UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08932

Artisan Partners Funds, Inc.

(Exact name of registrant as specified in charter)

875 East Wisconsin Avenue, Suite 800

Milwaukee, WI 53202

(Address of principal executive offices) (Zip Code)

| | |

| Sarah A. Johnson | | Alyssa Albertelli |

| Artisan Partners Funds, Inc. | | Ropes & Gray LLP |

| 875 East Wisconsin Avenue, Suite 800 | | One Metro Center |

| Milwaukee, Wisconsin 53202 | | 700 12th Street, N.W., Suite 900 |

| | Washington, D.C. 20005-3948 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (414) 390-6100

Date of fiscal year end: 9/30/11

Date of reporting period: 9/30/11

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Shareholders. |

ANNUAL

REPORT

September 30, 2011

ARTISAN GLOBAL EQUITY FUND

ARTISAN GLOBAL VALUE FUND

ARTISAN GROWTH OPPORTUNITIES FUND

(formerly known as

Artisan Opportunistic Growth Fund)

ARTISAN INTERNATIONAL FUND

ARTISAN INTERNATIONAL SMALL CAP FUND

ARTISAN INTERNATIONAL VALUE FUND

ARTISAN MID CAP FUND

ARTISAN MID CAP VALUE FUND

ARTISAN SMALL CAP FUND

ARTISAN SMALL CAP VALUE FUND

ARTISAN VALUE FUND

(formerly known as Artisan

Opportunistic Value Fund)

ARTISAN FUNDS

INVESTOR SHARES

TABLE OF CONTENTS

ARTISAN FUNDS

P.O. BOX 8412

BOSTON, MA 02266-8412

This report and the audited financial statements contained herein are provided for the general information of the shareholders of Artisan Funds. Before investing, investors should consider carefully each Fund’s investment objective, risks and charges and expenses. For a prospectus, which contains that information and more information about each Fund, please call 800.344.1770 or visit our website at www.artisanfunds.com. Read it carefully before you invest or send money.

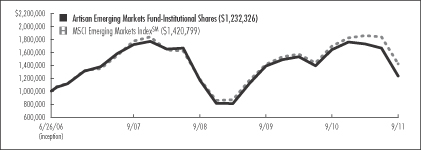

Company discussions are for illustration only and are not intended as recommendations of individual stocks. The discussions present information about the companies believed to be accurate, and the views of the portfolio managers, as of September 30, 2011. That information and those views may change, and the Funds disclaim any obligation to advise shareholders of any such changes. Artisan Emerging Markets Fund, Artisan Growth Opportunities Fund, Artisan International Fund, Artisan International Value Fund, Artisan Mid Cap Fund and Artisan Value Fund, offer other classes of shares. Reports on each of the other classes are available under separate cover.

Artisan Funds offered through Artisan Partners Distributors LLC, member FINRA.

ARTISAN GLOBAL EQUITY FUND (ARTHX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Global Equity Fund employs a fundamental stock selection process focused on identifying long-term growth opportunities. The investment team’s thematic approach identifies catalysts for change and develops investment themes with the objective of capitalizing on them globally.

Themes. Changing demographics, developing technology, privatization of economic resources, outsourcing and infrastructure are among the long-term catalysts for change that currently form the basis for our investment themes. The team incorporates these catalysts along with sector and regional fundamentals into a long-term global framework for investment analysis and decision-making.

Sustainable Growth. The team applies a fundamental approach to identifying the long-term, sustainable growth characteristics of potential investments. The team seeks high quality companies that are well managed, have a dominant or improving market position and competitive advantages compared to industry and regional peers.

Valuation. The team assesses the relationship between its estimate of a company’s sustainable growth prospects and its stock price. The team utilizes multiple valuation metrics to establish price targets.

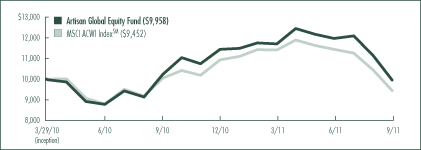

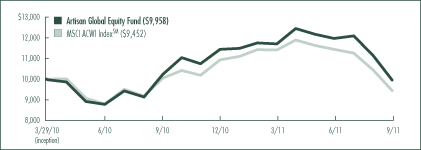

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/29/2010 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | |

| Fund / Index | | 1-Year | | | Since

Inception | |

Artisan Global Equity Fund | | | -2.66 | % | | | -0.28 | % |

MSCI ACWISM (All Country World Index) | | | -6.01 | | | | -3.67 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. The Fund’s investments in initial public offerings (IPOs) made a material contribution to the Fund’s performance. IPO investments are not an integral component of the Fund’s investment process and may not be available in the future. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s performance information reflects Artisan Partners’ contractual agreement to limit the Fund’s expenses to no more than 1.50%, which has been in effect since the Fund’s inception and has had a material impact on the Fund’s performance, which would have been lower in its absence. See page 113 for a description of the index.

2

INVESTING ENVIRONMENT

Although corporate earnings were generally solid during the period, global equity markets were volatile as various macro events, ranging from sovereign debt woes in Europe and the U.S. to natural disasters in Japan and political turmoil in Egypt, weighed on investor sentiment. Coupled with fears of a slowdown in global growth, the MSCI All Country World IndexSM ended the period in the red with declines across all regions. Buoyed by the U.S., which managed to turn out an approximately 1% gain, the Americas was the best faring region. Sector-wise, the traditionally defensive consumer staples and health care sectors posted gains while the financials, materials and industrials sectors suffered the largest declines.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 14.0 | % | | | 16.9 | % |

Consumer Staples | | | 15.3 | | | | 21.8 | |

Energy | | | 3.9 | | | | 4.7 | |

Financials | | | 20.9 | | | | 14.5 | |

Healthcare | | | 8.4 | | | | 8.6 | |

Industrials | | | 9.7 | | | | 9.9 | |

Information Technology | | | 21.0 | | | | 12.7 | |

Materials | | | 7.4 | | | | 5.6 | |

Telecommunication Services | | | — | | | | 1.8 | |

Other assets less liabilities | | | (0.6 | ) | | | 3.5 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Global Equity Fund declined 2.66%, outperforming the MSCI All Country World IndexSM, which fell 6.01% over the same period.

Over the past year, the Fund had several strong performers, including Japanese oil and natural gas holding company INPEX CORPORATION, fast-food restaurant operator McDonald’s Corporation and Hargreaves Lansdown PLC, a provider of investment management products and services in the U.K. Also contributing to our results was the Fund’s participation in initial public offerings, two of which were the top contributors to performance – Chinese internet content and application services provider ChinaCache International Holdings Ltd. and Chinese hypermarket operator Sun Art Retail Group.

Notable detractors over the past year included: Camelot Information Systems, Inc., a provider of enterprise application services and financial industry information technology services; Halliburton Company, an oilfield services company; Akzo Nobel N.V., a manufacturer of paints, coatings and specialty chemicals; MGM Resorts International, an operator of gaming, hospitality and entertainment resorts; and Bayer AG, a producer of health care and agricultural products.

REGION ALLOCATION

| | | | | | | | |

| Region | | 9/30/10 | | | 9/30/11 | |

Europe | | | 40.4 | % | | | 38.7 | % |

Americas | | | 28.5 | | | | 36.7 | |

Pacific Basin | | | 10.3 | | | | 11.7 | |

Emerging Markets | | | 21.4 | | | | 9.4 | |

As a percentage of total net assets.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including food processing company DANONE S.A., insurance and financial services provider AIA Group Ltd., consumer goods company Unilever NV, non-alcoholic beverage manufacturer The Coca-Cola Company, and consumer packaged goods provider The Procter & Gamble Company. We funded these purchases in part by selling our positions in previously mentioned ChinaCache International Holdings Ltd., Cisco Systems Inc., UBS AG, Tesco plc and Agricultural Bank of China Limited.

3

ARTISAN GLOBAL VALUE FUND (ARTGX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Global Value Fund employs a bottom-up investment process to construct a diversified portfolio of securities of undervalued U.S. and non-U.S. companies. The Fund’s investment process is focused on identifying what the investment team considers to be high quality, undervalued businesses that offer the potential for superior risk/reward outcomes. The team’s in-depth research process focuses on four key investment characteristics:

Undervaluation. Determining the intrinsic value of the business is the heart of the team’s research process. The team believes that intrinsic value represents the amount that a buyer would pay to own a company’s future cash flows. The team seeks to invest at a significant discount to the team’s estimate of the intrinsic value of a business.

Business quality. The team seeks to invest in companies with histories of generating strong free cash flow, improving returns on capital and strong competitive positions in their industries.

Financial strength. The team believes that investing in companies with strong balance sheets helps to reduce the potential for capital risk and provides company management the ability to build value when attractive opportunities are available.

Shareholder-oriented management. The team’s research process attempts to identify management teams with a history of building value for shareholders.

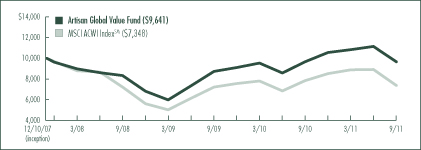

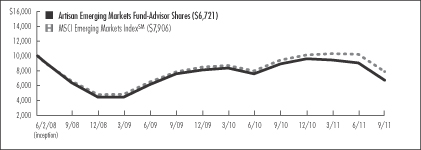

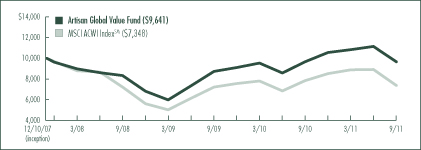

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/10/2007 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan Global Value Fund | | | -0.23 | % | | | 5.03 | % | | | -0.96 | % |

MSCI ACWISM (All Country World Index) | | | -6.01 | | | | 0.59 | | | | -7.77 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s performance information reflects Artisan Partners’ contractual agreement to limit the Fund’s expenses to no more than 1.50%, which has been in effect since the Fund’s inception and has had a material impact on the Fund’s performance, which would have been lower in its absence. See page 113 for a description of the index.

4

INVESTING ENVIRONMENT

Global equity markets experienced volatility during the year ended September 30, 2011 stemming from concerns over a global economic slowdown, indecision on the political fronts in the U.S. and Europe, sovereign debt downgrades and worries over contagion from Europe’s debt crisis. The tragic earthquake and tsunami in Japan and turmoil in the Middle East also contributed to market volatility. Despite the fear in the marketplace, many companies continued to report steady earnings results during the period.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 16.8 | % | | | 17.3 | % |

Consumer Staples | | | 11.5 | | | | 13.2 | |

Energy | | | 2.2 | | | | 2.1 | |

Financials | | | 26.8 | | | | 26.8 | |

Healthcare | | | 8.6 | | | | 7.9 | |

Industrials | | | 17.9 | | | | 11.9 | |

Information Technology | | | 10.1 | | | | 13.7 | |

Materials | | | 1.0 | | | | 1.7 | |

Other assets less liabilities | | | 5.1 | | | | 5.4 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Global Value Fund declined 0.23%, outperforming the MSCI All Country World IndexSM, which fell 6.01% over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: MasterCard Incorporated, a payment solutions company; Experian PLC, a credit and marketing services firm; Accenture plc, a provider of management and technology consulting services; Signet Jewelers Ltd., a jewelry retailer in the U.S. and U.K.; and Arch Capital Group Ltd., a provider of reinsurance and insurance products.

Notable detractors included financial services providers Lloyds Banking Group plc, ING Groep N.V., and The Bank of New York Mellon Corporation; medical systems, consumer electronics and lighting manufacturer Koninklijke Philips Electronics N.V.; and aggregates and cement producer HeidelbergCement AG.

REGION ALLOCATION

| | | | | | | | |

| Region | | 9/30/10 | | | 9/30/11 | |

Americas | | | 51.7 | % | | | 54.2 | % |

Europe | | | 37.9 | | | | 32.6 | |

Pacific Basin | | | 5.3 | | | | 7.8 | |

As a percentage of total net assets.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including household goods maker Kao Corporation, discount store operator Target Corporation; home improvement retailer Lowe’s Companies, Inc.; previously mentioned HeidelbergCement AG and previously mentioned Koninklijke Philips Electronics N.V. We funded these purchases in part by selling our positions in Sodexo, Cintas Corporation, The Procter & Gamble Company, Home Retail Group plc and Royal Dutch Shell PLC.

5

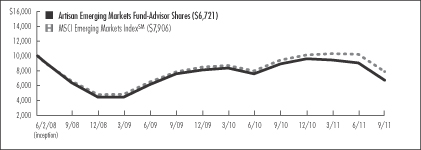

ARTISAN GROWTH OPPORTUNITIES FUND (ARTRX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Growth Opportunities Fund employs a bottom-up investment process to construct a diversified portfolio of growth companies across a broad capitalization range. The Fund’s investment process focuses on two distinct areas – security selection and capital allocation.

The Fund’s investment team attempts to identify companies that possess franchise characteristics that are selling at attractive valuations and benefiting from an accelerating profit cycle.

Franchise characteristics. These are characteristics that the team believes help to protect a company’s stream of cash flow from the effects of competition. The team looks for companies with at least two of the following characteristics: low-cost production capability, possession of a proprietary asset, dominant market share or a defensible brand name.

Attractive valuations. Through its own fundamental research, the team estimates the amount a buyer would pay to buy the entire company (the company’s “intrinsic value” or “private market value”) and considers whether to purchase a stock if it sells at a discount to that estimate.

Accelerating profit cycle. The team tries to invest in companies that are well positioned for long-term growth, at an early enough stage in their profit cycle to benefit from the increased cash flows produced by the profit cycle.

Based on the investment team’s fundamental analysis of a company’s profit cycle, portfolio holdings develop through three stages. GardenSM investments are small positions in the early part of their profit cycle that will warrant a more sizeable allocation once their profit cycle accelerates. CropSM investments are positions that are being increased to a full weight because they are moving through the strongest part of their profit cycle. HarvestSM investments are positions that are being reduced as they near the team’s estimate of full valuation or their profit cycle begins to decelerate.

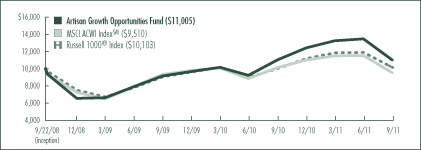

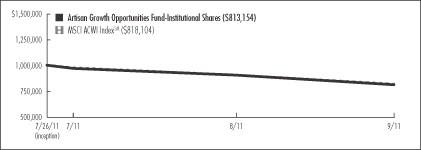

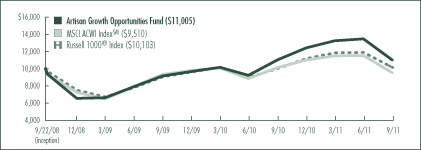

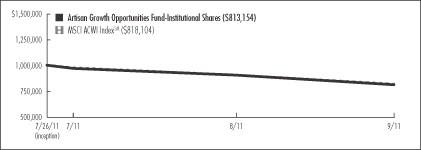

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/22/2008 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | Since

Inception | |

Artisan Growth Opportunities Fund | | | 0.14 | % | | | 5.70 | % | | | 3.22 | % |

MSCI ACWISM (All Country World Index) | | | -6.01 | | | | 0.59 | | | | -1.65 | |

Russell 1000® Index1 | | | 0.91 | | | | 1.61 | | | | 0.34 | |

| 1 | Effective January 28, 2011, the Fund’s benchmark was changed from the Russell 1000® Index to the MSCI ACWI (All Country World Index) IndexSM, to provide an appropriate comparison in light of the Fund’s investment strategy. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. The Fund’s performance information reflects Artisan Partners’ contractual agreement to limit the Fund’s expenses to no more than 1.50%, which has been in effect since the Fund’s inception and has had a material impact on the Fund’s performance, which would have been lower in its absence. See page 113 for a description of each index.

6

INVESTING ENVIRONMENT

For the one-year period ended September 30, 2011, the global stock markets, as represented by the MSCI All Country World IndexSM, posted negative returns. The best performing sectors included consumer staples and health care, whereas, financials and materials trailed. For much of the period, the economic backdrop was a disappointingly slow global economic recovery with some setbacks along the way including weakening sentiment caused by high sovereign debt levels in developed regions.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 14.5 | % | | | 13.2 | % |

Consumer Staples | | | — | | | | 2.9 | |

Energy | | | 2.2 | | | | 6.7 | |

Financials | | | 3.3 | | | | 5.4 | |

Healthcare | | | 9.8 | | | | 18.2 | |

Industrials | | | 22.5 | | | | 13.4 | |

Information Technology | | | 42.1 | | | | 28.1 | |

Materials | | | — | | | | 4.1 | |

Other assets less liabilities | | | 5.6 | | | | 8.0 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Growth Opportunities Fund returned 0.14%, outperforming the MSCI All Country World IndexSM, but underperforming the Russell 1000® Index, which returned -6.01% and 0.91%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: Cerner Corporation, a health care information technology provider; Apple Inc., a manufacturer of computers and electronic media devices; Starbucks Corporation, a specialty coffee retailer; Polo Ralph Lauren Corporation, an apparel designer and marketer; and Precision Castparts Corp., a manufacturer of complex metal components.

Notable detractors included: Telefonaktiebologet LM Ericsson, a manufacturer of products for wired and mobile communications, Citrix Systems, Inc., a technology solutions provider, Juniper Networks, Inc., a network infrastructure developer, Hexagon AB, an industrial and commercial group, and Baker Hughes Incorporated, a supplier of oil field services.

REGION ALLOCATION

| | | | | | | | |

| Region | | 9/30/10 | | | 9/30/11 | |

Americas | | | 72.3 | % | | | 62.0 | % |

Emerging Markets | | | 9.6 | | | | 17.2 | |

Europe | | | 8.5 | | | | 9.6 | |

Pacific Basin | | | 4.0 | | | | 3.2 | |

As a percentage of total net assets.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including Monsanto Company, a provider of agricultural products for farmers, Discover Financial Services, a payment services provider, Regeneron Pharmaceuticals, Inc., a biopharmaceutical company and Baidu, Inc., an Internet search engine provider. We funded these purchases in part by selling our positions in Cummins Inc., C.H. Robinson Worldwide, Inc., Trimble Navigation Limited and Localiza Rent a Car SA.

7

ARTISAN INTERNATIONAL FUND (ARTIX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan International Fund employs a fundamental stock selection process focused on identifying long-term growth opportunities.

Themes. The investment team’s thematic approach identifies catalysts for change and develops investment themes with the objective of capitalizing on them globally. Changing demographics, developing technology, privatization of economic resources, outsourcing and infrastructure are among the long-term catalysts for change that currently form the basis for the team’s investment themes. The team incorporates these catalysts along with sector and regional fundamentals into a long-term global framework for investment analysis and decision-making.

Sustainable Growth. The team applies a fundamental approach to identifying the long term, sustainable growth characteristics of potential investments. The team seeks high quality companies that are well managed, have a dominant or improving market position and competitive advantages compared to industry and regional peers.

Valuation. The team assesses the relationship between its estimate of a company’s sustainable growth prospects and the company’s stock price. The team uses multiple valuation metrics to establish price targets.

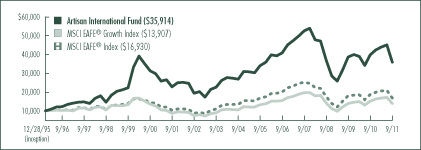

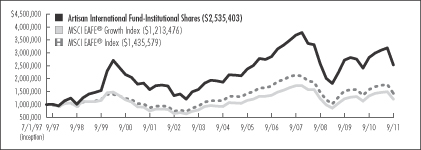

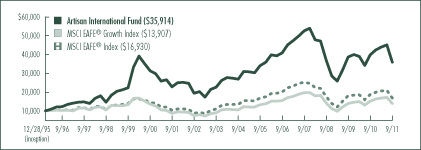

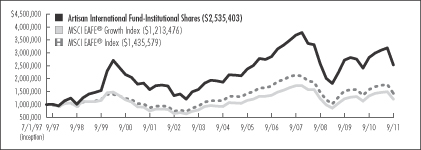

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/28/1995 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan International Fund | | | -9.95 | % | | | -0.79 | % | | | -2.53 | % | | | 4.64 | % | | | 8.45 | % |

MSCI EAFE® Growth Index | | | -8.79 | | | | -0.63 | | | | -2.16 | | | | 4.86 | | | | 2.11 | |

MSCI EAFE® Index | | | -9.36 | | | | -1.13 | | | | -3.46 | | | | 5.03 | | | | 3.40 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 113 for a description of each index.

8

INVESTING ENVIRONMENT

Over the past twelve-month period, investors reacted to a plethora of macroeconomic events happening in all parts of the globe, which sent stocks into some dramatic swings that were as abrupt as they were frequent. Developed and emerging markets alike were hard hit with meaningful declines in stock prices. When it came to the debt issues facing the U.S. and Europe, the biggest factor to weigh on stocks seemed to be the lack of decisive action from policymakers in both regions. Political stalemates and ambiguity about next steps for debt-laden countries only added to investor worry. Renewed fears of higher inflation and a hard landing for China’s economy also impacted sentiment across the globe, as China has been a key driver of global growth during this tough economic period. The combination of these events and other macroeconomic concerns resulted in negative returns for the MSCI EAFE® Index.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 19.2 | % | | | 19.0 | % |

Consumer Staples | | | 15.4 | | | | 28.6 | |

Energy | | | — | | | | 4.4 | |

Financials | | | 24.4 | | | | 14.8 | |

Healthcare | | | 5.3 | | | | 2.2 | |

Industrials | | | 16.4 | | | | 12.9 | |

Information Technology | | | 9.3 | | | | 4.4 | |

Materials | | | 6.6 | | | | 7.6 | |

Telecommunication Services | | | 1.3 | | | | 2.5 | |

Utilities | | | 0.4 | | | | — | |

Other assets less liabilities | | | 1.7 | | | | 3.6 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan International Fund declined 9.95%, underperforming the MSCI EAFE® Growth and MSCI EAFE® indices, which fell 8.79% and 9.36%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: Netherlands based semiconductor manufacturing equipment developer ASML Holding N.V., Macau casino operators Sands China Ltd. and Wynn Macau, Limited, Japanese cigarette and tobacco products manufacturer JAPAN TOBACCO INC. and U.K. listed credit and marketing services provider Experian PLC.

Notable detractors included: Brazilian oil and gas producer Petroleo Brasileiro S.A., Canadian freight and intermodal services provider Canadian Pacific Railway Limited, Hong Kong based property developer Sun Hung Kai Properties Limited, Italian truck and tractor manufacturer Fiat Industrial SpA, and Chinese flavors and fragrances producer Huabao International Holdings Limited.

REGION ALLOCATION

| | | | | | | | |

| Region | | 9/30/10 | | | 9/30/11 | |

Europe | | | 60.9 | % | | | 52.2 | % |

Pacific Basin | | | 20.2 | | | | 31.2 | |

Emerging Markets | | | 11.0 | | | | 7.9 | |

Americas | | | 6.2 | | | | 5.1 | |

As a percentage of total net assets.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including Japanese cigarette and tobacco products manufacturer JAPAN TOBACCO INC., Netherlands based branded and packaged consumer goods company Unilever NV, Hong Kong based insurance company AIA Group Ltd., Japanese household and chemical products manufacturer Kao Corporation and French food processing company DANONE S.A. We funded these purchases in part by selling our positions in ASML Holding N.V., Tesco plc, Experian PLC, ING Groep N.V. and Kingfisher plc.

9

ARTISAN INTERNATIONAL SMALL CAP FUND (ARTJX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan International Small Cap Fund employs a fundamental stock selection process focused on identifying long-term growth opportunities among small non-U.S. companies.

Themes. The investment team’s thematic approach identifies catalysts for change and develops investment themes with the objective of capitalizing on them globally. Changing demographics, developing technology, privatization of economic resources, outsourcing and infrastructure are among the long-term catalysts for change that currently form the basis for the team’s investment themes. The team incorporates these catalysts along with sector and regional fundamentals into a long-term global framework for investment analysis and decision-making.

Sustainable Growth. The team applies a fundamental approach to identifying the long term, sustainable growth characteristics of potential investments. The team seeks high quality companies that are well managed, have a dominant or improving market position and competitive advantages compared to industry and regional peers.

Valuation. The team assesses the relationship between its estimate of a company’s sustainable growth prospects and the company’s stock price. The team uses multiple valuation metrics to establish price targets.

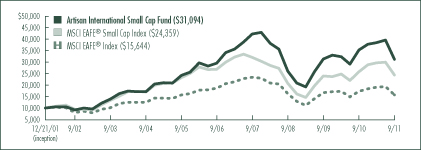

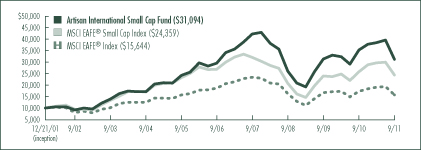

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (12/21/2001 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan International Small Cap Fund | | | -11.70 | % | | | 6.23 | % | | | 1.10 | % | | | 12.31 | % |

MSCI EAFE® Small Cap Index | | | -5.50 | | | | 5.64 | | | | -1.88 | | | | 9.54 | |

MSCI EAFE® Index | | | -9.36 | | | | -1.13 | | | | -3.46 | | | | 4.68 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 113 for a description of each index.

10

INVESTING ENVIRONMENT

The year ended September 30, 2011 was flecked with geopolitical and natural disasters that left investors jittery about the prospects for a global economic recovery. Escalating sovereign debt concerns in Europe, the downgrading of the U.S. national credit rating and the possibility of an economic hard landing in China only served to heighten investor anxiety over the prospects for global growth. Ultimately, the MSCI EAFE® Small Cap Index posted a loss for the period, with all European markets declining. In the Pacific Basin, a strong showing from Japan (up approximately 12%) helped counter double-digit losses in Hong Kong and Singapore.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 33.1 | % | | | 26.9 | % |

Consumer Staples | | | 15.6 | | | | 12.8 | |

Financials | | | 6.5 | | | | 2.9 | |

Healthcare | | | 4.4 | | | | 5.0 | |

Industrials | | | 22.5 | | | | 26.2 | |

Information Technology | | | 8.9 | | | | 8.5 | |

Materials | | | 4.0 | | | | 4.1 | |

Utilities | | | 4.2 | | | | 5.2 | |

Other assets less liabilities | | | 0.8 | | | | 8.4 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan International Small Cap Fund declined 11.70%, underperforming the MSCI EAFE® Small Cap and MSCI EAFE® indices, which fell 5.50% and 9.36%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: Bulgari S.p.A., a luxury goods manufacturer; SJM Holdings Limited, a casino operator in Macau; Melco Crown Entertainment Ltd., a casino operator in Macau; Wirecard AG, a provider of Internet payment and processing services, and Davide Campari – Milano S.p.A., a producer of spirits, wines and soft drinks.

Notable detractors included: Longtop Financial Technologies Limited, a Chinese software application developer; Beijing Enterprises Water Group Limited, a developer of water treatment systems; Smurfit Kappa Group PLC, a packaging products manufacturer; China Gas Holdings Ltd., a natural gas services operator; and Wacker Neuson SE, a manufacturer of light construction equipment and construction machines.

REGION ALLOCATION

| | | | | | | | |

| Region | | 9/30/10 | | | 9/30/11 | |

Europe | | | 58.4 | % | | | 52.7 | % |

Emerging Markets | | | 25.1 | | | | 22.0 | |

Pacific Basin | | | 12.8 | | | | 16.9 | |

Americas | | | 2.9 | | | | — | |

As a percentage of total net assets.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including Alliance Global Group, Inc., a holding company engaged in the food and beverage, real estate development and fast food restaurant business; Rubis, a company engaged in the storage and distribution of petroleum and other liquid products; Eurofins Scientific, a provider of bio-analytical testing services; AUTOBACS SEVEN CO., LTD., a Japanese retailer of automotive related products and services and NTN CORPORATION, a manufacturer of bearings and machinery parts for industrial use. We funded these purchases in part by selling our positions in Finning International Inc., Punch Taverns plc, Mothercare plc, Remy Cointreau SA and Enterprise Inns plc.

11

ARTISAN INTERNATIONAL VALUE FUND (ARTKX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan International Value Fund employs a bottom-up investment process to construct a diversified portfolio of stocks of undervalued non-U.S. companies. The Fund’s investment process is focused on identifying what the investment team believes are high quality, undervalued businesses that offer the potential for superior risk/reward outcomes. The team’s in-depth research process focuses on four key investment characteristics:

Undervaluation. Determining the intrinsic value of the business is the heart of the team’s research process. The team believes that intrinsic value represents the amount that a buyer would pay to own a company’s future cash flows. The team seeks to invest at a significant discount to its estimate of the intrinsic value of a business.

Business quality. The team seeks to invest in companies with histories of generating strong free cash flow, improving returns on capital and strong competitive positions in their industries.

Financial strength. The team believes that investing in companies with strong balance sheets helps to reduce the potential for capital risk and provides company management the ability to build value when attractive opportunities are available.

Shareholder-oriented management. The team’s research process attempts to identify management teams with a history of building value for shareholders.

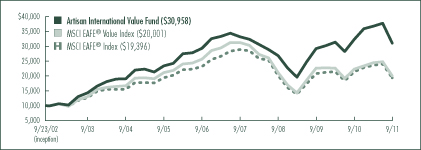

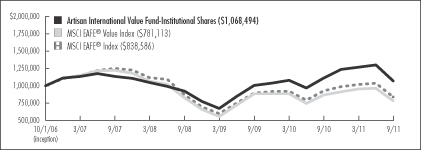

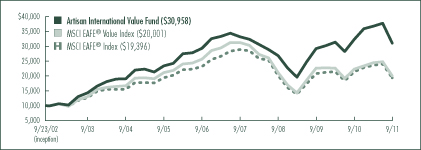

PERFORMANCE HISTORY

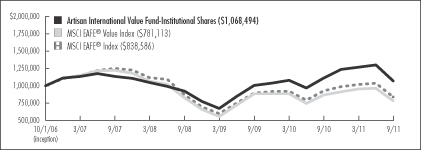

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/23/2002 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan International Value Fund | | | -4.01 | % | | | 4.90 | % | | | 1.13 | % | | | 13.35 | % |

MSCI EAFE® Value Index | | | -9.99 | | | | -1.69 | | | | -4.82 | | | | 7.99 | |

MSCI EAFE® Index | | | -9.36 | | | | -1.13 | | | | -3.46 | | | | 7.62 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. The performance shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted. See page 113 for a description of each index.

12

INVESTING ENVIRONMENT

International equity markets experienced volatility during the year ended September 30, 2011 stemming from concerns over a global economic slowdown, indecision on the political fronts in the U.S. and Europe, sovereign debt downgrades and worries over contagion from Europe’s debt crisis. The tragic earthquake and tsunami in Japan and turmoil in the Middle East also contributed to market volatility. Despite fear in the marketplace, many companies continued to report steady earnings results during the period.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 22.7 | % | | | 23.4 | % |

Consumer Staples | | | 9.2 | | | | 14.9 | |

Energy | | | 4.5 | | | | 2.6 | |

Financials | | | 21.1 | | | | 21.7 | |

Healthcare | | | 7.3 | | | | 7.9 | |

Industrials | | | 18.1 | | | | 15.6 | |

Information Technology | | | 7.7 | | | | 7.0 | |

Materials | | | 3.2 | | | | 2.5 | |

Other assets less liabilities | | | 6.2 | | | | 4.4 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan International Value Fund declined 4.01%, outperforming the MSCI EAFE® Value and MSCI EAFE® indices, which fell 9.99% and 9.36%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: Credit Saison Co., Ltd., a consumer card company; Experian PLC, a credit and marketing services firm; Accenture plc, a provider of management and technology consulting services; Signet Jewelers Ltd., a jewelry retailer in the U.S. and U.K.; and Arch Capital Group Ltd., a provider of reinsurance and insurance products.

Notable detractors included financial services providers ING Groep N.V. and Lloyds Banking Group plc; medical systems, consumer electronics and lighting manufacturer Koninklijke Philips Electronics N.V.; international brewer Carlsberg A/S; and aggregates and cement producer HeidelbergCement AG.

REGION ALLOCATION

| | | | | | | | |

| Region | | 9/30/10 | | | 9/30/11 | |

Europe | | | 63.8 | % | | | 61.9 | % |

Americas | | | 18.5 | | | | 17.0 | |

Pacific Basin | | | 11.1 | | | | 16.2 | |

Emerging Markets | | | 0.4 | | | | 0.5 | |

As a percentage of total net assets.

FUND CHANGES

We identified some new investment opportunities for the portfolio during the period, including household goods maker Kao Corporation, previously mentioned Koninklijke Philips Electronics N.V., previously mentioned ING Groep N.V., food retailer Koninklijke Ahold NV and lighting equipment manufacturer Stanley Electric Co., Ltd. We funded these purchases in part by selling our positions in Givaudan SA, Royal Dutch Shell PLC and Home Retail Group plc.

13

ARTISAN MID CAP FUND (ARTMX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Mid Cap Fund employs a bottom-up investment process to construct a diversified portfolio of primarily U.S. mid-cap growth companies. The Fund’s investment process focuses on two distinct areas – security selection and capital allocation.

The Fund’s investment team attempts to identify companies that possess franchise characteristics that are selling at attractive valuations and benefiting from an accelerating profit cycle.

Franchise characteristics. These are characteristics that the team believes help to protect a company’s stream of cash flow from the effects of competition. The team looks for companies with at least two of the following characteristics: low-cost production capability, possession of a proprietary asset, dominant market share or a defensible brand name.

Attractive valuations. Through its own fundamental research, the team estimates the amount a buyer would pay to buy the entire company (the company’s “intrinsic value” or “private market value”) and considers whether to purchase a stock if it sells at a discount to that estimate.

Accelerating profit cycle. The team tries to invest in companies that are well positioned for long-term growth, at an early enough stage in their profit cycle to benefit from the increased cash flows produced by the profit cycle.

Based on the investment team’s fundamental analysis of a company’s profit cycle, portfolio holdings develop through three stages. GardenSM investments are small positions in the early part of their profit cycle that will warrant a more sizeable allocation once their profit cycle accelerates. CropSM investments are positions that are being increased to a full weight because they are moving through the strongest part of their profit cycle. HarvestSM investments are positions that are being reduced as they near the team’s estimate of full valuation or their profit cycle begins to decelerate.

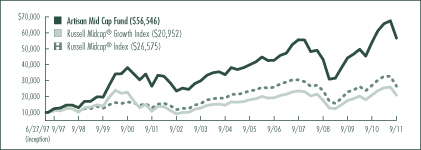

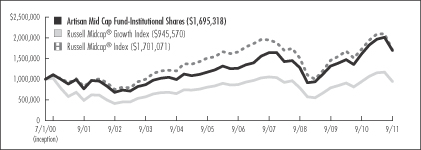

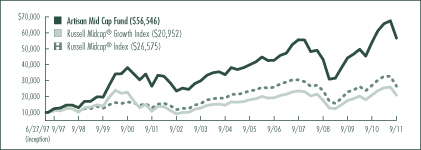

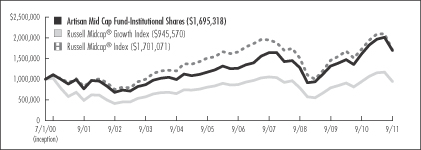

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (6/27/1997 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Mid Cap Fund | | | 5.38 | % | | | 9.53 | % | | | 5.76 | % | | | 7.90 | % | | | 12.92 | % |

Russell Midcap® Growth Index | | | 0.80 | | | | 5.89 | | | | 1.64 | | | | 6.70 | | | | 5.32 | |

Russell Midcap® Index | | | -0.88 | | | | 3.96 | | | | 0.56 | | | | 7.45 | | | | 7.09 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 113 for a description of each index.

14

INVESTING ENVIRONMENT

For the one-year period ended September 30, 2011 mid-cap stocks, as represented by the Russell Midcap® Index, finished slightly negative. Mid-cap growth stocks, as represented by the Russell Midcap® Growth Index performed better. The best performing sectors in the Russell Midcap® Growth Index included consumer staples, utilities and consumer discretionary, whereas, telecommunications services and information technology trailed. For much of the period, the economic backdrop was a slower than initially expected economic recovery, but there were also some setbacks along the way including weakening sentiment caused by high sovereign debt levels in developed regions. Overall, corporate earnings remained relatively healthy throughout the period.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 20.7 | % | | | 19.6 | % |

Consumer Staples | | | — | | | | 2.6 | |

Energy | | | 5.0 | | | | 7.3 | |

Financials | | | 7.4 | | | | 5.1 | |

Healthcare | | | 12.4 | | | | 22.5 | |

Industrials | | | 18.7 | | | | 12.6 | |

Information Technology | | | 33.5 | | | | 25.9 | |

Other assets less liabilities | | | 2.3 | | | | 4.4 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Mid Cap Fund returned 5.38%, outperforming the Russell Mid Cap® Growth and Russell Mid Cap® indices, which fell 0.80% and 0.88%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: Cerner Corporation, a health care information technology provider; lululemon athletica inc., a specialty apparel retailer; Regeneron Pharmaceuticals, Inc., a biopharmaceutical company; athenahealth, Inc., an internet-based business services provider; and Polo Ralph Lauren Corporation, an apparel designer and marketer.

Notable detractors included: Comerica Incorporated, a bank holding company; MercadoLibre, Inc., an online trading site operator; Ctrip.com International Ltd., an airline and hotel accommodation consolidator; Citrix Systems, Inc., a technology solutions provider; and Juniper Networks, Inc., a network infrastructure developer.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including Regeneron Pharmaceuticals, Inc., a biopharmaceutical company; Teradata Corporation, an enterprise data warehouse; Discover Financial Services, a payment services provider; and Cepheid, a molecular diagnostics company. We funded these purchases in part by selling our positions in Cummins Inc., C.H. Robinson Worldwide, Inc., GSI Commerce, Inc. and NetApp, Inc.

15

ARTISAN MID CAP VALUE FUND (ARTQX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Mid Cap Value Fund employs a bottom-up investment process to construct a diversified portfolio of stocks of medium-sized U.S. companies that the investment team believes are undervalued, in solid financial condition and have attractive business economics. The team believes companies with these characteristics are less likely to experience eroding values over the long term.

Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range.

Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interests of the companies’ shareholders.

Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle.

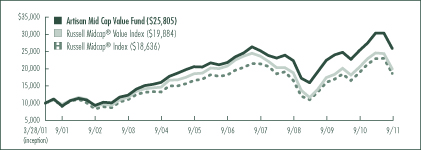

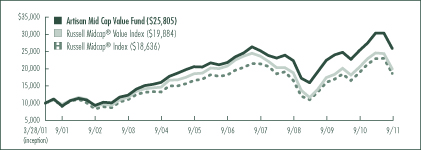

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/2001 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Mid Cap Value Fund | | | 2.51 | % | | | 4.89 | % | | | 3.51 | % | | | 10.92 | % | | | 9.44 | % |

Russell Midcap® Value Index | | | -2.36 | | | | 1.98 | | | | -0.84 | | | | 7.54 | | | | 6.76 | |

Russell Midcap® Index | | | -0.88 | | | | 3.96 | | | | 0.56 | | | | 7.45 | | | | 6.10 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 113 for a description of each index.

16

INVESTING ENVIRONMENT

The one-year period ended September 30, 2011 began strongly, with equities turning in solid gains through the first nine months buoyed by steady corporate profits. Equities fell sharply in the final three months of the period due to a variety of macroeconomic concerns, including the stability of the European banking system owing to sovereign debt exposures and slowing economic growth in the U.S. and around the world.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 7.9 | % | | | 7.3 | % |

Consumer Staples | | | 6.0 | | | | 5.5 | |

Energy | | | 8.4 | | | | 7.1 | |

Financials | | | 18.1 | | | | 21.8 | |

Healthcare | | | 4.2 | | | | 3.2 | |

Industrials | | | 20.6 | | | | 18.9 | |

Information Technology | | | 22.9 | | | | 25.0 | |

Utilities | | | 8.6 | | | | 7.9 | |

Other assets less liabilities | | | 3.3 | | | | 3.3 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Mid Cap Value Fund returned 2.51%, outperforming the Russell Midcap® Value and Russell Midcap® indices which fell 2.36% and 0.88%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: National Semiconductor Corporation, a semiconductor manufacturer; Nabors Industries Ltd., a land-based drilling contractor; Range Resources Corporation, an independent exploration and production company; Pride International, Inc., an offshore drilling contractor; and American Water Works Company, Inc., a waste and wastewater services provider.

Notable detractors included: Lexmark International, Inc., a worldwide printer vendor; SAIC, Inc., a research, engineering and technical services firm; Ensco plc, a global offshore driller; Manpower Inc., a provider of temporary staffing services; and The Allstate Corporation, a personal lines insurer.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including previously mentioned Lexmark International, Inc., in addition to Spirit AeroSystems Holdings, Inc., a maker of aerostructures; Loews Corporation, a diversified holding company; Broadridge Financial Solutions, Inc., a provider of investor communication and trade processing services; and Northern Trust Corporation, a provider of financial services. We funded these purchases in part by selling our positions in previously mentioned Nabors Industries Ltd., in addition to Cintas Corporation, Stryker Corporation, Acuity Brands, Inc. and H.J. Heinz Company.

17

ARTISAN SMALL CAP FUND (ARTSX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Small Cap Fund employs a bottom-up investment process to construct a diversified portfolio of primarily U.S. small-cap growth companies. The Fund’s investment process focuses on two distinct areas – security selection and capital allocation.

The Fund’s investment team attempts to identify companies that possess franchise characteristics that are selling at attractive valuations and benefiting from an accelerating profit cycle.

Franchise characteristics. These are characteristics that the team believes help to protect a company’s stream of cash flow from the effects of competition. The team looks for companies with at least two of the following characteristics: low-cost production capability, possession of a proprietary asset, dominant market share or a defensible brand name.

Attractive valuations. Through its own fundamental research, the team estimates the amount a buyer would pay to buy the entire company (the company’s “intrinsic value” or “private market value”) and considers whether to purchase a stock if it sells at a discount to that estimate.

Accelerating profit cycle. The team tries to invest in companies that are well positioned for long-term growth, at an early enough stage in their profit cycle to benefit from the increased cash flows produced by the profit cycle.

Based on the investment team’s fundamental analysis of a company’s profit cycle, portfolio holdings develop through three stages. GardenSM investments are small positions in the early part of their profit cycle that will warrant a more sizeable allocation once their profit cycle accelerates. CropSM investments are positions that are being increased to a full weight because they are moving through the strongest part of their profit cycle. HarvestSM investments are positions that are being reduced as they near the team’s estimate of full valuation or their profit cycle begins to decelerate.

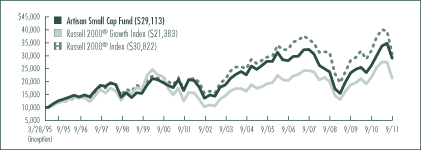

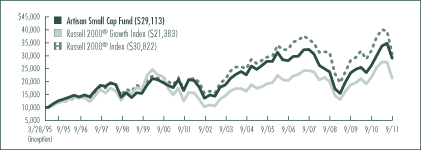

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/28/1995 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Small Cap Fund | | | 11.18 | % | | | 6.90 | % | | | 0.75 | % | | | 5.80 | % | | | 6.69 | % |

Russell 2000® Growth Index | | | -1.12 | | | | 2.07 | | | | 0.96 | | | | 5.45 | | | | 4.71 | |

Russell 2000® Index | | | -3.53 | | | | -0.37 | | | | -1.02 | | | | 6.12 | | | | 7.06 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 113 for a description of each index.

18

INVESTING ENVIRONMENT

For the one-year period ended September 30, 2011 small-cap stocks, as represented by the Russell 2000® Index, finished negative. Small-cap growth stocks, as represented by the Russell 2000® Growth Index, performed better though still negative. The best performing sector in the Russell 2000® Growth Index was consumer staples, whereas the materials sector trailed. For much of the period, the economic backdrop was a slower than initially expected economic recovery, but there were also some setbacks along the way including weakening sentiment caused by high sovereign debt levels in developed regions. Overall corporate earnings remained relatively healthy throughout the period.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 13.8 | % | | | 17.7 | % |

Consumer Staples | | | 1.4 | | | | 5.0 | |

Energy | | | 4.7 | | | | 4.0 | |

Financials | | | 9.7 | | | | 4.4 | |

Healthcare | | | 13.4 | | | | 23.5 | |

Industrials | | | 19.5 | | | | 18.9 | |

Information Technology | | | 33.4 | | | | 22.4 | |

Utilities | | | 1.5 | | | | 0.3 | |

Other assets less liabilities | | | 2.6 | | | | 3.8 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Small Cap Fund returned 11.18%, outperforming the Russell 2000® Growth and Russell 2000® indices, which fell 1.12% and 3.53%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: Cepheid, a molecular diagnostics provider; Ulta Salon, Cosmetics & Fragrance, Inc., a specialty cosmetics retailer; athenahealth, Inc., an internet-based business services company; Regeneron Pharmaceuticals, Inc., a biopharmaceutical company; and Varian Semiconductor Equipment Associates, Inc., a manufacturer of semiconductor processing equipment.

Notable detractors included: ReachLocal, Inc., an online marketing provider, FirstMerit Corporation, a bank holding company, Acuity Brands, Inc., a manufacturer of lighting equipment, MercadoLibre Inc., an online trading site for Latin American markets and K12 Inc., an online educational company.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including Regeneron Pharmaceuticals, Inc., a biopharmaceutical company; Woodward Governor Company, a manufacturer of energy control solutions; Universal Display Corporation, a manufacturer of organic light emitting diode technologies for displays; and Thomas & Betts Corporation, a manufacturer of electrical components. We funded these purchases in part by selling our positions in Rovi Corporation, Atheros Communications, Inc., GSI Commerce, Inc. and Moog Inc.

19

ARTISAN SMALL CAP VALUE FUND (ARTVX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Small Cap Value Fund employs a bottom-up investment process to construct a diversified portfolio of small-cap U.S. companies that the team believes are undervalued, in solid financial condition and have attractive business economics. The team believes companies with these characteristics are less likely to experience eroding values over the long term.

Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range.

Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interest of the companies’ shareholders.

Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle.

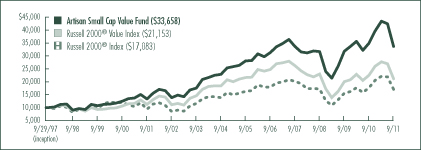

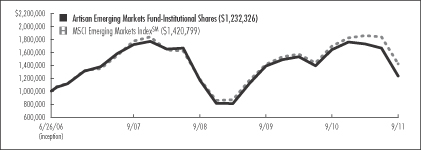

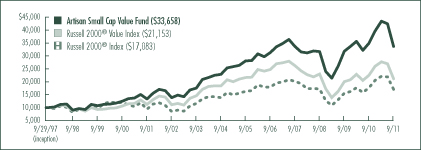

PERFORMANCE HISTORY

GROWTH OF AN ASSUMED $10,000 INVESTMENT (9/29/1997 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since

Inception | |

Artisan Small Cap Value Fund | | | -3.61 | % | | | 2.01 | % | | | 1.46 | % | | | 9.70 | % | | | 9.05 | % |

Russell 2000® Value Index | | | -5.99 | | | | -2.78 | | | | -3.08 | | | | 6.47 | | | | 5.50 | |

Russell 2000® Index | | | -3.53 | | | | -0.37 | | | | -1.02 | | | | 6.12 | | | | 3.90 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 113 for a description of each index.

20

INVESTING ENVIRONMENT

The one-year period ended September 30, 2011 began strongly, with equities turning in solid gains through the first nine months buoyed by steady corporate profits. Equities fell sharply in the final three months of the period due to a variety of macroeconomic concerns, including the stability of the European banking system owing to sovereign debt exposures and slowing economic growth in the U.S. and around the world.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | 6.4 | % | | | 12.1 | % |

Consumer Staples | | | 2.3 | | | | 1.5 | |

Energy | | | 12.0 | | | | 10.4 | |

Financials | | | 7.8 | | | | 8.9 | |

Healthcare | | | 2.6 | | | | 2.4 | |

Industrials | | | 21.7 | | | | 27.6 | |

Information Technology | | | 29.8 | | | | 23.9 | |

Materials | | | 3.9 | | | | 5.9 | |

Telecommunication Services | | | — | | | | 1.5 | |

Utilities | | | 10.1 | | | | 4.3 | |

Other assets less liabilities | | | 3.4 | | | | 1.5 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Small Cap Value Fund returned -3.61%, outperforming the Russell 2000® Value Index, but trailing the Russell 2000® Index, which fell 5.99% and 3.53%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: Patterson-UTI Energy, Inc., an onshore drilling rig contractor; MicroStrategy Incorporated, a provider of business intelligence software; Monster Worldwide, Inc., an internet company; Varian Semiconductor Equipment Associates, Inc., a supplier of semiconductor manufacturing equipment; and Lawson Software, Inc., an enterprise software developer.

Notable detractors included: exploration and production companies Forest Oil Corporation, Comstock Resources, Inc., and Penn Virginia Corporation; Quad/Graphics, Inc., a provider of print solutions; and Atlas Air Worldwide Holdings, Inc., a provider of outsourced wide-body freighter aircraft.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including Intersil Corporation, a manufacturer of analog integrated circuits; Hatteras Financial Corp., a mortgage real estate investment trust; and Cloud Peak Energy Inc., a U.S. coal producer. We funded these purchases in part by selling our positions in previously mentioned Patterson-UTI Energy, Inc. and Varian Semiconductor Equipment Associates, Inc., in addition to Anixter International Inc.

21

ARTISAN VALUE FUND (ARTLX)

INVESTMENT PROCESS HIGHLIGHTS

Artisan Value Fund employs a bottom-up investment process to construct a diversified portfolio of stocks that the team believes are undervalued, in solid financial condition with attractive business economics. The team believes companies with these characteristics are less likely to experience eroding values over the long term.

Attractive valuation. The team values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. This results in a range of values for the company that the team believes would be reasonable. The team generally will purchase a security if the stock price falls below or toward the lower end of that range.

Sound financial condition. The team favors companies with an acceptable level of debt and positive cash flow. At a minimum, the team tries to avoid companies that have so much debt that management may be unable to make decisions that would be in the best interest of the companies’ shareholders.

Attractive business economics. The team favors cash-producing businesses that it believes are capable of earning acceptable returns on capital over the company’s business cycle.

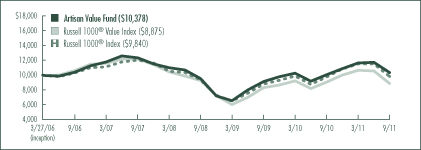

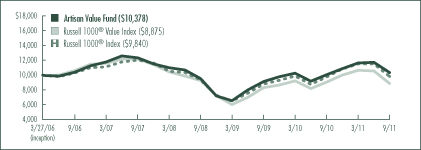

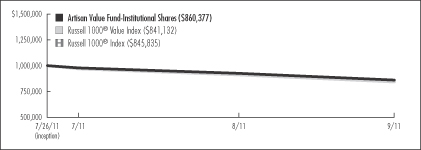

PERFORMANCE HISTORY

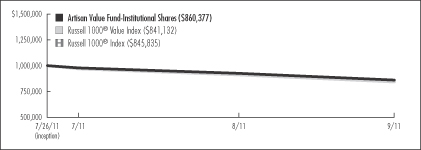

GROWTH OF AN ASSUMED $10,000 INVESTMENT (3/27/2006 to 9/30/2011)

AVERAGE ANNUAL TOTAL RETURNS (as of 9/30/2011)

| | | | | | | | | | | | | | | | |

| Fund / Index | | 1-Year | | | 3-Year | | | 5-Year | | | Since

Inception | |

Artisan Value Fund | | | 3.10 | % | | | 2.90 | % | | | -0.06 | % | | | 0.68 | % |

Russell 1000® Value Index | | | -1.89 | | | | -1.52 | | | | -3.53 | | | | -2.14 | |

Russell 1000® Index | | | 0.91 | | | | 1.61 | | | | -0.91 | | | | -0.29 | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current to most recent month-end performance information, visit www.artisanfunds.com or call 800.344.1770. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on distributions or sale of Fund shares. See page 113 for a description of each index.

22

INVESTING ENVIRONMENT

The one-year period ended September 30, 2011 began strongly, with equities turning in solid gains through the first nine months buoyed by steady corporate profits. Equities fell sharply in the final three months of the period due to a variety of macroeconomic concerns, including the stability of the European banking system owing to sovereign debt exposures and slowing economic growth in the U.S. and around the world.

SECTOR DIVERSIFICATION

| | | | | | | | |

| Sector | | 9/30/10 | | | 9/30/11 | |

Consumer Discretionary | | | — | % | | | 9.1 | % |

Consumer Staples | | | 4.6 | | | | 10.3 | |

Energy | | | 12.8 | | | | 10.8 | |

Financials | | | 23.5 | | | | 27.4 | |

Healthcare | | | 14.5 | | | | 2.9 | |

Industrials | | | 8.2 | | | | 2.6 | |

Information Technology | | | 34.0 | | | | 34.4 | |

Other assets less liabilities | | | 2.4 | | | | 2.5 | |

Total | | | 100.0 | % | | | 100.0 | % |

As a percentage of total net assets.

PERFORMANCE DISCUSSION

During the twelve-month period ended September 30, 2011, Artisan Value Fund returned 3.10%, outperforming the Russell 1000® Value and Russell 1000® indices which returned -1.89% and 0.91%, respectively, over the same period.

Performance of the following stocks had a positive impact on the portfolio during the period: National Semiconductor Corporation, a semiconductor manufacturer; Exxon Mobil Corporation, an integrated oil and gas company; Nabors Industries Ltd., a land-based drilling contractor; Accenture plc, a consulting services provider; and International Business Machines Corporation, an information technology company.

Notable detractors included: Hewlett-Packard Company, a diversified technology company; Cisco Systems, Inc., a communications networking solutions provider; Cimarex Energy Co., an independent oil and gas exploration and production company; and diversified financial services firms The Bank of New York Mellon Corporation and The Goldman Sachs Group, Inc.

REGION ALLOCATION

| | | | | | | | |

| Region | | 9/30/10 | | | 9/30/11 | |

Americas | | | 97.6 | % | | | 91.8 | % |

Europe | | | — | | | | 5.7 | |

As a percentage of total net assets.

FUND CHANGES

We identified several new investment opportunities for the portfolio during the period, including previously mentioned Cisco Systems, Inc., in addition to Apple Inc., a consumer electronics company; Avnet, Inc., a global distributor of electronic components and computer products; and retailers Target Corporation and Tesco plc. We funded these purchases in part by selling our positions in previously mentioned International Business Machines Corporation and Accenture plc, in addition to Baxter International Inc., Pfizer Inc. and Johnson & Johnson.

23

ARTISAN GLOBAL EQUITY FUND

Schedule of Investments – September 30, 2011

Dollar values in thousands

| | | | | | | | |

| | | Shares

Held | | | Value | |

| | | | | | | | |

COMMON AND

PREFERRED STOCKS - 96.5% | | | | | | | | |

| | | | | | | | |

| BELGIUM - 1.9% | | | | | | | | |

Anheuser-Busch InBev NV(1) | | | 3,963 | | | $ | 210 | |

| | | | | | | | |

| BRAZIL - 2.0% | | | | | | | | |

Banco Daycoval SA, Preferred(2) | | | 20,700 | | | | 94 | |

Fleury SA | | | 10,300 | | | | 123 | |

| | | | | | | | |

| | | | | | | 217 | |

| CANADA - 1.1% | | | | | | | | |

Canadian National Railway Company | | | 1,798 | | | | 120 | |

| | | | | | | | |

| DENMARK - 1.1% | | | | | | | | |

Novo Nordisk A/S, Class B(1) | | | 1,195 | | | | 119 | |

| | | | | | | | |

| FRANCE - 9.6% | | | | | | | | |

Air Liquide SA(1) | | | 1,202 | | | | 141 | |

Christian Dior SA(1) | | | 1,112 | | | | 124 | |

DANONE S.A.(1) | | | 4,306 | | | | 265 | |

Ipsos(1) | | | 4,177 | | | | 135 | |

Pernod Ricard SA(1) | | | 1,825 | | | | 143 | |

Schneider Electric SA(1) | | | 4,406 | | | | 237 | |

| | | | | | | | |

| | | | | | | 1,045 | |

| GERMANY - 4.0% | | | | | | | | |

Bayer AG(1) | | | 2,249 | | | | 124 | |

Henkel AG & Co.(1) | | | 3,585 | | | | 157 | |

Linde AG(1) | | | 1,135 | | | | 151 | |

| | | | | | | | |

| | | | | | | 432 | |

| HONG KONG - 6.0% | | | | | | | | |

AIA Group Ltd.(1) | | | 83,195 | | | | 236 | |

Dairy Farm International Holdings Limited(1) | | | 8,900 | | | | 76 | |

Samsonite International SA(1)(3) | | | 79,360 | | | | 111 | |

Sands China Ltd.(1)(3) | | | 99,610 | | | | 229 | |

| | | | | | | | |

| | | | | | | 652 | |

| INDIA - 2.6% | | | | | | | | |

Housing Development Finance Corporation Ltd.(1) | | | 22,165 | | | | 287 | |

| | | | | | | | |

| JAPAN - 5.7% | | | | | | | | |

CANON INC.(1) | | | 2,800 | | | | 127 | |

INPEX CORPORATION(1) | | | 28 | | | | 173 | |

Kao Corporation(1) | | | 5,800 | | | | 161 | |

LAWSON, INC.(1) | | | 2,800 | | | | 158 | |

| | | | | | | | |

| | | | | | | 619 | |

| | | | | | | | |

| KOREA - 1.1% | | | | | | | | |

Samsung Electronics Co., Ltd.(1) | | | 179 | | | $ | 125 | |

| | | | | | | | |

| NETHERLANDS - 3.6% | | | | | | | | |

Akzo Nobel N.V.(1) | | | 3,862 | | | | 171 | |

Unilever NV (DR)(1) | | | 7,201 | | | | 228 | |

| | | | | | | | |

| | | | | | | 399 | |

| PERU - 1.1% | | | | | | | | |

Credicorp Ltd. | | | 1,327 | | | | 122 | |

| | | | | | | | |

| PHILIPPINES - 1.6% | | | | | | | | |

Alliance Global Group, Inc.(1) | | | 618,830 | | | | 131 | |

Puregold Price Club, Inc.(1)(3)(4) | | | 150,000 | | | | 43 | |

| | | | | | | | |

| | | | | | | 174 | |

| RUSSIA - 1.0% | | | | | | | | |

Gazprom (DR)(1) | | | 10,985 | | | | 105 | |

| | | | | | | | |

| SWITZERLAND - 8.1% | | | | | | | | |

Givaudan SA(1) | | | 186 | | | | 145 | |

| Julius Baer Group Ltd.(1) | | | 3,451 | | | | 115 | |

Nestle SA(1) | | | 6,516 | | | | 358 | |

Sonova Holding AG(1) | | | 1,324 | | | | 119 | |

Swatch Group AG - Bearer Shares(1) | | | 436 | | | | 143 | |

| | | | | | | | |

| | | | | | | 880 | |

| UNITED KINGDOM - 10.4% | | | | | | | | |

Experian PLC(1) | | | 9,849 | | | | 111 | |

GlaxoSmithKline PLC(1) | | | 7,260 | | | | 150 | |

HSBC Holdings plc(1) | | | 21,865 | | | | 167 | |

Petrofac Limited(1) | | | 5,224 | | | | 97 | |

Prudential plc(1) | | | 15,025 | | | | 129 | |

Standard Chartered plc(1) | | | 4,841 | | | | 97 | |

Vodafone Group Plc(1) | | | 75,325 | | | | 194 | |

WPP plc(1) | | | 20,676 | | | | 191 | |

| | | | | | | | |

| | | | | | | 1,136 | |

| UNITED STATES - 35.6% | | | | | | | | |

3M Company | | | 2,334 | | | | 168 | |

Abercrombie & Fitch Co. | | | 2,933 | | | | 181 | |

Accenture plc, Class A | | | 2,578 | | | | 136 | |

Allergan, Inc. | | | 1,746 | | | | 144 | |

American Express Company | | | 4,033 | | | | 181 | |

Apple Inc.(3) | | | 431 | | | | 164 | |

CME Group Inc., Class A | | | 645 | | | | 159 | |

The Coca-Cola Company | | | 3,323 | | | | 224 | |

Colgate-Palmolive Company | | | 1,561 | | | | 138 | |

24

| | | | | | | | |

| | | Shares

Held | | | Value | |

| | | | | | | | |

| UNITED STATES (CONTINUED) | | | | | | | | |

The Dun & Bradstreet Corporation | | | 2,826 | | | $ | 173 | |

EMC Corporation(3) | | | 10,678 | | | | 224 | |

Google Inc., Class A(3) | | | 567 | | | | 292 | |

Halliburton Company | | | 4,478 | | | | 137 | |

MasterCard Incorporated, Class A | | | 387 | | | | 123 | |

McDonald’s Corporation | | | 2,306 | | | | 202 | |

Movado Group, Inc. | | | 12,585 | | | | 153 | |

Oracle Corporation | | | 6,656 | | | | 191 | |

The Procter & Gamble Company | | | 3,505 | | | | 221 | |

Thermo Fisher Scientific Inc.(3) | | | 3,234 | | | | 164 | |

United Technologies Corporation | | | 1,926 | | | | 135 | |

The Walt Disney Company | | | 5,851 | | | | 176 | |

YUM! Brands, Inc. | | | 3,943 | | | | 195 | |

| | | | | | | | |

| | | | | | | 3,881 | |

| | | | | | | | |

Total common and preferred stocks

(Cost $10,986) | | | | | | | 10,523 | |

| | |

| | | Par

Amount | | | | |

| SHORT-TERM INVESTMENTS (CASH EQUIVALENTS) - 4.9% | | | | | | | | |

Repurchase agreement with Fixed Income Clearing Corporation, 0.01%, dated 9/30/11, due 10/3/11, maturity value $541

(Cost $541)(5) | | $ | 541 | | | $ | 541 | |

| | | | | | | | |

| | | | | | | | |

Total investments - 101.4%

(Cost $11,527) | | | | | | | 11,064 | |

| | | | | | | | |

Other assets less liabilities - (1.4%) | | | | | | | (156 | ) |

| | | | | | | | |

| | | | | | | | |

Total net assets - 100.0%(6) | | | | | | $ | 10,908 | |

| | | | | | | | |

| (1) | Valued at a fair value in accordance with procedures established by the board of directors of Artisan Funds. In total, securities valued at a fair value were $6,183 or 56.7% of total net assets. See notes 2(a) and 2(b) in Notes to Financial Statements for additional information. |

| (3) | Non-income producing security. |

| (4) | Security has been determined to be illiquid under procedures established by the board of directors of Artisan Funds. In total, the value of securities determined to be illiquid were $43, or 0.4% of total net assets. |

| | | | | | | | | | | | |

Issuer | | Rate | | | Maturity | | | Value | |

U.S. Treasury Bond | | | 4.625 | % | | | 2/15/2040 | | | $ | 557 | |

| (6) | Percentages for the various classifications relate to total net assets. |

Company names are as reported by a data service provider and in some cases are translations; a company’s legal name may be different.

(DR) Depositary Receipt, voting rights may vary.

| | | | | | | | | | | | | | | | | | | | |

| FOREIGN CURRENCY FORWARD CONTRACTS | |

Dollar values in thousands | |

Description | | Counterparty | | Trans-

action

Type | | Settlement

Date | | | Cost on

Origination

Date | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

| Japanese Yen | | State Street Bank and Trust Company | | Buy | | | 11/17/2011 | | | $ | (173 | ) | | $ | (172 | ) | | $ | (1 | ) |

| Japanese Yen | | State Street Bank and Trust Company | | Sell | | | 11/17/2011 | | | | 173 | | | | 172 | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| PORTFOLIO DIVERSIFICATION - September 30, 2011 | |

Dollar values in thousands | |

| | | Value | | | Percentage

of Total

Net Assets | |

Consumer Discretionary | | $ | 1,840 | | | | 16.9 | % |

Consumer Staples | | | 2,382 | | | | 21.8 | |

Energy | | | 512 | | | | 4.7 | |

Financials | | | 1,587 | | | | 14.5 | |

Healthcare | | | 943 | | | | 8.6 | |

Industrials | | | 1,075 | | | | 9.9 | |

Information Technology | | | 1,382 | | | | 12.7 | |

Materials | | | 608 | | | | 5.6 | |

Telecommunication Services | | | 194 | | | | 1.8 | |

| | | | | | | | |

Total common and preferred stocks | | | 10,523 | | | | 96.5 | |

Short-term investments | | | 541 | | | | 4.9 | |

| | | | | | | | |

Total investments | | | 11,064 | | | | 101.4 | |

Other assets less liabilities | | | (156 | ) | | | (1.4 | ) |

| | | | | | | | |

Total net assets | | $ | 10,908 | | | | 100.0 | % |

| | | | | | | | |

| | | | | | | | |

| CURRENCY EXPOSURE - September 30, 2011 | |

Dollar values in thousands | |