| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | August 31, 2011 |

Estimated average burden |

hours per response: | | 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8934

ING Strategic Allocation Portfolios, Inc.

(Exact name of registrant as specified in charter)

| | |

| 7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Incorporated, 300 E. Lombard Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: December 31

Date of reporting period: January 1, 2008 to December 31, 2008

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2008

Classes ADV, I and S

VP Strategic Allocation Funds-of-Funds

| n | ING VP Strategic Allocation Conservative Portfolio |

| n | ING VP Strategic Allocation Growth Portfolio |

| n | ING VP Strategic Allocation Moderate Portfolio |

| | |

| | E-Delivery Sign-up – details inside |

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS

| |

TABLE OF CONTENTS

| | | | |

| | | |

| | Go Paperless with E-Delivery! | |  |

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs. Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll. You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail. |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds’ website at www.ingfunds.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds’ website at www.ingfunds.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Portfolios’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330; and is available upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT’S LETTER

Dear Shareholders,

We are in the midst of one of the most challenging periods ever faced by investors, and we at ING Funds are aware of the anxiety that you may be feeling at this time.

I want to assure you that we are actively engaged in monitoring the situation and are committed to keeping you fully informed of how the rapidly unfolding events around us may impact your investments with our company.

We recognize that the confidence of many investors is being tested, perhaps as never before. It is understandable that some of you may be second guessing your investment strategy due to these recent events. We encourage you to work with your investment professional and seek out their advice about your portfolio in light of the current conditions. But we also urge investors not to make rash decisions. ING Funds still believes that a well-diversified, globally allocated portfolio remains the most effective investment strategy of all. We ask that investors not lose sight of their commitment to the long-term.

We thank you for your support and confidence and we look forward to continuing to do business with you in the future.

Sincerely,

Shaun Mathews

President & Chief Executive Officer

ING Funds

January 23, 2009

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice. Consider the fund’s investment objectives, risks, and charges and expenses carefully before investing. The prospectus contains this information and other information about the fund.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2008

In our semi-annual report, we described a failed second quarter rally that fizzled when investors realized that borderline recessionary conditions and a credit crunch had not gone away. By year-end, governments were committing previously unimaginable sums of taxpayer money to prevent systemic collapse. Global equities in the form of the MSCI World® Index(1) measured in local currencies, including net reinvested dividends (“MSCI” for regions discussed below) plunged 29.70% in the six months ended December 31, 2008 (down 38.70% for the entire fiscal year). (The MSCI World® Index plunged 40.71% for the entire fiscal year, measured in U.S. dollars.) In currencies, the dollar at first drifted near record lows against the euro. But the tide turned in mid-July and for the six months ended December 31, 2008, the dollar strengthened by 12.10% (4.50% for the entire fiscal year). The dollar also soared 37.80% against the pound for the six months ended December 31, 2008 (37.90% for the entire fiscal year). But the yen advanced as carry trades (essentially short yen positions) were unwound and the dollar fell 14.90% for the six months ended December 31, 2008 (down 19.60% for the entire fiscal year).

Even more dramatic was the price of oil which marched to an all-time high of around $147 per barrel in mid-July, only to lose more than two thirds of that price by December 31, 2008.

The economic statistics remained bleak. By the end of October, the Standard & Poor’s (“S&P”)/Case-Shiller National U.S. Home Price Index(2) of house prices had fallen a record 18% over the year. New home sales were at 1991 levels. Some 45% of existing home sales were distressed.

Payrolls declined in every month of 2008, as the number of people claiming unemployment reached 4.1 million, a 26-year high. Gross domestic product (“GDP”) fell at an annualized rate of 0.50% in the third quarter, and the National Bureau of Economic Research announced that the recession had actually started in December 2007.

Yet these were side-shows to the fireworks display in the financial sector, where major institutions — hanging by a thread through problems rooted in unwise mortgage borrowing, lending and investment — met different fates in September 2008 at the hands of the U.S. government.

The Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”) were taken into “conservatorship.” Merrill Lynch was acquired by the

Bank of America with a wink from the authorities. AIG received an $85 billion loan from a reluctant government, which also took a 79.90% equity stake in AIG. But Lehman Brothers having sought capital, then a buyer, found neither and was left to file for Chapter 11 bankruptcy protection.

The U.S. government was now in the position of choosing winners and losers among financial institutions: none too successfully, for it quickly became obvious that by pointedly leaving Lehman Brothers to go under, a credit crisis had become a credit market collapse. Lending all but seized up.

Policy response was huge but at least initially muddled. A Troubled Asset Relief Plan (“TARP”) would set up a $700 billion fund to buy illiquid mortgage securities from financial institutions. But on November 12, 2008 with half of the money already used to recapitalize banks, Treasury Secretary Paulson announced that the rest of the funds would not be used to buy illiquid mortgage securities after all. This merely renewed the pressure on the holders of such securities like Citigroup, which within two weeks received guarantees from the government against losses and another $20 billion in capital.

Other programs were of more practical use, like support for the commercial paper market and a guarantee facility for money market funds. Arguably the most effective measure was the announced intention to buy vast quantities of agency mortgage-backed securities and debentures. This had the effect of driving down rates on the 30-year mortgage towards 5.00%, a record low. In the meantime, the newly-elected president promised a stimulus package worth approximately $1 trillion. And by year end, the Federal Open Market Committee (“FOMC”) reduced interest rates to a range of between 0% and 0.25%.

2008 ended with much gloom and bad news still to come, but the platform for recovery was perhaps taking shape.

In U.S. fixed-income markets, yields on the 90-day Treasury Bills briefly turned negative in December 2008, while the yield on the ten-year Treasury Note fell below 2.50%, something we had not seen in 50 years. The Barclays Capital U.S. Aggregate Bond Index(3), formerly known as the Lehman Brothers U.S. Aggregate Bond Index, of investment grade bonds returned 4.10% for the six months ended December 31, 2008, (5.20% for the entire fiscal year). By contrast, high yield bonds, represented by the Barclays Capital High Yield Bond — 2% Issuer Constrained

2

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2008

Composite Index(4), formerly known as the Lehman Brothers High Yield Bond — 2% Issuer Constrained Composite Index, behaved more like a stock index and returned (25.10)% for the six months ended December 31, 2008 (down 25.90% for the entire fiscal year).

U.S. equities, represented by the S&P 500® Composite Stock Price (“S&P 500®”) Index(5), including dividends, returned (28.50)% for the six months ended December 31, 2008, (down 37.00% for the entire fiscal year), increasingly unimpressed by sharply falling oil prices. Profits for S&P 500® Index companies suffered their fifth straight quarter of decline, led again by the financials sector, although taxpayer money was also potentially committed to save the big three auto makers from bankruptcy. On November 20, 2008, the S&P 500® Index plumbed a level not seen since April 1997, before a December recovery.

In international markets, plainly entering recession, the MSCI Japan® Index(6) slumped 35.90% for the six months ended December 31, 2008, (down 42.60% for the entire fiscal year). The strengthening yen hit exports in an export-dependent economy even as global demand slowed for other reasons. The MSCI Europe ex UK® Index(7) sagged 29.40% for the six months ended December 31, 2008 (down 43.20% for the entire fiscal year), beset by sharply falling economic activity and a European Central Bank in denial that inflation was falling fast. Finally, rates were reduced by an unprecedented 175 basis points (or 1.75%) in two months near the end of the year while governments, one after the other, proposed large stimulus packages. In the UK, the MSCI UK® Index(8) fell 19.40% for the six months ended December 31, 2008 (down 28.50% for the entire fiscal year). The UK had allowed a bigger housing bubble than the United States and deeper personal indebtedness in an economy more dependent on the financial sector. Rates were reduced to 1951 levels as venerable banks ceased to exist as independent entities.

(1) The MSCI World® Index is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The S&P/Case-Shiller National U.S. Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated quarterly.

(3) The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(4) The Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index is an unmanaged index that measures the performance of non-investment grade fixed-income securities.

(5) The S&P 500® Index is an unmanaged index that measures the performance of securities of

approximately 500 of the largest companies in the United States.

(6) The MSCI Japan® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(7) The MSCI Europe ex UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(8) The MSCI UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

| | |

| ING VP STRATEGIC ALLOCATION CONSERVATIVE PORTFOLIO | | PORTFOLIO MANAGERS’ REPORT |

ING VP Strategic Allocation Conservative Portfolio (the “Portfolio”) seeks to provide total return (i.e., income and capital growth, both realized and unrealized) consistent with preservation of capital. The Portfolio is managed by Paul Zemsky and Brian Gendreau, Portfolio Managers* of ING Investment Management Co. – the Sub-Adviser.

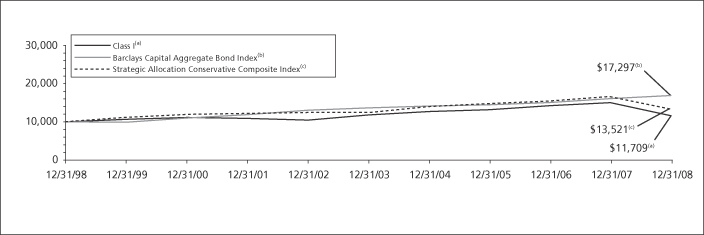

Performance: For the year ended December 31, 2008 the Portfolio’s Class I shares provided a total return of (23.65)% compared to the Barclays Capital U.S. Aggregate Bond Index**(1) and the Strategic Allocation Conservative Composite Index(2) (“Composite Index”), which returned 5.24% and (16.47)%, respectively, for the same period.

Portfolio Specifics: The structure of the Portfolio was converted in April 2008, into a fund-of-funds structure. Rather than holding individual securities, the Portfolio now holds shares of various underlying funds, which represent a portion of the performance of the year.

Prior to the conversion, the domestic equity portion of the Portfolio underperformed its sub-benchmark, the Russell 3000® Index. On a relative basis, the larger-cap stocks were the weakest performers. In particular, stock selection was negative, particularly in the healthcare and industrials sectors. Allocation effect within the equity portion was minimal, as there were only modest deviations from the benchmark. During this period, we experienced a brief change in market leadership from growth to value, which was accompanied by a spike in volatility, but the valuation factors’ outperformance was short-lived and price momentum drove returns through the Portfolio’s conversion.

Prior to the conversion, the international portion of the Portfolio underperformed its sub-benchmark, the MSCI Europe, Australasia Far East® (“MSCI EAFE®”) Index.

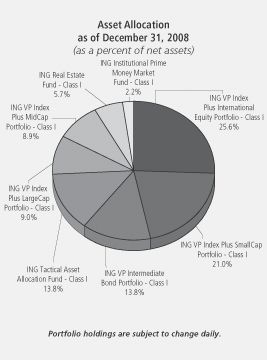

Asset Allocation

as of December 31, 2008

(as a percent of net assets)

| | |

ING VP Intermediate Bond Portfolio — Class I | | 52.0% |

ING VP Index Plus International Equity Portfolio — Class I | | 11.0% |

ING Real Estate Fund — Class I | | 9.2% |

ING Tactical Asset Allocation Fund — Class I | | 9.0% |

ING VP Index Plus SmallCap Portfolio — Class I | | 7.8% |

ING Institutional Prime Money Market

Fund — Class I | | 5.3% |

ING VP Index Plus LargeCap Portfolio — Class I | | 2.9% |

ING VP Index Plus MidCap Portfolio — Class I | | 2.9% |

Other Assets and Liabilities — Net | | (0.1)% |

| | |

Net Assets | | 100.0% |

| | |

Portfolio holdings are subject to change daily.

Negative selection effect in the industrials, utilities and materials sectors more than offset the favorable security selection within the financials and technology sectors.

Prior to the conversion, the fixed-income portion of the Portfolio also underperformed the Barclays Capital U.S. Aggregate Bond Index. During the period, both asset allocation and security selection were detractors. Security selection was a significant drag, but particularly for the month of March due to continued disruption in the mortgage market. Our interest rate strategy was beneficial for performance and, despite the fact we maintained a neutral duration posture for most of this partial reporting period, we maintained a steepened curve positioning, which benefited the Portfolio when heightened risk aversion led to increased demand for Treasuries.

Significant negative pricing action in March, driven by a dearth of liquidity, weighed heavily on returns for the mortgage portion of the Portfolio. An allocation to off-index collateralized mortgage obligations backed by non-agency collateral hurt performance.

Post conversion, performance was mixed for the underlying funds, with all posting negative absolute returns, but positive relative performance for many. Within domestic equity, relative performance was negative for the most part, with ING Tactical Asset Allocation Fund, ING VP Index Plus Mid Cap Portfolio and ING VP Index Plus Small Cap Portfolio underperforming their respective benchmarks. ING Tactical Asset Allocation Fund, which provides exposure to large-cap stocks and seeks to add value by engaging in a global tactical asset allocation overlay strategy, underperformed the Standard & Poor’s (“S&P”) 500® Index due mainly to the average long exposure to equity and short exposure to fixed income.

ING VP Index Plus Mid Cap Portfolio underperformed the S&P Mid Cap 400 Index due mainly to negative allocation effect, particularly by an underweight in utilities, which was the best relative performing sector during the period. ING VP Index Plus Small Cap Portfolio underperformed the S&P Small Cap 600 Index due to negative selection effect, predominantly in the financials, energy and industrials sectors. On the other hand, ING VP Index Plus Large Cap Portfolio outperformed the S&P 500® Index during the period, due mainly to positive stock selection. Of particular success was the selection in energy and financials sectors, both of which saw strong performance during the period.

Post conversion, the ING VP Index Plus International Equity Portfolio outperformed its benchmark, the MSCI EAFE® Index, before the deduction of Portfolio fees and expenses. This was due to a recovery of the predictive power of the sector models in the second half of the year. Overall, the mix of factors added modest value in the financials, materials and energy sectors. A new asset class was added to the Portfolio upon conversion, real estate, via the use of the ING Real Estate Fund. Since its addition, it has outperformed its benchmark, despite the negative returns in the real estate investment trust (“REIT”) asset class. For most of the period, the majority of the outperformance came from stock selection, led by portfolio holdings in the office, shopping center, mall, apartment and hotel sectors. Overweighting the strong healthcare sector also proved beneficial.

Post conversion, the ING VP Intermediate Bond Portfolio has underperformed its benchmark, the Barclays Capital U.S. Aggregate Bond Index. The bond market experienced an unprecedented year in volatility and dislocation. A large source of underperformance was the Portfolio’s underweight in Treasuries, which hurt when investors fled to their relative safety. The ING VP Intermediate Bond Portfolio was also overweight many of the sectors hit hardest by this risk aversion, including financials, corporate bonds and our off-benchmark holdings in non-agency residential mortgage-backed securities. The yield curve, duration and currency exposures in the ING VP Intermediate Bond Portfolio were largely beneficial throughout the year, but not by a margin large enough to nullify the negative selection effect.

Current Strategy and Outlook: Looking forward, we expect the recession to continue for the next two quarters, with growth resuming in the second half of 2009. We expect inflation to decline, and perhaps turn negative, but we don’t believe we are in the midst of a deflationary spiral. Finally, we expect a large fiscal stimulus to be enacted by Congress early in 2009. We ended the year overweight in equity versus fixed income, but would be looking to pare back our equity position once the effects of the fiscal stimulus are more evident. In our opinion, the market is near a bottom, although we expect the coming months to continue to be volatile.

The equity market is factoring in a growth slowdown well beyond what we feel will occur, and with a great number of policy responses from global governments already underway, we intend to stay the course. History has shown that chasing the market, either up or down, has not been a winning strategy.

| * | | Effective January 13, 2009, Brian Gendreau was replaced by Heather Hackett as co-portfolio manager to the Portfolio. |

| ** | | Formerly known as the Lehman Brothers U.S. Aggregate Bond Index. As of October 31, 2008, all Lehman Brothers indices were renamed: the words “Lehman Brothers” changed to “Barclays Capital.” |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

4

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING VP STRATEGIC ALLOCATION CONSERVATIVE PORTFOLIO |

| | | | | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Total Returns for the Periods Ended December 31, 2008 | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception of Class ADV December 29, 2006 | | | Since Inception of Class S August 5, 2005 | | | |

| | | Class ADV | | (24.07 | )% | | — | | | — | | | (10.49 | )% | | — | | | |

| | | Class I | | (23.65 | )% | | (0.37 | )% | | 1.57 | % | | — | | | — | | | |

| | | Class S | | (23.92 | )% | | — | | | — | | | — | | | (3.66 | )% | | |

| | | Barclays Capital U.S. Aggregate Bond Index(1) | | 5.24 | % | | 4.65 | % | | 5.63 | % | | 6.10 | %(3) | | 5.08 | %(4) | | |

| | | Strategic Allocation Conservative Composite Index(2) | | (16.47 | )% | | 1.26 | % | | 3.06 | % | | (5.80 | )%(3) | | (0.78 | )%(4) | | |

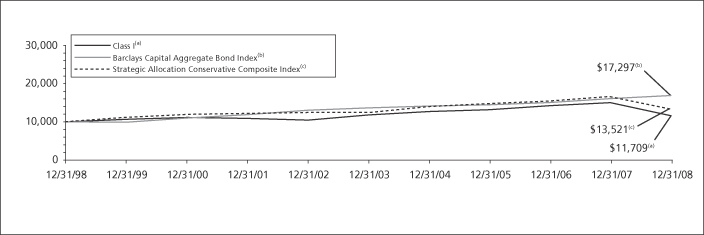

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Strategic Allocation Conservative Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) | | The Barclays Capital U.S. Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued fixed rate U.S. government, investment grade, mortgaged-backed and corporate debt securities. |

(2) | | The Strategic Allocation Conservative Composite Index is comprised of the asset class indices that correspond to the particular asset classes in which the Portfolio invests and their benchmark weightings. From time to time, adjustments have been made in the asset classes and/or weightings applicable to the Portfolio, and corresponding adjustments have been made to the composite. See page 10 for additional information. |

(3) | | Since inception performance for the indices is shown from January 1, 2007. |

(4) | | Since inception performance for the indices is shown from August 1, 2005. |

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

5

| | |

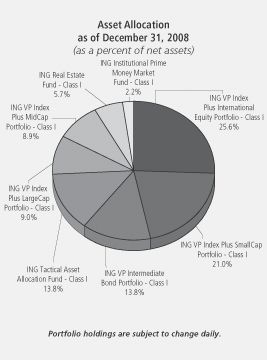

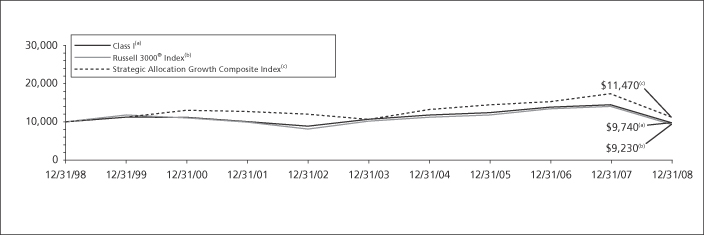

| ING VP STRATEGIC ALLOCATION GROWTH PORTFOLIO | | PORTFOLIO MANAGERS’ REPORT |

ING VP Strategic Allocation Growth Portfolio (the “Portfolio”) seeks to provide capital appreciation. The Portfolio is managed by Paul Zemsky and Brian Gendreau, Portfolio Managers* of ING Investment Management Co. — the Sub-Adviser.

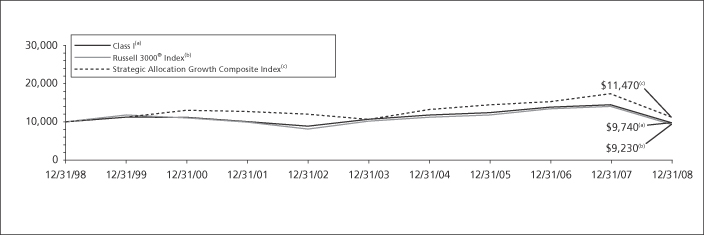

Performance: For the year ended December 31, 2008, the Portfolio’s Class I shares provided a total return of (36.13)% compared to the Russell 3000® Index(1) and the Strategic Allocation Growth Composite Index(2) (“Composite Index”), which returned (37.31)% and (32.93)%, respectively, for the same period.

Portfolio Specifics: The structure of the Portfolio was converted in April 2008, into a fund-of-funds structure. Rather than holding individual securities, the Portfolio now holds shares of various underlying funds, which represent a portion of the performance of the year.

Prior to the conversion, the domestic equity portion of the Portfolio underperformed the Russell 3000® Index. On a relative basis, the larger-cap stocks were the weakest performers. In particular, stock selection was negative, particularly in the healthcare and industrials sectors. Allocation effect within the equity portion was minimal, as there were only modest deviations from the benchmark. During this period, we experienced a brief change in market leadership from growth to value, which was accompanied by a spike in volatility, but the valuation factors’ outperformance was short-lived and price momentum drove returns through the Portfolio’s conversion.

Prior to the conversion, the international portion of the Portfolio underperformed its sub-benchmark, the MSCI Europe, Australasia and Far East® (“MSCI EAFE®”) Index. Negative selection effect in the industrials, utilities and materials sectors more than offset the favorable security selection within the financials and technology sectors.

Prior to the conversion, the fixed-income portion of the Portfolio also underperformed its sub-benchmark, the Barclays Capital U.S. Aggregate Bond Index.** During the period, both asset allocation and security selection were detractors. Security selection was a significant drag, but particularly for the month of March due to continued disruption in the mortgage market. Our interest rate strategy was beneficial for performance and, despite the fact we maintained a neutral duration posture for most of this partial reporting period, we maintained a steepened curve positioning, which benefited the Portfolio when heightened risk aversion led to increased demand for Treasuries.

Significant negative pricing action in March, driven by a dearth of liquidity, weighed heavily on returns for the mortgage portion of the Portfolio. An allocation to off-index collateralized mortgage obligations backed by non-agency collateral hurt performance.

Post conversion, performance was mixed for the underlying funds, with all posting negative absolute returns, but positive relative performance for many. Within domestic equity, relative performance was negative for the most part, with ING Tactical Asset Allocation Fund, ING VP Index Plus Mid Cap Portfolio and ING VP Index Plus Small Cap Portfolio underperforming their respective benchmarks. ING Tactical Asset Allocation Fund, which provides exposure to large-cap stocks and seeks to add value by engaging in a global tactical asset allocation overlay strategy, underperformed the Standard & Poor’s (“S&P”) 500® Index due mainly to the average long exposure to equity and short exposure to fixed income.

ING VP Index Plus Mid Cap Portfolio underperformed the S&P Mid Cap 400 Index due mainly to negative allocation effect, particularly by an underweight in utilities, which was the best relative performing sector during the period. ING VP Index Plus Small Cap Portfolio underperformed the S&P Small Cap 600 Index due to negative selection effect, predominantly in the financials, energy and industrials sectors. On the other hand, ING VP Index Plus Large Cap Portfolio outperformed the S&P 500® Index during the period, due mainly to positive stock selection. Of particular success was the selection in energy and financials sectors, both of which saw strong performance during the period.

Post conversion, the ING VP Index Plus International Equity Portfolio outperformed its benchmark, the MSCI EAFE® Index, before the deduction of Portfolio fees and expenses. This was due to a recovery of the predictive power of the sector models in the second half of the year. Overall, the mix of factors added modest value in the financials, materials and energy sectors. A new asset class was added to the Portfolio upon conversion, real estate, via the use of the ING Real Estate Fund. Since its addition, it has outperformed its benchmark, despite the negative returns in the real estate investment trust (“REIT”) asset class. For most of the period, the majority of the outperformance came from stock selection, led by portfolio holdings in the office, shopping center, mall, apartment and hotel sectors. Overweighting the strong healthcare sector also proved beneficial.

Post conversion, the ING VP Intermediate Bond Portfolio has underperformed its benchmark, the Barclays Capital U.S. Aggregate Bond Index. The bond market experienced an unprecedented year in volatility and dislocation. A large source of underperformance was the Portfolio’s underweight in Treasuries, which hurt when investors fled to their relative safety. The ING VP Intermediate Bond Portfolio was also overweight many of the sectors hit hardest by this risk aversion, including financials, corporate bonds and our off-benchmark holdings in non-agency residential mortgage-backed securities. The yield curve, duration and currency exposures in the ING VP Intermediate Bond Portfolio were largely beneficial throughout the year, but not by a margin large enough to nullify the negative selection effect.

Current Strategy and Outlook: Looking forward, we expect the recession to continue for the next two quarters, with growth resuming in the second half of 2009. We expect inflation to decline, and perhaps turn negative, but we don’t believe we are in the midst of a deflationary spiral. Finally, we expect a large fiscal stimulus to be enacted by Congress early in 2009. We ended the year overweight in equity versus fixed income, but would be looking to pare back our equity position once the effects of the fiscal stimulus are more evident. In our opinion, the market is near a bottom, although we expect the coming months to continue to be volatile.

The equity market is factoring in a growth slowdown well beyond what we feel will occur, and with a great number of policy responses from global governments already underway, we intend to stay the course. History has shown that chasing the market, either up or down, has not been a winning strategy.

| * | | Effective January 13, 2009, Brian Gendreau was replaced by Heather Hackett as co-portfolio manager to the Portfolio. |

| ** | | Formerly known as the Lehman Brothers U.S. Aggregate Bond Index. As of October 31, 2008, all Lehman Brothers indices were renamed: the words “Lehman Brothers” changed to “Barclays Capital.” |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

6

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING VP STRATEGIC ALLOCATION GROWTH PORTFOLIO |

| | | | | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Total Returns for the Periods Ended December 31, 2008 | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception of Class ADV December 29, 2006 | | | Since Inception of Class S August 5, 2005 | | | |

| | | Class ADV | | (36.27 | )% | | — | | | — | | | (18.28 | )% | | — | | | |

| | | Class I | | (36.13 | )% | | (2.01 | )% | | (0.27 | )% | | — | | | — | | | |

| | | Class S | | (36.19 | )% | | — | | | — | | | — | | | (7.07 | )% | | |

| | | Russell 3000® Index(1) | | (37.31 | )% | | (1.95 | )% | | (0.80 | )% | | (18.81 | )%(3) | | (7.10 | )%(4) | | |

| | | Strategic Allocation Growth Composite Index(2) | | (32.93 | )% | | (0.73 | )% | | 1.38 | % | | (15.58 | )%(3) | | (5.05 | )%(4) | | |

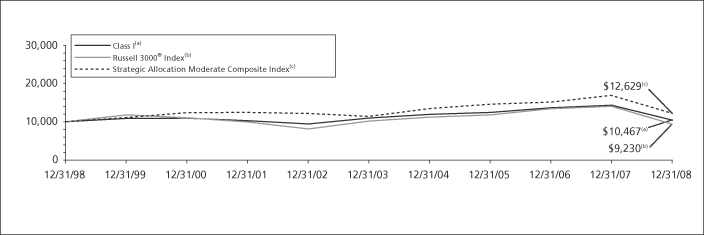

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Strategic Allocation Growth Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) | | The Russell 3000® Index is an unmanaged index that measures the performance of 3000 U.S. companies based on total market capitalization. |

(2) | | The Strategic Allocation Growth Composite Index is comprised of the asset class indices that correspond to the particular asset classes in which the Portfolio invests and their benchmark weightings. From time to time, adjustments have been made in the asset classes and/or weightings applicable to the Portfolio, and corresponding adjustments have been made to the composite. See page 10 for additional information. |

(3) | | Since inception performance for the indices is shown from January 1, 2007. |

(4) | | Since inception performance for the indices is shown from August 1, 2005. |

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

7

| | |

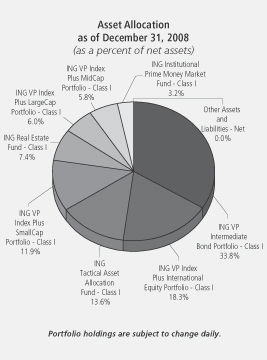

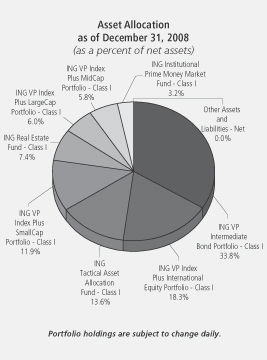

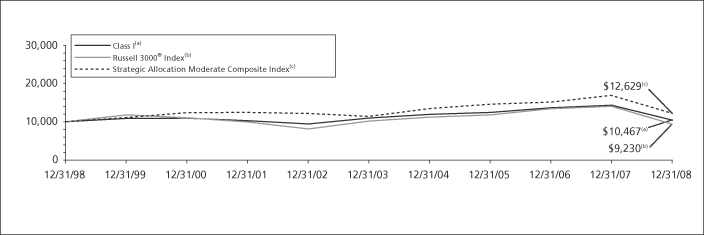

| ING VP STRATEGIC ALLOCATION MODERATE PORTFOLIO | | PORTFOLIO MANAGERS’ REPORT |

ING VP Strategic Allocation Moderate Portfolio (the “Portfolio”) seeks to provide total return (i.e., income and capital appreciation, both realized and unrealized). The Portfolio is managed by Paul Zemksy and Brian Gendreau, Portfolio Managers* of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2008, the Portfolio’s Class I shares provided a total return of (30.48)% compared to the Russell 3000® Index(1) and the ING Strategic Allocation Moderate Composite Index(2) (“Composite Index”), which returned (37.31)% and (25.26)%, respectively, for the same period.

Portfolio Specifics: The structure of the Portfolio was converted in April 2008, into a fund-of-funds structure. Rather than holding individual securities, the Portfolio now holds shares of various underlying funds, which represent a portion of the performance of the year.

Prior to the conversion, the domestic equity portion of the Portfolio underperformed the Russell 3000® Index. On a relative basis, the larger-cap stocks were the weakest performers. In particular, stock selection was negative, particularly in the healthcare and industrials sectors. Allocation effect within the equity portion was minimal, as there were only modest deviations from the benchmark. During this period, we experienced a brief change in market leadership from growth to value, which was accompanied by a spike in volatility, but the valuation factors’ outperformance was short-lived and price momentum drove returns through the Portfolio’s conversion.

Prior to the conversion, the international portion of the Portfolio underperformed its sub-benchmark, the MSCI Europe, Australasia and Far East® (“MSCI EAFE®”) Index. Negative selection effect in the industrials, utilities and materials sectors more than offset the favorable security selection within the financials and technology sectors.

Prior to the conversion, the fixed-income portion of the Portfolio also underperformed its sub-benchmark, the Barclays Capital U.S. Aggregate Bond Index.** During the period, both asset allocation and security selection were detractors. Security selection was a significant drag, but particularly for the month of March due to continued disruption in the mortgage market. Our interest rate strategy was beneficial for performance and, despite the fact we maintained a neutral duration posture for most of this partial reporting period, we maintained a steepened curve positioning, which benefited the Portfolio when heightened risk aversion led to increased demand for Treasuries.

Significant negative pricing action in March, driven by a dearth of liquidity, weighed heavily on returns for the mortgage portion of the Portfolio. An allocation to off-index collateralized mortgage obligations backed by non-agency collateral hurt performance.

Post conversion, performance was mixed for the underlying funds, with all posting negative absolute returns, but positive relative performance for many. Within domestic equity, relative performance was negative for the most part, with ING Tactical Asset Allocation Fund, ING VP Index Plus Mid Cap Portfolio and ING VP Index Plus Small Cap Portfolio underperforming their respective benchmarks. ING Tactical Asset Allocation Fund, which provides exposure to large-cap stocks and seeks to add value by engaging in a global tactical asset allocation overlay strategy, underperformed the Standard & Poor’s (“S&P”) 500® Index due mainly to the average long exposure to equity and short exposure to fixed income.

ING VP Index Plus Mid Cap Portfolio underperformed the S&P Mid Cap 400 Index due mainly to negative allocation effect, particularly by an underweight in utilities, which was the best relative performing sector during the period. ING VP Index Plus Small Cap Portfolio underperformed the S&P Small Cap 600 Index due to negative selection effect, predominantly in the financials, energy and industrials sectors. On the other hand, ING VP Index Plus Large Cap Portfolio outperformed the S&P 500® Index during the period, due mainly to positive stock selection. Of particular success was the selection in energy and financials sectors, both of which saw strong performance during the period.

Post conversion, the ING VP Index Plus International Equity Portfolio outperformed its benchmark, the MSCI EAFE® Index, before the deduction of Portfolio fees and expenses. This was due to a recovery of the predictive power of the sector models in the second half of the year. Overall, the mix of factors added modest value in the financials, materials and energy sectors. A new asset class was added to the Portfolio upon conversion, real estate, via the use of the ING Real Estate Fund. Since its addition, it has outperformed its benchmark, despite the negative returns in the real estate investment trust (“REIT”) asset class. For most of the period, the majority of the outperformance came from stock selection, led by portfolio holdings in the office, shopping center, mall, apartment and hotel sectors. Overweighting the strong healthcare sector also proved beneficial.

Post conversion, the ING VP Intermediate Bond Portfolio has underperformed its benchmark, the Barclays Capital U.S. Aggregate Bond Index. The bond market experienced an unprecedented year in volatility and dislocation. A large source of underperformance was the Portfolio’s underweight in Treasuries, which hurt when investors fled to their relative safety. The ING VP Intermediate Bond Portfolio was also overweight many of the sectors hit hardest by this risk aversion, including financials, corporate bonds and our off-benchmark holdings in non-agency residential mortgage-backed securities. The yield curve, duration and currency exposures in the ING VP Intermediate Bond Portfolio were largely beneficial throughout the year, but not by a margin large enough to nullify the negative selection effect.

Current Strategy and Outlook: Looking forward, we expect the recession to continue for the next two quarters, with growth resuming in the second half of 2009. We expect inflation to decline, and perhaps turn negative, but we don’t believe we are in the midst of a deflationary spiral. Finally, we expect a large fiscal stimulus to be enacted by Congress early in 2009. We ended the year overweight in equity versus fixed income, but would be looking to pare back our equity position once the effects of the fiscal stimulus are more evident. In our opinion, the market is near a bottom, although we expect the coming months to continue to be volatile.

The equity market is factoring in a growth slowdown well beyond what we feel will occur, and with a great number of policy responses from global governments already underway, we intend to stay the course. History has shown that chasing the market, either up or down, has not been a winning strategy.

| * | | Effective January 13, 2009, Brian Gendreau was replaced by Heather Hackett as co-portfolio manager to the Portfolio. |

| ** | | Formerly known as the Lehman Brothers U.S. Aggregate Bond Index. As of October 31, 2008, all Lehman Brothers indices were renamed: the words “Lehman Brothers” changed to “Barclays Capital.” |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

8

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING VP STRATEGIC ALLOCATION MODERATE PORTFOLIO |

| | | | | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Total Returns for the Periods Ended December 31, 2008 | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception of Class ADV December 29, 2006 | | | Since Inception of Class S June 7, 2005 | | | |

| | | Class ADV | | (30.75 | )% | | — | | | — | | | (14.73 | )% | | — | | | |

| | | Class I | | (30.48 | )% | | (1.21 | )% | | 0.46 | % | | — | | | — | | | |

| | | Class S | | (30.68 | )% | | — | | | — | | | — | | | (4.80 | )% | | |

| | | Russell 3000® Index(1) | | (37.31 | )% | | (1.95 | )% | | (0.80 | )% | | (18.81 | )%(3) | | (5.54 | )%(4) | | |

| | | Strategic Allocation Moderate Composite Index(2) | | (25.26 | )% | | 0.34 | % | | 2.36 | % | | (10.90 | )%(3) | | (2.03 | )%(4) | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Strategic Allocation Moderate Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) | | The Russell 3000® Index is an unmanaged index that measures the performance of 3000 U.S. companies based on total market capitalization. |

(2) | | The Strategic Allocation Moderate Composite Index is comprised of the asset class indices that correspond to the particular asset classes in which the Portfolio invests and their benchmark weightings. From time to time, adjustments have been made in the asset classes and/or weightings applicable to the Portfolio, and corresponding adjustments have been made to the composite. See page 10 for additional information. |

(3) | | Since inception performance for the indices is shown from January 1, 2007. |

(4) | | Since inception performance for the indices is shown from June 1, 2005. |

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

9

| | |

| ING VP STRATEGIC ALLOCATION PORTFOLIOS | | PORTFOLIO MANAGERS’ REPORT |

ING VP Strategic Allocation Conservative Portfolio, ING VP Strategic Allocation Growth Portfolio and ING VP Strategic Allocation Moderate Portfolio (collectively, the “Portfolios”) seek to obtain their individual investment objectives by investing in a combination of underlying funds (“Underlying Funds”) according to each Portfolio’s fixed formula. The Portfolios are managed by ING Investment Management Co. (“ING IM”) — the Sub-Adviser.

The Sub-Adviser uses the Strategic Allocation Conservative Composite, Strategic Allocation Growth Composite, and Strategic Allocation Moderate

Composite indices (each a “Composite Index”) as benchmarks to which it compares the performance of ING VP Strategic Allocation Conservative Portfolio, ING VP Strategic Allocation Growth Portfolio and ING VP Strategic Allocation Moderate Portfolio, respectively. Each Composite Index is a blended index that is derived from the asset class comparative indices set out in the chart below. The chart shows the weightings for each asset class comparative index represented in each benchmark Composite Index, as a percentage of the Composite Index.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | S&P 500®

Index(1) | | | S&P MidCap 400 Index(2) | | | S&P SmallCap 600 Index(3) | | | MSCI EAFE® Index(4) | | | Dow Jones Wilshire Real Estate Securities Index(5) | | | Barclays Capital U.S. Aggregate Bond Index(6) | | | 30-Day U.S. T-Bill(7) | | | |

| | VP Strategic Allocation Conservative Composite | | 18 | % | | 3 | % | | 3 | % | | 11 | % | | 10 | % | | 50 | % | | 5 | % | | |

| | VP Strategic Allocation Growth Composite | | 36 | % | | 9 | % | | 9 | % | | 25 | % | | 6 | % | | 13 | % | | 2 | % | | |

| | VP Strategic Allocation Moderate Composite | | 27 | % | | 6 | % | | 6 | % | | 18 | % | | 8 | % | | 32 | % | | 3 | % | | |

(1) | | The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the U.S. |

(2) | | The S&P MidCap 400 Index is a market capitalization-weighted index of 400 mid-capitalization stocks chosen for market size, liquidity, and industry group representation. |

(3) | | The S&P SmallCap 600 Index is an unmanaged index that measures the performance of the small-size company segment of the U.S. market. |

(4) | | The MSCI EAFE® Index is an unmanaged index that measures the performance of securities listed on exchanges in markets in Europe, Australia and the Far East. |

(5) | | The Dow Jones Wilshire Real Estate Securities Index consists of REITs and real estate operating companies. |

(6) | | The Barclays Capital U.S. Aggregate Bond Index, formerly known as the Lehman Brothers U.S. Aggregate Bond Index, is a widely recognized, unmanaged index of publicly issued fixed rate U.S. government, investment grade, mortgage-backed, asset backed and corporate debt securities. |

(7) | | The 30-Day U.S. T-Bill is a U.S government issued short-term debt sold at a discount and then redeemed at maturity at the full face value. |

| | | | | | | | | | | | | |

| | | Target Allocations(1) | | ING VP Strategic Allocation Conservative Portfolio | | | ING VP Strategic Allocation Growth Portfolio | | | ING VP Strategic Allocation Moderate Portfolio | | | |

| | U.S. Large-Capitalization Stocks | | 18 | % | | 36 | % | | 27 | % | | |

| | U.S. Mid-Capitalization Stocks | | 3 | % | | 9 | % | | 6 | % | | |

| | U.S. Small-Capitalization Stocks | | 3 | % | | 9 | % | | 6 | % | | |

| | Non-U.S./International Stocks | | 11 | % | | 25 | % | | 18 | % | | |

| | Real Estate Stocks | | 10 | % | | 6 | % | | 8 | % | | |

| | Fixed-Income Securities | | 50 | % | | 13 | % | | 32 | % | | |

| | Cash | | 5 | % | | 2 | % | | 3 | % | | |

| | | | | | | | | | | | | |

| | | | 100 | % | | 100 | % | | 100 | % | | |

(1) | | Portfolio’s current approximate target investment allocations (expressed as a percentage of its net assets). As these are target allocations, the actual allocations of each Portfolio’s assets may deviate from the percentages shown. Although the Portfolios expect to be fully invested at all times, they may maintain liquidity reserves to meet redemption requests. |

10

All indices are unmanaged.

An investor cannot invest directly in an index.

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees; and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the

entire period from July 1, 2008 to December 31, 2008. The Portfolios’ expenses are shown without the imposition of any charges which are, or may be, imposed under your annuity contract. Expenses would have been higher if such charges were included.

Actual Expenses

The first section of the table shown, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table shown, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Portfolio Return | | Hypothetical (5% return before expenses) |

| | | Beginning Account Value July 1, 2008 | | Ending Account Value December 31, 2008 | | Annualized Expense Ratio* | | | Expenses Paid During the Period Ended December 31, 2008** | | Beginning Account Value July 1, 2008 | | Ending Account Value December 31, 2008 | | Annualized Expense Ratio* | | | Expenses Paid During the Period Ended December 31, 2008** |

ING VP Strategic Allocation Conservative Portfolio | | | | | | | | | | | | |

Class ADV | | $ | 1,000.00 | | $ | 816.20 | | 0.77 | % | | $ | 3.52 | | $ | 1,000.00 | | $ | 1,021.27 | | 0.77 | % | | $ | 3.91 |

Class I | | $ | 1,000.00 | | $ | 817.40 | | 0.27 | % | | $ | 1.23 | | $ | 1,000.00 | | $ | 1,023.78 | | 0.27 | % | | $ | 1.37 |

Class S | | $ | 1,000.00 | | $ | 815.50 | | 0.52 | % | | $ | 2.37 | | $ | 1,000.00 | | $ | 1,022.52 | | 0.52 | % | | $ | 2.64 |

ING VP Strategic Allocation Growth Portfolio | | | | | | | | | | | | | | | | |

Class ADV | | $ | 1,000.00 | | $ | 719.60 | | 0.83 | % | | $ | 3.59 | | $ | 1,000.00 | | $ | 1,020.96 | | 0.83 | % | | $ | 4.22 |

Class I | | $ | 1,000.00 | | $ | 719.20 | | 0.33 | % | | $ | 1.43 | | $ | 1,000.00 | | $ | 1,023.48 | | 0.33 | % | | $ | 1.68 |

Class S | | $ | 1,000.00 | | $ | 719.20 | | 0.58 | % | | $ | 2.51 | | $ | 1,000.00 | | $ | 1,022.22 | | 0.58 | % | | $ | 2.95 |

ING VP Strategic Allocation Moderate Portfolio | | | | | | | | | |

Class ADV | | $ | 1,000.00 | | $ | 766.50 | | 0.81 | % | | $ | 3.60 | | $ | 1,000.00 | | $ | 1,021.06 | | 0.81 | % | | $ | 4.12 |

Class I | | $ | 1,000.00 | | $ | 766.60 | | 0.31 | % | | $ | 1.38 | | $ | 1,000.00 | | $ | 1,023.58 | | 0.31 | % | | $ | 1.58 |

Class S | | $ | 1,000.00 | | $ | 765.00 | | 0.56 | % | | $ | 2.48 | | $ | 1,000.00 | | $ | 1,022.32 | | 0.56 | % | | $ | 2.85 |

| * | | Expense ratios do not include expenses of the underlying funds. |

| ** | | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/366 to reflect the most recent fiscal half-year. |

11

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Directors

ING Strategic Allocation Portfolios, Inc.

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of ING VP Strategic Allocation Conservative Portfolio, ING VP Strategic Allocation Growth Portfolio, and ING VP Strategic Allocation Moderate Portfolio, each a series of ING Strategic Allocation Portfolios, Inc., as of December 31, 2008, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2008, by correspondence with the transfer agent of the underlying funds. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the aforementioned portfolios as of December 31, 2008, and the results of their operations, the changes in their net assets, and the financial highlights for the periods specified in the first paragraph above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 27, 2009

12

STATEMENTS OF ASSETS AND LIABILITIESASOF DECEMBER 31, 2008

| | | | | | | | | | | | |

| | | ING VP Strategic Allocation Conservative Portfolio | | | ING VP Strategic Allocation Growth Portfolio | | | ING VP Strategic Allocation Moderate Portfolio | |

ASSETS: | | | | | | | | | | | | |

Investments in affiliated underlying funds* | | $ | 83,049,555 | | | $ | 145,012,337 | | | $ | 150,239,604 | |

Short-term investments in affiliated underlying funds** | | | 4,631,390 | | | | 3,204,696 | | | | 4,995,158 | |

Cash | | | 277 | | | | 1,674 | | | | — | |

Receivables: | | | | | | | | | | | | |

Investments in affiliated underlying funds sold | | | 435,664 | | | | 399,302 | | | | 665,985 | |

Fund shares sold | | | 74 | | | | 20,401 | | | | 1,252 | |

Dividends and interest | | | 144,502 | | | | 262,413 | | | | 263,607 | |

Prepaid expenses | | | 8,526 | | | | 8,977 | | | | 9,319 | |

| | | | | | | | | | | | |

Total assets | | | 88,269,988 | | | | 148,909,800 | | | | 156,174,925 | |

| | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | |

Payable for investment in affiliated underlying funds purchased | | | 139,061 | | | | 210,220 | | | | 252,234 | |

Payable for fund shares redeemed | | | 436,015 | | | | 421,378 | | | | 667,237 | |

Payable to affiliates | | | 10,488 | | | | 17,555 | | | | 21,169 | |

Payable for directors fees | | | 2,930 | | | | 2,400 | | | | 7,155 | |

Other accrued expenses and liabilities | | | 55,836 | | | | 73,887 | | | | 69,423 | |

| | | | | | | | | | | | |

Total liabilities | | | 644,330 | | | | 725,440 | | | | 1,017,218 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 87,625,658 | | | $ | 148,184,360 | | | $ | 155,157,707 | |

| | | | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

Paid-in capital | | $ | 112,477,253 | | | $ | 212,951,200 | | | $ | 210,910,831 | |

Undistributed net investment income | | | 7,328,644 | | | | 15,498,327 | | | | 14,470,427 | |

Accumulated net realized gain (loss) on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | (3,439,348 | ) | | | 2,987,306 | | | | (1,577,256 | ) |

Net unrealized depreciation on affiliated underlying funds and foreign currency related transactions | | | (28,740,891 | ) | | | (83,252,473 | ) | | | (68,646,295 | ) |

| | | | | | | | | | | | |

NET ASSETS | | $ | 87,625,658 | | | $ | 148,184,360 | | | $ | 155,157,707 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Cost of investments in affiliated underlying funds | | $ | 111,791,029 | | | $ | 228,269,782 | | | $ | 218,887,144 | |

** Cost of short-term investments in affiliated underlying funds | | $ | 4,631,390 | | | $ | 3,204,696 | | | $ | 4,995,158 | |

| | | | | | | | | | | | |

Class ADV: | | | | | | | | | | | | |

Net assets | | $ | 677 | | | $ | 535 | | | $ | 599 | |

Shares authorized | | | 100,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

Shares outstanding | | | 75 | | | | 59 | | | | 66 | |

Net asset value and redemption price per share | | $ | 9.06 | | | $ | 9.01 | | | $ | 9.06 | |

Class I: | | | | | | | | | | | | |

Net assets | | $ | 86,257,410 | | | $ | 146,861,673 | | | $ | 152,965,343 | |

Shares authorized | | | 100,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

Shares outstanding | | | 9,446,743 | | | | 16,242,571 | | | | 16,818,614 | |

Net asset value and redemption price per share | | $ | 9.13 | | | $ | 9.04 | | | $ | 9.10 | |

Class S: | | | | | | | | | | | | |

Net assets | | $ | 1,367,571 | | | $ | 1,322,152 | | | $ | 2,191,765 | |

Shares authorized | | | 100,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

Shares outstanding | | | 151,004 | | | | 147,150 | | | | 242,158 | |

Net asset value and redemption price per share | | $ | 9.06 | | | $ | 8.99 | | | $ | 9.05 | |

See Accompanying Notes to Financial Statements

13

STATEMENTS OF OPERATIONSFORTHE YEAR ENDED DECEMBER 31, 2008

| | | | | | | | | | | | |

| | | ING VP Strategic Allocation Conservative Portfolio | | | ING VP Strategic Allocation Growth Portfolio | | | ING VP Strategic Allocation Moderate Portfolio | |

INVESTMENT INCOME: | | | | | | | | | | | | |

Dividends, net of foreign taxes withheld*(1) | | $ | 3,926,533 | | | $ | 6,097,659 | | | $ | 6,749,996 | |

Interest | | | 863,382 | | | | 421,681 | | | | 903,623 | |

Securities lending income, net | | | 108,549 | | | | 111,234 | | | | 157,759 | |

| | | | | | | | | | | | |

Total investment income | | | 4,898,464 | | | | 6,630,574 | | | | 7,811,378 | |

| | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | |

Investment management fees | | | 271,952 | | | | 504,716 | | | | 508,646 | |

Distribution and service fees: | | | | | | | | | | | | |

Class ADV | | | 6 | | | | 6 | | | | 6 | |

Class S | | | 4,069 | | | | 3,640 | | | | 5,726 | |

Transfer agent fees | | | 354 | | | | 665 | | | | 593 | |

Administrative service fees | | | 63,114 | | | | 115,341 | | | | 117,331 | |

Shareholder reporting expense | | | 19,677 | | | | 65,991 | | | | 66,320 | |

Registration fees | | | — | | | | 197 | | | | 299 | |

Professional fees | | | 33,655 | | | | 37,344 | | | | 45,496 | |

Custody and accounting expense | | | 42,573 | | | | 51,247 | | | | 39,031 | |

Directors fees | | | 5,774 | | | | 18,604 | | | | 19,170 | |

Miscellaneous expense | | | 8,087 | | | | 12,727 | | | | 14,482 | |

Interest Expense | | | 911 | | | | 771 | | | | 1,526 | |

| | | | | | | | | | | | |

Total expenses | | | 450,172 | | | | 811,249 | | | | 818,626 | |

Net waived and reimbursed fees | | | (132,810 | ) | | | (110,361 | ) | | | (146,843 | ) |

| | | | | | | | | | | | |

Net expenses | | | 317,362 | | | | 700,888 | | | | 671,783 | |

| | | | | | | | | | | | |

Net investment income | | | 4,581,102 | | | | 5,929,686 | | | | 7,139,595 | |

| | | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON AFFILIATED UNDERLYING FUNDS, INVESTMENTS, FOREIGN CURRENCY RELATED TRANSACTIONS, FUTURES, AND SWAPS | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Capital gain distributions from affiliated underlying funds | | | 3,947,139 | | | | 14,720,375 | | | | 11,003,906 | |

Net realized loss on sale of affiliated underlying funds | | | (3,661,370 | ) | | | (7,642,517 | ) | | | (8,239,190 | ) |

Investments | | | (1,030,583 | ) | | | 6,864,955 | | | | 4,273,425 | |

Foreign currency related transactions | | | 665 | | | | 3,916 | | | | 3,744 | |

Futures | | | 546,955 | | | | 23,203 | | | | 470,606 | |

Swaps | | | (21,370 | ) | | | (13,243 | ) | | | (23,618 | ) |

| | | | | | | | | | | | |

Net realized gain (loss) on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | (218,564 | ) | | | 13,956,689 | | | | 7,488,873 | |

| | | | | | | | | | | | |

Net change in unrealized appreciation or depreciation on: | | | | | | | | | | | | |

Affiliated underlying funds | | | (28,741,474 | ) | | | (83,257,445 | ) | | | (68,647,540 | ) |

Investments | | | (5,105,078 | ) | | | (25,330,898 | ) | | | (19,985,719 | ) |

Foreign currency related transactions | | | 55 | | | | (529 | ) | | | 281 | |

Futures | | | (14,927 | ) | | | 50,884 | | | | (48,155 | ) |

Swaps | | | (1,256 | ) | | | (775 | ) | | | (1,384 | ) |

| | | | | | | | | | | | |

Net change in unrealized appreciation or depreciation on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | (33,862,680 | ) | | | (108,538,763 | ) | | | (88,682,517 | ) |

| | | | | | | | | | | | |

Net realized and unrealized loss on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | (34,081,244 | ) | | | (94,582,074 | ) | | | (81,193,644 | ) |

| | | | | | | | | | | | |

Decrease in net assets resulting from operations | | $ | (29,500,142 | ) | | $ | (88,652,388 | ) | | $ | (74,054,049 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Foreign taxes withheld | | $ | 2,535 | | | $ | 15,999 | | | $ | 11,608 | |

(1) Dividends from affiliated underlying funds | | $ | 3,671,578 | | | $ | 5,075,802 | | | $ | 5,924,344 | |

See Accompanying Notes to Financial Statements

14

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | |

| | | ING VP Strategic Allocation Conservative Portfolio | | | ING VP Strategic Allocation Growth Portfolio | |

| | | Year Ended December 31, 2008 | | | Year Ended December 31, 2007 | | | Year Ended December 31, 2008 | | | Year Ended December 31, 2007 | |

FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 4,581,102 | | | $ | 4,851,387 | | | $ | 5,929,686 | | | $ | 5,209,628 | |

Net realized gain (loss) on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | (218,564 | ) | | | 10,002,461 | | | | 13,956,689 | | | | 31,053,080 | |

Net change in unrealized appreciation or depreciation on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | (33,862,680 | ) | | | (6,765,319 | ) | | | (108,538,763 | ) | | | (21,450,563 | ) |

| | | | | | | | | | | | | | | | |

Increase (decrease) in net assets resulting from operations | | | (29,500,142 | ) | | | 8,088,529 | | | | (88,652,388 | ) | | | 14,812,145 | |

| | | | | | | | | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | | | | | |

Class ADV | | | (35 | ) | | | (34 | ) | | | (17 | ) | | | (18 | ) |

Class I | | | (4,826,048 | ) | | | (4,671,907 | ) | | | (5,205,257 | ) | | | (5,100,107 | ) |

Class S | | | (60,248 | ) | | | (26,838 | ) | | | (20,702 | ) | | | (4,948 | ) |

Net realized gains: | | | | | | | | | | | | | | | | |

Class ADV | | | (75 | ) | | | (26 | ) | | | (116 | ) | | | (60 | ) |

Class I | | | (9,527,565 | ) | | | (3,523,332 | ) | | | (29,584,058 | ) | | | (17,046,119 | ) |

Class S | | | (124,012 | ) | | | (21,032 | ) | | | (122,997 | ) | | | (18,055 | ) |

| | | | | | | | | | | | | | | | |

Total distributions | | | (14,537,983 | ) | | | (8,243,169 | ) | | | (34,933,147 | ) | | | (22,169,307 | ) |

| | | | | | | | | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | 8,825,341 | | | | 14,766,602 | | | | 10,222,946 | | | | 13,458,976 | |

Reinvestment of distributions | | | 14,537,872 | | | | 8,243,110 | | | | 34,933,017 | | | | 22,169,228 | |

| | | | | | | | | | | | | | | | |

| | | 23,363,213 | | | | 23,009,712 | | | | 45,155,963 | | | | 35,628,204 | |

Cost of shares redeemed | | | (30,167,551 | ) | | | (31,501,546 | ) | | | (43,698,895 | ) | | | (56,718,248 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | (6,804,338 | ) | | | (8,491,834 | ) | | | 1,457,068 | | | | (21,090,044 | ) |

| | | | | | | | | | | | | | | | |

Net decrease in net assets | | | (50,842,463 | ) | | | (8,646,474 | ) | | | (122,128,467 | ) | | | (28,447,206 | ) |

| | | | | | | | | | | | | | | | |

NET ASSETS: | | | | | | | | | | | | | | | | |

Beginning of year | | | 138,468,121 | | | | 147,114,595 | | | | 270,312,827 | | | | 298,760,033 | |

| | | | | | | | | | | | | | | | |

End of year | | $ | 87,625,658 | | | $ | 138,468,121 | | | $ | 148,184,360 | | | $ | 270,312,827 | |

| | | | | | | | | | | | | | | | |

Undistributed net investment income at end of year | | $ | 7,328,644 | | | $ | 4,882,696 | | | $ | 15,498,327 | | | $ | 5,228,484 | |

| | | | | | | | | | | | | | | | |

See Accompanying Notes to Financial Statements

15

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | ING VP Strategic Allocation Moderate Portfolio | |

| | | Year Ended December 31, 2008 | | | Year Ended December 31, 2007 | |

FROM OPERATIONS: | | | | | | | | |

Net investment income | | $ | 7,139,595 | | | $ | 6,656,728 | |

Net realized gain on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | 7,488,873 | | | | 27,003,075 | |

Net change in unrealized appreciation or depreciation on affiliated underlying funds, investments, foreign currency related transactions, futures, and swaps | | | (88,682,517 | ) | | | (18,201,693 | ) |

| | | | | | | | |

Increase (decrease) in net assets resulting from operations | | | (74,054,049 | ) | | | 15,458,110 | |

| | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Net investment income: | | | | | | | | |

Class ADV | | | (21 | ) | | | (24 | ) |

Class I | | | (6,653,236 | ) | | | (6,567,496 | ) |

Class S | | | (32,570 | ) | | | (15,830 | ) |

Net realized gains: | | | | | | | | |

Class ADV | | | (105 | ) | | | (40 | ) |

Class I | | | (26,032,806 | ) | | | (10,985,363 | ) |

Class S | | | (136,028 | ) | | | (28,566 | ) |

| | | | | | | | |

Total distributions | | | (32,854,766 | ) | | | (17,597,319 | ) |

| | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Net proceeds from sale of shares | | | 11,572,906 | | | | 16,379,652 | |

Reinvestment of distributions | | | 32,854,640 | | | | 17,597,255 | |

| | | | | | | | |

| | | 44,427,546 | | | | 33,976,907 | |

Cost of shares redeemed | | | (47,312,829 | ) | | | (66,295,052 | ) |

| | | | | | | | |

Net decrease in net assets resulting from capital share transactions | | | (2,885,283 | ) | | | (32,318,145 | ) |

| | | | | | | | |

Net decrease in net assets | | | (109,794,098 | ) | | | (34,457,354 | ) |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 264,951,805 | | | | 299,409,159 | |

| | | | | | | | |

End of year | | $ | 155,157,707 | | | $ | 264,951,805 | |

| | | | | | | | |

Undistributed net investment income at end of year | | $ | 14,470,427 | | | $ | 6,687,528 | |

| | | | | | | | |

See Accompanying Notes to Financial Statements

16

FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding throughout each year or period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Income (loss)

from

investment

operations | | | | | | Less distributions | | | | | | | | | Ratios to average net

assets | | | Supplemental

data |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset value, beginning of year or period | | Net investment income (loss) | | | Net realized and unrealized gain (loss) | | | Total from investment operations | | | From net investment income | | From net realized gains | | From return of capital | | Total distributions | | Net asset value, end of year or period | | Total Return (1) | | | Expenses before reductions/ additions(2)(3)(4) | | Expenses net of fee waivers and/or recoupments, if any(2)(3)(4) | | | Expenses net of all reductions/ additions(2)(3)(4) | | | Net investment income (loss)(2)(3)(4) | | | Net assets, end of year or period | | Portfolio turnover rate |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year or period ended | | ($) | | ($) | | | ($) | | | ($) | | | ($) | | ($) | | ($) | | ($) | | ($) | | (%) | | | (%) | | (%) | | | (%) | | | (%) | | | ($000's) | | (%) |

| ING VP Strategic Allocation Conservative Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class ADV | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |