UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended February 2, 2008

Commission File No.0-25464

DOLLAR TREE, INC.

(Exact name of registrant as specified in its charter)

| Virginia | 26-2018846 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

500 Volvo Parkway, Chesapeake, VA 23320

(Address of principal executive offices)

Registrant’s telephone number, including area code: (757) 321-5000

| Securities Registered Pursuant to Section 12(b) of the Act: |

| Title of Each Class | Name of Each Exchange on Which Registered |

| None | None |

Securities Registered Pursuant to Section 12(g) of the Act:

Common Stock (par value $.01 per share)

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer (X) | Accelerated filer ( ) |

| Non-accelerated filer ( ) | Smaller reporting company ( ) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of Common Stock held by non-affiliates of the Registrant on August 3, 2007, was $3,664,182,086 based on a $39.28 average of the high and low sales prices for the Common Stock on such date. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

On March 28, 2008, there were 89,808,123 shares of the Registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information regarding securities authorized for issuance under equity compensation plans called for in Item 5 of Part II and the information called for in Items 10, 11, 12, 13 and 14 of Part III are incorporated by reference to the definitive Proxy Statement for the Annual Meeting of Stockholders of the Company to be held June 19, 2008, which will be filed with the Securities and Exchange Commission not later than May 30, 2008.

TABLE OF CONTENTS

| | | Page |

| | PART I | |

| | | |

| Item 1. | BUSINESS | 6 |

| | | |

| Item 1A. | RISK FACTORS | 10 |

| | | |

| Item 1B. | UNRESOLVED STAFF COMMENTS | 12 |

| | | |

| Item 2. | PROPERTIES | 13 |

| | | |

| Item 3. | LEGAL PROCEEDINGS | 14 |

| | | |

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 15 |

| | | |

| | PART II | |

| | | |

| Item 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED | |

| | STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 16 |

| | | |

| Item 6. | SELECTED FINANCIAL DATA | 17 |

| | | |

| Item 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL | |

| | CONDITION AND RESULTS OF OPERATIONS | 19 |

| | | |

| Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 29 |

| | | |

| Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 31 |

| | | |

| Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON | |

| | ACCOUNTING AND FINANCIAL DISCLOSURE | 57 |

| | | |

| Item 9A. | CONTROLS AND PROCEDURES | 57 |

| | | |

| Item 9B. | OTHER INFORMATION | 58 |

| | | |

| | PART III | |

| | | |

| Item 10. | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | 58 |

| | | |

| Item 11. | EXECUTIVE COMPENSATION | 58 |

| | | |

| Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | |

| | AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 58 |

| | | |

| Item 13. | CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 59 |

| | | |

| Item 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 59 |

| | | |

| | PART IV | |

| | | |

| Item 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K | 59 |

| | | |

| | SIGNATURES | 60 |

A WARNING ABOUT FORWARD-LOOKING STATEMENTS: This document contains "forward-looking statements" as that term is used in the Private Securities Litigation Reform Act of 1995. Forward-looking statements address future events, developments and results. They include statements preceded by, followed by or including words such as "believe," "anticipate," "expect," "intend," "plan," "view," “target” or "estimate." For example, our forward-looking statements include statements regarding:

· | our anticipated sales, including comparable store net sales, net sales growth and earnings growth; |

· | our growth plans, including our plans to add, expand or relocate stores, our anticipated square footage increase, and our ability to renew leases at existing store locations; |

· | the average size of our stores to be added in 2008 and beyond; |

· | the effect of a slight shift in merchandise mix to consumables and the increase in freezers and coolers on gross profit margin and sales; |

· | the effect that expanding tender types accepted by our stores will have on sales; |

· | the net sales per square foot, net sales and operating income attributable to smaller and larger stores and store-level cash payback metrics; |

· | the possible effect of inflation and other economic changes on our costs and profitability, including the possible effect of future changes in minimum wage rates, shipping rates, domestic and foreign freight costs, fuel costs and wage and benefit costs; |

· | our cash needs, including our ability to fund our future capital expenditures and working capital requirements; |

· | our gross profit margin, earnings, inventory levels and ability to leverage selling, general and administrative and other fixed costs; |

· | our seasonal sales patterns including those relating to the length of the holiday selling seasons and the effect of an earlier Easter in 2008; |

· | the capabilities of our inventory supply chain technology and other new systems; |

· | the future reliability of, and cost associated with, our sources of supply, particularly imported goods such as those sourced from China; |

· | the capacity, performance and cost of our distribution centers, including opening and expansion schedules; |

· | our expectations regarding competition and growth in our retail sector; |

· | costs of pending and possible future legal claims; |

· | management's estimates associated with our critical accounting policies, including inventory valuation, accrued expenses, and income taxes; |

You should assume that the information appearing in this annual report is accurate only as of the date it was issued. Our business, financial condition, results of operations and prospects may have changed since that date.

For a discussion of the risks, uncertainties and assumptions that could affect our future events, developments or results, you should carefully review the risk factors described in Item 1A “Risk Factors” beginning on page 10, as well as Item 7 "Management’s Discussion and Analysis of Financial Condition and Results of Operations" beginning on page 19 of this Form 10-K.

Our forward-looking statements could be wrong in light of these and other risks, uncertainties and assumptions. The future events, developments or results described in this report could turn out to be materially different. We have no obligation to publicly update or revise our forward-looking statements after the date of this annual report and you should not expect us to do so.

Investors should also be aware that while we do, from time to time, communicate with securities analysts and others, we do not, by policy, selectively disclose to them any material, nonpublic information or other confidential commercial information. Accordingly, shareholders should not assume that we agree with any statement or report issued by any securities analyst regardless of the content of the statement or report. We generally do not issue financial forecasts or projections and we do not, by policy, confirm those issued by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not our responsibility.

INTRODUCTORY NOTE: Unless otherwise stated, references to "we," "our" and "Dollar Tree" generally refer to Dollar Tree, Inc. and its direct and indirect subsidiaries on a consolidated basis. Unless specifically indicated otherwise, any references to “2008” or “fiscal 2008”, “2007” or “fiscal 2007”, “2006” or “fiscal 2006,” and “2005” or “fiscal 2005,” relate to as of or for the years ended January 31, 2009, February 2, 2008, February 3, 2007 and January 28, 2006, respectively.

On March 2, 2008, we reorganized by creating a new holding company structure. The new parent company is Dollar Tree, Inc., replacing Dollar Tree Stores, Inc., which is now an operating subsidiary. The primary purpose of the reorganization was to create a more efficient corporate structure. Outstanding shares of the capital stock of Dollar Tree Stores, Inc., were automatically converted, on a share for share basis, into identical shares of common stock of the new holding company. The articles of incorporation, the bylaws, the executive officers and the board of directors of our new holding company are the same as those of the former Dollar Tree Stores, Inc. in effect immediately prior to the reorganization. The common stock of our new holding company will continue to be listed on the NASDAQ Global Select Market under the symbol “DLTR”. The rights, privileges and interests of our stockholders will remain the same with respect to our new holding company.

AVAILABLE INFORMATION

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act are available free of charge on our website at www.dollartree.com as soon as reasonably practicable after electronic filing of such reports with the SEC.

PART I

Item 1. BUSINESS

Overview

Since our founding in 1986, we have become the leading operator of discount variety stores offering merchandise at the fixed price of $1.00. We believe the variety and quality of products we sell for $1.00 sets us apart from our competitors. At February 2, 2008, we operated 3,411 discount variety retail stores. Approximately 3,300 of these stores sell substantially all items for $1.00 or less. The remaining stores, operating as Deal$, which were acquired in March 2006, sell most items for $1.00 or less but also sell items at prices greater than $1.00. Our stores operate under the names of Dollar Tree, Deal$ and Dollar Bills. On March 2, 2008, Dollar Tree, Inc. became the new parent holding company for Dollar Tree Stores, Inc., which is now an operating subsidiary.

In the past five years, we have modified our average store size to reflect what we believe is our optimal store size of between 10,000 and 12,500 square feet. At February 2, 2008, approximately 14% of our stores are less than 6,000 square feet, which is down from approximately 40% of our stores at January 31, 2004. These smaller stores are comprised of mall and older strip shopping center locations and are candidates for relocation as their leases expire. Our current store size reflects our expanded merchandise offerings and improved service to our customers. As we have been expanding our merchandise offerings, we have added freezers and coolers to approximately 1,100 stores during the past three years to increase traffic and transaction size. At January 31, 2004, we operated 2,513 stores in 47 states. At February 2, 2008, we operated 3,411 stores in 48 states. Our selling square footage increased from approximately 16.9 million square feet in January 2004 to 28.4 million square feet in February 2008. Our store growth since 2003 has resulted from opening new stores and completing mergers and acquisitions. We centrally manage our store and distribution operations from our corporate headquarters in Chesapeake, Virginia.

Business Strategy

Value Merchandise Offering. We strive to exceed our customers' expectations of the variety and quality of products that they can purchase for $1.00 by offering items that we believe typically sell for higher prices elsewhere. We buy approximately 55% to 60% of our merchandise domestically and import the remaining 40% to 45%. Our domestic purchases include closeouts. We believe our mix of imported and domestic merchandise affords our buyers flexibility that allows them to consistently exceed the customer's expectations. In addition, direct relationships with manufacturers permit us to select from a broad range of products and customize packaging, product sizes and package quantities that meet our customers' needs.

Mix of Basic Variety and Seasonal Merchandise. We maintain a balanced selection of products within traditional variety store categories. We offer a wide selection of everyday basic products and we supplement these basic, everyday items with seasonal and closeout merchandise. We attempt to keep certain basic consumable merchandise in our stores continuously to establish our stores as a destination and we increased slightly the mix of consumable merchandise in order to increase the traffic in our stores. Closeout merchandise is purchased opportunistically and represents less than 10% of our purchases. National, regional and corporate brands have become a bigger part of our merchandise mix.

Our merchandise mix consists of:

| | |

· | consumable merchandise, which includes candy and food, basic health and beauty care, and household consumables such as paper, plastics and household chemicals and in select stores, frozen and refrigerated food; |

| | |

· | variety merchandise, which includes toys, durable housewares, gifts, fashion health and beauty care, party goods, greeting cards, apparel, and other items; and |

| | |

· | seasonal goods, which include Easter, Halloween and Christmas merchandise, along with summer toys and lawn and garden merchandise. |

We have added freezers and coolers to certain stores which has increased the consumable merchandise carried by those stores. We believe this initiative helps us drive additional transactions and allows us to appeal to a broader demographic mix, and these stores will carry more consumable merchandise than stores without freezers. We have added freezers and coolers to approximately 360 more stores in 2007. Therefore, as of February 2, 2008, we have freezers and coolers in approximately 1,100 of our stores. We plan to add them to approximately 150 more stores in 2008. As a result of the installation of freezers and coolers in select stores, consumable merchandise has grown as a percentage of purchases and sales and we expect this trend to continue. The following table shows the percentage of purchases of each major product group for the years ended February 2, 2008 and February 3, 2007:

| | February 2, | February 3, |

| Merchandise Type | 2008 | 2007 |

| | | |

| Variety categories | 48.1% | 48.9% |

| Consumable | 46.0% | 45.3% |

| Seasonal | 5.9% | 5.8% |

Customer Payment Methods. All of our stores accept cash, checks, debit cards and VISA credit cards and approximately 1,000 stores accept MasterCard credit cards. Prior to May 2005, approximately 900 of our stores accepted debit cards. By the end of 2005, approximately 2,300 of our stores accepted debit cards and as of the end of 2006, all of our stores accepted debit cards. We began accepting VISA credit cards at all of our stores in the fourth quarter of 2007. Along with the shift to more consumables, the rollout of freezers and coolers, and the acceptance of pin-based debit and VISA credit transactions, we increased the number of stores accepting Electronic Benefits Transfer cards and food stamps at qualified stores in the current year. We believe that expanding our tender types has helped increase both the traffic and the average size of transactions at our stores in the current year.

Convenient Locations and Store Size. We primarily focus on opening new stores in strip shopping centers anchored by mass merchandisers, whose target customers we believe to be similar to ours. Our stores have proven successful in metropolitan areas, mid-sized cities and small towns. The range of our store sizes allows us to target a particular location with a store that best suits that market and takes advantage of available real estate opportunities. Our stores are attractively designed and create an inviting atmosphere for shoppers by using bright lighting, vibrant colors, decorative signs and background music. We enhance the store design with attractive merchandise displays. We believe this design attracts new and repeat customers and enhances our image as both a destination and impulse purchase store.

For more information on retail locations and retail store leases, see Item 2 "Properties” beginning on page 13 of this Form 10-K.

Profitable Stores with Strong Cash Flow. We maintain a disciplined, cost-sensitive approach to store site selection in order to minimize the initial capital investment required and maximize our potential to generate high operating margins and strong cash flows. We believe that our stores have a relatively small shopping radius, which allows us to profitably concentrate multiple stores within a single market. Our ability to open new stores is dependent upon, among other factors, locating suitable sites and negotiating favorable lease terms.

Our older, smaller stores continue to generate significant store-level operating income and operating cash flows and have some of the highest operating margin rates among our stores; however, the increased size of our newer stores allows us to offer a wider selection of products, including more basic consumable merchandise, thereby making them more attractive as a destination store.

The strong cash flows generated by our stores allow us to self-fund infrastructure investment and new stores. Over the past five years, cash flows from operating activities have exceeded capital expenditures.

For more information on our results of operations and seasonality of sales, see Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page 19 of this Form 10-K.

Cost Control. We believe that substantial buying power at the $1.00 price point and our flexibility in making sourcing decisions contributes to our successful purchasing strategy, which includes disciplined, targeted merchandise margin goals by category. We believe our disciplined buying and quality merchandise help to minimize markdowns. We buy products on an order-by-order basis and have no material long-term purchase contracts or other assurances of continued product supply or guaranteed product cost. No vendor accounted for more than 10% of total merchandise purchased in any of the past five years.

Our supply chain systems continue to provide us with valuable sales information to assist our buyers and improve merchandise allocation to our stores. Controlling our inventory levels has resulted in more efficient distribution and store operations.

Information Systems. We believe that investments in technology help us to increase sales and control costs. Our inventory management system has allowed us to improve the efficiency of our supply chain, improve merchandise flow and control distribution and store operating costs. Our automatic replenishment system automatically reorders key items, based on actual store level sales and inventory. At the end of 2007, we had over 1,000 basic, everyday items on automatic replenishment.

Point-of-sale data allows us to track sales by merchandise category at the store level and assists us in planning for future purchases of inventory. We believe that this information allows us to ship the appropriate product to stores at the quantities commensurate with selling patterns. Using this point-of-sale data for planning purchases of inventory has helped us maintain our inventory levels on a per store basis in 2007 compared to 2006 despite lower than planned fourth quarter 2007 sales and increased merchandise flow resulting from the earlier Easter season in 2008. Our inventory turns also increased 25 basis points in 2007.

Corporate Culture and Values. We believe that honesty and integrity, doing the right things for the right reasons, and treating people fairly and with respect are core values within our corporate culture. We believe that running a business, and certainly a public company, carries with it a responsibility to be above reproach when making operational and financial decisions. Our management team visits and shops our stores like every customer; we have an open door policy for all our associates; and ideas and individual creativity are encouraged. We have standards for store displays, merchandise presentation, and store operations. Our distribution centers are operated based on objective measures of performance and virtually everyone in our store support center is available to assist associates in the stores and distribution centers.

Our disclosure committee meets at least quarterly and monitors our internal controls over financial reporting and ensures that our public filings contain discussions about the risks our business faces. We believe that we have the controls in place to be able to certify our financial statements. Additionally, we have complied with the updated listing requirements for the Nasdaq Stock Market.

Growth Strategy

Store Openings and Square Footage Growth. The primary factors contributing to our net sales growth have been new store openings, an active store expansion and remodel program, and selective mergers and acquisitions. From 2003 to 2007, net sales increased at a compound annual growth rate of 10.9%. We expect that the substantial majority of our future sales growth will come primarily from new store openings and from our store expansion and relocation program.

The following table shows the total selling square footage of our stores and the selling square footage per new store opened over the last five years. Our growth and productivity statistics are reported based on selling square footage because our management believes the use of selling square footage yields a more accurate measure of store productivity. The selling square footage statistics for 2003 through 2007 are estimates based on the relationship of selling to gross square footage.

| Year | Number of Stores | Average Selling Square Footage Per Store | Average Selling Square Footage Per New Store Opened |

| 2003 | 2,513 | 6,716 | 9,948 |

| 2004 | 2,735 | 7,475 | 10,947 |

| 2005 | 2,914 | 7,900 | 9,756 |

| 2006 | 3,219 | 8,160 | 8,780 |

| 2007 | 3,411 | 8,300 | 8,480 |

We expect to increase our selling square footage in the future by opening new stores in underserved markets and strategically increasing our presence in our existing markets via new store openings and store expansions (expansions include store relocations). In fiscal 2008 and beyond, we plan to predominantly open stores that are approximately 8,500 - 9,000 selling square feet and we believe this size allows us to achieve our objectives in the markets in which we plan to expand. At February 2, 2008, 1,370 of our stores, totaling 55.6% of our selling square footage, were 8,500 selling square feet or larger.

In addition to new store openings, we plan to continue our store expansion program to increase our net sales per store and take advantage of market opportunities. We target stores for expansion based on the current sales per selling square foot and changes in market opportunities. Stores targeted for expansion are generally less than 6,000 selling square feet in size. Store expansions generally increase the existing store size by approximately 4,000 selling square feet.

Since 1995, we have added a total of 609 stores through four mergers and several small acquisitions. Our acquisition strategy has been to target companies with a similar single-price point concept that have shown success in operations or provide a strategic advantage. We evaluate potential acquisition opportunities in our retail sector as they become available.

On March 25, 2006, we completed our acquisition of 138 Deal$ stores and paid $32.0 million for store-related and other assets and $22.1 million for inventory. These stores are located primarily in the Midwest part of the United States and we have existing logistics capacity to service these stores. This acquisition also included a few “combo” stores that offer an expanded assortment of merchandise including items that sell for more than $1. Substantially all Deal$ stores acquired continue to operate under the Deal$ banner while providing us an opportunity to leverage our Dollar Tree infrastructure in the testing of new merchandise concepts, including higher price points, without disrupting the single-price point model in our Dollar Tree stores.

In 2007, we also acquired the rights to 32 store leases through bankruptcy proceedings of certain discount retailers. We will take advantage of these opportunities as they arise in the future.

Merchandising and Distribution. Expanding our customer base is important to our growth plans. We plan to continue to stock our new stores with the ever-changing merchandise that our current customers have come to appreciate. In addition, we are opening larger stores that contain more basic consumable merchandise to attract new customers. Consumable merchandise typically leads to more frequent return trips to our stores resulting in increased sales. The presentation and display of merchandise in our stores are critical to communicating value to our customers and creating a more exciting shopping experience. We believe our approach to visual merchandising results in higher store traffic, higher sales volume and an environment that encourages impulse purchases.

A strong and efficient distribution network is critical to our ability to grow and to maintain a low-cost operating structure. We expect to continue to add distribution capacity to support our store opening plans, with the aim of remaining approximately one year ahead of our distribution needs. In 2007, we added capacity to our Briar Creek distribution center which services the northeast part of the country. We believe these distribution centers, including the expanded Briar Creek, Pennsylvania distribution center, in total are capable of supporting approximately $6.7 billion in annual sales. New distribution sites are strategically located to reduce stem miles, maintain flexibility and improve efficiency in our store service areas.

Our stores receive approximately 90% of their inventory from our distribution centers via contract carriers. The remaining store inventory, primarily perishable consumable items and other vendor-maintained display items, are delivered directly to our stores from vendors. For more information on our distribution center network, see Item 2 “Properties” beginning on page 13 of this Form 10-K.

Competition

The retail industry is highly competitive and we expect competition to increase in the future. The principal methods of competition include closeout merchandise, convenience and the quality of merchandise offered to the customer. Our competitors include single-price dollar stores, multi-price dollar stores, mass merchandisers, discount retailers and variety retailers. In addition, several mass merchandisers and grocery store chains carry "dollar store" or “dollar zone” concepts in their stores, which increases competition. Our sales and profits could be reduced by increases in competition, especially because there are no significant economic barriers for others to enter our retail sector.

Trademarks

We are the owners of federal service mark registrations for "Dollar Tree," the "Dollar Tree" logo, "1 Dollar Tree" together with the related design, and "One Price...One Dollar." We also own a concurrent use registration for "Dollar Bill$" and the related logo. During 1997, we acquired the rights to use trade names previously owned by Everything's A Dollar, a former competitor in the $1.00 price point industry. Several trade names were included in the purchase, including the marks "Everything's $1.00 We Mean Everything," and "Everything's $1.00," the registration of which is pending. With the acquisition of Dollar Express, we became the owner of the service marks "Dollar Express" and "Dollar Expres$." We became the owners of the "Greenbacks All A Dollar" and "All A Dollar" service marks, with the acquisition of Greenbacks. We also became the owners of “Deal$” and “Deal$ Nothing Over A Dollar” trademarks, with the acquisition of Deal$. We have applied for federal trademark registrations for various private labels that we use to market some of our product lines.

Employees

We employed approximately 13,300 full-time and 29,300 part-time associates on February 2, 2008. Part-time associates work 35 hours per week or less. The number of part-time associates fluctuates depending on seasonal needs. We consider our relationship with our associates to be good, and we have not experienced significant interruptions of operations due to labor disagreements. None of our employees are subject to collective bargaining agreements.

Item 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the specific risk factors listed below together with all other information included or incorporated in this report. Any of the following risks may materialize, and additional risks not known to us, or that we now deem immaterial, may arise. In such event, our business, financial condition, results of operations or prospects could be materially adversely affected. If that occurs, the market price of our common stock could fall, and you could lose all or part of your investment.

Our profitability is especially vulnerable to cost increases.

Future increase in costs such as the cost of merchandise, wage levels, shipping rates, freight costs, fuel costs and store occupancy costs may reduce our profitability. As a fixed price retailer, we cannot raise the sales price of our merchandise to offset cost increases. Unlike multi-price retailers, we are primarily dependent on our ability to operate more efficiently or effectively or increase our comparable store net sales in order to offset inflation. We can give you no assurance that we will be able to operate more efficiently or increase our comparable store net sales in the future. Please see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," beginning on page 19 of this Form 10-K for further discussion of the effect of Inflation and Other Economic Factors on our operations.

We could encounter disruptions or additional costs in receiving and distributing merchandise.

Our success depends on our ability to transport merchandise from our suppliers to our distribution centers and then ship it to our stores in a timely and cost-effective manner. We may not anticipate, respond to or control all of the challenges of operating our receiving and distribution systems. Some of the factors that could have an adverse effect on our shipping and receiving systems or costs are:

§ Shipping. Our oceanic shipping schedules may be disrupted or delayed from time to time. We also have experienced shipping rate increases over the last several years imposed by the trans-Pacific ocean carriers. |

§ Diesel fuel costs. We have experienced increases in diesel fuel costs over the past few years and expect increases in 2008. |

§ Vulnerability to natural or man-made disasters. A fire, explosion or natural disaster at any of our distribution facilities could result in a loss of merchandise and impair our ability to adequately stock our stores. Some of our facilities are especially vulnerable to earthquakes, hurricanes or tornadoes. |

§ Labor disagreement. Labor disagreements or disruptions may result in delays in the delivery of merchandise to our stores and increase costs. |

§ War, terrorism and other events. War and acts of terrorism in the United States, or in China or other parts of Asia where we buy a significant amount of our imported merchandise, could disrupt our supply chain. |

A downturn in economic conditions could adversely affect our sales.

Economic conditions, such as those caused by recession, inflation, cost increases, adverse weather conditions, or terrorism, could reduce consumer spending or cause customers to shift their spending to products we either do not sell or do not sell as profitably. Adverse economic conditions could disrupt consumer spending and significantly reduce our sales.

Sales below our expectations during peak seasons may cause our operating results to suffer materially.

Our highest sales periods are the Christmas and Easter seasons. We generally realize a disproportionate amount of our net sales and a substantial majority of our operating and net income during the fourth quarter. In anticipation, we stock extra inventory and hire many temporary employees to supplement our stores. An economic downturn during these periods could adversely affect our operating results, particularly operating and net income, to a greater extent than if a downturn occurred at other times of the year. Untimely merchandise delays due to receiving or distribution problems could have a similar effect. Sales during the Easter selling season are materially affected by the timing of the Easter holiday. Easter in fiscal 2007 was on April 8th, while in fiscal 2008, it will be two weeks earlier on March 23rd. We believe that the earlier Easter in 2008 could potentially result in $25.0 million of lost sales when compared to the first quarter of 2007. In fiscal 2008, there is one fewer weekend between Thanksgiving and Christmas compared to fiscal 2007. We believe this could potentially reduce the total foot traffic in our stores for the Christmas holiday in fiscal 2008 compared to fiscal 2007.

Our sales and profits rely on imported merchandise, which may increase in cost or become unavailable.

Merchandise imported directly from overseas accounts for approximately 40% to 45% of our total purchases at retail. In addition, we believe that a small portion of our goods purchased from domestic vendors is imported. China is the source of a substantial majority of our imports. Imported goods are generally less expensive than domestic goods and increase our profit margins. A disruption in the flow of our imported merchandise or an increase in the cost of those goods may significantly decrease our profits. Risks associated with our reliance on imported goods include:

§ disruptions in the flow of imported goods because of factors such as: |

o raw material shortages, work stoppages, strikes and political unrest; |

o problems with oceanic shipping, including shipping container shortages; and |

o economic crises and international disputes. |

| |

§ increases in the cost of purchasing or shipping foreign merchandise, resulting from: |

o increases in shipping rates imposed by the trans-Pacific ocean carriers; |

o changes in currency exchange rates and local economic conditions, including inflation in the country of origin; |

o failure of the United States to maintain normal trade relations with China; and |

o import duties, import quotas and other trade sanctions. |

We may be unable to expand our square footage as profitably as planned.

We plan to expand our selling square footage by approximately 9% in 2008 to increase our sales and profits. Expanding our square footage profitably depends on a number of uncertainties, including our ability to locate, lease, build out and open or expand stores in suitable locations on a timely basis under favorable economic terms. We must also open or expand stores within our established geographic markets, where new or expanded stores may draw sales away from our existing stores. We may not manage our expansion effectively, and our failure to achieve our expansion plans could materially and adversely affect our business, financial condition and results of operations.

Our profitability is affected by the mix of products we sell.

Our gross profit could decrease if we increase the proportion of higher cost goods we sell in the future. In recent years, the percentage of our sales from higher cost consumable products has increased and is likely to increase slightly in 2008. Our gross profit will decrease, unless we are able to maintain our current merchandise cost sufficiently to offset any decrease in our product margin percentage. We can give you no assurance that we will be able to do so.

Pressure from competitors may reduce our sales and profits.

The retail industry is highly competitive. The marketplace is highly fragmented as many different retailers compete for market share by utilizing a variety of store formats and merchandising strategies. We expect competition to increase in the future because there are no significant economic barriers for others to enter our retail sector. Many of our current or potential competitors have greater financial resources than we do. We cannot guarantee that we will continue to be able to compete successfully against existing or future competitors. Please see Item 1, “Business,” beginning on page 6 of this Form 10-K for further discussion of the effect of competition on our operations.

The resolution of certain legal matters could have a material adverse effect on our results of operations, accrued liabilities and cash.

For a discussion of current legal matters, please see Item 3. “Legal Proceedings” beginning on page 14 of this Form 10-K. Resolution of certain matters described in that item, if decided against the Company, could have a material adverse effect on our results of operations, accrued liabilities or cash flows.

Certain provisions in our articles of incorporation and bylaws could delay or discourage a takeover attempt that may be in a shareholder's best interest.

Our articles of incorporation and bylaws contain provisions that may delay or discourage a takeover attempt that a shareholder might consider in his best interest. These provisions, among other things:

· classify our board of directors into three classes, each of which serves for different three-year periods; |

· provide that only the board of directors, chairman or president may call special meetings of the shareholders; |

· establish certain advance notice procedures for nominations of candidates for election as directors and for shareholder proposals to be considered at shareholders' meetings; |

· require a vote of the holders of more than two-thirds of the shares entitled to vote in order to remove a director, change the number of directors, or amend the foregoing and certain other provisions of the articles of incorporation and bylaws; and |

· permit the board of directors, without further action of the shareholders, to issue and fix the terms of preferred stock, which may have rights senior to those of the common stock. |

However, we believe that these provisions allow our Board of Directors to negotiate a higher price in the event of a takeover attempt which would be in the best interest of our shareholders.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 2. PROPERTIES

Stores

As of February 2, 2008, we operated 3,411 stores in 48 states as detailed below:

| Alabama | 82 | | Maine | 17 | | Ohio | 157 |

| Arizona | 58 | | Maryland | 79 | | Oklahoma | 51 |

| Arkansas | 45 | | Massachusetts | 47 | | Oregon | 70 |

| California | 241 | | Michigan | 123 | | Pennsylvania | 186 |

| Colorado | 46 | | Minnesota | 51 | | Rhode Island | 12 |

| Connecticut | 29 | | Mississippi | 47 | | South Carolina | 70 |

| Delaware | 20 | | Missouri | 79 | | South Dakota | 6 |

| Florida | 206 | | Montana | 8 | | Tennessee | 86 |

| Georgia | 135 | | Nebraska | 14 | | Texas | 212 |

| Idaho | 23 | | Nevada | 28 | | Utah | 33 |

| Illinois | 145 | | New Hampshire | 16 | | Vermont | 6 |

| Indiana | 97 | | New Jersey | 79 | | Virginia | 131 |

| Iowa | 26 | | New Mexico | 25 | | Washington | 61 |

| Kansas | 30 | | New York | 154 | | West Virginia | 31 |

| Kentucky | 65 | | North Carolina | 149 | | Wisconsin | 66 |

| Louisiana | 56 | | North Dakota | 5 | | Wyoming | 8 |

We currently lease our stores and expect to continue to lease new stores as we expand. Our leases typically provide for a short initial lease term, generally five years, with options to extend, however in some cases we have initial lease terms of seven to ten years. We believe this leasing strategy enhances our flexibility to pursue various expansion opportunities resulting from changing market conditions. As current leases expire, we believe that we will be able to obtain lease renewals, if desired, for present store locations, or to obtain leases for equivalent or better locations in the same general area.

Distribution Centers

The following table includes information about the distribution centers that we currently operate. We expanded the Briar Creek distribution center in 2007. We believe our distribution center network, including this expansion, is capable of supporting approximately $6.7 billion in annual sales.

Location | Own/Lease | Lease Expires | Size in Square Feet |

| | | | |

| Chesapeake, Virginia | Own | N/A | 400,000 |

| Olive Branch, Mississippi | Own | N/A | 425,000 |

| Joliet, Illinois | Own | N/A | 1,200,000 |

| Stockton, California | Own | N/A | 525,000 |

| Briar Creek, Pennsylvania | Own | N/A | 1,003,000 |

| Savannah, Georgia | Own | N/A | 603,000 |

| Marietta, Oklahoma | Own | N/A | 603,000 |

| Salt Lake City, Utah | Lease | April 2010 | 252,000 |

| Ridgefield, Washington | Own | N/A | 665,000 |

In addition to our distribution centers noted above, during the past several years, we have used off-site facilities to accommodate limited quantities of seasonal merchandise.

Each of our distribution centers contains advanced materials handling technologies, including radio-frequency inventory tracking equipment and specialized information systems. With the exception of our Salt Lake City and Ridgefield facilities each of our distribution centers also contains automated conveyor and sorting systems.

For more information on financing of our distribution centers, see Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations- Funding Requirements" Beginning on page 25 of this Form 10-K.

Item 3. LEGAL PROCEEDINGS

From time to time, we are defendants in ordinary, routine litigation or proceedings incidental to our business, including allegations regarding:

| | |

· | employment related matters; |

| | |

· | infringement of intellectual property rights; |

| | |

· | product safety matters, which may include product recalls in cooperation with the Consumer Products Safety Commission or other jurisdictions; |

| | |

· | personal injury/wrongful death claims; and |

| | |

· | real estate matters related to store leases. |

In 2003, we were served with a lawsuit in a California state court by a former employee who alleged that employees did not properly receive sufficient meal breaks and paid rest periods, along with other alleged wage and hour violations. The suit requested that the Court certify the case as a class action. The parties engaged in mediation and reached an agreement which upon presentation to the Court, received preliminary approval and the certification of a settlement class. Notices have been mailed to the class members and the final fairness hearing is expected to occur on May 22, 2008. The settlement amount has been accrued in the accompanying consolidated balance sheet as of February 2, 2008.

In 2005, we were served with a lawsuit by former employees in Oregon who allege that they did not properly receive sufficient meal breaks and paid rest periods, and that terminated employees were not paid in a timely manner. The plaintiffs requested the Court to certify classes for their various claims and the presiding judge did so with respect to two classes, but denied others. After a partly successful appeal by the plaintiffs, one additional class has been certified. The certified classes now include two for alleged violations of that state’s labor laws concerning rest breaks and one related to untimely payments upon termination. Discovery is now on-going and no trial is anticipated before the latter part of 2008.

In 2006, we were served with a lawsuit by a former employee in a California state court alleging that she was paid for wages with a check drawn on a bank which did not have any branches in the state, an alleged violation of the state's labor code; that she was paid less for her work than other similar employees with the same job title based on her gender; and that she was not paid her final wages in a timely manner, also an alleged violation of the labor code. The plaintiff requested the Court to certify the case and those claims as a class action. The parties have reached a settlement and executed an Agreement by which the named plaintiff individually settled her Equal Pay Act and late payment claims. The Court accepted the proposed settlement and certified a class for the check claim. Notices have been mailed to class members and a hearing for final approval of the settlement has been scheduled for April 22, 2008. The estimated settlement amount has been accrued in the accompanying consolidated balance sheet as of February 2, 2008.

In 2006, we were served with a lawsuit filed in federal court in the state of Alabama by a former store manager. She claims that she should have been classified as a non-exempt employee under the Fair Labor Standards Act and, therefore, should have received overtime compensation and other benefits. She filed the case as a collective action on behalf of herself and all other employees (store managers) similarly situated. Plaintiff sought and received from the Court an Order allowing nationwide (except for the state of California) notice to be sent to all store managers employed by the Company now or within the past three years. Such notice has been mailed and each involved person will determine whether he or she wishes to opt-in to the class as a plaintiff. We intend at the appropriate time to challenge the anticipated effort by the opt-in plaintiffs to be certified as a class.

In 2007, we were served with a lawsuit filed in federal court in the state of California by one present and one former store manager. They claim they should have been classified as non-exempt employees under both the California Labor Code and the Fair Labor Standards Act. They filed the case as a class action on behalf of California based store managers. We responded with a motion to dismiss which the Court granted with respect to allegations of fraud. The plaintiff then filed an amended complaint which has been answered by us. We were thereafter served with a second suit in a California state court which alleges essentially the same claims as those contained in the federal action and which likewise seeks class certification of all California store managers. We have removed the case to the same federal court as the first suit, answered it and the two cases have been consolidated. We will defend plaintiffs’ anticipated effort to seek class certification.

In 2007, we were served with a lawsuit filed in federal court in California by two former employees who allege they were not paid all wages due and owing for time worked, that they were not paid in a timely manner upon termination of their employment and that they did not receive accurate itemized wage statements. They filed the suit as a class action and seek to include in the class all of our former employees in the state of California. We responded with a motion to dismiss which the Court denied. We answered and a motion for summary judgment on our part is presently pending before the Court.

We were recently served in federal court in California with a Complaint, on behalf of a former employee, alleging meal and rest break violations among other causes of action, and seeking class action status. The settlement Order entered by the Court in the 2003 case referenced above included an injunction against meal and rest break claims on the part of class members which we believe include this plaintiff. We will seek to stay this litigation in accordance with that injunction.

We will vigorously defend ourselves in these lawsuits. We do not believe that any of these matters will, individually or in the aggregate, have a material adverse effect on our business or financial condition. We cannot give assurance, however, that one or more of these lawsuits will not have a material adverse effect on our results of operations for the period in which they are resolved.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of our 2007 fiscal year.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock has been traded on The Nasdaq Stock Market® under the symbol "DLTR" since our initial public offering on March 6, 1995. The following table gives the high and low sales prices of our common stock as reported by Nasdaq for the periods indicated.

| | | High | | | Low | |

| Fiscal year ended February 3, 2007: | | | | | | |

| | | | | | | |

| First Quarter | | $ | 28.68 | | | $ | 24.34 | |

| Second Quarter | | | 27.89 | | | | 23.90 | |

| Third Quarter | | | 32.00 | | | | 25.62 | |

| Fourth Quarter | | | 32.78 | | | | 29.34 | |

| | | | | | | | | |

| Fiscal year ended February 2, 2008: | | | | | | | | |

| | | | | | | | | |

| First Quarter | | $ | 40.31 | | | $ | 31.24 | |

| Second Quarter | | | 45.98 | | | | 37.93 | |

| Third Quarter | | | 44.13 | | | | 33.69 | |

| Fourth Quarter | | | 36.17 | | | | 20.72 | |

On March 28, 2008, the last reported sale price for our common stock, as quoted by Nasdaq, was $27.00 per share. As of March 28, 2008, we had approximately 519 shareholders of record.

The following table presents our share repurchase activity for the 13 weeks ended February 2, 2008.

| | | | | | | | | | | | Approximate | |

| | | | | | | | | | | | dollar value | |

| | | | | | | | | Total number | | | of shares that | |

| | | | | | | | | of shares | | | may yet be | |

| | | | | | | | | purchased as | | | purchased under | |

| | | Total number | | | Average | | | part of publicly | | | the plans or | |

| | | of shares | | | price paid | | | announced plans | | | programs | |

| Period | | purchased | | | per share | | | or programs | | | (in millions) | |

| November 4, 2007 to December 1, 2007 | | | 358,953 | | | $ | 28.50 | | | | 358,953 | | | $ | 538.2 | |

| December 2, 2007 to January 5, 2008 | | | 3,018,093 | | | | 27.98 | | | | 3,018,093 | | | | 453.7 | |

| January 6, 2008 to February 2, 2008 | | | - | | | | - | | | | - | | | | 453.7 | |

| Total | | | 3,377,046 | | | $ | 28.03 | | | | 3,377,046 | | | $ | 453.7 | |

In October 2007, our Board of Directors authorized the repurchase of an additional $500.0 million of our common stock. This authorization was in addition to the November 2006 authorization which had approximately $98.4 million remaining. As of February 2, 2008 we have approximately $453.7 million remaining under Board authorization.

We anticipate that substantially all of our cash flow from operations in the foreseeable future will be retained for the development and expansion of our business, the repayment of indebtedness and, as authorized by our Board of Directors, the repurchase of stock. Management does not anticipate paying dividends on our common stock in the foreseeable future.

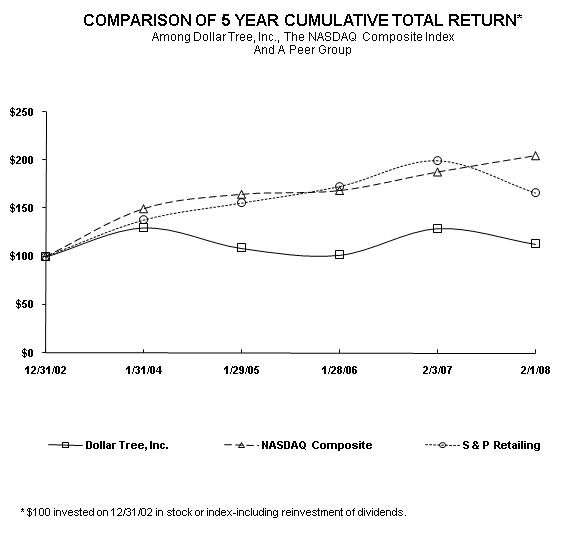

Stock Performance Graph

The following graph sets forth the yearly percentage change in the cumulative total shareholder return on our common stock during the five fiscal years ended February 2, 2008, compared with the cumulative total returns of the NASDAQ Composite Index and the S&P Retailing Index. The comparison assumes that $100 was invested in our common stock on December 31, 2002, and, in each of the foregoing indices on December 31, 2002, and that dividends were reinvested.

Item 6. SELECTED FINANCIAL DATA

The following table presents a summary of our selected financial data for the fiscal years ended February 2, 2008, February 3, 2007, January 28, 2006, January 29, 2005, and January 31, 2004. Fiscal 2006 included 53 weeks, commensurate with the retail calendar, while all other fiscal years reported in the table contain 52 weeks. The selected income statement and balance sheet data have been derived from our consolidated financial statements that have been audited by our independent registered public accounting firm. This information should be read in conjunction with the consolidated financial statements and related notes, "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and our financial information found elsewhere in this report.

Comparable store net sales compare net sales for stores open throughout each of the two periods being compared, including expanded stores. Net sales per store and net sales per selling square foot are calculated for stores open throughout the period presented.

Amounts in the following tables are in millions, except per share data, number of stores data, net sales per selling square foot data and inventory turns.

| | | Years Ended | |

| | | February 2, | | | February 3, | | | January 28, | | | January 29, | | | January 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Income Statement Data: | | | | | | | | | | | | | | | |

| Net sales | | $ | 4,242.6 | | | $ | 3,969.4 | | | $ | 3,393.9 | | | $ | 3,126.0 | | | $ | 2,799.9 | |

| Gross profit | | | 1,461.1 | | | | 1,357.2 | | | | 1,172.4 | | | | 1,112.5 | | | | 1,018.4 | |

| Selling, general and administrative expenses | | | 1,130.8 | | | | 1,046.4 | | | | 888.5 | | | | 819.0 | | | | 724.8 | |

| Operating income | | | 330.3 | | | | 310.8 | | | | 283.9 | | | | 293.5 | | | | 293.6 | |

| Net income | | | 201.3 | | | | 192.0 | | | | 173.9 | | | | 180.3 | | | | 177.6 | |

| | | | | | | | | | | | | | | | | | | | | |

| Margin Data (as a percentage of net sales): | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 34.4 | % | | | 34.2 | % | | | 34.5 | % | | | 35.6 | % | | | 36.4 | % |

| Selling, general and administrative expenses | | | 26.6 | % | | | 26.4 | % | | | 26.2 | % | | | 26.2 | % | | | 25.9 | % |

| Operating income | | | 7.8 | % | | | 7.8 | % | | | 8.3 | % | | | 9.4 | % | | | 10.5 | % |

| Net income | | | 4.7 | % | | | 4.8 | % | | | 5.1 | % | | | 5.8 | % | | | 6.3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted net income per share | | $ | 2.09 | | | $ | 1.85 | | | $ | 1.60 | | | $ | 1.58 | | | $ | 1.54 | |

| Diluted net income per share increase | | | 13.0 | % | | | 15.6 | % | | | 1.3 | % | | | 2.6 | % | | | 14.1 | % |

| | | As of | |

| | | February 2, | | | February 3, | | | January 28, | | | January 29, | | | January 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Balance Sheet Data: | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | | | | | | | | | | | | | |

| and short-term investments | | $ | 81.1 | | | $ | 306.8 | | | $ | 339.8 | | | $ | 317.8 | | | $ | 168.7 | |

| Working capital | | | 382.9 | | | | 575.7 | | | | 648.2 | | | | 675.5 | | | | 450.3 | |

| Total assets | | | 1,787.7 | | | | 1,882.2 | | | | 1,798.4 | | | | 1,792.7 | | | | 1,501.5 | |

| Total debt, including capital lease obligations | | | 269.4 | | | | 269.5 | | | | 269.9 | | | | 281.7 | | | | 185.1 | |

| Shareholders' equity | | | 988.4 | | | | 1,167.7 | | | | 1,172.3 | | | | 1,164.2 | | | | 1,014.5 | |

| | | Years Ended | |

| | | February 2, | | | February 3, | | | January 28, | | | January 29, | | | January 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Selected Operating Data: | | | | | | | | | | | | | | | | | | | | |

| Number of stores open at end of period | | | 3,411 | | | | 3,219 | | | | 2,914 | | | | 2,735 | | | | 2,513 | |

| Gross square footage at end of period | | | 36.1 | | | | 33.3 | | | | 29.2 | | | | 25.9 | | | | 21.4 | |

| Selling square footage at end of period | | | 28.4 | | | | 26.3 | | | | 23.0 | | | | 20.4 | | | | 16.9 | |

| Selling square footage annual growth | | | 8.0 | % | | | 14.3 | % | | | 12.6 | % | | | 21.1 | % | | | 27.5 | % |

| Net sales annual growth | | | 6.9 | % | | | 16.9 | % | | | 8.6 | % | | | 11.6 | % | | | 18.7 | % |

| Comparable store net sales increase (decrease) | | | 2.7 | % | | | 4.6 | % | | | (0.8 | %) | | | 0.5 | % | | | 2.9 | % |

| Net sales per selling square foot | | $ | 155 | | | $ | 161 | | | $ | 156 | | | $ | 168 | | | $ | 187 | |

| Net sales per store | | $ | 1.3 | | | $ | 1.3 | | | $ | 1.2 | | | $ | 1.2 | | | $ | 1.2 | |

| Selected Financial Ratios: | | | | | | | | | | | | | | | | | | | | |

| Return on assets | | | 11.0 | % | | | 10.4 | % | | | 9.7 | % | | | 10.9 | % | | | 13.7 | % |

| Return on equity | | | 18.7 | % | | | 16.4 | % | | | 14.9 | % | | | 16.5 | % | | | 19.0 | % |

| Inventory turns | | | 3.7 | | | | 3.5 | | | | 3.1 | | | | 2.9 | | | | 2.9 | |

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In Management’s Discussion and Analysis, we explain the general financial condition and the results of operations for our company, including:

| | |

· | what factors affect our business; |

| | |

· | what our net sales, earnings, gross margins and costs were in 2007, 2006 and 2005; |

| | |

· | why those net sales, earnings, gross margins and costs were different from the year before; |

| | |

· | how all of this affects our overall financial condition; |

| | |

· | what our expenditures for capital projects were in 2007 and what we expect them to be in 2008; and |

| | |

· | where funds will come from to pay for future expenditures. |

As you read Management’s Discussion and Analysis, please refer to our consolidated financial statements, included in Item 8 of this Form 10-K, which present the results of operations for the fiscal years ended February 2, 2008, February 3, 2007 and January 28, 2006. In Management’s Discussion and Analysis, we analyze and explain the annual changes in some specific line items in the consolidated financial statements for the fiscal year 2007 compared to the comparable fiscal year 2006 and the fiscal year 2006 compared to the comparable fiscal year 2005.

Key Events and Recent Developments

Several key events have had or are expected to have a significant effect on our operations. You should keep in mind that:

· | On March 2, 2008, we reorganized by creating a new holding company structure. The new parent company is Dollar Tree, Inc., replacing Dollar Tree Stores, Inc., which is now an operating subsidiary. Outstanding shares of the capital stock of Dollar Tree Stores, Inc., were automatically converted, on a share for share basis, into identical shares of common stock of the new holding company. The articles of incorporation, the bylaws, the executive officers and the board of directors of our new holding company are the same as those of the former Dollar Tree Stores, Inc. in effect immediately prior to the reorganization. The common stock of our new holding company will continue to be listed on the NASDAQ Global Select Market under the symbol “DLTR”. The rights, privileges and interests of our stockholders will remain the same with respect to our new holding company. |

· | On February 20, 2008, we entered into a five-year $550.0 million Credit Agreement (the Agreement). The Agreement provides for a $300.0 million revolving line of credit, including up to $150.0 million in available letters of credit, and a $250.0 million term loan. The interest rate on the facility will be based, at our option, on a LIBOR rate, plus a margin, or an alternate base rate, plus a margin. Our March 2004, $450.0 million unsecured revolving credit facility was terminated concurrent with entering into the Agreement. |

· | In November 2007, we completed the 400,000 square foot expansion of our Briar Creek distribution center. Including this expansion, we believe that our nine distribution centers will support approximately $6.7 billion in sales annually. |

· | In October 2007, our Board of Directors authorized the repurchase of an additional $500.0 million of our common stock. This authorization was in addition to the November 2006 authorization which had approximately $98.4 million remaining. At February 2, 2008, we had approximately $453.7 million remaining under Board authorization. |

· | In March 2006, we completed our acquisition of 138 Deal$ stores and related assets. We paid approximately $32.0 million for store related assets and $22.1 million for inventory. |

· | On December 15, 2005, the Compensation Committee of our Board of Directors approved the acceleration of the vesting date of all previously issued, outstanding and unvested options under all current stock option plans, effective as of December 15, 2005. This decision eliminated non-cash compensation expense that would have been recorded in future periods following our adoption of Statement of Financial Accounting Standards No. 123, Share-Based Payment (revised 2004) (FAS 123R), on January 29, 2006. Compensation expense has been reduced by approximately $14.9 million over a period of four years during which the options would have vested, as a result of the option acceleration program. |

Overview

Our net sales are derived from the sale of merchandise. Two major factors tend to affect our net sales trends. First is our success at opening new stores or adding new stores through acquisitions. Second, sales vary at our existing stores from one year to the next. We refer to this change as a change in comparable store net sales, because we compare only those stores that are open throughout both of the periods being compared. We include sales from stores expanded during the year in the calculation of comparable store net sales, which has the effect of increasing our comparable store net sales. The term 'expanded' also includes stores that are relocated.

At February 2, 2008, we operated 3,411 stores in 48 states, with 28.4 million selling square feet compared to 3,219 stores with 26.3 million selling square feet at February 3, 2007. During fiscal 2007, we opened 240 stores, expanded 102 stores and closed 48 stores, compared to 211 new stores opened, 85 stores expanded and 44 stores closed during fiscal 2006. In addition to the new stores opened in 2006, we acquired 138 Deal$ stores on March 25, 2006. In the current year we achieved 8% selling square footage growth. Of the 2.1 million selling square foot increase in 2007, 0.4 million was added by expanding existing stores. The average size of our stores opened in 2007 was approximately 8,500 selling square feet (or about 10,800 gross square feet). The average new store size decreased slightly in 2007 from approximately 9,000 selling square feet (or about 11,000 gross square feet) for new stores in 2006. For 2008, we continue to plan to open stores that are approximately 8,500 - 9,000 selling square feet (or about 10,000 - 12,500 gross square feet). We believe that this store size is our optimal size operationally and that this size also gives our customers an improved shopping environment that invites them to shop longer and buy more. We expect the substantial majority of our future net sales growth to come from the square footage growth resulting from new store openings and expansion of existing stores.

Fiscal 2006 ended on February 3, 2007 and included 53 weeks, commensurate with the retail calendar. The 53rd week in 2006 added approximately $70 million in sales. Fiscal 2007 and 2005 ended on February 2, 2008 and January 28, 2006, respectively, and both years included 52 weeks.

In fiscal 2007, comparable store net sales increased by 2.7%. This increase was based on the comparable 52 weeks for both years. We believe comparable store net sales were positively affected by a number of our initiatives over the past year, including expansion of forms of payment accepted by our stores and the roll-out of freezers and coolers to more of our stores. During 2006, we completed the roll-out of pin-capture debit card acceptance to all of our stores, which has enabled us to accept Electronic Benefit Transfer cards and we now accept food stamps in approximately 1,100 qualified stores. We believe the expansion of forms of payment accepted by our stores has helped increase the average transaction size in our stores. On October 31, 2007, all of our stores began accepting VISA credit as well, which we expect to have a positive impact on future sales.

We continued to experience a slight shift in the mix of merchandise sold to more consumables which we believe increases the traffic in our stores; however, this merchandise has lower margins. The negative impact from the planned shift toward more consumables was smaller in 2007 than in 2006. The planned shift in mix to more consumables is partially the result of the roll-out of frozen and refrigerated merchandise to more stores in 2007 and 2006. At February 2, 2008 we had frozen and refrigerated merchandise in approximately 1,100 stores compared to approximately 700 stores at February 3, 2007. We believe that this will continue to enable us to increase sales and earnings by increasing the number of shopping trips made by our customers and increasing the average transaction size.

Our point-of-sale technology provides us with valuable sales and inventory information to assist our buyers and improve our merchandise allocation to our stores. We believe that this has enabled us to better manage our inventory flow resulting in more efficient distribution and store operations and increased inventory turnover for each of the last two years. Inventory turnover improved by approximately 25 basis points in 2007 compared to 2006 and by approximately 45 basis points in 2006 compared to 2005. Inventory per store has also remained constant at February 2, 2008 compared to February 3, 2007 despite slightly lower than expected fourth-quarter 2007 sales and the increased merchandise flow due to the earlier Easter season in 2008.

We must continue to control our merchandise costs, inventory levels and our general and administrative expenses. Increases in these line items could negatively impact our operating results.

Our plans for fiscal 2008 anticipate net sales in the $4.49 billion to $4.62 billion range and diluted earnings per share of $2.17 to $2.35. This guidance for 2008 is predicated on selling square footage growth of approximately 9%. The earnings per share guidance for 2008 is exclusive of any share repurchase activity in 2008.

On March 25, 2006, we completed our acquisition of 138 Deal$ stores. These stores are located primarily in the Midwest part of the United States and we have existing logistics capacity to service these stores. This acquisition also included a few “combo” stores that offer an expanded assortment of merchandise including items that sell for more than $1. Substantially all Deal$ stores acquired continue to operate under the Deal$ banner while providing us an opportunity to leverage our Dollar Tree infrastructure in the testing of new merchandise concepts, including higher price points, without disrupting the single-price point model in our Dollar Tree stores. At February 2, 2008, 131 of these stores were selling items priced over $1.00, compared to 121 stores at February 3, 2007.

We paid approximately $32.0 million for store-related and other assets and $22.1 million for inventory. The results of Deal$ store operations are included in our financial statements since the acquisition date and did not have a significant impact on our operating results in fiscal 2007 or fiscal 2006.

Results of Operations

The following table expresses items from our consolidated statements of operations, as a percentage of net sales:

| | | Year Ended | | | Year Ended | | | Year Ended | |

| | | February 2, | | | February 3, | | | January 28, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | |

| Net sales | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| Cost of sales | | | 65.6 | % | | | 65.8 | % | | | 65.5 | % |

| Gross profit | | | 34.4 | % | | | 34.2 | % | | | 34.5 | % |

| | | | | | | | | | | | | |

| Selling, general and administrative | | | | | | | | | | | | |

| expenses | | | 26.6 | % | | | 26.4 | % | | | 26.2 | % |

| | | | | | | | | | | | | |

| Operating income | | | 7.8 | % | | | 7.8 | % | | | 8.3 | % |

| | | | | | | | | | | | | |

| Interest income | | | 0.1 | % | | | 0.2 | % | | | 0.2 | % |

| Interest expense | | | (0.4 | %) | | | (0.4 | %) | | | (0.4 | %) |

| | | | | | | | | | | | | |

| Income before income taxes | | | 7.5 | % | | | 7.6 | % | | | 8.1 | % |

| | | | | | | | | | | | | |

| Provision for income taxes | | | (2.8 | %) | | | (2.8 | %) | | | (3.0 | %) |

| | | | | | | | | | | | | |

| Net income | | | 4.7 | % | | | 4.8 | % | | | 5.1 | % |

Fiscal year ended February 2, 2008 compared to fiscal year ended February 3, 2007

Net Sales. Net sales increased 6.9%, or $273.2 million, in 2007 compared to 2006, resulting primarily from sales in our new and expanded stores. Our sales increase was also impacted by a 2.7% increase in comparable store net sales for the year. This increase is based on the comparable 52-weeks for both years. These increases were partially offset by an extra week of sales in 2006 due to the 53-week retail calendar for 2006. On a comparative 52-week basis, sales increased approximately 8.8% in 2007 compared to 2006. Comparable store net sales are positively affected by our expanded and relocated stores, which we include in the calculation, and, to a lesser extent, are negatively affected when we open new stores or expand stores near existing ones.

The following table summarizes the components of the changes in our store count for fiscal years ended February 2, 2008 and February 3, 2007.

| | February 2, 2008 | February 3, 2007 |

| | | |

| New stores | 208 | 190 |

| Deal$ acquisition | -- | 138 |

| Acquired leases | 32 | 21 |

| Expanded or relocated stores | 102 | 85 |

| Closed stores | (48) | (44) |

Of the 2.1 million selling square foot increase in 2007 approximately 0.4 million was added by expanding existing stores.

Gross Profit. Gross profit margin increased to 34.4% in 2007 compared to 34.2% in 2006. The increase was primarily due to a 50 basis point decrease in merchandise cost, including inbound freight, due to improved initial mark-up in many categories in the current year. This decrease was partially offset by a 40 basis point increase in occupancy costs due to the loss of leverage from the extra week of sales in the prior year and the lower comparable store net sales in the current year.

Selling, General and Administrative Expenses. Selling, general and administrative expenses, as a percentage of net sales, increased to 26.6% for 2007 compared to 26.4% for 2006. The increase is primarily due to the following:

| · | Operating and corporate expenses increased approximately 25 basis points due to increased debit and credit fees resulting from increased debit transactions in the current year and the rollout of VISA credit at October 31, 2007. Also, in 2006, we had approximately 10 basis points of income related to early lease terminations. |

· | Occupancy costs increased 15 basis points primarily due to increased repairs and maintenance costs in the current year. |

· | Partially offsetting these increases was an approximate 15 basis point decrease in depreciation expense due to the expiration of the depreciable life on much of the supply chain hardware and software placed in service in 2002. |

Operating Income. Due to the reasons discussed above, operating income margin was 7.8% in 2007 and 2006.

Income Taxes. Our effective tax rate was 37.1% in 2007 compared to 36.6% in 2006. The increase in the rate for 2007 reflects a reduction of tax-exempt interest income in the current year due to lower investment levels resulting from increased share repurchase activity and an increase in tax reserves in accordance with the Financial Accounting Standards Board’s Financial Interpretation No. 48, Accounting for Uncertainty in Income Taxes. These increases more than offset a slight decrease in our net state tax rate.

Fiscal year ended February 3, 2007 compared to fiscal year ended January 28, 2006

Net Sales. Net sales increased 16.9%, or $575.5 million, in 2006 compared to 2005, resulting from sales in our new and expanded stores, including 138 Deal$ stores acquired in March 2006 and the 53 weeks of sales in 2006 versus 52 weeks in 2005, which accounted for approximately $70 million of the increase. Our sales increase was also impacted by a 4.6% increase in comparable store net sales for the year. This increase is based on a 53-week comparison for both periods. Comparable store net sales are positively affected by our expanded and relocated stores, which we include in the calculation, and, to a lesser extent, are negatively affected when we open new stores or expand stores near existing ones.

The following table summarizes the components of the changes in our store count for fiscal years ended February 3, 2007 and January 28, 2006.

| | February 3, 2007 | January 28, 2006 |

| | | |

| New stores | 190 | 197 |

| Deal$ acquisition | 138 | -- |

| Acquired leases | 21 | 35 |

| Expanded or relocated stores | 85 | 93 |

| Closed stores | (44) | (53) |

Of the 3.3 million selling square foot increase in 2006, approximately 1.2 million resulted from the acquisition of the Deal$ stores and 0.4 million was added by expanding existing stores.

Gross Profit. Gross profit margin decreased to 34.2% in 2006 compared to 34.5% in 2005. The decrease was primarily due to a 35 basis point increase in merchandise cost, including inbound freight. This increase in merchandise cost was due to a slight shift in mix to more consumables, which have a lower margin, higher cost merchandise at our Deal$ stores and increased inbound domestic freight costs.

Selling, General and Administrative Expenses. Selling, general and administrative expenses, as a percentage of net sales, increased to 26.4% for 2006 as compared to 26.2% for 2005. The increase is primarily due to the following:

· | Payroll and benefit related costs increased 35 basis points due to increased incentive compensation costs resulting from better overall company performance in 2006 as compared to 2005 and increased stock compensation expense, partially offset by lower workers’ compensation costs in 2006. |

· | Operating and corporate expenses decreased 10 basis points primarily as the result of payments received for early lease terminations in 2006. |

Operating Income. Due to the reasons discussed above, operating income margin decreased to 7.8% in 2006 compared to 8.3% in 2005.

Income Taxes. Our effective tax rate was 36.6% in 2006 compared to 36.8% in 2005. The decreased tax rate for 2006 was due primarily to increased tax-exempt interest on certain of our investments in 2006.

Liquidity and Capital Resources

Our business requires capital to build and open new stores, expand our distribution network and operate existing stores. Our working capital requirements for existing stores are seasonal and usually reach their peak in September and October. Historically, we have satisfied our seasonal working capital requirements for existing stores and have funded our store opening and distribution network expansion programs from internally generated funds and borrowings under our credit facilities.

The following table compares cash-related information for the years ended February 2, 2008, February 3, 2007, and January 28, 2006:

| | | Year Ended | | | Year Ended | | | Year Ended | |

| | | February 2, | | | February 3, | | | January 28, | |

| (in millions) | | 2008 | | | 2007 | | | 2006 | |