteristics are less likely to experience eroding values over the long term.

Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range.

Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interest of the companies’ shareholders.

Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle.

The Fund will not initiate a position in a company unless it has a market capitalization below $2 billion.

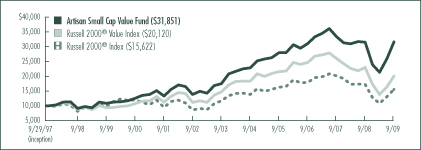

PERFORMANCE HISTORY

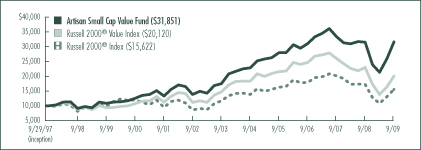

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/29/1997 to 9/30/2009)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2009)

| | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Small Cap Value Fund | | 0.46 | % | | 0.58 | % | | 6.77 | % | | 11.43 | % | | 10.13 | % |

Russell 2000® Value Index | | -12.61 | | | -6.65 | | | 1.78 | | | 8.05 | | | 6.00 | |

Russell 2000® Index | | -9.55 | | | -4.57 | | | 2.41 | | | 4.88 | | | 3.79 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 91 for a description of each index.

20

INVESTING ENVIRONMENT

For the twelve months ended September 30, 2009, the Russell 2000® Value Index returned -12.61% and the Russell 2000® Index returned -9.55. The past year has been a tale of two halves. In the first half, markets continued to decline amidst the recessionary environment and both indices declined approximately -50% through March 9, 2009. Small-cap equities subsequently rebounded off March lows and rallied more than 80% through September 30, 2009. The sectors that suffered the biggest losses in the first half, such as financials, consumer discretionary, materials and energy, were those that rebounded the most in the latter half of the period. The traditionally defensive utilities and consumer staples sectors held up the best through the market’s decline, but rallied the least.

SECTOR DIVERSIFICATION

| | | | | | |

| Sector | | 9/30/08 | | | 9/30/09 | |

Consumer Discretionary | | 13.1 | % | | 5.8 | % |

Consumer Staples | | 3.1 | | | 2.6 | |

Energy | | 6.3 | | | 7.8 | |

Financials | | 11.8 | | | 8.6 | |

Healthcare | | 5.6 | | | 5.6 | |

Industrials | | 20.3 | | | 22.8 | |

Information Technology | | 28.1 | | | 24.9 | |

Materials | | 2.3 | | | 4.7 | |

Utilities | | 3.2 | | | 9.1 | |

Other assets less liabilities | | 6.2 | | | 8.1 | |

Total | | 100.0 | % | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

With a return of 0.46%, the Fund outpaced both indices by more than 10%. Our biggest source of relative strength was the outperformance of our industrials holdings, led by energy services company McDermott International, Inc. and civil construction and transportation contractor Granite Construction Incorporated. Our investments in the financial sector also held up better than those in the Russell 2000® Value Index, primarily due to our lack of investment in commercial banks, which declined -40% in the Index. Similarly, our outsized position in the technology sector, one of only two sectors in the Index to post a gain, worked in our favor. Other top contributors this period included semiconductor processing equipment company Varian Semiconductor Equipment Associates, Inc., steel scrap recycler Schnitzer Steel Industries, Inc., computer products distributor Arrow Electronics, Inc. and chicken producer Sanderson Farms, Inc.

On the downside, we underperformed the Index in the health care and consumer discretionary sectors. The double digit losses of some of our health care services providers, namely AMN Healthcare Services, Inc. and Cross Country Healthcare, Inc., held back returns in the health care sector. Ethan Allen Interiors Inc., AnnTaylor Stores Corporation and The Men’s Wearhouse, Inc. were our biggest detractors in the consumer discretionary sector. Our relative positioning in the consumer discretionary sector also worked against us. Our overweight position at the end of 2008 proved negative and, after we sold a number of our names in the sector, our newly underweight position held back returns as the sector sharply rebounded.

FUND CHANGES

During the period we initiated positions in energy services company Cleco Corporation, global consulting firm Watson Wyatt Worldwide, Inc., electric utility Portland General Electric Company, chemicals manufacturer Olin Corporation and gas and electricity distributor Vectren Corporation.

Some of our larger sales during the period included Con-way Inc., Cymer, Inc., Ethan Allen Interiors Inc., Old Dominion Freight Line, Inc., Schnitzer Steel Industries, Inc. and Thor Industries, Inc.

21

ARTISAN GLOBAL VALUE FUND

Schedule of Investments – September 30, 2009

| | | | | |

| | | Shares

Held | | Value |

| | | | | |

| COMMON STOCKS AND EQUITY-LINKED SECURITIES - 95.9% | | | |

| | | | | |

| CHINA - 0.0%(1) | | | | | |

Wynn Macau Ltd.(2)(3)(4)(5) | | 550 | | $ | 715 |

| | | | | |

| FRANCE - 8.7% | | | | | |

Publicis Groupe | | 19,886 | | | 797,635 |

Societe Television Francaise 1 | | 39,872 | | | 700,743 |

Sodexo | | 11,328 | | | 678,655 |

Total SA | | 5,394 | | | 320,508 |

| | | | | |

| | | | | 2,497,541 |

| HONG KONG - 2.9% | | | | | |

Guoco Group Limited | | 79,250 | | | 835,954 |

| | | | | |

| IRELAND - 1.3% | | | | | |

Ryanair Holdings PLC, Equity-Linked Security, 144A(2)(3)(5)(6) | | 75,397 | | | 378,163 |

| | | | | |

| JAPAN - 3.5% | | | | | |

Credit Saison Co., Ltd. | | 25,900 | | | 304,689 |

Daiwa Securities Group Inc. | | 59,596 | | | 307,391 |

SANKYO CO., LTD. | | 6,248 | | | 391,174 |

| | | | | |

| | | | | 1,003,254 |

| MEXICO - 1.3% | | | | | |

Grupo Modelo, S.A. de C.V., Series C(3) | | 98,292 | | | 366,019 |

| | | | | |

| NETHERLANDS - 1.2% | | | | | |

Wolters Kluwer NV | | 16,551 | | | 353,489 |

| | | | | |

| SWITZERLAND - 13.4% | | | | | |

Adecco SA | | 11,071 | | | 588,644 |

Givaudan SA | | 930 | | | 697,298 |

Novartis AG | | 21,640 | | | 1,082,731 |

Panalpina Welttransport Holding AG | | 6,026 | | | 497,757 |

Pargesa Holding SA | | 11,072 | | | 956,233 |

| | | | | |

| | | | | 3,822,663 |

| UNITED KINGDOM - 20.6% | | | | | |

Cadbury PLC | | 8,099 | | | 103,936 |

Cadbury PLC (DR) | | 4,832 | | | 247,447 |

Compass Group PLC | | 106,266 | | | 649,257 |

Diageo plc | | 57,147 | | | 876,764 |

Experian PLC | | 152,166 | | | 1,280,365 |

Home Retail Group plc | | 64,357 | | | 279,655 |

Royal Dutch Shell PLC, Class A | | 11,866 | | | 339,468 |

Signet Jewelers Ltd.(3) | | 46,757 | | | 1,231,112 |

| | | | | | | |

| | | Shares

Held | | Value | |

| | | | | | | |

| UNITED KINGDOM (CONTINUED) | | | | | | | |

Unilever PLC (DR) | | | 30,508 | | $ | 874,969 | |

| | | | | | | |

| | | | | | 5,882,973 | |

| UNITED STATES - 43.0% | | | | | | | |

3M Company | | | 7,690 | | | 567,522 | |

American Express Company | | | 35,403 | | | 1,200,162 | |

Arch Capital Group Ltd.(3) | | | 13,901 | | | 938,873 | |

The Bank of New York Mellon Corporation | | | 29,425 | | | 853,031 | |

Cintas Corporation | | | 24,874 | | | 753,931 | |

Covidien plc | | | 11,403 | | | 493,294 | |

Dell Inc.(3) | | | 50,072 | | | 764,099 | |

FedEx Corporation | | | 1,051 | | | 79,056 | |

Johnson & Johnson | | | 15,595 | | | 949,580 | |

Marsh & McLennan Companies, Inc. | | | 43,149 | | | 1,067,075 | |

Microsoft Corporation | | | 40,701 | | | 1,053,749 | |

Mohawk Industries, Inc.(3) | | | 14,603 | | | 696,417 | |

The Procter & Gamble Company | | | 17,800 | | | 1,030,976 | |

The Sherwin-Williams Company | | | 6,086 | | | 366,134 | |

Tyco Electronics Ltd. | | | 35,811 | | | 797,869 | |

Wal-Mart Stores, Inc. | | | 11,135 | | | 546,617 | |

WellPoint Inc.(3) | | | 2,990 | | | 141,606 | |

| | | | | | | |

| | | | | | 12,299,991 | |

| | | | | | | |

Total common stocks and equity-linked securities

(Cost $21,903,825) | | | | | | 27,440,762 | |

| | |

| | | Par

Amount | | | |

SHORT-TERM INVESTMENTS

(CASH EQUIVALENTS) - 4.8% | | | | | | | |

Repurchase agreement with Fixed Income Clearing Corporation, 0.01%, dated 9/30/09, due 10/1/09, maturity value $1,368,000(7)

(Cost $1,368,000) | | $ | 1,368,000 | | | 1,368,000 | |

| | | | | | | |

| | | | | | | |

Total investments - 100.7%

(Cost $23,271,825) | | | | | | 28,808,762 | |

| | | | | | | |

Other assets less liabilities - (0.7%) | | | | | | (191,197 | ) |

| | | | | | | |

| | | | | | | |

Total net assets - 100.0%(8) | | | | | $ | 28,617,565 | |

| | | | | | | |

22

| (1) | Represents less than 0.1% of total net assets. |

| (2) | Valued at a fair value in accordance with procedures established by the board of directors of Artisan Funds, Inc. In total, securities valued at a fair value were $378,878 or 1.3% of total net assets. |

| (3) | Non-income producing security. |

| (4) | Security has been determined to be illiquid under procedures established by the board of directors of Artisan Funds, Inc. In total, the value of securities determined to be illiquid were $715, or less than 0.1% of total net assets. |

| (5) | Securities are restricted and were acquired in a transaction under Rule 144A of the Securities Act of 1933. Restricted securities may be resold in transactions exempt from registration normally to qualified institutional buyers. Ryanair Holdings PLC was acquired on various dates from August 26, 2009 to September 24, 2009 at an aggregate cost of $334,783. Wynn Macau Ltd. was acquired on September 30, 2009 at an aggregate cost of $723. In total, the value of restricted securities held by the Fund was $378,878 or 1.3% of total net assets. |

| (6) | Security is an equity-linked participation certificate issued by HSBC Bank plc. As described in Note 2(i) in Notes to Financial Statements, equity-linked participation certificates are subject to counterparty risk with respect to the bank or broker-dealer that issues them. |

| | | | | | | | |

Issuer | | Rate | | | Maturity | | Value |

U.S. Treasury Bond | | 2.625 | % | | 7/31/2014 | | $ | 1,399,063 |

| (8) | Percentages for the various classifications relate to total net assets. |

Company names are as reported by a data service provider and in some cases are translations; a company’s legal name may be different.

(DR) Depository Receipt, voting rights may vary.

| | | | | | | |

| PORTFOLIO DIVERSIFICATION - September 30, 2009 | |

| | | Value | | | Percentage

of Total

Net Assets | |

Consumer Discretionary | | $ | 6,144,986 | | | 21.5 | % |

Consumer Staples | | | 4,046,728 | | | 14.2 | |

Energy | | | 659,976 | | | 2.3 | |

Financials | | | 6,463,408 | | | 22.6 | |

Healthcare | | | 2,667,211 | | | 9.3 | |

Industrials | | | 4,145,438 | | | 14.5 | |

Information Technology | | | 2,615,717 | | | 9.1 | |

Materials | | | 697,298 | | | 2.4 | |

| | | | | | | |

Total common stocks | | | 27,440,762 | | | 95.9 | |

Short term investments | | | 1,368,000 | | | 4.8 | |

| | | | | | | |

Total investments | | | 28,808,762 | | | 100.7 | |

Other assets less liabilities | | | (191,197 | ) | | (0.7 | ) |

| | | | | | | |

Total net assets | | $ | 28,617,565 | | | 100.0 | % |

| | | | | | | |

| | | | | | |

| CURRENCY EXPOSURE - September 30, 2009 | | | |

| | | Value | | Percentage

of Total

Investments | |

British pound | | $ | 3,189,977 | | 11.1 | % |

Euro | | | 3,568,661 | | 12.4 | |

Hong Kong dollar | | | 836,669 | | 2.9 | |

Japanese yen | | | 1,003,254 | | 3.5 | |

Mexican peso | | | 366,019 | | 1.3 | |

Swiss franc | | | 3,822,663 | | 13.2 | |

U.S. dollar | | | 16,021,519 | | 55.6 | |

| | | | | | |

Total investments | | $ | 28,808,762 | | 100.0 | % |

| | | | | | |

| | | | | |

| TOP TEN HOLDINGS - September 30, 2009 | |

Company Name | | Country | | Percentage

of Total

Net Assets | |

Experian PLC | | United Kingdom | | 4.5 | % |

Signet Jewelers Ltd. | | United Kingdom | | 4.3 | |

American Express Company | | United States | | 4.2 | |

Novartis AG | | Switzerland | | 3.8 | |

Marsh & McLennan Companies, Inc. | | United States | | 3.7 | |

Microsoft Corporation | | United States | | 3.7 | |

The Procter & Gamble Company | | United States | | 3.6 | |

Pargesa Holding SA | | Switzerland | | 3.3 | |

Johnson & Johnson | | United States | | 3.3 | |

Arch Capital Group Ltd. | | United States | | 3.3 | |

| | | | | |

Total | | | | 37.7 | % |

| | | | | |

For the purpose of determining the Fund’s top ten holdings, securities of the same issuer are aggregated to determine the weight in the Fund.

The accompanying notes are an integral part of the financial statements.

23

ARTISAN INTERNATIONAL FUND

Schedule of Investments – September 30, 2009

| | | | | |

| | | Shares

Held | | Value |

| COMMON AND PREFERRED STOCKS AND EQUITY-LINKED SECURITIES - 98.9% | | | | | |

| | | | | |

| BELGIUM - 1.4% | | | | | |

Anheuser-Busch InBev NV | | 3,038,935 | | $ | 138,769,333 |

Umicore | | 306,886 | | | 9,188,204 |

| | | | | |

| | | | | 147,957,537 |

| BRAZIL - 1.5% | | | | | |

Petroleo Brasileiro S.A., Preferred (DR) | | 4,143,960 | | | 162,899,068 |

| | | | | |

| CANADA - 2.7% | | | | | |

Canadian Pacific Railway Limited | | 6,172,234 | | | 288,551,939 |

| | | | | |

| CHINA - 5.3% | | | | | |

China Construction Bank, H Shares | | 209,744,100 | | | 167,794,197 |

China Life Insurance Co., Limited, H Shares | | 50,676,900 | | | 220,688,302 |

China Merchants Bank Co., Ltd., H Shares | | 10,226,500 | | | 22,801,649 |

China Merchants Holdings International Company Limited | | 28,474,900 | | | 94,793,249 |

Industrial and Commercial Bank of China Ltd, H Shares | | 71,035,000 | | | 53,436,307 |

Wynn Macau Ltd.(1)(2)(3)(4) | | 213,200 | | | 277,296 |

| | | | | |

| | | | | 559,791,000 |

| DENMARK - 1.0% | | | | | |

Danske Bank A/S(2) | | 3,886,311 | | | 101,797,887 |

| | | | | |

| FRANCE - 12.9% | | | | | |

Accor S.A. | | 3,289,802 | | | 183,129,442 |

BNP Paribas | | 2,243,378 | | | 179,243,330 |

BNP Paribas Rights(2)(5)

Exercise Price: 40.00 EUR

Expiration: 10/13/09 | | 2,243,378 | | | 4,858,609 |

Compagnie de Saint-Gobain | | 1,321,134 | | | 68,534,778 |

Credit Agricole S.A. | | 2,645,543 | | | 55,282,915 |

DANONE S.A. | | 430,414 | | | 25,937,053 |

Natixis(2) | | 14,561,979 | | | 87,794,138 |

Pernod Ricard SA | | 3,142,325 | | | 249,550,719 |

Societe Generale | | 2,612,019 | | | 210,226,241 |

Unibail-Rodamco | | 531,342 | | | 110,371,628 |

Vinci SA | | 3,506,906 | | | 198,396,442 |

| | | | | |

| | | | | 1,373,325,295 |

| GERMANY - 15.3% | | | | | |

Allianz SE | | 1,149,794 | | | 143,639,281 |

| | | | | |

| | | Shares

Held | | Value |

| GERMANY (CONTINUED) | | | | | |

Bayer AG | | 5,149,899 | | $ | 356,834,304 |

Daimler AG | | 6,650,536 | | | 334,831,351 |

Deutsche Post AG | | 7,488,127 | | | 140,259,109 |

Fraport AG | | 763,372 | | | 40,605,844 |

Linde AG | | 3,227,712 | | | 349,899,768 |

Muenchener Rueckversicherungs-Gesellschaft AG | | 1,640,735 | | | 261,777,526 |

| | | | | |

| | | | | 1,627,847,183 |

| HONG KONG - 2.0% | | | | | |

The Bank of East Asia, Ltd. | | 21,134,040 | | | 76,354,749 |

Li & Fung Limited | | 16,282,000 | | | 66,808,292 |

NWS Holdings Limited | | 34,876,746 | | | 67,772,956 |

| | | | | |

| | | | | 210,935,997 |

| INDIA - 2.4% | | | | | |

Housing Development Finance Corporation Ltd. | | 1,248,822 | | | 71,777,735 |

ICICI Bank Limited | | 2,180,220 | | | 41,014,241 |

ICICI Bank Limited (DR) | | 3,781,414 | | | 145,811,324 |

| | | | | |

| | | | | 258,603,300 |

| IRELAND - 0.3% | | | | | |

The Governor and Company of the Bank of Ireland(2) | | 7,014,128 | | | 35,103,280 |

| | | | | |

| ITALY - 3.8% | | | | | |

Assicurazioni Generali S.p.A. | | 4,549,408 | | | 124,692,568 |

Banca Monte dei Paschi di Siena S.p.A. | | 33,618,584 | | | 71,924,143 |

Intesa Sanpaolo(2) | | 46,351,919 | | | 205,013,251 |

| | | | | |

| | | | | 401,629,962 |

| JAPAN - 5.9% | | | | | |

ADVANTEST CORPORATION | | 915,900 | | | 25,406,238 |

DENSO CORPORATION | | 3,723,834 | | | 109,518,429 |

JAPAN TOBACCO INC. | | 22,388 | | | 76,817,290 |

MITSUI & CO., LTD. | | 3,733,500 | | | 48,828,931 |

Mitsui Fudosan Co., Ltd. | | 421,250 | | | 7,128,377 |