| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | August 31, 2011 |

Estimated average burden |

hours per response: | | 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8934

ING Strategic Allocation Portfolios, Inc.

(Exact name of registrant as specified in charter)

| | |

| 7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Incorporated, 300 E. Lombard Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: December 31

Date of reporting period: January 1, 2010 to December 31, 2010

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2010

Classes I and S

Strategic Allocation Funds-of-Funds

| n | ING Strategic Allocation Conservative Portfolio |

| n | ING Strategic Allocation Growth Portfolio |

| n | ING Strategic Allocation Moderate Portfolio |

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS

| |

TABLE OF CONTENTS

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds’ website at www.ingfunds.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds’ website at www.ingfunds.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Portfolios’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330; and is available upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT’S LETTER

Big Picture vs. Details

Dear Shareholder,

On January 25, 2011, President Obama delivered his second State of the Union address. He called on Americans to put aside partisan differences and harness the nation’s creativity to adapt and thrive in a rapidly changing global economy. The president’s challenge is timely: the United States is approaching a nexus of intermediate- and long-term concerns, and the choices we make over the next two years could determine the nation’s competitiveness in the global economy for decades to come.

There are reasons to be optimistic — the International Monetary Fund (“IMF”) predicts the U.S. economy will grow about 3% in 2011. China and India are expected to grow at about 9% and even the euro zone appears to be recovering from crisis; this growth, however, is being accompanied by mounting inflation pressures in certain regions,

suggesting that many economies are expanding at unsustainable rates.

As I write this, the World Economic Forum is getting underway in Davos, Switzerland, and there are numerous concerns to deal with. Chief among them are the still-present risk of sovereign debt defaults in the euro zone; high unemployment and banking problems in the advanced economies; and inflationary pressures in emerging markets, especially with regard to food, fuel and commodities.

As we’ve noted before, uncertainty is a defining characteristic of our age and, in our opinion, is likely to remain so beyond this year. How should you respond within your investment portfolio? Remember that the most important consideration is your long-term goals, not the outlook for 2011. With investment hazards and opportunities everywhere, we believe it makes sense to cast as broad a net as possible around the globe. In our opinion, you want your portfolio to be well diversified so that it is not harmed too much by the trouble spots, and has some exposure to positive trends.

As always, we believe the best approach is a well-diversified portfolio and a well-defined investment plan. As we’ve noted many times before, it’s important to discuss any proposed changes thoroughly with your advisor before taking any action. Thank you for your continued confidence in ING Funds. We look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President & Chief Executive Officer

ING Funds

January 26, 2011

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice. Consider the fund’s investment objectives, risks, and charges and expenses carefully before investing. The prospectus contains this information and other information about the fund.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2010

In our semi-annual report we described how, after a 13-month advance through mid-April, a confluence of local and world issues sent global equities, in the form of the MSCI World IndexSM measured in local currencies, including net reinvested dividends (“MSCI” for regions discussed below), reeling to a loss for the first half of the fiscal year. In the second half of the year, the MSCI World IndexSM bounced back and for 2010 returned 10.01%. (The MSCI World IndexSM returned 11.76% for the one year ended December 31, 2010, measured in U.S. dollars.) By year end, investor sentiment had turned distinctly positive, despite the grave concerns that remained.

It was a bumpy ride. Markets from stocks to bonds to currencies were continually buffeted by news and events relating to three main themes: the stuttering U.S. economic recovery, the sovereign debt crisis in the Eurozone and growth dynamics in China.

In the U.S., quarterly gross domestic product (“GDP”) growth decelerated from 2.7% (annualized) in the first quarter of 2010 to 1.7% in the second, before recovering to 2.6% in the third. But attention was focused more on employment and housing. The 18-month recession which ended in June of 2009 had cost some 8.7 million jobs. But since then, the unemployment rate had been stuck between 9.4% and 10.1%, barely dented by private sector new jobs averaging 107,000 per month as 2010 ended.

The other weakening link was housing. Sales of new and existing homes collapsed after the expiry in April of a program of tax credits for home buyers and languished thereafter. House prices (based on the S&P/Case-Shiller 20-City Composite Home Price Index), having shown annual increases from February, resumed a downward trend in October with the index still 30% below the peak recorded in April 2006.

To be sure, there were some grounds for optimism as 2010 drew to a close. Consumer spending had risen for five straight months. Investment in equipment and software was growing at double-digit annual percentage rates. On December 30, new unemployment claims were reported below 400,000 for the first time since July 2008. The Federal Reserve in November announced a second round of quantitative easing and would buy $600 billion in Treasury notes and bonds. The mixed mid-term election results forced a “compromise” stimulus package worth an estimated $858 billion for 2011. In combination, these two measures increased the attractiveness of riskier asset classes like equities at the expense of high grade bonds, which sold off.

In the Eurozone, after default was narrowly averted on Greece’s maturing bonds, the creation in May of a European Financial Stabilization “mechanism”, funded with up to €750 billion seemed to calm nerves for a while. But in October, attention turned to Ireland, where the Irish government had injected huge sums into local banks, rendering its own fiscal position untenable. The November 29, 2010 European Union/International Monetary Fund bail-out worth €67.5 billion left markets unimpressed. Suddenly it was May again with downgrades, soaring yields on peripheral Eurozone bonds, fears of contagion, falling stock markets and doubts about the viability of the euro itself. The European Central Bank aggressively bought sovereign bonds and the mood settled. But with Spain’s banks needing to refinance €85 billion of debt in 2011, the issue remains unresolved.

Investors watched nervously as China, the source of much of the world’s growth, wrestled with inflation, which reached 5.1% in November, and a housing bubble. The authorities tightened

mortgage requirements, raised banks’ reserve ratio requirements six times in 2010 and interest rates twice in the last quarter. More interest rate increases seem inevitable.

In U.S. fixed income markets, the Barclays Capital U.S. Aggregate Bond Index of investment grade bonds returned 6.54% in 2010. A slight balance towards risk aversion in the first half gave way to improved risk appetite in the second. For the whole year, the Barclays Capital U.S. Treasury index returned 5.87%, underperforming the Barclays Capital Corporate Investment Grade Bond Index with a return of 9.00%, but both fell well short of the Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index which gained 14.94% for the one year period.

U.S. equities, represented by the S&P 500® Index including dividends, rose 15.06% in 2010, including its best September, a return of 8.92%, since 1939 and best December, a return of 6.68%, since 1991. Prices were supported by strong earnings reports, with operating earnings per share for S&P 500® companies recording four straight quarters of annual growth. Equities also benefited from improved risk appetite through the quantitative easing initiative and stimulus package referred to above.

In currencies, the worst of the gloom about the Eurozone in early June was replaced by renewed pessimism about the dollar in a stalling economy, before markets were seized by another bout of Eurozone angst. For the year, the dollar gained 8.15% against the euro and 2.95% against the pound, but lost 11.59% to the yen, which was sold in the market by the Bank of Japan after breaching 15-year high levels.

In international markets, the MSCI Japan® Index returned just 0.57% for the year after a strong last quarter, as quarterly GDP growth bounced back to 1.1% and the yen retreated from multi-year peaks. The tone of the market was generally poor with household spending fragile and consumer prices down for 21 months. The MSCI Europe ex UK® Index returned 4.84%, with Germany up 15.97% and Portugal, Italy, Ireland, Greece and Spain all falling. This broadly reflected the two-tier economy that has developed, with economic statistics favoring more soundly based countries at the expense of the peripherals. The MSCI UK® Index advanced 12.18%, despite the prospect of severe public spending cuts intended to eliminate an 11% budget deficit. Supporting sentiment was resilient, if perhaps temporary, quarterly GDP growth averaging 0.9% in the second half of the year.

Parentheses denote a negative number.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

2

BENCHMARK DESCRIPTIONS

| | |

| Index | | Description |

| MSCI World IndexSM | | An unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. |

| S&P/Case-Shiller 20-City Composite Home Price Index | | A composite index of the home price index for the top 20 Metropolitan Statistical Areas in the United States. The index is published monthly by Standard & Poor’s. |

| Barclays Capital U.S. Aggregate Bond Index | | An unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. |

| Barclays Capital U.S. Treasury Index | | An unmanaged index that includes public obligations of the U.S. Treasury. Treasury bills, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS and STRIPS, are excluded. |

Barclays Capital Corporate Investment Grade Bond Index | | The corporate component of the Barclays Capital U.S. Credit Index. The U.S. Credit Index includes publicly-issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. The index includes both corporate and non-corporate sectors. The corporate sectors are industrial, utility and finance, which includes both U.S. and non-U.S. corporations. |

Barclays Capital High Yield Bond — 2% Constrained Composite Index | | An unmanaged index that includes all fixed income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. |

| S&P 500® Index | | An unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. |

| MSCI Japan® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. |

| MSCI Europe ex UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. |

| MSCI UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. |

| Russell 3000® Index | | An unmanaged index that measures the performance of 3000 U.S. companies based on total market capitalization. |

3

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING STRATEGIC ALLOCATION PORTFOLIOS |

ING Strategic Allocation Conservative Portfolio seeks to provide total return (i.e., income and capital growth, both realized and unrealized) consistent with preservation of capital. ING Strategic Allocation Growth Portfolio seeks to provide capital appreciation. ING Strategic Allocation Moderate Portfolio seeks to provide total return (i.e., income and capital appreciation, both realized and unrealized). ING Strategic Allocation Conservative Portfolio, ING Strategic Allocation Growth Portfolio and ING Strategic Allocation Moderate Portfolio (each a “Portfolio” and collectively, the “Portfolios”) are managed by Paul Zemsky and Heather Hackett, Portfolio Managers of ING Investment Management Co. — the Sub-Adviser.

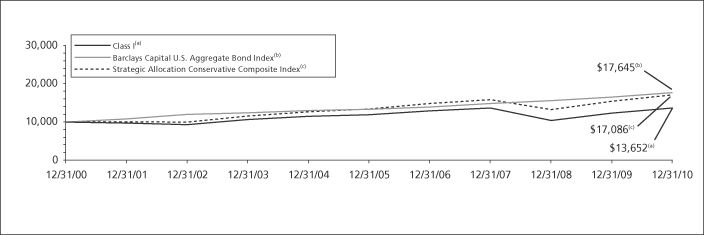

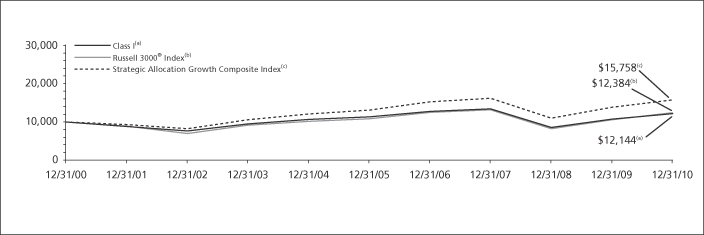

Performance: For the year ended December 31, 2010, ING Strategic Allocation Conservative Portfolio’s Class I shares provided a total return of 11.07% compared to the Barclays Capital U.S. Aggregate Bond Index and the Strategic Allocation Conservative Composite Index, which returned 6.54% and 10.53%, respectively, for the same period. For the year ended December 31, 2010, ING Strategic Allocation Growth Portfolio’s Class I shares provided a total return of 13.06% compared to the Russell 3000® Index and the ING Strategic Allocation Growth Composite Index, which returned 16.93% and 14.02%, respectively, for the same period. For the year ended December 31, 2010, ING Strategic Allocation Moderate Portfolio’s Class I shares provided a total return of 12.03% compared to the Russell 3000® Index and the ING Strategic Allocation Moderate Composite Index, which returned 16.93% and 12.24%, respectively, for the same period.

Portfolio Specifics: As the year drew to a close, investors were in a celebratory mood. A number of equity markets worldwide finished December at or near 2010 highs after a strong fourth quarter. Though most fixed income assets saw limited success in the quarter given rising rates, full-year returns were robust. However, despite the general sense of optimism that currently exists, two of 2010’s most compelling stories — the sluggish economic recovery in the United States and the sovereign debt issues in the euro zone — remain only partially told. How these narratives play out in 2011 will have a significant impact on market performance.

The Portfolios remained at strategic allocation weights and thus allocation results were flat. All asset classes demonstrated positive absolute returns. Equities and real estate outperformed bonds.

ING Intermediate Bond Portfolio significantly outperformed its sub-benchmark, the Barclays Capital U.S. Aggregate Bond Index, in large part due to favorable over weights to corporate bonds, financials and commercial mortgage-backed securities, as well as exposure to non-investment grade corporates. ING MidCap Opportunities Portfolio, significantly outperformed its relative benchmark and exhibited strong stock selection, especially in the energy and consumer staples sectors.

ING Clarion Global Real Estate Portfolio’s performance trailed its relative benchmark and was the largest relative detractor from performance, due to adverse regional allocation decisions during different parts of the year and unfavorable security selection in the Pacific region. Within our large cap equity exposure, ING Tactical Asset Allocation Fund (“TAAF”) underperformed the S&P 500® Index despite its average long exposure to equities as its overlay strategy detracted from returns. More specifically, TAAF’s average long exposure to Italian and Spanish equities in November hurt performance.

ING Alternative Beta Fund was added to the Portfolios’ line-up and seeks to achieve the investment results that approximate the return and risk characteristics of the beta component of the broad universe of hedge fund returns as represented by the HFRI Fund Weighted Composite Index. Although the Fund had success in meeting this objective in 2010, it is not designed to deliver the alpha of the index and underperformed.

The Portfolios are actively managed and may deviate from their strategic weights.

Current Strategy and Outlook: We believe the overall economic environment of the U.S. economy is developing in the direction of a sustainable recovery through an expansion driven more broadly by final demand. In our opinion, U.S. economic data have turned more positive with the PMI numbers, initial jobless claims and retail sales data suggesting that the economy is gaining momentum. In the U.S., policy remains highly stimulative. The extension of the Bush tax cuts along with the large scale Treasury purchases by the Federal Reserve should provide additional stimulus via consumer spending and stable interest rates.

Asset Allocation

as of December 31, 2010

(as a percentage of net assets)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Affiliated Underlying Funds | | | | | ING Strategic Allocation Conservative Portfolio | | | ING Strategic Allocation Growth Portfolio | | | ING Strategic Allocation Moderate Portfolio | | | | |

| | | | ING Alternative Beta Fund - Class I | | | % | | | | 5.0 | | | | 6.9 | | | | 6.0 | | | | | |

| | | | ING Clarion Global Real Estate Portfolio - Class I | | | % | | | | 4.1 | | | | 5.1 | | | | 5.1 | | | | | |

| | | | ING Growth and Income Portfolio - Class I | | | % | | | | 8.1 | | | | 19.1 | | | | 11.1 | | | | | |

| | | | ING Intermediate Bond Portfolio - Class I | | | % | | | | 54.7 | | | | 14.8 | | | | 34.7 | | | | | |

| | | | ING International Index Portfolio - Class I | | | % | | | | 13.1 | | | | 24.1 | | | | 19.1 | | | | | |

| | | | ING MidCap Opportunities Portfolio - Class I | | | % | | | | 4.0 | | | | 9.0 | | | | 6.0 | | | | | |

| | | | ING Small Company Portfolio - Class I | | | % | | | | 3.1 | | | | 8.1 | | | | 5.1 | | | | | |

| | | | ING Tactical Asset Allocation Fund - Class I | | | % | | | | 8.0 | | | | 12.9 | | | | 12.9 | | | | | |

| | | | Other assets and liabilities - Net | | | % | | | | (0.1 | ) | | | (0.0 | )* | | | (0.0 | )* | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | % | | | | 100.0 | | | | 100.0 | | | | 100.0 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| * | Amount is more than (0.05)% |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

4

| | |

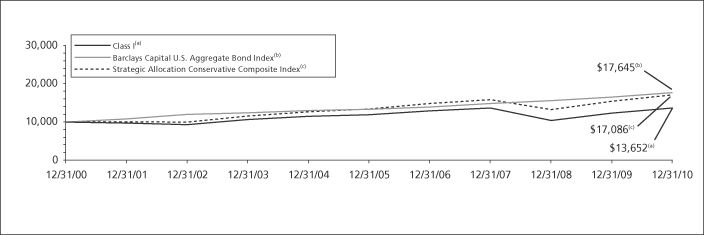

| PORTFOLIO MANAGERS’ REPORT | | ING STRATEGIC ALLOCATION CONSERVATIVE PORTFOLIO |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | Average Annual Total Returns for the Periods Ended December 31, 2010 | | | | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception

of Class S

August 5,

2005 | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Class I | | | 11.07 | % | | | 2.78 | % | | | 3.16 | % | | | — | | | | | |

| | | | | Class S | | | 10.91 | % | | | 2.55 | % | | | — | | | | 2.63 | % | | | | |

| | | | | Barclays Capital U.S. Aggregate Bond Index | | | 6.54 | % | | | 5.80 | % | | | 5.84 | % | | | 5.50 | %(1) | | | | |

| | | | | Strategic Allocation Conservative Composite Index | | | 10.53 | % | | | 5.00 | % | | | 5.50 | % | | | 5.13 | %(1) | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Strategic Allocation Conservative Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment

returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the indices is shown from August 1, 2005. |

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

5

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING STRATEGIC ALLOCATION GROWTH PORTFOLIO |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

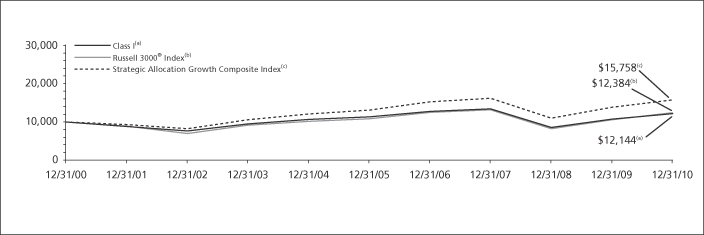

| | | | | Average Annual Total Returns for the Periods Ended December 31, 2010 | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception of Class S August 5, 2005 | | | | |

| | | | | Class I | | | 13.06 | % | | | 1.48 | % | | | 1.96 | % | | | — | | | | | |

| | | | | Class S | | | 12.81 | % | | | 1.24 | % | | | — | | | | 1.74 | % | | | | |

| | | | | Russell 3000® Index | | | 16.93 | % | | | 2.74 | % | | | 2.16 | % | | | 2.89 | %(1) | | | | |

| | | | | Strategic Allocation Growth Composite Index | | | 14.02 | % | | | 3.82 | % | | | 4.65 | % | | | 4.32 | %(1) | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Strategic Allocation Growth Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment

returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the indices is shown from August 1, 2005. |

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

6

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING STRATEGIC ALLOCATION MODERATE PORTFOLIO |

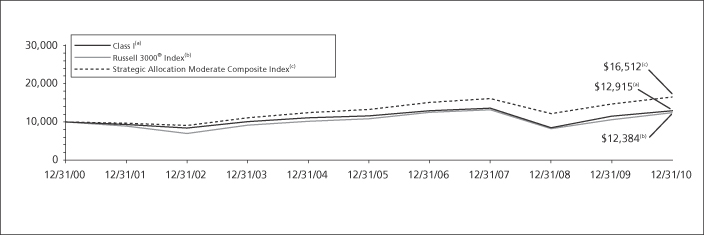

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

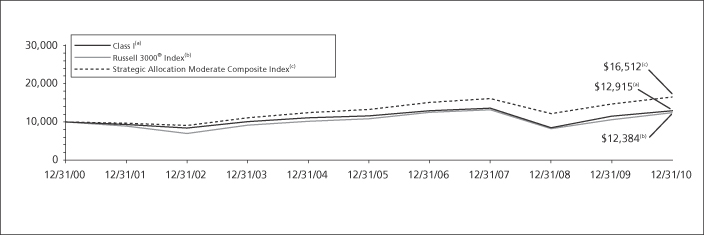

| | | | | Average Annual Total Returns for the Periods Ended December 31, 2010 | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception of Class S June 7, 2005 | | | | |

| | | | | Class I | | | 12.03 | % | | | 2.16 | % | | | 2.59 | % | | | — | | | | | |

| | | | | Class S | | | 11.77 | % | | | 1.90 | % | | | — | | | | 2.39 | % | | | | |

| | | | | Russell 3000® Index | | | 16.93 | % | | | 2.74 | % | | | 2.16 | % | | | 3.68 | %(1) | | | | |

| | | | | Strategic Allocation Moderate Composite Index | | | 12.24 | % | | | 4.46 | % | | | 5.14 | % | | | 6.86 | %(1) | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Strategic Allocation Moderate Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment

returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| (1) | | Since inception performance for the indices is shown from June 1, 2005. |

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

7

| | |

| ING STRATEGIC ALLOCATION PORTFOLIOS | | PORTFOLIO MANAGERS’ REPORT |

ING Strategic Allocation Conservative Portfolio, ING Strategic Allocation Growth Portfolio and ING Strategic Allocation Moderate Portfolio (collectively, the “Portfolios”) seek to obtain their individual investment objectives by investing in a combination of underlying funds (“Underlying Funds”) according to each Portfolio’s fixed formula. The Portfolios are managed by ING Investment Management Co. (“ING IM”) — the Sub-Adviser.

The Sub-Adviser uses the Strategic Allocation Conservative Composite, Strategic Allocation Growth Composite, and Strategic Allocation Moderate

Composite indices (each a “Composite Index”) as benchmarks to which it compares the performance of ING Strategic Allocation Conservative Portfolio, ING Strategic Allocation Growth Portfolio and ING Strategic Allocation Moderate Portfolio, respectively. Each Composite Index is a blended index that is derived from the asset class comparative indices set out in the chart below. The chart shows the weightings for each asset class comparative index represented in each benchmark Composite Index, as a percentage of the Composite Index.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | S&P 500®

Index | | | S&P MidCap 400 Index | | | S&P SmallCap 600 Index | | | MSCI EAFE® Index | | | S&P

Developed

Property

Index | | | Barclays Capital U.S. Aggregate Bond Index | | | HFRX Index | | | | |

| | | | Strategic Allocation Conservative Composite(1) | | | 16 | % | | | 4 | % | | | 3 | % | | | 13 | % | | | 4 | % | | | 55 | % | | | 5 | % | | | | |

| | | | Strategic Allocation Growth Composite(1) | | | 32 | % | | | 9 | % | | | 8 | % | | | 24 | % | | | 5 | % | | | 15 | % | | | 7 | % | | | | |

| | | | Strategic Allocation Moderate Composite(1) | | | 24 | % | | | 6 | % | | | 5 | % | | | 19 | % | | | 5 | % | | | 35 | % | | | 6 | % | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | Target Allocations(*) | | ING Strategic Allocation Conservative Portfolio | | | ING Strategic Allocation Growth Portfolio | | | ING Strategic Allocation Moderate Portfolio | | | | |

| | | | U.S. Large-Capitalization Stocks | | | 16 | % | | | 32 | % | | | 24 | % | | | | |

| | | | U.S. Mid-Capitalization Stocks | | | 4 | % | | | 9 | % | | | 6 | % | | | | |

| | | | U.S. Small-Capitalization Stocks | | | 3 | % | | | 8 | % | | | 5 | % | | | | |

| | | | Non-U.S./International Stocks | | | 13 | % | | | 24 | % | | | 19 | % | | | | |

| | | | Real Estate Stocks | | | 4 | % | | | 5 | % | | | 5 | % | | | | |

| | | | Fixed-Income Securities | | | 55 | % | | | 15 | % | | | 35 | % | | | | |

| | | | Alternatives | | | 5 | % | | | 7 | % | | | 6 | % | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | 100 | % | | | 100 | % | | | 100 | % | | | | |

| (1) | | The Composite Indices reflect the allocations in each Composite Index as of December 31, 2010, but do not reflect the historical changes in allocations throughout the history of each Composite Index. The returns on pages 4-7 reflect a calculation inclusive of allocation changes throughout the history of each Composite Index. |

| (*) | | Portfolio’s current approximate target investment allocations (expressed as a percentage of its net assets) as of December 31, 2010. As these are target allocations, the actual allocations of each Portfolio’s assets may deviate from the percentages shown. Although the Portfolios expect to be fully invested at all times, they may maintain liquidity reserves to meet redemption requests. |

8

All indices are unmanaged.

An investor cannot invest directly in an index.

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees; and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2010 to December 31, 2010. The Portfolios’ expenses are shown without the imposition of any charges which are, or may be, imposed under your variable annuity contract, variable life insurance policy, qualified pension or retirement plan. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Portfolio Return | | | Hypothetical (5% return before expenses) | |

| | | Beginning

Account

Value

July 1, 2010 | | | Ending

Account Value

December 31,

2010 | | | Annualized

Expense

Ratio* | | | Expenses Paid

During the

Period Ended

December 31,

2010** | | | Beginning

Account

Value

July 1, 2010 | | | Ending

Account Value

December 31,

2010 | | | Annualized

Expense

Ratio* | | | Expenses Paid

During the

Period Ended

December 31,

2010** | |

ING Strategic Allocation Conservative Portfolio | |

Class I | | $ | 1,000.00 | | | $ | 1,117.00 | | | | 0.09 | % | | $ | 0.48 | | | $ | 1,000.00 | | | $ | 1,024.75 | | | | 0.09 | % | | $ | 0.46 | |

Class S | | | 1,000.00 | | | | 1,116.60 | | | | 0.34 | | | | 1.81 | | | | 1,000.00 | | | | 1,023.49 | | | | 0.34 | | | | 1.73 | |

ING Strategic Allocation Growth Portfolio | |

Class I | | $ | 1,000.00 | | | $ | 1,206.10 | | | | 0.09 | % | | $ | 0.50 | | | $ | 1,000.00 | | | $ | 1,024.75 | | | | 0.09 | % | | $ | 0.46 | |

Class S | | | 1,000.00 | | | | 1,203.80 | | | | 0.34 | | | | 1.89 | | | | 1,000.00 | | | | 1,023.49 | | | | 0.34 | | | | 1.73 | |

ING Strategic Allocation Moderate Portfolio | |

Class I | | $ | 1,000.00 | | | $ | 1,161.00 | | | | 0.10 | % | | $ | 0.54 | | | $ | 1,000.00 | | | $ | 1,024.70 | | | | 0.10 | % | | $ | 0.51 | |

Class S | | | 1,000.00 | | | | 1,160.80 | | | | 0.35 | | | | 1.91 | | | | 1,000.00 | | | | 1,023.44 | | | | 0.35 | | | | 1.79 | |

| * | | Expense ratios do not include expenses of the underlying funds. |

| ** | | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

9

i

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Directors

ING Strategic Allocation Portfolios, Inc.

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of ING Strategic Allocation Conservative Portfolio, ING Strategic Allocation Growth Portfolio, and ING Strategic Allocation Moderate Portfolio, each a series of ING Strategic Allocation Portfolios, Inc., as of December 31, 2010, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2010, by correspondence with the transfer agent of the underlying funds. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the aforementioned portfolios as of December 31, 2010, and the results of their operations, the changes in their net assets, and the financial highlights for the periods specified in the first paragraph above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 24, 2011

10

STATEMENTS OF ASSETS AND LIABILITIESASOF DECEMBER 31, 2010

| | | | | | | | | | | | |

| | | ING Strategic

Allocation

Conservative

Portfolio | | | ING Strategic

Allocation

Growth

Portfolio | | | ING Strategic

Allocation

Moderate

Portfolio | |

ASSETS: | | | | | | | | | | | | |

Investments in affiliated underlying funds* | | $ | 91,884,517 | | | $ | 172,909,359 | | | $ | 167,362,612 | |

Receivables: | | | | | | | | | | | | |

Investments in affiliated underlying funds sold | | | 135,611 | | | | 597,205 | | | | 606,835 | |

Fund shares sold | | | 4,300 | | | | 33 | | | | 2,366 | |

Dividends | | | 13 | | | | 744 | | | | 905 | |

Prepaid expenses | | | 1,698 | | | | 2,997 | | | | 3,007 | |

Reimbursement due from manager | | | 6,672 | | | | 14,388 | | | | 4,418 | |

| | | | | | | | | | | | |

Total assets | | | 92,032,811 | | | | 173,524,726 | | | | 167,980,143 | |

| | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | |

Payable for fund shares redeemed | | | 139,911 | | | | 597,238 | | | | 609,201 | |

Payable to affiliates | | | 10,899 | | | | 20,079 | | | | 19,697 | |

Payable for directors fees | | | 468 | | | | 831 | | | | 828 | |

Other accrued expenses and liabilities | | | 43,997 | | | | 58,899 | | | | 64,213 | |

| | | | | | | | | | | | |

Total liabilities | | | 195,275 | | | | 677,047 | | | | 693,939 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 91,837,536 | | | $ | 172,847,679 | | | $ | 167,286,204 | |

| | | | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

Paid-in capital | | $ | 104,185,108 | | | $ | 211,871,396 | | | $ | 200,108,623 | |

Undistributed net investment income | | | 3,453,724 | | | | 4,173,132 | | | | 5,273,567 | |

Accumulated net realized loss | | | (23,450,141 | ) | | | (57,555,528 | ) | | | (52,385,708 | ) |

Net unrealized appreciation | | | 7,648,845 | | | | 14,358,679 | | | | 14,289,722 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 91,837,536 | | | $ | 172,847,679 | | | $ | 167,286,204 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Cost of investments in affiliated underlying funds | | $ | 84,235,671 | | | $ | 158,550,754 | | | $ | 153,072,912 | |

| | | | | | | | | | | | |

Class I: | | | | | | | | | | | | |

Net assets | | $ | 90,085,650 | | | $ | 171,094,203 | | | $ | 164,412,264 | |

Shares outstanding(1) | | | 8,651,474 | | | | 16,703,638 | | | | 15,948,760 | |

Net asset value and redemption price per share | | $ | 10.41 | | | $ | 10.24 | | | $ | 10.31 | |

Class S: | | | | | | | | | | | | |

Net assets | | $ | 1,751,886 | | | $ | 1,753,476 | | | $ | 2,873,940 | |

Shares outstanding(1) | | | 169,459 | | | | 172,588 | | | | 280,468 | |

Net asset value and redemption price per share | | $ | 10.34 | | | $ | 10.16 | | | $ | 10.25 | |

| (1) | 100,000,000 shares authorized; $0.001 par value. |

See Accompanying Notes to Financial Statements

11

STATEMENTS OF OPERATIONSFORTHE YEAR ENDED DECEMBER 31, 2010

| | | | | | | | | | | | |

| | | ING Strategic Allocation Conservative Portfolio | | | ING Strategic Allocation Growth Portfolio | | | ING Strategic Allocation Moderate Portfolio | |

INVESTMENT INCOME: | | | | | | | | | | | | |

Dividends from affiliated underlying funds | | $ | 3,510,135 | | | $ | 4,249,290 | | | $ | 5,375,982 | |

| | | | | | | | | | | | |

Total investment income | | | 3,510,135 | | | | 4,249,290 | | | | 5,375,982 | |

| | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | |

Investment management fees | | | 74,880 | | | | 133,001 | | | | 132,448 | |

Distribution and service fees | | | 4,291 | | | | 4,098 | | | | 7,024 | |

Transfer agent fees | | | 215 | | | | 303 | | | | 397 | |

Administrative service fees | | | 51,478 | | | | 91,435 | | | | 91,054 | |

Shareholder reporting expense | | | 13,783 | | | | 26,500 | | | | 24,158 | |

Professional fees | | | 26,929 | | | | 36,776 | | | | 37,577 | |

Custody and accounting expense | | | 6,445 | | | | 10,122 | | | | 9,437 | |

Directors fees | | | 5,636 | | | | 8,192 | | | | 8,187 | |

Miscellaneous expense | | | 9,429 | | | | 13,766 | | | | 11,087 | |

| | | | | | | | | | | | |

Total expenses | | | 193,086 | | | | 324,193 | | | | 321,369 | |

Net waived and reimbursed fees | | | (104,529 | ) | | | (170,403 | ) | | | (148,725 | ) |

| | | | | | | | | | | | |

Net expenses | | | 88,557 | | | | 153,790 | | | | 172,644 | |

| | | | | | | | | | | | |

Net investment income | | | 3,421,578 | | | | 4,095,500 | | | | 5,203,338 | |

| | | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Capital gain distributions from affiliated underlying funds | | | 145,648 | | | | 378,932 | | | | 315,106 | |

Sale of affiliated underlying funds | | | (5,925,967 | ) | | | (12,111,087 | ) | | | (12,743,822 | ) |

Foreign currency related transactions | | | 54 | | | | (5,833 | ) | | | (264 | ) |

| | | | | | | | | | | | |

Net realized loss | | | (5,780,265 | ) | | | (11,737,988 | ) | | | (12,428,980 | ) |

| | | | | | | | | | | | |

Net change in unrealized appreciation or depreciation on: | | | | | | | | | | | | |

Affiliated underlying funds | | | 12,152,046 | | | | 28,152,514 | | | | 25,778,559 | |

Foreign currency related transactions | | | (373 | ) | | | (5,224 | ) | | | (320 | ) |

| | | | | | | | | | | | |

Net change in unrealized appreciation or depreciation | | | 12,151,673 | | | | 28,147,290 | | | | 25,778,239 | |

| | | | | | | | | | | | |

Net realized and unrealized gain | | | 6,371,408 | | | | 16,409,302 | | | | 13,349,259 | |

| | | | | | | | | | | | |

Increase in net assets resulting from operations | | $ | 9,792,986 | | | $ | 20,504,802 | | | $ | 18,552,597 | |

| | | | | | | | | | | | |

See Accompanying Notes to Financial Statements

12

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | |

| | | ING Strategic Allocation Conservative Portfolio | | | ING Strategic Allocation Growth Portfolio | |

| | | Year Ended

December 31, 2010 | | | Year Ended

December 31, 2009 | | | Year Ended December 31, 2010 | | | Year Ended December 31, 2009 | |

FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 3,421,578 | | | $ | 4,329,682 | | | $ | 4,095,500 | | | $ | 6,185,165 | |

Net realized loss | | | (5,780,265 | ) | | | (14,191,003 | ) | | | (11,737,988 | ) | | | (40,236,147 | ) |

Net change in unrealized appreciation or depreciation | | | 12,151,673 | | | | 24,238,063 | | | | 28,147,290 | | | | 69,463,862 | |

| | | | | | | | | | | | | | | | |

Increase in net assets resulting from operations | | | 9,792,986 | | | | 14,376,742 | | | | 20,504,802 | | | | 35,412,880 | |

| | | | | | | | | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | | | | | |

Class ADV(1) | | | — | | | | (56 | ) | | | — | | | | (54 | ) |

Class I | | | (4,262,914 | ) | | | (7,207,695 | ) | | | (6,132,027 | ) | | | (15,357,206 | ) |

Class S | | | (73,828 | ) | | | (121,212 | ) | | | (57,848 | ) | | | (142,132 | ) |

Net realized gains: | | | | | | | | | | | | | | | | |

Class ADV(1) | | | — | | | | — | | | | — | | | | (31 | ) |

Class I | | | — | | | | — | | | | — | | | | (8,405,469 | ) |

Class S | | | — | | | | — | | | | — | | | | (79,792 | ) |

| | | | | | | | | | | | | | | | |

Total distributions | | | (4,336,742 | ) | | | (7,328,963 | ) | | | (6,189,875 | ) | | | (23,984,684 | ) |

| | | | | | | | | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | 10,768,391 | | | | 7,978,159 | | | | 5,717,089 | | | | 8,911,923 | |

Reinvestment of distributions | | | 4,336,742 | | | | 7,328,907 | | | | 6,189,875 | | | | 23,984,598 | |

| | | | | | | | | | | | | | | | |

| | | 15,105,133 | | | | 15,307,066 | | | | 11,906,964 | | | | 32,896,521 | |

Cost of shares redeemed | | | (24,147,209 | ) | | | (14,557,135 | ) | | | (23,160,975 | ) | | | (22,722,314 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | (9,042,076 | ) | | | 749,931 | | | | (11,254,011 | ) | | | 10,174,207 | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets | | | (3,585,832 | ) | | | 7,797,710 | | | | 3,060,916 | | | | 21,602,403 | |

| | | | | | | | | | | | | | | | |

NET ASSETS: | | | | | | | | | | | | | | | | |

Beginning of year | | | 95,423,368 | | | | 87,625,658 | | | | 169,786,763 | | | | 148,184,360 | |

| | | | | | | | | | | | | | | | |

End of year | | $ | 91,837,536 | | | $ | 95,423,368 | | | $ | 172,847,679 | | | $ | 169,786,763 | |

| | | | | | | | | | | | | | | | |

Undistributed net investment income at end of year | | $ | 3,453,724 | | | $ | 4,335,805 | | | $ | 4,173,132 | | | $ | 6,188,625 | |

| | | | | | | | | | | | | | | | |

| (1) | Class ADV liquidated on April 6, 2010. |

See Accompanying Notes to Financial Statements

13

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | ING Strategic Allocation Moderate Portfolio | |

| | | Year Ended

December 31, 2010 | | | Year Ended

December 31, 2009 | |

| | |

| | | | | | | | |

FROM OPERATIONS: | | | | | | | | |

Net investment income | | $ | 5,203,338 | | | $ | 6,809,799 | |

Net realized loss | | | (12,428,980 | ) | | | (33,508,265 | ) |

Net change in unrealized appreciation or depreciation | | | 25,778,239 | | | | 57,157,778 | |

| | | | | | | | |

Increase in net assets resulting from operations | | | 18,552,597 | | | | 30,459,312 | |

| | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Net investment income: | | | | | | | | |

Class ADV(1) | | | — | | | | (55 | ) |

Class I | | | (6,704,131 | ) | | | (14,264,050 | ) |

Class S | | | (112,464 | ) | | | (206,494 | ) |

Net realized gains: | | | | | | | | |

Class ADV(1) | | | — | | | | (20 | ) |

Class I | | | — | | | | (4,723,706 | ) |

Class S | | | — | | | | (70,284 | ) |

| | | | | | | | |

Total distributions | | | (6,816,595 | ) | | | (19,264,609 | ) |

| | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Net proceeds from sale of shares | | | 7,366,034 | | | | 10,438,408 | |

Reinvestment of distributions | | | 6,816,595 | | | | 19,264,534 | |

| | | | | | | | |

| | | 14,182,629 | | | | 29,702,942 | |

Cost of shares redeemed | | | (27,785,016 | ) | | | (26,902,763 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | (13,602,387 | ) | | | 2,800,179 | |

| | | | | | | | |

Net increase (decrease) in net assets | | | (1,866,385 | ) | | | 13,994,882 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 169,152,589 | | | | 155,157,707 | |

| | | | | | | | |

End of year | | $ | 167,286,204 | | | $ | 169,152,589 | |

| | | | | | | | |

Undistributed net investment income at end of year | | $ | 5,273,567 | | | $ | 6,816,339 | |

| | | | | | | | |

| (1) | Class ADV liquidated on April 6, 2010. |

See Accompanying Notes to Financial Statements

14

FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding throughout each year or period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (loss)

from

investment

operations | | | | | | Less distributions | | | | | | | | | | | | Ratios to average net

assets | | | Supplemental

data | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset value, beginning of year or period | | | Net investment income (loss) | | | Net realized and unrealized gain (loss) | | | Total from investment operations | | | From net investment income | | | From net realized gains | | | From return of capital | | | Total distributions | | | Net asset value, end of year or period | | | Total Return (1) | | | Expenses before reductions/ additions(2)(3)(4) | | | Expenses net of fee waivers and/or recoupments, if any(2)(3)(4) | | | Expenses net of all reductions/ additions(2)(3)(4) | | | Net investment income (loss)(2)(3)(4) | | | Net assets, end of year or period | | | Portfolio turnover rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year or period ended | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | (%) | | | (%) | | | (%) | | | (%) | | | (%) | | | ($000's) | | | (%) | |

| ING Strategic Allocation Conservative Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-10 | | | 9.80 | | | | 0.36 | · | | | 0.70 | | | | 1.06 | | | | 0.45 | | | | — | | | | — | | | | 0.45 | | | | 10.41 | | | | 11.07 | | | | 0.20 | | | | 0.09 | | | | 0.09 | | | | 3.66 | | | | 90,086 | | | | 88 | |

12-31-09 | | | 9.13 | | | | 0.45 | · | | | 1.03 | | | | 1.48 | | | | 0.81 | | | | — | | | | — | | | | 0.81 | | | | 9.80 | | | | 18.00 | | | | 0.20 | | | | 0.10 | | | | 0.10 | | | | 5.04 | | | | 93,792 | | | | 56 | |

12-31-08 | | | 13.51 | | | | 0.51 | | | | (3.39 | ) | | | (2.88 | ) | | | 0.51 | | | | 0.99 | | | | — | | | | 1.50 | | | | 9.13 | | | | (23.65 | ) | | | 0.39 | | | | 0.27 | † | | | 0.27 | † | | | 3.99 | † | | | 86,257 | | | | 277 | |

12-31-07 | | | 13.55 | | | | 0.46 | · | | | 0.29 | | | | 0.75 | | | | 0.45 | | | | 0.34 | | | | — | | | | 0.79 | | | | 13.51 | | | | 5.80 | | | | 0.73 | | | | 0.65 | † | | | 0.65 | † | | | 3.40 | † | | | 136,938 | | | | 422 | |

12-31-06 | | | 13.27 | | | | 0.42 | · | | | 0.64 | | | | 1.06 | | | | 0.35 | | | | 0.43 | | | | — | | | | 0.78 | | | | 13.55 | | | | 8.37 | | | | 0.72 | | | | 0.65 | | | | 0.65 | | | | 3.18 | | | | 146,397 | | | | 335 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-10 | | | 9.73 | | | | 0.34 | | | | 0.70 | | | | 1.04 | | | | 0.43 | | | | — | | | | — | | | | 0.43 | | | | 10.34 | | | | 10.91 | | | | 0.45 | | | | 0.34 | | | | 0.34 | | | | 3.53 | | | | 1,752 | | | | 88 | |

12-31-09 | | | 9.06 | | | | 0.43 | · | | | 1.02 | | | | 1.45 | | | | 0.78 | | | | — | | | | — | | | | 0.78 | | | | 9.73 | | | | 17.79 | | | | 0.45 | | | | 0.35 | | | | 0.35 | | | | 4.89 | | | | 1,631 | | | | 56 | |

12-31-08 | | | 13.44 | | | | 0.39 | | | | (3.29 | ) | | | (2.90 | ) | | | 0.49 | | | | 0.99 | | | | — | | | | 1.48 | | | | 9.06 | | | | (23.92 | ) | | | 0.64 | | | | 0.52 | † | | | 0.52 | † | | | 3.89 | † | | | 1,368 | | | | 277 | |

12-31-07 | | | 13.50 | | | | 0.42 | · | | | 0.29 | | | | 0.71 | | | | 0.43 | | | | 0.34 | | | | — | | | | 0.77 | | | | 13.44 | | | | 5.53 | | | | 0.98 | | | | 0.90 | † | | | 0.90 | † | | | 3.18 | † | | | 1,529 | | | | 422 | |

12-31-06 | | | 13.25 | | | | 0.39 | · | | | 0.64 | | | | 1.03 | | | | 0.35 | | | | 0.43 | | | | — | | | | 0.78 | | | | 13.50 | | | | 8.13 | | | | 0.97 | | | | 0.90 | | | | 0.90 | | | | 3.00 | | | | 717 | | | | 335 | |

| | | | | | | | | | | | | | | | |

| ING Strategic Allocation Growth Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-10 | | | 9.39 | | | | 0.23 | · | | | 0.97 | | | | 1.20 | | | | 0.35 | | | | — | | | | — | | | | 0.35 | | | | 10.24 | | | | 13.06 | | | | 0.19 | | | | 0.09 | | | | 0.09 | | | | 2.47 | | | | 171,094 | | | | 36 | |

12-31-09 | | | 9.04 | | | | 0.37 | | | | 1.48 | | | | 1.85 | | | | 0.97 | | | | 0.53 | | | | — | | | | 1.50 | | | | 9.39 | | | | 25.37 | | | | 0.20 | | | | 0.13 | | | | 0.13 | | | | 4.12 | | | | 168,071 | | | | 75 | |

12-31-08 | | | 16.57 | | | | 0.38 | | | | (5.65 | ) | | | (5.27 | ) | | | 0.33 | | | | 1.93 | | | | — | | | | 2.26 | | | | 9.04 | | | | (36.13 | ) | | | 0.39 | | | | 0.33 | † | | | 0.33 | † | | | 2.83 | † | | | 146,862 | | | | 235 | |

12-31-07 | | | 17.06 | | | | 0.30 | · | | | 0.52 | | | | 0.82 | | | | 0.30 | | | | 1.01 | | | | — | | | | 1.31 | | | | 16.57 | | | | 5.04 | | | | 0.71 | | | | 0.71 | † | | | 0.71 | † | | | 1.79 | † | | | 269,587 | | | | 240 | |

12-31-06 | | | 15.48 | | | | 0.28 | · | | | 1.73 | | | | 2.01 | | | | 0.22 | | | | 0.21 | | | | — | | | | 0.43 | | | | 17.06 | | | | 13.19 | | | | 0.71 | | | | 0.71 | | | | 0.71 | | | | 1.77 | | | | 298,451 | | | | 233 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-10 | | | 9.32 | | | | 0.21 | · | | | 0.96 | | | | 1.17 | | | | 0.33 | | | | — | | | | — | | | | 0.33 | | | | 10.16 | | | | 12.81 | | | | 0.44 | | | | 0.34 | | | | 0.34 | | | | 2.22 | | | | 1,753 | | | | 36 | |

12-31-09 | | | 8.99 | | | | 0.32 | · | | | 1.49 | | | | 1.81 | | | | 0.95 | | | | 0.53 | | | | — | | | | 1.48 | | | | 9.32 | | | | 24.90 | | | | 0.45 | | | | 0.38 | | | | 0.38 | | | | 3.88 | | | | 1,715 | | | | 75 | |

12-31-08 | | | 16.49 | | | | 0.32 | · | | | (5.57 | ) | | | (5.25 | ) | | | 0.32 | | | | 1.93 | | | | — | | | | 2.25 | | | | 8.99 | | | | (36.19 | ) | | | 0.64 | | | | 0.58 | † | | | 0.58 | † | | | 2.72 | † | | | 1,322 | | | | 235 | |

12-31-07 | | | 17.00 | | | | 0.26 | · | | | 0.52 | | | | 0.78 | | | | 0.28 | | | | 1.01 | | | | — | | | | 1.29 | | | | 16.49 | | | | 4.77 | | | | 0.96 | | | | 0.96 | † | | | 0.96 | † | | | 1.55 | † | | | 725 | | | | 240 | |

12-31-06 | | | 15.46 | | | | 0.23 | · | | | 1.73 | | | | 1.96 | | | | 0.21 | | | | 0.21 | | | | — | | | | 0.42 | | | | 17.00 | | | | 12.91 | | | | 0.96 | | | | 0.96 | | | | 0.96 | | | | 1.47 | | | | 308 | | | | 233 | |

| ING Strategic Allocation Moderate Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-10 | | | 9.58 | | | | 0.30 | · | | | 0.83 | | | | 1.13 | | | | 0.40 | | | | — | | | | — | | | | 0.40 | | | | 10.31 | | | | 12.03 | | | | 0.19 | | | | 0.10 | | | | 0.10 | | | | 3.15 | | | | 164,412 | | | | 60 | |

12-31-09 | | | 9.10 | | | | 0.39 | · | | | 1.30 | | | | 1.69 | | | | 0.91 | | | | 0.30 | | | | — | | | | 1.21 | | | | 9.58 | | | | 21.84 | | | | 0.21 | | | | 0.13 | | | | 0.13 | | | | 4.47 | | | | 166,449 | | | | 62 | |

12-31-08 | | | 15.16 | | | | 0.44 | | | | (4.54 | ) | | | (4.10 | ) | | | 0.40 | | | | 1.56 | | | | — | | | | 1.96 | | | | 9.10 | | | | (30.48 | ) | | | 0.38 | | | | 0.31 | † | | | 0.31 | † | | | 3.35 | † | | | 152,965 | | | | 255 | |

12-31-07 | | | 15.32 | | | | 0.36 | · | | | 0.44 | | | | 0.80 | | | | 0.36 | | | | 0.60 | | | | — | | | | 0.96 | | | | 15.16 | | | | 5.48 | | | | 0.72 | | | | 0.70 | † | | | 0.70 | † | | | 2.36 | † | | | 263,759 | | | | 302 | |

12-31-06 | | | 14.35 | | | | 0.33 | · | | | 1.23 | | | | 1.56 | | | | 0.27 | | | | 0.32 | | | | — | | | | 0.59 | | | | 15.32 | | | | 11.17 | | | | 0.71 | | | | 0.70 | | | | 0.70 | | | | 2.26 | | | | 298,715 | | | | 258 | |

See Accompanying Notes to Financial Statements

15

FINANCIAL HIGHLIGHTS (CONTINUED)

Selected data for a share of beneficial interest outstanding throughout each year or period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (loss)

from

investment

operations | | | | | | Less distributions | | | | | | | | | | | | Ratios to average net assets | | | Supplemental

data | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset value, beginning of year or period | | | Net investment income (loss) | | | Net realized and unrealized gain (loss) | | | Total from investment operations | | | From net investment income | | | From net realized gains | | | From return of capital | | | Total distributions | | | Net asset value, end of year or period | | | Total Return (1) | | | Expenses before reductions/ additions(2)(3)(4) | | | Expenses net of fee waivers and/or recoupments, if any(2)(3)(4) | | | Expenses net of all reductions/ additions(2)(3)(4) | | | Net investment income (loss)(2)(3)(4) | | | Net assets, end of year or period | | | Portfolio turnover rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year or period ended | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | (%) | | | (%) | | | (%) | | | (%) | | | (%) | | | ($000's) | | | (%) | |

| ING Strategic Allocation Moderate Portfolio (Continued) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-10 | | | 9.53 | | | | 0.27 | | | | 0.83 | | | | 1.10 | | | | 0.38 | | | | — | | | | — | | | | 0.38 | | | | 10.25 | | | | 11.77 | | | | 0.44 | | | | 0.35 | | | | 0.35 | | | | 2.92 | | | | 2,874 | | | | 60 | |

12-31-09 | | | 9.05 | | | | 0.38 | | | | 1.28 | | | | 1.66 | | | | 0.88 | | | | 0.30 | | | | — | | | | 1.18 | | | | 9.53 | | | | 21.60 | | | | 0.46 | | | | 0.38 | | | | 0.38 | | | | 4.34 | | | | 2,703 | | | | 62 | |

12-31-08 | | | 15.10 | | | | 0.37 | · | | | (4.48 | ) | | | (4.11 | ) | | | 0.38 | | | | 1.56 | | | | — | | | | 1.94 | | | | 9.05 | | | | (30.68 | ) | | | 0.63 | | | | 0.56 | † | | | 0.56 | † | | | 3.30 | † | | | 2,192 | | | | 255 | |

12-31-07 | | | 15.27 | | | | 0.32 | · | | | 0.44 | | | | 0.76 | | | | 0.33 | | | | 0.60 | | | | — | | | | 0.93 | | | | 15.10 | | | | 5.25 | | | | 0.97 | | | | 0.95 | † | | | 0.95 | † | | | 2.11 | † | | | 1,192 | | | | 302 | |

12-31-06 | | | 14.34 | | | | 0.29 | · | | | 1.22 | | | | 1.51 | | | | 0.26 | | | | 0.32 | | | | — | | | | 0.58 | | | | 15.27 | | | | 10.80 | | | | 0.96 | | | | 0.95 | | | | 0.95 | | | | 2.00 | | | | 693 | | | | 258 | |

| (1) | | Total return is calculated assuming reinvestment of all dividends, capital gain distributions and return of capital, if any, at net asset value and does not reflect the effect of insurance contract charges. Total return for periods less than one year is not annualized. |

| (2) | | Annualized for periods less than one year. |

| (3) | | Expense ratios do not include expenses of underlying funds and do not include fees and expenses charged under the variable annuity contract or life insurance policy. |

| (4) | | Expense ratios reflect operating expenses of a Portfolio. Expenses before reductions/additions do not reflect amounts reimbursed by the Investment Adviser and/or the Distributor or reductions from brokerage commission recapture arrangements or other expense offset arrangements and do not represent the amount paid by a Portfolio during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the Investment Adviser and/or Distributor but prior to reductions from brokerage commission recapture arrangements or other expense offset arrangements. Expenses net of all reductions/additions represent the net expenses paid by a Portfolio. Net investment income (loss) is net of all such additions or reductions. |

| · | | Calculated using average number of shares outstanding throughout the period. |

| † | | Impact of waiving the advisory fee for the ING Institutional Prime Money Market Fund holding has less than 0.005% impact on the expense ratio and net investment income ratio. |

See Accompanying Notes to Financial Statements

16

NOTES TO FINANCIAL STATEMENTSASOF DECEMBER 31, 2010

NOTE 1 — ORGANIZATION

Organization. ING Strategic Allocation Portfolios, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company.

The Company was incorporated under the laws of Maryland on October 14, 1994. There are three separate investment series (each a “Portfolio”, collectively the “Portfolios”) that comprise the Company: ING Strategic Allocation Conservative Portfolio (“Strategic Allocation Conservative”), ING Strategic Allocation Growth Portfolio (“Strategic Allocation Growth”), and ING Strategic Allocation Moderate Portfolio (“Strategic Allocation Moderate”). Each Portfolio currently seeks to achieve its investment objective by investing in other ING Funds (“Underlying Funds”) and each uses asset allocation strategies to determine how to invest in the Underlying Funds. The Underlying Funds, in turn, invest in equity and fixed-income securities and money market instruments.

Each Portfolio offers Class I and Class S shares. Each class has equal rights as to class and voting privileges. The two classes differ principally in the applicable distribution and service fees. Shareholders of each class also bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Portfolios and earn income and realized gains/losses from a Portfolio pro rata based on the average daily net assets of each class, without distinction between share classes. Expenses that are specific to a Portfolio or a class are charged directly to that Portfolio or class. Other operating expenses shared by several Portfolios are generally allocated among those Portfolios based on average net assets. Dividends are determined separately for each class based on income and expenses allocable to each class. Realized gain distributions are allocated to each class pro rata based on the shares outstanding of each class on the date of distribution. Differences in per share dividend rates generally result from differences in separate class expenses, including distribution and shareholder service fees, if applicable.

Shares of the Portfolios may be offered to separate accounts of insurance companies as investment options under variable annuity contracts and variable life insurance policies (“Variable Contracts”). Shares may also be offered to qualified pension and retirement plans outside the Variable Contract and to certain investment advisers and their affiliates.

Participating insurance companies and other designated organizations are authorized to receive purchase orders on each Portfolio’s behalf.

ING Investments, LLC serves as the investment adviser (“ING Investments” or the “Investment Adviser”) to the Portfolios. ING Investment Management Co. serves as the Sub-Adviser (“ING IIM” or the “Sub-Adviser”) to the Portfolios. ING Funds Services, LLC serves as the administrator (“IFS” or the “Administrator”) for the Portfolios. ING Investments Distributor, LLC (“IID” or the “Distributor”) serves as the principal underwriter to the Portfolios.

The Investment Adviser, the Sub-Adviser, IFS and IID are indirect, wholly-owned subsidiaries of ING Groep N.V. (“ING Groep”). ING Groep is a global financial institution of Dutch origin offering banking, investments, life insurance and retirement services.

ING Groep has adopted a formal restructuring plan that was approved by the European Commission in November 2009 under which the ING life insurance businesses, including the retirement services and investment management businesses, which include the Investment Adviser and its affiliates, would be divested by ING Groep by the end of 2013. While there can be no assurance that it will be carried out, the restructuring plan presents certain risks, including uncertainty about the effect on the businesses of the ING entities that service the Portfolios and potential termination of the Portfolios’ existing advisory agreement, which may trigger the need for shareholder approval of new agreements.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Portfolios in the preparation of their financial statements. Such policies are in conformity with U.S. generally accepted accounting principles for investment companies.

A. Security Valuation. All investments in Underlying Funds are recorded at their estimated fair value, as described below. The valuations of the Portfolios’ investments in Underlying Funds are based on the net asset value of the Underlying Funds each business day.

Fair value is defined as the price that a Portfolio would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. Each investment asset or liability of a Portfolio is assigned a level at measurement date based on the

17

NOTES TO FINANCIAL STATEMENTSASOF DECEMBER 31, 2010 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

significance and source of the inputs to its valuation. Quoted prices in active markets for identical securities are classified as “Level 1,” inputs other than quoted prices for an asset or liability that are observable are classified as “Level 2” and unobservable inputs, including the sub-adviser’s judgment about the assumptions that a market participant would use in pricing an asset or liability are classified as “Level 3.” The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Short-term securities of sufficient credit quality which are valued at amortized cost, which approximates fair value, are generally considered to be Level 2 securities under applicable accounting rules. A table summarizing each Portfolio’s investments under these levels of classification is included following the Portfolio of Investments.

For the year ended December 31, 2010, there have been no significant changes to the fair valuation methodologies.

The Portfolios classify each of their investments in the Underlying Funds as Level 1, without consideration as to the classification level of the specific investments held by the Underlying Funds.

B. Security Transactions and Revenue Recognition. Security transactions are accounted for on trade date. Dividend income received from the affiliated funds is recognized on the ex-dividend date and is recorded as income distributions in the Statement of Operations. Capital gain distributions received from the affiliated funds are recognized on ex-dividend date and are recorded on the Statement of Operations as such. Costs used in determining realized gains and losses on the sales of investment securities are on the basis of specific identification.

C. Distributions to Shareholders. The Portfolios record distributions to their shareholders on the ex-dividend date. Dividends from net investment income and capital gains, if any, are declared and paid annually by the Portfolios. The Portfolios may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code. The characteristics of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles for investment companies.

D. Federal Income Taxes. It is the policy of each Portfolio to comply with subchapter M of the Internal Revenue Code and related excise tax provisions applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized capital gains to their shareholders. Management has considered the sustainability of the Portfolios’ tax positions taken on federal income tax returns for all open tax years in making this determination. Therefore, no federal income tax provision is required. No capital gain distributions shall be made until any capital loss carryforwards have been fully utilized or expired.

E. Use of Estimates. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

F. Indemnifications. In the normal course of business, the Company may enter into contracts that provide certain indemnifications. The Company’s maximum exposure under these arrangements is dependent on future claims that may be made against the Portfolios and, therefore, cannot be estimated; however, based on experience, management considers the risk of loss from such claims remote.

NOTE 3 — INVESTMENT TRANSACTIONS

For the year ended December 31, 2010, the cost of purchases and the proceeds from the sales of the Underlying Funds, were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Strategic Allocation Conservative | | $ | 78,595,385 | | | $ | 83,772,260 | |

Strategic Allocation Growth | | | 57,808,068 | | | | 67,729,502 | |

Strategic Allocation Moderate | | | 95,551,293 | | | | 105,692,620 | |

NOTE 4 — INVESTMENT MANAGEMENT AND ADMINISTRATIVE FEES

The Portfolios entered into an investment management agreement (“Investment Management Agreement”) with the Investment Adviser.

During periods when each Portfolio invests all, or substantially all of its assets in another investment company, the Investment Management Agreement compensates the Investment Adviser with a fee of 0.08%, computed daily and payable monthly, based on the average daily net assets of each Portfolio.

18

NOTES TO FINANCIAL STATEMENTSASOF DECEMBER 31, 2010 (CONTINUED)

NOTE 4 — INVESTMENT MANAGEMENT AND ADMINISTRATIVE FEES (continued)

During periods when the Portfolios invest directly in investment securities, each Portfolio pays the Investment Adviser a fee of 0.60%, computed daily and payable monthly, based on the amount of average daily net assets of each Portfolio invested in such direct investment.

The Investment Adviser entered into a sub-advisory agreement with ING IM. Subject to such policies as the Board or the Investment Adviser may determine, ING IM manages the Portfolios’ assets in accordance with the Portfolios’ investment objectives, policies, and limitations.