| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | January 31, 2014 |

Estimated average burden |

hours per response: | | 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8934

ING Strategic Allocation Portfolios, Inc.

(Exact name of registrant as specified in charter)

| | |

| 7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Incorporated, 300 E. Lombard Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: December 31

Date of reporting period: January 1, 2013 to December 31, 2013

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2013

Classes I and S

Strategic Allocation Funds-of-Funds

| n | ING Strategic Allocation Conservative Portfolio |

| n | ING Strategic Allocation Growth Portfolio |

| n | ING Strategic Allocation Moderate Portfolio |

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS |

|

(THIS PAGE INTENTIONALLY LEFT BLANK)

TABLE OF CONTENTS

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds’ website at www.inginvestment.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds’ website at www.inginvestment.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Portfolios’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Portfolios’ Forms N-Q, as well as a complete portfolio of investments, are available without charge upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT’S LETTER

Taking the longer view

Dear Shareholder,

In my letters to you I’ve long advocated global diversification. As we look forward into 2014, it’s fair to ask whether this view should be tempered given the strong performance of U.S. assets last year. It’s true that U.S. equities were the world’s performance leaders in 2013; certain U.S. debt assets, most notably high yield corporate bonds and senior secured loans, also performed very well. Such results make it tempting to narrow one’s strategy to the top-performing markets or asset classes — in effect, only buying “the assets that go up.”

As the disclaimer says, however, past performance is no guarantee of future results. No one knows whether last year’s patterns will persist in 2014, or whether a new center of market leadership will emerge. Investment opportunities arise from economic activity, a dynamic process with unforeseen twists and turns. For example, what might happen

to the U.S. economy now that the Federal Reserve has begun to trim its bond purchases? Can the emerging markets overcome the challenge of a diminishing supply of U.S. liquidity? Will Europe continue on its path to recovery? Will Japan’s fiscal reforms lead to stronger earnings growth for Japanese corporations? A lot of intellectual energy is expended framing and answering such questions; at best, we can only define a range of possible outcomes — we can’t know what will happen.

Therefore, I maintain that the best approach is a well-diversified one. Stick to your long-term discipline — cast your net as far and wide as possible, and don’t risk your long-term goals against shorter-term trends. Review your portfolio with an eye toward adjustments that focus more on your goals and thoroughly discuss any contemplated changes with your financial advisor before taking action.

Earlier this year, ING U.S. announced plans to rebrand as Voya Financial at some point following its initial public offering, which occurred in May 2013. The actual rebranding of the various businesses that comprise ING U.S. — Retirement Solutions, Investment Management and Insurance Solutions — will occur in stages, with ING U.S. Investment Management among the first to rebrand.(1) As of May 1, 2014, ING U.S. Investment Management will be known as Voya Investment Management. Though the rebranding will affect product and legal entity names, there will be no disruption in service or product delivery to our clients. As always, we remain committed to delivering unmatched client service with a focus on sustainable long-term investment results, to help investors meet their long-term goals with confidence.

Best wishes for a healthy and prosperous New Year. We look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President and Chief Executive Officer

ING Funds

January 9, 2014

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

| (1) | | Please see the “Additional Information” section regarding rebranding details on page 35. |

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2013

By the middle of the fiscal year, global equities, in the form of the MSCI World IndexSM measured in local currencies including net reinvested dividends (“the Index”) had already surged 11.70%. But there was plenty of skepticism. Stock markets were only rising, it was argued, because of central banks’ ultra-loose monetary policy. This kept interest rates so low that many investors who would normally favor fixed income investments had turned to stocks. Others countered that interest rates might be low, but they would stay that way into the medium term, supporting capital values in the face of little threat from inflation. Such arguments would be tested in the months through December. But in the end the Index returned 28.87% for the whole fiscal year. (The Index returned 26.68% for the one year ended December 31, 2013, measured in U.S. dollars.)

In the U.S., investor sentiment was cushioned by the U.S. Federal Reserve Board (“Fed’s”) $85 billion of monthly Treasury and mortgage-backed securities purchases. Another force affecting sentiment was the pace of economic recovery, which was unimpressive for most of the year. Gross Domestic Product (“GDP”) in the first quarter of 2013 rose by just 1.8% (annualized) and in the second by only 2.5%. As late as October, the average number of new jobs being created was reported at fewer than 150,000 per month with the unemployment rate at 7.2%. However a slow recovery was a double-edged sword for markets in risky assets: a faster pace would probably cause the “tapering” of bond purchases by the Fed.

During most of the summer then, the tapering issue dominated investor confidence. On May 22 and again on June 19, Fed Chairman Bernanke attempted to prepare markets for the beginning of the end of quantitative easing. The reaction was soaring bond yields and by June 24 an 8% slump in the Index from its May 21 peak. This led nervous central bankers the world over, in the last days of June, to give assurances that easy money was here for a long time. Soothed by these and later words of comfort in July, markets recovered, but were dampened again by the threat of military engagement in the Middle East.

Yet a change in the dynamics of investor sentiment seemed to be underway. Middle East tensions eased and attention turned to the September 18 meeting of the Fed, which was widely expected to announce the imminent tapering of the Fed’s bond purchases. Surprisingly, on the day before Chairman Bernanke’s address, the Index had again reached a new high for the year. This would have been hard to imagine even a few months earlier, but the significance was apparently lost in the shock of the Fed’s decision not to taper.

Increasingly it appeared that markets were reconciled to tapering, no longer treating “bad” news on the economy, which might prolong the Fed’s bond purchases, as “good” news. And the real good news was starting to flow. By the end of the fiscal year the unemployment rate had fallen to 7.0% with new jobs averaging nearly 200,000 per month. GDP growth in the third quarter was revised up to 4.1% (flattered somewhat by inventory accumulation). Consumer confidence was clearly improving.

When on December 18 the Fed did announce a tapering to $75 billion per month with more to come, markets quickly took it in stride and the Index ended the year at a new all-time high.

In U.S. fixed income markets, the Barclays U.S. Aggregate Bond Index (“Barclays Aggregate”) of investment grade bonds fell 2.02% in the fiscal year, only the third loss in 20 years as the anticipated end to quantitative easing undermined longer-dated issues. Sub-indices with the shortest durations held on to tiny positive returns, but the Barclays Long Term U.S. Treasury sub-index dropped 12.66%. The Barclays U.S. Corporate Investment Grade Bond sub-index lost 1.53%. However the (separate) Barclays High Yield Bond — 2% Issuer Constrained Composite Index (not a part of the Barclays Aggregate) gained 7.44%.

U.S. equities, represented by the S&P 500® Index including dividends, soared 32.39%, to a record closing high. The consumer discretionary sector did best with a gain of 43.08%, followed by health care 41.46%. The worst performers were the telecommunications sector 11.47% and utilities 13.21%. Operating earnings per share for S&P 500® companies set another record in the third quarter of 2013, with the share of profits in national income historically high, supported by low interest rates and sluggish wage growth.

In currencies the dollar fell 4.00% against the euro during the 12 months and 1.82% against the pound on better economic news from Europe. But the dollar gained 21.39% on the yen in the face of the new Japanese government’s aggressive monetary easing.

In international markets, the MSCI Japan® Index exploded 54.58% to the upside during the fiscal year. Encouragingly GDP grew for three quarters in a row, albeit at declining rates. Consumer prices excluding fresh food and energy stopped falling year-over-year for the first time since 2008. The MSCI Europe ex UK® Index advanced 23.12%. The euro zone finally recorded quarterly GDP growth of 0.3% after six straight quarterly declines, but could only follow it up with a wafer-thin gain of 0.1%. The closely watched composite purchasing managers’ index registered expansion from July after 17 months of contraction. But there was still much to do with unemployment at 12.1%, near an all-time high. The MSCI UK® Index added 18.43%, held back by heavily weighted laggards especially among banks and miners. GDP in the third quarter of 2013 grew an improved 0.8% and unemployment continued to fall. But concerns remained about a housing bubble and consumer prices rising faster than wages.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.inginvestment.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

2

BENCHMARK DESCRIPTIONS

| | |

| Index | | Description |

Barclays High Yield Bond — 2% Issuer Constrained Composite Index | | An unmanaged index that includes all fixed-income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. |

| Barclays U.S. Aggregate Bond Index | | An unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. |

Barclays U.S. Corporate Investment Grade Bond Index | | The corporate component of the Barclays U.S. Credit Index. The U.S. Credit Index includes publicly-issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. The index includes both corporate and non-corporate sectors. The corporate sectors are industrial, utility and finance, which includes both U.S. and non-U.S. corporations. |

| Barclays Long Term U.S. Treasury Index | | The Index includes all publicly issued, U.S. Treasury securities that have a remaining maturity of 10 or more years, are rated investment grade, and have $250 million or more of outstanding face value. |

| MSCI Europe ex UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. |

| MSCI Japan® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. |

| MSCI UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. |

| MSCI World IndexSM | | An unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. |

| Russell 3000® Index | | An unmanaged index that measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. |

| S&P 500® Index | | An unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. |

3

| | |

| ING STRATEGIC ALLOCATION PORTFOLIOS | | PORTFOLIO MANAGERS’ REPORT |

ING Strategic Allocation Conservative Portfolio seeks to provide total return (i.e., income and capital growth, both realized and unrealized) consistent with preservation of capital. ING Strategic Allocation Growth Portfolio seeks to provide capital appreciation. ING Strategic Allocation Moderate Portfolio seeks to provide total return (i.e., income and capital appreciation, both realized and unrealized). ING Strategic Allocation Conservative Portfolio, ING Strategic Allocation Growth Portfolio and ING Strategic Allocation Moderate Portfolio (each a “Portfolio” and collectively, the “Portfolios”) are managed by Paul Zemsky, CFA, and Derek Sasveld, CFA, Portfolio Managers of ING Investment Management Co. LLC — the Sub-Adviser.*

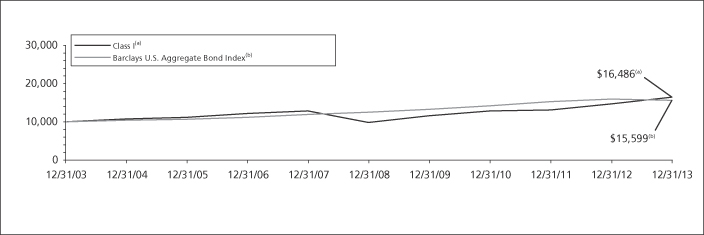

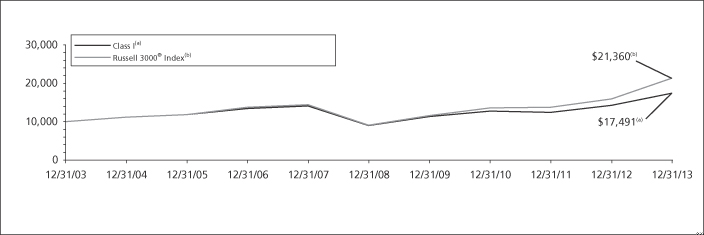

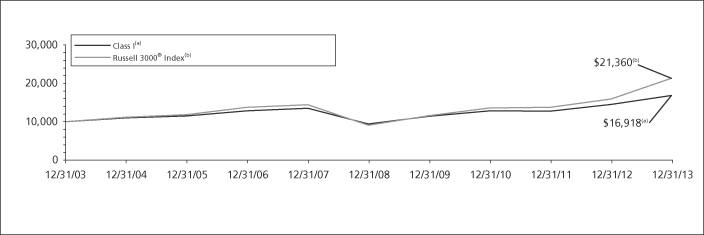

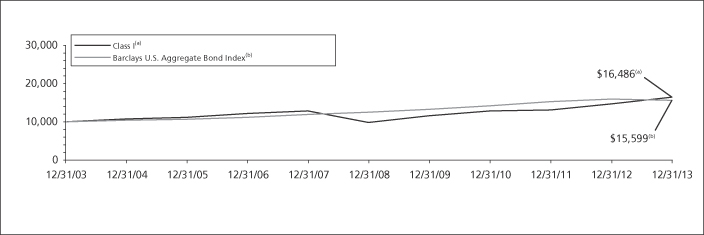

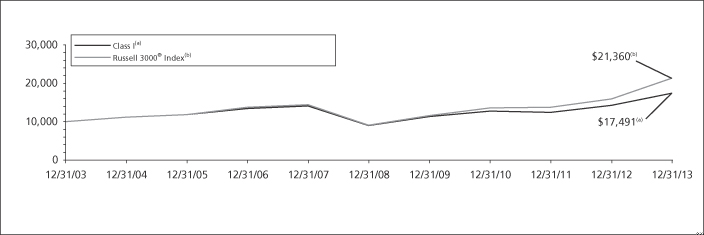

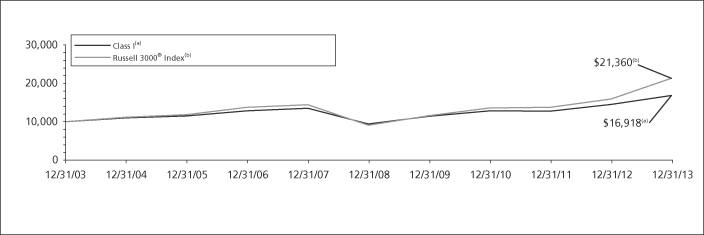

Performance: For the year ended December 31, 2013, ING Strategic Allocation Conservative Portfolio’s Class I shares provided a total return of 12.11% compared to the Barclays U.S. Aggregate Bond Index which returned -2.02% for the same period. For the year ended December 31, 2013, ING Strategic Allocation Growth Portfolio’s Class I shares provided a total return of 22.40% compared to the Russell 3000® Index, which returned 33.55% for the same period. For the year ended December 31, 2013, ING Strategic Allocation Moderate Portfolio’s Class I shares provided a total return of 16.60% compared to the Russell 3000® Index, which returned 33.55% for the same period.

Portfolio Specifics: Performance from our strategic asset allocation was additive in 2013 for all three portfolios while results from tactical decisions were mixed. At the beginning of the year, with a stronger than expected earnings season and domestic economic data showing modest growth, we removed our underweight position to U.S. large-cap equities to take profits from this previously defensive position. At the same time, we increased our exposure to developed market equities. We had a favorable view on this asset class as it seemed many of the political and fiscal fears surrounding the U.S. would not come to fruition. Our decision to overweight high yield bonds while underweighting core bonds had a strong positive on performance over the year.

Economic data in the U.S. began to strengthen toward the middle of the year, with U.S. labor and housing markets showing signs of recovery in May. Meanwhile, fixed income interest rates and credit spreads continued to decline, falling

back to levels seen at the beginning of the year. Given this, we reversed our underweight to domestic equities that had been a headwind to performance during the year and reduced exposure to investment grade U.S. fixed income. Although this tactical underweight to core bonds was additive, our periodic overweight during the year detracted from performance.

Over the course of the year our views evolved as markets abroad continued to stabilize, with positive economic activity occurring in Europe, and the European Central Bank providing confirmation that it would continue to provide conditions that support a growing economy. We also saw unexpected improvements in emerging markets, particularly China, culminated in an attractive international market. At the same time, uncertainty on the U.S. Federal Reserve Board’s (the “Fed”) seemingly inevitable decision to taper its asset purchases and an unimpressive earnings season in the U.S. presented a tactical opportunity. As a result, we initiated an overweight position to European stocks by reducing our exposure to large-cap equities. This position contributed to the Portfolio’s performance as European stocks performed well relative to other indices on a one year and three month time period.

Overall, underlying manager performance detracted from results in 2013. The lowest relative returns came from ING Large Cap Value Portfolio, ING Mid Cap Opportunities Portfolio and ING Emerging Markets Index Portfolio. The highest relative returns came from ING Intermediate Bond Fund and ING High Yield Bond Fund as both strategies outperformed their respective indices and contributed positively to performance over the year.

Current Strategy and Outlook: We believe global economic expansion is marching forward at a modest, almost fitful pace, but it is indeed marching forward. We believe this broadening of the global economic expansion is being fueled by improvements in worldwide manufacturing production and the global consumer, as well as global tectonic shifts — powerful catalysts for growth — in energy, technology, trade and frontier markets. Risks and uncertainties remain, especially in Europe and areas of the global banking system in our opinion. Still, we believe positive fundamentals should dominate in 2014 and contribute to continued positive corporate earnings growth.

Target Asset Allocations as of December 31, 2013

| | | | | | | | | | | | |

Long-Term Allocations | | Conservative | | | Moderate | | | Growth | |

US Large Cap Stocks | | | 28.0 | % | | | 34.0 | % | | | 40.0% | |

US Mid Cap Stocks | | | 6.0 | % | | | 9.0 | % | | | 16.0% | |

US Small Cap Stocks | | | 0.0 | % | | | 4.0 | % | | | 4.0% | |

Non US Inti Stocks | | | 8.0 | % | | | 11.0 | % | | | 17.0% | |

Emerging Markets Equity | | | 0.0 | % | | | 5.0 | % | | | 6.0% | |

Global REITs | | | 3.0 | % | | | 2.0 | % | | | 2.0% | |

Core Fixed Income | | | 38.0 | % | | | 27.0 | % | | | 8.0% | |

High Yield | | | 13.0 | % | | | 8.0 | % | | | 7.0% | |

Short Term Bonds | | | 4.0 | % | | | 0.0 | % | | | 0.0% | |

Cash | | | 0.0 | % | | | 0.0 | % | | | 0.00% | |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0% | |

| * | | Effective August 30, 2013, Heather Hackett was removed as a portfolio manager of the Portfolios and Derek Sasveld was added as a portfolio manager of the Portfolios. |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

4

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING STRATEGIC ALLOCATION CONSERVATIVE PORTFOLIO |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Total Returns for the Periods Ended December 31, 2013 | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S

August 5, 2005 | | | |

| | | Class I | | | 12.11 | % | | | 10.93 | % | | | 5.13 | % | | | — | | | |

| | | Class S | | | 11.76 | % | | | 10.68 | % | | | — | | | | 4.63 | % | | |

| | | Barclays U.S. Aggregate Bond Index | | | -2.02 | % | | | 4.44 | % | | | 4.55 | % | | | 4.76 | % | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Strategic Allocation Conservative Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment

returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.inginvestment.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co. LLC, the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

5

| | |

| ING STRATEGIC ALLOCATION GROWTH PORTFOLIO | | PORTFOLIO MANAGERS’ REPORT |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Total Returns for the Periods Ended December 31, 2013 | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S

August 5, 2005 | | | |

| | | Class I | | | 22.40 | % | | | 14.14 | % | | | 5.75 | % | | | — | | | |

| | | Class S | | | 22.11 | % | | | 13.83 | % | | | — | | | | 4.85 | % | | |

| | | Russell 3000® Index | | | 33.55 | % | | | 18.71 | % | | | 7.88 | % | | | 7.59 | % | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Strategic Allocation Growth Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment

returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.inginvestment.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co. LLC, the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

6

| | |

| PORTFOLIO MANAGERS’ REPORT | | ING STRATEGIC ALLOCATION MODERATE PORTFOLIO |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | Average Annual Total Returns for the Periods Ended December 31, 2013 | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S June 7, 2005 | | | |

| | | Class I | | | 16.60 | % | | | 12.44 | % | | | 5.39 | % | | | — | | | |

| | | Class S | | | 16.24 | % | | | 12.17 | % | | | — | | | | 4.77 | % | | |

| | | Russell 3000® Index | | | 33.55 | % | | | 18.71 | % | | | 7.88 | % | | | 7.84 | % | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Strategic Allocation Moderate Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment

returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.inginvestment.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co. LLC, the former investment adviser, began serving as sub-adviser to the Portfolio. Effective April 7, 2008, the Portfolio was converted from a mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds.

7

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2013 to December 31, 2013. The Portfolios’ expenses are shown without the imposition of any sales charges or fees. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Portfolio Return | | | Hypothetical (5% return before expenses) | |

| | | Beginning

Account

Value

July 1, 2013 | | | Ending

Account Value

December 31, 2013 | | | Annualized

Expense

Ratio* | | | Expenses Paid

During the

Period Ended

December 31, 2013** | | | Beginning

Account

Value

July 1, 2013 | | | Ending

Account Value

December 31, 2013 | | | Annualized

Expense

Ratio* | | | Expenses Paid

During the

Period Ended

December 31, 2013** | |

ING Strategic Allocation Conservative Portfolio | | | | | | | | | | | | | | | | | |

Class I | | $ | 1,000.00 | | | $ | 1,082.70 | | | | 0.11 | % | | $ | 0.58 | | | $ | 1,000.00 | | | $ | 1,024.65 | | | | 0.11 | % | | $ | 0.56 | |

Class S | | | 1,000.00 | | | | 1,080.60 | | | | 0.36 | | | | 1.89 | | | | 1,000.00 | | | | 1,023.39 | | | | 0.36 | | | | 1.84 | |

ING Strategic Allocation Growth Portfolio | | | | | | | | | | | | | |

Class I | | $ | 1,000.00 | | | $ | 1,141.60 | | | | 0.11 | % | | $ | 0.59 | | | $ | 1,000.00 | | | $ | 1,024.65 | | | | 0.11 | % | | $ | 0.56 | |

Class S | | | 1,000.00 | | | | 1,140.70 | | | | 0.36 | | | | 1.94 | | | | 1,000.00 | | | | 1,023.39 | | | | 0.36 | | | | 1.84 | |

ING Strategic Allocation Moderate Portfolio | |

Class I | | $ | 1,000.00 | | | $ | 1,112.00 | | | | 0.12 | % | | $ | 0.64 | | | $ | 1,000.00 | | | $ | 1,024.60 | | | | 0.12 | % | | $ | 0.61 | |

Class S | | | 1,000.00 | | | | 1,109.70 | | | | 0.37 | | | | 1.97 | | | | 1,000.00 | | | | 1,023.34 | | | | 0.37 | | | | 1.89 | |

| * | | Expense ratios do not include expenses of the underlying funds. |

| ** | | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

8

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Directors

ING Strategic Allocation Portfolios, Inc.

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of ING Strategic Allocation Conservative Portfolio, ING Strategic Allocation Growth Portfolio, and ING Strategic Allocation Moderate Portfolio, each a series of ING Strategic Allocation Portfolios, Inc., as of December 31, 2013, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2013, by correspondence with the custodian and transfer agent of the underlying funds. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of ING Strategic Allocation Conservative Portfolio, ING Strategic Allocation Growth Portfolio, and ING Strategic Allocation Moderate Portfolio as of December 31, 2013, and the results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 26, 2014

9

STATEMENTS OF ASSETS AND LIABILITIESASOF DECEMBER 31, 2013

| | | | | | | | | | | | |

| | | ING

Strategic

Allocation

Conservative

Portfolio | | | ING

Strategic

Allocation

Growth

Portfolio | | | ING

Strategic

Allocation

Moderate

Portfolio | |

ASSETS: | | | | | | | | | | | | |

Investments in securities at fair value* | | $ | 6,331,158 | | | $ | 11,179,329 | | | $ | 10,887,138 | |

Investments in affiliated underlying funds at fair value** | | | 84,138,035 | | | | 148,686,287 | | | | 144,227,453 | |

| | | | | | | | | | | | |

Total investments at fair value | | $ | 90,469,193 | | | $ | 159,865,616 | | | $ | 155,114,591 | |

| | | | | | | | | | | | |

Cash | | | 81,723 | | | | 138,582 | | | | 17,967 | |

Receivables: | | | | | | | | | | | | |

Investment in affiliated underlying funds sold | | | — | | | | — | | | | 74,792 | |

Fund shares sold | | | 215,928 | | | | 169,495 | | | | 15,719 | |

Dividends | | | 18,807 | | | | 31,805 | | | | 32,546 | |

Foreign tax reclaims | | | — | | | | — | | | | 363 | |

Prepaid expenses | | | 334 | | | | 589 | | | | 581 | |

Reimbursement due from manager | | | 5,633 | | | | 2,074 | | | | 14,390 | |

| | | | | | | | | | | | |

Total assets | | | 90,791,618 | | | | 160,208,161 | | | | 155,270,949 | |

| | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | |

Payable for investments in affiliated underlying funds purchased | | | 279,602 | | | | 268,549 | | | | — | |

Payable for fund shares redeemed | | | 18 | | | | 1,961 | | | | 90,512 | |

Payable for investment management fees | | | 8,840 | | | | 15,627 | | | | 15,276 | |

Payable for administrative fees | | | 4,165 | | | | 7,363 | | | | 7,154 | |

Payable for distribution and shareholder service fees | | | 639 | | | | 185 | | | | 367 | |

Payable for directors fees | | | 435 | | | | 757 | | | | 751 | |

Other accrued expenses and liabilities | | | 33,570 | | | | 32,418 | | | | 32,187 | |

| | | | | | | | | | | | |

Total liabilities | | | 327,269 | | | | 326,860 | | | | 146,247 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 90,464,349 | | | $ | 159,881,301 | | | $ | 155,124,702 | |

| | | | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

Paid-in capital | | $ | 89,505,276 | | | $ | 160,989,717 | | | $ | 158,537,810 | |

Undistributed net investment income | | | 2,399,672 | | | | 3,168,060 | | | | 3,587,504 | |

Accumulated net realized loss | | | (10,564,684 | ) | | | (38,523,568 | ) | | | (32,171,679 | ) |

Net unrealized appreciation | | | 9,124,085 | | | | 34,247,092 | | | | 25,171,067 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 90,464,349 | | | $ | 159,881,301 | | | $ | 155,124,702 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Cost of investments in securities | | $ | 6,083,097 | | | $ | 10,739,655 | | | $ | 10,460,027 | |

** Cost of investments in affiliated underlying funds | | $ | 75,262,011 | | | $ | 114,878,869 | | | $ | 119,483,541 | |

| | | |

Class I | | | | | | | | | | | | |

Net assets | | $ | 87,378,014 | | | $ | 159,018,115 | | | $ | 153,367,098 | |

Shares authorized | | | 100,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

Shares outstanding | | | 7,180,757 | | | | 12,028,662 | | | | 12,164,479 | |

Net asset value and redemption price per share | | $ | 12.17 | | | $ | 13.22 | | | $ | 12.61 | |

Class S | | | | | | | | | | | | |

Net assets | | $ | 3,086,335 | | | $ | 863,186 | | | $ | 1,757,604 | |

Shares authorized | | | 100,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

Shares outstanding | | | 255,601 | | | | 65,765 | | | | 140,160 | |

Net asset value and redemption price per share | | $ | 12.07 | | | $ | 13.13 | | | $ | 12.54 | |

See Accompanying Notes to Financial Statements

10

STATEMENTS OF OPERATIONSFORTHE YEAR ENDED DECEMBER 31, 2013

| | | | | | | | | | | | |

| | | ING

Strategic

Allocation

Conservative

Portfolio | | | ING

Strategic

Allocation

Growth

Portfolio | | | ING

Strategic

Allocation

Moderate

Portfolio | |

INVESTMENT INCOME: | | | | | | | | | | | | |

Dividends from affiliated underlying funds | | $ | 2,225,371 | | | $ | 2,503,797 | | | $ | 3,011,296 | |

Dividends | | | 170,473 | | | | 299,038 | | | | 297,163 | |

| | | | | | | | | | | | |

Total investment income | | | 2,395,844 | | | | 2,802,835 | | | | 3,308,459 | |

| | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | |

Investment management fees | | | 85,490 | | | | 149,130 | | | | 147,948 | |

Distribution and shareholder service fees: | | | | | | | | | | | | |

Class S | | | 6,299 | | | | 1,909 | | | | 3,742 | |

Transfer agent fees | | | 259 | | | | 396 | | | | 340 | |

Administrative service fees | | | 47,831 | | | | 83,326 | | | | 82,648 | |

Shareholder reporting expense | | | 10,080 | | | | 26,902 | | | | 25,442 | |

Professional fees | | | 33,435 | | | | 40,447 | | | | 42,053 | |

Custody and accounting expense | | | 4,884 | | | | 10,599 | | | | 8,784 | |

Directors fees | | | 2,609 | | | | 4,545 | | | | 4,508 | |

Miscellaneous expense | | | 2,486 | | | | 8,835 | | | | 6,064 | |

| | | | | | | | | | | | |

Total expenses | | | 193,373 | | | | 326,089 | | | | 321,529 | |

Net waived and reimbursed fees | | | (91,051 | ) | | | (156,925 | ) | | | (136,867 | ) |

| | | | | | | | | | | | |

Net expenses | | | 102,322 | | | | 169,164 | | | | 184,662 | |

| | | | | | | | | | | | |

Net investment income | | | 2,293,522 | | | | 2,633,671 | | | | 3,123,797 | |

| | | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Investments | | | 58,515 | | | | 123,588 | | | | 124,040 | |

Capital gain distributions from affiliated underlying funds | | | 425,676 | | | | 2,148,593 | | | | 1,776,367 | |

Foreign currency related transactions | | | — | | | | 32 | | | | 15 | |

Sale of affiliated underlying funds | | | 4,355,879 | | | | 11,671,507 | | | | 10,515,650 | |

| | | | | | | | | | | | |

Net realized gain | | | 4,840,070 | | | | 13,943,720 | | | | 12,416,072 | |

| | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

Investments | | | 204,992 | | | | 365,517 | | | | 352,754 | |

Affiliated underlying funds | | | 2,510,187 | | | | 13,604,572 | | | | 7,115,386 | |

Foreign currency related transactions | | | — | | | | (54 | ) | | | (11 | ) |

| | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) | | | 2,715,179 | | | | 13,970,035 | | | | 7,468,129 | |

| | | | | | | | | | | | |

Net realized and unrealized gain | | | 7,555,249 | | | | 27,913,755 | | | | 19,884,201 | |

| | | | | | | | | | | | |

Increase in net assets resulting from operations | | $ | 9,848,771 | | | $ | 30,547,426 | | | $ | 23,007,998 | |

| | | | | | | | | | | | |

See Accompanying Notes to Financial Statements

11

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | |

| | | ING Strategic Allocation

Conservative Portfolio | | | ING Strategic Allocation

Growth Portfolio | |

| | | Year Ended

December 31,

2013 | | | Year Ended

December 31,

2012 | | | Year Ended

December 31,

2013 | | | Year Ended

December 31,

2012 | |

FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 2,293,522 | | | $ | 2,219,923 | | | $ | 2,633,671 | | | $ | 2,547,976 | |

Net realized gain | | | 4,840,070 | | | | 6,510,356 | | | | 13,943,720 | | | | 10,151,450 | |

Net change in unrealized appreciation | | | 2,715,179 | | | | 997,407 | | | | 13,970,035 | | | | 7,214,614 | |

| | | | | | | | | | | | | | | | |

Increase in net assets resulting from operations | | | 9,848,771 | | | | 9,727,686 | | | | 30,547,426 | | | | 19,914,040 | |

| | | | | | | | | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | | | | | |

Class I | | | (2,185,674 | ) | | | (2,230,977 | ) | | | (2,554,231 | ) | | | (2,207,961 | ) |

Class S | | | (39,815 | ) | | | (37,094 | ) | | | (11,780 | ) | | | (6,963 | ) |

| | | | | | | | | | | | | | | | |

Total distributions | | | (2,225,489 | ) | | | (2,268,071 | ) | | | (2,566,011 | ) | | | (2,214,924 | ) |

| | | | | | | | | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | 12,170,049 | | | | 8,291,546 | | | | 7,154,907 | | | | 4,520,129 | |

Reinvestment of distributions | | | 2,225,489 | | | | 2,268,071 | | | | 2,566,011 | | | | 2,214,924 | |

| | | | | | | | | | | | | | | | |

| | | 14,395,538 | | | | 10,559,617 | | | | 9,720,918 | | | | 6,735,053 | |

Cost of shares redeemed | | | (14,578,287 | ) | | | (17,198,331 | ) | | | (20,361,380 | ) | | | (21,156,507 | ) |

| | | | | | | | | | | | | | | | |

Net decrease in net assets resulting from capital share transactions | | | (182,749 | ) | | | (6,638,714 | ) | | | (10,640,462 | ) | | | (14,421,454 | ) |

| | | | | | | | | | | | | | | | |

Net increase in net assets | | | 7,440,533 | | | | 820,901 | | | | 17,340,953 | | | | 3,277,662 | |

| | | | | | | | | | | | | | | | |

NET ASSETS: | | | | | | | | | | | | | | | | |

Beginning of year or period | | | 83,023,816 | | | | 82,202,915 | | | | 142,540,348 | | | | 139,262,686 | |

| | | | | | | | | | | | | | | | |

End of year or period | | $ | 90,464,349 | | | $ | 83,023,816 | | | $ | 159,881,301 | | | $ | 142,540,348 | |

| | | | | | | | | | | | | | | | |

Undistributed net investment income at end of year or period | | $ | 2,399,672 | | | $ | 2,212,734 | | | $ | 3,168,060 | | | $ | 2,543,949 | |

| | | | | | | | | | | | | | | | |

See Accompanying Notes to Financial Statements

12

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | ING Strategic Allocation

Moderate Portfolio | |

| | | Year Ended

December 31,

2013 | | | Year Ended

December 31,

2012 | |

FROM OPERATIONS: | | | | | | | | |

Net investment income | | $ | 3,123,797 | | | $ | 3,144,296 | |

Net realized gain | | | 12,416,072 | | | | 8,123,499 | |

Net change in unrealized appreciation | | | 7,468,129 | | | | 6,992,115 | |

| | | | | | | | |

Increase in net assets resulting from operations | | | 23,007,998 | | | | 18,259,910 | |

| | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Net investment income: | | | | | | | | |

Class I | | | (3,131,374 | ) | | | (3,020,695 | ) |

Class S | | | (26,752 | ) | | | (19,810 | ) |

| | | | | | | | |

Total distributions | | | (3,158,126 | ) | | | (3,040,505 | ) |

| | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Net proceeds from sale of shares | | | 7,904,099 | | | | 5,332,861 | |

Reinvestment of distributions | | | 3,158,126 | | | | 3,040,505 | |

| | | | | | | | |

| | | 11,062,225 | | | | 8,373,366 | |

Cost of shares redeemed | | | (19,210,446 | ) | | | (20,357,242 | ) |

| | | | | | | | |

Net decrease in net assets resulting from capital share transactions | | | (8,148,221 | ) | | | (11,983,876 | ) |

| | | | | | | | |

Net increase in net assets | | | 11,701,651 | | | | 3,235,529 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year or period | | | 143,423,051 | | | | 140,187,522 | |

| | | | | | | | |

End of year or period | | $ | 155,124,702 | | | $ | 143,423,051 | |

| | | | | | | | |

Undistributed net investment income at end of year or period | | $ | 3,587,504 | | | $ | 3,136,936 | |

| | | | | | | | |

See Accompanying Notes to Financial Statements

13

FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding throughout each year or period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (loss)

from

investment

operations | | | | | | Less distributions | | | | | | | | | | | | | | | Ratios to average net assets | | | Supplemental

data | |

| | | Net asset value, beginning of year

or period | | | Net investment income (loss) | | | Net realized and unrealized gain

(loss) | | | Total from investment operations | | | From net investment income | | | From net realized gains | | | From return of capital | | | Total distributions | | | Payment by affiliate | | | Net asset value,

end of year or period | | | Total Return(1) | | | Expenses before reductions/

additions(2)(3)(4) | | | Expenses net of fee waivers and/

or recoupments if any(2)(3)(4) | | | Expense net of all reductions/

additions(2)(3)(4) | | | Net investment income (loss)(2)(3) | | | Net assets, end of year or period | | | Portfolio turnover rate | |

Year or period ended | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | (%) | | | (%) | | | (%) | | | (%) | | | (%) | | | ($000’s) | | | (%) | |

ING Strategic Allocation Conservative Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-13 | | | 11.14 | | | | 0.31 | • | | | 1.02 | | | | 1.33 | | | | 0.30 | | | | — | | | | — | | | | 0.30 | | | | — | | | | 12.17 | | | | 12.11 | | | | 0.22 | | | | 0.11 | | | | 0.11 | | | | 2.64 | | | | 87,378 | | | | 55 | |

12-31-12 | | | 10.19 | | | | 0.28 | • | | | 0.96 | | | | 1.24 | | | | 0.29 | | | | — | | | | — | | | | 0.29 | | | | — | | | | 11.14 | | | | 12.31 | | | | 0.22 | | | | 0.09 | | | | 0.09 | | | | 2.64 | | | | 81,360 | | | | 107 | |

12-31-11 | | | 10.41 | | | | 0.27 | • | | | (0.07 | ) | | | 0.20 | | | | 0.42 | | | | — | | | | — | | | | 0.42 | | | | — | | | | 10.19 | | | | 1.79 | | | | 0.22 | | | | 0.06 | | | | 0.06 | | | | 2.63 | | | | 80,825 | | | | 59 | |

12-31-10 | | | 9.80 | | | | 0.36 | • | | | 0.70 | | | | 1.06 | | | | 0.45 | | | | — | | | | — | | | | 0.45 | | | | — | | | | 10.41 | | | | 11.07 | | | | 0.20 | | | | 0.09 | | | | 0.09 | | | | 3.66 | | | | 90,086 | | | | 88 | |

12-31-09 | | | 9.13 | | | | 0.45 | • | | | 1.03 | | | | 1.48 | | | | 0.81 | | | | — | | | | — | | | | 0.81 | | | | — | | | | 9.80 | | | | 18.00 | | | | 0.20 | | | | 0.10 | | | | 0.10 | | | | 5.04 | | | | 93,792 | | | | 56 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-13 | | | 11.06 | | | | 0.29 | • | | | 0.99 | | | | 1.28 | | | | 0.27 | | | | — | | | | — | | | | 0.27 | | | | — | | | | 12.07 | | | | 11.76 | | | | 0.47 | | | | 0.36 | | | | 0.36 | | | | 2.53 | | | | 3,086 | | | | 55 | |

12-31-12 | | | 10.12 | | | | 0.24 | | | | 0.96 | | | | 1.20 | | | | 0.26 | | | | — | | | | — | | | | 0.26 | | | | — | | | | 11.06 | | | | 12.02 | | | | 0.47 | | | | 0.34 | | | | 0.34 | | | | 2.51 | | | | 1,664 | | | | 107 | |

12-31-11 | | | 10.34 | | | | 0.24 | • | | | (0.07 | ) | | | 0.17 | | | | 0.39 | | | | — | | | | — | | | | 0.39 | | | | — | | | | 10.12 | | | | 1.53 | | | | 0.47 | | | | 0.31 | | | | 0.31 | | | | 2.29 | | | | 1,378 | | | | 59 | |

12-31-10 | | | 9.73 | | | | 0.34 | | | | 0.70 | | | | 1.04 | | | | 0.43 | | | | — | | | | — | | | | 0.43 | | | | — | | | | 10.34 | | | | 10.91 | | | | 0.45 | | | | 0.34 | | | | 0.34 | | | | 3.53 | | | | 1,752 | | | | 88 | |

12-31-09 | | | 9.06 | | | | 0.43 | • | | | 1.02 | | | | 1.45 | | | | 0.78 | | | | — | | | | — | | | | 0.78 | | | | — | | | | 9.73 | | | | 17.79 | | | | 0.45 | | | | 0.35 | | | | 0.35 | | | | 4.89 | | | | 1,631 | | | | 56 | |

| | | | | | | | | | | | | | | | | |

ING Strategic Allocation Growth Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-13 | | | 10.99 | | | | 0.21 | • | | | 2.22 | | | | 2.43 | | | | 0.20 | | | | — | | | | — | | | | 0.20 | | | | — | | | | 13.22 | | | | 22.40 | | | | 0.21 | | | | 0.11 | | | | 0.11 | | | | 1.74 | | | | 159,018 | | | | 53 | |

12-31-12 | | | 9.70 | | | | 0.18 | • | | | 1.27 | | | | 1.45 | | | | 0.16 | | | | — | | | | — | | | | 0.16 | | | | — | | | | 10.99 | | | | 14.99 | | | | 0.20 | | | | 0.06 | | | | 0.06 | | | | 1.77 | | | | 141,892 | | | | 74 | |

12-31-11 | | | 10.24 | | | | 0.14 | • | | | (0.41 | ) | | | (0.27 | ) | | | 0.27 | | | | — | | | | — | | | | 0.27 | | | | — | | | | 9.70 | | | | (2.92 | ) | | | 0.20 | | | | 0.05 | | | | 0.05 | | | | 1.42 | | | | 138,642 | | | | 53 | |

12-31-10 | | | 9.39 | | | | 0.23 | • | | | 0.97 | | | | 1.20 | | | | 0.35 | | | | — | | | | — | | | | 0.35 | | | | — | | | | 10.24 | | | | 13.06 | | | | 0.19 | | | | 0.09 | | | | 0.09 | | | | 2.47 | | | | 171,094 | | | | 36 | |

12-31-09 | | | 9.04 | | | | 0.37 | | | | 1.48 | | | | 1.85 | | | | 0.97 | | | | 0.53 | | | | — | | | | 1.50 | | | | — | | | | 9.39 | | | | 25.37 | | | | 0.20 | | | | 0.13 | | | | 0.13 | | | | 4.12 | | | | 168,071 | | | | 75 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-13 | | | 10.92 | | | | 0.18 | • | | | 2.21 | | | | 2.39 | | | | 0.18 | | | | — | | | | — | | | | 0.18 | | | | — | | | | 13.13 | | | | 22.11 | | | | 0.46 | | | | 0.36 | | | | 0.36 | | | | 1.54 | | | | 863 | | | | 53 | |

12-31-12 | | | 9.62 | | | | 0.16 | • | | | 1.25 | | | | 1.41 | | | | 0.11 | | | | — | | | | — | | | | 0.11 | | | | — | | | | 10.92 | | | | 14.71 | | | | 0.45 | | | | 0.31 | | | | 0.31 | | | | 1.51 | | | | 648 | | | | 74 | |

12-31-11 | | | 10.16 | | | | 0.12 | • | | | (0.42 | ) | | | (0.30 | ) | | | 0.24 | | | | — | | | | — | | | | 0.24 | | | | — | | | | 9.62 | | | | (3.16 | ) | | | 0.45 | | | | 0.30 | | | | 0.30 | | | | 1.14 | | | | 620 | | | | 53 | |

12-31-10 | | | 9.32 | | | | 0.21 | • | | | 0.96 | | | | 1.17 | | | | 0.33 | | | | — | | | | — | | | | 0.33 | | | | — | | | | 10.16 | | | | 12.81 | | | | 0.44 | | | | 0.34 | | | | 0.34 | | | | 2.22 | | | | 1,753 | | | | 36 | |

12-31-09 | | | 8.99 | | | | 0.32 | • | | | 1.49 | | | | 1.81 | | | | 0.95 | | | | 0.53 | | | | — | | | | 1.48 | | | | — | | | | 9.32 | | | | 24.90 | | | | 0.45 | | | | 0.38 | | | | 0.38 | | | | 3.88 | | | | 1,715 | | | | 75 | |

| | | | | | | | | | | | | | | | | |

ING Strategic Allocation Moderate Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-13 | | | 11.05 | | | | 0.24 | • | | | 1.57 | | | | 1.81 | | | | 0.25 | | | | — | | | | — | | | | 0.25 | | | | — | | | | 12.61 | | | | 16.60 | | | | 0.21 | | | | 0.12 | | | | 0.12 | | | | 2.08 | | | | 153,367 | | | | 54 | |

12-31-12 | | | 9.93 | | | | 0.23 | • | | | 1.11 | | | | 1.34 | | | | 0.22 | | | | — | | | | — | | | | 0.22 | | | | — | | | | 11.05 | | | | 13.60 | | | | 0.20 | | | | 0.09 | | | | 0.09 | | | | 2.18 | | | | 142,200 | | | | 84 | |

12-31-11 | | | 10.31 | | | | 0.20 | • | | | (0.24 | ) | | | (0.04 | ) | | | 0.34 | | | | — | | | | — | | | | 0.34 | | | | — | | | | 9.93 | | | | (0.57 | ) | | | 0.21 | | | | 0.07 | | | | 0.07 | | | | 1.97 | | | | 139,057 | | | | 57 | |

12-31-10 | | | 9.58 | | | | 0.30 | • | | | 0.83 | | | | 1.13 | | | | 0.40 | | | | — | | | | — | | | | 0.40 | | | | — | | | | 10.31 | | | | 12.03 | | | | 0.19 | | | | 0.10 | | | | 0.10 | | | | 3.15 | | | | 164,412 | | | | 60 | |

12-31-09 | | | 9.10 | | | | 0.39 | • | | | 1.30 | | | | 1.69 | | | | 0.91 | | | | 0.30 | | | | — | | | | 1.21 | | | | — | | | | 9.58 | | | | 21.84 | | | | 0.21 | | | | 0.13 | | | | 0.13 | | | | 4.47 | | | | 166,449 | | | | 62 | |

See Accompanying Notes to Financial Statements

14

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (loss)

from

investment

operations | | | | | | Less distributions | | | | | | | | | | | | | | | Ratios to average net assets | | | Supplemental

data | |

| | | Net asset value, beginning of year

or period | | | Net investment income (loss) | | | Net realized and unrealized gain

(loss) | | | Total from investment operations | | | From net investment income | | | From net realized gains | | | From return of capital | | | Total distributions | | | Payment by affiliate | | | Net asset value,

end of year or period | | | Total Return(1) | | | Expenses before reductions/

additions(2)(3)(4) | | | Expenses net of fee waivers and/

or recoupments if any(2)(3)(4) | | | Expense net of all reductions/

additions(2)(3)(4) | | | Net investment income (loss)(2)(3) | | | Net assets, end of year or period | | | Portfolio turnover rate | |

Year or period ended | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | (%) | | | (%) | | | (%) | | | (%) | | | (%) | | | ($000’s) | | | (%) | |

ING Strategic Allocation Moderate Portfolio (continued) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12-31-13 | | | 11.00 | | | | 0.22 | • | | | 1.55 | | | | 1.77 | | | | 0.23 | | | | — | | | | — | | | | 0.23 | | | | — | | | | 12.54 | | | | 16.24 | | | | 0.46 | | | | 0.37 | | | | 0.37 | | | | 1.84 | | | | 1,758 | | | | 54 | |

12-31-12 | | | 9.86 | | | | 0.21 | • | | | 1.11 | | | | 1.32 | | | | 0.18 | | | | — | | | | — | | | | 0.18 | | | | — | | | | 11.00 | | | | 13.45 | | | | 0.45 | | | | 0.34 | | | | 0.34 | | | | 1.96 | | | | 1,223 | | | | 84 | |

12-31-11 | | | 10.25 | | | | 0.15 | • | | | (0.22 | ) | | | (0.07 | ) | | | 0.32 | | | | — | | | | — | | | | 0.32 | | | | — | | | | 9.86 | | | | (0.91 | ) | | | 0.46 | | | | 0.32 | | | | 0.32 | | | | 1.44 | | | | 1,131 | | | | 57 | |

12-31-10 | | | 9.53 | | | | 0.27 | | | | 0.83 | | | | 1.10 | | | | 0.38 | | | | — | | | | — | | | | 0.38 | | | | — | | | | 10.25 | | | | 11.77 | | | | 0.44 | | | | 0.35 | | | | 0.35 | | | | 2.92 | | | | 2,874 | | | | 60 | |

12-31-09 | | | 9.05 | | | | 0.38 | | | | 1.28 | | | | 1.66 | | | | 0.88 | | | | 0.30 | | | | — | | | | 1.18 | | | | — | | | | 9.53 | | | | 21.60 | | | | 0.46 | | | | 0.38 | | | | 0.38 | | | | 4.34 | | | | 2,703 | | | | 62 | |

| (1) | Total return is calculated assuming reinvestment of all dividends, capital gain distributions and return of capital distributions, if any, at net asset value and does not reflect the effect of insurance contract charges. Total return for periods less than one year is not annualized. |

| (2) | Annualized for periods less than one year. |

| (3) | Expense ratios reflect operating expenses of a Portfolio. Expenses before reductions/additions do not reflect amounts reimbursed by an Investment Adviser and/or Distributor or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by a Portfolio during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by an Investment Adviser and/or Distributor but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions/additions represent the net expenses paid by a Portfolio. Net investment income (loss) is net of all such additions or reductions. |

| (4) | Expense ratios do not include expenses of underlying funds and do not include fees and expenses charged under the variable annuity contract or variable life insurance policy. |

| · | Calculated using average number of shares outstanding throughout the period. |

See Accompanying Notes to Financial Statements

15

NOTES TO FINANCIAL STATEMENTSASOF DECEMBER 31, 2013

NOTE 1 — ORGANIZATION

ING Strategic Allocation Portfolios, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The Company was incorporated under the laws of Maryland on October 14, 1994. There are three separate investment series (each a “Portfolio,” collectively the “Portfolios”) that comprise the Company: ING Strategic Allocation Conservative Portfolio (“Strategic Allocation Conservative”), ING Strategic Allocation Growth Portfolio (“Strategic Allocation Growth”), and ING Strategic Allocation Moderate Portfolio (“Strategic Allocation Moderate”), each a diversified series of the Company. Each Portfolio currently seeks to achieve its investment objective by investing in other investment companies (“Underlying Funds”) and each uses asset allocation strategies to determine how to invest in the Underlying Funds. The investment objective of the Portfolios is described in the Portfolios’ Prospectus.

Each Portfolio offers Class I and Class S shares. Each class has equal rights as to class and voting privileges. The two classes differ principally in the applicable distribution and service fees. Generally, shareholders of each class also bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of a Portfolio and earn income and realized gains/losses from a Portfolio pro rata based on the average daily net assets of each class, without distinction between share classes. Expenses that are specific to a portfolio or a class are charged directly to that portfolio or class. Other operating expenses shared by several portfolios are generally allocated among those portfolios based on average net assets. Distributions are determined separately for each class based on income and expenses allocable to each class. Realized gain distributions are allocated to each class pro rata based on the shares outstanding of each class on the date of distribution. Differences in per share dividend rates generally result from differences in separate class expenses, including distribution and shareholder service fees, if applicable.

ING Investments, LLC serves as the investment adviser (“ING Investments” or the “Investment Adviser”) to the Portfolios. ING Investment Management Co. LLC serves as the sub-adviser (“ING IM” or the “Sub-Adviser”) to the Portfolios. ING Funds Services, LLC serves as the administrator (“IFS” or the “Administrator”) for the Portfolios. ING Investments Distributor, LLC (“IID” or the “Distributor”), a Delaware limited liability company, serves as the principal underwriter to the Portfolios.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Portfolios in the preparation of their financial statements. Such policies are in conformity with U.S. generally accepted accounting principles (“GAAP”) for investment companies.

A. Security Valuation. All investments in Underlying Funds are recorded at their estimated fair value, as described below. U.S. GAAP defines fair value as the price the Portfolios would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation of the Portfolios’ investments in Underlying Funds is based on the net asset value (“NAV”) of the Underlying Funds each business day.

Each investment asset or liability of a Portfolio is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Quoted prices in active markets for identical securities are classified as “Level 1,” inputs other than quoted prices for an asset or liability that are observable are classified as “Level 2” and unobservable inputs, including the Sub-Adviser’s judgment about the assumptions that a market participant would use in pricing an asset or liability are classified as “Level 3.” The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Short-term securities of sufficient credit quality which are valued at amortized cost, which approximates fair value, are generally considered to be Level 2 securities under applicable accounting rules. The Portfolios classify each of their investments in the Underlying Funds as Level 1, without consideration as to the classification level of the specific investments held by the Underlying Funds. A table summarizing each Portfolio’s investments under these levels of classification is included following the Portfolio of Investments.

The Portfolios’ Board of Directors (“Board”) has adopted methods for valuing securities and other assets in circumstances where market quotes are not readily available, and has delegated the responsibility for applying the valuation methods to the “Pricing Committee” as established by the fund’s Administrator. The Pricing Committee considers all facts they deem relevant that are reasonably available, through either public information or information available to the Investment Adviser or Sub-Adviser, when determining the fair value of the security. In the event that a security or asset cannot be valued pursuant to one of the

16

NOTES TO FINANCIAL STATEMENTSASOF DECEMBER 31, 2013 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

valuation methods established by the Board, the fair value of the security or asset will be determined in good faith by the Pricing Committee. When a Portfolio uses these fair valuation methods that use significant unobservable inputs to determine its NAV, securities will be priced by a method that the Pricing Committee believes accurately reflects fair value and are categorized as Level 3 of the fair value hierarchy. The methodologies used for valuing securities are not necessarily an indication of the risks of investing in those securities nor can it be assured a Portfolio can obtain the fair value assigned to a security if they were to sell the security.

To assess the continuing appropriateness of security valuations, the Pricing Committee may compare prior day prices, prices on comparable securities, and traded prices to the prior or current day prices and the Pricing Committee challenges those prices exceeding certain tolerance levels with the independent pricing service or broker source. For those securities valued in good faith at fair value, the Pricing Committee reviews and affirms the reasonableness of the valuation on a regular basis after considering all relevant information that is reasonably available.

For fair valuations using significant unobservable inputs, U.S. GAAP requires a reconciliation of the beginning to ending balances for reported fair values that presents changes attributable to total realized and unrealized gains or losses, purchases and sales, and transfers in or out of the Level 3 category during the period. The end of period timing recognition is used for the transfers between Levels of a Portfolio’s assets and liabilities. A reconciliation of Level 3 investments is presented only when a Portfolio has a significant amount of Level 3 investments.

For the year ended December 31, 2013, there have been no significant changes to the fair valuation methodologies.

B. Security Transactions and Revenue Recognition. Security transactions are accounted for on trade date. Dividend income received from the affiliated funds is recognized on the ex-dividend date and is recorded as income distributions in the Statement of Operations. Capital gain distributions received from the affiliated funds are recognized on ex-dividend date and are recorded on the Statement of Operations as such. Costs used in determining realized gains and losses on the sales of investment securities are on the basis of specific identification.

C. Distributions to Shareholders. The Portfolios record distributions to their shareholders on the ex-dividend date. Dividends from net investment income and capital gains, if any, are declared and paid annually by the Portfolios. The Portfolios may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code. The characteristics of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from U.S. GAAP for investment companies.

D. Federal Income Taxes. It is the policy of each Portfolio to comply with subchapter M of the Internal Revenue Code and related excise tax provisions applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized capital gains to their shareholders. Management has considered the sustainability of the Portfolios’ tax positions taken on federal income tax returns for all open tax years in making this determination. Therefore, no federal income tax provision is required. No capital gain distributions shall be made until any capital loss carryforwards have been fully utilized or expired.

E. Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

F. Indemnifications. In the normal course of business, the Company may enter into contracts that provide certain indemnifications. The Company’s maximum exposure under these arrangements is dependent on future claims that may be made against the Portfolios and, therefore, cannot be estimated; however, based on experience, management considers the risk of loss from such claims remote.

NOTE 3 — INVESTMENTS IN UNDERLYING FUNDS

For the year ended December 31, 2013, the cost of purchases and the proceeds from the sales of the Underlying Funds, were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Strategic Allocation Conservative | | $ | 47,436,953 | | | $ | 47,518,510 | |

Strategic Allocation Growth | | | 80,523,066 | | | | 91,090,811 | |

Strategic Allocation Moderate | | | 80,535,975 | | | | 88,726,401 | |

17

NOTES TO FINANCIAL STATEMENTSASOF DECEMBER 31, 2013 (CONTINUED)

NOTE 4 — INVESTMENT MANAGEMENT AND ADMINISTRATIVE FEES

The Portfolios entered into an investment management agreement (“Investment Management Agreement”) with the Investment Adviser. The Investment Management Agreement compensates the Investment Adviser with a fee of 0.08% of each Portfolio’s average daily net assets invested in affiliated Underlying Funds and a fee of 0.60% of each Portfolio’s average daily net assets invested in unaffiliated Underlying Funds and/or direct investments.

The Investment Adviser entered into a sub-advisory agreement with ING IM with respect to each Portfolio. Subject to such policies as the Board or the Investment Adviser may determine, ING IM manages the Portfolios’ assets in accordance with the Portfolios’ investment objectives, policies, and limitations.

Pursuant to the Administration Agreement, IFS acts as administrator and provides certain administrative and shareholder services necessary for Portfolio operations and is responsible for the supervision of other service providers. For its services, IFS is entitled to receive from each Portfolio a fee at an annual rate of 0.055% on the first $5 billion of average daily net assets and 0.030% thereafter.

NOTE 5 — DISTRIBUTION AND SERVICE FEES

Class S shares of the Portfolios have a Distribution Plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), whereby the Distributor is compensated by each Portfolio for expenses incurred in the distribution of each Portfolio’s Class S shares. Pursuant to the 12b-1 Plan, the Distributor is entitled to a payment each month to compensate for expenses incurred in the distribution and promotion of each Portfolio’s S shares, including expenses incurred in printing prospectuses and reports used for sales purposes, expenses incurred in preparing and printing sales literature and other such distribution related expenses, including any distribution or shareholder servicing fees paid to securities dealers who have executed a distribution agreement with the Distributor. Under the 12b-1 Plan, Class S shares of the Portfolios pay the Distributor a fee calculated at an annual rate of 0.25% of average daily net assets.

NOTE 6 — OTHER TRANSACTIONS WITH AFFILIATES AND RELATED PARTIES

At Dec 31, 2013, the following indirect, wholly-owned subsidiaries of ING U.S., Inc. owned more than 5% of the following Portfolios:

| | | | | | |

Subsidiary | | Portfolios | | Percentage | |

ING Life Insurance and Annuity Company | | Strategic Allocation Conservative | | | 88.82 | % |

| | Strategic Allocation Growth | | | 91.60 | |

| | Strategic Allocation Moderate | | | 87.82 | |

ReliaStar Life Insurance

Company | | Strategic Allocation Conservative | | | 6.87 | |

| | Strategic Allocation Growth | | | 5.79 | |

| | Strategic Allocation Moderate | | | 9.33 | |

Control is defined by the 1940 Act as the beneficial ownership, either directly or through one or more controlled companies, of more than 25% of the voting securities of a company. The 1940 Act defines affiliates as companies that are under common control. Therefore, because the Portfolios have a common owner that owns over 25% of the outstanding securities of the Portfolios, they are deemed to be affiliates of each other. Investment activities of these shareholders could have a material impact on the Portfolios.

The Company has adopted a Deferred Compensation Plan (“Policy”), which allows eligible non-affiliated directors as described in the Policy to defer the receipt of all or a portion of the directors’ fees payable. Amounts deferred are treated as though invested in various “notional” funds advised by ING Investments until distribution in accordance with the Policy.

NOTE 7 — OTHER ACCRUED EXPENSES AND LIABILITIES

At December 31, 2013, the following Portfolio had the below payables included in Other Accrued Expenses and Liabilities on the Statements of Assets and Liabilities that exceeded 5% of total liabilities:

| | | | | | |

Portfolio | | Accrued Expenses | | Amount | |

Strategic Allocation Moderate | | Audit | | | 10,436 | |

| | Shareholder Reporting | | | 12,196 | |

NOTE 8 — EXPENSE LIMITATION AGREEMENTS

The Investment Adviser entered into written expense limitation agreement (“Expense Limitation Agreement”) with each Portfolio whereby the Investment Adviser has agreed to limit expenses, excluding interest, taxes, brokerage commissions, and extraordinary expenses to the levels listed below:

| | | | | | | | |

Portfolio(1) | | Class I | | | Class S | |

Strategic Allocation Conservative | | | 0.65 | % | | | 0.90 | % |

Strategic Allocation Growth(2) | | | 0.75 | % | | | 1.00 | % |

Strategic Allocation Moderate | | | 0.70 | % | | | 0.95 | % |